Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12 |

| DineEquity, Inc. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

|

No fee required. |

||

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

| | (1) | | Title of each class of securities to which transaction applies: |

|

| | (2) | | Aggregate number of securities to which transaction applies: |

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| | (4) | | Proposed maximum aggregate value of transaction: |

|

| | (5) | | Total fee paid: |

|

o |

|

Fee paid previously with preliminary materials. |

||

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

(1) |

|

Amount Previously Paid: |

|

| | (2) | | Form, Schedule or Registration Statement No.: |

|

| | (3) | | Filing Party: |

|

| | (4) | | Date Filed: |

|

450 North Brand Boulevard

Glendale, California 91203

(866) 995-DINE

April 4, 2016

Dear Fellow Stockholders:

We are pleased to invite you to attend the 2016 Annual Meeting of Stockholders of DineEquity, Inc., which will be held on Tuesday, May 17, 2016, at 8:00 a.m., Local Time, at our offices located at 450 North Brand Boulevard, Glendale, California 91203. At this year's Annual Meeting, you will be asked to: (i) elect the four Class I directors identified in this proxy statement; (ii) ratify the appointment of Ernst & Young LLP as our independent auditor; (iii) approve, on an advisory basis, the compensation of our named executive officers and (iv) approve the DineEquity, Inc. 2016 Stock Incentive Plan.

Whether or not you plan to attend the Annual Meeting in person, we hope you will vote as soon as possible. Voting your proxy will ensure your representation at the Annual Meeting. You can vote your shares over the Internet, by telephone or by using a traditional proxy card. Instructions on each of these voting methods are outlined in the enclosed proxy statement.

We urge you to review carefully the proxy materials and to vote: FOR the election of each of the Class I directors identified in this proxy statement; FOR the ratification of the appointment of Ernst & Young LLP as our independent auditor; FOR the approval, on an advisory basis, of the compensation of our named executive officers and FOR the approval of the DineEquity, Inc. 2016 Stock Incentive Plan.

Thank you for your continued support of and interest in DineEquity, Inc. We look forward to seeing you on May 17th.

Sincerely yours, |

|

|

|

| |

Julia A. Stewart |

|

|

Chairman and Chief Executive Officer |

|

|

450 North Brand Boulevard

Glendale, California 91203

(866) 995-DINE

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 17, 2016

April 4, 2016

To the Stockholders of DineEquity, Inc.:

NOTICE IS HEREBY GIVEN that the 2016 Annual Meeting of Stockholders (the "Annual Meeting") of DineEquity, Inc., a Delaware corporation (the "Corporation"), will be held at the Corporation's offices located at 450 North Brand Boulevard, Glendale, California 91203, on Tuesday, May 17, 2016, at 8:00 a.m., Local Time, for the following purposes as more fully described in the accompanying proxy statement:

- (1)

- To

elect the four Class I directors identified in the proxy statement;

- (2)

- To

ratify the appointment of Ernst & Young LLP as the Corporation's independent auditor for the fiscal year ending December 31, 2016;

- (3)

- To

approve, on an advisory basis, the compensation of the Corporation's named executive officers;

- (4)

- To

approve the DineEquity, Inc. 2016 Stock Incentive Plan; and

- (5)

- To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Only stockholders of record at the close of business on March 23, 2016, the record date for the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof.

By

Order of the Board of Directors,

Bryan

R. Adel

Senior Vice President, Legal, General Counsel and Secretary

Important Notice Regarding the Availability of

Proxy Materials for the Annual Meeting of Stockholders

to be Held on May 17, 2016

The proxy statement and 2015 annual report to stockholders and the means to vote by Internet are available at www.envisionreports.com/DIN.

Please vote as promptly as possible by using the Internet or telephone or by signing, dating and returning the proxy card mailed to those who receive paper copies of this proxy statement. All stockholders are cordially invited to attend the Annual Meeting in person. If you attend the Annual Meeting, you may vote in person if you wish, even if you have previously returned your proxy card.

450 North Brand Boulevard

Glendale, California 91203

(866) 995-DINE

PROXY STATEMENT

FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

Q: Why am I receiving these materials?

A: The Corporation has made these materials available to you on the Internet and by mail in connection with the Corporation's solicitation of proxies for use at the Annual Meeting to be held on Tuesday, May 17, 2016, at 8:00 a.m., Local Time, and at any adjournment or postponement thereof. These materials were first sent or made available to stockholders on April 4, 2016. You are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement. The Annual Meeting will be held at the Corporation's offices located at 450 North Brand Boulevard, Glendale, California 91203.

Q: What is included in these materials?

A: These materials include:

- •

- This proxy statement for the Annual Meeting; and

- •

- The Corporation's 2015 annual report to stockholders, which contains the annual report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the Securities and Exchange Commission ("SEC") on February 24, 2016.

Q: What items will be voted on at the Annual Meeting?

A: The DineEquity, Inc. Board of Directors is requesting that stockholders vote on the following four proposals at the Annual Meeting:

Proposal One: The election of the four Class I directors identified in this proxy statement.

Proposal Two: The ratification of the appointment of Ernst & Young LLP as the Corporation's independent auditor for the fiscal year ending December 31, 2016.

Proposal Three: The approval, on an advisory basis, of the compensation of the Corporation's named executive officers.

Proposal Four: The approval of the DineEquity, Inc. 2016 Stock Incentive Plan.

Q: What are the voting recommendations of the Board of Directors?

A: The Board of Directors recommends that you vote your shares:

- •

- "FOR" all four individuals nominated to serve as Class I directors;

- •

- "FOR" the ratification of the appointment of Ernst & Young LLP as the

Corporation's independent auditor for the fiscal year ending December 31, 2016;

- •

- "FOR" the approval, on an advisory basis, of the compensation of the Corporation's

named executive officers and

- •

- "FOR" the approval of the DineEquity, Inc. 2016 Stock Incentive Plan.

1

Q: Who is entitled to vote?

A: Only stockholders of record at the close of business on March 23, 2016 (the "Record Date") will be entitled to receive notice of, and to vote at, the Annual Meeting. As of the Record Date, there were outstanding 18,413,039 shares of common stock, par value $.01 per share (the "Common Stock"). The holders of Common Stock are entitled to one vote per share. Stockholders of record of the Common Stock may vote their shares either in person or by proxy.

Q: What constitutes a "quorum"?

A: A quorum is necessary to hold a valid meeting of stockholders. A quorum exists if the holders of a majority of the capital stock issued and outstanding and entitled to vote at the Annual Meeting are present in person or represented by proxy.

Q: How do I cast my vote?

A: There are four ways to vote:

- •

- By Internet. To vote by Internet, go to

www.envisionreports.com/DIN. Internet voting is available 24 hours a day, although your vote by Internet must be received by 11:59 p.m. Eastern Time on May 16, 2016. You will need

the control number found either on the Notice of Internet Availability of Proxy Materials or on the proxy card if you are receiving a printed copy of these materials. If you vote by Internet, do not

return your proxy card or voting instruction card. If you hold your shares in "street name," please refer to the Notice of Internet Availability of Proxy Materials or voting instruction card provided

to you by your broker, bank or other holder of record for Internet voting instructions.

- •

- By Telephone. To vote by telephone, registered

stockholders should dial 800-652-VOTE (8683) and follow the instructions. Telephone voting is available 24 hours a day, although your vote by phone must be received by 11:59 p.m. Eastern

Time, May 16, 2016. You will need the control number found either on the Notice of Internet Availability of Proxy Materials or on the proxy card if you are receiving a printed copy of these

materials. If you vote by telephone, do not return your proxy card or voting instruction card. If you hold your shares in "street name," please refer to the Notice of Internet Availability of Proxy

Materials or voting instruction card provided to you by your broker, bank or other holder of record for telephone voting instructions.

