Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year-ended December 31, 2013 | Commission file number: 0-12014 |

IMPERIAL OIL LIMITED

(Exact name of registrant as specified in its charter)

| CANADA | 98-0017682 | |||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |||

| 237 FOURTH AVENUE S.W., CALGARY, AB, CANADA | T2P 3M9 | |||

| (Address of principal executive offices) | (Postal Code) | |||

Registrant’s telephone number, including area code:

1-800-567-3776

Securities registered pursuant to Section 12(b) of the Act:

| Name of each exchange on | ||||

| Title of each class | which registered | |||

| None

|

None

| |||

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

Common Shares (without par value)

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act).

Yes ü No……

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934.

Yes……No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ü No……

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yesü No……

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Yes ü No……

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (see the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934).

Large accelerated filer ü Accelerated filer……Non-accelerated filer……Smaller reporting company……

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12 b-2 of the Securities Exchange Act of 1934).

Yes ……No ü

As of the last business day of the 2013 second fiscal quarter, the aggregate market value of the voting stock held by non-affiliates of the registrant was Canadian $10,345,478,926 based upon the reported last sale price of such stock on the Toronto Stock Exchange on that date.

The number of common shares outstanding, as of February 13, 2014, was 847,599,011.

1

Table of Contents

| Table of contents | Page | |||||

| 3 | ||||||

| Item 1. |

Business | 3 | ||||

| 4 | ||||||

| 4 | ||||||

| 5 | ||||||

| Oil and gas production, production prices and production costs |

6 | |||||

| 7 | ||||||

| 10 | ||||||

| 10 | ||||||

| 11 | ||||||

| 13 | ||||||

| 13 | ||||||

| 13 | ||||||

| 13 | ||||||

| 14 | ||||||

| 14 | ||||||

| 14 | ||||||

| 15 | ||||||

| 15 | ||||||

| 15 | ||||||

| 15 | ||||||

| 15 | ||||||

| 16 | ||||||

| Item 1A. |

Risk factors | 17 | ||||

| Item 1B. |

Unresolved staff comments | 20 | ||||

| Item 2. |

Properties | 20 | ||||

| Item 3. |

Legal proceedings | 20 | ||||

| Item 4. |

Mine safety disclosures | 20 | ||||

| 21 | ||||||

| Item 5. |

21 | |||||

| Item 6. |

22 | |||||

| Item 7. |

Management’s discussion and analysis of financial condition and results of operations |

22 | ||||

| Item 7A. |

23 | |||||

| Item 8. |

23 | |||||

| Item 9. |

Changes in and disagreements with accountants on accounting and financial disclosure |

23 | ||||

| Item 9A. |

23 | |||||

| Item 9B. |

23 | |||||

| 24 | ||||||

| Item 10. |

24 | |||||

| Item 11. |

24 | |||||

| Item 12. |

Security ownership of certain beneficial owners and management and related stockholder matters |

25 | ||||

| Item 13. |

Certain relationships and related transactions, and director independence |

25 | ||||

| Item 14. |

25 | |||||

| 26 | ||||||

| Item 15. |

Exhibits, financial statement schedules | 26 | ||||

| Financial section | 31 | |||||

| Proxy information section | 87 | |||||

All dollar amounts set forth in this report are in Canadian dollars, except where otherwise indicated.

Note that numbers may not add due to rounding.

The following table sets forth (i) the rates of exchange for the Canadian dollar, expressed in United States (U.S.) dollars, in effect at the end of each of the periods indicated, (ii) the average of exchange rates in effect on the last day of each month during such periods, and (iii) the high and low exchange rates during such periods, in each case based on the noon buying rate in New York City for wire transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York.

| dollars |

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

| Rate at end of period |

0.9348 | 1.0042 | 0.9835 | 0.9991 | 0.9559 | |||||||||||||||

| Average rate during period |

0.9665 | 1.0006 | 1.0144 | 0.9659 | 0.8793 | |||||||||||||||

| High |

1.0164 | 1.0299 | 1.0584 | 1.0040 | 0.9719 | |||||||||||||||

| Low |

0.9348 | 0.9600 | 0.9430 | 0.9280 | 0.7695 | |||||||||||||||

On February 13, 2014, the noon buying rate in New York City for wire transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York was $0.9108 U.S. = $1.00 Canadian.

2

Table of Contents

Forward-looking statements

Statements of future events or conditions in this report, including projections, targets, expectations, estimates, and business plans are forward-looking statements. Actual future results, including demand growth and energy source mix; production growth and mix; project plans, dates, costs and capacities; production rates and resource recoveries; cost savings; product sales; financing sources; and capital and environmental expenditures could differ materially depending on a number of factors, such as changes in the price, and supply of and demand for crude oil, natural gas, and petroleum and petrochemical products; political or regulatory events; project schedules; commercial negotiations; the receipt, in a timely manner, of regulatory and third-party approvals; unanticipated operational disruptions; unexpected technological developments; and other factors discussed in Item 1A of this annual report on Form 10-K and in the management’s discussion and analysis of financial condition and results of operations contained in Item 7. Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial. Imperial’s actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them.

The term “project” as used in this report can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

| Item 1. | Business |

Imperial Oil Limited was incorporated under the laws of Canada in 1880 and was continued under the Canada Business Corporations Act (the “CBCA”) by certificate of continuance dated April 24, 1978. The head and principal office of the company is located at 237 Fourth Avenue S.W. Calgary, Alberta, Canada T2P 3M9; telephone 1-800-567-3776. Exxon Mobil Corporation owns approximately 69.6 percent of the outstanding shares of the company. In this report, unless the context otherwise indicates, reference to “the company” or “Imperial” includes Imperial Oil Limited and its subsidiaries.

The company is one of Canada’s largest integrated oil companies. It is active in all phases of the petroleum industry in Canada, including the exploration for, and production and sale of, crude oil and natural gas. In Canada, it is a major producer of crude oil and natural gas and the largest petroleum refiner and a leading marketer of petroleum products. It is also a major producer of petrochemicals.

The company’s operations are conducted in three main segments: Upstream, Downstream and Chemical. Upstream operations include the exploration for, and production of, crude oil, natural gas, synthetic oil and bitumen. Downstream operations consist of the transportation and refining of crude oil, blending of refined products and the distribution and marketing of those products. Chemical operations consist of the manufacturing and marketing of various petrochemicals.

Financial information about segments and geographic areas for the company is contained in the Financial section of this report under note 2 to the consolidated financial statements: “Business segments”.

On February 26, 2013, ExxonMobil Canada acquired Celtic Exploration Ltd. (Celtic). Immediately following the acquisition, Imperial acquired a 50 percent interest in Celtic’s assets and liabilities from ExxonMobil Canada for $1.6 billion, financed by a combination of related party and third party debt. Concurrently, a general partnership was formed to hold and operate the assets of Celtic. The name of the general partnership was changed to XTO Energy Canada (XTO Canada). XTO Canada is involved in the exploration for, production of, and transportation and sale of natural gas and crude oil, condensate and natural gas liquids. Details of the transaction are contained in the Financial section of this report under note 18 to the consolidated financial statements: “Acquisition”. The company’s share of financial results and operating information, including reserves, volumes, wells and acreage relating to XTO Canada, are included for the first time in 2013.

3

Table of Contents

Summary of oil and gas reserves at year-end

The table below summarizes the net proved reserves for the company, as at December 31, 2013, as detailed in the “Supplemental information on oil and gas exploration and production activities” part of the Financial section, starting on page 31 of this report.

