UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2019

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-15283

Dine Brands Global, Inc.

Dine Brands Global, Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 95-3038279 (I.R.S. Employer Identification No.) | |

450 North Brand Boulevard, Glendale, California (Address of principal executive offices) | 91203-1903 (Zip Code) | |

(818) 240-6055

(Registrant’s telephone number, including area code)

______________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o | |

Non-accelerated filer o | ||

Smaller reporting company o | ||

Emerging growth company o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which registered | |

Common Stock, $0.01 par value | DIN | New York Stock Exchange | |

As of April 25, 2019, the Registrant had 17,535,046 shares of Common Stock outstanding.

Dine Brands Global, Inc. and Subsidiaries

Index

Page | ||

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this Quarterly Report on Form 10-Q may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results to be materially different from those expressed or implied in such statements. You can identify these forward-looking statements by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan,” “goal” and other similar expressions. You should consider our forward-looking statements in light of the risks discussed under the heading “Risk Factors,” as well as our consolidated financial statements, related notes, and the other financial information appearing elsewhere in this report and our other filings with the United States Securities and Exchange Commission. The forward-looking statements contained in this report are made as of the date hereof and Dine Brands Global, Inc. does not intend to, nor does it assume any obligation to, update or supplement any forward-looking statements after the date of this report to reflect actual results or future events or circumstances.

Factors that could cause actual results to differ materially from the projections, forecasts, estimates and expectations discussed in this Quarterly Report on Form 10-Q include, among other things: general economic conditions; our level of indebtedness; compliance with the terms of our securitized debt; our ability to refinance our current indebtedness or obtain additional financing; our dependence on information technology; potential cyber incidents; the implementation of restaurant development plans; our dependence on our franchisees; the concentration of our Applebee’s franchised restaurants in a limited number of franchisees; the financial health of our franchisees, including any insolvency or bankruptcy; credit risks from our IHOP franchisees operating under our Previous IHOP Business Model; insufficient insurance coverage to cover potential risks associated with the ownership and operation of restaurants; our franchisees’ and other licensees’ compliance with our quality standards and trademark usage; general risks associated with the restaurant industry; potential harm to our brands’ reputation; risks of food-borne illness or food tampering; possible future impairment charges; trading volatility and fluctuations in the price of our stock; our ability to achieve the financial guidance we provide to investors; successful implementation of our business strategy; the availability of suitable locations for new restaurants; shortages or interruptions in the supply or delivery of products from third parties or availability of utilities; the management and forecasting of appropriate inventory levels; development and implementation of innovative marketing and use of social media; changing health or dietary preference of consumers; risks associated with doing business in international markets; the results of litigation and other legal proceedings; third-party claims with respect to intellectual property assets; delivery initiatives and use of third-party delivery vendors; our

1

allocation of human capital and our ability to attract and retain management and other key employees; compliance with federal, state and local governmental regulations; risks associated with our self-insurance; natural disasters or other serious incidents; our success with development initiatives outside of our core business; the adequacy of our internal controls over financial reporting and future changes in accounting standards.

Fiscal Quarter End

The Company’s fiscal quarters end on the Sunday closest to the last day of each calendar quarter. For convenience, the fiscal quarters of each year are referred to as ending on March 31, June 30, September 30 and December 31. The first fiscal quarter of 2019 began on December 31, 2018 and ended on March 31, 2019. The first fiscal quarter of 2018 began on January 1, 2018 and ended on April 1, 2018.

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

Dine Brands Global, Inc. and Subsidiaries

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

Assets | March 31, 2019 | December 31, 2018 | ||||||

(Unaudited) | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 132,932 | $ | 137,164 | ||||

Receivables, net | 97,786 | 137,504 | ||||||

Restricted cash | 36,654 | 48,515 | ||||||

Prepaid gift card costs | 30,045 | 38,195 | ||||||

Prepaid income taxes | 19,370 | 17,402 | ||||||

Other current assets | 5,980 | 3,410 | ||||||

Total current assets | 322,767 | 382,190 | ||||||

Other intangible assets, net | 583,040 | 585,889 | ||||||

Operating lease right-of-use assets | 383,962 | — | ||||||

Goodwill | 343,862 | 345,314 | ||||||

Property and equipment, net | 225,396 | 240,264 | ||||||

Long-term receivables, net | 99,582 | 103,102 | ||||||

Deferred rent receivable | 75,569 | 77,069 | ||||||

Non-current restricted cash | 14,700 | 14,700 | ||||||

Other non-current assets, net | 27,239 | 26,152 | ||||||

Total assets | $ | 2,076,117 | $ | 1,774,680 | ||||

Liabilities and Stockholders’ Deficit | ||||||||

Current liabilities: | ||||||||

Current maturities of long-term debt | $ | — | $ | 25,000 | ||||

Accounts payable | 37,726 | 43,468 | ||||||

Gift card liability | 115,974 | 160,438 | ||||||

Current maturities of operating lease obligations | 67,340 | — | ||||||

Current maturities of finance lease and financing obligations | 13,708 | 14,031 | ||||||

Accrued employee compensation and benefits | 15,338 | 27,479 | ||||||

Dividends payable | 12,461 | 11,389 | ||||||

Deferred franchise revenue, short-term | 10,376 | 10,138 | ||||||

Other accrued expenses | 30,167 | 24,243 | ||||||

Total current liabilities | 303,090 | 316,186 | ||||||

Long-term debt, less current maturities | 1,274,916 | 1,274,087 | ||||||

Operating lease obligations, less current maturities | 386,364 | — | ||||||

Finance lease obligations, less current maturities | 87,624 | 87,762 | ||||||

Financing obligations, less current maturities | 38,306 | 38,482 | ||||||

Deferred income taxes, net | 102,074 | 105,816 | ||||||

Deferred franchise revenue, long-term | 62,472 | 64,557 | ||||||

Other non-current liabilities | 12,092 | 90,063 | ||||||

Total liabilities | 2,266,938 | 1,976,953 | ||||||

Commitments and contingencies | ||||||||

Stockholders’ deficit: | ||||||||

Common stock, $0.01 par value; shares: 40,000,000 authorized; March 31, 2019 - 24,974,665 issued, 17,650,765 outstanding; December 31, 2018 - 24,984,898 issued, 17,644,267 outstanding | 250 | 250 | ||||||

Additional paid-in-capital | 239,585 | 237,726 | ||||||

Retained earnings | 24,588 | 10,414 | ||||||

Accumulated other comprehensive loss | (61 | ) | (60 | ) | ||||

Treasury stock, at cost; shares: March 31, 2019 - 7,323,900; December 31, 2018 - 7,340,631 | (455,183 | ) | (450,603 | ) | ||||

Total stockholders’ deficit | (190,821 | ) | (202,273 | ) | ||||

Total liabilities and stockholders’ deficit | $ | 2,076,117 | $ | 1,774,680 | ||||

See the accompanying Notes to Consolidated Financial Statements.

3

Dine Brands Global, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In thousands, except per share amounts)

(Unaudited)

Three Months Ended | ||||||||

March 31, | ||||||||

2019 | 2018 | |||||||

Revenues: | ||||||||

Franchise revenues: | ||||||||

Royalties, franchise fees and other | $ | 96,296 | $ | 91,477 | ||||

Advertising revenue | 72,630 | 63,836 | ||||||

Total franchise revenues | 168,926 | 155,313 | ||||||

Company restaurant sales | 35,735 | — | ||||||

Rental revenues | 30,711 | 30,841 | ||||||

Financing revenues | 1,810 | 2,009 | ||||||

Total revenues | 237,182 | 188,163 | ||||||

Cost of revenues: | ||||||||

Franchise expenses: | ||||||||

Advertising expenses | 72,630 | 63,836 | ||||||

Other franchise expenses | 7,673 | 18,036 | ||||||

Total franchise expenses | 80,303 | 81,872 | ||||||

Company restaurant expenses | 31,538 | — | ||||||

Rental expenses: | ||||||||

Interest expense from finance leases | 1,529 | 1,877 | ||||||

Other rental expenses | 21,095 | 20,764 | ||||||

Total rental expenses | 22,624 | 22,641 | ||||||

Financing expenses | 146 | 150 | ||||||

Total cost of revenues | 134,611 | 104,663 | ||||||

Gross profit | 102,571 | 83,500 | ||||||

General and administrative expenses | 42,819 | 41,911 | ||||||

Interest expense, net | 15,393 | 15,199 | ||||||

Amortization of intangible assets | 2,924 | 2,502 | ||||||

Closure and impairment charges | 194 | 2,604 | ||||||

Loss (gain) on disposition of assets | 109 | (1,427 | ) | |||||

Income before income tax provision | 41,132 | 22,711 | ||||||

Income tax provision | (9,489 | ) | (5,638 | ) | ||||

Net income | 31,643 | 17,073 | ||||||

Other comprehensive income (loss) net of tax: | ||||||||

Adjustment to unrealized loss on available-for-sale investments | — | 50 | ||||||

Foreign currency translation adjustment | (1 | ) | (3 | ) | ||||

Total comprehensive income | $ | 31,642 | $ | 17,120 | ||||

Net income available to common stockholders: | ||||||||

Net income | $ | 31,643 | $ | 17,073 | ||||

Less: Net income allocated to unvested participating restricted stock | (1,111 | ) | (568 | ) | ||||

Net income available to common stockholders | $ | 30,532 | $ | 16,505 | ||||

Net income available to common stockholders per share: | ||||||||

Basic | $ | 1.76 | $ | 0.93 | ||||

Diluted | $ | 1.73 | $ | 0.92 | ||||

Weighted average shares outstanding: | ||||||||

Basic | 17,343 | 17,703 | ||||||

Diluted | 17,690 | 17,845 | ||||||

See the accompanying Notes to Consolidated Financial Statements.

4

Dine Brands Global, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Deficit

(In thousands)

(Unaudited)

Common Stock | Accumulated Other Comprehensive Loss | Treasury Stock | ||||||||||||||||||||||||||||

Shares Outstanding | Amount | Additional Paid-in Capital | Retained Earnings (Accumulated Deficit) | Shares | Cost | Total | ||||||||||||||||||||||||

Balance at December 31, 2017 | 17,993 | $ | 250 | $ | 276,408 | $ | (69,940 | ) | $ | (105 | ) | 7,029 | $ | (422,153 | ) | $ | (215,540 | ) | ||||||||||||

Net income | — | — | — | 17,073 | — | — | — | 17,073 | ||||||||||||||||||||||

Other comprehensive gain | — | — | — | — | 47 | — | — | 47 | ||||||||||||||||||||||

Purchase of Company common stock | (139 | ) | — | — | — | — | 139 | (10,003 | ) | (10,003 | ) | |||||||||||||||||||

Reissuance of treasury stock | 77 | — | (2,495 | ) | — | — | (77 | ) | 2,951 | 456 | ||||||||||||||||||||

Net issuance of shares for stock plans | 6 | — | — | — | — | — | — | — | ||||||||||||||||||||||

Repurchase of restricted shares for taxes | (15 | ) | — | (1,083 | ) | — | — | — | — | (1,083 | ) | |||||||||||||||||||

Stock-based compensation | — | — | 3,368 | — | — | — | — | 3,368 | ||||||||||||||||||||||

Dividends on common stock in excess of retained earnings | — | — | (11,204 | ) | — | — | — | — | (11,204 | ) | ||||||||||||||||||||

Balance at March 31, 2018 | 17,922 | $ | 250 | $ | 264,994 | $ | (52,867 | ) | $ | (58 | ) | 7,091 | $ | (429,205 | ) | $ | (216,886 | ) | ||||||||||||

Common Stock | Accumulated Other Comprehensive Loss | Treasury Stock | ||||||||||||||||||||||||||||

Shares Outstanding | Amount | Additional Paid-in Capital | Retained Earnings | Shares | Cost | Total | ||||||||||||||||||||||||

Balance at December 31, 2018 | 17,644 | $ | 250 | $ | 237,726 | $ | 10,414 | $ | (60 | ) | 7,341 | $ | (450,603 | ) | $ | (202,273 | ) | |||||||||||||

Adoption of ASC 842 (Note 3) | — | — | — | (5,030 | ) | — | — | — | (5,030 | ) | ||||||||||||||||||||

Net income | — | — | — | 31,643 | — | — | — | 31,643 | ||||||||||||||||||||||

Other comprehensive loss | — | — | — | — | (1 | ) | — | — | (1 | ) | ||||||||||||||||||||

Purchase of Company common stock | (151 | ) | — | — | — | — | 151 | (12,015 | ) | (12,015 | ) | |||||||||||||||||||

Reissuance of treasury stock | 168 | — | (667 | ) | — | — | (168 | ) | 7,435 | 6,768 | ||||||||||||||||||||

Net issuance of shares for stock plans | 9 | — | — | — | — | — | — | — | ||||||||||||||||||||||

Repurchase of restricted shares for taxes | (19 | ) | — | (1,817 | ) | — | — | — | — | (1,817 | ) | |||||||||||||||||||

Stock-based compensation | — | — | 4,107 | — | — | — | — | 4,107 | ||||||||||||||||||||||

Dividends on common stock | — | — | 236 | (12,439 | ) | — | — | — | (12,203 | ) | ||||||||||||||||||||

Balance at March 31, 2019 | 17,651 | $ | 250 | $ | 239,585 | $ | 24,588 | $ | (61 | ) | 7,324 | $ | (455,183 | ) | $ | (190,821 | ) | |||||||||||||

5

Dine Brands Global, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

Three Months Ended | ||||||||

March 31, | ||||||||

2019 | 2018 | |||||||

Cash flows from operating activities: | ||||||||

Net income | $ | 31,643 | $ | 17,073 | ||||

Adjustments to reconcile net income to cash flows provided by operating activities: | ||||||||

Depreciation and amortization | 10,179 | 7,940 | ||||||

Non-cash stock-based compensation expense | 4,107 | 3,368 | ||||||

Non-cash interest expense | 1,118 | 864 | ||||||

Closure and impairment charges | 194 | 2,594 | ||||||

Deferred income taxes | (1,149 | ) | (1,182 | ) | ||||

Loss (gain) on disposition of assets | 109 | (1,421 | ) | |||||

Other | (3,976 | ) | (6,199 | ) | ||||

Changes in operating assets and liabilities: | ||||||||

Accounts receivable, net | (3,210 | ) | (8,804 | ) | ||||

Current income tax receivables and payables | (1,399 | ) | 5,529 | |||||

Gift card receivables and payables | (890 | ) | (2,269 | ) | ||||

Other current assets | (2,570 | ) | 5,709 | |||||

Accounts payable | 1,826 | 65 | ||||||

Accrued employee compensation and benefits | (12,141 | ) | (3,448 | ) | ||||

Other current liabilities | 5,088 | (3,351 | ) | |||||

Cash flows provided by operating activities | 28,929 | 16,468 | ||||||

Cash flows from investing activities: | ||||||||

Principal receipts from notes, equipment contracts and other long-term receivables | 5,260 | 4,930 | ||||||

Additions to property and equipment | (4,717 | ) | (3,488 | ) | ||||

Proceeds from sale of property and equipment | 400 | 655 | ||||||

Additions to long-term receivables | (395 | ) | (2,325 | ) | ||||

Other | (100 | ) | (27 | ) | ||||

Cash flows provided by (used in) investing activities | 448 | (255 | ) | |||||

Cash flows from financing activities: | ||||||||

Repayment of Variable Funding Notes | (25,000 | ) | — | |||||

Repayment of long-term debt | — | (3,250 | ) | |||||

Dividends paid on common stock | (11,153 | ) | (17,453 | ) | ||||

Repurchase of common stock | (10,802 | ) | (10,003 | ) | ||||

Principal payments on financing lease obligations | (3,466 | ) | (4,536 | ) | ||||

Proceeds from stock options exercised | 6,768 | 456 | ||||||

Tax payments for restricted stock upon vesting | (1,817 | ) | (1,083 | ) | ||||

Cash flows used in financing activities | (45,470 | ) | (35,869 | ) | ||||

Net change in cash, cash equivalents and restricted cash | (16,093 | ) | (19,656 | ) | ||||

Cash, cash equivalents and restricted cash at beginning of period | 200,379 | 163,146 | ||||||

Cash, cash equivalents and restricted cash at end of period | $ | 184,286 | $ | 143,490 | ||||

Supplemental disclosures: | ||||||||

Interest paid in cash | $ | 16,346 | $ | 16,621 | ||||

Income taxes paid in cash | $ | 12,014 | $ | 934 | ||||

See the accompanying Notes to Consolidated Financial Statements.

