0000049600DEF 14Afalse00000496002023-01-012023-12-31iso4217:USDxbrli:pure00000496002022-01-012022-12-3100000496002021-01-012021-12-3100000496002020-01-012020-12-310000049600egp:StockAwardsReportedAdjustmentMemberecd:PeoMember2023-01-012023-12-310000049600egp:StockAwardsReportedAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310000049600egp:StockAwardsGrantedDuringYearOutstandingAndUnvestedMemberecd:PeoMember2023-01-012023-12-310000049600egp:StockAwardsGrantedDuringYearOutstandingAndUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000049600ecd:PeoMemberegp:ChangeInFairValueOfPriorYearStockAwardsOutstandingAndUnvestedMember2023-01-012023-12-310000049600ecd:NonPeoNeoMemberegp:ChangeInFairValueOfPriorYearStockAwardsOutstandingAndUnvestedMember2023-01-012023-12-310000049600egp:VestingDateFairValueOfStockAwardsGrantedAndVestedDuringTheYearMemberecd:PeoMember2023-01-012023-12-310000049600egp:VestingDateFairValueOfStockAwardsGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000049600egp:ChangeInFairValueFromPriorYearOfPriorYearStockAwardsVestedDuringCurrentYearMemberecd:PeoMember2023-01-012023-12-310000049600egp:ChangeInFairValueFromPriorYearOfPriorYearStockAwardsVestedDuringCurrentYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000049600ecd:PeoMemberegp:PriorYearAwardsFairValueFailedToVestMember2023-01-012023-12-310000049600ecd:NonPeoNeoMemberegp:PriorYearAwardsFairValueFailedToVestMember2023-01-012023-12-310000049600ecd:PeoMember2023-01-012023-12-310000049600ecd:NonPeoNeoMember2023-01-012023-12-310000049600egp:StockAwardsReportedAdjustmentMemberecd:PeoMember2022-01-012022-12-310000049600egp:StockAwardsReportedAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310000049600egp:StockAwardsGrantedDuringYearOutstandingAndUnvestedMemberecd:PeoMember2022-01-012022-12-310000049600egp:StockAwardsGrantedDuringYearOutstandingAndUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000049600ecd:PeoMemberegp:ChangeInFairValueOfPriorYearStockAwardsOutstandingAndUnvestedMember2022-01-012022-12-310000049600ecd:NonPeoNeoMemberegp:ChangeInFairValueOfPriorYearStockAwardsOutstandingAndUnvestedMember2022-01-012022-12-310000049600egp:VestingDateFairValueOfStockAwardsGrantedAndVestedDuringTheYearMemberecd:PeoMember2022-01-012022-12-310000049600egp:VestingDateFairValueOfStockAwardsGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000049600egp:ChangeInFairValueFromPriorYearOfPriorYearStockAwardsVestedDuringCurrentYearMemberecd:PeoMember2022-01-012022-12-310000049600egp:ChangeInFairValueFromPriorYearOfPriorYearStockAwardsVestedDuringCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000049600ecd:PeoMemberegp:PriorYearAwardsFairValueFailedToVestMember2022-01-012022-12-310000049600ecd:NonPeoNeoMemberegp:PriorYearAwardsFairValueFailedToVestMember2022-01-012022-12-310000049600ecd:PeoMember2022-01-012022-12-310000049600ecd:NonPeoNeoMember2022-01-012022-12-310000049600egp:StockAwardsReportedAdjustmentMemberecd:PeoMember2021-01-012021-12-310000049600egp:StockAwardsReportedAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310000049600egp:StockAwardsGrantedDuringYearOutstandingAndUnvestedMemberecd:PeoMember2021-01-012021-12-310000049600egp:StockAwardsGrantedDuringYearOutstandingAndUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000049600ecd:PeoMemberegp:ChangeInFairValueOfPriorYearStockAwardsOutstandingAndUnvestedMember2021-01-012021-12-310000049600ecd:NonPeoNeoMemberegp:ChangeInFairValueOfPriorYearStockAwardsOutstandingAndUnvestedMember2021-01-012021-12-310000049600egp:VestingDateFairValueOfStockAwardsGrantedAndVestedDuringTheYearMemberecd:PeoMember2021-01-012021-12-310000049600egp:VestingDateFairValueOfStockAwardsGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000049600egp:ChangeInFairValueFromPriorYearOfPriorYearStockAwardsVestedDuringCurrentYearMemberecd:PeoMember2021-01-012021-12-310000049600egp:ChangeInFairValueFromPriorYearOfPriorYearStockAwardsVestedDuringCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000049600ecd:PeoMemberegp:PriorYearAwardsFairValueFailedToVestMember2021-01-012021-12-310000049600ecd:NonPeoNeoMemberegp:PriorYearAwardsFairValueFailedToVestMember2021-01-012021-12-310000049600ecd:PeoMember2021-01-012021-12-310000049600ecd:NonPeoNeoMember2021-01-012021-12-310000049600egp:StockAwardsReportedAdjustmentMemberecd:PeoMember2020-01-012020-12-310000049600egp:StockAwardsReportedAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-310000049600egp:StockAwardsGrantedDuringYearOutstandingAndUnvestedMemberecd:PeoMember2020-01-012020-12-310000049600egp:StockAwardsGrantedDuringYearOutstandingAndUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000049600ecd:PeoMemberegp:ChangeInFairValueOfPriorYearStockAwardsOutstandingAndUnvestedMember2020-01-012020-12-310000049600ecd:NonPeoNeoMemberegp:ChangeInFairValueOfPriorYearStockAwardsOutstandingAndUnvestedMember2020-01-012020-12-310000049600egp:VestingDateFairValueOfStockAwardsGrantedAndVestedDuringTheYearMemberecd:PeoMember2020-01-012020-12-310000049600egp:VestingDateFairValueOfStockAwardsGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000049600egp:ChangeInFairValueFromPriorYearOfPriorYearStockAwardsVestedDuringCurrentYearMemberecd:PeoMember2020-01-012020-12-310000049600egp:ChangeInFairValueFromPriorYearOfPriorYearStockAwardsVestedDuringCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000049600ecd:PeoMemberegp:PriorYearAwardsFairValueFailedToVestMember2020-01-012020-12-310000049600ecd:NonPeoNeoMemberegp:PriorYearAwardsFairValueFailedToVestMember2020-01-012020-12-310000049600ecd:PeoMember2020-01-012020-12-310000049600ecd:NonPeoNeoMember2020-01-012020-12-31000004960012023-01-012023-12-31000004960022023-01-012023-12-31000004960032023-01-012023-12-31000004960042023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No.)

| | | | | | | | | | | |

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: |

| | | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under § 240.14a-12 |

EASTGROUP PROPERTIES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | | | | | | | |

Payment of Filing Fee (Check all boxes that apply): |

| | | |

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Letter to Shareholders

| | | | | | | | |

April 12, 2024 Dear Fellow Shareholders, On behalf of the entire Board of Directors, we would like to provide an update on how we are creating shareholder value and how we are progressing on key areas of stakeholder interest. We are proud of our people and our performance and believe that we are well positioned to continue our positive momentum through 2024 and future years. Another Year of Record Performance We continued our streak of outstanding performance in 2023, with another year of record financial performance and strong operational results. Our funds from operations attributable to common stockholders (“FFO”) increased over 11% – the thirteenth consecutive year of growth – and same property net operating income (“PNOI”) excluding lease termination fees increased over 6% in 2023 compared to 2022.(1) Occupancy rates were steady, and rental rates (both new and renewal) increased, marking the ninth consecutive year of double-digit straight-line rental rate increases. Our Growth Strategy Supports Long Term Shareholder Value Despite economic uncertainties, we believe we are positioned to continue to create value for our shareholders. We have confidence in our growth strategy of acquiring, developing, and operating multi-tenant business distribution parks for location-sensitive customers clustered around major transportation features in supply-constrained submarkets. In 2023, we acquired almost 1 million square feet of operating properties and nearly 330 acres of development land, and as of December 31, 2023, our development and value-add program consisted of 18 projects in 12 cities located in major Sunbelt markets. In 2023, we began construction of 11 projects totaling approximately 2.4 million square feet. We transferred 13 properties with approximately 2.3 million square feet, which were 100% leased as of December 31, 2023, into our operating portfolio. Our strong 2023 results support our commitment to deliver value to our shareholders. For 2023, we declared dividends of $5.04 per share. That marks 44 years of consecutive quarterly cash dividends, with increases in each of the last 12 years. At December 31, 2023, the five-year compounded annual total return (dividends plus change in our common stock price) to shareholders was almost 18%. We also strengthened our balance sheet and continue to be judicious with capital allocation and incremental risk. Commitment to Strong Governance and Shareholder Engagement In May 2023, we changed our Board leadership structure to have an independent Chairman of the Board. Read more about Board Leadership and Mr. Colleran’s strong background in operational and Board matters on page 25 and 17, respectively, of the proxy statement. Our leadership team actively engages with shareholders, and the Board has a demonstrated record of being responsive to shareholder feedback on such matters as Board refreshment and diversity, shareholder voting rights and supply chain responsibility. Advancing our Corporate Sustainability Initiatives Continuing to further our corporate sustainability initiatives remains an important focus for our Board and team. We continue to expand our development of properties to high sustainability standards, with the addition of electric vehicle charging stations at the majority of our new developments during 2023. We also regularly invest in energy-efficient improvements and resource conservation projects within our existing assets to complement our history of using sustainable design features in our development properties. In 2023, we completed our first GRESB Real Estate Assessment, which provided us with additional insight into our corporate sustainability management and performance as compared to industry peers, and are working to increase our data coverage for both owner- and tenant-controlled energy and water at our properties through expanded green lease language. In addition, we are assessing the climate resilience of our current portfolio and have begun conducting formal climate-related due diligence on potential future investments. Our record financial performance is not possible without our great people that continue to execute at a very high level and our unique family-oriented, employee-focused and entrepreneurial culture. We also focus on our relationships with our tenants, partners and local communities. We believe this people-first approach drives high engagement and satisfaction levels, evidenced by our low employee turnover and strong lease metrics. We hope you can join us at our 2024 Annual Meeting of Shareholders. You will find information about the meeting, including matters to be voted on, in this proxy statement. Thank you again for your support, and we look forward to continuing to engage with you on our performance and priorities. | |

|

“On behalf of the entire Board of Directors, I would like to thank you for your continued support of EastGroup Properties. We are proud of our people and our performance, and we are excited for the future.” Marshall A. Loeb Chief Executive Officer, President and Director |

|

|

|

Funds from operations attributable to common stockholders (FFO)(1) increased approximately 11%

Same property net operating income (PNOI)(1) increased >6%

Acquired > 0.9 million square feet of operating properties and > 300 acres of development land

Declared dividends of $5.04 per share, marking 176 consecutive quarters of cash dividends |

Donald F. Colleran Chairman of the Board | Marshall A. Loeb Chief Executive Officer, President and Director |

(1)FFO and Same PNOI (excluding income from lease terminations) are not computed in accordance with Generally Accepted Accounting Principles (“GAAP”). Reconciliations of FFO and Same PNOI (excluding income from lease terminations) and other required disclosure can be found on pages 23-24 of our Annual Report on Form 10-K for the year ended December 31, 2023, which we filed with the Securities and Exchange Commission on February 14, 2024. |

Table of Contents

| | | | | | | | | | | |

| | | |

| Frequently Requested Information | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

