UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| GRIFFON CORPORATION |

(Name of Registrant as Specified in Its Charter) |

VOSS VALUE MASTER FUND, LP VOSS VALUE-ORIENTED SPECIAL SITUATION FUND, LP VOSS ADVISORS GP, LLC VOSS CAPITAL, LLC TRAVIS W. COCKE H. C. CHARLES DIAO LEVIATHAN WINN |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED DECEMBER 29, 2021

VOSS VALUE MASTER FUND, LP

__________________, 2022

Dear Fellow Stockholders:

Voss Value Master Fund, LP, a Cayman Islands limited partnership (“Voss Value Master Fund”), and the other participants in this solicitation (collectively, the “Voss Group,” “we” or “us”) is a stockholder of Griffon Corporation, a Delaware corporation (“GFF” or the “Company”), who beneficially own, in the aggregate, 1,304,122 shares of common stock, $0.25 par value per share (the “Common Stock”), of the Company, representing approximately 2.3% of the outstanding shares of Common Stock. For the reasons set forth in the attached Proxy Statement, we believe meaningful changes to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that the Company is being run in a manner consistent with your best interests. We are seeking your support for the election of our two (2) nominees as Class III directors at the annual meeting of stockholders scheduled to be held February 17, 2022 at Dechert LLP’s offices located at 1095 Avenue of the Americas, New York, NY 10036, at 10:00 a.m. Eastern Standard Time (including any adjournments, postponements or continuations thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”).

We are seeking to refresh the Board with two truly independent, highly qualified directors who are committed to dissolving GFF's outdated conglomerate structure while serving the best interests of all stockholders in the boardroom. It appears that the Board has allowed Chairman and Chief Executive Officer Ronald Kramer to exert outsized influence over the Company for more than a decade. The Company’s recently announced agreement to acquire Hunter Fan Company is the latest example of decision-making at GFF that we believe shows a disregard for the best interests of stockholders. We believe that the Board will benefit from the addition of independent directors with relevant skill sets and a shared objective of enhancing value for the benefit of all GFF stockholders. The individuals that we have nominated are highly-qualified, capable and ready to work collaboratively with their fellow directors to serve the best interests of all stockholders of GFF.

In light of the Company’s poor financial and stock price underperformance under the oversight of the current Board, we strongly believe that the Board must be refreshed to ensure that the interests of the stockholders, the true owners of GFF, are appropriately represented in the boardroom. We believe that the Board will benefit from our nominees’ financial expertise and track records of value creation.

The Company has a classified Board, which is currently divided into three (3) classes. There are currently 14 directors serving on the Board. We believe the terms of four (4) Class III directors expire at the Annual Meeting. Through the attached Proxy Statement and enclosed BLUE proxy card, we are not only soliciting proxies to elect only our two (2) nominees, but also the candidates who have been nominated by the Company other than Louis J. Grabowsky and Robert F. Mehmel. This gives stockholders who wish to vote for our nominees the ability to vote for a full slate of four nominees in total. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. Your vote to elect our nominees will have the legal effect of replacing two incumbent directors with our nominees. There is no assurance that any of the Company’s nominees will serve as directors if all or some of the nominees are elected. If elected, our nominees will constitute a minority on the Board and there can be no guarantee that our nominees will be able to implement any actions that they may believe are necessary to unlock stockholder value.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed BLUE proxy card today. The attached Proxy Statement and the enclosed BLUE proxy card are first being mailed to stockholders on or about [______], 2022.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated BLUE proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, which is assisting us, at its address and toll-free numbers listed below.

| Thank you for your support, | |

| Voss Value Master Fund, LP | |

| Travis W. Cocke |

|

If you have any questions, require assistance in voting your BLUE proxy card, or need additional copies of the Voss Group’s proxy materials, please contact Saratoga at the phone numbers listed below.

Stockholders call toll free at (888) 368-0379 Email: info@saratogaproxy.com

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED DECEMBER 29, 2021

2022 ANNUAL MEETING OF STOCKHOLDERS

OF

GRIFFON CORPORATION

_________________________

PROXY STATEMENT

OF

VOSS MASTER VALUE FUND LP

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE PROXY CARD TODAY

Voss Value Master Fund, LP, a Cayman Islands limited partnership (“Voss Value Master Fund”), and the other participants in this solicitation (collectively, the “Voss Group,” “we” or “us”) are stockholders of Griffon Corporation, a Delaware corporation (“GFF” or the “Company”), who beneficially own, in the aggregate, 1,304,122 shares of common stock, $0.25 par value per share (the “Common Stock”), of the Company, representing approximately 2.3% of the outstanding shares of Common Stock. We believe that the Board of Directors of the Company (the “Board”) must be meaningfully refreshed to ensure that the best interests of stockholders are appropriately represented in the boardroom. We have nominated directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. This Proxy Statement and the enclosed BLUE proxy card are first being mailed to stockholders on or about [____________], 2022. We are seeking your support at the annual meeting of stockholders scheduled to be held February 17, 2022 at Dechert LLP’s offices located at 1095 Avenue of the Americas, New York, NY 10036, at 10:00 a.m. Eastern Standard Time (including any adjournments, postponements or continuations thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

| 1. | To elect the Voss Group’s two (2) director nominees, H. C. Charles Diao and Leviathan Winn (each a “Nominee” and, collectively, the “Nominees”), to the Board as Class III directors to serve until either (a) if the Declassification Proposal (defined below) is approved, the 2023 annual meeting of stockholders or until their respective successors are duly elected and qualified or (b) if the Declassification Proposal is not approved, the 2025 annual meeting of stockholders or until their respective successors are duly elected and qualified; |

| 2. | To conduct an advisory vote on the compensation of the Company’s executive officers (the “Say-on-Pay Proposal”); |

| 3. | To approve an amendment to the Company’s Certificate of Incorporation (as amended prior to the date hereof, the “Charter”) to phase out the classified structure of the Board (the “Declassification Proposal”); |

| 4. | To approve an amendment to the Charter to reduce the percentage of outstanding voting power required to call a special meeting (the “Special Meeting Request Reduction Proposal”); |

| 5. | To approve an amendment and restatement to the Company’s 2016 Equity Incentive Plan; |

| 6. | To ratify the selection by the Company’s Audit Committee of Grant Thornton LLP to serve as the Company’s independent registered public accounting firm for the Company’s fiscal year ending September 30, 2022; and |

| 7. | To transact any other matters that properly come before the Annual Meeting. |

The Board is currently composed of fourteen directors, divided into three classes. Through this Proxy Statement, we are soliciting proxies to elect not only our two Nominees, but also the candidates who have been nominated by the Company, other than Louis J. Grabowsky and Robert F. Mehmel. This gives stockholders who wish to vote for our Nominees the ability to vote for all four Class III directorships up for election. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. Your vote to elect our Nominees will have the legal effect of replacing two incumbent directors with our Nominees. If elected, our Nominees will constitute a minority on the Board and there can be no guarantee that our Nominees will be able to implement the actions that they believe are necessary to unlock stockholder value. However, we believe the election of our Nominees is an important step in the right direction for enhancing long-term value at the Company.

