Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| | |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the quarterly period ended April 1, 2017. |

Or

|

| | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number 000-06217

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 94-1672743 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2200 Mission College Boulevard, Santa Clara, California | | 95054-1549 |

(Address of principal executive offices) | | (Zip Code) |

(408) 765-8080

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | Emerging growth company ¨ |

| | (Do not check if a smaller reporting company) | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Shares outstanding of the Registrant’s common stock: |

| | |

Class | | Outstanding as of April 1, 2017 |

Common stock, $0.001 par value | | 4,709 million |

INTEL CORPORATION

FORM 10-Q

FOR THE FISCAL QUARTER ENDED APRIL 1, 2017

INDEX

|

| | |

| Page |

|

|

Item 1. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

|

|

Item 1. | | |

Item 1A. | | |

Item 2. | | |

Item 6. | | |

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements that involve a number of risks and uncertainties. Words such as "anticipates," "expects," "intends," "goals," "plans," "believes," "seeks," "estimates," "continues," "may," "will," “would,” "should," “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, uncertain events or assumptions, and other characterizations of future events or circumstances are forward-looking statements. Such statements are based on management's expectations as of the date of this filing and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include those described throughout this report and our Annual Report on Form 10-K for the year ended December 31, 2016, particularly the "Risk Factors" sections of such reports. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in this Form 10-Q and in other documents we file from time to time with the Securities and Exchange Commission that disclose risks and uncertainties that may affect our business. The forward-looking statements in this Form 10-Q do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that had not been completed as of April 27, 2017. In addition, the forward-looking statements in this Form 10-Q are made as of the date of this filing, and Intel does not undertake, and expressly disclaims any duty, to update such statements, whether as a result of new information, new developments or otherwise, except to the extent that disclosure may be required by law.

PART I – FINANCIAL INFORMATION

| |

ITEM 1. | FINANCIAL STATEMENTS |

INTEL CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF INCOME (Unaudited)

|

| | | | | | | | |

| | Three Months Ended |

(In Millions, Except Per Share Amounts) | | Apr 1,

2017 | | Apr 2,

2016 |

Net revenue | | $ | 14,796 |

| | $ | 13,702 |

|

Cost of sales | | 5,649 |

| | 5,572 |

|

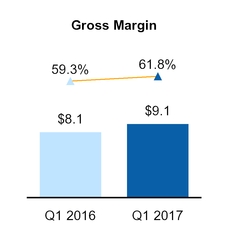

Gross margin | | 9,147 |

| | 8,130 |

|

Research and development | | 3,326 |

| | 3,246 |

|

Marketing, general and administrative | | 2,104 |

| | 2,226 |

|

Restructuring and other charges | | 80 |

| | — |

|

Amortization of acquisition-related intangibles | | 38 |

| | 90 |

|

Operating expenses | | 5,548 |

| | 5,562 |

|

Operating income | | 3,599 |

| | 2,568 |

|

Gains (losses) on equity investments, net | | 252 |

| | 22 |

|

Interest and other, net | | (36 | ) | | (82 | ) |

Income before taxes | | 3,815 |

| | 2,508 |

|

Provision for taxes | | 851 |

| | 462 |

|

Net income | | $ | 2,964 |

| | $ | 2,046 |

|

Basic earnings per share of common stock | | $ | 0.63 |

| | $ | 0.43 |

|

Diluted earnings per share of common stock | | $ | 0.61 |

| | $ | 0.42 |

|

Cash dividends declared per share of common stock | | $ | 0.5325 |

| | $ | 0.5200 |

|

Weighted average shares of common stock outstanding: | | | | |

Basic | | 4,723 |

| | 4,722 |

|

Diluted | | 4,881 |

| | 4,875 |

|

See accompanying notes.

INTEL CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

|

| | | | | | | | |

| | Three Months Ended |

(In Millions) | | Apr 1,

2017 | | Apr 2,

2016 |

Net income | | $ | 2,964 |

| | $ | 2,046 |

|

Changes in other comprehensive income, net of tax: | | | | |

Net unrealized holding gains (losses) on available-for-sale investments | | 543 |

| | 291 |

|

Deferred tax asset valuation allowance | | — |

| | (1 | ) |

Net unrealized holding gains (losses) on derivatives | | 195 |

| | 187 |

|

Net prior service (costs) credits | | 2 |

| | 2 |

|

Actuarial valuation | | 16 |

| | 19 |

|

Net foreign currency translation adjustment | | 1 |

| | 2 |

|

Other comprehensive income (loss) | | 757 |

| | 500 |

|

Total comprehensive income | | $ | 3,721 |

| | $ | 2,546 |

|

See accompanying notes.

INTEL CORPORATION

CONSOLIDATED CONDENSED BALANCE SHEETS (Unaudited)

|

| | | | | | | | |

(In Millions) | | Apr 1,

2017 | | Dec 31,

2016 |

Assets | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 4,934 |

| | $ | 5,560 |

|

Short-term investments | | 3,058 |

| | 3,225 |

|

Trading assets | | 9,303 |

| | 8,314 |

|

Accounts receivable, net | | 4,921 |

| | 4,690 |

|

Inventories | | 5,801 |

| | 5,553 |

|

Assets held for sale | | 5,138 |

| | 5,210 |

|

Other current assets | | 2,903 |

| | 2,956 |

|

Total current assets | | 36,058 |

| | 35,508 |

|

Property, plant and equipment, net of accumulated depreciation of $55,173 ($53,934 as of December 31, 2016) | | 36,911 |

| | 36,171 |

|

Marketable equity securities | | 6,831 |

| | 6,180 |

|

Other long-term investments | | 5,149 |

| | 4,716 |

|

Goodwill | | 14,099 |

| | 14,099 |

|

Identified intangible assets, net | | 9,157 |

| | 9,494 |

|

Other long-term assets | | 7,443 |

| | 7,159 |

|

Total assets | | $ | 115,648 |

| | $ | 113,327 |

|

Liabilities, temporary equity, and stockholders’ equity | | | | |

Current liabilities: | | | | |

Short-term debt | | $ | 5,073 |

| | $ | 4,634 |

|

Accounts payable | | 3,221 |

| | 2,475 |

|

Accrued compensation and benefits | | 2,145 |

| | 3,465 |

|

Accrued advertising | | 772 |

| | 810 |

|

Deferred income | | 1,698 |

| | 1,718 |

|

Liabilities held for sale | | 1,746 |

| | 1,920 |

|

Other accrued liabilities | | 6,650 |

| | 5,280 |

|

Total current liabilities |

| 21,305 |

| | 20,302 |

|

Long-term debt | | 20,678 |

| | 20,649 |

|

Long-term deferred tax liabilities | | 2,285 |

| | 1,730 |

|

Other long-term liabilities | | 3,658 |

| | 3,538 |

|

Contingencies (Note 15) | |

| |

|

Temporary equity | | 878 |

| | 882 |

|

Stockholders’ equity: | | | | |

Preferred stock | | — |

| | — |

|

Common stock and capital in excess of par value, 4,709 issued and outstanding (4,730 issued and outstanding as of December 31, 2016) | | 25,890 |

| | 25,373 |

|

Accumulated other comprehensive income (loss) | | 863 |

| | 106 |

|

Retained earnings | | 40,091 |

| | 40,747 |

|

Total stockholders’ equity | | 66,844 |

| | 66,226 |

|

Total liabilities, temporary equity, and stockholders’ equity | | $ | 115,648 |

| | $ | 113,327 |

|

See accompanying notes.