2023 Performance Highlights

Company Overview

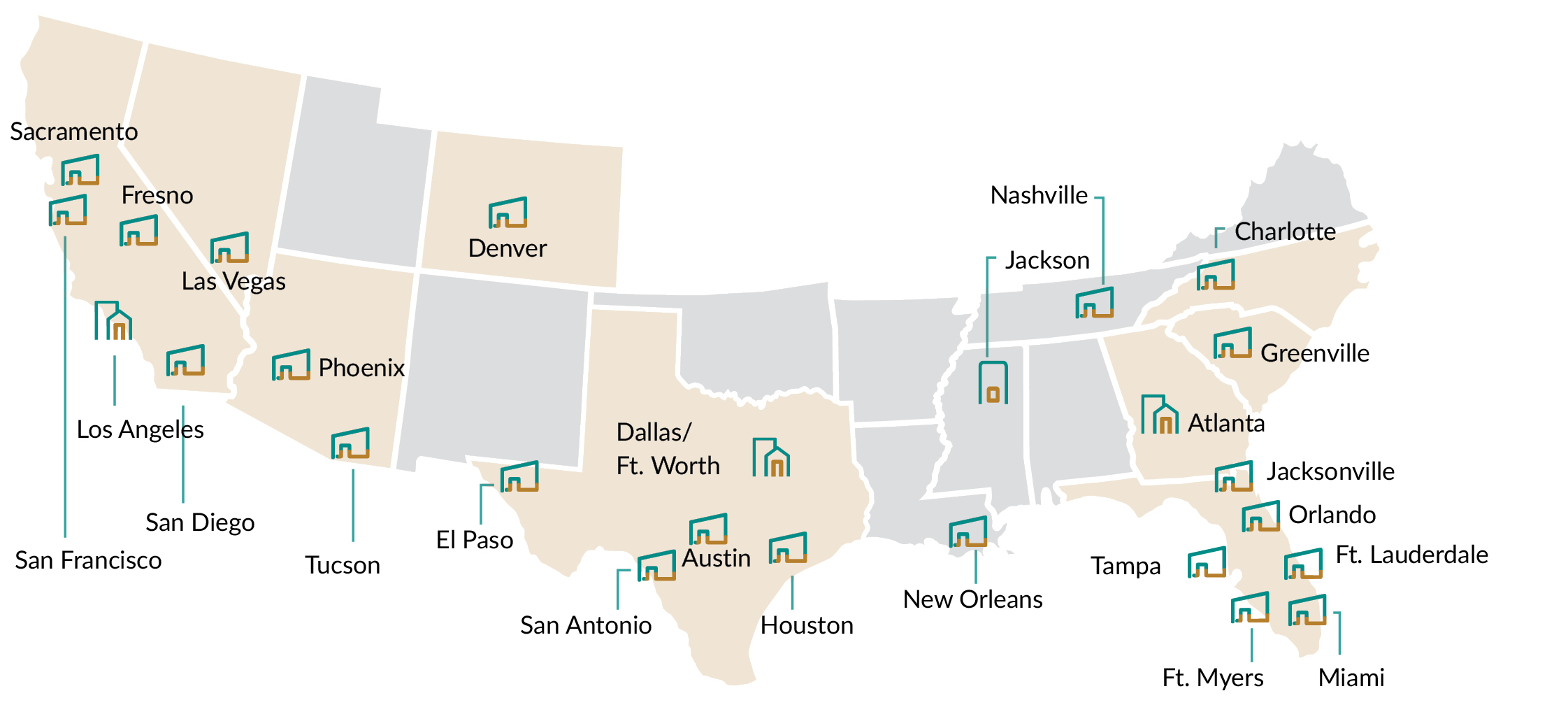

EastGroup Properties, Inc. (New York Stock Exchange (“NYSE”): EGP), a member of the S&P Mid-Cap 400 and Russell 1000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in major Sunbelt markets throughout the United States with an emphasis in the states of Florida, Texas, Arizona, California and North Carolina. The Company’s goal is to maximize shareholder value by being a leading provider in its markets of functional, flexible and quality business distribution space for location sensitive customers (primarily in the 20,000 to 100,000 square foot range). The Company’s strategy for growth is based on ownership of premier distribution facilities generally clustered near major transportation features in supply-constrained submarkets. EastGroup’s portfolio, including development projects and value-add acquisitions in lease-up and under construction, currently includes approximately 59.7 million square feet.(1)

GEOGRAPHIC FOCUS

| | | | | | | | |

uMajor Sunbelt Growth Markets | uEmphasis in Local Economies Growing Faster than the U.S. Economy | uEconomic Cycle Diversification |

| | | | | | | | | | | | | | | | | |

| Properties | | Regional

Offices | | Corporate

Headquarters |

PROPERTY FOCUS

| | | | | | | | |

u59.7 Million Square Feet Under Ownership(1) uMulti-tenant | uIn-fill Sites/Supply Constrained Submarkets uLast Mile E-commerce Locations | uShallow Bay Industrial uCompetitive Protection Through Location |

(1)As of March 31, 2024

2023 Performance Highlights

Business and Strategic Highlights

| | | | | | | | |

| | |

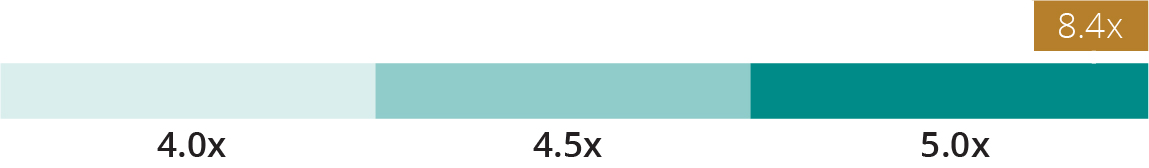

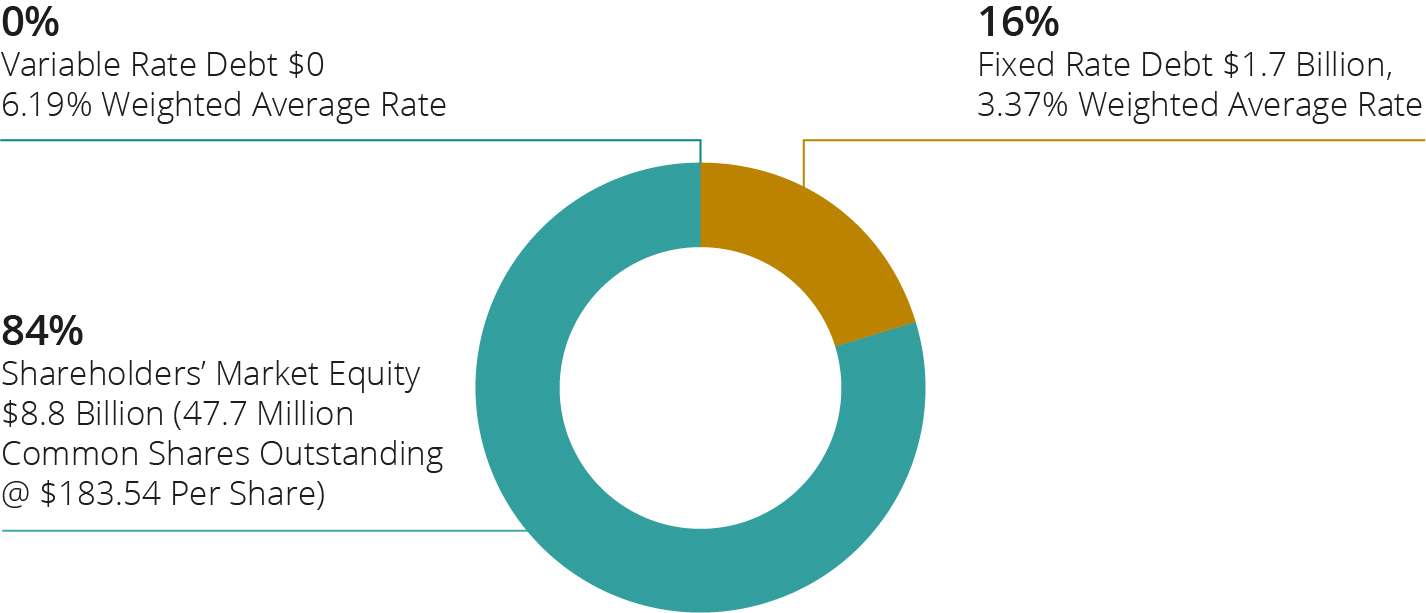

CAPITALIZATION (As of 12.31.2023) | | DIVIDEND GROWTH (As of Fourth Quarter 2023) uDeclared 176th Consecutive Quarterly Cash Dividend – $1.27 per Share uIncreased or Maintained Dividend for 31 Consecutive Years uDividend Has Increased 28 of the Past 31 Years – Increased in Each of the Last 12 Years |