6

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

1. General

The accompanying unaudited consolidated financial statements of Dine Brands Global, Inc. (the “Company” or “Dine Brands Global”) have been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. The operating results for the three months ended March 31, 2019 are not necessarily indicative of the results that may be expected for the twelve months ending December 31, 2019.

The consolidated balance sheet at December 31, 2018 has been derived from the audited consolidated financial statements at that date but does not include all of information and footnotes required by U.S. GAAP for complete financial statements.

These consolidated financial statements should be read in conjunction with the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018.

2. Basis of Presentation

The Company’s fiscal quarters end on the Sunday closest to the last day of each calendar quarter. For convenience, the fiscal quarters of each year are referred to as ending on March 31, June 30, September 30 and December 31. The first fiscal quarter of 2019 began on December 31, 2018 and ended on March 31, 2019. The first fiscal quarter of 2018 began on January 1, 2018 and ended on April 1, 2018.

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries that are consolidated in accordance with U.S. GAAP. All intercompany balances and transactions have been eliminated.

The preparation of financial statements in conformity with U.S. GAAP requires the Company’s management to make assumptions and estimates that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities, if any, at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant estimates are made in the calculation and assessment of the following: impairment of goodwill, other intangible assets and tangible assets; income taxes; allowance for doubtful accounts and notes receivables; lease accounting estimates; contingencies; and stock-based compensation. On an ongoing basis, the Company evaluates its estimates based on historical experience, current conditions and various other assumptions that are believed to be reasonable under the circumstances. The Company adjusts such estimates and assumptions when facts and circumstances dictate. Actual results could differ from those estimates.

3. Accounting Standards Adopted and Newly Issued Accounting Standards Not Yet Adopted

Accounting Standards Adopted

In February 2016, the Financial Accounting Standards Board (“FASB”) issued guidance with respect to the accounting for leases, as codified in Accounting Standards Topic 842 (“ASC 842”). The guidance is intended to improve financial reporting of leasing transactions by requiring entities that lease assets to recognize assets and liabilities for the rights and obligations created by leases, as well as requiring additional disclosures related to an entity's leasing activities. The Company adopted this change in accounting principle using the modified retrospective method as of the first day of the first fiscal quarter of 2019. Accordingly, financial information for periods prior to the date of initial application has not been adjusted. The Company has elected the package of practical expedients for adoption that permitted the Company not to reassess its prior conclusions regarding lease identification, lease classification and initial direct costs. The Company did not elect to use an allowable expedient that permitted the use of hindsight in performing evaluations of its leases.

Upon adoption of ASC 842, the Company recognized operating lease obligations of $453.0 million, which represents the present value of the remaining minimum lease payments, discounted using the Company's incremental borrowing rate. The Company recognized operating lease right-of-use assets of $395.6 million. The Company recognized an adjustment to retained earnings upon adoption of $5.0 million, net of tax of $1.7 million, primarily related to an impairment resulting from an unfavorable differential between lease payments to be made and sublease rentals to be received on certain leases. The remaining difference of $50.7 million between the recognized operating lease obligation and right-of-use assets relates to the derecognition of certain liabilities and assets that had been recorded in accordance with U.S. GAAP that had been applied prior

7

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

3. Accounting Standards Adopted and Newly Issued Accounting Standards Not Yet Adopted (Continued)

to the adoption of ASC 842, primarily $43.3 million of accrued rent payments. Lease-related reserves for lease incentives, closed restaurants and unfavorable leaseholds were also derecognized.

The accounting for the Company's existing finance (capital) leases upon adoption of ASC 842 remained substantially unchanged. Adoption of ASC 842 had no significant impact on the Company's cash flows from operations or its results of operations and did not impact any covenant related to the Company's long-term debt. The Company implemented internal controls necessary to ensure compliance with the accounting and disclosure requirements of ASC 842.

Additional new accounting guidance became effective for the Company as of the beginning of fiscal 2019 that the Company reviewed and concluded was either not applicable to its operations or had no material effect on its consolidated financial statements in the current or future fiscal years.

Newly Issued Accounting Standards Not Yet Adopted

In June 2016, the FASB issued new guidance on the measurement of credit losses on financial instruments. The new guidance will replace the incurred loss methodology of recognizing credit losses on financial instruments that is currently required with a methodology that estimates the expected credit loss on financial instruments and reflects the net amount expected to be collected on the financial instrument. Application of the new guidance may result in the earlier recognition of credit losses as the new methodology will require entities to consider forward-looking information in addition to historical and current information used in assessing incurred losses. The Company will be required to adopt the new guidance on a modified retrospective basis beginning with its first fiscal quarter of 2020, with early adoption permitted in its first fiscal quarter of 2019. The Company is currently evaluating the impact of the new guidance on its consolidated financial statements and related disclosures.

In August 2018, the FASB issued guidance designed to improve the effectiveness of disclosures by removing, modifying and adding disclosures related to fair value measurements. The Company will be required to adopt the new guidance beginning with its first fiscal quarter of 2020; early adoption in any interim period after issuance of the new guidance is permitted. The Company is currently assessing the impact this guidance will have on its consolidated financial statements.

In August 2018, the FASB issued new guidance on the accounting for implementation costs incurred in a cloud computing arrangement that is a service contract. The guidance aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with existing guidance for capitalizing implementation cost incurred to develop or obtain internal-use software. The guidance also provides presentation and disclosure requirements for such capitalized costs. The Company will be required to adopt the new guidance beginning with its first fiscal quarter of 2020; early adoption in any interim period after issuance of the new guidance is permitted. The Company is currently assessing the impact this guidance will have on its consolidated financial statements.

The Company reviewed all other newly issued accounting pronouncements and concluded that they either are not applicable to the Company's operations or that no material effect is expected on the Company's financial statements because of future adoption.

4. Revenue Disclosures

Franchise revenue (which comprises most of the Company's revenues) and revenue from company-operated restaurants are recognized in accordance with ASC 606. Under ASC 606, revenue is recognized upon transfer of control of promised services or goods to customers in an amount that reflects the consideration the Company expects to receive for those services or goods.

Franchising Activities

The Company owns and franchises the Applebee’s and IHOP restaurant concepts. The franchise arrangement for both brands is documented in the form of a franchise agreement and, in most cases, a development agreement. The franchise arrangement between the Company as the franchisor and the franchisee as the customer requires the Company to perform various activities to support the brand that do not directly transfer goods and services to the franchisee, but instead represent a single performance obligation, which is the transfer of the franchise license. The intellectual property subject to the franchise license is symbolic intellectual property as it does not have significant standalone functionality, and substantially all the utility is derived from its association with the Company’s past or ongoing activities. The nature of the Company’s promise in granting the franchise license is to provide the franchisee with access to the brand’s symbolic intellectual property over the term of the license. The services provided by the Company are highly interrelated with the franchise license and as such are considered to represent a single performance obligation.

8

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

4. Revenue Disclosures (Continued)

The transaction price in a standard franchise arrangement for both brands primarily consists of (a) initial franchise/development fees; (b) continuing franchise fees (royalties); and (c) advertising fees. Since the Company considers the licensing of the franchising right to be a single performance obligation, no allocation of the transaction price is required. Additionally, all domestic IHOP franchise agreements require franchisees to purchase proprietary pancake and waffle dry mix from the Company.