- •

- By Mail. By signing the proxy card and returning it in

the prepaid and addressed envelope enclosed with proxy materials delivered by mail, you are authorizing the individuals named on the proxy card to vote your shares at the Annual Meeting in the manner

you indicate. Stockholders are encouraged to sign and return the proxy card even if you plan to attend the Annual Meeting so that your shares will be voted if you are unable to attend the Annual

Meeting. If you receive more than one proxy card, it is an indication that your shares are held in multiple accounts. Please sign and return all proxy cards to ensure that all of your shares are

voted.

- •

- In Person. If you attend the Annual Meeting and plan to vote in person, you will be provided with a ballot at the Annual Meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares. Whether you are a stockholder of record or a beneficial owner, you must bring valid, government-issued photo identification to gain admission to the Annual Meeting. For directions to the Annual Meeting, please visit the Investors section of the Corporation's website at http://www.dineequity.com.

Whichever method you use, each valid proxy received in time will be voted at the Annual

2

Meeting by the persons named on the proxy card in accordance with your instructions. To ensure that your proxy is voted, it should be received by the close of business on May 16, 2016.

Q: What happens if I do not give specific voting instructions?

A: If you do not give specific voting instructions, the following will apply:

Stockholders of Record. If you are a stockholder of record and do not give specific voting instructions for each proposal when voting by signing and returning a proxy card, then the proxy holders will vote your shares as follows:

- •

- "FOR" all four individuals nominated to serve as Class I directors;

- •

- "FOR" the ratification of the appointment of Ernst & Young LLP as the

Corporation's independent auditor for the fiscal year ending December 31, 2016;

- •

- "FOR" the approval of the compensation of the Corporation's named executive officers

and

- •

- "FOR" the approval of our DineEquity, Inc. 2016 Stock Incentive Plan.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of the New York Stock Exchange (the "NYSE"), the organization that holds your shares may generally vote on routine matters (such as Proposal Two—ratification of the appointment of the Corporation's independent auditor) but cannot vote on non-routine matters (such as Proposal One—the election of the Corporation's Class I directors, Proposal Three—the approval, on an advisory basis, of the compensation of the Corporation's named executive officers and Proposal Four—the approval of the DineEquity, Inc. 2016 Stock Incentive Plan). If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform the tabulator of votes that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a "broker non-vote." Accordingly, stockholders are urged to give their broker or bank instructions on voting their shares on all non-routine matters.

Q: How will my stock be voted on other business brought up at the Annual Meeting?

A: By signing and submitting your proxy card or voting your shares on the Internet or by telephone, you authorize the persons named on the proxy card to use their discretion in voting on any other matter brought before the Annual Meeting. As of the date of this proxy statement, the Corporation does not know of any other business to be considered at the Annual Meeting.

Q: Can I change my vote or revoke my proxy?

A: Yes. If you are a stockholder of record, you can change your vote at any time before it is voted at the Annual Meeting by entering a new vote using the Internet or telephone, by submitting a later-dated proxy or by voting by ballot at the Annual Meeting. You may also revoke your proxy at any time before it is voted at the Annual Meeting by giving written notice of revocation to the Secretary of the Corporation or by revoking your proxy in person at the Annual Meeting. If you hold shares in street name, you may submit new voting instructions by contacting your broker or other nominee. You may also change your vote or revoke your proxy in person at the Annual Meeting if you obtain a legal proxy from your broker or other nominee authorizing you to vote the shares.

Q: What vote is necessary to pass the items of business at the Annual Meeting?

A: Assuming a quorum is present at the Annual Meeting, the four director nominees identified in this proxy statement will be elected if they receive a plurality of the votes cast. This means that the four individuals nominated for election to the Board of Directors who receive the most "FOR" votes will be elected unless other candidates properly nominated for election receive a greater

3

number of votes. No other candidates have been nominated. Only votes "FOR" are counted in determining whether a plurality has been cast in favor of a director nominee. If you withhold authority to vote with respect to the election of some or all of the nominees, your shares will not be voted with respect to those nominees indicated. Abstentions and broker non-votes have no effect on the proposal relating to the election of directors.

The affirmative vote of a majority of the shares present or represented by proxy and entitled to vote on the proposal is required to approve Proposal Two, the ratification of Ernst & Young LLP as the Corporation's independent auditor for the fiscal year ending December 31, 2016, Proposal Three, the approval, on an advisory basis, of the compensation of the Corporation's named executive officers and Proposal Four, the approval of the DineEquity, Inc. 2016 Stock Incentive Plan. If your shares are represented at the Annual Meeting but you abstain from voting on these matters, your shares will be counted as present and entitled to vote on that matter for purposes of establishing a quorum, and the abstention will have the same effect as a vote against that proposal.

Q: Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

A: Pursuant to rules adopted by the SEC, the Corporation has elected to provide access to its proxy materials via the Internet. Accordingly, the Corporation mailed a Notice of Internet Availability of Proxy Materials (the "Notice") to its stockholders on April 4, 2016. The Notice contains instructions on how to access the Corporation's proxy materials, including this proxy statement and the Corporation's 2015 annual report to stockholders. The Notice also instructs you on how to vote over the Internet or by telephone. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials by mail or electronically by email. The Corporation encourages stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of its annual meetings.

This process is designed to expedite stockholders' receipt of proxy materials, lower the cost of the Annual Meeting and help conserve natural resources. However, if you would prefer to receive printed proxy materials on an ongoing basis, please follow the instructions included in the Notice. If you have previously elected to receive the Corporation's proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

Q: What are the costs of this proxy solicitation and who will bear them?

A: The Corporation will bear the expense of printing, mailing and distributing these proxy materials and soliciting votes. In addition to using the mail, the Corporation's directors, officers, employees, and agents may solicit proxies by personal interview, telephone, or otherwise, although they will not be paid any additional compensation. The Corporation will request brokers and nominees who hold shares of the Corporation's Common Stock in their names to furnish proxy materials to beneficial owners of the shares. The Corporation will reimburse such brokers and nominees for their reasonable out-of-pocket expenses for forwarding proxy materials to such beneficial owners.

Q: Who will count the votes?

A: A representative of Computershare, transfer agent for the Corporation, will count the votes and will serve as the independent inspector of elections for the Annual Meeting.

The Corporate Governance section of the DineEquity, Inc. website provides up-to-date information about the Corporation's corporate governance policies and practices. In addition, the Investors section of the website includes links to the Corporation's filings with the SEC, news releases, and investor presentations by management. Please note that information contained on the Corporation's website does not constitute part of this proxy statement.

4

You should rely only on the information contained in this proxy statement to vote on the proposals at the Annual Meeting. The Corporation has not authorized anyone to provide you with information that is different from what is contained in this proxy statement. This proxy statement is dated April 4, 2016. You should not assume that the information contained in this proxy statement is accurate as of any date other than such date, unless indicated otherwise herein, and the mailing of this proxy statement to stockholders shall not create any implication to the contrary.

There are currently 10 members of the Board of Directors who are divided into the following three classes:

| Class I | Class II | Class III | ||

|---|---|---|---|---|

| Howard M. Berk | Larry A. Kay | Richard J. Dahl | ||

| Daniel J. Brestle | Douglas M. Pasquale | Stephen P. Joyce | ||

| Caroline W. Nahas | Julia A. Stewart | Patrick W. Rose | ||

| Gilbert T. Ray |

Class I directors will serve until the Annual Meeting, Class II directors will serve until the annual meeting in 2017 and Class III directors will serve until the annual meeting in 2018 (in each case, until their respective successors are duly elected and qualified). At the Annual Meeting, four Class I directors will be elected to serve a term of three years and until their respective successors are duly elected and qualified.

