SEC File Nos. 002-33371

811-01880

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

Registration Statement

Under

the Securities Act Of 1933

Post-Effective Amendment No. 89

and

Registration Statement

Under

the Investment Company Act Of 1940

Amendment No. 70

THE INCOME FUND OF AMERICA

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618-4518

(Address of Principal Executive Offices)

Registrant's Telephone Number, Including Area Code:

(213) 486-9200

Michael W. Stockton, Secretary

The Income Fund of America

333 South Hope Street

Los Angeles, California 90071-1406

(Name and Address of Agent for Service)

Copies to:

Michael Glazer

Morgan, Lewis & Bockius LLP

300 South Grand Avenue, 22nd Floor

Los Angeles, California 90071-3132

(Counsel for the Registrant)

Approximate date of proposed public offering:

It is proposed that this filing will become effective on April 7, 2017, pursuant to paragraph (b) of Rule 485.

|

The

Income Fund Prospectus April 7, 2017 |

| Class | A | C | T | F-1 | F-2 | F-3 | 529-A | 529-C | 529-E | 529-T |

| AMECX | IFACX | TIAFX | IFAFX | AMEFX | FIFAX | CIMAX | CIMCX | CIMEX | TFAAX | |

| Class | 529-F-1 | R-1 | R-2 | R-2E | R-3 | R-4 | R-5E | R-5 | R-6 | |

| CIMFX | RIDAX | RIDBX | RIEBX | RIDCX | RIDEX | RIDHX | RIDFX | RIDGX |

Table of contents

| Investment objectives | 1 |

| Fees and expenses of the fund | 1 |

| Principal investment strategies | 2 |

| Principal risks | 3 |

| Investment results | 4 |

| Management | 6 |

| Purchase and sale of fund shares | 6 |

| Tax information | 6 |

| Payments to broker-dealers and other financial intermediaries | 6 |

| Investment objectives, strategies and risks | 7 |

| Management and organization | 10 |

| Shareholder information | 13 |

| Purchase, exchange and sale of shares | 14 |

| How to sell shares | 18 |

| Distributions and taxes | 21 |

| Choosing a share class | 22 |

| Sales charges | 23 |

| Sales charge reductions and waivers | 25 |

| Rollovers from retirement plans to IRAs | 33 |

| Plans of distribution | 35 |

| Other compensation to dealers | 36 |

| Fund expenses | 38 |

| Financial highlights | 39 |

| The U.S. Securities and Exchange Commission has not approved or disapproved of these securities. Further, it has not determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense. |

Investment objectives The fund’s investment objectives are to provide you with current income while secondarily striving for capital growth.

Fees and expenses of the fund This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $25,000 in American Funds. More information about these and other discounts is available from your financial professional and in the “Sales charge reductions and waivers” section on page 25 of the prospectus and on page 70 of the fund’s statement of additional information.

| Shareholder fees (fees paid directly from your investment) | ||||||

| Share class: | A

and 529-A |

C

and 529-C |

529-E | T

and 529-T |

All F and 529-F share classes | All

R share classes |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.75% | none | none | 2.50% | none | none |

| Maximum deferred sales charge (load) (as a percentage of the amount redeemed) | 1.001 | 1.00% | none | none | none | none |

| Maximum sales charge (load) imposed on reinvested dividends | none | none | none | none | none | none |

| Redemption or exchange fees | none | none | none | none | none | none |

| Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||||

| Share class: | A | C | T | F-1 | F-2 | F-3 | 529-A |

| Management fees | 0.22% | 0.22% | 0.22% | 0.22% | 0.22% | 0.22% | 0.22% |

| Distribution and/or service (12b-1) fees | 0.24 | 1.00 | 0.25 | 0.25 | none | none | 0.23 |

| Other expenses | 0.10 | 0.14 | 0.142 | 0.18 | 0.17 | 0.062 | 0.21 |

| Total annual fund operating expenses | 0.56 | 1.36 | 0.61 | 0.65 | 0.39 | 0.28 | 0.66 |

| Share class: | 529-C | 529-E | 529-T | 529-F-1 | R-1 | R-2 | R-2E |

| Management fees | 0.22% | 0.22% | 0.22% | 0.22% | 0.22% | 0.22% | 0.22% |

| Distribution and/or service (12b-1) fees | 0.99 | 0.50 | 0.25 | 0.00 | 1.00 | 0.74 | 0.60 |

| Other expenses | 0.22 | 0.17 | 0.192 | 0.21 | 0.15 | 0.40 | 0.273 |

| Total annual fund operating expenses | 1.43 | 0.89 | 0.66 | 0.43 | 1.37 | 1.36 | 1.09 |

| Share class: | R-3 | R-4 | R-5E | R-5 | R-6 | ||

| Management fees | 0.22% | 0.22% | 0.22% | 0.22% | 0.22% | ||

| Distribution and/or service (12b-1) fees | 0.50 | 0.25 | none | none | none | ||

| Other expenses | 0.20 | 0.15 | 0.27 | 0.11 | 0.06 | ||

| Total annual fund operating expenses | 0.92 | 0.62 | 0.49 | 0.33 | 0.28 |

1 A contingent deferred sales charge of 1.00% applies on certain redemptions made within one year following purchases of $1 million or more made without an initial sales charge. Contingent deferred sales charge is calculated based on the lesser of the offering price and market value of shares being sold.

2 Based on estimated amounts for the current fiscal year.

3 Restated to reflect current fees.

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. You may be required to pay brokerage commissions on your purchases and sales of Class F-2 or F-3 shares of the fund, which are not reflected in the

1 The Income Fund of America / Prospectus

example. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Share class: | A | C | T | F-1 | F-2 | F-3 | 529-A | 529-C | 529-E | 529-T | 529-F-1 | R-1 | R-2 |

| 1 year | $ 629 | $ 238 | $311 | $ 66 | $ 40 | $ 29 | $ 639 | $ 246 | $ 91 | $ 317 | $ 44 | $ 139 | $ 138 |

| 3 years | 744 | 431 | 440 | 208 | 125 | 90 | 774 | 452 | 284 | 461 | 138 | 434 | 431 |

| 5 years | 870 | 745 | 582 | 362 | 219 | 157 | 922 | 782 | 493 | 618 | 241 | 750 | 745 |

| 10 years | 1,236 | 1,635 | 993 | 810 | 493 | 356 | 1,350 | 1,713 | 1,096 | 1,072 | 542 | 1,646 | 1,635 |

| Share class: | R-2E | R-3 | R-4 | R-5E | R-5 | R-6 | For the share classes listed to the right, you would pay the following if you did not redeem your shares: | Share class: | C | 529-C |

| 1 year | $ 111 | $ 94 | $ 63 | $ 50 | $ 34 | $ 29 | 1 year | $ 138 | $ 146 | |

| 3 years | 347 | 293 | 199 | 157 | 106 | 90 | 3 years | 431 | 452 | |

| 5 years | 601 | 509 | 346 | 274 | 185 | 157 | 5 years | 745 | 782 | |

| 10 years | 1,329 | 1,131 | 774 | 616 | 418 | 356 | 10 years | 1,635 | 1,713 |

Portfolio turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s investment results. During the most recent fiscal year, the fund’s portfolio turnover rate was 52% of the average value of its portfolio.

Principal investment strategies Normally the fund invests primarily in income-producing securities. These include equity securities, such as dividend-paying common stocks, and debt securities, such as interest-paying bonds.

Generally at least 60% of the fund’s assets will be invested in common stocks and other equity-type securities. However, the composition of the fund’s investments in equity, debt and cash or money market instruments may vary substantially depending on various factors, including market conditions. The fund may also invest up to 25% of its assets in equity securities of issuers domiciled outside the United States, including issuers in developing countries. In addition, the fund may invest up to 20% of its assets in lower quality, higher yielding nonconvertible debt securities (rated Ba1 and BB+ or below by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser or unrated but determined to be of equivalent quality by the fund’s investment adviser); such securities are sometimes referred to as “junk bonds.” The fund may also invest up to 10% of its assets in debt securities of issuers domiciled outside the United States; however, these securities must be denominated in U.S. dollars.

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers who decide how their respective segments will be invested.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively valued companies that, in its opinion, represent good, long-term investment opportunities. The investment adviser believes that an important way to accomplish this is through fundamental analysis, which may include meeting with company executives and employees, suppliers, customers and competitors. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

The Income Fund of America / Prospectus 2

Principal risks This section describes the principal risks associated with the fund’s principal investment strategies. You may lose money by investing in the fund. The likelihood of loss may be greater if you invest for a shorter period of time. Investors in the fund should have a long-term perspective and be able to tolerate potentially sharp declines in value.

Market conditions — The prices of, and the income generated by, the common stocks and other securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in income-oriented stocks — Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available for dividend payments at, the companies in which the fund invests.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

Investing in lower rated debt instruments — Lower rated bonds and other lower rated debt securities generally have higher rates of interest and involve greater risk of default or price declines due to changes in the issuer’s creditworthiness than those of higher quality debt securities. The market prices of these securities may fluctuate more than the prices of higher quality debt securities and may decline significantly in periods of general economic difficulty. These risks may be increased with respect to investments in junk bonds.

3 The Income Fund of America / Prospectus

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations or revenues outside the United States, may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as the imposition of price controls or punitive taxes, that could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the United States. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of investing outside the United States may be heightened in connection with investments in emerging markets.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

Your investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, entity or person. You should consider how this fund fits into your overall investment program.

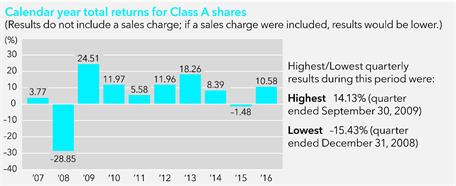

Investment results The following bar chart shows how the fund’s investment results have varied from year to year, and the following table shows how the fund’s average annual total returns for various periods compare with a broad measure of securities market results and other applicable measures of market results. This information provides some indication of the risks of investing in the fund. The 65%/35% S&P 500 Index/Bloomberg Barclays U.S. Aggregate Index is a composite blend of 65% of the S&P 500 Index and 35% of the Bloomberg Barclays U.S. Aggregate Index and represents a broad measure of the U.S. stock and bond markets, including market sectors in which the fund may invest. The Lipper Income Funds Index includes the fund and other funds that disclose investment objectives and/or strategies reasonably comparable to those of the fund. Past investment results (before and after taxes) are not predictive of future investment results. Updated information on the fund’s investment results can be obtained by visiting americanfunds.com.

The Income Fund of America / Prospectus 4

| Average annual total returns For the periods ended December 31, 2016 (with maximum sales charge): | |||||

| Share class | Inception date | 1 year | 5 years | 10 years | Lifetime |

| A — Before taxes | 12/1/1973 | 4.24% | 8.07% | 4.82% | 10.87% |

| — After taxes on distributions | 3.33 | 7.04 | 3.72 | N/A | |

| — After taxes on distributions and sale of fund shares | 2.87 | 6.18 | 3.59 | N/A | |

| Share classes (before taxes) | Inception date | 1 year | 5 years | 10 years | Lifetime |

| C | 3/15/2001 | 8.67% | 8.47% | 4.59% | 6.57% |

| F-1 | 3/15/2001 | 10.51 | 9.27 | 5.38 | 7.09 |

| F-2 | 8/1/2008 | 10.78 | 9.54 | N/A | 7.61 |

| 529-A | 2/15/2002 | 4.15 | 7.95 | 4.73 | 6.82 |

| 529-C | 2/19/2002 | 8.65 | 8.40 | 4.52 | 6.45 |

| 529-E | 2/25/2002 | 10.28 | 8.98 | 5.07 | 6.93 |

| 529-F-1 | 9/17/2002 | 10.76 | 9.49 | 5.58 | 8.27 |

| R-1 | 6/17/2002 | 9.69 | 8.46 | 4.59 | 6.49 |

| R-2 | 5/31/2002 | 9.70 | 8.47 | 4.56 | 6.26 |

| R-2E | 8/29/2014 | 10.06 | N/A | N/A | 3.45 |

| R-3 | 6/4/2002 | 10.16 | 8.94 | 5.05 | 6.84 |

| R-4 | 6/27/2002 | 10.52 | 9.27 | 5.37 | 7.50 |

| R-5E | 11/20/2015 | 10.64 | N/A | N/A | 8.31 |

| R-5 | 5/15/2002 | 10.89 | 9.60 | 5.69 | 7.36 |

| R-6 | 5/1/2009 | 10.89 | 9.64 | N/A | 12.16 |

| Indexes | 1 year | 5 years | 10 years | Lifetime (from Class A inception) |

| S&P 500 Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 11.96% | 14.66% | 6.95% | 10.86% |

| Bloomberg Barclays U.S. Aggregate Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 2.65 | 2.23 | 4.34 | N/A |

| 65%/35% S&P 500 Index/Bloomberg Barclays U.S. Aggregate Index (reflects no deductions for sales charges, account fees, expenses or U.S. federal income taxes) | 8.77 | 10.31 | 6.33 | N/A |

| Lipper Income Funds Index (reflects no deductions for sales charges, account fees or U.S. federal income taxes) | 6.86 | 5.93 | 4.34 | N/A |

| Class

A annualized 30–day yield at January 31, 2017: 2.91% (For current yield information, please call American FundsLine® at (800) 325-3590.) | ||||

5 The Income Fund of America / Prospectus

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above. In addition, after-tax returns are not relevant if you hold your fund shares through a tax-favored arrangement, such as a 401(k) plan, individual retirement account (IRA) or 529 college savings plan.