As of the date hereof, Voss Value Master Fund, Voss Value-Oriented Special Situations Fund, LP, a Delaware limited partnership (Voss Value Special Situations Fund), Voss Advisors GP, LLC, a Texas limited liability company (“Voss GP”), Voss Capital, LLC, a Texas limited liability company (“Voss Capital”) and Travis W. Cocke (collectively the “Voss Group”) and each of the Nominees (each a “Participant” and collectively, the “Participants”), collectively beneficially own 1,304,122 shares of Common Stock (the “Voss Group Shares”). We intend to vote such shares FOR the election of the Nominees, [FOR / AGAINST] approval of the advisory vote on the compensation of the Company’s named executive officers, FOR the Declassification Proposal, FOR the Special Meeting Request Reduction Proposal, [FOR / AGAINST] approval of the amendment and restatement to the Company’s 2016 Equity Incentive Plan, and FOR the ratification of the selection of Grant Thornton LLP as the Company’s independent registered public accounting firm for the Company’s fiscal year ending September 30, 2022, as described herein.

The Company has set the close of business on December 28, 2021 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 712 Fifth Ave, 18th Floor, New York, NY 10019. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were 56,303,873 shares of Common Stock outstanding.

THIS SOLICITATION IS BEING MADE BY THE VOSS GROUP AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH THE VOSS GROUP IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

THE VOSS GROUP URGES YOU TO SIGN, DATE AND RETURN THE BLUE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

| 2 |

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED BLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our BLUE proxy card are available at [_______]

______________________________

| 3 |

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. The Voss Group urges you to sign, date, and return the enclosed BLUE proxy card today to vote FOR the election of the Nominees and in accordance with the Voss Group’s recommendations on the other proposals on the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed BLUE proxy card and return it to the Voss Group, c/o Saratoga Proxy Consulting LLC (“Saratoga”), in the enclosed postage-paid envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a BLUE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, if you wish to vote, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the Company’s proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our two (2) Nominees only on our BLUE proxy card. So please make certain that the latest dated proxy card you return is the BLUE proxy card.

| 4 |

|

If you have any questions, require assistance in voting your BLUE proxy card, or need additional copies of the Voss Group’s proxy materials, please contact Saratoga at the phone numbers listed below.

Stockholders call toll free at (888) 368-0379 Email: info@saratogaproxy.com

|

| 5 |

BACKGROUND TO THE SOLICITATION

The following is a chronology of material events leading up to this proxy solicitation:

| · | In July 2021, the Voss Group began researching the Company concerning a potential investment. |

| · | In August 2021, the Voss Group began to establish a substantial investment in GFF, eventually becoming one of the Company’s largest stockholders, based on its belief that the Company’s non-synergistic collection of businesses is severely undervalued and suffering from a conglomerate discount, which issues are further exacerbated by bloated costs and poor corporate governance practices. |

| · | On September 2, 2021, Travis Cocke, Founder and Chief Investment Officer of Voss Capital, attempted to contact Company management in an effort to schedule a meeting to discuss the Voss Group’s concerns regarding the Company. |

| · | On September 7, 2021, after receiving no response, Mr. Cocke followed-up with the Company concerning a potential meeting. |

| · | On September 8, 2021, Michael Hansen, the Company’s Vice President of Corporate Strategy and Development, replied to Mr. Cocke, and scheduled a telephone call for September 9, 2021. |

| · | On September 9, 2021, representatives of the Voss Group had a telephone call with Mr. Hansen. During the call, representatives of the Voss Group indicated that GFF was not receiving the credit it deserved in the market for its individual businesses, to which Mr. Hansen agreed. In addition, representatives of the Voss Group raised the prospect of selling the Company’s Defense Electronics business, Telephonics, given the lack of strategic rationale in relation to the Company’s other business units. During the call, Mr. Hansen emphasized that various members of the management team, including Mr. Hansen himself, had previous experience in the defense industry and that the Defense Electronics business was “near and dear” to him, suggesting that management may have been holding on to the business for sentimental and/or entrenchment reasons. |

| · | On September 27, 2021, the Company announced that it had hired Lazard Ltd., a financial advisory and asset management firm, and would begin to explore strategic alternatives for the Defense Electronics business. |

| · | On October 5, 2021, representatives of the Voss Group requested a call with Ronald J. Kramer, the Company’s Chief Executive Officer and Chairman of the Board, and Brian Harris, the Company’s Chief Financial Officer. The Company informed the Voss Group that it was in a “quiet period” and would be unable to speak with us until mid-November. Representatives of the Voss Group replied that we were not looking to discuss the quarterly results, but rather would like to discuss corporate governance issues and corporate strategy before November, given the timing of the upcoming Annual Meeting. |

| 6 |

| · | On October 20, 2021, representatives of the Voss Group had a telephone call with Mr. Kramer. Mr. Kramer began the conversation by discussing the existing stockholder base and suggested that the Board would win a potential proxy contest with the Voss Group. We found Mr. Kramer’s immediate expectation of a proxy contest surprising, as we had not expressed an intention to launch a proxy contest. During the call, representatives of the Voss Group proposed a path to creating significant stockholder value by selling certain of the Company’s individual businesses. Representatives of the Voss Group explained its view that several of the Company’s businesses were severely undervalued in the public market, due to poor corporate governance practices coupled with a steep conglomerate discount. Mr. Kramer indicated agreement that certain businesses were not being valued properly and even stated that the Home and Building Products business alone could recoup GFF’s entire enterprise value in a sale, at valuation multiples in line with recent similar transactions. Mr. Kramer also disclosed that he had been receiving various calls from investment banks interested in pursuing such transactions. Despite these admissions of a clear value creation opportunity for stockholders, Mr. Kramer reaffirmed that his current strategy was for GFF to acquire even more businesses. Mr. Kramer seemed particularly defensive when representatives of the Voss Group raised their legitimate concerns regarding GFF’s corporate governance and implied that he viewed Board members as his “employees”, and how he picked the most recent directors himself. Lastly, Mr. Kramer requested that the Voss Group provide a referenced presentation detailing its suggestions regarding strategies to increase stockholder value. Later that day, representatives of the Voss Group emailed Mr. Kramer thanking him for the meeting and sent him the requested presentation. Representatives of the Voss Group also requested an introduction to Thomas Brosig, Chair of the Nominating and Corporate Governance Committee (the “NCGC”). |