| |

|

| | |

| | | | | | | | | | | |

| OPERATING RESULTS | | | |

| | | |

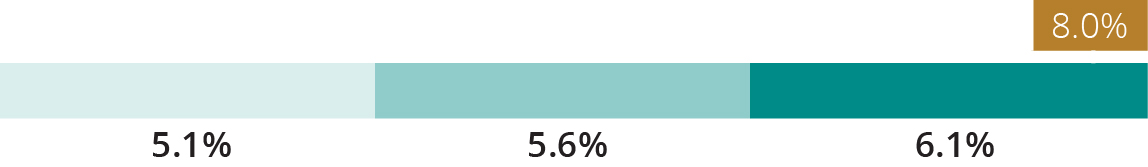

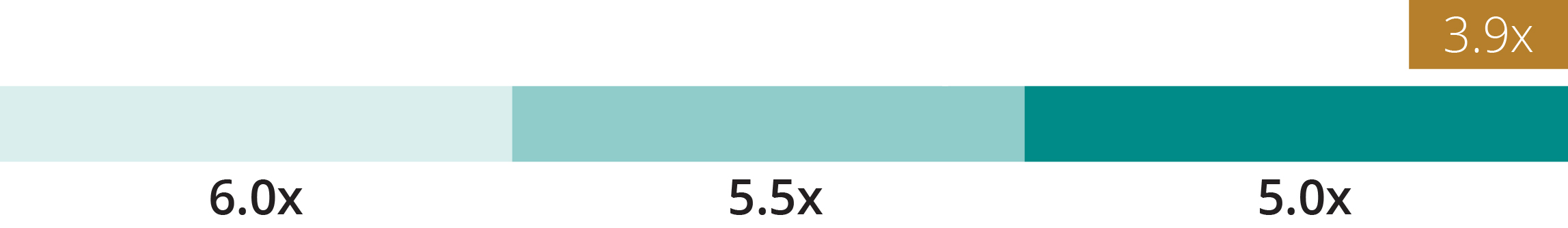

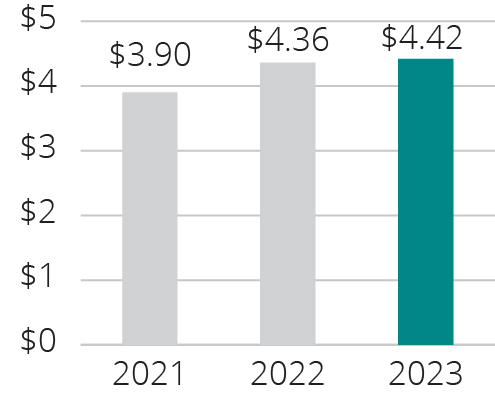

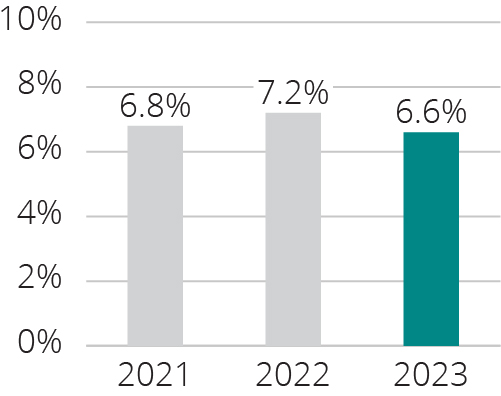

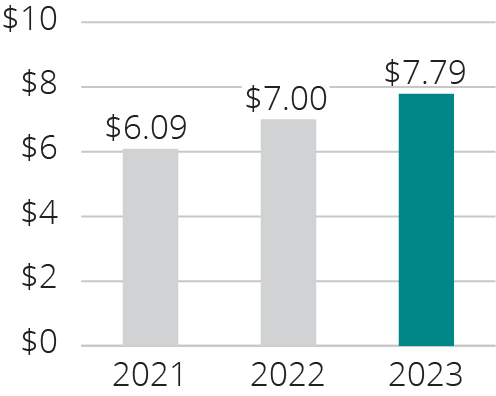

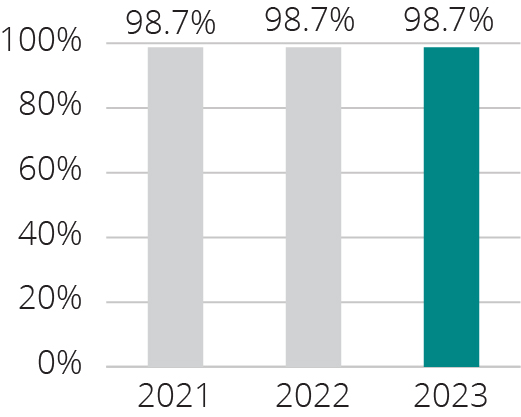

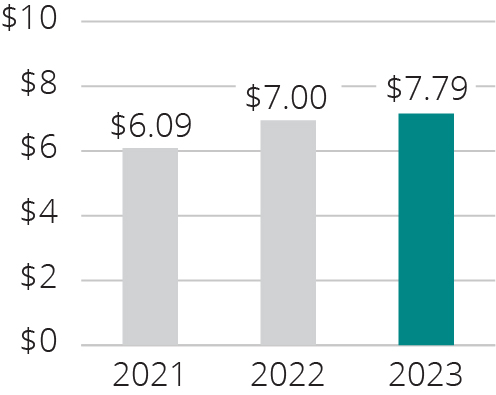

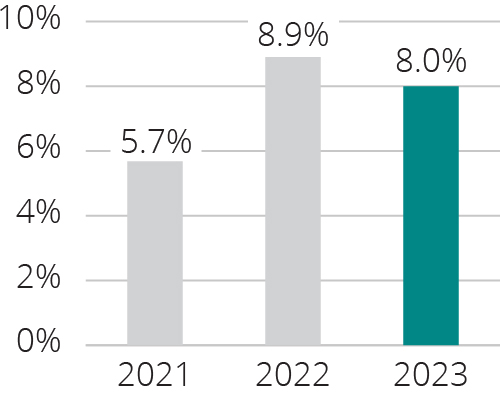

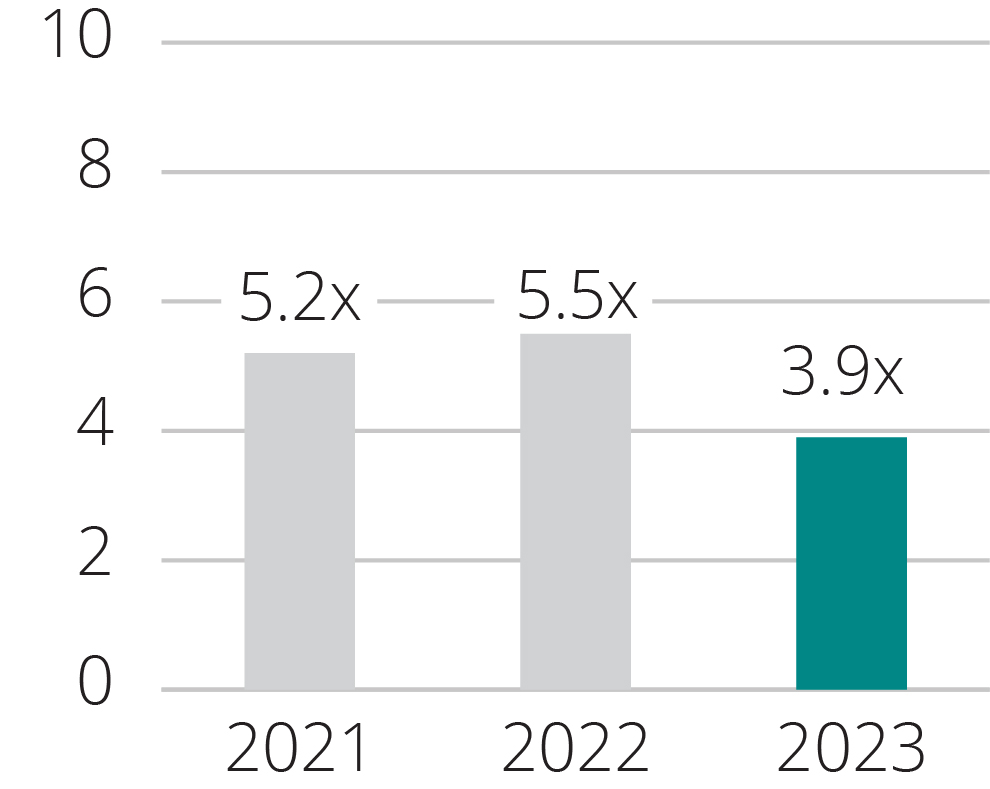

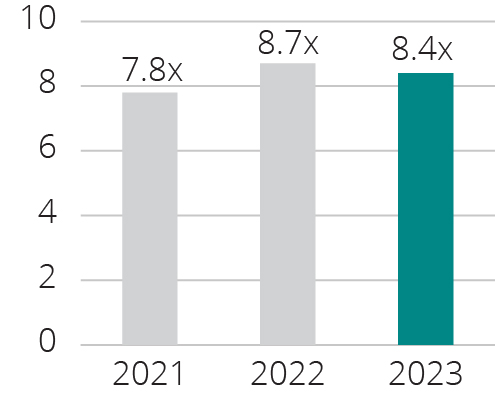

Net Income Attributable to Common Stockholders (per diluted share) | Same PNOI Growth (excluding income from lease terminations)(1) (straight-line basis) | FFO per Diluted Share(1) | Leased Operating Portfolio |

| | | |

| | | |

| | | |

(1)FFO and Same PNOI (excluding income from lease terminations) are not computed in accordance with GAAP. Reconciliations of FFO and Same PNOI (excluding income from lease terminations) and other required disclosure can be found on pages 23-24 of our Annual Report on Form 10-K for the year ended December 31, 2023, which we filed with the Securities and Exchange Commission (“SEC”) on February 14, 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| PRIMARY GOAL | | | OUR PORTFOLIO | | | STRATEGY

FOR GROWTH |

| | | | | | | |

Maximize shareholder value by being a leading provider in our markets of functional, flexible and quality business distribution space for location sensitive customers (primarily in the 20,000 to 100,000 square foot range). | | 59.7 million sq. ft. As of March 31, 2024 (including development projects and value-add acquisitions in lease-up and under construction). | | Ownership of premier distribution facilities in major Sunbelt markets, generally clustered near major transportation features in supply-constrained submarkets. |

| | | | |

2023 Performance Highlights

2023 Company Highlights

| | | | | | | | | | | | | | |

| | | | |

| NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | EARNINGS PERFORMANCE | SAME PNOI EXCLUDING INCOME FROM LEASE TERMINATIONS (STRAIGHT-LINE BASIS)(1) |

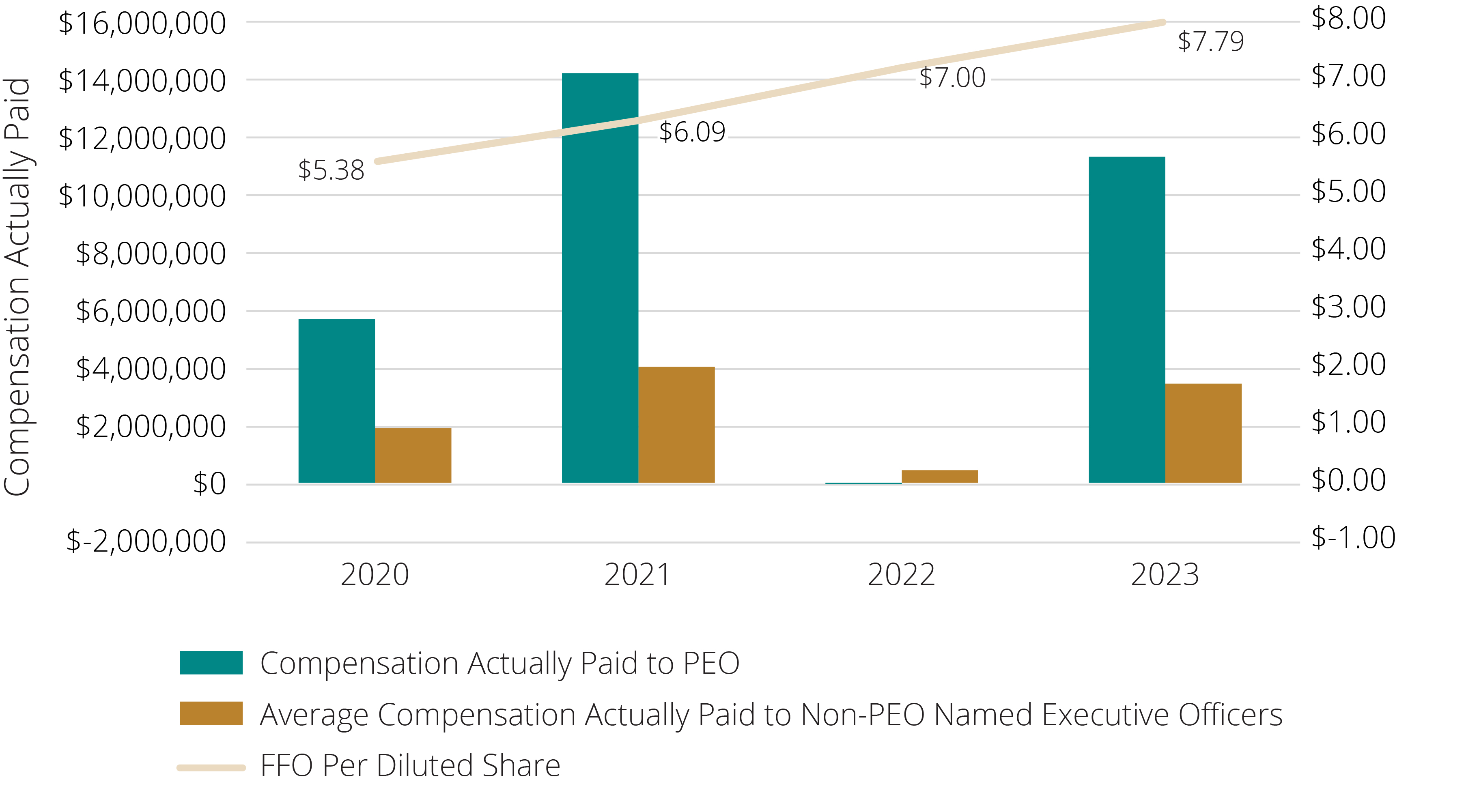

$4.42 per diluted share in 2023 | $7.79 per diluted share FFO(1) in 2023 | 6.6% growth year over year |

▲ 1.4% over 2022 | ▲ 11.3% over 2022 |

|

| | | | |

| | | | |

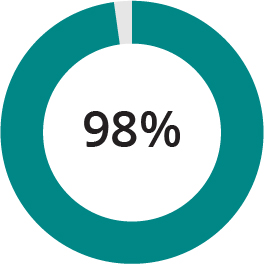

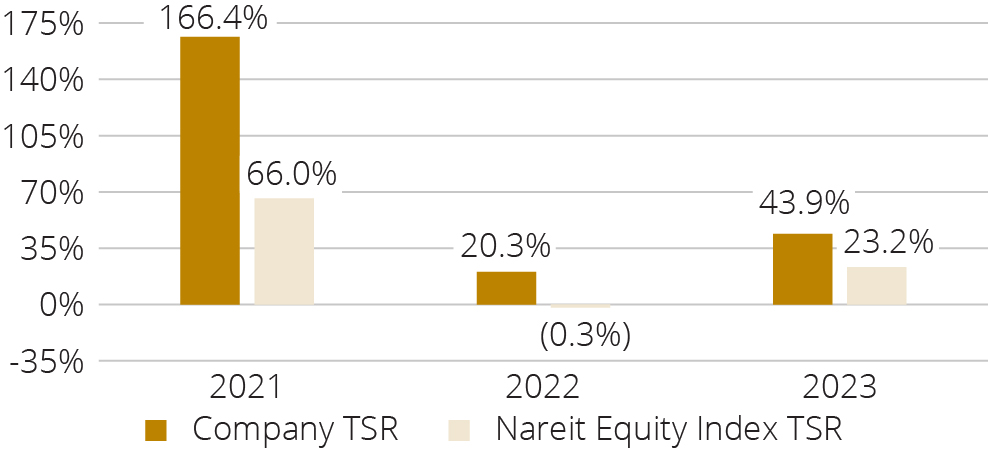

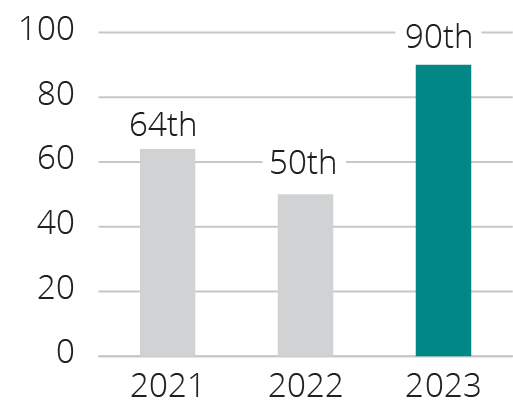

| LEASING | TOTAL SHAREHOLDER RETURN (“TSR”) | ACQUISITIONS AND DISPOSITIONS |

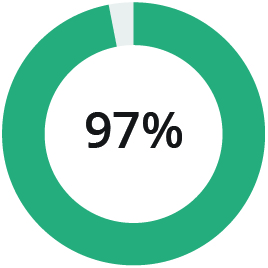

98.2% occupancy at the end of 2023 55.0% increase in rental rates on new and renewal leases in 2023 98.4% same property average occupancy for 2023 91.3% of expiring square feet renewed or re-leased within the quarter of expiration during 2023 | 27.6% in 2023 | $235.8 million in acquisition costs during 2023 Operating Properties Acquired 987,000 square feet Land Acquired 328 acres $18.4 million realized gain for selling 231,000 square feet of operating properties and 11.9 acres of land (not included in FFO) |

| S&P 500 Total Return | Nareit Equity REIT Total Return |

26.3% | 13.7% |

| | | | |

| | | | |

DEVELOPMENT AND VALUE-ADD PROGRAM | DIVIDENDS | MANAGEMENT OF THE BALANCE SHEET |

$575.7 million projected total investment with 18 projects (4,077,000 square feet) at December 31, 2023, including 11 new development projects (2,435,000 square feet) started in 2023 with a projected total investment of $363.4 million | $5.04 per share declared annual cash dividends in 2023 Increased annual cash dividends declared in 2023 by 7.2% | $699.3 million Common Stock issued under our continuous common equity program in 2023 at an average of $170.77 per share $675 million total capacity on our unsecured bank credit facilities (expanded total capacity by $200 million during 2023) |

| | | | |

(1)FFO and Same PNOI (excluding income from lease terminations) are not computed in accordance with GAAP. Reconciliations of FFO and Same PNOI (excluding income from lease terminations) and other required disclosure can be found on pages 23-24 of our Annual Report on Form 10-K for the year ended December 31, 2023, which we filed with the SEC on February 14, 2024.

