DEF 14AFALSEIDACORP, Inc.000105787700010578772023-01-012023-12-310001057877ida:MsGrowMember2023-01-012023-12-31iso4217:USD0001057877ida:MsGrowMember2022-01-012022-12-3100010578772022-01-012022-12-310001057877ida:MsGrowMember2021-01-012021-12-3100010578772021-01-012021-12-310001057877ida:MsGrowMember2020-01-012020-12-310001057877ida:MrAndersonMember2020-01-012020-12-3100010578772020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearMemberecd:PeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearMemberecd:PeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearMemberecd:NonPeoNeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearMemberecd:PeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearMemberecd:NonPeoNeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearMemberecd:PeoMemberida:MsGrowMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearMemberecd:PeoMemberida:MrAndersonMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearMemberecd:NonPeoNeoMember2020-01-012020-12-310001057877ida:AdjustmentChangeInPensionValueMemberecd:PeoMember2023-01-012023-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentChangeInPensionValueMember2023-01-012023-12-310001057877ida:AdjustmentChangeInPensionValueMemberecd:PeoMember2022-01-012022-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentChangeInPensionValueMember2022-01-012022-12-310001057877ida:AdjustmentChangeInPensionValueMemberecd:PeoMember2021-01-012021-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentChangeInPensionValueMember2021-01-012021-12-310001057877ida:AdjustmentChangeInPensionValueMemberecd:PeoMemberida:MsGrowMember2020-01-012020-12-310001057877ida:AdjustmentChangeInPensionValueMemberecd:PeoMemberida:MrAndersonMember2020-01-012020-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentChangeInPensionValueMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearUnvestedMemberecd:PeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearUnvestedMemberecd:PeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearUnvestedMemberecd:PeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearUnvestedMemberecd:PeoMemberida:MsGrowMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearUnvestedMemberecd:PeoMemberida:MrAndersonMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMemberida:MsGrowMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMemberida:MrAndersonMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberida:MsGrowMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMemberida:MrAndersonMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberida:MsGrowMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMemberida:MrAndersonMember2020-01-012020-12-310001057877ida:AdjustmentEquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001057877ida:AdjustmentForfeituresOfPriorYearAwardsThatFailedToVestDuringTheYearMemberecd:PeoMember2023-01-012023-12-310001057877ida:AdjustmentForfeituresOfPriorYearAwardsThatFailedToVestDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001057877ida:AdjustmentForfeituresOfPriorYearAwardsThatFailedToVestDuringTheYearMemberecd:PeoMember2022-01-012022-12-310001057877ida:AdjustmentForfeituresOfPriorYearAwardsThatFailedToVestDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310001057877ida:AdjustmentForfeituresOfPriorYearAwardsThatFailedToVestDuringTheYearMemberecd:PeoMember2021-01-012021-12-310001057877ida:AdjustmentForfeituresOfPriorYearAwardsThatFailedToVestDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310001057877ida:AdjustmentForfeituresOfPriorYearAwardsThatFailedToVestDuringTheYearMemberecd:PeoMemberida:MsGrowMember2020-01-012020-12-310001057877ida:AdjustmentForfeituresOfPriorYearAwardsThatFailedToVestDuringTheYearMemberecd:PeoMemberida:MrAndersonMember2020-01-012020-12-310001057877ida:AdjustmentForfeituresOfPriorYearAwardsThatFailedToVestDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310001057877ecd:PeoMemberida:AdjustmentDividendsPaidOnUnvestedAwardsMember2023-01-012023-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentDividendsPaidOnUnvestedAwardsMember2023-01-012023-12-310001057877ecd:PeoMemberida:AdjustmentDividendsPaidOnUnvestedAwardsMember2022-01-012022-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentDividendsPaidOnUnvestedAwardsMember2022-01-012022-12-310001057877ecd:PeoMemberida:AdjustmentDividendsPaidOnUnvestedAwardsMember2021-01-012021-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentDividendsPaidOnUnvestedAwardsMember2021-01-012021-12-310001057877ecd:PeoMemberida:MsGrowMemberida:AdjustmentDividendsPaidOnUnvestedAwardsMember2020-01-012020-12-310001057877ecd:PeoMemberida:MrAndersonMemberida:AdjustmentDividendsPaidOnUnvestedAwardsMember2020-01-012020-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentDividendsPaidOnUnvestedAwardsMember2020-01-012020-12-310001057877ecd:PeoMemberida:AdjustmentOptionsModifiedMember2023-01-012023-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentOptionsModifiedMember2023-01-012023-12-310001057877ecd:PeoMemberida:AdjustmentOptionsModifiedMember2022-01-012022-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentOptionsModifiedMember2022-01-012022-12-310001057877ecd:PeoMemberida:AdjustmentOptionsModifiedMember2021-01-012021-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentOptionsModifiedMember2021-01-012021-12-310001057877ecd:PeoMemberida:AdjustmentOptionsModifiedMemberida:MsGrowMember2020-01-012020-12-310001057877ecd:PeoMemberida:AdjustmentOptionsModifiedMemberida:MrAndersonMember2020-01-012020-12-310001057877ecd:NonPeoNeoMemberida:AdjustmentOptionsModifiedMember2020-01-012020-12-310001057877ida:AdjustmentPensionServiceCostMemberecd:PeoMember2023-01-012023-12-310001057877ida:AdjustmentPensionServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310001057877ida:AdjustmentPensionServiceCostMemberecd:PeoMember2022-01-012022-12-310001057877ida:AdjustmentPensionServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310001057877ida:AdjustmentPensionServiceCostMemberecd:PeoMember2021-01-012021-12-310001057877ida:AdjustmentPensionServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310001057877ida:AdjustmentPensionServiceCostMemberecd:PeoMemberida:MsGrowMember2020-01-012020-12-310001057877ida:AdjustmentPensionServiceCostMemberecd:PeoMemberida:MrAndersonMember2020-01-012020-12-310001057877ida:AdjustmentPensionServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310001057877ecd:PeoMember2023-01-012023-12-310001057877ecd:NonPeoNeoMember2023-01-012023-12-310001057877ecd:PeoMember2022-01-012022-12-310001057877ecd:NonPeoNeoMember2022-01-012022-12-310001057877ecd:PeoMember2021-01-012021-12-310001057877ecd:NonPeoNeoMember2021-01-012021-12-310001057877ecd:PeoMemberida:MsGrowMember2020-01-012020-12-310001057877ecd:PeoMemberida:MrAndersonMember2020-01-012020-12-310001057877ecd:NonPeoNeoMember2020-01-012020-12-31000105787712023-01-012023-12-31000105787722023-01-012023-12-31000105787732023-01-012023-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant □

Check the appropriate box: | | | | | |

| □ | Preliminary Proxy Statement |

| □ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| □ | Definitive Additional Materials |

| □ | Soliciting Material under §240.14a-12 |

| | | | | | | | | | | | | | | | | |

| IDACORP, INC. |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | |

| Payment of Filing Fee (Check all boxes that apply): |

| | |

| þ | No fee required |

| | |

| □ | Fee paid previously with preliminary materials |

| | |

| □ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

| | |

April 2, 2024

Dear Fellow Shareholders:

You are cordially invited to attend the 2024 Annual Meeting of Shareholders of IDACORP, Inc. The Annual Meeting will be held on Thursday, May 16, 2024 at 10:00 a.m. (Mountain Time). We have adopted again for this year a virtual format for our Annual Meeting to provide a consistent and convenient experience to all shareholders regardless of location. You may attend the Annual Meeting virtually via the Internet at www.proxydocs.com/IDA, where you will be able to vote electronically and submit questions. In order to attend, you must register in advance at www.proxydocs.com/IDA prior to the deadline of 3:00 p.m. (Mountain Time) on May 15, 2024. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will also permit you to submit questions. Please be sure to follow instructions found on your proxy card and voting authorization form and subsequent instructions that will be delivered to you via email.

The matters to be acted upon at the meeting are described in our proxy materials, which are being furnished to our shareholders over the Internet, other than to those shareholders who requested a paper copy. In addition, at the Annual Meeting we will discuss the company’s 2023 financial results, operational matters, and several of the company’s strategic initiatives and priorities.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, we urge you to promptly vote and submit your proxy via the Internet, by telephone, or by mail, in accordance with the instructions included in the proxy statement.

We appreciate your continued interest in and support of our company.

Sincerely,

| | | | | |

| |

Richard J. Dahl

Chair of the Board of Directors | Lisa A. Grow

President and CEO |

| |

| |

IDACORP, Inc.