INTEL CORPORATION

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS (Unaudited)

|

| | | | | | | | |

| | Three Months Ended |

(In Millions) | | Apr 1,

2017 | | Apr 2,

2016 |

Cash and cash equivalents, beginning of period | | $ | 5,560 |

| | $ | 15,308 |

|

Cash flows provided by (used for) operating activities: | | | | |

Net income | | 2,964 |

| | 2,046 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

Depreciation | | 1,625 |

| | 1,619 |

|

Share-based compensation | | 397 |

| | 448 |

|

Restructuring and other charges | | 80 |

| | — |

|

Amortization of intangibles | | 321 |

| | 396 |

|

(Gains) losses on equity investments, net | | (250 | ) | | (22 | ) |

Deferred taxes | | 212 |

| | (43 | ) |

Changes in assets and liabilities:1 | | | | |

Accounts receivable | | (105 | ) | | 942 |

|

Inventories | | (232 | ) | | (57 | ) |

Accounts payable | | 188 |

| | 434 |

|

Accrued compensation and benefits | | (1,277 | ) | | (1,307 | ) |

Income taxes payable and receivable | | 427 |

| | 497 |

|

Other assets and liabilities | | (452 | ) | | (898 | ) |

Total adjustments | | 934 |

| | 2,009 |

|

Net cash provided by operating activities | | 3,898 |

| | 4,055 |

|

Cash flows provided by (used for) investing activities: | | | | |

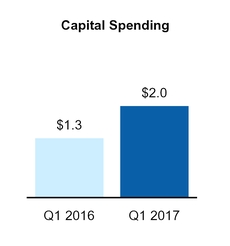

Additions to property, plant and equipment | | (1,952 | ) | | (1,346 | ) |

Acquisitions, net of cash acquired | | — |

| | (14,569 | ) |

Purchases of available-for-sale investments | | (1,746 | ) | | (2,847 | ) |

Sales of available-for-sale investments | | 431 |

| | 2,810 |

|

Maturities of available-for-sale investments | | 1,508 |

| | 1,359 |

|

Purchases of trading assets | | (3,075 | ) | | (4,533 | ) |

Maturities and sales of trading assets | | 2,433 |

| | 3,138 |

|

Investments in loans receivable and reverse repurchase agreements | | — |

| | (223 | ) |

Collection of loans receivable and reverse repurchase agreements | | — |

| | 650 |

|

Investments in non-marketable equity investments | | (422 | ) | | (182 | ) |

Purchases of licensed technology and patents | | (115 | ) | | — |

|

Other investing | | 160 |

| | 223 |

|

Net cash used for investing activities | | (2,778 | ) | | (15,520 | ) |

Cash flows provided by (used for) financing activities: | | | | |

Increase (decrease) in short-term debt, net | | 435 |

| | 956 |

|

Proceeds from sales of common stock through employee equity incentive plans | | 329 |

| | 343 |

|

Repurchase of common stock | | (1,242 | ) | | (793 | ) |

Restricted stock unit withholdings | | (70 | ) | | (63 | ) |

Payment of dividends to stockholders | | (1,229 | ) | | (1,228 | ) |

Other financing | | 31 |

| | 3 |

|

Net cash provided by (used for) financing activities | | (1,746 | ) | | (782 | ) |

Net increase (decrease) in cash and cash equivalents | | (626 | ) | | (12,247 | ) |

Cash and cash equivalents, end of period | | $ | 4,934 |

| | $ | 3,061 |

|

| | | | |

Supplemental disclosures of noncash investing activities and cash flow information: | | | | |

Acquisition of property, plant, and equipment included in accounts payable and accrued liabilities | | $ | 1,448 |

| | $ | 1,083 |

|

Cash paid during the period for: | | | | |

Interest, net of capitalized interest and interest rate swap payments/receipts | | $ | 97 |

| | $ | 254 |

|

Income taxes, net of refunds | | $ | 171 |

| | $ | (72 | ) |

| |

1 | The impact of assets and liabilities reclassified as held for sale was not considered in the changes in assets and liabilities within cash flows from operating activities. See "Note 8: Acquisitions and Divestitures" for additional information. |

See accompanying notes.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited

Note 1: Basis of Presentation

We prepared our interim consolidated condensed financial statements that accompany these notes in conformity with U.S. generally accepted accounting principles, consistent in all material respects with those applied in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (2016 Form 10-K).

We have a 52- or 53-week fiscal year that ends on the last Saturday in December. Our fiscal year 2017 is a 52-week year ending on December 30, 2017, while our fiscal year 2016 was a 53-week fiscal year that ended on December 31, 2016. The first quarter of fiscal year 2016 was a 14-week quarter compared to the standard 13-week quarters.

We have made estimates and judgments affecting the amounts reported in our consolidated condensed financial statements and the accompanying notes. The actual results that we experience may differ materially from our estimates. The interim financial information is unaudited, but reflects all normal adjustments that are, in our opinion, necessary to provide a fair statement of results for the interim periods presented. This report should be read in conjunction with the consolidated financial statements in our 2016 Form 10-K.

Note 2: Recent Accounting Standards

We assess the adoption impacts of recently issued accounting standards by the Financial Accounting Standards Board on our financial statements. The table below describes impacts from newly issued standards as well as material updates to our previous assessments, if any, from our 2016 Form 10-K.

|

| | |

Standard/Description | Effective Date and Adoption Considerations | Effect on Financial Statements or Other Significant Matters |

Compensation - Retirement Benefits - Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost. This amended standard was issued to provide additional guidance on the presentation of net benefit cost in the income statement and on the components eligible for capitalization in assets. The service cost component of the net periodic benefit cost will continue to be reported within operating income on the consolidated income statement. All other non-service components are required to be presented separately outside operating income and only service costs will be eligible for inventory capitalization.

| Effective in the first quarter of 2018. Changes to the presentation of benefit costs are required to be adopted retrospectively while changes to the capitalization of service costs into inventories are required to be adopted prospectively. The standard permits, as a practical expedient, to use the amounts disclosed in the Retirement Benefit Plans footnote for the prior comparative periods as the estimation basis for applying the retrospective presentation requirement.

| We expect the adoption of the amended standard to result in the reclassification of approximately $260 million from non-service components above the subtotal of operating income to interest and other, net, for the year ended December 31, 2016. We are continuing to assess the impacts of adoption to our 2017 financial statements.

|

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 3: Operating Segments Information

We manage our business through the following operating segments:

|

|

Client Computing Group (CCG) |

|

Includes platforms designed for notebooks, 2 in 1 systems, desktops (including all-in-ones and high-end enthusiast PCs), tablets, phones, wireless and wired connectivity products, and mobile communication components. |

|

Data Center Group (DCG) |

|

Includes workload-optimized platforms and related products designed for enterprise, cloud, and communication infrastructure market segments. |

|

Internet of Things Group (IOTG) |

|

Includes platforms designed for Internet of Things market segments, including retail, transportation, industrial, video, buildings and smart cities, along with a broad range of other market segments. |

|

Non-Volatile Memory Solutions Group (NSG) |

|

Includes Intel® Optane™ SSD products and NAND flash memory products primarily used in solid-state drives. |

|

Intel Security Group (ISecG) |

|

Includes security software products designed to deliver innovative solutions that secure computers, mobile devices, and networks around the world. |

|

Programmable Solutions Group (PSG) |

|

Includes programmable semiconductors primarily field-programmable gate array (FPGAs) and related products for a broad range of market segments, including communications, data center, industrial, military, and automotive. |

|

All other |

|

Includes results from our other non-reportable segments and corporate-related charges. |

We offer platforms that incorporate various components and technologies, including a microprocessor and chipset, a stand-alone System-on-Chip, or a multichip package. A platform may be enhanced by additional hardware, software, and services offered by Intel. Platforms are used in various form factors across our CCG, DCG, and IOTG operating segments. We derive a substantial majority of our revenue from platforms, which is our principal product.

In the third quarter of 2016, we announced our planned divestiture of ISecG, which closed on April 3, 2017, subsequent to the first quarter of 2017. We intend to recast our operating segment results to reflect the divestiture of ISecG to "all other" in the second quarter of 2017. For further information, see "Note 8: Acquisitions and Divestitures."

The “all other” category includes revenue, expenses, and charges such as:

| |

• | results of operations from non-reportable segments; |

| |

• | amounts included within restructuring and other charges; |

| |

• | a portion of profit-dependent compensation and other expenses not allocated to the operating segments; |

| |

• | divested businesses for which discrete operating results are not regularly reviewed by our Chief Operating Decision Maker (CODM), who is our Chief Executive Officer; |

| |

• | results of operations of start-up businesses that support our initiatives, including our foundry business; and |

| |

• | acquisition-related costs, including amortization and any impairment of acquisition-related intangibles and goodwill. |

The CODM does not evaluate operating segments using discrete asset information. Operating segments do not record inter-segment revenue. We do not allocate gains and losses from equity investments, interest and other income, or taxes to operating segments. Although the CODM uses operating income to evaluate the segments, operating costs included in one segment may benefit other segments. Except for these differences, the accounting policies for segment reporting are the same as for Intel as a whole.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

We have allocated the remaining unallocated goodwill in "all other" from acquisitions completed in 2016 to our non-reportable operating segments.

