Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under §240.14a-12 | |||

HARTE-HANKS, INC. | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ¨ | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Table of Contents

HARTE-HANKS, INC.

9601 McAllister Freeway, Suite 610

San Antonio, Texas 78216

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 23, 2012

As a stockholder of Harte-Hanks, Inc., a Delaware corporation, you are hereby given notice of, and invited to attend in person or by proxy, Harte-Hanks’ 2012 annual meeting of stockholders. The annual meeting will be held at the DoubleTree Hotel, 37 N.E. Loop 410, San Antonio, Texas 78216, on Wednesday, May 23, 2012, at 8:30 a.m. Central Time, for the following purposes:

| 1. | To elect two Class I directors, each for a three-year term; |

| 2. | To ratify the appointment of KPMG LLP as Harte-Hanks’ independent registered public accounting firm for fiscal 2012; and |

| 3. | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

The Board of Directors has fixed the close of business on March 30, 2012 as the record date for determining stockholders entitled to notice of and to vote at the annual meeting and any adjournment or postponement thereof.

Please note that we are requiring a form of personal identification and, for beneficial owners, appropriate proof of ownership of our common stock to attend the annual meeting. For more information, please refer to the enclosed proxy statement.

Pursuant to rules promulgated by the Securities and Exchange Commission (SEC), we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the online availability of our proxy materials. The enclosed proxy statement and our Form 10-K for the year ended December 31, 2011 (which we are distributing in lieu of a separate annual report to stockholders) are available on our website at www.harte-hanks.com, under the heading “About Us” in the section for “Investors.” Additionally, and in accordance with SEC rules, you may access our proxy statement and Form 10-K at www.proxyease.com/hhs/2012, which does not have “cookies” that identify visitors to the site.

Most stockholders have a choice of submitting a proxy (1) online, (2) by telephone, or (3) by mail using a traditional proxy card. Please refer to the proxy card or other voting instructions included with these proxy materials for information on the voting methods available to you.

Your vote is important. We urge you to review the accompanying materials carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

Thank you for your continued interest and support.

| By Order of the Board of Directors, |

|

| Robert L. R. Munden |

| Senior Vice President, General Counsel & Secretary |

San Antonio, Texas

April 13, 2012

Table of Contents

PROXY STATEMENT TABLE OF CONTENTS

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| Communications with Non-Management Directors and Other Board Communications |

12 | |||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| Principal Factors That Influenced 2011 Executive Compensation |

20 | |||

| 21 | ||||

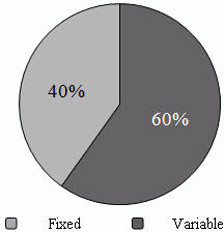

| Setting the Pay Mix – Cash Versus Equity; At-Risk Versus Fixed |

21 | |||

| 22 | ||||

| 23 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| Review of and Conclusion Regarding All Components of Executive Compensation |

30 | |||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 38 |

i

Table of Contents

| 39 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| AUDIT COMMITTEE AND INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

45 | |||

| 45 | ||||

| 46 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| PROPOSAL II – RATIFICATION OF THE APPOINTMENT OF INDEPENDENT AUDITORS |

47 | |||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 48 |

ii

Table of Contents

HARTE-HANKS, INC.

9601 McAllister Freeway, Suite 610

San Antonio, Texas 78216

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 23, 2012

This proxy statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors (the Board) of Harte-Hanks, Inc. for use at our 2012 annual meeting. In this proxy statement, references to “Harte-Hanks,” the “company,” “we,” “us,” “our” and similar expressions refer to Harte-Hanks, Inc., unless the context of a particular reference provides otherwise. We refer to various websites in this proxy statement. Neither the Harte-Hanks website nor any other website included in this proxy statement is intended to function as a hyperlink, and the information contained on such websites is not a part of this proxy statement.

2012 Annual Meeting Date and Location

Our 2012 annual meeting of stockholders will be held on Wednesday, May 23, 2012 at 8:30 a.m. (Central Time) at the DoubleTree Hotel, 37 N.E. Loop 410, San Antonio, Texas 78216, or at such other time and place to which the meeting may be adjourned or postponed. References in this proxy statement to the annual meeting also refer to any adjournments, postponements or changes in location of the meeting, to the extent applicable.

Mailing Date

The approximate date on which this proxy statement and accompanying proxy are first being sent or given to stockholders is April 13, 2012.

Important Notice Regarding Availability of Proxy Materials For Annual Meeting To Be Held On May 23, 2012

Pursuant to rules promulgated by the Securities and Exchange Commission (SEC), we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of our proxy materials online. This proxy statement and our Form 10-K for the year ended December 31, 2011 (which we are distributing in lieu of a separate annual report to stockholders) are available on our website at www.harte-hanks.com, under the heading “About Us” in the section for “Investors.” Additionally, and in accordance with SEC rules, you may access our proxy statement and Form 10-K at www.proxyease.com/hhs/2012, which does not have “cookies” that identify visitors to the site.

Stockholders Sharing an Address

Registered Stockholders — Each registered stockholder (you own shares in your own name on the books of our transfer agent, Computershare Trust Company, N.A.) will receive one copy of each of our proxy statement and annual report on Form 10-K per account even if at the same address.

Street-name Stockholders — Most banks and brokers are delivering only one copy of each of our proxy statement and annual report on Form 10-K to consenting street-name stockholders (you own shares beneficially in the name of a bank, broker or other holder of record on the books of our transfer agent) who share the same address. This procedure reduces our printing and distribution costs. Those who wish to receive separate copies may do so by contacting their bank, broker or other nominee, or (if offered) by checking the appropriate box on the voting instruction card sent to them. Similarly, most street-name stockholders who are receiving multiple copies of our proxy statement and annual report on Form 10-K at a single address may request that only a single set of materials be sent to them in the future by checking the appropriate box on the voting instruction card sent to them or by contacting their bank, broker or other nominee.

Electronic Delivery Option

Instead of receiving future copies of these materials by mail, street-name stockholders may have the opportunity to receive copies of the proxy materials electronically. Opting to receive your proxy materials online will save us the cost of producing and mailing documents to your home or business. Please check the information provided in the proxy materials mailed to you by your bank or broker or contact your bank or broker regarding the availability of this service. In addition, the notice of annual meeting, proxy statement and annual report on Form 10-K are available on our website at www.harte-hanks.com under the heading “About Us” in the section for “Investors.”

1

Table of Contents

Stockholders Entitled to Vote

The record date for determining the common stockholders entitled to notice of and to vote at the meeting and any adjournment or postponement thereof was the close of business on March 30, 2012, at which time we had issued and outstanding 63,606,913 shares of common stock, which were held by approximately 2,225 holders of record. Please refer to “Security Ownership of Management and Principal Stockholders” for information about common stock beneficially owned by our directors, executive officers and principal stockholders as of the date indicated in such section. Record date stockholders are entitled to one vote for each share of common stock owned as of the record date. For a period of at least ten days prior to the annual meeting, a complete list of stockholders entitled to vote at the annual meeting will be open to the examination of any stockholder for any purpose germane to the meeting, during ordinary business hours at our corporate headquarters located at 9601 McAllister Freeway, Suite 610, San Antonio, Texas 78216.

