Exhibit 99.1

ITW NEWS RELEASE

ITW Reports Diluted Income Per Share from Continuing Operations of $0.96 in 2011 Second Quarter,

a 22 Percent Increase; Total Revenues Grow 17.5 Percent and Organic Revenues Increase 6.3 Percent;

Company Executes $550 Million of Share Repurchases in the Quarter

GLENVIEW, ILLINOIS—(July 26, 2011)—Illinois Tool Works Inc. (NYSE: ITW) today reported second quarter 2011 diluted income per share from continuing operations of $0.96, a 22 percent increase compared to the 2010 second quarter. Excluding the impact of discontinued operations, second quarter 2011 diluted net income per share would have been $0.99. Total revenues of $4.615 billion increased 17.5 percent versus the year-ago period. The Company’s financial results and forecast reflect the reclassification of certain businesses to discontinued operations as announced on June 28, 2011.

Second quarter 2011 financial highlights versus the prior-year period included:

- Organic or base revenues grew 6.3 percent, with North American organic revenues increasing 7.4 percent and international organic revenues growing 5.1 percent.

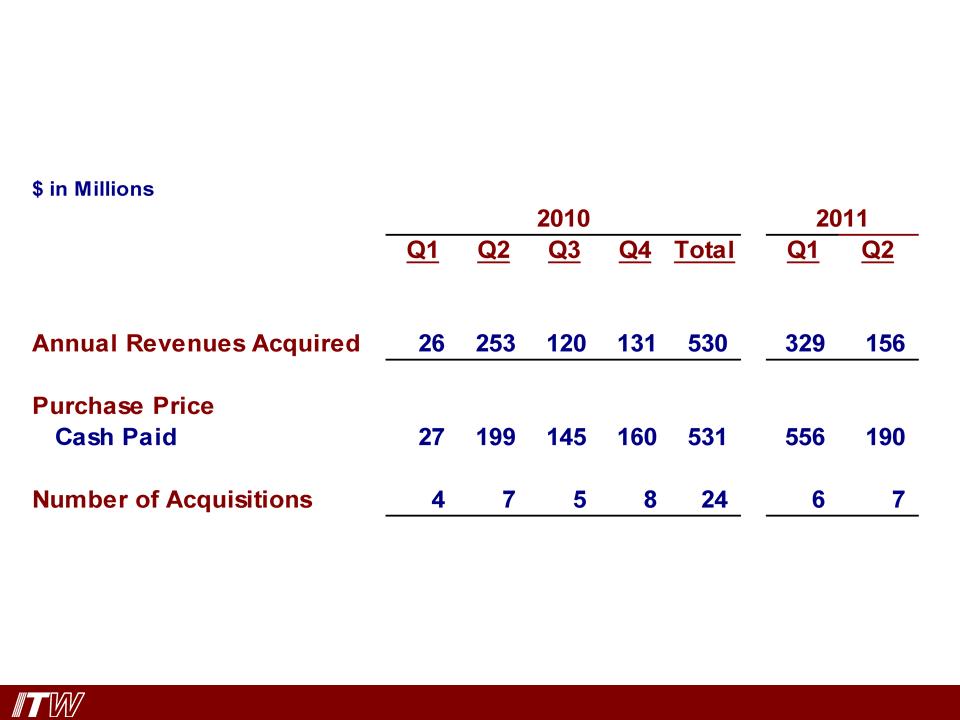

- Acquisitions net of divestitures added 4.8 percent and currency translation contributed 6.3 percent to total revenues.

- Operating income of $711.1 million increased 14 percent and income from continuing operations of $483.5 million grew 21 percent. Net income of $498.4 million increased a similar 21 percent.

- While total operating margins of 15.4 percent decreased 50 basis points, base operating margins increased 30 basis points. Acquisitions and restructuring negatively impacted operating margins by 90 basis points.