Net revenue and operating income (loss) for each period were as follows:

|

| | | | | | | | |

| | Three Months Ended |

(In Millions) | | Apr 1,

2017 | | Apr 2,

2016 |

Net revenue: | | | | |

Client Computing Group | | | | |

Platform | | $ | 7,397 |

| | $ | 7,199 |

|

Other | | 579 |

| | 350 |

|

| | 7,976 |

| | 7,549 |

|

Data Center Group | | | | |

Platform | | 3,879 |

| | 3,707 |

|

Other | | 353 |

| | 292 |

|

| | 4,232 |

| | 3,999 |

|

Internet of Things Group | | | | |

Platform | | 632 |

| | 571 |

|

Other | | 89 |

| | 80 |

|

| | 721 |

| | 651 |

|

Non-Volatile Memory Solutions Group | | 866 |

| | 557 |

|

Intel Security Group | | 534 |

| | 537 |

|

Programmable Solutions Group | | 425 |

| | 359 |

|

All other | | 42 |

| | 50 |

|

Total net revenue | | $ | 14,796 |

| | $ | 13,702 |

|

Operating income (loss): | | | | |

Client Computing Group | | $ | 3,031 |

| | $ | 1,885 |

|

Data Center Group | | 1,487 |

| | 1,764 |

|

Internet of Things Group | | 105 |

| | 123 |

|

Non-Volatile Memory Solutions Group | | (129 | ) | | (95 | ) |

Intel Security Group | | 95 |

| | 85 |

|

Programmable Solutions Group | | 92 |

| | (200 | ) |

All other | | (1,082 | ) | | (994 | ) |

Total operating income | | $ | 3,599 |

| | $ | 2,568 |

|

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 4: Earnings Per Share

We computed basic earnings per share of common stock based on the weighted average number of shares of common stock outstanding during the period. We computed diluted earnings per share of common stock based on the weighted average number of shares of common stock outstanding plus potentially dilutive shares of common stock outstanding during the period.

|

| | | | | | | | |

| | Three Months Ended |

(In Millions, Except Per Share Amounts) | | Apr 1,

2017 | | Apr 2,

2016 |

Net income available to common stockholders | | $ | 2,964 |

| | $ | 2,046 |

|

Weighted average shares of common stock outstanding—basic | | 4,723 |

| | 4,722 |

|

Dilutive effect of employee equity incentive plans | | 58 |

| | 66 |

|

Dilutive effect of convertible debt | | 100 |

| | 87 |

|

Weighted average shares of common stock outstanding—diluted | | 4,881 |

| | 4,875 |

|

Basic earnings per share of common stock | | $ | 0.63 |

| | $ | 0.43 |

|

Diluted earnings per share of common stock | | $ | 0.61 |

| | $ | 0.42 |

|

Potentially dilutive shares of common stock from employee incentive plans are determined by applying the treasury stock method to the assumed exercise of outstanding stock options, the assumed vesting of outstanding RSUs, and the assumed issuance of common stock under the stock purchase plan. Potentially dilutive shares of common stock for our 2005 debentures are determined by applying the if-converted method. However, as our 2009 debentures require settlement of the principal amount of the debt in cash upon conversion, with the conversion premium paid in cash or stock at our option, potentially dilutive shares of common stock are determined by applying the treasury stock method.

In all periods presented, potentially dilutive securities which would have been antidilutive are insignificant and are excluded from the computation of diluted earnings per share.

In all periods presented, we included our 2009 debentures in the calculation of diluted earnings per share of common stock because the average market price was above the conversion price. We could potentially exclude the 2009 debentures in the future if the average market price is below the conversion price.

Note 5: Other Financial Statement Details

Inventories

|

| | | | | | | | |

(In Millions) | | Apr 1,

2017 | | Dec 31,

2016 |

Raw materials | | $ | 786 |

| | $ | 695 |

|

Work in process | | 3,412 |

| | 3,190 |

|

Finished goods | | 1,603 |

| | 1,668 |

|

Total inventories | | $ | 5,801 |

| | $ | 5,553 |

|

Deferred Income

|

| | | | | | | | |

(In Millions) | | Apr 1,

2017 | | Dec 31,

2016 |

Deferred income on shipments of components to distributors | | $ | 1,461 |

| | $ | 1,475 |

|

Deferred income from software, services and other | | 237 |

| | 243 |

|

Current deferred income | | $ | 1,698 |

|

| $ | 1,718 |

|

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Gains (Losses) on Equity Investments, Net

The components of gains (losses) on equity investments, net for each period were as follows: |

| | | | | | | | |

| | Three Months Ended |

(In Millions) | | Apr 1,

2017 | | Apr 2,

2016 |

Share of equity method investee losses, net | | $ | (11 | ) | | $ | (8 | ) |

Impairments | | (48 | ) | | (29 | ) |

Gains on sales, net | | 274 |

| | 96 |

|

Other, net | | 37 |

| | (37 | ) |

Total gains (losses) on equity investments, net | | $ | 252 |

| | $ | 22 |

|

Interest and Other, Net

The components of interest and other, net for each period were as follows: |

| | | | | | | | |

| | Three Months Ended |

(In Millions) | | Apr 1,

2017 | | Apr 2,

2016 |

Interest income | | $ | 76 |

| | $ | 52 |

|

Interest expense | | (146 | ) | | (208 | ) |

Other, net | | 34 |

| | 74 |

|

Total interest and other, net | | $ | (36 | ) | | $ | (82 | ) |

Interest expense in the preceding table is net of $67 million of interest capitalized in the first three months of 2017 ($22 million in the first three months of 2016).

Note 6: Restructuring and Other Charges

|

| | | | |

| | Three Months Ended |

(In Millions) | | Apr 1,

2017 |

2016 Restructuring Program | | $ | (11 | ) |

Other charges | | 91 |

|

Total restructuring and other charges | | $ | 80 |

|

2016 Restructuring Program

In the second quarter of 2016, our management approved and commenced the 2016 Restructuring Program. We expect the program to be substantially complete by the second quarter of 2017.

For further information, see "Note 7: Restructuring and Other Charges" in Part II, Item 8 of our 2016 Form 10-K.

Restructuring and other charges by type for the 2016 Restructuring Program for the period were as follows:

|

| | | | |

| | Three Months Ended |

(In Millions) | | Apr 1,

2017 |

Employee severance and benefit arrangements | | $ | (21 | ) |

Asset impairment and other charges | | 10 |

|

Total restructuring and other charges | | $ | (11 | ) |

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Restructuring and other activity for the 2016 Restructuring Program for the first three months of 2017 was as follows:

|

| | | | | | | | | | | | |

(In Millions) | | Employee Severance and Benefits | | Asset Impairments and Other | | Total |

Accrued restructuring balance as of December 31, 2016 | | $ | 585 |

| | $ | 10 |

| | $ | 595 |

|

Additional accruals | | — |

| | 10 |

| | 10 |

|

Adjustments | | (21 | ) | | — |

| | (21 | ) |

Cash payments | | (108 | ) | | (8 | ) | | (116 | ) |

Non-cash settlements | | — |

| | (1 | ) | | (1 | ) |

Accrued restructuring balance as of April 1, 2017 | | $ | 456 |

| | $ | 11 |

| | $ | 467 |

|

We recorded the additional accruals as restructuring and other charges in the consolidated condensed statement of income and within the "all other" operating segments category. Substantially all of the accrued restructuring balance as of April 1, 2017 is expected to be paid within the next 12 months and was recorded within accrued compensation and benefits on the consolidated condensed balance sheets. Restructuring actions related to this program that were approved in 2016 are expected to impact approximately 15,000 employees.