The Structure of the Board of Directors and the Lead Director

The business and affairs of the Corporation are managed under the direction of the Board of Directors. It is management's responsibility to formalize, propose and implement strategic choices and the Board of Directors' role to approve strategic direction and evaluate strategic results, including both the performance of the Corporation and the performance of the Chief Executive Officer.

The Board of Directors believes that the combined role of Chairman and Chief Executive Officer promotes the execution of the strategic responsibilities of the Board of Directors and management because the Chief Executive Officer is the director most familiar with the Corporation's business and industry and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Ms. Stewart has served as both the Chairman and Chief Executive Officer of the Corporation since May 2006. Because the Chairman is a member of management, the Board of Directors considers it useful and appropriate to designate a Lead Director from among the independent directors to coordinate the activities of the independent directors. The presence of a Lead Director provides additional assurance as to the independence of the Board of Directors' oversight of management. Richard J. Dahl has served as the Lead Director since January 2010. The Board of Directors has adopted specific responsibilities of the Lead Director, which include:

- •

- presiding over executive sessions of the independent directors;

- •

- coordinating and developing the agenda for executive sessions of the independent directors;

- •

- assuming the lead role on behalf of the independent directors to communicate to the Chairman any feedback from executive sessions;

- •

- serving as principal liaison between the independent directors and the Chairman on Board of Directors issues;

5

- •

- calling meetings of the independent directors;

- •

- coordinating with the Chairman the schedule of Board of Directors meetings and the agenda, time allocation and quality, quantity,

appropriateness and timeliness of information provided for each Board of Directors meeting;

- •

- recommending, after consulting with the Chairman wherever appropriate, the retention of outside advisors and consultants who report

directly to the Board of Directors on certain issues; and

- •

- serving as interim Chairman in the event of a vacancy in that position.

The Board of Directors believes that the combined role of Chairman and Chief Executive Officer together with an independent Lead Director having the responsibilities outlined above provides the appropriate balance between strategy development and independent oversight of senior management.

The Role of the Board of Directors in Risk Oversight

The Board of Directors and each of its committees have an active role in overseeing management of the Corporation's risks. The Board of Directors regularly reviews information regarding the Corporation's strategic, financial and operational risks and believes that evaluating how the executive team manages the various risks confronting the Corporation is one of its most important areas of oversight.

In carrying out this critical responsibility, the Board of Directors has established an Enterprise Risk Management Council consisting of key members of the risk management, quality assurance, legal, finance and internal audit disciplines. The Enterprise Risk Management Council assists the Board of Directors and the Chairman and Chief Executive Officer with regard to risks inherent to the business of the Corporation, the identification, assessment, management, and monitoring of those risks, and risk management decisions, practices, and activities of the Corporation. The Enterprise Risk Management Council is led by the Corporation's Executive Director, Risk Management, who reports regularly to the Audit and Finance Committee and the Board of Directors.

The Audit and Finance Committee oversees the Corporation's policies with respect to risk assessment and risk management. In addition, the Audit and Finance Committee oversees and evaluates the management of risks associated with accounting, auditing, financial reporting and internal controls over financial reporting. The Audit and Finance Committee assists the Board of Directors in its oversight of the integrity of the Corporation's financial statements, the Corporation's compliance with legal and regulatory requirements, the performance, qualifications, and independence of the Corporation's independent auditor and the performance of the Corporation's internal audit function. The Audit and Finance Committee is responsible for reviewing and discussing the guidelines and policies governing the process by which senior management and the Corporation's internal audit function assess and manage the Corporation's exposure to risk, as well as the Corporation's major financial risk exposures and the steps management has taken to monitor and control such exposures.

The Compensation Committee and the Nominating and Corporate Governance Committee also oversee risk within their respective areas of responsibility. The Compensation Committee oversees the management of risks relating to the Corporation's compensation philosophy, policies and practices. The Nominating and Corporate Governance Committee oversees risks associated with the Board of Directors' organization, membership and structure, corporate governance, the independence of members of the Board of Directors and assessment of the performance and effectiveness of each member of the Board of Directors. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports and management updates about such risks.

6

The NYSE rules require listed companies to have a board of directors with at least a majority of independent directors. The Board of Directors has had a majority of independent directors since the Corporation went public in 1991.

Under the NYSE rules, a director qualifies as "independent" if the Board of Directors affirmatively determines that he or she has no material relationship with the Corporation (either directly or as a partner, stockholder or officer of an organization that has a material relationship with the Corporation). Based upon a review of the directors' backgrounds and business activities, the Board of Directors has affirmatively determined that directors Howard M. Berk, Daniel J. Brestle, Richard J. Dahl, Stephen P. Joyce, Larry A. Kay, Caroline W. Nahas, Douglas M. Pasquale, Gilbert T. Ray, and Patrick W. Rose have no material relationships (other than service as a director on the Board of Directors) with the Corporation and therefore that they each qualify as independent. In making its determination, the Board of Directors considered, amongst other factors, Mr. Berk's position as a partner of MSD Capital, L.P. and the fact that MSD Capital, L.P. may be deemed to beneficially own 727,356 shares of the Corporation's Common Stock. The Board of Directors also considered Mr. Dahl's position as the chairman of the board of directors and the president and chief executive officer of the James Campbell Company and the fact that the Corporation leases space from a building owned by the James Campbell Company in Novato, California. For the year ended December 31, 2015, the Corporation paid rent to the James Campbell Company totaling approximately $202,571. The Corporation entered into the lease before Mr. Dahl joined the James Campbell Company. The Corporation does not believe that Mr. Dahl has a material direct or indirect interest in such lease.

The Corporation's Chief Executive Officer, Julia A. Stewart, does not qualify as an independent director.

Both the Sarbanes-Oxley Act of 2002 and the NYSE rules require the Board of Directors to have an audit committee comprised solely of independent directors, and the NYSE rules also require the Board of Directors to have a compensation committee and a nominating and corporate governance committee, each of which is comprised solely of independent directors. The Corporation is in compliance with these requirements.

The Corporation is committed to maintaining high standards of business conduct and corporate governance, which we consider essential to running the business efficiently, serving the Corporation's stockholders well and maintaining the Corporation's integrity in the marketplace. Accordingly, the Board of Directors has adopted a Global Code of Conduct, which applies to all directors, officers and employees of the Corporation. The Global Code of Conduct sets forth the fundamental principles and key policies that govern the way the Corporation conducts business, including workplace conduct, conflicts of interest, gifts and entertainment, political and community involvement, protection of corporate assets, fair business practices, global relations and other laws and regulations applicable to the Corporation's business.

In addition to the Global Code of Conduct, the Board of Directors has adopted a Code of Conduct for Non-Employee Directors, which serves as guidance to the Corporation's non-employee directors on ethical issues including conflicts of interest, confidentiality, corporate opportunities, fair disclosure, protection and proper use of corporate assets, fair dealing, harassment and discrimination, and other laws and regulations applicable to the Corporation's business.

The Board of Directors has also adopted the Code of Ethics for Chief Executive Officer and Senior Financial Officers. These individuals are expected to avoid actual or apparent conflicts between their personal and professional relationships and make full disclosure of any material transaction or

7

relationship that could create or appear to create a conflict of interest to the General Counsel, who will inform and seek a determination from the Chair of the Audit and Finance Committee as to whether a conflict exists and the appropriate disposition of the matter. In addition, these individuals are expected to promote the corporate policy of making full, fair, accurate and understandable disclosure in all reports and documents filed with the SEC; report violations of the Code of Ethics to the General Counsel or the Chair of the Audit and Finance Committee; and request from the General Counsel any waivers of the Code of Ethics, which shall be publicly disclosed if required by applicable law.