2023 Performance Highlights

Corporate Sustainability Highlights

| | | | | | | | | | | | | | | | | |

| | | | | |

| Environmental Stewardship |

| | | | | |

| | | | | |

| | | | CORPORATE SUSTAINABILITY REPORTS In 2023, EastGroup published an update to its 2022 Corporate Sustainability Report, incorporating additional quantitative performance metrics based on full-year data and other enhanced disclosures. |

CORPORATE SUSTAINABILITY AWARDS uSeveral of our properties have been recognized by the Building Owners and Managers Association (“BOMA”) at the local and regional levels in various award categories. Most recently, our Gateway Commerce Park property received the BOMA Miami-Dade Earth Award for both 2022 and 2023 and was previously awarded The Outstanding Building of the Year (“TOBY®”) in the industrial office park category by BOMA Miami-Dade and the BOMA Southern Region. The property is also designated as a BOMA 360 Performance Building, awarded to properties that are being managed to the highest standards of excellence across all areas of operations and management. | |

| | | | | |

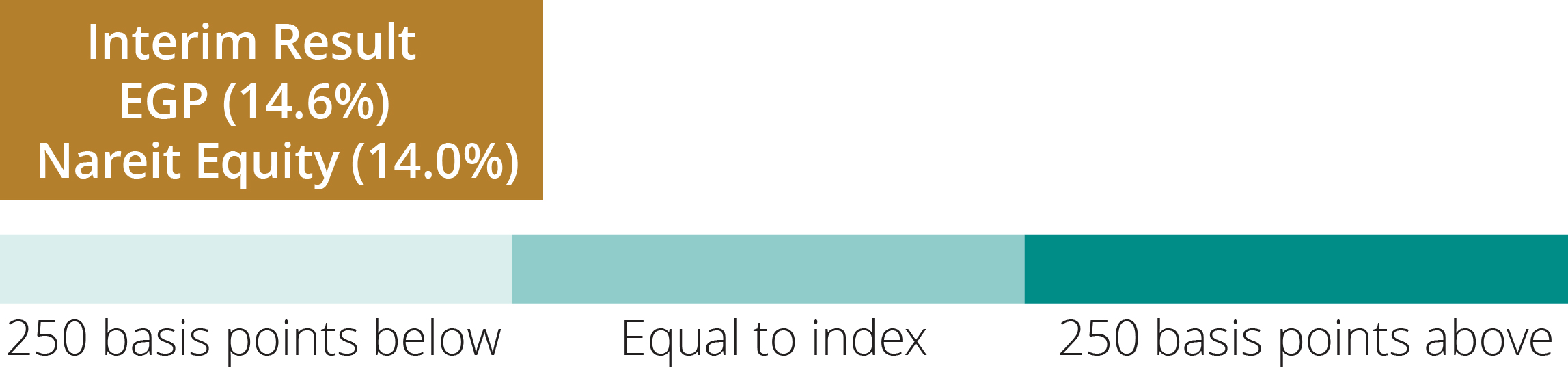

PROPERTY DEVELOPMENT uOur development and value-add program has produced tremendous value for our shareholders. While formal certification is not always pursued, since 2010, the Company has built all of its development properties with the intention of meeting LEED® certifiable standards. uIn June 2021, the Company amended and restated its unsecured revolving credit facility, providing for an incremental reduction in borrowing costs if a certain sustainability-linked metric is achieved. This metric is based on a target number of newly-constructed buildings with qualifying electric vehicle charging stations as a percentage of total qualifying buildings for each fiscal year. Beginning in 2022, if the metric is achieved, the applicable interest rate margin on the Company’s unsecured credit facility is reduced by one basis point for the following year. For the years ended December 31, 2022 and 2023, the metric was exceeded, which allowed for the interest rate reduction in each of the years subsequent to achieving the metric. | | We have developed approximately 50% of our properties (on a square foot basis) as of March 31, 2024. |

| | | | | |

ENVIRONMENTAL PERFORMANCE uEastGroup continues to focus on expanding utility data coverage for our buildings in order to better assess our environmental performance. Using the data obtained from these efforts, we completed our first GRESB Real Estate Assessment during 2023, which provided the Company with additional insight into its corporate sustainability management and performance as compared to industry peers. uWe also worked to formalize our approach toward corporate sustainability management and risk assessment during 2023 by creating an environmental management system and implementing a corporate sustainability due diligence scorecard for potential building acquisitions, which includes an assessment of each building’s environmental and resilience characteristics, as well as a physical climate risk assessment. | |

We have obtained 27 Leadership in Energy and Environmental Design (“LEED®”) certifications, including one LEED® Silver certification, and various ENERGY STAR® and BOMA 360 certifications. |

| | | | | |

2023 Performance Highlights

| | | | | | | | | | | |

| | | |

| Social Initiatives |

| | | |

| | | |

| | FLEXIBLE WORK ENVIRONMENT We offer: uremote work for up to two days per week for most employees and ugenerous paid time off, which includes vacation, sick and volunteer time in addition to 10 days of paid holiday. |

| | |

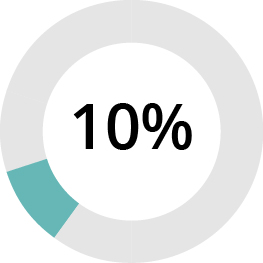

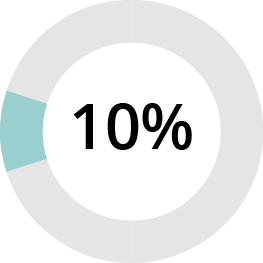

EMPLOYEE TENURE AND TURNOVER uThe average tenure of our workforce was 9 years, and 12 years for our officers, as of March 31, 2024. Our voluntary turnover rate was only 8% and there was no involuntary turnover during 2023. | |

| | | |

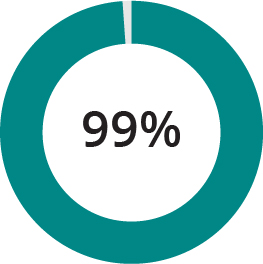

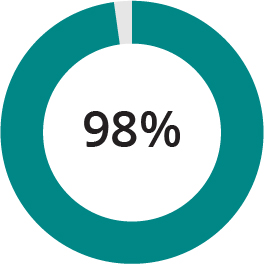

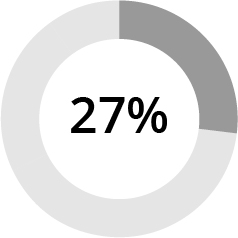

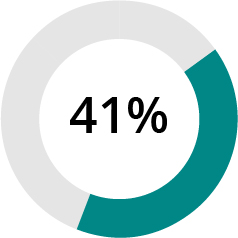

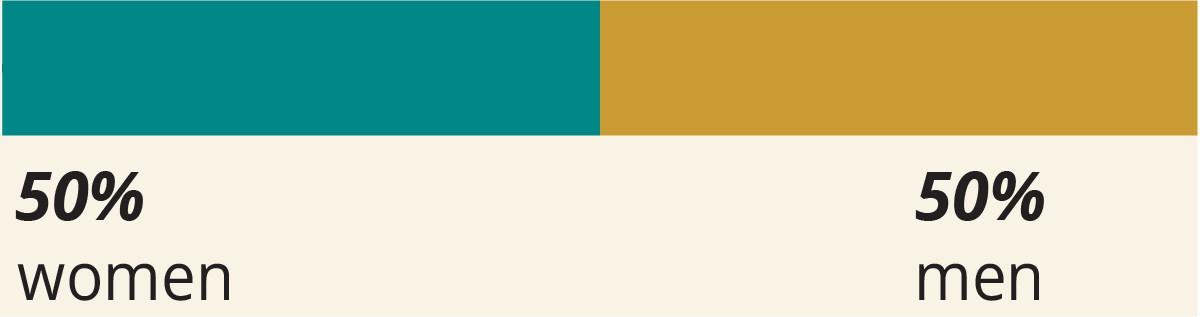

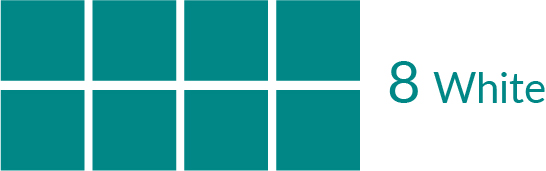

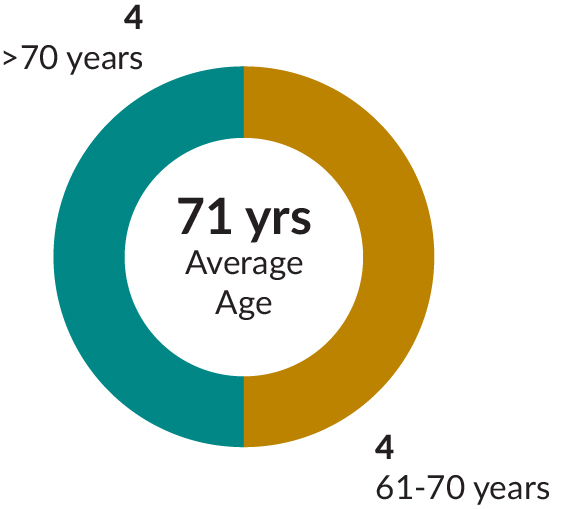

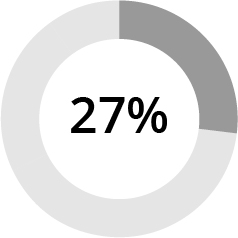

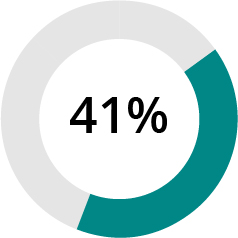

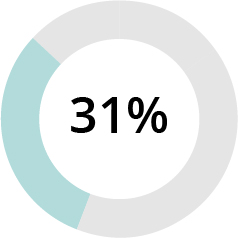

COMPENSATION, BENEFITS, HEALTH AND SAFETY uEastGroup offers a comprehensive employee benefits program and what we believe are socially-responsible policies and practices in order to support the overall well-being of our employees and to create a safe, professional and inclusive work environment. uDuring 2023, we implemented a company-wide Change in Control Severance Pay Plan for eligible employees, in the event of a qualifying change in control transaction. We also began offering new tools and incentives towards employee wellness in 2023 through our new healthcare provider. uEastGroup regularly conducts employee and tenant engagement surveys, the most recent of which were issued via a third party in 2023. Our overall response rates of 95% for employees and 33% for tenants were improvements from the previous response rates of 84% and 29%, respectively. The feedback received was very favorable overall, with 99% of employee respondents and 92% of tenant respondents rating their overall satisfaction as “Good” or “Excellent”, but also provided helpful direction on areas of interest and where we can continue to make improvements. | | WORKFORCE STATISTICS as of March 31, 2024 With only 99 employees, each team member plays a vital role in the success of the Company. CURRENT EMPLOYEE BASE CURRENT OFFICER GROUP |

| | | |

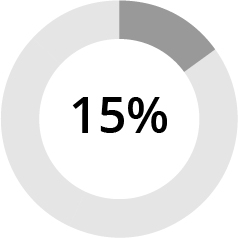

TRAINING AND DEVELOPMENT uOur employees are provided with training, education and peer mentoring programs to further develop their professional skill sets, enhancing the level of customer service provided to our customers and the quality of information disclosed to our stakeholders. As of December 31, 2023, 71% of our employees at the manager level and above were promoted from within the Company. uSince 2020, EastGroup has utilized a formal certificate-based learning program for all employees, requiring annual completion of trainings related to diversity, equity and inclusion, anti-discrimination, anti-harassment, cybersecurity, and other relevant topics. uIn 2022 and 2023, EastGroup implemented supplemental trainings to further educate our workforce on ways to improve empathy and approach difficult situations in the workplace. This included training on topics such as unconscious bias, microaggressions and workplace violence and bullying. | | 14% of our current employee base self-identified as members of a racial or ethnic minority group.

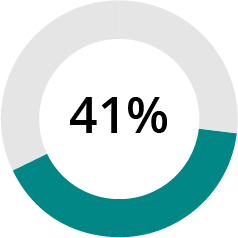

Two of the seven nominees to our Board of Directors (29%) and 64% of 2023 new hires identify as women. |

| | | |

For Governance Highlights see page 10.

Proxy Voting Roadmap

| | | | | | | | |

| | |

Proposal 1 Election of Directors | |

| | |

| | |

| The Board recommends a vote FOR each director nominee. | for more details. |

| | |

Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Primary Occupation | EEO-1 Data(1) | Age | Director Since | Committee Membership |

| AC | CC | NCGC | IC |

| D. Pike Aloian INDEPENDENT Managing Director of Neuberger Berman | White (M) | 69 | 1999 | | | | |

| H. Eric Bolton, Jr. INDEPENDENT Chief Executive Officer of Mid-America Apartment Communities, Inc. | White (M) | 67 | 2013 | | | | |

| Donald F. Colleran INDEPENDENT Chairman of the Board since 2023

Former President and Chief Executive Officer of FedEx Express | White (M) | 68 | 2017 | | | | |

| David M. Fields INDEPENDENT Executive Vice President, Chief Administrative Officer and General Counsel of Sunset Development Company | Black (M) | 66 | 2022 | | | | |

| Marshall A. Loeb Chief Executive Officer, President and Director of EastGroup Properties, Inc. | White (M) | 61 | 2016 | | | | |

| Mary E. McCormick INDEPENDENT Former Executive Director of the Center for Real Estate at The Ohio State University | White (F) | 66 | 2005 | | | | |

| Katherine M. Sandstrom INDEPENDENT Former Senior Managing Director at Heitman LLC | White (F) | 55 | 2020 | | | | |

| | | | | | | | | | | |

| AC | Audit Committee | | Chairperson |

| CC | Compensation Committee | | Member |

| NCGC | Nominating and Corporate Governance Committee | | |

| IC | Investment Committee | | |

(1)Equal Employment Opportunity (EEO-1) categories, as self-identified.