| · | On October 25, 2021, Mr. Kramer emailed representatives of the Voss Group confirming receipt of the presentation and indicated that he agreed that the stock was undervalued. He disagreed with our comments on the poor corporate governance and excessive management compensation but did not elaborate on why. Mr. Kramer emphasized that he had received overwhelming support from stockholders over the course of his tenure as Chief Executive Officer. In the email, Mr. Kramer also introduced the Voss Group to Seth Kaplan, the Company’s Corporate Secretary. |

| · | On October 28, 2021, the Voss Group delivered a nomination notice to the Company, nominating a slate of three highly-qualified candidates for election to the Board. |

| · | On November 9, 2021, representatives of the Voss Group traveled to New York to meet in person with three GFF Board members, including Mr. Brosig, Henry Alpert, chair of the Compensation Committee, and Kevin Sullivan, the Lead Independent Director (the “November 9 Meeting”). Similar to the Voss Group’s previous interactions with Mr. Kramer, the Board members began the meeting defensively, emphasizing that insiders and the employee stock ownership plan (the “ESOP”) controlled approximately 25% of the Company’s shares, implying a proxy contest would be difficult, if not futile. However, it appeared that at the time in question, insiders and the ESOP only owned approximately 14% of shares outstanding. During the November 9 Meeting, several of the Company’s responses concerned us, in particular, that the directors could not describe the expenses included in unallocated corporate expenses and could not explain the incentive compensation metrics for the three segment Presidents. The directors went on to indicate that they saw nothing subpar about GFF’s corporate governance, despite the presence of a classified board structure and a unified Chairman and CEO, both of which are indications of poor corporate governance. Representatives of the Company agreed to send representatives of the Voss Group the compensation metrics of the Presidents of the individual business segments, the Company’s return on invested capital at the segment level, and a breakdown of the unallocated corporate costs. Representatives of the Company requested that the Voss Group provide more details regarding the Nominees and also requested a written cooperation agreement focused on improving corporate governance at GFF. |

| 7 |

| · | On November 12, 2021, in the spirit of working collaboratively with the Company to improve corporate governance and unlock value for stockholders, representatives of the Voss Group sent representatives of the Company a term sheet for a proposed cooperation agreement (the “Cooperation Agreement Term Sheet”). Pursuant to the Cooperation Agreement Term Sheet, the Voss Group would be entitled to designate two directors for election to the Board at the 2022 Annual Meeting, and the Company, in collaboration with the Voss Group, would appoint a mutually agreeable independent director prior to April 30, 2022, at which time an additional incumbent director would resign from the Board. The Cooperation Agreement Term Sheet also contemplated that the size of the Board would also be reduced from 14 members to 12 members and that the Company would undertake certain actions to enhance corporate governance, including the separation of the Chairman and CEO roles, declassification of the Board, elimination of the supermajority voting requirements to amend the Company’s Restated Certificate of Incorporation, and the reduction of the threshold for stockholders to call a special meeting from 66 2/3% to 15% of the outstanding shares. |

| · | On November 14, 2021, Mr. Kaplan sent an email to representatives of the Voss Group acknowledging receipt of the proposed term sheet and confirming that it had been sent to the Board. |

| · | On November 15, 2021, representatives of the Voss Group sent certain additional information concerning the Nominees’ background information, as requested by the Company at the November 9 Meeting. |

| · | On November 16, 2021, the Company issued a press release (the “November 16 Press Release”), announcing their Q4 2021 earnings and proposing modest corporate governance changes. The proposed corporate governance reforms included elements of changes the Voss Group had requested in the Cooperation Agreement Term Sheet and during the course of its dialogue with the Board. In particular, the Company announced that it would take actions to declassify the Board over the next three years, lower the threshold for stockholders to call a special meeting and increase Board diversity by 2025. These changes were a clear response to issues the Voss Group had raised privately, but we do not believe they go far enough to fully correct the Company’s poor corporate governance practices. |

| · | On November 17, 2021, representatives of the Voss Group contacted Mr. Kaplan by email and expressed their disappointment that the Board never replied to their communications regarding the Cooperation Agreement Term Sheet and did not send the information requested at the November 9 Meeting, despite the Voss Group following through with its commitments. Representatives of the Voss Group again reiterated its strong preference to continue to negotiate privately with the Company. |

| · | On November 18, 2021, Mr. Kaplan responded to representatives of the Voss Group via email notifying them that the Voss Group’s previous email had been shared with the Board. Mr. Kaplan also informed the Voss Group that in the Company’s view, the Board’s announced corporate governance changes were not a response to the Voss Group’s suggestions, which we believe is highly unlikely, given that the Voss Group had proposed similar changes on various occasions and there had been no indication of any impending changes until the November 16 Press Release. |

| · | Between November 19, 2021 and November 23, 2021, the NCGC met virtually with the Nominees. The Voss Group was disappointed to learn, based on feedback from these meetings, that the NCGC appeared unprepared for and/or did not appear to take the meetings seriously. For instance, a member of the NCGC appeared to be unaware of the identity of Nominees, at one point asking Mr. Winn how he knew Mr. Winn. |

| 8 |

| · | On November 23, 2021, after failing to receive the information the Board agreed to provide to the Voss Group at the November 9 Meeting and receiving no response to the Cooperation Agreement Term Sheet, the Voss Group felt compelled to issue a public letter to the Board and all stockholders disclosing its nominations. In the letter, the Voss Group publicly announced that it had attempted to work collaboratively with the Company to unlock value for stockholders and highlighted the numerous corporate governance issues at the Company, the poor historical stockholder returns, and the highly concerning management compensation. The Voss Group also announced that it had nominated Board candidates for election at the Annual Meeting. |

| · | Also on November 23, 2021, the Company issued a response to the Voss Group’s public letter, in which it confirmed receipt of the Voss Group’s nominations and disagreed with several of the concerns raised in the Voss Group’s November 23, 2021 press release. In response to the Voss Group highlighting the Company’s poor total stockholder return as compared to its own chosen proxy peer group, the Company was only able to point to their three-year TSR in defense. The Company’s three-year TSR was the only period in the past ten years in which GFF’s TSR was not in the bottom half of their peer group. The Company also allegedly responded to the Voss Group’s concerns with Board independence by stating that it had refreshed six of their directors over the past five years, ignoring the Voss Group’s raised concern that at least half of these recently-appointed “independent” directors were handpicked by Mr. Kramer, raising concerns about their true independence. |

| · | As disclosed in the Company’s preliminary proxy statement, the Board nominated Michelle Taylor for election to the Board at the Annual Meeting on December 17, 2021. |

| · | As disclosed in the Company’s preliminary proxy statement, also on December 17, 2021, the NCGC voted to recommend that Louis J. Grabowsky, Robert F. Mehmel, Ms. Taylor and Cheryl L. Turnbull be nominated by the Company for election to the Board at the Annual Meeting, which the Board later approved. |