Any waiver of any provision of the Global Code of Conduct or the Code of Ethics for Chief Executive Officer and Senior Financial Officers for any executive officer may be granted only by the Board of Directors. Any waiver of the Code of Conduct for Non-Employee Directors may be granted only by the disinterested directors of the Board of Directors or the Audit and Finance Committee, and any such waiver shall be promptly disclosed to the Corporation's stockholders. The Board of Directors and the Audit and Finance Committee review whether such waivers are in the best interests of the Corporation and its stockholders, taking into account all relevant factors. In 2015, there were no waivers of (a) the Global Code of Conduct for executive officers, (b) the Code of Ethics for Chief Executive Officer and Senior Financial Officers, or (c) the Code of Conduct for Non-Employee Directors.

The Corporation also maintains an ethics hotline to allow any employee to express a concern or lodge a complaint, confidentially and anonymously, about any potential violation of the Corporation's Global Code of Conduct.

Copies of the Global Code of Conduct, the Code of Conduct for Non-Employee Directors and the Code of Ethics for Chief Executive Officer and Senior Financial Officers can be found in the Corporate Governance section of the Corporation's website, http://www.dineequity.com. In addition, printed copies of the codes of conduct are available at no charge upon request to the Secretary at DineEquity, Inc., 450 North Brand Boulevard, Glendale, California 91203, (866) 995-DINE. We will disclose any future substantive amendments to, or waivers granted to any officer from, the provisions of these ethics policies and standards as promptly as practicable as may be required under applicable rules of the SEC or the NYSE.

Corporate Governance Guidelines

The Corporation has adopted corporate governance guidelines which can be found in the Corporate Governance section of the Corporation's website, http://www.dineequity.com. In addition, printed copies of the Corporation's corporate governance guidelines are available at no charge upon request to the Secretary at DineEquity, Inc., 450 North Brand Boulevard, Glendale, California 91203, (866) 995-DINE.

Director Attendance at Meetings

Directors are expected to attend the Corporation's Annual Meeting and all 10 directors attended the 2015 annual meeting of stockholders. The Board of Directors held seven meetings during 2015. During 2015, each incumbent director attended 75% or more of the aggregate of the meetings of the Board of Directors and of the committees on which he or she served that were held during the period for which he or she served as a director.

Executive Sessions of Non-Management Directors

The NYSE rules require that the non-management directors of a listed company meet at regularly scheduled executive sessions without management. The Corporation's non-management directors meet separately at each regular meeting of the Board of Directors and most committee meetings. The Lead

8

Director, Richard J. Dahl, is not a member of management and presides during executive sessions of the Board of Directors.

Communications with the Board of Directors

Stockholders and other interested persons wishing to communicate directly with the Board of Directors, Chairman, Lead Director, any Committee or Committee Chairman, or the non-management directors, individually or as a group, may do so by sending written communications appropriately addressed to the following address:

DineEquity, Inc.

(or a particular subgroup or individual director)

c/o Office of the Secretary

450 North Brand Boulevard, 7th Floor

Glendale, California 91203

Each written communication should specify the applicable addressee or addressees to be contacted, as well as the general topic of the communication. The Board of Directors has designated the Secretary of the Corporation as its agent to receive and review communications addressed to the Board of Directors, Chairman, Lead Director, any committee or committee chairman, or the non-management directors, individually or as a group. The Office of the Secretary will initially receive and process communications to determine whether it is a proper communication for the Board of Directors. If the envelope containing a communication that a stockholder or other interested person wishes to be confidential is conspicuously marked "Confidential," the Secretary of the Corporation will not open the communication prior to forwarding it to the appropriate individual(s). Generally, any communication that is primarily commercial, offensive, illegal or otherwise inappropriate, or does not substantively relate to the duties and responsibilities of our Board of Directors, may not be forwarded.

Board of Directors Retirement Policy

No person may stand for election to serve as a member of the Corporation's Board of Directors if he or she shall have reached his or her 76th birthday. Under special circumstances, upon the recommendation of the Nominating and Corporate Governance Committee, and upon the consent and approval of a majority of the Board of Directors, a person who has reached his or her 76th birthday may be permitted to stand for election and, if elected, continue to serve on the Board of Directors.

Certain Relationships and Related Person Transactions

The Corporation's Global Code of Conduct and the Code of Ethics for Chief Executive Officer and Senior Financial Officers provide that executive officers who encounter a potential or actual conflict of interest must fully disclose all facts and circumstances to the Corporation's General Counsel, who will inform and seek a determination from the Audit and Finance Committee as to whether a conflict exists and the appropriate disposition of the matter. The Corporation's Code of Conduct for Non-Employee Directors provides that any director who becomes aware of any situation that involves, or reasonably may appear to involve, a conflict of interest with the Corporation must promptly bring it to the attention of the Corporation's General Counsel or to the Chair of the Audit and Finance Committee.

9

Neither the Global Code of Conduct nor the Code of Conduct for Non-Employee Directors addresses the conduct of director nominees who are not already Board of Directors members (or members of any such director nominee's immediate family) or beneficial owners of more than five percent of the Corporation's voting securities (or members of any such beneficial owner's immediate family). The charter of the Nominating and Corporate Governance Committee of the Board of Directors provides that it will consider conflicts of interest in evaluating director nominees. As a matter of practice, the Board of Directors or the Audit and Finance Committee would be called upon to review any transaction involving such security holders (or members of their immediate family) that would be required to be disclosed by the applicable rules of the SEC.

Board of Directors Committees and Their Functions

The Board of Directors has three standing committees, each of which operates under a written charter approved by the Board of Directors: the Audit and Finance Committee, Compensation Committee and Nominating and Corporate Governance Committee. Each member of these committees is an independent director in accordance with the NYSE listing standards and the applicable rules and regulations of the SEC. The Audit and Finance Committee Charter, the Compensation Committee Charter, and the Nominating and Corporate Governance Committee Charter can be found in the Corporate Governance section of the Corporation's website, http://www.dineequity.com, and printed copies are also available at no charge upon request to the Secretary at DineEquity, Inc., 450 North Brand Boulevard, Glendale, California 91203, (866) 995-DINE.

The chart below identifies directors who were members, and chairs, of each committee at the end of 2015 and as of the date of this proxy statement, the principal functions of each committee and the number of meetings held by each committee during 2015.

| |

|

|

|

|

|

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

|

|

Name of Committee and Membership |

|

Principal Functions of the Committee |

|

Meetings in 2015 |

|

||||||

| | | | | | | | | | | | | |

| Audit and Finance Committee Richard J. Dahl, Chairman Howard M. Berk Larry A. Kay Douglas M. Pasquale |

• Responsible for the appointment, compensation, retention and oversight of the work of any independent auditor engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Corporation. • Reviews with management and the independent auditor the Corporation's annual audited and quarterly financial statements and other financial disclosures, the adequacy and effectiveness of accounting and internal control policies and procedures and major issues regarding accounting principles and financial statement presentations. • Meets at each regular meeting with the Corporation's director of internal audit and the independent auditor in separate executive sessions. • Reviews and discusses with management and, when appropriate, makes recommendations to the Board of Directors regarding the following: (i) the Corporation's tax program, including tax planning and compliance; and (ii) the Corporation's insurance risk management policies and programs. • Reviews the Corporation's program to monitor compliance with the Corporation's Global Code of Conduct and meets periodically with the Corporation's General Counsel or Compliance Officer to discuss compliance with the Global Code of Conduct. |

