Table of Contents

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number IMPERIAL OIL LIMITED (Exact name of registrant as specified in its charter) |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| (Address of principal executive offices) |

(Postal Code) | |

| Title of each class | Trading symbol | Name of each exchange on which registered | ||

None |

None |

90 days.

✓ |

Smaller reporting company.. |

|||

| Accelerated filer...... | Emerging growth company. |

|||

Non-accelerated filer...... |

Page |

||||||

4 |

||||||

| Item 1. |

4 |

|||||

5 |

||||||

5 |

||||||

6 |

||||||

7 |

||||||

9 |

||||||

11 |

||||||

11 |

||||||

12 |

||||||

14 |

||||||

14 |

||||||

14 |

||||||

14 |

||||||

14 |

||||||

15 |

||||||

15 |

||||||

16 |

||||||

16 |

||||||

16 |

||||||

17 |

||||||

18 |

||||||

| Item 1A. |

19 |

|||||

| Item 1B. |

25 |

|||||

| Item 2. |

25 |

|||||

| Item 3. |

25 |

|||||

| Item 4. |

25 |

|||||

26 |

||||||

| Item 5. |

26 |

|||||

| Item 6. |

27 |

|||||

| Item 7. |

27 |

|||||

| Item 7A. |

27 |

|||||

| Item 8. |

28 |

|||||

| Item 9. |

28 |

|||||

| Item 9A. |

28 |

|||||

| Item 9B. |

28 |

|||||

29 |

||||||

| Item 10. |

29 |

|||||

| Item 11. |

29 |

|||||

| Item 12. |

30 |

|||||

| Item 13. |

31 |

|||||

| Item 14. |

32 |

|||||

33 |

||||||

| Item 15. |

33 |

|||||

| Item 16. |

34 |

|||||

35 |

||||||

36 |

||||||

101 |

||||||

dollars |

2019 |

2018 |

2017 |

2016 |

2015 |

|||||||||||||||

| Rate at end of period |

0.7715 |

0.7329 |

0.7989 |

0.7448 |

0.7226 |

|||||||||||||||

| Average rate during period |

0.7558 |

0.7693 |

0.7714 |

0.7559 |

0.7748 |

|||||||||||||||

| High |

0.7715 |

0.8143 |

0.8243 |

0.7972 |

0.8529 |

|||||||||||||||

| Low |

0.7358 |

0.7326 |

0.7275 |

0.6853 |

0.7148 |

|||||||||||||||

| Liquids (a) |

Natural gas | Synthetic oil | Bitumen | Total oil-equivalent basis |

||||||||||||||||

| millions of barrels |

billions of cubic feet |

millions of barrels |

millions of barrels |

millions of barrels |

||||||||||||||||

| Net proved reserves: |

||||||||||||||||||||

| Developed |

22 |

291 |

415 |

2,609 |

3,095 |

|||||||||||||||

| Undeveloped |

19 |

290 |

- |

330 |

397 |

|||||||||||||||

| Total net proved |

41 |

581 |

415 |

2,939 |

3,492 |

|||||||||||||||

| (a) | Liquids include crude oil, condensate and natural gas liquids (NGLs). NGL proved reserves are not material and are therefore included under liquids. |

thousands of barrels per day (a) |

2019 |

2018 | 2017 | |||||||||||

| Bitumen: |

||||||||||||||

| Kearl: |

- gross (b) |

145 |

146 | 126 | ||||||||||

| - net (c) |

140 |

135 | 123 | |||||||||||

| Cold Lake: |

- gross (b) |

140 |

147 | 162 | ||||||||||

| - net (c) |

114 |

120 | 132 | |||||||||||

| Total bitumen: |

- gross (b) |

285 |

293 | 288 | ||||||||||

| - net (c) |

254 |

255 | 255 | |||||||||||

| Synthetic oil (d) : |

- gross (b) |

73 |

62 | 62 | ||||||||||

| - net (c) |

65 |

60 | 57 | |||||||||||

| Liquids (e) : |

- gross (b) |

16 |

6 | 5 | ||||||||||

| - net (c) |

14 |

7 | 4 | |||||||||||

| Total: |

- gross (b) |

374 |

361 | 355 | ||||||||||

| - net (c) |

333 |

322 | 316 | |||||||||||

| (a) | Volume per day metrics are calculated by dividing the volume for the period by the number of calendar days in the period. |

| (b) | Gross production is the company’s share of production (excluding purchases) before deduction of the mineral owners’ or governments’ share or both. |

| (c) | Net production is gross production less the mineral owners’ or governments’ share or both. |

| (d) | The company’s synthetic oil production volumes were from the company’s share of production volumes in the Syncrude joint venture. |

| (e) | Liquids include crude oil, condensate and NGLs. |

| millions of cubic feet per day (a) |

2019 |

2018 | 2017 | |||||||||

| Gross production (b) (c) |

145 |

129 | 120 | |||||||||

| Net production (c) (d) (e) |

144 |

126 | 114 | |||||||||

| Net production available for sale (f) |

108 |

94 | 80 |

| (a) | Volume per day metrics are calculated by dividing the volume for the period by the number of calendar days in the period. |

| (b) | Gross production is the company’s share of production (excluding purchases) before deduction of the mineral owners’ or governments’ share or both. |

| (c) | Production of natural gas includes amounts used for internal consumption with the exception of the amounts reinjected. |

| (d) | Net production is gross production less the mineral owners’ or governments’ share or both. |

| (e) | Net production reported in the above table is consistent with production quantities in the net proved reserves disclosure. |

| (f) | Includes sales of the company’s share of net production and excludes amounts used for internal consumption. |

thousands of barrels per day (a) |

2019 |

2018 | 2017 | |||||||||

| Total production oil-equivalent basis: |

||||||||||||

| - gross (b) |

398 |

383 | 375 | |||||||||

| - net (c) |

357 |

343 | 335 | |||||||||

| (a) | Volume per day metrics are calculated by dividing the volume for the period by the number of calendar days in the period. |

| (b) | Gross production is the company’s share of production (excluding purchases) before deduction of the mineral owners’ or governments’ share or both. |

| (c) | Net production is gross production less the mineral owners’ or governments’ share or both. |

Canadian dollars per barrel |

2019 |

2018 | 2017 | |||||||||

| Bitumen |

50.02 |

37.56 | 39.13 | |||||||||

| Synthetic oil |

74.47 |

70.66 | 67.58 | |||||||||

| Liquids (a) |

42.91 |

40.20 | 38.49 | |||||||||

| Canadian dollars per thousand cubic feet |

||||||||||||

| Natural gas |

2.05 |

2.43 | 2.58 | |||||||||

| (a) | Liquids include crude oil, condensate and NGLs. |

Canadian dollars per barrel |

2019 |

2018 | 2017 | |||||||||

| Bitumen |

31.53 |

29.39 | 26.81 | |||||||||

| Synthetic oil |

54.44 |

60.34 | 58.96 | |||||||||

| Total oil-equivalent basis (a) |

34.82 |

35.28 | 32.96 | |||||||||

| (a) | Includes liquids, bitumen, synthetic oil and natural gas. |

wells |

2019 |

2018 | 2017 | |||||||||

| Net productive exploratory |

- |

- |

- |

|||||||||

| Net dry exploratory |

- |

- |

- |

|||||||||

| Net productive development |

28 |

19 | 5 | |||||||||

| Net dry development |

- |

1 | - |

|||||||||

| Total |

28 |

20 | 5 | |||||||||

2019 |

||||||||

wells |

Gross | Net | ||||||

| Total |

12 |

6 |

||||||

Year ended December 31, 2019 |

Year ended December 31, 2018 | |||||||||||||||||||||||||||||||

| Crude oil | Natural gas | Crude oil | Natural gas | |||||||||||||||||||||||||||||

wells |

Gross (a) |

Net (b) |

Gross (a) |

Net (b) |

Gross (a) |

Net (b) |

Gross (a) |

Net (b) |

||||||||||||||||||||||||

| Total (c) |

4,646 |

4,603 |

2,801 |

911 |

4,760 | 4,655 | 3,459 | 1,164 | ||||||||||||||||||||||||

| (a) | Gross wells are wells in which the company owns a working interest. |

| (b) | Net wells are the sum of the fractional working interest owned by the company in gross wells, rounded to the nearest whole number. |

| (c) | Multiple completion wells are permanently equipped to produce separately from two or more distinctly different geological formations. At year-end 2019, the company had an interest in 12 gross wells with multiple completions (2018 - 16 gross wells). |