The Company recognizes the primary components of the transaction price as follows:

• | Franchise and development fees are recognized as revenue ratably on a straight-line basis over the term of the franchise agreement commencing with the restaurant opening date. As these fees are typically received in cash at or near the beginning of the franchise term, the cash received is initially recorded as a contract liability until recognized as revenue over time; |

• | The Company is entitled to royalties and advertising fees based on a percentage of the franchisee's gross sales as defined in the franchise agreement. Royalty and advertising revenue are recognized when the franchisee's reported sales occur. Depending on timing within a fiscal period, the recognition of revenue results in either what is considered a contract asset (unbilled receivable) or, once billed, accounts receivable, on the balance sheet. |

• | Revenue from the sales of proprietary pancake and waffle dry mix is recognized in the period in which distributors ship the franchisee's order; recognition of revenue results in accounts receivable on the balance sheet. |

Company Restaurant Revenue

Sales by company-operated restaurants are recognized when food and beverage items are sold. Company restaurant sales are reported net of sales taxes collected from guests that are remitted to the appropriate taxing authorities.

In determining the amount and timing of revenue from contracts with customers, the Company exercises significant judgment with respect to collectibility of the amount; however, the timing of recognition does not require significant judgments as it is based on either the term of the franchise agreement, the month of reported sales by the franchisee or the date of product shipment, none of which require estimation. The Company does not incur a significant amount of contract acquisition costs in conducting its franchising activities. The Company believes its franchising arrangements do not contain a significant financing component.

The following table disaggregates franchise revenue by major type for the three months ended March 31, 2019 and 2018:

Three Months Ended | ||||||||

March 31, | ||||||||

2019 | 2018 | |||||||

(In thousands) | ||||||||

Franchise Revenue: | ||||||||

Royalties | $ | 78,730 | $ | 75,097 | ||||

Advertising fees | 72,630 | 63,836 | ||||||

Pancake and waffle dry mix sales and other | 14,431 | 13,097 | ||||||

Franchise and development fees | 3,135 | 3,283 | ||||||

Total franchise revenue | $ | 168,926 | $ | 155,313 | ||||

Receivables from franchisees as of March 31, 2019 and December 31, 2018 were $67.1 million (net of allowance of $2.1 million) and $62.6 million (net of allowance of $4.6 million), respectively, and were included in receivables, net in the Consolidated Balance Sheets.

9

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

4. Revenue Disclosures (Continued)

Changes in the Company's contract liability for deferred franchise and development fees during the three months ended March 31, 2019 are as follows:

Deferred Franchise Revenue (short- and long-term) | ||||

(In thousands) | ||||

Balance at December 31, 2018 | $ | 74,695 | ||

Recognized as revenue during the three months ended March 31, 2019 | (2,948 | ) | ||

Fees deferred during the three months ended March 31, 2019 | 1,101 | |||

Balance at March 31, 2019 | $ | 72,848 | ||

The balance of deferred revenue as of March 31, 2019 is expected to be recognized as follows:

(In thousands) | |||

Remainder of 2019 | $ | 6,633 | |

2020 | 10,066 | ||

2021 | 7,780 | ||

2022 | 7,251 | ||

2023 | 6,675 | ||

2024 | 5,987 | ||

Thereafter | 28,456 | ||

Total | $ | 72,848 | |

5. Lease Disclosures

The Company engages in leasing activity as both a lessee and a lessor. The majority of the Company's lease portfolio originated when the Company was actively involved in the development and financing of IHOP restaurants prior to the franchising of the restaurant to the franchisee. This activity included the Company's leasing or purchase of the site on which the restaurant was located and subsequently leasing/subleasing the site to the franchisee. With a few exceptions, the Company ended this practice in 2003 and the Company's current lease activity is predominantly comprised of renewals of existing lease arrangements and exercises of options on existing lease arrangements.

The Company currently leases from third parties the real property on which approximately 620 IHOP franchisee-operated restaurants are located; the Company (as lessor) subleases the property to the franchisees that operate those restaurants. The Company also leases property it owns to the franchisees that operate approximately 60 IHOP restaurants and one Applebee's restaurant. The Company leases from third parties the real property on which 69 Applebee's company-operated restaurants are located. The Company also leases office space for its principal corporate office in Glendale, California and a restaurant support center in Kansas City, Missouri. The Company does not have a significant amount of non-real estate leases.

The Company's existing leases related to IHOP restaurants generally provided for an initial term of 20 to 25 years with most having one or more five-year renewal options. Option periods were not included in determining liabilities and right-of-use assets related to operating leases. Approximately 260 of the Company's leases contain provisions requiring additional rent payments to the Company (as lessor) based on a percentage of restaurant sales. Approximately 220 of the Company's leases contain provisions requiring additional rent payments by the Company (as lessee) based on a percentage of restaurant sales.

The individual lease agreements do not provide information to determine the implicit rate in the agreements. The Company made significant judgments in determining the incremental borrowing rates that were used in calculating operating lease liabilities as of the adoption date. Due to the large number of leases, the Company applied a portfolio approach by grouping the leases based on the original lease term. The Company estimated the rate for each grouping primarily by reference to yield rates on debt issuances by companies of a similar credit rating as the Company, U.S. Treasury rates as of the adoption date and adjustments for differences in years to maturity.

10

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

5. Lease Disclosures (Continued)

The Company's lease cost for the three months ended March 31, 2019 was as follows:

Finance lease cost: | (In millions) | ||

Amortization of right-of-use assets | $ | 1.3 | |

Interest on lease liabilities | 2.1 | ||

Operating lease cost | 26.4 | ||

Variable lease cost | 0.7 | ||

Short-term lease cost | 0.0 | ||

Sublease income | (28.1 | ) | |

Lease cost | $ | 2.4 | |

Future minimum lease payments under noncancelable leases as lessee as of March 31, 2019 were as follows:

Finance Leases | Operating Leases | ||||||

(In millions) | |||||||

2019 (remaining nine months) | $ | 15.8 | $ | 69.0 | |||

2020 | 20.1 | 93.0 | |||||

2021 | 16.5 | 76.0 | |||||

2022 | 14.7 | 68.0 | |||||

2023 | 11.6 | 55.6 | |||||

Thereafter | 65.0 | 212.7 | |||||

Total minimum lease payments | 143.7 | 574.3 | |||||

Less: interest/imputed interest | (43.1 | ) | (120.6 | ) | |||

Total obligations | 100.6 | 453.7 | |||||

Less: current portion | (13.0 | ) | (67.3 | ) | |||

Long-term lease obligations | $ | 87.6 | $ | 386.4 | |||

The weighted average remaining lease term as of March 31, 2019 was 8.6 years for finance leases and 8.1 years for operating leases. The weighted average discount rate as of March 31, 2019 was 10.4% for finance leases and 5.8% for operating leases.

During the three months ended March 31, 2019, the Company made the following payments for leases:

(In millions) | |||

Principal payments on finance lease obligations | $ | 3.5 | |

Interest payments on finance lease obligations | $ | 2.0 | |

Payments on operating leases | $ | 22.9 | |

Variable lease payments | $ | 0.9 | |

The Company's income from operating leases for the three months ended March 31, 2019 was as follows:

(In millions) | |||

Minimum lease payments | $ | 25.7 | |

Variable lease income | 3.2 | ||

Total operating lease income | $ | 28.9 | |

11

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

5. Lease Disclosures (Continued)

Future minimum payments to be received as lessor under noncancelable operating leases as of March 31, 2019 were as follows:

(In millions) | |||

2019 (remaining nine months) | $ | 79.5 | |

2020 | 107.1 | ||

2021 | 101.2 | ||

2022 | 98.1 | ||

2023 | 93.7 | ||

Thereafter | 288.3 | ||

Total minimum rents receivable | 767.9 | ||

The Company's income from direct financing leases for the three months ended March 31, 2019 was as follows:

(In millions) | |||

Interest income | $ | 1.4 | |

Variable lease income | 0.4 | ||

Total operating lease income | $ | 1.8 | |

Future minimum payments to be received as lessor under noncancelable direct financing leases as of March 31, 2019 were as follows:

(In millions) | |||

2019 (remaining nine months) | $ | 12.1 | |

2020 | 14.8 | ||

2021 | 11.7 | ||

2022 | 8.4 | ||

2023 | 3.6 | ||

Thereafter | 3.7 | ||

Total minimum rents receivable | 54.3 | ||

Less: unearned income | (11.4 | ) | |

Total net investment in direct financing leases | 42.9 | ||

Less: current portion | (11.2 | ) | |

Long-term investment in direct financing leases | $ | 31.7 | |

6. Long-Term Debt

At March 31, 2019 and December 31, 2018, long-term debt consisted of the following:

March 31, 2019 | December 31, 2018 | ||||||

(In millions) | |||||||

Series 2014-1 4.277% Fixed Rate Senior Secured Notes, Class A-2 | $ | 1,283.8 | $ | 1,283.8 | |||

Series 2018-1 Variable Funding Senior Notes Class A-1, variable interest rate of 4.93% at December 31, 2018 | — | 25.0 | |||||

Class A-2 Note debt issuance costs | (8.9 | ) | (9.7 | ) | |||

Long-term debt, net of debt issuance costs | 1,274.9 | 1,299.1 | |||||

Current portion of long-term debt | — | (25.0 | ) | ||||

Long-term debt | $ | 1,274.9 | $ | 1,274.1 | |||

For a description of the Series 2014-1 4.277% Fixed Rate Senior Secured Notes, Class A-2 and the Series 2018-1 Variable Funding Notes Class A-1, refer to Note 8 of the Notes to Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018.