7 Meetings | ||||||||||

| | | | | | | | | | | | | |

10

| |

|

|

|

|

|

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

|

|

Name of Committee and Membership |

|

Principal Functions of the Committee |

|

Meetings in 2015 |

|

||||||

| | | | | | | | | | | | | |

|

• Reviews requests from directors and executive officers of the Corporation of the Corporation's Code of Conduct for Non-Employee Directors and Global Code of Conduct, respectively, and related policies of the Corporation, to make recommendations to the Board of Directors concerning such requests or to grant or deny such requests on behalf of the Board of Directors, as appropriate, and to review any public disclosures related to such waivers. • Reviews any potential related party transactions. • Reviews the performance and independence of the Corporation's independent auditor. • Prepares a report required by the rules of the SEC to be included in the Corporation's proxy statement for its annual meeting of stockholders. • Reviews and provides guidance to the Board of Directors and management regarding: dividend policy; sales, issuance or repurchases of the Corporation's Common Stock; policies and guidelines on investment of cash; policies and guidelines on short and long-term financing; debt/equity ratios, fixed charge ratios, working capital, other debt covenant ratios and other transactions or financial issues that management desires to have reviewed by the Audit and Finance Committee from time to time. • Oversees the Corporation's policies with respect to risk assessment and risk management. Oversees and evaluates the management of risks associated with accounting, auditing, financial reporting and internal controls over financial reporting, and reviews and discusses with the Board of Directors, at least annually and at the request of the Board of Directors, issues relating to the assessment and mitigation of major financial risk factors affecting the Corporation. |

|||||||||||

| | | | | | | | | | | | | |

|

Compensation Committee |

• Oversees the Corporation's compensation and employee benefit plans and practices, including its executive compensation plans and its incentive compensation and equity-based plans. • Reviews at least annually the goals and objectives of the Corporation's executive compensation plans, and amends, or recommends that the Board of Directors amend, these goals and objectives if the Compensation Committee deems it appropriate. • Reviews, at least annually, the Corporation's executive compensation plans in light of the Corporation's goals and objectives with respect to such plans and, if appropriate, adopts, or recommends that the Board of Directors adopt, any new executive compensation plans or the amendments of existing, executive compensation plans. • Reviews the Corporation's succession plans for officer level executives. • Evaluates annually the performance of the CEO and other executive officers in light of the goals and objectives of the Corporation's executive compensation plans, and either as a committee or, together with the other independent directors, determines and approves the CEO's compensation. |

7 Meetings |

|||||||||

| | | | | | | | | | | | | |

11

| |

|

|

|

|

|

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

|

|

Name of Committee and Membership |

|

Principal Functions of the Committee |

|

Meetings in 2015 |

|

||||||

| | | | | | | | | | | | | |

|

• Evaluates annually the appropriate level of compensation for the Board of Directors and committee service by non-employee members of the Board of Directors. • Prepares a report on executive compensation to be included in the Corporation's proxy statement for its annual meeting of stockholders or its annual report on Form 10-K. Reviews and discusses with management, the Corporation's Compensation Discussion and Analysis and, as part of this review, considers the results of the most recent stockholder advisory vote on executive compensation. • Reviews and approves severance or termination arrangements to be made with executive officers. • Reviews and approves a peer group of companies against which to compare the Corporation's executive compensation for the purposes of assessing the competitiveness of the Corporation's executive compensation programs. • Reviews annually the compliance of each director and executive officer with the Corporation's stock ownership guidelines. • Reviews and monitors risks related to compensation policies and practices, and reviews with the Board of Directors, at least annually, any issues regarding assessment and mitigation of risk factors affecting the Corporation related to the Corporation's compensation policies and practices. |

|||||||||||

| | | | | | | | | | | | | |

|

Nominating and Corporate |

• Identifies and recommends to the Board of Directors individuals qualified to serve as directors of the Corporation and on committees of the Board of Directors. • Recommends to the Board of Directors criteria for membership on the Board of Directors. • Reviews annually and advises the Board of Directors with respect to the Board of Directors' composition, size, frequency of meetings, and any other aspects of procedures of the Board of Directors and its committees. • Develops and recommends to the Board of Directors a set of corporate governance guidelines applicable to the Corporation; reviews periodically, and at least annually, the corporate governance guidelines adopted by the Board of Directors to assure that they are appropriate for the Corporation and comply with the requirements of the NYSE; and recommends any desirable changes to the Board of Directors. • Reviews periodically with management the Corporation's policies and programs in such areas as charitable contributions. • Reviews periodically the Corporation's Global Code of Conduct and Code of Conduct for Non-Employee Directors and makes recommendations to the Board of Directors for any changes deemed appropriate. • Oversees the evaluation of the Board of Directors as a whole and evaluates and reports to the Board of Directors on the performance and effectiveness of the Board of Directors. • Oversees and reviews policies with respect to assessment and management of risks associated with the Board of Directors' organization, membership and structure, succession planning, corporate governance, independence, and the performance and effectiveness of the Board of Directors. |

6 Meetings |

|||||||||

| | | | | | | | | | | | | |

12

Board of Directors Nominations

Consistent with its charter, the Nominating and Corporate Governance Committee considers various criteria in evaluating Board of Directors candidates, including: business experience, board of directors experience, skills, expertise, education, professions, backgrounds, diversity, personal and professional integrity, character, business judgment, business philosophy, time availability in light of other commitments, dedication, conflicts of interest, and such other relevant factors that the Nominating and Corporate Governance Committee considers appropriate in the context of the needs of the Board of Directors. In considering diversity, the Nominating and Corporate Governance Committee evaluates candidates with a broad range of expertise, experience, skills, professions, education, backgrounds and other board of directors experience. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, it seeks to identify directors who will bring diverse viewpoints, opinions and areas of expertise that will benefit the Board of Directors as a whole. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria in evaluating prospective nominees.

The Nominating and Corporate Governance Committee also considers whether a potential nominee would satisfy the NYSE's criteria for director "independence," the NYSE's "accounting or related financial management expertise" standard and the SEC's definition of "audit committee financial expert."

Whenever a vacancy or potential vacancy exists on the Board of Directors due to expansion of the size of the Board of Directors or the resignation or retirement of an existing director, the Nominating and Corporate Governance Committee begins its process of identifying and evaluating potential director nominees. The Nominating and Corporate Governance Committee considers recommendations of management, stockholders and others. The Nominating and Corporate Governance Committee has sole authority to retain and terminate any search firm to be used to identify director candidates, including approving its fees and other retention terms.

The Nominating and Corporate Governance Committee conducted an evaluation and assessment of each director whose term expires in 2016 for purposes of determining whether to recommend them for nomination for re-election to the Board of Directors. After reviewing the assessment results, the Nominating and Corporate Governance Committee determined to make a recommendation to the Board of Directors that Howard M. Berk, Daniel J. Brestle, Caroline W. Nahas and Gilbert T. Ray be nominated for re-election to the Board of Directors. The Board of Directors reviewed and accepted the Nominating and Corporate Governance Committee's recommendation and has nominated Howard M. Berk, Daniel J. Brestle, Caroline W. Nahas and Gilbert T. Ray for re-election to the Board of Directors.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. Stockholders wishing to recommend director candidates for consideration by the Nominating and Corporate Governance Committee may do so by writing to the Secretary, giving the recommended nominee's name, biographical data and qualifications, accompanied by the written consent of the recommended nominee to serve if elected. Any stockholder who wishes to directly nominate a director candidate must provide written notice that is timely and in proper form in accordance with the Corporation's Bylaws.

The Nominating and Corporate Governance Committee did not receive any recommendations from stockholders proposing candidates for election to the Board of Directors at the Annual Meeting.