Management

Investment

adviser Capital Research and Management CompanySM

Portfolio managers The individuals primarily responsible for the

portfolio management of the fund are:

| Portfolio

manager/ Fund title (if applicable) |

Portfolio manager experience in this fund |

Primary

title with investment adviser |

| Hilda L. Applbaum Vice Chairman of the Board | 19 years | Partner – Capital World Investors |

| David C. Barclay President | 21 years | Partner – Capital Fixed Income Investors |

| Dina N. Perry Senior Vice President | 25 years | Partner – Capital World Investors |

| Andrew B. Suzman Senior Vice President | 17 years | Partner – Capital World Investors |

| Paul Flynn Vice President | 4 years | Partner – Capital World Investors |

| Joanna F. Jonsson Vice President | 14 years | Partner – Capital World Investors |

| John H. Smet Vice President | 24 years | Partner – Capital Fixed Income Investors |

| David A. Daigle | 10 years | Partner – Capital Fixed Income Investors |

| James R. Mulally | 10 years | Partner – Capital Fixed Income Investors |

Purchase and sale of fund shares The minimum amount to establish an account for all share classes is $250 and the minimum to add to an account is $50. For a payroll deduction retirement plan account, payroll deduction savings plan account or employer-sponsored 529 account, the minimum is $25 to establish or add to an account.

If you are a retail investor, you may sell (redeem) shares on any business day through your dealer or financial advisor or by writing to American Funds Service Company® at P.O. Box 6007, Indianapolis, Indiana 46206-6007; telephoning American Funds Service Company at (800) 421-4225; faxing American Funds Service Company at (888) 421-4351; or accessing our website at americanfunds.com. Please contact your plan administrator or recordkeeper to sell (redeem) shares from your retirement plan.

Tax information Dividends and capital gain distributions you receive from the fund are subject to federal income taxes and may also be subject to state and local taxes, unless you are tax-exempt or your account is tax-favored.

Payments to broker-dealers and other financial intermediaries If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and the fund’s distributor or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your individual financial advisor to recommend the fund over another investment. Ask your individual financial advisor or visit your financial intermediary’s website for more information.

The Income Fund of America / Prospectus 6

Investment objectives, strategies and risks The fund’s investment objectives are to provide you with current income while secondarily striving for capital growth. While it has no present intention to do so, the fund’s board may change the fund’s investment objectives without shareholder approval upon 60 days’ written notice to shareholders. Normally the fund invests primarily in income-producing securities. These include equity securities, such as dividend-paying common stocks, and debt securities, such as interest-paying bonds.

Generally at least 60% of the fund’s assets will be invested in common stocks and other equity-type securities. However, the composition of the fund’s investments in equity, debt and cash or money market instruments may vary substantially depending on various factors, including market conditions. The fund may also invest up to 25% of its assets in equity securities of issuers domiciled outside the United States, including issuers in developing countries. In addition, the fund may invest up to 20% of its assets in lower quality, higher yielding nonconvertible debt securities (rated Ba1 and BB+ or below by Nationally Recognized Statistical Rating Organizations designated by the fund’s investment adviser or unrated but determined to be of equivalent quality by the fund’s investment adviser); such securities are sometimes referred to as “junk bonds.” The fund may also invest up to 10% of its assets in debt securities of issuers domiciled outside the United States; however, these securities must be denominated in U.S. dollars.

The fund may also hold cash or money market instruments, including commercial paper and short-term securities issued by the U.S. government, its agencies and instrumentalities. The percentage of the fund invested in such holdings varies and depends on various factors, including market conditions and purchases and redemptions of fund shares. The investment adviser may determine that it is appropriate to invest a substantial portion of the fund’s assets in such instruments in response to certain circumstances, such as periods of market turmoil. In addition, for temporary defensive purposes, the fund may invest without limitation in such instruments. A larger percentage of such holdings could moderate the fund’s investment results in a period of rising market prices. Alternatively, a larger percentage of such holdings could reduce the magnitude of the fund’s loss in a period of falling market prices and provide liquidity to make additional investments or to meet redemptions.

The following are principal risks associated with the fund’s investment strategies.

Market conditions — The prices of, and the income generated by, the common stocks and other securities held by the fund may decline – sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

7 The Income Fund of America / Prospectus

Investing in income-oriented stocks — Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available for dividend payments at, the companies in which the fund invests.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

Investing in lower rated debt instruments — Lower rated bonds and other lower rated debt securities generally have higher rates of interest and involve greater risk of default or price declines due to changes in the issuer’s creditworthiness than those of higher quality debt securities. The market prices of these securities may fluctuate more than the prices of higher quality debt securities and may decline significantly in periods of general economic difficulty. These risks may be increased with respect to investments in junk bonds.

Investing outside the United States — Securities of issuers domiciled outside the United States, or with significant operations or revenues outside the United States, may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as the imposition of price controls or punitive taxes, that could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the United States. Investments outside the United States may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the United States. In addition, the value of investments outside the United States may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of

The Income Fund of America / Prospectus 8

investing outside the United States may be heightened in connection with investments in emerging markets.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

The following are certain additional risks associated with the fund’s investment strategies.

Investing in emerging markets — Investing in emerging markets may involve risks in addition to and greater than those generally associated with investing in the securities markets of developed countries. For instance, developing countries may have less developed legal and accounting systems than those in developed countries. The governments of these countries may be less stable and more likely to impose capital controls, nationalize a company or industry, place restrictions on foreign ownership and on withdrawing sale proceeds of securities from the country, and/or impose punitive taxes that could adversely affect the prices of securities. In addition, the economies of these countries may be dependent on relatively few industries that are more susceptible to local and global changes. Securities markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries with more developed economies and/or markets. Less certainty with respect to security valuations may lead to additional challenges and risks in calculating the fund’s net asset value. Additionally, there may be increased settlement risks for transactions in local securities.

Exposure to country, region, industry or sector — Subject to the fund’s investment limitations, the fund may have significant exposure to a particular country, region, industry or sector. Such exposure may cause the fund to be more impacted by risks relating to the country, region, industry or sector than a fund without such levels of exposure. For example, if the fund has significant exposure in a particular country, then social, economic, regulatory or other issues that negatively affect that country may have a greater impact on the fund than on a fund that is more geographically diversified.

