Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on June 7, 2011

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

SEE TABLE OF ADDITIONAL REGISTRANTS ON FOLLOWING PAGE

(Exact name of registrant as specified in its

charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

4899 (Primary Standard Industrial Classification Code Number) |

13-3818604 (I.R.S. Employer Identification Number) |

4820 Eastgate Mall

San Diego, CA 92121

(858) 812-7300

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Eric DeMarco

President and Chief Executive Officer

4820 Eastgate Mall

San Diego, CA 92121

(858) 812-7300

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

| Copies to: | ||

Deyan Spiridonov, Esq. Teri O'Brien, Esq. Paul, Hastings, Janofsky & Walker LLP 4747 Executive Drive, 12th Floor San Diego, CA 92121 (858) 458-3000 |

||

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this registration statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of each class of securities to be registered |

Amount to be registered(1) |

Proposed maximum offering price per unit |

Proposed maximum aggregate offering price(1) |

Amount of registration fee(1) |

||||

|---|---|---|---|---|---|---|---|---|

10% Senior Secured Exchange Notes due 2017 |

$285,000,000 | 100% | $285,000,000 | $33,088.50 | ||||

Guarantees of 10% Senior Secured Exchange Notes due 2017(2) |

$285,000,000 | (3) | (3) | (3) | ||||

|

||||||||

- (1)

- Represents

the maximum principal amount at maturity of 10% Senior Secured Notes due 2017 that may be issued pursuant to the exchange offer described in this

registration statement. Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(f) under the Securities Act of 1933, as amended.

- (2)

- The

guarantors are U.S. wholly owned subsidiaries of Kratos Defense & Security Solutions, Inc. and have guaranteed the notes being registered.

- (3)

- Pursuant to Rule 457(n) under the Securities Act of 1933, as amended, no separate fee is payable for the guarantees of the notes.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

Exact name of Registrant as specified in its Charter*

|

State or other Jurisdiction of Incorporation or Organization | I.R.S. Employee Identification Number | ||

|---|---|---|---|---|

AI Metrix, Inc. |

Delaware | 94-3406239 | ||

Airorlite Communications, Inc. |

New Jersey | 27-0109331 | ||

Charleston Marine Containers, Inc. |

Delaware | 13-3895313 | ||

Dallastown Realty I, LLC |

Delaware | 13-3891517 | ||

Dallastown Realty II, LLC |

Delaware | 11-3531172 | ||

Defense Systems, Incorporated. |

Virginia | 54-1869791 | ||

DEI Services Corporation |

Florida | 59-3348607 | ||

Digital Fusion, Inc. |

Delaware | 13-3817344 | ||

Digital Fusion Solutions, Inc. |

Florida | 59-3443845 | ||

Diversified Security Solutions, Inc. |

New York | 20-3603298 | ||

DTI Associates, Inc. |

Virginia | 54-1462882 | ||

General Microwave Corporation |

New York | 11-1956350 | ||

General Microwave Israel Corporation |

Delaware | 11-2696835 | ||

Gichner Holdings, Inc. |

Delaware | 26-0537776 | ||

Gichner Systems Group, Inc. |

Delaware | 26-0537748 | ||

Gichner Systems International, Inc. |

Delaware | 13-3506543 | ||

Haverstick Consulting, Inc. |

Indiana | 35-1938389 | ||

Haverstick Government Solutions, Inc. |

Ohio | 61-1340684 | ||

Henry Bros. Electronics, Inc. |

California | 95-3613209 | ||

Henry Bros. Electronics, Inc. |

Colorado | 84-0600621 | ||

Henry Bros. Electronics, Inc. |

Delaware | 22-3690168 | ||

Henry Bros. Electronics, Inc. |

New Jersey | 22-3000080 | ||

Henry Bros. Electronics, Inc. |

Virginia | 54-1549782 | ||

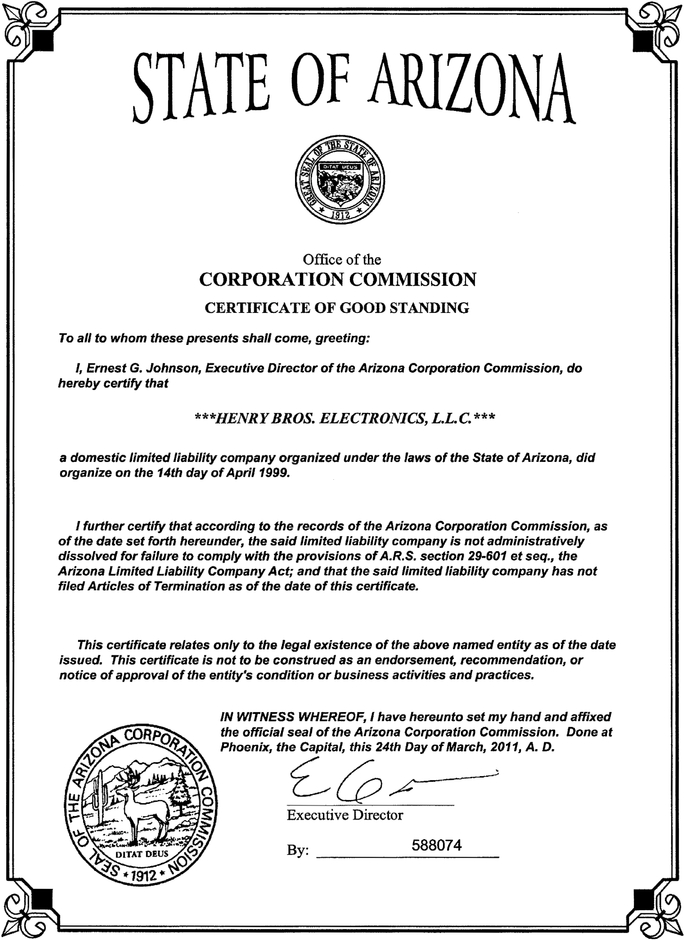

Henry Bros. Electronics, L.L.C. |

Arizona | 86-0950878 | ||

Herley Industries, Inc. |

Delaware | 23-2413500 | ||

Herley-CTI, Inc. |

Delaware | 11-3544929 | ||

Herley-RSS, Inc. |

Delaware | 20-1529679 | ||

HGS Holdings, Inc. |

Indiana | 35-2198582 | ||

JMA Associates, Inc. |

Delaware | 52-2228456 | ||

Kratos Defense Engineering Solutions, Inc. |

Delaware | 33-0431023 | ||

Kratos Mid-Atlantic, Inc. |

Delaware | 51-0261462 | ||

Kratos Public Safety & Security Solutions, Inc. |

Delaware | 33-0896808 | ||

Kratos Southeast, Inc. |

Georgia | 58-1885960 | ||

Kratos Southwest L.P. |

Texas | 74-2144182 | ||

Kratos Technology & Training Solutions, Inc. |

California | 95-2467354 | ||

Kratos Texas, Inc. |

Texas | 75-2982611 | ||

Madison Research Corporation |

Alabama | 63-0934056 | ||

Micro Systems, Inc. |

Florida | 59-1654615 | ||

MSI Acquisition Corp. |

Delaware | 20-2204612 | ||

National Safe of California, Inc. |

California | 95-2865458 | ||

Polexis, Inc. |

California | 33-0717132 | ||

Reality Based IT Services, Ltd. |

Maryland | 52-2191091 | ||

Rocket Support Services, LLC |

Indiana | 20-5113660 | ||

SCT Acquisition, LLC |

Delaware | 20-1825624 | ||

SCT Real Estate, LLC |

Delaware | N/A | ||

Shadow I, Inc. |

California | 51-0569123 | ||

Shadow II, Inc. |

California | 20-3744832 | ||

Shadow III, Inc. |

California | 20-5651555 | ||

Stapor Research, Inc. |

Virginia | 20-1666707 | ||

Summit Research Corporation |

Alabama | 63-1285794 | ||

WFI NMC Corp. |

Delaware | 33-0936782 |

- *

- The address of the principal executive offices of all of the registrants is 4820 Eastgate Mall, San Diego, CA 92121 and the telephone number is (858) 812-7300.

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer and issue these securities until the registration statement filed with the Securities and Exchange Commission, of which this prospectus is a part, is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any representation to the contrary is a criminal offense.

SUBJECT TO COMPLETION, DATED JUNE 7, 2011

PROSPECTUS

Kratos Defense & Security Solutions, Inc.

Offer to Exchange

10% Senior Secured Notes due 2017

($285,000,000 in principal amount outstanding)

We are offering to exchange, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, our new registered 10% Senior Secured Notes due 2017 (the "Exchange Notes") for all of our outstanding unregistered 10% Senior Secured Notes due 2017, issued on April 15, 2011 (the "Original Notes"). We will not receive any proceeds from the exchange offer.

Material Terms of the Exchange Offer

Terms of Exchange Notes. The terms of the Exchange Notes will be substantially identical to the Original Notes, except that the Exchange Notes will not be subject to transfer restrictions or registration rights relating to the Original Notes. See the section entitled "Description of the Exchange Notes" beginning on page 37 for more information about the Exchange Notes and related exchange guarantees to be issued in this exchange offer.

Expiration Date. The exchange offer expires at 5:00 p.m., New York City time, on , 2011, unless extended.

Notes Exchanged. All Original Notes tendered in accordance with the procedures in this prospectus and not withdrawn will be exchanged for an equal amount of Exchange Notes.

Conditions. The exchange offer is not conditioned upon a minimum aggregate principal amount of Original Notes being tendered. The exchange offer is subject only to the conditions that it not violate applicable laws or any applicable interpretation of the staff of the Securities and Exchange Commission ("SEC").

Guarantees. We are also offering to exchange the guarantees associated with the Original Notes (the "Original Guarantees"), for the guarantees associated with the Exchange Notes (the "Exchange Guarantees"). The terms of the Exchange Guarantees will be substantially identical to the Original Guarantees, except that the Exchange Guarantees will not be subject to the transfer restrictions or registration rights relating to the Original Guarantees.

Market for Exchange Notes. There is no existing market for the Exchange Notes, and we do not intend to apply for their listing on any securities exchange or arrange for them to be quoted on any quotation system.

If you do not exchange your Original Notes and related Original Guarantees for Exchange Notes and related Exchange Guarantees in the exchange offer, you will continue to be subject to the restrictions on transfer provided in the Original Notes and related Original Guarantees and the indenture governing those notes. In general, you may not offer or sell your Original Notes and related Original Guarantees unless such offer or sale is registered under the federal securities laws or are sold in a transaction exempt from or not subject to the registration requirements of the federal securities laws and applicable state securities laws.

See "Risk Factors" beginning on page 14 for a discussion of certain risks that you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus

is , 2011

Each broker-dealer that receives Exchange Notes for its own account pursuant to this exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. The letter of transmittal accompanying this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"). This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer during the 180-day period following the closing of the exchange offer in connection with resales of Exchange Notes received in exchange for Original Notes where such Original Notes were acquired by such broker-dealer as a result of market-making or other trading activities. We have agreed that during the 180-day period following the closing of the exchange offer we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

In making your decision regarding participation in the exchange offer, you should rely only on the information contained or incorporated by reference in this prospectus. This prospectus incorporates important business and financial information about us that is not included in or delivered with this prospectus. We have not authorized anyone to provide you with any other information. We are not making an offer of these securities in places where offers and sales are not permitted. The information contained in this prospectus and any applicable prospectus supplement is accurate only on the date such information is presented. Our business, financial condition, results of operations and prospectus may have changed since that date. You should read this prospectus together with the additional information described under the heading "Where You Can Find More Information."

This prospectus may be supplemented from time to time to add, update or change information in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus.

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information about us and the securities offered under this prospectus. The registration statement, including the exhibits, can be read on the website of the SEC or at the offices of the SEC as further described in "Where You Can Find More Information." You may obtain a copy of the registration statement and its exhibits, free of charge, by oral or written request directed to: Kratos Defense & Security Solutions, Inc., 4820 Eastgate Mall, San Diego, CA 92121, Attention: Corporate Secretary, phone number (858) 812-7300. The exchange offer is expected to expire on , 2011 and you must make your exchange decision by this expiration date. To obtain timely delivery of the requested information, you must request this information by , 2011, which is five business days before the expiration date of the exchange offer.

i

This prospectus and the documents incorporated by reference herein contain forward-looking statements. Forward-looking statements may include, but are not limited to, statements relating to our future financial performance, the growth of the market for our products and services, expansion plans and opportunities and statements regarding our plans, strategies and objectives for future operations. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue," the negative of such terms or other comparable terminology.

Forward-looking statements reflect our current views about future events, are based on assumptions, and are subject to known and unknown risks, uncertainties and other important factors. Many important factors could cause actual results or achievements to differ materially from the results, performance or achievements expressed in or implied by our forward-looking statements, including the following:

- •

- our high level of indebtedness;

- •

- our ability to make interest and principal payments on our debt and satisfy the other covenants contained in the indenture

that governs certain existing notes, our credit facility and other debt agreements;

- •

- general economic conditions and inflation, interest rate movements and access to capital;

- •

- changes or cutbacks in spending or the appropriation of funding by the U.S. Federal Government, including the risk of a

prolonged government continuing resolution or government shut down;

- •

- the timing, rescheduling or cancellation of significant customer contracts and agreements, or consolidation by, or the

loss of, key customers;

- •

- changes in the scope or timing of our projects;

- •

- our ability to successfully consummate acquisitions, to integrate acquired companies and to realize the benefits of our

acquisitions, including our ability to achieve anticipated opportunities and operating synergies, and accretion to reported earnings estimated to result from acquisitions in the time frame expected by

management or at all;

- •

- our revenue projections; and

- •

- the effect of competition.

These forward-looking statements reflect our views and assumptions only as of the date such forward-looking statements are made. Many of the factors that will determine future results, performance or achievements are beyond our ability to control or predict, and accordingly, you should not place undue reliance on forward-looking statements. Except as required by law, we assume no responsibility for updating any forward-looking statements nor do we intend to do so. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. The risks included in this section are not exhaustive. Additional factors that could cause actual results to differ materially from those described in the forward-looking statements are set forth under the heading "Risk Factors" beginning on page 14 of this prospectus, and in our most recent Annual Report on Form 10-K and in our subsequent reports on Forms 10-Q and 8-K and other filings with the SEC. You should carefully read this prospectus together with the information incorporated herein by reference as described under the heading "Where You Can Find More Information," completely and with the understanding that our actual future results may be materially different from what we expect.

ii

This summary highlights information from this prospectus, but does not contain all material features of the exchange offer. To understand all of the terms of the exchange offer and for a more complete understanding of our business, you should carefully read the entire prospectus and the documents incorporated by reference in this prospectus.

In this prospectus, references to "we," "our," "us," "the Company" or "Kratos" mean Kratos Defense & Security Solutions, Inc. and its subsidiaries on a consolidated basis. In this prospectus, we sometimes collectively refer to our acquisition of Herley Industries Inc. ("Herley"), our equity offering consummated on February 11, 2011, in which we received approximately $61.1 million in net proceeds, and the debt offering consummated on March 25, 2011, in which we issued $285.0 million in indebtedness and received $305.0 million in gross proceeds, and certain transactions related thereto as the "Transactions". Additionally, we use the term "Original Notes" to refer to the 10% Senior Secured Notes due 2017 that were issued by the Company on April 15, 2011, pursuant to that certain Indenture, dated as of May 19, 2010, by and among the Company, the guarantors party thereto and Wilmington Trust, FSB as trustee and collateral agent (as amended or supplemented, the "Indenture"); the term "Exchange Notes" to refer to the 10% Senior Secured Notes due 2017 that have been registered under the Securities Act and are being offered in exchange for the Original Notes as described in this prospectus; the term "Existing Kratos Notes" to refer to the 10% Senior Secured Notes due 2017 that were issued by the Company on May 19, 2010, pursuant to the Indenture and subsequently exchanged for registered notes on August 11, 2010; the term "Kratos Notes" to collectively refer to the Exchange Notes and the Existing Kratos Notes; the term "Existing Kratos Guarantees" to refer to the guarantees related to the Existing Kratos Notes; the term "Exchange Guarantees" to refer to the guarantees related to the Exchange Notes; and the term "Kratos Guarantees" to collectively refer to the Existing Kratos Guarantees and the Exchange Guarantees.

Company Overview

We are a specialized national security business providing mission-critical products, services and solutions for U.S. national security priorities. Our core capabilities are sophisticated engineering, manufacturing and system integration offerings for national security platforms and programs. Our principal services are related to, but are not limited to, Command, Control, Communications, Computing, Combat Systems, Intelligence, Surveillance and Reconnaissance ("C5ISR"); related cybersecurity; cyberwarfare; information assurance and situational awareness solutions; weapons systems lifecycle support and sustainment; military weapon range operations and technical services; missile, rocket and weapons system testing and evaluation; missile and rocket mission launch services, primarily for ballistic missile defense; public safety, critical infrastructure security and surveillance systems; modeling and simulation; unmanned aerial vehicle ("UAV") systems; and advanced network engineering and information technology services. We offer our customers products, solutions, services and expertise to support their mission-critical needs by leveraging our skills across our core offering areas.

Our primary end customers are U.S. Federal Government agencies, including the Department of Defense ("DoD"), classified agencies, intelligence agencies, other national security agencies and homeland security related agencies. We believe our stable client base, strong client relationships, broad array of contract vehicles, considerable employee base possessing national security clearances, extensive list of past performance qualifications, and significant management and operational capabilities position us for continued growth.

We serve 14 of the top 15 DoD programs in terms of total procurement and research, development, testing and evaluation spending. We provide products, solutions and services for a wide range of established, deployed and operating national security platforms, including, but not limited to, Aegis Ballistic Missile Defense systems, M1 Abrams tanks, Bradley fighting vehicles, F-5 Tiger,

1

HiMARS, Chaparral and HAWK missile systems, Kiowa AH-60 helicopters, DDG-1000 Zumwalt destroyers, attack and missile submarines, certain intelligence surveillance and reconnaissance systems and various unmanned systems.

Current Reporting Segments

We operate in two principal business segments: Kratos Government Solutions and Public Safety and Security. We organize our business segments based on the nature of the services offered. Transactions between segments are generally negotiated and accounted for under terms and conditions similar to other government and commercial contracts and these intercompany transactions are eliminated in consolidation. Our financial statements, incorporated by reference in this prospectus are presented in a manner consistent with our operating structure. For additional information regarding our operating segments, see Note 14 of our Notes to the Consolidated Financial Statements, included in our Annual Report on Form 10-K filed with the SEC on March 2, 2011. From a customer and solutions perspective, we view our business as an integrated whole, leveraging skills and assets wherever possible.

Kratos Government Solutions ("KGS") Segment

The KGS segment provides products, solutions and services primarily for mission-critical national security priorities. KGS customers primarily include national security related agencies, the DoD, intelligence agencies and classified agencies. Our work includes weapon systems sustainment, lifecycle support and extension; C5ISR services, including related cybersecurity, cyberwarfare, information assurance and situational awareness solutions; military range operations and technical services; missile, rocket, and weapons systems test and evaluation; mission launch services; modeling and simulation; UAV products and technology; advanced network engineering and information technology services; and public safety, security and surveillance systems integration. We produce products, solutions and services related to certain C5ISR platforms, unmanned system platforms, weapons systems, national security related assets and warfighter systems.

Public Safety and Security ("PSS") Segment

Our PSS segment provides independent integrated solutions for advanced homeland security, public safety, critical information, and security and surveillance systems for government and commercial applications. Our solutions include designing, installing and servicing building technologies that protect people, critical infrastructure, assets, information and property and make facilities more secure and efficient. We provide solutions in such areas as the design, engineering and operation of command and control centers; the design, engineering, deployment and integration of access control; building automation and control; communications; digital and closed circuit television security and surveillance; fire and life safety; maintenance and service; and project support services.

We provide solutions for customers in the critical infrastructure, power generation, power transport, nuclear energy, financial, information technology, healthcare, education, transportation and petrochemical industries, as well as certain government and military customers. For example, we provide biometrics and other access control technologies to customers such as pipelines, electrical grids, municipal port authorities, power plants, communication centers, large data centers, government installations and other commercial enterprises.

Recent Developments

On May 15, 2011, we entered into an Agreement and Plan of Merger (the "Merger Agreement") with Integral Systems, Inc., a Maryland corporation ("Integral Systems"), IRIS Merger Sub Inc., a Maryland corporation and our wholly owned subsidiary ("Merger Sub"), and IRIS Acquisition

2

Sub LLC, a Maryland limited liability company and our wholly owned subsidiary ("Merger LLC"). Pursuant to the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub will merge with and into Integral Systems, and Integral Systems will continue as the surviving corporation and as a wholly owned subsidiary of the Company (the "Merger"). The boards of directors of the Company and Integral Systems have unanimously approved the Merger Agreement and the transactions contemplated thereby.

At the effective time of the Merger (the "Effective Time"), holders of Integral Systems common stock will be entitled to receive (i) $5.00 in cash, without interest, and (ii) 0.588 shares of the Company's common stock for each share of Integral Systems common stock they own (the "Merger Consideration").

In addition, at the Effective Time, each Integral Systems stock option that has an exercise price less than $13.00 per share shall, if the holder thereof elects in writing, be cancelled in exchange for an amount in cash, without interest, equal to the product of the total number of shares of Integral Systems common stock subject to such in-the-money option, multiplied by the aggregate value of the excess, if any, of $13.00 over the exercise price per share subject to such option, less the amount of any tax withholding. Each Integral Systems stock option that has an exercise price equal to or greater than $13.00 per share and each Integral Systems in-the-money option the holder of which does not make the election described in the preceding sentence shall be converted into an option to purchase Kratos common stock, with (i) the number of shares subject to such option adjusted to equal the number of shares of Integral Systems common stock subject to such out-of-the-money option multiplied by 0.9559, rounded up to the nearest whole share, and (ii) the per share exercise price under each such option adjusted by dividing the per share exercise price under such option by 0.9559, rounded up to the nearest whole cent. Each share of restricted stock granted under an Integral Systems equity plan or otherwise, whether vested or unvested, that is outstanding immediately prior to the completion of the Merger shall be cancelled and the holder thereof shall be entitled to receive an amount in cash, without interest, equal to the product of the total number of restricted shares of Integral Systems common stock held by such holder, multiplied by $13.00, less the amount of any tax withholding. No fractional shares of Company common stock will be issued in the Merger. The Merger is intended to qualify as a "reorganization" within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended.

Completion of the Merger is subject to various customary conditions, including, among other things: (i) the approval of the stockholders of each of the Company and Integral Systems; (ii) subject to certain materiality exceptions, the accuracy of the representations and warranties made by each of the Company and Integral Systems and the compliance by each of the Company and Integral Systems with their respective obligations under the Merger Agreement; (iii) obtaining clearance under the Hart-Scott-Rodino Antitrust Improvements Act, as amended; and (iv) the declaration of the effectiveness by the SEC of the Registration Statement on Form S-4 filed by the Company on June 7, 2011.

The Merger Agreement contains customary representations, warranties and covenants, including covenants obligating the Company and Integral Systems to continue to conduct their respective businesses in the ordinary course and to cooperate on seeking regulatory approvals and providing access to each other's information. The Merger Agreement also contains a representation by the Company regarding the availability of funds to complete the transactions contemplated by the Merger Agreement, including certain financing commitments, and a customary "no solicitation" provision pursuant to which, prior to the completion of the Merger, neither the Company nor Integral Systems is permitted to solicit or engage in discussions with any third party regarding another acquisition proposal unless it has received an unsolicited proposal or offer that the recipient's board of directors determines is or could reasonably be expected to result in a "Superior Proposal".

3

The Merger Agreement contains certain termination rights in favor of each of the Company and Integral Systems, including each party's right to terminate the Merger Agreement under certain circumstances in connection with the acceptance of a "Superior Proposal". In addition, the Merger Agreement provides that in connection with certain terminations of the Merger Agreement, depending on the circumstances surrounding the termination, one party may be required to pay the other a termination fee of $9.3 million.

Background

Department of Defense Drives Strategic Priorities for the Company

The delivery and execution of our mission-critical engineering and support services are driven by the priorities of the U.S. Federal Government and primarily the DoD. The strategic priorities of the DoD are based in large part on the Quadrennial Defense Review, a legislatively mandated review of DoD strategy and priorities. These priorities are currently focused on mission-critical capabilities of the U.S. armed forces and providing the support infrastructure necessary to sustain these forces in a time of heightened warfare readiness and deployment.

The DoD's budget for the 2012 fiscal year is $671.0 billion, a decrease of 5% from fiscal year 2011. The top 28 programs account for approximately $64.0 billion in funding and require aggregate funding that is nearly 14% higher than what was set aside for them in the fiscal year 2010 budget, which closed on September 30, 2010. The increase in the top 28 programs represents a significant opportunity to key federal government contractors in support of the DoD's war fighter, information technology, and other operational priorities. We believe there will be significant market opportunities for providers of system sustainment, information technology ("IT") and engineering services and solutions to federal government agencies over the next several years, particularly those in the defense and homeland security communities.

The entire federal government is currently operating under the authority of a continuing resolution (the "Continuing Resolution") for the fiscal year ending September 30, 2011. The Continuing Resolution funds programs and services, including DoD budgets, at approximately the same levels as fiscal year 2010. The Continuing Resolution runs through September 30, 2011, after which Congress will either pass a new appropriations bill, extend the Continuing Resolution, or shut down the government for all nonessential federal government services.

Focus on Federal Government Transformation

The federal government, and the DoD in particular, is in the midst of a significant transformation that is driven by the federal government's need to address the changing nature of global threats. A significant aspect of this transformation is the use of C5ISR and information technology to increase the federal government's effectiveness and efficiency. The result is increased federal government spending on information technology to upgrade networks and transform the federal government from separate, isolated organizations into larger, enterprise level, network-centric organizations capable of sharing information broadly and quickly. While the transformation initiative is driven by the need to prepare for new world threats, adopting these IT transformation initiatives will also improve efficiency and reduce infrastructure costs across all federal government agencies.

An additional aspect of the military transformation includes significantly enhancing military readiness in areas such as missile defense, weapons system sustainment and extension, and the overall strengthening of intelligence and security. For example, the objective of the DoD as it relates to missile defense is to continue to develop, test, and field missile defense systems to protect America, its allies and deployed forces.

4

While the real rate of growth in the top line defense budget may be slowing for the first time since September 11, 2001, the U.S. Government's budgetary process continues to give us good visibility with respect to future spending and the threat areas that the government is addressing. We believe that our business is aligned with mission-critical national security priorities, particularly in the area of missile defense, C5ISR, cyber security and information assurance, and that our current contracts and strong backlog provide us with good insight regarding our future cash flows.

Competitive Strengths

We believe we have robust capabilities and past performance qualifications in our respective business areas, including a work force that is experienced with the various programs we service and the customers we serve. Additionally, a majority of our employees have national security clearances specifically related to the customers they work for and the contracts which they work on. We believe the following key strengths distinguish us competitively:

Significant and Highly Specialized Experience

Through existing customer engagements and the government focused acquisitions we have completed over the past several years, we have amassed significant and highly specialized experience in areas directly related to C5ISR weapon system lifecycle extension and sustainment; missile, rocket and weapons system testing and evaluation; military range operations and technical services; and other highly differentiated services and solutions. This collective experience, or past performance qualifications, is a requirement for the majority of our contract vehicles and customer engagements. Further enhancing our specialized expertise, a majority of our approximately 2,900 employees have national security clearances, including top secret and higher. We believe these characteristics represent a significant competitive strength and position us to win renewal or follow-on business.

Specialized National Security Focus Aligned with Mission-Critical National Security Priorities

Continued concerns related to the threat posed by certain foreign nations and terrorists have caused the U.S. Government to identify national security as an area of functional and spending priority. Budget pressures, particularly related to DoD spending, have placed a premium on developing and fielding relatively low-cost, high-technology solutions to assist in national security missions. Our primary capabilities and areas of focus, listed below, are strongly aligned with the objectives of the U.S. Government:

- •

- Intelligence, surveillance and reconnaissance

- •

- Command and control

- •

- Unmanned systems

- •

- Ballistic missile defense

- •

- Cyber security and information assurance

Strategic Geographic Locations and Base Realignment and Closure

The U.S. Base Realignment and Closure Act of 2005 ("BRAC") is the congressionally authorized process the DoD has implemented to reorganize its base structure to fewer, larger bases in order to support U.S. armed forces more efficiently and effectively, increase operational readiness and facilitate new ways of doing business. As a result of the DoD's BRAC transformation, we have concentrated part of our business strategy on building a significant presence in key BRAC receiving locations where the U.S. Federal Government is relocating its personnel and related technical and professional services. We

5

believe our focus on increasing our strategic presence in key BRAC receiving locations will provide us with a significant competitive advantage

Diverse Base of Key Contracts with Low Concentration

As a result of our business development focus on securing key contracts, we are a preferred contractor on numerous multiyear, government-wide acquisition contracts ("GWACs") and multiple award contracts. Our preferred contractor status provides us with the opportunity to bid on hundreds of millions of dollars of business each year against a discrete number of other prequalified companies. We have a highly diverse base of contracts with no contract representing more than 5% of 2010 revenue. Our fixed price contracts, almost all of which are production contracts, represent approximately 57% of our 2010 revenue. Our cost-plus-fee contracts and time and materials contracts represent approximately 22% and 21%, respectively, of our 2010 revenue. We believe our diverse base of key contracts and low reliance on any one contract provides us with a stable, balanced revenue stream.

In-Depth Understanding of Client Missions

We have a reputation for providing mission-critical services and solutions to our clients. Our relationships with our U.S. Army, U.S. Navy and U.S. Air Force customers generally exceed 10 years, enabling us to develop an in-depth understanding of their missions and technical needs. In addition, we have employees located at customer sites, providing us with valuable strategic insights into our clients' ongoing and future program requirements. Our in-depth understanding of our clients' missions, in conjunction with the strategic location of our employees, enables us to offer technical solutions tailored to our clients' specific requirements and evolving mission objectives. In addition, once we are on-site with a customer, we have historically been successful in winning recompete business in the vast majority of cases.

Significant Cash Flow Visibility Driven by Stable Backlog

As of March 27, 2011, our total backlog, on a pro forma basis with Herley and Integral Systems, was approximately $1.2 billion, of which approximately $676.0 million was funded backlog. The majority of our sales are from orders issued under long-term contracts, typically three to five years in duration. Our contract backlog provides visibility into stable future revenue and cash flow over a diverse set of contracts.

Highly Skilled Employees and an Experienced Management Team

We deliver our services through a skilled workforce of approximately 2,900 employees. Our senior managers have significant experience with U.S. Federal Government agencies, the U.S. military and federal government contractors. Members of our management team have experience growing businesses both organically and through acquisitions. We believe that the cumulative experience and differentiated expertise of our personnel in our core focus areas, coupled with our sizable employee base, the majority of which hold national security clearances, allows us to qualify for and bid on larger projects in a prime contracting role.

Our Strategy

Our strategy is to grow our business as a leading provider of highly differentiated products, solutions and services in our core areas of focus as noted above by delivering comprehensive, high-end engineering services, technical solutions, product manufacturing, and information technology solutions to federal government agencies, while improving our margin rates and overall profitability.

6

Capitalize on Current Contract Base

We are pursuing new program and contract opportunities and awards, as we build the business, with our expanding customer base, contract portfolio, and product, solution and service offerings. We are aggressively pursuing task orders under existing contract vehicles to maximize our revenue and strengthen our client relationships, though there is no assurance that the federal government will make awards up to the ceiling amounts or that we will be awarded any task orders under these vehicles. We have developed several internal tools that facilitate our ability to track, prioritize and win task orders under these vehicles. Combining these tools with our technical expertise, our strong past performance record and our knowledge of our clients' needs should position us to win additional task orders.

Expand Product, Solution and Service Offerings Provided to Existing Clients

We are focused on expanding the products, solutions and services we provide to our current clients by leveraging our strong relationships, technical capabilities and past performance record, and by offering a wider range of comprehensive solutions as we continue to acquire companies with new areas of specialization. In regard to new areas of specialization, two of our recent acquisitions have expanded our service offerings to include manufacturing of tactical combat vehicle shelters for C5ISR systems, unmanned systems, weapon systems and warfighters. We believe our understanding of client missions, processes and needs, in conjunction with our full lifecycle IT offerings, including cybersecurity, cyberwarfare and situational awareness, positions us to capture new work from existing clients as the federal government continues to increase the volume of IT services contracted to professional services providers. Moreover, we believe our strong past performance record positions us to expand the level of services we provide to our clients.

Expand Client and Contract Base

We are also focused on expanding our client base into areas with significant growth opportunities by leveraging our capabilities, industry reputation, long-term client relationships and diverse contract base. We anticipate that this expansion will enable us to both pursue additional higher value work and to further diversify our revenue base across the federal government. Our long-term relationships with federal government agencies, together with our GWAC vehicles, give us opportunities to win contracts with new clients within these agencies.

Improve Operating Margins

We believe that we have opportunities to increase our operating margins and improve profitability by capitalizing on our corporate infrastructure investments and internally developed tools, improving efficiencies and reducing costs, and concentrating our efforts on increasing the percentage of revenues generated from high value added contracts.

Capitalize on Corporate Infrastructure Investments

In recent periods, we have made significant investments in our senior management and corporate infrastructure in anticipation of future revenue growth. These investments included hiring senior executives with significant experience in the national security industry, strengthening our internal controls over financial reporting and accounting staff in support of public company reporting requirements, expanding our Sensitive Compartmented Information Facilities and other corporate facilities, and expanding our backlog and bid and proposal pipeline. We will be allocating additional resources in our pursuit of new and larger contract opportunities, leveraging our increased scale and robust past performance qualifications. We believe our management experience and corporate infrastructure are more typical of a company with a much larger revenue base than ours. We therefore

7

anticipate that, to the extent our revenue grows, we will be able to leverage this infrastructure base and increase our operating margins.

Concentrate on High Value Added Contracts

We expect to improve our operating margins as we strive to increase the percentage of revenue we derive from our work as a contractor and from engagements where contracts are awarded on a best value, rather than on a low cost, basis. The federal government's move toward performance-based contract awards to realize greater return on its investment has resulted in a shift to greater utilization of best value awards. We believe this shift will enable us to expand our operating margins as we are awarded more contracts of this nature.

Pursue Strategic Acquisitions

We intend to supplement our organic growth by identifying, acquiring and integrating businesses that meet our primary objective of providing us with enhanced capabilities to pursue a broader cross section of the DoD, Department of Homeland Security and other government markets, complement and broaden our existing client base and expand our primary service offerings. Our senior management team has significant acquisition experience.

Risk Factors

An investment in the Exchange Notes involves substantial risks. See "Risk Factors" beginning on page 14 of this prospectus and in our most recent Annual Report on Form 10-K and any subsequent reports on Forms 10-Q and 8-K and other filings with the SEC that are incorporated herein by reference.

Ratio of Earnings to Fixed Charges

The following summary is qualified by the more detailed information appearing in the computation table found in Exhibit 12.1 to the registration statement of which this prospectus is a part and the historical financial statements, including the notes thereto, incorporated by reference in this prospectus.

The following table sets forth our earnings to fixed charges and the dollar amount of the coverage deficiency for the three month period ended March 27, 2011 and the years ending December 31, 2006, December 31, 2007, December 28, 2008, December 27, 2009 and December 26, 2010. We have not included a ratio of earnings to combined fixed charges and preferred stock dividends because no preferred dividends are accrued, accruing or payable on our outstanding preference shares.

| |

(In millions, except ratio) | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Fiscal Year Ended | Three Month Period Ended |

|||||||||||||||||

| |

December 31, 2006 |

December 31, 2007 |

December 28, 2008 |

December 27, 2009 |

December 26, 2010 |

March 27, 2011 |

|||||||||||||

Ratio of Earnings to Fixed Charges |

— | — | — | — | 1.1 | — | |||||||||||||

Deficiency of Earnings Available to Cover Fixed Charges |

$ | (26.7 | ) | $ | (25.9 | ) | $ | (104.7 | ) | $ | (37.3 | ) | — | $ | (5.0 | ) | |||

Corporate Information

We were incorporated in the state of New York on December 19, 1994 and began operations in March 1995. We reincorporated in the state of Delaware in 1997. Our executive offices are located at 4820 Eastgate Mall, San Diego, California 92121, and our telephone number is (858) 812-7300. We maintain a website at www.kratosdefense.com. Information contained in or accessible through our website does not constitute part of this prospectus. Our common stock has been publicly traded since 1999 and is listed on the NASDAQ Global Select Market under the symbol "KTOS".

8

Summary of the Terms of the Exchange Offer

On March 25, 2011, Acquisition Co. Lanza Parent, a Delaware corporation and an indirect wholly owned subsidiary of the Company (the "Stage I Issuer"), issued $285.0 million aggregate principal amount of its 10% Senior Secured Notes due 2017 (the "Stage I Notes") pursuant to an indenture, dated as of March 25, 2011, among the Stage I Issuer, the guarantor party thereto and Wilmington Trust FSB ("Wilmington Trust"), as trustee and collateral agent (the "Stage I Indenture"). On April 4, 2011, the Stage I Issuer merged with and into the Company, and the Company assumed all the assets and liabilities of the Stage I Issuer including, pursuant to a supplemental indenture to the Stage I Indenture, all the obligations of the Stage I Issuer under the Stage I Indenture, the Stage I Notes and the Collateral Agreements (as defined in the Stage I Indenture) and (ii) the Company became the issuer of the Stage I Notes under the Stage I Indenture and pledgor under such Collateral Agreements. In addition, on April 15, 2011, the Company redeemed all of the outstanding Stage I Notes by issuing to each holder of Stage I Notes (each, a "Holder" and collectively, the "Holders") in exchange therefor the Original Notes issued by the Company pursuant to the Indenture in a like principal amount. On March 25, 2011, in connection with the issuance of the Stage I Notes, we entered into a registration rights agreement in which we agreed that you, as a holder of unregistered Original Notes, would be entitled to exchange your unregistered Original Notes for Exchange Notes registered under the Securities Act. The exchange offer is intended to satisfy these rights. After the exchange offer is completed, you will no longer be entitled to any registration rights with respect to your Original Notes. The Exchange Notes will be our obligation and will be entitled to the benefits of the Indenture relating to the Exchange Notes. The form and terms of the Exchange Notes are identical in all material respects to the form and terms of the Original Notes, except that the Exchange Notes will:

- •

- have been registered under the Securities Act and, therefore, will contain no restrictive legends;

- •

- not have registration rights;

- •

- not have rights to additional interest; and

- •

- bear different CUSIP and ISIN numbers from the Original Notes.

You should read the discussion under the heading "The Exchange Offer" beginning on page 27 and "Description of the Exchange Notes" beginning on page 37 for further information about the exchange offer and the Exchange Notes.

The Exchange Offer |

We are offering to exchange up to $285,000,000 aggregate principal amount of Exchange Notes for an identical principal amount of Original Notes. | |

Expiration of the Exchange Offer |

The exchange offer will expire at 5:00 p.m., New York City time, on , 2011, unless we extend the exchange offer, in which case the expiration date will mean the latest date and time to which we extend the exchange offer. See "The Exchange Offer—Expiration Date; Extensions; Amendments." |

9

Procedures for Tendering Original Notes Held in the Form of Book-Entry Interests |

The Original Notes were issued as global securities and were deposited with Wilmington Trust who holds the Original Notes as the custodian for The Depository Trust Company ("DTC"). Beneficial interests in the Original Notes are held by participants in DTC on behalf of the beneficial owners of the Original Notes. We refer to beneficial interests in notes held by participants in DTC as notes held in book-entry form. Beneficial interests in notes held in book-entry form are shown on, and transfers of the notes can be made only through, records maintained in book-entry form by DTC and its participants. |

|

|

If you are a holder of an Original Note held in the form of a book-entry interest and you wish to tender your book-entry interest for exchange in the exchange offer, you must transmit to Wilmington Trust, as exchange agent, on or prior to the expiration date of the exchange offer, the following: |

|

|

• a computer-generated message transmitted by means of DTC's Automated Tender Offer Program ("ATOP") system that, when received by the exchange agent will form a part of a confirmation of book-entry transfer in which you acknowledge and agree to be bound by the terms of the letter of transmittal; and |

|

|

• a timely confirmation of book-entry transfer of your Original Notes into the exchange agent's account at DTC, according to the procedure for book-entry transfers described in this prospectus under the heading "The Exchange Offer—Procedures for Tendering." |

|

Procedures for Tendering Original Notes Held in Certificated Form |

If you hold your Original Notes in certificated form and wish to accept the exchange offer, sign and date the letter of transmittal, and deliver the letter of transmittal, along with certificates for the Original Notes and any other required documentation, to the exchange agent on or before the expiration date in accordance with the instructions contained in this prospectus and the letter of transmittal. |

|

Special Procedures for Beneficial Owners |

If you are a beneficial owner whose Original Notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and wish to tender those Original Notes in the exchange offer, please contact the registered holder as soon as possible and instruct them to tender on your behalf and comply with the instructions in this prospectus and the letter of transmittal. |

10

Guaranteed Delivery Procedures |

If you are unable to deliver the Original Notes, the letter of transmittal or any other required documents to the exchange agent or comply with the applicable ATOP procedures prior to the expiration date, you may tender your Original Notes according to the guaranteed delivery procedures described in this prospectus under the heading "The Exchange Offer—Guaranteed Delivery Procedures." |

|

Withdrawal Rights |

You may withdraw the Original Notes you tendered by furnishing a notice of withdrawal to the exchange agent or by complying with applicable ATOP procedures at any time before 5:00 p.m. New York City time on the expiration date. See "The Exchange Offer—Withdrawal of Tenders." |

|

Acceptance of Original Notes and Delivery of Exchange Notes |

If the conditions described under "The Exchange Offer—Conditions" are satisfied, we will accept for exchange any and all Original Notes that are properly tendered and not withdrawn before the expiration date. See "The Exchange Offer—Procedures for Tendering." If we close the exchange offer, the Exchange Notes will be delivered promptly following the expiration date. Otherwise, we will promptly return any Original Notes accepted. |

|

Consequences of Failure to Exchange |

If you do not exchange your Original Notes for Exchange Notes, you will continue to be subject to the restrictions on transfer provided in the Original Notes and in the Indenture. In general, the Original Notes may not be offered or sold unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We do not intend to register the Original Notes under the Securities Act. |

|

Registration Rights |

You are entitled to exchange your Original Notes for Exchange Notes with substantially identical terms. This exchange offer satisfies this right. After the exchange offer is completed, you will no longer be entitled to any exchange or registration rights with respect to your Original Notes. |

|

Federal Income Tax Considerations |

The exchange of Original Notes for Exchange Notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. See "The Exchange Offer—Federal Income Tax Consequences" and "Certain U.S. Federal Income Tax Considerations" for a discussion of U.S. federal income tax considerations you should consider before tendering your Original Notes in the exchange offer. |

|

Exchange Agent |

Wilmington Trust is serving as exchange agent for the exchange offer. The address for the exchange agent is listed under "The Exchange Offer—Exchange Agent." If you would like more information about the procedures for the exchange offer, you should call the exchange agent at (302) 636-6181. The facsimile number for the exchange agent is (302) 636-4139, Attention: Sam Hamed. |

See "The Exchange Offer" for more detailed information concerning the terms of the exchange offer.

11

The form and terms of the Exchange Notes to be issued in the exchange offer are the same as the form and terms of the Original Notes, except that the Exchange Notes will be registered under the Securities Act and, accordingly, will not bear legends restricting their transfer and will not be entitled to any rights under the registration rights agreement. The Exchange Notes issued in the exchange offer will evidence the same debt as the Original Notes, and both the Original Notes and the Exchange Notes are governed by the same indenture.

| Issuer | Kratos Defense & Security Solutions, Inc. | |

Title |

$285,000,000 aggregate principal amount of 10% Senior Secured Notes due 2017. |

|

Maturity Date |

June 1, 2017. |

|

Interest Rate |

We will pay interest on the Exchange Notes at an annual interest rate of 10%. |

|

Interest Payment Dates |

We will make interest payments on the Exchange Notes semi-annually in arrears on each December 1 and June 1, beginning December 1, 2011. Interest will accrue from and including June 1, 2011. |

|

Guarantees |

The Exchange Notes will be fully and unconditionally guaranteed, jointly and severally, on a senior secured basis by our existing and future domestic restricted subsidiaries (other than discontinued subsidiaries). |

|

Ranking |

The Exchange Notes and the guarantees will rank senior in right of payment to all of our and the guarantors' existing and future subordinated indebtedness and equal in right of payment with all of our and the guarantors' existing and future senior indebtedness, including indebtedness under our revolving credit facility (the "Revolver"). |

|

Security Interest |

The Exchange Notes and the related guarantees will be secured by a lien on substantially all of our and the guarantors' assets, subject to certain exceptions and permitted liens. However, the security interest in such assets (other than real property, plant, equipment, certain intellectual property and the capital stock of our subsidiaries (collectively, the "Notes Priority Collateral")) that secure the Exchange Notes and the Exchange Guarantees will be contractually subordinated to liens thereon that secure the Revolver. The security interest in assets securing the Revolver that consist of Notes Priority Collateral will be contractually subordinated to liens thereon that secure the Exchange Notes. |

12

| Optional Redemption | On or after June 1, 2014, we may redeem some or all of the Exchange Notes at the redemption prices set forth under "Description of the Exchange Notes—Redemption—Optional Redemption on or after June 1, 2014," plus accrued and unpaid interest to the date of redemption. Prior to June 1, 2013, we may redeem up to 35% of the aggregate principal amount of the Exchange Notes at the premium set forth under "Description of the Exchange Notes—Redemption—Optional Redemption Upon Equity Offerings," plus accrued and unpaid interest to the redemption date, with the net cash proceeds of certain equity offerings. In addition, we may, at our option, redeem some or all of the Exchange Notes at any time prior to June 1, 2014, by paying a "make whole" premium, plus accrued and unpaid interest, if any, to the date of redemption. | |

Change of Control Offer |

If we experience certain change-of-control events, the holders of the Exchange Notes will have the right to require us to purchase all or a portion of their Exchange Notes at a price in cash equal to 101% of the principal amount thereof, plus accrued and unpaid interest to the date of purchase. |

|

Asset Sale Offer |

Upon certain asset sales, we may be required to offer to use the net proceeds thereof to purchase some of the Exchange Notes at 100% of the principal amount thereof, plus accrued and unpaid interest to the date of purchase. |

|

Use of Proceeds |

We will not receive any cash proceeds from the issuance of the Exchange Notes. See "Use of Proceeds." |

See "Description of the Exchange Notes" for more detailed information about the terms of Exchange Notes.

13

An investment in the Exchange Notes involves significant risks. You should consider carefully the following risk factors and all of the information contained in this prospectus before deciding whether to participate in the exchange offer. The risks and uncertainties described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of those risks actually occurs, our business, financial condition and results of operations would suffer. The risks discussed below also include forward-looking statements. See "Forward-Looking Statements" in this prospectus.

Risks Related to the Exchange Notes and the Exchange Offer

We significantly increased our leverage in connection with the financing of recent acquisitions and the Transactions and currently have substantial indebtedness, which could have a negative impact on our financing options and liquidity position and have adverse effects on our business.

In connection with the Transactions, we incurred an additional $285.0 million of indebtedness and, as of March 27, 2011, have approximately $521.1 million of total indebtedness. As a result of this increased indebtedness, our interest payment obligations have increased significantly. The degree to which we are leveraged could have adverse effects on our business, including the following:

- •

- it may make it difficult for us to satisfy our obligations under the Kratos Notes and our other indebtedness and

contractual and commercial commitments;

- •

- it may limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we

operate;

- •

- it may require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness,

thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes;

- •

- it may restrict us from making strategic acquisitions or exploiting business opportunities;

- •

- it may place us at a competitive disadvantage compared to our competitors that have less debt;

- •

- it may limit our ability to borrow additional funds;

- •

- it may prevent us from raising the funds necessary to repurchase the Kratos Notes or other outstanding notes tendered to

us if there is a change of control, which would constitute a default under the Indenture and under the Revolver; and

- •

- it may decrease our ability to compete effectively or operate successfully under adverse economic and industry conditions.

Our ability to meet our debt service obligations will depend upon our future performance, which may be subject to financial, business and other factors affecting our operations, many of which are beyond our control.

Despite our current indebtedness level, we and our subsidiaries may still be able to incur substantially more debt, which could exacerbate the risks associated with our substantial leverage.

We may be able to incur substantial additional indebtedness in the future. Although the Indenture and the credit agreement governing the Revolver will limit our ability and the ability of our subsidiaries to incur additional indebtedness, these restrictions are subject to a number of qualifications and exceptions and, under certain circumstances, debt incurred in compliance with these restrictions could be substantial. For example, indebtedness in excess of $25.0 million may be incurred under the Revolver in reliance on the $15.0 million general debt basket as well as the fixed charge debt

14

incurrence test, which additional indebtedness may be secured subject to certain conditions. See clause (22) of the definition of the term "Permitted Liens" under "Description of the Exchange Notes—Certain Definitions." In addition, the Indenture and the credit agreement governing the Revolver will not prevent us from incurring obligations that do not constitute indebtedness. See the sections entitled "Description of the Exchange Notes—Certain Covenants—Limitation on Incurrence of Additional Indebtedness and Issuance of Preferred Stock" and "Description of Certain Indebtedness." To the extent that we incur additional indebtedness or such other obligations, the risks associated with our substantial leverage described above, including our possible inability to service our debt, would increase.

Our debt service obligations may adversely affect our cash flow.

A higher level of indebtedness increases the risk that we may default on our debt obligations. We may not be able to generate sufficient cash flow to pay the interest on our debt, and future working capital, borrowings or equity financing may not be available to pay or refinance such debt. If we are unable to generate sufficient cash flow to pay the interest on our debt, we may have to delay or curtail our operations.

Our ability to generate cash flows from operations and to make scheduled payments on our indebtedness will depend on our future financial performance. Our future financial performance will be affected by a range of economic, competitive and business factors that we cannot control. A significant reduction in operating cash flows resulting from changes in economic conditions, increased competition or other events beyond our control could increase the need for additional or alternative sources of liquidity and could have a material adverse effect on our business, financial condition, results of operations, prospects and our ability to service our debt and other obligations. If we are unable to service our indebtedness, we will be forced to adopt an alternative strategy that may include actions such as reducing capital expenditures, selling assets, restructuring or refinancing our indebtedness or seeking additional equity capital. These alternative strategies may not be effected on satisfactory terms, if at all, and they may not yield sufficient funds to make required payments on the Kratos Notes and our other indebtedness.

If for any reason we are unable to meet our debt service and repayment obligations, we would be in default under the terms of the agreements governing our debt, which would allow our creditors at that time to declare certain outstanding indebtedness to be due and payable, which would in turn trigger cross-acceleration or cross-default rights between the relevant agreements. In addition, our lenders could compel us to apply all of our available cash to repay our borrowings or they could prevent us from making payments on the Kratos Notes. If the amounts outstanding under the Kratos Notes, the Revolver, and any other indebtedness, were to be accelerated, our assets may not be sufficient to repay in full the money owed to the lenders or to our other debt holders, including you as noteholders.

A portion of our business is conducted through foreign subsidiaries and the failure to generate sufficient cash flow from these subsidiaries, or otherwise repatriate or receive cash from these subsidiaries, could result in our inability to repay our indebtedness, including the Exchange Notes.

As of March 27, 2011, approximately 4% of our consolidated assets, based on book value, were held by foreign subsidiaries. Our ability to meet our debt service obligations (including those relating to the Exchange Notes) with cash from foreign subsidiaries will depend upon the results of operations of these subsidiaries and may be subject to legal, contractual or other restrictions and other business considerations. In addition, dividend and interest payments to us from the foreign subsidiaries may be subject to foreign withholding taxes, which would reduce the amount of funds we receive from such foreign subsidiaries. Dividends and other distributions from our foreign subsidiaries may also be subject

15

to fluctuations in currency exchange rates and legal and other restrictions on repatriation, which could further reduce the amount of funds we receive from such foreign subsidiaries.

In general, when an entity in a foreign jurisdiction repatriates cash to the U.S., the amount of such cash is treated as a dividend taxable at current U.S. tax rates. Accordingly, upon the distribution of cash to us from our foreign subsidiaries, we will be subject to U.S. income taxes. Although foreign tax credits may be available to reduce the amount of the additional tax liability, these credits may be limited and only offset the tax paid in the foreign jurisdiction, not the excess of the U.S. tax rate over the foreign tax rate. Therefore, to the extent that we must use cash generated in foreign jurisdictions to make principal or interest payments on the Kratos Notes, there may be a cost associated with repatriating the cash to the U.S.

The lien-ranking provisions set forth in the intercreditor agreement will substantially limit the rights of the holders of the Kratos Notes with respect to liens on the assets (other than Notes Priority Collateral) securing the Kratos Notes and the Kratos Guarantees.

The liens on our assets (other than Notes Priority Collateral, defined under "Description of the Exchange Notes—Collateral") securing the Kratos Notes and the Kratos Guarantees will be contractually subordinated to the liens thereon that secure the Revolver and will be pari passu with the liens that secure the Kratos Notes. The holders of obligations under the Revolver will be entitled to receive proceeds from any realization of such collateral to repay their obligations in full before the holders of the Kratos Notes and other obligations secured by liens subordinated to the Revolver will be entitled to any recovery from such collateral. In the event of a foreclosure, the proceeds from the sale of all of such collateral may not be sufficient to satisfy the amounts outstanding under the Kratos Notes after payment in full of all obligations secured by the Revolver.

The rights of the holders of the Kratos Notes with respect to the liens on our assets (other than Notes Priority Collateral) securing the Kratos Notes and the Kratos Guarantees will therefore be substantially limited pursuant to the terms of the lien-ranking provisions set forth in the intercreditor agreement. Under those lien-ranking provisions, at any time that the Revolver is outstanding, any actions that may be taken in respect of such assets, including the ability to cause the commencement of enforcement proceedings against such assets and to control the conduct of such proceedings, and the approval of releases of such assets from the lien of the collateral documents, will be at the direction of the lenders under the Revolver. The trustee, on behalf of the holders of the Kratos Notes, will not, for significant periods of time, have the ability to control or direct such actions, even if the rights of the holders of the Kratos Notes are adversely affected. See "Description of the Exchange Notes—Intercreditor Agreement."

The imposition of certain permitted liens will cause the assets on which such liens are imposed to be excluded from the collateral securing the Kratos Notes and the Kratos Guarantees. There are also certain other categories of property that are also excluded from the collateral.

The Indenture permits liens in favor of third parties to secure certain indebtedness, such as indebtedness incurred under the Revolver (which could exceed $35.0 million in the aggregate), purchase money indebtedness and capital lease obligations, and assets subject to such liens will in certain circumstances be excluded from the collateral securing the Kratos Notes and the Kratos Guarantees. Our ability to incur purchase money indebtedness and capital lease obligations on a secured basis is subject to limitations as described in "Description of the Exchange Notes—Certain Covenants—Limitation on Incurrence of Additional Indebtedness and Issuance of Preferred Stock" and "—Limitation on Liens." Certain of these third party liens rank senior to the liens securing the Kratos Notes. In addition, certain categories of assets are excluded from the collateral securing the Kratos Notes and the Kratos Guarantees and the liens on certain categories of assets are not required to be perfected. Excluded assets include certain contracts, certain equipment, and the assets of any

16

non-guarantor subsidiary and certain capital stock of certain subsidiaries. See "Description of the Exchange Notes—Collateral." If an event of default occurs and the Kratos Notes are accelerated, the Kratos Notes and the Kratos Guarantees will rank equally with the holders of other unsubordinated and unsecured indebtedness of the relevant entity with respect to such excluded property and will be effectively subordinated to holders of obligations secured by a lien perfected on such excluded property.

The value of the collateral securing the Kratos Notes may not be sufficient to satisfy all the obligations evidenced by or relating to such Kratos Notes secured by such collateral. As a result, holders of such Kratos Notes may not receive full payment on such Kratos Notes following an event of default.