Other charges

Other charges primarily include costs associated with the Intel Security Group divestiture.

|

| | | | |

| | Three Months Ended |

(In Millions) | | Apr 1,

2017 |

ISecG separation costs | | $ | 73 |

|

Other | | 18 |

|

Total other charges | | $ | 91 |

|

Note 7: Investments

Available-for-Sale Investments

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | April 1, 2017 | | December 31, 2016 |

(In Millions) | | Adjusted Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value | | Adjusted Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Fair Value |

Corporate debt | | $ | 4,396 |

| | $ | 7 |

| | $ | (10 | ) | | $ | 4,393 |

| | $ | 3,847 |

| | $ | 4 |

| | $ | (14 | ) | | $ | 3,837 |

|

Financial institution instruments | | 4,708 |

| | 8 |

| | (10 | ) | | 4,706 |

| | 6,098 |

| | 5 |

| | (11 | ) | | 6,092 |

|

Government debt | | 1,417 |

| | 1 |

| | (7 | ) | | 1,411 |

| | 1,581 |

| | — |

| | (8 | ) | | 1,573 |

|

Marketable equity securities | | 2,649 |

| | 4,182 |

| | — |

| | 6,831 |

| | 2,818 |

| | 3,363 |

| | (1 | ) | | 6,180 |

|

Total available-for-sale investments | | $ | 13,170 |

| | $ | 4,198 |

| | $ | (27 | ) | | $ | 17,341 |

| | $ | 14,344 |

| | $ | 3,372 |

| | $ | (34 | ) | | $ | 17,682 |

|

Government debt includes instruments such as non-U.S. government bonds and U.S. agency securities. Financial institution instruments include instruments issued or managed by financial institutions in various forms such as commercial paper, fixed and floating rate bonds, money market fund deposits, and time deposits. A substantial majority of time deposits were issued by institutions outside the U.S. as of April 1, 2017 (most time deposits were issued by institutions outside the U.S. as of December 31, 2016).

During the first three months of 2017, we sold available-for-sale investments for proceeds of $499 million ($2.9 billion in the first three months of 2016). The gross realized gains on sales of available-for-sale investments were $266 million in the first three months of 2017 ($86 million in the first three months of 2016).

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

The fair value of available-for-sale debt investments, by contractual maturity, as of April 1, 2017, were as follows: |

| | | | |

(In Millions) | | Fair Value |

Due in 1 year or less | | $ | 4,287 |

|

Due in 1–2 years | | 1,647 |

|

Due in 2–5 years | | 3,357 |

|

Due after 5 years | | 145 |

|

Instruments not due at a single maturity date | | 1,074 |

|

Total | | $ | 10,510 |

|

Equity Method Investments

IM Flash Technologies, LLC

Since the inception of IM Flash Technologies, LLC (IMFT) in 2006, Micron Technology, Inc. (Micron) and Intel have jointly developed NAND flash memory and, most recently, 3D XPoint™ technology products. Intel also purchases jointly developed products directly from Micron under certain supply agreements.

As of April 1, 2017, we own a 49% interest in IMFT. The carrying value of our investment was $849 million as of April 1, 2017 ($849 million as of December 31, 2016) and is classified within other long-term assets.

IMFT is a variable interest entity and all costs of IMFT are passed on to Micron and Intel through sale of products or services in proportional share of ownership. Our portion of IMFT costs, primarily related to product purchases and production-related services, was approximately $130 million in the first three months of 2017 (approximately $100 million in the first three months of 2016). The amount due to IMFT for product purchases and services provided was approximately $117 million as of April 1, 2017 (approximately $95 million as of December 31, 2016).

IMFT depends on Micron and Intel for any additional cash needs. Our known maximum exposure to loss approximated the carrying value of our investment balance in IMFT. Except for the amount due to IMFT for product purchases and production-related services, we did not have any additional liabilities recognized on our consolidated condensed balance sheets in connection with our interests in this joint venture as of April 1, 2017. Our potential future losses could be higher than the carrying amount of our investment, as Intel and Micron are liable for other future operating costs or obligations of IMFT. Future cash calls could also increase our investment balance and the related exposure to loss. In addition, because we are currently committed to purchasing 49% of IMFT’s production output and production-related services, we may be required to purchase products at a cost in excess of realizable value.

Cloudera, Inc.

Our investment in Cloudera, Inc. (Cloudera) is accounted for under the equity and cost methods of accounting based on the rights associated with different instruments we own, and is classified within other long-term assets. Our fully diluted ownership interest in Cloudera is 16% as of April 1, 2017. The carrying value of our equity method investment was $215 million and of our cost method investment was $454 million as of April 1, 2017 ($225 million for our equity method investment and $454 million for our cost method investment as of December 31, 2016).

Non-marketable Cost Method Investments

Beijing UniSpreadtrum Technology Ltd.

During 2014, we entered into a series of agreements with Tsinghua Unigroup Ltd. (Tsinghua Unigroup), an operating subsidiary of Tsinghua Holdings Co. Ltd., to, among other things, jointly develop Intel® architecture- and communications-based solutions for phones. We agreed to invest up to 9.0 billion Chinese yuan (approximately $1.5 billion as of the date of the agreement) for a minority stake of approximately 20% of Beijing UniSpreadtrum Technology Ltd., a holding company under Tsinghua Unigroup. During 2015, we invested $966 million to complete the first phase of the equity investment and accounted for our interest using the cost method of accounting.

Trading Assets

Net gains related to trading assets still held at the reporting date were $217 million in the first three months of 2017 (net gains of $243 million in the first three months of 2016). Net losses on the related derivatives were $186 million in the first three months of 2017 (net losses of $234 million in the first three months of 2016).

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 8: Acquisitions and Divestitures

Pending Acquisition of Mobileye

During the first quarter of 2017, we entered into a definitive agreement to acquire Mobileye N.V. (Mobileye). Pursuant to the terms of the agreement, a wholly-owned subsidiary of Intel commenced a tender offer on April 5, 2017 to acquire all of the issued and outstanding ordinary shares of Mobileye for $63.54 per share in cash, representing a fully-diluted equity value of approximately $15.3 billion. The transaction is expected to close within nine months of the date of the definitive agreement and is subject to certain regulatory approvals and customary closing conditions. Mobileye is a global leader in the development of computer vision and machine learning, data analysis, localization and mapping for advanced driver assistance systems and autonomous driving. This acquisition will combine Mobileye’s leading computer vision expertise with Intel’s high-performance computing and connectivity expertise to create automated driving solutions from cloud to car.

Divestiture of Intel Security Group

On September 7, 2016, we announced a definitive agreement with TPG VII Manta Holdings, L.P., now known as Manta Holdings, L.P. (TPG) to transfer certain assets and liabilities relating to ISecG to a newly formed, jointly-owned, separate cybersecurity company, called McAfee. The transaction closed on April 3, 2017, subsequent to the first quarter of 2017.

The transaction is valued at $4.2 billion, for consideration of $3.1 billion and a 49% ownership interest in McAfee. Intel financed $2.2 billion of the consideration and the debt can be refinanced and repaid by McAfee and TPG. TPG owns a 51% ownership interest in McAfee. We will reflect the divestiture in our consolidated condensed financial statements in the second quarter of 2017.

The carrying amounts of the major classes of ISecG assets and liabilities held for sale included the following:

|

| | | | |

(In Millions) | | Apr 1,

2017 |

Accounts receivable | | $ | 280 |

|

Goodwill | | 3,600 |

|

Identified intangible assets | | 966 |

|

Other assets | | 269 |

|

Total assets held for sale | | $ | 5,115 |

|

| | |

Deferred income | | $ | 1,552 |

|

Other liabilities | | 194 |

|

Total liabilities held for sale | | $ | 1,746 |

|

In addition to total assets and liabilities held for sale are currency translation adjustments totaling $507 million. This amount, classified as other comprehensive income, is associated with currency charges on the carrying values of ISecG goodwill and identified intangible assets. We expect to recognize a pre-tax gain of approximately $375 million as well as a provision for taxes charge of approximately $850 million in the second quarter of 2017.