12

DineEquity, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

6. Long-Term Debt (Continued)

During the three months ended March 31, 2019, the Company repaid $25.0 million of Variable Funding Notes, representing the amount outstanding at December 31, 2018. The Company did not draw on the Variable Funding Notes during the three months ended March 31, 2019. The maximum amount of Variable Funding Notes outstanding during the three months ended March 31, 2019 was $25.0 million and the weighted average interest rate on the Variable Funding Notes for the period outstanding was 4.88%.

At March 31, 2019, $2.2 million was pledged against the Variable Funding Notes for outstanding letters of credit, leaving $222.8 million of 2018 Variable Funding Notes available for borrowing. The letters of credit are used primarily to satisfy insurance-related collateral requirements.

7. Stockholders' Deficit

Dividends

During the three months ended March 31, 2019, the Company paid dividends on common stock of $11.2 million, representing a cash dividend of $0.63 per share declared in the fourth quarter of 2018. On February 20, 2019, the Company's Board of Directors declared a first quarter 2019 cash dividend of $0.69 per share of common stock. This dividend was paid on April 5, 2019 to stockholders of record at the close of business on March 20, 2019. The Company reported dividends payable of $12.5 million at March 31, 2019.

Dividends declared and paid per share for the three months ended March 31, 2019 and 2018 were as follows:

Three months ended March 31, | |||||||

2019 | 2018 | ||||||

Dividends declared per common share | $ | 0.69 | $ | 0.63 | |||

Dividends paid per common share | $ | 0.63 | $ | 0.97 | |||

Stock Repurchase Program

In February 2019, the Company’s Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to $200 million of the Company’s common stock (“2019 Repurchase Program”) on an opportunistic basis from time to time in the open market or in privately negotiated transactions based on business, market, applicable legal requirements and other considerations. The 2019 Repurchase Program, as approved by the Board of Directors, does not require the repurchase of a specific number of shares and can be terminated at any time.

In October 2015, the Company's Board of Directors approved a stock repurchase program authorizing the Company to repurchase up to $150 million of its common stock (the “2015 Repurchase Program”) on an opportunistic basis from time to time in open market transactions and in privately negotiated transactions based on business, market, applicable legal requirements and other considerations. The 2015 Repurchase Program, as approved by the Board of Directors, did not require the repurchase of a specific number of shares and could be terminated at any time. In connection with the approval of the 2019 Repurchase Program, the Board of Directors terminated the 2015 Repurchase Program.

A summary of shares repurchased under the 2019 Repurchase Program and the 2015 Repurchase Program, during the three months ended March 31, 2019 and cumulatively, is as follows:

Shares | Cost of shares | |||||

(In millions) | ||||||

2019 Repurchase Program: | ||||||

Repurchased during the three months ended March 31, 2019 | 40,817 | $ | 3.6 | |||

Cumulative (life-of-program) repurchases | 40,817 | $ | 3.6 | |||

Remaining dollar value of shares that may be repurchased | n/a | $ | 196.4 | |||

2015 Repurchase Program: | ||||||

Repurchased during the three months ended March 31, 2019 | 110,499 | $ | 8.4 | |||

Cumulative (life-of-program) repurchases | 1,589,995 | $ | 126.2 | |||

Remaining dollar value of shares that may be repurchased | n/a | n/a | ||||

13

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

7. Stockholders' Deficit (Continued)

Treasury Stock

Repurchases of the Company's common stock are included in treasury stock at the cost of shares repurchased plus any transaction costs. Treasury stock may be re-issued when stock options are exercised, when restricted stock awards are granted and when restricted stock units settle in stock upon vesting. The cost of treasury stock re-issued is determined using the first-in, first-out (“FIFO”) method. During the three months ended March 31, 2019, the Company re-issued 168,047 shares of treasury stock at a total FIFO cost of $7.4 million.

8. Income Taxes

The Company's effective tax rate was 23.1% for the three months ended March 31, 2019 as compared to 24.8% for the three months ended March 31, 2018. The effective tax rate of 23.1% for the three months ended March 31, 2019 was lower than the rate of the prior period primarily due to excess tax benefits on stock-based compensation.

The total gross unrecognized tax benefit as of March 31, 2019 and December 31, 2018 was $5.2 million and $5.2 million, respectively, excluding interest, penalties and related tax benefits. The Company estimates the unrecognized tax benefit may decrease over the upcoming 12 months by an amount up to $0.9 million related to settlements with taxing authorities and the lapse of statutes of limitations. For the remaining liability, due to the uncertainties related to these tax matters, the Company is unable to make a reasonably reliable estimate as to when cash settlement with a taxing authority will occur.

As of March 31, 2019, accrued interest was $1.3 million and accrued penalties were less than $0.1 million, excluding any related income tax benefits. As of December 31, 2018, accrued interest was $1.1 million and accrued penalties were less than $0.1 million, excluding any related income tax benefits. The Company recognizes interest accrued related to unrecognized tax benefits and penalties as a component of its income tax provision recognized in its Consolidated Statements of Comprehensive Income.

The Company files federal income tax returns and the Company or one of its subsidiaries files income tax returns in various state and foreign jurisdictions. With few exceptions, the Company is no longer subject to federal, state or non-United States tax examinations by tax authorities for years before 2011. The Internal Revenue Service commenced examination of the Company’s U.S. federal income tax return for the tax years 2011 to 2013 in fiscal year 2016. The examination is anticipated to conclude during fiscal year 2019. The Company believes that adequate reserves have been provided relating to all matters contained in the tax periods open to examination.

9. Stock-Based Compensation

The following table summarizes the components of stock-based compensation expense included in general and administrative expenses in the Consolidated Statements of Comprehensive Income:

Three months ended March 31, | |||||||

2019 | 2018 | ||||||

(In millions) | |||||||

Total stock-based compensation expense: | |||||||

Equity classified awards expense | $ | 4.1 | $ | 3.4 | |||

Liability classified awards expense | 1.0 | 0.5 | |||||

Total pre-tax stock-based compensation expense | 5.1 | 3.9 | |||||

Book income tax benefit | (1.3 | ) | (1.0 | ) | |||

Total stock-based compensation expense, net of tax | $ | 3.8 | $ | 2.9 | |||

As of March 31, 2019, total unrecognized compensation expense of $24.1 million related to restricted stock and restricted stock units and $5.8 million related to stock options are expected to be recognized over a weighted average period of 1.7 years for restricted stock and restricted stock units and 1.8 years for stock options.

14

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

9. Stock-Based Compensation (Continued)

Fair Value Assumptions

The Company granted 132,832 stock options during the three months ended March 31, 2019 for which the fair value was estimated using a Black-Scholes option pricing model. The following summarizes the assumptions used in the Black-Scholes model:

Risk-free interest rate | 2.5 | % |

Weighted average historical volatility | 30.3 | % |

Dividend yield | 2.8 | % |

Expected years until exercise | 4.7 | |

Weighted average fair value of options granted | $21.93 | |

Equity Classified Awards - Stock Options

Stock option balances at March 31, 2019, and activity for the three months ended March 31, 2019 were as follows:

Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (in Years) | Aggregate Intrinsic Value (in Millions) | ||||||||||

Outstanding at December 31, 2018 | 1,439,708 | $ | 63.21 | ||||||||||

Granted | 132,832 | 98.97 | |||||||||||

Exercised | (116,590 | ) | 58.05 | ||||||||||

Outstanding at March 31, 2019 | 1,455,950 | 66.88 | 6.8 | $ | 38.2 | ||||||||

Vested at March 31, 2019 and Expected to Vest | 1,311,896 | 67.76 | 6.6 | $ | 33.3 | ||||||||

Exercisable at March 31, 2019 | 682,494 | $ | 75.92 | 4.6 | $ | 12.1 | |||||||

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the closing stock price of the Company’s common stock on the last trading day of the first quarter of 2019 and the exercise price, multiplied by the number of in-the-money options) that would have been received by the option holders had all option holders exercised their options on March 31, 2019. The aggregate intrinsic value will change based on the fair market value of the Company’s common stock and the number of in-the-money options.