Voting of Proxies By Management Proxy Holders

The Board has appointed Mr. Doug Shepard, our Executive Vice President and Chief Financial Officer, and Ms. Jessica Huff, our Vice President – Finance, Controller and Chief Accounting Officer, as the management proxy holders for the annual meeting. Your shares will be voted in accordance with the instructions on the proxy card you submit by mail, or the instructions provided for any proxy submitted by telephone or online, as applicable. For stockholders who have their shares voted by duly submitting a proxy online, by mail or telephone, the management proxy holders will vote all shares represented by such valid proxies reflecting the Board’s recommendations, unless a stockholder appropriately specifies otherwise:

| • | Proposal I (Election of Directors) — FOR the election of each of the persons named under “Proposal I—Election of Directors” as nominees for election as Class I directors; and |

| • | Proposal II (Ratification of the Appointment of Independent Auditors) — FOR the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm (independent auditors) for fiscal 2012. |

As of the date of printing this proxy statement, the Board is not aware of any other business or nominee to be presented or voted upon at the annual meeting. Should any other matter requiring a vote of stockholders properly arise, the proxies in the enclosed form confer upon the person or persons entitled to vote the shares represented by such proxies discretionary authority to vote the same in accordance with their best judgment in the interest of the company. Where a stockholder has appropriately specified how a proxy is to be voted, it will be voted by the management proxy holders in accordance with the specification.

Quorum; Required Votes

The presence at the meeting, in person or by proxy, of the stockholders entitled to cast at least a majority of the votes that all common stockholders are entitled to cast is necessary to constitute a quorum for the transaction of business at the annual meeting. Each vote represented at the meeting in person or by proxy will be counted toward a quorum. Abstentions and broker “non-votes” (which are described below) are counted as present at the annual meeting for purposes of determining whether a quorum is present. If a quorum is not present, the meeting may be adjourned or postponed from time to time until a quorum is obtained.

Under the current rules of the New York Stock Exchange (NYSE), brokers holding shares of record for a customer have the discretionary authority to vote on some matters if the brokers do not receive timely instructions from the customer regarding how the customer wants the shares voted. There are also non-discretionary matters for which brokers do not have discretionary authority to vote, even if they do not receive timely instructions from the customer. When a broker does not have discretion to vote on a particular matter and the customer has not given timely instructions on how the broker should vote, a “broker non-vote” results. Although any broker non-vote would be counted as present at the meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters. Brokers will not have discretionary authority in the absence of timely instructions from their customers for proposal I, but brokers will have discretionary authority in the absence of timely instructions from their customers for proposal II.

| • | Proposal I (Election of Directors) — To be elected, each nominee for election as a Class I director must receive the affirmative vote of a plurality of the votes cast at the annual meeting, in person or by proxy. This means that director nominees with the most votes are elected. Votes may be cast in favor of or withheld from the election of each nominee. Votes that are withheld from a director’s election will be counted toward a quorum, but will not affect the outcome of the vote on the election of such director. |

| • | Proposal II (Ratification of the Appointment of Independent Auditors) — Ratification of the appointment of KPMG LLP as our independent auditors for fiscal 2012 requires the affirmative vote of the majority of the votes cast at the annual meeting, in person or by proxy. Abstentions may be specified on this proposal and will have the same effect as a vote against this proposal. Broker non-votes are not deemed to be votes cast and, therefore, will not affect the outcome. |

2

Table of Contents

Submission of proposal II for ratification by the stockholders is not legally required. However, the Board and its Audit Committee believe that such submission is an opportunity for stockholders to provide feedback to the Board and its Audit Committee on an important issue of corporate governance. If the stockholders do not ratify the selection of KPMG LLP, the Audit Committee will reconsider the selection of such firm as independent auditors, although the results of the vote are not binding on the Audit Committee. The Audit Committee has the sole authority and responsibility to retain, evaluate, and, where appropriate, replace the independent auditors. Ratification by the stockholders of the appointment of KPMG LLP does not limit the authority of the Audit Committee to direct the appointment of new independent auditors at any time during the year or thereafter.

Voting Procedures

Registered Stockholders — Registered stockholders may vote their shares or submit a proxy to have their shares voted by one of the following methods:

| • | By Mail. You may submit a proxy by signing, dating and returning your proxy card in the enclosed pre-addressed envelope. |

| • | By Telephone. You may submit a proxy by telephone using the toll-free number listed on the proxy card. Please have your proxy card in hand when you call. Telephone voting facilities will close and no longer be available on the date and time specified on the proxy card. |

| • | Online. You may submit a proxy online using the website listed on the proxy card. Please have your proxy card in hand when you log onto the website. Online voting facilities will close and no longer be available on the date and time specified on the proxy card. |

| • | In Person. You may vote in person at the annual meeting by completing a ballot; however, attending the meeting without completing a ballot will not count as a vote. |

Street-name Stockholders — Street-name stockholders may generally vote their shares or submit a proxy to have their shares voted by one of the following methods:

| • | By Mail. You may submit a proxy by signing, dating and returning your proxy card in the enclosed pre-addressed envelope. |

| • | By Methods Listed on Proxy Card. Please refer to your proxy card or other information forwarded by your bank, broker or other holder of record to determine whether you may submit a proxy by telephone or online, following the instructions on the proxy card or other information provided by the record holder. |

| • | In Person with a Proxy from the Record Holder. A street-name stockholder who wishes to vote in person at the meeting will need to obtain a legal proxy from their bank, broker or other nominee. Please consult the voting form or other information sent to you by your bank, broker or other nominee to determine how to obtain a legal proxy in order to vote in person at the annual meeting. |

Revoking Your Proxy

If you are a registered stockholder, you may revoke your proxy at any time before the shares are voted at the annual meeting by:

| • | timely delivery of a valid, later-dated executed proxy card; |

| • | timely submitting a proxy with new voting instructions using the telephone or online voting system; |

| • | voting in person at the meeting by completing a ballot; however, attending the meeting without completing a ballot will not revoke any previously submitted proxy; or |

| • | filing an instrument of revocation received by the Secretary of Harte-Hanks, Inc. at 9601 McAllister Freeway, Suite 610, San Antonio, Texas 78216, by 5:00 p.m., Central Time, on Monday, May 22, 2012. |

If you are a street-name stockholder and you vote by proxy, you may change your vote by submitting new voting instructions to your bank, broker or nominee in accordance with that entity’s procedures.

If you wish to attend the annual meeting in person, you must present a form of personal identification. If you are a beneficial owner of Harte-Hanks common stock that is held of record by a bank, broker or other nominee, you will also need proof of ownership to be admitted to the meeting. A recent brokerage statement or a letter from your bank or broker are examples of proof of ownership. No cameras, recording equipment, large bags, briefcases or packages will be permitted in the meeting.

