DEF 14AfalseAMERICAN ELECTRIC POWER COMPANY, INC.000000490400000049042023-01-012023-12-31iso4217:USDiso4217:USDxbrli:shares00000049042022-01-012022-12-3100000049042021-01-012021-12-3100000049042020-01-012020-12-310000004904aep:StockAwardsMemberecd:PeoMember2023-01-012023-12-310000004904ecd:PeoMemberaep:EquityAwardAdjustmentsMember2023-01-012023-12-310000004904aep:ChangeInPensionMemberecd:PeoMember2023-01-012023-12-310000004904ecd:PeoMemberaep:PensionBenefitAdjustmentsMember2023-01-012023-12-310000004904aep:StockAwardsMemberecd:PeoMember2022-01-012022-12-310000004904ecd:PeoMemberaep:EquityAwardAdjustmentsMember2022-01-012022-12-310000004904aep:ChangeInPensionMemberecd:PeoMember2022-01-012022-12-310000004904ecd:PeoMemberaep:PensionBenefitAdjustmentsMember2022-01-012022-12-310000004904aep:StockAwardsMemberecd:PeoMember2021-01-012021-12-310000004904ecd:PeoMemberaep:EquityAwardAdjustmentsMember2021-01-012021-12-310000004904aep:ChangeInPensionMemberecd:PeoMember2021-01-012021-12-310000004904ecd:PeoMemberaep:PensionBenefitAdjustmentsMember2021-01-012021-12-310000004904aep:StockAwardsMemberecd:PeoMember2020-01-012020-12-310000004904ecd:PeoMemberaep:EquityAwardAdjustmentsMember2020-01-012020-12-310000004904aep:ChangeInPensionMemberecd:PeoMember2020-01-012020-12-310000004904ecd:PeoMemberaep:PensionBenefitAdjustmentsMember2020-01-012020-12-310000004904aep:YearEndFairValueOfEquityAwardGrantedMemberecd:PeoMember2023-01-012023-12-310000004904aep:YOYChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:PeoMember2023-01-012023-12-310000004904ecd:PeoMemberaep:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMember2023-01-012023-12-310000004904aep:YOYChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:PeoMember2023-01-012023-12-310000004904ecd:PeoMemberaep:FairValueAtEndOfPriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310000004904aep:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotReflectedInFairValueMemberecd:PeoMember2023-01-012023-12-310000004904aep:YearEndFairValueOfEquityAwardGrantedMemberecd:PeoMember2022-01-012022-12-310000004904aep:YOYChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:PeoMember2022-01-012022-12-310000004904ecd:PeoMemberaep:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMember2022-01-012022-12-310000004904aep:YOYChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:PeoMember2022-01-012022-12-310000004904ecd:PeoMemberaep:FairValueAtEndOfPriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310000004904aep:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotReflectedInFairValueMemberecd:PeoMember2022-01-012022-12-310000004904aep:YearEndFairValueOfEquityAwardGrantedMemberecd:PeoMember2021-01-012021-12-310000004904aep:YOYChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:PeoMember2021-01-012021-12-310000004904ecd:PeoMemberaep:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMember2021-01-012021-12-310000004904aep:YOYChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:PeoMember2021-01-012021-12-310000004904ecd:PeoMemberaep:FairValueAtEndOfPriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310000004904aep:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotReflectedInFairValueMemberecd:PeoMember2021-01-012021-12-310000004904aep:YearEndFairValueOfEquityAwardGrantedMemberecd:PeoMember2020-01-012020-12-310000004904aep:YOYChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:PeoMember2020-01-012020-12-310000004904ecd:PeoMemberaep:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMember2020-01-012020-12-310000004904aep:YOYChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:PeoMember2020-01-012020-12-310000004904ecd:PeoMemberaep:FairValueAtEndOfPriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-310000004904aep:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotReflectedInFairValueMemberecd:PeoMember2020-01-012020-12-310000004904ecd:PeoMemberaep:AEPRetirementPlanServiceCostMember2023-01-012023-12-310000004904aep:AEPRetirementPlanPriorServiceCostMemberecd:PeoMember2023-01-012023-12-310000004904aep:AEPRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2023-01-012023-12-310000004904aep:CSWExecutiveRetirementPlanServiceCostMemberecd:PeoMember2023-01-012023-12-310000004904aep:CSWExecutiveRetirementPlanPriorServiceCostMemberecd:PeoMember2023-01-012023-12-310000004904aep:CSWExecutiveRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2023-01-012023-12-310000004904aep:ServiceCostMemberecd:PeoMember2023-01-012023-12-310000004904ecd:PeoMemberaep:PriorServiceCostMember2023-01-012023-12-310000004904aep:PensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2023-01-012023-12-310000004904ecd:PeoMemberaep:AEPRetirementPlanServiceCostMember2022-01-012022-12-310000004904aep:AEPRetirementPlanPriorServiceCostMemberecd:PeoMember2022-01-012022-12-310000004904aep:AEPRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2022-01-012022-12-310000004904aep:CSWExecutiveRetirementPlanServiceCostMemberecd:PeoMember2022-01-012022-12-310000004904aep:CSWExecutiveRetirementPlanPriorServiceCostMemberecd:PeoMember2022-01-012022-12-310000004904aep:CSWExecutiveRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2022-01-012022-12-310000004904aep:ServiceCostMemberecd:PeoMember2022-01-012022-12-310000004904ecd:PeoMemberaep:PriorServiceCostMember2022-01-012022-12-310000004904aep:PensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2022-01-012022-12-310000004904ecd:PeoMemberaep:AEPRetirementPlanServiceCostMember2021-01-012021-12-310000004904aep:AEPRetirementPlanPriorServiceCostMemberecd:PeoMember2021-01-012021-12-310000004904aep:AEPRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2021-01-012021-12-310000004904aep:CSWExecutiveRetirementPlanServiceCostMemberecd:PeoMember2021-01-012021-12-310000004904aep:CSWExecutiveRetirementPlanPriorServiceCostMemberecd:PeoMember2021-01-012021-12-310000004904aep:CSWExecutiveRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2021-01-012021-12-310000004904aep:ServiceCostMemberecd:PeoMember2021-01-012021-12-310000004904ecd:PeoMemberaep:PriorServiceCostMember2021-01-012021-12-310000004904aep:PensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2021-01-012021-12-310000004904ecd:PeoMemberaep:AEPRetirementPlanServiceCostMember2020-01-012020-12-310000004904aep:AEPRetirementPlanPriorServiceCostMemberecd:PeoMember2020-01-012020-12-310000004904aep:AEPRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2020-01-012020-12-310000004904aep:CSWExecutiveRetirementPlanServiceCostMemberecd:PeoMember2020-01-012020-12-310000004904aep:CSWExecutiveRetirementPlanPriorServiceCostMemberecd:PeoMember2020-01-012020-12-310000004904aep:CSWExecutiveRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2020-01-012020-12-310000004904aep:ServiceCostMemberecd:PeoMember2020-01-012020-12-310000004904ecd:PeoMemberaep:PriorServiceCostMember2020-01-012020-12-310000004904aep:PensionBenefitAdjustmentsDetailedTotalMemberecd:PeoMember2020-01-012020-12-310000004904aep:StockAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:ChangeInPensionMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:PensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:StockAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:ChangeInPensionMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:PensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:StockAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:ChangeInPensionMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:PensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:StockAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:ChangeInPensionMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:PensionBenefitAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:YearEndFairValueOfEquityAwardGrantedMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:YOYChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:YOYChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:FairValueAtEndOfPriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotReflectedInFairValueMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:YearEndFairValueOfEquityAwardGrantedMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:YOYChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:YOYChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:FairValueAtEndOfPriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotReflectedInFairValueMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:YearEndFairValueOfEquityAwardGrantedMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:YOYChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:YOYChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:FairValueAtEndOfPriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotReflectedInFairValueMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:YearEndFairValueOfEquityAwardGrantedMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:YOYChangeInFairValueOfOutstandingAndUnvestedEquityAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:FairValueAsOfVestingDateOfEquityAwardsGrantedAndVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:YOYChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:FairValueAtEndOfPriorYearOfEquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotReflectedInFairValueMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:AEPRetirementPlanServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:AEPRetirementPlanPriorServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:AEPRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:AEPSupplementBenefitPlanServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:AEPSupplementBenefitPlanPriorServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:AEPSupplementalBenefitPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:ServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:PriorServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:PensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2023-01-012023-12-310000004904aep:AEPRetirementPlanServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:AEPRetirementPlanPriorServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:AEPRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:AEPSupplementBenefitPlanServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:AEPSupplementBenefitPlanPriorServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:AEPSupplementalBenefitPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:ServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:PriorServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:PensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2022-01-012022-12-310000004904aep:AEPRetirementPlanServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:AEPRetirementPlanPriorServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:AEPRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:AEPSupplementBenefitPlanServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:AEPSupplementBenefitPlanPriorServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:AEPSupplementalBenefitPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:ServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:PriorServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:PensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2021-01-012021-12-310000004904aep:AEPRetirementPlanServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:AEPRetirementPlanPriorServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:AEPRetirementPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:AEPSupplementBenefitPlanServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:AEPSupplementBenefitPlanPriorServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:AEPSupplementalBenefitPlanPensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:ServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:PriorServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000004904aep:PensionBenefitAdjustmentsDetailedTotalMemberecd:NonPeoNeoMember2020-01-012020-12-31