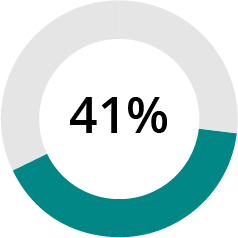

| | | | | | | | | | | | | | |

Director Nominee Snapshot(1) | | Director Nominee Skills and Experience(2) ACCOUNTING AND FINANCE CAPITAL MARKETS E-COMMERCE AND LOGISTICS CORPORATE SUSTAINABILITY MATTERS PUBLIC COMPANY BOARD EXPERIENCE REAL ESTATE OPERATIONS AND INVESTMENT REGULATORY, LEGAL OR RISK MANAGEMENT SENIOR LEADERSHIP AND STRATEGIC INITIATIVES |

| | | |

| GENDER IDENTITY | | | |

| | | |

| 2020 | | 2024 | |

| | | |

| | | |

| | | |

| | | |

| RACIAL IDENTITY | | | |

| | | |

| 2020 | | 2024 | |

| | | |

| | | |

| | | |

| | | |

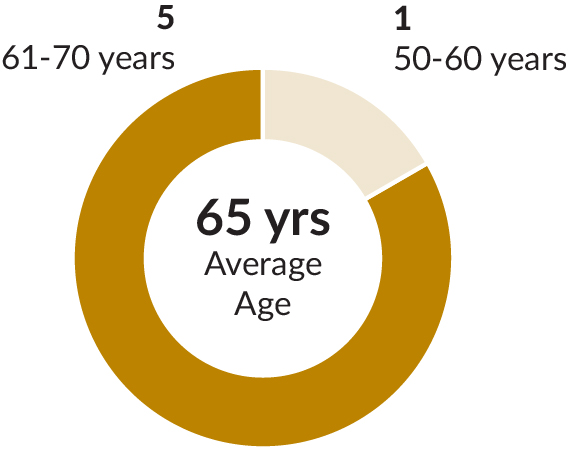

| AGE | | | |

| | | |

| 2020 | | 2024 | |

| | | |

| | | |

| | | |

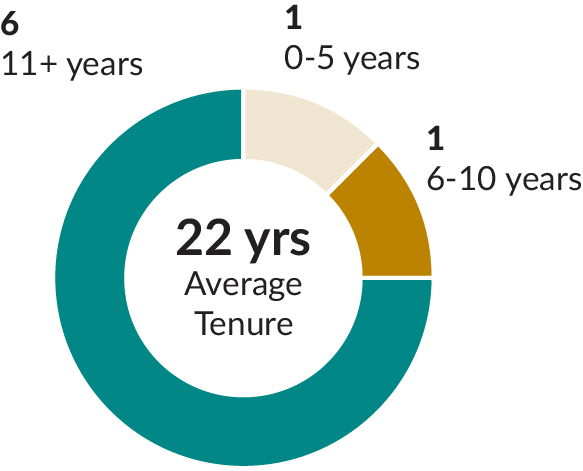

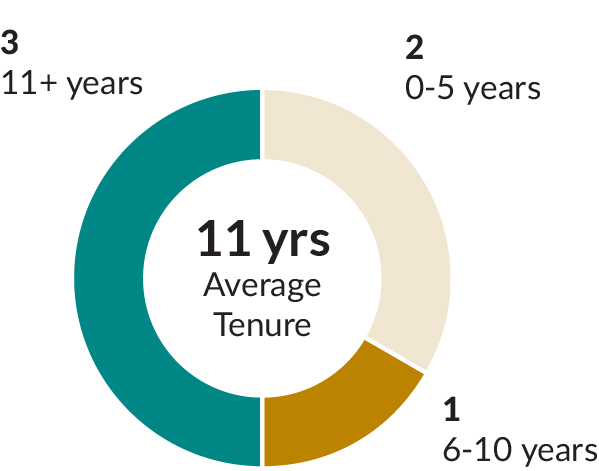

| TENURE | | | |

| | | |

| 2020 | | 2024 | |

| | | |

| | | |

(1)Excludes Marshall A. Loeb, our CEO

(2)Includes all director nominees

Corporate Governance Highlights

| | | | | |

| |

Independent Oversight | uSix of the seven Board nominees are independent u100% independent Audit, Compensation and Nominating and Corporate Governance Committees uSeparation of Chairman and CEO positions uAudit Committee meets with independent and internal auditors at least quarterly uFull Board oversight of strategy, risk management and corporate sustainability matters |

| |

| |

Board Refreshment | uAnnual director elections by shareholders (non-staggered board) uTwo of the seven Board nominees are women, and one nominee identifies as a racial or ethnic minority uChairpersons of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee rotated in 2020; Chairperson of the Nominating and Corporate Governance Committee rotated again in 2022 |

| |

| |

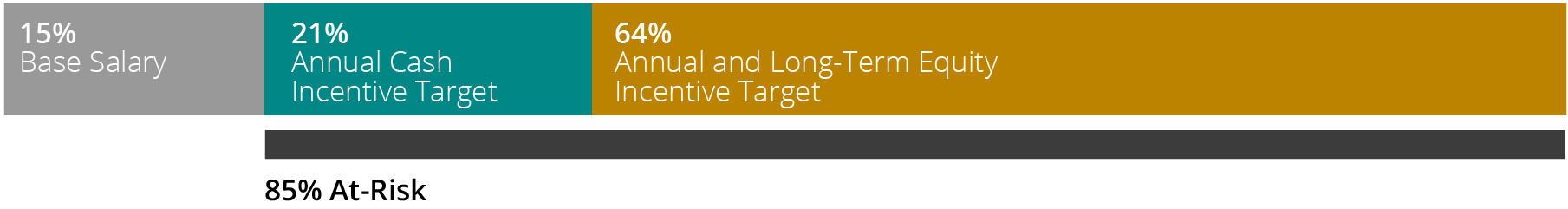

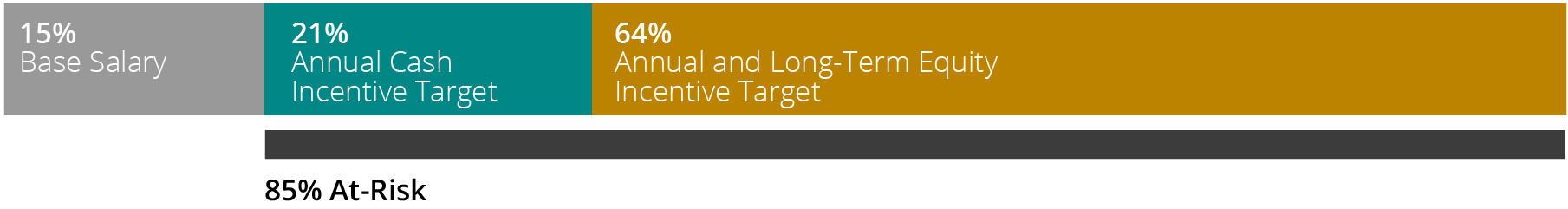

Sound Compensation Practices | uAll stock-based incentive plans have been approved by shareholders uRobust stock ownership guidelines for directors and executive officers uEliminated director meeting fees in 2020 by adopting a retainer compensation program for directors uShares granted to employees and directors have been less than 1% of the shares outstanding over the last three years uCompensation is strongly tied to performance, and we do not have employment agreements, automatic salary increases or guaranteed bonuses uThe Board has adopted a clawback policy that applies to both cash and equity incentive compensation uNo hedging or pledging of Company securities by directors or executive officers uNo excessive perquisites uNo supplemental executive retirement plans uNo tax gross-ups and no single-trigger provisions |

| |

| |

Other Best Practices | uGeneral and administrative expense as a percentage of revenue was less than 5% for the years ended December 31, 2023 and 2022 uInterested parties may communicate directly with the Board through a link on the Company’s website uNo collective bargaining agreements |

| |

| | | | | | | | |

| | |

Proposal 2 Ratification of Independent Registered Public Accounting Firm | |

| | |

| | |

| The Board recommends a vote FOR proposal 2. | for more details. |

| | |

| | | | | | | | |

| | |

Proposal 3 Non-Binding, Advisory Vote on Executive Compensation | |

| | |

| | |

| The Board recommends a vote FOR proposal 3. | for more details. |

| | |

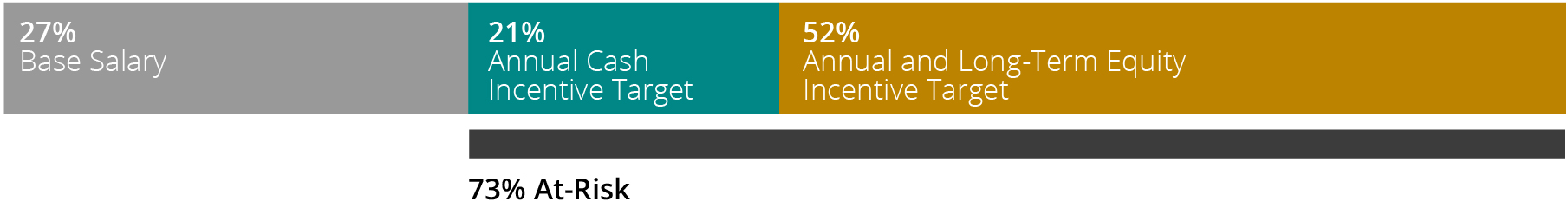

Executive Compensation Snapshot

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Pay Element | | |

| | | | CEO | Other NEOs | Why It Is Provided | Key Features |

| | | Base

Salary | | | uWe pay a base level of competitive cash salary to attract and retain executive talent. | uWe determine base salary based on experience, job scope, market data and individual performance. uWe annually review our Named Executive Officers’ (“NEOs”) base salaries against our peers to maintain competitive levels. |

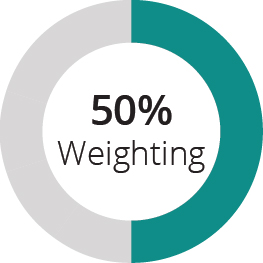

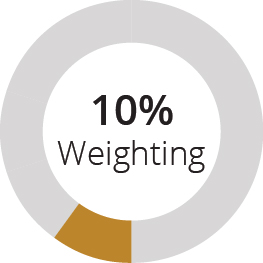

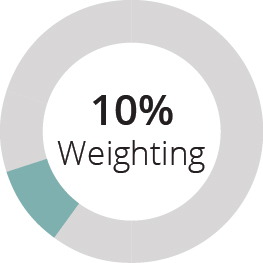

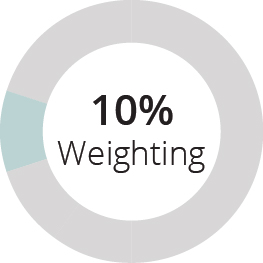

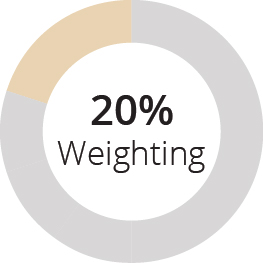

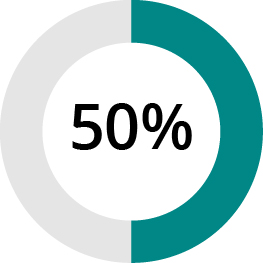

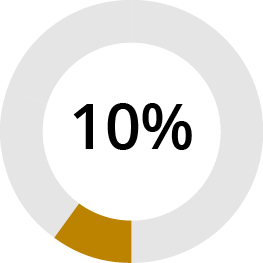

| | | Annual Cash and Equity Incentive Target | | | uOur annual cash and equity incentives are based on the achievement of objective at-risk Company performance metrics and individual goals to align compensation with strategic goals. | uA balanced mix of financial metrics commonly used to measure REIT performance and individual performance goals: uFFO per share (50%) uSame PNOI change (10%) uDebt to earnings before interest, taxes, depreciation and amortization for real estate (“EBITDAre”) ratio (10%) uFixed charge coverage ratio (10%) uIndividual objectives (20%) uPaid 50% in cash and 50% in equity. Cash is paid and a portion of the equity vests at the end of the one-year performance period, and the remainder vests ratably over an additional two years. |