13

The Corporation does not pay directors who are also employees of the Corporation additional compensation for their service on the Board of Directors. Compensation for non-employee directors is comprised of a cash component and an equity component. Cash compensation for non-employee directors is comprised of retainers for Board of Directors membership and retainers for serving as a member and/or chair of a Board of Directors committee and as the Lead Director.

During 2015, non-employee directors were entitled to receive $70,000 as an annual cash retainer for serving as a member of the Board of Directors. In addition, depending on their roles, non-employee directors were entitled to receive:

- •

- $25,000 as an annual retainer for the Lead Director;

- •

- $15,000, $12,500 and $7,500, respectively, as an annual retainer for the chairs of the Audit and Finance Committee, Compensation

Committee, and Nominating and Corporate Governance Committee;

- •

- $12,500, $10,000 and $7,500, respectively, as an annual retainer for the members of the Audit and Finance Committee, Compensation

Committee, and Nominating and Corporate Governance Committee; and

- •

- $1,500 per meeting beyond the eighth meeting attended for each director who serves on a standing committee that meets more than eight times per year.

Directors are eligible to defer up to 100% of their annual Board of Directors retainer fees pursuant to the IHOP Corp., Inc. Nonqualified Deferred Compensation Plan (the "Deferred Compensation Plan").

The Corporation also reimburses each of the directors for reasonable out-of-pocket expenses incurred for attendance at Board of Directors and committee meetings and other corporate events.

Under the DineEquity, Inc. 2011 Stock Incentive Plan ("2011 Stock Incentive Plan"), non-employee directors may receive periodic grants of stock options, restricted stock awards ("RSAs"), restricted stock units ("RSUs"), stock appreciation rights ("SARs") or performance unit awards. In February 2015, equity awards valued at approximately $105,000 in the form of RSUs were granted to each non-employee director under the 2011 Stock Incentive Plan. All of the currently outstanding RSUs granted to outside directors will generally vest on the third anniversary of the grant date. In the event a director retires from the Board of Directors after completing five years of service, all of the director's then outstanding RSUs will vest. To the extent the Corporation declares dividends, non-employee directors receive dividend equivalent rights in the form of additional RSUs in lieu of receiving cash dividends based upon the number of RSUs held by the director at the time of the dividend record dates. Dividend equivalent rights are subject to the same vesting restrictions as the underlying RSUs.

Non-employee directors are subject to stock ownership guidelines whereby each director is expected to hold the lesser of 7,000 shares of Common Stock or Common Stock with a value of at least five times the amount of the Board of Directors' annual retainer. Directors are expected to meet the ownership guidelines within five years of joining the Board of Directors. Upon review by the Compensation Committee in 2015, all directors met or exceeded the ownership guidelines.

14

Director Compensation Table for 2015

The following table sets forth certain information regarding the compensation earned or paid in cash and stock awards granted to each non-employee director who served on the Board of Directors in 2015.

Name

|

| Fees Earned or Paid in Cash ($) |

| Stock Awards ($)(1)(2) |

| Total ($) |

| |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Howard M. Berk |

| | 90,000 | | | 105,077 | | 195,077 | | |||

Daniel J. Brestle |

| | 80,000 | | | 105,077 | | 185,077 | | |||

Richard J. Dahl |

| | 122,500 | | | 105,077 | | 227,577 | | |||

Stephen P. Joyce |

| | 80,000 | | | 105,077 | | 185,077 | | |||

Larry A. Kay |

| | 82,500 | | | 105,077 | | 187,577 | | |||

Caroline W. Nahas(3) |

| | 95,000 | | | 105,077 | | 200,077 | | |||

Douglas M. Pasquale |

| | 82,500 | | | 105,077 | | 187,577 | | |||

Gilbert T. Ray |

| | 77,500 | | | 105,077 | | 182,577 | | |||

Patrick W. Rose |

| | 92,500 | | | 105,077 | | 197,577 | | |||

- (1)

- These

amounts reflect the aggregate grant date fair value computed in accordance with Financial Accounting Standards Boards Accounting Standards

Codification Topic 718, Compensation—Stock Compensation ("FASB ASC Topic 718"). See Note 13 to the Consolidated Financial Statements

in the Corporation's annual report on Form 10-K for the fiscal year ended December 31, 2015 for information regarding assumptions underlying the valuation of equity awards.

- (2)

- The following table sets forth the number of RSUs outstanding at December 31, 2015.

Name

|

| Stock Awards Outstanding at December 31, 2015 (#) |

| |||

|---|---|---|---|---|---|---|

Howard M. Berk |

| | 3,791 | | | |

Daniel J. Brestle |

| | 3,791 | | | |

Richard J. Dahl |

| | 3,791 | | | |

Stephen P. Joyce |

| | 3,791 | | | |

Larry A. Kay |

| | 3,791 | | | |

Caroline W. Nahas |

| | 3,791 | | | |

Douglas M. Pasquale |

| | 3,624 | | | |

Gilbert T. Ray |

| | 3,791 | | | |

Patrick W. Rose |

| | 3,791 | | | |

- (3)

- Ms. Nahas elected to defer all of her 2015 director cash compensation pursuant to the Deferred Compensation Plan.

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of more than 5% of the outstanding shares of any class of the Corporation's voting securities, which information is derived solely from certain SEC filings available as of March 23, 2016, as noted below. The percentages of Common Stock ownership have been calculated based upon 18,413,039 shares of Common Stock outstanding as of March 23, 2016.

| |

| Shares of Common Stock Beneficially Owned |

||||

|---|---|---|---|---|---|---|

Name and Address of Beneficial Owner

|

| Number | | Percent | ||

| FMR LLC | | 2,436,660(1) | | 13.23% | ||

|

245 Summer Street Boston, MA 02210 |

| | ||||

Jackson Square Partners, LLC |

|

2,002,582(2) |

|

10.88% |

||

| 101 California Street, Suite 3750 San Francisco, CA 94111 |

| | ||||

BlackRock, Inc. |

|

1,593,558(3) |

|

8.65% |

||

|

55 East 52nd Street New York, New York 10022 |

| | ||||

Capital Research Global Investors |

|

1,491,700(4) |

|

8.10% |

||

| 333 South Hope Street Los Angeles, CA 90071 |

| | ||||

Delaware Management Holdings Inc. |

|

1,348,113(5) |

|

7.32% |

||

|

Delaware Management Business Trust 2005 Market Street Philadelphia, PA 19103 |

| | ||||

The Vanguard Group. |

|

1,276,562(6) |

|

6.93% |

||

| 100 Vanguard Blvd. Malvern, PA 19355 |

| | ||||

- (1)

- Based

solely upon a Schedule 13G/A filed with the SEC on February 12, 2016 by FMR LLC reporting beneficial ownership as of

December 31, 2015. FMR LLC reported that it possessed sole power to vote or to direct the vote with respect to 256 of these shares and sole power to dispose or direct the disposition of

all of the shares indicated above.

- (2)

- Based

solely upon a Schedule 13G filed with the SEC on February 16, 2016 by Jackson Square Partners, LLC reporting beneficial ownership

as of December 31, 2015. Jackson Square Partners, LLC reported that it possessed sole power to vote or to direct the vote with respect to 474,764 of these shares, shared power to vote or

to direct the vote with respect to 1,314,440 of these shares and sole power to dispose or to direct the disposition of all of the shares indicated above.

- (3)

- Based

solely upon on a Schedule 13G/A filed with the SEC on January 26, 2016 by BlackRock, Inc. reporting beneficial ownership as of

December 31, 2015. BlackRock, Inc. reported that it possessed sole power to vote or direct the vote with respect to 1,542,188 of these shares and sole power to dispose or direct the

disposition of all the shares indicated above.

