UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-4797

ILLINOIS TOOL WORKS INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware | 36-1258310 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

155 Harlem Avenue, Glenview, Illinois | 60025 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (847) 724-7500

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock | New York Stock Exchange | |

1.75% Euro Notes due 2022 | New York Stock Exchange | |

1.25% Euro Notes due 2023 | New York Stock Exchange | |

2.125% Euro Notes due 2030 | New York Stock Exchange | |

3.00% Euro Notes due 2034 | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | o |

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2015 was approximately $26.7 billion based on the New York Stock Exchange closing sales price as of June 30, 2015.

Shares of Common Stock outstanding at January 31, 2016: 363,766,897.

Documents Incorporated by Reference

Portions of the 2016 Proxy Statement for Annual Meeting of Stockholders to be held on May 6, 2016. | Part III | |

Table of Contents | ||

PART I | ||

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

PART II | ||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

PART III | ||

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accounting Fees and Services | |

PART IV | ||

Item 15. | Exhibits and Financial Statement Schedules | |

Signatures | ||

Exhibit Index | ||

PART I

ITEM 1. Business

General

Illinois Tool Works Inc. (the "Company" or "ITW") was founded in 1912 and incorporated in 1915. The Company's ticker symbol is ITW. The Company is a global manufacturer of a diversified range of industrial products and equipment with 84 divisions in 57 countries. As of December 31, 2015, the Company employed approximately 48,000 persons.

The Company's operations are organized and managed based on similar product offerings and similar end markets, and are reported to senior management as the following seven segments: Automotive OEM; Test & Measurement and Electronics; Food Equipment; Polymers & Fluids; Welding; Construction Products; and Specialty Products. The following is a description of the Company's seven segments:

Automotive OEM: This segment is a global, niche supplier to top tier OEMs, providing unique innovation to address pain points for sophisticated customers with complex problems. Businesses in this segment produce components and fasteners for automotive-related applications. This segment primarily serves the automotive original equipment manufacturers and tiers market. Products in this segment include:

• | plastic and metal components, fasteners and assemblies for automobiles, light trucks and other industrial uses. |

Test & Measurement and Electronics: This segment is a branded and innovative producer of test and measurement and electronic manufacturing and maintenance, repair, and operations, or "MRO" solutions that improve efficiency and quality for customers in diverse end markets. Businesses in this segment produce equipment, consumables, and related software for testing and measuring of materials and structures, as well as equipment and consumables used in the production of electronic subassemblies and microelectronics. This segment primarily serves the electronics, general industrial, industrial capital goods, automotive original equipment manufacturers and tiers, and consumer durables markets. Products in this segment include:

• | equipment, consumables, and related software for testing and measuring of materials, structures, gases and fluids; |

• | electronic assembly equipment and related consumable solder materials; |

• | electronic components and component packaging; |

• | static control equipment and consumables used for contamination control in clean room environments; and |

• | pressure sensitive adhesives and components for telecommunications, electronics, medical and transportation applications. |

Food Equipment: This segment is a highly focused and branded industry-leader in commercial food equipment differentiated by innovation and integrated service offerings. This segment primarily serves the food institutional/restaurant, food service and food retail markets. Products in this segment include:

• | warewashing equipment; |

• | cooking equipment, including ovens, ranges and broilers; |

• | refrigeration equipment, including refrigerators, freezers and prep tables; |

• | food processing equipment, including slicers, mixers and scales; |

• | kitchen exhaust, ventilation and pollution control systems; and |

• | food equipment service, maintenance and repair. |

Polymers & Fluids: This segment is a highly branded supplier to niche markets that require value-added, differentiated products. Businesses in this segment produce adhesives, sealants, lubrication and cutting fluids, and fluids and polymers for auto aftermarket maintenance and appearance. This segment primarily serves the automotive aftermarket, general industrial, MRO, and construction markets. Products in this segment include:

• | adhesives for industrial, construction and consumer purposes; |

• | chemical fluids which clean or add lubrication to machines; |

• | epoxy and resin-based coating products for industrial applications; |

• | hand wipes and cleaners for industrial applications; |

• | fluids, polymers and other supplies for auto aftermarket maintenance and appearance; |

• | fillers and putties for auto body repair; and |

3

• | polyester coatings and patch and repair products for the marine industry. |

Welding: This segment is a branded value-added equipment and specialty consumable manufacturer with innovative and leading technology. Businesses in this segment produce arc welding equipment, consumables and accessories for a wide array of industrial and commercial applications. This segment primarily serves the general industrial market, which includes fabrication, shipbuilding and other general industrial markets, and energy, MRO, construction, and industrial capital goods markets. Products in this segment include:

• | arc welding equipment; |

• | metal arc welding consumables and related accessories; and |

• | metal jacketing and other insulation products. |

Construction Products: This segment is a branded supplier of innovative engineered fastening systems and solutions. This segment primarily serves the residential construction, renovation/remodel construction and commercial construction markets. Products in this segment include:

• | fasteners and related fastening tools for wood and metal applications; |

• | anchors, fasteners and related tools for concrete applications; |

• | metal plate truss components and related equipment and software; and |

• | packaged hardware, fasteners, anchors and other products for retail. |

Specialty Products: This segment is focused on diversified niche market opportunities that deliver strong operating results with substantial patent protection producing beverage packaging equipment and consumables, product coding and marking equipment and consumables, and appliance components and fasteners. This segment primarily serves the food and beverage, consumer durables, general industrial, printing and publishing and industrial capital goods markets. Products in this segment include:

• | line integration, conveyor systems and line automation for the food and beverage industries; |

• | plastic consumables that multi-pack cans and bottles and related equipment; |

• | foil, film and related equipment used to decorate consumer products; |

• | product coding and marking equipment and related consumables; |

• | plastic and metal fasteners and components for appliances; |

• | airport ground support equipment; and |

• | components for medical devices. |

The information set forth below is applicable to all segments of the Company unless otherwise noted.

The ITW Business Model

The powerful and highly differentiated ITW Business Model is the Company’s core source of value creation. This business model is the Company’s competitive advantage and defines how ITW creates value for its shareholders and comprises three unique elements:

• | ITW’s 80/20 management process is the operating system that is applied in every ITW business. Initially introduced as a manufacturing efficiency tool in the 1980’s, ITW has continually refined, improved and expanded 80/20 into a proprietary, holistic business management process that generates significant value for the Company. Through the application of data-driven insights generated by 80/20 practice, ITW focuses on its largest and best opportunities (the “80”) and eliminates complexity associated with the less profitable opportunities (the “20”). 80/20 enables ITW businesses to consistently deliver world-class operational excellence in regards to product availability, quality, and innovation, while generating superior financial performance; |

• | Customer-back innovation has fueled decades of profitable growth at ITW. The Company’s unique innovation approach is built on the insight gathered from the 80/20 management process. Working from the customer back, ITW businesses position themselves as the go-to problem solver for their “80” customers. ITW’s innovation efforts are focused on understanding customer needs, particularly those in “80” markets with solid long-term growth fundamentals, and then creating unique solutions to address those needs. These customer insights and learnings drive innovation at ITW and have contributed to a portfolio of more than 16,000 granted and pending patents; |

4

• | ITW’s decentralized, entrepreneurial culture allows ITW businesses to be fast, focused, and responsive. ITW businesses have significant flexibility within the framework of the ITW Business Model to customize their approach in order to best serve their customers. ITW colleagues are clear about what is expected of them with regard to ITW’s business model, strategy, and values. This leads to a focused and simple organizational structure that, combined with outstanding execution, delivers operational excellence adapted to their specific customers and end markets. |

Enterprise Strategy

In 2013, ITW began the process of transitioning the Company onto its current strategic path to fully leverage the compelling performance potential of the ITW Business Model. Since then, ITW has made considerable progress, as evidenced by the Company’s strong financial performance over the past three years.