We ceased recording depreciation and amortization on property, plant, and equipment and identified intangible assets, respectively, as of the date the assets triggered held for sale accounting.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 9: Identified Intangible Assets

|

| | | | | | | | | | | | |

| | April 1, 2017 |

(In Millions) | | Gross Assets | | Accumulated

Amortization | | Net |

Acquisition-related developed technology | | $ | 7,340 |

| | $ | (1,992 | ) | | $ | 5,348 |

|

Acquisition-related customer relationships | | 1,340 |

| | (190 | ) | | 1,150 |

|

Acquisition-related brands | | 79 |

| | (16 | ) | | 63 |

|

Licensed technology and patents | | 3,178 |

| | (1,390 | ) | | 1,788 |

|

Identified intangible assets subject to amortization | | 11,937 |

| | (3,588 | ) | | 8,349 |

|

In-process research and development | | 808 |

| | — |

| | 808 |

|

Identified intangible assets not subject to amortization | | 808 |

| | — |

| | 808 |

|

Total identified intangible assets | | $ | 12,745 |

| | $ | (3,588 | ) | | $ | 9,157 |

|

|

| | | | | | | | | | | | |

| | December 31, 2016 |

(In Millions) | | Gross Assets | | Accumulated

Amortization | | Net |

Acquisition-related developed technology | | $ | 7,405 |

| | $ | (1,836 | ) | | $ | 5,569 |

|

Acquisition-related customer relationships | | 1,449 |

| | (260 | ) | | 1,189 |

|

Acquisition-related brands | | 87 |

| | (21 | ) | | 66 |

|

Licensed technology and patents | | 3,285 |

| | (1,423 | ) | | 1,862 |

|

Identified intangible assets subject to amortization | | 12,226 |

| | (3,540 | ) | | 8,686 |

|

In-process research and development | | 808 |

| | — |

| | 808 |

|

Identified intangible assets not subject to amortization | | 808 |

| | — |

| | 808 |

|

Total identified intangible assets | | $ | 13,034 |

| | $ | (3,540 | ) | | $ | 9,494 |

|

Amortization expenses recorded in the consolidated condensed statements of income for each period were as follows:

|

| | | | | | | | | | |

| | | | Three Months Ended |

(In Millions) | | Location | | Apr 1,

2017 | | Apr 2,

2016 |

Acquisition-related developed technology | | Cost of sales | | $ | 209 |

| | $ | 235 |

|

Acquisition-related customer relationships | | Amortization of acquisition-related intangibles | | 35 |

| | 83 |

|

Acquisition-related brands | | Amortization of acquisition-related intangibles | | 3 |

| | 7 |

|

Licensed technology and patents | | Cost of sales | | 74 |

| | 71 |

|

Total amortization expenses | | | | $ | 321 |

| | $ | 396 |

|

We expect future amortization expense for the next five years to be as follows:

|

| | | | | | | | | | | | | | | | | | | | |

(In Millions) | | Remainder of 2017 | | 2018 | | 2019 | | 2020 | | 2021 |

Acquisition-related developed technology | | $ | 592 |

| | $ | 784 |

| | $ | 782 |

| | $ | 750 |

| | $ | 715 |

|

Acquisition-related customer relationships | | 101 |

| | 122 |

| | 121 |

| | 119 |

| | 119 |

|

Acquisition-related brands | | 10 |

| | 13 |

| | 13 |

| | 13 |

| | 14 |

|

Licensed technology and patents | | 205 |

| | 230 |

| | 218 |

| | 193 |

| | 177 |

|

Total future amortization expenses | | $ | 908 |

| | $ | 1,149 |

| | $ | 1,134 |

| | $ | 1,075 |

| | $ | 1,025 |

|

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 10: Other Long-Term Assets

|

| | | | | | | | |

(In Millions) | | Apr 1,

2017 | | Dec 31,

2016 |

Equity method investments | | $ | 1,315 |

| | $ | 1,328 |

|

Non-marketable cost method investments | | 3,418 |

| | 3,098 |

|

Non-current deferred tax assets | | 915 |

| | 907 |

|

Pre-payments for property, plant and equipment | | 419 |

| | 347 |

|

Loans receivable | | 360 |

| | 236 |

|

Reverse repurchase agreements | | — |

| | 250 |

|

Other | | 1,016 |

| | 993 |

|

Total other long-term assets | | $ | 7,443 |

| | $ | 7,159 |

|

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 11: Fair Value

For information about our fair value policies, and methods and assumptions used in estimating the fair value of our financial assets and liabilities, see “Accounting Policies" note and "Fair Value" note in Part II, Item 8 of our 2016 Form 10-K.

Assets and Liabilities Measured and Recorded at Fair Value on a Recurring Basis

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | April 1, 2017 | | December 31, 2016 |

| | Fair Value Measured and Recorded at Reporting Date Using | | | | Fair Value Measured and Recorded at Reporting Date Using | | |

(In Millions) | | Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets | | | | | | | | | | | | | | | | |

Cash equivalents: | | | | | | | | | | | | | | | | |

Corporate debt | | $ | — |

| | $ | 650 |

| | $ | — |

| | $ | 650 |

| | $ | — |

| | $ | 498 |

| | $ | — |

| | $ | 498 |

|

Financial institution instruments | | 1,075 |

| | 528 |

| | — |

| | 1,603 |

| | 1,920 |

| | 811 |

| | — |

| | 2,731 |

|

Government debt | | — |

| | 50 |

| | — |

| | 50 |

| | — |

| | 332 |

| | — |

| | 332 |

|

Reverse repurchase agreements | | — |

| | 1,398 |

| | — |

| | 1,398 |

| | — |

| | 768 |

| | — |

| | 768 |

|

Short-term investments: | | | | | | | | | | | | | | | | |

Corporate debt | | 320 |

| | 1,103 |

| | 6 |

| | 1,429 |

| | 391 |

| | 941 |

| | 6 |

| | 1,338 |

|

Financial institution instruments | | 253 |

| | 1,140 |

| | — |

| | 1,393 |

| | 119 |

| | 1,484 |

| | — |

| | 1,603 |

|

Government debt | | 100 |

| | 136 |

| | — |

| | 236 |

| | 71 |

| | 213 |

| | — |

| | 284 |

|

Trading assets: | | | | | | | | | | | | | | | | |

Asset-backed securities | | — |

| | 57 |

| | 6 |

| | 63 |

| | — |

| | 80 |

| | 7 |

| | 87 |

|

Corporate debt | | 2,307 |

| | 598 |

| | — |

| | 2,905 |

| | 2,237 |

| | 610 |

| | — |

| | 2,847 |

|

Financial institution instruments | | 873 |

| | 561 |

| | — |

| | 1,434 |

| | 973 |

| | 671 |

| | — |

| | 1,644 |

|

Government debt | | 2,313 |

| | 2,588 |

| | — |

| | 4,901 |

| | 2,063 |

| | 1,673 |

| | — |

| | 3,736 |

|

Other current assets: | | | | | | | | | | | | | | | | |

Derivative assets | | — |

| | 285 |

| | — |

| | 285 |

| | — |

| | 382 |

| | — |

| | 382 |

|

Loans receivable | | — |

| | 215 |

| | — |

| | 215 |

| | — |

| | 326 |

| | — |

| | 326 |

|

Marketable equity securities | | 6,831 |

| | — |

| | — |

| | 6,831 |

| | 6,180 |

| | — |

| | — |

| | 6,180 |

|

Other long-term investments: | | | | | | | | | | | | | | | | |

Corporate debt | | 1,644 |

| | 664 |

| | 6 |

| | 2,314 |

| | 1,126 |

| | 869 |

| | 6 |

| | 2,001 |

|

Financial institution instruments | | 1,021 |

| | 689 |

| | — |

| | 1,710 |

| | 663 |

| | 1,095 |

| | — |

| | 1,758 |

|

Government debt | | 888 |

| | 237 |

| | — |

| | 1,125 |

| | 681 |

| | 276 |

| | — |

| | 957 |

|

Other long-term assets: | | | | | | | | | | | | | | | | |

Derivative assets | | — |

| | 74 |

| | 9 |

| | 83 |

| | — |

| | 31 |

| | 9 |

| | 40 |

|

Loans receivable | | — |

| | 360 |

| | — |

| | 360 |

| | — |

| | 236 |

| | — |

| | 236 |

|

Total assets measured and recorded at fair value | | 17,625 |

| | 11,333 |

| | 27 |

| | 28,985 |

| | 16,424 |

| | 11,296 |

| | 28 |

| | 27,748 |

|

Liabilities | | | | | | | | | | | | | | | | |

Other accrued liabilities: | | | | | | | | | | | | | | | | |

Derivative liabilities | | — |

| | 304 |

| | — |

| | 304 |

| | — |

| | 371 |

| | — |

| | 371 |

|

Other long-term liabilities: | | | | | | | | | | | | | | | | |

Derivative liabilities | | — |

| | 193 |

| | 30 |

| | 223 |

| | — |

| | 179 |

| | 33 |

| | 212 |

|

Total liabilities measured and recorded at fair value | | $ | — |

| | $ | 497 |

| | $ | 30 |

| | $ | 527 |

| | $ | — |

| | $ | 550 |

| | $ | 33 |

| | $ | 583 |

|

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

During the first three months of 2017, we transferred approximately $736 million of assets from Level 1 to Level 2 of the fair value hierarchy and approximately $762 million of assets from Level 2 to Level 1 ($622 million of assets from Level 1 to Level 2 and $233 million from Level 2 to Level 1 during the first three months of 2016). These transfers were based on changes in market activity for the underlying instruments.