| Developed | Undeveloped | Total | ||||||||||||||||||||||||

thousands of acres |

2019 |

2018 | 2019 |

2018 | 2019 |

2018 | ||||||||||||||||||||

| Western provinces (a) : |

||||||||||||||||||||||||||

| Liquids and gas |

- gross (b) |

1,056 |

1,497 | 771 |

807 | 1,827 |

2,304 | |||||||||||||||||||

| - net (c) |

516 |

721 | 432 |

446 | 948 |

1,167 | ||||||||||||||||||||

| Bitumen |

- gross (b) |

197 |

197 | 601 |

595 | 798 |

792 | |||||||||||||||||||

| - net (c) |

182 |

182 | 269 |

292 | 451 |

474 | ||||||||||||||||||||

| Synthetic oil |

- gross (b) |

118 |

118 | 136 |

136 | 254 |

254 | |||||||||||||||||||

| - net (c) |

29 |

29 | 34 |

34 | 63 |

63 | ||||||||||||||||||||

| Canada lands (d): |

||||||||||||||||||||||||||

| Liquids and gas |

- gross (b) |

4 |

4 | 1,831 |

1,831 | 1,835 |

1,835 | |||||||||||||||||||

| - net (c) |

2 |

2 | 498 |

498 | 500 |

500 | ||||||||||||||||||||

| Atlantic offshore: |

||||||||||||||||||||||||||

| Liquids and gas |

- gross (b) |

65 |

65 | 267 |

286 | 332 |

351 | |||||||||||||||||||

| - net (c) |

6 |

6 | 36 |

45 | 42 |

51 | ||||||||||||||||||||

| Total (e): |

- gross (b) |

1,440 |

1,881 | 3,606 |

3,655 | 5,046 |

5,536 | |||||||||||||||||||

| - net (c) |

735 |

940 | 1,269 |

1,315 | 2,004 |

2,255 | ||||||||||||||||||||

| (a) | Western provinces include British Columbia and Alberta. |

| (b) | Gross acres include the interests of others. |

| (c) | Net acres exclude the interests of others. |

| (d) | Canada lands include the Arctic Islands, Beaufort Sea / Mackenzie Delta, and other Northwest Territories and Yukon regions. |

| (e) | Certain land holdings are subject to modification under agreements whereby others may earn interests in the company’s holdings by performing certain exploratory work (farm-out) and whereby the company may earn interests in others’ holdings by performing certain exploratory work (farm-in). |

| Refinery throughput (a) |

Rated capacities (b) |

|||||||||||||||

| Year ended December 31 | at December 31 | |||||||||||||||

thousands of barrels per day |

2019 |

2018 | 2017 | 2019 |

||||||||||||

| Strathcona, Alberta |

183 |

173 | 185 | 191 |

||||||||||||

| Sarnia, Ontario |

86 |

109 | 103 | 119 |

||||||||||||

| Nanticoke, Ontario |

84 |

110 | 95 | 113 |

||||||||||||

| Total |

353 |

392 | 383 | 423 |

||||||||||||

| (a) | Refinery throughput is the volume of crude oil and feedstocks that is processed in the refinery atmospheric distillation units. |

| (b) | Rated capacities are based on definite specifications as to types of crude oil and feedstocks that are processed in the refinery atmospheric distillation units, the products to be obtained and the refinery process, adjusted to include an estimated allowance for normal maintenance shutdowns. Accordingly, actual capacities may be higher or lower than rated capacities due to changes in refinery operation and the type of crude oil available for processing. |

thousands of barrels per day |

2019 |

2018 | 2017 | |||||||||

| Gasolines |

249 |

255 | 257 | |||||||||

| Heating, diesel and jet fuels |

167 |

183 | 177 | |||||||||

| Heavy fuel oils |

21 |

26 | 18 | |||||||||

| Lube oils and other products |

38 |

40 | 40 | |||||||||

| Net petroleum product sales |

475 |

504 | 492 | |||||||||

thousands of tonnes |

2019 |

2018 | 2017 | |||||||||

| Total petrochemical sales |

732 |

807 | 774 | |||||||||

career employees (a) |

2019 |

2018 | 2017 | |||||||||

| Total |

6,000 |

5,700 | 5,400 | |||||||||

| (a) | Rounded. Career employees are defined as active executive, management, professional, technical, administrative and wage employees who work full time or part time for the company and are covered by the company’s benefit plans. |

Item 1A. |

Risk factors |

| Unresolved staff comments |

| Properties |

| Legal proceedings |

| Mine safety disclosures |

| Market for registrant’s common equity, related stockholder matters and issuer purchases of equity securities |

· |

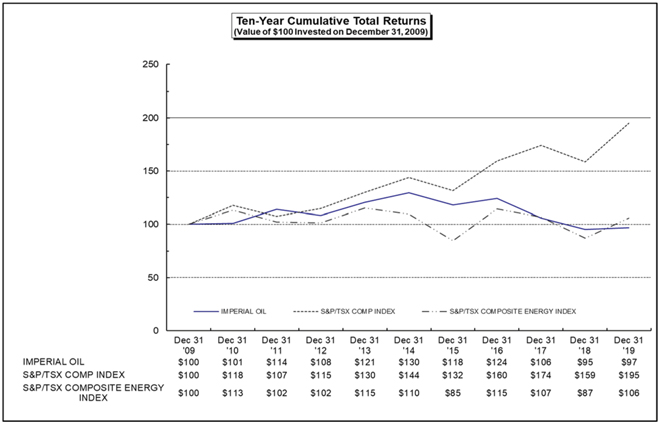

Entitled “Performance graph” within the “Compensation discussion and analysis” section on page 157 of this report; and |

· |

Entitled “Equity compensation plan information”, within the “Compensation discussion and analysis”, on page 163 of this report. |

| Total number of shares purchased |

Average price paid per share (Canadian dollars) |

Total number of shares purchased as part of publicly announced plans or programs |

Maximum number of shares that may yet be purchased under the plans or programs (a) | |||||||||||

| | ||||||||||||||

| October 2019 |

||||||||||||||

| (October 1 - October 31) |

3,431,196 |

32.81 |

3,431,196 |

24,954,195 | ||||||||||

| November 2019 |

||||||||||||||

| (November 1 - November 30) |

3,275,232 |

33.89 |

3,275,232 |

21,678,963 | ||||||||||

| December 2019 |

||||||||||||||

| (December 1 - December 31) |

2,340,102 |

33.25 |

2,340,102 |

19,338,861 (b) | ||||||||||

| | ||||||||||||||

| (a) | On June 21, 2019, the company announced by news release that it had received final approval from the Toronto Stock Exchange for a new normal course issuer bid and will continue its existing share purchase program. The program enables the company to purchase up to a maximum of 38,211,086 common shares during the period June 27, 2019 to June 26, 2020. This maximum includes shares purchased under the normal course issuer bid and from Exxon Mobil Corporation concurrent with, but outside of the normal course issuer bid. As in the past, Exxon Mobil Corporation has advised the company that it intends to participate to maintain its ownership percentage at approximately 69.6 percent. The program will end should the company purchase the maximum allowable number of shares, or on June 26, 2020. |

| (b) | In its most recent quarterly earnings release, the company stated that it currently anticipates exercising its share purchases uniformly over the duration of the program. Purchase plans may be modified at any time without prior notice. |

| Selected financial data |

millions of Canadian dollars |

2019 |

2018 | 2017 | 2016 | 2015 | |||||||||||||||

| Revenues |

34,002 |

34,964 | 29,125 | 25,049 | 26,756 | |||||||||||||||

| Net income (loss) |

2,200 |

2,314 | 490 | 2,165 | 1,122 | |||||||||||||||

| Total assets at year-end |

42,187 |

41,456 | 41,601 | 41,654 | 43,170 | |||||||||||||||

| Long-term debt at year-end |

4,961 |

4,978 | 5,005 | 5,032 | 6,564 | |||||||||||||||

| Total debt at year-end |

5,190 |

5,180 | 5,207 | 5,234 | 8,516 | |||||||||||||||

| Other long-term obligations at year-end |

3,637 |

2,943 | 3,780 | 3,656 | 3,597 | |||||||||||||||

| Canadian dollars |

||||||||||||||||||||

| Net income (loss) per common share - basic |

2.88 |

2.87 | 0.58 | 2.55 | 1.32 | |||||||||||||||

| Net income (loss) per common share - diluted |

2.88 |

2.86 | 0.58 | 2.55 | 1.32 | |||||||||||||||

| Dividends per common share - declared |

0.85 |

0.73 | 0.63 | 0.59 | 0.54 | |||||||||||||||

| Management’s discussion and analysis of financial condition and results of operations |

| Quantitative and qualitative disclosures about market risk |

| Financial statements and supplementary data |

● |

Consolidated financial statements, together with the report thereon of PricewaterhouseCoopers LLP (PwC) dated February 26, 2020 beginning with the section entitled “Report of independent registered public accounting firm” on page 62 and continuing through note 18, “Other comprehensive income (loss) information” on page 95; |