The roots of ITW’s Enterprise Strategy began in 2011-2012, when the Company undertook a complete review of its performance. ITW gathered deep insights from its businesses that were delivering consistent above-market growth with best-in-class margins and returns, and defined a strategy to replicate that performance throughout the Company.

Based on this rigorous and thorough evaluation, ITW determined two paths to deliver world-class financial performance and compelling long-term returns for its shareholders. One, ITW needed to shift the Company's primary growth engine to organic; and two, the Company needed to leverage the ITW Business Model to deliver best-in-class margins and returns.

Shift the Company’s Core Growth Engine to Organic

In order to pivot to fully focus on organic growth, the Company needed to first accomplish several preparatory steps. These key initiatives were a major focus of the Company in 2012-2015, which included portfolio management, business structure simplification and strategic sourcing.

The first step, portfolio management, was to construct and maintain a business portfolio capable of delivering consistent above-market organic growth. As part of this initiative to realign the portfolio, ITW exited businesses that were operating in commoditized market spaces and prioritized sustainable differentiation as a must-have requirement for all ITW businesses. This process included both divesting entire businesses and exiting commoditized product lines and customers inside otherwise highly differentiated ITW divisions.

As a result of this work, ITW’s business portfolio now has significantly higher organic growth potential. ITW segments and divisions now possess attractive and differentiated product lines and end markets as they continue to improve margins and generate price/cost increases. This was achieved through product line simplification which focuses on eliminating the complexity and overhead costs associated with smaller product lines and customers, and focuses businesses on supporting and growing their largest customers and product lines. Most of this initiative is complete and ITW businesses are demonstrating notably improved financial performance; the Company expects the remaining product line simplification work to largely be accomplished in 2016.

The second step, business structure simplification, was to scale-up ITW’s operating structure to support increased engineering, marketing, and sales resources, and to improve global reach and competitiveness, all of which were critical to ITW’s ability to drive accelerated organic growth. ITW now has 84 scaled-up divisions with significantly enhanced focus on growth investments, core customers and products, and customer-back innovation.

With the portfolio realignment and scale-up work largely complete, the Company is now able to shift its focus to preparing for, and accelerating, organic growth.

As a third preparatory step, ITW is currently in the process of reapplying 80/20 to optimize its newly scaled-up divisions for growth. This process involves first using 80/20 to build a foundation of operational excellence, and then applying 80/20-driven insights to identify the best opportunities to drive organic growth.

Once the business is operationally excellent and has identified the right growth opportunities, the final step is to accelerate organic growth. The process of preparing for accelerated organic growth generally takes 18 to 24 months.

Based on the financial performance of the divisions that are further along in this process, the Company believes that this framework is capable of delivering above market organic growth in all ITW segments. Many ITW divisions are ready to grow and growing above their respective markets, while the rest of the Company’s divisions are at various phases of

5

preparing to grow. ITW management is fully aligned on this plan and very focused on executing it. By the end of 2016, the Company expects approximately 85 percent of its businesses to be ready to grow.

Leverage the ITW Business Model to Deliver Best-in-Class Margins and Returns

The Company’s work to deliver best-in-class margins and returns is focused on two key areas of ongoing activity. The first is strategic sourcing, where the Company seeks to benefit from its size and scale in procurement processes. Sourcing is now a core strategic and operational capability and this improved competitiveness supports ITW’s organic growth framework. The Company’s 80/20-enabled sourcing organization has delivered an average of 1 percent reduction in spend each year in 2013-2015 and is on track to do the same in 2016 and 2017.

The second element of the margins and returns area of focus is to better leverage the full power of the ITW Business Model through a much more consistent and focused approach to 80/20 best practice implementation across the Company. ITW has clearly defined what excellence in the practice of ITW’s 80/20 management process looks like and the result is significant opportunity to create meaningful incremental improvement in margins and returns as evidenced by the Company’s improvement in both operating margin and after-tax return on invested capital. These 80/20 initiatives can result in restructuring initiatives that reduce costs and improve profitability and returns.

Divestiture of Majority Interest in Former Decorative Surfaces Segment

On October 31, 2012, the Company divested a 51% majority interest in the Decorative Surfaces segment. Accordingly, the Company ceased consolidating the results of the Decorative Surfaces segment as of October 31, 2012 and now reports its 49% ownership interest using the equity method of accounting. Due to the Company's continuing involvement through its 49% interest, the historical operating results of Decorative Surfaces are presented in continuing operations. Effective November 1, 2012, Decorative Surfaces was no longer a reportable segment of the Company.

Divestiture of the Industrial Packaging Segment

In February 2013, the Company announced that it was initiating a review process to explore strategic alternatives for the Industrial Packaging segment. In September 2013, the Company’s Board of Directors authorized a plan to commence a sale process for the Industrial Packaging segment. The Company classified the Industrial Packaging segment as held for sale beginning in the third quarter of 2013 and no longer presented this segment as part of its continuing operations.

On February 6, 2014, the Company announced that it had signed a definitive agreement to sell the Industrial Packaging business to The Carlyle Group for $3.2 billion. The transaction was completed on May 1, 2014, resulting in a pre-tax gain of $1.7 billion ($1.1 billion after-tax) in the second quarter of 2014 which was included in Income from discontinued operations.

See the Discontinued Operations note in Item 8. Financial Statements and Supplementary Data for further discussion of this transaction.

Current Year Developments

Refer to Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Financial Information about Segments

Segment and operating results are included in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and the Segment Information note in Item 8. Financial Statements and Supplementary Data.

Distribution Methods

The Company’s businesses primarily distribute their products directly to industrial manufacturers and through independent distributors.

6

Backlog

Backlog generally is not considered a significant factor in the Company’s businesses as relatively short delivery periods and rapid inventory turnover are characteristic of most of their products. Backlog by segment as of December 31, 2015 and 2014 was as follows:

In millions | 2015 | 2014 | |||||

Automotive OEM | $ | 403 | $ | 414 | |||

Test & Measurement and Electronics | 289 | 301 | |||||

Food Equipment | 203 | 237 | |||||

Polymers & Fluids | 53 | 60 | |||||

Welding | 68 | 84 | |||||

Construction Products | 34 | 28 | |||||

Specialty Products | 237 | 263 | |||||

Total | $ | 1,287 | $ | 1,387 | |||

Backlog orders scheduled for shipment beyond calendar year 2016 were not material as of December 31, 2015.

Competition

With operations in 57 countries, the Company offers a wide range of products in a myriad of markets, many of which are fragmented, and the Company encounters a variety of competitors that vary by product line, end market and geographic area. The Company's competitors include many regional or specialized companies, as well as large U.S. and non-U.S. companies or divisions of large companies. Each of the Company's segments generally has several main competitors and numerous smaller ones in most of their end markets and geographic areas. In addition to numerous smaller regional competitors, the Welding segment competes globally with Lincoln Electric and ESAB.

In virtually all segments, the Company differentiates its businesses from its competitors based on product innovation, product quality, brand preference, service delivery and price. Technical capability is also a competitive factor in most segments. The Company believes that each segment's primary competitive advantages derive from the Company's business model and decentralized operating structure, which creates a strong focus on end markets and customers at the local level, enabling its businesses to respond rapidly to market dynamics. This structure enables the Company's businesses to drive operational excellence utilizing the Company's 80/20 management process and leveraging its product innovation capabilities. The Company also believes that its global footprint is a competitive advantage in many of its markets, especially in its Automotive OEM segment.