Fair Value Option for Loans Receivable

As of April 1, 2017 and December 31, 2016, the fair value of our loans receivable for which we elected the fair value option did not significantly differ from the contractual principal balance based on the contractual currency.

Assets Measured and Recorded at Fair Value on a Non-Recurring Basis

Our non-marketable equity investments, marketable equity method investments, and non-financial assets, such as intangible assets and property, plant and equipment, are recorded at fair value only if an impairment is recognized.

We classified non-marketable equity investments as Level 3. Impairments recognized on non-marketable equity investments held as of April 1, 2017 were $48 million during the first three months of 2017 (impairments recognized during the first three months of 2016 on non-marketable equity investments held as of April 2, 2016 were insignificant.)

Financial Instruments Not Recorded at Fair Value on a Recurring Basis

The carrying amounts and fair values of financial instruments not recorded at fair value on a recurring basis at the end of each period were as follows: |

| | | | | | | | | | | | | | | | | | | | |

| | April 1, 2017 |

(In Millions) | | Carrying Amount | | Fair Value Measured Using | | Fair Value |

Level 1 | | Level 2 | | Level 3 | |

Grants receivable | | $ | 359 |

| | $ | — |

| | $ | 360 |

| | $ | — |

| | $ | 360 |

|

Loans receivable | | $ | 265 |

| | $ | — |

| | $ | 265 |

| | $ | — |

| | $ | 265 |

|

Non-marketable cost method investments | | $ | 3,418 |

| | $ | — |

| | $ | — |

| | $ | 4,287 |

| | $ | 4,287 |

|

Reverse repurchase agreements | | $ | 250 |

| | $ | — |

| | $ | 250 |

| | $ | — |

| | $ | 250 |

|

Short-term debt | | $ | 5,043 |

| | $ | 3,003 |

| | $ | 2,567 |

| | $ | — |

| | $ | 5,570 |

|

Long-term debt | | $ | 20,678 |

| | $ | 8,618 |

| | $ | 13,425 |

| | $ | — |

| | $ | 22,043 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | December 31, 2016 |

(In Millions) | | Carrying Amount | | Fair Value Measured Using | | Fair Value |

Level 1 | | Level 2 | | Level 3 | |

Grants receivable | | $ | 361 |

| | $ | — |

| | $ | 362 |

| | $ | — |

| | $ | 362 |

|

Loans receivable | | $ | 265 |

| | $ | — |

| | $ | 265 |

| | $ | — |

| | $ | 265 |

|

Non-marketable cost method investments | | $ | 3,098 |

| | $ | — |

| | $ | — |

| | $ | 3,890 |

| | $ | 3,890 |

|

Reverse repurchase agreements | | $ | 250 |

| | $ | — |

| | $ | 250 |

| | $ | — |

| | $ | 250 |

|

Short-term debt | | $ | 4,609 |

| | $ | 3,006 |

| | $ | 2,114 |

| | $ | — |

| | $ | 5,120 |

|

Long-term debt | | $ | 20,649 |

| | $ | 12,171 |

| | $ | 9,786 |

| | $ | — |

| | $ | 21,957 |

|

The carrying amount and fair value of short-term debt exclude drafts payable.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 12: Other Comprehensive Income (Loss)

The changes in accumulated other comprehensive income (loss) by component and related tax effects in the first three months of 2017 were as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

(In Millions) | | Unrealized Holding Gains (Losses) on Available-for-Sale Investments | | Unrealized Holding Gains (Losses) on Derivatives | | Prior Service Credits (Costs) | | Actuarial Gains (Losses) | | Foreign Currency Translation Adjustment | | Total |

December 31, 2016 | | $ | 2,164 |

| | $ | (259 | ) | | $ | (40 | ) | | $ | (1,240 | ) | | $ | (519 | ) | | $ | 106 |

|

Other comprehensive income (loss) before reclassifications | | 1,098 |

| | 266 |

| | — |

| | (6 | ) | | 1 |

| | 1,359 |

|

Amounts reclassified out of accumulated other comprehensive income (loss) | | (263 | ) | | (1 | ) | | 2 |

| | 22 |

| | — |

| | (240 | ) |

Tax effects | | (292 | ) | | (70 | ) | | — |

| | — |

| | — |

| | (362 | ) |

Other comprehensive income (loss) | | 543 |

| | 195 |

| | 2 |

| | 16 |

| | 1 |

| | 757 |

|

April 1, 2017 | | $ | 2,707 |

| | $ | (64 | ) | | $ | (38 | ) | | $ | (1,224 | ) | | $ | (518 | ) | | $ | 863 |

|

The amounts reclassified out of accumulated other comprehensive income (loss) into the consolidated condensed statements of income for each period were as follows: |

| | | | | | | | | | |

| | | | |

| | Three Months Ended | | |

Comprehensive Income Components | | Apr 1,

2017 | | Apr 2,

2016 | | Location |

Unrealized holding gains (losses)1 on available-for-sale investments: | | | | | | |

| | $ | 263 |

| | $ | 86 |

| | Gains (losses) on equity investments, net |

| | — |

| | (1 | ) | | Interest and other, net |

| | 263 |

| | 85 |

| | |

Unrealized holding gains (losses) on derivatives: | | | | | | |

Foreign currency contracts | | (20 | ) | | (42 | ) | | Cost of sales |

| | (16 | ) | | (10 | ) | | Research and development |

| | (5 | ) | | (4 | ) | | Marketing, general and administrative |

| | 4 |

| | — |

| | Gains (losses) on equity investments, net |

| | 38 |

| | 34 |

| | Interest and other, net |

| | 1 |

| | (22 | ) | | |

Amortization of pension and postretirement benefit components: | | | | | | |

Prior service credits (costs) | | (2 | ) | | (2 | ) | | |

Actuarial gains (losses) | | (22 | ) | | (12 | ) | | |

| | (24 | ) | | (14 | ) | | |

Total amounts reclassified out of accumulated other comprehensive income (loss) | | $ | 240 |

| | $ | 49 |

| | |

| |

1 | We determine the cost of the investment sold based on an average cost basis at the individual security level. |

The amortization of pension and postretirement benefit components are included in the computation of net periodic benefit cost. For further information, see the "Retirement Benefit Plans" note in Part II, Item 8 of our 2016 Form 10-K.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

We estimate that we will reclassify approximately $60 million (before taxes) of net derivative losses included in accumulated other comprehensive income (loss) into earnings within the next 12 months.

Note 13: Derivative Financial Instruments

For information about our derivative policies, see “Accounting Policies" note in Part II, Item 8 of our 2016 Form 10-K.

