UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________________________________

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| For the fiscal year ended | ||||||||

| OR | ||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the transition period from __________ to __________

| Commission File Number | Exact Name of Registrant as Specified in its Charter, Principal Executive Office Address, Zip Code and Telephone Number | State of Incorporation | I.R.S. Employer Identification No. | |||||||||||||||||||||||||||||

| Securities registered pursuant to Section 12(b) of the Act: | |||||||||||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |||||||||||||||||||||

| Hertz Global Holdings, Inc. | Par value $0.01 per share | The | |||||||||||||||||||||

| Hertz Global Holdings, Inc. | Each exercisable for one share of Hertz Global Holdings, Inc. common stock at an exercise price of $13.80 per share, subject to adjustment | The | |||||||||||||||||||||

| The Hertz Corporation | None | None | None | ||||||||||||||||||||

| Securities registered pursuant to Section 12(g) of the Act: | |||||||||||||||||||||||

| Hertz Global Holdings, Inc. | None | ||||||||||||||||||||||

| The Hertz Corporation | None | ||||||||||||||||||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Hertz Global Holdings, Inc. Yes x No o

The Hertz Corporation Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Hertz Global Holdings, Inc. Yes o No x

The Hertz Corporation1 Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Hertz Global Holdings, Inc. Yes x No o

The Hertz Corporation Yes o No x

1(Note: As a voluntary filer, The Hertz Corporation is not subject to the filing requirements of Section 13 or 15(d) of the Exchange Act. The Hertz Corporation has filed all reports pursuant to Section 13 or 15(d) of the Exchange Act during the preceding 12 months as if it was subject to such filing requirements.)

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Hertz Global Holdings, Inc. Yes x No o

The Hertz Corporation Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Hertz Global Holdings, Inc. | x | Accelerated filer | o | Non-accelerated filer | o | |||||||||||||||

| Smaller reporting company | Emerging growth company | |||||||||||||||||||

| If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | o | |||||||||||||||||||

| The Hertz Corporation | Large accelerated filer | o | Accelerated filer | o | x | |||||||||||||||

| Smaller reporting company | Emerging growth company | |||||||||||||||||||

| If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | o | |||||||||||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Hertz Global Holdings, Inc. x

The Hertz Corporation x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Hertz Global Holdings, Inc. ☐

The Hertz Corporation ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Hertz Global Holdings, Inc. ☐

The Hertz Corporation ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Hertz Global Holdings, Inc. Yes ☐ No x

The Hertz Corporation Yes ☐ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of Hertz Global Holdings, Inc. as of June 30, 2023, the last business day of the most recently completed second fiscal quarter, based on the closing price of the stock on the Nasdaq Global Select Market on such date was $2.4 billion. There is no market for The Hertz Corporation's common stock.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No ☐

Indicate the number of shares outstanding of each of the registrants' classes of common stock, as of the latest practicable date.

| Class | Shares Outstanding as of | February 7, 2024 | ||||||||||||||||||

| Hertz Global Holdings, Inc. | Common Stock, par value $0.01 per share | |||||||||||||||||||

| The Hertz Corporation | (1) | Common Stock, par value $0.01 per share | ||||||||||||||||||

(1)(100% owned by Rental Car Intermediate Holdings, LLC) | ||||||||||||||||||||

DOCUMENTS INCORPORATED BY REFERENCE

| Hertz Global Holdings, Inc. | Information required by Items 10, 11, 12 and 13 of Part III of this Form 10-K is incorporated by reference to Hertz Global Holdings, Inc.'s definitive proxy statement for its 2024 Annual Meeting of Stockholders. Hertz Global Holdings, Inc. intends to file such proxy statement with the Securities and Exchange Commission no later than 120 days after its fiscal year ended December 31, 2023. | |||||||

| The Hertz Corporation | ||||||||

TABLE OF CONTENTS

| Page | ||||||||

GLOSSARY OF TERMS

Unless the context otherwise requires in this Annual Report on Form 10-K for the year ended December 31, 2023, we use the following defined terms:

(i)"2023 Annual Report" or "Combined Form 10-K" means this Annual Report on Form 10-K for the year ended December 31, 2023, which combines the annual reports on Form 10-K for each of Hertz Global Holdings, Inc. and The Hertz Corporation into a single filing;

(ii)"2021 Rights Offering" means the Company's rights offering providing for the issuance of common stock in reorganized Hertz Global by Hertz Global's former equity holders, holders of the Company's Senior Notes and lenders under the Alternative Letter of Credit Facility and certain equity commitment parties pursuant to their obligations under an equity purchase and commitment agreement;

(iii)"All other operations" means our former All Other Operations reportable segment which was no longer deemed a reportable segment in the second quarter of 2021 resulting from the sale of our Donlen subsidiary on March 30, 2021;

(iv)"Americas RAC" means our rental car reportable segment established in the second quarter of 2021 consisting of the countries and regions of the U.S., Canada, Latin America and the Caribbean;

(v)"Apollo" means Apollo Capital Management L.P. and its affiliates;

(vi)"Bankruptcy Code" means Title 11 of the United States Code, 11 U.S.C. §§ 101-1532;

(vii)"Bankruptcy Court" means the U.S. Bankruptcy Court for the District of Delaware;

(viii)"Board" means board of directors;

(ix)"Chapter 11" means chapter 11 of the Bankruptcy Code;

(x)"Chapter 11 Cases" means the Chapter 11 cases jointly administered in the Bankruptcy Court under the caption In re The Hertz Corporation, et al., Case No. 20-11218 (MFW);

(xi)"the Code" means the Internal Revenue Code of 1986, as amended;

(xii)"the Company", "we", "our" and "us" mean Hertz Global and Hertz interchangeably;

(xiii)"company-operated" rental locations are those through which we, or an agent of ours, rent vehicles that we own or lease;

(xiv)"concessions" mean licensing or permitting agreements or arrangements granting us the right to conduct our vehicle rental business at airports;

(xv)"COVID-19" means the coronavirus disease declared a global pandemic by the World Health Organization in March 2020;

(xvi)"the Debtors" means Hertz Global, Hertz and their direct and indirect subsidiaries in the U.S. and Canada that filed voluntary petitions for relief under Chapter 11 in the Bankruptcy Court on May 22, 2020;

(xvii)"Donlen Sale" means the sale of substantially all assets and certain liabilities of the Company's Donlen subsidiary;

i

(xviii)"Dollar Thrifty" means Dollar Thrifty Automotive Group, Inc., a consolidated subsidiary of the Company;

(xix)"Effective Date" means June 30, 2021, the date on which the Plan of Reorganization became effective and the Company emerged from Chapter 11;

(xx)"Exchange Act" means the Securities Exchange Act of 1934;

(xxi)"ESG" means environmental, social and governance;

(xxii)"FASB" means the Financial Accounting Standards Board;

(xxiii)"First Lien Credit Agreement" means the credit agreement reorganized Hertz entered into on the Effective Date as further described in Note 6, "Debt," in Part II, Item 8 of this 2023 Annual Report;

(xxiv)"First Lien Credit Facilities" means the First Lien RCF and Term Loans, collectively, provided for under the First Lien Credit Agreement as further described in Note 6, "Debt," in Part II, Item 8 of this 2023 Annual Report;

(xxv)"First Lien RCF" means the senior secured revolving credit facility in an initial aggregate committed amount of $1.3 billion as further described in Note 6, "Debt," in Part II, Item 8 of this 2023 Annual Report;

(xxvi)"Hertz Gold Plus Rewards" means our customer loyalty program and our global expedited rental program;

(xxvii)"Hertz" means The Hertz Corporation, its consolidated subsidiaries and VIEs, our primary operating company and a direct wholly-owned subsidiary of Rental Car Intermediate Holdings, LLC, which is wholly owned by Hertz Holdings;

(xxviii)"Hertz Global" means Hertz Global Holdings, Inc., our top-level holding company, its consolidated subsidiaries and VIEs, including The Hertz Corporation;

(xxix)"Hertz Ultimate Choice" is an offering at select airport locations in the U.S. that allows customers to choose their vehicle from a range of makes, models and colors available within the zone indicated on their reservation;

(xxx)"Hertz Holdings" refers to Hertz Global Holdings, Inc. excluding its subsidiaries and VIEs;

(xxxi)"HVF III" refers to Hertz Vehicle Financing III LLC, a wholly-owned, special-purpose and bankruptcy-remote subsidiary of Hertz;

(xxxii)"International RAC" means our international rental car reportable segment, which, effective in the second quarter of 2021, no longer includes Canada, Latin America and the Caribbean ;

ii

(xxxiii)“non-program vehicles” means vehicles not purchased under repurchase or guaranteed depreciation programs and thus for which we are exposed to residual risk;

(xxxiv)"Plan of Reorganization" means the solicitation version of the First Modified Third Amended Joint Chapter 11 Plan of Reorganization of the Debtors (as amended, supplemented or otherwise modified in accordance with its terms);

(xxxv)"Plan Sponsors" means collectively Apollo, Knighthead Capital Management, LLC and its affiliates and Certares Opportunities LLC and its affiliates;

(xxxvi)"program vehicles" means vehicles purchased under repurchase or guaranteed depreciation programs with vehicle manufacturers;

(xxxvii)"Public Warrants" means 30-year public warrants as further described in Note 17, "Public Warrants - Hertz Global," in Part II, Item 8 of this 2023 Annual Report;

(xxxviii)"replacement renters" means renters who need vehicles while their vehicle is being repaired or is temporarily unavailable for other reasons;

(xxxix)"SEC" means the U.S. Securities and Exchange Commission;

(xl)"Series A Preferred Stock" means Hertz Global preferred stock that was issued in connection with the Plan of Reorganization, and subsequently repurchased and retired by Hertz Global in December 2021;

(xli)"Term Loans" means the Term B Loan and Term C Loan, collectively, as further described in Note 6, "Debt," in Part II, Item 8 of this 2023 Annual Report;

(xlii)"Ride Share Partners" means certain ride share companies with whom we have entered into commercial arrangements to provide rental vehicles to their drivers;

(xliii)"U.S." means the United States of America;

(xliv)"U.S. GAAP" means accounting principles generally accepted in the U.S.;

(xlv)"VIE" means variable interest entity; and

(xlvi)"vehicles” means cars, vans, crossovers and light trucks.

We have proprietary rights to a number of trademarks used in this 2023 Annual Report that are important to our business, including, without limitation, Hertz, Dollar, Thrifty, Hertz Gold Plus Rewards and Hertz Ultimate Choice. Solely for convenience, we have omitted the ® and ™ trademark designations for trademarks named in this 2023 Annual Report, but references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

iii

EXPLANATORY NOTE

COMBINED FORM 10-K

This 2023 Annual Report combines the annual reports on Form 10-K for the year ended December 31, 2023 of Hertz Global and Hertz.

Hertz Global owns all shares of the common stock of Hertz through its wholly-owned subsidiary, Rental Car Intermediate Holdings, LLC.

Management operates Hertz Global and Hertz as one enterprise. The management of Hertz Global consists of the same members as the management of Hertz. These individuals are officers of Hertz Global and Hertz and employees of Hertz. The members of Hertz's Board are all executive officers of Hertz Global.

We believe combining the annual reports on Form 10-K of Hertz Global and Hertz into this single report results in the following benefits:

•enhancing investors' understanding of Hertz Global and Hertz by enabling investors to view the business as a whole in the same manner as management views and operates the business;

•eliminating duplicative disclosure and providing a more streamlined and readable presentation since a substantial portion of the disclosures apply to both Hertz Global and Hertz; and

•creating time and cost efficiencies through the preparation of one combined annual report instead of two separate annual reports.

Hertz, generally through its subsidiaries, holds all of the revenue earning vehicles, property, plant and equipment and all other assets, including the ownership interests in consolidated and unconsolidated VIEs, of the business. Hertz conducts the operations of the business and is structured as a corporation with no publicly traded equity. Except to the extent that net proceeds from security issuances by Hertz Global and cash exercises of Hertz Global Public Warrants, are contributed to Hertz, Hertz generates its required capital through its operations or financing activities, including the incurrence of indebtedness.

Hertz Global does not conduct business itself, other than issuing public equity or debt obligations or receiving proceeds from cash exercises of Public Warrants from time to time, and incurring expenses required to operate as a public company.

Differences between the financial statements of Hertz Global and Hertz are generally limited to the activity described above and the remaining assets, liabilities, revenues and expenses of Hertz Global and Hertz are the same on their respective financial statements.

Although Hertz is generally the entity that enters into contracts, holds assets and incurs debt, Hertz Global consolidates Hertz for financial statement purposes, and therefore, disclosures that relate to activities of Hertz also generally apply to Hertz Global. In the sections that combine disclosures of Hertz Global and Hertz, this report refers to actions as being actions of the Company, or Hertz Global. When appropriate, Hertz Global and Hertz are named specifically for their individual disclosures and any significant differences between the operations and results of Hertz Global and Hertz are separately disclosed and explained.

This report also includes separate Exhibit 31 and 32 certifications for each of Hertz Global and Hertz in order to establish that the Chief Executive Officer and the Chief Financial Officer of each entity have made the requisite certifications and that Hertz Global and Hertz are compliant with Rule 13a-15 or Rule 15d-15 of the Exchange Act and 18 U.S.C. §1350.

This Combined Form 10-K is separately filed by Hertz Global Holdings, Inc. and The Hertz Corporation. Each registrant hereto is filing on its own behalf all of the information contained in this 2023 Annual Report that relates to such registrant. Each registrant hereto is not filing any information that does not relate to such registrant, and therefore makes no representation as to any such information.

iv

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND SUMMARY OF RISK FACTORS

Certain statements contained or incorporated by reference in this 2023 Annual Report include "forward-looking statements." Forward-looking statements are identified by words such as "believe," "expect," "project," "potential," "anticipate," "intend," "plan," "estimate," "seek," "will," "may," "would," "should," "could," "forecasts," "guidance" or similar expressions, and include information concerning our liquidity, our results of operations, our business strategies, the business environment and other information. These forward-looking statements are based on certain assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors. We believe these judgments are reasonable, but you should understand that these forward-looking statements are not guarantees of future performance or results and our actual results could differ materially from those expressed in the forward-looking statements due to a variety of important factors, both positive and negative.

Important factors that could affect our actual results and cause them to differ materially from those expressed in forward-looking statements include, among other things, those that may be disclosed from time to time in subsequent reports filed with or furnished to the SEC, those described under Item 1A,"Risk Factors," set forth in this 2023 Annual Report, and the following, which also summarizes the principal risks of our business:

•mix of program and non-program vehicles in our fleet, which can lead to increased exposure to residual value risk upon disposition;

•the potential for residual values associated with non-program vehicles in our fleet to decline, including suddenly or unexpectedly, or fail to follow historical seasonal patterns;

•our ability to purchase adequate supplies of competitively priced vehicles at a reasonable cost in order to efficiently service rental demand, including upon any disruptions in the global supply chain;

•our ability to effectively dispose of vehicles, at the times and through the channels, that maximize our returns;

•the age of our fleet, and its impact on vehicle carrying costs, customer service scores, as well as on our ability to sell vehicles at acceptable prices and times;

•whether a manufacturer of our program vehicle fulfills its repurchase obligations;

•the frequency or extent of manufacturer safety recalls;

•levels of travel demand, particularly business and leisure travel in the U.S. and in global markets;

•seasonality and other occurrences that disrupt rental activity during our peak periods, including in critical geographies;

•our ability to accurately estimate future levels of rental activity and adjust the number, location and mix of vehicles used in our rental operations accordingly;

•our ability to implement our business strategy or strategic transactions, including our ability to implement plans to support a large-scale electric vehicle fleet and to play a central role in the modern mobility ecosystem;

•our ability to adequately respond to changes in technology impacting the mobility industry;

•significant changes in the competitive environment and the effect of competition in our markets on rental volume and pricing;

•our reliance on third-party distribution channels and related prices, commission structures and transaction volumes;

•our ability to offer services for a favorable customer experience, and to retain and develop customer loyalty and market share;

•our ability to maintain our network of leases and vehicle rental concessions at airports and other key locations in the U.S. and internationally;

v

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS AND SUMMARY OF RISK FACTORS (Continued)

•our ability to maintain favorable brand recognition and a coordinated branding and portfolio strategy;

•our ability to attract and retain effective frontline employees, senior management and other key employees;

•our ability to effectively manage our union relations and labor agreement negotiations;

•our ability to manage and respond to cybersecurity threats and cyber attacks on our information technology systems, or those of our third-party providers;

•our ability, and that of our key third-party partners, to prevent the misuse or theft of information we possess, including as a result of cyber attacks and other security threats;

•our ability to maintain, upgrade and consolidate our information technology systems;

•our ability to comply with current and future laws and regulations in the U.S. and internationally regarding data protection, data security and privacy risks;

•risks associated with operating in many different countries, including the risk of a violation or alleged violation of applicable anti-corruption or anti-bribery laws and our ability to repatriate cash from non-U.S. affiliates without adverse tax consequences;

•risks relating to tax laws, including those that affect our ability to recapture accelerated tax depreciation and expensing, as well as any adverse determinations or rulings by tax authorities;

•our ability to utilize our net operating loss carryforwards;

•our exposure to uninsured liabilities relating to personal injury, death and property damage, or otherwise, including material litigation;

•the potential for adverse changes in laws, regulations, policies or other activities of governments, agencies and similar organizations, including those related to environmental matters, optional insurance products or policies, franchising and licensing matters, the ability to pass-through rental car related expenses, or taxes, among others, that affect our operations, our costs or applicable tax rates;

•our ability to recover our goodwill and indefinite-lived intangible assets when performing impairment analysis;

•the potential for changes in management's best estimates and assessments;

•our ability to maintain an effective compliance program;

•the availability of earnings and funds from our subsidiaries;

•our ability to comply, and the cost and burden of complying, with ESG regulations or expectations of stakeholders, and otherwise achieve our corporate responsibility goals;

•the availability of additional or continued sources of financing at acceptable rates for our revenue earning vehicles and to refinance our existing indebtedness;

•the extent to which our consolidated assets secure our outstanding indebtedness;

•volatility in our share price, our ownership structure and certain provisions of our charter documents could negatively affect the market price of our common stock;

•our ability to implement an effective business continuity plan to protect the business in exigent circumstances;

•our ability to effectively maintain effective internal controls over financial reporting; and

•our ability to execute strategic transactions.

You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements.

vi

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS AND SUMMARY OF RISK FACTORS (Continued)

All such statements speak only as of the date of this 2023 Annual Report and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

vii

PART I

ITEM 1. BUSINESS

OUR COMPANY

Hertz Holdings was incorporated in Delaware in 2015 to serve as the top-level holding company for Rental Car Intermediate Holdings, LLC, which wholly owns Hertz, Hertz Global's primary operating company. Hertz was incorporated in Delaware in 1967 and is a successor to corporations that have been engaged in the vehicle rental and leasing business since 1918.

We are engaged principally in the business of renting vehicles primarily through our Hertz, Dollar and Thrifty brands. As of December 31, 2023, we operated our vehicle rental business globally from approximately 11,400 company-operated and franchisee locations across approximately 160 countries and jurisdictions, including the U.S., Europe, Africa, Asia, Australia, Canada, the Caribbean, Latin America, the Middle East and New Zealand. We are one of the largest worldwide vehicle rental companies and our Hertz brand name is among the most recognized globally. We have an extensive network of airport and off airport rental locations in the U.S. and major European markets.

Our Strategy

Our strategy is focused on excellence in execution of our rental operations, presenting distinct product offerings through each of our brands, building on our leadership in ride share and selling vehicles from the fleet directly to consumers. Our core assets, capabilities and partnerships underpin this strategy and are positioning us at the center of the modern mobility ecosystem. We intend to continue building on our brand strength, global network and global fleet management expertise, combining those efforts with new investments in technology, electrification, shared mobility and a digital-first customer experience. We believe our key fleet management capabilities will allow us to diversify and profitably grow in new areas of the mobility sector.

OUR BUSINESS SEGMENTS

The Company has identified two reportable segments, which are consistent with its operating segments, as follows:

•Americas RAC - Rental of vehicles, as well as sales of vehicles and value-added services, in the U.S., Canada, Latin America and the Caribbean. We maintain a substantial network of company-operated rental locations in this segment and we have franchisees and partners that operate rental locations under our brands; and

•International RAC - Rental of vehicles, as well as sales of vehicles and value-added services, in locations other than the U.S., Canada, Latin America and the Caribbean. We maintain a substantial network of company-operated rental locations, a majority of which are in Europe, and we have franchisees and partners that operate rental locations under our brands. As of December 31, 2023, 72% of our franchised locations were in markets covered by our International RAC segment.

In addition to the two reportable segments, we have corporate operations. We assess performance and allocate resources based upon the financial information for our operating segments.

For further financial information on our segments, see (i) Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations and Selected Operating Data by Segment" and (ii) Note 18, "Segment Information," in Part II, Item 8 of this 2023 Annual Report.

1

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

Americas RAC and International RAC Segments

Our Brands

Our Americas RAC and International RAC vehicle rental businesses are primarily operated through our three largest brands — Hertz, Dollar, and Thrifty. We offer multiple brands to provide customers a full range of rental services at different price points, levels of service, offerings and products. These brands generally maintain separate rental locations (e.g., separate airport counters), and use distinct reservation, marketing and other customer contact activities. We achieve synergies across our brands by, among other things, utilizing a single fleet and fleet management team and, where applicable, combined vehicle maintenance, vehicle cleaning and back office functions.

Our top tier brand, Hertz, is one of the most recognized brands in the world. It offers premium customer service, as evidenced by the numerous published best-in-class vehicle rental awards that the brand has been awarded over time, both in the U.S. and internationally. The Hertz brand's tagline of "Hertz. Let's Go!” expresses our commitment to quality, seamless travel and customer service. The Hertz brand provides customers with several innovative offerings, such as Hertz Gold Plus Rewards, Hertz Ultimate Choice and access to vehicles offered through our electric vehicle ("EV") fleet and specialty collections. The Hertz brand seeks to maintain its position as a premier provider of vehicle rental services through an intense focus on service, loyalty, quality and product innovation.

Our smart value brand, Dollar, is marketed as a smart choice for financially focused travelers looking for a dependable car at a price they can afford. The Dollar brand’s core focus is serving family, leisure and small business travelers through the airport vehicle rental channel. Dollar’s tagline of “We never forget whose dollar it is” expresses the brand’s mission of providing a reliable rental experience at a price that works. Dollar operates primarily through company-operated locations in the U.S. and Canada.

Our deep value brand, Thrifty, competes as a cost-conscious offering for travelers seeking to find a good deal. The Thrifty brand’s core focus is serving leisure travelers through the airport vehicle rental channel. Thrifty’s tagline of “The Absolute Best Car for Your Money” expresses the brand’s focus on being the rental brand that puts the customer in control of where to splurge and where to save. Thrifty operates primarily through company-operated locations in the U.S. and Canada.

Operations

Locations

We operate our brands at both airport and off airport locations that utilize common vehicle fleets, are supervised by common country, regional and local area management, use many common systems and rely on common vehicle maintenance and administrative centers. Additionally, our airport and off airport locations utilize common marketing activities and have many of the same customers. We regard both types of locations as aspects of a single, unitary, vehicle rental business. Off airport revenues comprised 34% and 32% of our worldwide vehicle rental revenues in 2023 and 2022, respectively. Our Americas RAC vehicle rental operations have company-operated locations primarily in the U.S. and Canada. Our International RAC vehicle rental operations have company-operated locations in Australia, Belgium, the Czech Republic, France, Germany, Italy, Luxembourg, the Netherlands, New Zealand, Slovakia, Spain and the United Kingdom.

2

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

Airport

As of December 31, 2023, we had approximately 1,900 airport rental locations in our Americas RAC segment and approximately 1,500 airport rental locations in our International RAC segment. We believe that our extensive global network of locations contributes to our success by providing consistency of our service, cost control, Vehicle Utilization, competitive pricing and our ability to offer one-way rentals.

For our airport company-operated rental locations, we are dependent on, and have obtained, concessions or similar leasing agreements or arrangements, that grant us the right to conduct a vehicle rental business at the respective airport. Our concessions were obtained from the airports' operators, which are typically governmental bodies or authorities, following either negotiation or bidding for the right to operate a vehicle rental business. The terms of an airport concession typically require us to pay the airport's operator concession fees based upon a specified percentage of the revenues we generate at the airport, subject to a minimum annual guarantee. Under most concessions, we are required to pay fixed rent for terminal counters or other leased properties and facilities. Most concessions are for a fixed length of time, while others create operating rights and payment obligations that are terminable at any time.

The terms of our concessions typically do not forbid us from seeking, and in most instances actually explicitly permit us to seek, reimbursement from customers for concession fees we pay; however, in certain jurisdictions the law limits or forbids our ability to do so. Where we are permitted to seek such reimbursement, it is our general practice to do so. Certain of our concession agreements may require the consent of the airport's operator in connection with material changes in our ownership. A growing number of larger airports are building, or assessing the feasibility of, consolidated airport vehicle rental facilities to alleviate congestion at the airport. These consolidated rental facilities provide a more common customer experience and may eliminate certain competitive advantages among the brands as competitors operate out of one centralized facility for both customer rental and return operations, share consolidated busing operations and maintain image standards mandated by the airports. The costs associated with the development of these consolidated facilities are typically funded through the collection of customer facility charges, which are required to be collected by rental car companies from their customers.

Off Airport

As of December 31, 2023, we had approximately 3,300 off airport locations in our Americas RAC segment and approximately 4,700 off airport rental locations in our International RAC segment. Our off airport rental customers include people who prefer to rent vehicles closer to their home or place of work for business or leisure purposes, as well as those needing to travel to or from airports. Our off airport customers also include people who have been referred by, or whose rental costs are being wholly or partially reimbursed by, insurance companies following accidents in which their vehicles were damaged, those expecting to lease vehicles that are not yet available from their leasing companies and replacement renters. In addition, our off airport customers include drivers for our Ride Share Partners, which is further described in “Ride Share Rentals” below.

When compared to our airport rental locations, an off airport rental location typically uses a smaller rental facility with fewer employees, conducts pick-up and delivery services and serves replacement renters using specialized systems and processes. On average, off airport locations generate fewer transactions per period than airport locations.

Our off airport locations offer the following benefits:

•Providing customers a more convenient and geographically extensive network of rental locations, thereby creating revenue opportunities from replacement renters, non-airline travel renters and airline travelers with local rental needs;

•Providing us a more balanced revenue mix by reducing our reliance on air travel and therefore reducing our exposure to external events that may disrupt airline travel trends;

•Contributing to higher Vehicle Utilization as a result of the longer average rental periods associated with off airport business, compared to those of airport rentals;

3

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

•Creating efficiencies in vehicle and labor demand planning, as replacement rental volume is less seasonal than that of other business and leisure rentals; and

•Creating cross-selling opportunities for us to promote off airport rentals among frequent airport Hertz Gold Plus Rewards program renters and, conversely, to promote airport rentals to off airport renters.

Customers and Business Mix

We conduct various sales and marketing programs to attract and retain customers. Our sales force calls on companies, government agencies and other organizations whose employees and associates need to rent vehicles for business or official purposes. Our sales force also calls on organizations such as insurance and leasing companies, automobile repair companies and vehicle dealers whose customers need replacement rentals. In addition, our sales force works with membership associations, tour operators, travel companies, ride share companies and other groups whose members, participants and customers rent vehicles for either business or leisure purposes.

We also market directly to individual renters. We advertise our vehicle rental offerings through traditional media channels, partner publications (e.g., affinity clubs, airline and hotel partners) and direct mail. We also rely on digital marketing and, for the Hertz brand, we are increasingly seeking to expand access to and use of our Hertz mobile app.

In addition to advertising, we conduct other forms of marketing and promotion, including travel industry business partnerships and press and public relations activities.

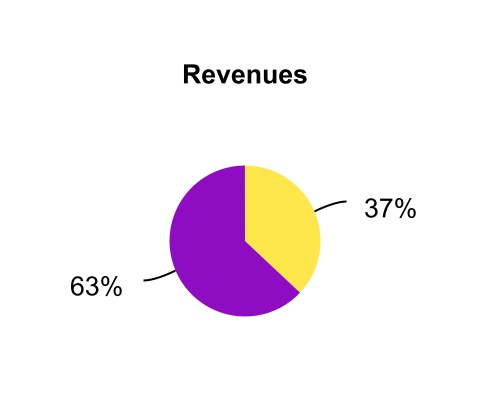

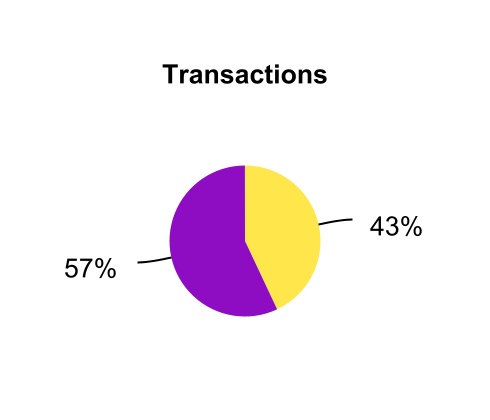

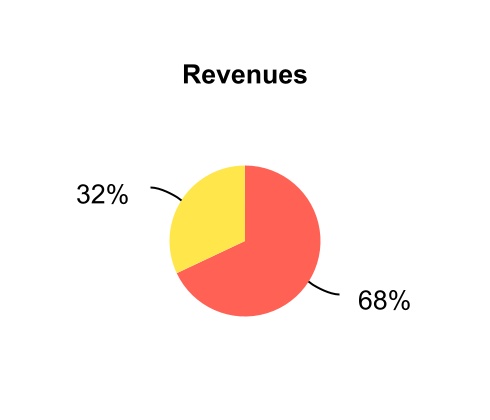

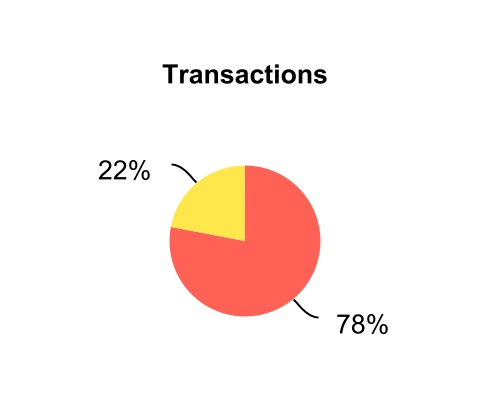

We categorize our vehicle rental business based on the general purpose (business or leisure) and type of location (airport or off airport) from which customers rent from us. The following charts set forth the percentages of rental revenues and rental transactions in our Americas RAC and International RAC segments based on these categories.

VEHICLE RENTALS BY CUSTOMER

Year Ended December 31, 2023

Americas RAC

| Business | ||||||||

| Leisure | ||||||||

4

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

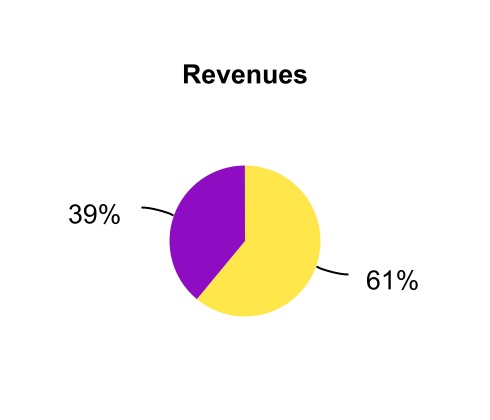

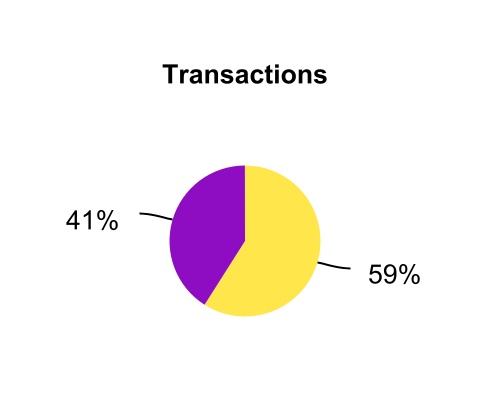

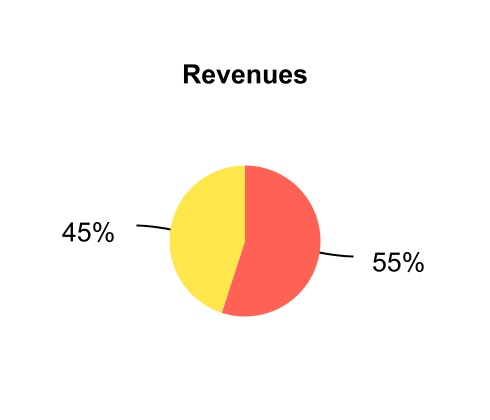

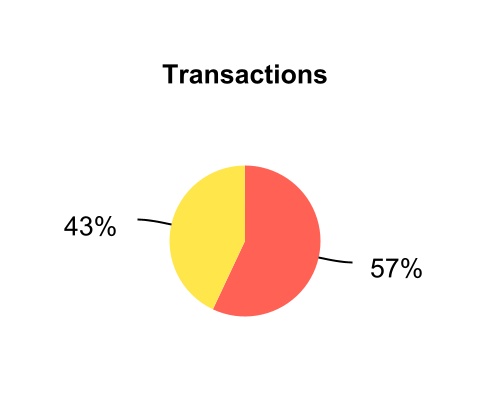

International RAC

| Business | ||||||||

| Leisure | ||||||||

Customers who rent from us for “business” purposes include those who require vehicles in connection with commercial activities, including drivers for our Ride Share Partners, the activities of governments and other organizations or for temporary vehicle replacement purposes (i.e., replacement rentals). Most business customers rent vehicles from us on terms that we have negotiated with their employers or other entities with which they are associated, and those terms can differ from the terms on which we rent vehicles to the general public.

Customers who rent from us for “leisure” purposes include individual travelers booking vacation rentals and people renting to meet other personal needs (other than replacement rentals). Leisure rentals are generally longer in duration and generate more revenue per transaction than business rentals. Leisure rentals also include rentals by customers of U.S. and international tour operators, which are usually a part of tour packages that can include air travel and hotel accommodations.

VEHICLE RENTALS BY LOCATION

Year Ended December 31, 2023

Americas RAC

| Airport | ||||||||

| Off airport | ||||||||

5

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

International RAC

| Airport | ||||||||

| Off airport | ||||||||

Demand for airport rentals is generally correlated with airline travel patterns, and transaction volumes generally follow global airline passenger traffic ("enplanement") and Gross Domestic Product ("GDP") trends. Customers often make reservations for airport rentals when they book their flight plans, which make our relationships with travel agents, associations and other participants in the broader travel industry (e.g., airlines and hotels) a key competitive strategy in generating consistent and recurring revenue streams.

Off airport rentals include insurance replacements, and we have agreements with the referring insurers establishing the relevant rental terms, including the arrangements made for billing and payment.

Customer Service Offerings

We offer customers a wide range of services to differentiate ourselves from the competition and increase and diversify our revenue.

Hertz Gold Plus Rewards Program

At our major airport rental locations and certain smaller airport and off airport locations, customers participating in our Hertz Gold Plus Rewards program are able to rent vehicles in an expedited manner. Participants in our Hertz Gold Plus Rewards program often bypass the rental counter entirely and proceed directly to their vehicle upon arrival at our facility. They are also eligible to earn Hertz Gold Plus Rewards points that may be redeemed for free rental days or converted to awards of other companies' loyalty programs.

Hertz's Gold Plus Rewards program offers three elite membership tiers that provide more frequent renters the opportunity to earn additional reward points and vehicle upgrades. When Hertz Gold Plus Rewards members make a reservation for a midsize car or above, they have access to exclusive vehicles based on their membership tier via our Hertz Ultimate Choice program which allows customers to choose their vehicle from a range of makes, models and colors available within the zone indicated on their reservation. Alternatively, they may upgrade at the pick-up location for a fee by choosing a vehicle from a premium upgrade zone. As of December 31, 2023, the Hertz Ultimate Choice program was offered at approximately 60 U.S. and Canada airport locations.

For the year ended December 31, 2023, rentals by Hertz Gold Plus Rewards members accounted for approximately 33% of our worldwide rental transactions. We believe the Hertz Gold Plus Rewards program provides us with a significant competitive advantage, particularly among frequent travelers, and we have targeted such travelers for participation in the program.

6

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

Other Customer Service Offerings

We offer electronic rental agreements and returns for our Hertz, Dollar and Thrifty U.S. customers. Simplifying the rental transaction saves customers time and provides greater convenience through access to digitally available rental contracts. We also offer Mobile Gold Alerts, a service available to participating Hertz Gold Plus Rewards customers, through which a text message and/or email with the vehicle information and location is sent approximately 30 minutes prior to arrival, providing a renter the option to choose another vehicle. We offer Hertz e-Return, which allows customers to drop off their vehicle and go without the need to visit the rental counter. Customers can also use cashless toll lanes with our PlatePass offering where the license plate acts as a transponder.

Ride Share Rentals

We have partnered with certain ride share companies to offer vehicle rentals to their drivers in select cities in North America and Europe. This program enables us to rent vehicles on a longer-term basis than traditional business rentals and is a component of our strategy to be an active participant in the future of mobility. Using vehicles for ride share rentals also results in an increased supply of higher mileage, and thus more economical, used vehicles for our vehicle disposition programs discussed below.

Drivers for our Ride Share Partners reserve vehicles online through Ride Share Partner websites and applications and pick up vehicles from select locations. Ride share drivers can extend the vehicle rental on a recurring basis.

Rates, Fees and Value-Added Services

We rent a wide variety of makes and models of vehicles. We rent vehicles on an hourly (in select international markets), daily, weekend, weekly, monthly or multi-month basis, with rental charges computed on a limited or unlimited mileage rate, or on a time rate plus a mileage charge. Our rates vary by brand and at different locations depending on local market conditions and other competitive and cost factors, such as vehicle supply and overall demand. While vehicles are usually returned to the locations from which they are rented, we also allow one-way rentals from and to certain locations.

We also generate revenues from reimbursements by customers of airport concession fees, unless the law limits or forbids us from doing so, and of vehicle licensing costs, fueling and electric charging, and charges for value-added services such as supplemental equipment (e.g., child seats and ski racks), loss or collision damage waiver, theft protection, liability and personal accident/effects insurance coverage, premium emergency roadside service and satellite radio.

Reservations

We price and accept reservations for our vehicles through each of our brands. Reservations are generally for a class of vehicles, such as compact, midsize or sport utility vehicle. Our introduction of EVs to the fleet in certain cities has enabled us to also provide the opportunity for customers in those locations to reserve an EV versus an internal-combustion engine vehicle. Additionally, certain reservations within our EV fleet can be made for specific makes and models.

We distribute pricing and content and accept reservations through multiple channels. Direct reservations are accepted at Hertz.com, Dollar.com and Thrifty.com, each of which has global and local versions in multiple languages. Hertz.com offers a range of products, prices and additional services, as well as Hertz Gold Plus Rewards benefits, serving both company-operated and franchise locations. In addition to our websites, direct reservations are enabled via our Hertz and Dollar smartphone apps, which include additional connected products and services.

Customers may also seek reservations via travel agents or third-party travel websites. In many of those cases, the travel agent or website utilizes an Application Programming Interface connection to Hertz or a third-party operated

7

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

computerized reservation system, also known as a Global Distribution System, to contact us and make the reservation.

In our major markets, including the U.S. and all other countries with company-operated locations, customers may also reserve vehicles for rental from us and our franchisees through local, national or toll-free telephone calls to our reservations center, directly through our rental locations or, in the case of insurance replacement rentals, through proprietary automated systems serving the insurance industry.

Franchisees

In certain U.S. and international markets, we have found it efficient to issue licenses under franchise arrangements to independent operators who are engaged in the vehicle rental business. Franchisees rent vehicles that they own or lease and may provide related services to customers, primarily under our Hertz, Dollar or Thrifty brands. In many markets, franchisees operate franchises for multiple brands.

Franchisees generally pay an initial license fee, royalties based on a percentage of their revenues as well as other fees, and in return are provided the use of the applicable brand name, certain operational support and training, reservations through our reservation channels, including access to reservations from corporate contracts and other services. Additionally, in countries with both corporate and franchised operations, franchisees may utilize our vehicles, and we may utilize their vehicles, to support one-way business within the country. Franchisee arrangements enable us to offer expanded national and international service and a broader one-way rental program. In addition to vehicle rental, certain international franchisees engage in vehicle leasing and the rental of chauffeur-driven vehicles, camper vans and motorcycles.

The ability to transfer a franchisee license is limited and requires our consent. Franchise licenses are generally terminable by us only for cause or after a fixed term. All of these agreements also include a company right of first refusal should a franchisee receive a bona fide offer to sell the license or its business. Franchisees in the U.S. typically may terminate without cause only on prior notice, generally 180 days. In certain international jurisdictions, franchisees typically do not have early termination rights absent cause. We continue to issue new licenses and, from time to time, re-acquire franchised businesses or sell company-operated locations to franchisees.

Franchise operations, including fleet acquisition, are financed independently by the franchisees and we do not have an investment interest in the franchisees. Fees from franchisees, including initial franchise fees, generally support a portion of our brand awareness program costs, reservations system, sales and marketing efforts and certain other services and comprised approximately 2% of our worldwide vehicle rental revenues for the year ended December 31, 2023.

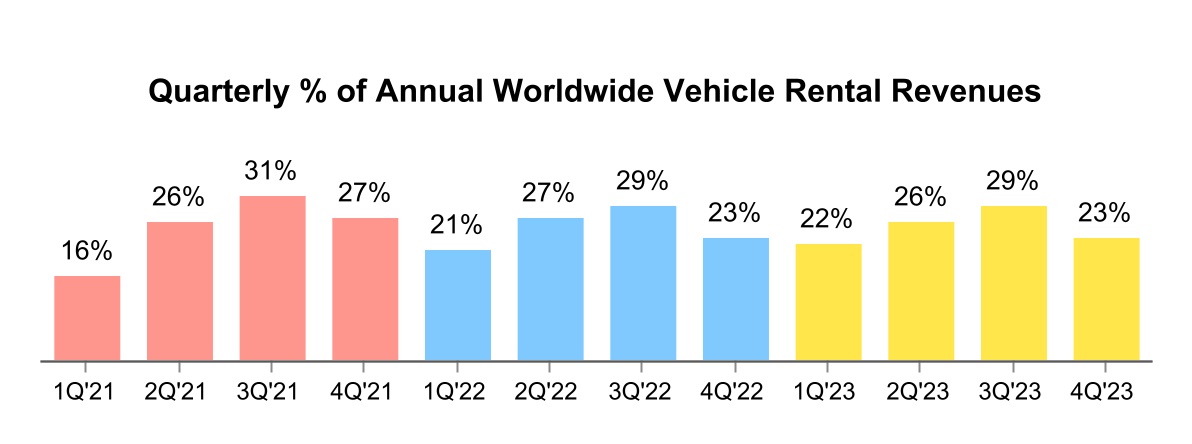

Seasonality

Our vehicle rental operations are a seasonal business with decreased levels of business in the winter months and heightened activity during the spring and summer months ("our peak season") for the majority of countries where we generate our revenues. To accommodate increased demand, we typically increase our available fleet and staff in the second and third quarters of the year to add a significant number of part-time and seasonal workers. A number of our other major operating costs, including airport concession fees, commissions and vehicle liability expenses, are directly related to revenues or transaction volumes and thus also increase in the second and third quarters. Certain operating expenses, including real estate taxes, rent, insurance, utilities, facility maintenance and other facility-related expenses, the costs of operating our information technology systems and minimum staffing costs, remain fixed and therefore do not vary based on seasonal demand.

8

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

The following chart presents the proportionate contribution of each quarter to full year revenue for each of the years ended December 31, 2023, 2022 and 2021. As discussed above, our peak season historically has been the second and third quarters of the year.

Fleet

During the year ended December 31, 2023, we operated a peak rental fleet in our Americas RAC and International RAC segments of approximately 467,000 vehicles and 124,600 vehicles, respectively. Purchases of vehicles are financed by active and ongoing global borrowing programs and through cash from operations. The vehicles purchased are either program vehicles or non-program vehicles. We periodically review the efficiencies of an optimal mix between program and non-program vehicles in our fleet and adjust the ratio of program and non-program vehicles as needed based on availability, vehicle economics and contract negotiations.

During the year ended December 31, 2023, our approximate average holding period for rental vehicles sold was 20 months in our Americas RAC segment, down 20% compared to 2022 due in part to our decision to sell newer vehicles instead of older vehicles due to residual values. In our International RAC segment, our approximate average holding period for rental vehicles sold was 16 months, down 11% compared to 2022 due in part to increased program vehicle dispositions.

9

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

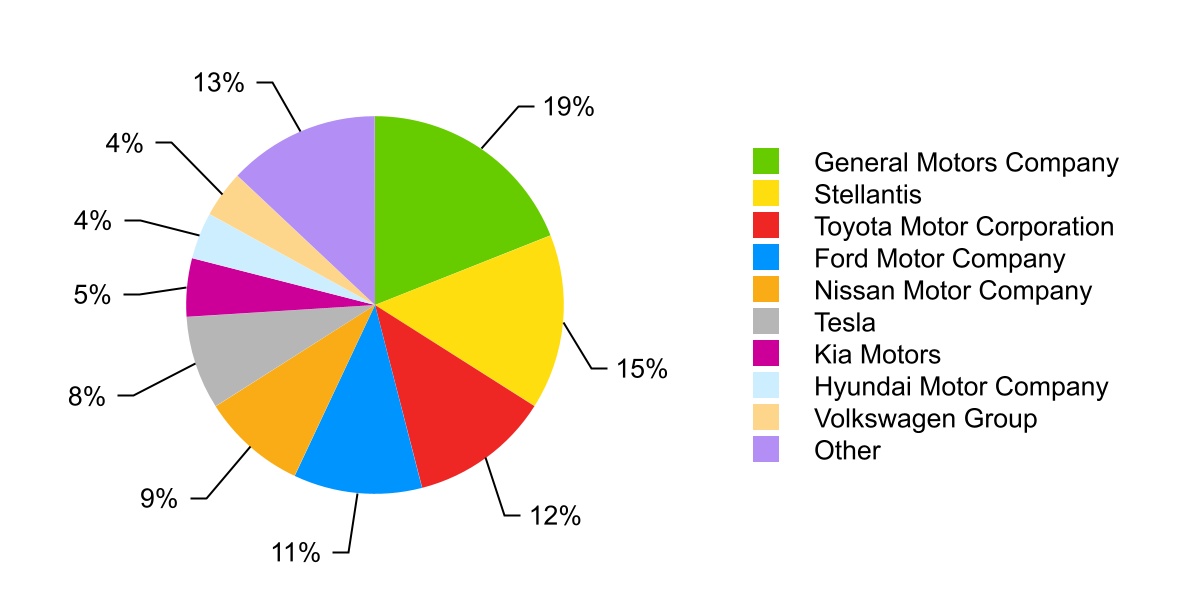

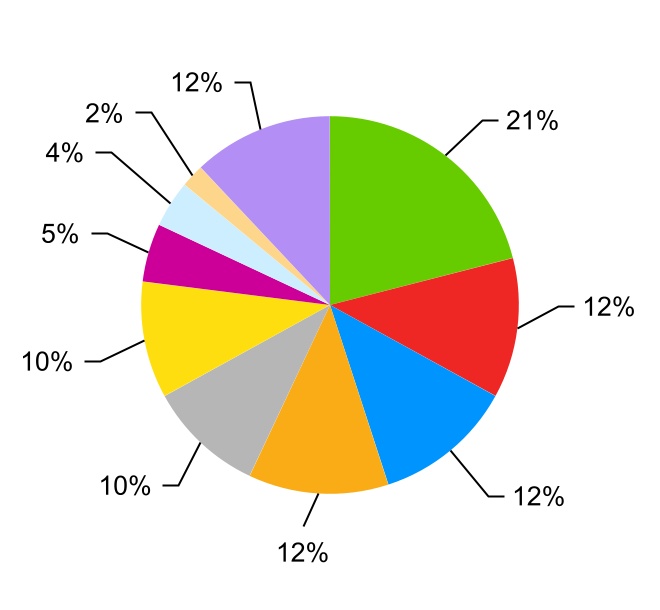

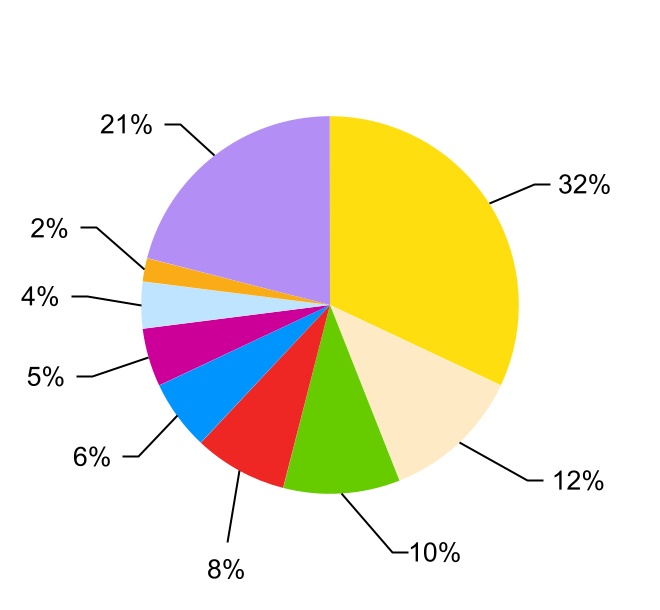

Our fleet composition is as follows:

Fleet Composition by Vehicle Manufacturer*

As of December 31, 2023

Americas RAC International RAC*

* Vehicle manufacturers Daimler AG (Mercedes Benz and Smart), Renault, Mitsubishi, Mazda, Volvo and Rover Group together comprise another 15% of the International RAC fleet and are included as "Other" in the overall and International RAC charts above.

We maintain vehicle maintenance centers which provide maintenance for our fleet, many of which include sophisticated vehicle diagnostic and repair equipment, and are accepted by automobile manufacturers, as eligible, to perform warranty work. Collision damage and major repairs are generally performed by independent contractors.

Vehicle Repurchase Programs

Program vehicles are purchased under repurchase or guaranteed depreciation programs with vehicle manufacturers wherein the manufacturers agree to repurchase vehicles at a specified price or guarantee the

10

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

depreciation rate on the vehicles during established repurchase periods, subject to, among other things, certain vehicle condition, mileage and holding period requirements. Repurchase prices under repurchase programs are based on the original cost less a set daily depreciation amount. These repurchase and guaranteed depreciation programs limit our residual risk with respect to vehicles purchased under the programs and allow us to reduce the variability of depreciation expense for each vehicle, however, typically the acquisition cost is higher. Program vehicles generally provide us with flexibility to increase or reduce the size of our fleet based on market demand. When we increase the percentage of program vehicles, the average age of our fleet decreases since the average holding period for program vehicles is shorter than for non-program vehicles.

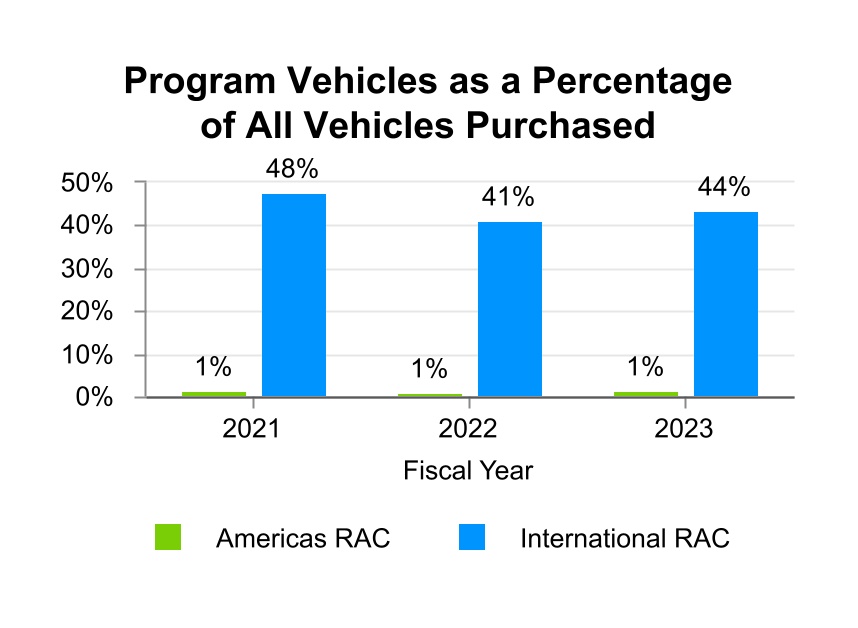

Program vehicles as a percentage of all vehicles purchased within our Americas RAC and International RAC segments during the last three fiscal years were as follows:

Other Vehicle Disposition Channels

During the year ended December 31, 2023, the vehicles sold in our U.S. and international vehicle rental operations that were not repurchased by manufacturers were sold through a variety of channels, including dealer direct wholesale channels, direct sales to third parties, retail channels and auction. We use multiple channels to provide greater flexibility and the opportunity for improved returns.

Our company-operated retail sales channel, Hertz Car Sales, consists of a network of company-operated vehicle sales locations throughout the U.S. dedicated to the sale of vehicles from our rental fleet. Vehicles disposed of through our retail outlets provide for ancillary vehicle sales revenue, such as warranty, financing and aftermarket products.

Competition

Competition among vehicle rental industry participants is intense and is primarily based on vehicle availability and quality, price, service, reliability, rental locations, product innovation and competition from online travel agents and vehicle rental brokers. We believe that the strength of the Hertz, Dollar and Thrifty brands, our extensive worldwide network of vehicle rental operations and our commitment to innovation, including our EV initiatives, provide us with a strong competitive advantage. Our principal vehicle rental industry competitors are Avis Budget Group, Inc., which currently operates the Avis, Budget, ZipCar and Payless brands; Enterprise Holdings, which operates the Enterprise

11

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

Rent-A-Car Company, National Car Rental and Alamo Rent A Car brands; and SIXT. We also compete with local and regional vehicle rental companies, ride share companies and peer-to-peer car sharing marketplaces.

Geographic Markets

U.S.

The U.S. represented approximately $38.4 billion in estimated annual industry revenues for 2023. The average number of vehicles in the U.S. vehicle rental industry in 2023 was approximately two million vehicles. U.S. industry Revenue Per Unit Per Month in 2023 was approximately $1,412.

Europe

Europe represented approximately $19.3 billion in estimated annual industry revenues for 2023. Europe has generally demonstrated a lower historical reliance on air travel because the European off airport vehicle rental market has been significantly more developed than in the U.S. Within Europe, the largest markets in which we do business are France, Germany, Italy, Spain and the United Kingdom. Throughout Europe, we do business through company-operated rental locations and through our franchisees or partners.

Asia Pacific

Asia Pacific represented approximately $21.7 billion in estimated annual industry revenues for 2023. Within this region, the largest markets in which we do business are Australia, China, Japan and New Zealand. In each of these countries we do business through company-operated rental locations and through our franchisees or partners.

Middle East and Africa

The Middle East and Africa represented approximately $3.5 billion in estimated annual industry revenues for 2023. Within these regions, the largest markets in which we do business are South Africa and the United Arab Emirates. In each of these countries we do business through our franchisees.

Latin America

Latin America represented approximately $5.1 billion in estimated annual industry revenues for 2023. Within Latin America, the largest markets in which we do business are Argentina, Mexico and Panama. In each of these countries, we do business through our franchisees or partners.

EMPLOYEES AND HUMAN CAPITAL MANAGEMENT

As of December 31, 2023, we employed approximately 27,000 persons, consisting of approximately 21,000 persons in the U.S. and approximately 6,000 persons internationally.

Certain employees outside the U.S. are covered by a wide variety of union contracts and governmental regulations affecting, among other things, compensation, job retention rights and pensions. Labor contracts covering the terms of employment of 26% of our workforce in the U.S. (including those in the U.S. territories) are presently in effect with local unions, affiliated primarily with the International Brotherhood of Teamsters and other plans. Labor contracts covering 45% of these employees will expire during 2024. We have had no material work stoppage as a result of labor problems during the last ten years, and we believe our labor relations to be good.

In addition to the employees referred to above, we engage outside services, as is customary in the industry, principally for the non-revenue movement of rental vehicles between rental locations.

12

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

Human Capital Management

Our people are our greatest asset. We believe that to continue to evolve as a business, and achieve our strategic goals, we must attract and retain the right talent. We therefore strive to have a constant focus on, and remain attentive to, matters concerning our employees.

Our human capital management strategy begins with our Board and senior management. Our Board and Board committees periodically review our employee programs and initiatives, and oversee our approach to attracting, retaining and developing talent. Our Board reviews key senior management compensation and benefit programs. Senior management uses various tools to strive to ensure its human capital management strategies are delivering intended results, such as seeking feedback from our employees.

Our focus on talent retention requires that we invest in our employees' professional development as well as their physical, emotional and financial well-being. We regularly assess our benefits and program offerings to provide a compelling and comprehensive portfolio, which currently includes the following in the U.S. (specific offerings vary for employees represented by labor unions):

•competitive salaries and wages;

•retirement savings with a 401(k) Plan and an employer match, up to a certain percentage;

•comprehensive health insurance, including medical, dental and vision plans for employees and their dependents;

•employer provided life insurance;

•no-cost employee assistance program, providing confidential counseling to help employees and their families dealing with hardships;

•paid parental leave;

•adoption benefits;

•free health screenings and programs for tobacco cessation, weight management and wellness coaching;

•employee referral incentive program;

•employee and family rental car and Hertz Car Sales discounts;

•employee training, professional development, education and tuition aid programs;

•employee relief fund that provides immediate, short-term financial assistance to employees through employee contributions and company match to assist employees dealing with natural disasters;

•training and development opportunities; and

•employee resource groups.

Outside of the U.S., we are committed to offering similar comprehensive programs that leverage the best of global benefits tailored by country to reflect local practices and culture. We evaluate our total benefits and programs annually and use feedback from employees to make thoughtful changes to ensure our programs continue to meet the needs of employees.

We are also committed to an inclusive workplace around the globe that champions equality, values different backgrounds and celebrates individuality. We believe the varied perspectives, experiences, skills and talents of our employees represent a significant part of our culture, as well as our success and reputation as a company.

As a global business, we have a firm commitment to equal opportunity, non-discrimination and anti-harassment. In addition, we strive to adhere to all relevant laws and mandatory reporting requirements. We are proud to have a diverse workforce around the world, and are committed to a journey that gives growth and opportunities throughout our organization. We embrace and encourage our employees' differences in age, race, religion, disability, ethnicity, gender, sexual orientation and other characteristics that make our employees unique.

At every level, we are committed to developing policies, practices and ways of working that support diversity and inclusion and aim to create a workplace where everyone feels respected and heard.

13

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

CORPORATE RESPONSIBILITY

We recognize our influence and are committed to do the right thing, the right way, every time for our employees and customers, as well as our communities and our planet. Delivering on this responsibility is a never-ending journey and one that we are proud to be on. We are committed to managing our businesses ethically and responsibly as we believe doing so enables us to realize the continuous improvement, sustainable innovation and enhanced business performance that are critical to our success.

The Environment

We are committed to understanding and addressing the impact of our operations and broader value chain on the environment and our communities through sustainable business practices, strategic decision-making, community partnerships and smart investments in future technologies, and to be a leader in the modern mobility landscape.

Climate Performance

We recognize the importance of reducing our greenhouse gas emissions as both a climate and business imperative. We are committed to our goal of being at the center of the modern mobility ecosystem and believe our investments in EVs and charging infrastructure will contribute towards our goal of enhancing the sustainability of our operations.

Fuel Efficient Fleet

As a critical connector between drivers, vehicles and technology, we have entered into relationships around EVs and technology. We offer a diverse fleet of EVs through agreements with a variety of EV manufactures, such as Tesla, Polestar and General Motors. We are also investing in EV infrastructure across our global operations by installing charging stations throughout our network to power our fleet and support customer adoption of EVs and supporting EV infrastructure expansion in several of the communities in which we operate through initiatives such as Hertz Electrifies and collaborations such as bp pulse. We have partnerships with certain ride share companies to provide EVs to drivers using their networks.

Water

We work to integrate environmental sustainability across our operations, including in our car washes. Car washes are the primary source of our water use, and we are focused on minimizing our demand on municipal water systems. We are committed to reviewing our procedures to prioritize water conservation from system efficiency upgrades in water stressed regions where we operate.

Waste Reduction and Recycling

Resource conservation and waste reduction is a component of our commitment to environmental sustainability across our global footprint. Recycling efforts include, but are not limited to, recycling used oils and solvents, tires, batteries, information technology equipment and general mixed materials.

Facilities and Construction

We seek to maximize energy and water efficiency at our facilities and rely on renewable energy at a number of locations. We incorporate sustainable design and construction practices based on Leadership in Energy and Environmental Design ("LEED") standards. LEED is administered by the U.S. Green Building Council and is the most widely used and respected green building rating system. Our world headquarters in Estero, Florida is LEED Gold® certified, and we have locations in St. Louis, Charlotte, Denver, Dulles and Newark airports that are also LEED certified. In addition to LEED, ISO 14001 sets environmental management standards and certifies facilities to those standards, while ISO 45001 addresses employee safety and workplace risks. Our Hertz European Service Center in Dublin, Ireland has achieved and maintains ISO 14001 and ISO 45001 certifications. Both LEED and ISO

14

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

standards enhance the health and comfort of building occupants, improve overall building performance and deliver cost savings.

In addition to incorporating leading standards into our buildings, we also strive to include on-site renewables consisting of solar photovoltaic systems at certain locations, which decreases our carbon footprint while lowering utility costs.

Our People and Communities

Our employees help drive our progress, innovation and success. We strive to empower our employees so they can build trust with our customers and the communities we serve around the world. As discussed above, attracting and retaining top talent is more than a measure of our business success; it is a measure of who we are and what we value. We also are committed to making a positive difference in the communities where we work, live and serve through our charitable giving and volunteer programs.

Our Business

Governance

We are committed to ensuring appropriate oversight and accountability of our corporate responsibility initiatives and our Board and senior management are directly engaged in this effort. Our Board's Governance Committee oversees this work and receives regular reports from management on our corporate responsibility efforts. In 2023, we launched a sustainability disclosure committee, comprised of senior leaders from a cross-functional spectrum, which is responsible for overseeing our sustainability-focused disclosure processes, resources and results.

Ethics

We seek to operate in compliance with all applicable laws and maintaining the highest standards of ethical conduct. Integrity is essential to every aspect of our business, both in policy and practice. Our Standards of Business Conduct outline specific practices to identify acceptable and unacceptable behavior for employees, officers and directors and helps promote our culture of acting ethically and doing the right thing in our operations around the world. Our Standards of Business Conduct also outline our policies and guidelines to help our employees navigate a variety of situations in relationships with each other and our stakeholders.

Supplier Diversity

We recognize that supporting diversity goes beyond our internal policies and practices, and we seek to build sustainable relationships with suppliers who integrate diversity into their own hiring processes and supply chain. Through our Supplier Diversity Program, we are committed to the equal and fair treatment of all suppliers. We aim to provide minority-owned, woman-owned and other socially or economically disadvantaged small businesses who perform at high levels the opportunity to compete to deliver products and services that support our brands.

As a long-standing member of the National Minority Supplier Development Council and the Women’s Business Enterprise National Council, we actively seek to do business with suppliers who are certified by such councils that recognize women and minorities.

Through these efforts, we seek to emphasize a supplier representation that reflects the customers and communities we serve. We believe that leveraging the global diversity of our workforce and supplier relations will enable us to address the local needs of the communities in which we live and work around the world.

15

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

INSURANCE AND RISK MANAGEMENT

In addition to managing risk associated with our business, rental car operations introduce several industry-specific generally insurable risks:

•legal liability arising from the operation of our vehicles (i.e., vehicle liability);

•legal liability to members of the public and employees from other causes (i.e., general liability/workers' compensation); and

•risk of property damage and/or business interruption and/or increased cost of operating as a consequence of property damage.

In many cases we self-insure for these risks or insure risks through wholly-owned insurance subsidiaries. We mitigate our exposure to large liability losses by maintaining excess insurance coverage, subject to deductibles and caps, through unaffiliated carriers. For certain of our international operations, we maintain some liability insurance coverage with unaffiliated carriers.

In addition, we offer customers optional liability insurance and other products providing insurance coverage, which create additional risk exposures for us. Our risk of property damage is also increased when we waive the provisions in our rental contracts that hold a renter responsible for damage or loss under an optional loss or damage waiver that we offer. We bear these and other risks, except to the extent the risks are transferred through insurance or contractual arrangements.

Third-Party Liability

In our U.S. operations, we are required by applicable financial responsibility laws to maintain insurance against legal liability for bodily injury, death or property damage to third parties arising from the operation of our vehicles, sometimes called “vehicle liability,” in stipulated amounts. In most jurisdictions, we satisfy those requirements by qualifying as a self-insurer, a process that typically involves governmental filings and demonstration of financial responsibility, which sometimes requires the posting of a bond or other security. In the remaining jurisdictions, we obtain an insurance policy from an unaffiliated insurance carrier and indemnify the carrier for any amounts paid under the policy. The regulatory method for protecting against such vehicle liability should be considered in the context of the Graves Amendment, as we generally bear limited economic responsibility for U.S. vehicle liability attributable to the negligence of our drivers, except to the extent that we successfully transfer such liability to others through insurance or contractual arrangements.

For our vehicle rental operations in Europe, we have established a wholly-owned insurance subsidiary, Probus Insurance Company Europe DAC (“Probus”), a direct writer of insurance domiciled in Ireland. In certain European countries with company-operated locations, we have purchased from Probus the vehicle liability insurance required by law. In other European countries, this coverage is purchased from unaffiliated carriers. Accordingly, as with our U.S. operations, we bear economic responsibility for vehicle liability in our European vehicle rental operations, except to the extent that we transfer such liability to others through insurance or contractual arrangements. For our international operations outside of Europe, we maintain some form of vehicle liability insurance coverage with unaffiliated carriers. The nature of such coverage and our economic responsibility for covered losses varies considerably. Nonetheless, we believe the amounts and nature of the coverage we obtain is adequate in light of the respective potential hazards.

In our U.S. and international operations, periodically in the course of our business, we become legally responsible to members of the public for bodily injury, death or property damage arising from causes other than the operation of our vehicles, sometimes known as “general liability.” As with vehicle liability, we bear economic responsibility for general liability losses, except to the extent we transfer such losses to others through insurance or contractual arrangements. In addition, to mitigate these exposures, we maintain excess liability insurance coverage with unaffiliated insurance carriers.

16

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

In our U.S. vehicle rental operations, we offer an optional liability insurance product, Liability Insurance Supplement (“LIS”), that provides vehicle liability insurance coverage substantially higher than state minimum levels to the renter and other authorized operators of a rented vehicle. LIS coverage is primarily provided under excess liability insurance policies issued by an unaffiliated insurance carrier, the risks under which are reinsured with a wholly-owned subsidiary, HIRE Bermuda Limited. Our offering of LIS coverage in our U.S. vehicle rental operations is conducted pursuant to limited licenses or exemptions under state laws governing the licensing of insurance producers.

Provisions on our books for self-insured public liability and property damage vehicle liability losses are made by charges to expense based upon evaluations of estimated ultimate liabilities on reported and unreported claims.

Damage to Our Property

We bear the risk of damage to our property, unless such risk is transferred through insurance or contractual arrangements.

To mitigate our risk of large, single-site property damage losses globally, we maintain property insurance with unaffiliated insurance carriers in such amounts as we deem adequate in light of the respective hazards, where such insurance is available on commercially reasonable terms.

Our rental contracts typically provide that the renter is responsible for damage to or loss (including loss through theft) of rented vehicles. We generally offer an optional rental product, known in various countries as “loss damage waiver,” “collision damage waiver” or “theft protection,” under which we waive or limit our right to make a claim for such damage or loss.

Collision damage costs and the costs of stolen or unaccounted-for vehicles, along with other damage to our property, are charged to expense as incurred.

Other Risks