| · | On December 20, 2021, the Company issued a press release announcing the acquisition of Hunter Fan Company (“Hunter Fan”) from MidOcean Partners for $845 million. |

| · | Also on December 20, 2021, the Voss Group issued a public release opposing the acquisition of Hunter Fan and raising concerns about the valuation, execution risk and possible conflicts of interest raised by the transaction. In the release, the Voss Group noted that Mr. Sullivan is a Managing Director at MidOcean Partners and is also chair of the Company’s Finance Committee where he is “responsible for reviewing proposed transactions that will materially impact the Company’s capital structure.” In the press release, the Voss Group also announced that it would be submitting a books and records demand to the Company in order to further investigate the facts and circumstances leading up to, and including, the process and diligence that led to the acquisition. |

| · | On December 21, 2021, the Company filed its preliminary proxy statement. |

| · | Also on December 21, 2021, Mr. Kaplan provided a communication to the Nominees informing them of the Board’s decision to nominate Mr. Grabowsky, Mr. Mehmel, Ms. Taylor and Ms. Turnbull for election to the Board at the Annual Meeting. |

| · | On December 23, 2021, the Voss Group delivered two books and records demands pursuant to Section 220 of the Delaware General Corporation Law, (i) demanding certain books and records concerning the process, diligence and entry into the acquisition of Hunter Fan and (ii) demanding certain books and records concerning GFF’s stockholder lists. |

| · | On December 28, 2021 the Company filed its definitive proxy statement. |

| 9 |

| · | On December 29, 2021, the Voss Group delivered a letter to the Company withdrawing the nomination of one of its original three Board candidates. |

| · | Also on December 29, 2021, the Voss Group filed this preliminary proxy statement. |

| 10 |

REASONS FOR THE SOLICITATION

The Voss Group is a significant stockholder of the Company, owning approximately 2.3% of the Company’s outstanding shares of Common Stock. We believe that GFF is deeply undervalued and significant opportunities exist to unlock substantial value for all stockholders. To that end, we are seeking your support to refresh the Board in order to enhance management oversight, ensure a focus on stockholders’ interests in the boardroom and send a message to the Board that stockholders are dissatisfied with the status quo.

Our concerns are centered around GFF’s anemic total shareholder return (“TSR”), subpar returns on capital, poor corporate governance, egregious management compensation and the current M&A strategy – in particular, the recently announced acquisition of Hunter Fan. After analyzing GFF from various perspectives and attempting to substantively engage with the Board without success, we have concluded that a majority of the current Board members appear more interested in entrenching themselves and the management team than looking out for stockholders’ interest. GFF has a collection of attractive businesses that are underperforming their potential and are being significantly undervalued in the public markets, in large part due to an outdated and inefficient conglomerate structure. We believe that the Company should be focused on selling, not buying, assets at this time.

After our initial discussions with the Company, it reactively announced incremental changes to its corporate governance. These do not go nearly far enough to rectify the Company’s existing deficiencies. Its announced changes do not address multiple remaining governance issues, such as the Board’s bloated size, the perceived lack of true Board independence, the separation of the Chairman and CEO roles, and excessive management compensation.

We believe additional Board refreshment is needed to bring new perspectives to the Company’s boardroom and more closely align Board interests with those of its stockholders. GFF’s stockholders deserve to have a responsive Board who understands the levers of value creation and will work tirelessly for all stockholders.

We Are Concerned by the Company’s Persistent Underperformance and Lack of Value Creation

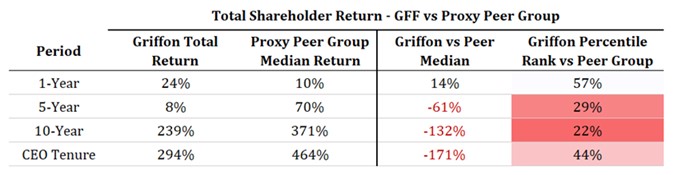

Over the past decade, GFF’s TSR has significantly lagged those of its self-selected peer group, as illustrated by the below table:

|

1 |

1 Source: FactSet. As of December 20th, 2021.

| 11 |

Further, GFF’s TSR has underperformed the S&P 600 by 60% over the past 5 years and 57% over Griffon’s CEO’s nearly 14-year tenure.

|

2 |

We Have Concerns with the Company’s Outsized Management Compensation

We believe the Board has long failed to adequately assert its authority over management. The CEO and Chairman, Mr. Kramer, as well as other executives, routinely receive outsized compensation packages despite mediocre performance. Over the past five years, Mr. Kramer has personally collected well over $74 million,3 and the top four executives combined have received over $118 million.4

Comparing Mr. Kramer’s compensation to the CEOs of the Company’s own selected peer group paints a troubling picture—Mr. Kramer has been paid more than any CEO in GFF’s chosen peer group on a trailing 1-year, 3-year, 5-year, and 10-year average basis. His compensation represents a steadily increasing multiple of the group’s median, which is now in excess of 3.0x. To make matters worse, the Company has selected peers that have, on average, over three times GFF’s market capitalization. On a size-adjusted basis Mr. Kramer is paid 9.1x the peer group average.

We reiterate that Mr. Kramer has received this compensation despite GFF’s TSR badly trailing the median of its peers throughout his entire tenure as CEO.

We Continue to Have Concerns with the Company’s Corporate Governance Practices and Conglomerate Structure

The Company has announced certain actions to improve corporate governance, including the planned declassification of the Board and the reduction of the threshold percentage of shares of common stock required to call a special meeting of stockholders. However, the recent timing of these announcements suggests that they were reactionary and would not have occurred absent our involvement. We had previously raised these very issues with the Board and management during our engagement with them. We believe these incremental changes do not go far enough to adequately address the corporate governance issues at the Company.

2 Source: FactSet. As of December 20th, 2021.

3 Company definitive proxy statements with respect to the annual meetings of stockholders for 2016 through 2021.

4 Company definitive proxy statements with respect to the annual meetings of stockholders for 2016 through 2021.

| 12 |

For example, the Company continues to maintain the following governance mechanics, which we view as stockholder-unfriendly:

| · | Stockholders cannot act by written consent; |

| · | Directors may only be removed for cause; and |

| · | A supermajority vote is required for certain Charter amendments. |

In addition, we believe GFF needs to undertake a comprehensive strategic review, as it owns several attractive businesses whose values, in our view, are depressed by the Company’s outdated conglomerate structure and diluted by its poor corporate governance. The Home and Building Products segment and the Consumer and Professional Products segment have minimal operational overlap and, should be easy to separate.

