Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the fiscal year ended December 27, 2015

Commission file number 1-6682

Hasbro, Inc.

(Exact Name of Registrant, As Specified in its Charter)

| Rhode Island | 05-0155090 | |

| (State of Incorporation) | (I.R.S. Employer | |

| Identification No.) |

| 1027 Newport Avenue, Pawtucket, Rhode Island |

02861 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code (401) 431-8697

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x or No ¨.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ or No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x or No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x or No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one:)

| Large Accelerated Filer |

x |

Accelerated Filer | ¨ | Non-Accelerated Filer ¨ | Smaller Reporting Company | ¨ | ||||||||||||||

| (Do not check if smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ or No x.

The aggregate market value on June 26, 2015 (the last business day of the Company’s most recently completed second quarter) of the voting common stock held by non-affiliates of the registrant, computed by reference to the closing price of the stock on that date, was approximately $8,638,748,000. The registrant does not have non-voting common stock outstanding.

The number of shares of common stock outstanding as of February 8, 2016 was 124,795,430.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our definitive proxy statement for our 2016 Annual Meeting of Shareholders are incorporated by reference into Part III of this Report.

Table of Contents

| Page | ||||||

| PART I | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

10 | |||||

| Item 1B. |

25 | |||||

| Item 2. |

25 | |||||

| Item 3. |

26 | |||||

| Item 4. |

26 | |||||

| PART II | ||||||

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 27 | ||||

| Item 6. |

28 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

29 | ||||

| Item 7A. |

54 | |||||

| Item 8. |

55 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

101 | ||||

| Item 9A. |

101 | |||||

| Item 9B. |

103 | |||||

| PART III | ||||||

| Item 10. |

103 | |||||

| Item 11. |

103 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 104 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

104 | ||||

| Item 14. |

104 | |||||

| PART IV | ||||||

| Item 15. |

104 | |||||

| 113 | ||||||

Table of Contents

From time to time, including in this Annual Report on Form 10-K and in our annual report to shareholders, we publish “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These “forward-looking statements” may relate to such matters as our business and marketing strategies, anticipated financial performance or business prospects in future periods, including with respect to our planned cost savings initiative, expected technological and product developments, the expected content of and timing for scheduled new product introductions or our expectations concerning the future acceptance of products by customers, the content and timing of planned entertainment releases including motion pictures, television and digital products; and marketing and promotional efforts, research and development activities, liquidity, and similar matters. Forward-looking statements are inherently subject to risks and uncertainties. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. These statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,” “could,” “expect,” “intend,” “looking forward,” “may,” “planned,” “potential,” “should,” “will” and “would” or any variations of words with similar meanings. We note that a variety of factors could cause our actual results and experience to differ materially from the anticipated results or other expectations expressed or anticipated in our forward-looking statements. The factors listed below and in Item 1A of this Annual Report are illustrative and other risks and uncertainties may arise as are or may be detailed from time to time in our public announcements and our filings with the Securities and Exchange Commission, such as on Forms 8-K, 10-Q and 10-K. We undertake no obligation to make any revisions to the forward-looking statements contained in this Annual Report on Form 10-K or in our annual report to shareholders to reflect events or circumstances occurring after the date of the filing of this report. Unless otherwise specifically indicated, all dollar or share amounts herein are expressed in millions of dollars or shares, except for per share amounts.

PART I

| Item 1. | Business. |

General Development and Description of Business and Business Segments

Except as expressly indicated or unless the context otherwise requires, as used herein, “Hasbro”, the “Company”, “we”, or “us”, means Hasbro, Inc., a Rhode Island corporation organized on January 8, 1926, and its subsidiaries.

Overview

We are a global branded-play company committed to Creating the World’s Best Play Experiences. We strive to do this through deep consumer engagement and the application of consumer insights, the use of immersive storytelling to build our brands, product innovation and development of global business reach. We apply these principles to leverage our beloved owned and controlled brands, including LITTLEST PET SHOP, MAGIC: THE GATHERING, MONOPOLY, MY LITTLE PONY, NERF, PLAY-DOH and TRANSFORMERS, as well as the licensed brands of our strategic partners. From toys and games to television programming, motion pictures, digital gaming and a comprehensive consumer products licensing program, Hasbro fulfills the fundamental need for play and connection for children and families around the world. The Company’s wholly-owned Hasbro Studios creates entertainment brand-driven storytelling across mediums, including television, film and more. These elements are executed globally within the construct of our strategic plan, the brand blueprint, at the center of which our brands reside. Using this blueprint, we innovate new brands and re-imagine, re-invent and re-ignite our owned and controlled brands through toy and game innovation, immersive entertainment offerings, including television programming and motion pictures, and a broad range of licensed products, ranging from traditional to high-tech and digital, all informed by storytelling and consumer insights.

Brand Architecture

Hasbro organizes owned, controlled and licensed intellectual properties within the brand architecture with a focus on the following: Franchise Brands, Challenger Brands, Mega Gaming Brands and Partner Brands. Implementation of the brand architecture has allowed us to leverage existing brand competencies outside the confines of our traditional product categories, creating significant growth opportunities in our brands.

1

Table of Contents

Franchise Brands are Hasbro’s most significant owned or controlled properties which we believe have the ability to deliver significant revenues and growth over the long-term. Our seven Franchise Brands are LITTLEST PET SHOP, MAGIC: THE GATHERING, MONOPOLY, MY LITTLE PONY, NERF, PLAY-DOH and TRANSFORMERS. As reported, net revenues from Franchise Brands declined 2% in 2015 but grew 31% and 15% in 2014 and 2013, respectively. Absent the impact of foreign currency translation in 2015, net revenues from Franchise Brands grew 7% in 2015 compared to 2014. Furthermore, in 2015, 2014 and 2013, Franchise Brands were 52%, 55% and 44% of total net revenues, respectively.

Challenger Brands are those owned or controlled Hasbro brands which have not yet achieved Franchise Brand status, but which the Company believes have the potential to do so over time with investment and further development. Challenger Brands includes BABY ALIVE, FURBY, FURREAL FRIENDS, KRE-O, PLAYSKOOL and PLAYSKOOL HEROES.

Hasbro continues to revolutionize traditional game play through its strong portfolio of Mega Gaming Brands, digital integration and the introduction of new gaming brands and play experiences. Mega Gaming Brands specifically include CONNECT 4, ELEFUN & FRIENDS, JENGA, THE GAME OF LIFE, OPERATION, SCRABBLE, TRIVIAL PURSUIT and TWISTER; however, Hasbro’s games portfolio also includes many other well-known game brands. Games offerings include face to face, trading card and digital game experiences played as board, off-the-board, digital, card, electronic, trading card and role-playing games.

Partner Brands include those licensed brands for which Hasbro develops products. Significant Partner Brands include MARVEL, including SPIDER-MAN and THE AVENGERS, STAR WARS, DISNEY‘S DESCENDANTS, JURASSIC WORLD, and SESAME STREET. 2016 marks the first year of our license agreement with The Walt Disney Company (“Disney”) to market DISNEY PRINCESS and FROZEN small and fashion doll product lines. Partner brands MARVEL, STAR WARS, DISNEY’S DESCENDANTS, DISNEY PRINCESS and FROZEN are all owned by Disney.

In 2015, Hasbro sold product supported by three major motion picture releases by our partners. These major motion picture releases comprised THE AVENGERS: AGE OF ULTRON, JURASSIC WORLD and STAR WARS: THE FORCE AWAKENS. The financial impact of these major motion picture releases on our results is discussed in detail in the management’s discussion and analysis section of this report. In 2016, Hasbro expects to sell product lines supported by the following expected theatrical releases from Disney: CAPTAIN AMERICA: CIVIL WAR in May 2016, MOANA in November 2016, and ROGUE ONE: A STAR WARS STORY in December 2016. We also expect to sell products related to the expected Dreamworks Animation theatrical release of TROLLS in the fall of 2016. Aside from these major brand categories, we continue to seek growth opportunities by imagining, inventing and igniting new or archived brands and by offering engaging branded-play experiences.

Storytelling and Other Entertainment Initiatives

Our brand blueprint focuses on reinforcing storylines associated with our brands through several outlets, including television, motion pictures and digital media.

As part of our brand blueprint, we seek to build our brands through entertainment-based storytelling. Hasbro Studios LLC (“Hasbro Studios”) is our wholly-owned production studio, which is responsible for brand-driven storytelling across mediums, including the development and global distribution of television programming primarily based on our brands. This programming currently airs in markets throughout the world. Domestically, Hasbro Studios primarily distributes programming to Discovery Family Channel (the “Network”) which is a joint venture between Discovery Communications, Inc. (“Discovery”) and ourselves which operates a cable television network in the United States dedicated to high-quality children’s and family entertainment and educational programming. Beginning in 2015, Hasbro Studios began distributing certain programming domestically to other outlets, including Cartoon Network. Internationally, Hasbro Studios distributes to various broadcasters and cable networks. Lastly, Hasbro Studios distributes programming globally on various digital platforms, including Netflix and iTunes.

During 2014, we formed Allspark Pictures, Hasbro’s film label, which is producing both animated and live action theatrical releases based on our brands. The Company’s storytelling initiatives support its strategy of

2

Table of Contents

growing its brands well beyond traditional toys and games and providing entertainment experiences for consumers of all ages accessible anytime in many forms and formats. In October 2015, Allspark Pictures released JEM AND THE HOLOGRAMS. In October 2016, Allspark Pictures expects to release OUIJA 2.

In addition to film and television initiatives, Hasbro understands the importance of digital media and digitally integrating our products. Digital media encompasses digital gaming applications and the creation of digital environments for analog products through the use of complementary digital applications and websites which extend storylines and enhance play. We own a 70% majority stake in Backflip Studios, LLC (“Backflip”), a mobile game developer. While certain of our trademarks, characters and other property rights are licensed by third parties in connection with digital gaming, we anticipate leveraging and applying Backflip’s digital gaming expertise to Hasbro brands in 2016 and beyond.

As we seek to grow our business in entertainment, licensing and digital gaming, we will continue to evaluate strategic alliances, acquisitions and investments, like Hasbro Studios, the Network and Backflip, which may complement our current product offerings, allow us entry into an area which is adjacent or complementary to our toy and game business, or allow us to further develop awareness of our brands and expand the ability of consumers to experience our brands in different forms and formats.

Product Categories

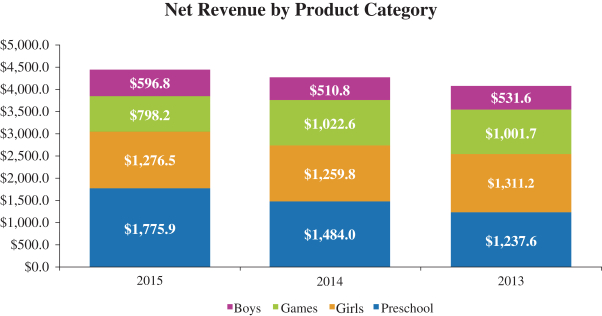

We market our brands under the following primary product categories: (1) boys; (2) games; (3) girls; and (4) preschool toys.

Boys Franchise Brands in our boys’ category include the NERF action sports products and TRANSFORMERS action figures and accessories. The TRANSFORMERS brand, which has been supported by the four major, successful theatrical releases over the past decade in combination with animated television program developed by Hasbro Studios, TRANSFORMERS: ROBOTS IN DISGUISE, has become a hallmark example of how successful our brand blueprint can be when properly executed across all mediums. In addition to these Franchise Brands, the boys’ category also includes SUPER SOAKER water blasters and G.I. JOE action figures and accessories. Another significant portion of our boys’ category includes licensed product lines based on popular movie, television and comic book characters, such as MARVEL and STAR WARS. In 2015, overall results from the boys category benefited from significant product sales related to three major motion picture releases: AVENGERS: AGE OF ULTRON, STAR WARS: THE FORCE AWAKENS and JURASSIC WORLD. In addition to marketing and developing traditional action figures and accessories for these entertainment brands, the Company also develops and markets products designed for collectors, which has been a key component of the success of the TRANSFORMERS, STAR WARS and MARVEL brands.

Games Over the years, we have established a diverse portfolio of well-known games brands through innovation, invention and acquisition. Our Franchise Brands, MAGIC: THE GATHERING and MONOPOLY, headline our portfolio and are accompanied by our mega gaming brands, including CONNECT 4, ELEFUN & FRIENDS, GAME OF LIFE, JENGA, OPERATION, SCRABBLE, TRIVIAL PURSUIT and TWISTER. To successfully execute our gaming strategy, we consider brands which may capitalize on existing trends while evolving our approach to gaming using consumer insights and offering gaming experiences relevant to consumer demand for face-to-face, board, off-the-board, digital, card, electronic, trading card, role playing and other game play including the launch of new play patterns. In the fourth quarter of 2015, net revenues from the games category benefited from the introduction of PIE FACE.

Girls Our girls’ category not only includes traditional girls’ toys but also provides a variety of contemporary and engaging play experiences. Girls’ Franchise Brands include LITTLEST PET SHOP, MY LITTLE PONY, NERF REBELLE and PLAY-DOH DOH VINCI while Girls’ Challenger Brands include BABY ALIVE, FURBY and FURREAL FRIENDS. Franchise Brands LITTLEST PET SHOP and MY LITTLE PONY are each supported by animated television programming developed by Hasbro Studios. In addition to Hasbro Franchise and Challenger Brands, we also have licenses to develop certain product lines based on popular television and film brands, including DISNEY’S DESCENDANTS, DISNEY PRINCESS, FROZEN and TROLLS. Our DISNEY PRINCESS and FROZEN product lines were introduced at retail in January 2016. Lastly, Hasbro

3

Table of Contents

continues to grow and promote existing brands by leveraging their strengths across other toy categories. Our NERF REBELLE and PLAY-DOH DOH VINCI product lines reflect this strategy.

Preschool Our preschool category encompasses a range of products for infants and preschoolers in various stages of development. In the preschool category, we are focused on our Franchise Brands and story-led initiatives where we believe we can differentiate our offerings and deliver higher profitability. Franchise Brand offerings in the preschool category include MY LITTLE PONY, TRANSFORMERS and PLAY-DOH, including modeling compound and playsets. Our offerings also include preschool product lines based on those aforementioned licensed entertainment properties, including JURASSIC WORLD, MARVEL and STAR WARS. In recent years, we have introduced preschool product lines which complement our girls and boys product lines. Generally, these product lines fall within our PLAYSKOOL HEREOS and PLAYSKOOL FRIENDS brands and include MY LITTLE PONY, JURASSIC WORLD, TRANSFORMERS RESCUE BOTS, MARVEL SUPER HERO ADVENTURES and STAR WARS GALACTIC HEROES. In addition to PLAYSKOOL HEROES and PLAYSKOOL FRIENDS, our PLAYSKOOL brand also includes well-known core products such as MR. POTATO HEAD, SIT ‘N SPIN and GLOWORM, along with a line of infant toys including STEP START WALK’ N RIDE and ELEFUN BUSY BALL POPPER.

Segments

Organizationally, our three principal segments are U.S. and Canada, International and Entertainment and Licensing. The U.S. and Canada and International segments engage in the marketing and selling of various toy and game products described above. Our toy and game products are primarily developed by cross-functional teams, including members of our global development and marketing groups, to establish a cohesive brand direction and assist the segments in establishing certain local marketing programs. The costs of these groups are allocated to the principal segments. Our U.S. and Canada segment covers the United States and Canada while the International segment primarily includes Europe, the Asia Pacific region and Latin and South America. The Entertainment and Licensing segment conducts our movie, television and digital gaming entertainment operations, including the operations of Hasbro Studios and Backflip as well as engages in the out-licensing of our trademarks, characters and other brand and intellectual property rights to third parties for non-competing products. Our Global Operations segment is responsible for arranging product manufacturing and sourcing for the U.S. and Canada and International segments. Financial information with respect to our segments and geographic areas is included in note 19 to our consolidated financial statements, which are included in Item 8 of this Form 10-K. The following is a discussion of each segment.

U.S. and Canada This segment engages in the marketing and sale of our products in the United States and Canada. The U.S. and Canada segment promotes our brands through innovation and reinvention of toys and games. This is accomplished through introducing new products and initiatives driven by consumer and marketplace insights and leveraging opportunistic toy and game lines and licenses. This strategy leverages efforts to increase consumer awareness of the Company’s brands through entertainment experiences, including motion pictures and television programming.

International The International segment engages in the marketing and sale of our product categories to retailers and wholesalers in most countries in Europe, Latin and South America, and the Asia Pacific region and through distributors in those countries where we have no direct presence. We have offices in more than 35 countries contributing to sales in more than 120 countries.

In addition to growing brands and leveraging opportunistic toy lines and licenses, we seek to grow our international business by continuing to opportunistically expand into emerging markets in Eastern Europe, Asia and Latin and South America. Emerging markets are an area of high priority for us as we believe they offer greater opportunities for revenue growth than developed markets. Key emerging markets include Russia, Brazil and the People’s Republic of China (“China”) and, during 2015, we opened offices in South Africa and Thailand. Net revenues from emerging markets represented 14% of our total consolidated net revenues in 2015. In 2015, net revenues from emerging markets decreased 9%, primarily due to a challenging foreign currency environment whereas 2014 and 2013 net revenues in emerging markets grew 20% and 25%, respectively. The strengthening of

4

Table of Contents

the U.S. dollar had a significant impact on the International segment during 2015. The U.S. dollar strengthened against nearly all of our major selling currencies, including the Brazilian Real, Euro, Mexican Peso and Russian Ruble. The negative impact from foreign currency translation on International segment net revenues for 2015 and 2014 was $379.4 million and $87.7 million, respectively. Furthermore, absent the negative impact of foreign currency, net revenues from emerging markets grew approximately 15%. Financial information with respect to foreign currency risk management is included in note 16 to our consolidated financial statements, which are included in Item 8 of this Form 10-K.

Entertainment and Licensing Our Entertainment and Licensing segment includes our consumer products licensing, digital gaming, television and movie entertainment operations.

Our consumer products licensing category seeks to promote our brands through the out-licensing of our intellectual properties to third parties for promotional and merchandising uses in businesses which do not compete directly with our own product offerings, such as apparel, publishing, home goods and electronics, or in certain situations, to utilize them for toy products where we consider the out-licensing of brands to be more effective.

Our digital gaming business seeks to promote our brands largely through the out-licensing of our intellectual properties to a number of partners who develop and offer digital games for play on mobile devices, personal computers, and video game consoles based on those brands. We have a 70% majority ownership in Backflip, a mobile game developer, as we seek to complement the aforementioned out-licensing with the development of internal digital gaming resources. Backflip’s product offerings include games for tablets and mobile devices, including the DRAGONVALE game. Backflip intends to continue focusing on its existing game titles, particularly DRAGONVALE, and to launch new games, including game offerings based on Hasbro brands. To further extend its brands into digital media and gaming, the Company also out-licenses its properties to a number of partners who develop and offer digital games and other gaming experiences based on those brands. The Company has digital gaming relationships with Electronic Arts Inc., Activision, Ubisoft and others. Lastly, we also license our brands to third parties engaged in other forms of gaming, including Scientific Games Corporation.

Major motion pictures and television programming based on our owned and controlled brands provide both immersive storytelling and the ability for our consumers to experience these properties in a different format, which we believe can result in increased product sales, royalty revenues, and overall brand awareness. To a lesser extent, we can also earn revenue from our participation in the financial results of motion pictures and related home entertainment releases and through the distribution of television programming. Revenue from toy and game product sales is a component of the U.S. and Canada and International segments, while royalty revenues, including revenues earned from movies and television programming, is included in the Entertainment and Licensing segment.

Global Operations Our Global Operations segment sources production of our toy and game products. Through August 2015, the Company owned and operated manufacturing facilities in East Longmeadow, Massachusetts and Waterford, Ireland which predominantly produced game products. These facilities were sold to Cartamundi NV (“Cartamundi”) on August 31, 2015. Cartamundi will continue to manufacture game products for us under a manufacturing agreement. Sourcing for our other production is done through unrelated third party manufacturers in various Far East countries, principally China, using a Hong Kong based wholly-owned subsidiary operation for quality control and order coordination purposes. See “Manufacturing and Importing” below for more details concerning overseas manufacturing and sourcing.

Other Information To further extend our range of products in the various segments of our business, we sell a portion of our toy and game products to retailers on a direct import basis from the Far East. These sales are reflected in the revenue of the related segment where the customer is geographically located.

Certain of our products are licensed to other companies for sale in selected countries where we do not otherwise have a direct business presence.

5

Table of Contents

Each of our four product categories, namely boys, games, girls and preschool, generate greater than 10% of our net revenues. For more information, including the amount of net revenues attributable to each of our four product categories, see note 19 to our consolidated financial statements, which are included in Item 8 of this Form 10-K.

Working Capital Requirements

Our working capital needs are financed through cash generated from operations, primarily through the sale of toys and games and secondarily through our consumer products licensing operations, and, when necessary, proceeds from short-term borrowings.

Our customer order patterns may vary from year to year largely due to fluctuations in the degree of consumer acceptance of product lines, product availability, marketing strategies and inventory policies of retailers, the dates of theatrical releases of major motion pictures for which we offer products, and changes in overall economic conditions. As such, a disproportionate volume of our net revenues are earned during the third and fourth quarters leading up to the retail industry’s holiday selling season, including Christmas. As a result, comparisons of unshipped orders on any date with those at the same date in the prior year are not necessarily indicative of our sales for that year. Moreover, quick response, or just-in-time, inventory management practices result in a significant proportion of orders being placed for immediate delivery. Although the Company may receive orders from customers in advance, it is general industry practice that these orders are subject to amendment or cancellation by customers prior to shipment and, as such, the Company does not believe that these unshipped orders, at any given date, are indicative of future sales. We expect that retailers will continue to follow this strategy. As such, our business generally earns more revenue in the second half of the year compared to the first half. In 2015, the second half of the year accounted for approximately 66% of full year revenues with the third and fourth quarters each accounting for 33% of full year net revenues. The types of programs that we plan to employ to promote sales in 2016 are substantially the same as those we employed in 2015 and in prior years.

Historically, we commit to the majority of our inventory production and advertising and marketing expenditures for a given year prior to the peak fourth quarter retail selling season. Our accounts receivable increase during the third and fourth quarter as customers increase their purchases to meet expected consumer demand in the holiday season. Due to the concentrated timeframe of this selling period, payments for these accounts receivable are generally not due until later in the fourth quarter or early in the first quarter of the subsequent year. The timing difference between expenses paid and revenues collected sometimes makes it necessary for us to borrow varying amounts during the year. During 2015, we utilized cash from our operations, borrowings under our commercial paper program and uncommitted lines of credit to meet our cash flow requirements.

Product Development and Royalties

Our success is dependent on continuous innovation in our branded-play and entertainment offerings and requires continued development of new brands and products alongside the redesign of existing products to drive consumer interest and market acceptance. Our toy and game products are developed by a global development function, the costs of which are allocated to the selling entities which comprise our principal operating segments. In 2015, 2014 and 2013, we incurred expenses of $242.9 million, $222.6 million and $207.6 million, respectively, on activities related to the development, design and engineering of new products and their packaging (including products brought to us by independent designers) and on the improvement or modification of ongoing products. Much of this work is performed by our internal staff of designers, artists, model makers and engineers.

In addition to the design and development work performed by our own staff, we deal with a number of independent toy and game designers for whose designs and ideas we compete with other toy and game manufacturers. Rights to such designs and ideas, when acquired by us, are usually exclusive and the agreements require us to pay the designer a royalty on our net sales of the item. These designer royalty agreements, in some cases, also provide for advance royalties and minimum guarantees.

6

Table of Contents

We also produce a number of toys and games under trademarks and copyrights utilizing the names or likenesses of characters from movies, television shows and other entertainment media, for whose rights we compete with other toy and game manufacturers. Licensing fees for these rights are generally paid as a royalty on our net sales of the item. Licenses for the use of characters are generally exclusive for specific products or product lines in specified territories. In many instances, advance royalties and minimum guarantees are required by these license agreements.

In 2015, 2014 and 2013, we incurred $379.2 million, $305.3 million and $338.9 million, respectively, of royalty expense. In 2013, royalty expense included $63.8 million related to the settlement of an arbitration award for a dispute between the Company and an inventor, as well as costs related to the amendment of the Company’s license agreement with Zynga. Our royalty expense in any given year may also vary depending upon the timing of movie releases and other entertainment media.

Marketing and Sales

While our global development function focuses on brand and product innovation and re-invention, our global marketing function establishes brand direction and messaging and assists the selling entities in establishing local marketing programs. The global marketing group works cross-functionally with the global development function to deliver unified, brand-specific points of view. The costs of this group are allocated to the selling entities which comprise our principal operating segments. In addition to the global marketing function, our local selling entities employ sales and marketing functions responsible for local market activities and execution.

Our products are sold globally to a broad spectrum of customers, including wholesalers, distributors, chain stores, discount stores, drug stores, mail order houses, catalog stores, department stores and other traditional retailers, large and small, as well as internet-based “e-tailers.” Our own sales forces account for the majority of sales of our products with remaining sales generated by independent distributors who, for the most part, sell our products in areas of the world where we do not otherwise maintain a direct presence. Notwithstanding our thousands of customers, the majority of our sales are to large chain stores, distributors and wholesalers. Customer concentration provides us with certain benefits, such as potentially more efficient product distribution practices and other reductions in costs of sales and distribution; however, customer concentration can also create additional risks for our business. These risks can create potential detriments to our business resulting from the financial difficulties of our major customers which could lead to reductions in sales or unfavorable changes in our business relationships with one, or more, of our major customers. Customer concentration may also decrease the prices we are able to obtain for some of our products and reduce the number of products we would otherwise be able to bring to market. During 2015, net revenues from our top five customers accounted for approximately 39% of our consolidated global net revenues, including our three largest customers, Wal-Mart Stores, Inc., Toys “R” Us, Inc. and Target Corporation who represented 16%, 9% and 9%, respectively, of consolidated global net revenues. In the U.S. and Canada segment, approximately 59% of our net revenues were derived from these top three customers.

We advertise many of our toy and game products extensively on television and through digital marketing and advertising of our brands. Products are strategically cross-promoted by spotlighting specific products alongside related offerings in a manner that promotes the sale of not only the selected item, but also those complementary products. In addition to those advertising initiatives, Hasbro Studios produces entertainment based primarily on our brands which appears on Discovery Family Channel and other major networks globally as well as on various other digital platforms, such as Netflix and iTunes. We also introduce many of our new products to major customers within one to two years leading up to their year of retail introduction. We generally showcase certain new products in New York City at the time of the American International Toy Fair in February, as well as at other international toy shows, including in Hong Kong and Nuremburg, Germany. In 2015, 2014 and 2013, we incurred $409.4 million, $420.3 million and $398.1 million, respectively, in expense related to advertising and promotional programs.

Manufacturing and Importing

During 2015 substantially all of our products were manufactured in third party facilities in the Far East, primarily China, as well as in two previously owned facilities located in East Longmeadow, Massachusetts and

7

Table of Contents

Waterford, Ireland. These facilities were owned by the Company through August 2015, at which point they were sold to Cartamundi, who will continue to manufacture game products for us under a manufacturing agreement.

We believe that the manufacturing capacity of our third party manufacturers, as well as the supply of components, accessories and completed products which we purchase from unaffiliated manufacturers, are adequate to meet the anticipated demand in 2016 for our products. Our reliance on designated external sources of manufacturing could be shifted, over a period of time, to alternative sources of supply for our products, should such changes be necessary or desirable. However, if we were to be prevented from obtaining products from a substantial number of our current Far East suppliers due to political, labor or other factors beyond our control, our operations and our ability to obtain products would be severely disrupted while alternative sources of product were secured and production shifted to those new sources. The imposition of trade sanctions by the United States or the European Union against a class of products imported by us from, or the loss of “normal trade relations” status with, China, or other factors which increase the cost of manufacturing in China, such as higher Chinese labor costs or an appreciation in the Chinese Yuan, could significantly disrupt our operations and/or significantly increase the cost of the products which are manufactured in China and imported into other markets.

Most of our products are manufactured from basic raw materials such as plastic, paper and cardboard, although certain products also make use of electronic components. All of these materials are readily available but may be subject to significant fluctuations in price. There are certain chemicals (including phthalates and BPA) that national, state and local governments have restricted or are seeking to restrict or limit the use of; however, we do not believe these restrictions have or will materially impact our business. We generally enter into agreements with suppliers at the beginning of a fiscal year that establish prices for that year. However, significant volatility in the prices of any of these materials may require renegotiation with our suppliers during the year.

The manufacturing processes of our vendors include injection molding, blow molding, spray painting, printing, box making and assembly. The countries of the Far East, particularly China, constitute the largest manufacturing center of toys in the world and the substantial majority of our toy products are manufactured in China. The 1996 implementation of the General Agreement on Tariffs and Trade reduced or eliminated customs duties on many of the products imported by us.

Competition

We are a worldwide leader in the design, manufacture and marketing of toys and games and other family entertainment offerings, but our business is highly competitive. We compete with several large toy and game companies in our product categories, as well as many smaller United States and international toy and game designers, manufacturers and marketers. We also compete with other companies that offer branded entertainment specific to children and their families. Competition is based primarily on meeting consumer entertainment preferences and on the quality and play value of our products. To a lesser extent, competition is also based on product pricing. In entertainment, Hasbro Studios and Discovery Family Channel compete with other children’s and family television networks and entertainment producers, such as Nickelodeon, Cartoon Network and Disney Channel, for viewers, advertising revenue and distribution.

In addition to contending with competition from other toy and game and branded-play entertainment companies, we contend with the phenomenon that children are increasingly sophisticated and have been moving away from traditional toys and games at a younger age. Thereby, the variety of product and entertainment offerings available for children has expanded and product life cycles have shortened as children move on to more sophisticated offerings at younger ages. This has been referred to as “children getting older younger” but may also be referred to as developmental compression. As a result, our products not only compete with those offerings produced by other toy and game manufacturers and companies offering branded family entertainment, we also compete, particularly in meeting the demands of older children, with entertainment offerings of many technology companies, such as makers of tablets, mobile devices, video games and other consumer electronic products.

The volatility in consumer preferences with respect to family entertainment and low barriers to entry as well as the emergence of new technologies continually creates new opportunities for existing competitors and start-ups to develop products that compete with our entertainment and toy and game offerings.

8

Table of Contents

Employees

At December 27, 2015, we employed approximately 5,000 persons worldwide, approximately 2,500 of whom were located in the United States.

Trademarks, Copyrights and Patents

We seek to protect our products, for the most part, and in as many countries as practical, through registered trademarks, copyrights and patents to the extent that such protection is available, cost effective, and meaningful. The loss of such rights concerning any particular product is unlikely to result in significant harm to our business, although the loss of such protection for a number of significant items might have such an effect.

Government Regulation

Our toy and game products sold in the United States are subject to the provisions of The Consumer Product Safety Act, as amended by the Consumer Product Safety Improvement Act of 2008, (as amended, the “CPSA”), The Federal Hazardous Substances Act (the “FHSA”), The Flammable Fabrics Act (the “FFA”), and the regulations promulgated thereunder. In addition, a few of our products, such as the food mixes for our EASY-BAKE ovens, are also subject to regulation by the Food and Drug Administration.

The CPSA empowers the Consumer Product Safety Commission (the “CPSC”) to take action against hazards presented by consumer products, including the formulation and implementation of regulations and uniform safety standards. The CPSC has the authority to seek to declare a product “a banned hazardous substance” under the CPSA and to ban it from commerce. The CPSC can file an action to seize and condemn an “imminently hazardous consumer product” under the CPSA and may also order equitable remedies such as recall, replacement, repair or refund for the product. The FHSA provides for the repurchase by the manufacturer of articles that are banned.

Consumer product safety laws also exist in some states and cities within the United States and in many international markets including Canada, Australia and Europe. We utilize independent third party laboratories that employ testing and other procedures intended to maintain compliance with the CPSA, the FHSA, the FFA, other applicable domestic and international product standards, and our own standards. Notwithstanding the foregoing, there can be no assurance that our products are or will be hazard free. Any material product recall or other safety issue impacting our product could have an adverse effect on our results of operations or financial condition, depending on the product and scope of the recall, could damage our reputation and could negatively affect sales of our other products as well.

The Children’s Television Act of 1990 and the rules promulgated thereunder by the United States Federal Communications Commission, the rules and regulations of the Federal Trade Commission, as well as the laws of certain other countries, also place limitations on television commercials during children’s programming and on advertising in other forms to children, and on the collection of information from children, such as restrictions on collecting information from children under the age of thirteen subject to the provisions of the Children’s Online Privacy Protection Act.

We maintain programs to comply with various United States federal, state, local and international requirements relating to the environment, health, safety and other matters.

Financial Information about Segments and Geographic Areas

The information required by this item is included in note 19 of the Notes to Consolidated Financial Statements included in Item 8 of Part II of this report and is incorporated herein by reference.

9

Table of Contents

Executive Officers of the Registrant

The following persons are the executive officers of the Company. Such executive officers are elected annually. The position(s) and office(s) listed below are the principal position(s) and office(s) held by such persons with the Company. The persons listed below generally also serve as officers and directors of certain of the Company’s various subsidiaries at the request and convenience of the Company.

| Name |

Age | Position and Office Held |

Period Serving in Current Position |

|||||||

| Brian D. Goldner(1) |

52 | Chairman of the Board, President and Chief Executive Officer | Since 2015 | |||||||

| Deborah M. Thomas(2) |

52 | Executive Vice President and Chief Financial Officer | Since 2013 | |||||||

| Duncan J. Billing(3) |

57 | Executive Vice President, Chief Global Operations and Business Development Officer | Since 2014 | |||||||

| Barbara Finigan(4) |

54 | Executive Vice President, Chief Legal Officer and Secretary | Since 2014 | |||||||

| John A. Frascotti(5) |

55 | President, Hasbro Brands | Since 2014 | |||||||

| Wiebe Tinga(6) |

55 | Executive Vice President and Chief Commercial Officer | Since 2013 | |||||||

| Martin R. Trueb |

63 | Senior Vice President and Treasurer | Since 1997 | |||||||

| (1) Prior thereto, President and Chief Executive Officer from 2008 to 2015. |

| (2) Prior thereto, Senior Vice President and Chief Financial Officer from 2009 to 2013. |

| (3) Prior thereto, Executive Vice President and Chief Development Officer from 2013 to 2014; prior thereto, Senior Vice President and Global Chief Development Officer from 2008 to 2013. |

| (4) Prior thereto, Senior Vice President, Chief Legal Officer and Secretary from 2010 to 2014. |

| (5) Prior thereto, Executive Vice President and Chief Marketing Officer from 2013 to 2014; prior thereto, Senior Vice President and Global Chief Marketing Officer from 2008 to 2013. |

| (6) Prior thereto, President, North America from 2012 to 2013; prior thereto, President, Latin America, Asia Pacific and Emerging Markets from 2006 to 2012. |

Availability of Information

Our internet address is http://www.hasbro.com. We make our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, available free of charge on or through our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

| Item 1A. | Risk Factors. |

Forward-Looking Information and Risk Factors That May Affect Future Results

From time to time, including in this Annual Report on Form 10-K and in our annual report to shareholders, we publish “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These “forward-looking statements” may relate to such matters as our business and marketing strategies, anticipated financial performance or business prospects in future periods, including with respect to our planned cost savings initiative, expected technological and product developments, the expected content of and timing for scheduled new product introductions or our expectations concerning the future acceptance of products by customers, the content and timing of planned entertainment releases including motion pictures, television and digital products; and marketing and promotional efforts, research and development activities, liquidity, and

10

Table of Contents

similar matters. Forward-looking statements are inherently subject to risks and uncertainties. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. These statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,” “could,” “expect,” “intend,” “looking forward,” “may,” “planned,” “potential,” “should,” “will” and “would” or any variations of words with similar meanings. We note that a variety of factors could cause our actual results and experience to differ materially from the anticipated results or other expectations expressed or anticipated in our forward-looking statements. The factors listed below are illustrative and other risks and uncertainties may arise as are or may be detailed from time to time in our public announcements and our filings with the Securities and Exchange Commission, such as on Forms 8-K, 10-Q and 10-K. We undertake no obligation to make any revisions to the forward-looking statements contained in this Annual Report on Form 10-K or in our annual report to shareholders to reflect events or circumstances occurring after the date of the filing of this report. Unless otherwise specifically indicated, all dollar or share amounts herein are expressed in millions of dollars or shares, except for per share amounts.

We are focusing our global efforts around our brand architecture, which includes a heightened emphasis and reliance on our franchise and key partner brands, and development of those brands across the brand blueprint.

We have made a strategic decision to focus on fewer, larger global brands as we build our business. We are moving away from SKU making behaviors, which involve building a large number of products across many brands, towards global brand building with an emphasis on developing our franchise and key partner brands, which we view as having the largest global potential. As we concentrate our efforts on a more select group of brands, our future success depends to a greater extent on our ability to successfully develop those brands across our brand blueprint and to maintain and extend the reach and relevance of those brands to global consumers in a wide array of markets. This strategy has required us to build and develop competencies in new areas, including storytelling, digital content and consumer products. Developing and growing these competencies has required significant effort, time and money. Our future success is dependent on our ability to continue building our brands across the blueprint.

In 2015 revenues from our seven franchise brands, LITTLEST PET SHOP, MAGIC: THE GATHERING, MONOPOLY, NERF, MY LITTLE PONY, PLAY-DOH and TRANSFORMERS, totaled 52% of our aggregate net revenues. Our key partner brands, including DISNEY, MARVEL and LUCASFILM, also constitute a significant portion of our overall business. In 2015, net revenues from our partner brands constituted 28% of our aggregate net revenues. Together our franchise and partner brands are critical to our business. If we are unable to successfully execute this strategy and to maintain and develop our franchise and key partner brands in the future, such that our product offerings based on these brands are not sought after by consumers to the extent required to maintain and grow those brands, our revenues and profits will decline and our business performance will be harmed. In addition to continuing to grow and develop our existing franchise brands, successfully executing our brand strategy may also require us to be able to successfully develop other brands, such as current challenger brands, to franchise brand status. There is no guarantee that we will be able to do this.

Consumer interests change rapidly, making it difficult to design and develop products which will be popular with children and families.

The interests of children and families evolve extremely quickly and can change dramatically from year to year. To be successful we must correctly anticipate the types of entertainment content, products and play patterns which will capture children’s and families’ interests and imagination and quickly develop and introduce innovative products which can compete successfully for consumers’ limited time, attention and spending. This challenge is more difficult with the ever increasing utilization of technology and digital media in entertainment offerings, and the increasing breadth of entertainment available to consumers. Evolving consumer tastes and shifting interests, coupled with an ever changing and expanding pipeline of entertainment and consumer properties and products which compete for children’s and families’ interest and acceptance, create an environment in which some products can fail to achieve consumer acceptance, and other products can be popular

11

Table of Contents

during a certain period of time but then be rapidly replaced. As a result, individual children’s and family entertainment products and properties often have short consumer life cycles. If we devote time and resources to developing entertainment and products that consumers do not find interesting enough to buy in significant quantities to be profitable to us, our revenues and profits may decline and our business performance may be damaged. Similarly, if our product offerings and entertainment fail to correctly anticipate consumer interests our revenues and earnings will be reduced.

Additionally, our business is increasingly global and depends on interest in and acceptance of our children’s and family entertainment products and properties by consumers in diverse markets around the world with different tastes and preferences. As such, our success depends on our ability to successfully predict and adapt to changing consumer tastes and preferences in multiple markets and geographies and to design product and entertainment offerings that can achieve popularity globally over a broad and diverse consumer audience.

The challenge of continuously developing and offering products that are sought after by children is compounded by the sophistication of today’s children and the increasing array of technology and entertainment offerings available to them.

Children are increasingly utilizing electronic offerings such as tablet devices and mobile phones and they are expanding their interests to a wider array of innovative, technology-driven entertainment products and digital and social media offerings at younger and younger ages. Our products compete with the offerings of consumer electronics companies, digital media and social media companies. To meet this challenge we, and our competitors, are designing and marketing products which incorporate increasing technology, seek to integrate digital and analog play, and aim to capitalize on new play patterns and increased consumption of digital and social media.

With the increasing array of competitive entertainment offerings, there is no guarantee that:

| • | Any of our brands, products or product lines will achieve popularity or continue to be popular; |

| • | Any property for which we have a significant license will achieve or sustain popularity; |

| • | Any new products or product lines we introduce will be considered interesting to consumers and achieve an adequate market acceptance; or |

| • | Any product’s life cycle or sales quantities will be sufficient to permit us to profitably recover our development, manufacturing, marketing, royalties (including royalty advances and guarantees) and other costs of producing, marketing and selling the product. |

Entertainment is an increasingly important success factor for our brand awareness, storytelling and brand building.

Entertainment media, in forms such as television, motion pictures, digital products, digital shorts, DVD releases and other media, have become increasingly important platforms for consumers to experience our brands and our partners’ brands and the success, or lack of success, of such media efforts can significantly impact the demand for our products and our financial success. We spend considerable resources in designing and developing products in conjunction with planned media releases, both by our partners and our own media releases. Not only our efforts, but the efforts of third parties, heavily impact the timing of media development, release dates and the ultimate consumer interest in and success of these media efforts.

For 2016 we are developing and marketing significant product lines tied to the scheduled motion picture releases by key partners of CAPTAIN AMERICA: CIVIL WAR, MOANA, ROGUE ONE: A STAR WARS STORY and TROLLS. Those motion pictures are all being developed and released by our partners and our partners control the content and schedule for such motion pictures. Other key partner product lines we are offering, such as YOKAI-WATCH, depend on television support by our partners for their successes. Similarly, we are developing and marketing products for entertainment we play a more active role in developing or develop ourselves. If those motion pictures, television shows, or any other key entertainment content for which we develop and market products are not as successful as we and our partners anticipate, our revenues and earnings will be reduced.

12

Table of Contents

The ultimate timing and success of such projects is critically dependent on the efforts and schedules of our licensors, and studio and media partners. We do not fully control when or if any particular motion picture projects will be greenlit, developed or released, and our licensors or media partners may change their plans with respect to projects and release dates or cancel development all together. This can make it difficult for us to get feature films developed, plan future entertainment slates and to successfully develop and market products in conjunction with future motion picture and other media releases, given the lengthy lead times involved in product development and successful marketing efforts.

When we say that products or brands will be supported by certain media releases, those statements are based on our current plans and expectations. Unforeseen factors may increase the cost of these releases, delay these media releases or even lead to their cancellation. Any delay or cancellation of planned product development work, introductions, or media support may decrease the number of products we sell and harm our business.

Lack of sufficient consumer interest in entertainment media for which we offer products can harm our business.

Motion pictures, television, digital products or other media for which we develop products may not be as popular with consumers as we anticipated. While it is difficult to anticipate what products may be sought after by consumers, it can be even more difficult to properly predict the popularity of media efforts and properties given the broad array of competing offerings. If our and our partners’ media efforts fail to garner sufficient consumer interest and acceptance, our revenues and the financial return from such efforts will be harmed.

Discovery Family Channel, our cable television joint venture with Discovery Communications, Inc. in the United States, competes with a number of other children’s television networks for viewers, advertising revenue and distribution fees. There is no guarantee that Discovery Family Channel will be successful. Similarly, Hasbro Studios’ programming distributed internationally and Backflip Studios’ digital products compete with content from many other parties. Lack of consumer interest in and acceptance of content developed by Hasbro Studios and Backflip Studios, or other content appearing on Discovery Family Channel, and products related to that content, could significantly harm our business. Similarly, our business could be harmed by greater than expected costs, or unexpected delays or difficulties, associated with our investment in Discovery Family Channel, such as difficulties in increasing subscribers to the network or in building advertising revenues for Discovery Family Channel. During 2015 we spent $42.5 million for television programming and film projects being developed by Hasbro Studios and we anticipate that we will continue spending at comparable levels in 2016 and future years.

At December 27, 2015, $242.9 million, or 5.1%, of our total assets, represented our investment in Discovery Family Channel. If Discovery Family Channel does not achieve success, or if there are subsequent declines in the success or profitability of the channel, then our investment may become impaired, which could result in a write-down through net earnings.

The children’s and family entertainment industry and consumer products industry are highly competitive and the barriers to entry are low. If we are unable to compete effectively with existing or new competitors or with our retailers’ private label toy products our revenues, market share and profitability could decline.

The children’s and family entertainment industry and the consumer products industry are, and will continue to be, highly competitive. We compete in the United States and internationally with a wide array of large and small manufacturers, marketers, and sellers of analog toys and games, digital gaming products, digital media, products which combine analog and digital play, and other entertainment and consumer products, as well as with retailers who offer such products under their own private labels. In addition, we compete with other companies who are focused on building their brands across multiple product and consumer categories. Across our business, we face competitors who are constantly monitoring and attempting to anticipate consumer tastes and trends, seeking ideas which will appeal to consumers and introducing new products that compete with our products for consumer acceptance and purchase.

In addition to existing competitors, the barriers to entry for new participants in the children’s and family entertainment industry and in the consumer products industry are low, and the increasing importance of digital

13

Table of Contents

media, and the heightened connection between digital media and consumer interest, has further increased the ability for new participants to enter our markets, and has broadened the array of companies we compete with. New participants with a popular product idea or entertainment property can gain access to consumers and become a significant source of competition for our products in a very short period of time. These existing and new competitors may be able to respond more rapidly than us to changes in consumer preferences. Our competitors’ products may achieve greater market acceptance than our products and potentially reduce demand for our products, lower our revenues and lower our profitability.

In recent years, retailers have also developed their own private-label products that directly compete with the products of traditional manufacturers and brand owners. Some retail chains that are our customers sell private-label children’s and family entertainment products designed, manufactured and branded by the retailers themselves. These products may be sold at prices lower than our prices for comparable products, which may result in lower purchases of our products by these retailers and may reduce our market share.

An inability to develop and introduce planned products, product lines and new brands in a timely and cost-effective manner may damage our business.

In developing products, product lines and new brands we have anticipated dates for the associated product and brand introductions. When we state that we will introduce, or anticipate introducing, a particular product, product line or brand at a certain time in the future those expectations are based on completing the associated development, implementation, and marketing work in accordance with our currently anticipated development schedule. There is no guarantee that we will be able to manufacture, source and ship new or continuing products in a timely manner and on a cost-effective basis to meet constantly changing consumer demands. This risk is heightened by our customers’ compressed shipping schedules and the seasonality of our business. The risk is also exacerbated by the increasing sophistication of many of the products we are designing, and brands we are developing in terms of combining digital and analog technologies, utilizing digital media to a greater degree, and providing greater innovation and product differentiation. Unforeseen delays or difficulties in the development process, significant increases in the planned cost of development, or changes in anticipated consumer demand for our products and new brands may cause the introduction date for products to be later than anticipated or, in some situations, may cause a product or new brand introduction to be discontinued.

Changes in foreign currency exchange rates can significantly impact our reported financial performance.

Our global operations mean we produce and buy products, and sell products, in many different jurisdictions with many different currencies. As a result, if the exchange rate between the United States dollar and a local currency for an international market in which we have significant sales or operations changes, our financial results as reported in U.S. dollars, may be meaningfully impacted even if our business in the local currency is not significantly affected. As an example, if the dollar appreciates 10% relative to a local currency for an international market in which we had $200 million of net revenues, the dollar value of those sales, as they are translated into U.S. dollars, would decrease by $20 million in our consolidated financial results. As such, we would recognize a $20 million decrease in our net revenues, even if the actual level of sales in the foreign market had not changed. Similarly, our expenses can be significantly impacted, in U.S. dollar terms, by exchange rates, meaning the profitability of our business in U.S. dollar terms can be negatively impacted by exchange rate movements which we do not control. Late in 2014 and throughout 2015, certain key currencies, such as the Euro, Russian Ruble, and Brazilian Real depreciated significantly compared to the U.S. dollar. This depreciation had a significant negative impact on our 2014 and 2015 revenues and earnings. Similar depreciation in key currencies during 2016 may have a significant negative impact on our revenues and earnings as they are reported in U.S. dollars.

Global and regional economic downturns that negatively impact the retail and credit markets, or that otherwise damage the financial health of our retail customers and consumers, can harm our business and financial performance.

We design, manufacture and market a wide variety of entertainment and consumer products worldwide through sales to our retail customers and directly to consumers. Our financial performance is impacted by the

14

Table of Contents

level of discretionary consumer spending in the markets in which we operate. Recessions, credit crises and other economic downturns, or disruptions in credit markets, in the United States and in other markets in which our products are marketed and sold can result in lower levels of economic activity, lower employment levels, less consumer disposable income, and lower consumer confidence. Similarly, reductions in the value of key assets held by consumers, such as their homes or stock market investments, can lower consumer confidence and consumer spending power. Any of these factors can reduce the amount which consumers spend on the purchase of our products. This in turn can reduce our revenues and harm our financial performance and profitability.

In addition to experiencing potentially lower revenues from our products during times of economic difficulty, in an effort to maintain sales during such times we may need to reduce the price of our products, increase our promotional spending and/or sales allowances, or take other steps to encourage retailer and consumer purchase of our products. Those steps may lower our net revenues or increase our costs, thereby decreasing our operating margins and lowering our profitability.

Challenging market conditions in certain developed economies, such as in Australia and certain Western European countries, make it more difficult for us to succeed.

Our future success in developed economies is impacted by market conditions. For example, a European sovereign debt crisis or other significant negative shock to European markets could lead to a recession in Europe, which may negatively impact consumers and in turn, sales of our products in the European markets. Similar negative events impacting the market in the United States and other developed economies may harm our business.

Many categories within the toy, game and family entertainment industries in certain developed economies, such as Australia and certain Western European countries, have not grown, or in some cases have even declined, in certain recent years. In addition, many current economic predictions suggest developed economies may grow only modestly, if at all, in the next several years. We have substantial business in developed economies, and these markets represent a majority of our current product sales. It is more difficult for us to grow, or even maintain, our business when the overall market in certain of the major countries we serve is not growing or is declining. To succeed in a market that is stable or declining, we must maintain or gain market share from our competitors, which is more difficult than growing in an expanding market. As long as economic conditions in the developed economies remain difficult, this will be an additional challenge for the Company.

An increasing portion of our business is expected to come from emerging markets, and growing business in emerging markets presents additional challenges.

We expect an increasing portion of our net revenues to come from emerging markets in the future, including Eastern Europe, Latin America and Asia. In 2015 revenues in emerging markets constituted approximately 14% of our net revenues, up from only 6% of our net revenues in 2010. Over time, we expect our emerging market net revenues to continue to grow both in absolute terms and as a percentage of our overall business as one of our key business strategies is to increase our presence in emerging and underserved international markets. Operating in an increasing number of markets, each with its own unique consumer preferences and business climates, presents additional challenges that we must meet. In addition to the need to successfully anticipate and serve different global consumer preferences and interests, sales and operations in emerging markets that we have entered, may enter, or may increase our presence in, are subject to other risks associated with international operations, including:

| • | Complications in complying with different laws in varying jurisdictions and in dealing with changes in governmental policies and the evolution of laws and regulations that impact our product offerings and related enforcement; |

| • | Potential challenges to our transfer pricing determinations and other aspects of our cross border transactions; |

| • | Difficulties understanding the retail climate, consumer trends, local customs and competitive conditions in foreign markets which may be quite different from the United States; |

15

Table of Contents

| • | Difficulties in moving materials and products from one country to another, including port congestion, strikes and other transportation delays and interruptions; and |

| • | The imposition of tariffs, quotas, or other protectionist measures. |

Because of the importance of our emerging market net revenues, our financial condition and results of operations could be harmed if any of the risks described above were to occur or if we are otherwise unsuccessful in managing our emerging market business.

Our business depends in large part on the success of our key partner brands and on our ability to maintain and extend solid relationships with our key partners.

As part of our strategy, in addition to developing and marketing products based on properties we own or control, we also seek to obtain licenses enabling us to develop and market products based on popular entertainment properties owned by third parties.

We currently have in-licenses to several successful entertainment properties, including MARVEL and STAR WARS, each owned by Disney. These licenses typically have multi-year terms and provide us with the right to market and sell designated classes of products. In recent years our sales of products under the MARVEL and STAR WARS licenses have been highly significant to our business. If we fail to meet our contractual commitments and/or any of these licenses were to terminate and not be renewed, or the popularity of any of these licensed properties was to significantly decline, our business would be damaged and we would need to successfully develop and market other products to replace the products previously offered under license. Beginning in 2016, our product offerings under licenses with Disney will expand to include product offerings based on the DISNEY PRINCESS and FROZEN brands.

Our license to the MARVEL property is granted from Marvel Entertainment, LLC and Marvel Characters B.V. (together “Marvel”). Our license to the STAR WARS property is granted by Lucas Licensing Ltd. and Lucasfilm Ltd. (together “Lucas”). Both Marvel and Lucas are owned by The Walt Disney Company.

Our business is seasonal and therefore our annual operating results will depend, in large part, on our sales during the relatively brief holiday shopping season. This seasonality is exacerbated by retailers’ quick response inventory management techniques.

Sales of our toys, games and other family entertainment products at retail are extremely seasonal, with a majority of retail sales occurring during the period from September through December in anticipation of the holiday season. This seasonality has increased over time, as retailers become more efficient in their control of inventory levels through quick response inventory management techniques. Customers are timing their orders so that they are being filled by suppliers, such as us, closer to the time of purchase by consumers. For toys, games and other family entertainment products which we produce, a majority of retail sales for the entire year generally occur in the fourth quarter, close to the holiday season. As a consequence, the majority of our sales to our customers occur in the period from September through December, as our customers do not want to maintain large on-hand inventories throughout the year ahead of consumer demand. While these techniques reduce a retailer’s investment in inventory, they increase pressure on suppliers like us to fill orders promptly and thereby shift a significant portion of inventory risk and carrying costs to the supplier.

The level of inventory carried by retailers may also reduce or delay retail sales resulting in lower revenues for us. If we or our customers determine that one of our products is more popular at retail than was originally anticipated, we may not have sufficient time to produce and ship enough additional products to fully meet consumer demand. Additionally, the logistics of supplying more and more product within shorter time periods increases the risk that we will fail to achieve tight and compressed shipping schedules, which also may reduce our sales and harm our financial performance. This seasonal pattern requires significant use of working capital, mainly to manufacture or acquire inventory during the portion of the year prior to the holiday season, and requires accurate forecasting of demand for products during the holiday season in order to avoid losing potential sales of popular products or producing excess inventory of products that are less popular with consumers. Our

16

Table of Contents

failure to accurately predict and respond to consumer demand, resulting in our under producing popular items and/or overproducing less popular items, would reduce our total sales and harm our results of operations. In addition, as a result of the seasonal nature of our business, we would be significantly and adversely affected, in a manner disproportionate to the impact on a company with sales spread more evenly throughout the year, by unforeseen events such as a terrorist attack or economic shock that harm the retail environment or consumer buying patterns during our key selling season, or by events such as strikes or port delays that interfere with the shipment of goods, particularly from the Far East, during the critical months leading up to the holiday shopping season.

The concentration of our retail customer base means that economic difficulties or changes in the purchasing or promotional policies or patterns of our major customers could have a significant impact on us.