Volume of Derivative Activity

Total gross notional amounts for outstanding derivatives (recorded at fair value) at the end of each period were as follows:

|

| | | | | | | | | | | | |

(In Millions) | | Apr 1,

2017 | | Dec 31,

2016 | | Apr 2,

2016 |

Foreign currency contracts | | $ | 18,575 |

| | $ | 17,960 |

| | $ | 17,520 |

|

Interest rate contracts | | 14,815 |

| | 14,228 |

| | 11,540 |

|

Other | | 1,357 |

| | 1,340 |

| | 1,210 |

|

Total | | $ | 34,747 |

| | $ | 33,528 |

| | $ | 30,270 |

|

Fair Value of Derivative Instruments in the Consolidated Condensed Balance Sheets

|

| | | | | | | | | | | | | | | | |

| | April 1, 2017 | | December 31, 2016 |

(In Millions) | | Assets 1 | | Liabilities 2 | | Assets 1 | | Liabilities 2 |

Derivatives designated as hedging instruments: | | | | | | | | |

Foreign currency contracts 3 | | $ | 173 |

| | $ | 94 |

| | $ | 21 |

| | $ | 252 |

|

Interest rate contracts | | 2 |

| | 200 |

| | 3 |

| | 187 |

|

Total derivatives designated as hedging instruments | | 175 |

| | 294 |

| | 24 |

| | 439 |

|

Derivatives not designated as hedging instruments: | | | | | | | | |

Foreign currency contracts 4 | | 167 |

| | 200 |

| | 374 |

| | 114 |

|

Interest rate contracts | | 16 |

| | 33 |

| | 15 |

| | 30 |

|

Other | | 10 |

| | — |

| | 9 |

| | — |

|

Total derivatives not designated as hedging instruments | | 193 |

| | 233 |

| | 398 |

| | 144 |

|

Total derivatives | | $ | 368 |

| | $ | 527 |

| | $ | 422 |

| | $ | 583 |

|

| |

1 | Derivative assets are recorded as other assets, current and non-current in the consolidated condensed balance sheets. |

| |

2 | Derivative liabilities are recorded as other liabilities, current and non-current in the consolidated condensed balance sheets. |

| |

3 | The substantial majority of these instruments mature within 12 months. |

| |

4 | The majority of these instruments mature within 12 months. |

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Amounts Offset in the Consolidated Condensed Balance Sheets

The gross amounts of our derivative instruments and reverse repurchase agreements subject to master netting arrangements with various counterparties, and cash and non-cash collateral posted under such agreements at the end of each period were as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | April 1, 2017 |

| | | | | | | | Gross Amounts Not Offset in the Balance Sheet | | |

(In Millions) | | Gross Amounts Recognized | | Gross Amounts Offset in the Balance Sheet | | Net Amounts Presented in the Balance Sheet | | Financial Instruments | | Cash and Non-Cash Collateral Received or Pledged | | Net Amount |

Assets: | | | | | | | | | | | | |

Derivative assets subject to master netting arrangements | | $ | 357 |

| | $ | — |

| | $ | 357 |

| | $ | (243 | ) | | $ | (82 | ) | | $ | 32 |

|

Reverse repurchase agreements | | 1,648 |

| | — |

| | 1,648 |

| | — |

| | (1,648 | ) | | — |

|

Total assets | | 2,005 |

| | — |

| | 2,005 |

| | (243 | ) | | (1,730 | ) | | 32 |

|

Liabilities: | | | | | | | | | | | | |

Derivative liabilities subject to master netting arrangements | | 499 |

| | — |

| | 499 |

| | (243 | ) | | (240 | ) | | 16 |

|

Total liabilities | | $ | 499 |

| | $ | — |

| | $ | 499 |

| | $ | (243 | ) | | $ | (240 | ) | | $ | 16 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2016 |

| | | | | | | | Gross Amounts Not Offset in the Balance Sheet | | |

(In Millions) | | Gross Amounts Recognized | | Gross Amounts Offset in the Balance Sheet | | Net Amounts Presented in the Balance Sheet | | Financial Instruments | | Cash and Non-Cash Collateral Received or Pledged | | Net Amount |

Assets: | | | | | | | | | | | | |

Derivative assets subject to master netting arrangements | | $ | 433 |

| | $ | — |

| | $ | 433 |

| | $ | (368 | ) | | $ | (42 | ) | | $ | 23 |

|

Reverse repurchase agreements | | 1,018 |

| | — |

| | 1,018 |

| | — |

| | (1,018 | ) | | — |

|

Total assets | | 1,451 |

| | — |

| | 1,451 |

| | (368 | ) | | (1,060 | ) | | 23 |

|

Liabilities: | | | | | | | | | | | | |

Derivative liabilities subject to master netting arrangements | | 588 |

| | — |

| | 588 |

| | (368 | ) | | (201 | ) | | 19 |

|

Total liabilities | | $ | 588 |

| | $ | — |

| | $ | 588 |

| | $ | (368 | ) | | $ | (201 | ) | | $ | 19 |

|

We obtain and secure available collateral from counterparties against obligations, including securities lending transactions and reverse repurchase agreements, when we deem it appropriate.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Derivatives in Cash Flow Hedging Relationships

The before-tax net gains or losses, attributed to the effective portion of cash flow hedges, recognized in other comprehensive income (loss), were $266 million net gains in the first three months of 2017 ($243 million net gains in first three months of 2016). Substantially all of our cash flow hedges are foreign currency contracts for first three months of 2017 and 2016.

During the first three months of 2017 and 2016, hedge ineffectiveness and amounts excluded from effectiveness testing were insignificant.

For information on the unrealized holding gains (losses) on derivatives reclassified out of accumulated other comprehensive income into the consolidated condensed statements of income, see "Note 12: Other Comprehensive Income (Loss)."

Derivatives in Fair Value Hedging Relationships

The effects of derivative instruments designated as fair value hedges, recognized in interest and other, net for each period were as follows: |

| | | | | | | | |

| | Three Months Ended |

(In Millions) | | Apr 1,

2017 | | Apr 2,

2016 |

Interest rate contracts | | $ | (14 | ) | | $ | 162 |

|

Hedged items | | 14 |

| | (162 | ) |

Total | | $ | — |

| | $ | — |

|

There was no ineffectiveness during all periods presented in the preceding table.

Derivatives Not Designated as Hedging Instruments

The effects of derivative instruments not designated as hedging instruments on the consolidated condensed statements of income for each period were as follows:

|

| | | | | | | | | | |

| | | | Three Months Ended |

(In Millions) | | Location of Gains (Losses) Recognized in Income on Derivatives | | Apr 1,

2017 | | Apr 2,

2016 |

Foreign currency contracts | | Interest and other, net | | $ | (160 | ) | | $ | (238 | ) |

Other | | Various | | 56 |

| | 4 |

|

Total | | | | $ | (104 | ) | | $ | (234 | ) |

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

Note 14: Employee Equity Incentive Plans

Our equity incentive plans are broad-based, long-term programs intended to attract and retain talented employees and align stockholder and employee interests. The 2006 Equity Incentive Plan has 210 million shares of common stock remaining through June 2018 for future grants.

Share-Based Compensation

Share-based compensation expense recognized was $397 million in the first three months of 2017 ($448 million in the first three months of 2016).

Restricted Stock Unit Awards

Restricted stock unit activity in the first three months of 2017 was as follows:

|

| | | | | | | |

| | Number of RSUs (In Millions) | | Weighted Average Grant-Date Fair Value |

December 31, 2016 | | 106.8 |

| | $ | 28.99 |

|

Granted | | 7.4 |

| | $ | 36.38 |

|

Vested | | (3.4 | ) | | $ | 30.72 |

|

Forfeited | | (2.1 | ) | | $ | 29.35 |

|

April 1, 2017 | | 108.7 |

| | $ | 29.43 |

|

The aggregate fair value of awards that vested in the first three months of 2017 was $172 million, which represents the market value of our common stock on the date that the RSUs vested. The grant-date fair value of awards that vested in first three months of 2017 was $105 million. The number of RSUs vested includes shares of common stock that we withheld on behalf of employees to satisfy the minimum statutory tax withholding requirements. RSUs that are expected to vest are net of estimated future forfeitures.

Stock Purchase Plan

The 2006 Stock Purchase Plan allows eligible employees to purchase shares of our common stock at 85% of the value of our common stock on specific dates. Rights to purchase shares of common stock are granted during the first and third quarters of each year. The 2006 Stock Purchase Plan has 157 million shares of common stock remaining through August 2021 for issuance.