Equity Classified Awards - Restricted Stock and Restricted Stock Units

Outstanding balances as of March 31, 2019, and activity related to restricted stock and restricted stock units for the three months ended March 31, 2019 were as follows:

Restricted Stock | Weighted Average Grant Date Fair Value | Stock-Settled Restricted Stock Units | Weighted Average Grant Date Fair Value | |||||||||||

Outstanding at December 31, 2018 | 267,242 | $ | 63.97 | 374,529 | $ | 31.05 | ||||||||

Granted | 51,457 | 98.58 | 13,464 | 98.97 | ||||||||||

Released | (48,022 | ) | 79.60 | (12,293 | ) | 90.34 | ||||||||

Forfeited | (2,562 | ) | 48.22 | — | — | |||||||||

Outstanding at March 31, 2019 | 268,115 | $ | 69.96 | 375,700 | $ | 30.95 | ||||||||

15

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

9. Stock-Based Compensation (Continued)

Liability Classified Awards - Cash-settled Restricted Stock Units

The Company has granted cash-settled restricted stock units to certain employees. These instruments are recorded as liabilities at fair value as of the respective period end.

Cash-Settled Restricted Stock Units | Weighted Average Grant Date Fair Value | ||||||

Outstanding at December 31, 2018 | 53,766 | $ | 94.77 | ||||

Granted | 19,736 | 91.05 | |||||

Released | (317 | ) | 82.16 | ||||

Forfeited | (3,622 | ) | 98.96 | ||||

Outstanding at March 31, 2019 | 69,563 | $ | 93.58 | ||||

For the three months ended March 31, 2019, and 2018, $0.6 million and $0.1 million, respectively, was included as stock-based compensation expense related to cash-settled restricted stock units.

Liability Classified Awards - Long-Term Incentive Awards

The Company has granted cash long-term incentive awards (“LTIP awards”) to certain employees. Annual LTIP awards vest over a three-year period and are determined using multipliers from 0% to 200% of the target award based on (i) the total stockholder return of Dine Brands Global common stock compared to the total stockholder returns of a peer group of companies and (ii) the percentage increase in the Company's adjusted earnings per share (as defined). The awards are considered stock-based compensation and are classified as liabilities measured at fair value as of the respective period end. For the three months ended March 31, 2019 and 2018, $0.4 million and $0.4 million, respectively were included in total stock-based compensation expense related to LTIP awards. At March 31, 2019 and December 31, 2018, liabilities of $1.7 million and $2.4 million, respectively, related to LTIP awards were included as part of accrued employee compensation and benefits in the Consolidated Balance Sheets.

10. Segments

The Company identifies its reporting segments based on the organizational units used by management to monitor performance and make operating decisions. The Company currently has five operating segments: Applebee's franchise operations, Applebee's company-operated restaurant operations, IHOP franchise operations, rental operations and financing operations. The Company has four reportable segments: franchise operations, (an aggregation of Applebee's and IHOP franchise operations), company-operated restaurant operations, rental operations and financing operations. The Company considers these to be its reportable segments, regardless of whether any segment exceeds 10% of consolidated revenues, income before income tax provision or total assets.

As of March 31, 2019, the franchise operations segment consisted of (i) 1,761 restaurants operated by Applebee’s franchisees in the United States, two U.S. territories and 13 countries outside the United States and (ii) 1,822 restaurants operated by IHOP franchisees and area licensees in the United States, three U.S. territories and 12 countries outside the United States. Franchise operations revenue consists primarily of franchise royalty revenues, franchise advertising revenue, sales of proprietary products to franchisees (primarily pancake and waffle dry mixes for the IHOP restaurants), and franchise fees. Franchise operations expenses include advertising expenses, the cost of IHOP proprietary products, bad debt expense, franchisor contributions to marketing funds, pre-opening training expenses and other franchise-related costs.

Company restaurant sales are retail sales at company-operated restaurants. Company restaurant expenses are operating expenses at company-operated restaurants and include food, labor, utilities, rent and other restaurant operating costs.

Rental operations revenue includes revenue from operating leases and interest income from direct financing leases. Rental operations expenses are costs of operating leases and interest expense from capital leases on franchisee-operated restaurants.

Financing operations revenue primarily consists of interest income from the financing of franchise fees and equipment leases and sales of equipment associated with refranchised IHOP restaurants. Financing expenses are primarily the cost of restaurant equipment associated with refranchised IHOP restaurants.

16

Dine Brand Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

10. Segments (Continued)

Information on segments is as follows:

Three months ended March 31, | ||||||||

2019 | 2018 | |||||||

(In millions) | ||||||||

Revenues from external customers: | ||||||||

Franchise operations | $ | 168.9 | $ | 155.3 | ||||

Rental operations | 30.7 | 30.9 | ||||||

Company restaurants | 35.8 | — | ||||||

Financing operations | 1.8 | 2.0 | ||||||

Total | $ | 237.2 | $ | 188.2 | ||||

Interest expense: | ||||||||

Rental operations | $ | 2.5 | $ | 2.4 | ||||

Company restaurants | 0.5 | — | ||||||

Corporate | 15.4 | 15.2 | ||||||

Total | $ | 18.4 | $ | 17.6 | ||||

Depreciation and amortization: | ||||||||

Franchise operations | $ | 2.6 | $ | 2.7 | ||||

Rental operations | 3.5 | $ | 2.9 | |||||

Company restaurants | 1.3 | — | ||||||

Corporate | 2.8 | 2.3 | ||||||

Total | $ | 10.2 | $ | 7.9 | ||||

Gross profit, by segment: | ||||||||

Franchise operations | $ | 88.6 | $ | 73.4 | ||||

Rental operations | 8.1 | 8.2 | ||||||

Company restaurants | 4.2 | — | ||||||

Financing operations | 1.7 | 1.9 | ||||||

Total gross profit | 102.6 | 83.5 | ||||||

Corporate and unallocated expenses, net | (61.5 | ) | (60.8 | ) | ||||

Income before income tax provision | $ | 41.1 | $ | 22.7 | ||||

11. Net Income per Share

The computation of the Company's basic and diluted net income per share is as follows:

Three months ended March 31, | |||||||

2019 | 2018 | ||||||

(In thousands, except per share data) | |||||||

Numerator for basic and diluted income per common share: | |||||||

Net income | $ | 31,643 | $ | 17,073 | |||

Less: Net income allocated to unvested participating restricted stock | (1,111 | ) | (568 | ) | |||

Net income available to common stockholders - basic | 30,532 | 16,505 | |||||

Effect of unvested participating restricted stock in two-class calculation | 12 | 2 | |||||

Net income available to common stockholders - diluted | $ | 30,544 | $ | 16,507 | |||

Denominator: | |||||||

Weighted average outstanding shares of common stock - basic | 17,343 | 17,703 | |||||

Dilutive effect of stock options | 347 | 142 | |||||

Weighted average outstanding shares of common stock - diluted | 17,690 | 17,845 | |||||

Net income per common share: | |||||||

Basic | $ | 1.76 | $ | 0.93 | |||

Diluted | $ | 1.73 | $ | 0.92 | |||

17

Dine Brands Global, Inc. and Subsidiaries

Notes to Consolidated Financial Statements (Continued)

12. Fair Value Measurements

The Company does not have a material amount of financial assets or liabilities that are required under U.S. GAAP to be measured on a recurring basis at fair value. The Company is not a party to any derivative financial instruments. The Company does not have a material amount of non-financial assets or non-financial liabilities that are required under U.S. GAAP to be measured at fair value on a recurring basis. The Company has not elected to use the fair value measurement option, as permitted under U.S. GAAP, for any assets or liabilities for which fair value measurement is not presently required.