Interest rate risk — The values and liquidity of the securities held by the fund may be affected by changing interest rates. For example, the values of debt securities may decline when interest rates rise and increase when interest rates fall. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities. The fund may invest in variable and floating rate securities. Although the values of such securities are generally less sensitive to interest rate changes than those of other debt securities, the value of variable and floating rate securities may decline if their interest rates do not rise as quickly, or as much, as general interest rates. Conversely, floating rate securities will not generally increase in value if interest rates decline. During periods of extremely low short-term interest rates, certain of the fund’s debt securities may not be able to maintain a positive yield and, given the current historically low interest rate environment, risks associated with rising rates are currently heightened.

9 The Income Fund of America / Prospectus

Liquidity risk — Certain fund holdings may be deemed to be less liquid or illiquid because they cannot be readily sold without significantly impacting the value of the holdings. Liquidity risk may result from the lack of an active market for a holding, legal or contractual restrictions on resale, or the reduced number and capacity of market participants to make a market in such holding. Market prices for less liquid or illiquid holdings may be volatile, and reduced liquidity may have an adverse impact on the market price of such holdings. Additionally, the sale of less liquid or illiquid holdings may involve substantial delays (including delays in settlement) and additional costs and the fund may be unable to sell such holdings when necessary to meet its liquidity needs.

In addition to the principal investment strategies described above, the fund has other investment practices that are described in the statement of additional information, which includes a description of other risks related to the fund’s principal investment strategies and other investment practices. The fund’s investment results will depend on the ability of the fund’s investment adviser to navigate the risks discussed above as well as those described in the statement of additional information.

Fund comparative indexes The investment results table in this prospectus shows how the fund’s average annual total returns compare with various broad measures of market results. The S&P 500 Index is a market capitalization-weighted index based on the results of 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. The Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. The 65%/35% S&P 500 Index/Bloomberg Barclays U.S. Aggregate Index blends the S&P 500 Index with the Bloomberg Barclays U.S. Aggregate Index by weighting their cumulative total returns at 65% and 35%, respectively. This assumes the blend is rebalanced monthly. The Lipper Income Funds Index is an equally weighted index of funds that normally seek a high level of current income through investing in income-producing stocks, bonds and money market instruments. The results of the underlying funds in the index include the reinvestment of dividends and capital gain distributions, as well as brokerage commissions paid by the funds for portfolio transactions and other fund expenses, but do not reflect the effect of sales charges, account fees or U.S. federal income taxes. Neither the Bloomberg Barclays Index, the 65%/35% S&P 500 Index/Bloomberg Barclays U.S. Aggregate Index nor the Lipper Index was in existence when Capital Research and Management Company became the fund’s investment adviser; therefore, lifetime results are not shown.

Fund results All fund results in this prospectus reflect the reinvestment of dividends and capital gain distributions, if any. Unless otherwise noted, fund results reflect any fee waivers and/or expense reimbursements in effect during the periods presented.

Management and organization

Investment adviser Capital Research and Management Company, an experienced investment management organization founded in 1931, serves as the investment adviser to the fund and other funds, including the American Funds. Capital Research and Management Company is a wholly owned subsidiary of The Capital Group Companies, Inc. and is located at 333 South Hope Street, Los Angeles, California 90071. Capital Research and Management Company manages the investment portfolio and business

The Income Fund of America / Prospectus 10

affairs of the fund. The total management fee paid by the fund to its investment adviser for the most recent fiscal year, as a percentage of average net assets, appears in the Annual Fund Operating Expenses table under “Fees and expenses of the fund.” As described more fully in the fund’s statement of additional information, the management fee is based on the daily net assets of the fund and the fund’s monthly gross investment income. A discussion regarding the basis for approval of the fund’s Investment Advisory and Service Agreement by the fund’s board of trustees is contained in the fund’s semi-annual report to shareholders for the fiscal period ended January 31, 2017.

Capital Research and Management Company manages equity assets through three equity investment divisions and fixed-income assets through its fixed-income investment division, Capital Fixed Income Investors. The three equity investment divisions — Capital World Investors, Capital Research Global Investors and Capital International Investors — make investment decisions independently of one another.

The equity investment divisions may, in the future, be incorporated as wholly owned subsidiaries of Capital Research and Management Company. In that event, Capital Research and Management Company would continue to be the investment adviser, and day-to-day investment management of equity assets would continue to be carried out through one or more of these subsidiaries. Although not currently contemplated, Capital Research and Management Company could incorporate its fixed-income investment division in the future and engage it to provide day-to-day investment management of fixed-income assets. Capital Research and Management Company and each of the funds it advises have received an exemptive order from the U.S. Securities and Exchange Commission that allows Capital Research and Management Company to use, upon approval of the fund’s board, its management subsidiaries and affiliates to provide day-to-day investment management services to the fund, including making changes to the management subsidiaries and affiliates providing such services. The fund’s shareholders have approved this arrangement; however, there is no assurance that Capital Research and Management Company will incorporate its investment divisions or exercise any authority granted to it under the exemptive order.

Portfolio holdings Portfolio holdings information for the fund is available on the American Funds website at americanfunds.com. A description of the fund’s policies and procedures regarding disclosure of information about its portfolio holdings is available in the statement of additional information.

The Capital SystemSM Capital Research and Management Company uses a system of multiple portfolio managers in managing mutual fund assets. Under this approach, the portfolio of a fund is divided into segments managed by individual managers who decide how their respective segments will be invested. In addition, Capital Research and Management Company’s investment analysts may make investment decisions with respect to a portion of a fund’s portfolio. Investment decisions are subject to a fund’s objective(s), policies and restrictions and the oversight of the appropriate investment-related committees of Capital Research and Management Company and its investment divisions. The table below shows the investment experience and role in management of the fund for each of the fund’s primary portfolio managers.

11 The Income Fund of America / Prospectus

| Portfolio manager | Investment experience |

Experience in this fund |

Role

in management of the fund |

| Hilda L. Applbaum | Investment

professional for 30 years in total; 22 years with Capital Research and Management Company or affiliate |

19

years (plus 3 years of prior experience as an investment analyst for the fund) |

Serves as an equity portfolio manager |

| David C. Barclay | Investment

professional for 36 years in total; 29 years with Capital Research and Management Company or affiliate |

21 years | Serves as a fixed-income portfolio manager |

| Dina N. Perry | Investment

professional for 39 years in total; 25 years with Capital Research and Management Company or affiliate |

25 years | Serves as an equity portfolio manager |

| Andrew B. Suzman | Investment

professional for 24 years, all with Capital Research and Management Company or affiliate |

17

years (plus 4 years of prior experience as an investment analyst for the fund) |

Serves as an equity portfolio manager |

| Paul Flynn | Investment

professional for 21 years in total; 19 years with Capital Research and Management Company or affiliate |

