Exhibit 99.1

Explanatory Note

Hertz Global Holdings, Inc. ("Hertz Global" when including its subsidiaries and variable interest entities ("VIEs") and "Hertz Holdings" when excluding its subsidiaries and VIEs) which wholly owns The Hertz Corporation ("Hertz" and interchangeably with Hertz Global, the "Company") is filing this exhibit to reflect changes to the presentation of our financial information as set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “2020 Form 10-K”), as filed with the Securities and Exchange Commission (the “SEC”) on February 26, 2021, in order to give effect to a change in segment reporting.

As previously disclosed in our Quarterly Report on Form 10-Q for the period ended June 30, 2021 (as filed with the SEC on August 9, 2021), effective in the second quarter of 2021, in connection with the Hertz Global, Hertz and certain of their direct and indirect subsidiaries in the U.S. and Canada (collectively the "Debtors") emergence from Chapter 11 on June 30, 2021 and changes in how the Company's chief operating decision maker ("CODM") regularly reviews operating results and allocates resources, the Company revised its reportable segments to include Canada, Latin America and the Caribbean in its Americas Rental Car ("Americas RAC") reportable segment, which were previously included in its International Rental Car ("International RAC") reportable segment. Accordingly, prior periods have been restated to conform with the revised presentation.

This exhibit updates the information in the following items as initially filed in order to reflect the change in segment reporting: Part I. Item 1, Business; Part II. Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations; and Part II. Item 8, Financial Statements and Supplementary Data. No items in the 2020 Form 10-K other than those identified above are being updated by this filing. Information in the 2020 Form 10-K is generally stated as of December 31, 2020 and this filing does not reflect any subsequent information or events other than the changes noted above. Without limiting the foregoing, this filing does not purport to update Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in the 2020 Form 10-K for any information, uncertainties, transactions, risks, events, or trends occurring, or known to management, other than the events described above. More current information is contained in our Quarterly Report on Form 10-Q for the period ended June 30, 2021 and other filings with the SEC. This exhibit should be read in conjunction with the 2020 Form 10-K, the Form 10-Q for the period ended June 30, 2021, and any other documents we have filed with the SEC subsequent to August 9, 2021.

PART I

ITEM 1. BUSINESS

OUR COMPANY

Hertz Holdings was incorporated in Delaware in 2015 to serve as the top-level holding company for Rental Car Intermediate Holdings, LLC, which wholly owns Hertz, our primary operating company. Hertz was incorporated in Delaware in 1967 and is a successor to corporations that have been engaged in the vehicle rental and leasing business since 1918.

In March 2020, the World Health Organization declared COVID-19 a pandemic, affecting multiple global regions, including areas in which we operate. The impact of this pandemic has been and will likely continue to be extensive in many aspects of the economy and society, which has resulted in, and will likely continue to result in, significant disruptions to the global economy, as well as businesses around the world. In an effort to halt the spread of COVID-19, many governments around the world placed significant restrictions on travel, individuals voluntarily reduced their air and other forms of travel in attempts to avoid the outbreak and many businesses announced closures and imposed travel restrictions. To varying degrees, restrictions on travel and reductions in air travel continued throughout 2020 and travel remains far below recent historical pre-COVID-19 levels. There is continued uncertainty about the duration of the negative impact from COVID-19 and the length and scope of travel restrictions and business closures imposed by governments of impacted countries and voluntarily undertaken by private businesses.

In connection with the expiration of the Forbearance Agreement and the Waiver Agreements, as described in Note 1, "Background," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2020 Annual Report, and the continuing economic impact from COVID-19, on May 22, 2020, the Debtors filed petitions under Chapter 11 of the Bankruptcy Code in the Bankruptcy Court. The Chapter 11 Cases are being jointly administered by the Bankruptcy Court under the caption In re The Hertz Corporation, et al., Case No. 20-11218 (MFW). Additional information about the Chapter 11 Cases, including access to documents filed with the Bankruptcy Court, is available online at https://restructuring.primeclerk.com/hertz, a website administered by Prime Clerk. The information on this website is not incorporated by reference and does not constitute part of this 2020 Annual Report.

In May 2020, the Bankruptcy Court approved motions filed by the Debtors that were designed primarily to mitigate the impact of the Chapter 11 Cases on our operations, customers and employees. The Debtors are authorized to conduct their business activities in the ordinary course, and pursuant to orders entered by the Bankruptcy Court, the Debtors are authorized to, among other things and subject to the terms and conditions of such orders (i) pay employees’ wages and related obligations; (ii) pay certain taxes; (iii) pay critical vendors and certain fees to airport authorities and provide adequate protection; (iv) continue to maintain certain customer programs; (v) maintain insurance programs; (vi) use certain cash collateral on an interim basis; (vii) honor certain obligations to franchisees; and (viii) maintain existing cash management systems.

The filing of the Chapter 11 Cases constituted defaults, termination events and/or amortization events with respect to certain of the Company's existing debt obligations. Additionally, as a result of the filing of the Chapter 11 Cases, the remaining capacity under almost all of our revolving credit facilities was terminated. Consequently, the sales proceeds of vehicles which serve as collateral for such vehicle finance facilities must be applied to the payment of the related indebtedness of the Non-Debtor Financing Subsidiaries, as defined in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2020 Annual Report, and are not otherwise available to fund our operations. Additionally, we are precluded from accessing any of our subordinated investment in the vehicle collateral until the related defaults are waived or the third party funding under those facilities has been retired, either through the monetization of the underlying collateral or the refinancing of the related indebtedness. Proceeds from vehicle receivables, excluding

1

ITEM 1. BUSINESS (Continued)

manufacturer rebates, as of December 31, 2020 and ongoing vehicle sales must be applied to vehicle debt in amortization.

For additional information on the Chapter 11 Cases, see Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Note 1, "Background," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2020 Annual Report.

We operate our vehicle rental business globally primarily through the Hertz, Dollar and Thrifty brands from approximately 12,000 corporate and franchisee locations in North America, Europe, Latin America, Africa, Asia, Australia, the Caribbean, the Middle East and New Zealand. We remain one of the largest worldwide vehicle rental companies and our Hertz brand name is one of the most recognized globally, signifying leadership in quality rental services and products. We have an extensive network of airport and off airport rental locations in the U.S. and in all major European markets. We are also a provider of integrated vehicle leasing and fleet management solutions through our Donlen subsidiary, as discussed below.

OUR BUSINESS SEGMENTS

We have identified three reportable segments, which are organized based on the products and services provided by our operating segments and the geographic areas in which our operating segments conduct business. In the second quarter of 2021, in connection with our Chapter 11 Emergence and changes in how our chief operating decision maker ("CODM") regularly reviews operating results and allocates resources, we revised our reportable segments to include Canada, Latin America and the Caribbean in our Americas Rental Car ("Americas RAC") reportable segment, historically our U.S. RAC reportable segment, which were previously included in our International RAC reportable segment. Accordingly, all periods have been restated to conform with the revised presentation. The Company has identified three reportable segments, which are consistent with its operating segments, as follows:

•Americas RAC - Rental of vehicles and sales of value-added services in the U.S., Canada, Latin America and the Caribbean. We maintain a substantial network of company-operated rental locations in this segment, enabling us to provide consistent quality and service. We also have franchisees and partners that operate rental locations under our brands;

•International RAC - Rental and leasing of vehicles as well as sales of value-added services in locations other than the U.S., Canada, Latin America and the Caribbean. We maintain a substantial network of company-operated rental locations, a majority of which are in Europe. Our franchisees and partners also operate rental locations in approximately 110 countries and jurisdictions, including many of the countries in which we also have company-operated rental locations; and

•All Other Operations - Primarily comprised of our Donlen business, which provides integrated vehicle leasing and fleet management solutions in the U.S. and Canada. Donlen is a provider of these services for commercial fleets and Donlen's fleet management programs provide solutions to reduce fleet operating costs and improve driver productivity and safety. These programs include administration of preventive vehicle maintenance, advisory services and fuel and accident management along with other complementary services. Additionally, Donlen provides specialized consulting and technology expertise that allows us and our customers to model, measure and manage fleet performance more effectively and efficiently. Also included are our other business activities which comprise less than 1% of revenues and expenses of the segment.

In the fourth quarter of 2020, we entered into a stock and asset purchase agreement to sell substantially all of the assets and certain liabilities of our wholly-owned subsidiary Donlen (the "Donlen Assets"). The sale is expected to close in the first quarter of 2021. See Note 3, "Divestitures," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2020 Annual Report for further information.

2

ITEM 1. BUSINESS (Continued)

In addition to the above reportable segments, we have Corporate operations. We assess performance and allocate resources based upon the financial information for our operating segments.

For further financial information on our segments, see (i) Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations and Selected Operating Data by Segment" and (ii) Note 18, "Segment Information," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2020 Annual Report.

Americas RAC and International RAC Segments

Brands

Our Americas and International vehicle rental businesses are primarily operated through three brands — Hertz, Dollar, and Thrifty. We offer multiple brands in order to provide customers a full range of rental services at different price points, levels of service, offerings and products. Each of our brands generally maintains separate airport counters, reservations, marketing and other customer contact activities. We achieve synergies across our brands by, among other things, utilizing a single fleet and fleet management team and combined vehicle maintenance, vehicle cleaning and back office functions, where applicable.

Our top tier brand, Hertz, is one of the most recognized brands in the world offering premium services that define the industry. This is consistent with numerous published best-in-class vehicle rental awards that we have won both in the U.S. and internationally over many years, including our ranking in 2019 and 2020 of #1 in Customer Satisfaction by J.D. Power. We go to market under the tagline of “Hertz. We’re here to get you there” which is true to our promise and reputation for quality and customer service. We have a number of innovative offerings, such as Hertz Gold Plus Rewards, Hertz Ultimate Choice and unique vehicles offered through our specialty collections. We continue to maintain our position as a premier provider of vehicle rental services through an intense focus on service, loyalty, quality and product innovation.

Our smart value brand, Dollar, is the choice for financially-focused travelers looking for a dependable car at a price they can afford. The Dollar brand’s main focus is serving the airport vehicle rental market, comprised of family, leisure and small business travelers. Dollar’s tagline of “We never forget whose dollar it is” indicates the brand’s mission to provide a reliable rental experience at a price that works. Dollar operates primarily through company-owned locations in the U.S. and Canada. We also globally license to independent franchisees which operate as a part of the Dollar brand system and have company-owned Dollar locations in certain countries.

Our deep value brand, Thrifty, is the brand for savvy travelers who enjoy the “thrill of the hunt” to find a good deal. The Thrifty brand’s main focus is serving the airport vehicle rental market, comprised of leisure travelers. Thrifty’s tagline “The Absolute Best Car for Your Money” indicates the brand’s focus on being the rental company that puts you in control of where you splurge and where you save. Thrifty operates primarily through company-owned locations in the U.S. and Canada. We also globally license to independent franchisees which operate as part of the Thrifty brand system and have company-owned Thrifty locations in certain countries.

In certain locations outside the U.S., we also offer our Firefly brand which is a deep value brand for price conscious leisure travelers. We have Firefly locations servicing local area airports in select non-U.S. leisure markets where other deep value brands have a significant presence.

3

ITEM 1. BUSINESS (Continued)

Operations

Locations

We operate both airport and off airport locations which utilize common vehicle fleets, are supervised by common country, regional and local area management, use many common systems and rely on common vehicle maintenance and administrative centers. Additionally, our airport and off airport locations utilize common marketing activities and have many of the same customers. We regard both types of locations as aspects of a single, unitary, vehicle rental business. Off airport revenues comprised approximately 46% of our worldwide vehicle rental revenues in 2020 and approximately 35% in 2019, where the increase in off airport revenues and associated decrease in airport revenues is primarily driven by the impact of COVID-19 discussed above.

Airport

We have approximately 2,000 airport rental locations in our Americas RAC segment and approximately 1,500 airport rental locations in our International RAC segment, representing a decrease of 5% from December 31, 2019 in our Americas RAC segment, where the decrease is primarily the product of a location rationalization effort in the Chapter 11 Cases as reflected in the Lease Rejection Orders entered by the Bankruptcy Court, as further described in Note 10, "Leases," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2020 Annual Report. Our International RAC vehicle rental operations have company-operated locations in Australia, Belgium, the Czech Republic, France, Germany, Italy, Luxembourg, the Netherlands, New Zealand, Slovakia, Spain, and the United Kingdom. We believe that our extensive global network of company-operated locations contributes to the consistency of our service, cost control, Vehicle Utilization, competitive pricing and our ability to offer one-way rentals.

For our airport company-operated rental locations, we have obtained concessions or similar leasing agreements or arrangements, granting us the right to conduct a vehicle rental business at the respective airport. Our concessions were obtained from the airports' operators, which are typically governmental bodies or authorities, following either negotiation or bidding for the right to operate a vehicle rental business. The terms of an airport concession typically require us to pay the airport's operator concession fees based upon a specified percentage of the revenues we generate at the airport, subject to a minimum annual guarantee. Under most concessions, we must also pay fixed rent for terminal counters or other leased properties and facilities. Most concessions are for a fixed length of time, while others create operating rights and payment obligations that are terminable at any time. As a result of the impact from COVID-19 we received rent concessions in the form of abatement and payment deferrals of fixed and variable rent payments for certain of our airport locations. See Note 10, "Leases," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2020 Annual Report for further details.

The terms of our concessions typically do not forbid us from seeking, and in a few instances actually require us to seek, reimbursement from customers for concession fees we pay; however, in certain jurisdictions the law limits or forbids our doing so. Where we are required or permitted to seek such reimbursement, it is our general practice to do so. Certain of our concession agreements may require the consent of the airport's operator in connection with material changes in our ownership. A growing number of larger airports are building consolidated airport vehicle rental facilities to alleviate congestion at the airport. These consolidated rental facilities provide a more common customer experience and may eliminate certain competitive advantages among the brands as competitors operate out of one centralized facility for both customer rental and return operations, share consolidated busing operations and maintain image standards mandated by the airports.

Off Airport

We have approximately 3,500 off airport locations in our Americas RAC segment and approximately 5,000 off airport rental locations in our International RAC segment, representing a decrease of 8% from December 31, 2019 in our Americas RAC segment, where the decrease is primarily the product of a location rationalization effort in the Chapter 11 Cases as reflected in the Lease Rejection Orders entered by the Bankruptcy Court, as further described in Note 10, "Leases," to the Notes to our consolidated financial statements under the caption Item 8, "Financial

4

ITEM 1. BUSINESS (Continued)

Statements and Supplementary Data” included in this 2020 Annual Report. Our off airport rental customers include people who prefer to rent vehicles closer to their home or place of work for business or leisure purposes, as well as those needing to travel to or from airports. Our off airport customers also include people who have been referred by, or whose rental costs are being wholly or partially reimbursed by, insurance companies following accidents in which their vehicles were damaged, those expecting to lease vehicles that are not yet available from their leasing companies and replacement renters. In addition, our off airport customers include drivers for our TNC Partners, which is further described in “TNC Rentals” below.

When compared to our airport rental locations, an off airport rental location typically uses smaller rental facilities with fewer employees, conducts pick-up and delivery services and serves replacement renters using specialized systems and processes. On average, off airport locations generate fewer transactions per period than airport locations.

Our off airport locations offer us the following benefits:

•Provide customers a more convenient and geographically extensive network of rental locations, thereby creating revenue opportunities from replacement renters, non-airline travel renters and airline travelers with local rental needs;

•Provide a more balanced revenue mix by reducing our reliance on air travel and therefore reducing our exposure to external events that may disrupt airline travel trends;

•Contribute to higher Vehicle Utilization as a result of the longer average rental periods associated with off airport business, compared to those of airport rentals;

•Insurance replacement rental volume is less seasonal than that of other business and leisure rentals, which permits efficiencies in both vehicle and labor planning; and

•Cross-selling opportunities exist for us to promote off airport rentals among frequent airport Hertz Gold Plus Rewards program renters and, conversely, to promote airport rentals to off airport renters.

Customers and Business Mix

We conduct various sales and marketing programs to attract and retain customers. Our sales force calls on companies and other organizations whose employees and associates need to rent vehicles for business purposes or for replacement rental needs, including insurance and leasing companies, automobile repair companies and vehicle dealers. In addition, our sales force works with membership associations, tour operators, travel companies and other groups whose members, participants and customers rent vehicles for either business or leisure purposes. We advertise our vehicle rental offerings through a variety of traditional media channels, partner publications (e.g. affinity clubs and airline and hotel partners), direct mail and digital marketing. In addition to advertising, we conduct other forms of marketing and promotion, including travel industry business partnerships and press and public relations activities. As a result of the impacts from COVID-19 and related cost-reduction initiatives, we have reduced the extent of our marketing and advertising activities. See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations and Selected Operating Data by Segment" for further details.

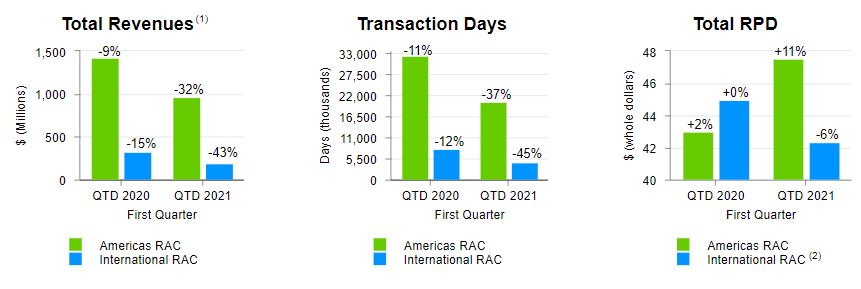

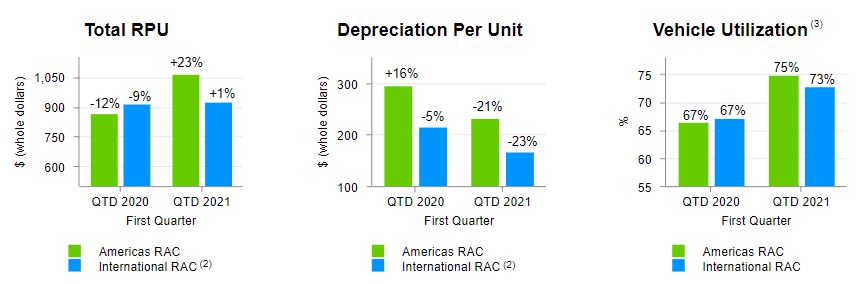

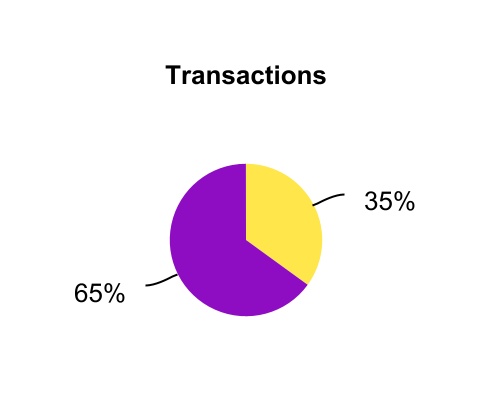

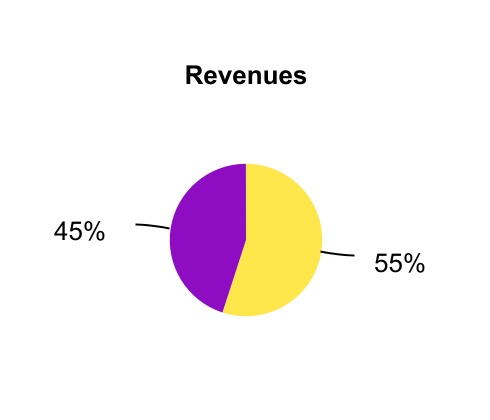

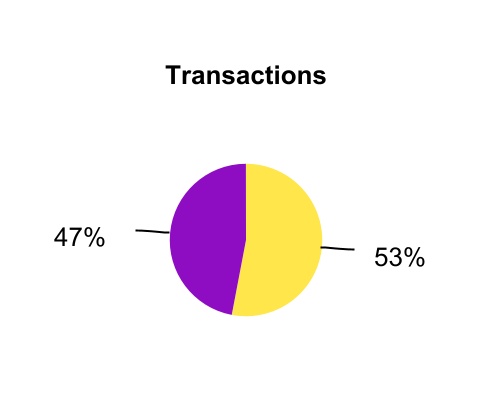

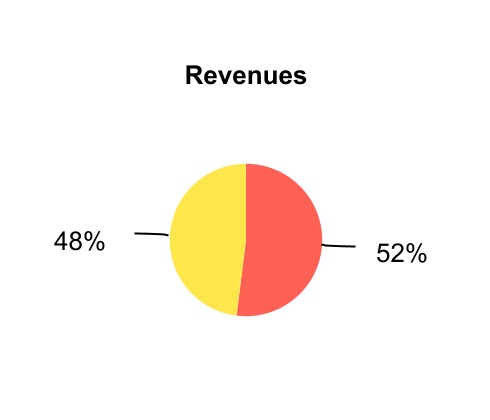

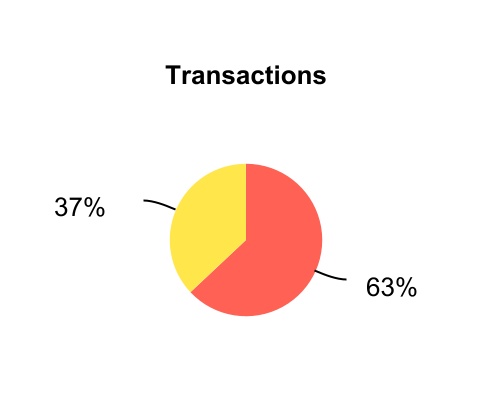

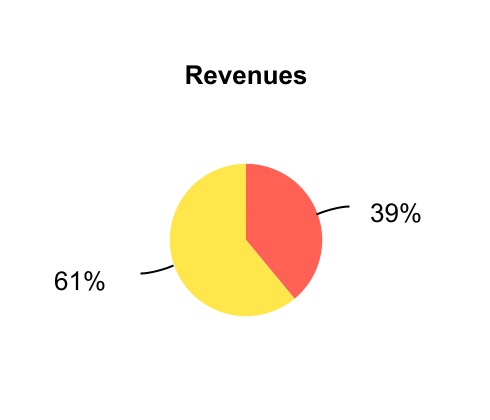

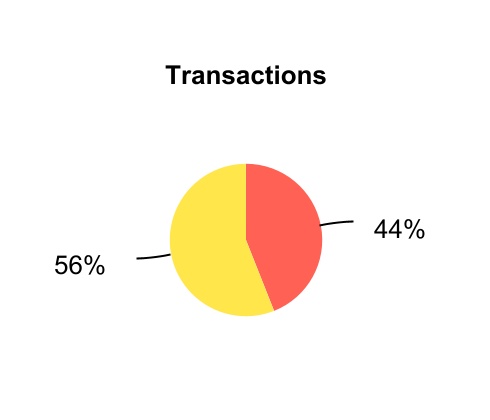

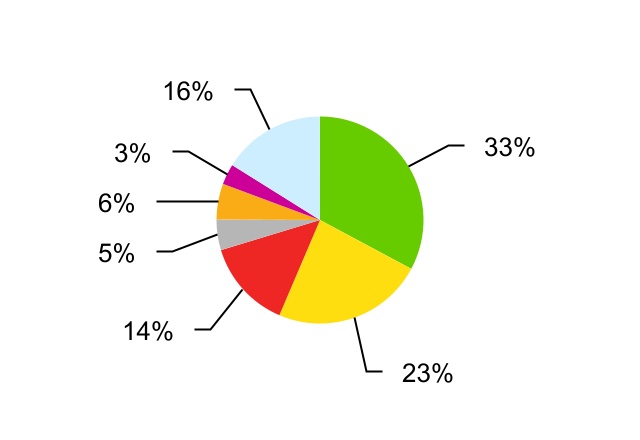

We categorize our vehicle rental business based on the purpose and type of location from which customers rent from us. The following charts set forth the percentages of rental revenues and rental transactions in our Americas RAC and International RAC segments based on these categories.

5

ITEM 1. BUSINESS (Continued)

VEHICLE RENTALS BY CUSTOMER

Year Ended December 31, 2020

Americas RAC

| Business | ||||||||

| Leisure | ||||||||

International RAC

| Business | ||||||||

| Leisure | ||||||||

Customers who rent from us for “business” purposes include those who require vehicles in connection with commercial activities, including drivers for our TNC Partners and delivery service providers, the activities of governments and other organizations or for temporary vehicle replacement purposes. As a result of increased online shopping due to the impact of COVID-19, we saw increased delivery service usage during 2020. Most business customers rent vehicles from us on terms that we have negotiated with their employers or other entities with which they are associated, and those terms can differ from the terms on which we rent vehicles to the general public. We have negotiated arrangements relating to vehicle rental with many businesses, governments and other organizations.

Customers who rent from us for “leisure” purposes include individual travelers booking vacation travel rentals with us and people renting to meet other personal needs. Leisure rentals are generally longer in duration and generate

6

ITEM 1. BUSINESS (Continued)

more revenue per transaction than business rentals. Leisure rentals also include rentals by customers of U.S. and international tour operators, which are usually a part of tour packages that can include air travel and hotel accommodations.

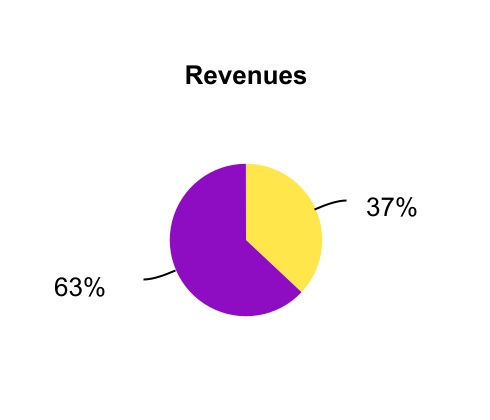

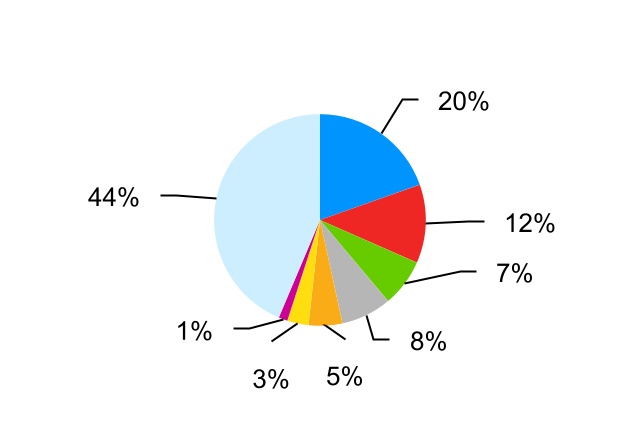

VEHICLE RENTALS BY LOCATION

Year Ended December 31, 2020

Americas RAC

| Airport | ||||||||

| Off airport | ||||||||

International RAC

| Airport | ||||||||

| Off airport | ||||||||

Demand for airport rentals is correlated with airline travel patterns, and transaction volumes generally follow global airline passenger traffic ("enplanement") and Gross Domestic Product ("GDP") trends. Customers often make reservations for airport rentals when they book their flight plans, which make our relationships with travel agents, associations and other partners (e.g., airlines and hotels) a key competitive strategy in generating consistent and recurring revenue streams. As discussed above, airport travel in 2020 was significantly reduced due to many governments around the world placing significant restrictions on travel, individuals voluntarily reducing their air travel and businesses implemented travel restrictions, resulting in a 72% decrease in U.S. airport traveler

7

ITEM 1. BUSINESS (Continued)

throughput, as measured by the U.S. Transportation Security Administration, during the period March 1, 2020 through December 31, 2020 compared to the same period in 2019.

Off airport rentals include insurance replacements, and we have agreements with the referring insurers establishing the relevant rental terms, including the arrangements made for billing and payment. We have identified approximately 200 insurance companies, ranging from local or regional vehicle carriers to large, national companies, as our target insurance replacement market. As of December 31, 2020, we were a preferred or recognized supplier for 61% of these insurance companies and a co-primary for 17% of them.

Customer Service Offerings

At our major airport rental locations and certain smaller airport and off airport locations, customers participating in our Hertz Gold Plus Rewards program are able to rent vehicles in an expedited manner. Participants in our Hertz Gold Plus Rewards program often bypass the rental counter entirely and proceed directly to their vehicle upon arrival at our facility. Participants in our Hertz Gold Plus Rewards program are also eligible to earn Hertz Gold Plus Rewards points that may be redeemed for free rental days or converted to awards of other companies' loyalty programs. Hertz's Gold Plus Rewards program offers three elite membership tiers which provide more frequent renters the opportunity to earn additional reward points and vehicle upgrades. For the year ended December 31, 2020, rentals by Hertz Gold Plus Rewards members accounted for approximately 31% of our worldwide rental transactions. We believe the Hertz Gold Plus Rewards program provides us with a significant competitive advantage, particularly among frequent travelers, and we have targeted such travelers for participation in the program. We offer electronic rental agreements and returns for our Hertz, Dollar and Thrifty customers in the U.S. Simplifying the rental transaction saves customers time and provides greater convenience through access to digitally available rental contracts.

When Hertz Gold Plus Rewards members make a reservation for a midsize car or above, they have access to exclusive vehicles based on their membership tier via our Hertz Ultimate Choice program which allows customers to choose their vehicle from a range of makes, models and colors available within the zone indicated on their reservation. Alternatively, they may upgrade at pick-up for a fee by choosing a vehicle from the Premium Upgrade zone. The Hertz Ultimate Choice program is offered at 62 U.S. airport locations as of December 31, 2020.

TNC Rentals

We have partnered with certain companies in the TNC market in the U.S. to offer vehicle rentals to their drivers in select U.S. cities. TNC rentals provide for an additional selection of higher mileage, and thus more economical, used vehicles in our retail sales outlets. Drivers for our TNC Partners reserve vehicles online through TNC Partner websites and pick up vehicles from select locations. TNC drivers can extend the vehicle rental on a weekly basis.

Hertz 24/7

We offer a car and van-sharing membership service, referred to as Hertz 24/7, which rents vehicles by the hour and/or by the day, at various locations internationally, primarily in Europe and in Australia under the Flexicar brand. Members reserve vehicles online, then receive the vehicles at convenient locations using keyless entry, without the need to visit a Hertz rental office. Members are charged an hourly or daily vehicle-rental fee which includes fuel, insurance, 24/7 roadside assistance and in-vehicle customer service. Hertz 24/7 specializes in Business-to-Business-to-Consumer (B2B2C) services working with retail partners to provide vans at their locations and with corporations providing pool fleets for use by their employees.

8

ITEM 1. BUSINESS (Continued)

Other Customer Service Initiatives

We offer a Mobile Gold Alerts service, available to participating Hertz Gold Plus Rewards customers, through which a text message and/or email with the vehicle information and location is sent approximately 30 minutes prior to arrival, providing the option to choose another vehicle. We offer Hertz e-Return, which allows customers to drop off their vehicle and go at the time of rental return. Customers can also use cashless toll lanes with our PlatePass offering where the license plate acts as a transponder, and we offer a vehicle-subscription service on a monthly or weekend basis in select locations that provides a flexible, cost-effective alternative to vehicle ownership, with no long-term commitment required, referred to as Hertz My Car and My Hertz Weekend. As a result of COVID-19, we began implementing enhanced safety measures to provide customers confidence while renting our vehicles. In May 2020, we introduced the Hertz Gold Standard Clean seal, in which each vehicle is sealed prior to rental following a rigorous 15-point cleaning and sanitization process that follows U.S. Centers for Disease Control and Prevention guidelines.

Rates

We rent a wide variety of makes and models of vehicles. We rent vehicles on an hourly (in select international markets), daily, weekend, weekly, monthly or multi-month basis, with rental charges computed on a limited or unlimited mileage rate, or on a time rate plus a mileage charge. Our rates vary by brand and at different locations depending on local market conditions and other competitive and cost factors. While vehicles are usually returned to the locations from which they are rented, we also allow one-way rentals from and to certain locations. In addition to vehicle rentals and franchise fees, we generate revenues from reimbursements by customers of airport concession fees, unless the law limits or forbids us from doing so, and vehicle licensing costs, fueling charges, and charges for value-added services such as supplemental equipment (e.g., child seats and ski racks), loss or collision damage waiver, theft protection, liability and personal accident/effects insurance coverage, premium emergency roadside service and satellite radio.

Reservations

We price and accept reservations for our vehicles through each of our brands. Reservations are generally for a class of vehicles, such as compact, midsize or sport utility vehicle.

We distribute pricing and content and accept reservations through multiple channels. Direct reservations are accepted at Hertz.com, Dollar.com and Thrifty.com, which have global and local versions in multiple languages. Hertz.com offers a range of products, prices and additional services as well as Hertz Gold Plus Rewards benefits, serving both company-operated and franchise locations. In addition to our websites, direct reservations are enabled via our Hertz and Dollar smartphone apps, which include additional connected products and services.

Customers may also seek reservations via travel agents or third-party travel websites. In many of those cases, the travel agent or website utilizes an Application Programming Interface (“API”) connection to Hertz or a third-party operated computerized reservation system, also known as a Global Distribution System (“GDS”), to contact us and make the reservation.

In our major markets, including the U.S. and all other countries with company-operated locations, customers may also reserve vehicles for rental from us and our franchisees worldwide through local, national or toll-free telephone calls to our reservations center, directly through our rental locations or, in the case of replacement rentals, through proprietary automated systems serving the insurance industry.

9

ITEM 1. BUSINESS (Continued)

Franchisees

In certain U.S. and international markets, we have found it efficient to issue licenses under franchise arrangements to independent franchisees who are engaged in the vehicle rental business. These franchise arrangements allow our franchisees to rent vehicles that they own or lease to customers, primarily under our Hertz, Dollar or Thrifty brand. In certain markets and under certain circumstances, franchisees are given the opportunity to acquire franchises for multiple brands.

Franchisees generally pay royalties based on a percentage of their revenues as well as other fees, and in return are provided the use of the applicable brand name, certain operational support and training, reservations through our reservation channels, and other services. Franchisee arrangements enable us to offer expanded national and international service and a broader one-way rental program. In addition to vehicle rental, certain international franchisees engage in vehicle leasing, and the rental of chauffeur-driven vehicles, camper vans and motorcycles.

Franchisees are ordinarily limited as to transferability of the license without our consent and are generally terminable by us only for cause or after a fixed term. Many of these agreements also include a right of first refusal on the part of the Company should a franchisee receive a bona fide offer to sell the license. Franchisees in the U.S. typically may terminate on prior notice, generally between 90 and 180 days. In Europe and certain other international jurisdictions, franchisees typically do not have early termination rights. Initial license fees or the price for the sale to a franchisee of a company-owned location may be payable over a term of several years. We continue to issue new licenses and, from time to time, purchase franchised businesses or sell corporate locations to franchisees.

Franchise operations, including the purchase and ownership of vehicles, are generally financed independently by the franchisees and we do not have an investment interest in the franchisees. Fees from franchisees, including initial franchise fees, are used to, among other things, generally support the cost of our brand awareness programs, reservations system, sales and marketing efforts and certain other services and are approximately 2% of our worldwide vehicle rental revenues for the year ended December 31, 2020.

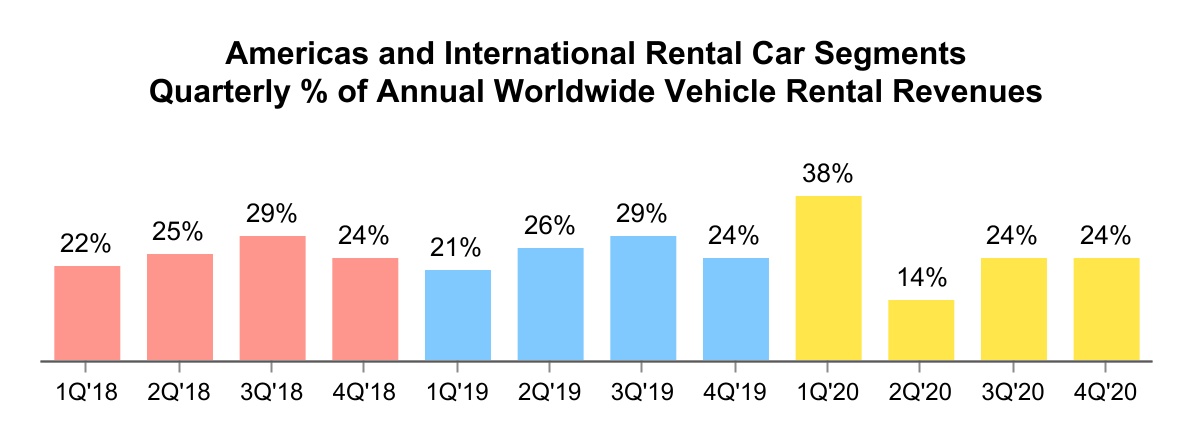

Seasonality

Our vehicle rental operations are historically a seasonal business, with decreased levels of business in the winter months and heightened activity during spring and summer peak ("our peak season") for the majority of countries where we generate our revenues. To accommodate increased demand, we historically have increased our available fleet and staff during the second and third quarters of the year. As business demand declines, vehicles and staff are decreased accordingly. However, as a result of COVID-19 mitigation actions, we initiated a restructuring program in the second quarter of 2020 affecting approximately 11,000 U.S. employees in our Americas RAC Segment and corporate operations. Additionally, we disposed of approximately 198,000 lease vehicles pursuant to or otherwise in satisfaction of our vehicle disposition obligations under the Interim Lease Order between June 1, 2020 and December 31, 2020. Certain operating expenses, including real estate taxes, rent, insurance, utilities, facility-related expenses, the costs of operating our information technology systems and minimum staffing costs, are fixed and cannot be adjusted for seasonal demand.

10

ITEM 1. BUSINESS (Continued)

The following chart sets forth this seasonal nature of our vehicle rental operations, as well as the impact of COVID-19, by presenting the proportionate contribution of each quarter to full year revenue for each of the years ended December 31, 2020, 2019 and 2018.

Fleet

In response to the outbreak of COVID-19, in 2020 we reduced our commitments to purchase vehicles by approximately $4.0 billion from original commitments in our Americas RAC segment. Additionally, the Interim Lease Order, among other things, directed us to dispose of at least 182,521 lease vehicles between June 1, 2020 and December 31, 2020. As of December 31, 2020, we have disposed of approximately 198,000 lease vehicles pursuant to or otherwise in satisfaction of our vehicle disposition obligations under the Interim Lease Order. During the year ended December 31, 2020, we operated a peak rental fleet in our Americas RAC and International RAC segments of approximately 530,400 vehicles and 116,600 vehicles, respectively.

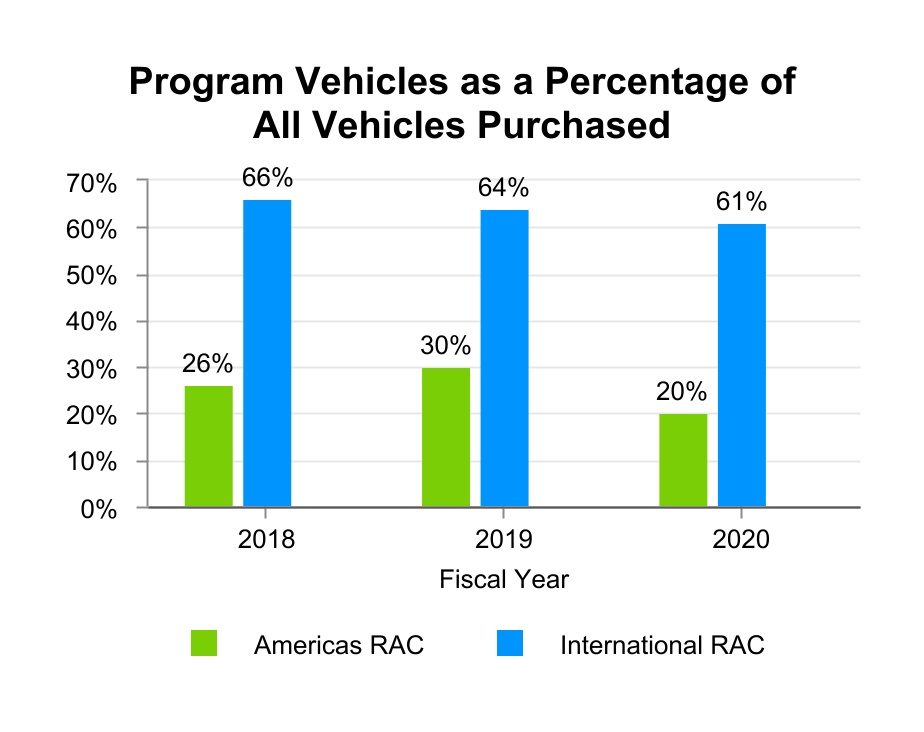

As authorized by the Bankruptcy Court, purchases of vehicles are financed under new borrowing programs supported by our HVIF facility and a designated portion of our DIP Credit Agreement, as further described in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2020 Annual Report. The vehicles we purchase are either program vehicles or non-program vehicles. We periodically review the efficiencies of an optimal mix between program and non-program vehicles in our fleet and adjust the ratio of program and non-program vehicles as needed based on contract negotiations, vehicle economics and availability. During the year ended December 31, 2020, our approximate average holding period for a rental vehicle was 16 months in our Americas RAC segment and 13 months in our International RAC segment.

11

ITEM 1. BUSINESS (Continued)

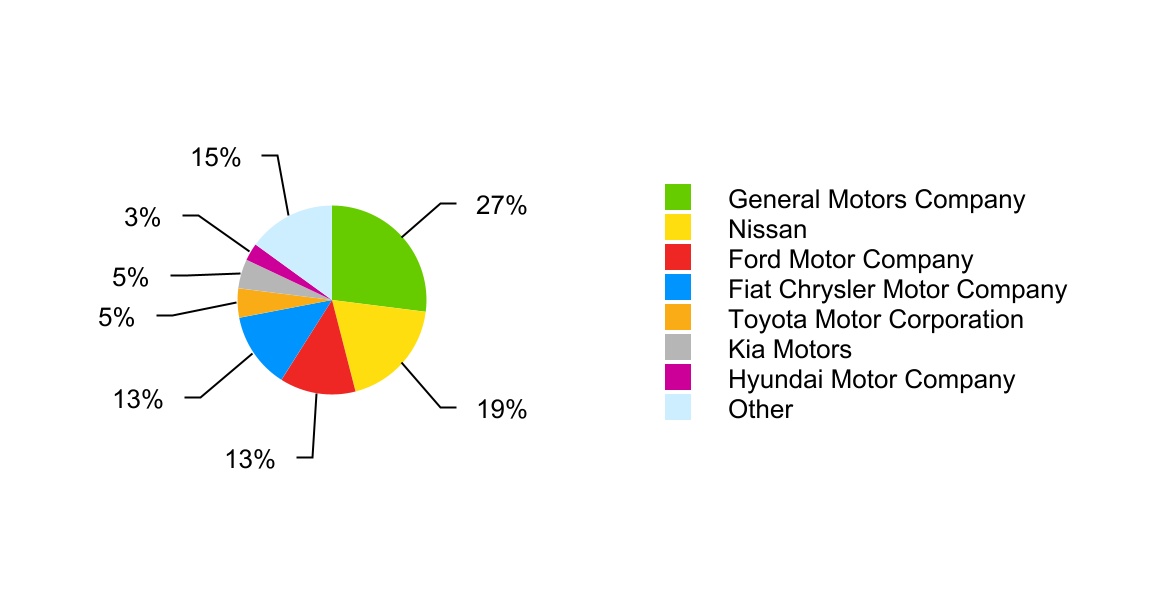

Our fleet composition is as follows:

Fleet Composition by Vehicle Manufacturer*

As of December 31, 2020

Americas RAC International RAC*

*Vehicle manufacturers Groupe PSA (Peugeot and Citroen), Volvo, Volkswagen Group (Volkswagen, Skoda, Audi and Seat), Daimler AG (Mercedes Benz), Renault and BMW together comprise another 41% of the International RAC fleet and are included as "Other" in the overall and International RAC charts above.

We maintain vehicle maintenance centers at or near certain airports and in certain urban and off airport areas, which provide maintenance for our fleet. Many of these facilities include sophisticated vehicle diagnostic and repair equipment and are accepted by automobile manufacturers as eligible to perform and receive reimbursement for warranty work. Collision damage and major repairs are generally performed by independent contractors.

Repurchase Programs

Program vehicles are purchased under repurchase or guaranteed depreciation programs with vehicle manufacturers wherein the manufacturers agree to repurchase vehicles at a specified price or guarantee the depreciation rate on the vehicles during established repurchase periods, subject to, among other things, certain vehicle condition, mileage and holding period requirements. Repurchase prices under repurchase programs are based on the original cost less a set daily depreciation amount. These repurchase and guaranteed depreciation

12

ITEM 1. BUSINESS (Continued)

programs limit our residual risk with respect to vehicles purchased under the programs and allow us to reduce the variability of depreciation expense for each vehicle, however, typically the acquisition cost is higher. Program vehicles generally provide us with flexibility to increase or reduce the size of our fleet based on market demand. When we increase the percentage of program vehicles, the average age of our fleet decreases since the average holding period for program vehicles is shorter than for non-program vehicles.

Program vehicles as a percentage of all vehicles purchased within our Americas RAC and International RAC segments during the last three fiscal years were as follows:

Hertz Car Sales and Rent2Buy

Hertz Car Sales consists of a network of company-operated vehicle sales locations throughout the U.S. dedicated to the sale of used vehicles from our rental fleet consisting of non-program vehicles and program vehicles that become ineligible for manufacturer repurchase or guaranteed depreciation programs. Vehicles disposed of through our retail outlets allow us the opportunity for ancillary vehicle sales revenue, such as warranty, financing and title fees.

We also offer Rent2Buy in 35 states in the U.S., an innovative program designed to sell used rental vehicles. Customers have an opportunity to rent a vehicle from our rental fleet and if the customer purchases the vehicle, the customer is credited with a portion of their rental charges. The purchase transaction is completed through the internet and by mail in those states where permitted.

We also dispose of vehicles through non-retail disposition channels such as auctions, brokered sales, sales to wholesalers and sales to dealers.

During the year ended December 31, 2020, of the vehicles sold in our U.S. vehicle rental operations that were not repurchased by manufacturers, we sold approximately 27% at auction, 46% through dealer direct and 27% at retail locations or through our Rent2Buy program. During the year ended December 31, 2020, of the vehicles sold in our international vehicle rental operations that were not repurchased by manufacturers, we sold approximately 5% at auction, 84% through dealer direct and 11% at retail locations.

13

ITEM 1. BUSINESS (Continued)

Markets and Competition

Competition among vehicle rental industry participants is intense and is primarily based on price, vehicle availability and quality, service, reliability, rental locations, product innovation and competition from online travel agents and vehicle rental brokers. We believe that the prominence and service reputation of the Hertz, Dollar and Thrifty brands, including our ranking in 2019 and 2020 of #1 in Customer Satisfaction by J.D. Power, our extensive worldwide ownership of vehicle rental operations and our commitment to innovation and service provide us with a strong competitive advantage. Our principal vehicle rental industry competitors are Avis Budget Group, Inc., which currently operates the Avis, Budget, ZipCar and Payless brands, and Enterprise Holdings, which operates the Enterprise Rent-A-Car Company, National Car Rental and Alamo Rent A Car brands. There are also local and regional vehicle rental companies and transportation network companies which provide ride-hailing services that have some overlap in customer use cases, largely with respect to short length trips in urban areas.

U.S.

The U.S. represents approximately $23 billion in estimated annual industry revenues for 2020, a decrease of 28% in 2020 versus 2019 primarily due to COVID-19 which has caused a substantial reduction to airline travel since March 2020. The average number of vehicles in the U.S. vehicle rental industry decreased 12% in 2020 to about 2 million vehicles. U.S. industry Revenue Per Unit Per Month was approximately $975 which was a decline of 17% from 2019.

Europe

Europe represents approximately $9 billion in annual industry revenues for 2020, a decrease of 47% in 2020 versus 2019 primarily due to COVID-19. Europe has generally demonstrated a lower historical reliance on air travel because the European off airport vehicle rental market has been significantly more developed than it is in the U.S. Within Europe, the largest markets in which we do business are France, Germany, Italy, Spain, and the United Kingdom. Throughout Europe, we do business through company-operated rental locations and through our partners or franchisees to whom we have licensed use of our brands.

Asia Pacific

Asia Pacific, which includes Australia and New Zealand, represents approximately $12 billion in annual industry revenues for 2020, a decrease of 29% in 2020 versus 2019 primarily due to COVID-19. Within this region, the largest markets in which we do business are Australia, China, Japan and South Korea. In each of these markets we have company-operated rental locations or do business through our partners or franchisees to whom we have licensed use of our brands.

Middle East and Africa

The Middle East and Africa represent approximately $2 billion in annual industry revenues for 2020, a decrease of 50% in 2020 versus 2019 primarily due to COVID-19. Within these regions, the largest markets in which we do business are Saudi Arabia, South Africa and the United Arab Emirates. In each of these markets we do business through our franchisees to whom we have licensed use of our brands.

Latin America

Latin America represents approximately $2 billion in annual industry revenues for 2020, a decrease of 50% in 2020 versus 2019 primarily due to COVID-19. Within Latin America the largest markets in which we do business are Argentina, Brazil, Colombia, Mexico and Panama. In each of these markets our Hertz, Dollar and Thrifty brands are present through our partners or franchisees to whom we have licensed use of the respective brand.

14

ITEM 1. BUSINESS (Continued)

All Other Operations

Our All Other Operations segment primarily consists of our Donlen business, which provides integrated vehicle leasing and fleet management solutions for commercial fleets. This segment generated $630 million in revenues during the year ended December 31, 2020, substantially all of which was attributable to Donlen.

Donlen

Donlen provides an array of vehicle leasing, financing, telematics and fleet management services to commercial fleets in the U.S. and Canada. Products offered by Donlen include:

•Vehicle financing, acquisition and remarketing;

•License, title and registration;

•Vehicle maintenance consultation;

•Fuel management;

•Accident management;

•Toll management;

•Telematics-based location, driver performance and scorecard reporting; and

•Lease financing.

In the fourth quarter of 2020, we entered into a stock and asset purchase agreement to sell substantially all of the Donlen Assets. The sale is expected to close in the first quarter of 2021. See Note 3, "Divestitures," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2020 Annual Report for further information.

Donlen’s leased fleet consists primarily of passenger vehicles, cargo vans and light trucks. Vehicles are acquired directly from domestic and foreign manufacturers, as well as dealers. As of December 31, 2020, approximately half of Donlen’s leased fleet is 2019 model year or newer.

Donlen’s primary product for vehicle and light to medium truck fleets is an open-ended terminal rental adjustment clause ("TRAC") lease. For most customers, the vehicle must be leased for a minimum of twelve months, after which the lease converts to a month-to-month lease allowing the vehicle to be surrendered any time thereafter. Our sale of the vehicle following the termination of the lease may result in a TRAC adjustment, through which the customer is credited or charged with the surplus or loss on the vehicle. Approximately 75% of Donlen’s lease portfolio consists of floating-rate leases which allow lease charges to be adjusted based on benchmark indices.

Donlen offers financing solutions for heavier-duty trucks and equipment. Lease financing is provided through syndication arrangements with lending institutions. Donlen originates the leases, acquires the assets and services the lease throughout the term.

Donlen provides services to leased and non-leased fleets consisting of fuel purchasing and management, preventive vehicle maintenance, repair consultation, toll management and accident management. Additionally, Donlen manages license and title, vehicle registration and regulatory compliance. Donlen’s telematics products provide enhanced visibility and reporting over driver and vehicle performance.

The commercial fleet market is one of the largest segments of the U.S. automotive industry, primarily consisting of vehicles utilized in a sales, service or delivery application. The fleet management industry has experienced significant consolidation over the years and today our principal fleet management competitors in the U.S. and

15

ITEM 1. BUSINESS (Continued)

Canada are Element Financial Corporation, Enterprise, Automotive Resources International, LeasePlan Corporation N.V. and Wheels, Inc.

EMPLOYEES AND HUMAN CAPITAL MANAGEMENT

As of December 31, 2020, we employed approximately 24,000 persons, consisting of approximately 17,000 persons in our U.S. operations and approximately 7,000 persons in our international operations, a decrease of 41% and 22% from December 31, 2019 in our U.S. and international operations, respectively. As a result of COVID-19 and its direct impact on our business, we initiated a restructuring program affecting approximately 11,000 U.S. employees in our Americas RAC segment and corporate operations, beginning in April 2020. Additionally, personnel levels in our international operations were reduced to align with decreased vehicle rental demands as a result of COVID-19, the cost of which was partially offset by government support across Europe. As of December 31, 2020, approximately 55% of our employees in our international operations have been furloughed.

Certain employees outside the U.S. are covered by a wide variety of union contracts and governmental regulations affecting, among other things, compensation, job retention rights and pensions. Labor contracts covering the terms of employment of approximately 23% of our workforce in the U.S. (including those in the U.S. territories) are presently in effect with local unions, affiliated primarily with the International Brotherhood of Teamsters and the International Association of Machinists. Labor contracts covering almost 57% of these employees will expire during 2021. We have had no material work stoppage as a result of labor problems during the last ten years, and we believe our labor relations to be good. Nevertheless, we may be unable to negotiate new labor contracts on terms advantageous to us, or without labor interruption.

In addition to the employees referred to above, we engage outside services, as is customary in the industry, principally for the non-revenue movement of rental vehicles between rental locations.

Human Capital Management

We continue to evolve for our customers, employees, partners and communities. With respect to our employees, our Board and Board committees conduct annual reviews of our employee programs and initiatives, providing oversight to how Hertz should attract, retain and develop a workforce that aligns with our values and strategies, including through competitive compensation and benefits, learning and development opportunities and cultivating an engaged and inclusive culture. In addition, we annually conduct anonymous surveys, seeking feedback from our broad employee base on topics including, but not limited to, effectiveness of company communication, confidence in leadership, competitiveness of our compensation and total rewards packages, and career growth and development opportunities. Survey results are reviewed by our senior management and shared with employees, along with action plans, for leveraging employee insights to drive meaningful improvements in employee experiences at Hertz.

We are committed to protecting the health and safety of our employees, customers and partners. In 2020, COVID-19 caused an unprecedented crisis for the travel and tourism industry, disrupting working practices, consumer behavior and long-term strategic plans. Despite these challenges, we’ve maintained our priority of supporting our people and our communities. We implemented heightened safety measures for employees and customers, and introduced the Hertz Gold Standard Clean process, an enhanced 15-point cleaning process. We deployed protocols, signage and employee training to ensure compliance with COVID-19 Centers for Disease Control guidelines and local regulations. We equipped our employees with personal protective equipment as well as plexiglass guards, implemented enhanced facility and vehicle cleaning practices, mandated face-coverings and established processes for assessing possible COVID-19 exposures and responding to known or suspected COVID-19 cases. In addition, we partnered with LapCorp Employer Services to provide at-home COVID-19 test kits at no charge to employees. We are always assessing ways to best support our employees and customers, and adapting our processes in response to changing guidelines as we continue to navigate through the COVID-19 pandemic.

Always for Hertz, our people are our greatest asset and we strive to have a constant focus and attention on matters concerning our employees including retention and professional development as well as employees’ physical, emotional and financial well-being. We are committed to an inclusive workplace around the globe that champions

16

ITEM 1. BUSINESS (Continued)

equality, values different backgrounds and celebrates individuality. We regularly assess our benefits and program offerings to provide a compelling and comprehensive portfolio, which currently includes:

•Competitive salaries and wages;

•Retirement savings with a 401(k) Plan and an employer match;

•Comprehensive health insurance, including medical, dental and vision plans for employees and their dependents;

•Employer provided life insurance with no cost to employees;

•No-cost employee assistance program, providing confidential counseling to help employees and their families dealing with hardships;

•Paid parental leave;

•Free health screenings and programs for tobacco cessation, weight management and wellness coaching;

•Employee referral program;

•Employee and family rental car and car sales discounts;

•Employee relief fund that provides immediate, short-term financial assistance to North America employees through employee contributions and company match to assist employees dealing with natural disasters;

•Training and development opportunities; and

•Employee resource groups.

Outside of the U.S., we are committed to offering similar comprehensive programs that leverage the best of global benefits but also tailored by country to reflect local practices and culture. We evaluate our total benefits and programs annually and use feedback from employees to make thoughtful changes to ensure our programs continue to meet the needs of employees.

CORPORATE RESPONSIBILITY

We believe that managing our businesses ethically and responsibly is critical to our success as well as the right thing to do. As such, our Board reviews our corporate social responsibility initiatives and maintains an executive steering council, comprised of members of our senior management group and leaders within our key functional areas, to enhance our long-term strategy and to assess annual performance against key indicators. We are committed to continuous improvement that encourages sustainable innovation and enhances our business performance in four key areas: people, community, planet and product.

Our People and Communities

Our employees help drive our progress, innovation and success. As a global company, we have a responsibility to ensure our people are taken care of and thrive in their environment. We are growing our business in a way that is inclusive and supportive to all. As discussed above, attracting and retaining top talent is more than a measure of our business success; it’s a measure of who we are and what we value. In addition, we engage with our communities, and, through our global charitable giving and volunteer program, we are committed to making a positive difference in the areas where we work, live and serve.

Diversity

We foster a diverse and inclusive work environment. Maintaining this diversity begins with a firm commitment to equal opportunity, non-discrimination and anti-harassment. In addition, we adhere to all relevant laws and mandatory reporting requirements.

17

ITEM 1. BUSINESS (Continued)

Communities

We believe community involvement is critical to operating as a responsible business and we have a long-standing commitment to our communities. That’s why we are committed to creating stronger, healthier places to live and work, whether through corporate philanthropy, employee giving or volunteerism.

The Environment

We are committed to reducing the impact our operations have on the environment and the communities we operate in through sustainable business practices, strategic decision-making, community partnerships and smart investments in future technologies.

Fuel Efficient Fleet

We work to make sustainable mobility a viable, global reality by providing customers and communities with access to fuel-efficient and lower emission vehicles. As improvements in technology and the charging infrastructure matures, as well as a wider variety of electric vehicle ("EV") models stimulate consumer acceptance, we can respond to adjust our rental fleet to offer EVs as influenced by customer demand and other economic factors.

We also partner with our corporate customers to create personalized, green travel programs which are aimed at reducing carbon emissions and fuel costs associated with their vehicle rentals, including a program through a leading third party administrator, for related carbon offsets. Additionally, we offer customization of green fleet goals to help our corporate customers reduce fuel costs and expand their employees’ use of alternative-fuel vehicles.

Waste Reduction and Recycling

We work to integrate environmental sustainability across our operations, from our car washes to the way we build our rental locations. Resource conservation and waste reduction is at the forefront of that integration. We are committed to waste reduction across our global footprint. Recycling efforts include, but are not limited to, recycling used oils and solvents, tires, batteries, information technology equipment and general mixed materials.

Green Construction

We incorporate sustainable design and construction practices across the company, based on Leadership in Energy and Environmental Design ("LEED") standards. LEED is a green building rating system administered by the U.S. Green Building Council. Following LEED standards ensures our rental and corporate locations are built in an environmentally sustainable manner, including our world headquarters in Estero, Florida, which is LEED Gold®. These standards also aim to enhance the health and comfort of building occupants, improve overall building performance and deliver cost savings.

Our Business

Ethics

We are committed to operating in compliance with all applicable laws and maintaining the highest standards of ethical conduct. Our expectations may be high, but they are clear. Integrity is essential to every aspect of our business, both in policy and practice. Our Standards of Business Conduct informs when we should ask for further direction to support a policy or procedure and provides information, guidance and references covering a range of topics.

Supplier Diversity

Our objective is to provide certified small, disadvantaged, minority and women-owned business enterprises with the opportunity to compete to deliver products and services that support our brands. We are a member of the National

18

ITEM 1. BUSINESS (Continued)

Minority Supplier Development Council and many of its local affiliate councils throughout the U.S. In support of our extensive presence at airports, we are also members of the Airport Minority Advisory Council.

Data Protection

Hertz is committed to operating in compliance with all applicable privacy and data security laws. We have standards and policies in place to ensure the proper handling, use and storage of customer and employee information, including privacy protection, maintenance of data integrity and security. In addition, our employees participate in mandatory training and ongoing engagement that ensures our entire team is on the same page regarding compliance with our policies and practices.

Our most recent Corporate Responsibility Report is available on our website (www.hertz.com).

INSURANCE AND RISK MANAGEMENT

There are three types of generally insurable risks that arise in our operations:

•legal liability arising from the operation of our vehicles (i.e., vehicle liability);

•legal liability to members of the public and employees from other causes (i.e., general liability/workers' compensation); and

•risk of property damage and/or business interruption and/or increased cost of operating as a consequence of property damage.

In addition, we offer optional liability insurance and other products providing insurance coverage, which create additional risk exposures for us. Our risk of property damage is also increased when we waive the provisions in our rental contracts that hold a renter responsible for damage or loss under an optional loss or damage waiver that we offer. We bear these and other risks, except to the extent the risks are transferred through insurance or contractual arrangements.

In many cases we self-insure our risks or insure risks through wholly-owned insurance subsidiaries. We mitigate our exposure to large liability losses by maintaining excess insurance coverage, subject to deductibles and caps, through unaffiliated carriers. For our international operations outside of Europe and for our long-term vehicle leasing operations, we maintain some liability insurance coverage with unaffiliated carriers.

Third-Party Liability

In our U.S. operations, we are required by applicable financial responsibility laws to maintain insurance against legal liability for bodily injury, death or property damage to third parties arising from the operation of our vehicles, sometimes called “vehicle liability,” in stipulated amounts. In most jurisdictions, we satisfy those requirements by qualifying as a self-insurer, a process that typically involves governmental filings and demonstration of financial responsibility, which sometimes requires the posting of a bond or other security. In the remaining jurisdictions, we obtain an insurance policy from an unaffiliated insurance carrier and indemnify the carrier for any amounts paid under the policy. The regulatory method for protecting against such vehicle liability should be considered in the context of the Graves Amendment, as we generally bear limited economic responsibility for U.S. vehicle liability attributable to the negligence of our drivers, except to the extent that we successfully transfer such liability to others through insurance or contractual arrangements.

For our vehicle rental operations in Europe, we have established a wholly-owned insurance subsidiary, Probus Insurance Company Europe DAC (“Probus”), a direct writer of insurance domiciled in Ireland. In certain European countries with company-operated locations, we have purchased from Probus the vehicle liability insurance required by law, and Probus reinsures the risks under such insurance with HIRE Bermuda Limited, a wholly-owned reinsurance company domiciled in Bermuda. In other European countries, this coverage is purchased from unaffiliated carriers. Accordingly, as with our U.S. operations, we bear economic responsibility for vehicle liability in

19

ITEM 1. BUSINESS (Continued)

our European vehicle rental operations, except to the extent that we transfer such liability to others through insurance or contractual arrangements. For our international operations outside of Europe, we maintain some form of vehicle liability insurance coverage with unaffiliated carriers. The nature of such coverage and our economic responsibility for covered losses varies considerably. Nonetheless, we believe the amounts and nature of the coverage we obtain is adequate in light of the respective potential hazards.

In our U.S. and international operations, from time to time in the course of our business, we become legally responsible to members of the public for bodily injury, death or property damage arising from causes other than the operation of our vehicles, sometimes known as “general liability.” As with vehicle liability, we bear economic responsibility for general liability losses, except to the extent we transfer such losses to others through insurance or contractual arrangements. In addition, to mitigate these exposures, we maintain excess liability insurance coverage with unaffiliated insurance carriers.

In our U.S. vehicle rental operations, we offer an optional liability insurance product, Liability Insurance Supplement (“LIS”), that provides vehicle liability insurance coverage substantially higher than state minimum levels to the renter and other authorized operators of a rented vehicle. LIS coverage is primarily provided under excess liability insurance policies issued by an unaffiliated insurance carrier, the risks under which are reinsured with a wholly-owned subsidiary, HIRE Bermuda Limited.

In our U.S. vehicle rental operations and our company-operated international vehicle rental operations in many countries, we offer optional products providing Personal Accident Insurance / Personal Effects Coverage (“PAI/PEC”) and Emergency Sickness Protection ("ESP") insurance coverage to the renter and the renter's immediate family members traveling with the renter for accidental death or accidental medical expenses arising during the rental period or for damage or loss of their property during the rental period. PAI/PEC and ESP coverages are provided under insurance policies issued by unaffiliated carriers or, in Europe, by Probus.

Our offering of LIS, PAI/PEC and ESP coverage in our U.S. vehicle rental operations is conducted pursuant to limited licenses or exemptions under state laws governing the licensing of insurance producers.

Provisions on our books for self-insured public liability and property damage vehicle liability losses are made by charges to expense based upon evaluations of estimated ultimate liabilities on reported and unreported claims.

Damage to Our Property

We bear the risk of damage to our property, unless such risk is transferred through insurance or contractual arrangements.

To mitigate our risk of large, single-site property damage losses globally, we maintain property insurance with unaffiliated insurance carriers in such amounts as we deem adequate in light of the respective hazards, where such insurance is available on commercially reasonable terms.

Our rental contracts typically provide that the renter is responsible for damage to or loss (including loss through theft) of rented vehicles. We generally offer an optional rental product, known in various countries as “loss damage waiver,” “collision damage waiver” or “theft protection,” under which we waive or limit our right to make a claim for such damage or loss.

Collision damage costs and the costs of stolen or unaccounted-for vehicles, along with other damage to our property, are charged to expense as incurred, net of reimbursements.

Other Risks

To manage other risks associated with our businesses, or to comply with applicable law, we purchase other types of insurance carried by business organizations, such as worker's compensation and employer's liability, commercial crime and fidelity, performance bonds, directors' and officers' liability insurance, terrorism insurance and cyber

20

ITEM 1. BUSINESS (Continued)

security insurance from unaffiliated insurance companies in amounts deemed by us to be adequate in light of the respective hazards, where such coverage is obtainable on commercially reasonable terms.

GOVERNMENT REGULATION AND ENVIRONMENTAL MATTERS

We are subject to numerous types of governmental controls, including those relating to prices and advertising, privacy and data protection, currency controls, labor matters, credit and charge card operations, insurance, environmental protection, used vehicle sales and licensing.

Dealings with Renters

In the U.S., vehicle rental transactions are generally subject to Article 2A of the Uniform Commercial Code, which governs leases of tangible personal property. Vehicle rental is also specifically regulated in more than half of the states of the U.S. and many other international jurisdictions. The subjects of these regulations include the methods by which we advertise, the methods used to quote and charge prices, the consequences of failing to honor reservations, the terms on which we deal with vehicle loss or damage (including the protections we provide to renters purchasing loss or damage waivers) and the terms and method of sale of the optional insurance coverage that we offer. Some states (including California, Nevada and New York) regulate the price at which we may sell loss or damage waivers, and many state insurance regulators have authority over the prices and terms of the optional insurance coverage we offer. See “Insurance and Risk Management-Damage to Our Property” above for further discussion regarding the loss or damage waivers and optional insurance coverages that we offer renters. In addition, various consumer protection laws and regulations may generally apply to our business operations. Internationally, regulatory regimes vary greatly by jurisdiction and include increasing scrutiny from consumer law regulators in Europe and a stronger focus on corporate compliance, but the regimes do not generally prevent us from dealing with customers in a manner similar to that employed in the U.S.

Both in the U.S. and internationally, we are subject to increasing regulation relating to customer privacy and data protection. In general, we are required to disclose our data collection and processing practices as well as our use and sharing of data that we collect from or about renters. In doing so, we are obligated to take reasonable steps to protect customer data while it is in our possession and comply with individual privacy right requests. Our failure to do so could subject us to substantial legal liability, require us to bear significant remediation costs or seriously damage our reputation.

Changes in Regulation

Changes in government regulation of our businesses have the potential to materially alter our business practices or our profitability. Depending on the jurisdiction, those changes may come about through new legislation, the issuance of new laws and regulations or changes in the interpretation of existing laws, regulations and treaties by a court, regulatory body or governmental official. Those changes may have prospective and/or retroactive effect, particularly when a change is made through reinterpretation of laws or regulations that have been in effect for some time. Moreover, changes in regulation that may seem neutral on their face may have a more significant effect on us than on our competitors, depending on the circumstances. Several U.S. states historically required “bundled pricing” by rental vehicle companies but those same states subsequently enacted statutory exceptions to allow for the separate pass-through of certain fees (e.g., airport concession fees, customer facility charges and vehicle licensing fees) with proper disclosure. In addition, the Canadian Competition Bureau has interpreted Canadian consumer law to prohibit “drip pricing” such that base rate advertising is not allowed and the first price that consumers view on the websites of rental vehicle companies needs to reflect the bundled price for the proposed rental. Recent or potential changes in law or regulation that affect us relate to insurance intermediaries, customer privacy, like-kind exchange programs, data security and rate regulation and our retail vehicle sales operations.

In addition, our operations, as well as those of our competitors, could also be affected by any limitation in the fuel supply or by any imposition of mandatory allocation or rationing regulations. We are not aware of any current proposal to impose such a regime in the U.S. or internationally. Such a regime could, however, be quickly imposed if there was a serious disruption in supply for any reason, including an act of war, terrorist incident or other problem affecting petroleum supply, refining, distribution or pricing.

21

ITEM 1. BUSINESS (Continued)

Environmental

We are subject to extensive federal, state, local and foreign environmental and safety laws, regulations, directives, rules and ordinances concerning, among other things, the operation and maintenance of vehicles; the ownership and operation of tanks for the storage of petroleum products, including gasoline, diesel fuel and oil; and the generation, storage, transportation and disposal of waste materials, including oil, vehicle wash sludge and waste water.

When applicable, we estimate and accrue for certain environmental costs, such as to study potential environmental issues at sites deemed to require investigation or clean-up activities and for costs to implement remediation actions, including ongoing maintenance, as required. Based on information currently available, we believe that the ultimate resolution of existing environmental remediation actions and our compliance in general with environmental laws and regulations will not have a material effect on our operating results or financial condition. However, it is difficult to predict with certainty the potential impact of future compliance efforts and environmental remedial actions and thus future costs associated with such matters may exceed the amount of the estimated accrued amount.

AVAILABLE INFORMATION

You may access, free of charge, Hertz Global and Hertz's reports filed with or furnished to the SEC (including the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and any amendments to those forms) directly through the SEC or indirectly through our website (www.hertz.com). Reports filed with or furnished to the SEC will be available as soon as reasonably practicable after they are filed with or furnished to the SEC. The information found on our website is not part of this or any other report filed with or furnished to the SEC.

Additional information about the Chapter 11 Cases, including access to documents filed with the Bankruptcy Court, is available online at https://restructuring.primeclerk.com/hertz, a website administered by Prime Clerk. The information on this website is not incorporated by reference and does not constitute part of this 2020 Annual Report.

22

PART II

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Hertz Global Holdings, Inc. is a holding company and its principal, wholly-owned subsidiary is The Hertz Corporation. Hertz Global consolidates Hertz for financial statement purposes, and Hertz comprises approximately the entire balance of Hertz Global’s assets, liabilities and operating cash flows. In addition, Hertz’s operating revenues and operating expenses comprise nearly 100% of Hertz Global’s revenues and operating expenses. As such, Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A") that follows herein is for Hertz and also applies to Hertz Global in all material respects, unless otherwise noted. Differences between the operations and results of Hertz and Hertz Global are separately disclosed and explained. We sometimes use the words “we,” “our,” “us,” and the “Company” in this MD&A for disclosures that relate to all of Hertz and Hertz Global.

The statements in this MD&A regarding industry outlook, our expectations regarding the performance of our business and the other non-historical statements are forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, the risks and uncertainties described in Item 1A, "Risk Factors.” The following MD&A provides information that we believe to be relevant to an understanding of our consolidated financial condition and results of operations. Our actual results may differ materially from those contained in or implied by any forward-looking statements. You should read the following MD&A together with the sections entitled “Cautionary Note Regarding Forward-Looking Statements” and Item 1A, "Risk Factors,” in our 2020 Annual Report and our consolidated financial statements and related notes included herein under the caption Item 8, "Financial Statements and Supplementary Data.”

In this MD&A we refer to the following non-GAAP measure and key metrics: