Barclays CEO Energy-Power Conference

Rich Kruger | September 13, 2013

—

Cautionary statement

This presentation contains forward-looking information on future production, project start-ups and future capital spending. Actual results could differ materially due to changes in project schedules, operating performance, demand for oil and gas, commercial negotiations or other technical and economic factors.

Oil-equivalent barrels (OEB) may be misleading, particularly if used in isolation. An OEB conversion ratio of 6,000 cubic feet to one barrel is based on an energy-equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the well head.

Proved reserves are calculated under United States Securities and Exchange Commission (SEC) requirements, as shown in Form 10-K dated December 31, 2012.

Pursuant to National Instrument 51-101 disclosure guidelines, and using Canadian Oil and Gas Evaluation Handbook definitions, Imperial’s non-proved resources are classified as a “contingent resource.” Such resources are a best estimate of the company’s net interest after royalties at year-end 2012, as determined by Imperial’s internal qualified reserves evaluator. Contingent resources are considered to be potentially recoverable from known accumulations, using established technology or technology under development, but are currently not considered to be commercially recoverable due to one or more contingencies. There is no certainty that it will be economically viable or technically feasible to produce any portion of the resource.

The term “project” as used in these materials does not necessarily have the same meaning as under Securities and Exchange Commission (“SEC”) Rule 13q-1 relating to government payment reporting. For example, a single project for purposes of the rule may encompass numerous properties, agreements, investments, developments, phases, work efforts, activities and components, each of which we may also informally describe as a “project”.

Financials in Canadian dollars.

2

Imperial Oil’s business model 3

Deliver superior, long-term shareholder value

1.Long-life, advantaged assets

2.Value chain integration and synergies

3.Disciplined investment, cost management

4.High-impact technologies and innovation

5.Operational excellence, responsible growth

ExxonMobil relationship

4

Chemical

Upstream

Downstream Integration & synergies

Delivering value and competitive advantage across the business chain World-class producing assets

Largest petroleum refiner in Canada

Leading polyethylene market share

5

0

10

20

30

IMO

HSE

CVE

CNRL

SU

Source: Bloomberg, company publications

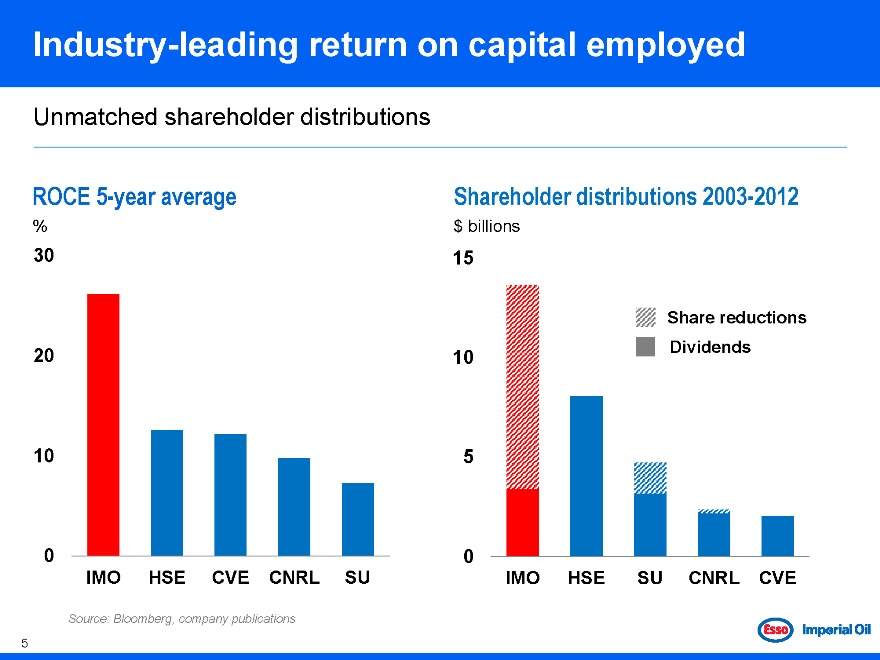

ROCE 5-year average

%

0

5

10

15

IMO

HSE

SU

CNRL

CVE

Shareholder distributions 2003-2012

$ billions

Dividends Share reductions

Industry-leading return on capital employed

Unmatched shareholder distributions

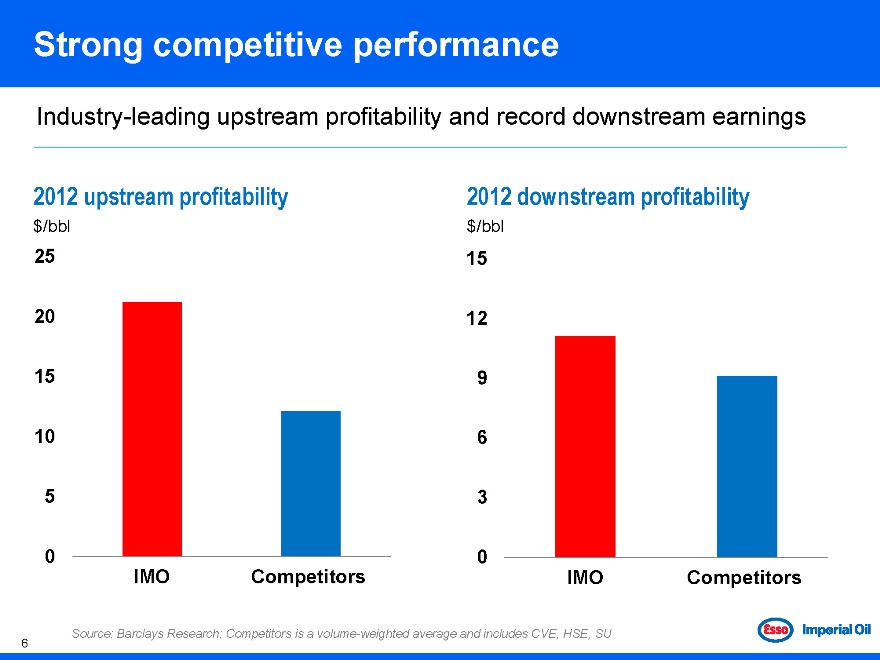

Strong competitive performance

Industry-leading upstream profitability and record downstream earnings

6

0

5

10

15

20

25

IMO

Competitors

0

3

6

9

12

15

IMO

Competitors

Source: Barclays Research; Competitors is a volume-weighted average and includes CVE, HSE, SU

2012 upstream profitability

$/bbl 2012 downstream profitability $/bbl

7

Long-life, high-quality proved reserves

3.6 billion oil-equivalent barrels, concentrated in world-class assets

0

1

2

3

4

Syncrude

Cold Lake

Kearl

Other YE 2012 proved reserves billion oeb*

* after royalties

Cold Lake

Kearl

Syncrude

8

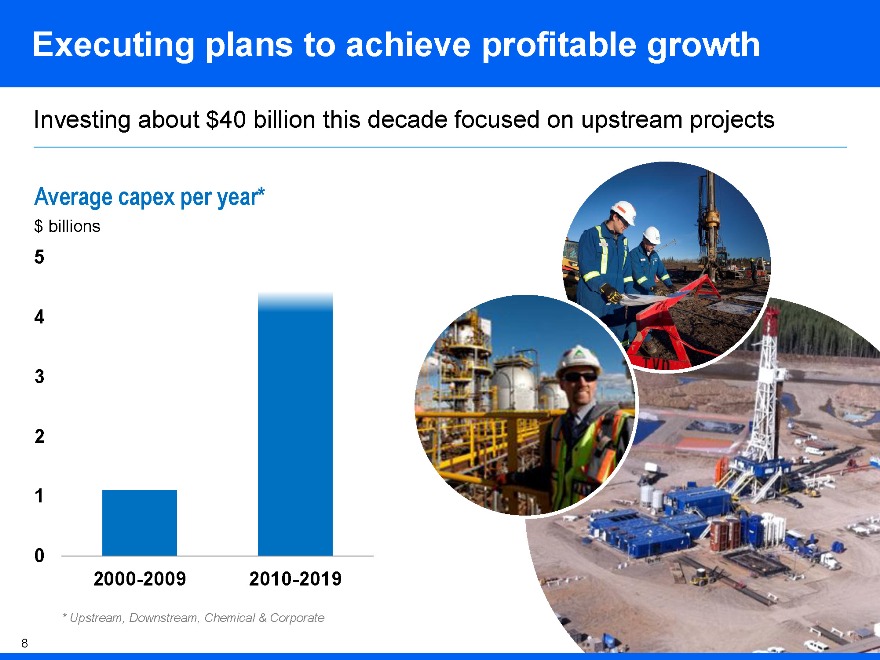

Executing plans to achieve profitable growth

Investing about $40 billion this decade focused on upstream projects Average capex per year* $ billions

0

1

2

3

4

5

2000-2009

2010-2019

* Upstream, Downstream, Chemical & Corporate

2010

2013

2016

0

200

400

600

New opportunities

Oil sands—mining

Oil sands—in-situ

Conventional

9

* before royalties

Production volumes to double by about 2020

Nearly 200 kbd of additional liquids in funded projects

Production outlook*

kboed

Existing Under construction

To be funded

Starting up

~2020

0

10

20

30

40

2012

2014

2016

2018

2020

2022

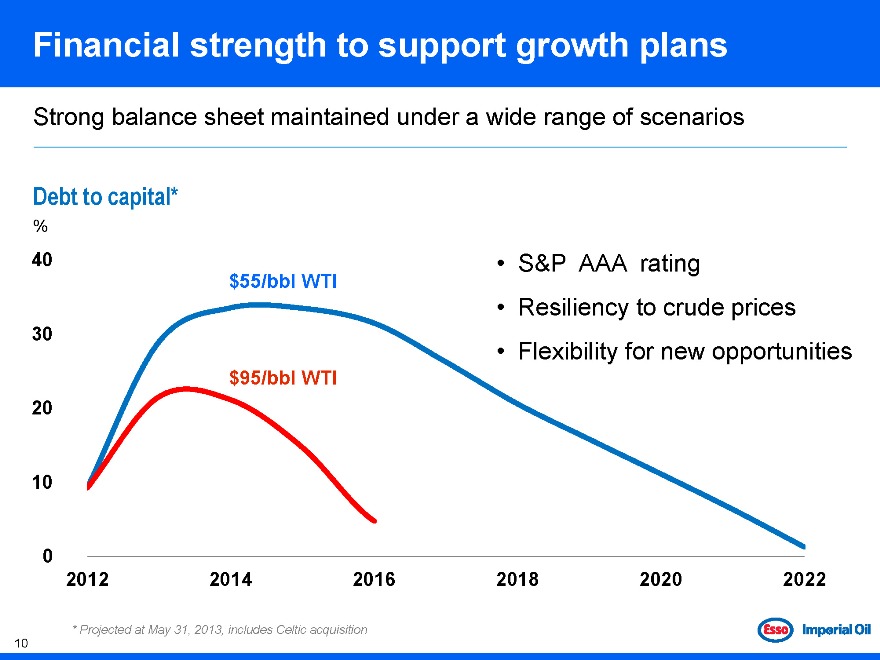

Financial strength to support growth plans

Strong balance sheet maintained under a wide range of scenarios 10

S&P AAA rating

Resiliency to crude prices

Flexibility for new opportunities

* Projected at May 31, 2013, includes Celtic acquisition

$55/bbl WTI

$95/bbl WTI

Debt to capital*

%

Cold Lake: a world-class in-situ operation 11 Ownership: 100% Imperial Oil Commercial start-up: 1985 Current production: 150+ kbd gross Active wells: ~ 4,500 Cumulative production: 1.2 billion bbls Proved reserves: 1.1 billion bbls* Non-proved resource: 2.9 billion bbls*

* after royalties

Consistently delivering nameplate capacity at low unit costs

Industry-leading operating performance

12

Reliability 3-year average1

% of capacity 2010-2012

1 Peters & Co. Limited, geoSCOUT

2 FirstEnergy Capital Corp., FirstFacts May 21, 2013; figures include cash G&A and stock-based compensation expense per boe * Industry averages are volume weighted

0

20

40

60

80

100

IMO

Cold Lake

Industry

average2012 in-situ cash operating costs2 $/bbl

0

5

10

15

20

IMO

Cold Lake

Industry

average

0

20

40

60

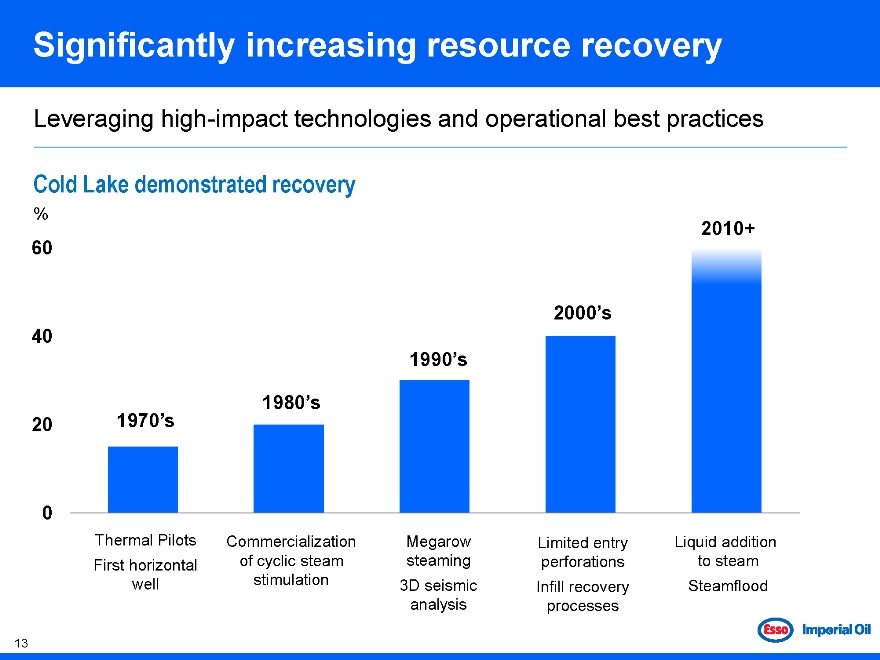

Significantly increasing resource recovery

Leveraging high-impact technologies and operational best practices

13

Cold Lake demonstrated recovery

%

1970’s 1980’s

1990’s

2000’s

2010+

Megarow steaming

3D seismic analysis

Commercialization

of cyclic steam

stimulation

Liquid addition to steam

Steamflood

Limited entry perforations

Infill recovery processes Thermal Pilots First horizontal well

Expansion via “design one, build multiple” approach

Over 1.2 billion barrels produced, continued growth planned Cold Lake production* kbd

14

0

50

100

150

200

1980

1990

2000

Maskwa

Mahihkan

Nabiye

Mahkeses

Pilots

2012 2015

* before royalties

Cold Lake Nabiye project 56% complete

15

Funded in 2012 for $2 billion, 40 kbd additional production

“Design one, build multiple” replicates Mahkeses

On schedule and on budget for late 2014 start-up

15

Kearl: a next generation mining development

16

Ownership: 71% Imperial Oil

29% ExxonMobil

Commercial start-up: 2013

Gross production: 110 kbd (initial)*

345 kbd (ultimate)*

Recoverable resource: 4.6 billion bbls*

* Gross, before royalties

17 Kearl’s competitive advantages

Proprietary froth treatment

Competitive cost structure

High-quality resource

Environmental performance

Adding value and establishing new performance standards

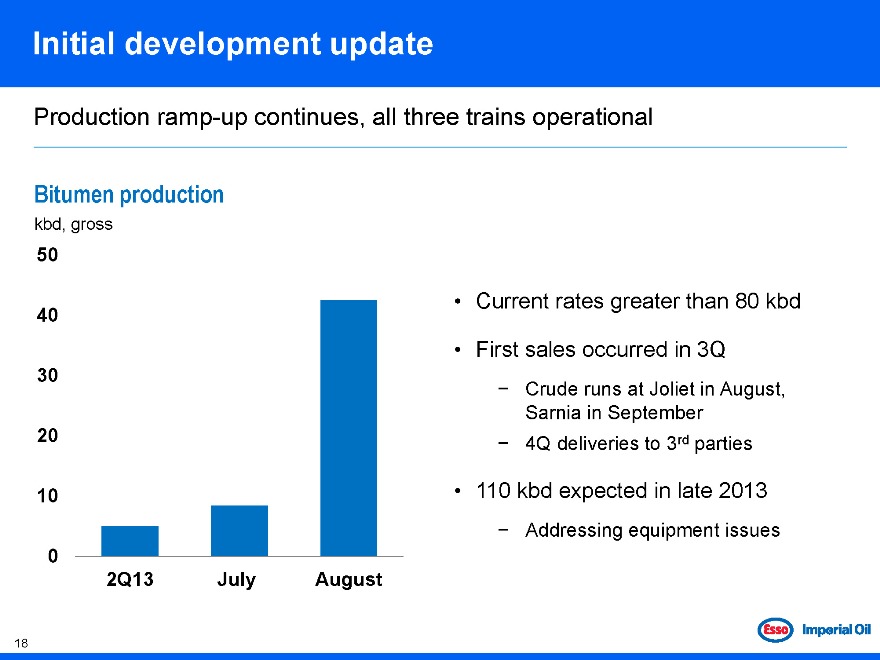

18 Initial development update Bitumen production

kbd, gross

0

10

20

30

40

50

2Q13

July

August

Current rates greater than 80 kbd

First sales occurred in 3Q

?Crude runs at Joliet in August, Sarnia in September

?4Q deliveries to 3rd parties

110 kbd expected in late 2013

?Addressing equipment issues

Production ramp-up continues, all three trains operational

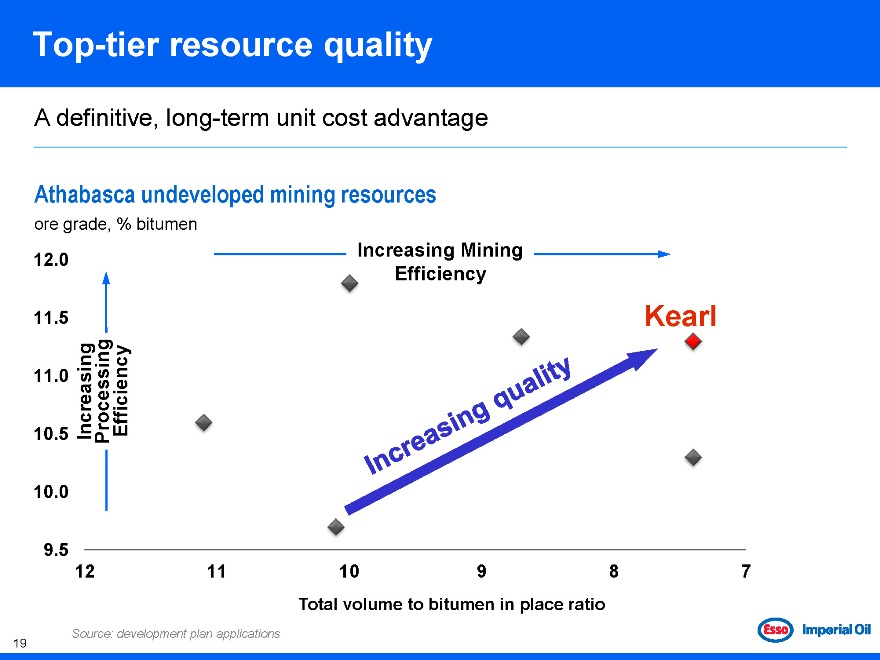

Increasing Mining Efficiency 9.5

10.0

10.5

11.0

11.5

12.0

7

8

9

10

11

12

Total volume to bitumen in place ratio Top-tier resource quality

Increasing

Processing

Efficiency A definitive, long-term unit cost advantage

Athabasca undeveloped mining resources

ore grade, % bitumen

19 Kearl

Source: development plan applications

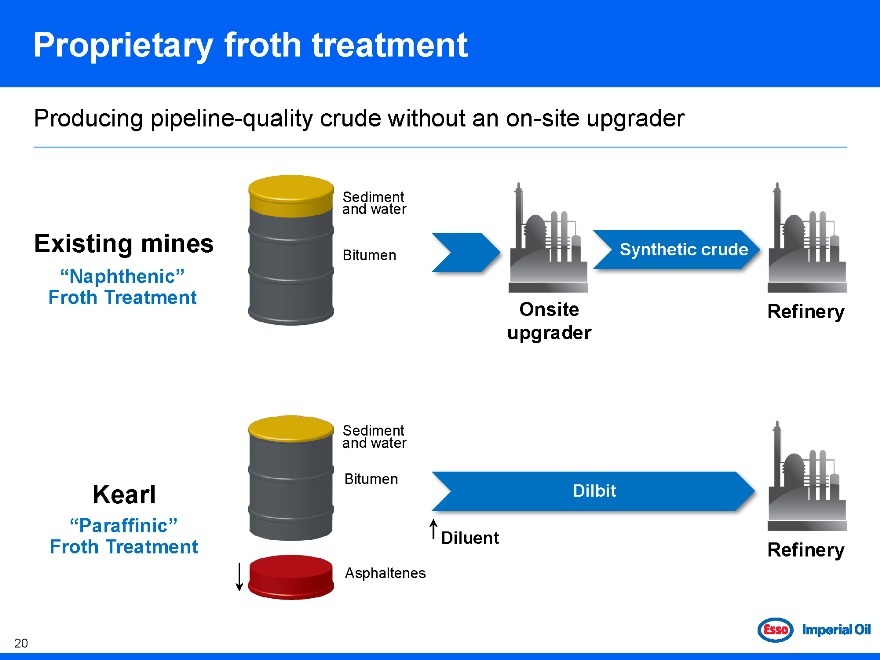

Onsite upgrader

“Naphthenic”

Froth Treatment

Refinery Refinery

“Paraffinic” Froth Treatment

Asphaltenes

Bitumen

Sediment and water

Bitumen

Sediment and water

20 Producing pipeline-quality crude without an on-site upgrader

Existing mines

Kearl

Synthetic crude

Proprietary froth treatment

Dilbit

Diluent

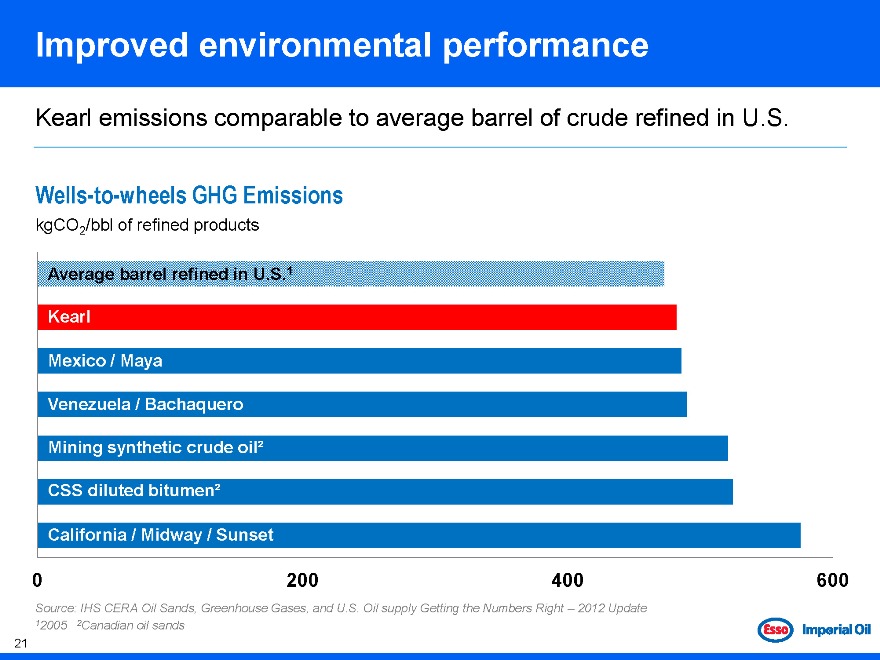

21

0

200

400

600Wells-to-wheels GHG Emissions kgCO2/bbl of refined products

Improved environmental performance

Kearl emissions comparable to average barrel of crude refined in U.S.

Source: IHS CERA Oil Sands, Greenhouse Gases, and U.S. Oil supply Getting the Numbers Right – 2012 Update

12005 2Canadian oil sands

Average barrel refined in U.S.1

Kearl

Mexico / Maya Venezuela / Bachaquero

Mining synthetic crude oil²

CSS diluted bitumen²

California / Midway / Sunset

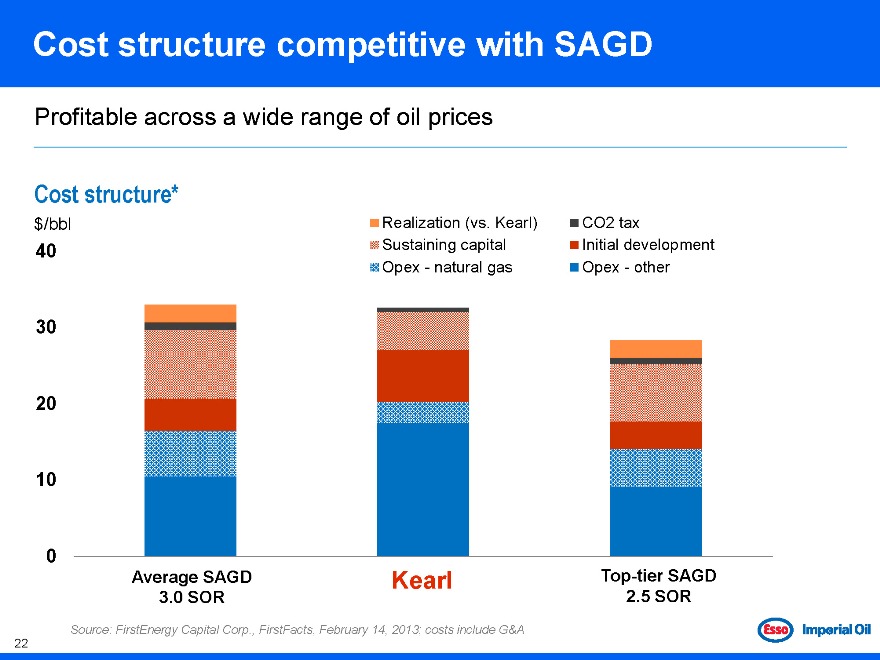

0

10

20

30

40

Realization (vs. Kearl)

CO2 tax

Sustaining capital

Initial development

Opex—natural gas

Opex—other

Average SAGD 3.0 SOR

Top-tier SAGD 2.5 SOR

Cost structure competitive with SAGD

Profitable across a wide range of oil prices 22

Source: FirstEnergy Capital Corp., FirstFacts, February 14, 2013; costs include G&A

Cost structure*

$/bbl

Kearl

23

Kearl development plan

kbd, gross

40+ year asset life Gross production plateau of 345 kbd, Imperial Oil share 71%

0

100

200

300

400

2013

2050

Initial Development

Expansion Project

Third Ore Preparation Plant

Plant Debottleneck

110 kbd 110 kbd

80 kbd

45 kbd

Funded

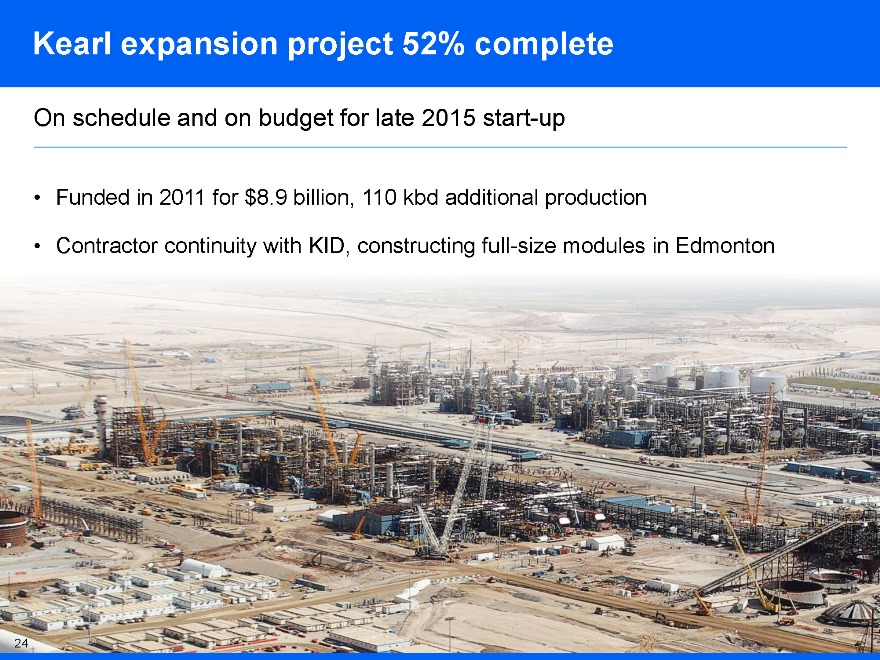

24 Kearl expansion project 52% complete

On schedule and on budget for late 2015 start-up

Funded in 2011 for $8.9 billion, 110 kbd additional production

Contractor continuity with KID, constructing full-size modules in Edmonton

25

Market access strategy

0

100

200

300

400

2014

2016

2018

Commitments to new pipeline capacity

kbd

Currently transporting 400 kbd from Alberta by pipeline

?Secured 390 kbd of additional capacity

?Keystone, Gulf Coast Access, Keystone XL, Trans Mountain, Energy East

Advancing rail options to mitigate pipeline uncertainties

Pursuing a portfolio of options, recognizing uncertainties

A history of success, commitment to further innovate 26

Advancing game-changing technologies

SA-SAGD

Solvent-assisted SAGD

CIMA Chemically induced

micro agglomeration CSP Cyclic solvent process NAE Non-aqueous extraction

in-situ mining

Now Future Time to commercialization

Large, non-proved resource base

13 billion oil-equivalent barrels to support further growth 27

YE 2012 resource base

billion oeb, excludes 2013 acquisitions (Celtic and Clyden)*

* after royalties

0

5

10

15

In-situ Mining Other

Liquids

Gas Growth opportunities

Progressing

28

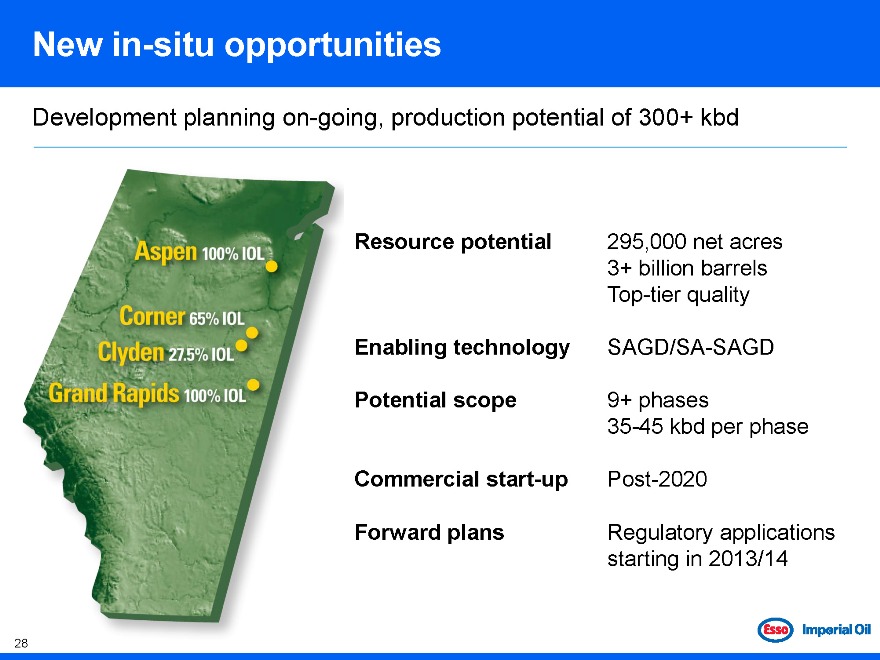

New in-situ opportunities Resource potential 295,000 net acres 3+ billion barrels Top-tier quality Enabling technology SAGD/SA-SAGD Potential scope 9+ phases 35-45 kbd per phase Commercial start-up Post-2020 Forward plans Regulatory applications starting in 2013/14 Development planning on-going, production potential of 300+ kbd

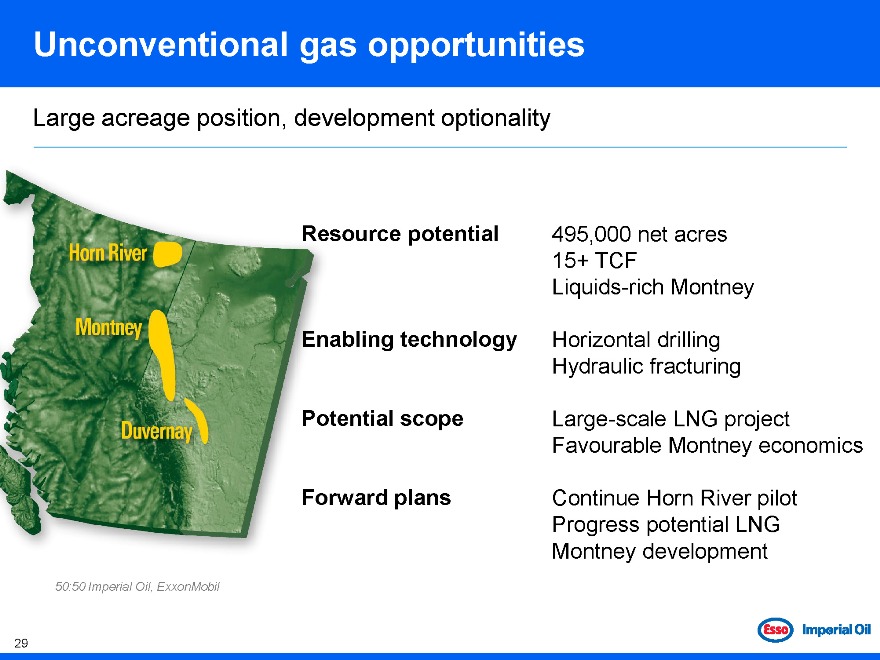

Unconventional gas opportunities

Large acreage position, development optionality Resource potential Enabling technology Potential scope Forward plans

29

50:50 Imperial Oil, ExxonMobil

495,000 net acres

15+ TCF

Liquids-rich Montney

Horizontal drilling

Hydraulic fracturing

Large-scale LNG project

Favourable Montney economics

Continue Horn River pilot

Progress potential LNG

Montney development

30 * before royalties 0

200

400

600

800

1000

2010

~2020

~2030

New technologies/opportunities

Oil sands—mining

Oil sands—in-situ

Conventional

Production outlook*

kboed

Long-term growth Potential of 1+ million barrels per day by about 2030

For more information

www.imperialoil.ca

For more detailed investor information, or to receive annual and interim reports, please contact:

John A. Charlton

Manager, Investor Relations

Imperial Oil Limited

237 Fourth Avenue SW

Calgary, Alberta T2P 3M9

Email: john.a.charlton@esso.ca

Phone: (403) 237-4537 31