- (4)

- Based solely upon a Schedule 13G filed with the SEC on February 16, 2016 by Capital Research Global Investors reporting beneficial ownership as of December 31, 2015. Capital Research Global Investors reported that it possessed sole power to vote or direct the vote and sole power to dispose or direct the disposition of all of the shares indicated above.

16

- (5)

- Based

solely upon a Schedule 13G filed with the SEC on February 16, 2016 by Delaware Management Business Trust, Delaware Management

Holdings, Inc., Macquarie Group Limited and Macquarie Bank Limited reporting beneficial ownership as of December 31, 2015. Each of Delaware Management Holdings Inc. and Delaware

Management Business Trust reported that it possessed sole power to vote or direct the vote with respect to 29,294 of these shares, shared power to vote or direct the vote with respect to 1,314,440 of

these shares, sole power to dispose or direct the disposition of 29,294 of these shares and shared power to dispose or direct the disposition of 1,314,440 of these shares.

- (6)

- Based solely upon a Schedule 13G/A filed with the SEC on February 11, 2016 by The Vanguard Group reporting beneficial ownership as of December 31, 2015. The Vanguard Group reported that it possessed sole power to vote or direct the vote with respect to 36,234 shares, shared power to vote or direct the vote with respect to 1,200 shares, sole power to dispose or direct the disposition of 1,240,482 shares and shared power to dispose or to direct the disposition of 36,080 of these shares.

The following table sets forth as of March 23, 2016 the beneficial ownership of the Corporation's Common Stock, including shares as to which a right to acquire ownership exists within the meaning of Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), within 60 days of March 23, 2016, of each director, each nominee for election as director, each Named Executive Officer, as such term is used in the Compensation Discussion and Analysis section of this proxy statement, and all directors and executive officers of the Corporation, as a group. The information contained in the table below does not include information for Steven R. Layt as he is no longer employed with the Corporation, and the Corporation does not have access to his beneficial ownership information. The percentages of ownership have been calculated based upon 18,413,039 shares of Common Stock outstanding as of March 23, 2016.

| |

| Amount and Nature of Beneficial Ownership |

| |

| |

| ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name

|

| Shares Beneficially Owned(1) |

| Unvested Restricted Shares(2) |

| Total Shares Beneficially Owned |

| Percent of Class | | ||||||||||||

Howard M. Berk |

| | 20,465 | (3) | | | — | | | | 20,465 | | | | * | | | ||||

Daniel J. Brestle |

| | 14,465 | | | | — | | | | 14,465 | | | | * | | | ||||

Richard J. Dahl |

| | 45,565 | (4) | | | — | | | | 45,565 | | | | * | | | ||||

Stephen P. Joyce |

| | 3,672 | | | | — | | | | 3,672 | | | | * | | | ||||

Larry A. Kay |

| | 20,555 | (5) | | | — | | | | 20,555 | | | | * | | | ||||

Caroline W. Nahas |

| | 23,290 | | | | — | | | | 23,290 | | | | * | | | ||||

Douglas M. Pasquale |

| | 2,853 | (6) | | | — | | | | 2,853 | | | | * | | | ||||

Gilbert T. Ray |

| | 22,401 | | | | — | | | | 22,401 | | | | * | | | ||||

Patrick W. Rose |

| | 44,137 | | | | — | | | | 44,137 | | | | * | | | ||||

Julia A. Stewart |

| | 186,181 | (7) | | | 41,099 | | | | 227,280 | | | | 1.23% | | | ||||

Thomas W. Emrey |

| | 66,858 | | | | 8,840 | | | | 75,698 | | | | * | | | ||||

Darren M. Rebelez |

| | 5,434 | | | | 30,102 | | | | 35,536 | | | | * | | | ||||

Bryan R. Adel |

| | 32,167 | | | | 5,064 | | | | 37,231 | | | | * | | | ||||

John B. Jakubek |

| | 54,659 | | | | 5,820 | | | | 60,479 | | | | * | | | ||||

All directors and executive officers as a group (16 persons) |

| | 554,755 | | | | 99,517 | | | | 654,272 | | | | 3.55% | | | ||||

- *

- Represents

less than 1% of the outstanding shares of Common Stock.

- (1)

- None of the shares have been pledged as security. Share amounts for each of the directors, each nominee for election as director, each NEO and for all directors and executive officers as a group

17

include shares subject to stock options that are exercisable within 60 days of March 23, 2016, as follows:

Name

|

| Shares Subject to Options |

| |||

|---|---|---|---|---|---|---|

Howard M. Berk |

| | — | | | |

Daniel J. Brestle |

| | — | | | |

Richard J. Dahl |

| | — | | | |

Stephen P. Joyce |

| | — | | | |

Larry A. Kay |

| | — | | | |

Caroline W. Nahas |

| | — | | | |

Douglas M. Pasquale |

| | — | | | |

Gilbert T. Ray |

| | — | | | |

Patrick W. Rose |

| | — | | | |

Julia A. Stewart |

| | 120,848 | | | |

Thomas W. Emrey |

| | 58,987 | | | |

Darren M. Rebelez |

| | 5,434 | | | |

Bryan R. Adel |

| | 23,343 | | | |

John B. Jakubek |

| | 53,513 | | | |

All directors and executive officers as a group (16 persons) |

| | 267,764 | | | |

Directors also hold RSUs that are not included in the beneficial ownership table because vesting will not occur within 60 days of March 23, 2016. The amounts of RSUs held by non-employee directors as of December 31, 2015 are provided in the section of this proxy statement entitled "Director Compensation."

- (2)

- Unvested

RSAs are deemed beneficially owned because grantees of unvested RSAs under the Corporation's equity compensation plans hold the sole right to vote

such shares.

- (3)

- The

amount for Mr. Berk does not include 727,356 shares of the Corporation's Common Stock beneficially owned by MSD SBI, L.P. MSD

Capital, L.P. is the general partner of MSD SBI, L.P. and may be deemed to beneficially own securities owned by MSD SBI, L.P. Mr. Berk is a partner of MSD

Capital, L.P. and may be deemed to beneficially own securities owned by MSD Capital, L.P. Mr. Berk disclaims beneficial ownership of the shares that may be deemed to be

beneficially owned by MSD Capital, L.P., except to the extent of his pecuniary interest therein.

- (4)

- The

amount for Mr. Dahl includes 44,012 shares of Common Stock held by the Richard J. Dahl Revocable Living Trust dated 1/20/1995, of which

Mr. Dahl serves as Trustee.

- (5)

- The

amount for Mr. Kay includes 12,645 shares of Common Stock held by the IRA Trustee for the benefit of Mr. Kay.

- (6)

- The

amount for Mr. Pasquale includes 1,250 shares of Common Stock held by the Pasquale Living Trust, dated October 17, 2007.

- (7)

- The amount for Ms. Stewart includes 64,702 shares of Common Stock held by the Julia Stewart Family Trust, of which Ms. Stewart is sole Trustee and sole beneficiary, and 631 shares of Common Stock held in the DineEquity, Inc. 401(k) Plan.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires that the Corporation's directors, executive officers and persons who own more than ten percent of the Corporation's equity securities file reports of ownership and changes in ownership with the SEC. Based on its review of such reports and other information furnished by the directors and executive officers, the Corporation believes that all reports required to be filed pursuant to Section 16(a) of the Exchange Act were filed on a timely basis in 2015.

18

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management. Based on its review and discussion, the Compensation Committee recommended that the Board of Directors include the Compensation Discussion and Analysis in this proxy statement and the Corporation's annual report on Form 10-K.