All of the company’s reported reserves are located in Canada. The company has reported proved reserves based on the average of the first-day-of-the-month price for each month during the last 12-month period ending December 31. Natural gas is converted to an oil-equivalent basis at six million cubic feet per one thousand barrels. No major discovery or other favourable or adverse event has occurred since December 31, 2013 that would cause a significant change in the estimated proved reserves as of that date.

| Liquids (a) |

Natural gas |

Synthetic oil |

Bitumen | Total oil- equivalent basis |

||||||||||||||||

| millions of barrels |

billions of cubic feet |

millions of barrels |

millions of barrels |

millions of barrels |

||||||||||||||||

| Net proved reserves: |

||||||||||||||||||||

| Developed |

55 | 368 | 579 | 1,417 | 2,113 | |||||||||||||||

| Undeveloped |

7 | 310 | - | 1,450 | 1,509 | |||||||||||||||

| Total net proved |

62 | 678 | 579 | 2,867 | 3,622 | |||||||||||||||

| (a) | Liquids include crude oil, condensate and natural gas liquids (NGLs). NGL proved reserves are not material and are therefore included under liquids. |

The estimation of proved reserves, which is based on the requirement of reasonable certainty, is an ongoing process based on rigorous technical evaluations, commercial and market assessments and detailed analysis of well information such as flow rates and reservoir pressure declines. Furthermore, the company only records proved reserves for projects which have received significant funding commitments by management made toward the development of the reserves. Although the company is reasonably certain that proved reserves will be produced, the timing and amount recovered can be affected by a number of factors, including completion of development projects, reservoir performance, regulatory approvals and significant changes in projections of long-term oil and gas price levels.

Technologies used in establishing proved reserves estimates

Additions to Imperial’s proved reserves in 2013 were based on estimates generated through the integration of available and appropriate geological, engineering and production data, utilizing well established technologies that have been demonstrated in the field to yield repeatable and consistent results.

Data used in these integrated assessments included information obtained directly from the subsurface via wellbores, such as well logs, reservoir core samples, fluid samples, static and dynamic pressure information, production test data, and surveillance and performance information. The data utilized also included subsurface information obtained through indirect measurements, including high-quality 2-D and 3-D seismic data, calibrated with available well control information. The tools used to interpret the data included proprietary seismic processing software, proprietary reservoir modeling and simulation software and commercially available data analysis packages.

In some circumstances, where appropriate analog reservoirs were available, reservoir parameters from these analogs were used to increase the quality of and confidence in the reserves estimates.

Preparation of reserves estimates

Imperial has a dedicated reserves management group that is separate from the base operating organization. Primary responsibilities of this group include oversight of the reserves estimation process for compliance with the United States Securities and Exchange Commission (SEC) rules and regulations, review of annual changes in reserves estimates and the reporting of Imperial’s proved reserves. This group also maintains the official company reserves estimates for Imperial’s proved reserves. In addition, this group provides training to personnel involved in the reserve estimation and reporting processes within Imperial.

4

Table of Contents

Key components of the reserves estimation process include technical evaluations and analysis of well and field performance and a rigorous peer review. The reserves management group maintains a central database containing the official company reserves estimates and production data. Appropriate controls, including limitations on database access and update capabilities, are in place to ensure data integrity within this central database. An annual review of the system’s controls is performed by internal audit. No changes may be made to reserves estimates in the central database, including the addition of any new initial reserves estimates or subsequent revisions, unless those changes have been thoroughly reviewed and evaluated by duly authorized personnel within the base operating organization. In addition, changes to reserves estimates that exceed certain thresholds require review and endorsement by the operating organization and the reserves management group, culminating in reviews with and approval by senior management and the company’s board of directors.

The Operations Technical Engineering Manager is a professional engineer registered in Alberta, Canada and has over 25 years of petroleum industry experience, including 20 years of reserves related experience. The position provides leadership to the internal reserves management group and is responsible for filing a reserves report with the Canadian securities regulatory authorities. The company’s internal reserves evaluation staff consists of 60 persons with an average of 16 years of relevant technical experience in evaluating reserves, of whom 38 persons are qualified reserves evaluators for purposes of Canadian securities regulatory requirements. The company’s internal reserves evaluation management team is made up of 16 persons with an average of 12 years of relevant experience in evaluating and managing the evaluation of reserves. No independent qualified reserves evaluator or auditor was involved in the preparation of the company’s reserves data.

As at December 31, 2013, approximately 42 percent of the company’s proved reserves were proved undeveloped reserves reflecting volumes of 1,509 million oil-equivalent barrels. Nearly all of those undeveloped reserves are associated with either the Kearl project or Cold Lake field. This compared to approximately 65 percent or 2,318 million oil-equivalent barrels of proved undeveloped reserves reported at the end of 2012. Decreased proved undeveloped bitumen reserves in 2013 were largely due to the start-up of the initial development at Kearl in the second quarter, resulting in a migration of proved undeveloped reserves to proved developed. Increased proved undeveloped liquids and natural gas reserves were primarily associated with the company’s share of reserves from the Celtic acquisition in 2013.

One of the company’s requirements to report resources as proved reserves is that management has made significant funding commitments towards the development of the reserves. The company has a disciplined investment strategy and many major fields require a significant lead-time in order to be developed. The company made investments of about $4.5 billion during the year to progress the development of reported proved undeveloped reserves. The largest project under development in 2013 was the Kearl project. Production from the initial development commenced in the second quarter of 2013. By 2013 year-end, the Kearl expansion project was 72 percent complete and remains on target for a 2015 start-up.

Proved undeveloped reserves at Cold Lake are associated with the ongoing drilling program and the Nabiye project. Imperial moved 19 million oil-equivalent barrels from proved undeveloped to proved developed reserves at Cold Lake through ongoing drilling programs. By 2013 year-end, the Nabiye project was 65 percent complete. Target start-up, although under pressure, remains year-end 2014.

Proved undeveloped reserves that have remained undeveloped for five years or more are primarily associated with Cold Lake and were not material compared to the company’s proved reserves and proved undeveloped reserves.

5

Table of Contents

Oil and gas production, production prices and production costs

Reference is made to the portion of the Financial section entitled “Management’s discussion and analysis of financial condition and results of operations” on page 35 of this report for a narrative discussion on the material changes.

Average daily production of oil

The company’s average daily oil production by final products sold during the three years ended December 31, 2013 was as follows. All reported production volumes were from Canada.

| thousands of barrels per day |

2013 | 2012 | 2011 | |||||||||||

| Bitumen (a): |

- gross (b) |

169 | 154 | 160 | ||||||||||

| - net (c) |

142 | 123 | 120 | |||||||||||

| Synthetic oil (d): |

- gross (b) |

67 | 72 | 72 | ||||||||||

| - net (c) |

65 | 69 | 67 | |||||||||||

| Liquids: |

- gross (b) |

25 | 24 | 23 | ||||||||||

| - net (c) |

20 | 18 | 17 | |||||||||||

| Total: |

- gross (b) |

261 | 250 | 255 | ||||||||||

| - net (c) |

227 | 210 | 204 | |||||||||||

| (a) | The company’s bitumen production volumes included production volumes from the Cold Lake operation for all years presented in the table above and, beginning in 2013, also included production volumes from the Kearl initial development (16,000 barrels per day gross, 15,000 net). |

| (b) | Gross production is the company’s share of production (excluding purchases) before deduction of the mineral owners’ or governments’ share or both. |

| (c) | Net production is gross production less the mineral owners’ or governments’ share or both. |

| (d) | The company’s synthetic oil production volumes were from the company’s share of production volumes in the Syncrude joint venture. |