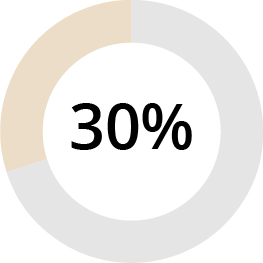

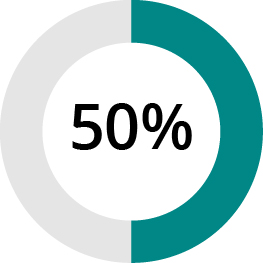

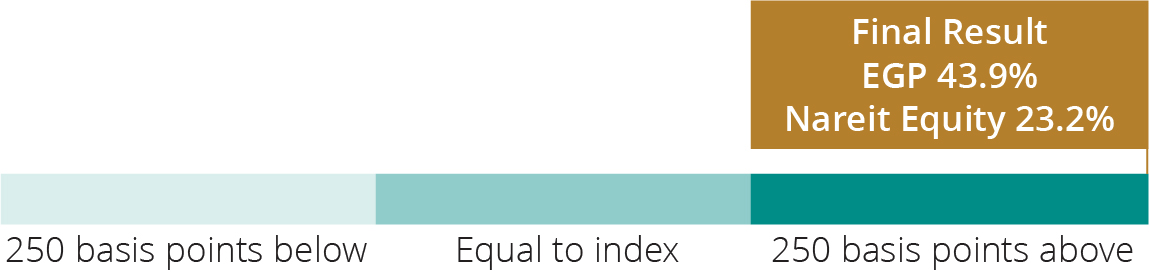

| | Performance- Based Long Term Equity Incentive Target | | | uWe grant performance-based (70%) and service-based restricted shares (30%) to our executives to encourage retention and align executive compensation with shareholders’ interests. | uPerformance-based awards are only earned by achieving the Company’s three-year Total Shareholder Return (“TSR”) performance hurdles relative to the Nareit Equity Index and member companies of the Nareit Industrial Index. uA portion of the shares vest at the end of the three-year performance period, and the remainder vests after an additional one-year vesting period. |

| | Service-Based

Long Term

Equity

Incentive

Target | | | uService-based awards vest ratably over four years. |

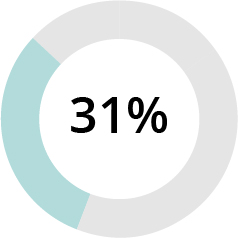

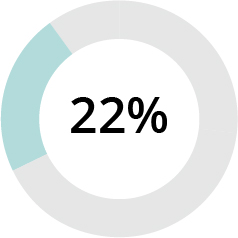

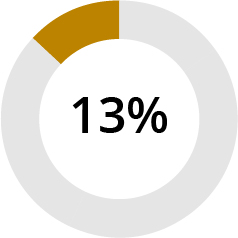

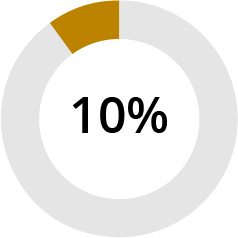

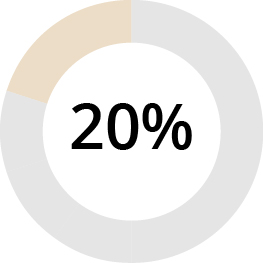

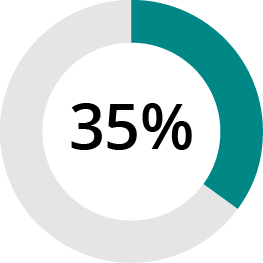

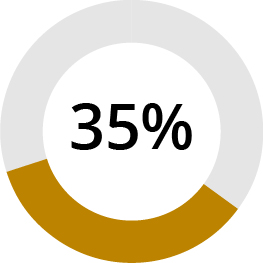

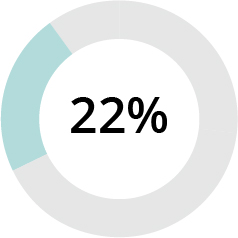

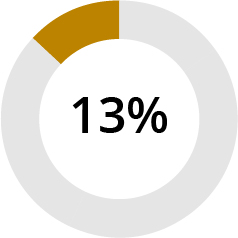

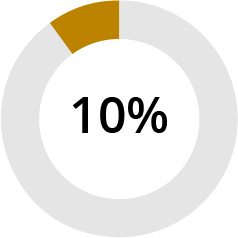

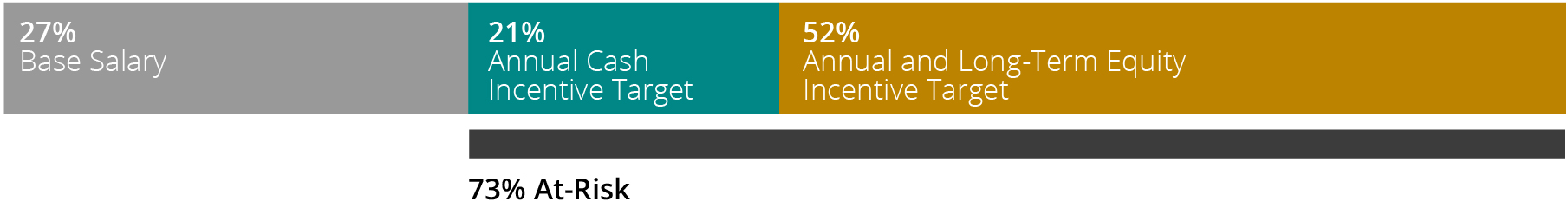

TARGET COMPENSATION MIX

| | | | | |

Chief

Executive

Officer | |

| |

Other Named

Executive

Officers | |

400 W. Parkway Place, Suite 100

Ridgeland, Mississippi 39157

Notice of 2024 Annual Meeting of Shareholders

To the Shareholders:

| | | | | | | | | | | | | | | | | |

| | | | | |

| DATE AND TIME May 23, 2024 (Thursday) 9:00 a.m. (Central Daylight Time) | | LOCATION Online: www.virtualshareholdermeeting.com/EGP2024 | | WHO CAN VOTE Shareholders as of March 22, 2024 are entitled to notice of and to vote at the Meeting or any adjournment thereof. |

| | | | | |

Items of Business

At the 2024 Annual Meeting of Shareholders (the “Meeting”), shareholders will be asked to:

| | | | | |

| 1. | Elect the seven director nominees named in this proxy statement for a one-year term to serve until the next annual meeting of shareholders and until their successors are duly elected and qualified; |

| 2. | Ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; |

| 3. | Approve, by a non-binding, advisory vote, the compensation of our Named Executive Officers as described in this proxy statement; and |

4. | Transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

All shareholders of record at the close of business on March 22, 2024 are entitled to notice of and to vote at the Meeting or any adjournment thereof.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their shareholders electronically. We believe these rules allow us to provide our shareholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of the Meeting.

By Order of the Board of Directors

BRENT WOOD

Executive Vice President, Chief

Financial Officer and Treasurer

DATED: April 12, 2024

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the Meeting to be Held on May 23, 2024. This proxy statement and our 2023 Annual Report to Shareholders are available at www.proxyvote.com |

|

Whether or not you plan to attend the 2024 Annual Meeting of Shareholders, please carefully read the proxy statement and other proxy materials and complete a proxy for your shares as soon as possible. You may authorize your proxy via the Internet or by telephone by following the instructions on the website indicated in the materials you received in the mail. If you received a Notice of Availability of Proxy Materials, you may also request a paper or an e-mail copy of our proxy materials and a paper proxy card at any time. If you receive a copy of the proxy card by mail, you may sign, date and mail the proxy card in the postage-paid envelope provided. If you attend the Meeting, you may vote via the virtual platform during the Meeting if you wish, even if you previously have submitted your proxy. However, please note that if your shares are held of record by a bank, broker or similar organization and you wish to vote via the virtual platform during the Meeting, you must obtain a “legal proxy” issued in your name from such bank, broker or similar organization.

Proxy Statement

The following information is furnished in connection with the 2024 Annual Meeting of Shareholders (the “Meeting”) of EastGroup Properties, Inc. (the “Company”), to be held on May 23, 2024 at 9:00 a.m., Central Daylight Time, in a virtual meeting format. This proxy statement and 2023 Annual Report to Shareholders are first being made available, and a Notice Regarding the Availability of Proxy Materials is first being mailed, to shareholders on or about April 12, 2024.

| | | | | |

| |

| Proposal 1 |

| |

| Election of Directors |

| |

| |

In accordance with our Amended and Restated Bylaws (the “Bylaws”), the Board of Directors (which we also refer to as the “Board”) has by resolution fixed the number of directors to be elected at the Meeting at seven. Each person so elected shall serve until the next Annual Meeting of Shareholders and until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. The nominees for director are: D. Pike Aloian, H. Eric Bolton, Jr., Donald F. Colleran, David M. Fields, Marshall A. Loeb, Mary E. McCormick and Katherine M. Sandstrom. All nominees are currently serving as directors of the Company and were elected at the 2023 Annual Meeting of Shareholders. Unless instructed otherwise, proxies will be voted “FOR” the nominees listed above. Although the directors do not contemplate that any of the nominees will be unable to serve prior to the Meeting, if such a situation arises, your proxy will be voted in accordance with the best judgment of the person or persons voting the proxy. Information regarding the director nominees can be found under “Director Nominee Biographical Information and Experience.” Nominees receiving more “For” votes than votes cast “Against” will be elected. Neither abstentions nor broker non-votes will have any legal effect on whether this proposal is approved. |

| |

| |

| |

| The Board unanimously recommends that shareholders vote “FOR” the election of each of Mmes. McCormick and Sandstrom and Messrs. Aloian, Bolton, Colleran, Fields and Loeb to serve on the Board until the 2025 Annual Meeting of Shareholders and until a successor for each is duly elected and qualified. |

| |

Proposal 1: Election of Directors

Director Nominee Biographical Information and Experience

The biography of each director nominee below contains information regarding that person’s principal occupation, tenure with the Company, business experience, other director positions currently held or held at any time during the past five years, and the specific experience, qualifications, attributes or skills that led to the conclusion by the Board that such person should serve as a director of the Company.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Age 69 Gender Male Director Since 1999 INDEPENDENT Board Positions Audit Committee Investment Committee | | | | |

| | | | |

| | D. Pike Aloian Managing Director, Neuberger Berman | | |

| | | | |

| | | | |

| | Skills uAccounting and Finance uCapital Markets uPublic Company Board Experience uReal Estate Operations and Investment uSenior Leadership and Strategic Initiatives Mr. Aloian brings financial and investment experience, knowledge of capital markets and experience on the boards of other public and private companies to our Board. He plays a senior role in the on-going management of Almanac Realty Investors, LLC (“Almanac”), including the origination, structuring and management of Almanac’s capital investments to public and private real estate companies. He graduated from Harvard College and received an MBA from Columbia University Graduate School of Business, where he also served as an adjunct professor. Select Business Experience uManaging Director of Neuberger Berman, a New York-based investment management firm since 2020 uPartner of Almanac and its predecessor entities through January 31, 2020, when the firm was acquired by Neuberger Berman uServes as a member of the Almanac Investment Committee | | |

| | | | |

| | | | | |

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | |

| | | | | |

| Age 67 Gender Male Director Since 2013 INDEPENDENT Board Positions Compensation Committee (Chairperson) Investment Committee | | | | |

| | | | |

| | H. Eric Bolton, Jr. Chief Executive Officer, Mid-America Apartment Communities, Inc. | | |

| | | | |

| | | | |

| | Skills uAccounting and Finance uCapital Markets uCorporate Sustainability Matters uPublic Company Board Experience uReal Estate Operations and Investment uRegulatory, Legal or Risk Management uSenior Leadership and Strategic Initiatives Mr. Bolton brings extensive public company business and real estate operating experience to the Board. He serves on the National Association of Real Estate Investment Trusts (“Nareit”) Advisory Board of Governors. He received a BBA in Accounting from the University of Memphis and an MBA with a concentration in Finance and Real Estate from the University of North Texas. Select Business Experience uChief Executive Officer of Mid-America Apartment Communities, Inc. (“MAA”) (NYSE: MAA), a real estate investment trust (“REIT”) that owns and operates apartment communities, since 2001 and Chairman of the Board of Directors of MAA since 2002 uJoined MAA in 1994 as Vice President of Development and was named Chief Operating Officer in February 1996 and promoted to President in December 1996; prior to that time, he was Executive Vice President and Chief Financial Officer of Trammell Crow Realty Advisors uServed on the Board of Directors of Interstate Hotels and Resorts, Inc. from 2008 to 2010 | | |

| | | | |

| | | | | |

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | |

| | | | | |

| Age 68 Gender Male Director Since 2017 INDEPENDENT Board Positions Chairman of the Board Compensation Committee Nominating and Corporate Governance Committee | | | | |

| | | | |

| | Donald F. Colleran Former President and Chief Executive Officer, FedEx Express | | |

| | | | |

| | | | |

| | Skills uE-Commerce and Logistics uPublic Company Board Experience uRegulatory, Legal or Risk Management uSenior Leadership and Strategic Initiatives Mr. Colleran’s global leadership positions provide broad experience and allow him to provide valuable insight to the Company and the Board regarding operational and strategic issues. He has served on the Board of Directors of ABM Industries (NYSE: ABM) since 2018. He received a BBA degree from the University of New Hampshire. Select Business Experience uPresident and Chief Executive Officer of FedEx Express from 2019 to 2023 and also served on the Strategic Management Committee of FedEx Corporation (“FedEx”), which sets the strategic direction for FedEx uJoined FedEx in 1989, where he served in a variety of leadership roles including Executive Vice President, Chief Sales Officer of FedEx from 2016 to 2019 and Executive Vice President, Global Sales of FedEx Services from 2006 to 2016 | | |

| | | | | |

| | | | | |

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | |

| | | | | |

| Age 66 Gender Male Director Since 2022 INDEPENDENT Board Positions Compensation Committee Nominating and Corporate Governance Committee | | | | |

| | | | |

| | David M. Fields Executive Vice President, Chief Administrative Officer and General Counsel, Sunset Development Company | | |