4 years (plus

5 years of |

Serves as an equity portfolio manager |

| Joanna F. Jonsson | Investment

professional for 28 years in total; 27 years with Capital Research and Management Company or affiliate |

14

years (plus 9 years of prior experience as an investment analyst for the fund) |

Serves as an equity portfolio manager |

| John H. Smet | Investment

professional for 35 years in total; 34 years with Capital Research and Management Company or affiliate |

24 years | Serves as a fixed-income portfolio manager |

The Income Fund of America / Prospectus 12

| Portfolio manager | Investment experience |

Experience in this fund |

Role

in management of the fund |

| David A. Daigle | Investment

professional for 23 years, all with Capital Research and Management Company or affiliate |

10

years (plus 11 years of prior experience as an investment analyst for the fund) |

Serves as a fixed-income portfolio manager |

| James R. Mulally | Investment

professional for 41 years in total; 37 years with Capital Research and Management Company or affiliate |

10 years | Serves as a fixed-income portfolio manager |

Information regarding the portfolio managers’ compensation, their ownership of securities in the fund and other accounts they manage is in the statement of additional information.

Certain privileges and/or services described on the following pages of this prospectus and in the statement of additional information may not be available to you, depending on your investment dealer or retirement plan recordkeeper. Please see your financial advisor, investment dealer or retirement plan recordkeeper for more information.

Shareholder information

Shareholder services American Funds Service Company, the fund’s transfer agent, offers a wide range of services that you can use to alter your investment program should your needs or circumstances change. These services may be terminated or modified at any time upon 60 days’ written notice.

A more detailed description of policies and services is included in the fund’s statement of additional information and the owner’s guide sent to new American Funds shareholders entitled Welcome. Class 529 shareholders should also refer to the applicable program description for information on policies and services relating specifically to their account(s). These documents are available by writing to or calling American Funds Service Company.

13 The Income Fund of America / Prospectus

Unless otherwise noted, references to Class A, C, T or F-1 shares on the following pages also refer to the corresponding Class 529-A, 529-C, 529-T or 529-F-1 shares. Unless otherwise noted, references to Class F shares refer to Class F-1, F-2 and F-3 shares and references to Class R shares refer to Class R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6 shares.

Purchase, exchange and sale of shares The fund’s transfer agent, on behalf of the fund and American Funds Distributors,® the fund’s distributor, is required by law to obtain certain personal information from you or any other person(s) acting on your behalf in order to verify your or such person’s identity. If you do not provide the information, the transfer agent may not be able to open your account. If the transfer agent is unable to verify your identity or that of any other person(s) authorized to act on your behalf, or believes it has identified potentially criminal activity, the fund and American Funds Distributors reserve the right to close your account or take such other action they deem reasonable or required by law.

When purchasing shares, you should designate the fund or funds in which you wish to invest. Subject to the exception below, if no fund is designated, your money will be held uninvested (without liability to the transfer agent for loss of income or appreciation pending receipt of proper instructions) until investment instructions are received, but for no more than three business days. Your investment will be made at the net asset value (plus any applicable sales charge, in the case of Class A or Class T shares) next determined after investment instructions are received and accepted by the transfer agent. If investment instructions are not received, your money will be invested in Class A shares (or, if you are investing through a financial intermediary who offers only Class T shares, in Class T shares) of American Funds U.S. Government Money Market FundSM on the third business day after receipt of your investment.

If the amount of your cash investment is $10,000 or less, no fund is designated, and you made a cash investment (excluding exchanges) within the last 16 months, your money will be invested in the same proportion and in the same fund or funds and in the same class of shares in which your last cash investment was made.

Different procedures may apply to certain employer-sponsored arrangements, including, but not limited to, SEPs and SIMPLE IRAs.

Valuing shares The net asset value of each share class of the fund is the value of a single share of that class. The fund calculates the net asset value each day the New York Stock Exchange is open for trading as of approximately 4 p.m. New York time, the normal close of regular trading. If, for example, the New York Stock Exchange closes at 1 p.m. New York time, the fund’s net asset value would still be determined as of 4 p.m. New York time. In this example, portfolio securities traded on the New York Stock Exchange would be valued at their closing prices unless the investment adviser determines that a “fair value” adjustment is appropriate due to subsequent events.

Equity securities are valued primarily on the basis of market quotations, and debt securities are valued primarily on the basis of prices from third-party pricing services. The fund has adopted procedures for making fair value determinations if market quotations or prices from third-party pricing services, as applicable, are not readily available or are not considered reliable. For example, if events occur between the close of markets outside the United States and the close of regular trading on the New York Stock Exchange that, in the opinion of the investment adviser, materially affect the value

The Income Fund of America / Prospectus 14

of any of the fund’s equity securities that trade principally in those international markets, those securities will be valued in accordance with fair value procedures. Similarly, fair value procedures may be employed if an issuer defaults on its debt securities and there is no market for its securities. Use of these procedures is intended to result in more appropriate net asset values and, where applicable, to reduce potential arbitrage opportunities otherwise available to short-term investors.

Because the fund may hold securities that are listed primarily on foreign exchanges that trade on weekends or days when the fund does not price its shares, the values of securities held in the fund may change on days when you will not be able to purchase or redeem fund shares.

Your shares will be purchased at the net asset value (plus any applicable sales charge, in the case of Class A or Class T shares) or sold at the net asset value next determined after American Funds Service Company receives your request, provided that your request contains all information and legal documentation necessary to process the transaction. A contingent deferred sales charge may apply at the time you sell certain Class A and C shares.

Purchase of Class A, C and T shares You may generally open an account and purchase Class A, C and T shares by contacting any financial advisor (who may impose transaction charges in addition to those described in this prospectus) authorized to sell the fund’s shares. You may purchase additional shares in various ways, including through your financial advisor and by mail, telephone, the Internet and bank wire.

Automatic conversion of Class C shares Class C shares automatically convert to Class F-1 shares in the month of the 10-year anniversary of the purchase date; however, Class 529-C shares will not convert to Class 529-F-1 shares. The Internal Revenue Service currently takes the position that such automatic conversions are not taxable. Should its position change, the automatic conversion feature may be suspended. If this were to happen, you would have the option of converting your Class C shares to Class F-1 shares at the anniversary date described above. This exchange would be based on the relative net asset values of the two classes in question, without the imposition of a sales charge or fee, but you might face certain tax consequences as a result.

Purchase of Class F shares You may generally open an account and purchase Class F shares only through fee-based programs of investment dealers that have special agreements with the fund’s distributor, through financial intermediaries that have been approved by, and that have special agreements with, the fund’s distributor to offer Class F shares to self-directed investment brokerage accounts that may charge a transaction fee, through certain registered investment advisors and through other intermediaries approved by the fund’s distributor. These intermediaries typically charge ongoing fees for services they provide. Intermediary fees are not paid by the fund and normally range from .75% to 1.50% of assets annually, depending on the services offered.