3

Table of Contents

We will bear all costs incurred in the solicitation of proxies by our Board. In addition to solicitation by mail, our directors, officers and employees may solicit proxies personally or by telephone, e-mail, facsimile or other means, without additional compensation. We may also make arrangements with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation materials to the beneficial owners of shares of common stock held by such persons, and we may reimburse these brokerage houses and other custodians, nominees and fiduciaries for reasonable expenses incurred in connection therewith.

A copy of our annual report on Form 10-K for the year ended December 31, 2011, including the financial statements and the financial statement schedules, if any, but not including exhibits, accompanies this proxy statement and will also be furnished at no charge to each person to whom a proxy statement is delivered upon the written request of such person addressed to Harte-Hanks, Inc., Attn: Secretary, 9601 McAllister Freeway, Suite 610, San Antonio, Texas 78216. Our Form 10-K and the exhibits filed with it are also available on our website, www.harte-hanks.com under the heading “About Us” in the section for “Investors.” Our Form 10-K and the exhibits filed with it do not constitute a part of the proxy solicitation material.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 and related rules of the SEC require our directors and officers, and persons who own more than 10% of a registered class of our equity securities, to file initial reports of ownership and reports of changes in ownership with the SEC. These persons are required by SEC regulations to furnish us with copies of all Section 16(a) reports that they file. As with many public companies, we provide assistance to our directors and executive officers in making their Section 16(a) filings pursuant to powers of attorney granted by our insiders. To our knowledge, based solely on our review of the copies of Section 16(a) reports received by us with respect to fiscal 2011, including those reports that we have filed on behalf of our directors and executive officers pursuant to powers of attorney, or written representations from certain reporting persons, we believe that all filing requirements applicable to our directors, officers and persons who own more than 10% of a registered class of our equity securities have been satisfied, except that:

| • | Karen Puckett’s Form 4 filings reflecting her annual director stock grants of February 5, 2010 and February 5, 2011 were improperly coded and thus indicated that CenturyLink, Inc. (Ms. Puckett’s employer) was the recipient and reporting person. Corrective filings were made December 30, 2011. |

| • | Christopher Harte failed to timely report a December 31, 2010, transaction involving a partnership through which he has indirect beneficial ownership of Harte-Hanks common stock. This transaction was reported March 24, 2011. |

4

Table of Contents

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information about our current directors and executive officers:

| Name |

Age |

Position | ||

| David L. Copeland |

56 | Director (Class I) | ||

| William F. Farley |

68 | Director (Class II) | ||

| Larry D. Franklin |

69 | Director (Class II); Chairman, President and Chief Executive Officer | ||

| William K. Gayden |

70 | Director (Class II) | ||

| Christopher M. Harte |

64 | Director (Class I); Lead Director | ||

| Houston H. Harte |

85 | Director Nominee (Class III); Vice Chairman | ||

| Judy C. Odom |

59 | Director Nominee (Class III) | ||

| Karen A. Puckett |

51 | Director Nominee (Class III) | ||

| Douglas C. Shepard |

44 | Executive Vice President and Chief Financial Officer | ||

| Gary J. Skidmore |

57 | Executive Vice President and President, Direct Marketing | ||

| Robert L. R. Munden |

43 | Senior Vice President, General Counsel & Secretary | ||

| Michael P. Paulsin |

49 | Senior Vice President and President, Shoppers | ||

| Jessica M. Huff |

51 | Vice President – Finance, Controller and Chief Accounting Officer |

Class I directors are to be elected at our 2012 annual meeting. Messrs. David L. Copeland and Christopher M. Harte are nominees for election as Class I directors. The term of Class II directors expires at the 2013 annual meeting of stockholders, and the term of Class III directors expires at the 2014 annual meeting of stockholders.

David L. Copeland has served as a director of Harte-Hanks since 1996. He has been employed by SIPCO, Inc., the management and investment company for the Andrew B. Shelton family, since 1980, and currently serves as its president. Since 1998, he has served as a director of First Financial Bankshares, Inc., a financial holding company. Currently, he serves on the executive and nominating committees and is also the audit committee chairman of First Financial Bankshares.

We believe that Mr. Copeland’s qualifications for our board include his experience serving on various committees for a publicly traded financial holding company. We also believe he offers us extensive knowledge of financial instruments, financial and economic trends and accounting expertise from serving as president of SIPCO, Inc. and on the audit committee of First Financial Bankshares. Mr. Copeland, a certified public accountant and a chartered financial analyst, qualifies as a financial expert on our audit committee.

William F. Farley has served as a director of Harte-Hanks since 2003. Currently, he is a principal with Livingston Capital, a private investment business he started in 2002. Since 2005, he has served on the board of trustees for Blue Cross Blue Shield of Minnesota and is a member of their human resources committee along with being the chair of the investment committee. He served as chairman and chief executive officer of Science, Inc., a medical device company, from 2000 to 2002. He also served as chairman and chief executive officer of Kinnard Investments, a financial services holding company, from 1997 to 2000. From 1990 to 1996, he served as vice chairman of U.S. Bancorp, a financial services holding company.

We believe that Mr. Farley’s qualifications for our board include his extensive leadership experience at various financial institutions serving in roles as chairman and chief executive officer. We believe he provides important perspectives on financial markets, complex securities and financial and economic trends, as well as a broad prospective on corporate governance and risk management issues facing businesses today. Mr. Farley qualifies as a financial expert on our audit committee.

Larry D. Franklin serves as our Chairman of the Board and, since January 2009, also serves as our President and Chief Executive Officer. Mr. Franklin joined Harte-Hanks in 1971, has been a director since 1974, and was previously our Chief Executive Officer from 1991 until 2002 and executive Chairman until the end of 2005. Mr. Franklin also has served in a variety of other management and leadership roles at Harte-Hanks, including as Chief Financial Officer and Chief Operating Officer. From 1994 to 2005, he was a director at John Wiley and Sons, a global publisher, serving on the governance committee and as audit committee chairman.

Mr. Franklin’s qualifications for our board include his demonstrated leadership skills as our Chief Executive Officer and in his various other roles with Harte-Hanks, including as our former Chief Financial Officer and Chief Operating Officer. He is highly experienced in driving operational and financial performance at Harte-Hanks as both a private and public company in a number of economic market conditions.

William K. Gayden has served as a director of Harte-Hanks since 2001. He is chairman and chief executive officer of Merit Energy Company, a private firm specializing in direct investments in oil and gas producing properties, which he formed in 1989. From 1998 to 2004 he served as a director of Perot Systems Corporation, an international technology services provider. He spent twenty years at Electronic Data Systems holding many senior positions and was on the board of directors from 1972 to 1984.

5

Table of Contents

We believe that Mr. Gayden’s qualifications for our board include his extensive leadership and prior director experience of large complex organizations that experienced rapid growth both organically and from acquisitions. In addition, we believe that he provides an experienced entrepreneurial perspective having founded Merit Energy Company, and that his experience in senior leadership roles at companies with international operations can serve us well.