Raw Materials

The Company uses raw materials of various types, primarily steel, resins, chemicals and paper, that are available from numerous commercial sources. The availability of materials and energy has not resulted in any significant business interruptions or other major problems, and no such problems are currently anticipated.

Research and Development

Developing new and improved products, broadening the application of established products, and continuing efforts to improve and develop new methods, processes and equipment all contribute to the Company's organic growth. Many new products are designed to reduce customers' costs by eliminating steps in their manufacturing processes, reducing the number of parts in an assembly or improving the quality of customers' assembled products. Typically, the development of such products is accomplished by working closely with customers on specific applications. Research and development expenses were $218 million in 2015, $227 million in 2014 and $240 million in 2013.

Intellectual Property

The Company owns approximately 3,400 unexpired U.S. patents and 7,200 foreign patents covering articles, methods and machines. In addition, the Company has approximately 1,500 applications for patents pending in the U.S. Patent Office and

7

4,500 applications pending in foreign patent offices. There is no assurance that any of these patents will be issued. The Company maintains a patent group for the administration of patents and processing of patent applications.

The Company believes that many of its patents are valuable and important; however, the expiration of any one of the Company's patents would not have a material effect on the Company's results of operations or financial position. The Company also credits its success in the markets it serves to engineering capability; manufacturing techniques; skills and efficiency; marketing and sales promotion; and service and delivery of quality products to its customers.

In addition to patents, many of the Company's products and services are sold under various owned or licensed trademarks, which are important to the Company in the aggregate. Some of the Company's more significant trademarks include ITW, which is also used in conjunction with the trademarks of many of the Company's businesses; Deltar and Shakeproof in the Automotive OEM segment; Instron in the Test & Measurement and Electronics segment; Hobart in the Food Equipment segment; Permatex and Wynn's in the Polymers & Fluids segment; Miller in the Welding segment; Paslode in the Construction Products segment; and Hi-Cone in the Specialty Products segment.

Environmental

The Company believes that its manufacturing plants and equipment are in substantial compliance with all applicable environmental regulations. Additional measures to maintain compliance are not expected to materially affect the Company’s capital expenditures, competitive position, financial position or results of operations.

Various legislative and administrative regulations concerning environmental issues have become effective or are under consideration in many parts of the world relating to manufacturing processes and the sale or use of certain products. To date, such developments have not had a substantial adverse impact on the Company's revenues, earnings or cash flows.

Employees

The Company employed approximately 48,000 persons as of December 31, 2015 and considers its employee relations to be excellent.

International

The Company's international operations include subsidiaries and joint ventures in 56 foreign countries on six continents. These operations serve such end markets as automotive OEM/tiers, automotive aftermarket, general industrial, commercial food equipment, construction, and others on a worldwide basis. The Company's revenues from sales to customers outside the U.S. were approximately 54% of revenues in 2015 and 57% of revenues in 2014 and 2013.

Refer to Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and the Segment Information note in Item 8. Financial Statements and Supplementary Data for additional information on international activities. International operations are subject to certain potential risks inherent in conducting business in foreign countries, including price controls, exchange controls, limitations on participation in local enterprises, nationalization, expropriation and other governmental action, and fluctuations in currency exchange rates. Additional risks of the Company's international operations are described under Item 1A. Risk Factors.

8

Executive Officers

Executive Officers of the Company as of February 11, 2016 were as follows:

Name | Office | Age | |

E. Scott Santi | Chairman & Chief Executive Officer | 54 | |

John R. Hartnett | Executive Vice President | 55 | |

Michael M. Larsen | Senior Vice President & Chief Financial Officer | 47 | |

Mary K. Lawler | Senior Vice President & Chief Human Resources Officer | 50 | |

Roland M. Martel | Executive Vice President | 61 | |

Steven L. Martindale | Executive Vice President | 59 | |

Sundaram Nagarajan | Executive Vice President | 53 | |

Christopher O’Herlihy | Vice Chairman | 52 | |

David C. Parry | Vice Chairman | 62 | |

Randall J. Scheuneman | Vice President & Chief Accounting Officer | 48 | |

Lei Schlitz | Executive Vice President | 49 | |

Juan Valls | Executive Vice President | 54 | |

Michael R. Zimmerman | Executive Vice President | 55 | |

The executive officers of the Company serve at the discretion of the Board of Directors. Set forth below is information regarding the principal occupations and employment and business experience over the past five years for each executive officer. Unless otherwise stated, employment is by the Company.

Mr. Santi is the Chairman of the Board and Chief Executive Officer of the Company. He was elected Chairman of the Board in 2015 after having served as President and Chief Executive Officer, as well as a director, since November 2012. In October 2012, he was elected President and Chief Operating Officer. Mr. Santi served as Vice Chairman from 2008 to October 2012.

Mr. Hartnett was elected Executive Vice President in 2012. He joined Signode in 1980, which was acquired by ITW in 1986, and has held various management positions of increasing responsibility. Most recently, he served as Group President of the automotive aftermarket businesses.

Mr. Larsen joined the Company and was elected Senior Vice President and Chief Financial Officer in September 2013. From October 2010 to August 2013, he served as Vice President and Chief Financial Officer of Gardner Denver, Inc., a global manufacturer of highly engineered compressors, blowers, pumps and other fluid transfer equipment. In addition, he served as interim CEO of Gardner Denver from July 2012 to November 2012, and as President, Chief Executive Officer and a director of that company from November 2012 to July 2013. Prior to joining Gardner Denver, he was Chief Financial Officer at General Electric Water & Process Technologies, a global provider of water treatment and process solutions. His previous experience includes more than 15 years with General Electric, where he held a number of global finance leadership roles with increasing responsibility.

Ms. Lawler joined the Company and was elected Senior Vice President and Chief Human Resources Officer in October 2014. From June 2013 to October 2014, she served as Executive Vice President, Human Resources, at GATX Corporation, a rail car leasing company. Prior to that, she served as Senior Vice President, Human Resources, at GATX Corporation, from May 2008 to May 2013.

Mr. Martel has served in his present position since 2006.

Mr. Martindale has served in his present position since 2008.

Mr. Nagarajan has served in his present position since 2010.

Mr. O’Herlihy was elected Vice Chairman in 2015. Prior to that, he served as Executive Vice President from 2010 to 2015.

Mr. Parry has served in his present position since 2010.

9

Mr. Scheuneman has served in his present position since 2009.

Ms. Schlitz was elected Executive Vice President in 2015. She joined the Company in 2008 and has held various operational, management and leadership positions of increasing responsibility. Most recently, she served as Group President of the food equipment businesses since 2011.

Mr. Valls has served in his present position since 2007.

Mr. Zimmerman was elected Executive Vice President in 2015. He joined Permatex in 1999, which was acquired by ITW in 2005, and has held various management positions of increasing responsibility. Most recently, he served as Group President of the welding businesses.