Average daily production and sales of natural gas

The company’s average daily production and sales of natural gas during the three years ended December 31, 2013 are set forth below. All reported production volumes were from Canada. All gas volumes in this report are calculated at a pressure base of 14.73 pounds per square inch absolute at 60 degrees Fahrenheit. Reference is made to the portion of the Financial section entitled “Management’s discussion and analysis of financial condition and results of operations” on page 35 of this report for a narrative discussion on the material changes.

| millions of cubic feet per day |

2013 | 2012 | 2011 | |||||||||

| Gross production (a) (b) |

201 | 192 | 254 | |||||||||

| Net production (b) (c) |

189 | 195 | 228 | |||||||||

| Sales (d) |

167 | 177 | 237 | |||||||||

| (a) | Gross production is the company’s share of production (excluding purchases) before deduction of the mineral owners’ or governments’ share or both. |

| (b) | Production of natural gas includes amounts used for internal consumption with the exception of the amounts reinjected. |

| (c) | Net production is gross production less the mineral owners’ or governments’ share or both. Net natural gas production in 2012 included favourable royalty cost adjustments. |

| (d) | Includes sales of the company’s share of production (before deduction of the mineral owners’ and/or governments’ share) and sales of gas purchased, processed and/or resold. Sales of natural gas exclude amounts used for internal consumption. |

Total average daily oil-equivalent basis production

The company’s total average daily production expressed in oil-equivalent basis is set forth below, with natural gas converted to an oil-equivalent basis at six million cubic feet per one thousand barrels.

| thousands of barrels per day |

2013 | 2012 | 2011 | |||||||||

| Total production oil-equivalent basis: |

||||||||||||

| - gross (a) |

295 | 282 | 297 | |||||||||

| - net (b) |

259 | 243 | 242 | |||||||||

| (a) | Gross production is the company’s share of production (excluding purchases) before deduction of the mineral owners’ or governments’ share or both. |

| (b) | Net production is gross production less the mineral owners’ or governments’ share or both. |

6

Table of Contents

Average unit sales price

The company’s average unit sales price and average unit production costs by product type for the three years ended December 31, 2013, were as follows.

| dollars per barrel |

2013 | 2012 | 2011 | |||||||||

| Liquids |

75.61 | 71.52 | 77.34 | |||||||||

| Synthetic oil |

99.69 | 92.48 | 101.43 | |||||||||

| Bitumen |

60.57 | 59.76 | 63.95 | |||||||||

| dollars per thousand cubic feet |

||||||||||||

| Natural gas |

3.27 | 2.33 | 3.59 | |||||||||

Average unit production costs

| dollars per barrel |

2013 | 2012 | 2011 | |||||||||

| Synthetic oil |

53.27 | 48.41 | 48.33 | |||||||||

| Bitumen |

32.20 | 21.98 | 19.30 | |||||||||

| Total oil-equivalent basis (a) |

35.93 | 29.10 | 26.63 | |||||||||

| (a) | Includes liquids, bitumen, synthetic oil and natural gas. |

Synthetic oil production costs increased in 2013 primarily due to higher planned maintenance activities at Syncrude. Increased bitumen production costs in 2013 were primarily driven by Kearl start-up and operating costs.

In 2012, unit production costs increased on a net basis primarily due to pre start-up costs associated with the Kearl initial development.

Drilling and other exploratory and development activities

The company has been involved in the exploration for and development of crude oil and natural gas in Canada only.

Wells Drilled

The following table sets forth the net exploratory and development wells that were drilled or participated in by the company during the three years ended December 31, 2013.

| wells |

2013 | 2012 | 2011 | |||||||||

| Net productive exploratory |

1 | 1 | 3 | |||||||||

| Net dry exploratory |

1 | - | - | |||||||||

| Net productive development |

157 | 39 | 96 | |||||||||

| Net dry development |

- | - | - | |||||||||

| Total |

159 | 40 | 99 | |||||||||

In 2013, the following wells were drilled to add productive capacity: 120 development wells at the Cold Lake Nabiye expansion project, 34 net tight oil development wells and three net other wells.

In 2012, the following wells were drilled to add productive capacity: 28 bitumen development wells in undeveloped areas of existing phases at Cold Lake, three development evaluation wells at Cold Lake, four net Horn River pilot wells and four net tight oil development wells.

In 2011, the following wells were drilled to add productive capacity: 34 bitumen development wells in undeveloped areas of existing phases at Cold Lake, 60 gas development wells in the shallow gas area and two net tight oil wells in the company’s existing conventional acreage.

7

Table of Contents

Wells drilling

At December 31, 2013, the company was participating in the drilling of the following exploratory and development wells. All wells were located in Canada.

| 2013 | ||||||||

| wells |

Gross | Net | ||||||

| Total |

85 | 78 | ||||||

Exploratory and development activities regarding oil and gas resources

Cold Lake

In February 2012, the Nabiye expansion at Cold Lake was sanctioned. The expansion is expected to ultimately bring on additional production of 40,000 barrels per day, before royalties. The expansion was 65 percent complete by 2013 year-end. During the fourth quarter of 2013, plant construction progressed somewhat slower than planned due to lower contractor productivity and harsh winter conditions. Target start-up, although under pressure, remains year-end 2014.

To maintain production at Cold Lake, additional wells were drilled on existing phases in 2013. In 2014, a development drilling program is planned within the approved development area to add productive capacity from undeveloped areas of existing Cold Lake phases.

The company also conducts experimental pilot operations to improve recovery of bitumen from wells by means of new drilling, production and recovery techniques.

Mackenzie Delta

In 1999, the company and three other companies entered into an agreement to study the feasibility of developing Mackenzie Delta gas, anchored by three large onshore natural gas fields. The company retains a 100 percent interest in the largest of these fields.

In late 2010, the National Energy Board (NEB) announced its approval of plans to build and operate the project subject to 264 conditions in areas such as engineering, safety and environmental protection. Federal cabinet approved the project in early 2011.

The commercial viability of these natural gas resources, and the pipeline required to transport this natural gas to markets, is dependent on a number of factors. These factors include natural gas markets, continued support from northern parties, fiscal framework and the cost of constructing, operating and abandoning the field production and pipeline facilities.

The company continues to maintain the right of way agreements and permits required to develop its Mackenzie Delta natural gas resource and in December 2013, updated costs were filed as required under one of the conditions of the permits. No final investment decision has been made.

Beaufort Sea

In 2007, the company acquired a 50 percent interest in an exploration licence in the Beaufort Sea. As part of the evaluation, a 3-D seismic survey was conducted in 2008 and the company has since carried out data collection programs to support environmental studies and safe exploration drilling operations.

In 2010, the company executed an agreement to cross-convey interests with another company to acquire a 25 percent interest in an additional Beaufort Sea exploration licence. As a result of that agreement, the company’s interest in its original licence was reduced to 25 percent. The exploration licences are held through 2019 and 2020, respectively.

In 2013, the company and its joint venture partners filed a project description, initiating the formal regulatory review of the project, and continued community consultations. No final investment decision has been made.

The company’s share of the total work commitment for the Beaufort Sea licence is $441 million.

8

Table of Contents

Other oil sands activity

In the third quarter of 2013, the company (27.5 percent) and ExxonMobil Canada (72.5 percent) acquired an interest in the Clyden oil sands lease, 150 kilometres south of Fort McMurray, Alberta. The 226,000 gross acre lease is amenable to in-situ recovery techniques.

The company filed a regulatory application for a new in-situ oil sands project at Aspen (south of Kearl) in December 2013. Steam-assisted gravity drainage (SAGD) technology would be used to develop the project in three phases of about 45,000 barrels per day before royalties, per phase. No final investment decision has been made. Work continues on technical evaluations to support potential Cold Lake Grand Rapids and Corner in-situ development regulatory applications.