Christopher M. Harte has served as a director of Harte-Hanks since 1993, and is our current Lead Director. He is a private investor. He was chairman and subsequently publisher of the Minneapolis Star Tribune from March 2007 through September 2009. The Minneapolis Star Tribune entered bankruptcy in January 2009 and emerged from bankruptcy in September 2009. He had previously been president and publisher of Knight-Ridder newspapers in State College, Pennsylvania and Akron, Ohio, and later president of the newspaper in Portland, Maine. He serves as a director of Geokinetics, Inc., a provider of three-dimensional seismic acquisition services to U.S. and international oil and gas businesses. He was a director of Crown Resources Corporation from 2002 until its merger with Kinross Gold Corporation in 2006. Mr. Harte is the nephew of director Houston H. Harte.

We believe that Mr. Harte’s qualifications for our board include his extensive experience in managing, investing in and serving on the board of directors of a number of media companies in various segments of the media industry. Also, he offers the perspective of a seasoned board member having served on our board of directors when it was a private company and a public company.

Houston H. Harte has served as a director of Harte-Hanks since 1952 and served as Chairman of the Board from 1972 until May 1999. Since May 1999, Mr. Harte has served as Vice Chairman of the Board of Harte-Hanks. Mr. Harte is the uncle of director Christopher M. Harte.

We believe that Mr. Harte’s service on our board for over fifty-five years provides us with invaluable historical perspective and experience in various economic climates. In addition, he has witnessed our evolution from a newspaper holding company to a traditional media company and finally to our present targeted marketing operations, and thus brings valuable insights on industry transformations driven by technological change.

Judy C. Odom has served as a director of Harte-Hanks since 2003. Since November 2002, she has also served on the board of directors of Leggett & Platt, Incorporated, a diversified manufacturing company. She served on the board of Storage Technology Corporation, a provider of data storage hardware and software products and services, from November 2003 to August 2005. From 1985 until 2002, she held numerous positions, most recently chief executive officer and chairman of the board, at Software Spectrum, Inc., a global business to business software services company, which she co-founded in 1983. Prior to founding Software Spectrum, she was a partner with the international accounting firm, Grant Thornton.

We believe that Ms. Odom’s qualifications to serve on our board include her board service with several companies allowing her to offer a broad leadership perspective on strategic and operating issues facing companies today. Her experience co-founding Software Spectrum, growing it to a large public company before selling it to another public company and serving as board chair provides the insight and perspective of a successful entrepreneur and long-serving chief executive officer with international operating experience. As a partner in an international accounting firm she supervised audits of many companies in various industries.

Karen A. Puckett has served as a director of Harte-Hanks since 2009. Ms. Puckett is currently an executive vice president and chief operating officer with CenturyLink, Inc., and has served as CenturyLink’s chief operating officer since 2000. CenturyLink is a leading provider of communications, high-speed internet and entertainment services in small-to-mid-size cities through its broadband and fiber transport networks.

We believe that Ms. Puckett’s qualifications for our board include her perspective of an active chief operating officer based on her leadership experience at CenturyLink, Inc., the third largest local exchange telephone company operating in 37 states. In addition, she recently helped lead CenturyLink’s combination with Qwest Communications International, Inc. We believe her involvement in the transformation of CenturyLink gives her broad perspective on all aspects of growing businesses.

Douglas C. Shepard has served as our Executive Vice President and Chief Financial Officer since December 2007. From September 2006 to December 2007, he served as chief financial officer and treasurer of Highmark’s vision holding company, HVHC Inc. From November 2004 to December 2007, he served as the executive vice president, chief financial officer, treasurer and secretary of Eye Care Centers of America, Inc. (“ECCA”). From March 1997 to November 2004, he served as ECCA’s vice president of finance and controller. Mr. Shepard joined ECCA in March 1995. Prior to his employment with ECCA, Mr. Shepard served at a publicly traded restaurant company and at Deloitte & Touche, LLP.

Gary J. Skidmore has served as our Executive Vice President and President, Direct Marketing since August 2007, with responsibility for our entire Direct Marketing division. From January 2007 to August 2007, he served as Executive Vice President,

6

Table of Contents

Direct Marketing, where he had responsibility for a portion of our Direct Marketing business units. From 2000 to January 2007, he served as Senior Vice President, Direct Marketing. He previously served as our Vice President, Direct Marketing. He has been with Harte-Hanks since 1994.

Robert L. R. Munden joined the company in April 2010 as our Senior Vice President, General Counsel and Secretary. From April 2005 through March 2010, Mr. Munden served as vice president and corporate counsel of Safeguard Scientifics, Inc., a NYSE-listed company. From June 2002 through April 2005, he served as corporate counsel, North America for Taylor Nelson Sofres, a market research company (now a division of WPP PLC). From November 1999 through December 2001, Mr. Munden served as vice president, general counsel and secretary of Naviant, Inc., an internet marketing and database services firm. Prior to his employment with Naviant, Mr. Munden was an associate with the law firm Brobeck, Phleger & Harrison, and an armor and cavalry officer in the U.S. Army.

Michael P. Paulsin has served as our Senior Vice President and President, Shoppers since September 2011, with responsibility for our entire Shoppers division. From April 2007 to August 2011, he served as Vice President and President, California Shoppers. He previously served in a variety of financial and leadership positions with Shoppers beginning in 1988.

Jessica M. Huff has served as our Controller since 1996. In 1999, she was also named Chief Accounting Officer. In 2003, she was also named Vice President, Finance. Prior to joining Harte-Hanks, she was corporate manager of financial planning at SBC Communications. Ms. Huff also spent eight years with Ernst & Young and three years as controller and vice president of a financial institution.

7

Table of Contents

We believe that strong corporate governance helps to ensure that our company is managed for the long-term benefit of our stockholders. During the past year, we continued to review our corporate governance policies and practices, the applicable federal securities laws regarding corporate governance, and the corporate governance standards of the NYSE, the stock exchange on which our common stock is listed. This review is part of our continuing effort to enhance corporate governance at Harte-Hanks and to communicate our governance policies to stockholders and other interested parties.

You can access and print, free of charge, the charters of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee (“Governance Committee”), as well as our Corporate Governance Principles, Business Conduct Policy, Code of Ethics and certain other policies and procedures at our website at www.harte-hanks.com under the heading “About Us” in the section for “Corporate Governance.” Additionally, stockholders can request copies of any of these documents free of charge by writing to the following address:

Harte-Hanks, Inc.

9601 McAllister Freeway, Suite 610

San Antonio, Texas 78216

Attention: Secretary

From time to time, these governance documents may be revised in response to changing regulatory requirements, our evaluation of evolving best practices and industry norms and input from our stockholders and other interested parties. We encourage you to check our website periodically for the most recent versions.

Board of Directors and Board Committees

Our business is managed under the direction of our Board. The Board elects the Chief Executive Officer (“CEO”) and other corporate officers, acts as an advisor to and resource for management, and monitors management’s performance. The Board, with the assistance of the Compensation Committee, also assists in planning for the succession of the CEO and certain other key positions. In addition, the Board oversees the conduct of our business and strategic plans to evaluate whether the business is being properly managed, and reviews and approves our financial objectives and major corporate plans and actions. Through the Audit Committee, the Board reviews and approves significant changes in the appropriate auditing and accounting principles and practices, provides oversight of internal and external audit processes, financial reporting and internal controls.