Available Information

The Company electronically files reports with the Securities and Exchange Commission ("SEC"). The public may read and copy any materials the Company has filed with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Copies of the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are also available free of charge through the Company's website (www.itw.com), as soon as reasonably practicable after electronically filing with or otherwise furnishing such information to the SEC, and are available in print to any shareholder who requests them. The Company will furnish any exhibit not contained herein upon the payment of a fee representing the reasonable cost to the Company of furnishing the exhibit. Requests for exhibits may be sent to Illinois Tool Works Inc., 155 Harlem Avenue, Glenview, IL 60025, Attention: Secretary. Also posted on the Company’s website are the following:

• | Statement of Principles of Conduct; |

• | Code of Ethics for CEO and key financial and accounting personnel; |

• | Charters of the Audit, Corporate Governance and Nominating, and Compensation Committees of the Board of Directors; |

• | Corporate Governance Guidelines; |

• | Global Anti-Corruption Policy; |

• | Corporate Citizenship Statement; |

• | Conflict Minerals Policy Statement; and |

• | Government Affairs Information. |

ITEM 1A. Risk Factors

The Company's business, financial condition, results of operations and cash flows are subject to various risks, including, but not limited to, those set forth below, which could cause actual results to vary materially from recent results or from anticipated future results. These risk factors should be considered together with information included elsewhere in this Annual Report on Form 10-K.

The Company's results are impacted by global economic conditions. Downturns in the markets served by the Company could adversely affect its businesses, results of operations or financial condition.

The Company's businesses are impacted by economic conditions around the globe. Slower economic growth, financial market instability, high unemployment, government deficit reduction, sequestration and other austerity measures impacting the markets we serve can adversely affect the Company’s businesses by reducing demand for the Company's products and services, limiting financing available to the Company's customers, increasing order cancellations and the difficulty in collecting accounts receivable, increasing price competition, and increasing the risk that counterparties to the Company's contractual arrangements will become insolvent or otherwise unable to fulfill their obligations.

The global nature of the Company's operations subjects it to political and economic risks that could adversely affect its business, results of operations or financial condition.

The Company currently operates in 57 countries. The risks inherent in the Company's global operations include:

• | fluctuation in currency exchange rates; |

10

• | limitations on ownership or participation in local enterprises; |

• | price controls, exchange controls and limitations on repatriation of earnings; |

• | transportation delays and interruptions; |

• | political, social and economic instability and disruptions; |

• | acts of terrorism; |

• | government embargoes or foreign trade restrictions; |

• | the imposition of duties and tariffs and other trade barriers; |

• | import and export controls; |

• | labor unrest and current and changing regulatory environments; |

• | the potential for expropriation or nationalization of enterprises; |

• | difficulties in staffing and managing multi-national operations; |

• | limitations on its ability to enforce legal rights and remedies; and |

• | potentially adverse tax consequences. |

If the Company is unable to successfully manage these and other risks associated with managing and expanding its international businesses, the risks could have a material adverse effect on the Company's business, results of operations or financial condition.

The timing and amount of benefits from the Company’s enterprise initiatives may not be as expected and the Company's financial results could be adversely impacted.

The Company’s enterprise strategy and associated initiatives include portfolio management, business structure simplification and strategic sourcing. The portfolio management initiative, which included divesting businesses no longer aligned with the Company’s long-term objectives, is essentially complete; however, product line and customer base simplification, which is a core element of the Company’s 80/20 management process, is being reapplied to the Company’s scaled up operating divisions and remains an active element of this initiative. Although these activities are expected to improve future operating margins and organic revenue growth, they are also expected to have a negative impact on the Company’s overall organic revenue growth in the short term. The Company's business structure simplification initiative is also essentially completed, although efforts to realize efficiencies in structure are continuous. In addition, the Company continues to seek to benefit from its size and scale in the procurement process through its strategic sourcing initiatives, and the leveraging of purchasing power across businesses involves some execution risk. Also, as its portfolio and 80/20 management activities have positioned its businesses for profitable growth, the Company has shifted its focus to organic growth and has expressed its belief that organic growth will be 200 basis points above global GDP by the end of 2017. If the Company is unable to achieve the expected benefits from these initiatives or is unable to complete these initiatives without material disruption to its businesses, the timing and amount of benefits from these initiatives may not be as expected and the Company's financial results could be adversely impacted.

The timing and amount of the Company’s share repurchases are subject to a number of uncertainties.

Share repurchases constitute a significant component of the Company’s capital allocation strategy. The Company funds its share repurchases with free cash flow and short-term borrowings. The amount and timing of share repurchases will be based on a variety of factors. Important factors that could cause the Company to limit, suspend or delay its share repurchases include unfavorable trading market conditions, the price of the Company's common stock, the nature of other investment opportunities presented to us from time to time, the ability to obtain financing at attractive rates and the availability of U.S. cash.

The Company may incur fines or penalties, damage to its reputation or other adverse consequences if its employees, agents or business partners violate anti-bribery, competition, export and import, environmental or other laws.

The Company has a decentralized operating structure under which its individual businesses are allowed significant decision-making autonomy within the Company’s strategic framework and internal financial and compliance controls. The Company cannot ensure that its internal controls will always protect against reckless or criminal acts committed by its employees, agents or business partners that might violate U.S. and/or non-U.S. laws, including anti-bribery, competition, export and import, and environmental laws. Any such improper actions could subject the Company to civil or criminal investigations, could lead to substantial civil or criminal monetary and non-monetary penalties against the Company or its subsidiaries, or could damage its reputation.

11

A significant fluctuation between the U.S. Dollar and other currencies could adversely impact the Company's operating income.

Although the Company's financial results are reported in U.S. Dollars, a significant portion of its sales and operating costs are realized in other currencies, with the largest concentration of foreign sales occurring in Europe. The Company's profitability is affected by movements of the U.S. Dollar against the Euro and other foreign currencies in which it generates revenues and incurs expenses. Significant long-term fluctuations in relative currency values, and in particular, an increase in the value of the U.S. Dollar against foreign currencies, has had and could have an adverse effect on profitability and financial condition.

If the Company is unable to successfully introduce new products or adequately protect its intellectual property, its future growth may be adversely affected.

The Company's ability to develop new products based on innovation can affect its competitive position and sometimes requires the investment of significant time and resources. Difficulties or delays in research, development, production or commercialization of new products and services may reduce future revenues and adversely affect the Company's competitive position. If the Company is unable to create sustainable product differentiation, its organic growth may be adversely affected.

Protecting the Company's intellectual property is critical to its innovation efforts. The Company owns patents, trade secrets, copyrights, trademarks and/or other intellectual property rights related to many of its products, and also has exclusive and non-exclusive license rights under intellectual property owned by others. The Company's intellectual property rights may be challenged or infringed upon by third parties, particularly in countries where property rights are not highly developed or protected, or the Company may be unable to maintain, renew or enter into new license agreements with third-party owners of intellectual property on reasonable terms. Unauthorized use of the Company's intellectual property rights or inability to preserve existing intellectual property rights could adversely impact the Company's competitive position and results of operations.

Recent divestitures pose the risk of retained liabilities that could adversely affect the Company's financial results.

The Company's divestiture activity increased in 2012, 2013 and 2014 in accordance with its portfolio management initiative. Though the divestiture element of its portfolio management initiative is essentially complete, the Company has retained certain liabilities directly or through indemnifications made to the buyer against known and unknown contingent liabilities such as lawsuits, tax liabilities, product liability claims and environmental matters.

The Company has significant goodwill and other intangible assets, and future impairment of these assets could have a material adverse impact on our financial results.

In the past the Company has recorded significant goodwill and other identifiable intangible assets on its balance sheet as a result of acquisitions. A number of factors may result in impairments to goodwill and other intangible assets, including significant negative industry or economic trends, disruptions to our business, increased competition and significant changes in the use of the assets. Impairment charges could result that adversely affect the Company's financial condition or results of operations in the periods recognized.

Disruptions or volatility in global financial markets or changes in our credit ratings could increase our funding costs or reduce the availability of credit.