The company also has interests in other oil sands leases in the Athabasca and Peace River areas of northern Alberta. Evaluation wells completed on these leased areas established the presence of bitumen. The company continues to evaluate these leases to determine their potential for future development.

Liquefied natural gas (LNG) export application

In December 2013, WCC LNG Ltd., jointly owned by the company (50 percent) and ExxonMobil Canada Ltd. (50 percent), received approval from the NEB to export up to 30 million tonnes of LNG per year for a period of 25 years. No final investment decision has been made.

Exploratory and development activities regarding oil and gas resources extracted by mining methods

Kearl

The company holds a 70.96 percent participating interest in the Kearl oil sands project, a joint venture with ExxonMobil Canada Properties, a subsidiary of Exxon Mobil Corporation. The Kearl project recovers shallow deposits of oil sands using open-pit mining methods. The project is located approximately 75 kilometres north of Fort McMurray, Alberta.

The Kearl project received project development approvals from the Province of Alberta in 2007 and the Government of Canada in 2008. The Province of Alberta issued an operating and construction licence in 2008, which permits the project to mine oil sands and produce bitumen from approved development areas on oil sands leases. Production from the initial development commenced in April 2013, as discussed in the “Present activities” section on page 10.

The Kearl expansion project was 72 percent complete at the end of 2013. The Kearl expansion project remains on schedule for a 2015 start-up and is expected to produce 110,000 barrels of bitumen per day, before royalties, of which the company’s share would be about 78,000 barrels per day.

Potential future debottlenecking of both the initial development and expansion would increase output to reach the regulatory capacity of 345,000 barrels of bitumen per day by about 2020, of which the company’s share would be about 245,000 barrels per day.

Other oil sands activity

The company is continuing to evaluate other undeveloped, mineable oil sands acreage in the Athabasca region.

9

Table of Contents

Review of principal ongoing activities

Cold Lake

During 2013, average net production at Cold Lake was about 127,000 barrels per day and gross production was about 153,000 barrels per day.

Most of the production from Cold Lake is sold to refineries in the United States. The remainder of Cold Lake production is shipped to certain of the company’s refineries and to third-party Canadian refineries.

The Province of Alberta, in its capacity as lessor of Cold Lake oil sands leases, is entitled to a royalty on production at Cold Lake. Royalty rates are based upon a sliding scale determined by the price of crude oil.

Kearl

Bitumen from the Kearl project is extracted from oil sands produced from open-pit mining operations and is processed through bitumen extraction facilities and froth treatment trains. The product, a blend of bitumen and diluent, is shipped to certain of the company’s refineries, ExxonMobil refineries and to other unrelated third parties.

Production of mined diluted bitumen began in April 2013 and continued to ramp-up throughout the remainder of the year. Since start-up, improvements have been made to equipment reliability. Although gross production rates of 100,000 barrels per day (71,000 Imperial’s share) were reached in the fourth quarter, ongoing activities to stabilize performance at these higher levels are progressing. Also in the fourth quarter, sales to unrelated third parties commenced as planned. During 2013, average gross production at Kearl was about 23,000 barrels per day (16,000 barrels per day Imperial’s share).

The Province of Alberta, in its capacity as lessor of Kearl oil sands leases, is entitled to a royalty on production at Kearl. Royalty rates are based upon a sliding scale determined by the price of crude oil.

Syncrude

The company holds a 25 percent participating interest in Syncrude, a joint venture established to recover shallow deposits of oil sands using open-pit mining methods to extract the crude bitumen, and to produce a high-quality, light (32 degree API), sweet, synthetic crude oil. The Syncrude operation, located near Fort McMurray, Alberta, mines a portion of the Athabasca oil sands deposit. The produced synthetic crude oil is shipped from the Syncrude site to Edmonton, Alberta by Alberta Oil Sands Pipeline Ltd.

In 2013, the company’s share of Syncrude’s net production of synthetic crude oil was about 65,000 barrels per day and gross production was about 67,000 barrels per day.

Effective January 1, 2009, the Syncrude Crown Royalty Agreement was amended. Under the amended agreement, starting in 2010 and through 2015, Syncrude will pay the existing Crown royalty rates plus an incremental royalty, the amount of which will be subject to minimum production thresholds, before transitioning to the new generic royalty framework in 2016. Also, beginning January 1, 2009, Syncrude’s royalty is based on bitumen value with upgrading costs and revenues excluded from the calculation.

Conventional oil and gas

The Norman Wells oil field in the Northwest Territories is the company’s largest conventional oil producing asset and currently accounts for about 50 percent of the company’s gross production of conventional crude oil. In 2013, gross production of conventional crude oil from Norman Wells was about 11,000 barrels per day.

In 2013, the company commenced marketing of three mature conventional properties; Boundary Lake, Pembina and Rocky Mountain House. Combined production from these properties totalled about 15,000 oil-equivalent barrels per day in 2013, split about evenly between oil and gas.

The company has no material commitments to provide a fixed and determinable quantity of oil or gas under existing contracts or agreements.

10

Table of Contents

Oil and gas properties, wells, operations, and acreage

Production wells

The company’s production of liquids, bitumen and natural gas is derived from wells located exclusively in Canada. The total number of wells capable of production, in which the company had interests at December 31, 2013 and December 31, 2012, is set forth in the following table. The statistics in the table are determined in part from information received from other operators.

| Year-ended December 31, 2013 | Year-ended December 31, 2012 | |||||||||||||||||||||||||||||||

| Crude oil | Natural gas | Crude oil | Natural gas | |||||||||||||||||||||||||||||

| wells |

Gross (a) | Net (b) | Gross (a) | Net (b) | Gross (a) | Net (b) | Gross (a) (c) | Net (b) (c) | ||||||||||||||||||||||||

| Total (d) |

5,207 | 4,847 | 3,615 | 1,235 | 5,036 | 4,736 | 3,328 | 1,140 | ||||||||||||||||||||||||

| (a) | Gross wells are wells in which the company owns a working interest. |

| (b) | Net wells are the sum of the fractional working interests owned by the company in gross wells, rounded to the nearest whole number. |

| (c) | Natural gas wells in 2012 reflect revised numbers from properties operated by others. |

| (d) | Multiple completion wells are permanently equipped to produce separately from two or more distinctly different geological formations. At year-end 2013, the company had an interest in four gross wells with multiple completions (2012 - four gross wells). |

The total number of wells increased in 2013 primarily due to the acquisition of a 50 percent interest in Celtic’s assets and liabilities.