- The Company also executed share repurchases of $550 million or 9.7 million shares in the second quarter.

Operating highlights for the 2011 second quarter compared to the year-ago period included:

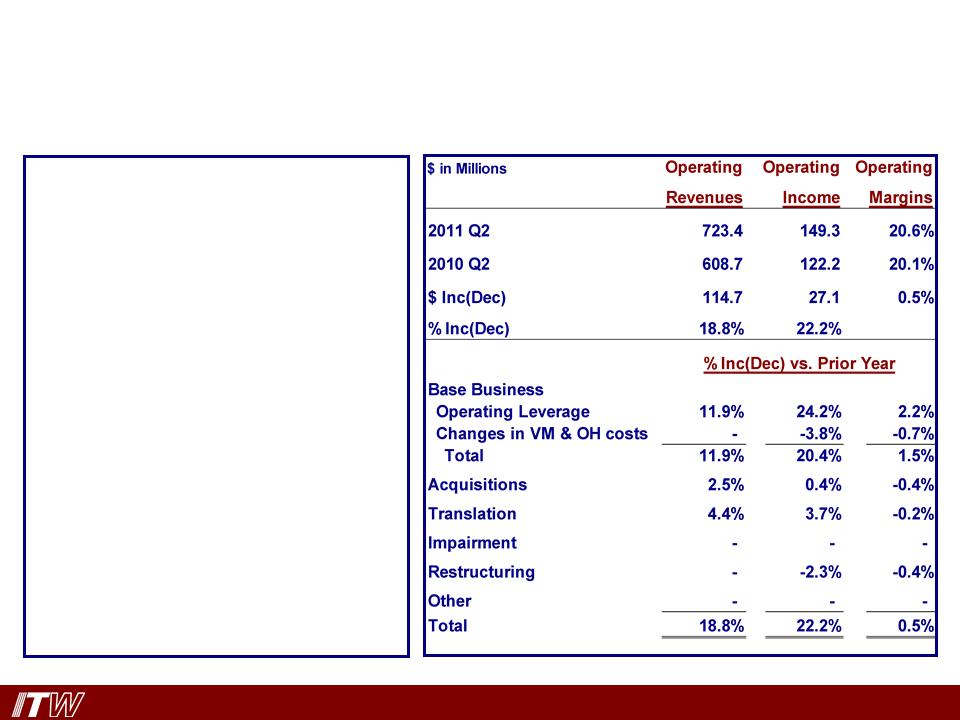

- Total revenues for the Power Systems and Electronics segment increased 18.8 percent. Segment organic revenues grew 11.9 percent largely based on ongoing strength from the welding businesses. The welding group’s worldwide organic revenues grew 18.2 percent in the second quarter, with both North American and international organic revenues increasing by double digits. Both geographies were helped by solid demand from heavy equipment manufacturers. Organic revenues for the electronics businesses increased 4.1 percent largely due to the PC Board fabrication businesses. Segment operating margins of 20.6 percent were 50 basis points higher than the year-ago period, with base margins improving 150 basis points.