The Company believes the fair values of cash equivalents, accounts receivable and accounts payable approximate their carrying amounts due to their short duration.

The fair values of the Company's Series 2014-1 Class A-2 Notes (the “Class A-2 Notes”) at March 31, 2019 and December 31, 2018 were as follows:

March 31, 2019 | December 31, 2018 | ||||||||

(In millions) | |||||||||

Carrying amount of Class A-2 Notes | $ | 1,283.8 | $ | 1,283.8 | |||||

Fair Value of Class A-2 Notes | $ | 1,289.0 | $ | 1,280.9 | |||||

The fair values were determined based on Level 2 inputs, including information gathered from brokers who trade in the Company’s Class A-2 Notes and information on notes that are similar to those of the Company.

13. Commitments and Contingencies

Litigation, Claims and Disputes

The Company is subject to various lawsuits, administrative proceedings, audits and claims arising in the ordinary course of business. Some of these lawsuits purport to be class actions and/or seek substantial damages. The Company is required under U.S. GAAP to record an accrual for litigation loss contingencies that are both probable and reasonably estimable. Legal fees and expenses associated with the defense of all of the Company's litigation are expensed as such fees and expenses are incurred. Management regularly assesses the Company's insurance coverage, analyzes litigation information with the Company's attorneys and evaluates the Company's loss experience in connection with pending legal proceedings. While the Company does not presently believe that any of the legal proceedings to which it is currently a party will ultimately have a material adverse impact on the Company, there can be no assurance that the Company will prevail in all the proceedings the Company is party to, or that the Company will not incur material losses from them.

Lease Guarantees

In connection with the sale of Applebee’s restaurants to franchisees, the Company has, in certain cases, guaranteed or has potential continuing liability for lease payments totaling $280.0 million as of March 31, 2019. This amount represents the maximum potential liability for future payments under these leases. These leases have been assigned to the buyers and expire at the end of the respective lease terms, which range from 2019 through 2048. Excluding unexercised option periods, the Company's potential liability for future payments under these leases is $42.1 million. In the event of default, the indemnity and default clauses in the sale or assignment agreements govern the Company's ability to pursue and recover damages incurred.

14. Restricted Cash

Current restricted cash of $36.7 million at March 31, 2019 primarily consisted of $33.7 million of funds required to be held in trust in connection with the Company's securitized debt and $2.9 million of funds from Applebee's franchisees pursuant to franchise agreements, usage of which was restricted to advertising activities. Current restricted cash of $48.5 million at December 31, 2018 primarily consisted of $42.3 million of funds required to be held in trust in connection with the Company's securitized debt and $6.2 million of funds from Applebee's franchisees pursuant to franchise agreements, usage of which was restricted to advertising activities.

Non-current restricted cash of $14.7 million at March 31, 2019 and December 31, 2018 represents interest reserves required to be set aside for the duration of the Company's securitized debt.

18

15. Acquisition of Business

In December 2018, the Company acquired 69 Applebee’s restaurants in North Carolina and South Carolina from a former Applebee's franchisee for a total purchase price of $21.6 million. The Company entered into the transaction to resolve certain franchisee financial health issues in what the Company believes was the most expedient and favorable manner for the Company and the Applebee's system.

During the three months ended March 31, 2019, the Company completed the calculation of deferred income taxes related to the transaction and adjusted the preliminary purchase price as follows:

Preliminary Allocation | Adjustments | Adjusted Allocation | |||||||||

(In millions) | |||||||||||

Reacquired franchise rights | $ | 11.6 | $ | — | $ | 11.6 | |||||

Equipment and fixtures | 10.0 | — | 10.0 | ||||||||

Inventory | 1.4 | — | 1.4 | ||||||||

Deferred income taxes | — | 1.5 | 1.5 | ||||||||

Total identifiable assets acquired | 23.0 | 1.5 | 24.5 | ||||||||

Above-market leaseholds, net | (6.5 | ) | — | (6.5 | ) | ||||||

Other liabilities | (1.0 | ) | — | (1.0 | ) | ||||||

Net identifiable assets acquired | 15.5 | 1.5 | 17.0 | ||||||||

Goodwill | 6.1 | (1.5 | ) | 4.6 | |||||||

Consideration transferred | $ | 21.6 | $ | — | $ | 21.6 | |||||

In conjunction with the acquisition, the Company assumed capital (finance) lease obligations and related property under capital (finance) leases of $9.1 million. The Company also entered into new capital (finance) leases totaling $28.1 million of property under capital (finance) leases and capital (finance) lease obligations.

19

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following Management's Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) in conjunction with the consolidated financial statements and the related notes that appear elsewhere in this report. Statements contained in this report may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Please refer to the section of this report under the heading “Cautionary Statement Regarding Forward-Looking Statements” for more information.

Overview

The following discussion and analysis provides information which we believe is relevant to an assessment and understanding of our consolidated results of operations and financial condition. The discussion should be read in conjunction with the consolidated financial statements and the notes thereto included in Item 1 of Part I of this Quarterly Report and the audited consolidated financial statements and notes thereto and the MD&A contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018. Except where the context indicates otherwise, the words “we,” “us,” “our,” “Dine Brands Global” and the “Company” refer to Dine Brands Global, Inc., together with its subsidiaries that are consolidated in accordance with United States generally accepted accounting principles (“U.S. GAAP”).

Through various subsidiaries, we own, franchise and operate the Applebee's Neighborhood Grill & Bar® (“Applebee's”) concept in the bar and grill segment within the casual dining category of the restaurant industry and we own and franchise the International House of Pancakes® (“IHOP”) concept in the family dining category of the restaurant industry. References herein to Applebee's® and IHOP® restaurants are to these two restaurant concepts, whether operated by franchisees, area licensees and their sub-licensees (collectively, “area licensees”) or by us. With over 3,600 restaurants combined, the substantial majority of which are franchised, we believe we are one of the largest full-service restaurant companies in the world.

We identify our business segments based on the organizational units used by management to monitor performance and make operating decisions. We currently have five operating segments: Applebee's franchise operations, Applebee's company-operated restaurant operations, IHOP franchise operations, rental operations and financing operations. We have four reportable segments: franchise operations, (an aggregation of Applebee's and IHOP franchise operations), company-operated restaurant operations, rental operations and financing operations. We consider these to be our reportable segments, regardless of whether any segment exceeds 10% of consolidated revenues, income before income tax provision or total assets.

The financial tables appearing in Management's Discussion and Analysis present amounts in millions of dollars that are rounded from our consolidated financial statements presented in thousands of dollars. As a result, the tables may not foot or crossfoot due to rounding.

Key Financial Results

Three months ended March 31, | Favorable (Unfavorable) Variance | ||||||||||

2019 | 2018 | ||||||||||

(In millions, except per share data) | |||||||||||

Income before income taxes | $ | 41.1 | $ | 22.7 | $ | 18.4 | |||||

Income tax provision | (9.5 | ) | (5.6 | ) | (3.9 | ) | |||||

Net income | $ | 31.6 | $ | 17.1 | $ | 14.6 | |||||

Effective tax rate | 23.1 | % | 24.8 | % | 1.7 | % | |||||

Net income per diluted share | $ | 1.73 | $ | 0.92 | $ | 0.81 | |||||

20

The following table highlights the primary reasons for the increase in our income before income taxes in the three months ended March 31, 2019 compared to the same period of 2018:

Favorable (Unfavorable) Variance | |||

(In millions) | |||

Increase (decrease) in gross profit: | |||

Applebee's franchise operations | $ | 13.4 | |

IHOP franchise operations | 1.8 | ||

Company restaurant operations | 4.2 | ||

All other operations | (0.3 | ) | |

Total gross profit increase | 19.1 | ||

Increase in General and Administrative (“G&A”) expenses | (0.9 | ) | |

Other | 0.2 | ||

Increase in income before income taxes | $ | 18.4 | |

The changes in Applebee's franchise gross profit for the three months ended March 31, 2019 compared to the same period of the prior year were primarily due to franchisor contributions to the Applebee’s National Advertising Fund (the “Applebee's NAF”) of $13.5 million we made during the three months ended March 31, 2018 that did not recur in 2019. See “Consolidated Results of Operations - Comparison of the Three Months ended March 31, 2019 and 2018” for additional discussion of the changes presented above.

Our effective income tax rate for the three months ended March 31, 2019 was lower than the comparable period of 2018 due to the recognition of excess tax benefits on stock-based compensation during the three months ended March 31, 2019.

Key Performance Indicators

In evaluating the performance of each restaurant concept, we consider the key performance indicators to be the system-wide sales percentage change, the percentage change in domestic system-wide same-restaurant sales (“domestic same-restaurant sales”), net franchise restaurant development and the change in effective restaurants. Changes in both domestic same-restaurant sales and in the number of Applebee's and IHOP restaurants will impact our system-wide retail sales that drive franchise royalty revenues. Restaurant development also impacts franchise revenues in the form of initial franchise fees and, in the case of IHOP restaurants, sales of proprietary pancake and waffle dry mix.

Our key performance indicators for the three months ended March 31, 2019 were as follows:

Three months ended March 31, 2019 | |||||

Applebee's | IHOP | ||||

Sales percentage (decrease) increase | (1.4 | )% | 2.4 | % | |

% increase in domestic system-wide same-restaurant sales | 1.8 | % | 1.2 | % | |

Net franchise restaurant reductions (1) | (7 | ) | (9 | ) | |

Net (decrease) increase in total effective restaurants (2) | (92 | ) | 30 | ||

________________________________________________

(1) Franchise and area license restaurant openings, net of closings, during the three months ended March 31, 2019.

(2) Change in effective franchise, area license and company-operated restaurants open for the three months ended March 31, 2019 compared to the same period of 2018.

The Applebee's sales percentage decrease for the three months ended March 31, 2019 when compared to the same period of 2018 was due to restaurant closures over the past 12 months that were partially offset by an increase in domestic same-restaurant sales. The IHOP sales percentage increase for the three months ended March 31, 2019 was due to net restaurant development over the past 12 months and an increase in domestic same-restaurant sales.

21

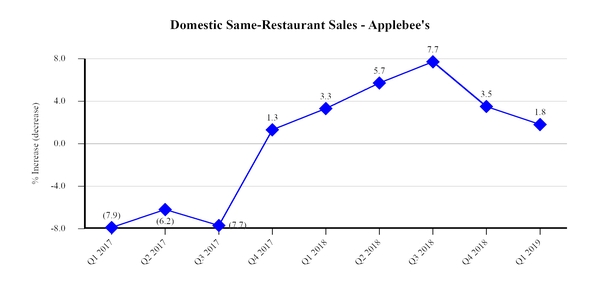

Domestic Same-Restaurant Sales

Applebee’s domestic same-restaurant sales increased 1.8% for the three months ended March 31, 2019 from the same period in 2018, the sixth consecutive quarter of growth in same-restaurant sales. The improvement resulted from an increase in average customer check that was partially offset by a decline in customer traffic. The increase in domestic same-restaurant sales for three months ended March 31, 2019 primarily was due to an increase in off-premise sales, which comprised 13% of Applebee's sales mix during the quarter.

The increase in same-restaurant sales for the three months ended March 31, 2019 was impacted by comparisons against significant increases in same-restaurant sales and traffic for the three months ended March 31, 2018. In terms of a two-year comparison, Applebee's domestic same-restaurant sales have grown 5.1%, with increases in both average customer check and customer traffic.

Based on data from Black Box Intelligence, a restaurant sales reporting firm (“Black Box”), Applebee's outperformed the casual dining segment of the restaurant industry during the three months ended March 31, 2019. During that period, the casual dining segment experienced an increase in same-restaurant sales that was smaller than the Applebee's increase, due to an increase in average customer check that was partially offset by a decline in customer traffic. Applebee's increase in average customer check for the three months ended March 31, 2019 was larger than that of the casual dining segment, while Applebee's decrease in traffic was also larger than that of the casual dining segment.

22

* Same-restaurant sales data includes area license restaurants beginning in 2019

IHOP’s domestic same-restaurant sales increased 1.2% (including area license restaurants) for the three months ended March 31, 2019 from the same period in 2018. This growth was due to an increase in average customer check that was partially offset by a decline in customer traffic. The increase in average customer check was due in part to a favorable mix shift we believe was driven by successful promotional activity during the quarter. The increase in domestic same-restaurant sales for three months ended March 31, 2019 was favorably impacted by an increase in off-premise sales, which comprised 9.5% of IHOP's sales mix during the quarter. We believe the results for the first quarter were adversely impacted by a shift in the Easter holiday period which fell in the second quarter of 2019 as compared to the first quarter of 2018. Typically, the Easter holiday period has had a positive impact on IHOP sales.

Based on data from Black Box, the family dining segment of the restaurant industry experienced a small increase in same-restaurant sales during the three months ended March 31, 2019, compared to the same period of the prior year, due to an increase in average customer check that was offset by a decrease in customer traffic. IHOP's increase in same-restaurant sales during the three months ended March 31, 2019 was larger than that of that the family dining segment because of a larger increase in average customer check than that experienced by the family dining segment. This was partially offset by IHOP experiencing a decrease in customer traffic that was larger than that of the family dining segment.

Restaurant Data

The following table sets forth the number of “Effective Restaurants” in the Applebee’s and IHOP systems and information regarding the percentage change in sales at those restaurants compared to the same period of the prior year. Sales at restaurants that are owned by franchisees and area licensees are not attributable to the Company and, as such, the percentage change in sales at Effective Restaurants is based on non-GAAP sales data. However, we believe that presentation of this information is useful in analyzing our revenues because franchisees and area licensees pay us royalties and advertising fees that are based on a percentage of their sales, and, where applicable, rental payments under leases that partially may be based on a percentage of their sales. Management also uses this information to make decisions about plans for future development of additional restaurants as well as evaluation of current operations.

23

Three months ended March 31, | ||||||||

2019 | 2018 | |||||||

Applebee's Restaurant Data | (Unaudited) | |||||||

Effective Restaurants(a) | ||||||||

Franchise | 1,762 | 1,923 | ||||||

Company | 69 | — | ||||||

Total | 1,831 | 1,923 | ||||||

System-wide(b) | ||||||||

Domestic sales percentage change(c) | (1.4 | )% | 0.9 | % | ||||

Domestic same-restaurant sales percentage change(d) | 1.8 | % | 3.3 | % | ||||

Franchise(b) | ||||||||

Domestic sales percentage change(c) | (4.7 | )% | 0.9 | % | ||||

Domestic same-restaurant sales percentage change(d) | 1.6 | % | 3.3 | % | ||||

Average weekly domestic unit sales (in thousands) | $ | 49.6 | $ | 47.6 | ||||

IHOP Restaurant Data | ||||||||

Effective Restaurants(a) | ||||||||

Franchise | 1,657 | 1,619 | ||||||

Area license | 156 | 164 | ||||||

Total | 1,813 | 1,783 | ||||||

System-wide(b) | ||||||||

Sales percentage change(c) | 2.4 | % | 3.9 | % | ||||

Domestic same-restaurant sales percentage change, including area license restaurants(d) | 1.2 | % | 1.0 | % | ||||

Domestic same-restaurant sales percentage change, excluding area license restaurants(d) | 1.1 | % | 1.0 | % | ||||

Franchise(b) | ||||||||

Sales percentage change(c) | 2.3 | % | 4.9 | % | ||||

Domestic same-restaurant sales percentage change(d) | 1.1 | % | 1.0 | % | ||||

Average weekly unit sales (in thousands) | $ | 37.1 | $ | 37.1 | ||||

Area License(b) | ||||||||

Sales percentage change(c) | 2.7 | % | (0.2 | )% | ||||

(a) “Effective Restaurants” are the weighted average number of restaurants open in each fiscal period, adjusted to account for restaurants open for only a portion of the period. Information is presented for all Effective Restaurants in the Applebee’s and IHOP systems, which consist of restaurants owned by franchisees and area licensees as well as those owned by the Company.