Land holdings

At December 31, 2013 and 2012, the company held the following oil and gas rights, bitumen and synthetic oil leases, all of which are located in Canada, specifically in the western provinces, in the Canada lands and in the Atlantic offshore.

| Developed | Undeveloped | Total | ||||||||||||||||||||||||

| thousands of acres |

2013 | 2012 | 2013 | 2012 | 2013 | 2012 | ||||||||||||||||||||

| Western provinces: |

||||||||||||||||||||||||||

| Liquids and gas (a) |

- gross (b) |

2,337 | 2,127 | 1,312 | 658 | 3,649 | 2,785 | |||||||||||||||||||

| - net (c) |

764 | 687 | 662 | 359 | 1,426 | 1,046 | ||||||||||||||||||||

| Bitumen (a) |

- gross (b) |

156 | 103 | 737 | 606 | 893 | 709 | |||||||||||||||||||

| - net (c) |

130 | 103 | 370 | 345 | 500 | 448 | ||||||||||||||||||||

| Synthetic oil |

- gross (b) |

118 | 118 | 135 | 135 | 253 | 253 | |||||||||||||||||||

| - net (c) |

29 | 29 | 34 | 34 | 63 | 63 | ||||||||||||||||||||

| Canada lands (d): |

||||||||||||||||||||||||||

| Liquids and gas |

- gross (b) |

4 | 4 | 2,272 | 2,314 | 2,276 | 2,318 | |||||||||||||||||||

| - net (c) |

2 | 2 | 718 | 722 | 720 | 724 | ||||||||||||||||||||

| Atlantic offshore: |

||||||||||||||||||||||||||

| Liquids and gas |

- gross (b) |

65 | 65 | 288 | 1,780 | 353 | 1,845 | |||||||||||||||||||

| - net (c) |

6 | 6 | 46 | 270 | 52 | 276 | ||||||||||||||||||||

| Total (e): |

- gross (b) |

2,680 | 2,417 | 4,744 | 5,493 | 7,424 | 7,910 | |||||||||||||||||||

| - net (c) |

931 | 827 | 1,830 | 1,730 | 2,761 | 2,557 | ||||||||||||||||||||

| (a) | Land holdings associated with the acquisition of the Celtic assets in February 2013 are primarily included within western provinces liquids and gas acreage and at 2013 year-end totalled about 191,000 gross developed acres (about 67,000 net developed) and about 694,000 gross undeveloped acres (about 315,000 net undeveloped). Land holdings associated with the acquisition of Celtic assets included in bitumen are de minimis. |

| (b) | Gross acres include the interests of others. |

| (c) | Net acres exclude the interests of others. |

| (d) | Canada lands include the Arctic Islands, Beaufort Sea/Mackenzie Delta, and other Northwest Territories, Nunavut and Yukon regions. |

| (e) | Certain land holdings are subject to modification under agreements whereby others may earn interests in the company’s holdings by performing certain exploratory work (farm-out) and whereby the company may earn interests in others’ holdings by performing certain exploratory work (farm-in). |

11

Table of Contents

Western provinces

The company’s bitumen leases include about 193,000 net acres of oil sands leases near Cold Lake and an area of about 34,000 net acres at Kearl. The company also has about 80,000 net acres of undeveloped, mineable oil sands acreage in the Athabasca region. In addition, the company has interests in other bitumen oil sands leases in the Athabasca areas totalling about 193,000 net acres, which include about 62,000 net acres of oil sands leases in the Clyden area, acquired by the company in 2013. These 193,000 net acres are amenable to in-situ recovery techniques.

The company’s share of Syncrude joint venture leases covering about 63,000 net acres accounts for the entire synthetic oil acreage.

Oil sands leases have an exploration period of fifteen years and are continued beyond that point by meeting the minimum level of evaluation, payment of rentals, or by production. The majority of the acreage in Cold Lake, Kearl and Syncrude is continued by production.

The company holds interests in an additional 1,426,000 net acres of developed and undeveloped land in western Canada related to crude oil and natural gas. Included in this number is a total acreage position of about 170,000 net acres at Horn River, British Columbia. Crude oil and natural gas acreage increased in 2013, largely due to the acquisition of the Celtic assets in February 2013.

Petroleum and natural gas leases and licences from western provinces have exploration periods ranging from two to 15 years and are continued beyond that point by production.

Canada lands

Land holdings in Canada lands primarily include acreage in the Beaufort Sea of about 252,000 net acres, the Summit Creek area of central Mackenzie Valley totalling about 222,000 net acres and the Mackenzie Delta of about 181,000 net acres.

Exploration licences on Canada lands and Atlantic offshore have a finite term. If a significant discovery is made, a significant discovery licence (SDL) may be granted that holds the acreage under the SDL indefinitely, subject to certain conditions.

The company’s net acreage in Canada lands is either continued by production or held through exploration licences and SDLs.

Atlantic offshore

In 2013, the company assigned its land holdings in the Orphan Basin area totalling about 224,000 net acres to an unrelated third party.

The remaining Atlantic offshore acreage is continued by production or held by SDLs.

12

Table of Contents

To supply the requirements of its own refineries and condensate requirements for blending with crude bitumen, the company supplements its own production with substantial purchases from others.

The company purchases domestic crude oil at freely negotiated prices from a number of sources. Domestic purchases of crude oil are generally made under renewable contracts with 30 to 60 day cancellation terms.

When required, crude oil from foreign sources is purchased by the company at market prices mainly through Exxon Mobil Corporation (which has beneficial access to major market sources of crude oil throughout the world). Following the conversion of the Dartmouth refinery to a fuels terminal, crude oil from foreign sources is anticipated to decline significantly.

Imperial currently transports about 400,000 barrels per day by pipeline and has secured an additional 390,000 barrels per day capacity on pipeline projects set to be in service over the next several years. To mitigate uncertainty associated with the timing of pipeline projects, the company is developing rail infrastructure with potential incremental capacity up to 200,000 barrels per day over the next several years. These transportation capacities are primarily to ship crude oil.

The company owns and operates three refineries. The Strathcona and Sarnia refineries process Canadian crude oil and the Nanticoke refinery processes a combination of Canadian and foreign crude oil. The Strathcona refinery operates lubricating oil production facilities. In addition to crude oil, the company purchases finished products to supplement its refinery production.

In the second quarter of 2013, the company announced its decision to convert the Dartmouth refinery to a fuels terminal. In the third quarter, refinery operations at the Dartmouth refinery were discontinued. The company continues to supply east coast Canadian markets with petroleum products.

In 2013, capital expenditures of about $82 million were made at the company’s refineries. Capital expenditures focused mainly on refinery projects to improve reliability, feedstock flexibility, energy efficiency and environmental performance.

The approximate average daily volumes of refinery throughput during the three years ended December 31, 2013, and the daily rated capacities of the refineries as at December 31, 2013 were as follows.

| Refinery throughput (a) | Rated capacities (b) at |

|||||||||||||||

| Year-ended December 31 |

December 31 | |||||||||||||||

| thousands of barrels per day |

2013 | 2012 | 2011 | 2013 | ||||||||||||

| Strathcona, Alberta |

172 | 163 | 169 | 189 | ||||||||||||

| Sarnia, Ontario |

105 | 103 | 102 | 119 | ||||||||||||

| Nanticoke, Ontario |

99 | 99 | 93 | 113 | ||||||||||||

| Dartmouth, Nova Scotia (c) (d) |

50 | 70 | 66 | n/a | ||||||||||||

| Total |

426 | 435 | 430 | 421 | ||||||||||||

| (a) | Refinery throughput is the volume of crude oil and feedstocks that is processed in the refinery atmospheric distillation units. |

| (b) | Rated capacities are based on definite specifications as to types of crude oil and feedstocks that are processed in the refinery atmospheric distillation units, the products to be obtained and the refinery process, adjusted to include an estimated allowance for normal maintenance shutdowns. Accordingly, actual capacities may be higher or lower than rated capacities due to changes in refinery operation and the type of crude oil available for processing. |

| (c) | Refinery operations at the Dartmouth refinery were discontinued on September 16, 2013. |

| (d) | Dartmouth refinery rated capacity as at December 31, 2012 was 85,000 barrels per day. |

In 2013, refinery throughput was 88 percent of capacity, two percent higher than the previous year. The higher rate was primarily a result of increased product sales and reduced maintenance activities. Capacity utilization in 2013 is calculated based on the number of days the refineries were operated as a refinery.

13

Table of Contents

The company maintains a nationwide distribution system, including 22 primary terminals, to handle bulk and packaged petroleum products moving from refineries to market by pipeline, tanker, rail and road transport. The company owns and operates natural gas liquids and products pipelines in Alberta, Manitoba and Ontario and has interests in the capital stock of one crude oil and two products pipeline companies.

