Table of Contents

SCHEDULE 14A

Joint Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement. |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| x | Definitive Proxy Statement. |

| ¨ | Definitive Additional Materials. |

| ¨ | Soliciting Material under §240.14a-12. |

RiverSource Bond Series, Inc.

RiverSource Diversified Income Series, Inc.

RiverSource Equity Series, Inc.

RiverSource Global Series, Inc.

RiverSource Government Income Series, Inc.

RiverSource High Yield Income Series, Inc.

RiverSource Income Series, Inc.

RiverSource International Managers Series, Inc.

RiverSource International Series, Inc.

RiverSource Investment Series, Inc.

RiverSource Large Cap Series, Inc.

RiverSource Managers Series, Inc.

RiverSource Market Advantage Series, Inc.

RiverSource Money Market Series, Inc.

RiverSource Sector Series, Inc.

RiverSource Series Trust

RiverSource Short Term Investments Series, Inc.

RiverSource Special Tax-Exempt Series Trust

RiverSource Strategic Allocation Series, Inc.

RiverSource Strategy Series, Inc.

RiverSource Tax-Exempt Series, Inc.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6((i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Table of Contents

50606 Ameriprise Financial Center, Minneapolis, MN 55474

| Current Fund Name |

Previous Fund Name |

Registrant | ||

| Columbia 120/20 Contrarian Equity Fund | RiverSource 120/20 Contrarian Equity Fund | RiverSource Series Trust | ||

| Columbia Absolute Return Currency and Income Fund | RiverSource Absolute Return Currency and Income Fund | RiverSource Global Series, Inc. | ||

| Columbia AMT-Free Tax-Exempt Bond Fund | RiverSource Tax-Exempt Bond Fund | RiverSource Tax-Exempt Series, Inc. | ||

| Columbia Asia Pacific ex-Japan Fund | Threadneedle Asia Pacific Fund | RiverSource International Series, Inc. | ||

| Columbia Diversified Bond Fund | RiverSource Diversified Bond Fund | RiverSource Diversified Income Series, Inc. | ||

| Columbia Diversified Equity Income Fund | RiverSource Diversified Equity Income Fund | RiverSource Investment Series, Inc. | ||

| Columbia Dividend Opportunity Fund | RiverSource Dividend Opportunity Fund | RiverSource Sector Series, Inc. | ||

| Columbia Emerging Markets Bond Fund | RiverSource Emerging Markets Bond Fund | RiverSource Global Series, Inc. | ||

| Columbia Emerging Markets Opportunity Fund | Threadneedle Emerging Markets Fund | RiverSource Global Series, Inc. | ||

| Columbia Equity Value Fund | RiverSource Equity Value Fund | RiverSource Strategy Series, Inc. | ||

| Columbia European Equity Fund | Threadneedle European Equity Fund | RiverSource International Series, Inc. | ||

| Columbia Floating Rate Fund | RiverSource Floating Rate Fund | RiverSource Bond Series, Inc. | ||

| Columbia Global Bond Fund | RiverSource Global Bond Fund | RiverSource Global Series, Inc. | ||

| Columbia Global Equity Fund | Threadneedle Global Equity Fund | RiverSource Global Series, Inc. | ||

| Columbia Global Extended Alpha Fund | Threadneedle Global Extended Alpha Fund | RiverSource Global Series, Inc. | ||

| Columbia High Yield Bond Fund | RiverSource High Yield Bond Fund | RiverSource High Yield Income Series, Inc. | ||

| Columbia Income Builder Fund | RiverSource Income Builder Basic Income Fund | RiverSource Income Series, Inc. | ||

| Columbia Income Opportunities Fund | RiverSource Income Opportunities Fund | RiverSource Bond Series, Inc. | ||

| Columbia Inflation Protected Securities Fund | RiverSource Inflation Protected Securities Fund | RiverSource Bond Series, Inc. | ||

| Columbia Large Core Quantitative Fund | RiverSource Disciplined Equity Fund | RiverSource Large Cap Series, Inc. | ||

| Columbia Large Growth Quantitative Fund | RiverSource Disciplined Large Cap Growth Fund | RiverSource Investment Series, Inc. | ||

| Columbia Large Value Quantitative Fund | RiverSource Disciplined Large Cap Value Fund | RiverSource Investment Series, Inc. | ||

| Columbia Limited Duration Credit Fund | RiverSource Limited Duration Bond Fund | RiverSource Bond Series, Inc. | ||

| Columbia Marsico Flexible Capital Fund | n/a | RiverSource Series Trust | ||

| Columbia Mid Cap Growth Opportunity Fund | RiverSource Mid Cap Growth Fund | RiverSource Equity Series, Inc. | ||

| Columbia Mid Cap Value Opportunity Fund | RiverSource Mid Cap Value Fund | RiverSource Investment Series, Inc. | ||

| Columbia Minnesota Tax-Exempt Fund | RiverSource Minnesota Tax-Exempt Fund | RiverSource Special Tax-Exempt Series Trust | ||

| Columbia Money Market Fund | RiverSource Cash Management Fund | RiverSource Money Market Series, Inc. | ||

| Columbia Multi-Advisor International Value Fund | RiverSource Partners International Select Value Fund | RiverSource International Managers Series, Inc. | ||

| Columbia Multi-Advisor Small Cap Value Fund | RiverSource Partners Small Cap Value Fund | RiverSource Managers Series, Inc. | ||

| Columbia Portfolio Builder Aggressive Fund | RiverSource Portfolio Builder Aggressive Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Conservative Fund | RiverSource Portfolio Builder Conservative Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Moderate Aggressive Fund | RiverSource Portfolio Builder Moderate Aggressive Fund | RiverSource Market Advantage Series, Inc. |

Table of Contents

| Current Fund Name |

Previous Fund Name |

Registrant | ||

| Columbia Portfolio Builder Moderate Conservative Fund | RiverSource Portfolio Builder Moderate Conservative Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Moderate Fund | RiverSource Portfolio Builder Moderate Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Recovery and Infrastructure Fund | RiverSource Recovery and Infrastructure Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2010 Fund | RiverSource Retirement Plus 2010 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2015 Fund | RiverSource Retirement Plus 2015 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2020 Fund | RiverSource Retirement Plus 2020 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2025 Fund | RiverSource Retirement Plus 2025 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2030 Fund | RiverSource Retirement Plus 2030 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2035 Fund | RiverSource Retirement Plus 2035 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2040 Fund | RiverSource Retirement Plus 2040 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2045 Fund | RiverSource Retirement Plus 2045 Fund | RiverSource Series Trust | ||

| Columbia Short-Term Cash Fund | RiverSource Short-Term Cash Fund | RiverSource Short Term Investments Series, Inc. | ||

| Columbia Strategic Allocation Fund | RiverSource Strategic Allocation Fund | RiverSource Strategic Allocation Series, Inc. | ||

| Columbia U.S. Government Mortgage Fund | RiverSource U.S. Government Mortgage Fund | RiverSource Government Income Series, Inc. | ||

| RiverSource Partners International Select Growth Fund | n/a | RiverSource International Managers Series, Inc. | ||

| RiverSource Partners International Small Cap Fund | n/a | RiverSource International Managers Series, Inc. | ||

| (each, a “Fund” and collectively, |

(each, a “Company” and collectively, the “Companies”) |

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND

AND VOTE ON THE PROPOSALS

This is a brief overview of the matters on which you are being asked to vote. The accompanying Joint Proxy Statement contains more detailed information about each proposal, and we encourage you to read it in its entirety before voting. Your vote is important.

| Q. | Why are you sending me this information? |

| A. | On February 15, 2011, a Joint Special Meeting of Shareholders of each Fund and each Company (defined above) as a whole (the “Meeting”) will be held at One Financial Center (5th Floor Conference Room A), Boston, Massachusetts, 02111, at 1:00 p.m. (Eastern). You are receiving the Joint Proxy Statement and one or more proxy cards (the “Proxy Cards”) because you own shares of one or more of the Funds and have the right to vote on these important proposals concerning your investment. |

| Q. | What are the proposals? |

| A. | Shareholders are being asked to vote on the following proposals: |

| • | The election of 16 individuals to serve on the boards of directors/trustees of the Companies (Proposal 1); |

| • | For the following Funds, an amendment to their Company’s governing documents to increase the maximum permissible number of directors/trustees: (i) each Fund that is a series of a Minnesota corporation and (ii) Columbia Minnesota Tax-Exempt Fund (Proposal 2); |

| • | An Agreement and Plan of Redomiciling to reorganize or “redomicile” (i) each Fund that is a series of a Minnesota corporation and (ii) Columbia Minnesota Tax-Exempt Fund, in each case, into a series of an existing Massachusetts business trust (Proposal 3); |

ii

Table of Contents

| • | For certain Funds, the approval of a proposed Investment Management Services Agreement (Proposal 4); and |

| • | For certain Funds, the authorization of the Fund’s investment manager to enter into and materially amend such Fund’s subadvisory agreements in the future without obtaining shareholder approval (Proposal 5). |

| Q. | Why am I being asked to elect directors/trustees? |

| A. | On May 1, 2010, Ameriprise Financial, Inc., the parent company of Columbia Management Investment Advisers, LLC (formerly known as RiverSource Investments, LLC), the Funds’ investment manager (“Columbia Management”), acquired the long-term asset management business of Columbia Management Group, LLC and certain of its affiliated companies from Bank of America, N.A. (the “Transaction”). In connection with the Transaction, Columbia Management became the investment manager of the Columbia-branded funds (the “Columbia Fund Complex”), in addition to the funds that were formerly (and in some cases, currently) branded as RiverSource, Seligman and Threadneedle funds (the “RiverSource Fund Complex,” and together with the Columbia Fund Complex, the “Combined Fund Complex”). |

| Following the Transaction, the boards of directors/trustees of the RiverSource Fund Complex (each, a “Columbia RiverSource Board” and collectively, the “Columbia RiverSource Boards”) and the boards of trustees of the Columbia Fund Complex had ongoing discussions regarding a potential consolidated board of directors/trustees to oversee all or a portion of the Combined Fund Complex. In September 2010, these discussions culminated in an agreement between the Columbia RiverSource Boards and the current board of trustees of certain of the trusts in the Columbia Fund Complex (the “Columbia Nations Board”) to have a consolidated board of directors/trustees for a portion of the Combined Fund Complex. Specifically, they agreed that the RiverSource Fund Complex and the portion of the Columbia Fund Complex overseen by the Columbia Nations Board should be overseen by a combined board of directors/trustees. In this regard, even though the Columbia RiverSource Board that oversees each Fund would be larger and cause the portion of the fund complex overseen by it to pay more in director/trustee compensation in the aggregate, reducing the number of separate boards overseeing a fund complex can lead to operational efficiencies by reducing the number of board meetings, minimizing inconsistencies in governance and oversight matters, and streamlining the resources needed to support board reporting and interaction. |

| In order to effect the consolidation, each Board Governance Committee and its respective full Columbia RiverSource Board have nominated the 16 individuals listed in the Joint Proxy Statement for election to the Columbia RiverSource Boards, each to hold office for an indefinite term. Information about each nominee is set forth in the Joint Proxy Statement under Proposal 1. |

| Q. | For certain Funds, why am I being asked to vote on an amendment to my Company’s Articles of Incorporation or Declaration of Trust? |

| A. | The Articles of Incorporation of the Companies that are Minnesota corporations (each, a “Charter Company” and collectively, the “Charter Companies”) and the Declaration of Trust of RiverSource Special Tax-Exempt Series Trust, a Massachusetts business trust (also a “Charter Company”), include provisions that limit board size to 15 directors/trustees. To permit the implementation of Proposal 1, each Charter Company’s Articles of Incorporation or Declaration of Trust must be amended to increase the maximum permissible number of directors/trustees, which requires shareholder approval. |

| Q. | For certain Funds, why am I being asked to approve an Agreement and Plan of Redomiciling (the “Redomiciling Agreement”)? |

| A. | The redomicilings are being proposed to change the domicile and/or form of organization (each, a “Redomiciling” and collectively, the “Redomicilings”) of each Fund that is a series of a Charter Company (each, a “Redomiciling Company” and collectively, the “Redomiciling Companies”), into new series of |

iii

Table of Contents

| RiverSource Series Trust, an existing Massachusetts business trust. In order to effect the Redomicilings, shareholders of the following Funds (each, a “Redomiciling Fund” and collectively, the “Redomiciling Funds”) are being asked to approve the Redomiciling Agreement: |

| • Columbia Absolute Return Currency and Income Fund • Columbia AMT-Free Tax-Exempt Bond Fund • Columbia Asia Pacific ex-Japan Fund • Columbia Diversified Bond Fund • Columbia Diversified Equity Income Fund • Columbia Dividend Opportunity Fund • Columbia Emerging Markets Bond Fund • Columbia Emerging Markets Opportunity Fund • Columbia Equity Value Fund • Columbia European Equity Fund • Columbia Floating Rate Fund • Columbia Global Bond Fund • Columbia Global Equity Fund • Columbia Global Extended Alpha Fund • Columbia High Yield Bond Fund • Columbia Income Builder Fund • Columbia Income Opportunities Fund • Columbia Inflation Protected Securities Fund • Columbia Large Core Quantitative Fund • Columbia Large Growth Quantitative Fund • Columbia Large Value Quantitative Fund |

• Columbia Limited Duration Credit Fund • Columbia Mid Cap Growth Opportunity Fund • Columbia Mid Cap Value Opportunity Fund • Columbia Minnesota Tax-Exempt Fund • Columbia Money Market Fund • Columbia Minnesota Tax-Exempt Fund • Columbia Multi-Advisor International Value Fund • Columbia Multi-Advisor Small Cap Value Fund • Columbia Portfolio Builder Aggressive Fund • Columbia Portfolio Builder Conservative Fund • Columbia Portfolio Builder Moderate Aggressive Fund • Columbia Portfolio Builder Moderate Conservative Fund • Columbia Portfolio Builder Moderate Fund • Columbia Short-Term Cash Fund • Columbia Strategic Allocation Fund • Columbia U.S. Government Mortgage Fund |

| The boards of directors/trustees of the Redomiciling Companies believe that the Redomicilings into series of RiverSource Series Trust should benefit the Redomiciling Funds and their shareholders in several ways, including enhancing the opportunity for operating efficiencies and cost savings by becoming part of the same legal entity under which many of the funds in the Combined Fund Complex are organized. In addition, as part of a combined Massachusetts business trust, the Redomiciling Funds that are series of Minnesota corporations should have greater flexibility to implement certain types of changes in the future that may provide cost savings or other benefits for shareholders without seeking shareholder approval. Certain differences and similarities between the Redomiciling Companies and RiverSource Series Trust are summarized in Appendix F to this Joint Proxy Statement. |

| A vote to approve the Redomiciling with respect to any Fund will also constitute a vote to approve, if necessary to effect the Redomiciling, any amendments to the governing documents of the Fund’s corresponding Redomiciling Company. |

| The reasons why each Redomiciling Fund’s Board unanimously recommends that shareholders vote “FOR” this proposal are discussed in more detail in the Joint Proxy Statement. |

| Q. | Will I pay any taxes, sales charges, or other similar fees in connection with the Redomicilings? |

| A. | No. Each Redomiciling is expected to qualify as a tax-free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, and no sales charges or other similar fees will be charged in connection with the Redomicilings. |

| Q. | If approved, will the Redomicilings affect my investment? |

| A. | No. If approved by shareholders, the Redomicilings will not affect your investment in a Redomiciling Fund or how your Fund is managed, and will not change investment policies or strategies or any of the |

iv

Table of Contents

| Redomiciling Fund’s service providers, including the investment manager, subadvisers or current portfolio managers. Your Redomiciling Fund’s directors/trustees will continue to have the duty to act with due care and in the best interests of Fund shareholders. |

| Q. | For certain Funds, why am I being asked to approve a proposed Investment Management Services Agreement? |

| A. | For each Fund except Columbia Marsico Flexible Capital Fund, RiverSource Partners International Select Growth Fund and RiverSource Partners International Small Cap Fund, Proposal 4 requests your vote on a proposed Investment Management Services Agreement (each, a “Proposed IMS Agreement” and together, the “Proposed IMS Agreements”) between Columbia Management and each Company, on behalf of the Funds. The Proposed IMS Agreements, if approved, would conform to the standard form of Investment Management Services Agreement used by other funds in the Combined Fund Complex and are designed to achieve consistent investment management service and fee structures across the Combined Fund Complex. Under the Proposed IMS Agreements, the Funds would continue to be managed by Columbia Management and are expected to receive at least the same level and quality of services as those received under the Investment Management Services Agreements currently in effect. Additionally, as summarized below, for certain Funds, the Proposed IMS Agreements include an increase in the applicable investment advisory fee rates at various asset levels. With respect to each Fund that has a performance incentive adjustment (a “PIA”) to its applicable investment advisory fee rate, the Proposed IMS Agreements include the elimination of the PIA. |

| Q. | How would the Proposed IMS Agreements affect my Fund? |

| A. | The Proposed IMS Agreements would affect different Funds in different ways: |

| (a) | For certain Funds (each, an “IMS Fund” and collectively, the “IMS Funds”), the Proposed IMS Agreements include certain changes to the terms and conditions of the Funds’ existing Investment Management Services Agreements, but would neither increase investment advisory fee rates nor eliminate a PIA because a PIA does not currently exist for such Fund (“Non-Fee Changes”). As further described in the accompanying Joint Proxy Statement, these Non-Fee Changes include, among other things, the elimination of a list of specific expenses that a Fund is responsible for in favor of a general obligation of the Fund to bear any operating expenses incurred (though there will be no actual change in the allocation of expenses between Columbia Management and a Fund) and a change in governing law from Minnesota to Massachusetts. The IMS Funds are: |

| • Columbia Absolute Return Currency and Income Fund • Columbia AMT-Free Tax-Exempt Bond Fund • Columbia Emerging Markets Bond Fund • Columbia Floating Rate Fund • Columbia Global Bond Fund • Columbia High Yield Bond Fund • Columbia Income Builder Fund • Columbia Income Opportunities Fund • Columbia Inflation Protected Securities Fund • Columbia Limited Duration Credit Fund • Columbia Money Market Fund • Columbia Portfolio Builder Aggressive Fund |

• Columbia Portfolio Builder Conservative Fund • Columbia Portfolio Builder Moderate Aggressive Fund • Columbia Portfolio Builder Moderate Conservative Fund • Columbia Portfolio Builder Moderate Fund • Columbia Retirement Plus 2010 Fund • Columbia Retirement Plus 2015 Fund • Columbia Retirement Plus 2020 Fund • Columbia Retirement Plus 2025 Fund • Columbia Retirement Plus 2030 Fund • Columbia Retirement Plus 2035 Fund • Columbia Retirement Plus 2040 Fund • Columbia Retirement Plus 2045 Fund • Columbia Short-Term Cash Fund |

v

Table of Contents

| (b) | For certain Funds (each, an “IMS/Fee Increase Fund” and collectively, the “IMS/Fee Increase Funds”), the Proposed IMS Agreements include (i) the Non-Fee Changes and (ii) an increase to the investment advisory fee rates payable to Columbia Management at certain asset levels. The IMS/Fee Increase Funds are: |

| • | Columbia Diversified Bond Fund |

| • | Columbia Minnesota Tax-Exempt Fund |

| • | Columbia U.S. Government Mortgage Fund |

| (c) | For certain Funds (each, an “IMS/PIA Fund” and collectively, the “IMS/PIA Funds”), the Proposed IMS Agreements include (i) the Non-Fee Changes and (ii) the elimination of a PIA. The IMS/PIA Funds are: |

| • | Columbia 120/20 Contrarian Equity Fund |

| • | Columbia Asia Pacific ex-Japan Fund |

| • | Columbia Emerging Markets Opportunity Fund |

| • | Columbia European Equity Fund |

| • | Columbia Global Equity Fund |

| • | Columbia Global Extended Alpha Fund |

| • | Columbia Multi-Advisor International Value Fund |

| • | Columbia Multi-Advisor Small Cap Value Fund |

| • | Columbia Recovery and Infrastructure Fund |

| (d) | For certain Funds (each, an “IMS/Fee Increase/PIA Fund” and collectively, the “IMS/Fee Increase/PIA Funds”), the Proposed IMS Agreements include (i) the Non-Fee Changes, (ii) an increase to the investment advisory fee rates payable to Columbia Management at all or most asset levels and (iii) the elimination of a PIA. The IMS/Fee Increase/PIA Funds are: |

| (e) | • Columbia Diversified Equity Income Fund | |

| • Columbia Dividend Opportunity Fund | ||

| • Columbia Equity Value Fund | ||

| • Columbia Large Core Quantitative Fund | ||

| • Columbia Large Growth Quantitative Fund | ||

| • Columbia Large Value Quantitative Fund | ||

| • Columbia Mid Cap Growth Opportunity Fund | ||

| • Columbia Mid Cap Value Opportunity Fund | ||

| • Columbia Strategic Allocation Fund |

| Q. | For the IMS/Fee Increase Funds, the IMS/PIA Funds and the IMS/Fee Increase/PIA Funds, why should I approve a Proposed IMS Agreement that would or could increase the investment advisory fee rates payable by my Fund? |

| A. | The Proposed IMS Agreements are part of a group of related proposals that are designed to enhance consistency and uniformity across the Combined Fund Complex. These proposals are intended to provide shareholders of the Combined Fund Complex with the potential to realize the full range of benefits resulting from a much larger mutual fund group, including: |

| • | Standardizing investment advisory fee rates and total management fee rates (i.e., the investment advisory fee rates and the administration/administrative fee rates), to the extent practicable, across funds in the Combined Fund Complex that are in the same investment category (e.g., the Proposed IMS Agreements would align the investment advisory fee rates of Columbia Minnesota Tax-Exempt Fund with those of other single state tax-exempt funds in the Combined Fund Complex) to promote uniformity of pricing among similar funds; |

| • | Continuing to implement contractual expense limitations that will generally cap total annual operating expense ratios for each fund in the Combined Fund Complex at levels that are at or below the median |

vi

Table of Contents

| net operating expense ratio of funds in the respective fund’s peer group (as determined annually after the initial term by an independent third-party data provider); and |

| • | Correlating investment advisory and administration/administrative fee rates across the Combined Fund Complex commensurate with the level of services being provided. |

| The investment advisory fee rates payable by the IMS/Fee Increase Funds would increase at certain asset levels, the investment advisory fee rates payable by the IMS/PIA Funds would increase under certain circumstances and the investment advisory fee rates payable by the IMS/Fee Increase/PIA Funds would increase at all or most asset levels (with current effective advisory fees increasing by up to 0.14% of average daily net assets depending on your Fund), as described in the accompanying Joint Proxy Statement. Even though certain fee rates will increase for certain funds, including the IMS/Fee Increase Funds, the IMS/PIA Funds and the IMS/Fee Increase/PIA Funds, the net effect of the larger group of proposals, which for many of the funds comprising the Combined Fund Complex include reductions in administration/administrative fee rates and contractual expense limitations, is expected to be a reduction in the overall fees paid, on a cumulative basis, by the various funds comprising the Combined Fund Complex. Thus, on a cumulative basis, shareholders, many of whom own shares of more than one fund, may pay lower fees overall even if the fee rate of a particular fund is increasing. |

| Q. | How would the proposed increase in investment advisory fee rates affect my Fund’s expenses? |

| A. | Although the Proposed IMS Agreements would result in higher investment advisory fee rates payable by certain Funds at various asset levels, they would not necessarily result in higher gross expenses for many of those Funds in light of their current asset levels. |

| Moreover, Columbia Management has agreed to continue implementing contractual expense limitations that will generally cap total annual operating expense ratios at levels that are at or below the median net operating expense ratio of funds in the respective Fund’s peer group. These commitments may mitigate the impact of any investment advisory fee rate increases resulting from the amended fee schedules. |

| Comparisons of the investment advisory fee rates for each IMS/Fee Increase Fund and each IMS/Fee Increase/PIA Fund and, if its effective investment advisory fee rate would increase, gross and net expense ratios, are included in the accompanying Joint Proxy Statement. Information about the PIAs that are proposed to be eliminated is also included in the accompanying Joint Proxy Statement. If you do not hold shares of an IMS/Fee Increase Fund, an IMS/PIA Fund or an IMS/Fee Increase/PIA Fund, the investment advisory fee rates payable by your Fund under the Proposed IMS Agreements will not increase from the investment advisory fee rates currently payable by your Fund. |

| Q. | For the IMS/PIA Funds and the IMS/Fee Increase/PIA Funds, why should I approve a Proposed IMS Agreement that would eliminate the PIA? |

| A. | Columbia Management has proposed eliminating the PIA for each fund in the Combined Fund Complex that has a PIA. In the case of each IMS/PIA Fund and each IMS/Fee Increase/PIA Fund, the corresponding Columbia RiverSource Board has determined that the elimination of a PIA would be in the best interests of shareholders of such Fund because, among other things, it would align the fee structures of each IMS/PIA Fund and each IMS/Fee Increase/PIA Fund with the fee structures currently in place across most funds in the Combined Fund Complex. In addition, the Columbia RiverSource Board reviewed current industry practices and determined that the use of a PIA is not prevalent among major fund complexes. |

| The elimination of a PIA may result in an increase or decrease in the investment advisory fee that would actually be payable by a particular IMS/PIA Fund or IMS/Fee Increase/PIA Fund to Columbia Management in any given year, depending on whether investment performance lagged or exceeded the relevant benchmark. For certain IMS/PIA Funds and IMS/Fee Increase/PIA Funds, Columbia Management has begun phasing out the PIA over a pre-determined transition period as further described in the accompanying Joint Proxy Statement. |

vii

Table of Contents

| Q: | What is the Manager of Managers Proposal? |

| A. | The Board of Directors of certain Companies (each, a “MofM Board” and collectively, the “MofM Boards”), on behalf of certain of their respective Funds (each, a “MofM Fund” and collectively, the “MofM Funds”), have approved a proposal (the “Manager of Managers Proposal”) authorizing Columbia Management to enter into and materially amend subadvisory agreements in the future, with the approval of the applicable MofM Board, but without obtaining approval from shareholders of the MofM Fund. |

| Q: | Why am I being asked to vote on the Manager of Managers Proposal? |

| A. | The Manager of Managers Proposal will afford Columbia Management the flexibility to enter into and materially amend subadvisory agreements in the future with subadvisers that are not affiliated with Columbia Management, with the approval of only the applicable MofM Board, and without incurring the costs and delays associated with holding a shareholder meeting. Most of the funds in the Combined Fund Complex already have an identical policy. Therefore, approval of the Manager of Managers Proposal will conform the MofM Funds’ policies in this respect to the current policy of most of the funds in the Combined Fund Complex. |

| Although none of the MofM Funds currently has any subadvisory agreements, if shareholders of the MofM Funds approve Proposal 5, Columbia Management would have the authority to enter into such relationships and evaluate them in the broader context of its manager of managers/subadviser program. To the extent Columbia Management decides to enter into or change any such subadvisory relationship, that recommendation could not be implemented without Board approval, but would not require future shareholder approval unless an affiliated subadviser is selected. |

| Q. | How do the Columbia RiverSource Boards recommend that I vote? |

| A. | The Columbia RiverSource Boards unanimously recommend that you vote FOR the election of each nominee and FOR all other Proposals. |

| Q. | Will my Fund pay for this proxy solicitation? |

| A. | No. Columbia Management or an affiliated company will bear all of these costs. |

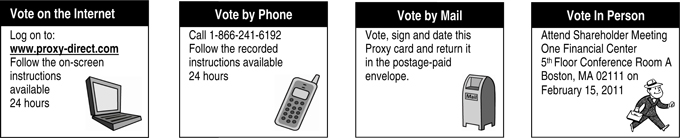

| Q. | How can I vote? |

| A. | You can vote in one of four ways: |

| • | By telephone: Call the toll-free number printed on the enclosed Proxy Card(s) and follow the directions. |

| • | By internet: Access the website address printed on the enclosed Proxy Card(s) and follow the directions on the website. |

| • | By mail: Complete, sign and return the enclosed Proxy Card(s) in the enclosed self-addressed, postage-paid envelope. |

| • | In person at the Meeting scheduled to occur on February 15, 2011 at One Financial Center (5th Floor Conference Room A), Boston, Massachusetts, 02111, at 1:00 p.m. (Eastern). If you decide to vote in person, you must attend the Meeting at the time and place described in the accompanying Joint Proxy Statement. To attend the Meeting in person, you will need proof of ownership of the shares of the relevant Fund, such as your Proxy Card (or a copy thereof) or, if your shares are held of record by a financial intermediary, such as a broker, or nominee, a Proxy Card from the record holder or other proof of beneficial ownership, such as a brokerage statement showing your holdings of the shares of the relevant Fund. |

| Q. | Why might I receive more than one Proxy Card? |

| A. | If you own shares of more than one Fund or own shares of a Fund in more than one account, you may receive a separate Proxy Card for each such Fund or account, and should vote each Proxy Card received. |

viii

Table of Contents

| Q. | Will I be notified of the results of the vote? |

| A. | The final voting results will be included in each Fund’s next report to shareholders following the Meeting. |

| Q. | Whom should I call if I have questions? |

| A. | If you have questions about any of the proposals described in the Joint Proxy Statement or about voting procedures, please call the Funds’ proxy solicitor, Computershare Fund Services, toll free at (800) 708-7953. |

ix

Table of Contents

NOTICE OF A JOINT SPECIAL MEETING OF SHAREHOLDERS

| Current Fund Name |

Previous Fund Name |

Registrant | ||

| Columbia 120/20 Contrarian Equity Fund | RiverSource 120/20 Contrarian Equity Fund | RiverSource Series Trust | ||

| Columbia Absolute Return Currency and Income Fund | RiverSource Absolute Return Currency and Income Fund | RiverSource Global Series, Inc. | ||

| Columbia AMT-Free Tax-Exempt Bond Fund | RiverSource Tax-Exempt Bond Fund | RiverSource Tax-Exempt Series, Inc. | ||

| Columbia Asia Pacific ex-Japan Fund | Threadneedle Asia Pacific Fund | RiverSource International Series, Inc. | ||

| Columbia Diversified Bond Fund | RiverSource Diversified Bond Fund | RiverSource Diversified Income Series, Inc. | ||

| Columbia Diversified Equity Income Fund | RiverSource Diversified Equity Income Fund | RiverSource Investment Series, Inc. | ||

| Columbia Dividend Opportunity Fund | RiverSource Dividend Opportunity Fund | RiverSource Sector Series, Inc. | ||

| Columbia Emerging Markets Bond Fund | RiverSource Emerging Markets Bond Fund | RiverSource Global Series, Inc. | ||

| Columbia Emerging Markets Opportunity Fund | Threadneedle Emerging Markets Fund | RiverSource Global Series, Inc. | ||

| Columbia Equity Value Fund | RiverSource Equity Value Fund | RiverSource Strategy Series, Inc. | ||

| Columbia European Equity Fund | Threadneedle European Equity Fund | RiverSource International Series, Inc. | ||

| Columbia Floating Rate Fund | RiverSource Floating Rate Fund | RiverSource Bond Series, Inc. | ||

| Columbia Global Bond Fund | RiverSource Global Bond Fund | RiverSource Global Series, Inc. | ||

| Columbia Global Equity Fund | Threadneedle Global Equity Fund | RiverSource Global Series, Inc. | ||

| Columbia Global Extended Alpha Fund | Threadneedle Global Extended Alpha Fund | RiverSource Global Series, Inc. | ||

| Columbia High Yield Bond Fund | RiverSource High Yield Bond Fund | RiverSource High Yield Income Series, Inc. | ||

| Columbia Income Builder Fund | RiverSource Income Builder Basic Income Fund | RiverSource Income Series, Inc. | ||

| Columbia Income Opportunities Fund | RiverSource Income Opportunities Fund | RiverSource Bond Series, Inc. | ||

| Columbia Inflation Protected Securities Fund | RiverSource Inflation Protected Securities Fund | RiverSource Bond Series, Inc. | ||

| Columbia Large Core Quantitative Fund | RiverSource Disciplined Equity Fund | RiverSource Large Cap Series, Inc. | ||

| Columbia Large Growth Quantitative Fund | RiverSource Disciplined Large Cap Growth Fund | RiverSource Investment Series, Inc. | ||

| Columbia Large Value Quantitative Fund | RiverSource Disciplined Large Cap Value Fund | RiverSource Investment Series, Inc. | ||

| Columbia Limited Duration Credit Fund | RiverSource Limited Duration Bond Fund | RiverSource Bond Series, Inc. | ||

| Columbia Marsico Flexible Capital Fund | n/a | RiverSource Series Trust | ||

| Columbia Mid Cap Growth Opportunity Fund | RiverSource Mid Cap Growth Fund | RiverSource Equity Series, Inc. | ||

| Columbia Mid Cap Value Opportunity Fund | RiverSource Mid Cap Value Fund | RiverSource Investment Series, Inc. | ||

| Columbia Minnesota Tax-Exempt Fund | RiverSource Minnesota Tax-Exempt Fund | RiverSource Special Tax-Exempt Series Trust | ||

| Columbia Money Market Fund | RiverSource Cash Management Fund | RiverSource Money Market Series, Inc. | ||

| Columbia Multi-Advisor International Value Fund | RiverSource Partners International Select Value Fund | RiverSource International Managers Series, Inc. | ||

| Columbia Multi-Advisor Small Cap Value Fund | RiverSource Partners Small Cap Value Fund | RiverSource Managers Series, Inc. | ||

| Columbia Portfolio Builder Aggressive Fund | RiverSource Portfolio Builder Aggressive Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Conservative Fund | RiverSource Portfolio Builder Conservative Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Moderate Aggressive Fund | RiverSource Portfolio Builder Moderate Aggressive Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Moderate Conservative Fund | RiverSource Portfolio Builder Moderate Conservative Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Moderate Fund | RiverSource Portfolio Builder Moderate Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Recovery and Infrastructure Fund | RiverSource Recovery and Infrastructure Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2010 Fund | RiverSource Retirement Plus 2010 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2015 Fund | RiverSource Retirement Plus 2015 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2020 Fund | RiverSource Retirement Plus 2020 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2025 Fund | RiverSource Retirement Plus 2025 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2030 Fund | RiverSource Retirement Plus 2030 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2035 Fund | RiverSource Retirement Plus 2035 Fund | RiverSource Series Trust |