| | | | |

| | | | |

| | Skills uPublic Company Board Experience uReal Estate Operations and Investment uRegulatory, Legal or Risk Management uSenior Leadership and Strategic Initiatives uCorporate Sustainability Matters Mr. Fields has more than 30 years of experience leading multiple disciplines for major companies with large-scale branded real estate. He brings to our Board his extensive background in strategic planning, executive leadership, legal and compliance matters, technology and human resources with prior profit and loss statement responsibility. He has served on the board of directors of CBL & Associates Properties, Inc. (NYSE: CBL), since 2021, where he is the chairman of the Nominating and Corporate Governance Committee and is a member of the Compensation Committee. He received a BA degree from Yale University and a Juris Doctor degree from Harvard Law School. Select Business Experience uExecutive Vice President, Chief Administrative Officer and General Counsel since 2014 of San Ramon, California-based Sunset Development Company, the developer, owner and manager of Bishop Ranch, home to 500 businesses, along with retail, entertainment and plans for 10,000 residential homes uExecutive Vice President and Chief Administrative Officer of Bayer Properties in Birmingham, Alabama from 2006 to 2013 uServed as counsel to the industrial and retail divisions at the Irvine Company in Newport Beach, California prior to becoming Vice President and General Counsel of Irvine Company Retail Properties | | |

| | | | |

| | | | | |

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | |

| | | | | |

| Age 61 Gender Male Director Since 2016 Board Positions Investment Committee (Chairperson) | | | | |

| | | | |

| | Marshall A. Loeb Chief Executive Officer, President and Director, EastGroup Properties, Inc. | | |

| | | | |

| | | | |

| | Skills uAccounting and Finance uCapital Markets uPublic Company Board Experience uReal Estate Operations and Investment uSenior Leadership and Strategic Initiatives Mr. Loeb has over 30 years of experience with publicly held REITs and brings real estate industry, finance, operations, development, and executive leadership expertise to the Board. He serves on the Board of Directors and Audit Committee of Lamar Advertising Company (Nasdaq: LAMR), one of the largest outdoor advertising companies in the world specializing in billboard, interstate logo, transit and airport advertising formats. He serves as a member of the Nareit 2024 Advisory Board of Governors, the advisory body to the Nareit executive board, and as chairman of the Audit and Investment Committee of Nareit. He received a BS in Accounting and a Master of Tax Accounting degree from the University of Alabama, then earned a MBA from the Harvard Graduate School of Business. Select Business Experience uRejoined the Company as President and Chief Operating Officer in March 2015 and named Chief Executive Officer and a director in January 2016 uServed as President and Chief Operating Officer of Glimcher Realty Trust, a former retail REIT, from 2005 to 2015, when it was acquired by Washington Prime Group Inc. uChief Financial Officer of Parkway Properties, Inc., a former office REIT, from 2000 to 2005 uPreviously employed by the Company from 1991 to 2000, beginning as an asset manager and rising to senior vice president | | |

| | | | |

| | | | | |

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | |

| | | | | |

| Age 66 Gender Female Director Since 2005 INDEPENDENT Board Positions Audit Committee (Chairperson) Nominating and Corporate Governance Committee | | | | |

| | | | |

| | Mary E. McCormick Former Executive Director, The Ohio State University Center for Real Estate | | |

| | | | |

| | | | |

| | Skills uAccounting and Finance uCapital Markets uCorporate Sustainability Matters uPublic Company Board Experience uReal Estate Operations and Investment uRegulatory, Legal or Risk Management uSenior Leadership and Strategic Initiatives Ms. McCormick brings extensive experience in real estate, capital markets, and corporate governance to our Board. She held a number of leadership positions for a variety of national and regional real estate associations, including Chairperson of the Pension Real Estate Association. She is on the Board of Directors of Xenia Hotels and Resorts, Inc. (NYSE: XHR), a lodging REIT, since 2015, where she serves on the Audit Committee and as Nominating and Corporate Governance Committee chairperson. She previously served on the Board of Directors of MAA from 2006 to 2010. Ms. McCormick is a member of the Urban Land Institute. She received a Bachelor’s degree and an MBA from The Ohio State University. Select Business Experience uExecutive Director of the Center for Real Estate at The Ohio State University from 2017 to 2022, where she also served as a Senior Lecturer at the Fisher College of Business uServed the Ohio Public Employees Retirement System from 1989 through 2005, where she was responsible for directing real estate investments and overseeing an internally managed REIT portfolio uServed on the boards of multiple public and private real estate companies and as a Senior Advisor for Almanac Realty Partners from 2010 to 2016 | | |

| | | | |

| | | | | |

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | |

| | | | | |

| Age 55 Gender Female Director Since 2020 INDEPENDENT Board Positions Audit Committee Nominating and Corporate Governance Committee (Chairperson) | | | | |

| | | | |

| | Katherine M. Sandstrom Former Senior Managing Director, Heitman LLC | | |

| | | | |

| | | | |

| | Skills uAccounting and Finance uCapital Markets uCorporate Sustainability Matters uPublic Company Board Experience uSenior Leadership and Strategic Initiatives Ms. Sandstrom brings valuable business, financial and investment expertise to the Board. She serves on the Board of Directors of Healthpeak Properties, Inc. (NYSE: PEAK), a REIT serving the healthcare industry, since 2018, and as Chair of their Board of Directors, since 2023. She also serves as chair of their Nominating and Corporate Governance Committee. She is on the Board of Directors of Urban Edge Properties (NYSE: UE), a shopping center REIT, since 2022, where she has served on the Audit Committee and Corporate Governance and Nominating Committee, and she is on the Board of Directors of Toll Brothers, Inc. (NYSE: TOL), since 2023. She received a BA in Accounting from the University of West Florida, and she is a certified public accountant. Select Business Experience uServed as Senior Managing Director at Heitman LLC (“Heitman”), a real estate investment management firm, as an Advisor from July 2018 to March 2019 and Senior Managing Director and global head of Heitman’s Public Real Estate Securities business from 2013 to 2018 uJoined Heitman in 1996 and held several senior leadership positions across multiple facets of the institutional real estate investment industry. Additionally, Ms. Sandstrom previously served on Heitman’s Global Management Committee, the Board of Managers and the Allocation Committee | | |

| | | | |

| | | | | |

Proposal 1: Election of Directors

Director Nominee Skills and Diversity Matrix

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Link to Strategy | | | | | | | |

| | | | | | | | | |

| ACCOUNTING AND FINANCE | As a publicly traded company, we believe an understanding of accounting, finance and internal controls is essential to providing oversight of our financial reporting and internal control environment. We seek to have multiple directors who qualify as Audit Committee financial experts. | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| CAPITAL MARKETS | Significant capital is required to fund our operations and grow our business. We value directors with experience in capital markets, including debt and equity financing. | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| E-COMMERCE AND LOGISTICS | As a developer, owner and operator of business distribution buildings, we are an integral part of many businesses’ warehousing and supply chain needs. We believe it is valuable to the Company for a director to have experience in the e-commerce and logistics fields. | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| CORPORATE SUSTAINABILITY MATTERS | We strive to conduct business in a responsible manner, to integrate corporate sustainability into our operational decision-making and to provide informative ESG-related disclosures. We value a director’s corporate sustainability experience from a Company and investor perspective. | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| PUBLIC COMPANY BOARD EXPERIENCE | We believe a director’s experience serving on other public company boards is valuable, as it provides them with knowledge, insights and perspectives on business operations, corporate governance and other board-related matters. | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| REAL ESTATE OPERATIONS AND INVESTMENT | Directors with real estate experience bring valuable expertise that is useful in guiding and overseeing our business operations, including real estate development, acquisitions and operations. | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| REGULATORY, LEGAL OR RISK MANAGEMENT | Directors with experience in regulatory, legal and risk management matters provide valuable oversight to our management and Board. | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| SENIOR LEADERSHIP AND STRATEGIC INITIATIVES | We believe directors who serve or have served in senior leadership positions bring valuable experience and perspectives, providing guidance to our management and Board on a variety of business matters, including strategy, human capital management, and execution. | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

TOTAL NUMBER OF DIRECTOR NOMINEES: 7(1) | | |

| GENDER IDENTITY | Female | Male |

| Director nominees | 2 | 5 |

| RACIAL IDENTITY | | |

| African American or Black | — | 1 |

| White | 2 | 4 |

(1)For the gender and racial identities of each director nominee, see page 8.

Proposal 1: Election of Directors

Board Composition and Refreshment

Our Board has an ongoing director succession planning process designed to provide for a highly independent, well-qualified Board, with the diversity, experience and background to be effective and to provide strong oversight. Our Board regularly evaluates the needs of the Company and values a mix of new directors, who bring fresh perspectives and enhanced skills, and longer-serving directors who provide continuity and experience with our strategies and risk management processes.

Board Evaluation

Our Board recognizes that a regular Board and committee evaluation process is an essential component of Board effectiveness and thoughtful Board refreshment. On an annual basis, each of our directors completes an overall Board evaluation and an evaluation for each committee on which the director serves. The Nominating and Corporate Governance Committee oversees the evaluation process.

| | | | | | | | | | | | | | |

| | | | |

QUESTIONNAIRE uDirectors are asked to provide an effectiveness rating to a variety of Board actions and processes. uDirectors are able to provide anonymous comments on a variety of Board and committee matters. | | DISCUSSION uThe Nominating and Corporate Governance Committee discusses the findings of the Board assessments. uEach committee discusses the findings of its committee assessment. | | EVALUATION RESULTS uThe Nominating and Corporate Governance Committee reports the findings to the full Board. uFeedback is taken into consideration as the Board carries out its duties. |

| | | | |

Nominating Procedures

In identifying suitable candidates for nomination as a director – whether new candidates or incumbent directors – the Nominating and Corporate Governance Committee considers the needs of the Board and the range of skills and characteristics required for effective functioning of the Board. The Committee regularly discusses director succession and refreshment of the Board to further cultivate diversity of skill sets, experiences, backgrounds and demographics.

| | | | | | | | | | | | | | |

| | | | |

GENERAL CONSIDERATION In evaluating the suitability of individual board members, the Nominating and Corporate Governance Committee takes into account many factors, including experience in the real estate industry; understanding of finance and accounting; exposure to disciplines relevant to the success of a public company, such as capital markets, finance, investor relations, and corporate governance; experience in real estate development and construction; and diversity (including diversity of gender, race, ethnicity, age, sexual orientation, skill sets, background and experience), and other considerations memorialized in our Corporate Governance Guidelines. | | RELEVANT SKILLS AND EXPERIENCE Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination. | | SUGGESTIONS In addition, the Nominating and Corporate Governance Committee will consider nominees suggested by incumbent Board members, management, shareholders and, in certain circumstances, outside search firms; as such, shareholders may influence the composition of the Board. |

| | | | |

Proposal 1: Election of Directors

| | |

|

OUR COMMITMENT TO BOARD DIVERSITY Our Board believes that it is in the Company’s and shareholders’ best interest that the Board be comprised of directors with diversity of thought, opinion, skill sets, background, gender and ethnicity. In April 2023, the Board amended our Corporate Governance Guidelines to reflect that, in evaluating candidates, the Board will consider diversity (including diversity of gender, race, ethnicity, age, sexual orientation and gender identity) as it deems appropriate given the current needs of the Board and the Company. Additionally, in identifying potential independent director candidates, the Nominating and Corporate Governance Committee will include in its initial list for consideration for any vacancy on the Board one or more qualified candidates who reflect diverse backgrounds, including diversity of gender and race or ethnicity. Two of our directors are women, and one of our directors identifies as a racial minority. In 2021, the Nominating and Corporate Governance Committee engaged Korn Ferry, a third-party search firm, to assist the committee in the identification and recruitment of an experienced, ethnically diverse candidate for our Board. Korn Ferry recommended Mr. Fields, along with various potential other candidates, and in February 2022, Mr. Fields was appointed to our Board. |

|

Consideration of New Nominees

| | | | | | | | | | | | | | |

| | | | |

COLLECT CANDIDATE POOL uThe Nominating and Corporate Governance Committee considers candidates brought forth by incumbent Board members, management and shareholders. uThe Nominating and Corporate Governance Committee has also previously engaged, and may in the future engage, an outside search firm to assist in identifying qualified candidates. | | REVIEW CANDIDATES uThe Nominating and Corporate Governance Committee reviews the candidate pool to identify candidates it believes are best suited to serve as a director. uThe Nominating and Corporate Governance Committee and other directors and members of management interview candidates. | | RECOMMEND TO BOARD uAfter interviewing and discussing candidates, the Nominating and Corporate Governance Committee recommends a candidate’s nomination to the full Board. uThe Board evaluates and approves the new director. |

| | | | |

Shareholder Recommendations

In accordance with the nominating procedures outlined above, the Nominating and Corporate Governance Committee will consider written recommendations for potential nominees suggested by shareholders. Any such person will be evaluated in the same manner as any other potential nominee for director. Any suggestion for a nominee for director by a shareholder should be sent to the Company’s Secretary at 400 W. Parkway Place, Suite 100, Ridgeland, Mississippi 39157, within the time periods set forth under the heading “About the 2024 Annual Meeting – How do I submit a proposal for the 2025 Annual Meeting?”.