The company markets more than 550 petroleum products throughout Canada under well-known brand names, most notably Esso and Mobil, to all types of customers.

The company sells to the motoring public through Esso retail service stations. On average during the year, there were more than 1,700 retail service stations, of which about 470 were company owned or leased, but none of which were company operated. The company continues to improve its Esso retail service station network, providing more customer services such as car washes and convenience stores, primarily at high volume sites in urban centres.

The Canadian agriculture, residential heating and small commercial markets are served by about 28 branded resellers. The company also sells petroleum products to large industrial and commercial accounts as well as to other refiners and marketers.

The approximate daily volumes of net petroleum products (excluding purchases/sales contracts with the same counterparty) sold during the three years ended December 31, 2013, are set out in the following table.

| thousands of barrels per day |

2013 | 2012 | 2011 | |||||||||

| Gasolines |

223 | 221 | 220 | |||||||||

| Heating, diesel and jet fuels |

160 | 151 | 157 | |||||||||

| Heavy fuel oils |

29 | 30 | 29 | |||||||||

| Lube oils and other products |

42 | 43 | 41 | |||||||||

| Net petroleum product sales |

454 | 445 | 447 | |||||||||

Total Downstream capital expenditures were $187 million in 2013.

The company’s Chemical operations manufacture and market ethylene, benzene, aromatic and aliphatic solvents, plasticizer intermediates and polyethylene resin. Its major petrochemical and polyethylene manufacturing operations are located in Sarnia, Ontario, adjacent to the company’s petroleum refinery. As part of the decision to convert the Dartmouth refinery to a fuels terminal, the heptene and octene plant located at Dartmouth was shut down.

Progress continued on the infrastructure required to implement a long-term supply agreement for ethane from the nearby Marcellus shale gas development. First deliveries of this feedstock to the Sarnia chemical plant are expected in the first quarter of 2014.

The company’s total sales volumes of petrochemicals during the three years ended December 31, 2013, were as follows.

| thousands of tonnes |

2013 | 2012 | 2011 | |||||||||

| Total sales of petrochemicals |

940 | 1,044 | 1,016 | |||||||||

Lower sales volumes in 2013 were primarily due to lower manufacturing as a result of the plant shutdown at Dartmouth noted above and lower ethylene feed availability.

Capital expenditures in 2013 were $9 million.

14

Table of Contents

In 2013, the company’s total gross research expenditures, before credits, were about $199 million, as compared with $201 million in 2012, and $163 million in 2011. Research expenditures are mainly for developing technologies to reduce the environmental impact and improve bitumen recovery in the Upstream and for supporting environmental and process improvements in the refineries, as well as accessing ExxonMobil’s data worldwide.

The company has scientific research agreements with affiliates of Exxon Mobil Corporation, which provide for technical and engineering work to be performed by all parties, the exchange of technical information and the assignment and licensing of patents and patent rights. These agreements provide mutual access to scientific and operating data related to nearly every phase of the petroleum and petrochemical operations of the parties.

The company is concerned with and active in protecting the environment in connection with its various operations. The company works in cooperation with government agencies, industry associations and communities to deal with existing, and to anticipate potential, environmental protection issues. In the past five years, the company has made capital and operating expenditures of about $4.7 billion on environmental protection and facilities. In 2013, the company’s environmental capital and operating expenditures totalled approximately $1.5 billion, which was spent primarily on air emissions reductions, water and tailings treatment at both company owned facilities and Syncrude and remediation of idled facilities and operations. Capital and operating expenditures relating to environmental protection are expected to be about $1.7 billion in 2014.

| Career employees (a) |

2013 | 2012 | 2011 | |||||||||

| Total |

5,300 | 5,100 | 4,900 | |||||||||

| (a) | Career employees are defined as active executive, management, professional, technical and wage employees who work full time or part time for the company and are covered by the company’s benefit plans. |

The increase in career employees in 2013 is primarily associated with start-up of the Kearl oil sands project. About eight percent of the company’s employees are members of unions.

The Canadian petroleum, natural gas and chemical industries are highly competitive. Competition exists in the search for and development of new sources of supply, the construction and operation of crude oil, natural gas and refined products pipelines and facilities and the refining, distribution and marketing of petroleum products and chemicals. The petroleum industry also competes with other industries in supplying energy, fuel and other needs of consumers.

Petroleum and natural gas rights

Most of the company’s petroleum and natural gas rights were acquired from governments, either federal or provincial. These rights in the form of leases or licences are generally acquired for cash or work commitments. A lease or licence entitles the holder to explore for petroleum and/or natural gas on the leased lands for a specified period.

In western provinces, the lease holder can produce the petroleum or natural gas discovered on the leased lands and retains the rights based on continued production. Oil sands leases are retained by meeting the minimum level of evaluation, payment of rentals, or by production.

The holder of a licence relating to Canada lands and the Atlantic offshore can apply for a SDL if a discovery is made. If granted, the SDL holds the lands indefinitely subject to certain conditions. The holder may then apply for a production licence in order to produce petroleum or natural gas from the licenced land.

15

Table of Contents

Crude oil

Production

The maximum allowable gross production of crude oil from wells in Canada is subject to limitation by various regulatory authorities on the basis of engineering and conservation principles.

Exports

Export contracts of more than one year for light crude oil and petroleum products and two years for heavy crude oil (including crude bitumen) require the prior approval of the NEB and the Government of Canada.

Natural gas

Production

The maximum allowable gross production of natural gas from wells in Canada is subject to limitations by various regulatory authorities. These limitations are to ensure oil recovery is not adversely impacted by accelerated gas production practices. These limitations do not impact gas reserves, only the timing of production of the reserves and did not have a significant impact on 2013 gas production rates.

Exports

The Government of Canada has the authority to regulate the export price for natural gas and has a gas export pricing policy, which accommodates export prices for natural gas negotiated between Canadian exporters and U.S. importers.

Exports of natural gas from Canada require approval by the NEB and the Government of Canada. The Government of Canada allows the export of natural gas by NEB order without volume limitation for terms not exceeding 24 months.

Royalties

The Government of Canada and the provinces in which the company produces crude oil and natural gas impose royalties on production from lands where they own the mineral rights. Some producing provinces also receive revenue by imposing taxes on production from lands where they do not own the mineral rights.

Different royalties are imposed by the Government of Canada and each of the producing provinces. Royalties imposed on crude oil, natural gas and natural gas liquids vary depending on a number of parameters, including well production volumes, selling prices and recovery methods. For information with respect to royalties for Cold Lake, Syncrude and Kearl, see “Upstream” section under Item 1.

Investment Canada Act

The Investment Canada Act requires Government of Canada approval, in certain cases, of the acquisition of control of a Canadian business by an entity that is not controlled by Canadians. The acquisition of natural resource properties may, in certain circumstances, be considered a transaction that constitutes an acquisition of control of a Canadian business requiring Government of Canada approval.

The Act also requires notification of the establishment of new unrelated businesses in Canada by entities not controlled by Canadians, but does not require Government of Canada approval except when the new business is related to Canada’s cultural heritage or national identity. The Government of Canada is also authorized to take any measures that it considers advisable to protect national security, including the outright prohibition of a foreign investment in Canada. By virtue of the majority stock ownership of the company by Exxon Mobil Corporation, the company is considered to be an entity which is not controlled by Canadians.

The company’s website www.imperialoil.ca contains a variety of corporate and investor information which is available free of charge, including the company’s annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to these reports, as well as required interactive data filings. These reports are made available as soon as reasonably practicable after they are filed or furnished to the SEC.