We Have Significant Concerns with the Company’s Planned Acquisition of Hunter Fan

Instead of meaningfully considering strategic asset sales, the Company has engaged in the exact opposite approach. It recently announced a definitive agreement to acquire Hunter Fan from MidOcean Partners for $845 million. We believe this deal is unattractive and likely to destroy stockholder value. The Company will be paying 9.4x its estimate of Hunter Fan’s fiscal 2023 EBITDA5. However, GFF currently trades at under 8x EV/FY 2023 EBITDA. Given GFF is trading near a 5-year low valuation and building products transaction valuations are hitting record highs, we believe the Company should be selling, not buying, assets.

We believe the Hunter Fan acquisition demonstrates a disregard for stockholders’ best interests. It has heightened execution risk, given the scale and short closing timeframe. This will be the largest acquisition in the Company’s history and is immense relative to the Company’s current size. The $845 million purchase price represents more than 55% of GFF’s current market cap and more than 35% of its enterprise value.6 We believe GFF’s weak TSR and low return on invested capital clearly demonstrate that its management has not earned the right to invest more capital, especially in a new, unrelated business.

We also have serious concerns regarding blatant conflicts of interest implicated by the Hunter Fan acquisition. GFF’s lead “independent” director and Chair of its Finance Committee, Kevin Sullivan, is a Managing Director at MidOcean Partners, the private equity firm who has owned Hunter Fan for 14 years and is rumored to have struggled to sell the company. Mr. Sullivan’s dual roles strike us as an inherent conflict of interest, irrespective of what safeguards GFF might claim were put in place.

In our view, the Hunter Fan acquisition exemplifies the long-standing issues with the current Board and provides yet another reason why stockholders should elect the Voss Group’s qualified nominees at the Company’s upcoming Annual Meeting.

We Believe the Board is Stale and Beholden to Mr. Kramer

Further, we have significant concerns the Board is stale and has allowed Chairman and CEO, Mr. Kramer, to exert outsized influence over the Company. Half of the independent directors are over the age of 70, including several long-tenured directors.

5 In the announcement, GFF estimated that it will be paying “an approximate 9.4 times multiple of EBITDA from the first full fiscal year of operation,” which would be GFF’s FY 2023.

6 Both as of GFF’s closing stock prices as of Friday, Dec. 17, 2021, the last trading day before the deal was announced.

| 13 |

The Company claims to have 12 “independent” directors under the NYSE rules, of which we fear several are independent in name only. According to the Company’s own proxy statements, Mr. Kramer recommended three of the last four “independent” directors added to the Board.

We believe the Board requires truly independent directors who will bring fresh perspectives and experiences to bear in their role as fiduciaries, and who will work proactively and always consider the best interests of stockholders. The Voss Group does not believe GFF’s recent corporate governance maneuvers will meaningfully enhance the Board’s true independence and stockholder alignment. Your vote represents an opportunity to add truly independent directors to the Board who will critically examine GFF’s outdated conglomerate structure and work to realize value for all stockholders.

We Believe There is a Better Path Forward for the Company with the Addition of Our Highly Qualified Nominees

In light of the issues we have summarized herein and our unsuccessful attempts at engaging constructively with the Board to enact much-needed change, we have nominated two independent director candidates who possess valuable management and industry experience and would work to pursue value for all constituencies. We believe that our fellow stockholders deserve a Board who is committed to holding management accountable and to creating enduring value for all stakeholders.

H.C. Charles Diao

Mr. Diao is a veteran director and corporate advisor with extensive public company board experience. If elected to the Board, Mr. Diao would bring valuable financial, operational and management experience to the Company.

| · | Former Senior Vice President of Finance, Corporate Development, and Corporate Treasurer of DXC Technology Company (NYSE: DXC). |

| · | Served as DXC’s Chairman of the Corporate Finance Executive Committee. |

| · | He currently serves on the Board of Directors of Turning Point Brands, Inc. (NYSE: TPB), where he is the Chairman of the Audit Committee and Member of the Nominating, Governance and ESG Committee. |

| · | He has over 20 years of experience as an investment and merchant banker advising and executing an array of corporate actions, including segment spinoffs, acquisitions, and divestitures. |

| · | Holds a B.S.E. from Princeton University and an M.B.A. from Harvard Business School. |

Leviathan Winn

Mr. Winn is a seasoned c-level executive with extensive financial and operations experience. If elected to the Board, Mr. Winn would bring valuable financial, capital allocation and management experience to the Company.

| · | Chief Financial Officer of Zulily, LLC, a subsidiary of Qurate Retail, Inc. (NASDAQ: QRTEA). |

| · | Former Chief Financial Officer of Qdoba Restaurant Corporation, a portfolio company of Apollo Global Management (NYSE: APO). |

| · | Former Chief Financial Officer of Taco Bell Corporation, a fast food subsidiary of Yum! Brands, Inc. (NYSE: YUM). |

| · | Over the course of his career, he worked in various financial and strategic capacities, including serving as Head of Strategic Development in the consumer banking arm of JP Morgan Chase & Co. (NYSE: JPM). |

| · | Holds a M.B.A. from The Wharton School at the University of Pennsylvania and a B.A. in finance, cum laude, from Texas A&M University. |

| 14 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company currently has a classified Board, which is divided into three (3) classes. The directors in each class are elected for staggered terms of three (3) years so that the term of office of one (1) class of directors expires at each annual meeting of stockholders. As disclosed in the Company’s proxy statement, the Company is submitting the Declassification Proposal for approval by stockholders at the Annual Meeting. If approved, effective upon conclusion of the Annual Meeting, the classified Board structure will be phased out commencing upon the Annual Meeting, such that from and after the Annual Meeting, all directors who are up for election at an annual meeting of stockholders will be elected to serve for a term of one year, and the Board will be fully declassified as of the 2024 annual meeting of stockholders.

According to the Company’s proxy statement, the terms of the four (4) Class III directors will expire at the Annual Meeting. We are not only seeking your support at the Annual Meeting to elect our two (2) Nominees, H. C. Charles Diao, and Leviathan Winn, but also the candidates who have been nominated by the Company other than Louis J. Grabowsky and Robert F. Mehmel. This gives stockholders who wish to vote for our Nominees the ability to vote for a full slate of four Class III nominees in total. Your vote to elect the Nominees will have the legal effect of replacing two (2) incumbent directors of the Company with the Nominees. If elected, the Nominees will represent a minority of the members of the Board, and therefore it is not guaranteed that they will be able to implement any actions that they may believe are necessary to enhance stockholder value. There is no assurance that any incumbent director will serve as a director if our Nominees are elected to the Board. You should refer to the Company’s proxy statement for the names, background, qualifications and other information concerning the Company’s nominees.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five (5) years of each of the Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States of America.

