UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a) of

the Securities Exchange Act of 1934 (Amendment

No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

HP INC. |

|

(Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Proxy Statement

|

|

“We welcome all our stockholders to join and participate in the meeting, regardless of location, by accessing the virtual meeting. We look forward to hearing from you and responding to your questions.” |

We are pleased to invite you to attend the annual meeting of stockholders of HP Inc. on Tuesday, April 23, 2019 at 2:00 p.m., Pacific Time. This year’s annual meeting will again be a virtual meeting of stockholders, conducted via live audio webcast. You will be able to attend the annual meeting of stockholders online and submit questions before and during the meeting by visiting www.hpannualmeeting.com or https://hp.onlineshareholdermeeting.com. You will also be able to vote your shares electronically at the annual meeting (other than shares held through our 401(k) Plan, which must be voted prior to the meeting).

We are embracing the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the Company. As we’ve learned, hosting a virtual meeting enables increased stockholder attendance and participation from locations around the world. In addition, the online format allows us to communicate more effectively via a pre-meeting forum that you can enter by visiting www.hpannualmeeting.com or www.proxyvote.com/HP.

Further details about how to attend the meeting online, submit questions before or during the meeting, and information on the business to be conducted at the annual meeting are included in the accompanying Notice of Annual Meeting and Proxy Statement.

We are again providing access to our proxy materials online under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to many of our stockholders a notice instead of a paper copy of this proxy statement and our 2018 Annual Report. The notice contains instructions on how to access documents online. The notice also contains instructions on how stockholders can receive a paper copy of our materials, including this proxy statement, our 2018 Annual Report, and a form of proxy card or voting instruction card. Those who do not receive a notice, including stockholders who have previously requested to receive paper copies of proxy materials, will receive a paper copy by mail unless they have previously requested delivery of materials electronically. This distribution process is more resource- and cost-efficient.

Your vote is important. Regardless of whether you participate in the annual meeting, we hope you vote as soon as possible. You may vote by proxy online or by phone, or, if you received paper copies of the proxy materials by mail, you may also vote by mail by following the instructions on the proxy card or voting instruction card. Voting online or by phone, written proxy or voting instruction card ensures your representation at the annual meeting regardless of whether you attend the virtual meeting.

Thank you for your ongoing support of, and continued interest in, HP Inc.

Sincerely,

Charles “Chip” V. Bergh

Chairman of the Board

| 2 |

|

www.hpannualmeeting.com |

Palo Alto, California 94304

(650) 857-1501

| Notice of Annual Meeting of Stockholders | ||

This notice of annual meeting, proxy statement and form of proxy for HP Inc. (“HP” or the “Company”) are being distributed and made available on or about February 26, 2019.

|

Time and Date | |

| 2:00 p.m., Pacific Time, on Tuesday, April 23, 2019 | |

| Place | |

| Online at www.hpannualmeeting.com or https://hp.onlineshareholdermeeting.com | |

| Voting | |

|

Internet |

|

www.hpannualmeeting.com or www.proxyvote.com/HP prior to the meeting. During the meeting please visit www.hpannualmeeting.com or https://hp.onlineshareholdermeeting.com | |

|

Telephone |

|

1-800-690-6903 | |

|

|

|

You can vote by mail by requesting a paper copy of the materials, which will include a proxy card. Return the card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. | |

|

| |

|

Your vote is very important. Regardless of whether you plan to virtually attend the annual meeting, we hope you will vote as soon as possible. You may vote your shares over the Internet or via a toll-free telephone number. If you received a paper copy of a proxy or voting instruction card by mail, you may submit your proxy or voting instruction card for the annual meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. Stockholders of record and beneficial owners will be able to vote their shares electronically at the annual meeting (other than shares held through the HP Inc. 401(k) Plan, which must be voted prior to the meeting). For specific instructions on how to vote your shares, please refer to the section entitled Questions and Answers—Voting Information beginning on page 68 of the proxy statement. | |

|

Items of Business Management Proposals | ||

| (1) |

To elect the 11 Directors named in this proxy statement | |

| (2) |

To ratify the appointment of the independent registered public accounting firm for the fiscal year ending October 31, 2019 | |

| (3) |

To approve, on an advisory basis, the Company’s executive compensation (“say on pay” vote) | |

|

Stockholder Proposals | ||

| (4) |

To consider and vote on a stockholder proposal, if properly presented at the meeting | |

| (5) |

Such other business as may properly come before the meeting | |

Virtual Meeting Admission

Stockholders of record as of February 22, 2019, will be able to participate in the annual meeting by visiting our annual meeting website www.hpannualmeeting.com or https://hp.onlineshareholdermeeting.com. To participate in the annual meeting, you will need the 16-digit control number included on your notice of Internet availability of the proxy materials, on your proxy card or on the instructions that accompanied your proxy materials.

The annual meeting will begin promptly at 2:00 p.m., Pacific Time. Online check-in will begin at 1:30 p.m., Pacific Time, and you should allow ample time for the online check-in procedures.

Annual Meeting Website and Pre-Meeting Forum

The online format used by HP Inc. for the annual meeting also allows us to communicate more effectively with you. Stockholders can access our pre-meeting forum, where you can submit questions in advance of the annual meeting, by visiting our annual meeting website at www.hpannualmeeting.com or www.proxyvote.com/HP. Stockholders can also access copies of our proxy statement and annual report at the annual meeting website.

Adjournments and Postponements

Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed.

Record Date

You are entitled to vote only if you were an HP Inc. stockholder as of the close of business on February 22, 2019.

By order of the Board of Directors,

Kim M. Rivera

President, Strategy and Business Management and

Chief Legal Officer, General Counsel and Secretary

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on April 23, 2019. The definitive proxy statement and HP Inc.’s 2018 Annual Report are available electronically at www.proxyvote.com/HP.

| Proxy Statement |

|

3 |

| Proxy Statement Summary | ||

The following is a summary of certain key disclosures in our proxy statement. This is only a summary, and it may not contain all of the information that is important to you. For more complete information, please review the proxy statement as well as our 2018 Annual Report, which includes our Annual Report on Form 10-K. References to “HP,” “the Company,” “we,” “us” or “our” refer to HP Inc. (formerly known as Hewlett-Packard Company (“HP Co.”)).

|

Management

Proposal No. 1  |

Election of Directors

The Board recommends a vote FOR each Director nominee

●Our Board is committed to independent oversight of HP.

●10 of our 11 Director nominees are independent.

●Our Board is led by an independent Chairman.

●Key information regarding all of our 11 Board nominees is summarized in the table below.

Further information beginning on page 11. Further information beginning on page 11. |

| Name Principal Occupation |

Age | HP Director Since |

Committees | Other Current Public Company/ Public Registrant Boards | ||||||

|

Aida M. Alvarez Independent |

69 |

2016 |

|

|

K12 Inc. | ||||

|

Shumeet Banerji Independent |

59 |

2011 |

|

|

Reliance Industries Ltd. | ||||

|

Robert R. Bennett Independent |

60 |

2013 |

|

|

Discovery Communications, Inc. Liberty Media Corporation | ||||

|

Charles “Chip” V. Bergh Independent |

61 |

2015 |

|

|

Levi Strauss & Co. | ||||

|

Stacy Brown-Philpot Independent |

43 |

2015 |

|

|

Nordstrom, Inc. | ||||

|

Stephanie A. Burns Independent |

64 |

2015 |

|

|

Corning Incorporated Kellogg Company | ||||

|

Mary Anne Citrino Independent |

59 |

2015 |

|

|

Barclays plc Royal Ahold Delhaize Alcoa Corporation | ||||

|

Yoky Matsuoka Independent |

46 |

2019 |

|

|

None | ||||

|

Stacey Mobley Independent |

73 |

2015 |

|

|

None | ||||

|

Subra Suresh Independent |

62 |

2015 |

|

|

Singapore Exchange Limited | ||||

|

Dion J. Weisler |

51 |

2015 |

Thermo Fisher Scientific Inc. | ||||||

|

Audit Committee |

|

Finance, Investment and Technology Committee |

|

HR and Compensation Committee |

|

Nominating, Governance and Social Responsibility Committee |

|

Chair |

| 4 |

|

www.hpannualmeeting.com |

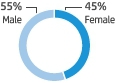

| Independence | Gender Diversity | Tenure (inc. HP Co. tenure) | ||

|

|

|

Governance Highlights

| ✓ | Robust board oversight and leadership by an independent Chairman (more details beginning on page 26). |

| ✓ | Our independent Chairman participates in a robust stockholder outreach program. |

| ✓ | Our independent Chairman leads and coordinates the annual performance evaluation of the CEO. |

| ✓ | Our independent Chairman oversees the Board and committee evaluations and recommends changes to improve Board, committee, and individual Director effectiveness. |

| ✓ | Our Bylaws provide our stockholders with a proxy access right. |

| ✓ | All members of our committees are independent. |

| ✓ | Our stockholders owning 15% or more of our common stock have a right to call special meetings. We lowered this right from 25% after engaging with our stockholders on how they would prefer to act outside of the annual meeting. |

| ✓ | Directors are elected annually by majority vote in uncontested Director elections. |

| ✓ | Each Director nominee has agreed to resign from the Board in the event that he or she fails to receive a majority vote. |

| ✓ | We have a robust and ongoing stockholder outreach program. |

| ✓ | Non-employee Directors are expected to own Company stock equal to at least five times their annual cash Board retainer within five years of joining the Board. |

|

Management

Proposal No. 2  |

Ratification of Independent Registered Public Accounting Firm

The Board recommends a vote FOR this Proposal

●The Audit Committee of the Board has selected Ernst & Young LLP to act as HP’s registered public accounting firm for the fiscal year ending October 31, 2019 and seeks ratification of the selection.

Further information beginning on page 36. Further information beginning on page 36. |

|

Management

Proposal No. 3  |

Advisory Vote to Approve Executive Compensation (“Say on Pay” Vote)

The Board recommends a vote FOR this Proposal

●Our Board and the HRC Committee are committed to excellence in corporate governance and to an executive compensation program that aligns the interests of our executives with those of our stockholders. To fulfill this mission, we have a pay-for-performance philosophy that forms the foundation for decisions regarding executive compensation.

●Our compensation programs have been structured to balance near-term results with long-term success, and enable us to attract, retain, focus, and reward our executive team for delivering stockholder value.

Further information, including an overview of the compensation of our Named Executive Officers (“NEOs”), beginning on page 38. Further information, including an overview of the compensation of our Named Executive Officers (“NEOs”), beginning on page 38. |

| Proxy Statement |

|

5 |

|

Stockholder

Proposal  |

Stockholder Proposal: Independent Board Chairman

The Board recommends a vote AGAINST this Proposal

●This stockholder proposal, which would require HP to amend its governance documents to require an independent Chairman of the Board, if properly presented, will be voted on at the annual meeting.

Further information beginning on page 65. Further information beginning on page 65. |

Business Overview and Performance

HP Inc. is a leading global provider of personal computing and other access devices, imaging and printing products, and related technologies, solutions and services. We sell to individual consumers, small- and medium-sized businesses and large enterprises, including customers in the government, health and education sectors. HP is comprised of the following business segments: Personal Systems, Printing, and Corporate Investments. In fiscal 2018, HP delivered profitable growth in both Personal Systems and Printing segments while investing strategically to fuel growth and capture the future.

Our continued efforts resulted in the following accomplishments:

| ● | Delivered revenue growth and margin expansion in Personal Systems, driven by innovation and focus on strategic growth areas such as Device as a Service. |

| ● | Executed effectively in Printing with consistent revenue and profit growth combined with progress in strategic growth areas including Graphics and A3 printing. |

| ● | Continued the integration of Samsung Electronics Co., Ltd.’s printer business expanding our A3 product portfolio and acquired Apogee Corporation, which enhanced our ability to deliver value-added services while accelerating the deployment of our superior technology into the growing A3 contractual market. |

| ● | Strengthened our leadership position in 3D printing by extending our product portfolio with the addition of full color and metals, expanding our application ecosystem, and increasing the number of repeat orders and larger scale customer deployments. |

| ● | Returned over $3.5 billion of capital to stockholders in the form of dividends and share repurchases. |

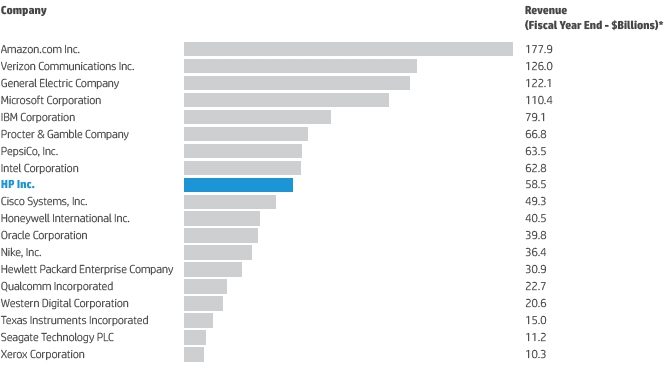

The global-macroeconomic and foreign-currency environment was challenging in fiscal 2018. Nevertheless, as illustrated below for the three key financial measures used to fund our annual pay-for-performance incentive awards, we exceeded rigorous goals that reflected our business plan. In the three years since we separated from Hewlett Packard Enterprise “HPE,” ending in fiscal 2018, our relative total shareholder return (“TSR”) performance has been in the top-quartile of the S&P 500, which attests to the rigor of our goals:

| Corporate Revenue | Corporate Net Earnings |

Corporate Free Cash Flow | ||

| $58.5 | $3.5 | 7.1% | ||

| billion | billion | |||

| (as defined on page 43) compared to a target goal of $54.7 billion under our annual incentive plan. | (as defined on page 43) compared to a target goal of $3.2 billion under our annual incentive plan. | (as a percentage of revenue; as defined on page 43) compared to a target goal of 5.85% under our annual incentive plan. |

As a company, we are delivering on our commitments to our stockholders and optimizing the business to consistently deliver long-term, sustainable and profitable growth. We are continuing to grow with profitable market share in our core expansion efforts, to advance our position in our growth segments, and to invest in future categories where we can disrupt with innovation and new business models. At the same time, we are focused on increasing productivity and taking cost out of the business. We have an incredible channel network, passionate employees and a culture committed to keep reinventing. And just as importantly, we are winning the right way with a sustainable impact framework focused on people, planet and the communities in which we operate.

| 6 |

|

www.hpannualmeeting.com |

| Alignment with Stockholders and Compensation Best Practices |

| Pay-for-Performance | Corporate Governance | |||

|

The majority of target total direct compensation for executives is performance-based as well as equity-based to align executives’ rewards with stockholder value. |

|

We do not utilize executive employment contracts for senior officers. | |

|

Total direct compensation is targeted at or near the market median. |

|

We devote significant time to management succession planning and leadership development efforts. | |

|

Actual realized total direct compensation and pay positioning are designed to fluctuate with, and be commensurate with, actual annual and long-term performance recognizing company-wide, business, and individual results. |

|

We maintain a market-aligned severance policy for executives and a conservative change in control policy which requires a double trigger for execution. | |

|

Incentive awards are heavily dependent upon our stock performance and are measured against objective financial metrics that we believe link either directly or indirectly to the creation of value for our stockholders. In addition, 25% of our target annual incentives are contingent upon the achievement of qualitative objectives that we believe will contribute to our long-term success. |

|

The HRC Committee engages an independent compensation consultant. | |

|

Our compensation programs are designed to mitigate compensation-related risk (both financial and reputational) and promote long-term growth for the organization by determining award payouts based on a wide range of performance goals. | |||

|

We maintain strong stock ownership guidelines for executive officers and non-employee Directors. | |||

|

We balance growth, cash flow, revenue and profit objectives, as well as short- and long-term objectives to reward for overall performance that does not over-emphasize a singular focus. |

|

We prohibit executive officers and Directors from engaging in any form of hedging transaction, holding HP securities in margin accounts and pledging stock as collateral for loans in a manner that could create compensation-related risk for the Company. | |

|

A significant portion of our long-term incentives are delivered in the form of performance-adjusted restricted stock units, referred to as “PARSUs,” which vest only upon the achievement of relative TSR and EPS objectives. |

|

We conduct a robust stockholder outreach program throughout the year. | |

|

We validate our pay-for-performance relationship on an annual basis and our HRC Committee is actively involved in the review and approval of performance goals under our incentive plans. |

|

We disclose our corporate performance goals and achievements relative to these goals. | |

|

The compensation of peer companies is considered in order to ensure that pay levels for the NEOs are appropriate and competitive. |

|

We do not provide excessive perquisites to our employees including our executive officers. | |

|

The maximum payouts under annual incentive awards and under long-term incentives (“PARSUs”) are capped. |

|

We do not allow our executives to participate in the determination of their own compensation. | |

| Proxy Statement |

|

7 |

Our primary focus in compensating executives is on the longer-term and performance-based elements of compensation. The table below shows our pay components, along with the role and factors for determining each pay component. The percentages are based on the average percentage among the NEOs including the CEO.

| Pay Component | Role | Determination Factors | ||

| Base Salary |

●Provides a fixed portion of annual cash income |

●Value of role in competitive marketplace

●Value of role to the Company

●Skills and performance of individual compared to the market as well as others in the Company | ||

|

||||

| Annual Incentive (i.e., Pay-for-Results (“PfR”)) |

●Provides a variable and performance-based portion of annual cash income

●Focuses executives on annual objectives that support the long-term strategy and creation of value |

●Target awards based on competitive marketplace, level of position, skills and performance of executive

●Actual awards based on achievement against annual corporate, business unit, and individual goals as set and approved by the HRC | ||

|

||||

| Payments to executives for annual PfR incentive purposes are made under the Stock Incentive Plan (the “Plan”) | ||||

| Long-term Incentives |

●Supports need for long-term sustained performance

●Aligns interests of executives and stockholders, reflecting the time-horizon and risk to investors

●Encourages equity ownership and stockholder alignment

●Retains key employees |

●Target awards based on competitive marketplace, level of position, skills and performance of the executive

●Actual values based on performance against corporate goals and total stockholder return (“TSR”) performance | ||

|

||||

|

●Restricted Stock Units (“RSUs”)

●Performance-Adjusted Restricted Stock Units (“PARSUs”) |

||||

| All others: |

●Supports the health and security of our executives and their ability to save on a tax-deferred basis

●Enhances executive productivity |

●Competitive market practices for similar roles

●Level of executive

●Standards of best-in-class governance |

||

|

●Benefits

●Perquisites

●Severance protection |

| 8 |

|

www.hpannualmeeting.com |

HP’s Board considers the appropriate format of the meeting on an annual basis. HP’s current virtual format allows stockholders to submit questions and comments in our stockholder forum both before and during the meeting. We respond to all stockholder submissions received through the forum in writing on our investor relations website. The virtual meeting format allows our stockholders to engage with us no matter where they live in the world, and is accessible and available on any internet-connected device, be it a phone, a tablet, or a computer. We’re able to reach a base of stockholders that is broader than just those who can afford to travel to an in-person meeting. The virtual meeting gives us the opportunity to respond in thoughtful detail to every question all of our stockholders may have, rather than just the limited number of questions stockholders are able to ask at in-person meetings, which are answered on the fly. All of these benefits of a virtual meeting allow our stockholders to have truly robust engagement with HP.

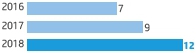

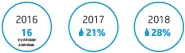

| Previous Virtual Meeting Highlights |

|

|

|

| Questions answered during the virtual annual meeting | Total questions asked and answered before and during the annual meeting | Meeting attendance year over year |

| |

| HP commits to answering every question received, in writing, within one week of the annual meeting. Please visit our HP investor events page at https://investor.hp.com to read previously answered questions. |

|

Please join us for our Virtual Annual Meeting at www.hpannualmeeting.com or https://hp.onlineshareholdermeeting.com |

|

|

|

| Stockholders can access our pre-meeting forum, where you can submit questions in advance of the annual meeting, by visiting our annual meeting website. All questions received, both during and prior to the meeting, are presented as submitted, uncensored and unedited with the exception of certain personal details for data protection purposes. If we receive substantially similar questions, we will group such questions together and provided a single response to avoid repetition. We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call: 1-855-449-0991 (Toll-free) |

| Proxy Statement |  | 9 |

| 10 |  | www.hpannualmeeting.com |

|

Election of Directors

The Board recommends a vote FOR each Director nominee |

The Board of Directors of HP Inc. (the “Board”) currently consists of eleven (11) Directors. On the recommendation of the Nominating, Governance and Social Responsibility (“NGSR”) Committee, the Board has nominated the 11 persons named below for election as Directors this year, each to serve for a one-year term and until the Director’s successor is elected and qualified or, if earlier, until his or her resignation or removal.

Each Director nominee who receives more “FOR” votes than “AGAINST” votes representing shares of HP common stock present in person or represented by proxy and entitled to be voted at the annual meeting will be elected.

If you sign your proxy or voting instruction card but do not give instructions with respect to voting for Directors, your shares will be voted by Dion J. Weisler, Steven J. Fieler and Kim M. Rivera, as proxy holders. If you wish to give specific instructions with respect to voting for Directors, you may do so by indicating your instructions on your proxy or voting instruction card.

Director Election Voting Standard and Resignation Policy

We have adopted a policy whereby any incumbent Director nominee who receives a greater number of votes “AGAINST” his or her election than votes “FOR” such election will tender his or her offer of resignation for consideration by the NGSR Committee. The NGSR Committee will then make a recommendation to the Board regarding the appropriate response to such an offer of resignation.

| Identifying and Evaluating Candidates for Directors |

The NGSR Committee uses a variety of methods for identifying and evaluating nominees for Director. The NGSR Committee, in consultation with the Chairman, regularly assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the NGSR Committee considers various potential candidates for Director. Candidates may come to the attention of the NGSR Committee through current Board members, professional search firms, stockholders or other persons. Identified candidates are evaluated at regular or special meetings of the NGSR Committee and may be considered at any point during the year. As described above, the NGSR Committee considers properly submitted stockholder recommendations of candidates for the Board to be included in our proxy statement. Following verification of the stockholder status of individuals proposing candidates, recommendations are considered collectively by the NGSR Committee at a regularly scheduled meeting, which is generally the first or second meeting prior to the issuance of the proxy statement for our annual meeting. If any materials are provided by a stockholder in connection with the nomination of a Director candidate, such materials are forwarded to the NGSR Committee. The NGSR Committee also reviews materials provided by professional search firms and other parties in connection with a nominee who is not proposed by a stockholder. In evaluating such nominations, the NGSR Committee seeks to achieve a balance of diverse knowledge, experience and capability on the Board. The NGSR Committee evaluates nominees recommended by stockholders using the same criteria it uses to evaluate all other candidates. In the case of Ms. Matsuoka, a third-party professional search firm identified her as a potential director nominee.

| Proxy Statement |  | 11 |

| Corporate Governance | |

| Stockholder Recommendations |

The policy of the NGSR Committee is to consider properly submitted stockholder recommendations of candidates for membership on the Board as described above under “Identifying and Evaluating Candidates for Directors.” In evaluating such recommendations, the NGSR Committee seeks to achieve a balance of diverse knowledge, experience and capability on the Board and to address the membership criteria set forth below. Any stockholder recommendations submitted for consideration by the NGSR Committee should include verification of the stockholder status of the person submitting the recommendation and the recommended candidate’s name and qualifications for Board membership and should be addressed to:

|

Corporate Secretary |

| Stockholder Nominations |

In addition, our Bylaws permit stockholders to nominate Directors for consideration at an annual stockholder meeting and, under certain circumstances, to include their nominees in the HP proxy statement. For a description of the process for nominating Directors in accordance with our Bylaws, see “Questions and Answers—Voting Information.”

| Director Nominees and Director Nominees’ Experience and Qualifications |

The Board annually reviews the appropriate skills and characteristics required of Directors in the context of the current composition of the Board, our operating requirements and the long-term interests of our stockholders. The Board believes that its members should possess a variety of skills, professional experience, and backgrounds in order to effectively oversee our business. In addition, the Board believes that each Director should possess certain attributes, as reflected in the Board membership criteria described below.

Our Corporate Governance Guidelines contain the current Board membership criteria that apply to nominees recommended for a position on the Board. Under those criteria, members of the Board should:

| ● | have the highest professional and personal ethics and values, consistent with our long-standing values and standards; |

| ● | have broad experience at the policy-making level in business, government, education, technology or public service; |

| ● | be committed to enhancing stockholder value and represent the interests of all of our stockholders; and |

| ● | have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience (which means that Directors’ service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all Director duties). |

In addition, the NGSR Committee takes into account a potential Director’s ability to contribute to the diversity of background (such as race, gender, and cultural background) and experience represented on the Board, and it reviews its effectiveness in balancing these considerations when assessing the composition of the Board. Although the Board uses these and other criteria as appropriate to evaluate potential nominees, it has no stated minimum criteria for nominees. Our Corporate Governance Guidelines can be found on our website at https://investor.hp.com/governance/ governance-documents/default.aspx.

All members of the HP Board are provided with opportunities for in-person and remote Director education on an ongoing basis, covering a variety on subjects relevant to HP. Recent topics have included strategy, innovation, people and culture development, best-practices in governance and leadership, industry updates and technology trends.

The Board believes that all the nominees named below are highly qualified, and have the skills and experience required for effective service on the Board. The biographies describe each Director’s qualifications and relevant experience in more detail. The biographies include key qualifications, skills, and attributes most relevant to the decision to nominate candidates to serve on the Board.

All of the nominees have indicated to us that they will be available to serve as Directors. In the event that any nominee should become unavailable, the proxy holders, Dion J. Weisler, Steven J. Fieler and Kim M. Rivera, will vote for a nominee or nominees designated by the Board, or the Board may choose to decrease the size of the Board or leave a vacancy on the Board.

There are no family relationships among our executive officers and Directors.

| 12 |  | www.hpannualmeeting.com |

| Corporate Governance | |

| HP’s Philosophy on Director Skills and Background |

|

Academics |

| |

| HP benefits from having leading academics in relevant fields sharing their expertise and providing valuable guidance on research trends and emerging areas of innovation. | |

|

Disruptive Innovation |

| |

| At HP we continually seek to reinvent the Print and PC industries to deliver amazing innovative experiences to our customers - having disruptive innovators on our Board helps inform our strategy and drive us forward. | |

|

Finance |

| |

| As a Fortune 100 company with a vast financial footprint, it’s essential that we have Directors with strong financial acumen and experience to provide sound oversight and guide our investment strategies. | |

|

Government |

| |

| Substantive government experience on our Board offers us insight into the regulatory environment of the many jurisdictions in which we operate, their legislative and administrative priorities, and the potential implications for our business. | |

|

International Business |

| |

| HP operates in 180 countries worldwide, making international business experience a vital perspective on our Board and enabling us to succeed in the many markets in which we operate. | |

|

Sustainability |

| |

| Sustainability fuels HP’s innovation and growth while strengthening our business for the long term. Directors with a background and interest in cutting-edge sustainability initiatives offer important leadership as we pursue a more sustainable future. | |

|

Technology |

| |

| With our deep history of innovation, we know that design, technology and user experience add valuable and vital components to our Board dialogue. | |

|

Operations |

| |

| HP operates one of the world’s largest supply chains, spanning a diverse mix of geographies, suppliers, contractors and partners – we benefit from Directors who have successfully led complex operations and can help us to optimize our business model. | |

|

Robust Business Experience |

| |

| As a large global company serving a diverse set of customer segments, HP requires a Board well-versed in navigating complexity and capitalizing on business opportunities to further our innovation and growth. | |

|

Science |

| |

| Cutting edge R&D, science and engineering have been core to HP’s success for decades – Directors with scientific backgrounds can provide technical advice and bring a deep understanding of the innovative core of our company. | |

|

Strategy |

| |

| The dynamic and fast-moving markets in which HP operates globally require a Board with strong strategic insights gained through multi-faceted and challenging prior experiences. | |

|

Engagement |

| |

| Engagement with our stockholders and customers provides HP’s Directors with a unique understanding of the Company and the individuals and institutions we serve worldwide. | |

Our Directors bring an extraordinary wealth of skills and backgrounds to the Board. From Subra Suresh, an acclaimed scientist whose background in microfluidics gives him key understanding into the future of technologies including 3D printing, to Stacy Brown-Philpot, CEO of TaskRabbit, a company at the forefront of today’s personal services-oriented disruptive technology boom, our Board members are advising us based on real world experiences. MacArthur Fellow Yoky Matsuoka brings her leadership and research and development experiences from acclaimed academic institutions and industry leading companies. Their skills are complementary. Chip Bergh’s experience at Procter & Gamble and now Levi’s means he can instantly grasp the complexities of our supply chain while Shumeet Banerji and Mary Anne Citrino both come from financial industry careers, lending keen eyes to our financial management, risk oversight and investment strategy. Former public company CEOs Stephanie Burns and Robert Bennett lend the benefit of their experience at the helms of companies and Aida Alvarez and Stacey Mobley provide perspectives from the fields of government and corporate law, respectively. Together, these Directors and their skills help us to keep reinventing.

| Proxy Statement |  | 13 |

| Corporate Governance | |

| International Experience of our Directors |

| North America | Europe | Asia | Australia | |||

|

|

|

|

| Collective Skills of the Director Nominees |

|

|

|

|

|

|

|

|

|

|

| ||

| Aida Alvarez |

Shumeet Banerji |

Robert R. Bennett |

Charles V. Bergh |

Stacy Brown- Philpot |

Stephanie A. Burns |

Mary Anne Citrino |

Yoky Matsuoka |

Stacey Mobley |

Subra Suresh |

Dion J. Weisler | ||

|

Academics |  |

|

|

|

|

|

|

|

|

|

|

|

Disruptive Innovation |

|

|

|

|

|

|

|

|

|

|

|

|

Engagement |  |

|

|

|

|

|

|

|

|

|

|

|

Finance |  |

|

|

|

|

|

|

|

|

|

|

|

Government |  |

|

|

|

|

|

|

|

|

|

|

|

International Business |

|

|

|

|

|

|

|

|

|

|

|

|

Operations |  |

|

|

|

|

|

|

|

|

|

|

|

Robust Business Experience |

|

|

|

|

|

|

|

|

|

|

|

|

Science |  |

|

|

|

|

|

|

|

|

|

|

|

Strategy |  |

|

|

|

|

|

|

|

|

|

|

|

Sustainability |  |

|

|

|

|

|

|

|

|

|

|

|

Technology |  |

|

|

|

|

|

|

|

|

|

|

|

Independent |  |

|

|

|

|

|

|

|

|

|

|

|

Diversity |  |

|

|

|

|

|

|

|

|

|

|

|

Tenure (including HP Co.) |

3 years | 8 years | 6 years | 4 years | 4 years | 4 years | 4 years | <1 year | 4 years | 4 years | 4 years |

| 14 |

|

www.hpannualmeeting.com |

| Corporate Governance | |

| Aida M. Alvarez | |

|

Current Role

●Chair, Latino Community Foundation (since 2003)

Current Public Company Boards

●HP

●K12 Inc.

Prior Public Company Boards

●MUFG Americas Holdings Corporation

●Wal-Mart Stores, Inc. Qualifications:

Prior Business and Other Experience

●Administrator, U.S. Small Business Administration (1997–2001)

●Director, Office of Federal Housing Enterprise Oversight (1993–1997)

●Vice President, First Boston Corporation and Bear Stearns & Co. (prior to 1993) |

|

Independent Director

Age 69

Director since 2016

HP Board Committees: HRC NGSR |

Other Key Qualifications

The Honorable Aida Alvarez brings to the Board a wealth of expertise in media, public affairs, finance, and government. She led important financial and government agencies and served in the Cabinet of U.S. President William J. Clinton. She has also been a public finance executive, has chaired a prominent philanthropic organization and was an award-winning journalist. The Board also benefits from Ms. Alvarez’s knowledge of investment banking and finance. |

Engagement  Finance  Government | |

| Shumeet Banerji | |

|

Current Role

●Co-founder and Partner of Condorcet, LP, an advisory and investment firm that specializes in developing early stage companies (since 2013)

Current Public Company Boards

●HP

●Reliance Industries Limited

Prior Public Company Boards

●Innocoll AG Qualifications:

Prior Business and Other Experience

●Senior Partner, Booz & Company, a consulting company (May 2012–March 2013)

●Chief Executive Officer, Booz & Company (July 2008–May 2012)

●President of the Worldwide Commercial Business, Booz Allen Hamilton (February 2008–July 2008)

●Managing Director, Europe, Booz Allen Hamilton (2007–2008)

●Managing Director, United Kingdom, Booz Allen Hamilton (2003–2007)

●Faculty, University of Chicago Graduate School of Business |

|

Independent Director

Age 59

Director since 2011

HP Board Committees: HRC NGSR, Chair |

Other Key Qualifications

Mr. Banerji brings to the Board a robust understanding of the issues facing companies and governments in both mature and emerging markets around the world through his two decades of work with Booz & Company. In particular, Mr. Banerji has valuable experience in addressing a variety of complex issues ranging from corporate strategy, organizational structure, governance, transformational change, operational performance improvement, and merger integration. |

Academics  Finance  International Business  Robust Business Experience  Strategy | |

| Proxy Statement |

|

15 |

| Corporate Governance | |

| Robert R. Bennett | |

|

Current Role

●Managing Director, Hilltop Investments, LLC, a private investment company (since 2005)

Current Public Company Boards

●HP

●Discovery Communications, Inc.

●Liberty Media Corporation

Prior Public Company Boards

●Sprint Corporation

●Demand Media, Inc.

●Discovery Holding Company

●Liberty Interactive Corporation

●Sprint Nextel Corporation Qualifications:

Prior Business and Other Experience

●President, Discovery Holding Company (2005–2008)

●President and Chief Executive Officer, Liberty Media Corporation (now Liberty Interactive Corporation) (prior to 2005) |

|

Independent Director

Age 60

Director since 2013

HP Board Committees: Audit FIT, Chair |

Other Key Qualifications

Mr. Bennett brings to the Board in-depth knowledge of the media and telecommunications industry and his knowledge of the capital markets and other financial and operational matters from his experience as the president and chief executive officer of another public company, which allows him to provide an important perspective to the Board’s discussions on financial and operational issues. Mr. Bennett also has an in-depth understanding of finance and has held various financial management positions during the course of his career. He also contributes valuable insight to the Board due to his experience serving on the boards of both public and private companies. |

Finance  Operations  Robust Business Experience  Strategy | |

| 16 |

|

www.hpannualmeeting.com |

| Corporate Governance | |

| Charles “Chip” V. Bergh | |

|

Current Role

●President, Chief Executive Officer, and Director of Levi Strauss & Co., an apparel/ retail company (since September 2011)

Current Public Company and Public Registrant Boards

●HP

●Levi Strauss & Co.

Prior Public Company Boards

●VF Corporation Qualifications:

Prior Business and Other Experience

●Group President, Global Male Grooming, Procter & Gamble Co. (2009–September 2011)

●In 28 years at Procter & Gamble, Mr. Bergh served in a variety of executive roles, including managing business in multiple regions worldwide |

|

Independent Chairman

of the Board

Age 61

Director since 2015

Chairman since 2017

HP Board Committees: HRC NGSR |

Other Key Qualifications

Mr. Bergh brings to the Board extensive experience in executive leadership at large global companies and international business management. From his more than 30 years at Levi Strauss and Procter & Gamble, Mr. Bergh has a strong operational and strategic background with significant experience in brand management. He also brings public company governance experience as a board member and chair of boards and board committees of other public and private companies. |

International Business  Operations  Robust Business Experience  Strategy | |

| Stacy Brown-Philpot | |

|

Current Role

●Chief Executive Officer, TaskRabbit, an online labor interface company (since April 2016)

Current Public Company Boards

●HP

●Nordstrom, Inc.

Prior Public Company Boards

●None Qualifications:

Prior Business and Other Experience

●Chief Operating Officer, TaskRabbit (January 2013-April 2016)

●Entrepreneur-in-Residence, Google Ventures, the venture capital investment arm of Google, Inc., a technology company (“Google”) (May 2012–December 2012)

●Senior Director of Global Consumer Operations, Google (2010–May 2012)

●Prior to 2010, Ms. Brown-Philpot served in a variety of Director-level positions at Google

●Prior to joining Google in 2003, Ms. Brown-Philpot served as a senior analyst and senior associate at the financial firms Goldman Sachs and PwC |

|

Independent Director

Age 43

Director since 2015

HP Board Committees: Audit NGSR |

Other Key Qualifications

Ms. Brown-Philpot brings to the Board extensive operational, analytical, financial, and strategic experience. In addition to her current role as CEO of TaskRabbit, Ms. Brown-Philpot’s decade of experience leading various operations at Google and her prior financial experience from her roles at Goldman Sachs and PwC provide unique operational and financial expertise to the Board. |

Disruptive Innovation  Finance  Operations  Robust Business Experience  Strategy | |

| Proxy Statement |

|

17 |

| Corporate Governance | |

| Stephanie A. Burns | |

|

Current Role

●Director

Current Public Company Boards

●HP

●Corning Incorporated

●Kellogg Company

Prior Public Company Boards

●Dow Corning Corporation

●GlaxoSmithKline plc

●Manpower, Inc. Qualifications:

Prior Business and Other Experience

●Chief Executive Officer, Dow Corning Corp., a silicon-based manufacturing company (2004–May 2011)

●President, Dow Corning (2003–November 2010)

●Executive Vice President, Dow Corning (2000–2003) |

|

Independent Director

Age 64

Director since 2015

HP Board Committees: FIT HRC, Chair |

Other Key Qualifications

Dr. Burns has more than 30 years of global innovation and business leadership experience and brings significant expertise in scientific research, product development, issues management, science and technology leadership, and business management to the Board. Dr. Burns also brings public company governance experience to the Board as a member of boards and board committees of other public companies. |

Finance  International Business  Operations  Robust Business Experience  Science  Strategy | |

| Mary Anne Citrino | |

|

Current Role

●Senior Advisor and former Senior Managing Director, The Blackstone Group, an investment firm (since 2004)

Current Public Company Boards

●HP

●Royal Ahold Delhaize

●Alcoa Corporation

●Barclays

Prior Public Company Boards

●Health Net, Inc.

●Dollar Tree Inc. Qualifications:

Prior Business and Other Experience

●Managing Director, Global Head of Consumer Products Investment Banking Group, and Co-head of Health Care Services Investment Banking, Morgan Stanley (1986–2004) |

|

Independent Director

Age 59

Director since 2015

HP Board Committees: Audit, Chair FIT |

Other Key Qualifications

Ms. Citrino’s more than 30-year career as an investment banker provides the Board with substantial knowledge regarding business operations strategy, as well as valuable financial and investment expertise. She also brings public company governance experience as a member of boards and board committees of other public companies. |

Finance  International Business  Strategy | |

| 18 |

|

www.hpannualmeeting.com |

| Corporate Governance | |

| Yoky Matsuoka | |

|

Current Role

●Vice President, Healthcare at Google, a

subsidiary of Alphabet Inc. (“Alphabet”), a technology company (since 2018)

Current Public Company Boards

●None

Prior Public Company Boards

●None

Qualifications:

Prior Business and Other Experience

●Chief Technology Officer, Nest, Alphabet

(2010-2015; 2017-2018)

●Executive experience in healthcare, Apple Inc.,

a technology company (May 2016-December 2016)

●Chief Executive Officer, Quanttus, a technology

company (2015-2016)

●Head of Innovation and Co-Founder, Google [X],

Alphabet (2009-2010)

●Academic experience including professorships at

Carnegie Mellon University and the University of Washington (2000-2011)

●MacArthur Fellow

(2007) |

|

Independent Director

Age 46

Director since 2019

HP Board Committees: Audit FIT |

Other Key Qualifications

Yoky Matsuoka is an accomplished executive and technologist who brings more than two decades of leadership experience to the HP Board. Throughout her career, she has held innovation-centric

roles in both Silicon Valley and in academia and brings her strong background in management, strategy and research & development to the Board. |

Academics  Disruptive Innovation  Finance  Robust Business Experience  Science  Technology | |

| Stacey Mobley | |

|

Current Role

●Director

Current Public Company Boards

●HP

Prior Public Company Boards

●International Paper Company Qualifications:

Prior Business and Other Experience

●Senior Counsel and Advisor, Dickstein Shapiro,

LLP, a law firm (2008–2016)

●Senior Vice President, Chief Administrative

Officer and General Counsel, E.I. du Pont de Nemours and Company (“DuPont”), a chemical company (1999–2008)

●35 years of experience at DuPont

(1973–2008) serving in a variety of leadership roles |

|

Independent Director

Age 73

Director since 2015

HP Board Committees: HRC NGSR |

Other Key Qualifications

Mr. Mobley’s more than 35 years of legal and senior management experience at DuPont brings a deep understanding of governance, regulations and risk management. He also brings public

company governance experience as a member of boards and board committees of other public and private companies. |

International Business  Operations  Robust Business Experience  Technology | |

| Proxy Statement |

|

19 |

| Corporate Governance | |

| Subra Suresh | |

|

Current Role

●President, Nanyang Technological University,

autonomous university in Singapore (since January 2018)

Current Public Company Boards

●HP

●Singapore Exchange Limited

Prior Public Company Boards

●None

Qualifications:

Prior Business and Other Experience

●Senior Advisor, Temasek International Private

Ltd., an investment company headquartered in Singapore (since September 2017)

●President, Carnegie Mellon University, a global

research university (July 2013–June 2017)

●Director, National Science Foundation, a federal

agency charged with advancing science and engineering research and education (October 2010–March 2013)

●Dean, School of Engineering, and the Vannevar

Bush Professor of Engineering, Massachusetts Institute of Technology (2007–2010) |

|

Independent Director

Age 62

Director since 2015

HP Board Committees: Audit FIT |

Other Key Qualifications

Mr. Suresh’s experience as the president of a prominent research university and his experience leading new entrepreneurship, innovations, and creativity efforts bring the Board valuable

insights with respect to strategic opportunities and a robust understanding of the organizational, scientific, and technological requirements of ongoing innovation. |

|

Disruptive Innovation  Finance  Government  Science  Strategy  Technology | |

| Dion J. Weisler | |

|

Current Role

●President and Chief Executive Officer, HP (since

November 2015)

Current Public Company Boards

●HP

●Thermo Fisher Scientific Inc.

Prior Public Company Boards

●None

Qualifications:

Prior Business and Other Experience

●Executive Vice President, the Printing and

Personal Systems Group, Hewlett-Packard Company (June 2013–November 2015)

●Senior Vice President and Managing Director,

Printing and Personal Systems, Asia Pacific and Japan, Hewlett-Packard Company (January 2012–June 2013)

●Vice President and Chief Operating Officer, the

Product and Mobile Internet Digital Home Groups, Lenovo Group Ltd. (January 2008–December 2011) |

|

President, Chief Executive

Officer and Director Age 51

Director since 2015

HP Board Committees: N/A |

Other Key Qualifications

Mr. Weisler’s international business and leadership experience provide the Board with an enhanced global perspective. Mr. Weisler’s more than 25 years of experience in the

information & technology industry and his position as HP’s Chief Executive Officer provide the Board with valuable industry insight and expertise. |

Disruptive Innovation  International Business  Operations  Robust Business Experience  Strategy  Technology | |

| 20 |

|

www.hpannualmeeting.com |

| Corporate Governance | |

We believe that effective corporate governance should include regular, constructive conversations with our stockholders. Over the past year, the Board has continued to engage with stockholders, including seeking and encouraging feedback from stockholders about our corporate governance practices by conducting stockholder outreach and engagement throughout the year. Our annual corporate governance investor outreach cycle, in which the Chair of the Board, Chair of the HRC and other Directors typically participate, is outlined below.

| Our Investor Outreach Calendar |

|

November 2017

●Q4 2017 HP Inc. Earnings Conference Call

●Credit Suisse Technology, Media &

Telecom Conference | ||

|

December 2017

●2017 Wells Fargo Tech Summit

●Global Mizuho Investor Conference (MIC) 2017

●Barclays Global Technology, Media & Telecommunications

Conference | |||

|

January 2018

●CES 2018

●Citi 2018 Global TMT West Conference

●2018 HP Inc. Sustainability Webcast |

|

Annual Stockholder outreach conducted* | |

|

February 2018

●Q1 2018 HP Inc. Earnings Conference Call

●Morgan Stanley Technology, Media & Telecom Conference,

San Francisco | |||

|

April 2018

●HP Inc. Annual Stockholder Meeting | |||

|

May 2018

●Q2 2018 HP Inc. Earnings Conference Call

●Bernstein’s 34th Annual Strategic Decisions

Conference (SDC) | |||

|

June 2018

●2018 Bank of America Merrill Lynch Global Technology

Conference | |||

|

August 2018

●Q3 2018 HP Inc. Earnings Conference Call |

|

Ongoing governance Stockholder outreach conducted | |

|

September 2018

●Citi 2018 Global Technology Conference

●HPQ 3D Printing Metal Jet Technology Briefing

●Deutsche Bank’s Technology

Conference | |||

|

October 2018

●HP Securities Analyst Meeting*

●HP Inc. Announces Fiscal 2019 Financial

Outlook | |||

| * |

Event attended by member(s) of the HP Board. |

In fiscal 2018, we conducted two outreach programs: the first in early 2018, as part of our annual investor outreach cycle, and the second in September and October 2018, as part of our outreach regarding our governance profile and the 2018 written consent proposal, described below. Through these two programs, we met or spoke with institutional investors representing more than 50% of our outstanding stock during fiscal 2018 as well as with proxy advisor firms.

| Proxy Statement |

|

21 |

| Corporate Governance | |

Response to 2018 Written Consent Proposal

HP values input from stockholders throughout the year. We currently afford stockholders the opportunity to act between annual meetings through the combination of a special meeting right as well as a robust stockholder outreach program that demonstrates our openness to direct stockholder engagement. At our 2018 Annual Meeting, holders of 37.5% of our outstanding shares expressed support for an advisory proposal to provide stockholders with the ability to act by written consent without a meeting of stockholders. Of the votes cast, 50.4% supported the proposal while 49.2% voted against it, with 0.3% abstaining.

In 2018, the Board recommended voting against this proposal for the following key reasons:

| ● |

HP’s commitment to good corporate governance; |

| ● |

the existing right of HP stockholders to call a special meeting of stockholders; and |

| ● |

the Board’s belief that the proposal would circumvent the protections, procedural safeguards and advantages provided to all stockholders by stockholder meetings. |

The Board remains concerned about the disruptive effect a stockholder written consent solicitation could have on the Board’s and stockholders’ ability to thoroughly consider significant corporate actions and possible alternatives. The Board also is mindful of the closeness of the written consent proposal vote at the 2018 Annual Meeting and the significant lack of consensus reflected in the vote, as well as the importance of respecting the perspectives expressed by all stockholders. The Board determined that, in light of these and other concerns raised regarding written consent, the appropriate approach would be to conduct further engagement with our stockholders to better understand the vote results and incorporate stockholder feedback into any actions we might take.

We view our relationships with stockholders and other stakeholders as fundamental to good corporate governance practices, and we have a strong record of stockholder engagement and responsiveness to stockholder concerns. We believe that effective corporate governance should include regular, constructive conversations with our stockholders. The Board and management have continued to seek out and encourage feedback from stockholders about our corporate governance practices by conducting annual stockholder outreach and engagement in January 2019. In addition, consistent with our commitment to soliciting and considering feedback from stockholders, during September and October 2018, and again in January 2019, we solicited specific feedback from our stockholders related to the written consent proposal to better understand how stockholders think about responsiveness in light of the closeness of the vote for the proposal. We also sought to assess from stockholders whether support for the proposal in fact represents a desire for written consent or was intended to convey other preferences or priorities (for example, a view that our original 25% threshold for calling a special meeting was higher than that particular stockholder preferred).

On this particular issue, HP representatives engaged with our 75 largest stockholders in September and October of 2018 and again in January of 2019, representing over 68% of our outstanding shares as of September 2018. We received feedback from stockholders that represented over 50% of our outstanding shares. Of those that provided feedback, approximately 60% (representing almost 30% of our outstanding shares at the time) voted against the proposal and almost 40% (representing over 20% of our outstanding shares at the time) voted for the proposal. Senior management and three members of the Board, including the Chair of the Board and the Chair of the HRC and a member of the NGSRC, then invited our top 20 stockholders, representing an aggregate of over 46% of our outstanding shares at the time, to engage in further discussions during our annual stockholder outreach program in January 2019.

During these interactions, we discussed HP’s record of strong governance practices and responsiveness to stockholder concerns. We specifically focused on the 2018 written consent proposal with our stockholders, explaining the Board’s reasons for opposing the proposal and asking the stockholders to provide their perspectives on the rationale underlying their particular vote decisions and on potential next steps for HP. Our stockholders were pleased to be consulted and overall expressed their appreciation of our current corporate governance profile, long record of engagement with and responsiveness to stockholders, commitment to transparency, and openness to addressing stockholders’ desires through a more accessible opportunity to act between annual meetings. Not one of the stockholders with whom we spoke raised any concerns or issues with the approach we took with respect to seeking additional feedback and conducting further engagement rather than unilaterally acting without the benefit of such additional outreach.

We heard the following key perspectives from our stockholders. First, a large majority of the stockholders we consulted prefer the right to call a special meeting over the right to act by written consent, expressing the views that the former is more protective of stockholders, accessible and inclusive, among other reasons. Nearly 76% of the stockholders we conversed with during our engagement (representing over 38% of our outstanding shares at the time) preferred that we consider lowering our special meeting threshold instead of implementing written consent. Many of those with whom we spoke volunteered that they had voted against the written consent proposal specifically because HP already afforded stockholders the right to call a special meeting. Many of these stockholders further noted they prefer the right to call a special meeting over the right to act by written consent because, while both provide stockholders an avenue to be heard outside the annual meeting cycle, special meetings better facilitate participation of all stockholders to discuss the topic under consideration through an orderly process.

Regardless of their views on the right to act by written consent, stockholders believed it was important that the Board appropriately respond to the various views expressed in the vote outcome regarding the written consent proposal, including through engagement. Before taking action, however, the Board wanted to understand how our stockholders would view the Board unilaterally amending our Bylaws to lower the special meeting threshold in lieu of adopting written consent, and whether they would consider this approach responsive to the close vote outcome on the written consent proposal.

| 22 |

|

www.hpannualmeeting.com |

| Corporate Governance | |

In addition to stockholder feedback, the Board considered the following factors when considering implementation of the proposal:

| ● |

the slim margin by which the proposal passed (50.4% of the votes cast, representing 37.5% of the outstanding shares), and the significant number of stockholders that opposed the proposal (49.2% of the votes cast); |

| ● |

the lack of consensus among our stockholders regarding whether written consent would in fact be a desirable feature if included in our governance profile; |

| ● |

a nearly identical written consent stockholder proposal having failed at our 2015 Annual Meeting, with support of only 43.3% of votes cast; |

| ● |

our special meeting threshold of 25% was appropriate at the time Hewlett-Packard Company adopted the right in 2007, and it continues to be the median threshold for stockholders to call a special meeting among S&P 500 companies; |

| ● |

evolving voting policies and guidelines of investors and third-party advisory firms regarding the ability to act in between annual meetings; |

| ● |

the rights we already provide our stockholders, which include the right to call a special meeting and nominate Directors to the Board through proxy access; and |

| ● |

our current stockholder base and the relatively constant presence of at least one stockholder that has owned or controlled the vote of more than ten percent of our outstanding shares over the past few years, which led the Board to believe a 15% threshold was appropriate for the right to call a special meeting. |

During our engagement, all stockholders we conversed with approved of or did not express an adverse view on the Board’s process in responding to the stockholder proposal and thoughtful approach to gathering feedback. Many stockholders even expressed the view that HP’s then-current governance regime, including the right for stockholders to call a special meeting at a 25% threshold, provides appropriate stockholder rights and that the Board did not need to take any action to provide additional stockholder rights. The Board and management, however, are mindful of some stockholders’ desires for accessible rights, and therefore concluded that non-action would not be necessarily responsive to stockholders’ concerns in our particular circumstances.

Accordingly, the Board determined it would be consistent with the wishes of the broadest group of our stockholders and responsive to the vote on the written consent proposal to facilitate the ability of stockholders to act in between annual meetings. Specifically, the Board determined, taking into account the feedback received from stockholders among other factors, to amend the existing stockholder right to call special meetings in our Bylaws to lower the threshold requirement to call a special meeting from 25% to 15% of our outstanding shares in lieu of adopting the right to act by written consent. This amendment was made effective as of February 7, 2019. We will continue to welcome stockholder feedback on these and other matters of importance to our investors and will incorporate such feedback appropriately into our decision-making actions and approach to engagement and governance.

Recent Corporate Governance Updates

HP’s corporate governance policies and practices are continuously evolving – from our time as Hewlett-Packard Company to our new identity as HP Inc., we’ve always led by example, adopting changes in line with our commitment to the highest standards of governance. Stockholder input has been key to our progression and as we continue to evolve our corporate governance policies and practices, we will continue to solicit feedback from our stockholders regarding our governance profile. The following examples highlight some of the key features of our corporate governance policies and practices, including updates we have recently made to strengthen our policies and practices:

| ● |

Our Board continues to believe that it is in the current best interests of our stockholders and the Company to have an independent Chairman. Accordingly, Chip Bergh has served as our independent Chairman since July 2017. |

| ● |

We continue to engage in a robust and ongoing stockholder engagement program. In fiscal 2018, in addition to our CEO and independent Chairman, the Chair of our HRC Committee also met with stockholders during our stockholder engagement program. In particular, as described in detail above, we also conducted robust outreach to stockholders in the fall of 2018 focused specifically on our governance profile and engaged in substantive discussions regarding desired responses to the 2018 stockholder proposal on stockholder action by written consent. |

| ● |

Since 2016, our NGSR Committee has reviewed and discussed our environmental, sustainability, diversity and social impact strategy at every regular meeting of the Committee, providing valuable advice and insights. As a result, in 2018 HP was awarded the highest possible score during ISS’s first-ever Environmental & Social (E&S) Disclosure QualityScore review process. For more information on our efforts in this space including our Sustainable Impact Report please visit https://www8.hp.com/us/en/hp-information/global-citizenship/index.html. |

| ● |

As described above, effective as of January 22, 2019, we have amended the stockholder right to call special meetings in our Bylaws to lower the threshold requirement to call such a meeting from 25% to 15% of our outstanding shares. We decided to amend this right after extensive outreach to our top 75 stockholders regarding their desired response to the 2018 stockholder proposal on stockholder action by written consent. |

| ● |

As part of our commitment to the highest standards of governance, in 2018 we became a signatory to the Commonsense Principles of Corporate Governance 2.0, a set of corporate governance principles we and the other signatories believe serve the best interests of U.S. corporations and financial markets. |

| Proxy Statement |

|

23 |

| Corporate Governance | |

| ● | We have evaluated our governance practices against the Corporate Governance Principles for U.S. Listed Companies published by the Investor Stewardship Group (“ISG”), a collective of some of the largest U.S.-based institutional investors and global asset managers, and we believe that our governance policies and practices are consistent with the ISG principles. The following table shows how certain of our key governance practices align with the ISG principles: |

| ISG Principle | HP Governance Policy or Practice | ||

|

Principle 1: |

Boards are accountable to stockholders. |

●Annual election of each Director, for a one-year term

●Proxy access that allows stockholder to nominate Directors

●Each Director has agreed to tender his or her resignation if they fail to receive a majority of votes cast

●Annual stockholder outreach program that typically includes the Chair of the Board, the Chair of the HRC and other Directors

●No poison pill

●Extensive disclosure of our corporate governance and Board practices | |

|

Principle 2: |

Stockholders should be entitled to voting rights in proportion to their economic interest. |

●One share, one vote | |

|

Principle 3: |

Boards should be responsive to stockholders and be proactive in order to understand their perspectives. |

●Directors participate in our stockholder outreach programs, including in our outreach regarding the 2018 written consent proposal

●Directors are available for stockholder engagement outside our engagement programs

●Many Directors participate in and attend our annual meeting, at which management and those Directors present respond to each stockholder question | |

|

Principle 4: |

Boards should have a strong, independent leadership structure. |

●Independent Chair of the Board, with clearly defined responsibilities

●Structure for a Lead Independent Director if the Chair is not independent

●Robust independent key committees and other structures for facilitating contribution of independent Directors | |

|

Principle 5: |

Boards should adopt structures and practices that enhance their effectiveness. |

●Ten of our eleven Director nominees are independent, with our Director nominees representing diverse backgrounds, skills and experiences

●Each Board committee is fully independent

●Track record of open dialogue between the Board and management

●Robust annual self-evaluation program | |

|

Principle 6: |

Boards should develop management incentive structures that are aligned with the long-term strategy of the company. |

●Performance-oriented LTI mix with metrics that support our long-term strategy

●Combination of short- and long-term performance goals

●Executive and Director share ownership requirements |

Our Corporate Governance Guidelines, which are available on our website at https://investor.hp.com/governance/governance-documents/default.aspx, provide that a substantial majority of the Board will consist of independent Directors and that the Board can include no more than three Directors who are not independent Directors. The independence standards can be found as Exhibit A to our Corporate Governance Guidelines. Our Director independence standards are consistent with, and in some respects more stringent than, the New York Stock Exchange (“NYSE”) Director independence standards. In addition, each member of the Audit Committee meets the heightened independence standards required for audit committee members under the applicable listing and the U.S. Securities and Exchange Commission (the “SEC”) standards and each member of the HRC Committee meets the heightened independence standards required for compensation committee members under the applicable listing standards and SEC standards.

| 24 |

|

www.hpannualmeeting.com |

| Corporate Governance | |

Under our Corporate Governance Guidelines, a Director will not be considered independent in the following circumstances:

| ● | The Director is, or has been within the last three years, an employee of HP, or an immediate family member of the Director is, or has been within the last three years, an executive officer of HP. |

| ● | The Director has been employed as an executive officer of HP, its subsidiaries or affiliates within the last five years. |

| ● | The Director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from HP, other than compensation for Board service, compensation received by a Director’s immediate family member for service as a non-executive employee of HP, and pension or other forms of deferred compensation for prior service with HP that is not contingent on continued service. |

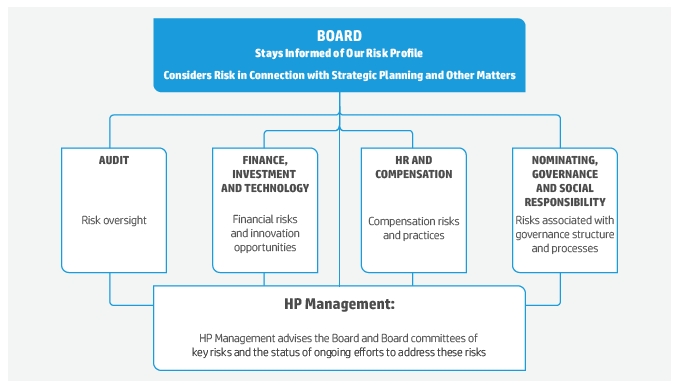

| ● | (A) The Director or an immediate family member is a current partner of the firm that is HP’s internal or external auditor; (B) the Director is a current employee of such a firm; (C) the Director has an immediate family member who is a current employee of such a firm and who personally worked on HP’s audit; or (D) the Director or an immediate family member was within the last three years (but is no longer) a partner or employee of such a firm and personally worked on HP’s audit within that time. |