Employees purchased 8 million shares of common stock in the first three months of 2017 for $235 million (9.2 million shares of common stock in the first three months of 2016 for $227 million) under the 2006 Stock Purchase Plan.

Note 15: Contingencies

Legal Proceedings

We are a party to various legal proceedings, including those noted in this section. Although management at present believes that the ultimate outcome of these proceedings, individually and in the aggregate, will not materially harm our financial position, results of operations, cash flows, or overall trends, legal proceedings and related government investigations are subject to inherent uncertainties, and unfavorable rulings or other events could occur. Unfavorable resolutions could include substantial monetary damages. In addition, in matters for which injunctive relief or other conduct remedies are sought, unfavorable resolutions could include an injunction or other order prohibiting us from selling one or more products at all or in particular ways, precluding particular business practices, or requiring other remedies. An unfavorable outcome may result in a material adverse impact on our business, results of operations, financial position, and overall trends. We might also conclude that settling one or more such matters is in the best interests of our stockholders, employees and customers, and any such settlement could include substantial payments. Except as specifically described below, we have not concluded that settlement of any of the legal proceedings noted in this section is appropriate at this time.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

European Commission Competition Matter

In 2001, the European Commission (EC) commenced an investigation regarding claims by Advanced Micro Devices, Inc. (AMD) that we used unfair business practices to persuade customers to buy our microprocessors. We received numerous requests for information and documents from the EC and we responded to each of those requests. The EC issued a Statement of Objections in July 2007 and held a hearing on that Statement in March 2008. The EC issued a Supplemental Statement of Objections in July 2008. In May 2009, the EC issued a decision finding that we had violated Article 82 of the EC Treaty and Article 54 of the European Economic Area Agreement. In general, the EC found that we violated Article 82 (later renumbered as Article 102 by a new treaty) by offering alleged "conditional rebates and payments" that required our customers to purchase all or most of their x86 microprocessors from us. The EC also found that we violated Article 82 by making alleged "payments to prevent sales of specific rival products." The EC imposed a fine in the amount of €1.1 billion ($1.4 billion as of May 2009), which we subsequently paid during the third quarter of 2009, and ordered us to "immediately bring to an end the infringement referred to in" the EC decision.

The EC decision contained no specific direction on whether or how we should modify our business practices. Instead, the decision stated that we should "cease and desist" from further conduct that, in the EC's opinion, would violate applicable law. We took steps, which are subject to the EC's ongoing review, to comply with that decision pending appeal. We had discussions with the EC to better understand the decision and to explain changes to our business practices.

We appealed the EC decision to the Court of First Instance (which has been renamed the General Court) in July 2009. The hearing of our appeal took place in July 2012. In June 2014, the General Court rejected our appeal in its entirety. In August 2014, we filed an appeal with the European Court of Justice. In November 2014, Intervener Association for Competitive Technologies filed comments in support of Intel’s grounds of appeal. The EC and interveners filed briefs in November 2014, we filed a reply in February 2015, and the EC filed a rejoinder in April 2015. The Court of Justice held oral argument in June 2016. In October 2016, Advocate General Wahl, an advisor to the Court of Justice, issued a non-binding advisory opinion which favored Intel on a number of grounds, with the 25-judge grand chamber’s decision expected in 2017.

Shareholder Derivative Litigation regarding In re High Tech Employee Antitrust Litigation

In March 2014, the Police Retirement System of St. Louis (PRSSL) filed a shareholder derivative action in the Superior Court of California in Santa Clara County against Intel, certain current and former members of our Board of Directors, and former officers. The complaint alleges that the defendants breached their duties to the company by participating in, or allowing, purported antitrust violations, which were alleged in a now-settled antitrust class action lawsuit captioned In re High Tech Employee Antitrust Litigation claiming that Intel, Adobe Systems Incorporated, Apple Inc., Google Inc., Intuit Inc., Lucasfilm Ltd., and Pixar conspired to suppress their employees’ compensation. In March 2014, a second plaintiff, Barbara Templeton, filed a substantially similar derivative suit in the same court. In May 2014, a third shareholder, Robert Achermann, filed a substantially similar derivative action in the same court. The court consolidated the three actions into one, which is captioned In re Intel Corporation Shareholder Derivative Litigation. Plaintiffs filed a consolidated complaint in July 2014. In August 2015, the court granted our motion to dismiss the consolidated complaint. The plaintiffs thereafter filed a motion for reconsideration and a motion for new trial, both of which the court denied in October 2015. In November 2015, plaintiffs PRSSL and Templeton appealed the court's decision.

In June 2015, the International Brotherhood of Electrical Workers (IBEW) filed a shareholder derivative action in the Chancery Court in Delaware against Intel, certain current and former members of our Board of Directors, and former officers. The lawsuit makes allegations substantially similar to those in the California shareholder derivative litigation described above, but additionally alleges breach of the duty of disclosure with respect to In re High Tech Employee Antitrust Litigation and that Intel's 2013 and 2014 proxy statements misrepresented the effectiveness of the Board’s oversight of compliance issues at Intel and the Board’s compliance with Intel’s Code of Conduct and Board of Director Guidelines on Significant Corporate Governance Issues. In October 2015, the court stayed the IBEW lawsuit for six months pending further developments in the California case. In March 2016, Intel and IBEW entered into a stipulated dismissal pursuant to which IBEW dismissed its complaint but may re-file upon the withdrawal or final resolution of the appeal in the PRSSL California shareholder derivative litigation.

INTEL CORPORATION

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS — Unaudited (Continued)

In April 2016, John Esposito filed a shareholder derivative action in the Superior Court of California in Santa Clara County against Intel, current members of our Board, and certain former officers and employees. Esposito made a demand on our Board in 2013 to investigate whether our officers or directors should be sued for their participation in the events described in In re High Tech Employee Antitrust Litigation. In November 2015, our Board decided not to take further action on Esposito’s demand based on the recommendation of the Audit Committee of the Board after its investigation of relevant facts and circumstances. Esposito seeks to set aside such decision, and alleges that the Board was not disinterested in making that decision and that the investigation was inadequate. In August 2016, Intel filed a motion to dismiss Esposito’s complaint. In November 2016, the court granted Intel’s motion to dismiss the case, without leave to amend. Esposito may appeal this decision.

McAfee, Inc. Shareholder Litigation

On August 19, 2010, we announced that we had agreed to acquire all of the common stock of McAfee, Inc. (McAfee) for $48.00 per share. Four McAfee shareholders filed putative class-action lawsuits in Santa Clara County, California Superior Court challenging the proposed transaction. The cases were ordered consolidated in September 2010. Plaintiffs filed an amended complaint that named former McAfee board members, McAfee, and Intel as defendants, and alleged that the McAfee board members breached their fiduciary duties and that McAfee and Intel aided and abetted those breaches of duty. The complaint requested rescission of the merger agreement, such other equitable relief as the court may deem proper, and an award of damages in an unspecified amount. In June 2012, the plaintiffs’ damages expert asserted that the value of a McAfee share for the purposes of assessing damages should be $62.08.

In January 2012, the court certified the action as a class action, appointed the Central Pension Laborers’ Fund to act as the class representative, and scheduled trial to begin in January 2013. In March 2012, defendants filed a petition with the California Court of Appeal for a writ of mandate to reverse the class certification order; the petition was denied in June 2012. In March 2012, at defendants’ request, the court held that plaintiffs were not entitled to a jury trial and ordered a bench trial. In April 2012, plaintiffs filed a petition with the California Court of Appeal for a writ of mandate to reverse that order, which the court of appeal denied in July 2012. In August 2012, defendants filed a motion for summary judgment. The trial court granted that motion in November 2012, and entered final judgment in the case in February 2013. In April 2013, plaintiffs appealed the final judgment. Intel, McAfee, and McAfee’s board of directors filed an opposition to plaintiff’s appeal in December 2014. Because the resolution of the appeal may materially impact the scope and nature of the proceeding, we are unable to make a reasonable estimate of the potential loss or range of losses, if any, arising from this matter. We dispute the class-action claims and intend to continue to defend the lawsuit vigorously.

| |

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is provided in addition to the accompanying consolidated condensed financial statements and notes to assist readers in understanding our results of operations, financial condition, and cash flows. MD&A is organized as follows:

| |