The Board meets on a regularly scheduled basis to review significant developments affecting our company, to act on matters requiring approval by the Board and to otherwise fulfill its responsibilities. It also holds special meetings when an important matter requires action or review by the Board between regularly scheduled meetings. The Board met four times and acted by unanimous written consent three times during 2011. In 2011, each director participated in all Board meetings, as well as each meeting of a Board committee of which he or she was a member.

The Board has separately designated standing Audit, Compensation and Governance Committees. The following table provides Board and committee membership and meeting information for each of the Board’s standing committees:

| Director |

Independent (1) | Audit Committee | Compensation Committee |

Governance Committee | ||||

| David L. Copeland |

Yes | Chair (2) | ||||||

| William F. Farley |

Yes | Member (2) | Member | |||||

| Larry D. Franklin |

No | |||||||

| William K. Gayden |

Yes | Member | Member | |||||

| Christopher M. Harte |

Yes | Member | Chair | |||||

| Houston H. Harte |

No | |||||||

| Judy C. Odom |

Yes | Chair | Member | |||||

| Karen A. Puckett |

Yes | Member | ||||||

| Number of Meetings in 2011 |

8 | 4 | 3 | |||||

| Number of Written Consents in 2011 |

0 | 0 | 0 |

| (1) | The Board has determined that the director is independent as described under “Independence of Directors.” |

| (2) | The Board has determined that the director is an audit committee financial expert as described under “Audit Committee Financial Experts and Financial Literacy.” |

A brief description of the principal functions of each of the Board’s three standing committees follows. The Board retains the right to exercise the powers of any committee to the extent consistent with applicable rules and regulations, and may do so from time to time. For additional information, please refer to the committee charters that are available on our website at www.harte-hanks.com under the heading “About Us” in the section for “Corporate Governance.”

8

Table of Contents

| • | Audit Committee — The primary function of the Audit Committee is to assist the Board in fulfilling its oversight of (1) the integrity of our financial statements, including the financial reporting process and systems of internal controls regarding finance, accounting, and legal compliance, (2) the qualifications and independence of our independent auditors, (3) the performance of our internal audit function and independent auditors, and (4) our compliance with legal and regulatory requirements. |

| • | Compensation Committee — The primary functions of the Compensation Committee are to (1) review and approve corporate goals and objectives relevant to CEO compensation, evaluate the CEO’s performance in light of those goals and objectives, and together with the other independent directors (as directed by the Board), determine and approve the CEO’s compensation level based on this evaluation, (2) review and recommend to the Board (as directed by the Board) non-CEO officer compensation, incentive-compensation plans and equity-based plans, and (3) review and discuss with management the company’s “Compensation Discussion and Analysis” and produce a committee report on executive compensation as required by the SEC to be included in our annual proxy statement or annual report on Form 10-K filed with the SEC. |

| • | Governance Committee — The primary functions of the Corporate Governance Committee are to (1) develop, recommend to the Board, implement and maintain our company’s corporate governance principles and policies, (2) identify, screen and recruit, consistent with criteria approved by the Board, qualified individuals to become Board members, (3) recommend that the Board select the director nominees for the next annual meeting of stockholders, (4) assist the Board in determining the appropriate size, function, operation and composition of the Board and its committees, and (5) oversee the evaluation of the Board and management. |

The Governance Committee is responsible for managing the process for the nomination of new directors. The Governance Committee may identify potential candidates for first-time nomination as a director using a variety of sources—recommendations from current Board members, our management, stockholders or contacts in communities served by Harte-Hanks, or by conducting a formal search using an outside search firm selected and engaged by the Governance Committee.

Following the identification of a potential director nominee, the Governance Committee commences an inquiry to obtain sufficient information on the background of a potential new director nominee. Included in this inquiry is an initial review of the candidate with respect to whether the individual would be considered independent under NYSE and SEC rules and whether the individual would meet any additional requirements imposed by law or regulation on the members of the Audit and Compensation Committees of the Board. The Governance Committee evaluates candidates for director nominees in the context of the current composition of the Board, taking into account all factors it considers appropriate, including the characteristics of independence, diversity, age, skills, background and experience, financial acumen, availability of service to Harte-Hanks, tenure of incumbent directors on the Board and the Board’s anticipated needs. Candidates should also have the skills and fortitude to assess and challenge the way things are done and recommend alternative solutions to the problems; the independence necessary to make an unbiased evaluation of management performance and effectively carry out responsibilities of oversight; an awareness of both the business and social environment in which today’s corporation operates; and a sense of urgency and spirit of cooperation that will enable them to interact with other Board members in directing the future and profitable growth of the company. The Governance Committee has determined that it is desirable for the Board to have a variety of differences in viewpoints, professional experiences, educational background, skills, race, gender and age, and considers issues of diversity and background in determining the appropriate composition of the Board and identifying director nominees. However, the company does not have a formal policy concerning diversity considerations, nor any formal means of assessing the efficacy of its diversity consideration.

The Governance Committee will consider potential nominees recommended by our stockholders taking into account the same considerations as are taken into account for other potential nominees. Stockholders may recommend candidates by writing to the Governance Committee in care of our Secretary at Harte-Hanks, Inc., 9601 McAllister Freeway, Suite 610, San Antonio, Texas 78216. Our by-laws provide additional procedures and requirements for stockholders wishing to nominate a director for election as part of the official business to be conducted at an annual stockholders meeting, as described further under “Submission of Stockholder Proposals for 2013 Annual Meeting” and in our by-laws.

Assuming a satisfactory conclusion to the Governance Committee’s review and evaluation process, the Governance Committee presents the candidate’s name to the Board for nomination for election as a director and, if applicable, inclusion in our proxy statement.

Annual questionnaires are used to gather input to assist the Governance Committee and the Board in their determinations of the independence of the non-employee directors. Based on the foregoing and on such other due consideration and diligence as it deemed

9

Table of Contents

appropriate, the Governance Committee presented its findings to the Board on the independence of (1) David L. Copeland, (2) William F. Farley, (3) William K. Gayden, (4) Christopher M. Harte, (5) Judy C. Odom and (6) Karen A. Puckett, in each case in accordance with applicable federal securities laws and the rules of the NYSE. The Board determined that, other than in their capacity as directors, none of these non-employee directors had a material relationship with Harte-Hanks, either directly or as a partner, stockholder or officer of an organization that has a relationship with Harte-Hanks. The Board further determined that (i) each such non-employee director is otherwise independent under applicable NYSE listing standards for purposes of serving on the Board, the Audit Committee, the Compensation Committee and the Governance Committee, (ii) each such non-employee director satisfies the additional audit committee independence standards under Rule 10A-3 of the SEC and (iii) for purposes of serving on the Audit Committee, each such non-employee director is financially literate and, where applicable, certain of such directors are “audit committee financial experts” as such term is defined in the applicable SEC rules.