● |

“Supplemental information on oil and gas exploration and production activities” (unaudited) starting on page 96; and |

● |

“Quarterly financial data” on page 100. |

| Changes in and disagreements with accountants on accounting and financial disclosure |

| Controls and procedures |

| Other information |

| Directors, executive officers and corporate governance |

· |

“Director nominee tables”, on pages 102 to 105 of this report; |

· |

“Skills and experience of our board members”, on page 109 of this report. |

· |

“Other public company directorships of our board members”, on page 113 of this report. |

· |

The table entitled “Audit committee” under “Board and committee structure”, on page 119 of this report; |

· |

“Ethical business conduct”, starting on page 131 of this report; and |

· |

“Largest shareholder”, on page 134 of this report. |

· |

“Named executive officers of the company” and “Other executive officers of the company”, on pages 136 to 139 of this report. |

| Executive compensation |

· |

“Director compensation”, on pages 123 to 129 of this report; and |

· |

“Share ownership guidelines of independent directors and chairman, president and chief executive officer”, on page 130 of this report. |

· |

“Letter to shareholders from the executive resources committee on executive compensation”, starting on page 140 of this report; and |

· |

“Compensation discussion and analysis”, on pages 142 to 165 of this report. |

| Security ownership of certain beneficial owners and management and related stockholder matters |

Imperial Oil Limited |

Exxon Mobil Corporation |

|||||||||||||||

Named executive officer |

Common shares (a) |

Restricted stock units (b) |

Common shares (a) |

Restricted stock units (b) |

||||||||||||

| R.M. Kruger (c) |

- | 599,100 | 2,007 | 118,500 | ||||||||||||

| D.E. Lyons |

- | 38,400 | 8,770 | 29,850 | ||||||||||||

| B.W. Corson |

- | 78,200 | 96,903 | 144,200 | ||||||||||||

| J.R. Whelan |

- | 66,000 | 28,607 | 15,850 | ||||||||||||

| T.B. Redburn |

3,407 | 98,050 | - | - | ||||||||||||

| Incumbent directors and executive officers as a group (17 people) |

140,042 | 581,325 | 146,549 | 263,000 | ||||||||||||

| (a) | No common shares are beneficially owned by reason of exercisable options. None of these individuals owns more than 0.01 percent of the outstanding shares of Imperial Oil Limited or Exxon Mobil Corporation. The directors and officers as a group own approximately 0.02 percent of the outstanding shares of Imperial Oil Limited, and less than 0.01 percent of the outstanding shares of Exxon Mobil Corporation. Information not being within the knowledge of the company has been provided by the directors and the executive officers individually. |

| (b) | Restricted stock units do not carry voting rights prior to the issuance of shares on settlement of the awards. |

| (c) | R.M. Kruger was the company’s chairman, president and chief executive officer until September 16, 2019, and continued as chairman and chief executive officer until his retirement on December 31, 2019. |

| Certain relationships and related transactions, and director independence |

| Principal accountant fees and services |

| thousands of Canadian dollars |

2019 |

2018 | ||||||

| Audit fees |

1,782 |

1,808 | ||||||

| Audit-related fees |

94 |

94 | ||||||

| Tax fees |

- |

- | ||||||

| All other fees |

- |

- | ||||||

| Total fees |

1,876 |

1,902 |

Item 15. |

Exhibits, financial statement schedules |

| (3) (i) | Restated certificate and articles of incorporation of the company (Incorporated herein by reference to Exhibit (3.1) to the company’s Form 8-K filed on May 3, 2006 (File No. 0-12014)). | |

By-laws of the company (Incorporated herein by reference to Exhibit (3)(ii) to the company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2003 (File No. 0-12014)). | ||

| (4) (vi) | Description of capital stock. | |

| (10) (ii) | (1) Syncrude Ownership and Management Agreement, dated February 4, 1975 (Incorporated herein by reference to Exhibit 13(b) of the company’s Registration Statement on Form S-1, as filed with the Securities and Exchange Commission on August 21, 1979 (File No. 2-65290)). | |

| (2) Letter Agreement, dated February 8, 1982, between the Government of Canada and Esso Resources Canada Limited, amending Schedule “C” to the Syncrude Ownership and Management Agreement filed as Exhibit (10)(ii)(2) (Incorporated herein by reference to Exhibit (20) of the company’s Annual Report on Form 10-K for the year ended December 31, 1981 (File No. 2-9259)). | ||

| (3) Amendment to Syncrude Ownership and Management Agreement, dated March 10, 1982 (Incorporated herein by reference to Exhibit (10)(ii)(14) of the company’s Annual Report on Form 10-K for the year ended December 31, 1989 (File No. 0-12014)). | ||

| (4) Alberta Cold Lake Transition Agreement, effective January 1, 2000, relating to the royalties payable in respect of the Cold Lake production project and terminating the Alberta Cold Lake Crown Agreement dated June 25, 1984. (Incorporated herein by reference to Exhibit (10)(ii)(20) of the company’s Annual Report on Form 10-K for the year ended December 31, 2001 (File No. 0-12014)). | ||

| (5) Amendment to Syncrude Ownership and Management Agreement effective January 1, 2001 (Incorporated herein by reference to Exhibit (10)(ii)(22) of the company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2002 (File No. 0-12014)). | ||

| (6) Amendment to Syncrude Ownership and Management Agreement effective September 16, 1994 (Incorporated herein by reference to Exhibit (10)(ii)(23) of the company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2002 (File No. 0-12014)). | ||

| (7) Syncrude Bitumen Royalty Option Agreement, dated November 18, 2008, setting out the terms of the exercise by the Syncrude Joint Venture owners of the option contained in the existing Crown Agreement to convert to a royalty payable on the value of bitumen, effective January 1, 2009 (Incorporated herein by reference to Exhibit 1.01(10)(ii)(2) of the company’s Form 8-K filed on November 19, 2008 (File No. 0-12014)). | ||

| (iii)(A) | (1) Form of Letter relating to Supplemental Retirement Income (Incorporated herein by reference to Exhibit (10)(c)(3) of the company’s Annual Report on Form 10-K for the year ended December 31, 1980 (File No. 2-9259)). | |

| (2) Deferred Share Unit Plan for Nonemployee Directors. (Incorporated herein by reference to Exhibit (10)(iii)(A)(6) of the company’s Annual Report on Form 10-K for the year ended December 31, 1998 (File No. 0-12014)). | ||

| (3) Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2008 and subsequent years, as amended effective November 20, 2008 (Incorporated herein by reference to Exhibit 9.01(c)[10(iii)(A)(5)] of the company’s Form 8-K filed on November 25, 2008 (File No. 0-12014)). | ||

| (4) Short Term Incentive Program for selected executives effective February 2, 2012 (Incorporated herein by reference to Exhibit 9.01(c)[10(iii)(A)(1)] of the company’s Form 8-K filed on February 7, 2012 (File No. 0-12014)). | ||

| (5) Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2011 and subsequent years, as amended effective November 14, 2011 (Incorporated herein by reference to Exhibit 9.01(c)[10(iii)(A)(1)] of the company’s Form 8-K filed on February 23, 2012 (File No. 0-12014)). | ||

| (6) Amended Restricted Stock Unit Plan with respect to Restricted Stock Units granted in 2016 and subsequent years, as amended effective October 26, 2016 (Incorporated herein by reference to Exhibit 9.01(c)[10(iii)(A)(1)] of the company’s Form 8-K filed on October 31, 2016 (File No. 0-12014)). | ||

| (7) Amended Short Term Incentive Program with respect to awards granted in 2016 and subsequent years, as amended effective October 26, 2016 (Incorporated herein by reference to Exhibit 9.01(c)[10(iii)(A)(1)] of the company’s Form 8-K filed on October 31, 2016 (File No. 0-12014)). | ||

| (21) | Imperial Oil Resources Limited is incorporated in Canada, and is a wholly-owned subsidiary of the company. The names of all other subsidiaries of the company are omitted because, considered in the aggregate as a single subsidiary, they would not constitute a significant subsidiary as of December 31, 2019. | |

| (31.1) | Certification by principal executive officer of Periodic Financial Report pursuant to Rule 13a-14(a). | |

| (31.2) | Certification by principal financial officer of Periodic Financial Report pursuant to Rule 13a-14(a). | |