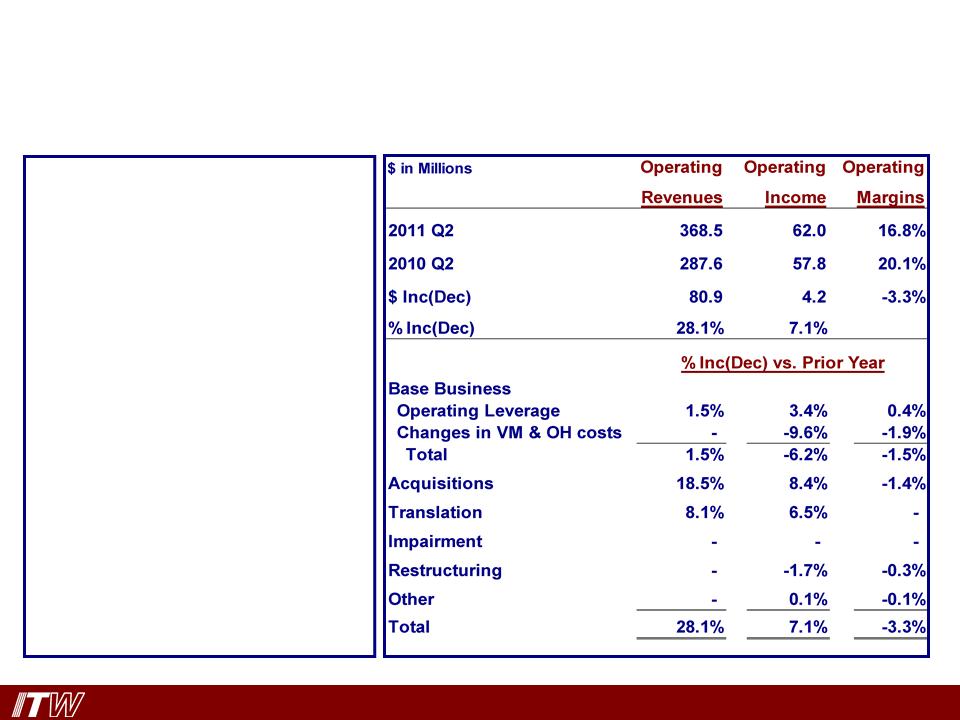

- Total revenues for the Industrial Packaging segment grew 20.9 percent. Organic revenues for the segment increased 9.6 percent due to contributions from all major business groups. The North American and international businesses grew organic revenues 11.2 percent and 7.6 percent, respectively. North American strapping’s organic revenues grew 12.9 percent while international strapping’s organic revenues increased 6.2 percent. The equipment portion of the strapping business helped drive sales in the quarter. Segment operating margins of 10.9 percent were 20 basis points higher than the year-earlier period.

“While our second quarter performance reflected solid demand from a number of worldwide end markets, our 17.5 percent total revenue growth was slightly below our original expectations,” said David B. Speer, chairman and chief executive officer. “Both our total revenue and organic revenue growth rates in the second quarter were approximately 100 basis points lower than forecasted in April. We also anticipate similar moderating demand levels in the second half of 2011. As a result, we have modestly adjusted our third quarter revenue assumptions as well as our full-year earnings forecast. Nonetheless, we still believe overall end markets continue to be in a long-term recovery mode.”

The Company is forecasting 2011 third quarter diluted income per share from continuing operations to be in a range of $0.95 to $1.03. The midpoint of this earnings range represents 24 percent growth versus the third quarter of 2010. The third quarter forecast assumes a total revenue growth range of 15 percent to 18 percent. For the 2011 full year, the Company is forecasting diluted income per share from continuing operations to be in a range of $4.05 to $4.21 and assumes a total revenue growth range of 16 percent to 18 percent. The full-year forecast includes the $0.33 per share one-time tax benefit recorded in the 2011 first quarter. Excluding the one-time tax gain, the midpoint of the full-year earnings would be $3.80 and would represent a 32 percent increase compared to the year-ago period.

This earnings release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding diluted net income per share, end markets, market penetration, total revenue growth, organic or base revenue growth, and future growth prospects. The statements are subject to certain risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated. Such factors are contained in ITW’s Form 10-K for 2010.

With nearly 100 years of history, ITW is a Fortune 200 global diversified industrial manufacturer. The Company’s value-added consumables, equipment and service businesses serve customers in developed as well as emerging markets around the globe. ITW’s key business platforms, including welding, automotive OEM, industrial packaging, food equipment, construction, polymers and fluids, test and measurement, electronics, decorative surfaces and automotive aftermarket, employ more than 60,000 people worldwide. ITW’s revenues totaled $15.4 billion in 2010, with more than half of these revenues generated outside of the United States.