Global economic conditions may cause volatility and disruptions in the financial markets. The Company’s continued ability to meet its cash requirements requires substantial liquidity and access to the financial markets. In addition, the Company’s borrowing costs can be affected by short and long-term ratings assigned by independent rating agencies. If conditions in the financial markets decline or the Company’s credit ratings are negatively impacted, its funding costs could be increased or the availability of credit could be diminished.

Raw material price increases and supply shortages could adversely affect results.

The supply of raw materials to the Company and to its component parts suppliers could be interrupted for a variety of reasons, including availability and pricing. Prices for raw materials necessary for production have fluctuated significantly in the past and significant increases could adversely affect the Company's results of operations and profit margins. Due to pricing pressure or other factors, the Company may not be able to pass along increased raw material and components parts

12

prices to its customers in the form of price increases or its ability to do so could be delayed. Consequently, its results of operations and financial condition may be adversely affected.

Unfavorable tax law changes and tax authority rulings may adversely affect results.

The Company is subject to income taxes in the U.S. and in various foreign jurisdictions. Domestic and international tax liabilities are based on the income and expenses in various tax jurisdictions. The Company's effective tax rate could be adversely affected by changes in the mix of earnings among countries with differing statutory tax rates, changes in the valuation allowance of deferred tax assets or changes in tax laws. The amount of income taxes and other taxes are subject to ongoing audits by U.S. federal, state and local tax authorities and by non-U.S. authorities. If these audits result in assessments different from amounts recorded, future financial results may include unfavorable tax adjustments.

The Company's defined benefit pension plans are subject to financial market risks that could adversely affect its results of operations and cash flows.

The performance of financial markets and interest rates impact the Company's funding obligations under its defined benefit pension plans. Significant changes in market interest rates, decreases in the fair value of plan assets and investment losses on plan assets may increase the Company's funding obligations and adversely impact its results of operations and cash flows.

Potential adverse outcomes in legal proceedings may adversely affect results.

The Company's businesses expose it to potential toxic tort and other types of product liability claims that are inherent in the design, manufacture and sale of its products and the products of third-party vendors. The Company currently maintains insurance programs consisting of self-insurance up to certain limits and excess insurance coverage for claims over established limits. There can be no assurance that the Company will be able to obtain insurance on acceptable terms or that its insurance programs will provide adequate protection against actual losses. In addition, the Company is subject to the risk that one or more of its insurers may become insolvent and become unable to pay claims that may be made in the future. Even if it maintains adequate insurance programs, claims could have a material adverse effect on the Company's financial condition, liquidity and results of operations and on its ability to obtain suitable, adequate or cost-effective insurance in the future.

If the Company is unable to protect its information technology infrastructure against service interruptions, data corruption, cyber-based attacks or network security breaches, there could be a negative impact on operating results or the Company may suffer financial or reputational damage.

The Company relies on information technology networks and systems, including the Internet, to process, transmit and store electronic information, and to manage or support a variety of business processes and activities, including procurement, manufacturing, distribution, invoicing and collection. These technology networks and systems may be susceptible to damage, disruptions or shutdowns due to failures during the process of upgrading or replacing software, databases or components; power outages; hardware failures; or computer viruses. In addition, security breaches could result in unauthorized disclosure of confidential information. If these information technology systems suffer severe damage, disruption, or shutdown, and business continuity plans do not effectively resolve the issues in a timely manner, there could be a negative impact on operating results or the Company may suffer financial or reputational damage.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "believe," "expect," "plans," "intends," "may," "strategy," "prospects," "estimate," "project," "target," "anticipate," "guidance," "forecast," and other similar words, including, without limitation, statements regarding the expected acquisition or disposition of businesses, economic conditions in various geographic regions, the timing and amount of share repurchases, the Company's Enterprise Strategy and its ability to manage its strategic business initiatives and the timing and amount of benefits therefrom, the adequacy of internally generated funds and credit facilities to service debt and finance the Company's capital allocation priorities, the sufficiency of U.S. generated cash to fund cash requirements in the U.S., the cost and availability of additional financing, the Company's portion of future benefit payments related to pension and postretirement benefits, the availability of raw materials and energy, the expiration of any one of the Company's patents, the cost of compliance with environmental regulations, the likelihood of future goodwill or intangible asset impairment charges, the impact of failure of the Company's employees to comply with applicable laws and regulations, the impact of foreign currency fluctuations, the outcome of outstanding legal proceedings, the impact of adopting new accounting pronouncements, and the

13

estimated timing and amount related to the resolution of tax matters. These statements are subject to certain risks, uncertainties, and other factors, which could cause actual results to differ materially from those anticipated. Important risks that may influence future results include those risks described above. These risks are not all inclusive and given these and other possible risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

Any forward-looking statements made by ITW speak only as of the date on which they are made. ITW is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, subsequent events or otherwise.

ITW practices fair disclosure for all interested parties. Investors should be aware that while ITW regularly communicates with securities analysts and other investment professionals, it is against ITW's policy to disclose to them any material non-public information or other confidential commercial information. Investors should not assume that ITW agrees with any statement or report issued by any analyst irrespective of the content of the statement or report.

ITEM 1B. Unresolved Staff Comments

Not applicable.

ITEM 2. Properties

Due to the Company’s decentralized operating structure, the Company operates out of a number of facilities worldwide, none of which are individually significant to the Company or its segments.

As of December 31, 2015, the Company operated the following plants and office facilities, excluding regional sales offices and warehouse facilities:

Number Of Properties | |||||||||

Owned | Leased | Total | |||||||

Automotive OEM | 53 | 38 | 91 | ||||||

Test & Measurement and Electronics | 24 | 73 | 97 | ||||||

Food Equipment | 19 | 18 | 37 | ||||||

Polymers & Fluids | 26 | 46 | 72 | ||||||

Welding | 25 | 22 | 47 | ||||||

Construction Products | 32 | 24 | 56 | ||||||

Specialty Products | 44 | 47 | 91 | ||||||

Corporate | 1 | 10 | 11 | ||||||

Total | 224 | 278 | 502 | ||||||

The Company’s properties are highly suitable for the purposes for which they were designed and are maintained in good operating condition. Production capacity, in general, currently exceeds operating levels. Capacity levels are somewhat flexible based on the number of shifts operated and on the number of overtime hours worked. The Company adds production capacity from time to time as required by increased demand. Additions to capacity can be made within a reasonable period of time due to the nature of the Company’s businesses.

The Company operated 314 plants and office facilities outside of the U.S. Principal countries include China, France, Germany and the United Kingdom.

ITEM 3. Legal Proceedings

Not applicable.

ITEM 4. Mine Safety Disclosures

Not applicable.

14

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Common Stock Price and Dividend Data—The Company's common stock is listed on the New York Stock Exchange. Quarterly market price and dividend data for 2015 and 2014 were as shown below:

Market Price Per Share | Dividends Declared Per Share | ||||||||||

High | Low | ||||||||||

2015: | |||||||||||

Fourth quarter | $ | 95.00 | $ | 80.16 | $ | 0.55 | |||||

Third quarter | 94.33 | 78.79 | 0.55 | ||||||||

Second quarter | 99.92 | 91.41 | 0.485 | ||||||||

First quarter | 100.14 | 90.43 | 0.485 | ||||||||

2014: | |||||||||||

Fourth quarter | $ | 97.79 | $ | 79.06 | $ | 0.485 | |||||

Third quarter | 89.58 | 81.72 | 0.485 | ||||||||

Second quarter | 89.50 | 80.80 | 0.42 | ||||||||

First quarter | 84.12 | 76.25 | 0.42 | ||||||||

There were approximately 6,822 holders of record of common stock as of January 31, 2016. This number does not include beneficial owners of the Company's securities held in the name of nominees.