The public may read and copy any materials the company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC’s website, www.sec.gov, contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

16

Table of Contents

| Item 1A. | Risk factors |

Volatility of oil and natural gas prices

The company’s results of operations and financial condition are dependent on the prices it receives for its oil and natural gas production. Crude oil and natural gas prices are determined by global and North American markets and are subject to changing supply and demand conditions. These can be influenced by a wide range of factors including economic conditions, international political developments and weather. Disruptions to pipelines linking production to markets may reduce the price for that production or lead to curtailment of production. In the past, crude oil and natural gas prices have been volatile, and the company expects that volatility to continue. Any material decline in oil or natural gas prices could have a material adverse effect on the company’s operations, financial condition, proved reserves and the amount spent to develop oil and natural gas reserves.

A significant portion of the company’s production is bitumen. The market prices for bitumen differ from the established market indices for light and medium grades of oil principally due to the higher transportation and refining costs associated with bitumen and limited refining capacity capable of processing bitumen. Bitumen may also be subject to limits on transportation capacity to markets to a larger extent than light crude oil. As a result, the price received for bitumen is generally lower than the price for medium and light oil. Future differentials are uncertain and increases in the bitumen differentials could have a material adverse effect on the company’s business.

Industry crude oil and natural gas commodity prices and petroleum and chemical product prices are commonly benchmarked in U.S. dollars. The majority of Imperial’s sales and purchases are related to these industry U.S. dollar benchmarks. As the company records and reports its financial results in Canadian dollars, to the extent that the Canadian/U.S. dollar exchange rate fluctuates, the company’s earnings will be affected.

The company does not use derivative instruments to offset exposures associated with hydrocarbon prices, currency exchange rates and interest rates that arise from existing assets, liabilities and transactions. The company does not engage in speculative derivative activities nor does it use derivatives with leveraged features.

Competitive factors

The oil and gas industry is highly competitive, particularly in the following areas: searching for and developing new sources of supply; constructing and operating crude oil, natural gas and refined products pipelines and facilities; and the refining, distribution and marketing of petroleum products and chemicals. The company’s competitors include major integrated oil and gas companies and numerous other independent oil and gas companies. The petroleum industry also competes with other industries in supplying energy, fuel and related products to customers.

Competitive forces may result in shortages of prospects to drill, services to carry out exploration, development or operating activities and infrastructure to produce and transport production. It may also result in an oversupply of crude oil, natural gas, petroleum products and chemicals. Each of these factors could have a negative impact on costs and prices and, therefore, the company’s financial results.

Environmental risks

All phases of the Upstream, Downstream and Chemical businesses are subject to environmental regulation pursuant to a variety of Canadian federal, provincial and municipal laws and regulations, as well as international conventions (collectively, “environmental legislation”).

Environmental legislation imposes, among other things, restrictions, liabilities and obligations in connection with the generation, handling, storage, transportation, treatment and disposal of hazardous substances and waste and in connection with spills, releases and emissions of various substances to the environment. As well, environmental regulations are imposed on the qualities and compositions of the products sold and imported. Environmental legislation also requires that wells, facility sites and other properties associated with the company’s operations be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. In addition, certain types of operations, including exploration and development projects and significant changes to certain existing projects, may require the submission and approval of environmental impact assessments. Compliance with environmental legislation can require significant expenditures and failure to comply with environmental legislation may result in the imposition of fines and penalties and liability for clean-up costs and damages. The costs of complying with environmental legislation

17

Table of Contents

in the future could have a material adverse effect on the company’s financial condition or results of operations. The company anticipates that changes in environmental legislation may require, among other things, reductions in emissions to the air from its operations and result in increased capital expenditures. Changes in environmental regulations or other laws (including changes in laws related to hydraulic fracturing) may increase our cost of compliance or reduce or delay available business opportunities. Future changes in environmental legislation could occur and result in stricter standards and enforcement, larger fines and liability, and increased capital expenditures and operating costs, which could have a material adverse effect on the company’s financial condition or results of operations.

There are operational risks inherent in oil and gas exploration and production activities, as well as the potential to incur substantial financial liabilities if those risks are not effectively managed. The ability to insure such risks is limited by the capacity of the applicable insurance markets, which may not be sufficient to cover the likely cost of a major adverse operating event. Accordingly, the company’s primary focus is on prevention, including through its rigorous operations integrity management system. The company’s future results will depend on the continued effectiveness of these efforts.

Climate change

The Government of Canada has confirmed its intent to introduce a set of regulations to limit emissions of greenhouse gas and air pollutants from major industrial facilities in Canada and to align Canadian policy in this area with that of the U.S. As these policies and potential regulations remain under development, attempts to assess the impact on the company are premature.

In the Province of Alberta, regulations governing greenhouse gas emissions from large industrial facilities came into effect in 2007. The regulation requires a reduction by 12 percent in the greenhouse gas emissions per unit of production from each facility’s average annual intensity. Allowed compliance measures include participation in an Alberta emission-trading system or payment to Alberta’s Climate Change and Emissions Management Fund. The impact on the company has not been material.

The Province of British Columbia has established a carbon tax, applicable to purchases of hydrocarbon fuels and emissions of greenhouse gases. The impact on the company has not been material.

The Province of Quebec has implemented a cap-and-trade system which will regulate greenhouse gas emissions from transportation and heating sources in 2015. The impact on the company is not anticipated to be material.

The Province of Ontario has passed legislation authorizing the issuing of regulations for the creation of a provincial cap-and-trade system controlling greenhouse gas emissions. Details on such possible regulations have not been issued so an assessment of impacts is premature.

The Province of British Columbia’s Renewable and Low Carbon Fuel Requirement Regulation requires suppliers of transportation fuels to reduce the carbon intensity of fuels sold in the province by an increasing amount over time. To date, there has not been a significant impact to the company’s operations.

Further federal, provincial or international legislation or regulation controlling greenhouse gas emissions could occur. Such requirements could make our products more expensive; lengthen project implementation times; reduce demand for hydrocarbons and shift hydrocarbon demand toward relatively lower-carbon sources, such as natural gas; and may result in increased capital expenditures and operating costs. Such requirements may have a material adverse effect on the company’s financial condition or results of operations, but this cannot be estimated at this time.

Other regulatory risk

The company is subject to a wide range of legislation and regulation governing its operations and industry transportation infrastructure, over which it has no control. Changes may affect every aspect of the company’s operations and financial performance. In addition, the company’s longer-term development plans may be adversely affected if, for regulatory or other reasons, necessary additional transportation infrastructure is not added in a timely fashion.

Need to replace reserves

The company’s future liquids, bitumen, synthetic oil and natural gas reserves and production, and therefore cash flows, are highly dependent upon the company’s success in exploiting its current reserve base and acquiring or discovering additional reserves. Without additions to the company’s reserves through exploration,

18

Table of Contents

acquisition or development activities, reserves and production will decline over time as reserves are depleted. The business of exploring for, developing or acquiring reserves is capital intensive. To the extent cash flows from operations are insufficient to fund capital expenditures and external sources of capital become limited or unavailable, the company’s ability to make the necessary capital investments to maintain and expand oil and natural gas reserves will be impaired. In addition, the company may be unable to find and develop or acquire additional reserves to replace oil and natural gas production at acceptable costs.

Research and development

To maintain our competitive position, especially in light of the technological nature of our business and the need for continuous efficiency improvement, the research and development organizations of the company and ExxonMobil, with whom the company conducts shared research, must be successful and able to adapt to a changing market and policy environment.

