UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2018

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to |

Commission file number: 0-04041 |

ALLIED MOTION TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

|

Colorado |

|

84-0518115 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

495 Commerce Drive, Amherst, New York |

|

14228 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (716) 242-8634

Securities registered pursuant to Section 12(b) of the Act: Common Stock, no par value Nasdaq Global Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

Accelerated filer x |

Non-accelerated filer o |

Smaller reporting company o |

Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of voting stock held by non-affiliates of the Registrant, computed by reference to the average bid and asked prices of such stock as of the last business day of the Registrant’s most recently completed second fiscal quarter was approximately $359,222,177.

Number of shares of the only class of Common Stock outstanding: 9,534,885 as of March 13, 2019

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2019 Annual Meeting of Shareholders are incorporated into Part III.

Disclosure Regarding Forward-Looking Statements

All statements contained herein that are not statements of historical fact constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements, and may contain the word “believe,” “anticipate,” “expect,” “project,” “intend,” “will continue,” “will likely result,” “should” or words or phrases of similar meaning. Forward-looking statements involve known and unknown risks and uncertainties that may cause actual results to differ materially from the expected results described in the forward-looking statements. The risks and uncertainties include those associated with: the domestic and foreign general business and economic conditions in the markets we serve, including political and currency risks and adverse changes in local legal and regulatory environments; the introduction of new technologies and the impact of competitive products; the ability to protect the Company’s intellectual property; our ability to sustain, manage or forecast its growth and product acceptance to accurately align capacity with demand; the continued success of our customers and the ability to realize the full amounts reflected in our order backlog as revenue; the loss of significant customers or the enforceability of the Company’s contracts in connection with a merger, acquisition, disposition, bankruptcy, or otherwise; our ability to meet the technical specifications of our customers; the performance of subcontractors or suppliers and the continued availability of parts and components; changes in government regulations; the availability of financing and our access to capital markets, borrowings, or financial transactions to hedge certain risks; the ability to attract and retain qualified personnel who can design new applications and products for the motion industry; the ability to implement our corporate strategies designed for growth and improvement in profits including to identify and consummate favorable acquisitions to support external growth and the development of new technologies; the ability to successfully integrate an acquired business into our business model without substantial costs, delays, or problems; our the ability to control costs, including the establishment and operation of low cost region manufacturing and component sourcing capabilities; and the additional risk factors discussed under “Item 1A. Risk Factors” in Part I of this report. Actual results, events and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements as a prediction of actual results. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict the occurrence of those matters or the manner in which they may affect us. The Company has no obligation or intent to release publicly any revisions to any forward-looking statements, whether as a result of new information, future events, or otherwise.

New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. The Company’s expectations, beliefs and projections are believed to have a reasonable basis; however, the Company makes no assurance that expectations, beliefs or projections will be achieved.

All dollar amounts are in thousands except share and per share amounts.

Description of the Business

Allied Motion Technologies Inc. (“Allied Motion” or the “Company” or “we” or “our”) is a global company that designs, manufactures and sells precision and specialty controlled motion components and systems used in a broad range of industries. Our target markets include Vehicle, Medical, Aerospace & Defense (A&D), and Industrial. We are headquartered in Amherst, NY, and have global operations and sell to markets across the United States, Canada, South America, Europe and Asia. We are known worldwide for our expertise in electro-magnetic, mechanical and electronic motion technology. Our products include brush and brushless DC motors, brushless servo and torque motors, coreless DC motors, integrated brushless motor-drives, gearmotors, gearing, modular digital servo drives, motion controllers, incremental and absolute optical encoders, active and passive filters for power quality and harmonic issues, and other controlled motion-related products.

Our growth strategy is focused on becoming the controlled motion solution leader in our selected target markets by leveraging our “technology/know how” to develop integrated precision motion solutions. Our intent is to utilize multiple Allied Motion technologies/products to “change the game” by enhancing and optimizing the operation, performance and efficiency of our customers’ products and manufacturing equipment. Our goal is to grow sales with a larger base of customers, new applications and technologies, and increase market share globally and within our targeted markets.

We design and develop our products within our Technology Centers and can manufacture these products in various facilities located in the United States, Canada, Mexico, Europe and Asia. We also operate Allied Motion Solution Centers that apply all Allied Motion products to create integrated controlled motion solutions for our customers. We sell our products and solutions globally to a broad spectrum of customers through our own direct sales force and authorized manufacturers’ representatives and distributors. Our customers include end users and original equipment manufacturers (“OEMs”).

Allied Motion was established in 1962 under the laws of Colorado and operates in the United States, Canada, Mexico, Europe and Asia. We are headquartered in Amherst, New York and the mailing address of our corporate headquarters is 495 Commerce Drive, Suite 3, Amherst, New York 14228. The telephone number at this location is (716) 242-8634. Our website is www.alliedmotion.com. We trade under the ticker symbol “AMOT” on the NASDAQ exchange.

Acquisitions

Maval OE Steering: On January 19, 2018, we completed the purchase of substantially all of the operating assets associated with the original equipment steering business of Maval Industries, LLC. The addition of the Maval OE steering product line enables us to provide a fully integrated power steering system solution to our customers.

TCI, LLC: We completed the acquisition of TCI, LLC on December 6, 2018. TCI is a leading developer and manufacturer of active (electronic) and passive (magnetic) products to monitor and resolve power quality and harmonic distortion issues associated with industrial power conversion. TCI’s manufacturing capabilities include magnetic and electronic product assembly expertise to support a broad suite of power quality solutions that are used in oil and gas, HVAC, water and wastewater, and general industrial end markets.

Markets and Applications

Our products and solutions are applied broadly to support a wide range of applications in several served markets. Examples of applications in these markets that use Allied Motion components and systems include the following:

Vehicle: electronic power steering and drive-by-wire applications to electrically replace, or provide power-assist to, a variety of mechanical linkages, traction / drive systems and pumps, automated and remotely guided power steering systems, various high performance vehicle applications, actuation systems (e.g., lifts, slide-outs, covers, etc.), HVAC systems, solutions to improve energy efficiency of vehicles while idling and alternative fuel systems such as LPG, fuel cell and hybrid vehicles. Vehicle types include off- and on-road construction and agricultural equipment; trucks, buses, boats, utility, recreational (e.g., RVs, ATVs (all-terrain vehicles), specialty automotive, automated and remotely guided vehicles).

Medical: surgical robots, prosthetics, electric powered surgical hand pieces, programmable pumps to meter and administer infusions associated with chemotherapy, pain control and antibiotics, nuclear imaging systems, radiology equipment, automated pharmacy dispensing equipment, kidney dialysis equipment, respiratory ventilators, heart pumps, and patient handling equipment (e.g., wheel chairs, scooters, stair lifts, patient lifts, transport tables and hospital beds).

Aerospace & Defense: inertial guided missiles, mid-range smart munitions systems, weapons systems on armed personnel carriers, unmanned vehicles, security and access control, camera systems, door access control, airport screening and scanning devices.

Industrial: products are used in factory automation, specialty equipment, material handling equipment, commercial grade floor polishers and cleaners, commercial building equipment such as welders, cable pullers and assembly tools, the handling, inspection, and testing of components and final products such as PCs, gaming equipment and cell phones, high definition printers, tunable lasers and spectrum analyzers for the fiber optic industry, test and processing equipment for the semiconductor manufacturing industry, power quality products to filter distortion caused by variable frequency drives and other power electronic equipment.

Organization Structure

Allied Motion’s “One Team” approach to the market is realized through the close collaboration of our Sales Organization, Solution Centers, Technology Centers and Production Centers all working together to provide innovative controlled motion solutions and create value for our customers.

Allied Motion Sales Organization: Our sales organization is evolving with the goal of becoming the best sales and service force in our industry. Through our “One Team” approach for providing controlled motion solutions and components that best address our customers’ needs, we are broadening the knowledge and skills of our direct sales force, while creating sales and service support in our Solution Centers. This enables the entire sales organization to be capable of selling globally all products designed, developed and produced by Allied Motion. Currently, our primary channels to market include our direct sales force and external authorized Sales Representatives, Agents and Distributors that provide field coverage in Asia, Europe, Canada, Israel and the Americas. While the majority of our sales are directly to OEMs, we are working to expand our market reach through Distribution channels.

Allied Motion Solution Centers: Allied has Solution Centers in China, Europe and North America that enable the design and sale of individual products as well as integrated controlled motion systems that utilize multiple Allied Motion products. In addition to providing sales and applications support, the solution center function may include final assembly, integration and tests, as required, to support customers within their geographic region.

China Solution Center — Changzhou, China

European Solution Centers include:

· Stockholm, Sweden: Scandinavian Countries, with a specialty in larger vehicle applications

· Kelheim, Germany: German speaking countries, with a specialty in Industrial applications

· Porto, Portugal: with a specialty in automotive applications

· Dordrecht, Netherlands: with a specialty in commercial applications

North American Solution Center — Amherst, New York, USA

Allied Motion Technology Centers: Allied has Technology Centers in China, Europe and North America that design, develop and support the various products and systems offered by Allied Motion with a focus on specific technologies/products in each individual location. Our most recent acquisition of TCI will be fully integrated into our structure over the coming year.

North American Motors: During 2017, we consolidated all motor design, development and support activities in North America under the umbrella of North American Motors which includes: Dayton, OH: automotive brushless DC motors, power steering solutions and special purpose motors. Owosso, MI: fractional horsepower permanent magnet DC and brushless DC motors serving a wide range of original equipment applications. Tulsa, OK: high performance brushless DC motors, including servo motors, frameless motors, torque motors, high speed (60,000 RPM+) slotless motors, high resolution encoders and motor/encoder assemblies.

North American Mechatronics: Under the umbrella of North American Mechatronics, the Company designs gearing, mechanical and electronic products and solutions to combine with motor solutions for a wide range of market based and custom engineered solutions. The locations under the Mechatronics umbrella include:

· Watertown, NY: gearing solutions in both stand-alone and integrated gearing/motor configurations.

· Amherst NY and Oakville, Ontario: advanced electronic controlled motion products and custom solutions including integrated power electronics, digital controls and network communications for motor control and power conversion to support Allied Motion’s broad range of motors.

· Twinsburg, OH: steering system components for the automotive, off-road, performance and specialty vehicle markets.

Dordrecht, Netherlands: Designs and develops fractional horsepower brushless DC (“BLDC”) outer rotor motors and traditional BLDC motor part sets with or without integrated electronics and coreless DC motors.

Kelheim, Germany: Designs and develops high performance and highly configurable synchronous BLDC servo motor solutions and asynchronous BLDC motors for a wide variety of demanding motion applications. Additionally, trolleys for use in medical environments are designed and produced for customer specific applications.

Stockholm, Sweden and Ferndown, UK: Designs and develops high performance electronic controls and platform based integrated steering system solutions for market specific vehicle solutions that may utilize the various technologies and products developed by other Allied Motion locations.

TCI, LLC: Designs and manufactures active (electronic) and passive (magnetic) products to monitor and resolve power quality and harmonic distortion issues associated with industrial power conversion.

Allied Motion Production Centers: Allied has designated Production Centers in China, Europe and North America that provide dedicated manufacturing capabilities for the various products and systems offered by Allied Motion with a focus on specific technologies/products in each individual location. In certain cases, products may be produced in multiple locations to better serve our customers within the geographic region in which they are located. Locations include:

Changzhou, China

Mrakov, Czech Republic

Porto, Portugal

Reynosa, Mexico

Dothan, Alabama, USA

Competitive Environment

Our products and solutions are sold into a global market with a large and diverse group of competitors that vary by product, geography, industry and application. We believe the controlled motion market is highly fragmented with many competitors, some of which are substantially larger and have greater resources than Allied Motion. We believe our competitive advantages include our electro-magnetic, mechanical and electronic controlled motion expertise, the breadth of our motor technologies and our ability to integrate these technologies with our encoders, gearing, power electronics, digital control technologies and network/feedback communications capabilities, as well as our global presence. Unlike many of our competitors, we are unique in our ability to provide custom-engineered controlled motion solutions that integrate the products we manufacture such as embedded or external electrical control solutions with our motors. We compete on technological capabilities, quality, reliability, service responsiveness, delivery speed and price. Our competitors include Altra Industrial Motion Corp., Ametek, Inc., Parker Hannifin Corporation and other smaller competitors.

Availability of Parts and Raw Materials

We purchase critical raw materials from a limited number of suppliers due to the technically challenging requirements of the supplied product and/or the lengthy process required to qualify these materials both internally and with our customers. We cannot quickly establish additional or replacement suppliers for these materials in some cases because of these rigid requirements. For these critical raw materials, we maintain minimum safety stock levels and partner with suppliers through contract to help ensure the continuity of supply. Historically, we have not experienced any significant interruptions or delays in obtaining critical raw materials.

Patents, Trademarks, Licenses, Franchises and Concessions

We hold a number of patents and trademarks for components manufactured by our various subsidiaries, and we have several patents pending on new products recently developed, which are considered to be of significance.

Working Capital Items

We currently maintain inventory levels adequate for our short-term needs based upon present levels of production. We consider the component parts of our different product lines to be generally available and current suppliers to be reliable and capable of satisfying anticipated needs.

Major Customers

During 2018, 2017 and 2016, the Company’s total annual revenues increased significantly as a result of both sales to customers of businesses acquired by the Company during that period and from increased sales to a number of existing customers of the Company, with five customers accounting for approximately 34% of the Company’s total revenue during 2018, 33% during 2017 and 35% during 2016.

Sales Backlog

Backlog as of December 31, 2018 was $131,997 compared with $100,708 as of December 31, 2017. The time to convert the majority of backlog to sales is approximately three to four months. Given the short product lead times, we do not believe that the amount of our backlog of orders is a reliable indication of our future sales. We may on occasion receive multi-year orders from customers for product to be delivered on demand over that time frame. There is no assurance that the Company’s backlog from these customers will be converted into revenue.

Engineering and Development Activities

Our engineering and development (E&D) activities are for the development of new products, enhancement of the functionality, effectiveness and reliability of current products, to redesign products to reduce the cost of manufacturing of products or to expand the types of applications for which our products and solutions can be used. Our expenditures on engineering and development for the years ended December 31, 2018, 2017 and 2016 were $19,913, $17,542, and $16,170, respectively, or 6.4% of sales in 2018 and 7% of sales in 2017 and 2016. We believe E&D is critical to our success and expect to continue to invest at these levels in the future. Of these expenditures, no material amounts were charged directly to customers, although we record non-recurring engineering charges to certain customers for custom engineering required to develop products that meet the customer’s specifications.

Environmental Issues

No significant pollution or other types of hazardous emission result from the Company’s operations and it is not anticipated that our operations will be materially affected by Federal, State or local provisions concerning environmental controls. Our costs of complying with environmental, health and safety requirements have not been material.

We do not believe that existing or pending climate change legislation, regulation, or international treaties or accords are reasonably likely to have a material effect in the foreseeable future on our business or markets that we serve, nor on our results of operations, capital expenditures or financial position. We will continue to monitor emerging developments in this area.

International Operations

Our operations outside the United States are conducted through wholly-owned foreign subsidiaries and are located primarily in Europe and Asia. Our international operations are subject to the usual risks inherent in international trade, including currency fluctuations, local government contracting regulations, local governmental restrictions on foreign investment and repatriation of profits, exchange controls, regulation of the import and distribution of foreign goods, as well as changing economic and social conditions in countries in which our operations are conducted. The information required by this item is set forth in Note 12, Segment Information, of the notes to consolidated financial statements contained in Item 8 of this report.

Employees

At December 31, 2018, we employed approximately 1,600 full-time employees worldwide. Of those, approximately 54% are located in North America, 42% are located in Europe and the balance are located in China and the rest of the world.

Available Information

The Company maintains a website at www.alliedmotion.com. We make available, free of charge on or through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the SEC.

We have a Code of Ethics for our chief executive officer and president and senior financial officers regarding their obligations in the conduct of Company affairs. We also have a Code of Ethics and Business Conduct that is applicable to all directors, officers and employees. The Codes are available on our website. We intend to disclose on our website any amendment to, or waiver of, the Codes that would otherwise be required to be disclosed under the rules of the SEC and the Nasdaq Global Market. A copy of both Codes is also available in print to any stockholder upon written request addressed to Allied Motion Technologies Inc., 495 Commerce Drive, Suite 3, Amherst, NY 14228-2313, Attention: Secretary.

In the ordinary course of our business, we face various strategic, operating, compliance and financial risks. These risks could have a material impact on our business, reputation, financial condition or results of operations. Our most significant risks are set forth below and elsewhere in this Report. These risk factors should be considered in addition to our cautionary comments concerning forward-looking statements in this Report, including statements related to markets for our products and trends in our business that involve a number of risks and uncertainties.

Our global sales and operations are subject to a variety of economic, market and financial risks and costs that could affect our profitability and operating results.

We do business around the world and are continuing our strategy of global expansion. Our international sales are primarily to customers in Europe, Canada and Asia. In addition, our manufacturing operations, suppliers and employees are located in many places around the world. The future success of our business depends in large part on growth in our sales in non-U.S. markets. Our global operations are subject to numerous financial, legal and operating risks, such as political and economic instability; imposition of trade or foreign exchange restrictions, including in the U.S.; trade protection measures such as the imposition of or increase in tariffs and other trade barriers, including in the U.S.; unexpected changes in regulatory requirements, including in the U.S., prevalence of corruption in certain countries; enforcement of contract and intellectual property rights and compliance with existing and future laws, regulations and policies, including those related to tariffs, investments, taxation, trade controls, product content and performance, employment and repatriation of earnings. In addition, we are affected by changes in foreign currency exchange rates, inflation rates and interest rates.

Foreign currency exchange rates may adversely affect our financial results.

Sales and purchases in currencies other than the U.S. dollar expose us to fluctuations in foreign currencies relative to the U.S. dollar and may adversely affect our financial results. Increased strength of the U.S. dollar increases the effective price of our products sold in U.S. dollars into other countries, which may require us to lower our prices or adversely affect sales to the extent we do not increase local currency prices. Decreased strength of the U.S. dollar could adversely affect the cost of materials, products and services we purchase from non-U.S. denominated locations. Sales and expenses of our non-U.S. businesses are also translated into U.S. dollars for reporting purposes and the strengthening or weakening of the U.S. dollar could result in unfavorable translation effects. The Company also faces exchange rate risk from its investments in subsidiaries owned and operated in foreign countries.

Our international operations expose us to legal and regulatory risks, which could have a material effect on our business.

Our profitability and international operations are, and will continue to be, subject to risks relating to changes in foreign legal and regulatory requirements. In addition, our international operations are governed by various U.S. laws and regulations, including Foreign Corrupt Practices Act (FCPA), the U.K. Bribery Act and other foreign anti-bribery laws. The FCPA generally prohibits companies and their intermediaries from making improper payments to foreign government officials for the purpose of obtaining or retaining business. Other countries in which we operate also have anti-bribery laws, some of which prohibit improper payments to government and non-government persons and entities. Any alleged or actual violations of these regulations may subject us to government scrutiny, severe criminal or civil sanctions and other liabilities and could negatively affect our business, reputation, operating results and financial condition.

We are required to comply with various import laws and export control and economic sanctions laws, which may affect our transactions with certain customers, business partners and other persons and dealings between our employees and subsidiaries. In certain circumstances, export control and economic sanctions regulations or embargos may prohibit the export of certain products, services and technologies. In other circumstances, we may be required to obtain an export license before exporting the controlled item. Compliance with the various import laws that apply to our businesses can restrict our access to, and increase the cost of obtaining, certain products and at times can interrupt our supply of imported inventory.

In addition to government regulations regarding sale and export, we are subject to other regulations regarding our products. For example, the U.S. Securities and Exchange Commission has adopted disclosure rules for companies that use conflict minerals in their products, with substantial supply chain verification requirements in the event that the materials come from, or could have come from, the Democratic Republic of the Congo or adjoining countries. These rules and verification requirements impose additional costs on us and on our suppliers, and may limit the sources or increase the cost of materials used in our products. Further, if we are unable to certify that our products are conflict free, we may face challenges with our customers that could place us at a competitive disadvantage, and our reputation may be harmed.

We may explore additional acquisitions that complement, enhance or expand our business. We may not be able to complete these transactions, and, if completed, we may experience operational and financial risks in connection with our acquisitions that may materially adversely affect our business, financial condition and operating results.

Acquisitions are part of our strategic growth plans. We may have difficulty finding these opportunities, or if we do identify these opportunities, we may not be able to complete the transactions for various reasons including a failure to secure financing.

To the extent that we are able to complete the transactions, we will face the operational and financial risks commonly encountered with an acquisition strategy. These risks include the challenge of integrating acquired businesses while managing the ongoing operations of each business, the challenge of combining the business cultures of each company, and the need to retain key personnel of our existing business and the acquired business. The process of integrating operations could cause an interruption of, or loss of momentum in, the activities of the acquired business and our existing business. Members of our senior management may be required to devote considerable amounts of time to the integration process, which will decrease the time they will have to manage our businesses, service existing customers, attract new customers and develop new products. If our senior management is not able to effectively manage the integration process, or if any significant business activities are interrupted as a result of the integration process, our business could be adversely affected.

The indemnification provisions of acquisition agreements by which we have acquired companies may not fully protect us and as a result we may face unexpected liabilities.

Certain of the acquisition agreements by which we have acquired companies require the former owners to indemnify us against certain liabilities related to the operation of the company before we acquired it. In most of these agreements, however, the liability of the former owners is limited and certain former owners may be unable to meet their indemnification responsibilities. We cannot assure that these indemnification provisions will protect us fully or at all, and as a result we may face unexpected liabilities that adversely affect our financial results.

Our inability to adequately enforce and protect our intellectual property or defend against assertions of infringement could prevent or restrict our ability to compete.

We rely on patents, trademarks and proprietary knowledge and technology, both internally developed and acquired, in order to maintain a competitive advantage. Our inability to defend against the unauthorized use of these rights and assets could have an adverse effect on our results of operations and financial condition. Litigation may be necessary to protect our intellectual property rights or defend against claims of infringement. This litigation could result in significant costs and divert our management’s focus away from operations.

Our indebtedness may limit our operations and our use of our cash flow, and any failure to comply with the covenants that apply to our indebtedness could adversely affect our liquidity and financial results.

Our ability to service our indebtedness depends on our financial performance, which is affected by prevailing economic conditions and financial, business, regulatory and other factors. Some of these factors are beyond our control. Our debt level and related debt service obligations can have negative consequences, including requiring us to dedicate significant cash flow from operations to the payment of principal and interest on our debt, which reduces the funds we have available for other purposes such as acquisitions and capital investment; reducing our flexibility in planning for or reacting to changes in our business and market conditions; and exposing us to interest rate risk since a portion of our debt obligations are at variable rates. In addition, certain of our indebtedness will have significant outstanding principal balances on their maturity dates, commonly known as “balloon payments.” Therefore, we will likely need to refinance at least a portion of our outstanding debt as it matures. We may incur more debt in the future, particularly to finance acquisitions, and there can be no assurance that our cost of funding will not substantially increase.

Our existing credit agreements contain, and any future debt agreements we may enter into may contain, certain financial tests and other covenants that limit our ability to incur indebtedness, acquire other businesses and impose various other restrictions. If we breach any of the covenants and do not obtain a waiver from the lenders, the outstanding indebtedness could be declared immediately due and payable. If we are unable to obtain sufficient capital in the future, we may have to curtail our capital expenditures and other expenses. Any such actions could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Economic and credit market uncertainty could interrupt our access to capital markets, borrowings, or financial transactions to hedge certain risks, which could adversely affect our financial condition.

To date, we have been able to access debt and equity financing that has allowed us to make investments in growth opportunities and fund working capital requirements. In addition, we enter into financial transactions to hedge certain risks, including foreign exchange and interest rate risk. Our continued access to capital markets, the stability of our lenders and their willingness to support our needs, and the stability of the parties to our financial transactions that hedge risks are essential for us to meet our current and long-term obligations, fund operations, and fund our strategic initiatives. An interruption in our access to external financing or financial transactions to hedge risk could affect our business prospects and financial condition.

Our growth could suffer if the markets into which we sell our products and services decline.

Our growth depends in part on the growth of the markets which we serve. Any decline or lower than expected growth in our served markets could diminish demand for our products and services, which would adversely affect our financial results. Certain of our businesses operate in industries that may experience periodic, cyclical downturns. Demand for our products and services is also sensitive to changes in customer order patterns, which may be affected by announced price changes, changes in incentive programs, new product introductions and customer inventory levels. Any of these factors could adversely affect our growth and results of operations in any given period.

We could experience a failure of a key information technology system, process or site or a breach of information security, including a cybersecurity breach or failure of one or more key information technology systems, networks, processes, associated sites or service providers.

We rely extensively on information technology (“IT”) systems for the storage, processing, and transmission of our electronic, business-related information assets used in or necessary to conduct business. We leverage our internal information technology infrastructures, and those of our business partners, to enable, sustain, and support our global business activities. In addition, we rely on networks and services, including internet sites, data hosting and processing facilities and tools and other hardware, software and technical applications and platforms, some of which are managed, hosted, provided and/or used by third-parties or their vendors, to assist in conducting our business. The data we store and process may include customer payment information, personal information concerning our employees, confidential financial information, and other types of sensitive business-related information. Numerous and evolving cybersecurity threats pose potential risks to the security of our IT systems, networks and services, as well as the confidentiality, availability and integrity of our data. In addition, the laws and regulations governing security of data on IT systems is evolving, and adding another layer of complexity in the form of new requirements. We have made, and continue to make investments, seeking to address these threats, including monitoring of networks and systems, hiring of experts, employee training and security policies for employees and third-party providers. The techniques used in these attacks change frequently and may be difficult to detect for periods of time and we may face difficulties in anticipating and implementing adequate preventative measures. While the breaches of our IT systems to date have not been material to our business or results of operations, the costs of attempting to protect IT systems and data may increase, and there can be no assurance that these added security efforts will prevent all breaches of our IT systems or thefts of our data. If our IT systems are damaged or cease to function properly, the networks or service providers we rely upon fail to function properly, or we or one of our third-party providers suffer a loss or disclosure of our business or stakeholder information due to any number of causes ranging from catastrophic events or power outages to improper data handling or security breaches and our business continuity plans do not effectively address these failures on a timely basis, we may be exposed to potential disruption in operations, loss of customers, reputational, competitive and business harm as well as significant costs from remediation, litigation and regulatory actions.

We are also subject to an increasing number of evolving data privacy and security laws and regulations. Failure to comply with such laws and regulations could result in the imposition of fines, penalties and other costs. The European Union’s implementation of the General Data Protection Regulation in 2018 and their pending ePrivacy Regulation could disrupt our ability to sell products and solutions or use and transfer data because such activities may not be in compliance with applicable laws.

We rely on suppliers to provide equipment, components and services, which creates certain risks and uncertainties that may adversely affect our business.

Our business requires that we buy equipment, components and services from third parties. Our reliance on suppliers involves certain risks, including poor quality or an insecure supply chain, which could adversely affect the reliability and reputation of our products; changes in the cost of these purchases due to inflation, exchange rates, or other factors; shortages of

components, commodities or other materials, which could adversely affect our manufacturing efficiencies and ability to make timely delivery.

Any of these uncertainties could adversely affect our profitability and ability to compete. The effect of unavailability or delivery delays would be more severe if associated with our higher volume and more profitable products. Even where substitute sources of supply are available, qualifying the alternate suppliers and establishing reliable supplies could cost more or could result in delays and a loss of sales.

We intend to develop new products and expand into new markets, which may not be successful and could harm our operating results.

We intend to expand into new markets and develop new and modified products based on our existing technologies and engineering capabilities, including the continued expansion of our controlled motion systems. These efforts have required and will continue to require us to make substantial investments, including significant research, development and engineering expenditures and capital expenditures for new, expanded or improved manufacturing facilities. Specific risks in connection with expanding into new products and markets include: longer product development cycles, the inability to transfer our quality standards and technology into new products, and the failure of our customers to accept the new or modified products.

We may experience difficulties that could delay or prevent the successful development of new products or product enhancements under new and existing contracts, and new products or product enhancements may not be accepted by our customers. In addition, the development expenses we incur may exceed our cost estimates, and new products we develop may not generate sales sufficient to offset our costs. If any of these events occur, our sales and profits could be adversely affected.

Our profits may decline if the price of raw materials continues to rise and we cannot recover the increases from our customers.

We use various raw materials, such as copper, steel, zinc and rare earth magnets, in our manufacturing operations. The prices of these raw materials have been subject to volatility. As a result of price increases, we have generally implemented price surcharges to our customers; however, we may be unable to collect surcharges without suffering reductions in unit volume, revenue and operating income. There can be no assurance that we will be able to fully recover the price increases through surcharges in a timely manner. We are also subject to risks associated with U.S. and foreign legislation and regulations relating to imports, including quotas, duties, tariffs or taxes, and other charges or restrictions on imports, which could adversely affect our operations and our ability to import products at current or increased levels. We cannot predict whether additional U.S. and foreign customs quotas, duties, tariffs, taxes or other charges or restrictions, requirements as to where raw materials must be purchased, or other restrictions on our imports will be imposed upon the importation of our products in the future or adversely modified, or what effect such actions would have on our costs of operations.

We face competition that could harm our business and we may be unable to compete successfully against new entrants and established companies with greater resources.

Competition in connection with the manufacturing of our products may intensify in the future. The market for our technologies is competitive and subject to rapid technological change. We compete globally on the basis of product performance, customer service, availability, reliability, productivity and price. Our competitors may be larger and may have greater financial, operational, economies of scale, personnel, sales, technical and marketing resources than us. Certain of our competitors also may pursue aggressive pricing or product strategies that may cause us to reduce the prices we charge for our original equipment and aftermarket products and services or lose sales. These actions may lead to reduced revenues, lower margins and/or a decline in market share, any of which may adversely affect our business, financial condition and results of operations.

We are subject to a variety of litigation and other legal and regulatory proceedings in the course of our business that could adversely affect our financial results.

We are potentially subject to a variety of litigation and other legal and regulatory proceedings incidental to our business, including claims for damages arising out of the use of products or services and claims relating to intellectual property, employment, tax, commercial disputes, competition, sales and trading practices, environmental, personal injury, insurance coverage, acquisition, as well as regulatory investigations or enforcement. We may also become subject to lawsuits as a result of past or future acquisitions including liabilities retained from, or representations, warranties or indemnities provided in connection with these acquisitions. These lawsuits may include claims for compensatory damages, punitive and

consequential damages and/or injunctive relief. The defense of these lawsuits may divert our management’s attention, we may incur significant expenses in defending these lawsuits and we may be required to pay damage awards or settlements or become subject to equitable remedies that could adversely affect our operations and financial results. Moreover, any insurance or indemnification rights that we may have may be insufficient or unavailable to protect us against such losses. We estimate loss contingencies and establish reserves based on our assessment where liability is deemed probable and reasonably estimable given the facts and circumstances known to us at a particular point in time. Subsequent developments may affect our assessment and estimates of the loss contingencies recorded as liabilities. We cannot guarantee that our liabilities in connection with litigation and other legal and regulatory proceedings will not exceed our estimates or adversely affect our financial results and reputation.

Unforeseen exposure to additional income tax liabilities may negatively affect our operating results.

Our distribution of taxable income is subject to domestic tax and, as a result of our significant manufacturing and sales presence in foreign countries, foreign tax. Our effective tax rate may be affected by shifts in our mix of earnings in countries with varying statutory tax rates, changes in reinvested foreign earnings, alterations to tax regulations or interpretations and outcomes of any audits performed on previous tax returns.

Our business is subject to costly environmental regulations that could negatively affect our operating results.

Federal, state and local regulations impose various environmental controls on the manufacturing, transportation, storage, use and disposal of batteries and hazardous chemicals and other materials used in, and hazardous waste produced by the manufacturing of our products. Conditions relating to our historical operations may require expenditures for clean-up in the future and changes in environmental laws and regulations may impose costly compliance requirements on us or otherwise subject us to future liabilities. Additional or modified regulations relating to the manufacture, transportation, storage, use and disposal of materials used to manufacture our products or restricting disposal or transportation of our products may be imposed that may result in higher costs or lower operating results. In addition, we cannot predict the effect that additional or modified environmental regulations may have on us or our customers.

Quality problems with our products could harm our reputation, erode our competitive advantage and could result in warranty claims and additional costs.

Quality is important to us and our customers, and our products are held to high quality and performance standards. In the event our products fail to meet these standards, our reputation could be harmed, which could damage our competitive advantage, causing us to lose customers and resulting in lower revenues. We generally allow customers to return defective or damaged products for credit, replacement, repair or exchange. We generally warrant that our products will meet customer specifications and will be free from defects in materials and workmanship. We reserve for our exposure to warranty claims based upon recent historical experience and other specific information as it becomes available. However, these reserves may not be adequate to cover future warranty claims and additional warranty costs or inventory write-offs may be incurred which could harm our operating results.

If we are unable to attract and retain qualified personnel, our ability to operate and grow our company will be in jeopardy.

We are required to hire and retain skilled employees at all levels of our operations in a market where such qualified employees are in high demand and are subject to receiving competing offers. We believe that there is, and will continue to be, competition for qualified personnel in our industry, and there is no assurance that we will be able to attract or retain the personnel necessary for the management and development of our business. The inability to attract or retain employees currently or in the future may have a material adverse effect on our business.

Our future success depends in part on the continued service of our engineering and technical personnel and our ability to identify, hire and retain personnel.

Our success will depend in large part upon our ability to attract, train, retain and motivate highly skilled employees. There is currently aggressive competition for employees who have experience in technology and engineering. We may not be able to continue to attract and retain engineers or other qualified personnel necessary for the development and growth of our business or to replace personnel who may leave our employ in the future. The failure to retain and recruit key technical personnel could cause additional expense, potentially reduce the efficiency of our operations and could harm our business.

Our operating results could fluctuate significantly.

Our quarterly and annual operating results are affected by a wide variety of factors that could materially adversely affect revenues and profitability, including: the timing of customer orders and the deferral or cancellation of orders previously received, the level of orders received which can be shipped in a quarter, fulfilling backlog on a timely basis, competitive pressures on selling prices, changes in the mix of products sold, the timing of investments in engineering and development, development of and response to new technologies, and delays in new product qualifications.

As a result of the foregoing and other factors, we may experience material fluctuations in future operating results on a quarterly or annual basis which could materially and adversely affect our business, financial condition, operating results and stock price.

We may never realize the full value of our substantial intangible assets.

These intangible assets consist primarily of goodwill, customer lists, trade names and patented technology arising from our acquisitions. Goodwill is not amortized, it is tested annually or upon the occurrence of certain events which indicate that the assets may be impaired. Definite lived intangible assets are amortized over their estimated useful lives and are tested for impairment upon the occurrence of certain events which indicate that the assets may be impaired. We may not receive the recorded value for our intangible assets if we sell or liquidate our business or assets. In addition, intangible assets with definite lives will continue to be amortized. Amortization expenses relating to these intangible assets will continue to reduce our future earnings.

We face the potential harms of natural disasters, pandemics, acts of war, terrorism, international conflicts or other disruptions to our operations.

Natural disasters, pandemics, acts or threats of war or terrorism, international conflicts, political instability, and the actions taken by governments could cause damage to or disrupt our business operations, our suppliers or our customers, and could create economic instability. Although it is not possible to predict such events or their consequences, these events could decrease demand for our products or make it difficult or impossible for us to deliver products.

Increased healthcare, pension and other costs under the Company’s benefit plans could adversely affect the Company’s financial condition and results of operations.

We provide health benefits to many of our employees and the costs to provide such benefits continue to increase annually. The amount of any increase or decrease in the cost of Company-sponsored health plans will depend on a number of different factors including new governmental regulations mandating types of coverage and reporting and other requirements.

We also sponsor defined benefit pension, defined contribution pension, and other postretirement benefit plans. Our costs to provide such benefits generally continue to increase annually. We use actuarial valuations to determine the Company’s benefit obligations for certain benefit plans, which require the use of significant estimates, including the discount rate, expected long-term rate of return on plan assets, mortality rates and the rates of increase in compensation and health care costs. Changes to these significant estimates could increase the cost of these plans, which could also have a material adverse effect on the Company’s financial condition and results of operations.

Failure of our internal control over financial reporting could limit our ability to report our financial results accurately and timely or prevent fraud.

We believe that effective internal controls are necessary to provide reliable financial reports and to assist in the effective prevention of fraud. If we are unable to detect or correct any issues in the design or operating effectiveness of internal controls over financial reporting or fail to prevent fraud, current and potential customers and shareholders could lose confidence in our financial reporting, which could harm our business and the trading price of our stock.

Our operating results depend in part on our ability to contain or reduce costs. There is substantial price competition in our industry, and our success and profitability will depend on our ability to maintain a competitive cost and price structure.

Our efforts to maintain and improve profitability depend in part on our ability to reduce the costs of materials, components, supplies and labor, including establishing production capabilities at our low cost regional subcontractors. While the failure of

any single cost containment effort by itself would most likely not significantly impact our results, we cannot give any assurances that we will be successful in implementing cost reductions and maintaining a competitive cost structure.

There is substantial price competition in our industry, and our success and profitability will depend on our ability to maintain a competitive cost and price structure. We may have to reduce prices in the future to remain competitive. Also, our future profitability will depend in part upon our ability to continue to improve our manufacturing efficiencies and maintain a cost structure that will enable us to offer competitive prices. Our inability to maintain a competitive cost structure could have a material adverse effect on our business, financial condition and results of operations.

We depend heavily upon a limited number of customers, and if we lose any of them or they reduce their business with us, we would lose a substantial portion of our revenues.

A significant portion of our revenues and trade receivables are concentrated with a small group of customers. These customers have a variety of suppliers to choose from and therefore can make substantial demands on us, including demands on product pricing and on contractual terms, often resulting in the allocation of risk to us as the supplier. Our ability to maintain strong relationships with our principal customers is essential to our future performance. If we lose a key customer, if any of our key customers reduce their orders of our products or require us to reduce our prices before we are able to reduce costs, if a customer is acquired by one of our competitors or if a key customer suffers financial hardship, our operating results would likely be harmed.

If we do not respond to changes in technology, our products may become obsolete and we may experience a loss of customers and lower revenues.

We sell our products to customers in several industries that experience rapid technological changes, new product introductions and evolving industry standards. Without the timely introduction of new products and enhancements, our products and services will likely become technologically obsolete over time and we may lose a significant number of our customers. Our product development efforts may be affected by a number of factors, including our ability to anticipate customer needs, allocate our research and development funding, innovate and develop new products, differentiate our offerings and commercialize new technologies, secure intellectual property protection for our product and manufacture products in a cost-effective manner. We would be harmed if we did not meet customer requirements and expectations. Our inability, for technological or other reasons, to successfully develop and introduce new and innovative products could result in a loss of customers and lower revenues.

Our competitiveness depends on successfully executing our growth initiatives and our globalization strategies.

We continue to invest in initiatives to support future growth, such as the creation of an effective corporate structure, implementation of our enterprise resource planning system, launch of a new integrated website, implementation of a structured approach to identify target markets, and the expansion of our Allied Systematic Tools (“AST”) (continuous improvement initiatives in quality, delivery, and cost). The failure to achieve our objectives on these initiatives could have an adverse effect on our operating results and financial condition. Our globalization strategy includes localization of our products and services to be closer to our customers and identified growth opportunities. Localization of our products and services includes expanding our capabilities, including supply chain and sourcing activities, product design, manufacturing, engineering, marketing and sales and support. These activities expose us to risks, including those related to political and economic uncertainties, transportation delays, labor market disruptions and challenges to protect our intellectual property.

We face the challenge of accurately aligning our capacity with our demand.

We have experienced capacity constraints and longer lead times for certain products in times of growing demand while we have also experienced idle capacity as economies slow or demand for certain products decline. Accurately forecasting our expected volumes and appropriately adjusting our capacity have been, and will continue to be, important factors in determining our results of operations. We cannot guarantee that we will be able to increase manufacturing capacity to a level that meets demand for our products, which could prevent us from meeting increased customer demand and could harm our business. However, if we overestimate our demand and overbuild our capacity, we may have significantly underutilized assets and we may experience reduced margins. If we do not accurately align our manufacturing capabilities with demand it could have a material adverse effect on our results of operations.

The manufacture of many of our products is a highly exacting and complex process, and if we directly or indirectly encounter problems manufacturing products, our reputation, business and financial results could suffer.

The manufacture of many of our products is an exacting and complex process. Problems may arise during manufacturing for a variety of reasons, including equipment malfunction, failure to follow specific protocols and procedures, problems with raw materials, natural disasters and environmental factors, and if not discovered before the product is released to market could result in recalls and product liability exposure. Because of the time required to develop and maintain manufacturing facilities, an alternative manufacturer may not be available on a timely basis to replace such production capacity. Any of these manufacturing problems could result in significant costs and liability, as well as negative publicity and damage to our reputation that could reduce demand for our products.

Item 1B. Unresolved Staff Comments.

Not applicable.

As of December 31, 2018, the Company occupies facilities as follows:

|

Description / Use |

|

Location |

|

Approximate |

|

Owned |

|

|

Corporate headquarters |

|

Amherst, New York |

|

6,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Amherst, New York |

|

6,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Changzhou, China |

|

30,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Changzhou, China |

|

40,000 |

|

Leased |

|

|

Office |

|

Dayton, Ohio |

|

29,000 |

|

Owned |

|

|

Office and manufacturing facility |

|

Dayton, Ohio |

|

25,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Dordrecht, The Netherlands |

|

32,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Dothan, Alabama |

|

88,000 |

|

Owned |

|

|

Office |

|

Ferndown, Great Britain |

|

1,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Germantown, Wisconsin |

|

66,000 |

|

Leased |

|

|

Office and manufacturing facilities (2) |

|

Kelheim, Germany |

|

154,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Mrakov, Czech Republic |

|

42,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Owosso, Michigan |

|

85,000 |

|

Owned |

|

|

Office |

|

Oakville, Ontario, Canada |

|

2,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Porto, Portugal |

|

52,000 |

|

Owned |

|

|

Office and manufacturing facility |

|

Reynosa, Mexico |

|

50,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Stockholm, Sweden |

|

20,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Tulsa, Oklahoma |

|

30,000 |

|

Leased |

|

|

Office and manufacturing facility |

|

Twinsburg, Ohio |

|

28,800 |

|

Leased |

|

|

Office and manufacturing facility |

|

Watertown, New York |

|

107,000 |

|

Owned |

|

The Company’s management believes the above-described facilities are adequate to meet the Company’s current and foreseeable needs.

The Company is involved in certain actions that have arisen out of the ordinary course of business. Management believes that resolution of the actions will not have a significant adverse effect on the Company’s consolidated financial statements.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Allied Motion’s common stock is listed on the Nasdaq Global Market System and trades under the symbol AMOT. The number of holders of record as reported by the Company’s transfer agent of the Company’s common stock as of the close of business on March 12, 2019 was 260.

Dividends

During 2018 and 2017, we declared regular quarterly cash dividends on our common stock. We paid $0.025 per quarter for 2017. We paid $0.025 for the first quarter of 2018 and $0.03 per quarter for the second, third and fourth quarters of 2018. While it is our current intention to pay regular quarterly cash dividends, any decision to pay future cash dividends will be made by our Board and will depend on our earnings, financial condition and other factors.

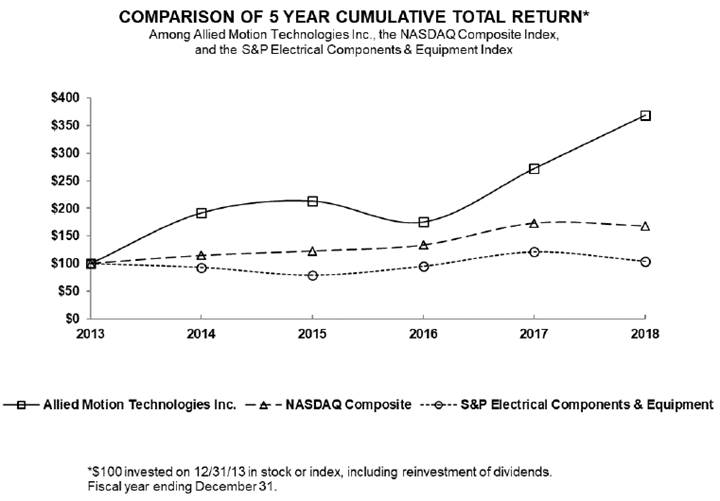

Performance Graph

The following performance graph and tables reflect the five year change in the Company’s cumulative total stockholder return on Common Stock as compared with the cumulative total return of the NASDAQ Stock Market Index and the NASDAQ Electrical and Industrial Apparatus Index for a $100 investment made on December 31, 2013, including reinvestment of any dividends.

|

|

|

12/31/2013 |

|

12/31/2014 |

|

12/31/2015 |

|

12/31/2016 |

|

12/31/2017 |

|

12/31/2018 |

| ||||||

|

Allied Motion Technologies |

|

$ |

100.00 |

|

$ |

191.85 |

|

$ |

213.12 |

|

$ |

175.15 |

|

$ |

272.27 |

|

$ |

368.67 |

|

|

NASDAQ (U.S.) |

|

$ |

100.00 |

|

$ |

114.75 |

|

$ |

122.74 |

|

$ |

133.62 |

|

$ |

173.22 |

|

$ |

168.30 |

|

|

S&P Electrical Components & Equipment |

|

$ |

100.00 |

|

$ |

93.05 |

|

$ |

78.93 |

|

$ |

95.27 |

|

$ |

121.28 |

|

$ |

104.11 |

|

Unregistered Sales of Equity Securities and Use of Proceeds

(1) As permitted under the Company’s equity compensation plan, these shares were withheld by the Company to satisfy tax withholding obligations for employees in connection with the vesting of stock. Shares withheld for tax withholding obligations do not affect the total number of shares available for repurchase under any approved common stock repurchase plan. At December 31, 2018, the Company did not have an authorized stock repurchase plan in place.

Item 6. Selected Financial Data.

|

Dollars in thousands, except share data |

|

2018 (1) |

|

2017 |

|

2016 (2) |

|

2015 |

|

2014 |

| |||||

|

Results from Operations |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Revenues |

|

$ |

310,611 |

|

$ |

252,012 |

|

$ |

245,893 |

|

$ |

232,434 |

|

$ |

249,682 |

|

|

Net income |

|

15,925 |

|

8,036 |

|

9,078 |

|

11,074 |

|

13,860 |

| |||||

|

Diluted earnings per share |

|

$ |

1.70 |

|

$ |

0.87 |

|

$ |

1.00 |

|

$ |

1.20 |

|

$ |

1.51 |

|

|

Dividends declared per share |

|

$ |

0.115 |

|

$ |

0.10 |

|

$ |

0.10 |

|

$ |

0.10 |

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Year-End Financial Position |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Cash and cash equivalents |

|

$ |

8,673 |

|

$ |

15,590 |

|

$ |

15,483 |

|

$ |

21,278 |

|

$ |

13,113 |

|

|

Working capital |

|

66,304 |

|

53,358 |

|

50,987 |

|

39,931 |

|

34,828 |

| |||||

|

Total assets |

|

285,301 |

|

187,922 |

|

179,919 |

|

162,147 |

|

165,640 |

| |||||

|

Short term debt |

|

— |

|

461 |

|

936 |

|

9,860 |

|

7,723 |

| |||||

|

Long-term debt |

|

122,516 |

|

52,694 |

|

70,483 |

|

57,518 |

|

67,125 |

| |||||

|

Shareholders’ equity |

|

101,813 |

|

87,347 |

|

72,286 |

|

64,597 |

|

55,951 |

| |||||

|

Shareholders’ equity per common share outstanding |

|

$ |

10.74 |

|

$ |

9.27 |

|

$ |

7.71 |

|

$ |

6.96 |

|

$ |

6.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Supplemental Financial Data |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Capital expenditures |

|

$ |

14,333 |

|

$ |

6,201 |

|

$ |

5,188 |

|

$ |

4,730 |

|

$ |

4,046 |

|

|

Depreciation expense |

|

7,921 |

|

7,055 |

|

6,545 |

|

4,822 |

|

4,553 |

| |||||

|

Engineering and development |

|

19,913 |

|

17,542 |

|

16,170 |

|

14,229 |

|

13,881 |

| |||||

|

Interest expense |

|

2,701 |

|

2,474 |

|

6,449 |

|

6,023 |

|

6,435 |

| |||||

|

Intangible amortization |

|

3,655 |

|

3,219 |

|

3,204 |

|

2,644 |

|

2,714 |

| |||||

|

Backlog (3) |

|

131,997 |

|

100,708 |

|

78,602 |

|

70,999 |

|

75,065 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Ratios |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Net return on sales |

|

5.1 |

% |

3.2 |

% |

3.7 |

% |

4.8 |

% |

5.6 |

% | |||||

|

Return on shareholders’ equity |

|

16.8 |

% |

10.1 |

% |

13.3 |

% |

18.4 |

% |

26.7 |

% | |||||

|

Current ratio |

|

2.5 |

|

2.8 |

|

3.1 |

|

2.2 |

|

2.0 |

| |||||

|

Net debt to capitalization (4) |

|

53 |

% |

30 |

% |

44 |

% |

42 |

% |

52 |

% | |||||

(1) Includes the effect of the Maval OE Steering acquisition in the first quarter of 2018 and the TCI acquisition in the fourth quarter of 2018.

(2) Includes the effect of the Heidrive acquisition in the first quarter of 2016.

(3) Backlog is defined as confirmed orders for which the customer has provided a release and delivery date.

(4) Net debt is total debt less cash and cash equivalents. Capitalization is the sum of net debt and shareholders’ equity.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

We are a global company that designs, manufactures and sells precision and specialty controlled motion components and systems used in a broad range of industries. Our target markets include Vehicle, Medical, Aerospace & Defense, and Industrial. We are headquartered in Amherst, NY, and have operations in the United States, Canada, Mexico, Europe and Asia. We are known worldwide for our expertise in electro-magnetic, mechanical and electronic motion technology. We sell component and integrated controlled motion solutions to end customers and original equipment manufacturers (“OEMs”) through our own direct sales force and authorized manufacturers’ representatives and distributors. Our products include brush and brushless DC motors, brushless servo and torque motors, coreless DC motors, integrated brushless motor-drives, gearmotors, gearing, modular digital servo drives, motion controllers, incremental and absolute optical encoders, active and passive filters for power quality and harmonic issues, and other controlled motion-related products.

Financial Overview

Highlights for our fiscal year ended December 31, 2018, include:

· Revenue was $310,611 compared with $252,012 in 2017. Growth was evident in all of our served markets. Sales to U.S. customers were 53% of total sales for both 2018 and 2017, with the balance of sales to customers primarily in Europe, Canada and Asia.

· Gross profit was $91,403 for 2018, a 21% increase from $75,679 in 2017. As a percentage of revenue, gross margin declined 60 basis points to 29.4% primarily due to the expected lower gross margin profile of the Maval OE Steering business acquisition.

· Operating income was $23,229, or 7% of revenue, for 2018 compared with $18,800, or 8% of revenue, for 2017.

· Net income was $15,925, or $1.70 per diluted share, compared with $8,036, or $0.87 per diluted share, for 2017. Net income for 2017 included fourth quarter adjustments to the provision for income taxes of $3,133 resulting from the enactment of the Tax Cuts and Jobs Act.

· Bookings were $336,930 for 2018 compared with $271,941 for 2017. Backlog as of December 31, 2018 was $131,997, an increase of 31% from $100,708 at year end 2017.

· Debt of $122,516, net of cash of $8,673, increased by $76,278 to $113,843 at December 31, 2018 from debt of $53,155, net of cash of $15,590 of $37,565 at December 31, 2017.

· We declared and paid a dividend of $0.025 per share for the first quarter, and $0.030 for the remaining quarters of 2018 pursuant to our quarterly dividend program. Dividends to shareholders for 2018 and 2017 were $0.115 and $0.10 per diluted share, respectively. The dividend payout ratio was 7% and 11% for 2018 and 2017, when compared with the diluted earnings per share of $1.70 and $0.87, respectively.

The Company’s 2018 sales were 23% higher than in the prior year. Our market position in all of our served markets continues to grow with the addition of TCI and Maval OE Steering to our Company portfolio.

Net income was 98% higher in 2018 compared to 2017, and earnings per diluted share increased by 95%. These increases reflect increased sales and gross margin growth, both organically and from acquisitions, along with a continued focus on cost control.