| 15 |

H. C. Charles Diao, age 64, currently serves as Managing Director of Diao & Co. LLC (“DiaoCo”), a provider of advisory services, which he founded in 2008. Mr. Diao has served on the board of directors of Turning Point Brands, Inc. (NYSE: TPB) (“Turning Point Brands”), a manufacturer, marketer and distributor of branded consumer products, since 2012. He is the Chairman of the Audit Committee at Turning Point Brands and a member of the Nominating and ESG Committee. Previously, Mr. Diao served as Senior Vice President – Finance, Corporate Development, and Corporate Treasurer of DXC Technology Company (NYSE: DXC) (“DXC”), a global provider of enterprise information technology services, software solutions, and engineering and business processing services, from April 2017 to June 2021. Mr. Diao previously served as Vice President – Finance, Corporate Development, and Corporate Treasurer of Computer Sciences Corporation (formerly NYSE: CSC) (“CSC”), which provided information technology services and digital software solutions to enterprise and public sector institutions, from 2012 until it was merged with HP Enterprise Services to form DXC in April 2017. Mr. Diao led the transaction team that effected the spin-off of DXC’s federal government contracting business to form Perspecta, Inc. (NYSE: PRSP), and previously the spin-off of CSC’s federal contracting business, CS Government Services, and its concurrent merger with SRA International to form CSRA Inc. (formerly NYSE:CSRA). Mr. Diao served on the board of directors of Young Broadcasting Inc., a privately held media company, from 2012 until November 2013 when it merged with its successor Media General, Inc. (formerly NYSE: MEG) (“Media General”), a leading local television broadcasting and digital media company, where he served on the board of directors until January 2017 when Media General was acquired by Nexstar Broadcasting (Nasdaq: NXST). Mr. Diao served as Chairman of Media General’s Nominating and Governance Committee and as a member of the Audit and Compensation Committees. Mr. Diao previously served as Managing Director of DiaoCo and as Chief Investment Officer of Diao Capital Management LLC, which is an affiliate of DiaoCo, from 2008 to 2012. Prior to that, Mr. Diao served in various capacities at Bear, Stearns & Co. (formerly NYSE: BSC), a global investment bank, securities trading and broker firm, including as Senior Managing Director and Group Head - Special Situations Credit and Senior Managing Director of the Telecommunications Group of the Investment Banking Department, from 1996 to 2008. Earlier in his career, Mr. Diao served as Managing Director and Group Head, Telecommunications and Media Group of the Investment Banking Division as well as previously in the merchant banking unit at Prudential Securities (f/k/a Prudential Securities Incorporated), which was the financial services arm of the insurer, Prudential Financial, Inc. (NYSE: PRU), from 1987 to 1996; Chief Financial Officer of Proxy Message Centers, a consolidator in the telemessaging service bureau industry, from 1984 to 1987; President and Founder of American Mobile Cellular Communications Corporation, a reseller and retailer of cellular services and equipment, from 1983 to 1984; and in product planning and business development at the Distribution Equipment Division of General Electric Company (NYSE: GE) from 1979 to 1981. Mr. Diao received an M.B.A. in Finance from the Harvard Graduate School of Business and a B.S.E. in Management Science Engineering from Princeton University.

Voss Value Master Fund believes that Mr. Diao’s extensive senior management experience, along with his financial, operational and management expertise and extensive public company board experience, would make him a valuable addition to the Board.

| 16 |

Leviathan Winn, age 37, currently serves as the Chief Financial Officer of Zulily, LLC, a leading e-commercial retail company that is a brand in the portfolio of Qurate Retail Group (NASDAQ: QRTEA), since November 2021. Mr. Winn previously served as Chief Financial Officer of Qdoba Restaurant Corporation, a chain of fast casual Mexican restaurants and a portfolio company of Apollo Global Management (NYSE: APO) (“Apollo”), from December 2020 to August 2021. Prior to that, Mr. Winn served as Global Chief Financial Officer of Taco Bell Corporation, a fast food subsidiary of Yum! Brands, Inc. (NYSE: YUM), from March 2020 to December 2020. Prior to that, Mr. Winn served as Head of Strategic Development for the Consumer Bank at JPMorgan Chase & Co. (NYSE: JPM), a multinational investment bank and financial services holding company, from November 2018 to March 2020. Previously, Mr. Winn served as a Managing Director at LBC Small Cap Management, an affiliate of LBC Credit Partners that is a leading provider of middle market financing solutions, from September 2016 to September 2018; Strategy, Financial Restructuring and Transformation Consultant at McKinsey & Company, a management consulting firm, from 2013 to 2016; Private Equity Investment Professional and Portfolio Company Chief Financial Officer at Capital Point Partners, L.P., an investment management firm, from 2009 to 2012; Investment Analyst in Asset Management of Private Credit at American International Group, Inc. (NYSE: AIG), a multinational finance and insurance corporation, from 2007 to 2009; and Investment Banker at Citigroup Inc. (NYSE: C), a multinational investment bank and financial services corporation, from 2006 to 2007. Mr. Winn most recently served on the board of directors and Audit Committee for Smart & Final, a former portfolio company of Apollo and one of the longest continuously operating food retailers in the United States, from October 2020 to July 2021. Smart & Final was sold to Bodega Latina Corporation, a subsidiary of publicly traded Mexican retailer Grupo Comercial Chedraui (BMV: CHDRAUI). Mr. Winn received an M.B.A. from The Wharton School at the University of Pennsylvania and B.A. in Finance, cum laude, from Texas A&M University.

Voss Value Master Fund believes that Mr. Winn’s senior management experience in various industries and financial services expertise would make him a valuable addition to the Board.

The principal business address of Mr. Diao is 1100 Brickell Bay Dr., 43E, Miami, Florida 33131. The principal business address of Mr. Winn is 1441 9th Avenue, Unit 706, San Diego, California 92101.

As of the date hereof, none of the Nominees beneficially own any securities of the Company nor have they entered into any transactions in the securities of the Company during the past two years.

On October 28, 2021, the Nominees and the other Participants entered into a Group Agreement (the “Group Agreement”) in connection with the Annual Meeting, pursuant to which, among other things, the parties agreed (i) to solicit proxies or written consents for the election of the Nominees to the Board at the Annual Meeting, (ii) to take such other actions the parties deem necessary or advisable to achieve the foregoing, and (iii) that the Voss Group would bear all expenses incurred in connection with the group’s activities, including approved expenses incurred by any of the parties in connection with the solicitation, subject to certain limitations. Each Nominee may be deemed part of a “group” for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each Nominee disclaims beneficial ownership of the shares of Common Stock reported owned by the other Participants in this solicitation. For information regarding transactions in securities of the Company during the past two years by the Participants, please see Schedule I.

Voss Value Master Fund has signed separate letter agreements (the “Indemnification Agreements”) with each of the Nominees pursuant to which it and its affiliates have agreed to indemnify such Nominees against certain claims arising from the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting and any related transactions. For the avoidance of doubt, such indemnification does not apply to any claims made against such Nominees in their capacities as directors of the Company, if so elected.