Contact: John Brooklier, 847-657-4104 or jbrooklier@itw.com

|

Illinois Tool Works Inc. and Subsidiaries

|

|

|

(In thousands except per share amounts)

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

|

Statement of Income (Unaudited)

|

|

2011

|

|

|

2010

|

|

|

2011

|

|

|

2010

|

|

|

Operating Revenues

|

|

$ |

4,614,914 |

|

|

$ |

3,928,056 |

|

|

$ |

8,886,759 |

|

|

$ |

7,560,820 |

|

|

Cost of revenues

|

|

|

2,996,014 |

|

|

|

2,514,222 |

|

|

|

5,758,023 |

|

|

|

4,842,085 |

|

|

Selling, administrative, and research

and development expenses

|

|

|

845,145 |

|

|

|

735,847 |

|

|

|

1,641,145 |

|

|

|

1,463,491 |

|

|

Amortization of intangible assets

|

|

|

62,705 |

|

|

|

51,952 |

|

|

|

117,949 |

|

|

|

103,534 |

|

|

Operating Income

|

|

|

711,050 |

|

|

|

626,035 |

|

|

|

1,369,642 |

|

|

|

1,151,710 |

|

|

Interest expense

|

|

|

(45,396 |

) |

|

|

(43,269 |

) |

|

|

(89,378 |

) |

|

|

(87,564 |

) |

|

Other income (expense)

|

|

|

15,357 |

|

|

|

2,207 |

|

|

|

21,252 |

|

|

|

6,085 |

|

|

Income from Continuing Operations Before Income Taxes

|

|

|

681,011 |

|

|

|

584,973 |

|

|

|

1,301,516 |

|

|

|

1,070,231 |

|

|

Income taxes

|

|

|

197,482 |

|

|

|

185,181 |

|

|

|

211,750 |

|

|

|

349,143 |

|

|

Income from Continuing Operations

|

|

$ |

483,529 |

|

|

$ |

399,792 |

|

|

$ |

1,089,766 |

|

|

$ |

721,088 |

|

|

Income from Discontinued Operations

|

|

|

14,901 |

|

|

|

11,664 |

|

|

|

31,804 |

|

|

|

24,173 |

|

|

Net Income

|

|

$ |

498,430 |

|

|

$ |

411,456 |

|

|

$ |

1,121,570 |

|

|

$ |

745,261 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Per Share from Continuing Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.97 |

|

|

$ |

0.79 |

|

|

$ |

2.19 |

|

|

$ |

1.43 |

|

|

Diluted

|

|

$ |

0.96 |

|

|

$ |

0.79 |

|

|

$ |

2.17 |

|

|

$ |

1.43 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Per Share from Discontinued Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

0.06 |

|

|

$ |

0.05 |

|

|

Diluted

|

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

0.06 |

|

|

$ |

0.05 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income Per Share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

1.00 |

|

|

$ |

0.82 |

|

|

$ |

2.25 |

|

|

$ |

1.48 |

|

|

Diluted

|

|

$ |

0.99 |

|

|

$ |

0.81 |

|

|

$ |

2.23 |

|

|

$ |

1.47 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding during the period:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average

|

|

|

497,798 |

|

|

|

503,265 |

|

|

|

498,178 |

|

|

|

502,847 |

|

|

Average assuming dilution

|

|

|

501,861 |

|

|

|

506,297 |

|

|

|

502,300 |

|

|

|

501,479 |

|

|

Estimated Free Operating Cash Flow

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

|

| |

|

2011

|

|

|

2010

|

|

|

2011

|

|

|

2010

|

|

|

Net cash provided by operating activities

|

|

$ |

312,570 |

|

|

$ |

333,351 |

|

|

$ |

457,169 |

|

|

$ |

608,171 |

|

|

Less: Additions to plant & equipment

|

|

|

(87,601 |

) |

|

|

(64,100 |

) |

|

|

(175,954 |

) |

|

|

(123,281 |

) |

|

Free operating cash flow

|

|

$ |

224,969 |

|

|

$ |

269,251 |

|

|

$ |

281,215 |

|

|

$ |

484,890 |

|

|

Illinois Tool Works Inc. and Subsidiaries

|

|

|

|

|

|

|

|

(In thousands)