Class F-2 and F-3 shares may also be available on brokerage platforms of firms that have agreements with the fund’s distributor to offer such shares solely when acting as an agent for the investor. An investor transacting in Class F-2 or F-3 shares in these programs may be required to pay a commission and/or other forms of compensation to the broker. Shares of the fund are available in other share classes that have different fees and expenses.

15 The Income Fund of America / Prospectus

In addition, Class F-3 shares are available to institutional investors, which include, but are not limited to, charitable organizations, governmental institutions and corporations, with a minimum investment amount of $1,000,000.

Purchase of Class 529 shares Class 529 shares may be purchased only through an account established with a 529 college savings plan managed by the American Funds organization. You may open this type of account and purchase Class 529 shares by contacting any financial advisor (who may impose transaction charges in addition to those described in this prospectus) authorized to sell such an account. You may purchase additional shares in various ways, including through your financial advisor and by mail, telephone, the Internet and bank wire.

Class 529-E shares may be purchased only by employees participating through an eligible employer plan.

Accounts holding Class 529 shares are subject to a $10 account setup fee and an annual $10 account maintenance fee. These fees are waived until further notice.

Investors residing in any state may purchase Class 529 shares through an account established with a 529 college savings plan managed by the American Funds organization. Class 529-A, 529-C, 529-T and 529-F-1 shares are structured similarly to the corresponding Class A, C, T and F-1 shares. For example, the same initial sales charges apply to Class 529-A shares as to Class A shares.

Purchase of Class R shares Class R shares are generally available only to retirement plans established under Internal Revenue Code Sections 401(a), 403(b) or 457, and to nonqualified deferred compensation plans and certain voluntary employee benefit association and post-retirement benefit plans. Class R shares also are generally available only to retirement plans for which plan level or omnibus accounts are held on the books of the fund. Class R-5E, R-5 and R-6 shares are generally available only to fee-based programs or through retirement plan intermediaries. In addition, Class R-5 and R-6 shares are available for investment by other registered investment companies approved by the fund’s investment adviser or distributor. Class R shares generally are not available to retail nonretirement accounts, traditional and Roth individual retirement accounts (IRAs), Coverdell Education Savings Accounts, SEPs, SARSEPs, SIMPLE IRAs and 529 college savings plans.

Purchases by employer-sponsored retirement plans Eligible retirement plans generally may open an account and purchase Class A or R shares by contacting any investment dealer (who may impose transaction charges in addition to those described in this prospectus) authorized to sell these classes of the fund’s shares. Some or all R share classes may not be available through certain investment dealers. Additional shares may be purchased through a plan’s administrator or recordkeeper.

Class A shares are generally not available for retirement plans using the PlanPremier® or Recordkeeper Direct® recordkeeping programs. These programs are proprietary recordkeeping solutions for small retirement plans.

Employer-sponsored retirement plans that are eligible to purchase Class R shares may instead purchase Class A shares and pay the applicable Class A sales charge, provided that their recordkeepers can properly apply a sales charge on plan investments. These plans are not eligible to make initial purchases of $1 million or more in Class A shares and thereby invest in Class A shares without a sales charge, nor are they eligible to

The Income Fund of America / Prospectus 16

establish a statement of intention that qualifies them to purchase Class A shares without a sales charge. More information about statements of intention can be found under “Sales charge reductions and waivers” in this prospectus. Plans investing in Class A shares with a sales charge may purchase additional Class A shares in accordance with the sales charge table in this prospectus.

Employer-sponsored retirement plans that invested in Class A shares of any of the American Funds without any sales charge before April 1, 2004, and that continue to meet the eligibility requirements in effect as of that date for purchasing Class A shares at net asset value, may continue to purchase Class A shares of the American Funds without any initial or contingent deferred sales charge.

A 403(b) plan may not invest in Class A or C shares of any of the American Funds unless it was invested in Class A or C shares before January 1, 2009.

Purchase minimums and maximums Purchase minimums described in this prospectus may be waived in certain cases. In addition, the fund reserves the right to redeem the shares of any shareholder for their then current net asset value per share if the shareholder’s aggregate investment in the fund falls below the fund’s minimum initial investment amount. See the statement of additional information for details.

For accounts established with an automatic investment plan, the initial purchase minimum of $250 may be waived if the purchases (including purchases through exchanges from another fund) made under the plan are sufficient to reach $250 within five months of account establishment.

The effective purchase maximums for Class 529-A, 529-C, 529-E, 529-T and 529-F-1 shares will reflect the maximum applicable contribution limits under state law. See the applicable program description for more information.

The purchase maximum for Class C shares is $500,000 per transaction. In addition, if you have significant American Funds holdings, you may not be eligible to invest in Class C or 529-C shares. Specifically, you may not purchase Class C or 529-C shares if you are eligible to purchase Class A or 529-A shares at the $1 million or more sales charge discount rate (that is, at net asset value). See “Sales charge reductions and waivers” in this prospectus and the statement of additional information for more details regarding sales charge discounts.

Exchange Except for Class T shares or as otherwise described in this prospectus, you may exchange your shares for shares of the same class of other American Funds without a sales charge. Class A, C, T or F-1 shares of any American Fund (other than American Funds U.S. Government Money Market Fund, as described below) may be exchanged for the corresponding 529 share class without a sales charge. Exchanges from Class A, C, T or F-1 shares to the corresponding 529 share class, particularly in the case of Uniform Gifts to Minors Act or Uniform Transfers to Minors Act custodial accounts, may result in significant legal and tax consequences, as described in the applicable program description. Please consult your financial advisor before making such an exchange.

Except as indicated above, Class T shares are not eligible for exchange privileges. Accordingly, an exchange of your Class T shares for Class T shares of any other American Fund will normally be subject to any applicable sales charges.

17 The Income Fund of America / Prospectus

Exchanges of shares from American Funds U.S. Government Money Market Fund initially purchased without a sales charge to shares of another American Fund generally will be subject to the appropriate sales charge applicable to the other fund. For purposes of computing the contingent deferred sales charge on Class C shares, the length of time you have owned your shares will be measured from the first day of the month in which shares were purchased and will not be affected by any permitted exchange.

Exchanges have the same tax consequences as ordinary sales and purchases. For example, to the extent you exchange shares held in a taxable account that are worth more now than what you paid for them, the gain will be subject to taxation.

See “Transactions by telephone, fax or the Internet” in the section “How to sell shares” of this prospectus for information regarding electronic exchanges.

Please see the statement of additional information for details and limitations on moving investments in certain share classes to different share classes and on moving investments held in certain accounts to different accounts.