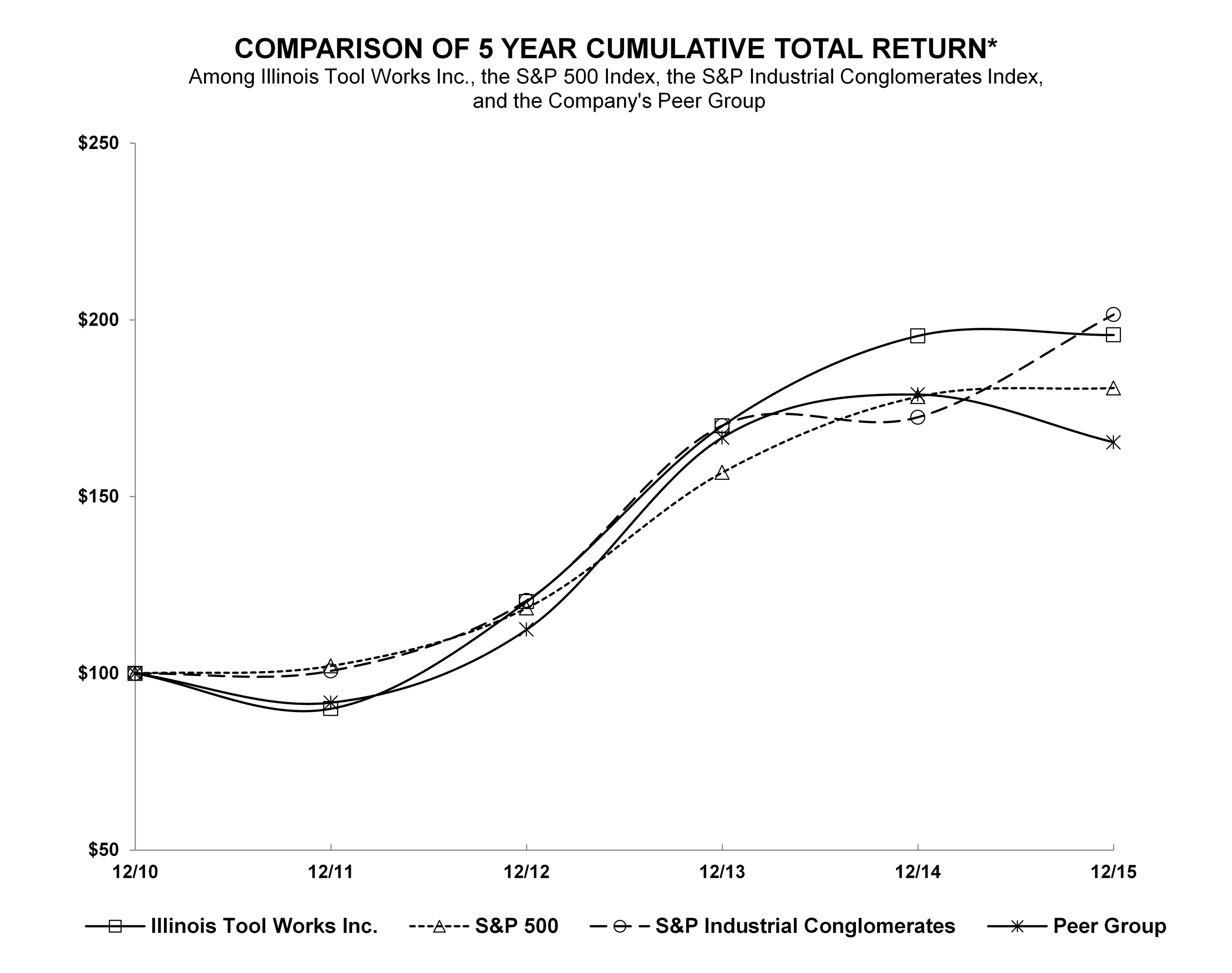

*Assumes $100 invested on 12/31/10 in stock or index, including reinvestment of dividends. Fiscal year ended December 31.

Copyright© 2016 S&P, a division of McGraw Hill Financial. All rights reserved.

15

In 2015, the Company replaced the S&P Industrial Conglomerates index with the following group of 19 public companies which represents the Company's peer group:

3M Company | E.I. du Pont de Nemours and Company | Masco Corporation |

BorgWarner Inc. | Eaton Corporation plc | Parker-Hannifin Corporation |

Caterpillar Inc. | Emerson Electric Co. | PPG Industries, Inc. |

Cummins Inc. | Honeywell International Inc. | Pentair plc |

Danaher Corporation | Ingersoll-Rand plc | Stanley Black & Decker, Inc. |

Deere & Company | Johnson Controls, Inc. | Textron Inc. |

Dover Corporation | ||

Repurchases of Common Stock—On February 13, 2015, the Company’s Board of Directors authorized a stock repurchase program which provides for the repurchase of up to $6.0 billion of the Company’s common stock over an open-ended period of time (the "2015 Program"). As of December 31, 2015, there were approximately $5.4 billion of authorized repurchases remaining under the 2015 Program. There was no share repurchase activity under the Company's share repurchase program for the fourth quarter of 2015.

ITEM 6. Selected Financial Data

In millions except per share amounts | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||

Operating revenue | $ | 13,405 | $ | 14,484 | $ | 14,135 | $ | 14,791 | $ | 14,515 | |||||||||

Income from continuing operations | 1,899 | 1,890 | 1,630 | 2,233 | 1,775 | ||||||||||||||

Income per share from continuing operations: | |||||||||||||||||||

Basic | 5.16 | 4.70 | 3.65 | 4.75 | 3.61 | ||||||||||||||

Diluted | 5.13 | 4.67 | 3.63 | 4.72 | 3.59 | ||||||||||||||

Total assets at year-end | 15,729 | 17,465 | 19,599 | 19,138 | 17,946 | ||||||||||||||

Long-term debt at year-end | 6,896 | 5,943 | 2,771 | 4,564 | 3,471 | ||||||||||||||

Cash dividends declared per common share | 2.07 | 1.81 | 1.60 | 1.48 | 1.40 | ||||||||||||||

Certain reclassifications of prior year data have been made to conform to current year reporting, including discontinued operations and adoption of new accounting guidance as discussed below.

On October 31, 2012, the Company divested a 51% majority interest in its Decorative Surfaces segment. Accordingly, the Company ceased consolidating the results of the Decorative Surfaces segment as of October 31, 2012 and now reports its 49% ownership interest using the equity method of accounting. Due to the Company's continuing involvement through its 49% interest, the historical operating results of Decorative Surfaces are presented in continuing operations. Effective November 1, 2012, Decorative Surfaces was no longer a reportable segment of the Company.

In April 2014, the Financial Accounting Standards Board ("FASB") issued authoritative guidance to change the criteria for reporting discontinued operations. Under the new guidance, only disposals representing a strategic shift in a company's operations and financial results should be reported as discontinued operations. In addition, disclosure of the pre-tax income attributable to a disposal of a significant part of an organization that does not qualify as a discontinued operation is required. The Company adopted this new guidance effective January 1, 2015. The new guidance applies prospectively to new disposals and new classifications of disposal groups held for sale after such date. There were no discontinued operations during 2015 under this new accounting guidance. For businesses reported as discontinued operations in the statement of income prior to adoption, all related prior period income statement information has been restated. Income from discontinued operations was $1.1 billion, $49 million, $637 million, and $296 million in the years 2014, 2013, 2012, and 2011, respectively. Refer to the Discontinued Operations note in Item 8. Financial Statements and Supplementary Data for discussion of the Company's discontinued operations.