1221 W. Idaho Street

Boise, Idaho 83702

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

VIRTUAL MEETING ONLY - NO PHYSICAL LOCATION

| | | | | |

| Date and Time: | Thursday, May 16, 2024 at 10:00 a.m. (Mountain Time) |

| |

| Place: | To register for and participate in the live online Annual Meeting, please visit www.proxydocs.com/IDA. Please note that you will need the control number included on your proxy card and Notice of Internet Availability in order to register for and to access the Annual Meeting. Registration to participate is due by 3:00 p.m. (Mountain Time) on Wednesday, May 15, 2024. |

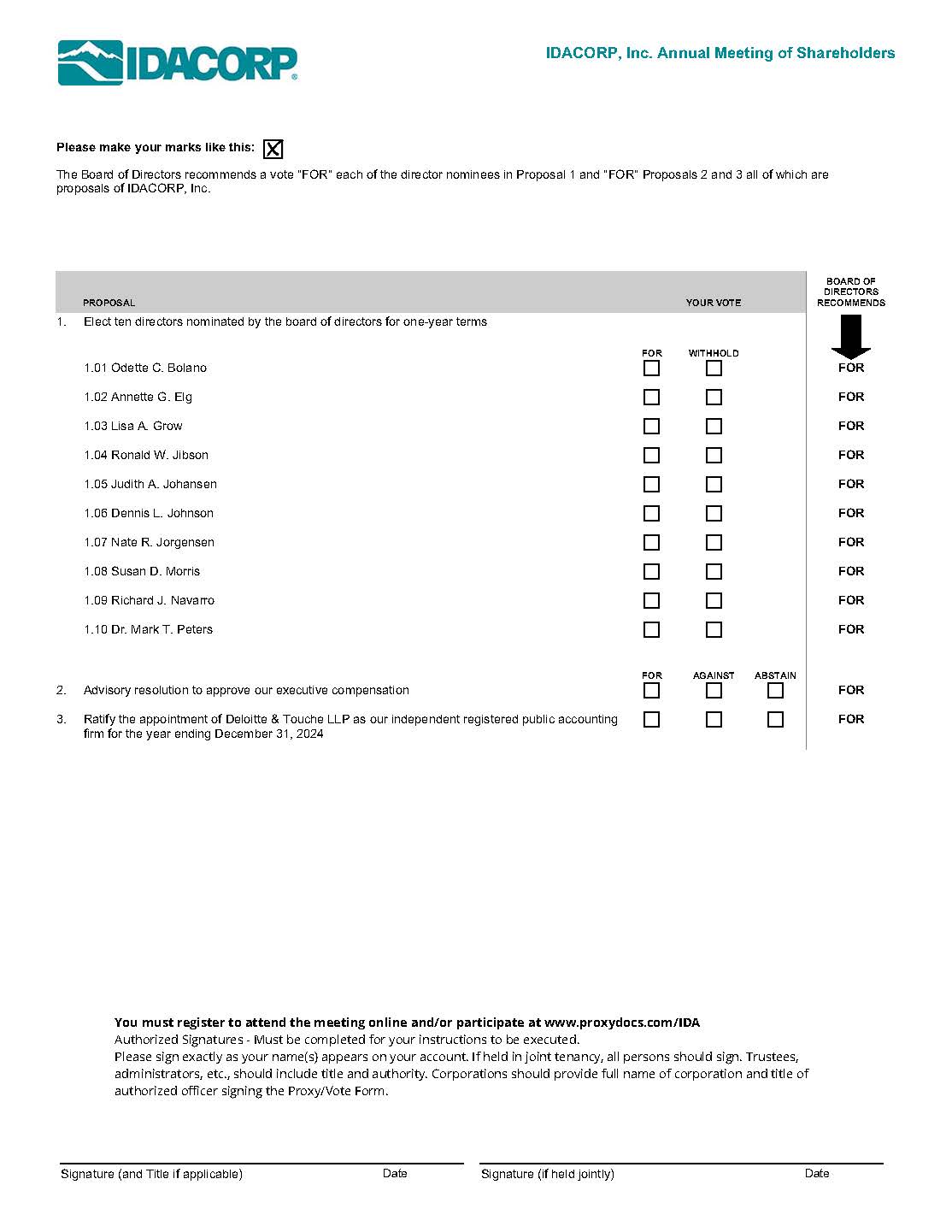

| Items of Business: | •To elect ten directors nominated by the board of directors for one-year terms; •To vote on an advisory resolution to approve executive compensation; •To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2024; and •To transact such other business that may properly come before the meeting and any adjournments or postponements of the meeting. |

| Other Matters: | As of the date of this notice, the company has received no notice of any matters, other than those listed above, that may properly be presented at the Annual Meeting. If any other matters are properly presented for consideration at the meeting, the persons named as proxies on the proxy card that accompanies this proxy statement, or their duly constituted substitutes, will be deemed authorized to vote the shares represented by proxy or otherwise act on those matters in accordance with their judgment. |

| Record Date: | Holders of record of IDACORP common stock at the close of business on March 27, 2024, are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

| How to Vote: | Please vote your shares at your earliest convenience. Registered holders may vote (a) by Internet prior to the Annual Meeting at www.proxydocs.com/IDA; (b) by Internet during the Annual Meeting at www.proxydocs.com/IDA (advance registration required); (c) by toll-free telephone by calling (866) 702-2221; or (d) by mail (if you received a paper copy of the proxy materials by mail) by marking, signing, dating, and promptly mailing the enclosed proxy card in the postage-paid envelope. If you hold your shares through an account with a brokerage firm, bank, or other nominee, please follow the instructions you receive from them to vote your shares. |

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting of Shareholders: Our 2024 proxy statement and our annual report for the year ended December 31, 2023, are available free of charge at

www.proxydocs.com/IDA.

By Order of the Board of Directors

Patrick A. Harrington

Corporate Secretary

April 2, 2024

CONTENTS

| | | | | | | | |

| | Page |

PROXY STATEMENT HIGHLIGHTS | | i |

| | |

PART 1 – INFORMATION ABOUT THIS PROXY STATEMENT AND THE ANNUAL MEETING | | 1 |

General Information | | 1 |

| | |

PART 2 – CORPORATE GOVERNANCE AT IDACORP | | 2 |

| | |

PART 3 – BOARD OF DIRECTORS | | 17 |

PROPOSAL NO. 1: Election of Directors | | 17 |

Committees of the Board of Directors | | 23 |

Director Compensation | | 25 |

| | |

PART 4 – EXECUTIVE COMPENSATION | | 28 |

Compensation Discussion and Analysis | | 28 |

Compensation and Human Resources Committee Report | | 43 |

Our Compensation Policies and Practices as They Relate to Risk Management | | 44 |

Compensation Tables | | 45 |

2023 Summary Compensation Table | | 45 |

Grants of Plan-Based Awards in 2023 | | 46 |

Outstanding Equity Awards at Fiscal Year-End 2023 | | 48 |

Option Exercises and Stock Vested During 2023 | | 49 |

Pension Benefits for 2023 | | 50 |

Potential Payments Upon Termination or Change in Control | | 55 |

PROPOSAL NO. 2: Advisory Resolution to Approve Executive Compensation | | 63 |

CEO Pay Ratio | | 64 |

| Pay Versus Performance | | 65 |

| | |

PART 5 – AUDIT COMMITTEE MATTERS | | 69 |

PROPOSAL NO. 3: Ratification of Appointment of Independent Registered Public Accounting Firm | | 69 |

Independent Accountant Billings | | 70 |

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services | | 71 |

Report of the Audit Committee | | 72 |

| | |

PART 6 – OTHER MATTERS | | 73 |

Other Business | | 73 |

Shared-Address Shareholders | | 73 |

2025 Annual Meeting of Shareholders | | 73 |

Annual Report and Financial Statements | | 73 |

Questions and Answers About the Annual Meeting, this Proxy Statement, and Voting | | 75 |

| | |

APPENDICES | | A-1 |

APPENDIX A – Compensation Survey Data Companies | | A-1 |

PROXY STATEMENT HIGHLIGHTS

2024 Annual Meeting Information:

In the Proxy Statement Highlights, we have included highlights of some of the matters discussed in more detail later in the proxy statement. As it is only a summary, please refer to the complete proxy statement and the 2023 Annual Report on Form 10-K for more information before you vote.

•Date and Time: May 16, 2024 at 10:00 a.m. (Mountain Time)

•Meeting Place and Registration Link: www.proxydocs.com/IDA. Virtual Meeting Only - No Physical Location

◦You must register by 3:00 p.m. (Mountain Time) on May 15, 2024

•Eligibility: You are eligible to vote if you were a shareholder of record at the close of business on March 27, 2024

•Your Vote: You may cast your vote in any of the following ways:

| | | | | | | | | | | |

| | | |

| Internet | Telephone | Mail | Virtual |

For registered holders, visit www.proxydocs.com/IDA to vote. If your shares are held in street name, follow the instructions delivered to you by your bank or broker. You will need the control number included in your proxy card, voter instruction form, or Notice of Internet Availability. | For registered holders, call

1-866-702-2221. If your shares are held in street name, call the number on your voter instruction form. You will need the control number included in your proxy card, voter instruction form, or Notice of Internet Availability. | Mail your completed and signed proxy card or voter instruction form (if you received a paper copy of the proxy materials by mail) to the address on your proxy card or voter instruction form. | To register for and vote in the live online Annual Meeting, please visit www.proxydocs.com/IDA. To register, you will need the control number included on your proxy card or Notice of Internet Availability. Registration is due by 3:00 p.m. (Mountain Time) on Wednesday, May 15, 2024. |

Agenda and Voting Matters:

| | | | | |

Summary Description of Voting Matters | Board Voting Recommendation |

1. Election of ten director nominees for a one-year term | ü FOR each director nominee |

2. Advisory resolution to approve our executive compensation | ü FOR |

3. Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2024 | ü FOR |

Information on Our Director Nominees:

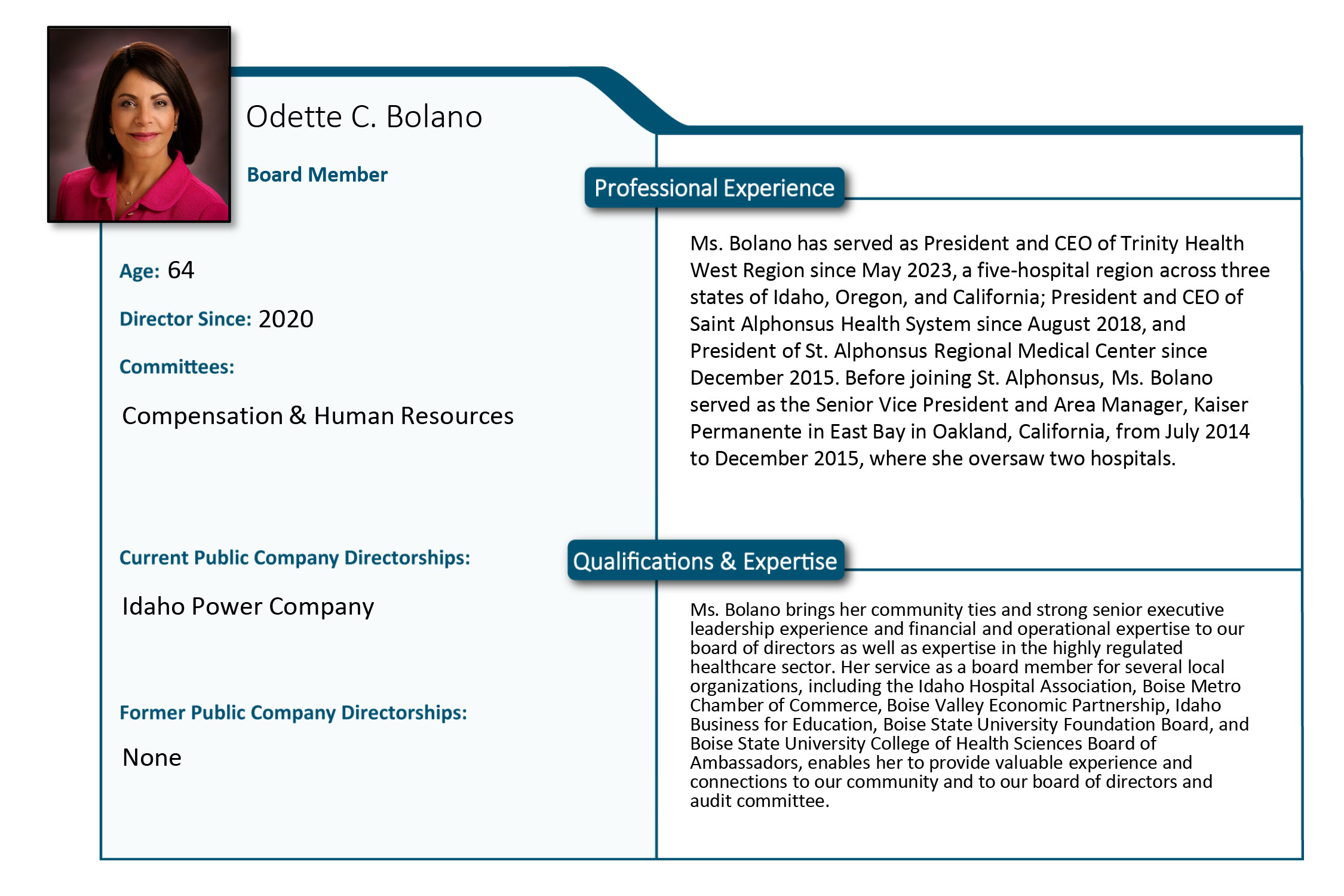

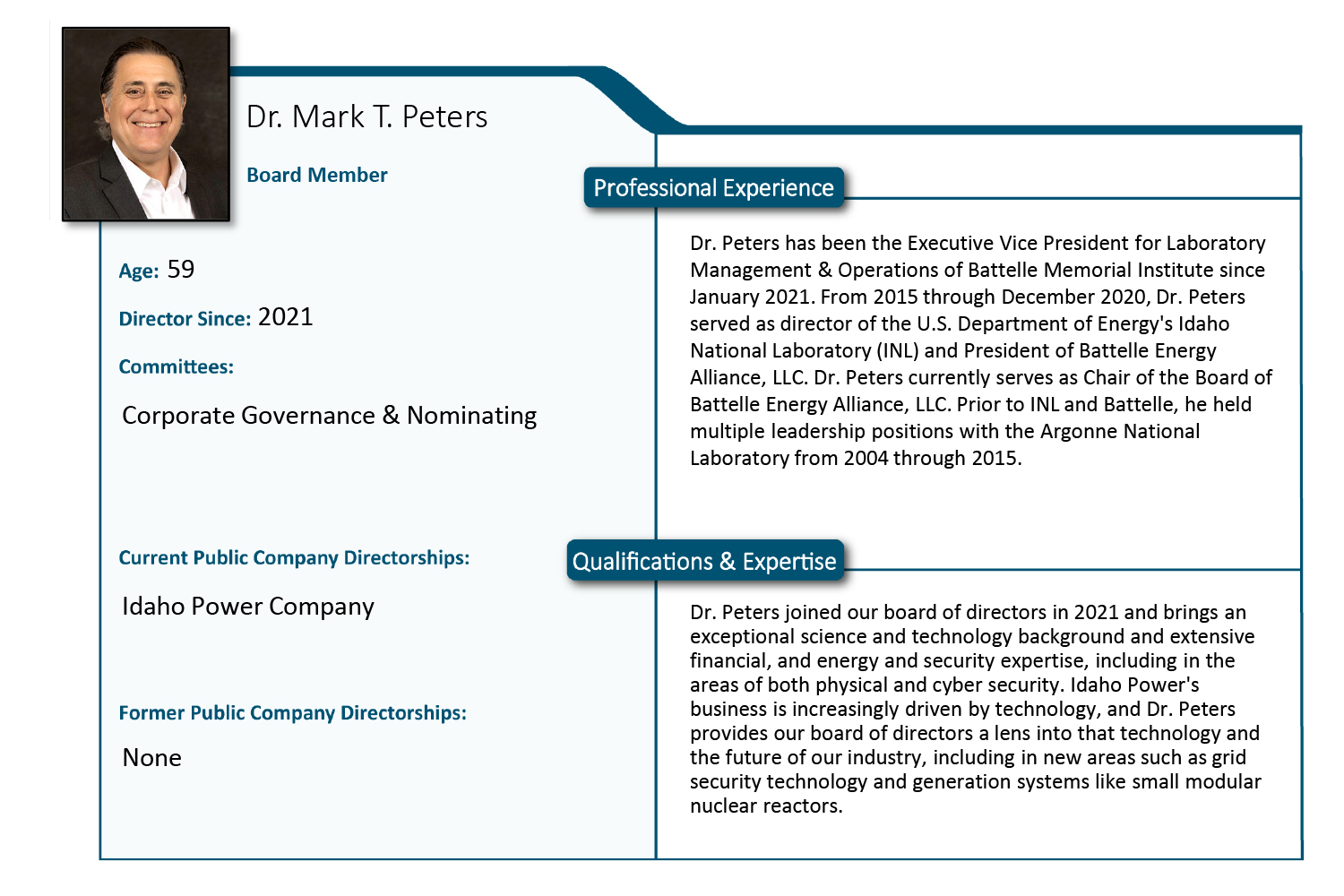

Our board of directors has nominated ten directors for election at the 2024 Annual Meeting. You are being asked to vote on the election of each of the ten nominees. Please see Part 3 – “Board of Directors” in this proxy statement for more information about each nominee. Below are the director nominee committee memberships and information as of the date of this proxy statement.

IDACORP, Inc. 2024 PROXY STATEMENT i

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Committee Memberships |

| Director Nominee | Director Since | Age | Independent1 | Audit | Comp & HR | Corp. Gov. & Nominating | Executive |

| Odette C. Bolano | 2020 | 64 | ü | | ü | | |

| Annette G. Elg | 2017 | 67 | ü | ü | ü | | |

| Lisa A. Grow | 2020 | 58 | | | | | © |

| Ronald W. Jibson | 2013 | 71 | ü | | ü | | |

| Judith A. Johansen | 2007 | 65 | ü | | © | ü | ü |

Dennis L. JohnsonBC | 2013 | 69 | ü | | | © | ü |

| Nate R. Jorgensen | 2023 | 59 | ü | ü | | | |

| Susan D. Morris | 2023 | 55 | ü | ü | | | |

| Richard J. Navarro | 2015 | 71 | ü | © | | | ü |

| Dr. Mark T. Peters | 2021 | 59 | ü | | | ü | |

© — Committee Chair

BC — Chair of the Board of Directors effective May 16, 2024 following Mr. Dahl's retirement

1 Independent according to New York Stock Exchange listing standards and our Corporate Governance Guidelines

IDACORP, Inc. 2024 PROXY STATEMENT ii

Our 2023 Performance Highlights

| | | | | |

| |

| *Dividends as of February 2024 |

We had a successful year during 2023 in a number of respects:

•IDACORP achieved net income growth for a sixteenth consecutive year;

•IDACORP increased its quarterly common stock dividend to $0.83 per share from $0.79 per share, as a part of a 177 percent increase in quarterly dividends approved over the last 12 years;

•Idaho Power reliably served its growing customer base, with customer growth of 2.4 percent in 2023;

•Megawatt-hour (“MWh”) sales to retail customers in 2023 were the second highest in Idaho Power's history, only behind 2022;

•Idaho Power’s reliability metrics continued to be among the best in company history, as Idaho Power provided uninterrupted service to its retail customers 99.97 percent of the time;

•Idaho Power achieved a settlement in its Idaho general rate case, with a 9.6 percent authorized return on equity;

•Idaho Power filed its 2023 Integrated Resource Plan (“IRP”) with the Idaho Public Utilities Commission (“IPUC”) and Oregon Public Utility Commission (“OPUC”) in September 2023. The 2023 IRP preferred resource portfolio plans for a significant increase in energy and capacity resources over the next 20 years to meet growing demand, primarily solar, wind, and battery resource additions, as well as conversions of multiple jointly-owned coal-fired generation units to natural gas-fired generation units and the addition of several transmission lines; and

•Idaho Power issued a formal request for proposal in April 2023, soliciting bids for new energy and capacity resources as well as energy that can be delivered via transmission, beginning in 2026.