Voss Value Master Fund believes that each Nominee presently is, and if elected as a director of the Company, each of the Nominees would be, an “independent director” within the meaning of (i) applicable NYSE listing standards applicable to board composition, including Rule 303A.02 and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, we acknowledge that no director of a NYSE listed company qualifies as “independent” under the NYSE listing standards unless the board of directors affirmatively determines that such director is independent under such standards. Accordingly, we acknowledge that if any Nominee is elected, the determination of the Nominee’s independence under the NYSE listing standards ultimately rests with the judgment and discretion of the Board. No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

| 17 |

Other than as stated herein, there are no arrangements or understandings between the members of the Voss Group and the Nominees or any other person or persons pursuant to which the nomination of the Nominees described herein are to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

We do not expect that any of the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed BLUE proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Company’s Amended and Restated By-laws (the “Bylaws”) and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Common Stock represented by the enclosed BLUE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of the Voss Group that any attempt to increase the size of the current Board or to reconstitute or reconfigure the classes on which the current directors serve, constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE “FOR” THE ELECTION OF THE NOMINEES ON THE ENCLOSED BLUE PROXY CARD.

| 18 |

PROPOSAL NO. 2

ADVISORY VOTE REGARDING THE COMPANY’S EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement, as required by Section 14A of the Exchange Act, the Company is asking stockholders vote to approve, on an advisory (nonbinding) basis, the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2022 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission.”

As disclosed in the Company’s proxy statement, the say-on-pay vote is advisory, and therefore not binding on the Company, the Company’s Compensation Committee (the “Compensation Committee”) or the Board. However, as disclosed in the Company’s proxy statement, to the extent there is any significant vote against the named executive officer compensation, the Board and Compensation Committee will consider the results of the vote in future compensation deliberations.

[WE MAKE NO RECOMMENDATION] WITH RESPECT TO THE SAY-ON-PAY PROPOSAL AND INTEND TO VOTE OUR SHARES “[FOR / AGAINST]” THIS PROPOSAL.

| 19 |

PROPOSAL NO. 3

DECLASSIFICATION PROPOSAL

As discussed in further detail in the Company’s proxy statement, the Charter currently provides that the Board be divided into three classes, with members of each class holding office for staggered three-year terms. The Company is asking stockholders approve at the Annual Meeting an amendment to the Charter to phase out the present three-year, staggered terms of the Company’s directors and instead provide for the annual election of directors (the “Declassification Amendment”).

As more fully described in the Company’s proxy statement, if the Declassification Proposal is adopted and approved by stockholders, the classified structure of the Board would be phased out commencing with the Annual Meeting and would result in the Board being fully declassified (and all members of the Board standing for annual elections) commencing with the 2024 annual meeting of stockholders (the “2024 Annual Meeting”). Under the proposed amendment in the Declassification Proposal, each director elected at the Annual Meeting would be elected for a one-year term expiring at the 2023 annual meeting of stockholders (the “2023 Annual Meeting”), while Class I directors and Class II directors will continue to serve out the remainder of their three-year terms. In addition, each director elected at the 2023 Annual Meeting would be elected for a one-year term expiring at the 2024 Annual Meeting. At the 2024 Annual Meeting, and each annual meeting of stockholders thereafter, all directors would be elected for a one-year term expiring at the next annual meeting of stockholders held after such director’s election.

The foregoing description of the Declassification Amendment is qualified in its entirety to the full text of the Declassification Amendment, which is attached as Annex A to the Company’s proxy statement and incorporated by reference herein.

According to the Company’s proxy statement, if the Declassification Proposal is adopted and approved, the Board will also amend certain provisions of the Bylaws to, among other things, phase out the Board’s classified board structure. According to the Company’s proxy statement, pursuant to the Charter and Delaware law, the amendments to the Bylaws are not subject to stockholder approval.

According to the Company’s proxy statement, pursuant to Article THIRTEENTH of the Company’s Charter, the approval of the Declassification Proposal’s proposed amendment to the Charter requires the affirmative vote of the holders of at least 66-2/3% of the total voting power of all outstanding shares of the Company’s capital stock. According to the Company’s proxy statement, if you fail to vote or fail to instruct your broker or other nominee to vote, abstain from voting on this proposal, it will have the same effect as a vote AGAINST this proposal.

WE RECOMMEND A VOTE “FOR” THE DECLASSIFICATION PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THE DECLASSIFICATION PROPOSAL

| 20 |

PROPOSAL NO. 4

SPECIAL MEETING REQUEST REDUCTION PROPOSAL

As discussed in further detail in the Company’s proxy statement, the Charter and By-laws currently provide that a special meeting of stockholders may be called only by the Chairman of the Board, the Board, or at the written request of stockholders holdings 66-2/3% of the entire voting power of the Company’s capital stock. The Company is asking stockholders approve an amendment to the Charter (the “Special Meeting Charter Amendment”) and an amendment to the Bylaws (the “Special Meeting Bylaw Amendment” and together with the Special Meeting Charter Amendment, the “Special Meeting Amendments”) to reduce the percentage of outstanding shares required to call a special meeting of stockholders.

As more fully described in the Company’s proxy statement, the proposed amendments to the Charter and Bylaws would permit stockholders holding, in the aggregate, a “net long position (as defined in the Company’s proxy statement)” in the Company’s capital stock representing at least 25% of the entire voting power of the Company’s capital stock, subject to certain limitations and procedures described in the Company’s proxy statement.

The foregoing description of the Special Meeting Amendments are qualified in their entirety to the full text of the Special Meeting Charter Amendment, which is attached as Annex B to the Company’s proxy statement and incorporated by reference herein, and the fully text of the Special Meeting Bylaw Amendment, which is attached at Annex C to the Company’s proxy statement and incorporated by reference herein.

According to the Company’s proxy statement, pursuant to Article THIRTEENTH of the Charter, the approval of the Special Meeting Request Reduction Proposal’s proposed amendment to the Charter requires the affirmative vote of the holders of at least 66-2/3% of the total voting power of all outstanding shares of the Company’s capital stock. According to the Company’s proxy statement, if you fail to vote or fail to instruct your broker or other nominee to vote, or abstain from voting on this proposal, it will have the same effect as a vote AGAINST this proposal.

WE RECOMMEND A VOTE “FOR” THE SPECIAL MEETING REQUEST REDUCTION PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THE SPECIAL MEETING REQUEST REDUCTION PROPOSAL

| 21 |

PROPOSAL NO. 5

AMENDMENT AND RESTATEMENT OF 2016 EQUITY INCENTIVE PLAN

As disclosed in the Company’s proxy statement, the Board approved the Griffon Corporation Amended and Restated 2016 Equity Incentive Plan (the “Incentive Plan,” formerly known as the Griffon Corporation 2016 Equity Incentive Plan (the “Prior Incentive Plan”) to increase by 1,000,000, the number of shares of common stock available for future awards of equity-based compensation, and to make certain other changes to the Prior Inventive Plan as further described in the Company’s proxy statement.