Table of Contents

| Current Fund Name |

Previous Fund Name |

Registrant | ||

| Columbia Retirement Plus 2040 Fund | RiverSource Retirement Plus 2040 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2045 Fund | RiverSource Retirement Plus 2045 Fund | RiverSource Series Trust | ||

| Columbia Short-Term Cash Fund | RiverSource Short-Term Cash Fund | RiverSource Short Term Investments Series, Inc. | ||

| Columbia Strategic Allocation Fund | RiverSource Strategic Allocation Fund | RiverSource Strategic Allocation Series, Inc. | ||

| Columbia U.S. Government Mortgage Fund | RiverSource U.S. Government Mortgage Fund | RiverSource Government Income Series, Inc. | ||

| RiverSource Partners International Select Growth Fund | n/a | RiverSource International Managers Series, Inc. | ||

| RiverSource Partners International Small Cap Fund | n/a | RiverSource International Managers Series, Inc. | ||

| (each, a “Fund” and collectively, the “Funds”) |

(each, a “Company” and collectively, the “Companies”) |

To be held on February 15, 2011

A Joint Special Meeting of Shareholders (the “Meeting”) of each Fund and Company listed above as a whole will be held at One Financial Center (5th Floor Conference Room A), Boston, Massachusetts, 02111 at 1:00 p.m. (Eastern) on February 15, 2011. At the Meeting, shareholders will be asked to:

| 1. | Elect 16 directors/trustees to the board of directors/trustees of the Company, each to hold office for an indefinite term; |

| 2. | For certain Funds, approve a proposed amendment to the Articles of Incorporation or Declaration of Trust of certain Companies, which would increase the maximum number of directors/trustees of such Company; |

| 3. | For certain Funds, approve a proposed Agreement and Plan of Redomiciling, which provides for a change in the domicile and/or form of organization of (i) each Fund that is currently a series of a Company that is organized as a Minnesota corporation and (ii) Columbia Minnesota Tax-Exempt Fund (which is a series of RiverSource Special Tax-Exempt Series Trust), into new series of RiverSource Series Trust, an existing Massachusetts business trust. A vote to approve the Redomiciling with respect to any Fund will also constitute a vote to approve, if necessary to effect the Redomiciling, any amendments to the governing documents of the Fund’s corresponding Redomiciling Company; |

| 4. | For all Funds other than Columbia Marsico Flexible Capital Fund, RiverSource Partners International Select Growth Fund and RiverSource Partners International Small Cap Fund, approve a proposed Investment Management Services Agreement between the Company, on behalf of the Fund, and Columbia Management Investment Advisers, LLC; and |

| 5. | For certain Funds, approve a proposal to authorize Columbia Management Investment Advisers, LLC to enter into and materially amend subadvisory agreements in the future, with the approval of the Company’s board of directors/trustees, but without obtaining shareholder approval. |

The following table shows the applicability of each proposal to each Fund:

| Fund |

1. Board |

2. Charter |

3. Redomiciling |

4. IMS |

5. Manager of |

|||||||||||||||

| Columbia 120/20 Contrarian Equity Fund |

X | X | * | |||||||||||||||||

| Columbia Absolute Return Currency and Income Fund |

X | X | X | X | ||||||||||||||||

| Columbia AMT-Free Tax-Exempt Bond Fund |

X | X | X | X | X | |||||||||||||||

| Columbia Asia Pacific ex-Japan Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Diversified Bond Fund |

X | X | X | X | * | X | ||||||||||||||

| Columbia Diversified Equity Income Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Dividend Opportunity Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Emerging Markets Bond Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Emerging Markets Opportunity Fund |

X | X | X | X | ||||||||||||||||

| Columbia Equity Value Fund |

X | X | X | X | * | |||||||||||||||

| Columbia European Equity Fund |

X | X | X | X | * | |||||||||||||||

-2-

Table of Contents

| Fund |

1. Board |

2. Charter |

3. Redomiciling |

4. IMS |

5. Manager of |

|||||||||||||||

| Columbia Floating Rate Fund |

X | X | X | X | ||||||||||||||||

| Columbia Global Bond Fund |

X | X | X | X | X | |||||||||||||||

| Columbia Global Equity Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Global Extended Alpha Fund |

X | X | X | X | * | |||||||||||||||

| Columbia High Yield Bond Fund |

X | X | X | X | X | |||||||||||||||

| Columbia Income Builder Fund |

X | X | X | X | ||||||||||||||||

| Columbia Income Opportunities Fund |

X | X | X | X | ||||||||||||||||

| Columbia Inflation Protected Securities Fund |

X | X | X | X | ||||||||||||||||

| Columbia Large Core Quantitative Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Large Growth Quantitative Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Large Value Quantitative Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Limited Duration Credit Fund |

X | X | X | X | ||||||||||||||||

| Columbia Marsico Flexible Capital Fund |

X | |||||||||||||||||||

| Columbia Mid Cap Growth Opportunity Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Mid Cap Value Opportunity Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Minnesota Tax-Exempt Fund |

X | X | X | X | * | X | ||||||||||||||

| Columbia Money Market Fund |

X | X | X | X | X | |||||||||||||||

| Columbia Multi-Advisor International Value Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Multi-Advisor Small Cap Value Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Portfolio Builder Aggressive Fund |

X | X | X | X | ||||||||||||||||

| Columbia Portfolio Builder Conservative Fund |

X | X | X | X | ||||||||||||||||

| Columbia Portfolio Builder Moderate Aggressive Fund |

X | X | X | X | ||||||||||||||||

| Columbia Portfolio Builder Moderate Conservative Fund |

X | X | X | X | ||||||||||||||||

| Columbia Portfolio Builder Moderate Fund |

X | X | X | X | ||||||||||||||||

| Columbia Recovery and Infrastructure Fund |

X | X | * | |||||||||||||||||

| Columbia Retirement Plus 2010 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2015 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2020 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2025 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2030 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2035 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2040 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2045 Fund |

X | X | ||||||||||||||||||

| Columbia Short-Term Cash Fund |

X | X | X | X | ||||||||||||||||

| Columbia Strategic Allocation Fund |

X | X | X | X | * | |||||||||||||||

| Columbia U.S. Government Mortgage Fund |

X | X | X | X | * | |||||||||||||||

| RiverSource Partners International Select Growth Fund |

X | X | ||||||||||||||||||

| RiverSource Partners International Small Cap Fund |

X | X | ||||||||||||||||||

| * | For these Funds, the IMS Agreement Proposal would impact investment advisory fee rates, as described in the accompanying Joint Proxy Statement. |

Please take some time to read the enclosed Joint Proxy Statement. It discusses these proposals in more detail. If you were a shareholder of a Fund as of the close of business on December 17, 2010, you may vote at the Meeting or at any adjournment of the Meeting on the proposal(s) applicable to your Fund(s). You are welcome to attend the Meeting in person. If you cannot attend in person to cast your vote, please vote by mail, telephone or internet. Just follow the instructions on the enclosed Proxy Card. If you have questions, please call the Funds’ proxy solicitor toll free at (800) 708-7953. It is important that you vote. The board of directors/trustees of each Company unanimously recommends that you vote FOR each nominee and FOR all other Proposals in the Joint Proxy Statement.

By order of the Boards of Directors/Trustees,

Scott R. Plummer, Secretary

December 20, 2010

-3-

Table of Contents

| RiverSource Bond Series, Inc. |

RiverSource Managers Series, Inc. | |

| RiverSource Diversified Income Series, Inc. |

RiverSource Market Advantage Series, Inc. | |

| RiverSource Equity Series, Inc. |

RiverSource Money Market Series, Inc. | |

| RiverSource Global Series, Inc. |

RiverSource Sector Series, Inc. | |

| RiverSource Government Income Series, Inc. |

RiverSource Series Trust | |

| RiverSource High Yield Income Series, Inc. |

RiverSource Short Term Investments Series, Inc. | |

| RiverSource Income Series, Inc. |

RiverSource Special Tax-Exempt Series Trust | |

| RiverSource International Managers Series, Inc. |

RiverSource Strategic Allocation Series, Inc. | |

| RiverSource International Series, Inc. |

RiverSource Strategy Series, Inc. | |

| RiverSource Investment Series, Inc. |

RiverSource Tax-Exempt Series, Inc. | |

| RiverSource Large Cap Series, Inc. |

50606 Ameriprise Financial Center, Minneapolis, MN 55474

| Current Fund Name |

Previous Fund Name |

Registrant | ||

| Columbia 120/20 Contrarian Equity Fund | RiverSource 120/20 Contrarian Equity Fund | RiverSource Series Trust | ||

| Columbia Absolute Return Currency and Income Fund | RiverSource Absolute Return Currency and Income Fund | RiverSource Global Series, Inc. | ||

| Columbia AMT-Free Tax-Exempt Bond Fund | RiverSource Tax-Exempt Bond Fund | RiverSource Tax-Exempt Series, Inc. | ||

| Columbia Asia Pacific ex-Japan Fund | Threadneedle Asia Pacific Fund | RiverSource International Series, Inc. | ||

| Columbia Diversified Bond Fund | RiverSource Diversified Bond Fund | RiverSource Diversified Income Series, Inc. | ||

| Columbia Diversified Equity Income Fund | RiverSource Diversified Equity Income Fund | RiverSource Investment Series, Inc. | ||

| Columbia Dividend Opportunity Fund | RiverSource Dividend Opportunity Fund | RiverSource Sector Series, Inc. | ||

| Columbia Emerging Markets Bond Fund | RiverSource Emerging Markets Bond Fund | RiverSource Global Series, Inc. | ||

| Columbia Emerging Markets Opportunity Fund | Threadneedle Emerging Markets Fund | RiverSource Global Series, Inc. | ||

| Columbia Equity Value Fund | RiverSource Equity Value Fund | RiverSource Strategy Series, Inc. | ||

| Columbia European Equity Fund | Threadneedle European Equity Fund | RiverSource International Series, Inc. | ||

| Columbia Floating Rate Fund | RiverSource Floating Rate Fund | RiverSource Bond Series, Inc. | ||

| Columbia Global Bond Fund | RiverSource Global Bond Fund | RiverSource Global Series, Inc. | ||

| Columbia Global Equity Fund | Threadneedle Global Equity Fund | RiverSource Global Series, Inc. | ||

| Columbia Global Extended Alpha Fund | Threadneedle Global Extended Alpha Fund | RiverSource Global Series, Inc. | ||

| Columbia High Yield Bond Fund | RiverSource High Yield Bond Fund | RiverSource High Yield Income Series, Inc. | ||

| Columbia Income Builder Fund | RiverSource Income Builder Basic Income Fund | RiverSource Income Series, Inc. | ||

| Columbia Income Opportunities Fund | RiverSource Income Opportunities Fund | RiverSource Bond Series, Inc. | ||

| Columbia Inflation Protected Securities Fund | RiverSource Inflation Protected Securities Fund | RiverSource Bond Series, Inc. | ||

| Columbia Large Core Quantitative Fund | RiverSource Disciplined Equity Fund | RiverSource Large Cap Series, Inc. | ||

| Columbia Large Growth Quantitative Fund | RiverSource Disciplined Large Cap Growth Fund | RiverSource Investment Series, Inc. | ||

| Columbia Large Value Quantitative Fund | RiverSource Disciplined Large Cap Value Fund | RiverSource Investment Series, Inc. | ||

| Columbia Limited Duration Credit Fund | RiverSource Limited Duration Bond Fund | RiverSource Bond Series, Inc. | ||

| Columbia Marsico Flexible Capital Fund | n/a | RiverSource Series Trust | ||

| Columbia Mid Cap Growth Opportunity Fund | RiverSource Mid Cap Growth Fund | RiverSource Equity Series, Inc. | ||

| Columbia Mid Cap Value Opportunity Fund | RiverSource Mid Cap Value Fund | RiverSource Investment Series, Inc. | ||

| Columbia Minnesota Tax-Exempt Fund | RiverSource Minnesota Tax-Exempt Fund | RiverSource Special Tax-Exempt Series Trust | ||

| Columbia Money Market Fund | RiverSource Cash Management Fund | RiverSource Money Market Series, Inc. | ||

| Columbia Multi-Advisor International Value Fund | RiverSource Partners International Select Value Fund | RiverSource International Managers Series, Inc. | ||

| Columbia Multi-Advisor Small Cap Value Fund | RiverSource Partners Small Cap Value Fund | RiverSource Managers Series, Inc. | ||

| Columbia Portfolio Builder Aggressive Fund | RiverSource Portfolio Builder Aggressive Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Conservative Fund | RiverSource Portfolio Builder Conservative Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Moderate Aggressive Fund | RiverSource Portfolio Builder Moderate Aggressive Fund | RiverSource Market Advantage Series, Inc. |

Table of Contents

| Current Fund Name |

Previous Fund Name |

Registrant | ||

| Columbia Portfolio Builder Moderate Conservative Fund | RiverSource Portfolio Builder Moderate Conservative Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Portfolio Builder Moderate Fund | RiverSource Portfolio Builder Moderate Fund | RiverSource Market Advantage Series, Inc. | ||

| Columbia Recovery and Infrastructure Fund | RiverSource Recovery and Infrastructure Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2010 Fund | RiverSource Retirement Plus 2010 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2015 Fund | RiverSource Retirement Plus 2015 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2020 Fund | RiverSource Retirement Plus 2020 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2025 Fund | RiverSource Retirement Plus 2025 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2030 Fund | RiverSource Retirement Plus 2030 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2035 Fund | RiverSource Retirement Plus 2035 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2040 Fund | RiverSource Retirement Plus 2040 Fund | RiverSource Series Trust | ||

| Columbia Retirement Plus 2045 Fund | RiverSource Retirement Plus 2045 Fund | RiverSource Series Trust | ||

| Columbia Short-Term Cash Fund | RiverSource Short-Term Cash Fund | RiverSource Short Term Investments Series, Inc. | ||

| Columbia Strategic Allocation Fund | RiverSource Strategic Allocation Fund | RiverSource Strategic Allocation Series, Inc. | ||

| Columbia U.S. Government Mortgage Fund | RiverSource U.S. Government Mortgage Fund | RiverSource Government Income Series, Inc. | ||

| RiverSource Partners International Select Growth Fund | n/a | RiverSource International Managers Series, Inc. | ||

| RiverSource Partners International Small Cap Fund | n/a | RiverSource International Managers Series, Inc. | ||

| (each, a “Fund” and collectively, the “Funds”) |

(each, a “Company” and collectively, the “Companies”) |

JOINT PROXY STATEMENT

Joint Special Meeting of Shareholders to be held on February 15, 2011

This Joint Proxy Statement is furnished to you in connection with the solicitation of proxies by the board of directors/trustees (each, a “Columbia RiverSource Board” and collectively, the “Columbia RiverSource Boards”) of the Companies listed above relating to a Joint Special Meeting of Shareholders (the “Meeting”) of the Funds and the Companies listed above as a whole to be held at One Financial Center (5th Floor Conference Room A), Boston, Massachusetts, 02111 on February 15, 2011 at 1:00 p.m. (Eastern). It is expected that this Joint Proxy Statement will be mailed to shareholders on or about January 5, 2011.

The purpose of the Meeting is to ask Fund shareholders to:

| 1. | Elect 16 directors/trustees to the board of directors/trustees of the Company, each to hold office for an indefinite term; |

| 2. | For certain Funds, approve a proposed amendment to the Articles of Incorporation or Declaration of Trust of certain Companies, which would increase the maximum number of directors/trustees of such Company; |

| 3. | For certain Funds, approve a proposed Agreement and Plan of Redomiciling, which provides for a change in the domicile and/or form of organization of (i) each Fund that is currently a series of a Company that is organized as a Minnesota corporation and (ii) Columbia Minnesota Tax-Exempt Fund (which is a series of RiverSource Special Tax-Exempt Series Trust), into new series of RiverSource Series Trust, an existing Massachusetts business trust. A vote to approve the Redomiciling with respect to any Fund will also constitute a vote to approve, if necessary to effect the Redomiciling, any amendments to the governing documents of the Fund’s corresponding Redomiciling Company; |

| 4. | For all Funds other than Columbia Marsico Flexible Capital Fund, RiverSource Partners International Select Growth Fund and RiverSource Partners International Small Cap Fund, approve a proposed Investment Management Services Agreement between the Company, on behalf of the Fund, and Columbia Management Investment Advisers, LLC; and |

-2-

Table of Contents

| 5. | For certain Funds, approve a proposal to authorize Columbia Management Investment Advisers, LLC to enter into and materially amend subadvisory agreements in the future, with the approval of the Company’s board of directors/trustees, but without obtaining shareholder approval. |

The following table shows the applicability of each proposal to each Fund:

| Fund |

1. Board Election |

2. Charter Amendment |

3. Redomiciling | 4. IMS Agreement |

5. Manager of Managers Proposal |

|||||||||||||||

| Columbia 120/20 Contrarian Equity Fund |

X | X | * | |||||||||||||||||

| Columbia Absolute Return Currency and Income Fund |

X | X | X | X | ||||||||||||||||

| Columbia AMT-Free Tax-Exempt Bond Fund |

X | X | X | X | X | |||||||||||||||

| Columbia Asia Pacific ex-Japan Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Diversified Bond Fund |

X | X | X | X | * | X | ||||||||||||||

| Columbia Diversified Equity Income Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Dividend Opportunity Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Emerging Markets Bond Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Emerging Markets Opportunity Fund |

X | X | X | X | ||||||||||||||||

| Columbia Equity Value Fund |

X | X | X | X | * | |||||||||||||||

| Columbia European Equity Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Floating Rate Fund |

X | X | X | X | ||||||||||||||||

| Columbia Global Bond Fund |

X | X | X | X | X | |||||||||||||||

| Columbia Global Equity Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Global Extended Alpha Fund |

X | X | X | X | * | |||||||||||||||

| Columbia High Yield Bond Fund |

X | X | X | X | X | |||||||||||||||

| Columbia Income Builder Fund |

X | X | X | X | ||||||||||||||||

| Columbia Income Opportunities Fund |

X | X | X | X | ||||||||||||||||

| Columbia Inflation Protected Securities Fund |

X | X | X | X | ||||||||||||||||

| Columbia Large Core Quantitative Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Large Growth Quantitative Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Large Value Quantitative Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Limited Duration Credit Fund |

X | X | X | X | ||||||||||||||||

| Columbia Marsico Flexible Capital Fund |

X | |||||||||||||||||||

| Columbia Mid Cap Growth Opportunity Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Mid Cap Value Opportunity Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Minnesota Tax-Exempt Fund |

X | X | X | X | * | X | ||||||||||||||

| Columbia Money Market Fund |

X | X | X | X | X | |||||||||||||||

| Columbia Multi-Advisor International Value Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Multi-Advisor Small Cap Value Fund |

X | X | X | X | * | |||||||||||||||

| Columbia Portfolio Builder Aggressive Fund |

X | X | X | X | ||||||||||||||||

| Columbia Portfolio Builder Conservative Fund |

X | X | X | X | ||||||||||||||||

| Columbia Portfolio Builder Moderate Aggressive Fund |

X | X | X | X | ||||||||||||||||

| Columbia Portfolio Builder Moderate Conservative Fund |

X | X | X | X | ||||||||||||||||

| Columbia Portfolio Builder Moderate Fund |

X | X | X | X | ||||||||||||||||

| Columbia Recovery and Infrastructure Fund |

X | X | * | |||||||||||||||||

| Columbia Retirement Plus 2010 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2015 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2020 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2025 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2030 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2035 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2040 Fund |

X | X | ||||||||||||||||||

| Columbia Retirement Plus 2045 Fund |

X | X | ||||||||||||||||||

-3-

Table of Contents

| Fund |

1. Board Election |

2. Charter Amendment |

3. Redomiciling | 4. IMS Agreement |

5. Manager of Managers Proposal |

|||||||||||||||

| Columbia Short-Term Cash Fund |

X | X | X | X | ||||||||||||||||

| Columbia Strategic Allocation Fund |

X | X | X | X | * | |||||||||||||||

| Columbia U.S. Government Mortgage Fund |

X | X | X | X | * | |||||||||||||||

| RiverSource Partners International Select Growth Fund |

X | X | ||||||||||||||||||

| RiverSource Partners International Small Cap Fund |

X | X | ||||||||||||||||||

| * | For these Funds, the IMS Agreement Proposal would impact investment advisory fee rates, as described in the accompanying Joint Proxy Statement. |

Under Minnesota law, shareholders who do not wish to accept the redomiciling of a fund organized as a Minnesota corporation have the right to dissent and to receive the fair value of their shares. The provisions under Minnesota law addressing the rights of dissenters and the procedures to assert such rights have been attached as Appendix A. To exercise such rights, a shareholder must send a written notice to the Fund while the Fund’s corresponding Company is still organized as a Minnesota corporation to demand the fair value of the shares before a vote takes place. In addition, the shareholder must not vote the shares in favor of the proposal. Also, as with any mutual fund, shareholders may redeem their Fund shares to receive the full net asset value of those shares, net of any applicable contingent deferred sales charges, at any time. See Proposal 3 for more information on shareholders’ rights in connection with the proposed Redomiciling Agreement.

Additional information about the Funds is available in their respective prospectuses, statements of additional information and semi-annual and annual reports to shareholders. The Funds’ most recent semi-annual and annual reports previously have been mailed to shareholders.

Additional copies of any of these documents are available without charge upon request by writing Columbia Management Investment Services Corp., P.O. Box 8081, Boston, MA 02266-8081 or by calling (800) 345-6611. All of these documents also are filed with the U.S. Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at www.sec.gov.

-4-

Table of Contents

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| Proposal 4: Approve Proposed Investment Management Services Agreement |

7 | |||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 20 | ||||

| Procedures for Communications to the Columbia RiverSource Boards |

21 | |||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| Approval of Redomiciling Agreement by the Redomiciling Boards |

29 | |||

| 30 | ||||

| 31 | ||||

| Description and Comparison of the Proposed IMS Agreements and the Current IMS Agreements |

32 | |||

| 36 | ||||

| 37 | ||||

| 39 | ||||

| 43 | ||||

| 48 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 58 |

-5-

Table of Contents

| 59 | ||||

| 59 | ||||

| 59 | ||||

| 59 | ||||

| 59 | ||||

| 59 | ||||

| 59 |

| Dissenting Shareholders’ Rights under Minnesota Law | A-1 | |||||

| Share Ownership of Nominees | B-1 | |||||

| Board Governance Committee Charter | C-1 | |||||

| Executive Officer and Director Information | D-1 | |||||

| Director/Trustee Compensation | E-1 | |||||

| Comparison of Redomiciling Funds and New Funds | F-1 | |||||

| More Information on Columbia Management | G-1 | |||||

| Dates on Which Current IMS Agreements Were Last Approved by Shareholders | H-1 | |||||

| Comparison of Current and Proposed Annual Operating Expenses | I-1 | |||||

| Shares Outstanding | J-1 | |||||

| Principal Holders and Control Persons | K-1 |

-6-

Table of Contents

Proposal 1: Elect Directors/Trustees

The shareholders of the Funds of each Company are being asked to elect the 16 individuals identified in Proposal 1 (the “Nominees”) to serve as directors/trustees on the Columbia RiverSource Boards of the Companies. The Board Governance Committee of each Columbia RiverSource Board has recommended and nominated, and the full Columbia RiverSource Board has nominated, the Nominees for election to the Columbia RiverSource Boards, each to hold office for an indefinite term. Information about each Nominee is set forth below under Proposal 1.

Proposal 2: Approve Amendment to Charter Documents

To permit the implementation of Proposal 1, the shareholders of certain Funds are being asked to approve a proposed amendment to either (i) the Articles of Incorporation of each Company that is a Minnesota corporation (each, a “Charter Company” and collectively, the “Charter Companies”) or (ii) the Declaration of Trust of RiverSource Special Tax-Exempt Series Trust (also a “Charter Company”), which provides for an increase in the maximum number of directors/trustees of the Charter Companies. For ease of reference, the Articles of Incorporation and Declaration of Trust of the Companies are sometimes referred to in the Joint Proxy Statement as a “Charter” or the “Charters.” Information about the proposed amendment to the Charter Companies’ Charters is set forth under Proposal 2.

Proposal 3: Approve Agreement and Plan of Redomiciling

The shareholders of certain Funds are being asked to approve the Redomiciling Agreement, which provides for the redomiciling of (i) Funds that are series of Companies that are organized as Minnesota corporations and (ii) Columbia Minnesota Tax-Exempt Fund into new series of an existing Massachusetts business trust. A vote to approve the redomiciling with respect to any Fund will also constitute a vote to approve, if necessary to effect the redomiciling, any amendments to the governing documents of the Fund’s corresponding Company. Information about the Redomiciling Agreement is set forth under Proposal 3. Information about certain rights that shareholders of Minnesota corporations have is set forth in Appendix A.

Proposal 4: Approve Proposed Investment Management Services Agreement

The shareholders of each Fund (except Columbia Marsico Flexible Capital Fund, RiverSource Partners International Select Growth Fund and RiverSource Partners International Small Cap Fund) are being asked to approve a proposed Investment Management Services Agreement between such Fund’s corresponding Company, on behalf of such Fund, and Columbia Management Investment Advisers, LLC (“Columbia Management”). The proposed Investment Management Services Agreements, if approved, would conform to the standard form of Investment Management Services Agreement used by the Columbia-branded funds (the “Columbia Fund Complex”) and the funds that were formerly (and in some cases, currently) branded as RiverSource, Seligman and Threadneedle funds (the “RiverSource Fund Complex,” and together with the Columbia Fund Complex, the “Combined Fund Complex”), and are designed to achieve consistent investment management service and fee structures across the Combined Fund Complex. Under the proposed Investment Management Services Agreements, the Funds would continue to be managed by Columbia Management and are expected to receive at least the same level and quality of services as those received under the Investment Management Services Agreements currently in effect. Information about the proposed Investment Management Service Agreements is set forth under Proposal 4.

Proposal 5: Approve Manager of Managers Proposal

The shareholders of certain Funds are being asked to vote on a proposal to authorize Columbia Management to enter into and materially amend subadvisory agreements in the future, with the approval of their Company’s

-7-

Table of Contents

board of directors/trustees, but without obtaining shareholder approval. Information about the Manager of Managers Proposal is set forth under Proposal 5.

Effectiveness of the Proposals

Proposal 1 (election of directors/trustees) is contingent on Proposal 2 to the extent that if shareholders of a Charter Company elect all 16 Nominees but do not approve the proposed amendment to such Charter Company’s Charter, then William F. Truscott, an “interested person” of the Companies as defined in the Investment Company Act of 1940 (the “1940 Act”), would not continue as a director of that Charter Company. Approval of Proposal 1 by a Company is not contingent on the approval of Proposal 1 by any other Company.

Proposal 2 (approval of Charter amendment) is not contingent on the outcome of any other Proposal. Approval of Proposal 2 by a Charter Company is not contingent on the approval of Proposal 2 by any other Charter Company.

In the event that shareholders of a Fund that is listed under Proposal 3 (each, a “Redomiciling Fund” and collectively, the “Redomiciling Funds”) approve Proposal 3 with respect to their Fund, then upon the closing of the Redomiciling (defined below), the Redomiciling Fund will be reorganized and redomiciled as a new series (each, a “New Fund,” and collectively, the “New Funds”) of RiverSource Series Trust, an existing Massachusetts business trust. Shareholders of RiverSource Series Trust are concurrently considering and voting on a proposal that is identical to Proposal 1 (with the same slate of nominees), the outcome of which would determine the composition of the board of trustees that will oversee the New Funds following the closing of the Redomicilings, regardless of the outcome of the vote of the Redomiciling Funds’ shareholders on Proposal 1. Therefore, if the Redomiciling is approved for a Redomiciling Fund, the composition of the board of directors/trustees for such fund will not be determined by the outcome of Proposal 1. Approval of Proposal 3 by a Redomiciling Fund is not contingent on the approval of Proposal 3 by any other Redomiciling Fund.

Proposal 4 (approval of proposed Investment Management Services Agreement) and Proposal 5 (Manager of Managers Proposal) are not contingent on the outcome of any other Proposal. In the event that shareholders of a Redomiciling Fund approve the Redomiciling of their Fund, then the outcome of their Fund’s vote on the new Investment Management Services Agreement covered by Proposal 4 and the authorization covered by Proposal 5 shall apply to the New Fund. In the event that shareholders of a Redomiciling Fund do not approve the Redomiciling of their Fund, then the outcome of the vote on their Fund’s vote on the new Investment Management Services Agreement covered by Proposal 4 and the outcome of the authorization covered by Proposal 5 shall apply to such Redomiciling Fund as it currently exists within its Redomiciling Company (defined below). Approval of one or both of Proposal 4 and 5 by a Fund is not contingent on the approval of such Proposal(s) by any other Fund.

-8-

Table of Contents

PROPOSAL 1 — ELECT DIRECTORS/TRUSTEES

(All Funds)

On May 1, 2010, Ameriprise Financial, Inc. (“Ameriprise”), the parent company of Columbia Management, the Funds’ investment manager, acquired the long-term asset management business of Columbia Management Group, LLC and certain of its affiliated companies from Bank of America, N.A. (the “Transaction”). In connection with the Transaction, Columbia Management became the investment manager of the Columbia Fund Complex, in addition to the RiverSource Fund Complex.

Following the Transaction, the Columbia RiverSource Boards and the boards of trustees of the Columbia Fund Complex had ongoing discussions regarding a potential consolidated board of directors/trustees to oversee all or a portion of the Combined Fund Complex. In September 2010, these discussions culminated in an agreement between the Columbia RiverSource Boards and the current board of trustees of certain of the trusts in the Columbia Fund Complex (the “Columbia Nations Board”) to have a consolidated board of directors/trustees for a portion of the Combined Fund Complex. Specifically, they agreed that the RiverSource Fund Complex and the portion of the Columbia Fund Complex overseen by the Columbia Nations Board should be overseen by a combined board of directors/trustees. In this regard, even though the Columbia RiverSource Board that oversees each Fund would be larger and cause the portion of the fund complex overseen by it to pay more in director/trustee compensation in the aggregate, reducing the number of separate boards overseeing a fund complex can lead to operational efficiencies by reducing the number of board meetings, minimizing inconsistencies in governance and oversight matters, and streamlining the resources needed to support board reporting and interaction.

Each Fund is a series of one of the Companies, which are either corporations or business trusts. In order to effect the consolidation, at a joint meeting held on September 29, 2010, the Board Governance Committee of each Columbia RiverSource Board, in joint session with each Columbia RiverSource Board, recommended the nomination of the Non-Interested Nominees (defined below) and the Interested Nominees (defined below). Each Columbia RiverSource Board, including a majority of the directors/trustees who are not “interested persons,” as that term is defined in the 1940 Act, of such Columbia RiverSource Board (each, a “Non-Interested Director/Trustee” and collectively, the “Non-Interested Directors/Trustees”), and each Board Governance Committee voting separately, unanimously nominated the Non-Interested Nominees and Interested Nominees (defined below) and voted to present each Nominee to shareholders for election as directors/trustees. The Columbia RiverSource Boards currently have no reason to believe that any Nominee will become unavailable for election as a director/trustee, but if such unavailability should occur before the Meeting, the proxies will be voted for such other individuals as the Board Governance Committee of each Columbia RiverSource Board and each full Columbia RiverSource Board may designate.

The Board elections will be effective in the second quarter of 2011.

A Nominee is deemed to be “non-interested” to the extent the Nominee is not an “interested person,” as that term is defined in the 1940 Act, of the Companies (each, a “Non-Interested Nominee” and collectively, the “Non-Interested Nominees”). The Non-Interested Nominees are: Kathleen Blatz, Edward J. Boudreau, Jr., Pamela G. Carlton, William P. Carmichael, Patricia M. Flynn, William A. Hawkins, R. Glenn Hilliard, Stephen R. Lewis, Jr., John F. Maher, John J. Nagorniak, Catherine James Paglia, Leroy C. Richie, Alison Taunton-Rigby and Minor M. Shaw.

William F. Truscott and Anthony M. Santomero (each, an “Interested Nominee” and together, the “Interested Nominees”) are “interested persons” of the Companies. Mr. Truscott is an “interested person” of the Companies (an “Interested Director/Trustee”) because he serves as Chairman of the Board of Columbia Management (and was previously the President, Chairman of the Board and Chief Investment Officer of Columbia Management from 2001-2010) and as a senior executive of Ameriprise, the parent company of Columbia Management, in which he is also a stockholder. Although Dr. Santomero is “independent” of Columbia Management and its affiliates, in that he is not a director, officer or employee thereof, he is an “interested person” of the Companies because he serves as a director of Citigroup, Inc. and Citigroup, N.A., which may engage from time to time in brokerage execution, principal transactions and/or lending relationships with the Funds or other funds or accounts advised/managed by Columbia Management and/or a Fund’s subadviser.

-9-

Table of Contents