Executive Compensation Program Design Highlights

We believe strong performance by our executive officers is essential to achieving long-term growth in shareholder value and to delivering superior service to our utility customers. We seek to accomplish this by making the majority of our executive officers’ pay “at-risk,” meaning we tie much of our executive officers’ target compensation to our financial and operational performance. To be earned, a substantial portion of our executives’ compensation requires that we achieve successful results over one- and three-year performance periods. As an executive’s level of responsibility increases, so does the percentage of total compensation at-risk, which we believe aligns the interests of our executives who have the highest level of decision-making authority with the interests of our shareholders. Our executive compensation policy provides that between 35 percent and 85 percent of our executive officers’ total target compensation should be at-risk incentive compensation under the short-term and long-term incentive plans.

ESG Highlights

We plan and operate with environmental, social, and governance (“ESG”) stewardship in mind, in addition to the financial aspects of the company’s operations. We recognize all decisions have financial, as well as non-financial, impacts on our customers, employees, shareholders, communities, and the environment.

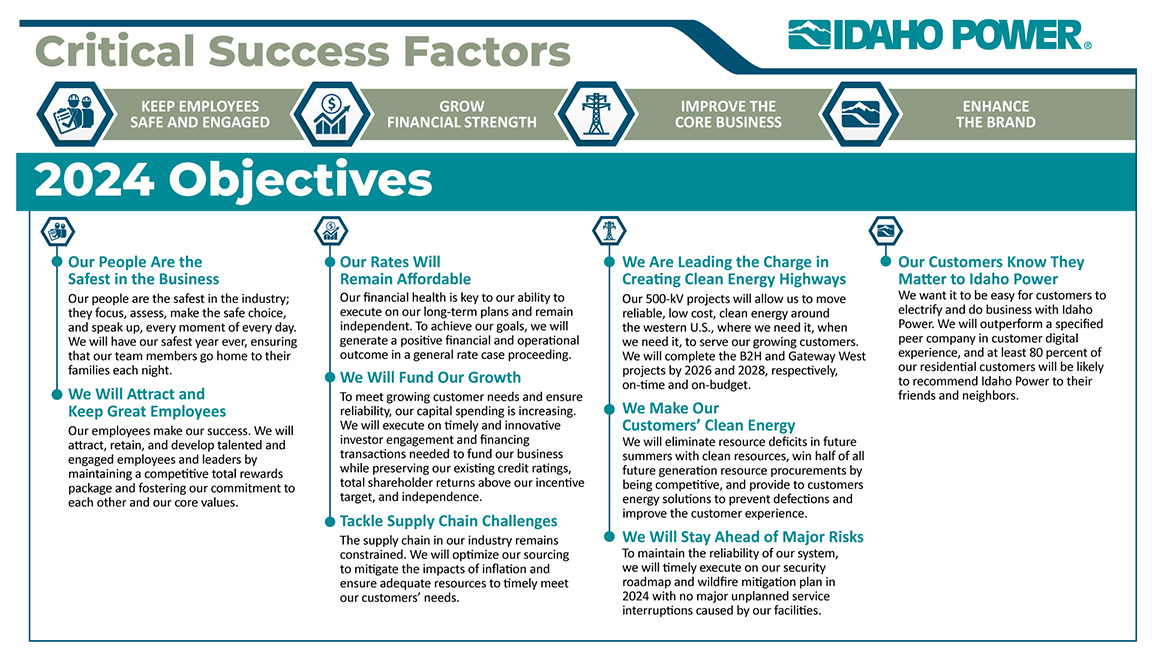

We intentionally include ESG action items across four priorities: keep employees safe and engaged, grow financial strength, improve the core business, and enhance the brand. In addition, we view our commitment to ESG as furthering the company’s short-, medium-, and long-term business strategies to safely provide our customers with reliable, affordable, clean energy while promoting an inclusive workplace where all employees are valued and respected. We believe this commitment will also enhance long-term owner value and promote environmental and community stewardship.

IDACORP, Inc. 2024 PROXY STATEMENT iii

Some of Idaho Power's environmental initiatives include conducting cloud-seeding operations, implementing a wildfire mitigation plan, enhancing grid resiliency and reliability, and continuing to further Snake River shading and in-stream river enhancement projects. We also plan for the social and economic impacts of climate change by working to achieve our carbon emissions intensity reduction goals, continuing efforts to transition from coal generation, increasing the integration of renewable energy, and enhancing outage communication efforts. We have actively engaged in voluntary carbon emissions intensity reduction over the past decade with multiple short-term goals, and in 2019, we set our “Clean Today. Cleaner Tomorrow.®” goal to provide Idaho Power's customers with 100-percent clean energy by 2045.

We are committed to the safety of our employees, customers, and the communities we serve. We believe that safe, engaged, and effective employees are critical to the company’s success and that the company’s record of safety helps keep our service to customers reliable and affordable. One of our core values is safety first. Reflective of our focus on safety, Idaho Power's average Occupational Safety and Health Administration (“OSHA”) recordable injury rate was below the industry average rate from 2018 through 2021. In 2023, we saw a decrease in our OSHA recordable injury rate, severity rate, and lost-time injury rate compared to 2022.

Governance Highlights and Investor Engagement

We seek to adopt and implement corporate governance practices that we believe are in the interests of our shareholders and that reflect best practices. Some of our governance practices include the following:

Our relationship with our shareholders and the investment community is of great importance to our company. To that end, shareholder engagement is a consideration in the performance evaluation of members of our executive team. Aside from our normal corporate communications, we engage with shareholders, the investment community, and interest groups through our participation in various utility and investment conferences, mini road shows, and one-on-one meetings and telephone discussions with investors. During those meetings, we solicit input on topics such as corporate governance, executive leadership, dividends, disclosure and corporate communications, transparency, and sustainability. In 2023, management and the chair of our compensation and human resources committee reached out directly to shareholders holding over 50 percent, and met with shareholders holding over 15 percent, of IDACORP's outstanding shares. The shareholders we engaged with in 2023 remained supportive of our strategy and financial performance and our executive compensation program. Shareholder support is further evidenced by our 2023 say-on-pay advisory vote, which received a 94.5 percent positive vote from our shareholders.

IDACORP, Inc. 2024 PROXY STATEMENT iv

Summary of Our Compensation Policies

We seek to establish performance metrics for incentive compensation that reward our executive officers for achieving objectives that align with our customers' and shareholders’ interests, and we use both operational and financial metrics for our incentive compensation. Our long-term incentive metrics are measures of the creation of shareholder value, rewarding appreciation in stock price and total shareholder return (“TSR”). Short-term incentive is paid in cash and long-term incentive is paid in IDACORP restricted stock units. Because of the diversity of our performance metrics, our executive officers’ annual compensation can vary considerably depending on our actual performance in any period. For 2023, we used the following metrics:

| | | | | | | | |

| |

In the chart above, the term “ADITC” refers to accumulated deferred investment tax credits. |

We have a number of compensation policies and practices that we use to help align the interests of management with our shareholders, including the following:

ü We use a number of financial and operational performance metrics for executive compensation and have a policy that a significant percentage of our executives’ target compensation be at-risk;

ü We have solely independent directors on our compensation and human resources committee;

ü Our compensation and human resources committee retains an independent compensation consultant;

ü We impose minimum stock ownership and retention obligations for executive officers and performance-based RSUs are not counted toward the ownership obligations;

ü We have a clawback policy that provides for the recovery of incentive compensation pursuant to SEC and New York Stock Exchange requirements;

ü We impose maximum limits on incentive compensation;

ü We do not provide employment agreements;

ü We do not permit hedging or pledging of our stock by executive officers;

ü We provide only limited perquisites;

ü We do not provide stock options;

ü We have a low burn rate on equity for incentive awards;

ü We analyze peer groups and market data; and

ü We set our target goal for TSR performance at the 55th percentile of our peer group for long-term incentive.

In 2023, we received 94.5 percent of votes cast in favor of our executive compensation programs. Please see Part 4 – “Executive Compensation” in this proxy statement for a more detailed discussion of our compensation programs, including plan metrics and payouts, and our shareholder engagement efforts.

IDACORP, Inc. 2024 PROXY STATEMENT v

| | |

|

PROXY STATEMENT

IDACORP, Inc. – 1221 W. Idaho Street – Boise, Idaho 83702

PART 1 – INFORMATION ABOUT THIS PROXY STATEMENT AND THE ANNUAL MEETING |

General Information

This proxy statement contains information about the 2024 Annual Meeting of Shareholders (“Annual Meeting”) of IDACORP, Inc. (“IDACORP”). The Annual Meeting will be held on Thursday, May 16, 2024 at 10:00 a.m. (Mountain Time). We have adopted a virtual-only format for our Annual Meeting to provide a consistent and convenient experience to all shareholders regardless of location. You may attend the Annual Meeting virtually via the Internet at www.proxydocs.com/IDA, where you will be able to vote electronically and submit questions. In order to attend, you must register in advance at www.proxydocs.com/IDA prior to 3:00 p.m. (Mountain Time) on May 15, 2024. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting and will also permit you to submit questions. Please be sure to follow instructions found on your proxy card and voting authorization form and subsequent instructions that will be delivered to you via email.

References in this proxy statement to the “company,” “we,” “us,” or “our” refer to IDACORP. We also refer to Idaho Power Company (“Idaho Power”) in this proxy statement. Idaho Power is an electric utility engaged in the generation, transmission, distribution, sale, and purchase of electric energy and is our principal operating subsidiary.

This proxy statement is being furnished to you by our board of directors to solicit your proxy to vote your shares at the Annual Meeting and any adjournment of the Annual Meeting. All returned proxies that are not revoked will be voted in accordance with your instructions.