Refreshment and Succession Planning

| | | | | | | | | | | | | | |

| | | | |

As a result of our commitment to thoughtful Board refreshment and increased Board diversity, we have added three new directors since 2017 and enhanced the composition of our Board in recent years. Since 2020, we have: |

| | | | |

| | | | |

| Doubled | Two | By six years(1) | By 11 years(1) | Enhanced |

the number of women on our Board (from one to two) | new diverse directors | Reduced average director nominee age | Reduced average director nominee tenure | the Board Skills related to Corporate Sustainability, Capital Markets and Regulatory/Legal/Risk |

| | | | |

We continue to seek Board refreshment and to enhance the diversity of perspectives on our Board. |

| | | | |

(1)Director nominees excluding our CEO, Marshall A. Loeb

Proposal 1: Election of Directors

Corporate Governance

Leadership Structure

Our current leadership structure includes an independent Chairman of the Board, a separate Chief Executive Officer, and a Board of Directors with six of the seven directors, including the Chairman, considered independent. Additionally, our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are comprised entirely of independent directors. The Board of Directors believes that separating the Chairman and Chief Executive Officer positions, as well as having an independent Chairman of the Board, provides the Board of Directors and the Company with strong leadership and independent oversight while allowing the Chief Executive Officer to focus on the Company’s strategic direction, management, and business operations.

| | | | | | | | |

| | |

CHIEF EXECUTIVE OFFICER Marshall A. Loeb uThe Chief Executive Officer is responsible for setting the strategic direction of the Company. uHe is also responsible for the day to day leadership and management of the Company. | | INDEPENDENT CHAIRMAN OF THE BOARD Donald F. Colleran uThe Chairman of the Board leads the Board in providing Company oversight and direction. uHe actively manages the Board by presiding over meetings of the Board. |

| | |

| | |

| |

BOARD COMMITTEES AND DIRECTORS uOur independent directors are also actively involved in overseeing the Company’s business, both at the Board and committee level. uUnder the NYSE listing standards, six of our seven directors are considered independent. uOur Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are comprised entirely of independent directors and perform oversight functions independent of management. uDirectors may suggest topics for inclusion on an agenda for a Board meeting and raise topics during a meeting that are not on the agenda. uOur Board and each committee have complete and open access to any member of management and the authority to retain independent legal, financial and other advisors as they deem appropriate without consulting or obtaining the approval of any member of management. uOur Board may hold executive sessions with only independent directors present. Such sessions are led by our independent Chairman and promote discussion among the independent directors and assure independent oversight of management. |

| |

Independent Directors

Under the NYSE listing standards, at least a majority of the Company’s directors and all of the members of the Company’s Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee must meet the test of “independence” as defined by the NYSE. The NYSE standards provide that, to qualify as an “independent” director, in addition to satisfying certain bright-line criteria, the Board must affirmatively determine that a director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) that would interfere with such person’s ability to exercise independent judgment as a member of the Company’s Board. Our Board currently has seven members: D. Pike Aloian, H. Eric Bolton, Jr., Donald F. Colleran, David M. Fields, Marshall A. Loeb, Mary E. McCormick and Katherine M. Sandstrom. The Board has determined that each director who served during the fiscal year ended December 31, 2023, was and continues to be independent other than Mr. Loeb, the Company’s Chief Executive Officer.

Board Size

Our Bylaws provide that the number of directors will be initially as provided in our Articles of Amendment and Restatement, and subsequently as determined by the Board. The size of our Board is currently set at seven directors.

Proposal 1: Election of Directors

Committees of the Board

The Board has a standing Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Investment Committee; membership of these committees is outlined in the table below. Each member of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee is “independent” as that term is defined in the NYSE listing standards, and the Board has adopted written charters for each of these committees, which are reviewed annually by the respective committee and are available on our website at http://investor.eastgroup.net/governance-documents. Materials located on our website and referenced herein are not deemed to be part of this proxy statement and are not incorporated by reference.

| | | | | |

|

| Audit Committee |

|

| |

MEMBERS Mary E. McCormick (Chairperson) D. Pike Aloian Katherine M. Sandstrom Meetings in 2023: 6 | PRINCIPAL RESPONSIBILITIES uOversee the financial reporting of the Company, including the audit by the Company’s independent registered public accounting firm and the internal audit department. uReview and provide oversight of the Company’s cybersecurity and other information technology risks. uMonitor financial risks relevant to the Company, potential related party arrangements and a variety of other accounting and financial matters. Mmes. McCormick and Sandstrom and Mr. Aloian have each been designated as an “Audit Committee financial expert” in accordance with the SEC rules and regulations, and the Board has determined that they have accounting and related financial management expertise within the meaning of the listing standards of the NYSE. See “Report of the Audit Committee” on page 36 of this proxy statement. |

| |

| | | | | |

|

| Compensation Committee |

|

| |

MEMBERS H. Eric Bolton, Jr. (Chairperson) Donald F. Colleran David M. Fields Meetings in 2023: 6 | PRINCIPAL RESPONSIBILITIES uReview and recommend to the Board an appropriate executive compensation policy. uApprove compensation of the Company’s executive officers. uReview and recommend to the Board appropriate compensation for the Company’s directors. uReview and make recommendations with respect to executive and employee benefit plans and programs. |

| |

| | | | | |

|

| Nominating and Corporate Governance Committee |

|

| |

MEMBERS Katherine M. Sandstrom (Chairperson) Donald F. Colleran David M. Fields Mary E. McCormick Meetings in 2023: 3 | PRINCIPAL RESPONSIBILITIES uAssess Board membership needs and identify, screen, recruit and present director candidates to the Board. uImplement policies regarding corporate governance matters. uEvaluate and make recommendations regarding committee memberships and chairpersonships. uSponsor and oversee performance evaluations for the Board as a whole and the directors. uReview and provide oversight of the Company’s corporate sustainability strategy, practices and policies. |

| |

Proposal 1: Election of Directors

| | | | | |

|

| Investment Committee |

|

| |

MEMBERS Marshall A. Loeb (Chairperson) D. Pike Aloian H. Eric Bolton, Jr. Meetings in 2023: 3 | PRINCIPAL RESPONSIBILITIES uReview and approve any real estate investment or disposition that has a transaction value greater than $55.0 million and less than $125.0 million. Real estate investments or dispositions that either have a transaction value equal to or greater than $125.0 million or are in geographic markets where the Company does not already have a presence are reviewed and approved by the full Board of Directors. |

| |

Board Oversight and Engagement

The Board’s role is to maximize long-term shareholder value. In order to maximize long-term shareholder value, the directors’ primary functions are:

| | | | | | | | |

| | |

STRATEGIC OVERSIGHT | RISK OVERSIGHT | SUCCESSION PLANNING |

| | |

uReview management’s business strategies to evaluate their efficacy uSeek to ensure that the Company’s compensation strategy for key executives i.is effective in attracting and retaining key executives; ii.links pay to performance based on goals that are aligned with the long-term interests of the Company’s shareholders; and iii.is administered fairly and in the shareholders’ interests | uReview, and where appropriate, approve and evaluate financial and internal controls uSeek to ensure that the Company’s business is conducted in conformity with applicable laws and regulations uReview with management and monitor the material risks related to the Company’s business | uSelect the Chief Executive Officer and other senior officers uDevelop and periodically review a management succession plan |

| | |

Risk Oversight

The Company believes that its leadership structure allows the Board to provide effective oversight of the Company’s risk management function by receiving and discussing regular reports prepared by the Company’s senior management on areas of material risk to the Company, including market conditions; tenant concentrations and credit worthiness; leasing activity and expirations; compliance with debt covenants; management of our balance sheet and debt maturities; access to debt and equity capital markets; existing and potential legal claims against the Company; cybersecurity, including cyber-attacks and computer viruses; corporate sustainability initiatives; enterprise risk management; and various other matters relating to the Company’s business.

Proposal 1: Election of Directors

| | | | | | | | | | | | | | | | | |

| | | | | |

| BOARD The Board administers its risk oversight function through: uThe required approval by the Board (or a committee thereof) of significant transactions and other decisions, including, among others, development and acquisitions of properties, the markets in which the Company operates, sourcing of capital, and the appointment and retention of the Company’s senior management; uRegular meetings with management to discuss the Company’s operations and strategy; uReviewing, on at least an annual basis, the Company’s enterprise risk management program; uThe coordination of the direct oversight of specific areas of the Company’s business by the Audit, Compensation and Nominating and Corporate Governance Committees, with oversight by the full Board as appropriate; and uPeriodic reports from the Company’s auditors and other outside consultants regarding various areas of potential risk, including, among others, those relating to the qualification of the Company as a REIT for tax purposes, the Company’s internal control over financial reporting, and the security of the electronic systems which the Company relies upon to conduct its business. | |

| | | | | |

| | | | | |

| AUDIT COMMITTEE uOversees the Company’s financial reporting and internal control environment; uOversees the internal and external audit functions; uReviews and provides oversight of the Company’s cybersecurity and other information technology risks; and uMonitors the Company’s financial risks. | COMPENSATION COMMITTEE uConsiders various risks when approving the Company’s compensation structure for its executive officers and directors, including retention, pay for performance, and aligning the Company’s interests with those of shareholders; and uEngages an independent compensation consultant and works together with them to apply the Committee’s compensation philosophy to its compensation programs by analyzing current market trends, peer compensation metrics, and evaluating risks associated with executive compensation. | NOMINATING AND CORPORATE GOVERNANCE COMMITTEE uAssesses governance risks and the various risks associated with Board leadership; uConsiders various risks and the value of diversity of thought, skill sets, experiences and demographics when identifying potential candidates to serve as directors; and uReviews and provides oversight of the Company’s corporate sustainability program. | |

| | | | | |

| | | | | |

| | | | |

| MANAGEMENT uConducts the operations of the business while identifying and considering associated risks; uDiscusses within the management team and with the Board areas of potential risks and actions to mitigate those risks; uEstablishes and follows a system of internal controls to prevent, deter and detect any potential fraudulent or erroneous activity; and uEngages third-party professionals on a variety of matters to ensure the Company is following best practices. | |

| | | | | |

| | | | | |

| Enterprise-Wide Teams and Risk Mitigation Efforts Cross-functional committees including the Disclosure Committee, Corporate Sustainability Committee and Cyber Risk Committee meet regularly to promote strategic leadership and provide management with important perspectives, as well as advise on risk mitigation strategies from their areas of specialization. Management also administers other risk mitigation features such as a Code of Ethics and Business Conduct and a comprehensive internal and external audit process. | Enterprise Risk Management (“ERM”) Program The ERM program was created to proactively identify and address risks and related opportunities and help achieve business objectives through risk-informed decision making. Responsibilities include identification and prioritization of the top risks through a comprehensive risk assessment process, designation of clear risk ownership, and facilitation of a collaborative environment that promotes risk dialogue internally and with various stakeholders. | |

| | | | | |

| | | | | |

| | |

|

Outside Advisors Advisors may be engaged either on a regular basis to inform the Board or management of ongoing risks facing our business, or occasionally to advise on specific topics. Such advisors include auditors, attorneys, financial firms, compensation consultants, corporate sustainability consultants, cybersecurity experts and other consultants. |

|

Proposal 1: Election of Directors

Strategic Oversight

The Board is responsible for oversight of strategy, the operation of the business and performance evaluation, so as to promote the long-term successful performance of the Company.

| | | | | |

| |

| |

The Board meets at least quarterly to review the results of the Company’s operations, financial reports, market-specific business reports, strategic transactions, corporate sustainability program updates and capital funding. | The Board and senior management conduct an annual strategic planning meeting to discuss longer-term strategy and goals for the Company, enterprise risk management, corporate sustainability topics, potential new business opportunities and/or shifts in the market/business landscape. |

| |

Human Capital Management

We believe our employees are a critical component of the success and sustainability of our Company, and we are committed to providing a diverse and inclusive work environment that encourages collaboration and teamwork. We have various policies and practices in place, including a Code of Ethics and Business Conduct, Whistleblower Program, Equal Opportunity and Commitment to Diversity, Human Rights Statement, Vendor Code of Conduct, ADA & Reasonable Accommodation, Commitment to Safety, Community Service, Family Medical Leave, Parental Leave, Standards of Conduct, Corporate Green Office Guide, Environmental Management System, Workplace Violence Prevention, Healthy, Wealthy, and Wise Benefits Summary, and Cybersecurity Policy.

We value our employees, and our focus on human capital management and other socially-responsible initiatives is at the forefront of discussions and decisions with both management and the Board. The Nominating and Corporate Governance Committee reviews and provides oversight of the Company’s human capital management program.

Management Succession Planning

Members of the Board and senior management regularly discuss succession planning for senior management and other key employees. Discussions include interim and longer-term solutions to future succession-related events, internal and external candidates, and considerations of potential structural changes in the Company’s personnel organizational chart.

Proposal 1: Election of Directors

Corporate Sustainability Oversight

EastGroup’s commitment to corporate sustainability initiatives is evidenced by its building standards, corporate policies and procedures and Company culture. At EastGroup, protecting the environment is important to the Company’s employees, customers and communities. The Company strives to support sustainability through its commitment to build high performance and environmentally responsible properties. The following table describes how we manage our corporate sustainability program.

| | | | | | | | |

| Board Oversight | Full Board | Nominating and Corporate Governance Committee |

| |

Ongoing oversight of the Company’s corporate sustainability program throughout the year | Direct oversight of the Company’s corporate sustainability program |

| |

| |

uReceive periodic updates from, and provides high-level guidance to, our management on ESG-related topics. uIn 2023, our management and the Board met four times, and the Nominating and Corporate Governance Committee met two times to formally discuss corporate sustainability topics. |

| | |

| | |