UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 28, 2012

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-2402

HORMEL FOODS CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

41-0319970 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

1 Hormel Place |

|

|

|

Austin, Minnesota |

|

55912-3680 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (507) 437-5611

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Stock, $.0293 par value |

|

New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T during the preceding 12 months. Yes x Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of April 29, 2012, was $3,886,325,520, based on the closing price of $29.02 on the last business day of the registrant’s most recently completed second fiscal quarter.

As of November 30, 2012, the number of shares outstanding of each of the registrant’s classes of common stock was as follows:

Common Stock, $.0293 Par Value — 263,612,318 shares

Common Stock Non-Voting, $.01 Par Value — 0 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Annual Stockholders’ Report for the fiscal year ended October 28, 2012, are incorporated by reference into Part I, Items 1 and 1A and Part II, Items 5-8 and 9A, and included as Exhibit 13.1 filed herewith.

Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held January 29, 2013, are incorporated by reference into Part III, Items 10-14.

HORMEL FOODS CORPORATION

(a) General Development of Business

Hormel Foods Corporation, a Delaware corporation (the Company), was founded by George A. Hormel in 1891 in Austin, Minnesota, as George A. Hormel & Company. The Company started as a processor of meat and food products and continues in this line of business. The Company’s name was changed to Hormel Foods Corporation on January 31, 1995. The Company is primarily engaged in the production of a variety of meat and food products and the marketing of those products throughout the United States and internationally. Although pork and turkey remain the major raw materials for its products, the Company has emphasized for several years the manufacturing and distribution of branded, value-added consumer items rather than the commodity fresh meat business. The Company has continually expanded its product portfolio through organic growth, new product development, and acquisitions.

Internationally, the Company markets its products through Hormel Foods International Corporation (HFIC), a wholly owned subsidiary. HFIC has a presence in the international marketplace through joint ventures and placement of personnel in strategic foreign locations such as Australia, Canada, China, Japan, and the Philippines. HFIC also has a global presence with minority positions in food companies in Mexico (Hormel Alimentos, 50% holding) and the Philippines (Purefoods-Hormel, 40% holding), and in a hog production and processing operation in Vietnam (San Miguel Purefoods (Vietnam) Co. Ltd., 49% holding).

The Company has not been involved in any bankruptcy, receivership, or similar proceedings during its history. Substantially all the assets of the Company have been acquired in the ordinary course of business.

The Company had no significant change in the type of products produced or services rendered, or in the markets or methods of distribution since the beginning of the 2012 fiscal year.

(b) Segments

The Company’s business is reported in five segments: Grocery Products, Refrigerated Foods, Jennie-O Turkey Store (JOTS), Specialty Foods, and All Other. Net sales to unaffiliated customers, operating profit, total assets, and the presentation of certain other financial information by segment, are reported in Note O of the Notes to Consolidated Financial Statements and in the Management’s Discussion and Analysis of Financial Condition and Results of Operations of the Annual Stockholder’s Report for the fiscal year ended October 28, 2012, incorporated herein by reference.

(c) Description of Business

Products and Distribution

The Company’s products primarily consist of meat and other food products. The meat products are sold fresh, frozen, cured, smoked, cooked, and canned. The percentages of total revenues contributed by classes of similar products for the last three fiscal years of the Company are as follows:

|

|

|

Fiscal Year Ended |

| ||||

|

|

|

October 28, 2012 |

|

October 30, 2011 |

|

October 31, 2010 |

|

|

Perishable meat |

|

53.5 |

% |

55.1 |

% |

54.3 |

% |

|

Poultry |

|

19.3 |

|

19.1 |

|

18.7 |

|

|

Shelf-stable |

|

17.6 |

|

16.8 |

|

17.5 |

|

|

Other |

|

9.6 |

|

9.0 |

|

9.5 |

|

|

|

|

100.0 |

% |

100.0 |

% |

100.0 |

% |

Reporting of revenues from external customers is based on similarity of products, as the same or similar products are sold across multiple distribution channels such as retail, foodservice, or international. Revenues reported are based on financial information used to produce the Company’s general-purpose financial statements.

Perishable meat includes fresh meats, refrigerated meal solutions, sausages, hams, wieners, and bacon (excluding JOTS products). The Poultry category is composed primarily of JOTS products. Shelf-stable includes canned luncheon meats, shelf-stable microwaveable meals, stews, chilies, hash, meat spreads, flour and corn tortillas, salsas, tortilla chips, and other items that do not require refrigeration. The Other category primarily consists of nutritional food products and supplements, sugar and sugar substitutes, creamers, salt and pepper products, sauces and salad dressings, dessert and drink mixes, and industrial gelatin products.

Domestically, the Company sells its products in all 50 states. The Company’s products are sold through its sales personnel, operating in assigned territories or as dedicated teams serving major customers, coordinated from sales offices located in most of the larger U.S. cities. The Company also utilizes independent brokers and distributors. As of October 28, 2012, the Company had approximately 720 sales personnel engaged in selling its products. Distribution of products to customers is primarily by common carrier.

Through HFIC, the Company markets its products in various locations throughout the world. Some of the larger markets include Australia, Canada, China, England, Japan, Mexico, Micronesia, the Philippines, and South Korea. The distribution of export sales to customers is by common carrier, while the China operations own and operate their own delivery system. The Company, through HFIC, has licensed companies to manufacture various Company products internationally on a royalty basis, with the primary licensees being Tulip International of Denmark and CJ CheilJedang Corporation of South Korea.

Raw Materials

The Company has, for the past several years, been concentrating on processed branded products for consumers with year-round demand to minimize the seasonal variation experienced with commodity-type products. Pork continues to be the primary raw material for Company products. Although the live pork industry has evolved to large, vertically integrated, year-round operations, and supply contracts have become prevalent in the industry, there is still a seasonal variation in the supply of fresh pork materials. The Company’s expanding line of processed items has reduced, but not eliminated, the sensitivity of Company results to raw material supply and price fluctuations.

The majority of the hogs harvested by the Company are purchased under supply contracts from producers located principally in California, Colorado, Illinois, Iowa, Kansas, Minnesota, Nebraska, North Dakota, Oklahoma, South Dakota, Texas, Utah, and Wisconsin. The cost of hogs and the utilization of the Company’s facilities are affected by both the level and the methods of pork production in the United States. The movement toward larger operations, which operate under supply agreements with processors, has resulted in fewer hogs being available on the spot cash market. The Company, like others in the industry, uses supply contracts to manage the effects of this trend and to ensure a stable supply of raw materials. The Company’s contracts are based on market-based formulas and/or the cost of production, to better balance input costs with customer pricing, and all contract costs are fully reflected in the Company’s reported financial statements. In fiscal 2012, the Company purchased 97 percent of its hogs under supply contracts. The Company also procures a portion of its hogs through farms that it either owns or operates in Arizona, California, Colorado, Kansas, and Wyoming.

In fiscal 2012, JOTS raised turkeys representing approximately 77 percent of the volume needed to meet its raw material requirements for whole bird and processed turkey products. Turkeys not sourced within the Company are contracted with independent turkey growers. JOTS’ turkey-raising farms are located throughout Minnesota and Wisconsin.

Production costs in raising hogs and turkeys are subject primarily to fluctuations in feed grain prices and, to a lesser extent, fuel costs. To manage this risk, the Company hedges a portion of its anticipated purchases of grain using futures contracts.

Manufacturing

The Company has three plants that harvest hogs for processing. Quality Pork Processors, Inc. of Dallas, Texas, operates the harvesting facility at Austin, Minnesota, under a custom harvesting arrangement. The Company has seven turkey harvest and processing operations, and 36 facilities that produce and distribute other manufactured items. Albert Lea Select Foods, Inc. operates the processing facility at Albert Lea, Minnesota, under a custom manufacturing agreement. Company products are also custom manufactured by several other companies. The following are the Company’s larger custom manufacturers: Abbyland Foods, Inc., Abbotsford, Wisconsin; Agropur Division Natrel USA, Maplewood, Minnesota; Cloverleaf Cold Storage, Sioux City, Iowa; Lakeside Packing Company, Manitowoc, Wisconsin; Mrs. Clark’s Foods, Ankeny, Iowa; OSI Industries LLC, Chicago, Illinois; Power Packaging, St. Charles, Illinois; Reichel Foods, Inc., Rochester, Minnesota; Reser’s Fine Foods, Topeka, Kansas; and Steuben Foods, Jamaica, New York. Exel, Inc., based in Westerville, Ohio, operates distribution centers for the Company in Dayton, Ohio, and Osceola, Iowa.

Patents and Trademarks

There are numerous patents and trademarks that are important to the Company’s business. The Company holds 44 U.S.-issued and six foreign patents. Most of the trademarks are registered. Some of the more significant owned or licensed trademarks used by the Company or its affiliates are:

HORMEL, ALWAYS TENDER, AMERICAN CLASSICS, AUSTIN BLUES, BANGKOK PADANG, BLACK LABEL, BREAD READY, BÚFALO, CAFÉ H, CALIFORNIA NATURAL, CHI-CHI’S, COMPLEATS, COUNTRY CROCK, CURE 81, CUREMASTER, DAN’S PRIZE, DI LUSSO, DINTY MOORE, DODGER DOG, DON MIGUEL, DOÑA MARIA, DUBUQUE, EMBASA, FARMER JOHN, FAST ‘N EASY, FIRE-BRAISED, HERB-OX, HERDEZ, HIBACHI GRILL, HOMELAND, HOUSE OF TSANG, JENNIE-O TURKEY STORE, KID’S KITCHEN, LA VICTORIA, LAYOUT, LITTLE SIZZLERS, LLOYD’S, MAGNIFOODS, MANNY’S, MARRAKESH EXPRESS, MARY KITCHEN, NATURAL CHOICE, NATURASELECT, OLD SMOKEHOUSE, PELOPONNESE, PILLOW PACK, POCO PAC, PREP CHEF, PREMORO, RANGE BRAND, REV, RICO OLE’, ROSA GRANDE, SAAG’S, SANDWICH MAKER, SAUCY BLUES, SPAM, SPAMTASTIC, STAGG, TEZZATA, THICK & EASY, VALLEY FRESH, WHOLLY GUACAMOLE, WHOLLY SALSA, and WRANGLERS.

Country Crock® remains a registered trademark of the Unilever Group of Companies and is being used under license.

The Company’s patents expire after a term that is typically 20 years from the date of filing, with earlier expiration possible based on the Company’s decision to pay required maintenance fees. As long as the Company intends to continue using its trademarks, they are renewed indefinitely.

Customers and Backlog Orders

During fiscal year 2012, sales to Wal-Mart Stores, Inc. (Wal-Mart) represented approximately 13.2 percent of the Company’s revenues (measured as gross sales less returns and allowances), compared to 12.5 percent in fiscal 2011. Wal-Mart is a customer for all five segments of the Company. The five largest customers in each segment make up approximately the following percentage of segment sales: 45 percent of Grocery Products, 36 percent of Refrigerated Foods, 37 percent of JOTS, 44 percent of Specialty Foods, and 27 percent of All Other. The loss of one or more of the top customers in any of these segments could have a material adverse effect on the results of such segment. Backlog orders are not significant due to the perishable nature of a large portion of the products. Orders are accepted and shipped on a current basis.

Competition

The production and sale of meat and food products in the United States and internationally are highly competitive. The Company competes with manufacturers of pork and turkey products, as well as national and regional producers of other meat and protein sources, such as beef, chicken, and fish. The Company believes that its largest domestic competitors for its Refrigerated Foods segment in 2012 were Tyson Foods and Smithfield Foods; for its Grocery Products segment, ConAgra Foods, General Mills, and Campbell Soup Co.; and for JOTS, Cargill, Inc. and Butterball, LLC.

All segments compete on the basis of price, product quality, brand identification, breadth of product line, and customer service. Through aggressive marketing and strong quality assurance programs, the Company’s strategy is to provide higher quality products that possess strong brand recognition, which would then support higher value perceptions from customers.

The Company competes using this same strategy in international markets around the world.

Research and Development

Research and development continues to be a vital part of the Company’s strategy to extend existing brands and expand into new branded items. The expenditures for research and development for fiscal 2012, 2011, and 2010, were approximately $29.8 million, $29.4 million, and $27.6 million, respectively. There are 131 employees engaged in full time research and development, 57 in the area of improving existing products and 74 in developing new products.

Employees

As of October 28, 2012, the Company had approximately 19,700 active domestic and foreign employees.

(d) Geographic Areas

Financial information about geographic areas, including total revenues attributed to the U.S. and all foreign countries in total for the last three fiscal years of the Company, is reported in Note O of the Notes to Consolidated Financial Statements of the Annual Stockholder’s Report for the fiscal year ended October 28, 2012, incorporated herein by reference.

(e) Available Information

The Company makes available, free of charge on its Web site at www.hormelfoods.com, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. These reports are accessible under the caption, “Investors — SEC Filings” on the Company’s Web site and are available as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission.

The documents noted above are also available in print, free of charge, to any stockholder who requests them.

(f) Executive Officers of the Registrant

|

|

|

|

|

|

|

|

|

YEAR |

|

|

|

|

|

|

|

|

|

FIRST |

|

|

|

|

|

CURRENT OFFICE AND PREVIOUS |

|

|

|

ELECTED |

|

NAME |

|

AGE |

|

FIVE YEARS EXPERIENCE |

|

DATES |

|

OFFICER |

|

|

|

|

|

|

|

|

|

|

|

Jeffrey M. Ettinger |

|

54 |

|

Chairman of the Board, President and Chief Executive Officer |

|

11/21/06 to Present |

|

1998 |

|

|

|

|

|

|

|

|

|

|

|

Jody H. Feragen |

|

56 |

|

Executive Vice President and Chief Financial Officer |

|

11/01/10 to Present |

|

2000 |

|

|

|

|

|

Senior Vice President and Chief Financial Officer |

|

01/01/07 to 10/31/10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Steven G. Binder |

|

55 |

|

Executive Vice President/President Hormel Business Units |

|

10/31/11 to Present |

|

1998 |

|

|

|

|

|

Executive Vice President (Refrigerated Foods) |

|

11/01/10 to 10/30/11 |

|

|

|

|

|

|

|

Group Vice President (Refrigerated Foods) |

|

07/30/07 to 10/31/10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald W. Fielding |

|

59 |

|

Executive Vice President (Corporate Strategy, Planning and Development) |

|

11/01/10 to Present (retires 12/31/12) |

|

1997 |

|

|

|

|

|

Executive Vice President (Grocery Products/ Corporate Development) |

|

04/07/08 to 10/31/10 |

|

|

|

|

|

|

|

Executive Vice President (Grocery Products/ Mergers and Acquisitions) |

|

01/01/07 to 04/06/08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard A. Bross |

|

61 |

|

Group Vice President/President Hormel Foods International Corporation |

|

10/29/01 to Present (retires 12/31/12) |

|

1995 |

|

|

|

|

|

|

|

|

|

|

|

Thomas R. Day |

|

54 |

|

Group Vice President (Foodservice) |

|

11/01/10 to Present |

|

2000 |

|

|

|

|

|

Senior Vice President (Foodservice) |

|

07/30/07 to 10/31/10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Donald H. Kremin |

|

52 |

|

Group Vice President (Specialty Foods Group) |

|

10/31/11 to Present |

|

2007 |

|

|

|

|

|

Vice President/Senior Vice President Consumer Product Sales (Wal-Mart) |

|

10/29/07 to 10/30/11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Glenn R. Leitch |

|

52 |

|

Group Vice President/President Jennie-O Turkey Store, Inc. |

|

10/31/11 to Present |

|

2011 |

|

|

|

|

|

General Manager (Jennie-O Turkey Store, Inc.) |

|

05/30/11 to 10/30/11 |

|

|

|

|

|

|

|

Senior Vice President — Commodity (Supply Chain Division — Jennie-O Turkey Store, Inc.) |

|

04/30/01 to 05/29/11 |

|

|

(f) Executive Officers of the Registrant - Continued

|

|

|

|

|

|

|

|

|

YEAR |

|

|

|

|

|

|

|

|

|

FIRST |

|

|

|

|

|

CURRENT OFFICE AND PREVIOUS |

|

|

|

ELECTED |

|

NAME |

|

AGE |

|

FIVE YEARS EXPERIENCE |

|

DATES |

|

OFFICER |

|

|

|

|

|

|

|

|

|

|

|

James P. Snee |

|

45 |

|

Group Vice President/President Hormel Foods International |

|

10/29/12 to Present |

|

2008 |

|

|

|

|

|

Vice President/Senior Vice President Hormel Foods International Corporation |

|

10/31/11 to 10/28/12 |

|

|

|

|

|

|

|

Vice President (Affiliated Business Units — Refrigerated Foods) |

|

10/27/08 to 10/30/11 |

|

|

|

|

|

|

|

Director (Purchasing) |

|

02/13/06 to 10/26/08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

James M. Splinter |

|

50 |

|

Group Vice President (Grocery Products) |

|

11/01/10 to Present |

|

2003 |

|

|

|

|

|

Vice President (Marketing-Consumer Products- Refrigerated Foods) |

|

06/02/03 to 10/31/10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Larry L. Vorpahl |

|

49 |

|

Group Vice President/President Consumer Products Sales |

|

10/31/05 to Present |

|

1999 |

|

|

|

|

|

|

|

|

|

|

|

William F. Snyder |

|

55 |

|

Senior Vice President (Supply Chain) |

|

10/31/05 to Present |

|

1999 |

|

|

|

|

|

|

|

|

|

|

|

Roland G. Gentzler |

|

58 |

|

Vice President (Finance) and Treasurer |

|

01/01/07 to Present |

|

2007 |

|

|

|

|

|

|

|

|

|

|

|

Brian D. Johnson |

|

52 |

|

Vice President and Corporate Secretary |

|

11/22/10 to Present |

|

2007 |

|

|

|

|

|

Corporate Secretary and Senior Attorney |

|

10/29/07 to 11/21/10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

David P. Juhlke |

|

53 |

|

Vice President (Human Resources) |

|

10/31/05 to Present |

|

2005 |

|

|

|

|

|

|

|

|

|

|

|

Lori J. Marco |

|

45 |

|

Vice President (External Affairs) and General Counsel |

|

01/24/11 to Present |

|

2011 |

|

|

|

|

|

Senior Attorney |

|

01/01/07 to 01/23/11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Phillip L. Minerich, Ph.D. |

|

59 |

|

Vice President (Research and Development) |

|

10/31/05 to Present |

|

2005 |

|

|

|

|

|

|

|

|

|

|

|

James N. Sheehan |

|

57 |

|

Vice President and Controller |

|

05/01/00 to Present |

|

1999 |

No family relationship exists among the executive officers.

Executive officers are elected annually by the Board of Directors at the first meeting following the Annual Meeting of Stockholders. Vacancies may be filled and additional officers elected at any time.

Information on the Company’s risk factors included in the Management’s Discussion and Analysis of Financial Condition and Results of Operations on pages 27 through 29 of the Annual Stockholders’ Report for the fiscal year ended October 28, 2012, is incorporated herein by reference.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

|

Location |

|

Principal Segment (1) |

|

Approximate Area |

|

Owned or |

|

Lease |

|

|

|

|

|

|

|

|

|

|

|

Harvest and Processing Plants |

|

|

|

|

|

|

|

|

|

Austin, Minnesota |

|

Refrigerated Foods |

|

1,399,000 |

|

Owned |

|

|

|

Barron, Wisconsin |

|

JOTS |

|

392,000 |

|

Owned |

|

|

|

Faribault, Minnesota |

|

JOTS |

|

173,000 |

|

Owned |

|

|

|

Fremont, Nebraska |

|

Refrigerated Foods |

|

700,000 |

|

Owned |

|

|

|

Melrose, Minnesota |

|

JOTS |

|

134,000 |

|

Owned |

|

|

|

Vernon, California |

|

Refrigerated Foods |

|

632,000 |

|

Owned |

|

|

|

|

|

All Other |

|

93,000 |

|

Leased |

|

March 2014 |

|

Willmar, Minnesota |

|

JOTS |

|

338,000 |

|

Owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

Processing Plants |

|

|

|

|

|

|

|

|

|

Albert Lea, Minnesota |

|

Refrigerated Foods |

|

78,000 |

|

Owned |

|

|

|

Algona, Iowa |

|

Refrigerated Foods |

|

153,000 |

|

Owned |

|

|

|

Alma, Kansas |

|

Refrigerated Foods |

|

66,000 |

|

Owned |

|

|

|

Aurora, Illinois |

|

Specialty Foods |

|

141,000 |

|

Owned |

|

|

|

Beijing, China |

|

All Other |

|

95,000 |

|

80% Owned |

|

|

|

Beloit, Wisconsin |

|

Grocery Products |

|

339,000 |

|

Owned |

|

|

|

|

|

Grocery Products |

|

5,000 |

|

Leased |

|

Monthly |

|

Bremen, Georgia |

|

Specialty Foods |

|

156,000 |

|

Owned |

|

|

|

Browerville, Minnesota |

|

Refrigerated Foods |

|

95,000 |

|

Owned |

|

|

|

Dubuque, Iowa |

|

Grocery Products |

|

342,000 |

|

Owned |

|

|

|

Duluth, Georgia |

|

Specialty Foods |

|

80,000 |

|

Owned |

|

|

|

Knoxville, Iowa |

|

Refrigerated Foods |

|

130,000 |

|

Owned |

|

|

|

Lathrop, California |

|

Refrigerated Foods |

|

85,000 |

|

Owned |

|

|

|

Long Prairie, Minnesota |

|

Refrigerated Foods |

|

86,000 |

|

Owned |

|

|

|

Mendota Heights, Minnesota |

|

Refrigerated Foods |

|

58,000 |

|

Owned |

|

|

|

Mitchellville, Iowa |

|

Specialty Foods |

|

81,000 |

|

Owned |

|

|

|

Montevideo, Minnesota |

|

JOTS |

|

89,000 |

|

Owned |

|

|

|

Nevada, Iowa |

|

Refrigerated Foods |

|

139,000 |

|

Owned |

|

|

|

New Berlin, Wisconsin |

|

Grocery Products |

|

70,000 |

|

Leased |

|

February 2016 |

|

Osceola, Iowa |

|

Refrigerated Foods |

|

365,000 |

|

Owned |

|

|

|

Pelican Rapids, Minnesota |

|

JOTS |

|

373,000 |

|

Owned |

|

|

|

Perrysburg, Ohio |

|

Specialty Foods |

|

183,000 |

|

Owned |

|

|

|

Quakertown, Pennsylvania |

|

Specialty Foods |

|

10,000 |

|

Owned |

|

|

|

Rochelle, Illinois |

|

Refrigerated Foods |

|

398,000 |

|

Owned |

|

|

|

San Leandro, California |

|

Refrigerated Foods |

|

41,000 |

|

Leased |

|

November 2021 |

|

Savannah, Georgia |

|

Specialty Foods |

|

300,000 |

|

Owned |

|

|

|

Shanghai, China |

|

All Other |

|

33,000 |

|

81% Owned |

|

|

|

Sparta, Wisconsin |

|

Specialty Foods |

|

385,000 |

|

Owned |

|

|

|

Stockton, California |

|

Grocery Products |

|

139,000 |

|

Owned |

|

|

|

Tucker, Georgia |

|

Grocery Products |

|

283,000 |

|

Owned |

|

|

Item 2. PROPERTIES — Continued

|

Location |

|

Principal Segment (1) |

|

Approximate Area |

|

Owned or |

|

Lease |

|

|

|

|

|

|

|

|

|

|

|

Processing Plants (continued) |

|

|

|

|

|

|

|

|

|

Visalia, California |

|

Specialty Foods |

|

107,000 |

|

Owned |

|

|

|

Wichita, Kansas |

|

Refrigerated Foods |

|

87,000 |

|

Owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

Warehouse/Distribution Centers |

|

|

|

|

|

|

|

|

|

Austin, Minnesota |

|

Refrigerated Foods |

|

82,000 |

|

Owned |

|

|

|

Bondurant, Iowa |

|

Specialty Foods |

|

99,000 |

|

Owned |

|

|

|

Dayton, Ohio |

|

Refrigerated Foods |

|

140,000 |

|

Owned |

|

|

|

Eldridge, Iowa |

|

Grocery Products |

|

424,000 |

|

Leased |

|

July 2019 |

|

Fresno, California |

|

Refrigerated Foods |

|

25,000 |

|

Owned |

|

|

|

Nevada, Iowa |

|

Refrigerated Foods |

|

87,000 |

|

Owned |

|

|

|

Osceola, Iowa |

|

Refrigerated Foods |

|

233,000 |

|

Owned |

|

|

|

Shanghai, China |

|

All Other |

|

26,000 |

|

Leased |

|

June 2016 |

|

Stockton, California |

|

Grocery Products |

|

330,000 |

|

Leased |

|

December 2014 |

|

Tucker, Georgia |

|

Grocery Products |

|

96,000 |

|

Leased |

|

September 2013 |

|

Vernon, California |

|

Refrigerated Foods |

|

118,000 |

|

Owned |

|

|

|

Willmar, Minnesota |

|

JOTS |

|

119,000 |

|

Owned |

|

|

|

|

|

|

|

3,000 |

|

Leased |

|

November 2016 |

|

|

|

|

|

|

|

|

|

|

|

Hog Production Facilities |

|

|

|

|

|

|

|

|

|

Albin, Wyoming |

|

Refrigerated Foods |

|

458,000 |

|

Owned |

|

|

|

Corcoran, California |

|

Refrigerated Foods |

|

816,000 |

|

Owned |

|

|

|

Holbrook, Arizona |

|

Refrigerated Foods |

|

13,000 |

|

Owned |

|

|

|

Las Animas, Colorado |

|

Refrigerated Foods |

|

801,000 |

|

Owned |

|

|

|

Pine Bluffs, Wyoming |

|

Refrigerated Foods |

|

64,000 |

|

Owned |

|

|

|

Snowflake, Arizona |

|

Refrigerated Foods |

|

1,529,000 |

|

Owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

Hatcheries |

|

|

|

|

|

|

|

|

|

Barron, Wisconsin |

|

JOTS |

|

29,000 |

|

Owned |

|

|

|

Detroit Lakes, Minnesota |

|

JOTS |

|

27,000 |

|

Owned |

|

|

|

Henning, Minnesota |

|

JOTS |

|

21,000 |

|

Owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

Feed Mills |

|

|

|

|

|

|

|

|

|

Albin, Wyoming |

|

Refrigerated Foods |

|

6,000 |

|

Owned |

|

|

|

Atwater, Minnesota |

|

JOTS |

|

19,000 |

|

Owned |

|

|

|

Barron, Wisconsin |

|

JOTS |

|

26,000 |

|

Owned |

|

|

|

Corcoran, California |

|

Refrigerated Foods |

|

5,000 |

|

Owned |

|

|

|

Dawson, Minnesota |

|

JOTS |

|

37,000 |

|

Owned |

|

|

|

Faribault, Minnesota |

|

JOTS |

|

25,000 |

|

Owned |

|

|

|

Henning, Minnesota |

|

JOTS |

|

5,000 |

|

Owned |

|

|

|

Northfield, Minnesota |

|

JOTS |

|

17,000 |

|

Owned |

|

|

|

Perham, Minnesota |

|

JOTS |

|

26,000 |

|

Owned |

|

|

|

Snowflake, Arizona |

|

Refrigerated Foods |

|

28,000 |

|

Owned |

|

|

|

Swanville, Minnesota |

|

JOTS |

|

29,000 |

|

Owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

Turkey Farms |

|

|

|

|

|

|

|

|

|

Minnesota and Wisconsin |

|

JOTS |

|

15,500 |

(2) |

Owned |

|

|

Item 2. PROPERTIES — Continued

|

Location |

|

Principal Segment (1) |

|

Approximate Area |

|

Owned or |

|

Lease |

|

|

|

|

|

|

|

|

|

|

|

Research and Development |

|

|

|

|

|

|

|

|

|

Austin, Minnesota |

|

All Segments |

|

83,000 |

|

Owned |

|

|

|

Shanghai, China |

|

All Other |

|

5,000 |

|

Leased |

|

September 2013 |

|

Willmar, Minnesota |

|

JOTS |

|

10,000 |

|

Owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative Offices |

|

|

|

|

|

|

|

|

|

Austin, Minnesota |

|

All Segments |

|

260,000 |

|

Owned |

|

|

|

Beijing, China |

|

All Other |

|

4,000 |

|

Leased |

|

May 2013 |

|

Gainesville, Georgia |

|

Refrigerated Foods |

|

5,000 |

|

Leased |

|

November 2014 |

|

Las Animas, Colorado |

|

Refrigerated Foods |

|

4,000 |

|

Leased |

|

January 2014 |

|

Moorabbin, Australia |

|

All Other |

|

3,000 |

|

Leased |

|

August 2013 |

|

Savannah, Georgia |

|

Specialty Foods |

|

14,000 |

|

Owned |

|

|

|

Shanghai, China |

|

All Other |

|

13,000 |

|

Leased |

|

September 2013 |

|

Taylor, Arizona |

|

Refrigerated |

|

5,000 |

|

Leased |

|

January 2015 |

|

Spicer, Minnesota |

|

JOTS |

|

14,000 |

|

Leased |

|

June 2013 |

|

Vernon, California |

|

Refrigerated Foods |

|

17,000 |

|

Leased |

|

March 2014 |

|

Willmar, Minnesota |

|

JOTS |

|

21,000 |

|

Owned |

|

|

(1) Many of the Company’s properties are not exclusive to any one segment, and a few of the properties are utilized in all five segments. For locations that support multiple segments, but with a substantial percentage of activity attributable to certain segments, only the principal segments have been listed.

(2) Acres

The Company believes its operating facilities are well maintained and suitable for current production volumes, and expansion plans are either completed or in process to accommodate all volumes anticipated in the foreseeable future.

The Company is a party to various legal proceedings related to the on-going operation of its business, including claims both by and against the Company. At any time, such proceedings typically involve claims related to product liability, contract disputes, wage and hour laws, employment practices, or other actions brought by employees, consumers, competitors, or suppliers. Resolution of any currently known matters, either individually or in the aggregate, is not expected to have a material effect on the Company’s financial condition, results of operations, or liquidity.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

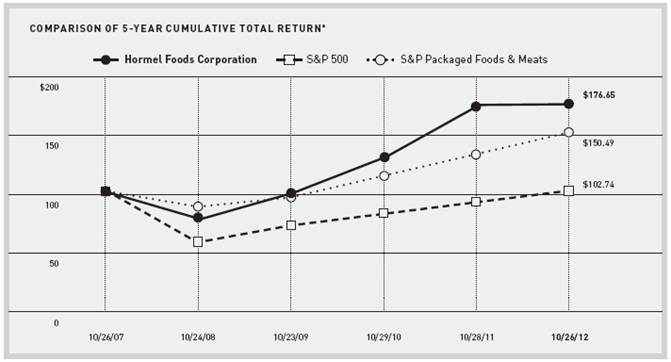

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The high and low sales price of the Company’s common stock and the dividends per share declared for each quarter of fiscal 2012 and fiscal 2011 are shown below:

|

2012 |

|

High |

|

Low |

|

Dividend |

| |||

|

First Quarter |

|

$ |

30.330 |

|

$ |

28.170 |

|

$ |

0.1500 |

|

|

Second Quarter |

|

29.650 |

|

27.980 |

|

0.1500 |

| |||

|

Third Quarter |

|

30.700 |

|

27.700 |

|

0.1500 |

| |||

|

Fourth Quarter |

|

29.850 |

|

27.280 |

|

0.1500 |

| |||

|

|

|

|

|

|

|

|

| |||

|

2011 |

|

High |

|

Low |

|

Dividend |

| |||

|

First Quarter |

|

$ |

26.135 |

|

$ |

22.515 |

|

$ |

0.1275 |

|

|

Second Quarter |

|

29.480 |

|

24.525 |

|

0.1275 |

| |||

|

Third Quarter |

|

30.500 |

|

27.600 |

|

0.1275 |

| |||

|

Fourth Quarter |

|

30.060 |

|

25.880 |

|

0.1275 |

| |||

On November 22, 2010, the Board of Directors authorized a two-for-one split of the Company’s common stock, which was subsequently approved by shareholders at the Company’s Annual Meeting on January 31, 2011, and effected on February 1, 2011. All numbers in the table above reflect the impact of this stock split.

Additional information about dividends, principal market of trade, and number of stockholders on page 60 of the Annual Stockholders’ Report for the fiscal year ended October 28, 2012, is incorporated herein by reference. The Company’s common stock has been listed on the New York Stock Exchange since January 16, 1990.

Issuer purchases of equity securities in the fourth quarter of fiscal year 2012 are shown below:

|

Period |

|

Total |

|

Average |

|

Total Number of |

|

Maximum Number of |

| |

|

July 30, 2012 — September 2, 2012 |

|

381,800 |

|

$ |

27.96 |

|

381,800 |

|

1,190,200 |

|

|

September 3, 2012 — September 30, 2012 |

|

— |

|

— |

|

— |

|

1,190,200 |

| |

|

October 1, 2012 — October 28, 2012 |

|

— |

|

— |

|

— |

|

1,190,200 |

| |

|

Total |

|

381,800 |

|

$ |

27.96 |

|

381,800 |

|

|

|

1 On May 26, 2010, the Company announced that its Board of Directors had authorized the Company to repurchase up to 5,000,000 shares of common stock with no expiration date. On November 22, 2010, the Board of Directors authorized a two-for-one split of the Company’s common stock. As part of the Board’s approval of that stock split, the number of shares remaining to be repurchased was adjusted proportionately. The stock split was approved by shareholders and was subsequently effected on February 1, 2011. All numbers in the table above reflect the impact of this stock split.

Item 6. SELECTED FINANCIAL DATA

Selected Financial Data for the five fiscal years ended October 28, 2012, on page 13 of the Annual Stockholders’ Report for the fiscal year ended October 28, 2012, is incorporated herein by reference.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Information in the Management’s Discussion and Analysis of Financial Condition and Results of Operations on pages 14 through 30 of the Annual Stockholders’ Report for the fiscal year ended October 28, 2012, is incorporated herein by reference.

Item 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Information on the Company’s exposure to market risk included in the Management’s Discussion and Analysis of Financial Condition and Results of Operations on pages 29 and 30 of the Annual Stockholders’ Report for the fiscal year ended October 28, 2012, is incorporated herein by reference.

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Consolidated Financial Statements, including unaudited quarterly data, on pages 34 through 59 and the Report of Independent Registered Public Accounting Firm on page 33 of the Annual Stockholders’ Report for the fiscal year ended October 28, 2012, are incorporated herein by reference.

Item 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

Item 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

As of the end of the period covered by this report (the Evaluation Date), the Company carried out an evaluation, under the supervision and with the participation of management, including the Chief Executive Officer and the Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) of the Securities Exchange Act of 1934, as amended (the Exchange Act)). In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of the Evaluation Date, our disclosure controls and procedures were effective to provide reasonable assurance that information we are required to disclose in reports we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

Internal Control over Financial Reporting

(a) The report entitled “Management’s Report on Internal Control Over Financial Reporting” on page 31 of the Annual Stockholder’s Report for the fiscal year ended October 28, 2012, is incorporated herein by reference.

(b) The report entitled “Report of Independent Registered Public Accounting Firm” on page 32 of the Annual Stockholder’s Report for the fiscal year ended October 28, 2012, is incorporated herein by reference.

(c) During the fourth quarter of fiscal year 2012, there has been no change in the Company’s internal control over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act) that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

None.

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Information under “Item 1 - Election of Directors” on pages 2 through 6, information under “Board Independence” on pages 7 and 8, and information under “Board of Director and Committee Meetings” on pages 8 and 9 of the definitive proxy statement for the Annual Meeting of Stockholders to be held January 29, 2013, is incorporated herein by reference.

Information concerning Executive Officers is set forth in Part I, Item 1(f) of this Annual Report on Form 10-K, pursuant to Instruction 3 to Paragraph (b) of Item 401 of Regulation S-K.

Information under “Section 16(a) Beneficial Ownership Reporting Compliance,” on page 35 of the definitive proxy statement for the Annual Meeting of Stockholders to be held January 29, 2013, is incorporated herein by reference.

The Company has adopted a Code of Ethical Business Conduct in compliance with applicable rules of the Securities and Exchange Commission that applies to its principal executive officer, its principal financial officer, and its principal accounting officer or controller, or persons performing similar functions. A copy of the Code of Ethical Business Conduct is available on the Company’s Web site at www.hormelfoods.com, free of charge, under the caption, “Investors — Corporate Governance.” The Company intends to satisfy any disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of this Code of Ethical Business Conduct by posting such information on the Company’s Web site at the address and location specified above.

Item 11. EXECUTIVE COMPENSATION

Information commencing with “Executive Compensation” on page 14 through “Potential Payments Upon Termination at Fiscal 2012 Year End” on pages 30 and 31, and information under “Compensation of Directors” on pages 10 through 12 of the definitive proxy statement for the Annual Meeting of Stockholders to be held January 29, 2013, is incorporated herein by reference.

Item 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Information under “Equity Compensation Plan Information” on page 33, and information under “Security Ownership of Certain Beneficial Owners” and “Security Ownership of Management” on pages 13 and 14 of the definitive proxy statement for the Annual Meeting of Stockholders to be held January 29, 2013, is incorporated herein by reference.

Item 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Information under “Related Party Transactions” on pages 34 and 35 and “Board Independence” on pages 7 and 8 of the definitive proxy statement for the Annual Meeting of Stockholders to be held January 29, 2013, is incorporated herein by reference.

Item 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

Information under “Independent Registered Public Accounting Firm Fees” and “Audit Committee Preapproval Policies and Procedures” on pages 12 and 13 of the Company’s definitive proxy statement for the Annual Meeting of Stockholders to be held January 29, 2013, is incorporated herein by reference.

Item 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

The response to Item 15 is submitted as a separate section of this report.

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

HORMEL FOODS CORPORATION |

| |

|

|

|

| |

|

|

By: |

/s/ JEFFREY M. ETTINGER |

December 19, 2012 |

|

|

|

JEFFREY M. ETTINGER, Chairman of the |

Date |

|

|

|

Board, President, and Chief Executive Officer |

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Name |

|

Date |

|

Title |

|

|

|

|

|

|

|

/s/ JEFFREY M. ETTINGER |

|

12/19/12 |

|

Chairman of the Board, President, Chief Executive Officer, and Director (Principal Executive Officer) |

|

JEFFREY M. ETTINGER |

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

/s/ JODY H. FERAGEN |

|

12/19/12 |

|

Executive Vice President, Chief Financial Officer, and Director (Principal Financial Officer) |

|

JODY H. FERAGEN |

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

/s/ JAMES N. SHEEHAN |

|

12/19/12 |

|

Vice President and Controller (Principal Accounting Officer) |

|

JAMES N. SHEEHAN |

|

|

| |

|

|

|

|

|

|

|

|

|

12/19/12 |

|

Director |

|

TERRELL K. CREWS |

|

|

|

|

|

|

|

|

|

|

|

/s/ GLENN S. FORBES* |

|

12/19/12 |

|

Director |

|

GLENN S. FORBES |

|

|

|

|

|

|

|

|

|

|

|

/s/ STEPHEN M. LACY* |

|

12/19/12 |

|

Director |

|

STEPHEN M. LACY |

|

|

|

|

|

|

|

|

|

|

|

/s/ SUSAN I. MARVIN* |

|

12/19/12 |

|

Director |

|

SUSAN I. MARVIN |

|

|

|

|

|

|

|

|

|

|

|

/s/ JOHN L. MORRISON* |

|

12/19/12 |

|

Director |

|

JOHN L. MORRISON |

|

|

|

|

|

|

|

|

|

|

|

/s/ ELSA A. MURANO* |

|

12/19/12 |

|

Director |

|

ELSA A. MURANO |

|

|

|

|

|

|

|

|

|

|

|

/s/ ROBERT C. NAKASONE* |

|

12/19/12 |

|

Director |

|

ROBERT C. NAKASONE |

|

|

|

|

|

|

|

|

|

|

|

/s/ SUSAN K. NESTEGARD* |

|

12/19/12 |

|

Director |

|

SUSAN K. NESTEGARD |

|

|

|

|

|

|

|

|

|

|

|

/s/ DAKOTA A. PIPPINS* |

|

12/19/12 |

|

Director |

|

DAKOTA A. PIPPINS |

|

|

|

|

|

|

|

|

|

|

|

/s/ CHRISTOPHER J. POLICINSKI* |

|

12/19/12 |

|

Director |

|

CHRISTOPHER J. POLICINSKI |

|

|

|

|

|

|

|

|

|

|

|

*By: /s/ JAMES N. SHEEHAN |

|

12/19/12 |

|

|

|

JAMES N. SHEEHAN, |

|

|

|

|

|

as Attorney-In-Fact |

|

|

|

|

F-1

ANNUAL REPORT ON FORM 10-K

ITEM 15

LIST OF FINANCIAL STATEMENTS

FINANCIAL STATEMENT SCHEDULE

LIST OF EXHIBITS

FISCAL YEAR ENDED OCTOBER 28, 2012

HORMEL FOODS CORPORATION

Austin, Minnesota

F-2

Item 15

LIST OF FINANCIAL STATEMENTS AND FINANCIAL STATEMENT SCHEDULES

HORMEL FOODS CORPORATION

FINANCIAL STATEMENTS

The following consolidated financial statements of Hormel Foods Corporation included in the Annual Stockholders’ Report for the fiscal year ended October 28, 2012, are incorporated herein by reference in Item 8 of Part II of this report:

Consolidated Statements of Financial Position--October 28, 2012, and October 30, 2011.

Consolidated Statements of Operations--Fiscal Years Ended October 28, 2012, October 30, 2011, and October 31, 2010.

Consolidated Statements of Comprehensive Income--Fiscal Years Ended October 28, 2012, October 30, 2011, and October 31, 2010.

Consolidated Statements of Changes in Shareholders’ Investment--Fiscal Years Ended October 28, 2012, October 30, 2011, and October 31, 2010.

Consolidated Statements of Cash Flows--Fiscal Years Ended October 28, 2012, October 30, 2011, and October 31, 2010.

Notes to Financial Statements--October 28, 2012.

Report of Independent Registered Public Accounting Firm

FINANCIAL STATEMENT SCHEDULES

The following consolidated financial statement schedule of Hormel Foods Corporation required pursuant to Item 15(c) is submitted herewith:

Schedule II - Valuation and Qualifying Accounts and Reserves...F-3

FINANCIAL STATEMENTS AND SCHEDULES OMITTED

All other financial statements and schedules for which provision is made in the applicable accounting regulations of the Securities and Exchange Commission are not required under the related instructions or are inapplicable, and therefore have been omitted.

F-3

SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS AND RESERVES

HORMEL FOODS CORPORATION

(In Thousands)

|

|

|

|

|

Additions/(Benefits) |

|

|

|

|

| |||||||

|

|

|

Balance at |

|

Charged to |

|

Charged to |

|

|

|

Balance at |

| |||||

|

|

|

Beginning |

|

Costs and |

|

Other Accounts- |

|

Deductions- |

|

End of |

| |||||

|

Classification |

|

of Period |

|

Expenses |

|

Describe |

|

Describe |

|

Period |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Valuation reserve deduction from assets account: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Fiscal year ended October 28, 2012 |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Allowance for doubtful accounts |

|

|

|

|

|

|

|

$ |

169 |

(1) |

|

| ||||

|

receivable |

|

$ |

4,000 |

|

$ |

155 |

|

$ |

0 |

|

(14) |

(2) |

$ |

4,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Fiscal year ended October 30, 2011 |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Allowance for doubtful accounts |

|

|

|

|

|

|

|

$ |

233 |

(1) |

|

| ||||

|

receivable |

|

$ |

4,000 |

|

$ |

(149 |

) |

$ |

0 |

|

(382) |

(2) |

$ |

4,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Fiscal year ended October 31, 2010 |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Allowance for doubtful accounts |

|

|

|

|

|

|

|

$ |

340 |

(1) |

|

| ||||

|

receivable |

|

$ |

4,064 |

|

$ |

(307 |

) |

$ |

0 |

|

(583) |

(2) |

$ |

4,000 |

| |

Note (1) — Uncollectible accounts written off.

Note (2) — Recoveries on accounts previously written off.

LIST OF EXHIBITS

HORMEL FOODS CORPORATION

|

NUMBER |

|

DESCRIPTION OF DOCUMENT |

|

3.1(1) |

|

Restated Certificate of Incorporation as amended to date. (Incorporated by reference to Exhibit 3.1 to Hormel’s Quarterly Report on Form 10-Q for the quarter ended January 30, 2011, File No. 001-02402.) |

|

|

|

|

|

3.2(1) |

|

Bylaws as amended to date. (Incorporated by reference to Exhibit 3.2 to Hormel’s Quarterly Report on Form 10-Q for the quarter ended January 24, 2010, File No. 001-02402.) |

|

|

|

|

|

4.1(1) |

|

Indenture dated as of April 1, 2011, between the Company and U.S. Bank National Association. (Incorporated by reference to Exhibit 4.3 to Hormel’s Registration Statement on Form S-3 filed on April 4, 2011, File No. 333-173284.) |

|

|

|

|

|

4.2(1) |

|

Form of 4.125% Notes due 2021. (Incorporated by reference to Exhibit 4.1 to Hormel’s Current Report on Form 8-K dated April 11, 2011, File No. 001-02402.) |

|

|

|

|

|

4.3 |

|

Pursuant to Item 601(b)(4)(iii) of Regulation S-K, copies of instruments defining the rights of holders of certain long-term debt are not filed. Hormel agrees to furnish copies thereof to the Securities and Exchange Commission upon request. |

|

|

|

|

|

10.1(1)(3) |

|

Hormel Foods Corporation Operators’ Shares Incentive Compensation Plan. (Incorporated by reference to Appendix A to Hormel’s definitive Proxy Statement filed on December 19, 2012, File No. 001-02402.) |

|

|

|

|

|

10.2(1)(3) |

|

Hormel Foods Corporation Supplemental Executive Retirement Plan (2007 Restatement). (Incorporated by reference to Exhibit 10.2 to Hormel’s Current Report on Form 8-K dated November 21, 2011, File No. 001-02402.) |

|

|

|

|

|

10.3(1)(3) |

|

First Amendment of Hormel Foods Corporation Supplemental Executive Retirement Plan (2007 Restatement). (Incorporated by reference to Exhibit 10.3 to Hormel’s Current Report on Form 8-K dated November 21, 2011, File No. 001-02402.) |

|

|

|

|

|

10.4(1)(3) |

|

Second Amendment of Hormel Foods Corporation Supplemental Executive Retirement Plan (2007 Restatement). (Incorporated by reference to Exhibit 10.4 to Hormel’s Current Report on Form 8-K dated November 21, 2011, File No. 001-02402.) |

|

|

|

|

|

10.5(1)(3) |

|

Third Amendment of Hormel Foods Corporation Supplemental Executive Retirement Plan (2007 Restatement). (Incorporated by reference to Exhibit 10.5 to Hormel’s Current Report on Form 8-K dated November 21, 2011, File No. 001-02402.) |

|

|

|

|

|

10.6(1)(3) |

|

Hormel Foods Corporation 2000 Stock Incentive Plan (Amended 1-31-2006). (Incorporated by reference to Exhibit 10.1 to Hormel’s Current Report on Form 8-K dated January 31, 2006, File No. 001-02402.) |

|

|

|

|

|

10.7(1)(3) |

|

Hormel Foods Corporation Executive Deferred Income Plan II (November 21, 2011 Restatement). (Incorporated by reference to Exhibit 10.1 to Hormel’s Current Report on Form 8-K dated November 21, 2011, File No. 001-02402.) |

|

|

|

|

|

10.8(1)(3) |

|

Form of Indemnification Agreement for Directors and Officers. (Incorporated by reference to Exhibit 10.1 to Hormel’s Quarterly Report on Form 10-Q for the quarter ended April 29, 2012, File No. 001-02402.) |

|

|

|

|

|

10.9(1)(3) |

|

Hormel Foods Corporation Nonemployee Director Deferred Stock Plan (Plan Adopted October 4, 1999; Amended and Restated Effective January 1, 2008). (Incorporated by reference to Exhibit 10.6 to Hormel’s Annual Report on Form 10-K for the fiscal year ended October 26, 2008, File No. 001-02402.) |

|

|

|

|

|

10.10(1)(3) |

|

Hormel Foods Corporation 2009 Nonemployee Director Deferred Stock Plan (Plan Adopted November 24, 2008). (Incorporated by reference to Exhibit 10.2 to Hormel’s Quarterly Report on Form 10-Q for the quarter ended January 25, 2009, File No. 001-02402.) |

|

|

|

|

|

10.11(1)(3) |

|

Hormel Foods Corporation 2009 Long-Term Incentive Plan. (Incorporated by reference to Exhibit 10.1 to Hormel’s Current Report on Form 8-K dated January 27, 2009, File No. 001-02402.) |

LIST OF EXHIBITS (CONTINUED)

HORMEL FOODS CORPORATION

|

NUMBER |

|

DESCRIPTION OF DOCUMENT |

|

10.12(1)(3) |

|

Hormel Survivor Income Plan for Executives (1993 Restatement). (Incorporated by reference to Exhibit 10.11 to Hormel’s Annual Report on Form 10-K for the fiscal year ended October 29, 2006, File No. 001-02402.) |

|

|

|

|

|

10.13(1) |

|

Underwriting Agreement, dated as of April 4, 2011, by and between the Company and J.P. Morgan Securities LLC and Merrill Lynch, Pierce, Fenner, & Smith Incorporated as representatives of the several underwriters named in Schedule 1 thereto. (Incorporated by reference to Exhibit 1.1 to Hormel’s Current Report on Form 8-K dated April 11, 2011, File No. 001-02402.) |

|

|

|

|

|

11.1(2) |

|

Statement re: computation of per share earnings. (Included in Exhibit 13.1 filed with this Annual Report on Form 10-K for the fiscal year ended October 28, 2012.) |

|

|

|

|

|

13.1(2) |

|

Pages 13 through 62 of the Annual Stockholders’ Report for the fiscal year ended October 28, 2012. |

|

|

|

|

|

21.1(2) |

|

Subsidiaries of the Registrant. |

|

|

|

|

|

23.1(2) |

|

Consent of Independent Registered Public Accounting Firm. |

|

|

|

|

|

24.1(2) |

|

Power of Attorney. |

|

|

|

|

|

31.1(2) |

|

Certification Required Under Section 302 of the Sarbanes-Oxley Act of 2002. |

|

|

|

|

|

31.2(2) |

|

Certification Required Under Section 302 of the Sarbanes-Oxley Act of 2002. |

|

|

|

|

|

32.1(2) |

|

Certification Pursuant to 18 U.S.C. Section 1350 as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

|

|

|

|

|

99.1(1) |

|

U.S. $300,000,000 Revolving Credit Agreement, dated as of May 25, 2010, between the Company, Wells Fargo Bank, National Association, as Administrative Agent, and the lenders identified on the signature pages thereof. (Incorporated by reference to Exhibit 99 to Hormel’s Current Report on Form 8-K dated May 25, 2010, File No. 001-02402.) |

|

|

|

|

|

99.2(1) |

|

First Amendment to U.S. $300,000,000 Revolving Credit Agreement, dated as of May 25, 2010, between the Company, Wells Fargo Bank, National Association, as Administrative Agent, and the lenders identified on the signature pages thereof. (Incorporated by reference to Exhibit 99 to Hormel’s Current Report on Form 8-K dated November 22, 2011, File No. 001-02402.) |

|

|

|

|

|

101.INS(2) |

|

XBRL Instance Document |

|

|

|

|

|

101.SCH(2) |

|

XBRL Taxonomy Extension Schema Document |

|

|

|

|

|

101.CAL(2) |

|

XBRL Taxonomy Extension Calculation Linkbase Document |

|

|

|

|

|

101.DEF(2) |

|

XBRL Taxonomy Extension Definition Linkbase Document |

|

|

|

|

|

101.LAB(2) |

|

XBRL Taxonomy Extension Labels Linkbase Document |

|

|

|

|

|

101.PRE(2) |

|

XBRL Taxonomy Extension Presentation Linkbase Document |

(1) Document has previously been filed with the Securities and Exchange Commission and is incorporated herein by reference.

(2) These exhibits transmitted via EDGAR.

(3) Management contract or compensatory plan or arrangement.