QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

HEWLETT-PACKARD COMPANY |

||

(Name of Registrant as Specified In Its Charter) |

||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

||||

| Mark V. Hurd Chairman, Chief Executive Officer and President |

|

Hewlett-Packard Company 3000 Hanover Street Palo Alto, CA 94304 www.hp.com |

To our Stockholders:

I am pleased to invite you to attend the annual meeting of stockholders of Hewlett-Packard Company to be held on Wednesday, March 14, 2007 at 2 p.m., local time, at the Hyatt Regency Santa Clara, 5101 Great America Parkway, Santa Clara, California.

Details regarding admission to the meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

Your vote is important. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote over the Internet, by telephone or by mailing a proxy or voting instruction card. Voting over the Internet, by phone or by written proxy will ensure your representation at the annual meeting regardless of whether you attend in person. Please review the instructions on the proxy or voting instruction card regarding each of these voting options.

Thank you for your ongoing support of and continued interest in Hewlett-Packard Company.

Sincerely,

Mark V. Hurd

Chairman, Chief Executive Officer

and President

2007 ANNUAL MEETING OF STOCKHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | 1 | ||

| QUESTIONS AND ANSWERS | 2 | ||

| Proxy Materials | 2 | ||

| Voting Information | 3 | ||

| Stock Ownership Information | 7 | ||

| Annual Meeting Information | 8 | ||

| Stockholder Proposals, Director Nominations and Related Bylaw Provisions | 8 | ||

| Further Questions | 9 | ||

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | 10 | ||

| Board Policy Regarding Voting for Directors | 10 | ||

| Board Independence | 10 | ||

| HP's Director Independence Standards | 10 | ||

| Board Structure and Committee Composition | 11 | ||

| Director Nominees | 14 | ||

| Executive Sessions | 16 | ||

| Communications with the Board | 16 | ||

| DIRECTOR COMPENSATION AND STOCK OWNERSHIP GUIDELINES | 17 | ||

| PROPOSALS TO BE VOTED ON | 19 | ||

| PROPOSAL NO. 1 Election of Directors | 19 | ||

| PROPOSAL NO. 2 Ratification of Independent Registered Public Accounting Firm | 21 | ||

| PROPOSAL NO. 3 Stockholder Proposal Relating to Stockholder Nominees for Election to the HP Board | 22 | ||

| PROPOSAL NO. 4 Stockholder Proposal entitled "Separate the Roles of CEO and Chairman" | 24 | ||

| PROPOSAL NO. 5 Stockholder Proposal entitled "Subject Any Future Poison Pill to Shareholder Vote" | 26 | ||

| PROPOSAL NO. 6 Stockholder Proposal entitled "Link Pay to Performance" | 28 | ||

| COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 31 | ||

| Beneficial Ownership Table | 31 | ||

| Section 16(a) Beneficial Ownership Reporting Compliance | 33 | ||

| EXECUTIVE COMPENSATION | 34 | ||

| Summary Compensation Table | 34 | ||

| Option Grants in Last Fiscal Year | 37 | ||

| Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values | 38 | ||

| Long-Term Incentive Plans—Awards in Last Fiscal Year | 39 | ||

| Equity Compensation Plan Information | 41 | ||

| Employment Contracts, Termination of Employment and Change-in-Control Arrangements | 43 | ||

| Pension Plan | 48 | ||

| Report of the HR and Compensation Committee of the Board of Directors on Executive Compensation | 51 | ||

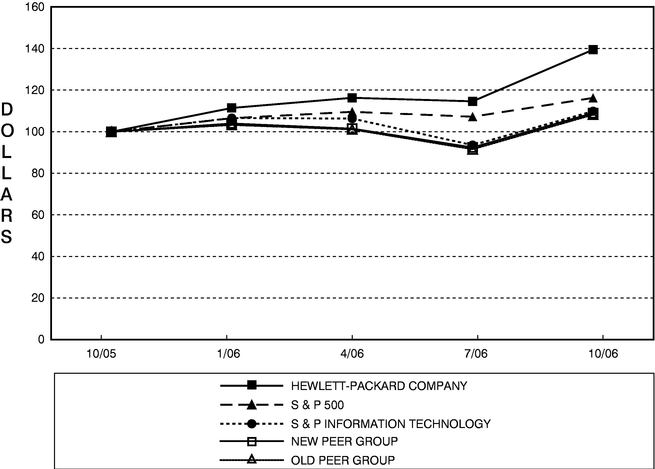

| Stock Performance Graphs | 58 | ||

| PRINCIPAL ACCOUNTANT FEES AND SERVICES | 59 | ||

| REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | 60 | ||

| APPENDIX A: AUDIT COMMITTEE CHARTER | A-1 | ||

| APPENDIX B: HR AND COMPENSATION COMMITTEE CHARTER | B-1 | ||

| APPENDIX C: NOMINATING AND GOVERNANCE COMMITTEE CHARTER | C-1 | ||

HEWLETT-PACKARD COMPANY

3000 Hanover Street

Palo Alto, California 94304

(650) 857-1501

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Time and Date | 2:00 p.m., local time, on Wednesday, March 14, 2007 | ||

Place |

Hyatt Regency Santa Clara, 5101 Great America Parkway, Santa Clara, California |

||

Items of Business |

(1) |

To elect directors |

|

(2) |

To ratify the appointment of the independent registered public accounting firm for the fiscal year ending October 31, 2007 |

||

(3) |

To consider and vote upon four stockholder proposals, if properly presented |

||

(4) |

To consider such other business as may properly come before the meeting |

||

Adjournments and Postponements |

Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed. |

||

Record Date |

You are entitled to vote only if you were an HP stockholder as of the close of business on January 16, 2007. |

||

Meeting Admission |

You are entitled to attend the annual meeting only if you were an HP stockholder as of the close of business on January 16, 2007 or hold a valid proxy for the annual meeting. You should be prepared to present photo identification for admittance. In addition, if you are a stockholder of record or hold your shares through the Hewlett-Packard Company 401(k) Plan or the Hewlett-Packard Company 2000 Employee Stock Purchase Plan, also known as the Share Ownership Plan, your ownership as of the record date will be verified prior to being admitted to the meeting. If you are not a stockholder of record but hold shares through a broker, trustee or nominee (i.e., in street name), you should provide proof of beneficial ownership as of the record date, such as your most recent account statement prior to January 16, 2007, a copy of the voting instruction card provided by your broker, trustee or nominee, or similar evidence of ownership. If you do not provide photo identification and comply with the other procedures outlined above, you will not be admitted to the annual meeting. |

||

The annual meeting will begin promptly at 2:00 p.m., local time. Check-in will begin at 12:30 p.m., local time, and you should allow ample time for the check-in procedures. |

|||

Voting |

Your vote is very important. Whether or not you plan to attend the annual meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. You may submit your proxy or voting instruction card for the annual meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided, or, in most cases, by using the telephone or the Internet. For specific instructions on how to vote your shares, please refer to the section entitled Questions and Answers—Voting Information beginning on page 3 of this proxy statement and the instructions on the proxy or voting instruction card. |

||

By order of the Board of Directors, |

|

CHARLES N. CHARNAS Acting General Counsel, Vice President and Assistant Secretary |

This notice of annual meeting and proxy statement and form of proxy are being distributed on or about January 23, 2007.

1. Why am I receiving these materials?

The Board of Directors (the "Board") of Hewlett-Packard Company, a Delaware corporation ("HP"), is providing these proxy materials for you in connection with HP's annual meeting of stockholders, which will take place on Wednesday, March 14, 2007. As a stockholder, you are invited to attend the annual meeting and are entitled to and requested to vote on the items of business described in this proxy statement.

2. What information is contained in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, HP's Board and Board committees, the compensation of directors and certain current and former executive officers for fiscal 2006, and other required information.

3. How may I obtain HP's Form 10-K and other financial information?

A copy of our 2006 Annual Report, which includes our 2006 Form 10-K, is enclosed.

Stockholders may request another free copy of our 2006 Annual Report, which includes our 2006 Form 10-K, from:

Hewlett-Packard Company

Attn: Investor Relations

3000 Hanover Street

Palo Alto, California 94304

(866) 438-4771 (U.S. and Canada) or (202) 315-4211 (International)

http://investor.hp.com/docreq.cfm

Alternatively, current and prospective investors can access the 2006 Annual Report, which includes our 2006 Form 10-K and other financial information, on HP's Investor Relations web site at:

http://investor.hp.com/edgar.cfm

HP also will furnish any exhibit to the 2006 Form 10-K if specifically requested.

4. How may I obtain a separate set of proxy materials?

If you share an address with another stockholder, you may receive only one set of proxy materials (including our 2006 Annual Report with our 2006 Form 10-K and proxy statement) unless you have provided contrary instructions. If you wish to receive a separate set of proxy materials now, please request the additional copies by contacting our proxy solicitor, Innisfree M&A Incorporated ("Innisfree"), at:

(877) 750-5838

(U.S. and Canada)

(412) 232-3651 (International)

E-mail: info@innisfreema.com

A separate set of proxy materials will be sent promptly following receipt of your request.

If you are a stockholder of record and wish to receive a separate set of proxy materials in the future, please call Computershare Investor Services, LLC ("Computershare") at:

(800) 286-5977

(U.S. and Canada)

(312) 360-5138 (International)

2

If you hold shares beneficially in street name and you wish to receive a separate set of proxy materials in the future, please call Automatic Data Processing, Inc. (ADP) at:

(800) 542-1061

All stockholders also may write to us at the address below to request a separate copy of these materials:

Hewlett-Packard

Company

Attn: Investor Relations

3000 Hanover Street

Palo Alto, California 94304

5. How may I request a single set of proxy materials for my household?

If you share an address with another stockholder and have received multiple copies of our proxy materials, you may write us at the address above to request delivery of a single copy of these materials.

6. How may I request an electronic copy of the proxy materials?

If you wish to request electronic delivery of proxy materials in the future, please sign up at:

http://www.hp.com/hpinfo/investor/financials/edelivery/

7. What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each HP proxy card and voting instruction card that you receive.

8. What items of business will be voted on at the annual meeting?

The items of business scheduled to be voted on at the annual meeting are:

- •

- The

election of directors

- •

- The

ratification of HP's independent registered public accounting firm for the 2007 fiscal year

- •

- The consideration of four stockholder proposals

We also will consider any other business that properly comes before the annual meeting. See question 19 "What happens if additional matters are presented at the annual meeting?" below.

9. How does the Board recommend that I vote?

Our Board recommends that you vote your shares "FOR" each of the nominees to the Board, "FOR" the ratification of HP's independent registered public accounting firm for the 2007 fiscal year, and "AGAINST" each of the stockholder proposals.

10. What shares can I vote?

Each share of HP common stock issued and outstanding as of the close of business on January 16, 2007, the Record Date, is entitled to be voted on all items being voted upon at the annual meeting. You may vote all shares owned by you as of this time, including (1) shares held directly in your name as the stockholder of record, including shares purchased through HP's Dividend Reinvestment Plan and HP's employee stock

3

purchase plans and shares held through HP's Direct Registration Service, and (2) shares held for you as the beneficial owner through a broker, trustee or other nominee such as a bank. On the Record Date HP had approximately 2,700,518,509 shares of common stock issued and outstanding.

11. How can I vote my shares in person at the annual meeting?

Shares held in your name as the stockholder of record may be voted in person at the annual meeting. Shares held beneficially in street name may be voted in person at the annual meeting only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the annual meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the meeting.

12. How can I vote my shares without attending the annual meeting?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the annual meeting. If you are a stockholder of record, you may vote by submitting a proxy. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee. For directions on how to vote, please refer to the instructions below and those included on your proxy card or, for shares held beneficially in street name, the voting instruction card provided by your broker, trustee or nominee.

By Internet—Stockholders of record of HP common stock with Internet access may submit proxies by following the "Vote by Internet" instructions on their proxy cards. Most HP stockholders who hold shares beneficially in street name may vote by accessing the website specified on the voting instruction cards provided by their brokers, trustees or nominees. Please check the voting instruction card for Internet voting availability.

By Telephone—Stockholders of record of HP common stock who live in the United States or Canada may submit proxies by following the "Vote by Telephone" instructions on their proxy cards. Most HP stockholders who hold shares beneficially in street name and live in the United States or Canada may vote by phone by calling the number specified on the voting instruction cards provided by their brokers, trustee or nominees. Please check the voting instruction card for telephone voting availability.

By Mail—Stockholders of record of HP common stock may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying pre-addressed envelopes. HP stockholders who hold shares beneficially in street name may vote by mail by completing, signing and dating the voting instruction cards provided and mailing them in the accompanying pre-addressed envelopes.

13. What is the deadline for voting my shares?

If you hold shares as the stockholder of record, or through the Hewlett-Packard Company 2000 Employee Stock Purchase Plan (the "Share Ownership Plan"), your vote by proxy must be received before the polls close at the annual meeting.

If you hold shares in the Hewlett-Packard Company 401(k) Plan (the "HP 401(k) Plan"), your voting instructions must be received by 11:59 p.m. Eastern time on March 11, 2007 for the trustee to vote your shares.

If you hold shares beneficially in street name with a broker, trustee or nominee, please follow the voting instructions provided by your broker, trustee or nominee.

14. May I change my vote?

You may change your vote at any time prior to the vote at the annual meeting, except that any change to your voting instructions for the HP 401(k) Plan must be provided by 11:59 p.m. Eastern time on March 11, 2007 as described above. If you are the stockholder of record, you may change your vote by granting a new

4

proxy bearing a later date (which automatically revokes the earlier proxy), by providing a written notice of revocation to the Corporate Secretary at the address below in question 27 prior to your shares being voted, or by attending the annual meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically make that request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, trustee or nominee, or, if you have obtained a legal proxy from your broker or nominee giving you the right to vote your shares, by attending the meeting and voting in person.

15. Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within HP or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide on their proxy card written comments, which are then forwarded to HP management.

16. How are votes counted?

In the election of directors, you may vote "FOR," "AGAINST" or "ABSTAIN" with respect to each of the nominees. If you elect to "ABSTAIN" in the election of directors, the abstention will not impact the election of directors. In tabulating the voting results for the election of directors, only "FOR" and "AGAINST" votes are counted. You also may cumulate your votes as described in question 18 "Is cumulative voting permitted for the election of directors?"

For the other items of business, you may vote "FOR," "AGAINST" or "ABSTAIN." If you elect to "ABSTAIN," the abstention has the same effect as a vote "AGAINST."

If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If you sign your proxy card or voting instruction card without giving specific instructions, your shares will be voted in accordance with the recommendations of the Board ("FOR" all of HP's nominees to the Board, "FOR" ratification of HP's independent registered public accounting firm, and "AGAINST" approval of each of the stockholder proposals).

For any shares you hold in the HP 401(k) Plan, if your voting instructions are not received by 11:59 p.m. Eastern time on March 11, 2007, your shares will be voted in proportion to the way the other HP 401(k) Plan participants vote their shares, except as may be otherwise required by law.

17. What is the voting requirement to approve each of the proposals?

In the election of directors, each director will be elected by the vote of the majority of votes cast with respect to that director nominee. A majority of votes cast means that the number of votes cast "FOR" a nominee's election must exceed the number of votes cast "AGAINST" such nominee's election. Each nominee receiving more "FOR" votes than "AGAINST" votes will be elected.

With respect to Proposal No. 3, HP believes that approval of the proposal requires the affirmative vote of sixty-six and two-thirds percent (662/3%) of the outstanding shares entitled to vote on the proposal at the meeting. All other proposals require the affirmative vote of a majority of those shares present in person or represented by proxy and entitled to vote on those proposals at the annual meeting.

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute "broker non-votes." Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the

5

outcome of any matter being voted on at the meeting, assuming that a quorum is obtained. Abstentions have the same effect as votes against the matter except in the election of directors, as described above.

18. Is cumulative voting permitted for the election of directors?

In the election of directors, you may elect to cumulate your vote. Cumulative voting will allow you to allocate among the director nominees, as you see fit, the total number of votes equal to the number of director positions to be filled multiplied by the number of shares you hold. For example, if you own 100 shares of stock and there are eight directors to be elected at the annual meeting, you may allocate 800 "FOR" votes (eight times 100) among as few or as many of the eight nominees to be voted on at the annual meeting as you choose. You may not cumulate your votes against a nominee.

If you choose to cumulate your votes, you will need to submit a proxy card or a ballot and make an explicit statement of your intent to cumulate your votes, either by so indicating in writing on the proxy card or by indicating in writing on your ballot when voting at the annual meeting. If you hold shares beneficially in street name and wish to cumulate votes, you should contact your broker, trustee or nominee.

If you sign your proxy card or voting instruction card with no further instructions, Mark V. Hurd and Charles N. Charnas, as proxy holders, may cumulate and cast your votes in favor of the election of some or all of the applicable nominees in their sole discretion, except that none of your votes will be cast for any nominee as to whom you vote against or abstain from voting.

Cumulative voting applies only to the election of directors. For all other matters, each share of common stock outstanding as of the close of business on the Record Date is entitled to one vote.

19. What happens if additional matters are presented at the annual meeting?

Other than the six items of business described in this proxy statement, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the persons named as proxy holders, Mark V. Hurd and Charles N. Charnas, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason any of our nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board.

20. Who will serve as inspector of elections?

The inspector of elections will be a representative from an independent firm, IVS Associates, Inc.

21. Who will bear the cost of soliciting votes for the annual meeting?

HP is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. We also have hired Innisfree to assist us in the distribution of proxy materials and the solicitation of votes described above. We will pay Innisfree a base fee of $15,000 plus customary costs and expenses for these services. HP has agreed to indemnify Innisfree against certain liabilities arising out of or in connection with its agreement. We also will reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy and solicitation materials to stockholders.

6

22. Where can I find the voting results of the annual meeting?

We intend to announce preliminary voting results at the annual meeting and publish final results in our quarterly report on Form 10-Q for the second quarter of fiscal 2007.

23. What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most HP stockholders hold their shares through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

If your shares are registered directly in your name with HP's transfer agent, Computershare, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by HP. As the stockholder of record, you have the right to grant your voting proxy directly to HP or to a third party, or to vote in person at the meeting. HP has enclosed a proxy card for you to use.

If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you together with a voting instruction card on behalf of your broker, trustee or nominee. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote and you also are invited to attend the annual meeting. Your broker, trustee or nominee has enclosed or provided voting instructions for you to use in directing the broker, trustee or nominee how to vote your shares.

Since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a "legal proxy" from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the meeting.

24. What if I have questions for HP's transfer agent?

Please contact HP's transfer agent, at the phone number or address listed below, with questions concerning stock certificates, dividend checks, transfer of ownership or other matters pertaining to your stock account.

Computershare

Investor Services, LLC

Shareholder Services

250 Royall Street

Canton, Massachusetts 02021

(800) 286-5977 (U.S. and Canada)

(312) 360-5138 (International)

A dividend reinvestment and stock purchase program is also available through Computershare. For information about this program, please contact Computershare at the following address or the phone number listed above:

Computershare

Trust Company

Dividend Reinvestment Services

250 Royall Street

Canton, Massachusetts 02021

7

25. How can I attend the annual meeting?

You are entitled to attend the annual meeting only if you were an HP stockholder or joint holder as of the close of business on January 16, 2007 or you hold a valid proxy for the annual meeting. You should be prepared to present photo identification for admittance. In addition, if you are a stockholder of record or hold your shares through the HP 401(k) Plan or the Share Ownership Plan, your name will be verified against the list of stockholders of record or plan participants on the record date prior to your admission to the annual meeting. If you are not a stockholder of record but hold shares through a broker, trustee or nominee (i.e., in street name), you should provide proof of beneficial ownership on the record date, such as your most recent account statement prior to January 16, 2007, a copy of the voting instruction card provided by your broker, trustee or nominee, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the annual meeting.

The meeting will begin promptly at 2:00 p.m., local time. Check-in will begin at 12:30 p.m., local time, and you should allow ample time for the check-in procedures.

26. How many shares must be present or represented to conduct business at the annual meeting?

The quorum requirement for holding the annual meeting and transacting business is that holders of a majority of shares of HP common stock entitled to vote must be present in person or represented by proxy. Both abstentions and broker non-votes described previously in question 17 are counted for the purpose of determining the presence of a quorum.

Stockholder Proposals, Director Nominations and Related Bylaw Provisions

27. What is the deadline to propose actions for consideration at next year's annual meeting of stockholders?

You may submit proposals for consideration at future stockholder meetings. For a stockholder proposal to be considered for inclusion in HP's proxy statement for the annual meeting next year, the Corporate Secretary must receive the written proposal at our principal executive offices no later than September 25, 2007. Such proposals also must comply with Securities and Exchange Commission ("SEC") regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to:

Corporate

Secretary

Hewlett-Packard Company

3000 Hanover Street

Palo Alto, California 94304

Fax: (650) 857-4837

For a stockholder proposal that is not intended to be included in HP's proxy statement under Rule 14a-8, the stockholder must provide the information required by HP's Bylaws and give timely notice to the Corporate Secretary in accordance with HP's Bylaws, which, in general, require that the notice be received by the Corporate Secretary:

- •

- Not

earlier than the close of business on November 9, 2007, and

- •

- Not later than the close of business on December 10, 2007.

If the date of the stockholder meeting is moved more than 30 days before or 60 days after the anniversary of the HP annual meeting for the prior year, then notice of a stockholder proposal that is not intended to be included in HP's proxy statement under Rule 14a-8 must be received not earlier than the close of

8

business 120 days prior to the meeting and not later than the close of business on the later of the following two dates:

- •

- 90 days

prior to the meeting; and

- •

- 10 days after public announcement of the meeting date.

28. How may I recommend or nominate individuals to serve as directors?

You may propose director candidates for consideration by the Board's Nominating and Governance Committee. Any such recommendations should include the nominee's name and qualifications for Board membership and should be directed to the Corporate Secretary at the address of our principal executive offices set forth in question 27 above.

In addition, HP's Bylaws permit stockholders to nominate directors for election at an annual stockholder meeting. To nominate a director, the stockholder must deliver the information required by HP's Bylaws and a statement by the nominee acknowledging that he or she will owe a fiduciary obligation to HP and its stockholders.

29. What is the deadline to propose or nominate individuals to serve as directors?

A stockholder may send a proposed director candidate's name and information to the Board at anytime. Generally, such proposed candidates are considered at the Board meeting prior to the annual meeting.

To nominate an individual for election at an annual stockholder meeting, the stockholder must give timely notice to the Corporate Secretary in accordance with HP's Bylaws, which, in general, require that the notice be received by the Corporate Secretary between the close of business on November 9, 2007 and the close of business on December 10, 2007, unless the annual meeting is moved by more than 30 days before or 60 days after the anniversary of the prior year's annual meeting, in which case the deadline will be as described in question 27.

30. How may I obtain a copy of HP's Bylaw provisions regarding stockholder proposals and director nominations?

You may contact the Corporate Secretary at our principal executive offices for a copy of the relevant Bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates. HP's Bylaws also are available on HP's website at http://www.hp.com/hpinfo/investor/bylaws.html.

31. Who can help answer my questions?

If you have any questions about the annual meeting or how to vote or revoke your proxy, you should contact HP's proxy solicitor:

Innisfree

M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Stockholders: (877) 750-5838 (U.S. and Canada)

(412) 232-3651 (International)

Banks and brokers (call collect):

(212) 750-5833

If you need additional copies of this proxy statement or voting materials, please contact Innisfree as described above or send an e-mail to info@innisfreema.com.

9

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

HP is committed to maintaining the highest standards of business conduct and corporate governance, which we believe are essential to running our business efficiently, serving our stockholders well and maintaining HP's integrity in the marketplace. HP has adopted a code of business conduct and ethics for directors, officers (including HP's principal executive officer, principal financial officer and controller) and employees, known as the Standards of Business Conduct. HP also has adopted Corporate Governance Guidelines, which, in conjunction with the Certificate of Incorporation, Bylaws and Board committee charters, form the framework for governance of HP. All of these documents are available at http://www.hp.com/investor/corp_governance. HP will post on this web site any amendments to the Standards of Business Conduct or waivers of the Standards of Business Conduct for directors and executive officers.

Stockholders may request free printed copies of the Standards of Business Conduct, the Corporate Governance Guidelines and the Board committee charters from:

Hewlett-Packard

Company

Attention: Investor Relations

3000 Hanover Street

Palo Alto, California 94304

(866) GET-HPQ1 or (866) 438-4771

http://www.hp.com/investor/home

Board Policy Regarding Voting for Directors

HP has implemented a majority vote standard in the election of directors. In addition, HP has adopted a policy whereby any incumbent director nominee who receives a greater number of votes "against" his or her election than votes "for" such election will tender his or her resignation for consideration by the Nominating and Governance Committee. The Nominating and Governance Committee will recommend to the Board the action to be taken with respect to such offer of resignation.

HP's Corporate Governance Guidelines provide that a substantial majority of the Board will consist of independent directors. The Board has determined that each of the non-employee director nominees standing for election, including Lawrence T. Babbio, Jr., Sari M. Baldauf, Richard A. Hackborn, John H. Hammergren, Robert L. Ryan, Lucille S. Salhany and G. Kennedy Thompson, and each of the members of each Board committee has no material relationship with HP (either directly or as a partner, stockholder or officer of an organization that has a relationship with HP) and is independent within the meaning of HP's director independence standards. These standards are available on our web site at http://www.hp.com/investor/director_standards. These standards reflect New York Stock Exchange, Inc. and NASDAQ Global Select Market, Inc. corporate governance listing standards. In addition, each member of the Audit Committee meets the heightened independence standards required for audit committee members under the applicable listing standards.

HP's Director Independence Standards

In determining independence, the Board reviews whether directors have any material relationship with HP. The Board considers all relevant facts and circumstances. In assessing the materiality of a director's relationship to HP, the Board considers the issues from the director's standpoint and from the perspective of the persons or organizations with which the director has an affiliation and is guided by the standards set forth below. The Board reviews commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships. An independent director must not have any material relationship with HP, either directly or as a partner, stockholder or officer of an organization that has a

10

relationship with HP, or any relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

A director will not be considered independent in the following circumstances:

- (1)

- The

director is, or has been in the past three years, an employee of HP, or an immediate family member of the director is, or has been in the past three years, an executive officer of

HP.

- (2)

- The

director has received, or has an immediate family member who has received during any twelve-month period within the last three years, more than $60,000 in direct compensation from

HP, other than compensation for Board service, compensation received by the director's immediate family member for service as a non-executive employee of HP, and pension or other forms of

deferred compensation for prior service with HP that is not contingent on continued service.

- (3)

- (A) The

director or an immediate family member is a current partner of the firm that is HP's internal or external auditor; (B) the director is a current employee of such

a firm; (C) the director has an immediate family member who is a current employee of such a firm and who participates in the firm's audit, assurance or tax compliance (but not tax planning)

practice; or (D) the director or an immediate family member is or was within the last three years (but is no longer) a partner or employee of such a firm and personally worked on HP's audit

within that time.

- (4)

- The

director or an immediate family member is, or has been in the past three years, employed as an executive officer of another company where any of HP's present executive officers at

the same time serves or has served on that company's compensation committee.

- (5)

- The

director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, HP for property or

services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of the recipient's consolidated gross revenues.

- (6)

- The director is, or has an immediate family member who is, a partner in, or a controlling stockholder or an executive officer of, any organization to which HP made, or from which HP received, payments for property or services in the current or any of the past three fiscal years that exceed the greater of 5% of the recipient's consolidated gross revenues for that year, or $200,000.

For these purposes, an "immediate family" member includes a director's spouse, parents, children, siblings, mother-and father-in-law, sons-and daughters-in-law, brothers-and sisters-in-law, and anyone who shares the director's home.

Board Structure and Committee Composition

As of the date of this proxy statement, our Board has nine directors and the following four standing committees: (1) Acquisitions, (2) Audit, (3) HR and Compensation, and (4) Nominating and Governance. The Technology Committee was dissolved on November 16, 2006. The committee membership and meetings during the last fiscal year and the function of each of the standing committees are described below. Each of the standing committees operates under a written charter adopted by the Board. All of the committee charters are available on HP's website at http://www.hp.com/investor/board_charters. During fiscal 2006, the Board held 17 meetings. Each current director attended at least 75% of all Board and

11

applicable standing committee meetings. Directors are encouraged to attend annual meetings of HP stockholders. All then-current directors attended the last annual meeting of stockholders.

| |

||||||||

|---|---|---|---|---|---|---|---|---|

| Name of Director |

Acquisitions |

Audit |

HR and Compensation |

Nominating and Governance |

||||

| Non-Employee Directors: | ||||||||

| Lawrence T. Babbio, Jr. | Chair | Chair | Member | |||||

| Sari M. Baldauf(1) | Member | |||||||

| Richard A. Hackborn(2) | ||||||||

| John H. Hammergren(3) | Member | Member | ||||||

| Robert L. Ryan | Member | Chair | ||||||

| Lucille S. Salhany(4) | Member | Member | Chair | |||||

| G. Kennedy Thompson(5) | Member | |||||||

| Employee Directors | ||||||||

| Mark V. Hurd | ||||||||

| Robert P. Wayman | ||||||||

| Former Directors | ||||||||

| Patricia C. Dunn(6) | * | |||||||

| George A. Keyworth II(7) | * | * | ||||||

| Thomas J. Perkins(8) | * | |||||||

| Number of Meetings in Fiscal 2006 | 7 | 14 | 8 | 9 | ||||

* = Former Committee Chair or member

- (1)

- Ms. Baldauf

was elected to the Board effective March 16, 2006. She joined the Audit Committee effective May 18, 2006.

- (2)

- Mr. Hackborn

became the lead independent director on September 22, 2006.

- (3)

- Mr. Hammergren

joined the Nominating and Governance Committee after the annual meeting of stockholders in March 2006 and attended his first committee meeting in May 2006.

- (4)

- Ms. Salhany

was appointed to the Audit Committee on September 19, 2006 and became the Chair of the Nominating and Governance Committee on September 14, 2006.

- (5)

- Mr. Thompson

was elected to the Board effective November 16, 2006 and appointed to the Audit Committee effective November 27, 2006.

- (6)

- Ms. Dunn

resigned from the Board on September 22, 2006.

- (7)

- Dr. Keyworth

resigned from the Board on September 12, 2006.

- (8)

- Mr. Perkins resigned from the Board on May 18, 2006.

On May 18, 2006, during a meeting of the Board, Thomas J. Perkins resigned as a director. During the meeting or in subsequent correspondence, Mr. Perkins stated that he objected to the process surrounding the decision of the Board to request another director to resign due to that director's disclosure of confidential information about HP, specifically the then Chairman's decision to bring the matter to the full Board and the manner in which the meeting was conducted, and that he questioned the wisdom and propriety of the investigation and the methods that the then Chairman employed in conducting the investigation.

Acquisitions Committee

The Acquisitions Committee assists the Board in overseeing HP's investment, acquisition, managed services, joint venture and divestiture transactions as part of HP's business strategy. The Acquisitions Committee evaluates and revises policies with respect to such transactions, and reviews and approves proposed transactions in accordance with such policies. The Acquisitions Committee also oversees HP's integration planning and execution and the financial results of transactions after integration.

12

The charter of the Acquisitions Committee is available at http://www.hp.com/investor/acquisitions_charter. A free printed copy also is available to any stockholder who requests it from the address on page 10.

Audit Committee

HP has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The Audit Committee assists the Board in fulfilling its responsibilities for generally overseeing HP's financial reporting processes and the audit of HP's financial statements, including the integrity of HP's financial statements, HP's compliance with legal and regulatory requirements, the qualifications and independence of the independent registered public accounting firm, the performance of HP's internal audit function and the independent registered public accounting firm, risk assessment and risk management, and finance and investment functions. Among other things, the Audit Committee prepares the Audit Committee report for inclusion in the annual proxy statement; annually reviews its charter and performance; appoints, evaluates and determines the compensation of the independent registered public accounting firm; reviews and approves the scope of the annual audit, the audit fee and the financial statements; reviews and approves all permissible non-audit services to be performed by the independent registered public accounting firm; reviews HP's disclosure controls and procedures, internal controls, information security policies, internal audit function, and corporate policies with respect to financial information and earnings guidance; reviews regulatory and accounting initiatives and off-balance sheet structures; oversees HP's compliance programs with respect to legal and regulatory requirements; oversees investigations into complaints concerning financial matters; reviews other risks that may have a significant impact on HP's financial statements; reviews the activities of the Investment Review Committee; reviews and oversees treasury matters, HP's loans and debt, loan guarantees and outsourcings; reviews HP Financial Services' capitalization and operations; reviews the activities of Investor Relations; and coordinates with the HR and Compensation Committee regarding the cost, funding and financial impact of HP's equity compensation plans and benefit programs. The Audit Committee works closely with management as well as the independent registered public accounting firm. The Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding from HP for, outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

The Board determined that each of Robert L. Ryan, Chair of the Audit Committee, and Audit Committee members Sari M. Baldauf, Lucille S. Salhany and G. Kennedy Thompson is independent pursuant to applicable listing standards governing audit committee members. The Board also determined that each of Robert L. Ryan, Sari M. Baldauf and G. Kennedy Thompson is an audit committee financial expert as defined by SEC rules and applicable listing standards.

The report of the Audit Committee is included herein on page 60. The charter of the Audit Committee is available at http://www.hp.com/investor/audit_charter and also is included herein as Appendix A. A free printed copy also is available to any stockholder who requests it from the address on page 10.

HR and Compensation Committee

The HR and Compensation Committee discharges the Board's responsibilities relating to the compensation of HP's executives and directors; prepares the report required to be included in the annual proxy statement; provides general oversight of HP's total rewards compensation structure; reviews and provides guidance on HP's human resources programs; and retains and approves the terms of the retention of compensation consultants and other compensation experts. Other specific duties and responsibilities of the HR and Compensation Committee include reviewing senior management selection and overseeing succession planning, including reviewing the leadership development process; reviewing and approving objectives relevant to executive officer compensation, evaluating performance and determining the

13

compensation of executive officers in accordance with those objectives; approving severance arrangements and other applicable agreements for executive officers; overseeing HP's equity-based and incentive compensation plans; overseeing non-equity based benefit plans and approving any changes to such plans involving a material financial commitment by HP; monitoring workforce management programs; establishing compensation policies and practices for service on the Board and its committees; developing guidelines for and monitoring director and executive stock ownership; and annually evaluating its performance and its charter.

The report of the HR and Compensation Committee is included herein beginning on page 51. The charter of the HR and Compensation Committee is available at http://www.hp.com/investor/compensation_charter and also is included herein as Appendix B. A free printed copy is available to any stockholder who requests it from the address on page 10.

Nominating and Governance Committee

The Nominating and Governance Committee recommends candidates to be nominated for election as directors at HP's annual meeting, consistent with criteria approved by the Board; develops and regularly reviews corporate governance principles and related policies for approval by the Board; oversees the organization of the Board to discharge the Board's duties and responsibilities properly and efficiently; and sees that proper attention is given and effective responses are made to stockholder concerns regarding corporate governance. Other specific duties and responsibilities of the Nominating and Governance Committee include: annually assessing the size and composition of the Board, including developing and reviewing director qualifications for approval by the Board; identifying and recruiting new directors and considering candidates proposed by stockholders; recommending assignments of directors to committees to ensure that committee membership complies with applicable laws and listing standards; conducting a preliminary review of director independence and financial literacy and expertise of Audit Committee members and making recommendations to the Board relating to such matters; and overseeing director orientation and continuing education. The Nominating and Governance Committee also reviews proposed changes to and makes recommendations regarding HP's Certificate of Incorporation, Bylaws and Board committee charters; assesses and makes recommendations regarding stockholder rights plans or other stockholder protections, as appropriate; reviews and approves any executive officers for purposes of Section 16 of the Exchange Act ("Section 16 Officers") standing for election for outside for-profit boards of directors; reviews stockholder proposals and recommends Board responses; oversees the self-evaluation of the Board and its committees; ensures that the annual evaluation of the Chief Executive Officer is conducted by the lead independent director in conjunction with the HR and Compensation Committee with input from all Board members; evaluates senior management in conjunction with the HR and Compensation Committee; and reviews requests for permissive indemnification.

The charter of the Nominating and Governance Committee is available at http://www.hp.com/investor/nominating_charter and also is included herein as Appendix C. A free printed copy is available to any stockholder who requests it from the address on page 10.

Stockholder Recommendations

The policy of the Nominating and Governance Committee is to consider properly submitted stockholder recommendations of candidates for membership on the Board as described below under "Identifying and Evaluating Candidates for Directors." In evaluating such recommendations, the Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth below under "Director Qualifications." Any stockholder recommendations proposed for consideration by the Nominating and

14

Governance Committee should include the candidate's name and qualifications for Board membership and should be addressed to:

Corporate

Secretary

Hewlett-Packard Company

3000 Hanover Street

Palo Alto, California 94304

Fax: (650) 857-4837

Stockholder Nominations

In addition, HP's Bylaws permit stockholders to nominate directors for consideration at an annual stockholder meeting and to solicit proxies in favor of such nominees. For a description of the process for nominating directors in accordance with HP's Bylaws, see "Questions and Answers—Stockholder Proposals, Director Nominations and Related Bylaw Provisions—28. How may I recommend or nominate individuals to serve as directors?"

Director Qualifications

HP's Corporate Governance Guidelines contain Board membership criteria that apply to nominees recommended for a position on HP's Board. Under these criteria, members of the Board should have the highest professional and personal ethics and values, consistent with longstanding HP values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public service. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all stockholders of HP.

Identifying and Evaluating Candidates for Directors

The Nominating and Governance Committee uses a variety of methods for identifying and evaluating nominees for director. The Nominating and Governance Committee regularly assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Nominating and Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Nominating and Governance Committee through current Board members, professional search firms, stockholders or other persons. Identified candidates are evaluated at regular or special meetings of the Nominating and Governance Committee and may be considered at any point during the year. As described above, the Nominating and Governance Committee considers properly submitted stockholder recommendations for candidates for the Board to be included in HP's proxy statement. Following verification of the stockholder status of people proposing candidates, recommendations are considered together by the Nominating and Governance Committee at a regularly scheduled meeting, which is generally the first or second meeting prior to the issuance of the proxy statement for HP's annual meeting. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials are forwarded to the Nominating and Governance Committee. The Nominating and Governance Committee also reviews materials provided by professional search firms and other parties in connection with a nominee who is not proposed by a stockholder. In evaluating such nominations, the Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board.

HP engages a professional search firm on an ongoing basis to identify and assist the Nominating and Governance Committee in identifying, evaluating and conducting due diligence on potential director

15

nominees. On November 16, 2006, the Board elected G. Kennedy Thompson as a director effective immediately. Mr. Thompson was identified by the professional search firm.

Executive sessions of independent directors are held at least three times a year. The sessions are scheduled and chaired by the lead independent director. Any independent director may request that an additional executive session be scheduled.

Individuals may communicate with the Board by contacting:

Secretary

to the Board of Directors

3000 Hanover Street, MS 1050

Palo Alto, California 94304

e-mail: bod@hp.com

All directors have access to this correspondence. In accordance with instructions from the Board, the Secretary to the Board reviews all correspondence, organizes the communications for review by the Board and posts communications to the full Board or individual directors, as appropriate. HP's independent directors have requested that certain items that are unrelated to the Board's duties, such as spam, junk mail, mass mailings, solicitations, resumes and job inquiries, not be posted.

Communications that are intended specifically for the lead independent director, the independent directors or non-management directors should be sent to the e-mail address or street address noted above, to the attention of the lead independent director.

16

DIRECTOR COMPENSATION AND STOCK OWNERSHIP GUIDELINES

Employee directors do not receive any separate compensation for their Board activities. Non-employee directors receive the compensation described below.

Each non-employee director is entitled to receive an annual cash retainer of $50,000 but may elect to receive an equivalent amount of securities in lieu of the cash retainer. In addition, each non-employee director is entitled to receive an annual retainer of $150,000 in the form of restricted stock or stock options (under special circumstances, the securities portion of the annual retainer may be paid in cash, but no such exceptions were made during fiscal 2006). The restricted stock awards are determined based on the fair market value of HP common stock on the grant date, and stock options are determined based on a Black-Scholes option valuation model. The restricted stock and options generally vest after one year from the date of grant, which is approximately one month after the annual meeting. Non-employee directors may elect to defer the cash portion of their annual retainer under the Hewlett-Packard Company 2005 Executive Deferred Compensation Plan. Under that plan, investment earnings are credited based on investment choices that are available to employees under the HP 401(k) Plan, and there is no formula that would result in above-market earnings or a preferential interest rate.

In addition to the annual retainer, non-employee directors who serve as committee chairs receive a retainer for such service, in the amount of $15,000 for the Chair of the Audit Committee and $10,000 for the chair of other Board committees. In addition, the non-executive Chairman of the Board was awarded an additional retainer of $100,000, effective March 16, 2006. Non-employee directors also receive $2,000 for each Board meeting attended in excess of six per year, and $2,000 for each committee meeting attended in excess of six per year for each committee on which the non-employee director serves. Non-employee directors are reimbursed for their expenses in connection with attending Board meetings (including expenses related to spouses when spouses are invited to attend Board events), and non-employee directors may use the company aircraft for travel to and from HP events. Each non-employee director also may receive up to $2,500 worth of HP equipment each year. In addition, each non-employee director is eligible to participate in the product matching portion of the HP Employee Giving Program. Under this program, each non-employee director may contribute up to $20,000 worth of HP products each year to a school or qualified charity by paying 25% of the list price of those products and with HP paying the remaining 75%.

The following table provides information on compensation for non-employee directors who served during fiscal 2006.

| |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NON-EMPLOYEE DIRECTOR COMPENSATION TABLE |

||||||||||||

| |

||||||||||||

| Name |

Cash Retainer(1) |

Equity Retainer(2) |

Additional Meeting Fees(3) |

Committee Chair Fees(1) |

||||||||

| Lawrence T. Babbio, Jr. | $ | 50,000 | $ | 150,000 | $ | 34,000 | $ | 20,000 | ||||

| Sari M. Baldauf(4) | 200,000 | 12,000 | ||||||||||

| Richard A. Hackborn | 50,000 | 150,000 | 16,000 | |||||||||

| John H. Hammergren(5) | 250,000 | 22,000 | ||||||||||

| Robert L. Ryan | 50,000 | 150,000 | 36,000 | 15,000 | ||||||||

| Lucille S. Salhany | 50,000 | 150,000 | 32,000 | |||||||||

| Former Directors | ||||||||||||

| Patricia C. Dunn(6) | 155,338 | 18,000 | ||||||||||

| George A. Keyworth II(7) | 50,000 | 73,562 | 30,000 | 10,000 | ||||||||

| Thomas J. Perkins(8) | 200,000 | 7,500 | ||||||||||

- (1)

- The term of office for directors begins immediately following election at HP's annual meeting of stockholders (typically held in mid-March) and ends upon the election of directors at the next annual meeting held the following year, which does not coincide

17

with HP's November 1st through October 31st fiscal year. Cash retainers and committee chair fees are paid quarterly in April, June, September and December, which results in only three payments being made during the fiscal year of election and the remaining payment being made in the following fiscal year. All cash retainer and committee chair fee payments made during fiscal 2006 are reported in the table irrespective of the term of office to which the payment applies.

- (2)

- Equity

retainers are granted in April and may be prorated for non-employee directors whose service terminates during the term. Equity retainers granted in April 2006 with respect to

the March 2006-March 2007 term are reported in the table.

- (3)

- Additional

meeting fees are determined based on the number of Board and committee meetings attended during each fiscal year. Additional meeting fees included in the table represent

fees paid for meetings attended during fiscal 2006.

- (4)

- Ms. Baldauf

was elected to the Board on March 15, 2006.

- (5)

- Mr. Hammergren

was elected to the Board effective November 22, 2005. Mr. Hammergren received a prorated retainer of $50,000 that he elected to receive in the form

of 1,708 shares of restricted stock for his service from November 2005 to March 2006 in addition to an annual retainer for his service from March 2006 to March 2007.

- (6)

- In

March 2006, Ms. Dunn elected to receive 100% of her annual retainer of $200,000 and her $100,000 retainer for service as non-executive Chairman in the

form of a grant of 9,245 shares of restricted stock. Ms. Dunn resigned from the Board on September 22, 2006. In connection with her resignation, the grant of 9,245 shares

of restricted stock was reduced to 4,787 shares of restricted stock, representing the pro-rata share of the original grant applicable to the portion of the year during which

Ms. Dunn served as a director. The amount shown in the table represents the grant date value of the prorated award.

- (7)

- In

March 2006, Dr. Keyworth elected to receive a cash retainer of $50,000 and an equity retainer in the form of an option to purchase 12,999 shares of HP common

stock. Dr. Keyworth resigned from the Board on September 12, 2006. In connection with his resignation, the $50,000 cash retainer was reduced to $37,500 and the option to purchase

12,999 shares of HP common stock was reduced to an option to purchase 6,375 shares of HP common stock, representing the pro-rata share of the original option grant applicable

to the portion of the year during which Dr. Keyworth served as a director. In addition, as a result of his resignation, Dr. Keyworth also received $70,861 in deferred compensation paid

pursuant to the 1989 Independent Director Deferred Compensation Program.

- (8)

- Mr. Perkins resigned from the Board on May 18, 2006.

Under HP's stock ownership guidelines, non-employee directors are required to accumulate over time shares of HP common stock equal in value to at least three times the value of the regular annual cash and equity retainers. Shares counted toward these guidelines include:

- •

- any

shares held by the director directly or through a broker, including shares received under restricted stock grants;

- •

- restricted

stock; and

- •

- vested but unexercised stock options (50% of the in-the-money value of such options is used for the calculation).

All non-employee directors with more than two years of service have met HP's stock ownership guidelines. See "Common Stock Ownership of Certain Beneficial Owners and Management" on page 31.

18

ELECTION OF DIRECTORS

There are eight nominees for election to our Board this year. All of the nominees except G. Kennedy Thompson have served as directors since the last annual meeting. Mr. Thompson was elected by the Board to serve as a director effective November 16, 2006. Each director is elected annually to serve until the next annual meeting or until his or her successor is elected. There are no family relationships among our executive officers and directors.

If you sign your proxy or voting instruction card but do not give instructions with respect to voting for directors, your shares will be voted for the eight persons recommended by the Board. If you wish to give specific instructions with respect to voting for directors, you may do so by indicating your instructions on your proxy or voting instruction card.

You may cumulate your votes in favor of one or more directors. If you wish to cumulate your votes, you will need to indicate explicitly your intent to cumulate your votes among the eight persons who will be voted upon at the annual meeting. See "Questions and Answers—Voting Information 18. Is cumulative voting permitted for the election of directors?" for further information about how to cumulate your votes. Mark V. Hurd and Charles N. Charnas, as proxy holders, reserve the right to cumulate votes and cast such votes in favor of the election of some or all of the applicable nominees in their sole discretion, except that a stockholder's votes will not be cast for a nominee as to whom such stockholder instructs that such votes be cast "AGAINST" or "ABSTAIN."

All of the nominees have indicated to HP that they will be available to serve as directors. In the event that any nominee should become unavailable, however, the proxy holders, Mr. Hurd and Mr. Charnas, will vote for a nominee or nominees designated by the Board.

If an incumbent director nominee receives a greater number of votes "AGAINST" his or her election than votes "FOR" such election, he or she is required to tender his or her resignation for consideration by the Nominating and Governance Committee in accordance with Section V. of the Corporate Governance Guidelines and as described on page 10.

Our Board recommends a vote FOR the election to the Board of the each of the following nominees.

Vote Required

Each director nominee who receives more "FOR" votes than "AGAINST" votes representing shares of HP common stock present in person or represented by proxy and entitled to be voted at the annual meeting will be elected.

| Lawrence T. Babbio, Jr. Director since 2002 Age 62 |

Mr. Babbio has served as Vice Chairman and President of Verizon Communications, Inc. (formerly Bell Atlantic Corporation), a telecommunications company, since 2000. He was a director of Compaq Computer Corporation from 1995 until HP's acquisition of Compaq in May 2002. Mr. Babbio is also a director of ARAMARK Corporation. Mr. Babbio has announced that he intends to retire from Verizon in the first calendar quarter of 2007. | |

19

Sari M. Baldauf Director since 2006 Age 51 |

Ms. Baldauf served as Executive Vice President and General Manager of the Networks business group of Nokia Corporation, a communications company, from July 1998 until February 2005. She previously held various positions at Nokia since 1983. Ms. Baldauf also serves as a director of SanomaWSOY, a director of F-Secure Corporation, a director of YIT Corporation, the non-executive chairman of the Savonlinna Opera Festival, and a member of the Global Board of the International Youth Foundation. |

|

Richard A. Hackborn Director since 1992 Age 69 |

Mr. Hackborn has served as HP's lead independent director since September 2006. Previously, Mr. Hackborn served as HP's Chairman of the Board from January 2000 to September 2000. He was HP's Executive Vice President, Computer Products Organization from 1990 until his retirement in 1993 after a 33-year career with HP. |

|

John H. Hammergren Director since 2005 Age 47 |

Mr. Hammergren has served as Chairman of McKesson Corporation, a healthcare services and information technology company, since July 2002 and as President and Chief Executive Officer of McKesson since April 2001. Mr. Hammergren is also a director of Nadro, S.A. de C.V. (Mexico) and Verispan LLC. |

|

Mark V. Hurd Director since 2005 Age 50 |

Mr. Hurd has served as Chairman of HP since September 2006 and as Chief Executive Officer, President and a member of the Board since April 2005. Prior to that, he served as Chief Executive Officer of NCR Corporation, a technology company, from March 2003 to March 2005 and as President from July 2001 to March 2005. From September 2002 to March 2003, Mr. Hurd was the Chief Operating Officer of NCR, and from July 2000 until March 2003 he was Chief Operating Officer of NCR's Teradata data-warehousing division. |

|

Robert L. Ryan Director since 2004 Age 63 |

Mr. Ryan served as Senior Vice President and Chief Financial Officer of Medtronic, Inc., a medical technology company, from 1993 until his retirement in May 2005. He also is a director of UnitedHealth Group Incorporated, General Mills, Inc. and The Black and Decker Corporation. |

|

Lucille S. Salhany Director since 2002 Age 60 |

Ms. Salhany has served as President and Chief Executive Officer of JHMedia, a consulting company, since 1997. Since 2003, she has been a partner and director of Echo Bridge Entertainment, an independent film distribution company. From 1999 to March 2002, she was President and Chief Executive Officer of LifeFX Networks, Inc., which filed for federal bankruptcy protection in May 2002. From 1994 to 1997, Ms. Salhany was the Chief Executive Officer and President of UPN (United Paramount Network), a broadcasting company. From 1993 to 1994, she was Chairman of Fox Broadcasting Company, a national television network, and from 1991 to 1993 she was Chairman of Twentieth Television, a division of Fox Broadcasting Company. Ms. Salhany was a director of Compaq from 1997 until HP's acquisition of Compaq in May 2002. Ms. Salhany is also a director of Ion Media Networks, Inc. |

|

G. Kennedy Thompson Director since 2006 Age 56 |

Mr. Thompson has served as Chairman of the Board of Wachovia Corporation, a financial services company, since February 2003 and as a director since 1999. He has also served as Chief Executive Officer of Wachovia since April 2000 and President since 1999. Mr. Thompson also is a director of Wachovia Preferred Funding Corp. |

20

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has appointed Ernst & Young LLP as the independent registered public accounting firm to audit HP's consolidated financial statements for the fiscal year ending October 31, 2007. During fiscal 2006, Ernst & Young LLP served as HP's independent registered public accounting firm and also provided certain tax and other audit-related services. See "Principal Accountant Fees and Services" on page 59. Representatives of Ernst & Young LLP are expected to attend the annual meeting, where they will be available to respond to appropriate questions and, if they desire, to make a statement.

Our Board recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as HP's independent registered public accounting firm for the 2007 fiscal year. If the appointment is not ratified, the Board will consider whether it should select another independent registered public accounting firm.

Vote Required

Ratification of the appointment of Ernst & Young LLP as HP's independent registered public accounting firm for the 2007 fiscal year requires the affirmative vote of a majority of the shares of HP common stock present in person or represented by proxy and entitled to be voted at the meeting.

21

STOCKHOLDER PROPOSAL RELATING TO

STOCKHOLDER NOMINEES FOR ELECTION TO THE HP BOARD

HP has received a stockholder proposal from the AFSCME Employee Pension Plan, the New York State Common Retirement Fund, the Connecticut Retirement Plans and Trust Funds and the North Carolina Equity Investment Fund Pooled Trust. These proponents have requested that HP include the following proposal and supporting statement in its proxy statement for the 2007 annual meeting of stockholders, and, if properly presented, this proposal will be voted on at the annual meeting. HP will provide the addresses of these proponents and the number of shares beneficially owned by each upon oral or written request of any stockholder. The stockholder proposal is quoted verbatim in italics below.

Management of HP does not support the adoption of the resolution proposed below and asks stockholders to consider management's response, which follows the stockholder proposal.

Our Board recommends a vote AGAINST Proposal No. 3.

Vote Required

HP believes that approval of the stockholder proposal requires the affirmative vote of sixty-six and two-thirds percent (662/3%) of the outstanding shares entitled to vote on the proposal at the annual meeting. Article IX of HP's Bylaws requires such a vote for any proposal by a stockholder to amend provisions of the Bylaws that relate to the nomination and election of directors. While the stockholder proposal seeks to add a new section to the Bylaws, it clearly relates to the nomination and election of directors and the 662/3% standard should apply. Among other things, the stockholder proposal expressly requires compliance with some, but not all, provisions of Section 2.2 of HP's Bylaws, and, therefore, effectively amends Section 2.2.

STOCKHOLDER PROPOSAL

RESOLVED, pursuant to Article IX of the Bylaws (the "Bylaws") of Hewlett-Packard Company ("HP") and section 109(a) of the Delaware General Corporation Law, stockholders amend the Bylaws to add section 3.17:

- (a)

- have beneficially owned 3% or more of HP's outstanding common stock ("Required Shares") continuously for at least two years;

- (b)

- provide written notice received by HP's Secretary within the time period specified in section 2.2(c) of these Bylaws containing (i) with respect to the

nominee,

(A) the information required by section 2.2(f) of these Bylaws and (B) such nominee's consent to being named in the proxy statement and to serving as a director if elected; and

(ii) with respect to the Nominator, proof of ownership of the Required Shares; and

- (c)