You are entitled to participate in the Annual Meeting only if you are an IDACORP shareholder as of the close of business on March 27, 2024, the record date, or hold a valid proxy for the meeting. In order to be admitted to the online Annual Meeting, you must have the control number included on your proxy card and Notice of Internet Availability.

We make our proxy materials and our annual report to shareholders available on the Internet as our primary distribution method. Most shareholders will only be mailed a Notice of Internet Availability. The scheduled mailing date of the Notice of Internet Availability is on or about April 2, 2024. The Notice of Internet Availability specifies how to access proxy materials on the Internet, how to submit your proxy vote, and how to request a hard copy of the proxy materials. On or about April 2, 2024, we also began mailing printed copies of our proxy materials to our shareholders who had previously requested paper copies of our proxy materials.

Note About Forward-Looking Statements: Statements in this proxy statement that relate to future plans, objectives, expectations, performance, events, and the like, including statements regarding future financial and operational performance (whether associated with compensation arrangements or otherwise) and ESG goals and targets, may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Forward-looking statements may be identified by words including, but not limited to, “anticipates,” “believes,” “intends,” “estimates,” “expects,” “targets” “should,” and similar expressions. Shareholders are cautioned that any such forward-looking statements are subject to risks and uncertainties. Actual results may differ materially from those projected in the forward-looking statements. We assume no obligation to update any such forward-looking statement, except as required by applicable law. Shareholders should review the risks and uncertainties listed in our most recent Annual Report on Form 10-K and other reports we file with the U.S. Securities and Exchange Commission (“SEC”), including the risks described therein, which contain factors that may cause results to differ materially from those contained in any forward-looking statement.

No Incorporation by Reference: This proxy statement includes several website addresses and references to additional materials and reports found on those websites. These websites, materials, and reports are not incorporated by reference herein.

IDACORP, Inc. 2024 PROXY STATEMENT 1

| | |

PART 2 – CORPORATE GOVERNANCE AT IDACORP |

Overview of Our Corporate Governance Practices

The goals of our corporate governance principles and practices are to promote the long-term interests of our shareholders, as well as to maintain appropriate checks and balances and compliance systems, to strengthen management accountability, engender public trust, and facilitate prudent decision making. We evaluate our corporate governance principles and practices and modify existing, or develop new, policies and standards when appropriate. Some of our notable corporate governance practices include the following:

| | | | | | | | | | | |

| ü | Annual election of all directors

| ü | Majority vote resignation policy for directors in uncontested elections |

| ü | Independent chair | ü | Compensation clawback policy |

| ü | 11 of our 12 current directors and 9 of 10 director nominees are independent | ü | Stock retention requirement for officers |

| ü | Regular board and committee executive sessions by non-management and independent directors | ü | Mandatory continuing education requirements for our directors |

| ü | Mandatory director retirement age of 72 | ü | No shareholder rights plan |

| ü | Stock ownership requirement for directors and officers and performance-based RSUs are not counted toward the requirement | ü | Independent audit, compensation and human resources, and corporate governance and nominating committees |

| ü | Prohibition on hedging and pledging of securities for directors and officers | ü | Robust codes of conduct and ethics, reviewed by our board |

| ü | Annual self-evaluations of the board and committees | ü | Significant participation by the board in succession planning |

| ü | Board oversight of our cultural values of safety, integrity, and respect | ü | Consideration of diversity in our board member selection |

IDACORP, Inc. 2024 PROXY STATEMENT 2

Our Strategy and ESG Initiatives

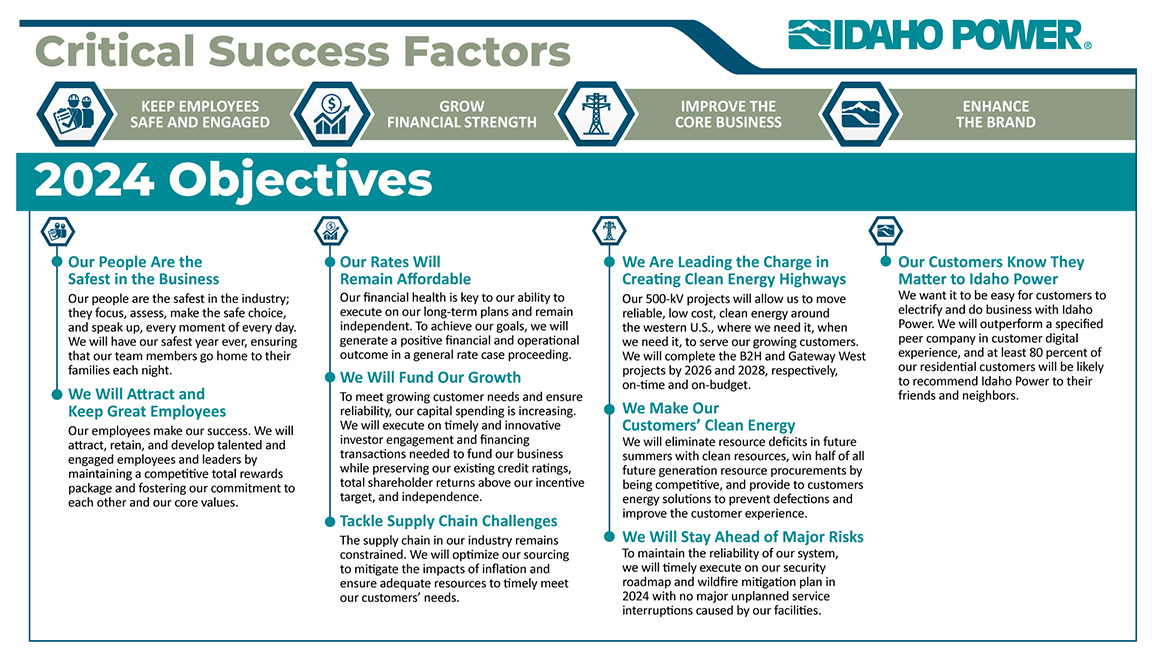

We are committed to our focus on competitive total returns and generating long-term value for shareholders. Our business strategy emphasizes Idaho Power as our core business, as Idaho Power's regulated utility operations are the primary driver of our operating results. Our board of directors regularly reviews our long-term strategy, which for 2024 is focused on the following objectives:

Note: In the chart above, the term “B2H” refers to the Boardman-to-Hemingway project, a proposed 300-mile, high-voltage transmission line between a substation near Boardman, Oregon, and the Hemingway substation near Boise, Idaho.

In executing on the objectives above, we seek to balance the interests of shareholders, Idaho Power customers and employees, and other stakeholders. Idaho Power is committed to working for strong, sustainable financial results by continuing to safely provide reliable, affordable, clean energy to its customers from diversified generation resources.

ESG Initiatives

Our corporate governance and nominating committee, with considerable focus from our board of directors, is primarily responsible for the oversight of our ESG initiatives. These initiatives are identified by management as material to the company's business and the board of directors is informed at least quarterly by members of the company's ESG steering committee (comprised of officers and business area experts) of the goals, measures, and results of our ESG programs. We publicly release annual ESG reports and the most current ESG report is located on Idaho Power’s website, together with other information on ESG issues relevant to Idaho Power. Our ESG report incorporates elements of the Taskforce on Climate-related Financial Disclosure (“TCFD”) guidelines and the Sustainability Accounting Standards Board (“SASB”) reporting framework, as well as the Edison Electric Institute (“EEI”) ESG reporting template. Additionally, Idaho Power responded to the Climate Disclosure Project (“CDP”) annual questionnaire, providing emissions data and management plans to address risks associated with climate change. The ESG reports, CDP filing, and related website content are not incorporated by reference into this proxy statement.

IDACORP, Inc. 2024 PROXY STATEMENT 3

Our ESG initiatives include:

•establishing responsible management goals and strategies related to our impact on the environment, such as:

◦Idaho Power's “Clean Today. Cleaner Tomorrow.®” goal to provide Idaho Power's customers with 100-percent clean energy by 2045, and its short- and medium-term carbon dioxide (“CO2”) emission reduction targets described below in this proxy statement under “Carbon Emission Reduction;”

◦the sustainability benefits from the Boardman-to-Hemingway and Gateway West transmission projects, which include integrating renewable energy generation and deferring or eliminating the need for development of additional fossil-fueled resources;

◦integrating renewable resources into Idaho Power's generation mix and identifying and investigating new generation and storage technologies;

◦continuing various environmental stewardship programs along the Snake River, including fish habitat preservation, water temperature reduction, and fish and plant restoration;

◦wildfire mitigation planning and actions; and

◦wildlife habitat, archaeological and cultural resource, and raptor protection stewardship programs;

•operational excellence in providing reliable, affordable, and clean energy, including enhanced grid resiliency and reliability;

•engaging and empowering Idaho Power’s workforce (including succession planning at all levels, employee development, leadership education, retirement planning education, and providing competitive compensation and benefits, including post-retirement benefits);

•promoting a culture of safety, security, and inclusiveness for all employees; and

•building strong community partnerships for healthy, sustainable economic development in Idaho Power’s service area.

Carbon Emission Reduction

Carbon emissions intensity is a measure of the pounds of CO2 emitted per MWh of energy generated. Idaho Power tracks carbon emissions intensity to measure the impact of its efforts to reduce carbon emissions relative to growing power demand in its service area. We have actively engaged in voluntary carbon emissions intensity reduction over the past decade with an original short-term goal to reduce emissions 10-15 percent from the baseline year of 2005 levels. We increased the short-term goal to reduce carbon emission intensity by at least 15-20 percent for the period from 2010 to 2020, and we exceeded this goal with an average reduction of 29 percent over that period compared to 2005. In May 2020, our board of directors approved an increased short-term goal to reduce carbon emission intensity by 35 percent for the period from 2021-2025 compared to 2005.