THIS REPORT IS SUBMITTED BY THE

COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

Patrick W. Rose (Chairman)

Daniel J. Brestle

Stephen P. Joyce

Caroline W. Nahas

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion provides an overview and analysis of the Corporation's compensation programs and policies, the material compensation decisions made under those programs and policies with respect to the Corporation's named executive officers (the "NEOs") and the material factors that were considered in making those decisions. Following this Compensation Discussion and Analysis is a series of tables under the heading "Compensation Tables" containing specific data about the compensation earned by or granted to the following NEOs in 2015:

- •

- Chairman and Chief Executive Officer ("CEO") and Interim President of the Applebee's Business Unit, Ms. Julia A. Stewart;

- •

- Chief Financial Officer ("CFO"), Mr. Thomas W. Emrey;

- •

- President of the IHOP Business Unit, Mr. Darren M. Rebelez, who commenced employment with the Corporation on May 4,

2015;

- •

- Senior Vice President, Legal, General Counsel and Secretary, Mr. Bryan R. Adel;

- •

- Senior Vice President, Human Resources, Mr. John B. Jakubek; and

- •

- Former President of the Applebee's Business Unit, Mr. Steven R. Layt, who ceased service as an executive officer and separated from the Corporation on September 4, 2015.

2015 Fiscal Year Performance Highlights† and Link to Pay Decisions

During 2015, the Corporation and its Applebee's and IHOP Business Units delivered several notable achievements against their key strategic priorities to innovate and evolve strong brands, facilitate franchisee restaurant development and maintain strong financial discipline. These are highlighted by the following key accomplishments:

- Ø

- Achieved Adjusted Earnings Per Share of $6.19, a 31% increase over fiscal 2014;

- †

- For complete information regarding the Corporation's 2015 performance, stockholders should read "Management's Discussion and Analysis of Results of Operation and Financial Condition" and the audited consolidated financial statements and accompanying notes thereto contained in the Corporation's 2015 annual report on Form 10-K filed with the SEC on February 24, 2016, which is being made available to stockholders with this proxy statement.

19

- Ø

- Generated Operating Profit for the Applebee's Business Unit and the IHOP Business Unit

at 100.5% and 107.2% of operating plan targets, respectively, under the Corporation's 2015 Annual Incentive Plan;

- Ø

- Returned approximately $136 million to stockholders in share repurchases and

quarterly cash dividends combined;

- Ø

- Generated strong free cash flow of $142 million compared to $121 million

in fiscal 2014;

- Ø

- Increased domestic system-wide comparable same-restaurant sales by 4.5% at IHOP, the

third consecutive year of growth in domestic system-wide same-restaurant sales and the highest yearly increase since 2004;

- Ø

- Generated positive traffic growth at IHOP restaurants for the second consecutive year

and outperformed the family dining segment of the restaurant industry;

- Ø

- Increased domestic system-wide comparable same-restaurant sales 0.2% at Applebee's; and

- Ø

- Opened 99 new IHOP and Applebee's restaurants worldwide by franchisees, the largest combined total from both brands since 2009.

While the Corporation and its Applebee's and IHOP Business Units delivered several notable achievements during 2015, performance against certain metrics fell below expectations.

- Ø

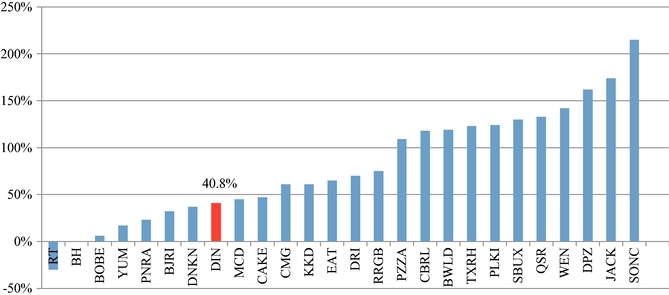

- The Corporation's total stockholder return ("TSR") since the beginning of 2010 is over

92% and, for fiscal years 2013 through 2015, was 40.8%. However, the Corporation's TSR for the 2013-2015 performance period ranked in the bottom third of the Value Line Restaurant Index ("VLRI").

- Ø

- Traffic growth for the domestic Applebee's Business Unit fell below its target by 3%

(and was below threshold performance) and underperformed against the casual dining segment.

- Ø

- Traffic growth for the domestic IHOP Business Unit was positive for the second consecutive year and outperformed the family dining segment, but fell short of its target by 0.7%.

"Adjusted Earnings Per Share" (or "AEPS") is defined as total adjusted net income available to common stockholders divided by weighted average diluted shares. AEPS is considered to be a non-U.S. GAAP measure. Reconciliation of earnings per share to AEPS is provided in Appendix A.

"Free Cash Flow" is defined as cash provided by operating activities, plus net receipts from notes and equipment contracts receivable, less capital expenditures. Free cash flow is considered to be a non-U.S. GAAP measure. Reconciliation of the cash provided by operating activities to free cash flow is provided in Appendix A.

"Operating Profit" is defined as Segment Profit plus gains on asset dispositions, less Direct G&A and losses on asset dispositions. Segment Profit is defined as segment revenues less segment expenses. Direct G&A is defined as general and administrative expenses directly incurred at operating units excluding any allocation of shared service and general corporate overhead.

"Same-Restaurant Sales" is defined as sales, in any given fiscal year compared to the prior fiscal year, for restaurants that have been operated throughout both fiscal periods that are being compared and have been open for at least 18 months.

"Traffic", a growth performance indicator used by the Corporation and the restaurant industry, provides a measure of the change in number of guests visiting restaurants.

We believe the Corporation's 2015 compensation results were commensurate with the Corporation's performance, reflecting the Corporation's pay-for-performance philosophy.

20

- •

- No payouts were made under the Corporation's long-term performance based cash plan ("cash LTIP") covering fiscal years 2013 through

2015 based on the Corporation's TSR of 40.8% ranking at the 27th percentile of the VLRI. Awards under the cash LTIP represented approximately one-third of the annual long-term incentives

awarded to NEO's in 2013, including a cash LTIP target payout of $1,056,000 for Ms. Stewart. We believe this demonstrates the alignment of a material portion of our executives' compensation

with the Corporation's long-term performance and the interests of our stockholders.

- •

- Base salary merit increases for the NEOs ranged from 0% to 3.5%, excluding Mr. Layt, based on individual performance and

external market competitiveness. For the fourth consecutive year, Ms. Stewart did not receive an increase in base salary, reflecting the Compensation Committee's preference that

Ms. Stewart's overall compensation structure should emphasize corporate performance, the achievement of corporate goals, alignment with long-term stockholder interests and the creation of

stockholder value.

- •

- Annual cash incentive compensation received by the Corporation's NEOs under the 2015 Annual Incentive Plan ranged from 146.7% to 183.4% of each individual's target. Payout levels reflect the Corporation's strong overall performance for 2015, including with respect to AEPS and Applebee's and IHOP Business Unit Operating Profit, as well as reductions resulting from the failure to meet target (for the IHOP Business Unit) and threshold (for the Applebee's Business Unit) traffic growth performance metrics. See "Compensation Decisions Made in 2015" for additional detail regarding the 2015 Annual Incentive Plan.

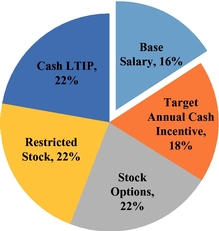

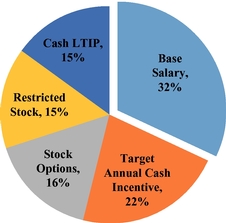

Additional information regarding 2015 NEO compensation can be found in the Summary Compensation Table below.