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

| | | | | | | | | | | |

| Filed by the Registrant x | | | |

| | | |

| Filed by a Party other than the Registrant ☐ | | |

| | | |

| Check the appropriate box: | | | |

| | | |

| ☐ Preliminary Proxy Statement | | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x Definitive Proxy Statement | | | |

| | | |

| ☐ Definitive Additional Materials | | | |

| | | |

| ☐ Soliciting Material Pursuant to Rule 14a-12. |

American Electric Power Company, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| x | No fee required. |

| |

| ☐ | Fee paid previously with preliminary materials. |

| |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 14a-b(i)(1) and 0-11 |

TABLE OF CONTENTS

| | | | | |

| Proxy Summary | |

| Rules of Conduct | |

| Proxy and Voting Information | |

| Item 1: Election of Directors | |

| AEP’s Board of Directors and Committees | |

| Corporate Governance | |

| Director Compensation | |

| Item 2: Proposal to Ratify Appointment of Independent Registered Public Accounting Firm | |

| Audit Committee Report | |

| Item 3: Advisory Vote on Executive Compensation | |

| Item 4: Proposal to Approve the American Electric Power System 2024 Long-Term Incentive Plan | |

| Compensation Discussion and Analysis | |

| Executive Summary | |

| Overview | |

| 2023 Compensation Peer Group | |

| Executive Compensation Program Detail | |

| Annual Incentive Compensation | |

| Long-Term Incentive Compensation | |

| Retirement, Health and Welfare Benefits | |

| Other Compensation Information | |

| Human Resources Committee Report | |

| Executive Compensation | |

| Summary Compensation Table | |

| Grants of Plan-Based Awards for 2023 | |

| Outstanding Equity Awards at Fiscal Year-End for 2023 | |

| Option Exercises and Stock Vested for 2023 | |

| Pension Benefits for 2023 | |

| Nonqualified Deferred Compensation for 2023 | |

| Potential Payments Upon Termination of Employment or Change in Control | |

| CEO Pay Ratio | |

| Pay for Performance | |

| Share Ownership of Directors and Executive Officers | |

| Share Ownership of Certain Beneficial Owners | |

| Shareholder Proposals and Nominations | |

| Exhibit A: Reconciliation of GAAP and Non-GAAP Financial Measures | |

| Exhibit B: American Electric Power System 2024 Long-Term Incentive Plan | |

Rules of Conduct for the Annual Meeting

| | | | | |

AEP strives to provide our shareholders attending the online-only Annual Meeting the same opportunities to participate they would have had at an in-person Annual Meeting. AEP believes the online-only format will provide an enhanced opportunity for participation and discourse. |

| |

| • | Representatives of Computershare Trust Company, N.A. have been appointed as the independent inspectors of elections. |

| |

| • | Shareholders participating in the live webcast of the Annual Meeting at https://meetnow.global/AEP2024 can submit questions in writing during the Annual Meeting. Management will read questions to the audience and respond to these questions throughout the Annual Meeting. Shareholders are encouraged to provide their name and contact information in case the Company needs to contact them after the Annual Meeting. |

| |

| • | Individuals who are not shareholders as of the record date who are interested in listening to the Annual Meeting will be allowed to listen to the Annual Meeting toll-free at 855-761-5600, confirmation code 6993059. |

| |

| • | Questions submitted by shareholders will be read during the Annual Meeting unedited, except to the extent questions from multiple shareholders on the same topic or that are otherwise related, in which case such questions may be grouped, summarized and answered together. Questions that are of an inappropriate personal nature or that use offensive language will not be read during the Annual Meeting or posted on our website after the Annual Meeting. Questions regarding technical issues related to the Annual Meeting will be referred to technical support personnel to respond separately. |

| |

| • | A video replay of the Annual Meeting, will be available on our website at aep.com/investors under "2024 Annual Meeting of Shareholders" until the release of the proxy statement for the 2025 Annual Meeting. |

| |

| • | The Annual Meeting will end upon the earlier of 10:00 a.m. Eastern Time, or after all question topics that are not of an inappropriate nature have been answered. |

Proxy Statement

March 13, 2024

Proxy and Voting Information

A notice of Internet availability of proxy materials or paper copy of this proxy statement, our 2023 Annual Report and a form of proxy or voting instruction card is first being mailed or made available to shareholders on or about March 13, 2024, in connection with the solicitation of proxies by the Board of Directors of American Electric Power Company, Inc., 1 Riverside Plaza, Columbus, Ohio 43215, for the annual meeting of shareholders to be held on April 23, 2024 exclusively via live webcast at https://meetnow.global/AEP2024.

We use the terms “AEP,” the “Company,” “we,” “our” and “us” in this proxy statement to refer to American Electric Power Company, Inc. and, where applicable, its subsidiaries. All references to “years,” unless otherwise noted, refer to our fiscal year, which ends on December 31.