In April 2015, the FASB issued authoritative guidance to simplify the balance sheet presentation of long-term debt issuance costs. Under the new guidance, long-term debt issuance costs are presented as a reduction of the carrying amount of the related long-term debt. The Company early adopted this guidance in the fourth quarter of 2015 and restated $38 million, $22

16

million, $26 million, and $17 million of deferred long-term debt issuance costs from Other assets to Long-term debt in the years 2014, 2013, 2012, and 2011, respectively. Refer to the Debt note in Item 8. Financial Statements and Supplementary Data for further information.

In November 2015, the FASB issued authoritative guidance to simplify the presentation of deferred taxes. Under the new guidance, all deferred tax assets and liabilities are presented as noncurrent in the statement of financial position. Early adoption of this guidance in the fourth quarter of 2015 decreased total assets by $175 million, $345 million, $145 million, and $21 million in the years 2014, 2013, 2012, and 2011, respectively. Refer to the Income Taxes note in Item 8. Financial Statements and Supplementary Data for further information.

Additional information on the comparability of results is included in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

17

ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

INTRODUCTION

Illinois Tool Works Inc. (the "Company" or "ITW") is a global manufacturer of a diversified range of industrial products and equipment with 84 divisions in 57 countries. As of December 31, 2015, the Company employed approximately 48,000 persons.

The Company's operations are organized and managed based on similar product offerings and similar end markets, and are reported to senior management as the following seven segments: Automotive OEM; Test & Measurement and Electronics; Food Equipment; Polymers & Fluids; Welding; Construction Products; and Specialty Products.

Due to the large number of diverse businesses and the Company's decentralized operating structure, the Company does not require its businesses to provide detailed information on operating results. Instead, the Company's corporate management collects data on several key measurements: operating revenue, operating income, operating margin, overhead costs, number of months on hand in inventory, days sales outstanding in accounts receivable, past due receivables and return on invested capital. These key measures are monitored by management and significant changes in operating results versus current trends in end markets and variances from forecasts are discussed with operating unit management.

THE ITW BUSINESS MODEL

The powerful and highly differentiated ITW Business Model is the Company’s core source of value creation. This business model is the Company’s competitive advantage and defines how ITW creates value for its shareholders and comprises three unique elements:

• | ITW’s 80/20 management process is the operating system that is applied in every ITW business. Initially introduced as a manufacturing efficiency tool in the 1980’s, ITW has continually refined, improved and expanded 80/20 into a proprietary, holistic business management process that generates significant value for the Company. Through the application of data-driven insights generated by 80/20 practice, ITW focuses on its largest and best opportunities (the “80”) and eliminates complexity associated with the less profitable opportunities (the “20”). 80/20 enables ITW businesses to consistently deliver world-class operational excellence in regards to product availability, quality, and innovation, while generating superior financial performance; |

• | Customer-back innovation has fueled decades of profitable growth at ITW. The Company’s unique innovation approach is built on the insight gathered from the 80/20 management process. Working from the customer back, ITW businesses position themselves as the go-to problem solver for their “80” customers. ITW’s innovation efforts are focused on understanding customer needs, particularly those in “80” markets with solid long-term growth fundamentals, and then creating unique solutions to address those needs. These customer insights and learnings drive innovation at ITW and have contributed to a portfolio of more than 16,000 granted and pending patents; |

• | ITW’s decentralized, entrepreneurial culture allows ITW businesses to be fast, focused, and responsive. ITW businesses have significant flexibility within the framework of the ITW Business Model to customize their approach in order to best serve their customers. ITW colleagues are clear about what is expected of them with regard to ITW’s business model, strategy, and values. This leads to a focused and simple organizational structure that, combined with outstanding execution, delivers operational excellence adapted to their specific customers and end markets. |

ENTERPRISE STRATEGY

In 2013, ITW began the process of transitioning the Company onto its current strategic path to fully leverage the compelling performance potential of the ITW Business Model. Since then, ITW has made considerable progress, as evidenced by the Company’s strong financial performance over the past three years.

The roots of ITW’s Enterprise Strategy began in 2011-2012, when the Company undertook a complete review of its performance. ITW gathered deep insights from its businesses that were delivering consistent above-market growth with best-in-class margins and returns, and defined a strategy to replicate that performance throughout the Company.

18

Based on this rigorous and thorough evaluation, ITW determined two paths to deliver world-class financial performance and compelling long-term returns for its shareholders. One, ITW needed to shift the Company's primary growth engine to organic; and two, the Company needed to leverage the ITW Business Model to deliver best-in-class margins and returns.

Shift the Company’s Core Growth Engine to Organic

In order to pivot to fully focus on organic growth, the Company needed to first accomplish several preparatory steps. These key initiatives were a major focus of the Company in 2012-2015, which included portfolio management, business structure simplification and strategic sourcing.

The first step, portfolio management, was to construct and maintain a business portfolio capable of delivering consistent above-market organic growth. As part of this initiative to realign the portfolio, ITW exited businesses that were operating in commoditized market spaces and prioritized sustainable differentiation as a must-have requirement for all ITW businesses. This process included both divesting entire businesses and exiting commoditized product lines and customers inside otherwise highly differentiated ITW divisions.

As a result of this work, ITW’s business portfolio now has significantly higher organic growth potential. ITW segments and divisions now possess attractive and differentiated product lines and end markets as they continue to improve margins and generate price/cost increases. This was achieved through product line simplification which focuses on eliminating the complexity and overhead costs associated with smaller product lines and customers, and focuses businesses on supporting and growing their largest customers and product lines. Most of this initiative is complete and ITW businesses are demonstrating notably improved financial performance; the Company expects the remaining product line simplification work to largely be accomplished in 2016.

The second step, business structure simplification, was to scale-up ITW’s operating structure to support increased engineering, marketing, and sales resources, and to improve global reach and competitiveness, all of which were critical to ITW’s ability to drive accelerated organic growth. ITW now has 84 scaled-up divisions with significantly enhanced focus on growth investments, core customers and products, and customer-back innovation.

With the portfolio realignment and scale-up work largely complete, the Company is now able to shift its focus to preparing for, and accelerating, organic growth.

As a third preparatory step, ITW is currently in the process of reapplying 80/20 to optimize its newly scaled-up divisions for growth. This process involves first using 80/20 to build a foundation of operational excellence, and then applying 80/20-driven insights to identify the best opportunities to drive organic growth.

Once the business is operationally excellent and has identified the right growth opportunities, the final step is to accelerate organic growth. The process of preparing for accelerated organic growth generally takes 18 to 24 months.

Based on the financial performance of the divisions that are further along in this process, the Company believes that this framework is capable of delivering above market organic growth in all ITW segments. Many ITW divisions are ready to grow and growing above their respective markets, while the rest of the Company’s divisions are at various phases of preparing to grow. ITW management is fully aligned on this plan and very focused on executing it. By the end of 2016, the Company expects approximately 85 percent of its businesses to be ready to grow.

Leverage the ITW Business Model to Deliver Best-in-Class Margins and Returns

The Company’s work to deliver best-in-class margins and returns is focused on two key areas of ongoing activity. The first is strategic sourcing, where the Company seeks to benefit from its size and scale in procurement processes. Sourcing is now a core strategic and operational capability and this improved competitiveness supports ITW’s organic growth framework. The Company’s 80/20-enabled sourcing organization has delivered an average of 1 percent reduction in spend each year in 2013-2015 and is on track to do the same in 2016 and 2017.