Safety, business controls and environmental risk management

The scope and nature of the company’s operations present a variety of significant hazards and risks, including operational hazards and risks such as explosions, fires, pipeline ruptures, crude oil spills, severe weather, and geological events. Our operations are also subject to the additional hazards of pollution, releases of toxic gas and other environmental hazards and risks. Our results depend on management’s ability to minimize these inherent risks, to control effectively our business activities and to minimize the potential for human error. We apply rigorous management systems and continuous focus to workplace safety and to avoiding spills or other adverse environmental events. For example, we work to minimize spills through a combined program of effective operations integrity management, ongoing upgrades, key equipment replacements, and comprehensive inspection and surveillance. We also maintain a disciplined framework of internal controls and apply a controls management system for monitoring compliance with this framework. Substantial liabilities and other adverse impacts could result if our management systems and controls do not function as intended. The company’s insurance may not provide adequate coverage in certain unforeseen circumstances.

Operational efficiency

An important component of the company’s competitive performance, especially given the commodity-based nature of many of our business segments, is our ability to operate efficiently, including our ability to manage expenses and improve production yields on an ongoing basis. This requires continuous management focus, including technology improvements, cost control, productivity enhancements, regular reappraisal of our asset portfolio, and the recruitment, development and retention of high caliber employees.

Preparedness

The company’s operations may be disrupted by severe weather events, natural disasters, human error, and similar events. Our ability to mitigate the adverse impacts of these events depends in part upon the effectiveness of our rigorous disaster preparedness and response planning, as well as business continuity planning.

Other business risks

The marketability of the company’s production is subject in part to the risks associated with transporting, processing and storing crude oil, natural gas and other related products. The availability, proximity, and capacity of pipeline facilities and railcars could negatively impact our ability to produce at capacity levels. Transportation disruptions could adversely affect commodity prices, the company’s price realizations, refining operations and sales volumes, or limit our ability to deliver production to market.

Other factors that may affect the demand for oil, gas and petrochemicals, and therefore impact the company’s results, include technological improvements in energy efficiency; seasonal weather patterns, which affect the demand for energy associated with heating and cooling; increased competitiveness of alternative energy sources; and changes in technology or consumer preferences that alter fuels choices, such as toward alternative fueled vehicles.

Business risks also include the risk of cyber security breaches. If management’s systems for protecting against cyber security risk prove not to be sufficient, the company could be adversely affected such as by having its business systems compromised, its proprietary information altered, lost or stolen, or its business operations disrupted.

19

Table of Contents

Uncertainty of reserve estimates

There are numerous uncertainties inherent in estimating quantities of reserves, including many factors beyond the company’s control. In general, estimates of economically recoverable oil and natural gas reserves and the future net cash flow are based upon a number of factors and assumptions made as of the date on which the reserve estimates were determined, such as geological and engineering estimates which have inherent uncertainties, the assumed effects of regulation by governmental agencies and future commodity prices and operating costs, all of which may vary considerably from actual results. All such estimates are, to some degree, uncertain and classifications of reserves are only attempts to define the degree of uncertainty involved. For these reasons, estimates of the economically recoverable oil and natural gas reserves, the classification of such reserves based on risk of recovery and estimates of future net revenues expected therefrom, prepared by different reserves evaluators or by the same evaluators at different times, may vary substantially. Actual production, revenues, taxes, and development, abandonment and operating expenditures with respect to reserves will likely vary from such estimates, and such variances could be material.

Estimates with respect to reserves that may be developed and produced in the future are often based upon volumetric calculations and upon analogy to similar types of reserves, rather than upon actual production history. Estimates based on these methods generally are less reliable than those based on actual production history. Subsequent evaluation of the same reserves based upon production history will result in variations, which may be material, in the estimated reserves.

Project factors

The company’s results depend on its ability to develop and operate major projects and facilities as planned. The company’s results will, therefore, be affected by events or conditions that affect the advancement, operation, cost or results of such projects or facilities. These risks include the company’s ability to obtain the necessary environmental and other regulatory approvals; changes in resources and operating costs including the availability and cost of materials, equipment and qualified personnel; the impact of general economic, business and market conditions; and the occurrence of unforeseen technical difficulties.

| Item 1B. | Unresolved staff comments |

None.

| Item 2. | Properties |

Reference is made to Item 1 above.

| Item 3. | Legal proceedings |

Not applicable.

| Item 4. | Mine safety disclosures |

Not applicable.

20

Table of Contents

| Item 5. | Market for registrant’s common equity, related stockholder matters and issuer purchases of equity securities |

Market information

The company’s common shares trade on the Toronto Stock Exchange and the NYSE MKT LLC, a subsidiary of NYSE Euronext. Reference is made to the “Quarterly financial and stock trading data” portion of the Financial section on page 86 of this report. The closing price for Imperial Oil Limited common shares on the Toronto Stock Exchange was $47.27 as at February 13, 2014.

Dividends

The following table sets forth the frequency and amount of all cash dividends declared by the company on its outstanding common shares for the two most recent fiscal years.

| 2013 | 2012 | |||||||||||||||||||||||||||||||

| dollars |

Q4 | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | ||||||||||||||||||||||||

| Declared dividend per share: |

0.13 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | ||||||||||||||||||||||||

Information for security holders outside Canada

Cash dividends paid to shareholders resident in countries with which Canada has an income tax convention are usually subject to a Canadian non-resident withholding tax of 15 percent, but may vary from one tax convention to another.

The withholding tax is reduced to five percent on dividends paid to a corporation resident in the U.S. that owns at least ten percent of the voting shares of the company.

The company is a qualified foreign corporation for purposes of the reduced U.S. capital gains tax rates, which are applicable to dividends paid by U.S. domestic corporations and qualified foreign corporations.

There is no Canadian tax on gains from selling shares or debt instruments owned by non-residents not carrying on business in Canada, as long as the shareholder does not, in any given 60 month period, own 25 percent or more of the shares of the company.

As of February 13, 2014 there were 12,215 holders of record of common shares of the company.

During the period October 1, 2013 to December 31, 2013, there were no shares issued by the company to employees or former employees outside the U.S. under its restricted stock unit plan.

21

Table of Contents

Securities authorized for issuance under equity compensation plans

Sections of the company’s management proxy circular are contained in the Proxy information section, starting on page 87. The company’s management proxy circular is prepared in accordance with Canadian securities regulations.

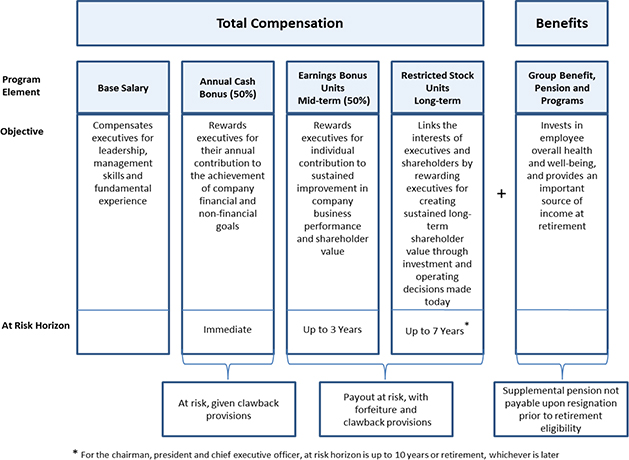

Reference is made to the section under the “IV. Company executives and executive compensation”:

| — | entitled “Performance graph” within the “Compensation discussion and analysis section” on page 133 of this report; and |

| — | entitled “Equity compensation plan information”, within the “Compensation discussion and analysis section”, on page 139 of this report. |

Issuer purchases of equity securities

| Total number of shares purchased |

Average price paid per share (dollars) |

Total number of shares purchased as part of publicly announced plans or programs |