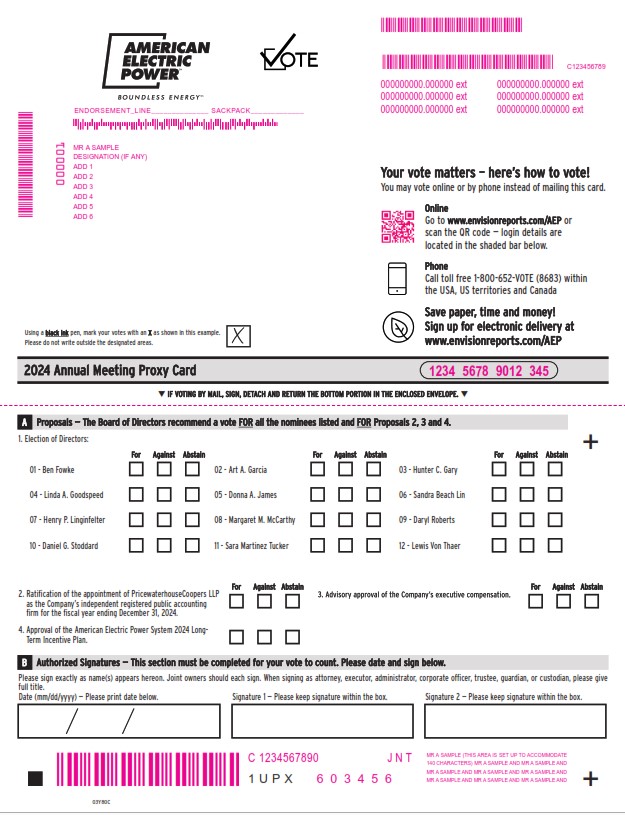

Who Can Vote. Only the holders of shares of AEP common stock at the close of business on the record date, February 26, 2024, are entitled to vote at the Annual Meeting. Each such holder has one vote for each share held on all matters to come before the meeting. On February 26, 2024, there were 526,590,278 shares of AEP common stock, $6.50 par value, outstanding.

How to Attend the Virtual Annual Meeting. The 2024 Annual Meeting will be a virtual meeting of shareholders, which will be conducted exclusively by webcast. No physical meeting will be held.

You will be able to attend the Annual Meeting online and submit your questions during the meeting at https://meetnow.global/AEP2024. You also will be able to vote your shares online during the virtual Annual Meeting.

To participate in the Annual Meeting, you will need to review the information included on your notice of Internet availability of proxy materials, on your proxy card or on the instructions that accompanied your proxy materials.

If you hold your shares through an intermediary, such as a bank or broker, you can access the virtual meeting as a guest, or if you would like to vote or ask a question at the virtual Annual Meeting, you must register in advance using the instructions below.

The virtual Annual Meeting will begin promptly at 9:00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time leaving ample time to check in. Please follow the registration instructions as outlined in this proxy statement.

How to Register to Attend the Virtual Annual Meeting. All shareholders can listen to the virtual Annual Meeting by signing onto the virtual Annual Meeting as a guest. However, if you wish to participate in the virtual Annual Meeting, you must sign on as a shareholder.

If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the virtual Annual Meeting. Please follow the instructions on the proxy card or the notice of Internet availability of proxy materials, or in the proxy material notification email that you received.

If you hold shares through an intermediary, such as a bank or broker (a Beneficial Holder), and want to attend the virtual Annual Meeting (with the ability to ask a question and/or vote, if you choose to do so) you have two options:

(1)submit proof of your proxy power (legal proxy) from your bank or broker reflecting your AEP holdings along with your name and email address to Computershare by email to: legalproxy@computershare.com, or by mail:

P.O. Box 43001 Providence, RI 02940-3001

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on April 18, 2024.

You will receive a confirmation of your registration by email after your registration materials have been received.

(2)For the 2024 proxy season, standards have been agreed upon to allow Beneficial Holders to register online at the virtual Annual Meeting to attend, ask questions and vote. We expect that the vast majority of Beneficial Holders will be able to fully participate using the control number received with their voting instruction form. Please note, however, that this option is provided as a convenience to Beneficial Holders only. There is no guarantee this option will be available for every type of Beneficial Holder voting control number. The inability to provide this option to any or all Beneficial Holders will in no way impact the validity of the virtual Annual Meeting. Beneficial Holders may choose to register in advance, as described in (1), above, if they prefer to use this traditional, paper-based option.

Please go to https://meetnow.global/AEP2024 for more information on the available options and registration instructions.

How You Can Vote. Shareholders of record can vote by (i) mailing their signed proxy cards; (ii) calling a toll-free telephone number; (iii) using the Internet; or (iv) participating in the Annual Meeting at https://meetnow.global/AEP2024. The telephone, Internet and in-person virtual voting procedures are designed to authenticate shareholders’ identities, to allow shareholders to give their voting instructions and to confirm that shareholders’ instructions have been properly recorded. Instructions for shareholders of record who wish to use the telephone or Internet voting procedures are on the proxy card or the website shown on the notice of Internet availability of proxy materials.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record that you must follow in order for you to vote your shares.

When proxies are signed and returned, the shares represented thereby will be voted by the persons named on the proxy card or by their substitutes in accordance with shareholders’ directions. If a proxy card is signed and returned without choices marked, it will be voted for the nominees for directors listed on the card and as recommended by the Board of Directors with respect to other matters. The proxies of shareholders who are participants in the Dividend Reinvestment and Stock Purchase Plan include both the shares registered in their names and the whole shares held in their plan accounts on February 26, 2024.

Revocation of Proxies. A shareholder giving a proxy may revoke it at any time before it is voted at the meeting by voting again after the date of the proxy being revoked or by attending the meeting and voting in person.

How Votes are Counted. The presence of the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting, present in person or represented by proxy, is necessary to constitute a quorum. Abstentions and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

Under the NASDAQ Stock Market LLC (NASDAQ) rules, the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm is considered a “routine” item. This means that brokerage firms may vote in their discretion on this matter on behalf of their clients who have not furnished voting instructions. The proposals to elect directors, the advisory vote on executive compensation, and the vote on the American Electric Power System 2024 Long-Term Incentive Plan are “non-routine” matters. That means that brokerage firms may not use their discretion to vote on such matters without express voting instructions from their clients.

The Company has implemented a majority voting standard for the election of directors in uncontested elections. The election of directors at the Annual Meeting is an uncontested election, so for a nominee to be elected to the Board, the number of votes cast “for” the nominee’s election must exceed the number of votes cast “against” his or her election. If a nominee does not receive a greater number of votes “for” his or her election than “against” such election, he or she will be required to tender his or her resignation for the Board’s consideration of whether to accept such resignation in accordance with our Bylaws.

The following table summarizes the Board’s voting recommendations for each proposal, the vote required for each proposal to pass, and the effect of abstentions and uninstructed shares on each proposal.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Item | | Board

Recommendation | | Voting Standard | | Abstentions | | Broker

Non-Votes |

Item 1 – Election of Directors | | ü | | FOR ALL | | Majority of votes cast for each Director | | No effect | | No effect |

Item 2 – Ratification of the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for 2024(1) | | ü | | FOR | | Majority of shares voted | | No effect | | Discretionary voting by broker permitted |

Item 3 – Advisory vote to approve executive compensation (Say on Pay)(1) | | ü | | FOR | | Majority of shares voted | | No effect | | No effect |

Item 4 – Approval of the Company's 2024 Long-term Incentive Plan | | ü | | FOR | | Majority of shares voted | | No effect | | No effect |

(1)As advisory votes, the proposals to ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for 2024 and to approve executive compensation are not binding upon the Company. However, the Board, the Audit Committee and the Human Resources Committee value the opinions expressed by shareholders and will consider the outcome of these votes when making future decisions.

Your Vote is Confidential. It is AEP’s policy that shareholders be provided privacy in voting. All proxies, voting instructions and ballots, which identify shareholders, are held on a confidential basis, except as may be necessary to meet any applicable legal requirements. We direct proxies to an independent third-party tabulator who receives, inspects, and tabulates them. Voted proxies and ballots are not seen by nor reported to AEP except (i) in aggregate number or to determine if (rather than how) a shareholder has voted, (ii) in cases where shareholders write comments on their proxy cards or (iii) in a contested proxy solicitation.