The second element of the margin and return area of focus is to better leverage the full power of the ITW Business Model through a much more consistent and focused approach to 80/20 best practice implementation across the Company. ITW has clearly defined what excellence in the practice of ITW’s 80/20 management process looks like and the result is significant opportunity to create meaningful incremental improvement in margins and returns as evidenced by the

19

Company’s improvement in both operating margin and after-tax return on invested capital. These 80/20 initiatives can result in restructuring initiatives that reduce costs and improve profitability and returns.

TERMS USED BY ITW

Management uses the following terms to describe the financial results of operations of the Company:

• | Organic business - acquired businesses that have been included in the Company's results of operations for more than 12 months on a constant currency basis. |

• | Operating leverage - the estimated effect of the organic revenue volume changes on organic operating income, assuming variable margins remain the same as the prior period. |

• | Price/cost - represents the estimated net impact of increases or decreases in the cost of materials used in the Company's products versus changes in the selling price to the Company's customers. |

• | Product line simplification (PLS) - focuses businesses on eliminating the complexity and overhead costs associated with smaller product lines and customers, and focuses businesses on supporting and growing their largest customers and product lines; in the short-term, PLS may result in a decrease in revenue and overhead costs while improving operating margin. In the long-term, PLS is expected to result in growth in revenue, profitability, and returns. |

Unless otherwise stated, the changes in financial results in the consolidated results of operations and the results of operations by segment represent the current year period versus the comparable period in the prior year.

CONSOLIDATED RESULTS OF OPERATIONS

In 2015, the Company delivered solid financial results driven by the continued successful execution of enterprise initiatives despite foreign currency translation headwinds and challenging end market conditions.

The Company’s consolidated results of operations for 2015, 2014 and 2013 are summarized as follows:

2015 compared to 2014

For the Years Ended | |||||||||||||||||||||

Dollars in millions | December 31, | Components of Increase (Decrease) | |||||||||||||||||||

2015 | 2014 | Inc (Dec) | Organic | Acquisition/Divestiture | Restructuring | Foreign Currency | Total | ||||||||||||||

Operating revenue | $ | 13,405 | $ | 14,484 | (7.4 | )% | (0.4 | )% | (0.2 | )% | — | % | (6.8 | )% | (7.4 | )% | |||||

Operating income | 2,867 | 2,888 | (0.7 | )% | 5.8 | % | (0.3 | )% | 1.2 | % | (7.4 | )% | (0.7 | )% | |||||||

Operating margin % | 21.4 | % | 19.9 | % | 150 bps | 130 bps | — | 20 bps | — | 150 bps | |||||||||||

• | Operating revenue decreased 7.4% primarily due to the unfavorable effect of foreign currency translation as the U.S. Dollar strengthened against most major currencies. |

• | Organic revenue decreased 0.4% in 2015 as compared to the prior year. |

◦ | Automotive OEM, Food Equipment and Construction Products had solid worldwide organic revenue growth primarily due to penetration gains, higher market demand and product innovation. Organic revenue declined in the Welding and Test & Measurement and Electronics segments primarily due to lower demand in the oil and gas end markets and a challenging capital spending environment. |

◦ | PLS activities reduced organic revenue growth by approximately one percentage point. |

◦ | North American organic revenue decreased 0.5% as a decline in the Welding and Test & Measurement and Electronics segments was partially offset by growth in the Automotive OEM, Food Equipment and Construction Products segments. |

◦ | European organic revenue increased 1.2%. Double-digit growth in the Automotive OEM segment was partially offset by a decline in the Polymers & Fluids, Test & Measurement and Electronics and Welding segments. |

◦ | Asia Pacific organic revenue decreased 1.4% primarily due to a decline in the Welding and Test & Measurement and Electronics segments, partially offset by growth in the Construction Products segment. |

• | Operating income of $2.9 billion decreased 0.7%. Excluding the negative impact from foreign currency translation of 7.4%, operating income would have increased 6.7%. |

20

• | Record operating margin of 21.4% increased 150 basis points primarily due to the benefit of the Company's enterprise initiatives related to business structure simplification and strategic sourcing that contributed 110 basis points. Lower restructuring expenses and favorable price/cost each contributed 20 basis points of operating margin expansion. |

• | Diluted earnings per share (EPS) from continuing operations of $5.13 increased 9.9%. Excluding the negative impact from foreign currency of approximately $0.41 per diluted share, EPS would have increased 18.6%. |

• | Free cash flow was $2.0 billion in 2015. Refer to the Cash Flow section of Liquidity and Capital Resources for a reconciliation of this non-GAAP measure. |

• | The Company repurchased approximately 21.0 million shares of its common stock in 2015 for approximately $2.0 billion. |

• | Total cash dividends of $742 million were paid in 2015. |

• | Adjusted after-tax return on average invested capital was 20.4%, an increase of 140 basis points. Refer to the Adjusted After-Tax Return on Average Invested Capital section of Liquidity and Capital Resources for a reconciliation of this non-GAAP measure. |

2014 compared to 2013

For the Years Ended | |||||||||||||||||||||

Dollars in millions | December 31, | Components of Increase (Decrease) | |||||||||||||||||||

2014 | 2013 | Inc (Dec) | Organic | Acquisition/Divestiture | Restructuring | Foreign Currency | Total | ||||||||||||||

Operating revenue | $ | 14,484 | $ | 14,135 | 2.5 | % | 2.6 | % | 0.6 | % | — | % | (0.7 | )% | 2.5 | % | |||||

Operating income | $ | 2,888 | $ | 2,514 | 14.9 | % | 14.5 | % | 0.2 | % | 0.9 | % | (0.7 | )% | 14.9 | % | |||||

Operating margin % | 19.9 | % | 17.8 | % | 210 bps | 200 bps | (10) bps | 20 bps | — | 210 bps | |||||||||||

• | Operating revenue increased $349 million, or 2.5%, due to an increase in organic and acquisition revenue, partially offset by the unfavorable effect of currency translation which primarily occurred in the fourth quarter. Acquisitions primarily included the purchase of a European consumer packaging equipment business and a Chinese food equipment business in the third quarter of 2013. |

• | Organic revenue increased 2.6% in 2014 as compared to 2013. |

◦ | Growth in the Automotive OEM and the Food Equipment segments was partially offset by modest declines in the Polymers & Fluids and Specialty Products segments. |

◦ | PLS activities reduced organic revenue growth by approximately one percentage point. |

◦ | European organic revenue increased 2.4% primarily driven by the Automotive OEM, Food Equipment and Test & Measurement and Electronics segments, partially offset by the Welding, Polymers & Fluids and Construction Products segments. |

◦ | Asia Pacific organic revenue increased 4.9% primarily due to growth in the Automotive OEM segment in China and the Construction Products segment in Australia. |

◦ | North American organic revenue increased 2.3% primarily due to growth in the Automotive OEM, Welding and Food Equipment segments. |

• | Operating margin of 19.9% increased 210 basis points primarily due to the benefit of the Company's enterprise initiatives related to business structure simplification and strategic sourcing that contributed 120 basis points and positive operating leverage of 60 basis points. Lower restructuring expenses of 20 basis points, favorable price/cost of 10 basis points and lower operating expenses also contributed to the increase in operating margin. Operating expenses in 2014 included the impact of lower employee benefit expenses, offset by costs related to continued investment in the business. |

• | Diluted EPS from continuing operations of $4.67 increased 28.7%. |

• | Free cash flow was $1.3 billion in 2014. The 2014 net cash provided by operating activities included $724 million of tax payments related to the disposition of the Industrial Packaging business. Refer to the Cash Flow section of Liquidity and Capital Resources for a reconciliation of this non-GAAP measure. |

• | The Company repurchased approximately 50.4 million shares of its common stock in 2014 for approximately $4.3 billion. |