| (32.1) | Certification by chief executive officer of Periodic Financial Report pursuant to Rule 13a-14(b) and 18 U.S.C. Section 1350. | |

| (32.2) | Certification by chief financial officer of Periodic Financial Report pursuant to Rule 13a-14(b) and 18 U.S.C. Section 1350. | |

| (101) | Interactive Data Files (formatted as Inline XBRL). | |

| (104) | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). | |

| Imperial Oil Limited |

| by /s/ Bradley W. Corson |

| (Bradley W. Corson) |

| Chairman, president and chief executive officer |

| Signature | Title | |||

| /s/ Bradley W. Corson (Bradley W. Corson) |

Chairman, president and chief executive officer and director (Principal executive officer) | |||

| /s/ Daniel E. Lyons (Daniel E. Lyons) |

Senior vice-president, finance and administration, and controller (Principal financial officer and principal accounting officer) | |||

| /s/ David C. Brownell (David C. Brownell) |

Director | |||

| /s/ David W. Cornhill |

Director | |||

| (David W. Cornhill) | ||||

| /s/ Krystyna T. Hoeg |

Director | |||

| (Krystyna T. Hoeg) |

||||

| /s/ Miranda C. Hubbs |

Director | |||

| (Miranda C. Hubbs) | ||||

| /s/ Jack M. Mintz |

Director | |||

| (Jack M. Mintz) | ||||

| /s/ David S. Sutherland |

Director | |||

| (David S. Sutherland) | ||||

Table of contents |

Page |

|||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 45 | ||||

| 50 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 70 | ||||

| 75 | ||||

| 76 | ||||

| 78 | ||||

| 79 | ||||

| 84 | ||||

| 85 | ||||

| 86 | ||||

| 87 | ||||

| 87 | ||||

| 88 | ||||

| 89 | ||||

| 89 | ||||

| 90 | ||||

| 92 | ||||

| 93 | ||||

| 94 | ||||

| 95 | ||||

| 96 | ||||

| 100 | ||||

| millions of Canadian dollars |

2019 |

2018 | 2017 | 2016 | 2015 | |||||||||||||||

| Revenues |

34,002 |

34,964 | 29,125 | 25,049 | 26,756 | |||||||||||||||

| Net income (loss): |

||||||||||||||||||||

| Upstream |

1,348 |

(138 | ) | (706 | ) | (661 | ) | (704 | ) | |||||||||||

| Downstream |

961 |

2,366 | 1,040 | 2,754 | 1,586 | |||||||||||||||

| Chemical |

108 |

275 | 235 | 187 | 287 | |||||||||||||||

| Corporate and other |

(217 |

) |

(189 | ) | (79 | ) | (115 | ) | (47 | ) | ||||||||||

| Net income (loss) |

2,200 |

2,314 | 490 | 2,165 | 1,122 | |||||||||||||||

| Cash and cash equivalents at year-end |

1,718 |

988 | 1,195 | 391 | 203 | |||||||||||||||

| Total assets at year-end |

42,187 |

41,456 | 41,601 | 41,654 | 43,170 | |||||||||||||||

| Long-term debt at year-end |

4,961 |

4,978 | 5,005 | 5,032 | 6,564 | |||||||||||||||

| Total debt at year-end |

5,190 |

5,180 | 5,207 | 5,234 | 8,516 | |||||||||||||||

| Other long-term obligations at year-end |

3,637 |

2,943 | 3,780 | 3,656 | 3,597 | |||||||||||||||

| Shareholders’ equity at year-end |

24,276 |

24,489 | 24,435 | 25,021 | 23,425 | |||||||||||||||

| Cash flow from operating activities |

4,429 |

3,922 | 2,763 | 2,015 | 2,167 | |||||||||||||||

| Per share information (Canadian dollars) |

||||||||||||||||||||

| Net income (loss) per common share - basic |

2.88 |

2.87 | 0.58 | 2.55 | 1.32 | |||||||||||||||

| Net income (loss) per common share - diluted |

2.88 |

2.86 | 0.58 | 2.55 | 1.32 | |||||||||||||||

| Dividends per common share - declared |

0.85 |

0.73 | 0.63 | 0.59 | 0.54 | |||||||||||||||

| millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Business uses: asset and liability perspective |

||||||||||||

| Total assets |

42,187 |

41,456 | 41,601 | |||||||||

| Less: Total current liabilities excluding notes and loans payable |

(4,366) |

(3,753 | ) | (3,934 | ) | |||||||

| Total long-term liabilities excluding long-term debt |

(8,355) |

(8,034 | ) | (8,025 | ) | |||||||

| Add: Imperial’s share of equity company debt |

24 |

23 | 19 | |||||||||

| Total capital employed |

29,490 |

29,692 | 29,661 | |||||||||

| Total company sources: Debt and equity perspective |

||||||||||||

| Notes and loans payable |

229 |

202 | 202 | |||||||||

| Long-term debt |

4,961 |

4,978 | 5,005 | |||||||||

| Shareholders’ equity |

24,276 |

24,489 | 24,435 | |||||||||

| Add: Imperial’s share of equity company debt |

24 |

23 | 19 | |||||||||

| Total capital employed |

29,490 |

29,692 | 29,661 | |||||||||

| millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Net income |

2,200 |

2,314 | 490 | |||||||||

| Financing (after-tax), including Imperial’s share of equity companies |

66 |

77 | 48 | |||||||||

| Net income excluding financing |

2,266 |

2,391 | 538 | |||||||||

| Average capital employed |

29,591 |

29,677 | 29,967 | |||||||||

| Return on average capital employed (percent) – corporate total |

7.7 |

8.1 | 1.8 | |||||||||

| millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Cash flows from operating activities |

4,429 |

3,922 | 2,763 | |||||||||

| Proceeds from asset sales |

82 |

59 | 232 | |||||||||

| Total cash flows from operating activities and asset sales |

4,511 |

3,981 | 2,995 |

| millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| From Imperial’s Consolidated statement of income |

||||||||||||

| Total expenses |

32,055 |

32,026 | 28,842 | |||||||||

| Less: |

||||||||||||

| Purchases of crude oil and products |

20,946 |

21,541 | 18,145 | |||||||||

| Federal excise tax and fuel charge |

1,808 |

1,667 | 1,673 | |||||||||

| Financing |

93 |

108 | 78 | |||||||||

| Subtotal |

22,847 |

23,316 | 19,896 | |||||||||

| Imperial’s share of equity company expenses |

76 |

74 | 62 | |||||||||

| Total operating costs |

9,284 |

8,784 | 9,008 |

| millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| From Imperial’s Consolidated statement of income |

||||||||||||

| Production and manufacturing |

6,520 |

6,121 | 5,586 | |||||||||

| Selling and general |

900 |

908 | 883 | |||||||||

| Depreciation and depletion |

1,598 |

1,555 | 2,172 | |||||||||

| Non-service pension and postretirement benefit |

143 |

107 | 122 | |||||||||

| Exploration |

47 |

19 | 183 | |||||||||

| Subtotal |

9,208 |

8,710 | 8,946 | |||||||||

| Imperial’s share of equity company expenses |

76 |

74 | 62 | |||||||||

| Total operating costs |

9,284 |

8,784 | 9,008 |

millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Net income (loss) |

2,200 |

2,314 | 490 | |||||||||

millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Net income (loss) |

1,348 |

(138 | ) | (706 | ) | |||||||

| Average realizations |

||||||||||||

Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Bitumen (per barrel) |

50.02 |

37.56 | 39.13 | |||||||||

| Synthetic oil (per barrel) |

74.47 |

70.66 | 67.58 | |||||||||

| Conventional crude oil (per barrel) |

51.81 |

41.84 | 53.51 | |||||||||

| Natural gas liquids (per barrel) |

22.83 |

38.66 | 31.46 | |||||||||

| Natural gas (per thousand cubic feet) |

2.05 |

2.43 | 2.58 | |||||||||

thousands of barrels per day |

2019 |

2018 | 2017 | |||||||||||||||||||||

gross |

net |

gross | net | gross | net | |||||||||||||||||||

| Bitumen |

285 |

254 |

293 | 255 | 288 | 255 | ||||||||||||||||||

| Synthetic oil (b) |

73 |

65 |

62 | 60 | 62 | 57 | ||||||||||||||||||

| Conventional crude oil |

14 |

13 |

5 | 5 | 4 | 3 | ||||||||||||||||||

| Total crude oil production |

372 |

332 |

360 | 320 | 354 | 315 | ||||||||||||||||||

| NGLs available for sale |

2 |

1 |

1 | 2 | 1 | 1 | ||||||||||||||||||

| Total crude oil and NGL production |

374 |

333 |

361 | 322 | 355 | 316 | ||||||||||||||||||

| Bitumen sales, including diluent (c) |

387 |

406 | 381 | |||||||||||||||||||||

| NGL sales |

6 |

6 | 6 | |||||||||||||||||||||

millions of cubic feet per day |

2019 |

2018 | 2017 | |||||||||||||||||||||

gross |

net |

gross | net | gross | net | |||||||||||||||||||

| Production (d) (e) |

145 |

144 |

129 | 126 | 120 | 114 | ||||||||||||||||||

| Production available for sale (f) |

108 |

94 | 80 | |||||||||||||||||||||

| (a) | Volume per day metrics are calculated by dividing the volume for the period by the number of calendar days in the period. Gross production is the company’s share of production (excluding purchases) before deduction of the mineral owners’ or governments’ share or both. Net production excludes those shares. |

| (b) | The company’s synthetic oil production volumes were from the company’s share of production volumes in the Syncrude joint venture. |

| (c) | Diluent is natural gas condensate or other light hydrocarbons added to crude bitumen to facilitate transportation to market by pipeline and rail. |

| (d) | Gross production of natural gas includes amounts used for internal consumption with the exception of the amounts re-injected. |

| (e) | Net production is gross production less the mineral owners’ or governments’ share or both. Net production reported in the above table is consistent with production quantities in the net proved reserves disclosure. |

| (f) | Includes sales of the company’s share of net production and excludes amounts used for internal consumption. |

| Downstream |

||||||||||||

millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Net income (loss) |

961 |

2,366 | 1,040 | |||||||||

thousands of barrels per day (a) |

2019 |

2018 | 2017 | |||||||||

| Total refinery throughput (b) |

353 |

392 | 383 | |||||||||

| Refinery capacity at December 31 |

423 |

423 | 423 | |||||||||

| Utilization of total refinery capacity (percent) |

83 |

93 | 91 | |||||||||

thousands of barrels per day (a) |

2019 |

2018 | 2017 | |||||||||

| Gasolines |

249 |

255 | 257 | |||||||||

| Heating, diesel and jet fuels |

167 |

183 | 177 | |||||||||

| Heavy fuel oils |

21 |

26 | 18 | |||||||||

| Lube oils and other products |

38 |

40 | 40 | |||||||||

| Net petroleum product sales |

475 |

504 | 492 | |||||||||

| (a) | Volume per day metrics are calculated by dividing the volume for the period by the number of calendar days in the period. |

| (b) | Crude oil and feedstocks sent directly to atmospheric distillation units. |

millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Net income (loss) |

108 |

275 | 235 | |||||||||

thousands of tonnes |

2019 |

2018 | 2017 | |||||||||

| Polymers and basic chemicals |

575 |

602 | 564 | |||||||||

| Intermediate and others |

157 |

205 | 210 | |||||||||

| Total petrochemical sales |

732 |

807 | 774 | |||||||||

| Corporate and other |

||||||||||||

millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Net income (loss) |

(217 |

) |

(189 | ) | (79 | ) | ||||||

millions of Canadian dollars |

2019 |

2018 | 2017 | |||||||||

| Cash provided by (used in) |

||||||||||||

| Operating activities |

4,429 |

3,922 | 2,763 | |||||||||

| Investing activities |

(1,704 |

) |

(1,559 | ) | (781 | ) | ||||||

| Financing activities |

(1,995 |

) |

(2,570 | ) | (1,178 | ) | ||||||

| Increase (decrease) in cash and cash equivalents |

730 |

(207 | ) | 804 | ||||||||

| Cash and cash equivalents at end of year |

1,718 |

988 | 1,195 | |||||||||

percent |

||||||||||||

At December 31 |

2019 |

2018 | 2017 | |||||||||

| Debt to capital (a) |

18 |

18 | 18 | |||||||||

| (a) | Debt, defined as the sum of Notes and loans payable and Long-term debt (page 67), divided by capital, defined as the sum of debt and Total shareholders’ equity (page 67). |

| Payment due by period | ||||||||||||||||||||||||

millions of Canadian dollars |

Note reference |

2020 | 2021 to 2022 |

2023 to 2024 |

2025 and beyond |

Total | ||||||||||||||||||

| Long-term debt excluding finance lease obligations (a) |

15 | - |

4,447 |

- |

- |

4,447 |

||||||||||||||||||

| Operating and finance leases (b) |

14 | 194 |

203 |

119 |

1,116 |

1,632 |

||||||||||||||||||

| Firm capital commitments (c) |

217 |

111 |

66 |

- |

394 |

|||||||||||||||||||

| Pension and other postretirement obligations (d) |

5 | 275 |

120 |

122 |

1,363 |

1,880 |

||||||||||||||||||

| Asset retirement obligations (e) |

6 | 76 |

64 |

47 |

1,213 |

1,400 |

||||||||||||||||||

| Other long-term purchase agreements (f) |

883 |

1,599 |

1,470 |

8,637 |

12,589 |

|||||||||||||||||||

| (a) | Long-term debt includes a loan from an affiliated company of ExxonMobil of $4,447 million. The payment by period for the related party long-term loan is estimated based on the right of the related party to cancel the loan on at least 370 days advance written notice. |

| (b) | Minimum commitments for finance and operating leases, both commenced and non-commenced, are shown on an undiscounted basis. Leases are primarily associated with storage tanks, rail cars, marine vessels, transportation facilities and service agreements. |

| (c) | Firm capital commitments represent legally-binding payment obligations to third parties where agreements specifying all significant terms have been executed for the construction and purchase of fixed assets and other permanent investments. In certain cases where the company executes contracts requiring commitments to a work scope, those commitments have been included to the extent that the amounts and timing of payments can be reliably estimated. Firm capital commitments related to capital projects are shown on an undiscounted basis. |

| (d) | The amount by which the benefit obligations exceeded the fair value of fund assets for pension and other postretirement plans at year end. The payments by period include expected contributions to funded pension plans in 2020 and estimated benefit payments for unfunded plans in all years. |

| (e) | Asset retirement obligations represent the fair value of legal obligations associated with site restoration on the retirement of assets with determinable useful lives. |

| (f) | Other long-term purchase agreements are non-cancelable, or cancelable only under certain conditions and long-term commitments other than unconditional purchase obligations. They include primarily transportation services agreements, raw material supply and community benefits agreements. |

millions of Canadian dollars |

2019 |

2018 | ||||||

| Upstream (a) |

1,248 |

991 | ||||||

| Downstream |

484 |

383 | ||||||

| Chemical |

34 |

25 | ||||||

| Corporate and other |

48 |

28 | ||||||

| Total |

1,814 |

1,427 | ||||||

| (a) | Exploration expenses included. |

millions of Canadian dollars, after tax |

||||||||

| One dollar (U.S.) per barrel increase (decrease) in crude oil prices |

+ (-) | 105 |

||||||

| One dollar (U.S.) per barrel increase (decrease) in light and heavy crude price differentials (b) |

+ (-) | 40 |

||||||

| Ten cents per thousand cubic feet decrease (increase) in natural gas prices |

+ (-) | 7 |

||||||

| One dollar (U.S.) per barrel increase (decrease) in refining 2-1-1 (c) |

+ (-) | 140 |

||||||

| One cent (U.S.) per pound increase (decrease) in sales margins for polyethylene |

+ (-) | 7 |

||||||

| One cent decrease (increase) in the value of the Canadian dollar versus the U.S. dollar |

+ (-) | 100 |

||||||

| (a) | Each sensitivity calculation shows the impact on net income resulting from a change in one factor, after tax and royalties and holding all other factors constant. These sensitivities have been updated to reflect current market conditions. They may not apply proportionately to larger fluctuations. |

| (b) | Light and heavy crude differentials represent the difference between WTI benchmark prices and western Canadian prices for light and heavy crudes. |

| (c) | The 2-1-1 |

· |

Proved oil and natural gas reserves are determined in accordance with U.S. Securities and Exchange Commission (SEC) requirements. Proved reserves are those quantities of oil and natural gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible under existing economic and operating conditions and government regulations. Proved reserves are determined using the average of first-day-of-the-month |

· |

Unproved reserves are quantities of oil and natural gas with less than reasonable certainty of recoverability and include probable reserves. Probable reserves are reserves that, together with proved reserves, are as likely as not to be recovered. |

● |

A significant decrease in the market price of a long-lived asset; |

| ● | A significant adverse change in the extent or manner in which an asset is being used or in its physical condition including a significant decrease in the company’s current and projected reserve volumes; |

| ● | A significant adverse change in legal factors or in the business climate that could affect the value, including a significant adverse action or assessment by a regulator; |

| ● | An accumulation of project costs significantly in excess of the amount originally expected; |

| ● | A current-period operating loss combined with a history and forecast of operating or cash flow losses; and |

| ● | A current expectation that, more likely than not, a long-lived asset will be sold or otherwise disposed of significantly before the end of its previously estimated useful life. |

| millions of Canadian dollars |

||||||||||||||

| For the years ended December 31 |

2019 |

2018 |

2017 |

|||||||||||

| Revenues and other income |

||||||||||||||

| Revenues (a) |

|

|

|

|||||||||||

| Investment and other income (note 9) |

|

|

|

|||||||||||

| Total revenues and other income |

|

|

|

|||||||||||

| Expenses |

||||||||||||||

| Exploration (note 16) |

|

|

|

|||||||||||

| Purchases of crude oil and products (b) |

|

|

|

|||||||||||

| Production and manufacturing (c) |

|

|

|

|||||||||||

| Selling and general (c) |

|

|

|

|||||||||||

| Federal excise tax and fuel charge |

|

|

|

|||||||||||

| Depreciation and depletion |

|

|

|

|||||||||||

| Non-service pension and postretirement benefit |

|

|

|

|||||||||||

| Financing (d) (note 13) |

|

|

|

|||||||||||

| Total expenses |

|

|

|

|||||||||||

| Income (loss) before income taxes |

|

|

|

|||||||||||

| Income taxes (note 4) |

( |

) |

|

|

||||||||||

| Net income (loss) |

|

|

|

|||||||||||

| Per share information (Canadian dollars) |

||||||||||||||

| Net income (loss) per common share - basic (note 11) |

|

|

|

|||||||||||

| Net income (loss) per common share - diluted (note 11) |

|

|

|

|||||||||||

| (a) |

Amounts from related parties included in revenues, (note 17). |

|

|

|

||||||||||

| (b) |

Amounts to related parties included in purchases of crude oil and products, (note 17). |

|

|

|

||||||||||

| (c) |

Amounts to related parties included in production and manufacturing, and selling and general expenses, (note 17). |

|

|

|

||||||||||

| (d) |

Amounts to related parties included in financing, (note 17). |

|

|

|

||||||||||

| millions of Canadian dollars |

||||||||||||

| For the years ended December 31 |

2019 |

2018 |

2017 |

|||||||||

| Net income (loss) |

|

|

|

|||||||||

| Other comprehensive income (loss), net of income taxes Postretirement benefits liability adjustment (excluding amortization) |

( |

) |

|

( |

) | |||||||

| Amortization of postretirement benefits liability adjustment included in net periodic benefit costs |

|

|

|

|||||||||

| Total other comprehensive income (loss) |

( |

) |

|

|

||||||||

| Comprehensive income (loss) |

|

|

|

|||||||||

| millions of Canadian dollars |

||||||||

| At December 31 |

2019 |

2018 |

||||||

| Assets |

||||||||

| Current assets |

||||||||

| Cash |

|

|

||||||

| Accounts receivable, less estimated doubtful accounts (a) |

|

|

||||||

| Inventories of crude oil and products (note 12) |

|

|

||||||

| Materials, supplies and prepaid expenses |

|

|

||||||

| Total current assets |

|

|

||||||

| Investments and long-term receivables (b) |

|

|

||||||

| Property, plant and equipment, less accumulated depreciation and depletion |

|

|

||||||

| Goodwill |

|

|

||||||

| Other assets, including intangibles, net |

|

|

||||||

| Total assets |

|

|

||||||

| Liabilities |

||||||||

| Current liabilities |

||||||||

| Notes and loans payable (c) (note 13) |

|

|

||||||

| Accounts payable and accrued liabilities (a) (note 12) |

|

|

||||||

| Income taxes payable |

|

|

||||||

| Total current liabilities |

|

|

||||||

| Long-term debt (d) (note 15) |

|

|

||||||

| Other long-term obligations (e) (note 6) |

|

|

||||||

| Deferred income tax liabilities (note 4) |

|

|

||||||

| Total liabilities |

|

|

||||||

| Commitments and contingent liabilities (note 10) |

||||||||

| Shareholders’ equity |

||||||||

| Common shares at stated value (f) (note 11) |

|

|

||||||

| Earnings reinvested |

|

|

||||||

| Accumulated other comprehensive income (loss) (note 18) |

( |

) |

( |

) | ||||

| Total shareholders’ equity |

|

|

||||||

| Total liabilities and shareholders’ equity |

|

|

| (a) | Accounts receivable, less estimated doubtful accounts included net amounts receivable from related parties of $ |

| (b) | Investments and long-term receivables included amounts from related parties of $ |

| (c) | Notes and loans payable included amounts to related parties of $ |

| (d) | Long-term debt included amounts to related parties of $ |

| (e) | Other long-term obligations included amounts to related parties of $ |

| (f) | Number of common shares authorized and outstanding were |

| /s/ Bradley W. Corson B.W. Corson Chairman, president and chief executive officer |

/s/ Daniel E. Lyons D.E. Lyons Senior vice-president, finance and administration, and controller | |

| millions of Canadian dollars |

||||||||||||

| At December 31 |

|

2018 |

2017 |

|||||||||

| Common shares at stated value (note 11) |

||||||||||||

| At beginning of year |

|

|

|

|||||||||

| Issued under the stock option plan |

|

|

|

|||||||||

| Share purchases at stated value |

( |

) |

( |

) | ( |

) | ||||||

| At end of year |

|

|

|

|||||||||

| Earnings reinvested |

||||||||||||

| At beginning of year |

|

|

|

|||||||||

| Net income (loss) for the year |

|

|

|

|||||||||

| Share purchases in excess of stated value |

( |

) |

( |

) | ( |

) | ||||||

| Dividends declared |

( |

) |

( |

) | ( |

) | ||||||

| At end of year |

|

|

|

|||||||||

| Accumulated other comprehensive income (loss) (note 18) |

||||||||||||

| At beginning of year |

( |

) |

( |

) | ( |

) | ||||||

| Other comprehensive income (loss) |

( |

) |

|

|

||||||||

| At end of year |

( |

) |

( |

) | ( |

) | ||||||

| Shareholders’ equity at end of year |

|

|

|

|||||||||

| millions of Canadian dollars |

||||||||||||

| Inflow (outflow) |

||||||||||||

| For the years ended December 31 |

2019 |

2018 |

|

2017 |

||||||||

| Operating activities |

||||||||||||

| Net income (loss) |

|

|

|

|||||||||

| Adjustments for non-cash items: |

||||||||||||

| Depreciation and depletion |

|

|

|

|||||||||

| Impairment of intangible assets |

|

|

|

|||||||||

| (Gain) loss on asset sales (note 9) |

( |

) |

( |

) | ( |

) | ||||||

| Deferred income taxes and other |

( |

) |

|

|

||||||||

| Changes in operating assets and liabilities: |

||||||||||||

| Accounts receivable |

( |

) |

|

( |

) | |||||||

| Inventories, materials, supplies and prepaid expenses |

( |

) |

( |

) |

( |

) | ||||||

| Income taxes payable |

|

|

( |

) | ||||||||

| Accounts payable and accrued liabilities |

|

( |

) |

|

||||||||

| All other items - net (a) (c) |

|

|

|

|||||||||

| Cash flows from (used in) operating activities |

|

|

|

|||||||||

| Investing activities |

||||||||||||

| Additions to property, plant and equipment (a) |

( |

) |

( |

) |

( |

) | ||||||

| Proceeds from asset sales (note 9) |

|

|

|

|||||||||

| Additional investments |

|

|

( |

) | ||||||||

| Loan to equity company |

( |

) |

( |

) |

( |

) | ||||||

| Cash flows from (used in) investing activities |

( |

) |

( |

) |

( |

) | ||||||

| Financing activities |

||||||||||||

| Short-term debt - net (note 13) |

|

|

|

|||||||||

| Reduction in finance lease obligations (note 15) |

( |

) |

( |

) |

( |

) | ||||||

| Dividends paid |

( |

) |

( |

) |

( |

) | ||||||

| Common shares purchased (note 11) |

( |

) |

( |

) |

( |

) | ||||||

| Cash flows from (used in) financing activities |

( |

) |

( |

) |

( |

) | ||||||

| Increase (decrease) in cash |

|

( |

) |

|

||||||||

| Cash at beginning of year |

|

|

|

|||||||||

| Cash at end of year (b) |

|

|

|

|||||||||

| (a) The impact of carbon emission programs are included in A dditions to property, plant and equipment, and A ll other items - net. |

||||||||||||

| (b) Cash is composed of cash in bank and cash equivalents at cost. Cash equivalents are all highly liquid securities with maturity of three months or less when purchased. |

||||||||||||

| (c) Included contributions to registered pension plans. |

( |

) |

( |

) |

( |

) | ||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income taxes (paid) refunded. |

|

( |

) |

( |

) | |||||||

| Interest (paid), net of capitalization. |

( |

) |

( |

) |

( |

) | ||||||

● |

A significant decrease in the market price of a long-lived asset; |

● |

A significant adverse change in the extent or manner in which an asset is being used or in its physical condition including a significant decrease in the company’s current and projected reserve volumes; |

● |

A significant adverse change in legal factors or in the business climate that could affect the value, including a significant adverse action or assessment by a regulator; |

● |

An accumulation of project costs significantly in excess of the amount originally expected; |

● |

A current-period operating loss combined with a history and forecast of operating or cash flow losses; and |

● |

A current expectation that, more likely than not, a long-lived asset will be sold or otherwise disposed of significantly before the end of its previously estimated useful life. |

Upstream |

Downstream |

Chemical |

||||||||||||||||||||||||||||||||||

millions of Canadian dollars |

2019 |

2018 |

2017 |

2019 |

2018 |

2017 |

2019 |

2018 |

2017 |

|||||||||||||||||||||||||||

Revenues and other income |

||||||||||||||||||||||||||||||||||||

Revenues (a) |

||||||||||||||||||||||||||||||||||||

| Intersegment sales | ||||||||||||||||||||||||||||||||||||

Investment and other income (note 9) |

- |

- | - | |||||||||||||||||||||||||||||||||

Expenses |

||||||||||||||||||||||||||||||||||||

Exploration (b) (note 16) |

- |

- | - | - |

- | - | ||||||||||||||||||||||||||||||

| Purchases of crude oil and products | ||||||||||||||||||||||||||||||||||||

Production and manufacturing (c) |

||||||||||||||||||||||||||||||||||||

Selling and general (c) |

- |

- | - | |||||||||||||||||||||||||||||||||

| Federal excise tax and fuel charge | - |

- | - | - |

- | - | ||||||||||||||||||||||||||||||

Depreciation and depletion (b) (d) |

||||||||||||||||||||||||||||||||||||

Non-service pension and postretirement benefit(c) |

- |

- | - | - |

- | - | - |

- | - | |||||||||||||||||||||||||||

Financing (note 13) |

- | - |

- | - | ||||||||||||||||||||||||||||||||

Total expenses |

||||||||||||||||||||||||||||||||||||

Income (loss) before income taxes |

( |

) | ( |

) | ||||||||||||||||||||||||||||||||

Income tax expense (benefit) (e) (note 4) |

( |

) |

( |

) | ( |

) | ||||||||||||||||||||||||||||||

Net income (loss) |

( |

) | ( |

) | ||||||||||||||||||||||||||||||||

Cash flows from (used in) operating activities |

||||||||||||||||||||||||||||||||||||

Capital and exploration expenditures (f) |

||||||||||||||||||||||||||||||||||||

Property, plant and equipment |

||||||||||||||||||||||||||||||||||||

| Cost | ||||||||||||||||||||||||||||||||||||

| Accumulated depreciation and depletion | ( |

) |

( |

) | ( |

) | ( |

) |

( |

) | ( |

) | ( |

) |

( |

) | ( |

) | ||||||||||||||||||

Net property, plant and equipment (g) |

||||||||||||||||||||||||||||||||||||

Total assets (h) (i) |

||||||||||||||||||||||||||||||||||||

Corporate and other |

Eliminations |

Consolidated |

||||||||||||||||||||||||||||||||||

millions of Canadian dollars |

2019 |

2018 |

2017 |

2019 |

2018 |

2017 |

2019 |

2018 |

2017 |

|||||||||||||||||||||||||||

Revenues and other income |

||||||||||||||||||||||||||||||||||||

Revenues (a) |

- |

- | - | - |

- | - | ||||||||||||||||||||||||||||||

| Intersegment sales | - |

- | - | ( |

) |

( |

) | ( |

) | - |

- | - | ||||||||||||||||||||||||

Investment and other income (note 9) |

- |

- | - | |||||||||||||||||||||||||||||||||

( |

) |

( |

) | ( |

) | |||||||||||||||||||||||||||||||

Expenses |

||||||||||||||||||||||||||||||||||||

Exploration (b) (note 16) |

- |

- | - | - |

- | - | ||||||||||||||||||||||||||||||

| Purchases of crude oil and products | - |

- | - | ( |

) |

( |

) | ( |

) | |||||||||||||||||||||||||||

Production and manufacturing (c) |

- |

- | - | - |

- | - | ||||||||||||||||||||||||||||||

Selling and general (c) |

( |

) |

( |

) | ( |

) | ||||||||||||||||||||||||||||||

| Federal excise tax and fuel charge | - |

- | - | - |

- | - | ||||||||||||||||||||||||||||||

Depreciation and depletion (b) (d) |

- |

- | - | |||||||||||||||||||||||||||||||||

Non-service pension and postretirement benefit(c) |

- |

- | - | - | ||||||||||||||||||||||||||||||||

Financing (note 13) |

- |

- | - | |||||||||||||||||||||||||||||||||

Total expenses |

( |

) |

( |

) |

( |

) |

||||||||||||||||||||||||||||||

Income (loss) before income taxes |

( |

) |

( |

) | ( |

) | - |

- | - | |||||||||||||||||||||||||||

Income tax expense (benefit) (e) (note 4) |

( |

) |

( |

) | ( |

) | - |

- | - | ( |

) |

|||||||||||||||||||||||||

Net income (loss) |

( |

) |

( |

) | ( |

) | - |

- | - | |||||||||||||||||||||||||||

Cash flows from (used in) operating activities |

( |

) |

( |

) | ( |

) | ( |

) |

- | |||||||||||||||||||||||||||

Capital and exploration expenditures (f) |

- |

- | - | |||||||||||||||||||||||||||||||||

Property, plant and equipment |

||||||||||||||||||||||||||||||||||||

| Cost | - |

- | - | |||||||||||||||||||||||||||||||||

| Accumulated depreciation and depletion | ( |

) |

( |

) | ( |

) | - |

- | - | ( |

) |

( |

) | ( |

) | |||||||||||||||||||||

Net property, plant and equipment (g) |

- |

- | - | |||||||||||||||||||||||||||||||||

Total assets (h) (i) |

( |

) |

( |

) | ( |

) | ||||||||||||||||||||||||||||||

| |

|

| (a) | Includes export sales to the United States of $ |

| (b) | The Upstream segment in 2017 includes non-cash impairment charges of $ |

| (c) | As part of the implementation of Accounting Standard Update, Compensation – Retirement Benefits (Topic 715), beginning January 1, 2018, Corporate and other includes all non-service pension and postretirement benefit expense. Prior to 2018, the majority of these costs were allocated to the operating segments. |

| (d) | In 2018, the Downstream segment included a non-cash impairment charge of $ |

| (e) | Segment results in 2019 include a largely non- cash favourable impact of $ |

| (f) | Capital and exploration expenditures (CAPEX) include exploration expenses, additions to property, plant and equipment, additions to finance leases, additional investments and acquisitions. CAPEX excludes the purchase of carbon emission credits. |

| (g) | Includes property, plant and equipment under construction of $ |

| (h) | Effective January 1, 2019, Imperial adopted the Financial Accounting Standards Board’s standard, Leases (Topic 842) |

| (i) | In 2019, the company removed $ . |

| millions of Canadian dollars |

2019 |

2018 |

2017 |

|||||||||

| Current income tax expense (a) |

|

( |

) |

( |

) | |||||||

| Deferred income tax expense (a) |

( |

) |

|

|

||||||||

| Total income tax expense (a) |

( |

) |

|

|

||||||||

| Statutory corporate tax rate (percent) |

|

|

|

|||||||||

| Increase (decrease) resulting from: |

||||||||||||

| Disposals (b) |

( |

) |

( |

) |

( |

) | ||||||

| Enacted tax rate change (a) |

( |

) |

- |

|

||||||||

| Other (c) |

( |

) |

( |

) |

( |

) | ||||||

| Effective income tax rate |

( |

) |

|

|

| (a) | On June 28, 2019 the Alberta government enacted a |

| (b) | 2017 disposals we re primarily associated with the sale of surplus property in Ontario. |

(c) |

Other decreases in 2017 and 2018 were primarily related to prior year adjustments and re-assessments. |

| millions of Canadian dollars |

2019 |

2018 |

2017 |

|||||||||

| Depreciation and amortization |

|

|

|

|||||||||

| Successful drilling and land acquisitions |

|

|

|

|||||||||

| Pension and benefits |

( |

) |

( |

) |

( |

) | ||||||

| Asset retirement obligation |

( |

) |

( |

) |

( |

) | ||||||

| Capitalized interest |

|

|

|

|||||||||

| LIFO inventory valuation |

( |

) |

( |

) |

( |

) | ||||||

| Tax loss carryforwards |

( |

) |

( |

) |

( |

) | ||||||

| Other |

( |

) |

( |

) |

( |

) | ||||||

| Net deferred income tax liabilities |

|

|

|

| millions of Canadian dollars |

2019 |

2018 |

2017 |

|||||||||

| Balance as of January 1 |

|

|

|

|||||||||

| Additions for prior years’ tax positions |

|

|

|

|||||||||

| Reductions for prior years’ tax positions |

- |

( |

) |

- |

||||||||

| Reductions due to lapse of the statute of limitations |

- |

- |

- |

|||||||||

| Settlements with tax authorities |

( |

) |

( |

) |

( |

) | ||||||

| Balance as of December 31 |

|

|

|

Pension benefits |

Other postretirement benefits |

|||||||||||||||||||

2019 |

2018 |

2019 |

2018 |

|||||||||||||||||

Assumptions used to determine benefit obligations at December 31 (percent) |

||||||||||||||||||||

Discount rate |

||||||||||||||||||||

Long-term rate of compensation increase |

||||||||||||||||||||

millions of Canadian dollars |

||||||||||||||||||||

Change in projected benefit obligation |

||||||||||||||||||||

Projected benefit obligation at January 1 |

||||||||||||||||||||

Current service cost |

||||||||||||||||||||

Interest cost |

||||||||||||||||||||

Actuarial loss (gain) |

( |

) |

( |

) | ||||||||||||||||

Amendments |

- |

- |

- |

|||||||||||||||||

Benefits paid (a) |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Projected benefit obligation at December 31 |

||||||||||||||||||||

Accumulated benefit obligation at December 31 |

||||||||||||||||||||

Pension benefits |

Other postretirement benefits |

|||||||||||||||||||

millions of Canadian dollars |

2019 |

2018 |

2019 |

2018 |

||||||||||||||||

Change in plan assets |

||||||||||||||||||||

Fair value at January 1 |

||||||||||||||||||||

Actual return (loss) on plan assets |

||||||||||||||||||||

Company contributions |

||||||||||||||||||||

Benefits paid (b) |

( |

) |

( |

) |

||||||||||||||||

Fair value at December 31 |

||||||||||||||||||||

Plan assets in excess of (less than) projected benefit obligation at December 31 |

||||||||||||||||||||

Funded plans |

( |

) |

( |

) |

||||||||||||||||

Unfunded plans |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Total (c) |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

| (a) | Benefit payments for funded and unfunded plans. |

| (b) | Benefit payments for funded plans only. |

| (c) | Fair value of assets less projected benefit obligation shown above. |

Pension benefits |

Other postretirement benefits |

|||||||||||||||||||

millions of Canadian dollars |

2019 |

2018 |

2019 |

2018 |

||||||||||||||||

Amounts recorded in the Consolidated balance sheet consist of: |

||||||||||||||||||||

Current liabilities |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Other long-term obligations |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Total recorded |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Amounts recorded in accumulated other comprehensive income consist of: |

||||||||||||||||||||

Net actuarial loss (gain) |

||||||||||||||||||||

Prior service cost |

- |

- |

- |

|||||||||||||||||

Total recorded in accumulated other comprehensive income, before tax |

||||||||||||||||||||

2019 |

2018 | 2017 | 2019 |

2018 | 2017 | |||||||||||||||||||

Assumptions used to determine net periodic benefit cost for years ended December 31 (percent) |

||||||||||||||||||||||||

Discount rate |

||||||||||||||||||||||||

Long-term rate of return on funded assets |

- |

- |

- |

|||||||||||||||||||||

Long-term rate of compensation increase |

||||||||||||||||||||||||

millions of Canadian dollars |

||||||||||||||||||||||||

Components of net periodic benefit cost |

||||||||||||||||||||||||

Current service cost |

||||||||||||||||||||||||

Interest cost |

||||||||||||||||||||||||

Expected return on plan assets |

( |

) |

( |

) |

( |

) |

- |

- |

- |

|||||||||||||||

Amortization of prior service cost |

- |

- |

- |

- |

||||||||||||||||||||

Amortization of actuarial loss (gain) |

( |

) |

||||||||||||||||||||||

Net periodic benefit cost |

||||||||||||||||||||||||

Changes in amounts recorded in accumulated other comprehensive income |

||||||||||||||||||||||||

Net actuarial loss (gain) |

( |

) |

( |

) |

( |

) | ||||||||||||||||||

Amortization of net actuarial (loss) gain included in net periodic benefit cost |

( |

) |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||||

Prior service cost |

- |

- |

- |

- |

- |

|||||||||||||||||||

Amortization of prior service cost included in net periodic benefit cost |

- |

( |

) |

( |

) |

- |

- |

- |

||||||||||||||||

Total recorded in other comprehensive income |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||||||

Total recorded in net periodic benefit cost and other comprehensive income, before |

( |

) |

( |

) | ||||||||||||||||||||

| Total pension and other postretirement benefits |

||||||||||||

| millions of Canadian dollars |

2019 |

2018 |

2017 |

|||||||||

| (Charge) credit to other comprehensive income, before tax |

( |

) |

|

|

||||||||

| Deferred income tax (charge) credit (note 18) |

|

( |

( |

|||||||||

| (Charge) credit to other comprehensive income, after tax |

( |

) |

|

|

||||||||

| Fair value measurements at December 31, 2019, using: | ||||||||||||||||||||

millions of Canadian dollars |

Total | Level 1 | Level 2 | Level 3 | Net Asset Value |

|||||||||||||||

| Asset class |

||||||||||||||||||||

| Equity securities |

||||||||||||||||||||

| Canadian |

|

|

|

|

|

|||||||||||||||

| Non-Canadian |

|

|

|

|

|

|||||||||||||||

| Debt securities - Canadian |

||||||||||||||||||||

| Corporate |

|

|

|

|

|

|||||||||||||||

| Government |

|

|

|

|

|

|||||||||||||||

| Asset backed |

|

|

|

|

|

|||||||||||||||

| Equities – Venture capital |

|

|

|

|

|

|||||||||||||||

| Cash |

|

|

|

|

|

|||||||||||||||

| Total plan assets at fair value |

|

|

|

|

|

|||||||||||||||

| Fair value measurements at December 31, 2018, using: |

||||||||||||||||||||

millions of Canadian dollars |

Total |

Level 1 |

Level 2 |

Level 3 |

Net Asset Value |

|||||||||||||||

| Asset class |

||||||||||||||||||||

| Equity securities |

||||||||||||||||||||

| Canadian |

|

|

||||||||||||||||||

| Non-Canadian |

|

|

||||||||||||||||||

| Debt securities - Canadian |

||||||||||||||||||||

| Corporate |

|

|

||||||||||||||||||

| Government |

|

|

||||||||||||||||||

| Asset backed |

|

|

||||||||||||||||||

| Equities – Venture capital |

|

|

||||||||||||||||||

| Cash |

|

|

|

|||||||||||||||||

| Total plan assets at fair value |

|

|

- |

- |

|

|||||||||||||||

| Pension benefits |

||||||||||||

millions of Canadian dollars |

2019 |

2018 |

||||||||||

| For funded pension plans with accumulated benefit obligations in excess of plan assets: (a) |

||||||||||||

| Projected benefit obligation |

|

|

||||||||||

| Accumulated benefit obligation |

|

|

||||||||||

| Fair value of plan assets |

|

|

||||||||||

| Accumulated benefit obligation less fair value of plan assets |

|

|

||||||||||

| For unfunded plans covered by book reserves: |

||||||||||||

| Projected benefit obligation |

|

|

||||||||||

| Accumulated benefit obligation |

|

|

||||||||||

(a) |

The amounts shown for funded pension plans with accumulated benefit obligations in excess of plan assets represent the company’s proportionate share of a joint venture sponsored pension plan. For the company sponsored funded plan, plan assets exceeded the accumulated benefit obligation in both 2019 and 2018. |

millions of Canadian dollars |

Pension benefits |

Other postretirement benefits |

||||||

| Net actuarial loss (gain) (a) |

|

|

||||||

| Prior service cost (b) |

|

- |

||||||

(a) |