How to sell shares

You may sell (redeem) shares in any of the following ways:

Employer-sponsored retirement plans

Shares held in eligible retirement plans may be sold through the plan’s administrator or recordkeeper.

Through your dealer or financial advisor (certain charges may apply)

· Shares held for you in your dealer’s name must be sold through the dealer.

· Generally, Class F shares must be sold through intermediaries such as dealers or financial advisors.

Writing to American Funds Service Company

· Requests must be signed by the registered shareholder(s).

· A signature guarantee is required if the redemption is:

— more than $125,000;

— made payable to someone other than the registered shareholder(s); or

— sent to an address other than the address of record or to an address of record that has been changed within the previous 10 days.

· American Funds Service Company reserves the right to require signature guarantee(s) on any redemption.

· Additional documentation may be required for redemptions of shares held in corporate, partnership or fiduciary accounts.

Telephoning or faxing American Funds Service Company or using the Internet

· Redemptions by telephone, fax or the Internet (including American FundsLine and americanfunds.com) are limited to $125,000 per American Funds shareholder each day.

· Checks must be made payable to the registered shareholder.

· Checks must be mailed to an address of record that has been used with the account for at least 10 days.

The Income Fund of America / Prospectus 18

If you recently purchased shares and subsequently request a redemption of those shares, you will receive proceeds from the redemption once a sufficient period of time has passed to reasonably ensure that checks or drafts, including certified or cashier’s checks, for the shares purchased have cleared (normally 10 business days).

Although payment of redemptions normally will be in cash, the fund’s declaration of trust permits payment of the redemption price wholly or partly with portfolio securities or other fund assets under conditions and circumstances determined by the fund’s board of trustees. The disposal of the securities received in-kind may be subject to brokerage costs and, until sold, such securities remain at market risk and liquidity risk, including the risk that such securities are or become difficult to sell. If the fund pays your redemption with illiquid or less liquid securities, you will bear the risk of not being able to sell such securities.

Transactions by telephone, fax or the Internet Generally, you are automatically eligible to redeem or exchange shares by telephone, fax or the Internet, unless you notify us in writing that you do not want any or all of these services. You may reinstate these services at any time.

Unless you decide not to have telephone, fax or Internet services on your account(s), you agree to hold the fund, American Funds Service Company, any of its affiliates or mutual funds managed by such affiliates, and each of their respective directors, trustees, officers, employees and agents harmless from any losses, expenses, costs or liabilities (including attorney fees) that may be incurred in connection with the exercise of these privileges, provided that American Funds Service Company employs reasonable procedures to confirm that the instructions received from any person with appropriate account information are genuine. If reasonable procedures are not employed, American Funds Service Company and/or the fund may be liable for losses due to unauthorized or fraudulent instructions.

Frequent trading of fund shares The fund and American Funds Distributors reserve the right to reject any purchase order for any reason. The fund is not designed to serve as a vehicle for frequent trading. Frequent trading of fund shares may lead to increased costs to the fund and less efficient management of the fund’s portfolio, potentially resulting in dilution of the value of the shares held by long-term shareholders. Accordingly, purchases, including those that are part of exchange activity, that the fund or American Funds Distributors has determined could involve actual or potential harm to the fund may be rejected.

The fund, through its transfer agent, American Funds Service Company, maintains surveillance procedures that are designed to detect frequent trading in fund shares. Under these procedures, various analytics are used to evaluate factors that may be indicative of frequent trading. For example, transactions in fund shares that exceed certain monetary thresholds may be scrutinized. American Funds Service Company also may review transactions that occur close in time to other transactions in the same account or in multiple accounts under common ownership or influence. Trading activity that is identified through these procedures or as a result of any other information available to the fund will be evaluated to determine whether such activity might constitute frequent trading. These procedures may be modified from time to time as appropriate to improve the detection of frequent trading, to facilitate monitoring for

19 The Income Fund of America / Prospectus

frequent trading in particular retirement plans or other accounts and to comply with applicable laws.

In addition to the fund’s broad ability to restrict potentially harmful trading as described above, the fund’s board of trustees has adopted a “purchase blocking policy” under which any shareholder redeeming shares having a value of $5,000 or more from a fund will be precluded from investing in that fund for 30 calendar days after the redemption transaction. This policy also applies to redemptions and purchases that are part of exchange transactions. Under the fund’s purchase blocking policy, certain purchases will not be prevented and certain redemptions will not trigger a purchase block, such as:

· purchases and redemptions of shares having a value of less than $5,000;

· transactions in Class 529 shares;

· purchases and redemptions by investment companies managed or sponsored by the fund’s investment adviser or its affiliates, including reallocations and transactions allowing the investment company to meet its redemptions and purchases;

· retirement plan contributions, loans and distributions (including hardship withdrawals) identified as such on the retirement plan recordkeeper’s system;

· purchase transactions involving in-kind transfers of shares of the fund, rollovers, Roth IRA conversions and IRA recharacterizations, if the entity maintaining the shareholder account is able to identify the transaction as one of these types of transactions; and

· systematic redemptions and purchases, if the entity maintaining the shareholder account is able to identify the transaction as a systematic redemption or purchase.

Generally, purchases and redemptions will not be considered “systematic” unless the transaction is prescheduled for a specific date.

The fund reserves the right to waive the purchase blocking policy with respect to specific shareholder accounts if American Funds Service Company determines that its surveillance procedures are adequate to detect frequent trading in fund shares in such accounts.

American Funds Service Company will work with certain intermediaries (such as investment dealers holding shareholder accounts in street name, retirement plan recordkeepers, insurance company separate accounts and bank trust companies) to apply their own procedures, provided that American Funds Service Company believes the intermediary’s procedures are reasonably designed to enforce the frequent trading policies of the fund. You should refer to disclosures provided by the intermediaries with which you have an account to determine the specific trading restrictions that apply to you.

If American Funds Service Company identifies any activity that may constitute frequent trading, it reserves the right to contact the intermediary and request that the intermediary either provide information regarding an account owner’s transactions or restrict the account owner’s trading. If American Funds Service Company is not satisfied that the intermediary has taken appropriate action, American Funds Service Company may terminate the intermediary’s ability to transact in fund shares.

There is no guarantee that all instances of frequent trading in fund shares will be prevented.

The Income Fund of America / Prospectus 20

Notwithstanding the fund’s surveillance procedures and purchase blocking policy described above, all transactions in fund shares remain subject to the right of the fund, American Funds Distributors and American Funds Service Company to restrict potentially abusive trading generally, including the types of transactions described above that will not be prevented or trigger a block under the purchase blocking policy. See the statement of additional information for more information about how American Funds Service Company may address other potentially abusive trading activity in the American Funds.

Distributions and taxes

Dividends and distributions The fund intends to distribute dividends to you, usually in March, June, September and December.

Capital gains, if any, are usually distributed in December. When a dividend or capital gain is distributed, the net asset value per share is reduced by the amount of the payment.

You may elect to reinvest dividends and/or capital gain distributions to purchase additional shares of this fund or other American Funds, or you may elect to receive them in cash. Dividends and capital gain distributions for 529 share classes and retirement plan shareholders will be reinvested automatically.

Taxes on dividends and distributions For federal tax purposes, dividends and distributions of short-term capital gains are taxable as ordinary income. The fund’s distributions of net long-term capital gains are taxable as long-term capital gains. Any dividends or capital gain distributions you receive from the fund will normally be taxable to you when made, regardless of whether you reinvest dividends or capital gain distributions or receive them in cash.

Dividends and capital gain distributions that are automatically reinvested in a tax-favored retirement or education savings account do not result in federal or state income tax at the time of reinvestment.

Taxes on transactions Your redemptions, including exchanges, may result in a capital gain or loss for federal tax purposes. A capital gain or loss on your investment is the difference between the cost of your shares, including any sales charges, and the amount you receive when you sell them.

Exchanges within a tax-favored retirement plan account will not result in a capital gain or loss for federal or state income tax purposes. With limited exceptions, distributions from a retirement plan account are taxable as ordinary income.

Shareholder fees Fees borne directly by the fund normally have the effect of reducing a shareholder’s taxable income on distributions. By contrast, fees paid directly to advisors by a fund shareholder for ongoing advice are deductible for income tax purposes only to the extent that they (combined with certain other qualifying expenses) exceed 2% of such shareholder’s adjusted gross income.

Please see your tax advisor for more information. Holders of Class 529 shares should refer to the applicable program description for more information regarding the tax consequences of selling Class 529 shares.

21 The Income Fund of America / Prospectus

Choosing a share class The fund offers different classes of shares through this prospectus. The services or share classes available to you may vary depending upon how you wish to purchase shares of the fund.

Each share class represents an investment in the same portfolio of securities, but each class has its own sales charge and expense structure, allowing you to choose the class that best fits your situation. For example, while Class F-1 shares are subject to 12b-1 fees and subtransfer agency fees payable to third-party service providers, Class F-2 shares are subject only to subtransfer agency fees payable to third-party service providers (and not 12b-1 fees) and Class F-3 shares are not subject to any such additional fees. The different fee structures allow the investor to choose how to pay for advisory platform expenses. Class R shares offer different levels of 12b-1 and recordkeeping fees so that a plan can choose the class that best meets the cost associated with obtaining investment related services and participant level recordkeeping for the plan. When you purchase shares of the fund for an individual-type account, you should choose a share class. If none is chosen, your investment will be made in Class A shares or, in the case of a 529 plan investment, Class 529-A shares (or, if you are investing through a financial intermediary who offers only Class T and 529-T shares, your investment will be made in Class T or Class 529-T shares, as applicable).

Factors you should consider when choosing a class of shares include:

· how long you expect to own the shares;

· how much you intend to invest;

· total expenses associated with owning shares of each class;

· whether you qualify for any reduction or waiver of sales charges (for example, Class A or 529-A or Class T or 529-T shares may be a less expensive option over time, particularly if you qualify for a sales charge reduction or waiver);

· whether you want or need the flexibility to effect exchanges among the American Funds without the imposition of a sales charge (for example, while Class A shares offer such exchange privileges, Class T shares do not);

· whether you plan to take any distributions in the near future (for example, the contingent deferred sales charge will not be waived if you sell your Class 529-C shares to cover higher education expenses); and

· availability of share classes:

— Class C shares are not available to retirement plans that do not currently invest in such shares and that are eligible to invest in Class R shares, including retirement plans established under Internal Revenue Code Sections 401(a) (including 401(k) plans), 403(b) or 457;

— Class F and 529-F-1 shares are generally available only to fee-based programs of investment dealers that have special agreements with the fund’s distributor, to financial intermediaries that have been approved by, and that have special agreements with, the fund’s distributor to offer Class F and 529-F-1 shares to self-directed investment brokerage accounts that may charge a transaction fee, to certain registered investment advisors and to other intermediaries approved by the fund’s distributor;

— Class F-3 shares are also available to institutional investors, which include, but are not limited to, charitable organizations, governmental institutions and corporations, with a minimum investment amount of $1,000,000; and

The Income Fund of America / Prospectus 22

— Class R shares are generally available only to retirement plans established under Internal Revenue Code Sections 401(a) (including 401(k) plans), 403(b) or 457, and to nonqualified deferred compensation plans and certain voluntary employee benefit association and post-retirement benefit plans.

Each investor’s financial considerations are different. You should speak with your financial advisor to help you decide which share class is best for you.

Sales charges

Class A shares The initial sales charge you pay each time you buy Class A shares differs depending upon the amount you invest and may be reduced or eliminated for larger purchases as indicated below. The “offering price,” the price you pay to buy shares, includes any applicable sales charge, which will be deducted directly from your investment. Shares acquired through reinvestment of dividends or capital gain distributions are not subject to an initial sales charge.

| Sales

charge as a percentage of: |

|||

| Investment | Offering price | Net

amount invested |

Dealer

commission as a percentage of offering price |

| Less than $25,000 | 5.75% | 6.10% | 5.00% |

| $25,000 but less than $50,000 | 5.00 | 5.26 | 4.25 |

| $50,000 but less than $100,000 | 4.50 | 4.71 | 3.75 |

| $100,000 but less than $250,000 | 3.50 | 3.63 | 2.75 |

| $250,000 but less than $500,000 | 2.50 | 2.56 | 2.00 |

| $500,000 but less than $750,000 | 2.00 | 2.04 | 1.60 |

| $750,000 but less than $1 million | 1.50 | 1.52 | 1.20 |

| $1 million or more and certain other investments described below | none | none | see below |

The sales charge, expressed as a percentage of the offering price or the net amount invested, may be higher or lower than the percentages described in the table above due to rounding. This is because the dollar amount of the sales charge is determined by subtracting the net asset value of the shares purchased from the offering price, which is calculated to two decimal places using standard rounding criteria. The impact of rounding will vary with the size of the investment and the net asset value of the shares. Similarly, any contingent deferred sales charge paid by you on investments in Class A shares may be higher or lower than the 1% charge described below due to rounding.

Except as provided below, investments in Class A shares of $1 million or more may be subject to a 1% contingent deferred sales charge if the shares are sold within one year of purchase. The contingent deferred sales charge is based on the original purchase cost or the current market value of the shares being sold, whichever is less.

Class A share purchases not subject to sales charges The following investments are not subject to any initial or contingent deferred sales charge if American Funds Service Company is properly notified of the nature of the investment: