Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed By The Registrant ☒

Filed By A Party Other Than The Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

HASBRO, INC.

(Name of Registrant as Specified In Its Charter)

Payment Of Filing Fee (Check The Appropriate Box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Table of Contents

Notice of 2020 Annual Meeting of Shareholders and Proxy Statement

Table of Contents

| Letter to our Shareholders |

Dear Fellow Hasbro Shareholders,

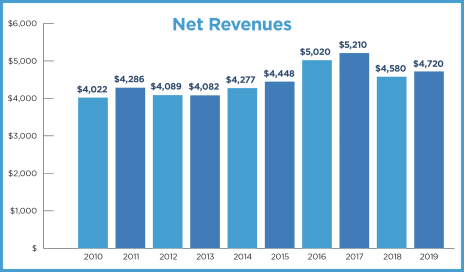

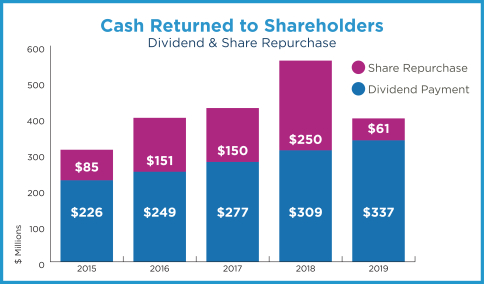

2019 was a successful year for Hasbro. The Company returned to profitable growth, increasing revenues 3% to $4.72 billion. Absent an unfavorable $78.5 million impact of foreign exchange, revenues grew 5%. Operating profit increased to $652.1 million. Hasbro generated $653.1 million in operating cash flow and returned $398.0 million to shareholders through dividend and share repurchases.

As we mail this letter and Proxy Statement, our team is proactively managing the impacts of the coronavirus (Covid-19). Our immediate focus is on the health and well-being of our employees and stakeholders as well as their families throughout the world. Management is taking the necessary precautions to safely operate our business globally and work through this unprecedented economic and public health disruption.

While we can’t fully predict the impact to Hasbro’s business, through our diverse portfolio, Hasbro is able to provide families with fun and educational activities. The team is working with online and omni-channel retailers to help Bring Home the Fun — with Hasbro Gaming, PLAY-DOH, PLAYSKOOL and active play with NERF. We are also supporting Save the Children and No Kid Hungry in their efforts to address the most urgent needs of children, including providing nutritious meals and distributing books and learning resources to those children and families most in need.

We have scheduled our 2020 Annual Meeting of Shareholders for Thursday, May 14, 2020 at 11:00 a.m. Eastern Time. At this time, we plan to have an in-person meeting at Hasbro’s Corporate headquarters located at 1027 Newport Avenue, Pawtucket, RI 02861, but we are also including the ability to attend and vote at our meeting virtually via the Internet at www.meetingcenter.io/227440037. If we are unable to have the meeting at our offices, we will announce our decision to hold the meeting virtually only over the Internet.

We encourage you to closely review the enclosed Notice of Annual Meeting and Proxy Statement as you vote your shares for this important meeting. Whether you attend the meeting in person or virtually, you will be able to vote your shares and participate in the meeting. As always, we encourage you to vote your shares in advance of the meeting.

As a Board, we are focused not only on the short-term, but we remain keenly focused on the long-term strategy and execution of the organization.

With a view to the long-term growth of our business, during the past year, Hasbro made meaningful investments in growth initiatives which we believe will expand the revenue and profit drivers of the company. These include the acquisition of eOne, which was financed in 2019 but closed in early 2020, and ongoing investments in digital gaming focused on new opportunities for MAGIC: THE GATHERING and DUNGEONS AND DRAGONS. These initiatives complement the investments made in 2018 to strengthen and modernize our toy and game teams as consumer engagement and the retail landscape shifted following the Toys“R”Us bankruptcy.

The Hasbro team also navigated a global trade disruption. Several years ago, from a risk management position, Hasbro began diversifying its manufacturing footprint. In 2019, these efforts accelerated, and the goal is to have approximately half of global production sourced from outside of China in the next one to two years. This requires incremental investments, but better positions Hasbro for long-term success in Creating the World’s Best Play and Entertainment Experiences.

As our business diversifies, the talent to successfully run Hasbro continues to evolve. Succession planning is among the Board’s top priorities and included in the annual goals for executive management. We worked closely with Hasbro management to ensure retention agreements were in place with the key talent at eOne prior to announcing the acquisition. The diverse experiences of our Board, including in managing acquisitions, in entertainment and in digital gaming, are essential as we advance Hasbro across these dimensions.

Table of Contents

As Hasbro evolves, the purpose of our organization remains intact: Making the World a Better Place for Children and their Families. The Nominating, Governance and Social Responsibility Committee oversees Hasbro’s corporate social responsibility (CSR) activities. Hasbro has a long-standing commitment to CSR and focuses on four key pillars: product safety, environmental sustainability, human rights & ethical sourcing as well as diversity & inclusion, with stated goals across each of the four pillars. We are proud of our leadership in this area. During 2019, Hasbro announced a new goal to eliminate virtually all plastic from its packaging for new products by 2022. As a result of the work we have done in this area Hasbro ranked No. 13 on the 2019 “100 Best Corporate Citizens” list by CR Magazine; named one of the “World’s Most Ethical Companies®” by Ethisphere Institute for the past eight years; #1 in our category for Just Capital “America’s Most Just Companies”; and in the Civic 50 list of the “Most Community Minded Companies in America”, among many others.

Over its history, Hasbro’s management has successfully transformed the company from a toy and game producer, to a global play and entertainment company. Each year presents different challenges and opportunities, but we are confident we are positioned to drive long-term value for our stakeholders. We value your input and support and look forward to sharing our progress. As we all do our part to navigate through this unprecedented time, we hope that Hasbro’s play and entertainment experiences help make an extremely difficult and uncertain time a bit more manageable.

Sincerely,

|

Brian D. Goldner Chairman of the Board and Chief Executive Officer, Hasbro, Inc. |

|

Edward M. Philip Lead Independent Director Hasbro’s Board of Directors |

Table of Contents

Hasbro, Inc. Notice of 2020

Annual Meeting of Shareholders

| Date: | Thursday, May 14, 2020 | |

| Time: | 11:00 a.m. Local Time | |

| Place: | Hasbro, Inc. Corporate Office 1027 Newport Avenue Pawtucket, RI 02861 | |

| Virtual Meeting: | As part of our precautions regarding the coronavirus or COVID-19, we are also holding our meeting virtually on the Internet at www.meetingcenter.io/227440037. If we are unable to have the meeting at our offices, we will announce our decision to hold the meeting only virtually via the Internet. | |

| Record Date: | Only shareholders of record of the Company’s common stock at the close of business on March 18, 2020 may vote at the meeting. | |

| Purpose

|

||||||

|

|

Elect thirteen directors. | |||||

|

|

Approve advisory vote on the compensation of the Company’s named executive officers. | |||||

|

|

Approve amendments to the Company’s Restated 2003 Stock Incentive Performance Plan, as amended. | |||||

|

|

Ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for the 2020 fiscal year. | |||||

|

|

Transact such other business as may properly come before the meeting and any adjournment or postponement of the meeting.

|

|||||

Voting

You are cordially invited to attend the meeting to vote your shares in person or virtually over the Internet, to hear from our senior management, and to ask questions. If you are not able to attend the meeting in person or virtually, you may vote by Internet, telephone or mail. See the Proxy Statement for specific instructions. Please vote your shares.

Important Notice Regarding the Availability of Proxy Materials

On or about April 1, 2020 we will begin mailing a Notice of Internet Availability of Hasbro’s Proxy Materials to shareholders informing them that this Proxy Statement, our 2019 Annual Report to Shareholders and voting instructions are available online. As is more fully described in that Notice, all shareholders may choose to access our proxy materials on the Internet or may request to receive paper copies of the proxy materials.

By Order of the Board of Directors,

Tarrant Sibley

Executive Vice President, Chief Legal Officer &

Corporate Secretary

April 1, 2020

Table of Contents

1

Table of Contents

2

Table of Contents

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider and you should read the entire Proxy Statement before voting.

| Annual Meeting Information |

|

Date and Time 11:00 a.m. Local Time Thursday, May 14, 2020 |

Record Date Wednesday March 18, 2020 |

Place Hasbro, Inc. Corporate Office 1027 Newport Avenue Pawtucket, Rl 02861 and online at www.meetingcenter.io/227440037

|

| Meeting Agenda and Recommendation of the Board of Directors |

| Agenda Item |

Board Recommendation |

Page Number | ||

| Proposal 1 Election of Thirteen Directors |

FOR each director nominee |

6

| ||

| Proposal 2 Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers |

FOR

|

82

| ||

| Proposal 3 Approval of Amendments to the Restated 2003 Stock Incentive Performance Plan |

FOR

|

83

| ||

| Proposal 4 Ratification of KPMG LLP as the Independent Registered Public Accounting Firm for 2020 |

FOR

|

93

| ||

| How to Vote |

| Vote Right Away Through Advance Voting Methods | Voting During the Meeting | |||||

|

|

|

|

| |||

|

Vote by Internet Go to the website identified and enter the control number provided on your proxy card or voting instruction form. |

Vote by Phone Call the number on your proxy card or voting instruction form. You will need the control number provided on your proxy card or voting instruction form. |

Vote by Mail Complete, sign and date the proxy card or voting instruction form and mail it in the accompanying pre-addressed envelope. |

Vote at the Meeting See the instructions below regarding how to vote at the meeting. | |||

i

Table of Contents

| 2019 Business Highlights |

2019 OVERVIEW

2019 was a pivotal year for Hasbro. We achieved our plan to profitably grow revenues, performing well in a dynamic retail and global trade environment. This followed a disruptive year in 2018 due to the bankruptcy of Toys“R”Us and significant challenges and changes in markets in which we operate. We achieved profitable growth in 2019 while taking significant steps to accelerate our Brand Blueprint strategy through our early fiscal 2020 acquisition of eOne, a global independent studio that specializes in the development, acquisition, production, financing, distribution and sales of entertainment content. The acquisition of eOne expands our brand portfolio with eOne’s beloved global children’s brands, including PEPPA PIG, PJ MASKS and RICKY ZOOM; adds proven TV and film expertise; enhances our brand building capabilities through increased storytelling talent in TV, film and other mediums, which we believe will strengthen core Hasbro brands and help activate vault brands; and creates additional opportunities for long-term profitable growth through in-sourcing and cost synergies, as well as future revenue opportunities.

2019 HIGHLIGHTS

| • | Delivered net revenue growth and increased operating profit; |

| • | Grew revenue in each major region, including in the U.S. and Canada and Europe absent foreign exchange impact; |

| • | Drove growth through our channel strategy, including double-digit gains in the value, fan, grocery and drug channels; |

| • | Advanced our retail strategy and execution for online and omni-channel partners; |

| • | Delivered significant growth in our Wizards of the Coast business, including through the successful launch of MAGIC: THE GATHERING ARENA and compelling tabletop and digital game experiences; |

| • | MONOPOLY had a record year with double-digit growth with new themes and entertainment tie-ins; |

| • | NERF made significant progress with new product lines, such as NERF Fortnite and NERF Ultra; |

| • | Advanced our consumer products licensing business, growing revenues and expanding operating profit margin; |

| • | Broadened our licensed brand portfolio and expanded our reach with original live events to drive consumer engagement; |

| • | Executed as an agile, modern and digitally-driven company; |

| • | Navigated challenges in the global trade environment, implementing programs to achieve revenue and margin goals; |

| • | Leveraged and created compelling entertainment to drive creativity across brands; and |

| • | Importantly, on December 30, 2019, we acquired eOne, adding beloved global children’s brands and proven TV and film expertise to our company. |

2019 FINANCIAL PERFORMANCE

| • | Delivered net revenues of $4.72 billion, an increase of 3% compared to 2018; |

| • | Revenues increased 5% excluding an unfavorable $78.5 million impact of foreign exchange; |

| • | Revenues grew 3% in the U.S. and Canada segment, 4% in the International segment absent foreign exchange, and 22% in our Entertainment, Licensing and Digital segment; |

| • | Franchise Brands revenue declined 1%, Partner Brands revenue increased 24%, Hasbro Gaming revenues decreased 10% and Emerging Brands revenue increased 5%; |

| • | Operating profit increased to $652.1 million, or 13.8% of revenues; |

| • | Adjusted operating profit of $669.8 million, or 14.2% of revenue, excluding $17.8 million of costs associated with the eOne acquisition; |

| • | Reported net earnings were $520.5 million, or $4.05 per diluted share; |

| • | Adjusted net earnings were $524.7 million, or $4.08 per diluted share, excluding after-tax net charges of $4.2 million, or $0.03 per diluted share; |

| • | Year-end cash and cash equivalents of $4.58 billion, which included $3.4 billion of eOne acquisition financing, cash received from foreign exchange hedges and other activities; |

| • | Generated $653.1 million in operating cash flow; and |

| • | Returned $398.0 million to shareholders in 2019 including $336.6 million in dividends. |

Adjusted operating profit, adjusted net earnings and adjusted earnings per diluted share are non-GAAP financial measures as defined under SEC rules. A reconciliation of these non-GAAP financial measures to GAAP is provided in Appendix B to this Proxy Statement.

ii

Table of Contents

Proposal 1 — Election of Directors

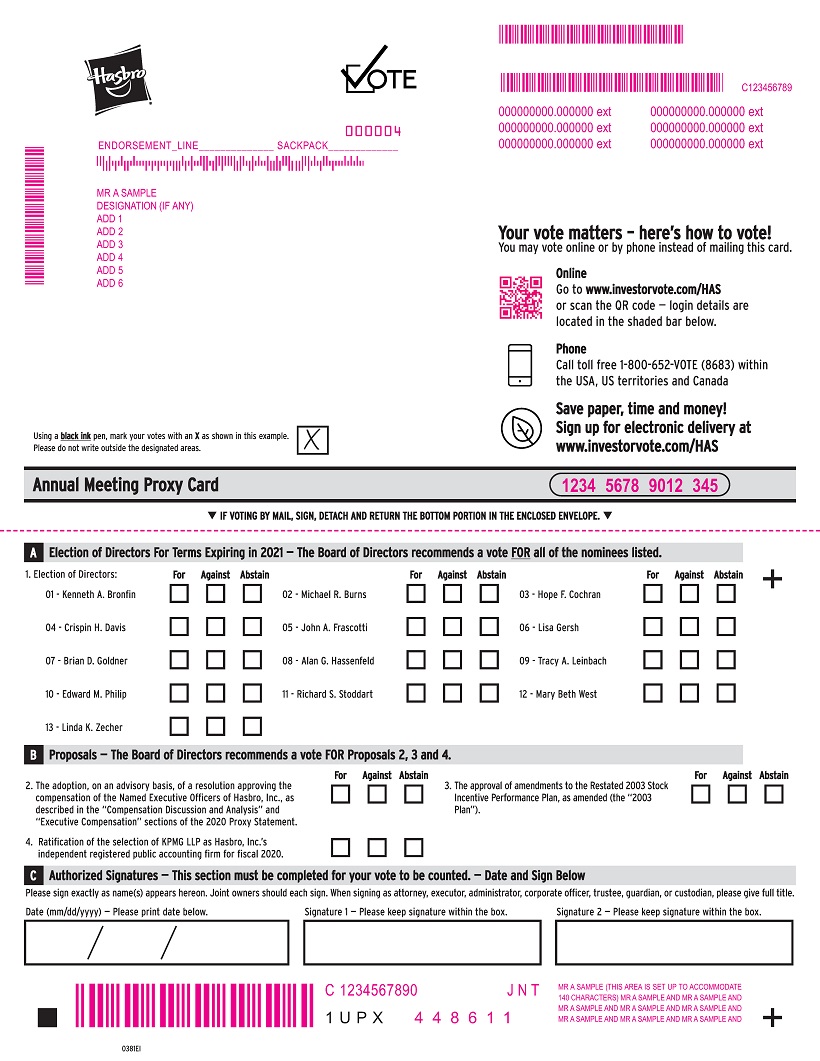

You are being asked to vote on the election of the following thirteen nominees for director. All directors are elected annually by the affirmative vote of a majority of votes cast. Detailed information about each director’s background, skills and areas of expertise can be found beginning on page 6.

| Current Committee Membership* | ||||||||||||||||||||||||||||||||||||

| Name and Principal Occupation |

Age* | Director Since |

Independent | Audit | Comp | Cyber | Exec | Fin | NGS | |||||||||||||||||||||||||||

| Kenneth A. Bronfin Senior Managing Director of Hearst Ventures |

60 | 2008 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| Michael R. Burns Vice Chairman of Lions Gate Entertainment Corp. |

61 | 2014 | ✓ |

|

|

|||||||||||||||||||||||||||||||

| Hope F. Cochran Managing Director of Madrona Venture Group |

48 | 2016 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| Sir Crispin H. Davis Retired Chief Executive Officer of Reed Elsevier |

71 | 2016 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| John A. Frascotti President and Chief Operating Officer of Hasbro |

59 | 2018 | ||||||||||||||||||||||||||||||||||

| Lisa Gersh Outside Advisor; Former Chief Executive Officer of Alexander Wang |

61 | 2010 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| Brian D. Goldner Chairman and Chief Executive Officer of Hasbro |

56 | 2008 | ||||||||||||||||||||||||||||||||||

| Alan G. Hassenfeld Retired Chairman and Chief Executive Officer of Hasbro |

71 | 1978 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| Tracy A. Leinbach Retired Executive Vice President and Chief Financial Officer of Ryder System, Inc. |

60 | 2008 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| Edward M. Philip Retired Chief Operating Officer of Partners in Health |

54 | 2002 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| Richard S. Stoddart President and Chief Executive Officer of InnerWorkings, Inc. |

57 | 2014 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| Mary Beth West Former Senior Vice President, Chief Growth Officer of The Hershey Company |

57 | 2016 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| Linda K. Zecher Chief Executive Officer and Managing Partner of The Barkley Group |

66 | 2014 | ✓ |

|

|

|

||||||||||||||||||||||||||||||

| * | Age and Committee memberships are as of April 1, 2020. |

| Chair:

|

Member:

|

Audit Committee Financial Expert:

|

| AC: | AuditCommittee | |

| Comp: |

Compensation Committee | |

| Cyber: |

Cybersecurity and Data Privacy Committee | |

| Exec: |

Executive Committee | |

| Fin: |

Finance Committee | |

| NGS: |

Nominating, Governance and Social Responsibility Committee |

iii

Table of Contents

Our Board Profile

Our Board consists of a strong group of proven leaders and executives with experience across a wide range of industries giving us a diverse set of skills, viewpoints and expertise. It is also well balanced by age, gender and tenure. The Board is an experienced, well-functioning group, with each member contributing and having his or her voice heard while supporting and appropriately challenging management. We believe the mix of experience, diversity and perspectives on the Board serves to strengthen management and our Company.

iv

Table of Contents

| Corporate Governance Matters |

Hasbro is committed to strong corporate governance, ethical conduct, sustainability and the accountability of our Board and our senior management team to the Company’s shareholders.

Corporate Governance Highlights

| Board and Board Committee Practices

|

||||||

|

|

Entire Board is elected annually | |||||

|

|

11 out of 13 directors are independent | |||||

|

|

38% of our Board nominees are women | |||||

|

|

Balance of experience, gender, tenure and qualifications | |||||

|

|

Lead Independent Director role with clearly defined responsibilities | |||||

|

|

All required committees consist of independent directors | |||||

|

|

Risk oversight by Board and its committees | |||||

|

|

Separate Cybersecurity and Data Privacy Committee | |||||

|

|

Annual Board and committee self-evaluations | |||||

|

|

Director orientation and continuing education | |||||

|

|

Policy limiting the number of boards on which our directors may serve | |||||

| Shareholder Rights, Accountability and Other Governance Practices

|

||||||

|

|

Comprehensive shareholder outreach program | |||||

|

|

No shareholder rights plan | |||||

|

|

Annual shareholder advisory vote on executive compensation (“Say-on-Pay”) | |||||

|

|

Majority vote standard with a plurality carve-out for contested elections | |||||

|

|

Proxy access bylaw provision | |||||

|

|

Prohibit the pledging or hedging of Company stock | |||||

|

|

Strong compensation clawback policy | |||||

|

|

Stock ownership and share retention policy for Board members, executive officers and other key employees | |||||

|

|

Written code of conduct and corporate governance principles | |||||

|

|

Long-standing commitment to corporate sustainability | |||||

Shareholder Outreach and Responsiveness to Shareholders

Hasbro has engaged with our major shareholders on governance and compensation matters for several years. We do this as part of our commitment to be responsive to shareholders and to ensure that our actions are informed by the viewpoints of our investors. Over the past several years, our discussions with shareholders have led to changes to our executive compensation and corporate governance programs, such as amendments to the terms of the employment agreement with our Chief Executive Officer, Brian Goldner, and the adoption of a proxy access bylaw. Our shareholders overwhelmingly supported our Say-on-Pay votes in the last three years, with favorable votes from 97.9%, 96.8% and 96.7% of the shares voted at the 2017, 2018 and 2019 Annual Meetings, respectively. Based upon our continuing dialog with shareholders and our Say-on-Pay vote results, we believe our current compensation program for our executive officers reflects the views of our shareholders and strongly drives our pay for performance objectives.

In 2019 and early 2020, we proactively extended an invitation to our top 25 shareholders (who held in aggregate approximately 50% of our outstanding shares) to meet and we had discussions with all of such shareholders who accepted our invitation. We also spoke with shareholders who reached out to us. This year we covered a variety of topics, including:

| • | our recently completed acquisition of eOne and how we believe it can accelerate our Brand Blueprint strategy; |

v

Table of Contents

| • | our compensation policies and practices, performance metrics, and how we expect to consider the eOne acquisition for purposes of compensation; |

| • | our corporate governance practices; and |

| • | key focus areas, achievements and goals in the corporate social responsibility space. |

We shared the feedback we received from our shareholders with our Board and its committees. The Board and its committees continue to consider feedback, particularly in relation to the inclusion of performance metrics for compensation programs to account for goals and objectives relating to our acquisition of eOne.

Corporate Social Responsibility (CSR)

At Hasbro, we believe that every day is a chance to do better. We strive to always act responsibly, and in doing so we find smarter ways of doing business. Our deep commitment to CSR reflects our desire to help build a safer, more sustainable world for future generations. It inspires and guides us to play with purpose: To take what we love most about play and entertainment — creativity, innovation, imagination — and make a difference where it matters most. And it makes every part of Hasbro’s business stronger. Our CSR focus areas and commitment are outlined below.

For a further discussion of our CSR efforts and goals, please see “—Governance of the Company; Corporate Social Responsibility” on page 25.

vi

Table of Contents

| Executive Compensation Matters |

Proposal 2 — Advisory Vote on Compensation of Named Executive Officers

Our Board of Directors recommends that shareholders vote, on an advisory basis, to approve the compensation paid to our named executive officers (“NEOs”) as described in this Proxy Statement. Detailed information can be found beginning on page 32. Our compensation programs embody a pay-for-performance philosophy that supports our business strategy and aligns executive interests with those of our shareholders. Highlights of our compensation programs for 2019 and our compensation best practices follow.

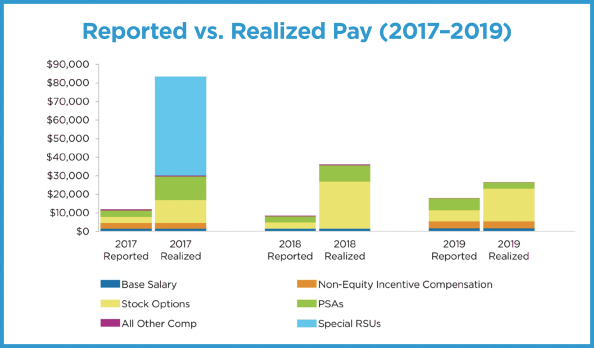

| Pay-for-Performance |

| • Our executive compensation program is tightly linked to long-term shareholder value creation, incorporating short-term and long-term forms of executive compensation that are structured to incentivize company performance and the achievement of corporate objectives the Committee believes are critical to driving sustained long-term shareholder value. |

| • Program elements are designed to attract and retain top executive talent with the creativity, innovation, relentless drive and diverse skills in storytelling and entertainment, branded-play, consumer products, media and technology that are critical to execution of our strategy and ongoing business transformation. |

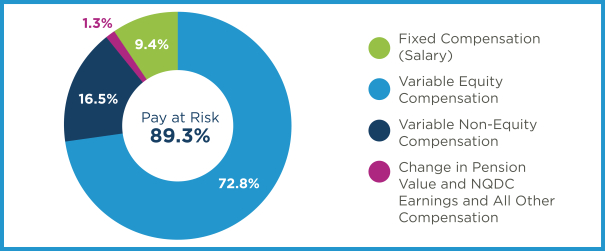

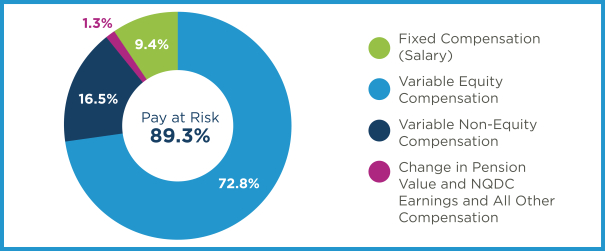

| • In 2019, 89.3% of our Chief Executive Officer’s total target compensation was performance-based and at-risk. |

| 2019 CEO/NEO Compensation Program Elements | ||

| Type of Annual Cash Compensation | ||

| Base Salary |

• Fixed compensation • Set at industry competitive level, in light of individual experience and performance | |

| Management Incentive Awards |

• Performance-based • Tied to company and individual achievement against stated annual financial and strategic goals • Aligns management behavior with shareholder interests • Performance measures evaluated (weighting) • Total Net Revenues (40%) • Operating Margin (40%) • Free Cash Flow (20%) | |

vii

Table of Contents

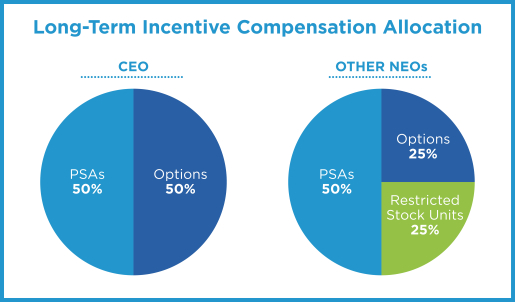

| Type of Long-Term Incentive Compensation | ||

| Performance Contingent Stock Awards |

• Represent ~50% of annual target equity award value • Earned based on challenging long-term three-year goals requiring sustained strong operating performance • Tied to achievement of EPS, Net Revenue and ROIC targets over a 3-year performance period | |

| Stock Options |

• Represent ~50% of annual target equity award value for CEO (25% for the other NEOs) • 7-year term • Vest in three equal annual installments over the first three anniversaries of the grant date | |

| Restricted Stock Units |

• Granted to the NEOs other than the CEO (25% of annual target equity award value for NEOs) • Vest in three equal annual installments over the first three anniversaries of the grant date | |

|

Compensation Best Practices

| ||

|

|

| |

| Our Stock Incentive Plan |

Proposal 3 — Approval of Amendments to our Restated 2003 Stock Incentive Performance Plan

You are being asked to approve amendments to our Restated 2003 Stock Incentive Performance Plan, as amended (the “2003 Plan”) to increase the authorized shares available for issuance under the plan, revise the sublimit on the grant of full value shares, and extend the duration of the plan. As we continue to evolve our Brand Blueprint strategy, including through the acquisition of eOne, we need the ability to grant appropriate and competitive incentives intended to attract and retain key personnel and reward those who contribute to the success and performance of our business. We provide variable performance-based compensation that aligns the interests of those persons with shareholders while appropriately rewarding those persons for contributing to our success and the delivery of strong performance.

We are requesting shareholders to approve an increase in the shares available for issuance under the 2003 Plan by 5,350,000 shares, including the sublimit on the grant of full value shares, and to extend the duration of the 2003 Plan to December 31, 2025. Detailed information about this proposal can be found beginning on page 83.

viii

Table of Contents

All provisions that we believe promote best practices and reinforce the alignment between compensation payable to or realizable by participating officers, other key employees and directors, and shareholders’ interests, will continue to be in effect following approval of the amendment to the 2003 Plan. These provisions include, but are not limited to, the following:

|

Key Plan Provisions

| ||

|

|

| |

| Our Auditors |

Proposal 4 — Ratification of Independent Registered Public Accounting Firm

You are being asked to vote to ratify the selection of KPMG LLP as our independent registered public accounting firm for fiscal 2020. Detailed information about this proposal can be found beginning on page 93.

ix

Table of Contents

Table of Contents

2

Table of Contents

3

Table of Contents

4

Table of Contents

5

Table of Contents

Election of Directors (Proposal 1)

You are being asked to elect thirteen directors at the Meeting. All of the directors elected at the Meeting will serve until the 2021 Annual Meeting of Shareholders (the “2021 Meeting”), and until their successors are duly elected and qualified, or until their earlier death, resignation or removal.

The Board, upon recommendation of the Nominating, Governance and Social Responsibility Committee of the Board, has recommended the persons named below as nominees for election as directors to serve until the 2021 Meeting. All of the nominees are currently directors of the Company. The proxies cannot be voted for more than thirteen directors at the Meeting.

Unless otherwise specified in your voting instructions, the shares voted pursuant thereto will be cast “FOR” the persons named below as nominees for election as directors. If, for any reason, any of the nominees named below should be unable to serve as a director, it is intended that such proxy will be voted for the election, in his or her place, of a substituted nominee who would be recommended by the Board. The Board, however, has no reason to believe that any nominee named below will be unable to serve as a director.

Selection of Board Nominees

In considering candidates for election to the board, the Nominating, Governance and Social Responsibility Committee and the Board consider a number of factors, including employment and other experience, qualifications, attributes, skills, expertise and involvement in areas that are of importance to the Company’s business, business ethics and professional reputation, other board service, business, financial and strategic judgment, the Company’s needs, and the desire to have a Board that represents a diverse mix of backgrounds, perspectives and expertise. Each of the nominees for election to the Board at the Meeting has served in senior positions at complex organizations and has demonstrated a successful track record of strategic, business and financial planning, execution and operating skills in these positions. In addition, each of the nominees for election to the Board has proven experience in management and leadership development and an understanding of operating and corporate governance issues for a large multinational company.

The following chart highlights certain skills, experience and characteristics possessed by the nominees for election to the Board. Further information on each nominee’s qualifications is provided below in the individual biographies. In addition to the skills listed below, our directors each have experience with oversight of risk management, as further described below under the heading “Role of the Board in Risk Oversight.”

| Bronfin | Burns | Cochran | Davis | Frascotti | Gersh | Goldner | Hassenfeld | Leinbach | Philip | Stoddart | West | Zecher | ||||||||||||||||||||||||||||||||||||||||

| EXPERIENCE |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior Management |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||

| Industry Background |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Sales and Marketing |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Strategic Planning |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||

| Global Business |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||

| Digital Gaming/Media/ Products |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||||

| Talent Development |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||

| Governance/ ESG |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||

| Finance/ Accounting |

● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||||||||

| IT/Technology |

● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||||||||

| GENDER |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Female |

● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||||||||||||||

| Male |

● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||||||

6

Table of Contents

Nominees for Election as Directors

The following sets forth certain biographical information regarding each director nominee as of April 1, 2020, as well as particular experience, qualifications, attributes or skills (beyond those indicated in the preceding chart), which led the Company’s Board to conclude that the nominee should serve as a director of the Company. Except as otherwise indicated, each person has had the same principal occupation or employment during the past five years.

7

Table of Contents

8

Table of Contents

9

Table of Contents

10

Table of Contents

11

Table of Contents

12

Table of Contents

Vote Required. Under the Company’s majority vote standard in order to be elected a director must receive a number of “For” votes that exceed the number of votes cast “Against” the election of the director. As such, an abstention is effectively a vote against a director. The Company’s majority vote standard and mandatory resignation policy are discussed in detail beginning on page 23 of this Proxy Statement.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE ELECTION OF EACH OF THE THIRTEEN DIRECTOR NOMINEES NAMED ABOVE.

13

Table of Contents

Our Board of Directors has six standing committees:

| • | Audit |

| • | Compensation |

| • | Cybersecurity and Data Privacy |

| • | Executive |

| • | Finance |

| • | Nominating, Governance and Social Responsibility |

The members of each of our required committees, namely Audit, Compensation and Nominating, Governance and Social Responsibility, are all independent directors, as defined by the rules of The NASDAQ Stock Market (“Nasdaq”) and our Standards for Director Independence (“Independence Standards”). Additionally, all members of our Audit Committee meet the additional SEC and Nasdaq independence and experience requirements applicable specifically to audit committee members, and all members of our Compensation Committee satisfy the additional Nasdaq independence requirements specifically applicable to compensation committee members. The Chair of each committee regularly reports to our Board of Directors on committee deliberations and decisions. Each committee’s charter is posted on our website, www.hasbro.com, under the “Corporate — Investors — Corporate Governance — Overview” subsection of the website.

The principal functions of each committee, together with the committee composition and number of meetings held in 2019, are set forth in the table below.

| Committee | Principal Function | Number of Meetings in 2019 |

2019 Committee Members | ||||||

| Audit |

• Directly responsible for the appointment, compensation, retention and oversight of the Company’s independent auditor

• Assists the Board in its oversight of:

- the integrity of the Company’s financial statements, including management’s conduct of the Company’s financial reporting process, the financial reports provided by the Company, the Company’s systems of internal accounting and financial controls, and the quarterly review and annual independent audit of the Company’s financial statements;

- the Company’s compliance with legal and regulatory requirements;

- the independent auditor’s qualifications and independence; and

- performance of the Company’s internal audit function and internal auditor. |

12 | • Hope F. Cochran (Chair)†

• Kenneth A. Bronfin

• Lisa Gersh†

• Tracy A. Leinbach†

• Linda K. Zecher†

† The Board has determined that this person qualifies as an Audit Committee Financial Expert under applicable SEC rules. | ||||||

14

Table of Contents

| Committee | Principal Function | Number of Meetings in 2019 |

2019 Committee Members | ||||||

| Compensation |

• Responsible for establishing and overseeing the compensation policies, arrangements and plans of the Company with respect to senior management, including all executive officers.

• Oversight of the Company’s incentive compensation and equity-based plans, including authorization to make grants and awards under the Company’s employee stock equity plan.

• Shares responsibility for evaluation of the Company’s Chief Executive Officer with the Nominating, Governance and Social Responsibility Committee. |

6 | • Lisa Gersh (Chair)

• Kenneth A. Bronfin

• Crispin H. Davis

• Tracy A. Leinbach

• Edward M. Philip | ||||||

| Cybersecurity |

• Assists the Board in its oversight of the protection of information and assets collected, created, used, processed and/or maintained by or on behalf of the Company, including intellectual property, whether belonging to the Company or the Company’s customers, consumers, employees or business partners, globally.

• Assists the Board in its oversight of the protection of the Company’s customers’, consumers’, and employees’ privacy and personal information.

• Assists the Board in its oversight of the Company’s compliance with applicable global data privacy and security regulations and requirements, and the Company’s other cyber risk management activities, including measures to maintain the availability, integrity and functionality of the Company’s information technology systems, networks, and assets. |

5 | • Linda K. Zecher (Chair)

• Kenneth A. Bronfin

• Alan G. Hassenfeld

• Richard S. Stoddart | ||||||

| Executive |

• Acts on such matters as are specifically assigned to it from time to time by the Board and is vested with all of the powers that are held by the Board to the extent permitted by law. |

— | • Alan G. Hassenfeld (Chair)

• Hope F. Cochran

• Lisa Gersh

• Edward M. Philip

• Richard S. Stoddart

• Mary Beth West

• Linda K. Zecher | ||||||

15

Table of Contents

| Committee | Principal Function | Number of Meetings in 2019 |

2019 Committee Members | ||||||

| Finance |

• Assists the Board in overseeing the Company’s annual and long-term financial plans, capital structure, use of funds, investments, financial and risk management and proposed significant transactions.

• Reviews short and long term financing plans, including debt and equity financings and use of securitization facilities.

• Reviews use of funds for investments, dividends and share repurchases and acquisitions. |

4 | • Mary Beth West (Chair)

• Michael R. Burns

• Hope F. Cochran

• Crispin H. Davis

• Alan G. Hassenfeld | ||||||

| Nominating, Governance and Social Responsibility |

• Identifies and evaluates individuals qualified to become Board members and makes recommendations to the full Board for possible additions to the Board and on the director nominees for election at the Company’s annual meeting.

• Oversees and makes recommendations regarding the governance of the Board and its committees.

• Shares responsibility for evaluation of the CEO.

• Periodically reviews and makes recommendations to the full Board with respect to, the compensation paid to non-employee directors for their service on the Company’s Board.

• Oversees the Company’s codes of conduct and ethics.

• Analyzes significant issues of corporate social responsibility and related corporate conduct, including product safety, environmental sustainability and climate change, human rights and ethical sourcing, responsible marketing, transparency, public policy matters, community relations and charitable contributions. |

5 | • Richard S. Stoddart (Chair)

• Michael R. Burns

• Crispin H. Davis

• Tracy A. Leinbach

• Edward M. Philip

• Mary Beth West | ||||||

16

Table of Contents

The Board of Directors is actively involved in risk oversight for the Company. Although the Board as a whole has retained oversight over the Company’s risk assessment and risk management efforts, the efforts of the various committees of the Board are instrumental in this process. Each committee, generally through its Chair, then regularly reports back to the full Board on the conduct of the committee’s functions. The Board, as well as the individual Board committees, also regularly speaks directly with key officers and employees of the Company involved in risk assessment and risk management.

Set forth below is a description of the role of the various Board committees, and the full Board, in risk oversight for the Company.

| Committee | Risk Oversight | |

| Audit |

• Assists the Board in risk oversight for the Company by reviewing and discussing with management, internal auditors and the independent auditors the Company’s significant financial and other exposures, and guidelines and policies relating to enterprise risk assessment and risk management, including the Company’s procedures for monitoring and controlling such risks. • Oversees, on behalf of the Board, financial reporting, tax, and accounting matters, as well as the Company’s internal controls over financial reporting. • Key role in oversight of the Company’s compliance with legal and regulatory requirements. | |

| Compensation |

• Assists the Board in oversight of the compensation programs for the Company’s executive officers. • Ensures that the performance goals and metrics being used in the Company’s compensation plans and arrangements align the interests of executives with those of the Company and its shareholders and maximize executive and Company performance, while not creating incentives on the part of executives to take excessive or inappropriate risks. | |

| Cybersecurity and Data Privacy |

• Assists the Board in its oversight of the protection of information and assets collected, created, used, processed and/or maintained by or on behalf of the Company. • Assists the Board in its oversight of the protection of the Company’s customers’, consumers’, and employees’ privacy and personal information. • Assists the Board in its oversight of the Company’s compliance with applicable global data privacy and security regulations and requirements, and the Company’s other cyber risk management activities, including measures to maintain the availability, integrity and functionality of the Company’s information technology systems, networks, and assets. | |

| Finance |

• Reviews and discusses with management the Company’s financial risk management activities and strategies, including with respect to foreign currency, credit risk, interest rate exposure, and the use of hedging and other techniques to manage these risks. • As part of its review of the operating budget and strategic plan, the Finance Committee reviews major business risks to the Company and the Company’s efforts to manage those risks. | |

| Nominating, Governance and Social Responsibility |

• Assists the Board in its oversight of the Company’s governance policies and structures, management and director succession planning, corporate social responsibility, and issues related to health, safety and the environment, as well as risks and efforts to manage risks to the Company in those areas. | |

| Board |

• The full Board regularly reviews the efforts of each of its committees and discusses, at the level of the full Board, the key strategic, financial, business, legal and other risks facing the Company, as well as the Company’s efforts to manage those risks. | |

17

Table of Contents

The following table sets forth information concerning compensation of the Company’s directors for fiscal 2019. Mr. Goldner, the Company’s Chairman and Chief Executive Officer, and Mr. Frascotti, the Company’s President and Chief Operating Officer, served on the Board during fiscal 2019. However, neither Mr. Goldner nor Mr. Frascotti received any compensation for their Board service in fiscal 2019 beyond their compensation as officers of the Company.

| Name | Fees Earned or Paid in Cash(a) |

Stock Awards (b)(c) |

Option Awards (b)(c) |

Change

in Compensation |

All Other Compensation (d) |

Total | ||||||||||||||||||||||||

| Kenneth A. Bronfin |

$ | 154,115 | $ | 160,000 | $ | 0 | N/A | $ | 90,490 | $ | 404,605 | |||||||||||||||||||

| Michael R. Burns |

$ | 112,096 | $ | 160,000 | $ | 0 | N/A | $ | 0 | $ | 272,096 | |||||||||||||||||||

| Hope F. Cochran |

$ | 142,503 | $ | 160,000 | $ | 0 | N/A | $ | 2,500 | $ | 305,003 | |||||||||||||||||||

| Crispin H. Davis |

$ | 0 | $ | 296,732 | $ | 0 | N/A | $ | 31,284 | $ | 328,016 | |||||||||||||||||||

| Lisa Gersh |

$ | 0 | $ | 316,809 | $ | 0 | N/A | $ | 119,567 | $ | 436,376 | |||||||||||||||||||

| Alan G. Hassenfeld |

$ | 110,003 | $ | 160,000 | $ | 0 | N/A | $ | 73,629 | $ | 343,632 | |||||||||||||||||||

| Tracy A. Leinbach |

$ | 138,664 | $ | 160,000 | $ | 0 | N/A | $ | 32,685 | $ | 331,349 | |||||||||||||||||||

| Edward M. Philip |

$ | 162,046 | $ | 160,000 | $ | 0 | N/A | $ | 238,893 | $ | 560,939 | |||||||||||||||||||

| Richard S. Stoddart |

$ | 0 | $ | 302,949 | $ | 0 | N/A | $ | 58,426 | $ | 361,375 | |||||||||||||||||||

| Mary Beth West |

$ | 134,596 | $ | 160,000 | $ | 0 | N/A | $ | 3,337 | $ | 297,933 | |||||||||||||||||||

| Linda K. Zecher |

$ | 135,935 | $ | 160,000 | $ | 0 | N/A | $ | 44,159 | $ | 340,094 | |||||||||||||||||||

| (a) | Includes amounts which are deferred by directors into the interest account under the Deferred Compensation Plan for Non-Employee Directors, as well as interest earned by directors on existing balances in the interest account. Does not include the amount of cash retainer payments deferred by the director into the stock unit account under the Deferred Compensation Plan for Non-Employee Directors, which amounts are reflected in the Stock Awards column. |

| (b) | Please see note 14 to the financial statements included in the Company’s Annual Report on Form 10-K, for the year ended December 29, 2019, for a detailed discussion of the assumptions used in valuing stock and option awards. |

| In addition to reflecting the grant date fair value for stock awards made to the directors (this expense for the director stock award in 2019 was $160,000 per director continuing service on the Board), the stock awards column also includes, to the extent applicable, the (i) amount of cash retainer payments deferred by the director into the stock unit account under the Deferred Compensation Plan for Non-Employee Directors and (ii) a 10% matching contribution which the Company makes to a director’s account under the Deferred Compensation Plan for Non-Employee Directors on all amounts deferred by such director into the Company’s stock unit account under that plan. |

| No options were granted to any of the non-employee directors in 2019. |

| (c) | The non-employee directors who were serving on the Board at that time held the following outstanding stock and option awards as of December 29, 2019. |

| Name | Outstanding Option Awards |

Outstanding Stock Awards | ||||||||

| Kenneth A. Bronfin |

0 | 27,404 | ||||||||

| Michael R. Burns |

0 | 0 | ||||||||

| Hope F. Cochran |

0 | 0 | ||||||||

18

Table of Contents

| Name | Outstanding Option Awards |

Outstanding Stock Awards | ||||||||

| Crispin H. Davis |

0 | 7,179 | ||||||||

| Lisa Gersh |

0 | 23,115 | ||||||||

| Alan G. Hassenfeld |

0 | 27,962 | ||||||||

| Tracy A. Leinbach |

0 | 10,369 | ||||||||

| Edward M. Philip |

0 | 38,389 | ||||||||

| Richard S. Stoddart |

0 | 11,039 | ||||||||

| Mary Beth West |

0 | 1,636 | ||||||||

| Linda K. Zecher |

0 | 8,563 | ||||||||

| The outstanding stock awards consist of the aggregate number of non-employee director stock grants that the director elected to defer the receipt of any such shares until his or her retirement from the Board. To the extent a director did not defer the stock award, it is not included in the table and the shares have already been issued to the director. Each director was given the option, prior to the beginning of the year of grant, to receive the shares subject to the upcoming annual grant either at the time of grant, or to defer receipt of the shares until he or she retires from the Board. |

| (d) | Comprised of (i) deemed dividends which are paid on outstanding balances in stock unit accounts under the Deferred Plan and (ii) deemed dividends paid on annual stock awards which have been deferred. Balances deferred by directors into the stock unit account track the performance of the Company’s common stock. Also includes the Company’s matching charitable contribution of up to $5,000 per director per fiscal year. An aggregate of $22,500 was paid by the Company in fiscal 2019 in director matching contributions. |

Current Director Compensation Arrangements

In structuring the Company’s director compensation, the Nominating, Governance and Social Responsibility Committee seeks to attract and retain talented directors who will contribute significantly to the Company, fairly compensate directors for their work on behalf of the Company and align the interests of directors with those of stockholders. As part of its review of director compensation, the Nominating, Governance and Social Responsibility Committee reviews external director compensation market studies to assure that director compensation is set at reasonable levels which are commensurate with those prevailing at other similar companies and that the structure of the Company’s non-employee director compensation programs is effective in attracting and retaining highly qualified directors.

All members of the Board who are not otherwise employed by the Company (“non-employee directors”) receive annual cash retainers for service on the Board and its committees. Below is a summary of the cash retainers for service in 2019.

| Annual Retainers | Amount ($) | ||||

| Annual Base Board Retainer |

$ | 95,000 | |||

| Annual Retainers (in addition to Annual Base Board Retainer) |

|||||

| • Lead Independent Director |

$ | 35,000 | |||

| • Chair of Audit Committee |

$ | 40,000 | |||

| • Chair of Compensation Committee |

$ | 35,000 | |||

| • Chair of Finance Committee |

$ | 30,000 | |||

| • Chair of Nominating, Governance and Social Responsibility Committee |

$ | 20,000 | |||

19

Table of Contents

| Annual Retainers | Amount ($) | ||||

| • Chair of Cybersecurity and Data Privacy Committee |

$ | 20,000 | |||

| • Audit Committee Member (other than Chair) |

$ | 20,000 | |||

| • Compensation Committee Member (other than Chair) |

$ | 15,000 | |||

| • Finance Committee (other than Chair) |

$ | 7,500 | |||

| • Nominating, Governance and Social Responsibility Committee (other than Chair) |

$ | 12,500 | * | ||

| • Cybersecurity and Data Privacy Committee (other than Chair) |

$ | 7,500 | |||

| * | Increased from $7,500 to $12,500 in August 2019. |

No meeting fees were paid for attendance at meetings of the full Board or committees.

In May of every year, the Company anticipates issuing to each non-employee director that number of shares of Common Stock which have a set fair market value (based on the fair market value of the Common Stock on the date of grant). In fiscal 2019, the director stock grants had grant date fair market values of $160,000. These shares are immediately vested, but the Board has adopted stock ownership guidelines which mandate that Board members may not sell any shares of the Company’s Common Stock which they hold, including shares which are obtained as part of this yearly stock grant, until they own shares of Common Stock with an aggregate market value equal to at least $475,000 (which is equivalent to five times the annual Board retainer). Board members are permitted to sell shares of Common Stock they hold with a value in excess of $475,000, as long as they continue to hold at least $475,000 worth of Common Stock. Pursuant to the Deferred Compensation Plan for non-employee directors (the “Deferred Plan”), which is unfunded, non-employee directors may defer some or all of the annual Board retainer and meeting fees into a stock unit account, the value of each unit initially being equal to the fair market value of one share of Common Stock as of the end of the quarter in which the compensation being deferred would otherwise be payable. Stock units increase or decrease in value based on the fair market value of the Common Stock. In addition, an amount equal to the dividends paid on an equivalent number of shares of Common Stock is credited to each non-employee director’s stock unit account as of the end of the quarter in which the dividend was paid. Non-employee directors may also defer any portion of their retainer and/or meeting fees into an interest account under the Deferred Plan, which bears interest at the five-year treasury rate.

The Company makes a deemed matching contribution to a director’s stock unit account under the Deferred Plan equal to 10% of the amount deferred by the director into the stock unit account, with one-half of such Company contribution vesting on December 31st of the calendar year in which the deferred compensation otherwise would have been paid and one-half on the next December 31st, provided that the participant remains a director on such vesting date. Unvested Company contributions will automatically vest on death, total disability or retirement by the director at or after age seventy-two. Compensation deferred under the Deferred Plan, whether in the stock unit account or the interest account, will be paid out in cash after termination of service as a director. Directors may elect that compensation so deferred be paid out in a lump sum or in up to ten annual installments, commencing either in the quarter following, or in the January following, the quarter in which service as a director terminates.

The Company also offers a matching gift program for its Board members pursuant to which the Company will match charitable contributions, up to a maximum yearly Company match of $5,000, made by Board members to qualifying non-profit organizations and academic institutions.

20

Table of Contents

Hasbro is committed to strong corporate governance, ethical conduct, sustainability and the accountability of our Board and our senior management team to the Company’s shareholders. We review our corporate governance principles and practices on a regular basis. Set forth below is a summary of our key governance principles and practices.

| Code of Conduct |

Hasbro has a Code of Conduct which is applicable to all of the Company’s officers, employees and directors, including the Company’s Chief Executive Officer, Chief Financial Officer and Controller. The Code of Conduct addresses such issues as conflicts of interest, protection of confidential Company information, financial integrity, compliance with laws, rules and regulations, insider trading and proper public disclosure. Compliance with the Code of Conduct is mandatory for all Company officers, other employees and directors. Any violation of the Code of Conduct can subject the person at issue to a range of sanctions, including dismissal.

The Code of Conduct is available on Hasbro’s website at https://hasbro.gcs-web.com/corporate-governance. Although the Company generally does not intend to provide waivers of, or amendments to, the Code of Conduct for its Chief Executive Officer, Chief Financial Officer, Controller, or any other officers, directors or employees, information concerning any waiver of, or amendment to, the Code of Conduct for the Chief Executive Officer, Chief Financial Officer, Controller, or any other executive officer or director of the Company, will be promptly disclosed on the Company’s website in the location where the Code of Conduct is posted.

| Corporate Governance Principles |

Hasbro has adopted a set of Corporate Governance Principles which address qualifications for members of the Board of Directors, director responsibilities, director access to management and independent advisors, director compensation and many other matters related to the governance of the Company. The Corporate Governance Principles are available on Hasbro’s website at https://hasbro.gcs-web.com/corporate-governance.

| Director Independence |

Hasbro’s Board has adopted Independence Standards in accordance with Nasdaq corporate governance listing standards. The Independence Standards specify criteria used by the Board in making determinations with respect to the independence of its members and include strict guidelines for directors and their immediate family members with respect to past employment or affiliation with the Company or its independent auditor. The Independence Standards restrict commercial relationships between directors and the Company and include the consideration of other relationships with the Company, including charitable relationships, in making independence determinations. The Independence Standards are available on Hasbro’s website at https://hasbro.gcs-web.com/corporate-governance. A copy of the Independence Standards is also attached as Appendix A to this Proxy Statement.

The Board has determined in accordance with our Independence Standards, that each of the following directors are independent and have no relationships which impact an independence determination under the Company’s Independence Standards: Kenneth A. Bronfin, Michael R. Burns, Hope F. Cochran, Sir Crispin H. Davis, Lisa Gersh, Alan G. Hassenfeld, Tracy A. Leinbach, Edward M. Philip, Richard S. Stoddart, Mary Beth West and Linda K. Zecher.

Alan G. Hassenfeld was formerly an employee and Chief Executive Officer of the Company. However, Mr. Hassenfeld’s officer and employee relationship with the Company ended in December 2005. Although Mr. Hassenfeld has a greater than 5% shareholding in the Company, that interest is only a minority interest in the total share ownership of the Company. The Board does not believe that the former employment relationship or equity interest impact Mr. Hassenfeld’s independence.

21

Table of Contents

The only members of the Company’s Board who were determined not to be independent were Brian D. Goldner, the Company’s current Chairman and Chief Executive Officer, and John A. Frascotti, the Company’s President and Chief Operating Officer.

| Lead Independent Director |

At the Company’s 2015 Annual Meeting, the role of Presiding Non-Management Director was replaced with an expanded role of Lead Independent Director. This reflected Hasbro’s continued commitment to good governance and to providing a strong voice for its independent directors. Edward M. Philip currently serves in the role of Lead Independent Director.

The Lead Independent Director’s primary responsibilities include:

| • | reviewing and approving all information and materials to be sent to the Board; |

| • | reviewing and approving agendas and meeting schedules for all Board and Committee meetings, including to assure that there is sufficient time for discussion of all agenda items; |

| • | developing the agendas for, and moderating, executive sessions of the Board’s non-management and independent directors; |

| • | advising management on the quality, quantity and timeliness of information provided to the Board; |

| • | presiding at all meetings of the Board at which the Chairman and Chief Executive Officer is not present, including all executive sessions of the non-management and independent directors; |

| • | providing feedback to the Chairman and Chief Executive Officer regarding the matters discussed at such meetings and sessions, as appropriate; |

| • | having the authority to call meetings of the non-management and independent directors whenever the Lead Independent Director deems it appropriate or necessary; |

| • | serving as the principal liaison between the non-management and independent directors and the Chairman and Chief Executive Officer and management; |

| • | serving as the liaison between the non-management and independent directors and other constituents of the Company, such as shareholders, and meeting and consulting with major shareholders as part of the Company’s shareholder outreach programs and when otherwise requested by such shareholders; |

| • | serving as a conduit for third parties to contact the non-management and independent Directors as a group; |

| • | regularly consulting with the Chairman and Chief Executive Officer and other members of the Board on matters related to corporate governance and Board performance; |

| • | facilitating the retention of outside advisors for the independent directors and the Board as needed; and |

| • | performing such other duties as the Board may from time to time delegate or request. |

| Board Leadership Structure |

The Chairman of the Board is elected by the Board on an annual basis. Currently, Mr. Goldner serves as Chairman of the Board, as well as Chief Executive Officer. Mr. Goldner’s appointment as Chairman in May 2015 reflected the integral role he has played and continues to play in the transformation of Hasbro’s business globally and in successfully formulating, reshaping, executing and accelerating the Company’s strategy, both before and following his appointment as Chief Executive Officer in 2008. The Board believes that combining these roles at this time is best for the Company and its shareholders as it will facilitate the functioning of the Board with senior management in strategic planning for the Company, in determining the Company’s key business opportunities and objectives as well as setting plans for achieving those objectives. Hasbro believes the combination of these roles with a proven leader positions the Company well for future success.

22

Table of Contents

The Chairman of the Board provides leadership to the Board by, among other things, working with the Lead Independent Director and the Chief Legal Officer and Corporate Secretary to set Board calendars, determine agendas for Board meetings, ensure proper flow of information to Board members, facilitate effective operation of the Board and its Committees, help promote Board succession planning and the recruitment and orientation of new directors, oversee director performance, assist in consideration and Board adoption of the Company’s strategic plan and annual operating plans, and help promote senior management succession planning.

The Lead Independent Director, whose responsibilities are described in detail above, works with the Chairman to ensure the proper operation of the Board, and serves as the principal liaison between the non-management, independent directors and the Chairman and other constituents of the Company, such as shareholders.

| Majority Vote Standard |

The Company has a majority vote standard for the election of directors in uncontested director elections (with a plurality vote standard applying to contested director elections), coupled with a director resignation policy for those directors who do not receive a majority vote.

In an election of directors which is not a contested election (as defined below), when a quorum is present, each nominee to be elected by shareholders shall be elected if the votes cast “for” such nominee exceed the votes cast “against” such nominee. In cases where as of the tenth (10th) day preceding the date on which the Company first mails its notice of meeting, for the meeting at which directors are being elected, the number of nominees for director exceeds the number of directors to be elected (referred to as a “contested election”), when a quorum is present, each nominee to be elected by shareholders shall be elected by a plurality of the votes cast.

In order for an incumbent director to become a nominee for re-election to the Board, such person must submit an irrevocable resignation, contingent on both that person not receiving a “for” vote that exceeds the “against” vote cast in an election that is not a contested election and acceptance of that resignation by the Board in accordance with the policies and procedures of the Board adopted for such purpose. In the event an incumbent director fails to receive a “for” vote that exceeds the “against” vote in an election that is not a contested election, the Company’s Nominating, Governance and Social Responsibility Committee shall make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent director.

The Board shall act on the resignation, taking into account the recommendation of the Nominating, Governance and Social Responsibility Committee, and publicly disclose (by filing an appropriate disclosure with the SEC) its decision regarding the resignation and, if such resignation is rejected, the rationale for that decision, within sixty (60) days following the final certification of the vote at which the election was held. The Nominating, Governance and Social Responsibility Committee in making its recommendation, and the Board in making its decision, may each consider all factors and information that they consider relevant and appropriate. Both the Nominating, Governance and Social Responsibility Committee, in making their recommendation, and the Board in making its decision, with respect to any given nominee who has not received the requisite vote in an election that is not a contested election, will act without the participation of the nominee in question.

| Director Outside Board Service |

The Company has a policy providing that our board members may not serve on the boards of directors of more than a total of four public companies (including the Company’s Board) and/or registered investment fund families. If the director is also a sitting chief executive officer of a public company, the director may not serve on more than one other public company board or registered investment fund family board, in addition to the Company’s board.

The Board does not have a policy setting rigid limits on the number of audit committees on which a member of the Company’s Audit Committee can serve. Instead, in cases where an Audit Committee member serves on more than three public company audit committees, the Board evaluates whether such simultaneous service would impair the service of such member on the Company’s Audit Committee.

23

Table of Contents

| Director Orientation and Continuing Education |

New directors receive an orientation to assist them in their roles as Board and committee members. Orientation includes subjects such as board governance and operation, Company history, strategic plans, business operations, financial position and legal and regulatory environment. Management also provides information on an ongoing basis to assure that Board members are aware of the business, legal and other developments necessary to fulfill their role. We also make available outside educational opportunities as the Board deems relevant and appropriate.

| Annual Self-Evaluation for the Board and Board Committees |

Every year the entire Board, as well as each of the committees of the Board, conduct a self-evaluation process. This process includes each director and each committee member submitting confidential feedback on the performance of the Board, as well as the performance of each committee on which they serve. The feedback is then collected and reviewed and discussed by the applicable committees, as well as the entire Board of Directors. This feedback informs changes the Board and the committees consider making to their processes and areas of review for the next year.

| Board Tenure |

Although the Company does not have a formal policy with respect to Board tenure, the Board does seek to keep a balance of tenures to provide continuity of understanding of the business, long-term succession planning, and meaningful onboarding of new directors, including educating new directors with respect to the Company’s business, while also providing for new perspectives brought to bear by new Board members. The Board is targeting a mix of tenures in which roughly one-third of the Board members have been on the Board for five years or less, one-third of the members have been on the Board for six to ten years, and one-third of the members have served on the Board for longer than ten years. Although that is a general target, the composition of Board tenures may vary over time for many factors, including the availability of appropriate director candidates.

| Proxy Access |

We have adopted a “proxy access” procedure in our Amended and Restated By-Laws. Our proxy access bylaw allows a shareholder or a group of up to 20 shareholders, who has maintained continuous ownership of at least 3% of the voting power of the Company’s outstanding voting stock for at least 3 years, to include nominees for election to the Board of Directors in the Company’s proxy statement. Subject to compliance with the requirements of the proxy access By-Law provisions, the shareholder or group of shareholders may include director nominees for up to the greater of (i) 20% of the Board, rounded down to the nearest whole number, or (ii) 2 nominees.

| Share Retention Requirements |

The Company has share ownership guidelines which apply to all officers and employees at or above the Senior Vice President level and establish target share ownership levels which executives are expected to achieve over a five-year period and then maintain, absent extenuating circumstances. The Company also requires employees at those levels to retain a portion of any net shares realized from stock vesting or option exercises during the five-year period an executive has to achieve their stock ownership requirement until the executive’s ownership requirement level is satisfied. Until the applicable ownership level is achieved, the executive is required to retain an amount equal to at least 50% of the net shares received as a result of the exercise, vesting or payment of any equity awards granted to the executive following such executive becoming subject to the policy. Once the required stock ownership level is achieved, the executive is required to maintain the stock ownership level for as long as the executive is employed by the Company and is subject to the policy.

24

Table of Contents

| Equity Awards Granted in 2013 and Beyond Subject to Double Trigger Following a Change in Control |

At the Company’s 2013 Annual Shareholder Meeting, shareholders approved amendments to the Company’s Restated 2003 Stock Incentive Performance Plan, as amended. This approval by our shareholders provided that all awards granted in 2013 and thereafter will be subject to a double trigger change in control provision. This means that rather than vesting automatically upon a change in control of the Company, such awards will only vest following a change in control if the award recipient’s employment with the Company is terminated under specified circumstances.

| Clawback Policy |

Under our Board approved Clawback Policy, all equity and non-equity incentive plan compensation granted by the Company in 2013 and thereafter is subject to this Clawback Policy. The policy provides that if an accounting restatement is required due to the Company’s material non-compliance with any accounting requirements, then all of the Company’s executive officers, regardless of whether they were at fault or not in the circumstances leading to the restatement, will be subject to forfeiting any excess in the incentive compensation they earned over the prior three years over what they would have earned if there had not been a material non-compliance in the financial statements.

| Policy Prohibiting the Pledging or Hedging of Company Stock |

Under the Company’s Board approved insider trading policy, we prohibit any pledges or hedges of Company stock by directors, officers or other employees on a prospective basis. The Board believes this policy furthers the interest of shareholders by ensuring that directors, officers and employees have the same economic incentives as shareholders and that equity held by directors, officers and employees will not be sold in situations beyond the control of the director, officer or employee.

| No Tax Gross-Ups |

We do not have any existing tax gross-up arrangements with any of our directors, officers or other employees and we have made a commitment to not enter into such arrangements in the future.

| Corporate Social Responsibility |

At Hasbro, we believe that every day is a chance to do better. We strive to always act responsibly, and in doing so we find smarter ways of doing business. Our deep commitment to corporate social responsibility (CSR) reflects our desire to help build a safer, more sustainable world for future generations. It inspires and guides us to play with purpose: To take what we love most about play and entertainment — creativity, innovation, imagination — and make a difference where it matters most. And it makes every part of Hasbro’s business stronger.

While our CSR commitments address many areas, we focus on four key priorities: product and content safety, environmental sustainability, human rights and ethical sourcing, and diversity and inclusion.

| • | Product & Content Safety — At Hasbro, product safety is essential to upholding our consumers’ trust and expectations, and we embed quality and safety into every Hasbro product and play experience. This includes embracing our responsibility to create high quality products, entertainment and play experiences and marketing them responsibly. It’s an important part of how we uphold our commitments to children, families, and all our consumers. |

25

Table of Contents

| • | Environmental Sustainability — We are passionate about protecting our planet and conserving natural resources for future generations, including pursuing innovative ways to reduce our environmental impacts across business. Through Hasbro’s Sustainability Center of Excellence, we drive our strategic environmental blueprint across our global organization with a focus on reducing the environmental impacts of our products and packaging, minimizing the environmental footprint of our operations and supply chain, and encouraging our employees to embrace and promote environmental responsibility. |

| • | Human Rights & Ethical Sourcing — Treating people with fairness, dignity and respect and operating ethically in our supply chain are core values at Hasbro. We demonstrate these deep beliefs in the way we treat our employees and, in the expectations, and requirements we have of those with whom we do business. We work closely with our third-party factories and licensees to ensure all products are manufactured in safe and healthy environments and the human rights of workers in our supply chain are being upheld. |