IDACORP, Inc. 2024 PROXY STATEMENT 4

In January 2022, Idaho Power began posting its emissions reduction report on its website that established short-, medium-, and long-term targets for further CO2 reductions. This report also includes projections of annual power generation levels and associated CO2 emissions and emissions intensity for the 2024-2043 period. The emissions reduction report is not incorporated in this proxy statement. Idaho Power has significantly reduced its CO2 emissions since the 2005 baseline year, primarily by decreasing its coal generation levels, including terminating coal generation at the North Valmy Unit 1 in 2019 and at the Boardman plant in 2020, and also by upgrading its hydropower facilities, and through its energy efficiency, demand-side management, and cloud-seeding programs. Idaho Power plans to continue to reduce CO2 emissions intensity in future years, including a medium-term goal with a targeted 88 percent reduction in annual CO2 emissions intensity from all sources by 2030, compared to the 2005 baseline year. In 2019, we announced our long-term goal to provide 100 percent clean energy by 2045.

We monitor environmental requirements and assess whether environmental control measures are economically appropriate. Our 2023 IRP identified the following schedule to cease coal-fired operations in our remaining co-owned coal-fired plants and convert those operations to natural gas.*

*Idaho Power's planned conversion of its coal-fired units to natural gas and the timing of those conversions are subject to a number of assumptions and uncertainties described in the 2023 IRP as well as regulatory approval.

Climate Change Adaptation

We believe our practice of in-depth planning and prudent preparation helps us adapt to and address the risks of climate change. For more than 100 years, Idaho Power has adapted to changes in temperatures, water conditions, economic impacts, and regulatory requirements. In recent years, we have proactively addressed risks associated with climate change through preventative measures. To address the physical impacts of climate change, Idaho Power conducts cloud-seeding operations, implements a wildfire mitigation plan, enhances grid resiliency and reliability, and continues to further Snake River shading and in-stream river enhancement projects. We also plan for the social and economic impacts of climate change by working to achieve our carbon emissions intensity reduction goals, continuing efforts to transition away from coal generation, increasing the integration of renewable energy, and enhancing customer and stakeholder outage communication. Additionally, to plan for the potential regulatory impacts of climate change, we consider climate-related impacts in planning efforts, plan and advocate for additional transmission capacity to integrate additional renewable energy onto our system, identify and investigate new technologies, including battery storage, hydrogen generation, and modular nuclear reactor technology, and evaluate modifications to our pricing structure we believe will help ensure fair pricing for all customers.

Board and Board Committee Oversight of Human Capital Management

Our board of directors provides oversight for the company's human capital management. Management updates the full board of directors and its committees regularly on safety metrics, total rewards for employees, benefit and pension programs, succession planning and training programs, and unity and inclusion initiatives, among other things. Each committee of the board of directors is delegated and takes on specific roles in this oversight. The compensation and human resources committee is responsible for overseeing employee compensation and benefit plans and general labor issues, as well as unity and inclusion matters. The audit committee is responsible for overseeing risk management, including compliance with the code of business conduct and physical and cybersecurity risks. The corporate governance and nominating committee is responsible for overseeing risks associated with governance and social issues associated with employees as part of its ESG risk oversight function.

Safety

We are committed to the safety of our employees, customers, and the communities we serve. We believe that safe, engaged, and effective employees are critical to the company’s success and that the company’s record of safety helps keep our service to customers reliable and affordable. One of our core values is safety first. Reflective of our focus on safety, Idaho Power's average

IDACORP, Inc. 2024 PROXY STATEMENT 5

OSHA recordable injury rate was below the industry average rate from 2018 through 2021. In 2023, we saw a decrease in our OSHA recordable injury rate, severity rate, and lost-time injury rate compared to 2022.

In 2023, we trained all employees on proactively identifying warning signs to help prevent incidents; held a safety summit for our lines and stations contractors; improved our contractor onboarding and evaluation process; and trained our human resources and safety staff on how to better help employees with mental health in response to critical stress incidents. On our 2023 employee engagement survey, 94% of employees indicated they feel comfortable speaking up for safety. We also had 97% participation in meeting safety goals around focusing, assessing, making the safe choice, and speaking up.

Our Culture of Inclusivity

One of our core values as a company is “respect for all.” Our Code of Business Conduct, available publicly on our website, states our position that employees deserve a workplace where they are treated in a professional and respectful manner, and each of our employees has the responsibility to create and maintain such an environment. In furtherance of this core value, we post our “Our Commitment to Each Other” statement on our website, which promotes an inclusive company environment as follows:

At Idaho Power, we are committed to an inclusive environment where we are all valued, respected and given equal consideration for our contributions. We believe that to be successful as a company we must be able to innovate and adapt, which only happens when we seek out and value diverse backgrounds, opinions and perspectives. Our collaborative environment thrives when we are engaged, feel we belong and are empowered to do our best work. We are a stronger company when we stand together and embrace our differences.

Our talent acquisition and talent development teams within our Human Resources department partner closely with senior management to ensure alignment of the company's human capital management with our corporate values. We strive to recruit and retain diverse talent from all backgrounds, instill an inclusive culture and strengthen programs that provide advancement opportunities for all. We have programs in place to encourage science, technology, engineering, and mathematics (“STEM”) participation, training to minimize bias and ensure a respectful and inclusive workplace, community outreach to underserved communities, and partnerships with multiple diversity-focused organizations. We also have a steering committee consisting of officers, senior managers, and other employees to help the company foster a culture of respect and belonging. We consider unity and inclusion to be important components of our overall ESG program, and certain of our officers regularly provide information on those and other ESG efforts to our board of directors and board committees.

As of December 31, 2023, 44 percent of our senior management were women, 29 percent of our officers were women, 42 percent of our board of directors were women, three members of our board of directors (25 percent) were racially or ethnically diverse, one committee chair was ethnically diverse, and, in total 7 of our 12 directors (58 percent) had diverse identities. The board of director nominees for the 2024 Annual Meeting consist of 50 percent women, two members (20 percent) who are racially or ethnically diverse, one committee chair nominee is ethnically diverse, and in total, 6 of our 10 director nominees (60 percent) have diverse identities.

Employee Satisfaction

Our human capital programs are designed to attract, retain, and develop the highest quality employees. We consistently experience a relatively low voluntary attrition rate of less than 3 percent that we attribute to maintaining a good relationship with our employees due to a strong safety culture, respectful and inclusive environment, opportunities for development, and competitive compensation and benefits. We regularly conduct employee engagement surveys to seek feedback from our employees on a variety of topics, including safety reporting, support for personal development, understanding of the company’s initiatives, communication, being treated with respect, and feeling valued. We share the survey results with employees, and senior management incorporates the results of the surveys in their action plans in order to respond to the feedback and improve employee relations. We achieved a 77 percent participation rate in the 2023 employee engagement survey with an overall 82 percent positive employee satisfaction score.

Total Rewards

We provide our employees with competitive pay and benefits, based in large part on salary studies and market data. We use a structured compensation schedule and regularly conduct compensation analyses that help mitigate the potential for gender, race, or ethnicity-based disparities in compensation. Beyond base salaries and incentive compensation, benefits for all full-time employees include a 401(k) plan with company matching contributions, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leave, parental leave, employee assistance programs, and tuition assistance. Currently after five years of employment, a full-time employee vests in Idaho Power’s defined benefit pension plan. We also tie

IDACORP, Inc. 2024 PROXY STATEMENT 6

annual employee incentive compensation to metrics based on the categories of earnings, power system reliability, and customer satisfaction reflective of broad stakeholder interests and the value of each employee's contribution.

We deliver a variety of training opportunities and provide rotational assignment and continuous learning and development opportunities to our employees. Our talent development programs, overseen by a talent development team in the Human Resources department, are designed to help employees achieve their career goals, build management skills, and lead their organizations.

We also encourage and enable our employees to support many charitable causes. This includes volunteer program engagement promoted by the company or employees. We also have an employee-led organization called the “Employee Community Funds,” which administers charitable contributions from employees; Idaho Power matches a portion of employee donations, which supplements the company’s separate charitable contributions.

Additional ESG Information

To learn more about our corporate responsibility and ESG efforts, see our most recent ESG Report on our website at www.idacorpinc.com/about-us/sustainability. The information in that report is not incorporated by reference into this proxy statement.

Codes of Business Conduct

We have a Code of Business Conduct that applies to all of our officers and employees. We also have a separate Code of Business Conduct and Ethics for directors. These are posted on our website at www.idacorpinc.com/corporate-governance/governance-documents. We will also post on that website any amendments to, or waivers of, our Codes of Business Conduct, as required by SEC rules or New York Stock Exchange listing standards.

Board Leadership Structure

The board of directors separated the positions of chair of the board of directors and chief executive officer (“CEO”) in 1999. Our CEO is responsible for leadership, overall management of our business strategy, and day-to-day operations, while our chair presides over meetings of our board of directors and provides guidance to our CEO regarding policies and procedures approved by our board of directors. Separating these two positions allows our CEO to focus on our day-to-day business and operations, while allowing the chair of the board of directors to lead the board of directors in its fundamental role of providing advice to, and independent oversight of, management. The board of directors recognizes the time, effort, and energy that the CEO is required to devote to his or her position, as well as the increasing commitment required of the chair position, particularly as the board of directors’ oversight responsibilities continue to grow.

While our bylaws and Corporate Governance Guidelines do not mandate that our chair and CEO positions be separate, the board of directors believes for the reasons outlined above that having separate positions and having an independent director serve as chair is the appropriate leadership structure for the company at this time. The board of directors believes that this issue is part of the succession planning process and that it is in the best interests of the company for the board of directors to make a determination as to the advisability of continuing to have separate positions when it appoints a new CEO.

Risk Oversight and Succession Planning

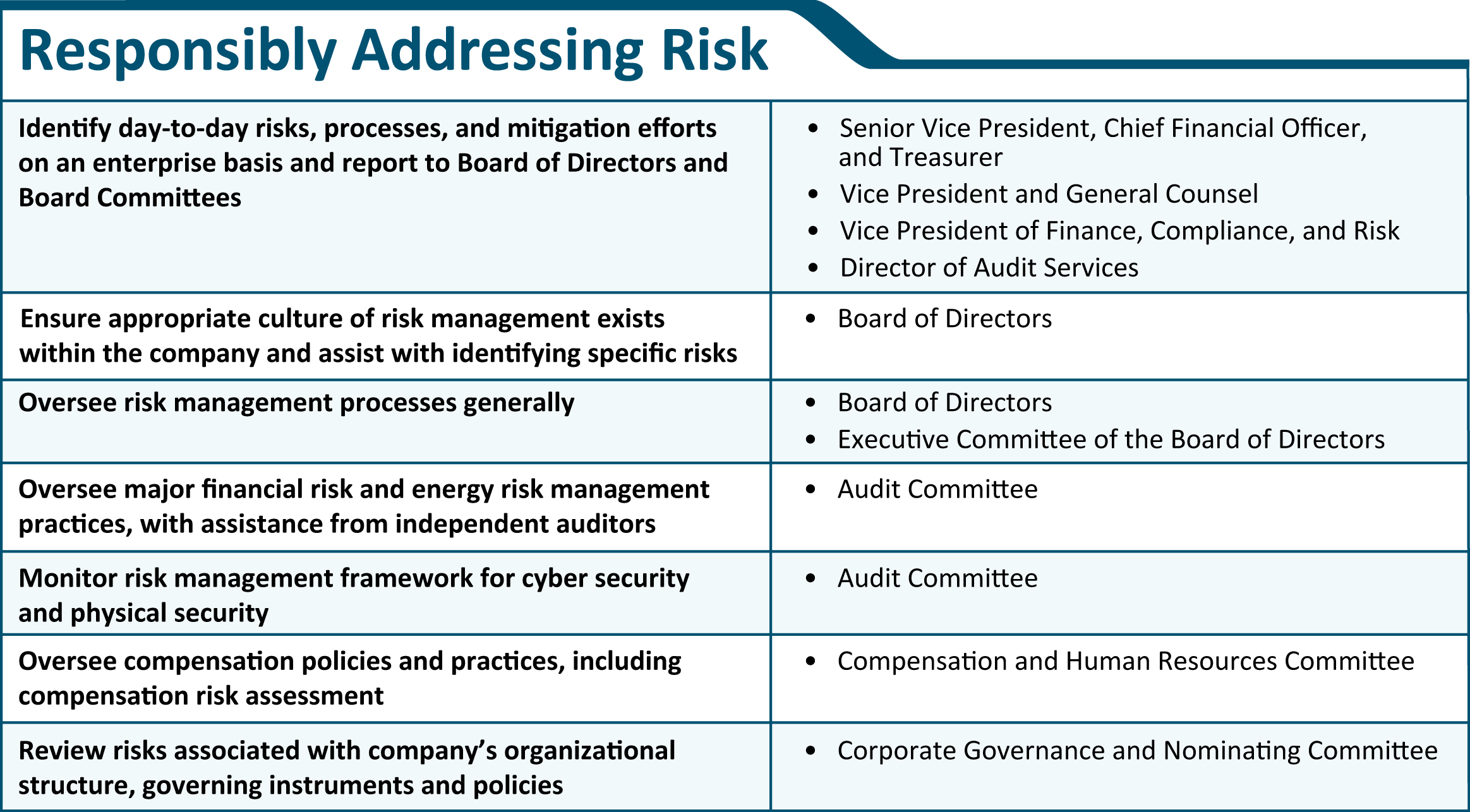

Our management team is responsible for the day-to-day management of risks the company faces. Our senior vice president, chief financial officer, and treasurer, our vice president and general counsel, and our vice president of finance, compliance, and risk, together with our director of audit services, are responsible for overseeing and coordinating risk assessment processes and mitigation efforts on an enterprise-wide basis. These leaders administer processes intended to identify key business risks, assist in appropriately assessing and managing these risks within stated limits, enforce policies and procedures designed to mitigate risk, and report on these items to other members of senior management and the board of directors. These leaders report regularly to the board of directors and appropriate board committees regarding risks the company faces and how the company is managing those risks.

IDACORP, Inc. 2024 PROXY STATEMENT 7

While our senior vice president, chief financial officer, and treasurer, our vice president and general counsel, our vice president of finance, compliance, and risk, and our director of audit services, together with other members of our senior leadership team, are responsible for the day-to-day management of risk, our board of directors is responsible for ensuring that an appropriate culture of risk management exists within our company, for setting the right “tone at the top,” and assisting management in addressing specific risks that our company faces. The board of directors has the responsibility to oversee the risk management processes designed and implemented by management and confirm the processes are adequate and functioning as designed.

While the full board of directors is ultimately responsible for high-level risk oversight at our company, it is assisted by the executive committee, the audit committee, the compensation and human resources committee, and the corporate governance and nominating committee in fulfilling its oversight responsibilities in certain areas of risk. The executive committee assists the board of directors in fulfilling its oversight responsibilities with respect to the company’s risk management processes generally. The audit committee assists the board of directors in fulfilling its oversight responsibilities with respect to major financial risk exposures and our energy risk management practices (including hedging transactions and collateral requirements) and discusses policies with respect to risk assessment and risk management. Representatives from our independent registered public accounting firm attend audit committee meetings, regularly make presentations to the audit committee, comment on management presentations, and engage in private sessions with the audit committee, without members of management present, to raise any concerns they may have with our risk management practices. The audit committee and the executive committee also assist the board of directors in monitoring management’s risk management framework for cybersecurity and physical security on a regular basis. The compensation and human resources committee assists the board of directors in fulfilling its oversight responsibilities with respect to risks arising from our compensation policies and practices. The corporate governance and nominating committee undertakes periodic reviews of processes for management of risks associated with our company’s organizational structure, governing instruments and policies, and ESG issues. In fulfilling their respective responsibilities, the committees meet regularly with our officers and members of senior management, as well as our internal and external auditors. Each committee has full access to management, as well as the ability to engage and compensate its own independent advisors.

The board of directors receives regular reports from the executive committee, audit committee, compensation and human resources committee, and corporate governance and nominating committee relating to the oversight of risks in their areas of responsibility. Based on this and information provided by management, the board of directors evaluates our risk management processes and oversight and considers whether any changes should be made to those processes or the board of directors’ risk oversight function. We believe that this division of risk oversight ensures that oversight of each type of risk the company faces is allocated, at least initially, to the particular directors most qualified to oversee it. It also promotes board efficiency because the committees are able to select the most timely or important risk-related issues for the full board of directors to consider.

Another area where our board of directors is actively involved is in monitoring our succession planning. The board of directors reviews the succession plans developed by members of senior management at least annually, with a focus on ensuring a talent pipeline at the officer level and for specific critical roles. We seek to ensure that our directors are exposed to a variety of members of our leadership team, and not just the senior-most officers, on a regular basis, through formal presentations and

IDACORP, Inc. 2024 PROXY STATEMENT 8

informal events. Our board of directors is also informed of general workforce trends, expected retirement levels or turnover, and recruiting and development programs, which is of particular importance given Idaho Power’s specialized workforce.

Board Meetings and Director Attendance

The members of our board of directors are expected to attend board meetings and the meetings of board committees on which they serve, to spend the time needed and to meet as frequently as necessary to properly discharge their responsibilities. The board of directors held four meetings in 2023. Each director attended at least 75 percent of the aggregate of the meetings held by (i) the board of directors in 2023 (during the period for which he or she was a director) and (ii) the committees on which he or she served in 2023 (during the periods that he or she served). Our Corporate Governance Guidelines provide that all directors are expected to attend our annual meeting of shareholders and be available, when requested by the chair of the board of directors, to answer any questions shareholders may have. All then-serving members of the board of directors attended our 2023 annual meeting of shareholders.

Board Committee Charters

Our standing committees of the board of directors are the executive committee, the audit committee, the compensation and human resources committee, and the corporate governance and nominating committee. We have:

• charters for the audit committee, compensation and human resources committee, and corporate governance and nominating committee; and

• Corporate Governance Guidelines, which address issues including the responsibilities, qualifications, and compensation of the board of directors, as well as board leadership, board committees, director resignation, and board self-evaluation.

Our committee charters and our Corporate Governance Guidelines may be accessed on our website at www.idacorpinc.com/corporate-governance/governance-documents. Information on our committees of the board of directors is included in Part 3 – “Board of Directors – Committees of the Board of Directors.”

Director Independence and Executive Sessions

Our board of directors has adopted a policy, contained in our Corporate Governance Guidelines, that the board of directors will be composed of a majority of independent directors. The board of directors reviews annually the relationships that each director has with the company (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the company). Following the annual review, only those directors who the board of directors affirmatively determines have no material relationship with the company and can exercise independent judgment will be considered independent directors, subject to additional qualifications prescribed under the listing standards of the New York Stock Exchange and under applicable laws.

All members of our board of directors are non-employees, except Lisa A. Grow, who is our president and CEO. The board of directors has determined that all members of our board of directors, other than Ms. Grow, are independent, based on all relevant facts and circumstances and under the New York Stock Exchange listing standards and our Corporate Governance Guidelines. In making its determination for Mr. Kinneeveauk, the board of directors specifically considered the fact that he is a director of Arctic Slope Regional Corporation (“ASRC”), and that Petrochem Insulation, Inc., a wholly-owned subsidiary of ASRC, provides construction services to Idaho Power under compensation arrangements comparable to other similar entities providing construction services to Idaho Power.

Our directors meet in executive session at each regular meeting of the board of directors. Additionally, our independent directors meet separately in executive session periodically, and not less frequently than annually. The independent chair of the board of directors presides at board meetings and at executive sessions of independent and non-management directors.

Board Membership Criteria and Consideration of Diversity

We believe that directors should possess the highest personal and professional ethics, integrity, and values and be committed to representing the long-term interests of our shareholders. Directors must also have an inquisitive and objective perspective, practical wisdom, and mature judgment. We also consider a nexus to Idaho Power’s service area a desirable trait. We endeavor to have a diverse board with a variety of attributes and experience at policy-making levels in areas that are relevant to our business activities, in addition to diversity with respect to gender, race, and ethnicity, among other characteristics. We believe our director nominees bring a strong diversity of attributes and experiences to the board of directors as leaders in business, finance, accounting, regulation, and the utility industry as shown in the chart below.

IDACORP, Inc. 2024 PROXY STATEMENT 9

Under the oversight of the corporate governance and nominating committee, the board of directors conducts an annual self-evaluation of its performance and utilizes the results to assess and determine the characteristics and critical skills required of directors. Each of our audit, compensation and human resources, and corporate governance and nominating committees also performs an annual self-assessment. The board of directors and committees self-assessment surveys are completed anonymously by each board member and committee member and provide for a full assessment of board of directors and committee performance, including recommendations for improvement. The board of directors and committees review the compiled results from the respective self-assessment surveys and discuss responsive actions to the survey results. Each board member also completes a questionnaire related to compliance with independence standards and director qualifications annually. The responses are provided to our general counsel and corporate secretary and a report is compiled for the corporate governance and nominating committee. This report is also presented for review by the full board of directors. In addition, our Corporate Governance Guidelines and the corporate governance and nominating committee charter provide that the corporate governance and nominating committee will annually review board committee assignments and consider the rotation of the chair and members of the committees with a view toward balancing the benefits derived from continuity against the benefits derived from the diversity of experience and viewpoints of the various directors. The corporate governance and nominating committee recommendations are then provided to the board of directors for review and approval.

In addition, we require that:

•at least one member of our audit committee be an “audit committee financial expert;”

IDACORP, Inc. 2024 PROXY STATEMENT 10

•the audit, compensation and human resources, and corporate governance and nominating committees are comprised solely of independent directors;

•our directors automatically retire immediately prior to the first annual meeting of shareholders after they reach age 72; and

•a majority of board members be independent under our Corporate Governance Guidelines and applicable New York Stock Exchange listing standards.

Director Resignation Policy

We have a policy that provides that if any director nominee in an uncontested election receives a greater number of votes “withheld” from his or her election than votes “for” such election, the director nominee must tender his or her resignation to the board of directors promptly after the voting results are certified. The corporate governance and nominating committee, comprised entirely of independent directors and which will specifically exclude any director who is required to tender his or her own resignation, will consider the tendered resignation and make a recommendation to the board of directors, taking into account all factors deemed relevant. These factors include, without limitation, the underlying reasons why shareholders withheld votes from the director (if ascertainable) and whether the underlying reasons are curable, the length of service and qualifications of the director whose resignation has been tendered, the director's contributions to our company, whether by accepting the resignation we will no longer be in compliance with any applicable law, rule, regulation, or governing document, and whether or not accepting the resignation is in the best interests of our company and our shareholders. Our board of directors will act upon the corporate governance and nominating committee’s recommendation within 90 days following certification of the shareholder vote and will consider the factors considered by the corporate governance and nominating committee and any additional information and factors as the board of directors believes to be relevant. We will publicly disclose the board of directors’ decision and rationale with regard to any resignation offered under the director resignation policy.

Process for Determining Director Nominees

In determining the composition of our board of directors, we seek a balanced mix of local experience, which we believe is specifically relevant for a utility, and national or public company experience, among other factors related to experience and diversity. As a utility company with operations predominantly in Idaho and Oregon, we believe it is important for our company and our local directors to be involved in and otherwise support local community and charitable organizations.

Our corporate governance and nominating committee is responsible for selecting and recommending to the board of directors candidates for election as directors. Our Corporate Governance Guidelines contain procedures for the committee to identify and evaluate new director nominees, including candidates our shareholders recommend in compliance with our Corporate Governance Guidelines. The corporate governance and nominating committee begins the process of identifying and evaluating potential nominees for director positions by taking into consideration the results of the annual director questionnaires and self-evaluation process described above while keeping the full board of directors informed of the nominating process. The corporate governance and nominating committee reviews candidates recommended by shareholders and may hire a search firm to identify other candidates.

The corporate governance and nominating committee gathers additional information on the candidates to determine if they qualify to be members of our board of directors. The corporate governance and nominating committee examines whether the candidates are independent, whether their election would violate any federal or state laws, rules, or regulations that apply to us, and whether they meet all requirements under our Corporate Governance Guidelines, committee charters, bylaws, codes of business conduct and ethics, and any other applicable corporate document or policy. The corporate governance and nominating committee also considers whether the nominees will have potential conflicts of interest, and whether they will represent a single or special interest, before finalizing a list of candidates for the full board of directors to consider for nomination.

Process for Shareholders to Recommend Candidates for Director

Our Corporate Governance Guidelines set forth the requirements that you must follow if you wish to recommend director candidates to our corporate governance and nominating committee. If you recommend a candidate for director, you must provide the following information:

• the candidate’s name, age, business address, residence address, telephone number, principal occupation, the class and number of shares of our voting stock the candidate owns beneficially and of record, a statement as to how long the candidate has held such stock, a description of the candidate’s qualifications to be a director, whether the candidate would be an independent director, and any other information you deem relevant with respect to the recommendation; and

IDACORP, Inc. 2024 PROXY STATEMENT 11

• your name and address as they appear on our stock records, the class and number of shares of voting stock you own beneficially and of record, and a statement as to how long you have held the stock.

Recommendations must be sent to our corporate secretary at the address provided below. Our corporate secretary will review all written recommendations and send those conforming to the requirements described above to the corporate governance and nominating committee for review and consideration. The corporate governance and nominating committee evaluates the qualifications of candidates properly submitted by shareholders in the same manner as it evaluates the qualifications of director candidates identified by the committee or the board of directors.

Shareholders who wish to nominate persons for election to the board of directors, rather than recommend candidates for consideration by the corporate governance and nominating committee and board of directors, must follow the procedures set forth in our bylaws, and must comply with the requirements of Rule 14a-19 under the Exchange Act. Copies of our bylaws may be obtained by writing to our corporate secretary at IDACORP, Inc., 1221 West Idaho Street, Boise, Idaho 83702-5627, or by calling our corporate secretary at (208) 388-2200. See also the section entitled 2025 Annual Meeting of Shareholders in Part 6 - “Other Matters” in this proxy statement.

Communications with the Board of Directors and Audit Committee

Shareholders and other interested parties may communicate with members of the board of directors by:

• calling (866) 384-4277 if they have a concern to bring to the attention of the board of directors, our chair of the board of directors, or our non-employee directors as a group; or

• logging on to http://secure.ethicspoint.com/domain/media/en/gui/62899/index.html and following the instructions to file a report if the concern is of an ethical nature.

Our general counsel receives all such communications. These communications are distributed to the board of directors, or to the chair or specific directors as appropriate, depending on the facts and circumstances of the communication. Communications may include the reporting of concerns related to governance, corporate conduct, business ethics, financial practices, legal issues, and accounting or audit matters. If a report concerns questionable accounting practices, internal accounting controls, or auditing matters, our general counsel will also forward your report to the chair of the audit committee. The acceptance and forwarding of communication to any director does not imply that the director owes or assumes any fiduciary duty to the person submitting the communication, all such duties being only as prescribed by applicable law.

Political Advocacy and Lobbying Activities

We routinely engage in federal, state, and local public policy discussions ranging from issues that specifically impact the generation, transmission, and distribution of electricity to more general topics related to regulation, taxation, business, and labor. Our political advocacy objectives focus on a variety of interests, including costs to customers and owners, safety, reliability of service, and our responsibility to the environment, employees, stakeholders, and communities. To that end, we are also active in a number of state, regional, and national trade associations that may engage in political activity on these issues.

Our voluntary, non-partisan employee political action committee (“IDA-PAC”) participates in the political process through contributions to candidate campaigns, other political action committees, and ballot measure campaigns in compliance with applicable laws. Those contributions are made in furtherance of the company’s interests and without regard to the personal political preferences of our directors, executives, or employees. In 2015, the board of directors voluntarily adopted a policy in response to the 2010 U.S. Supreme Court decision in Citizens United v. Federal Election Commission that we will not provide direct corporate funding for independent advertisements that support or oppose political candidates for election to federal office.

Further, our senior vice president of public affairs who monitors and approves all such activities, is required to report lobbying expenditures; contributions to candidates, ballot measures and initiatives, trade and industry associations, and certain other organizations that may engage in activities involving legislative measures; and electioneering to the corporate governance and nominating committee for their review on an annual basis. The corporate governance and nominating committee reviews our political contributions (including contributions to IDA-PAC) and our lobbying efforts and updates the full board of directors on such activities.

Corporate political contributions and lobbying activities are subject to regulation by the states in which we operate and the federal government, including requirements to provide disclosures of federal and state lobbying expenses, which are made publicly available by the various government authorities to which we report. For 2023, we contributed approximately $81,000 to

IDACORP, Inc. 2024 PROXY STATEMENT 12