Multiple Copies of Annual Report, Proxy Statement or Notice of Internet Availability of Proxy Materials to Shareholders. Securities and Exchange Commission (SEC) rules provide that more than one annual report, proxy statement or notice of Internet availability of proxy materials need not be sent to the same address. This practice is commonly called “householding” and is intended to eliminate duplicate mailings of shareholder documents. Mailing of your annual report, proxy statement or notice of Internet availability of proxy materials is being householded indefinitely unless you instruct us otherwise. We will deliver promptly, upon written or oral request, a separate copy of the annual report, proxy statement or notice of Internet availability of proxy materials to a shareholder at a shared address. To receive a separate copy of the annual report, proxy statement or notice of Internet availability of proxy materials, write to AEP, attention: Investor Relations, 1 Riverside Plaza, Columbus, OH 43215 or call 1-800-237-2667. If more than one annual report, proxy statement or notice of Internet availability of proxy materials is being sent to your address, at your request, mailing of the duplicate copy can be discontinued by contacting our transfer agent, Computershare Trust Company, N.A. (Computershare), at 800-328-6955 or writing to them at P.O Box 43078 Providence, RI 02940-3078. If you wish to resume receiving separate annual reports, proxy statements or notice of Internet availability of proxy materials at the same address in the future, you can contact Computershare at 800-328-6955 or write to them at P.O Box 43078 Providence, RI 02940-3078. The change will be effective 30 days after receipt.

Additional Information. Our website address is www.aep.com. We make available free on the Investor Relations section of our website (www.aep.com/investors) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (Exchange Act). We also make available through our website other reports filed with or furnished to the SEC under the Exchange Act, including our proxy statements and reports filed by officers and directors under Section 16(a) of the Exchange Act. You may request free printed copies of any of these materials and information by contacting Investor Relations at: AEP, attention: Investor Relations, 1 Riverside Plaza, Columbus, OH 43215. We do not intend for information posted on our website to be part of this proxy statement. In addition, this proxy statement and the Annual Report for the fiscal year ended December 31, 2023 are available at www.edocumentview.com/aep.

Item 1. Election of Directors

Currently, AEP's Board of Directors consists of 13 members. In accordance with AEP's retirement policy, Mr. Beasley will end his service as a member of the Board effective on the date of the Annual Meeting. Therefore, the Board of Directors has authorized a reduction in the size of the Board to 12 members, effective April 23, 2024, as permitted by the Bylaws. Accordingly, twelve directors are to be elected at the 2024 Annual Meeting to hold office until the next annual meeting and until their successors have been elected. AEP’s Bylaws provide that the number of directors of AEP shall be such number, not less than 9 nor more than 17, as shall be determined from time to time by resolution of the Board.

Ten of the twelve nominees were nominated by the Board on the recommendation of the Committee on Directors and Corporate Governance (the Corporate Governance Committee) following an individual evaluation of each nominee’s qualifications and 2023 performance. Mr. Gary and Mr. Linginfelter were elected by the Board, effective February 12, 2024, and were nominated pursuant to a Director Appointment and Nomination Agreement (Nomination Agreement) described below in “Director Nomination Agreement” and “Certain Relationships and Related Person Transactions” and following an evaluation of their respective qualifications. The proxies named on the proxy card or their substitutes will vote for the Board’s nominees, unless instructed otherwise. Mr. Oliver G. Richard, III resigned from the Board on August 17, 2023 and Nicholas K. Akins resigned from the Board effective October 1, 2023, in each case due to personal reasons and not due to any disagreement with the Company on any matter relating to the Company's operations, policies, or practices. On February 20, 2024, the Board determined to remove Julia A. Sloat from her roles as Chair, Chief Executive Officer and President of the Company, effective February 25, 2024.

All of the Board’s nominees were elected by the shareholders at the 2023 annual meeting, except for Messrs. Stoddard, Gary and Linginfelter. Mr. Stoddard was elected to the Board effective August 18, 2023 following input from a director search firm, which was paid a fee to identify and evaluate potential Board members. Messrs. Gary and Linginfelter were elected to the Board pursuant to the Nomination Agreement. In connection with their election to the Board, Messrs. Stoddard, Gary and Linginfelter were interviewed by certain members of the Corporate Governance Committee, which also reviewed their respective qualifications and recommended their elections to the full Board. We do not expect any of the nominees will be unable to stand for election or be unable to serve if elected. If a vacancy in the slate of nominees occurs before the meeting, the proxies may be voted for another person nominated by the Board or the number of directors may be reduced accordingly.

The Board of Directors unanimously recommends a vote FOR each of the director nominees below.

Biographical Information. The following brief biographies of the nominees include their principal occupations, ages on the date of this proxy statement, accounts of their business experience and names of certain companies of which they are directors. Data with respect to the number of shares of AEP’s common stock and stock-based units beneficially owned by each of them appears on page 93.

Nominees For Director

| | | | | | | | |

Ben Fowke | Interim CEO and President | Current Public Company Directorships: |

| American Electric Power Company, Inc. | None |

| |

Age: 65 | Prior Public Company Directorships

|

Director Since: February 2022 | (within last five years): |

| Independent: No | • Xcel Energy Inc. (2011 - 2021) |

| |

| AEP Committees: | Other Directorships and Memberships: |

| • Executive | • Energy Insurance Mutual Limited (Director) |

| • Finance (Chair) | •Securian Financial Group, Inc. (Director) |

| • Policy | |

Professional Highlights

Elected Interim Chief Executive Officer and President of the Company in February 2024. Retired chairman of the board of directors of Xcel Energy Inc., a utility holding company (Xcel) (August 2011-December 2021), and retired chief executive officer of Xcel (August 2011 – August 2021). Mr. Fowke served as president of Xcel (August 2011 – March 2020), chief operating officer of Xcel (August 2009- August 2011) and chief financial officer of Xcel (October 2003 – August 2009). Mr. Fowke also served as chief executive officer of Xcel’s utility subsidiaries Northern States Power Company, Public Service Company of Colorado and Southwestern Public Service Co. (January 2015 – August 2021).

Skills and Qualifications

Mr. Fowke’s qualifications to serve on the Board include his executive experience in the regulated electric and gas utility industry and his experience as a public company director. Having served as a chief financial officer, he has a strong background in finance, financial reporting and shareholder outreach. Mr. Fowke also has experience in environmental issues, operations and the energy business. His extensive experience in the utility industry provides valuable insight into the risks we face and provides unique insight into effective management of those risks to deliver strong results over the long term. His involvement in the utility industry also provides significant expertise on regulatory and policy issues that are central to our business.

| | | | | | | | |

Art A. Garcia | Retired Executive Vice President and CFO, | Current Public Company Directorships: |

| Ryder System, Inc. | • ABM Industries Incorporated |

| • Elanco Animal Health Incorporated |

Age: 62 | • Raymond James Financial, Inc. |

Director Since: September 2019 | |

Independent: Yes | Prior Public Company Directorships |

| (within the last five years): |

| AEP Committees: | None |

| • Audit (Chair) | |

| • Finance | |

| • Governance | |

| • Policy | |

Professional Highlights

Retired chief financial officer of Ryder System, Inc., a provider of fleet management, supply chain management and logistic solutions (2010-2019). Senior Vice President and Controller of Ryder (2005-2009). Mr. Garcia is a certified public accountant who began his career with Coopers & Lybrand before joining Ryder.

Skills and Qualifications

Mr. Garcia’s qualifications to serve on the Board include his corporate finance and accounting expertise as a chief financial officer and his experience as a public company director. While at Ryder, Mr. Garcia held several positions of increasing responsibility, including group director accounting services, as well as senior vice president and corporate controller before his appointment as chief financial officer. Mr. Garcia also oversaw corporate strategy and development, and led the reengineering of the company’s finance function to drive increased efficiencies. His extensive finance expertise provides valuable insight in the areas of financial reporting and accounting and controls. He also brings to the Board relevant experience in risk management, regulated industries, safety and strategy development.

| | | | | | | | |

Hunter C. Gary | Senior Managing Director, | Current Public Company Directorships: |

| Icahn Enterprises L.P. | • Conduent Inc. |

| • CVR Energy, Inc. |

| Age: 49 | |

Director Since: February 2024 | Prior Public Company Directorships |

Independent: Yes | (within last five years): |

| • CVR Partners, LP (2018 - 2021) |

| AEP Committees: | • CVR Refining, LP (2018 - 2019) |

| • Audit | • Herc Holdings, Inc. (2022 - 2023) |

| • Policy | • Herbalife Nutrition Ltd. (2014 - 2021) |

| • Technology | |

| Other Directorships and Memberships: |

| • Various Icahn Group Holdings |

| | |

Professional Highlights

Mr. Gary is a Senior Managing Director of Icahn Enterprises L.P. (IEP), a diversified holding company engaged in a variety of businesses, including investment, energy, automotive, food packaging, metals, real estate, and home fashion, and has been employed by IEP since November 2010. Prior to that time, Mr. Gary had been employed by Icahn Associates Corporation, an affiliate of IEP, in various roles since June 2003, most recently as the Chief Operating Officer of Icahn Sourcing LLC. Mr. Gary was selected for his position as a director pursuant to the terms of the Nomination Agreement with the Icahn Group.

Skills and Qualifications

Mr. Gary’s qualifications to serve on the Board include significant operational expertise and experience providing strategic advice and guidance gained from his positions with IEP. He also brings experience as a director and in operational roles at other public and private companies.

| | | | | | | | |

Linda A. Goodspeed | Retired Managing Partner, | Current Public Company Directorships: |

| Wealth Strategies Financial Advisors, LLC | • Autozone, Inc. |

| • Darling Ingredients Inc. |

| Age: 62 | |

Director Since: October 2005 | Prior Public Company Directorships |

Independent: Yes | (within last five years): |

| • Williams Industrial Services Group Inc. (2021 - 2023) |

| AEP Committees: | |

| • Audit | Other Directorships and Memberships: |

| • Nuclear Oversight | • Lynx Franchising, LLC (Director) |

| • Policy | • MidOcean Partners (Director) |

| • Technology (Chair) | |

Professional Highlights

Retired managing partner of Wealth Strategies Financial Advisors, LLC (2008-2017). Retired senior vice president and chief information officer of The ServiceMaster Company, a residential and commercial service company (2011-2013). From 2008 to 2011, vice president of information systems of Nissan North America, Inc., an automobile manufacturer.

Skills and Qualifications

Ms. Goodspeed's qualifications to serve on the Board include her information technology expertise as a chief information officer and her experience as a public company director. Ms. Goodspeed has experience in key strategic and operational roles with several large global companies as chief information officer. Ms. Goodspeed brings to the Board a wealth of experience leading complex IT organizations and brings innovation experience. She has completed the National Association of Corporate Directors certification in cybersecurity oversight. She has experience as a senior leader of business developing electric vehicles, and past experience developing and marketing new customer facing products and technology in the appliance and automotive industries.

| | | | | | | | |

Donna A. James | Managing Director | Current Public Company Directorships: |

| Lardon & Associates LLC | • The Hartford Financial Services Group, Inc. |

| • Victoria's Secret & Co. |

| Age: 66 | |

Director Since: June 2022 | Prior Public Company Directorships |

Independent: Yes | (within last five years): |

| • Marathon (2011 - 2020) |

| AEP Committees: | • L Brands (2003 - 2021) |

| • Audit | • Boston Scientific Corporation (2015 - 2023) |

| • Finance | |

| • Policy | Other Directorships and Memberships: |

| • Xponance Investment Management (Director) |

| • OhioHealth (Director) |

| • The African American Leadership Academy |

| | (Advisory Board Director & Co-Executive Director) |

Professional Highlights

Managing Director of Lardon & Associates LLC (2006-present), a business and executive advisory services firm. Held multiple positions at Nationwide Mutual Insurance Company from 1981 to 2006, and is the retired president of Nationwide Strategic Investments and executive vice president-chief administrative officer of Nationwide Mutual Insurance Company (2000-2006). Ms. James is a certified public accountant (non-practicing) and began her career as an auditor with Coopers & Lybrand LLP.

Skills and Qualifications

Ms. James' qualifications to serve on the Board include her extensive senior executive employment in a range of functions, including accounting, investing, operations, treasury, human resources, and corporate diversity and related issues. Ms. James also brings experience of serving as a director on several large public company boards, including on the audit, finance, governance and human resources committees.

| | | | | | | | |

Sandra Beach Lin | Retired CEO, | Current Public Company Directorships: |

| Calisolar, Inc. | • Avient Corporation |

| • Trinseo Plc |

| Age: 66 | |

Director Since: July 2012 | Prior Public Company Directorships |

Independent: Yes | (within last five years): |

| • WESCO International, Inc. (2002 - 2019) |

| AEP Committees: | |

| • Audit | Other Directorships and Memberships: |

| • Executive | • Ripple Therapeutics Corporation (Director) |

| • Governance (Chair) | • Achievement Foundation (Director) |

| • Policy | • Paradigm for Parity (Director) |

| • Technology | |

Professional Highlights

Retired chief executive officer of Calisolar, Inc., a solar silicon company (2010-2011). Executive vice president, then corporate executive vice president of Celanese Corporation, a global hybrid chemical company (2007-2010). Previous senior operating roles at Avery Dennison, Alcoa and Honeywell. Member, Nominating and Corporate Governance Committee Chair Advisory Council of the National Association of Corporate Directors.

Skills and Qualifications

Ms. Lin’s qualifications to serve on the Board include her extensive senior executive experience managing large global businesses in multiple industries and her experience as a public company director. Ms. Lin has served as a senior executive in operational roles at numerous industrial manufacturing sites, which gave her significant experience in employee safety and manufacturing. In her senior leadership positions, she created and executed strategies in diverse industries, including automotive, packaging, specialty chemicals and solar energy. She also has extensive knowledge of sales and marketing. In her executive leadership as the chief executive officer of a materials supplier to the solar industry, she helped bring to market new, innovative technology to reduce costs to solar cell manufacturers. Her service as a board leadership fellow for the National Association of Corporate Directors has given her additional expertise related to corporate governance.

| | | | | | | | |

Henry P. Linginfelter | Retired Executive Vice President, | Current Public Company Directorships: |

| Southern Company Gas | • Southwest Gas Holdings, Inc. |

| |

| Prior Public Company Directorships |

| Age: 63 | (within last five years): |

Director Since: February 2024 | None |

Independent: Yes | |

| Other Directorships and Memberships: |

| AEP Committees: | • Southwest Gas Corporation |

| • Finance | |

| • Nuclear Oversight | |

| • Policy | |

Professional Highlights

Mr. Linginfelter is the retired Executive Vice President of Southern Company Gas, the largest gas utility in the United States. He also served on the board of The Southern Company’s captive insurance business, which assessed and mitigated risk and liability issues across the corporation. Mr. Linginfelter is the former Chair of the Southern Gas Association and served on the American Gas Association Leadership Council for several years. Mr. Linginfelter was selected for his position as a director pursuant to the terms of the Nomination Agreement with the Icahn Group.

Skills and Qualifications

Mr. Linginfelter’s qualifications to serve on the Board include his extensive experience while at Southern Company with operations, safety, construction and engineering, supply chain, environmental compliance, corporate planning and budgeting, financial planning, risk oversight, customer service, and federal and state regulatory and legislative affairs.

| | | | | | | | |

Margaret M. McCarthy | Retired Executive Vice President - | Current Public Company Directorships: |

| Technology Integration, | • Alignment Healthcare |

| CVS Health Corporation | • First American Financial Corporation |

| • Marriott International Inc. |

| Age: 70 | |

Director Since: April 2019 | Prior Public Company Directorships |

Independent: Yes | (within last five years): |

| • Brighthouse Financial, Inc. (2018 - 2021) |

| AEP Committees: | |

| • Audit | |

| • Nuclear Oversight | |

| • Policy (Chair) | |

| • Technology | |

Professional Highlights

Retired Executive Vice President – Technology Integration of CVS Health Corporation, a U.S.-based healthcare company (December 2018 to June 2019). Executive vice president of operations and technology for Aetna, Inc., a diversified health care benefits company (2010 – 2018). Prior to joining Aetna in 2003, she served in information technology-related roles at CIGNA Healthcare and Catholic Health Initiatives.

Skills and Qualifications

Ms. McCarthy’s qualifications to serve on the Board include her extensive senior executive experience in the healthcare industry and her experience as public company director. Ms. McCarthy was responsible for innovation, technology, data security, procurement, real estate and service operations at Aetna. Ms. McCarthy also worked in technology consulting at Accenture and was a consulting partner at Ernst & Young. She was previously a director of a data center and cloud security company. She has extensive experience in the regulated insurance industry, business strategy, customer experience and cyber and physical security.

| | | | | | | | |

Daryl Roberts | Senior Vice President and Chief | Current Public Company Directorships: |

| Operations and Engineering Officer, | None |

| DuPont de Nemours Inc. | |

| Prior Public Company Directorships |

| Age: 55 | (within last five years): |

Director Since: December 2020 | None |

Independent: Yes | |

| Other Directorships and Memberships: |

| AEP Committees: | • American Institute of Chemical Engineers (Director) |

| • Audit | • National Action Council for Minorities in Engineering |

| • Nuclear Oversight | (Director) |

| • Policy | |

| • Technology | |

Professional Highlights

Senior Vice President and Chief Operations and Engineering Officer of DuPont de Nemours Inc., a diversified global specialty chemicals company since 2018. From 2015-2018, Vice President, Manufacturing, Engineering and Regulatory Services and from 2012-2015 Senior Director, Manufacturing and Regulatory Services of Arkema S.A. From 1998-2012, he served in various manufacturing, health and safety, operations and engineering positions at Arkema S.A.

Skills and Qualifications

Mr. Roberts' qualifications to serve on the Board include his service as a senior executive in the global manufacturing industry. He also brings to the Board relevant experience in engineering, manufacturing, operations, regulatory and health and safety. Through his roles in the manufacturing industry, he also has experience managing compliance, regulatory and public policy matters.

| | | | | | | | |

Daniel G. Stoddard | Retired Senior Vice President and Chief | Current Public Company Directorships: |

| Nuclear Officer and President - | None |

| Contracted Assets | |

| Dominion Energy Inc. | Prior Public Company Directorships |

| (within last five years): |

| Age: 61 | None |

Director Since: August 2023 | |

Independent: Yes | |

| |

| AEP Committees: | |

| • Nuclear Oversight | |

| • Policy | |

Professional Highlights

Retired senior vice president and chief nuclear officer of Dominion Energy, Inc., a utility holding company (Dominion) (2016 – August 2023) and retired president-contracted assets of Dominion (2019 – August 2023). Mr. Stoddard also served as senior vice president-nuclear operations of Dominion (2011 – 2016), and vice president-nuclear operations of Dominion (2010 – 2011).

Skills and Qualifications

Mr. Stoddard’s qualifications to serve on the Board include his nuclear expertise as the chief nuclear officer of Dominion where he oversaw the operations of Dominion’s seven nuclear units in three states, and his experience managing renewables facilities as president of Dominion’s contracted assets business where he oversaw more than 50 contracted solar generating facilities in nine states. Mr. Stoddard brings to the Board decades of experience in the nuclear and utility industries, including high level executive management and business oversight experience. He has substantial experience working with federal government administrators, which provides valuable insights in governmental and regulatory issues. His extensive experience in operations provides insights in risk management, safety, personnel development, and environmental matters. His experience in the nuclear industry also provides him substantial experience in physical security and cybersecurity.

| | | | | | | | |

Sara Martinez Tucker | Chair | Current Public Company Directorships: |

| American Electric Power Company, Inc. | • Service Corporation International |

| |

Age: 68 | Prior Public Company Directorships |

Director Since: January 2009 | (within last five years): |

Independent: Yes | • Cornerstone OnDemand, Inc. (2021) |

| • Sprint Corporation (2013 - 2020) |

| AEP Committees: | • Xerox Corporation (2011 - 2019) |

| • Executive | |

| • Governance | Other Directorships and Memberships: |

| • Human Resources (Chair) | • Achieve Partners (Unpaid advisory Board) |

| • Policy | • Guild (Unpaid advisory Board) |

Professional Highlights

Elected Chair of the Board of the Company in February 2024. Former Chief Executive Officer of the National Math and Science Initiative from February 2013 to March 2015. From 2009 to February 2013, independent consultant. Former Under Secretary of Education in the U.S. Department of Education (2006-2008). Chief executive officer and president of the Hispanic Scholarship Fund from 1997 to 2006. Retired executive of AT&T.

Skills and Qualifications

Ms. Tucker’s qualifications to serve on the Board include her experience in governmental affairs in the highly regulated telecommunications industry and as the Under Secretary of Education, her management positions in human resources and customer service operations, and her experience as a public company director. Her leadership positions in government and education provide perspective on social responsibility and diversity. Ms. Tucker brings to the Board relevant expertise from her various leadership positions in government and education and her business experience at AT&T in regulatory affairs, government and public policy matters. As an executive at AT&T, she had experience in consumer and retail businesses and human resources.

| | | | | | | | |

Lewis Von Thaer | President and Chief Executive Officer, | Current Public Company Directorships: |

| Battelle Memorial Institute | None |

| |

| Prior Public Company Directorships |

Age: 63 | (within last five years): |

Director Since: February 2022 | None |

Independent: Yes | |

| Other Directorships and Memberships: |

| AEP Committees: | • Ambri, Inc. (Board Member) |

| • Human Resources | • AmplifyBio (Board Chair) |

| • Nuclear Oversight | • Hughes Research Laboratories, LLC (Advisory Board) |

| • Policy | |

| • Technology | |

Professional Highlights

President and chief executive officer of Battelle Memorial Institute, the world’s largest independent research and development organization, since October 2017. Mr. Von Thaer served as chief executive officer of DynCorp International (June 2015 – October 2017), executive vice president and president of the National Security Sector of Leidos, Inc. (2013 – 2015) and corporate vice president of General Dynamics Corporation and president of its Advanced Information Systems division (2005 –2013).

Skills and Qualifications

Mr. Von Thaer’s qualifications to serve on the Board include his technology expertise as the chief executive officer of Battelle and his experience as a director of Pacific Northwest National Laboratory and UT-Battelle (the operator of Oak Ridge National Laboratory). Mr. Von Thaer brings to the Board decades of employment in the global manufacturing and research industries, including high level executive management and business oversight experience. He has substantial experience working with federal government administrators, which provides valuable insights in governmental, regulatory and public policy issues. His extensive experience in management and operations provides insights in risk management, safety and health, personnel development and environmental matters. As a former Bell Laboratories engineer and a member of the defense science board from 2010 - 2012, Mr. Von Thaer also brings significant engineering experience.

AEP’s Board of Directors and Committees

Under New York law, AEP is managed under the direction of the Board of Directors. The Board establishes broad corporate policies and authorizes various types of transactions, but it is not involved in day-to-day operational details. During 2023, the Board held six regular meetings in person, and one regular meeting and one special meeting by videoconference. AEP typically encourages, but does not require, members of the Board to attend the annual shareholders’ meeting. Last year, all directors attended the annual meeting virtually.

One member of our Corporate Governance Committee, Ms. Lin, is a member of The National Association of Corporate Directors’ (NACD) Nominating and Governance Chair Advisory Council, a group that seeks to identify ways that board nominating and governance committees can help build investor confidence in publicly traded companies. Ms. Lin is also an NACD Board Leadership Fellow.

Leadership Updates. On February 26, 2024, the Company announced that the Board determined to remove Ms. Sloat from her roles as Chair, Chief Executive Officer and President of the Company, effective February 25, 2024. This decision was not the result of any disagreement with Ms. Sloat regarding the Company’s operations, policies, or financial performance, and was not made for cause or related to any ethical or compliance concern. For continuity while the Board searches for a permanent Chief Executive Officer, the Board appointed Ms. Tucker as Chair of the Board and Mr. Fowke as Interim Chief Executive Officer and President of the Company, effective February 26, 2024.

The Board has engaged a leading executive search firm to conduct an external search for a permanent CEO. The Board is seeking candidates who will bring strong leadership to the Company to further its strategic vision for long-term, sustainable growth. The process will be undertaken in accordance with programs and practices established by the Board for Chief Executive Officer for succession planning.

Board Meetings and Committees. The Board expects that its members will rigorously prepare for, attend and participate in all Board and applicable committee meetings. Directors are also expected to become familiar with AEP’s management team and operations as a basis for discharging their oversight responsibilities.

The Board has eight standing committees. The table below shows the number of meetings conducted in 2023 by each committee and the directors who currently serve on these committees. Each director attended 92 percent or more of the meetings of the Board and Board committees on which he or she served during 2023, and the average director attendance in 2023 was 99.3 percent. Mr. Stoddard was appointed to the Nuclear Oversight Committee and Policy Committee in August 2023. Mr. Gary was appointed to the Audit, Technology and Policy Committees and Mr. Linginfelter was appointed to the Finance, Nuclear and Policy Committees in February 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| DIRECTOR | BOARD COMMITTEES |

| Audit | Directors

and

Corporate

Governance | Executive | Finance | Human

Resources | Nuclear

Oversight | Policy | Technology |

| Mr. Beasley | | | | | X | X (Chair) | X | X |

| Mr. Fowke | | | X | X (Chair) | | | X | |

| Mr. Garcia | X (Chair) | X | | X | | | X | |

| Mr. Gary | X | | | | | | X | X |

| Ms. Goodspeed | X | | | | | X | X | X (Chair) |

| Ms. James | X | | | X | | | X | |

| Ms. Lin | X | X (Chair) | X | | | | X | X |

| Mr. Linginfelter | | | | X | | X | X | |

| Ms. McCarthy | X | | | | | X | X (Chair) | X |

| Mr. Roberts | X | | | | | X | X | X |

| Mr. Stoddard | | | | | | X | X | |

| Ms. Tucker | | X | X (Chair) | | X (Chair) | | X | |

| Mr. Von Thaer | | | | | X | X | X | X |

| 2023 Meetings | 8 | 5 | 0 | 4 | 7 | 4 | 3 | 4 |

The functions of the committees are described below. The committee charters provide a more detailed discussion of the purposes, duties and responsibilities of the committees. The charters for each of our standing committees can be found on our website at www.aep.com/investors/governance.

The Committee on Directors and Corporate Governance (the Corporate Governance Committee) is responsible for:

1.Recommending the size of the Board within the limits imposed by the Bylaws.

2.Recommending selection criteria for nominees for election or appointment to the Board.

3.Conducting independent searches for qualified nominees and screening the qualifications of candidates recommended by others.

4.Recommending to the Board nominees for appointment to fill vacancies on the Board as they occur and the slate of nominees for election at the annual meeting.

5.Reviewing and making recommendations to the Board with respect to compensation of directors and corporate governance.

6.Recommending members to serve on committees and chairs of the committees of the Board.

7.Reviewing the independence and possible conflicts of interest of directors and executive officers.

8.Overseeing the AEP Corporate Compliance Program.

9.Overseeing the annual evaluation of the Board of Directors.

10.Overseeing the annual evaluation of individual directors.

11.Monitoring AEP’s Related Person Transaction Approval Policy.

12.Overseeing AEP’s Corporate Sustainability Report which includes information on sustainability, responsible business practices and governance matters and material concerning political contributions.

Consistent with the rules of NASDAQ and the SEC and our Director Independence Standards, all members of the Corporate Governance Committee are independent.

The Human Resources Committee (the HR Committee) annually reviews and approves AEP’s executive compensation in the context of the performance of management and the Company. None of the members of the HR Committee is or has been an officer or employee of the Company or any of its subsidiaries. In addition, each of the current members of the HR Committee has been determined to be independent by the Board in accordance with NASDAQ and SEC rules applicable for board and committee service and our Director Independence Standards. Each member is also a “non-employee director” as defined in SEC Rule 16b-3 under the Exchange Act.

The HR Committee also reviews the Compensation, Discussion and Analysis section of this proxy statement, and recommends that it be included in the Company’s Annual Report on Form 10-K.

For a more complete description of the HR Committee’s responsibilities, see the Human Resources Committee Report on page 64.

The Audit Committee is responsible for, among other things, the appointment of the independent registered public accounting firm (independent auditor) for the Company; reviewing with the independent auditor the plan and scope of the audit and approving audit fees; monitoring the adequacy of financial reporting and internal control over financial reporting; and meeting periodically with the internal auditor and the independent auditor.

Consistent with the rules of NASDAQ and the SEC and our Director Independence Standards, all members of the Audit Committee are independent. The Board has also determined that Mr. Garcia and Mses. Goodspeed, James, and Lin are “audit committee financial experts” as defined by SEC rules.

The Finance Committee monitors and reports to the Board with respect to the capital requirements and financing plans and programs of AEP and its subsidiaries, including reviewing and making recommendations concerning their short and long-term financing plans and programs. The Finance Committee also provides recommendations to the Board on dividend policy, including the declaration and payment of dividends. The Finance Committee also reviews and approves the treasury policies of the Company.

The Nuclear Oversight Committee is responsible for overseeing and reporting to the Board with respect to the management and operation of AEP’s nuclear generation.

The Policy Committee is responsible for examining AEP’s policies on major public issues affecting the AEP System, including environmental, technology, industry change and other matters. During 2023, the Policy Committee held three meetings that focused on strategic issues for the electric utility industry through 2030, including a discussion on the decarbonization of power generation, grid flexibility and customer resiliency, and climate adaptability; energy sector cybersecurity risks; and the role of nuclear energy in the clean energy transition.

The Technology Committee provides review and oversight of AEP’s information technology strategy and investments, including internal and external labor strategy; provides review and oversight of AEP’s framework and programs designed to address risks related to cybersecurity, information technology, and associated operational resiliency; and otherwise provides review and oversight of issues related to setting the information technology and cybersecurity strategy of the Company.

The Executive Committee is empowered to exercise all the authority of the Board, subject to certain limitations prescribed in the Bylaws, during the intervals between meetings of the Board.

Corporate Governance

AEP maintains a corporate governance page on its website that includes key information about corporate governance initiatives, including AEP’s Principles of Corporate Governance (Principles), AEP’s Principles of Business Conduct, Code of Business Conduct and Ethics for Members of the Board of Directors, Director Independence Standards, and charters for the Audit Committee, the Corporate Governance Committee and the HR Committee. The corporate governance page can be found at www.aep.com/investors/governance. Printed copies of all of these materials also are available without charge upon written request to Investor Relations at: AEP, attention: Investor Relations, 1 Riverside Plaza, Columbus, Ohio 43215.

We are committed to strong governance practices that protect the long-term interests of our shareholders. Our governance framework includes the following key governance best practices:

| | | | | | | | | | | |

| Governance Highlights |

| • | 11 out of 12 director nominees are independent | • | Annual shareholder engagement on governance issues, including sustainability and responsible business practices and strategy with independent Chair (or Lead Director if that role exists) participation |

| • | Strong independent Chair | • | Executive sessions of non-management directors at every Board meeting |

| • | Annual election of all directors | • | Robust stock ownership guidelines for executive officers and non-employee directors |

| • | Majority voting in the election of directors with director resignation policy (plurality standard to apply in contested elections) | • | Risk oversight by full Board and Committees |

| • | Annual Board and Committee self-evaluations, including individual Board member evaluations | • | Board and Committees may hire outside advisors independently of management |

| • | Audit Committee, HR Committee, and Corporate Governance Committee composed entirely of independent directors | • | Limit on the number of public company directorships Board members may hold (4) |

| • | Diverse Board in terms of gender, ethnicity and specific skills and qualifications | • | Proxy access for shareholders |

Directors

Qualifications

The Principles are available on our website at www.aep.com/investors/governance. With respect to director qualifications and attributes, the Principles provide that, in nominating a slate of directors, it is the Board’s objective, with the assistance of the Corporate Governance Committee, to select individuals with skills and experience to effectively oversee management’s operation of the Company’s business.

In addition, the Principles provide that directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the shareholders, and that directors must also have an inquisitive and objective perspective, practical wisdom and mature judgment.

These requirements are expanded upon in the Criteria for Evaluating Directors (Criteria). The Criteria are available on the Company’s website at www.aep.com/investors/governance.

As indicated in the Principles and the Criteria, directors should have personal attributes such as high integrity, intelligence, wisdom and judgment. In addition, they should have skills and experience that mesh effectively with the skills and experience of other Board members, so that the talents of all members blend together to be as effective as possible in overseeing a large energy business.

Diversity

The Criteria also includes the Company’s statement regarding how the Board considers diversity in identifying nominees for our Board. The Criteria provides:

Two central objectives in selecting board members and continued board service are that the skills, experiences and perspectives of the Board as a whole should be broad and diverse, and that the talents of all members of the Board should blend together to be as effective as possible. Diversity in gender, race, age, tenure of board service, geography and background of directors, consistent with the Board’s requirements for knowledge, standards and experience, are desirable in the mix of the Board.

Our Corporate Governance Committee considers these criteria each year as it determines the slate of director nominees to recommend to the Board for election at our annual meeting. It also considers these criteria each time a new director is recommended for election or appointment to the Board. The Corporate Governance Committee is committed to including in each director search qualified candidates who reflect diverse backgrounds, including diversity of gender, race and ethnicity. The Board believes that its implementation of this policy is effective in maintaining the diversity of the members of the Board.

Understanding the importance of Board composition and refreshment for effective oversight, the Corporate Governance Committee strives to maintain an appropriate balance of tenure, diversity, skills and experience on the Board. Below are highlights of the composition of our director nominees:

| | | | | | | | | | | | | | |

| Board Diversity Matrix |

| Part I: Gender Identity | Male | Female | Non-Binary | Did Not Disclose Gender |

| Directors | 7 | 5 | | |

| Part II: Demographic Background |

| African American or Black | 1 | 1 | | |

| Alaskan Native or American Indian | | | | |

| Asian | | | | |

| Hispanic, Latino or Latina | 1 | 1 | | |

| Native Hawaiian or Pacific Islander | | | | |

| White | 5 | 3 | | |

| Two or More Races or Ethnicities | | | | |

| LGBTQ+ | |

| Undisclosed | |

Selection of Director Candidates

The Corporate Governance Committee is responsible for recruiting new directors and identifies, evaluates and recommends director candidates to the Board. The Corporate Governance Committee regularly assesses the appropriate size and composition of the Board, the needs of the Board and the respective committees of the Board and the qualifications of candidates in light of these needs. Candidates may come to the attention of the Corporate Governance Committee through shareholders, management, current members of the Board or search firms. Shareholders who wish to recommend director candidates to the Corporate Governance Committee may do so by following the procedures described in Shareholder Proposals and Nominations.

Director Nomination Agreement

On February 12, 2024, the Company entered into a Director Appointment and Nomination Agreement (Nomination Agreement) with Carl C. Icahn, Hunter C. Gary, Henry P. Linginfelter, Beckton Corp., Icahn Capital LP, Icahn Enterprises Holdings L.P., Icahn Enterprises G.P. Inc., Icahn Offshore LP, Icahn Onshore LP, Icahn Partners LP, Icahn Partners Master Fund LP, IPH GP LLC, and Icahn Capital LP (collectively, the “Icahn Group”). Pursuant to the Nomination Agreement, effective as of February 12, 2024, the Board, among other matters, agreed to: (i) increase the size of the Board from 12 to 14 directors, resulting in a total of two vacancies; and (ii) appoint Hunter C. Gary (the "Icahn Designee") and Henry P. Linginfelter (the “New Independent Director”) to serve as directors of the Company to fill such vacancies, each with a term expiring at the Annual Meeting. A summary of the terms of the Nomination Agreement is provided in the “Certain Relationships and Related Person Transactions” section below.

Linking Business Strategy with Key Skills Represented on the Board

AEP’s long-term strategy is to be a fully regulated, premier energy company focused on investment in infrastructure and energy solutions that customers want and need. We are focused on building a smarter energy infrastructure and delivering new technologies and custom energy solutions to our customers. And we continue to grow our regulated renewable generation portfolio as part of our strategy to diversify generation resources to provide clean energy options to customers. We operate and maintain the nation’s largest electricity transmission system and more than 225,000 circuit miles of distribution lines to efficiently deliver safe, reliable power to nearly 5.6 million regulated customers in 11 states. AEP also is one of the nation’s largest electricity producers with approximately 29,000 megawatts of diverse generating capacity, including more than 6,100 megawatts of renewable energy.

The Corporate Governance Committee and the Board regularly consider the Company’s strategy and the particular skills, experiences and other qualifications that should be represented on the Board as a whole, to effectively oversee the Company’s strategic direction. As part of the Board’s succession planning, the Board reviews the skills currently represented on the Board but, more importantly, focuses on the skills needed in the short-, medium-, and long-term. In that regard, during the past year, the Board sought a new director, specifically targeting a director with senior executive experience in nuclear, renewables, strategy and risk management and recruited Mr. Stoddard, who served as Senior Vice President and Chief Nuclear Officer and President-Contracted Renewables at Dominion Energy, to join the Board in August 2023.

We believe that our director nominees, taken together as a group, possess the skills and expertise appropriate for maintaining an effective Board aligned with the Company’s long term strategy. Listed below are summaries of specific qualifications that the Corporate Governance Committee and the Board believe should be represented on the Board.

| | | | | | | | | | | | | | |

| Senior Executive Leadership and Business Strategy | | Regulated Industry Experience |

| Directors who hold or have held significant senior leadership experience as a CEO or senior executive provide the Company with unique insights. They generally possess extraordinary leadership skills as well as the ability to recognize and develop leadership skills in others. They have a practical understanding of organizations, strategy and risk management, and know how to drive growth.

| | | Our business is heavily regulated. AEP engages in a complex business with significant public policy and public safety implications. A portion of our business deals with nuclear regulations and operations. The development and execution of our strategy depends on directors who have experience with public policy issues in heavily regulated industries, energy markets, technology, renewable energy, and electric transmission and distribution infrastructure.

|

| Government, Legal and Environmental Affairs | | Industrial Operations and Safety Experience |