As discussed in further detail in the Company’s proxy statement, the Board approved the Incentive Plan, including the increase in shares available for future awards, with the goal of preserving the Company’s flexibility to use equity-based compensation in order to incentivize and attract valued directors, employees and other service providers, and to motivate them to make significant contributions to the Company.

As discussed in further details in the Company’s proxy statement, in addition to increasing the number of shares available for awards of equity-based incentive compensation, the Incentive Plan also revises the Prior Incentive Plan to (i) provide that, except in the case of a participant’s death or disability, the Committee shall not have the authority to accelerate the vesting, exercise, or payment of any award or the performance period for any award, (ii) eliminate references to Code Section 162(m), and (iii) clarify that only the full Board (and not the Board’s Compensation Committee) can approve grants of awards to non-employee directors.

The foregoing description of the Incentive Plan is qualified in its entirety to the full text of the Incentive Plan, a copy of which is attached as Annex D to the Company’s proxy statement and is incorporated by reference herein.

According to the Company’s proxy statement, the approval of stockholders holding a majority of the shares present (in person or by proxy) at the Annual Meeting is required for the Incentive Plan to become effective. According to the Company’s proxy statement, abstentions will be counted and will have the same effect as a vote against the proposal and broker non-votes will be disregarded and will have no effect on the outcome of the vote.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “[FOR / AGAINST]” THIS PROPOSAL.

| 22 |

PROPOSAL NO. 6

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to ratify the Company’s Audit Committee’s appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2022.

As disclosed in the Company’s proxy statement, the Company’s Audit Committee is not bound by the outcome of this vote but will consider the voting results when selecting the Company’s independent auditor for fiscal year 2022. Additional information regarding this proposal is contained the Company’s proxy statement.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE SELECTION OF GRANT THORNTON LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2022, AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

| 23 |

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares after the Record Date. Based on publicly available information, the Voss Group believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Common Stock.

Shares of Common Stock represented by properly executed BLUE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, [FOR / AGAINST] the advisory vote on executive compensation, FOR the Declassification Proposal, FOR the Special Meeting Request Reduction Proposal, [FOR / AGAINST] the 2016 Equity Incentive Plan, and FOR the ratification of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2022, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate four (4) candidates for election as Class III directors at the Annual Meeting. This Proxy Statement is not only soliciting proxies to elect only our two (2) Nominees as directors, but also the candidates who have been nominated by the Company other than Louis J. Grabowsky and Robert F. Mehmel. Stockholders will therefore be able to vote for the total number of directors up for election at the Annual Meeting. Under applicable proxy rules we are required either to solicit proxies only for our Nominees, which could result in limiting the ability of stockholders to fully exercise their voting rights with respect to the Company’s nominees, or to solicit for our Nominees while also allowing stockholders to vote for fewer than all of the Company’s nominees, which enables a stockholder who desires to vote for our Nominees to also vote for certain of the Company’s nominees. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. In the event that some of the Nominees are elected, there can be no assurance that the Company nominee(s) who get the most votes and are elected to the Board will choose to serve as on the Board with the Nominees who are elected. The Participants intend to vote the Voss Group Shares in favor of the Nominee, and the candidates who have been nominated by the Company other than Louis J. Grabowsky and Robert F. Mehmel.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of at least a majority of the outstanding shares of Common Stock as of the Record Date will be considered a quorum for the transaction of business.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under applicable rules, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

If you are a stockholder of record, you must deliver your vote by mail, attend the Annual Meeting in person and vote, vote by Internet or vote by telephone in order to be counted in the determination of a quorum.

| 24 |

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum, but will not be voted on the proposals.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ The Company has adopted a plurality vote standard for director elections, meaning the four candidates receiving the highest number of “FOR” votes will be elected. A properly executed proxy card marked “WITHHOLD” with respect to the election of a director nominee will be counted for purposes of determining if there is a quorum at the Annual Meeting, but will not be considered to have been voted “FOR” the director nominee. According to the Company’s proxy statement, “WITHHOLD” votes and broker non-votes will have no effect on the outcome of the election.

Advisory Vote on Executive Compensation ─ According to the Company’s proxy statement, although the vote is non-binding, approval of the advisory vote on executive compensation requires the favorable vote of a majority of the shares of Common Stock present in person or by proxy and entitled to vote on the matter at the Annual Meeting once a quorum is present. Abstentions will have the same impact as a vote against this proposal. Broker non-votes will have no impact on the outcome of this vote.

Approval of the Charter to Declassify the Board ─ According to the Company’s proxy statement, the favorable vote of two-thirds of the total outstanding shares of common stock is required to approve the Declassification Proposal, therefore, a share not voted, and abstentions and broker non-votes, all have the same effect as a vote “AGAINST” this proposal.

Approval of the Special Meeting Request Reduction Proposal ─ According to the Company’s proxy statement, the favorable vote of two-thirds of the total outstanding shares of common stock is required to approve the Special Meeting Request Reduction Proposal, therefore, a share not voted, and abstentions and broker non-votes, all have the same effect as a vote “AGAINST” this proposal.

Approval of the 2016 Equity Incentive Plan ─ According to the Company’s proxy statement, the favorable vote of a majority of the shares present in person or by proxy and entitled to vote on the matter at the Annual Meeting once a quorum is present is required to approve the amendment and restatement of the 2016 Equity Incentive Plan. According to the Company’s proxy statement, in determining whether this proposal receives the required number of affirmative votes, a vote to abstain will be counted and will have the same effect as a vote “AGAINST” the proposal and broker non-votes will have no impact on the outcome of this vote.

Ratification of the Selection of Accounting Firm ─ According to the Company’s proxy statement, although the vote is non-binding, the affirmative vote of the holders of a majority of the shares present in person or by proxy and entitled to vote on the item will be required for approval is required for approval. According to the Company’s proxy statement, abstentions will have the same impact as a vote “AGAINST” this proposal and broker non-votes will have no impact on the outcome of this vote.

Under applicable New York law, none of the holders of Common Stock is entitled to appraisal rights in connection with any matter to be acted on at the Annual Meeting. If you sign and submit your BLUE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with the Voss Group’s recommendations specified herein and in accordance with the discretion of the persons named on the BLUE proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

| 25 |

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although, attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a revocation or a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to the Voss Group in care of Saratoga at the address set forth on the back cover of this Proxy Statement or to the Secretary of the Company at the Company’s principal executive offices located at 712 Fifth Ave, 18th Floor, New York, NY 10019 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to the Voss Group in care of Saratoga at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares entitled to be voted at the Annual Meeting. Additionally, Saratoga may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED BLUE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

| 26 |

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by the Voss Group. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.