|

|

|

|

|

|

|

| |

|

June 30,

|

|

|

December 31,

|

|

|

Statement of Financial Position (Unaudited)

|

|

2011

|

|

|

2010

|

|

|

Assets

|

|

|

|

|

|

|

|

Cash & equivalents

|

|

$ |

1,230,662 |

|

|

$ |

1,186,367 |

|

|

Trade receivables

|

|

|

3,146,005 |

|

|

|

2,581,592 |

|

|

Inventories

|

|

|

1,919,679 |

|

|

|

1,634,856 |

|

|

Deferred income taxes

|

|

|

329,523 |

|

|

|

301,486 |

|

|

Prepaid expenses and other current assets

|

|

|

507,436 |

|

|

|

266,187 |

|

|

Assets held for sale

|

|

|

423,774 |

|

|

|

— |

|

|

Total current assets

|

|

|

7,557,079 |

|

|

|

5,970,488 |

|

| |

|

|

|

|

|

|

|

|

|

Net plant & equipment

|

|

|

2,132,013 |

|

|

|

2,066,156 |

|

|

Investments

|

|

|

435,576 |

|

|

|

440,760 |

|

|

Goodwill

|

|

|

5,101,220 |

|

|

|

4,971,818 |

|

|

Intangible assets

|

|

|

2,105,649 |

|

|

|

1,731,016 |

|

|

Deferred income taxes

|

|

|

566,621 |

|

|

|

615,326 |

|

|

Other assets

|

|

|

628,017 |

|

|

|

616,747 |

|

| |

|

$ |

18,526,175 |

|

|

$ |

16,412 311 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Short-term debt

|

|

$ |

1,450,332 |

|

|

$ |

326,236 |

|

|

Accounts payable

|

|

|

864,955 |

|

|

|

749,489 |

|

|

Accrued expenses

|

|

|

1,430,842 |

|

|

|

1,391,396 |

|

|

Cash dividends payable

|

|

|

167,081 |

|

|

|

169,233 |

|

|

Income taxes payable

|

|

|

43,673 |

|

|

|

386,498 |

|

|

Deferred income taxes

|

|

|

3,097 |

|

|

|

— |

|

|

Liabilities held for sale

|

|

|

102,175 |

|

|

|

— |

|

|

Total current liabilities

|

|

|

4,062,155 |

|

|

|

3,022,852 |

|

|

Noncurrent Liabilities

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

2,622,796 |

|

|

|

2,542,087 |

|

|

Deferred income taxes

|

|

|

114,120 |

|

|

|

194,590 |

|

|

Other liabilities

|

|

|

1,305,080 |

|

|

|

1,080,783 |

|

|

Total noncurrent liabilities

|

|

|

4,041,996 |

|

|

|

3,817,460 |

|

|

Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

5,418 |

|

|

|

5,385 |

|

|

Additional paid-in capital

|

|

|

631,621 |

|

|

|

460,806 |

|

|

Income reinvested in the business

|

|

|

11,192,418 |

|

|

|

10,407,946 |

|

|

Common stock held in treasury

|

|

|

(2,291,851 |

) |

|

|

(1,740,682 |

) |

|

Accumulated other comprehensive income

|

|

|

870,881 |

|

|

|

427,155 |

|

|

Noncontrolling interest

|

|

|

13,537 |

|

|

|

11,389 |

|

|

Total stockholders' equity

|

|

|

10,422,024 |

|

|

|

9,571,999 |

|

| |

|

$ |

18,526,175 |

|

|

$ |

16,412,311 |

|