When assessing the materiality of a director’s relationship with us, if any, the Board considers all known relevant facts and circumstances, not merely from the director’s standpoint, but from that of the persons or organizations with which the director has an affiliation, the frequency or regularity of the services, whether the services are being carried out at arm’s length in the ordinary course of business and whether the services are being provided substantially on the same terms to us as those prevailing at the time from unrelated parties for comparable transactions. Material relationships can include commercial, banking, industrial, consulting, legal, accounting, charitable and familial relationships. In making its most recent independence determinations, the Board considered the following matters with respect to Mr. Copeland and Ms. Puckett and determined that they do not constitute material relationships with Harte-Hanks or otherwise impair their independence as members of the Board or any of its committees, including the Audit Committee:

| • | As previously disclosed in our 2011 proxy statement, Mr. Copeland’s son is a member of the transaction services group of KPMG LLP, our independent registered public accounting firm. This issue was previously reviewed and discussed by the Board in connection with assessing the continued independence of Mr. Copeland. This review process included discussing with KPMG the nature of its transaction services group and whether there was any relation to KPMG’s audit or tax compliance groups. As a result of this diligence and discussions with KPMG, it was determined that KPMG’s transaction services group is a separate and distinct group from KPMG’s audit and tax compliance practice groups. Accordingly, based on the nature of the services provided by the transaction services group and the fact that Harte-Hanks has not purchased such transaction services from KPMG, this matter was not deemed to constitute a material relationship with Harte-Hanks. |

| • | As disclosed in our 2011 proxy statement and further in this proxy statement, in accordance with SEC rules, Mr. Copeland has reported, but disclaimed, “beneficial ownership” of approximately 8.6% of our outstanding shares of our common stock that are owned by (1) various trusts for which Mr. Copeland serves as trustee or co-trustee, (2) a limited partnership of which he is an officer of the general partner, and (3) the Shelton Family Foundation, of which he is one of nine directors and an employee. Based on the nature of Mr. Copeland’s role with these entities, his absence of any pecuniary interest in these shares and his disclaimer of any beneficial ownership in these shares, this matter is not deemed to constitute a material relationship with Harte-Hanks. |

| • | As previously disclosed in our 2011 proxy statement, Ms. Puckett serves as an executive officer of CenturyLink, Inc., which is both a client and a vendor of the company. Partly owing to the acquisition of Qwest Communications International, Inc. by CenturyLink during 2011, the value of commercial transactions between CenturyLink and us increased in 2011: CenturyLink purchased or licensed approximately $1.5 million of software, data and services from our Trillium Software and Data Services business units, and we purchased approximately $400,000 telecommunications services from CenturyLink, all in the ordinary course of business. Ms. Puckett is not compensated directly or indirectly as a result of these transactions other than that the company’s payments to CenturyLink add to the overall revenue of CenturyLink. Moreover, Ms. Puckett did not actively participate in negotiating or consummating the terms of the applicable transactions between the company and CenturyLink and did not have any direct or indirect material interest in such transactions. |

As previously mentioned, six of our eight Board members are independent directors. Mr. Franklin serves as our Chairman of the Board and since January 2009, he has served as our CEO and President. Mr. Franklin has been a member of the Board since 1974. The non-management and independent members of the Board meet in executive session outside the presence of management directors at every regular meeting of the Board, and as-needed at special meetings. We believe the number of independent, experienced directors that make up our Board benefits the company and its stockholders.

We recognize that different board leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. We believe our current Board leadership structure is appropriate for us because it demonstrates to our employees, suppliers, customers and other stakeholders that we are under strong leadership, with a single person having primary responsibility for managing our operations. Having a single leader for both the company and the Board eliminates the potential for confusion or duplication of efforts, and provides clear leadership. We believe Harte-Hanks, like many other U.S. companies, has been well-served by this leadership structure.

10

Table of Contents

The Board has adopted a Lead Director Policy for the company, and elected Christopher M. Harte as Lead Director. The Lead Director Policy provides that:

| • | the Board shall conduct an annual evaluation of whether to combine (or continue combining, as the case may be) the roles of Chairman of the Board and CEO, with a view to ensuring significant independent oversight of management; |

| • | when the Chairman of the Board is also the CEO, the independent members of the Board shall elect one of the independent Directors to serve as Lead Director, such director to serve in such role for a one-year term; |

| • | at each regular meeting of the Board, the independent directors shall meet in executive session; and |

| • | the Lead Director shall have the following powers and duties (1) presiding over all meetings of the Board at which the Chairman of Board is not present, (2) presiding over executive sessions of independent and/or non-management directors, (3) calling meetings of the independent directors, and (4) serving as a liaison between the Chairman of the Board and the independent directors if so requested. |

Our Board conducts an annual evaluation in order to determine whether it and its committees are functioning effectively. As part of this annual self-evaluation, the Board evaluates whether the current leadership structure continues to be optimal for Harte-Hanks and its stockholders. Our corporate governance guidelines provide the flexibility for our Board to modify or continue our leadership structure in the future, as it deems appropriate.

Our Corporate Governance Principles provide that the non-management members of the Board will hold regular executive sessions in connection with regular Board meetings to consider issues that they may determine from time to time without the presence of any member of management. If the Chairman of the Board is not a member of management, the Chairman will chair each such session and report any material issues to the full Board. If the Chairman is a member of management, the Lead Director serves as the chairman of the executive sessions. If the non-management directors include directors who are not “independent” under applicable NYSE and SEC rules, then the independent directors will hold an executive session at least once a year. The Chairman of the Board, if an independent director, will chair each such session and report any material issues to the full Board. If the Chairman is not an independent director, the Lead Director serves as the chairman of such sessions. Our current Chairman, Mr. Franklin, has also served as our President and CEO since January 2009.

Our Board is responsible for overseeing the risk management process. The Board focuses on our general risk management strategy and the most significant risks we face (such as information security and data protection), and ensures that appropriate risk mitigation strategies are implemented by management. The Board is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters.

In performing the risk management process, the Board reviews with management (1) our policies with respect to risk assessment and management of risks that may be material to us, (2) our system of disclosure controls and system of internal controls over financial reporting, and (3) our compliance with legal and regulatory requirements. The Board also reviews major legislative and regulatory developments that could materially impact our contingent liabilities and risks. Our other Board committees also consider and address risk as they perform their respective committee responsibilities. For example, our Compensation Committee evaluates the risks associated with our compensation plans and policies, and our Audit Committee monitors risks relating to our financial controls and reporting. All committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise level risk.

Management is responsible for day-to-day risk management. Our finance, treasury, general counsel and internal audit departments serve as the primary monitoring and testing function for company-wide policies and procedures, and manage the day-to-day oversight of the risk management strategy for our ongoing business. This oversight includes identifying, evaluating and addressing potential risks that may exist at the enterprise, strategic, financial and operational levels, as well as compliance and reporting.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing the company and that our Board leadership structure supports this approach.

Audit Committee Financial Experts and Financial Literacy

The Board has determined that David L. Copeland, William F. Farley and Christopher M. Harte, the current members of the Audit Committee, are each financially literate as interpreted by the Board in its business judgment based on applicable NYSE rules, and that Messrs. Copeland and Farley each further qualifies as an audit committee financial expert, as such term is defined in applicable SEC rules.

11

Table of Contents

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee of our Board is or has been an officer or employee of the company. All members of the Compensation Committee participate in decisions related to compensation of our executive officers. No interlocking relationship exists between our Board and the board of directors or compensation committee of any other company.

Communications with Non-Management Directors and Other Board Communications

The Board provides a process to enhance the ability of stockholders and other interested parties to communicate directly with the non-management directors as a group, the entire Board, Board committees or individual directors, including the Chairman and chair of any Board committee.

Stockholders and other interested parties may communicate by writing to: Board of Directors – Stockholder Communication, Harte-Hanks, Inc., 9601 McAllister Freeway, Mail Box 8, San Antonio, Texas 78216. Our independent directors have instructed the Chair of the Governance Committee to collect and distribute all such communications to the intended recipient(s), assuming he reasonably determines in good faith that such communications do not relate to an improper or irrelevant topic.

Concerns about accounting or auditing matters may be forwarded on a confidential or anonymous basis to the Audit Committee by writing to: Audit Committee, Harte-Hanks, Inc., 9601 McAllister Freeway, Mail Box 8, San Antonio, Texas 78216, in an envelope labeled “To be opened by the Audit Committee only. Submitted pursuant to Audit Committee’s whistleblower policy.” These complaints will be reviewed and addressed under the direction of the Audit Committee.

Items unrelated to the duties and responsibilities of the Board, such as mass mailings, business solicitations, advertisements and other commercial communications, surveys and questionnaires, and resumes or other job inquiries, will not be forwarded.

Director Attendance at Annual Meetings

Although we do not have a formal policy regarding director attendance at the annual meeting of stockholders, all directors are encouraged to attend. All directors except Ms. Puckett attended the 2011 annual meeting of stockholders.

Policies on Business Conduct and Ethics

We have established a corporate compliance program as part of our commitment to responsible business practices in all of the communities in which we operate. The Board has adopted a Business Conduct Policy that applies to all of our directors, officers and employees, which promotes the fair, ethical, honest and lawful conduct in our business relationships with employees, customers, suppliers, competitors, government representatives, and all other business associates. In addition, we have adopted a Code of Ethics applicable to our CEO and all of our senior financial officers. The Business Conduct Policy and Code of Ethics form the foundation of a compliance program that includes policies and procedures covering a variety of specific areas of professional conduct, including compliance with laws, conflicts of interest, confidentiality, public corporate disclosures, insider trading, trade practices, protection and proper use of company assets, intellectual property, financial accounting, employment practices, health, safety and environment, and political contributions and payments.

Both our Business Conduct Policy and our Code of Ethics are available on our website at www.harte-hanks.com, under the heading “About Us” in the section for “Corporate Governance.” In accordance with NYSE and SEC rules, we currently intend to disclose any future amendments to our Code of Ethics, or waivers from our Code of Ethics for our CEO, Chief Financial Officer (“CFO”) and Controller, by posting such information on our website (www.harte-hanks.com) within the time period required by applicable SEC and NYSE rules.

Certain Relationships and Related Transactions

The Board has adopted certain policies and procedures relating to its review, approval or ratification of any transaction in which Harte-Hanks is a participant and that is required to be reported by the SEC’s rules and regulations regarding transactions with related persons. As set forth in the Governance Committee’s charter, except for matters delegated by the Board to the Audit Committee, all proposed related transactions and conflicts of interest should be presented to the Governance Committee for its consideration. If required by law, NYSE rules or SEC regulations, such transactions must obtain Governance Committee approval. In reviewing any such transactions and potential transactions, the Governance Committee may take into account a variety of factors that it deems appropriate, which may include, for example, whether the transaction is on terms comparable to those that could be obtained in arm’s length dealings with an unrelated third party, the value and materiality of such transaction, any affiliate transaction restrictions that may be included in our debt agreements, any impact on the Board’s evaluation of a non-employee director’s independence or on such director’s eligibility to serve on one of the Board’s committees and any required public disclosures by Harte-Hanks.

12

Table of Contents

Indemnification of Officers and Directors

Our certificate of incorporation and bylaws require us to indemnify our officers and directors to the fullest extent permitted by the Delaware General Corporation Law. These documents also contain provisions that provide for the indemnification of our directors for third party actions and actions by or in the right of Harte-Hanks that mirror Section 145 of the Delaware General Corporation Law.

Our certificate of incorporation also states that Harte-Hanks has the power to purchase and maintain insurance, at its expense, to protect itself and any such director, officer, employee or agent of Harte-Hanks or another corporation, partnership, joint venture, trust or other enterprise against such expense, liability or loss, whether or not we would have the power to indemnify such person against such expense, liability or loss under the Delaware General Corporation Law. We also have and intend to maintain director and officer liability insurance, if available on reasonable terms.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us under the foregoing provisions, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

In accordance with the Sarbanes-Oxley Act of 2002 and SEC rules thereunder, our CEO and CFO have signed certifications under Sarbanes-Oxley Section 302, which have been filed as exhibits to our annual report on Form 10-K for the year ended December 31, 2011. In addition, our CEO submitted his most recent annual certification to the NYSE under Section 303A.12(a) of the NYSE listing standards on June 3, 2011.

13

Table of Contents

SECURITY OWNERSHIP OF MANAGEMENT AND PRINCIPAL STOCKHOLDERS

The following table sets forth information with respect to the number of shares of our common stock beneficially owned by (1) our “named executive officers,” which, for purposes of this proxy statement, refers to the six executive officers included in the Summary Compensation Table below in this proxy statement, (2) each current Harte-Hanks director and each nominee for director, and (3) all current Harte-Hanks directors and executive officers as a group. The following table also sets forth information with respect to the number of shares of common stock beneficially owned by each person known by Harte-Hanks to beneficially own more than 5% of the outstanding shares of our common stock. Except as otherwise noted, (1) the persons named in the table have sole voting and investment power with respect to all shares beneficially owned by them, and (2) ownership is as of March 30, 2012. As of March 30, 2012, there were 63,606,913 shares of our common stock outstanding.

| Name and Address of Beneficial Owner (1) |

Number of Shares of Common Stock |

Percent of Class |

||||||

| Houston H. Harte |

6,609,780 | 10.4% | ||||||

| Larry D. Franklin (2) |

5,724,639 | 9.0% | ||||||

| David L. Copeland (3) (4) |

5,455,227 | 8.6% | ||||||

| Pzena Investment Management LLC (5) |

4,511,886 | 7.1% | ||||||

| Fiduciary Management, Inc. (6) |

4,063,585 | 6.4% | ||||||

| BlackRock, Inc. (including subsidiaries) (7) |

3,942,451 | 6.2% | ||||||

| Janus Capital Management LLC (8) |

3,740,035 | 5.9% | ||||||

| FMR LLC (9) |

3,360,000 | 5.3% | ||||||

| Heartland Advisors, Inc. (10) |

3,177,040 | 5.0% | ||||||

| Christopher M. Harte (11) (4) |

1,003,231 | 1.6% | ||||||

| Peter E. Gorman (12) |

460,295 | * | ||||||

| Gary J. Skidmore (13) |

404,976 | * | ||||||

| Michael P. Paulsin (14) |

190,565 | * | ||||||

| Douglas C. Shepard (15) |

157,990 | * | ||||||

| William K. Gayden (4) |

112,596 | * | ||||||

| Jessica M. Huff (16) |

111,598 | * | ||||||

| William F. Farley (4) (17) |

66,088 | * | ||||||

| Judy C. Odom (4) |

50,417 | * | ||||||

| Robert L. R. Munden (18) |

36,170 | * | ||||||

| Karen A. Puckett (19) |

26,585 | * | ||||||

| All Current Executive Officers and Directors as a Group (14 persons) (20) |

19,996,757 | 31.4% | ||||||

| * | Less than 1%. |

| (1) | The address of (a) Pzena Investment Management LLC is 120 West 45th Street, 20th Floor, New York, New York 10036, (b) Fiduciary Management, Inc. is 100 East Wisconsin Avenue, Suite 2200, Milwaukee, Wisconsin 53202, (c) BlackRock, Inc. is 40 East 52nd Street, New York, New York 10022, (d) (j) Janus Capital Management LLC is 151 Detroit Street, Denver, Colorado 80206, (e) FMR LLC is 82 Devonshire Street, Boston, Massachusetts 02109, (f) Heartland Advisors, Inc. is 789 North Water Street, Milwaukee, Wisconsin 53202, and (g) each other beneficial owner is c/o Harte-Hanks, Inc., 9601 McAllister Freeway, Suite 610, San Antonio, Texas 78216. |

| (2) | Includes 150,000 shares that may be acquired upon the exercise of options exercisable within the next 60 days; 19,483 shares of stock subject to certain restrictions until February 2013; 54,419 shares of stock subject to certain restrictions until February, 2014; 9,333 shares of stock subject to certain restrictions until February 2012; 1,448,560 shares held in trusts for Mr. Franklin, his wife and children; 221,264 shares held by his spouse; and the following shares to which he disclaims beneficial ownership: (a) 3,258,558 shares owned by eight trusts for which he serves as co-trustee and holds shared voting and dispositive power, and (b) 50,305 shares owned by the Franklin Family Foundation, of which he is one of four directors. |

| (3) | Includes the following shares to which Mr. Copeland disclaims beneficial ownership: (a) 44,200 shares held as custodian for unrelated minors, (b) 2,041,071 shares that are owned by 22 trusts for which he serves as trustee or co-trustee, (c) 200,500 shares held by a limited partnership of which he is sole manager of the general partner, and (e) 3,062,465 shares owned by the Shelton Family Foundation, of which he is one of nine directors and an employee. |

| (4) | Includes 13,400 shares that may be acquired upon the exercise of options exercisable within the next 60 days; 7,236 shares of stock subject to certain restrictions until February 2013; 3,036 shares of stock subject to certain restrictions until February 2014; and 1,682 shares of stock subject to certain restrictions until February 2015. |

| (5) | Represents shares held by investment advisory clients of Pzena Investment Management LLC (“Pzena”), no one of which to the knowledge of Pzena owns more than 5.0% of the class. Of such shares, Pzena has sole voting power as to 3,728,327 shares and sole dispositive power as to all shares. Information relating to this stockholder is based on the stockholder’s Schedule 13G/A, filed with the SEC on February 10, 2012. |

14

Table of Contents

| (6) | Represents shares held by investment advisory clients of Fiduciary Management, Inc. (“Fiduciary”), no one of which to the knowledge of Fiduciary owns more than 5.0% of the class. Includes 7,400 shares as to which Fiduciary has shared voting and dispositive power. Information relating to this stockholder is based on the stockholder’s Schedule 13G/A, filed with the SEC on February 10, 2012. |

| (7) | Represents shares held by investment advisory clients of BlackRock, Inc.’s (“BlackRock”) investment advisory subsidiaries (BlackRock Japan Co. Ltd., BlackRock Institutional Trust Company, N.A., BlackRock Fund Advisors, BlackRock Asset Management Canada Limited, BlackRock Asset Management Australia Limited, BlackRock Advisors, LLC, BlackRock Investment Management, LLC, BlackRock Asset Management Ireland Limited and BlackRock International Limited), no one of which to the knowledge of BlackRock owns more than 5.0% of the class. Information relating to this stockholder is based on the stockholder’s Schedule 13G/A, filed with the SEC on February 13, 2012. |

| (8) | Represents shares held by investment advisory clients of entities in which Janus Capital Management LLC (“Janus Capital”) holds a majority interest (INTECH Investment Management and Perkins Investment Management LLC), and no one of which (to the knowledge of Janus Capital) owns more than 5.0% of the class. Janus Capital shares voting and dispositive power with respect to all such shares. Information relating to this stockholder is based on the stockholder’s Schedule 13G, filed with the SEC on February 14, 2012. |

| (9) | Represents shares held Fidelity Low-Priced Stock Fund, of which Fidelity Management & Research Company (a subsidiary of FMR LLC) serves as investment advisor. FMR LLC has no voting power (but does have dispositive power ) with respect such shares. Information relating to this stockholder is based on the stockholder’s Schedule 13G, filed with the SEC on February 14, 2012. |

| (10) | Represents shares that may be deemed beneficially owned within the meaning of Rule 13d-3 of the Act by (1) Heartland Advisors, Inc. (“Heartland”) by virtue of its investment discretion and voting authority granted by certain clients, which may be revoked at any time; and (2) William J. Nasgovitz, by virtue of his control of Heartland. Mr. Nasgovitz disclaims beneficial ownership of such shares. To the best of Heartland’s knowledge, no account owns more than 5.0% of the class. Heartland shares voting and dispositive power with respect to all such shares. Information relating to this stockholder is based on the stockholder’s Schedule 13G, filed with the SEC on February 10, 2012. |

| (11) | Includes 768,939 shares held by Spicewood Family Partners, Ltd., of which he is the sole general partner with exclusive voting and dispositive power over all the partnership’s shares, and the following shares to which he disclaims beneficial ownership: (a) 450 shares owned indirectly by his wife, (b) 300 shares held as custodian for Mr. Harte’s step-children and child, (c) 26,779 shares held by trusts for which Mr. Harte and his wife serve as co-trustees, and (d) 120,001 shares held by other trusts for which Mr. Harte serves as a co-trustee. |

| (12) | Includes 432,500 shares that may be acquired upon the exercise of options exercisable within the next 60 days; and 27,795 shares held in a family trust. |

| (13) | Includes 323,750 shares that may be acquired upon the exercise of options exercisable within the next 60 days; 15,006 shares of stock subject to certain restrictions until February 2013; 17,416 shares of stock subject to certain restrictions until February 2014; 4,000 shares of stock subject to certain restrictions until February 2015; and 6,318 shares held in trusts for the benefit of Mr. Skidmore’s adult children and for which his brother serves as trustee. |

| (14) | Includes 161,000 shares that may be acquired upon the exercise of options exercisable within the next 60 days; 8,333 shares of stock subject to certain restrictions until February 2013; and 6,334 shares of stock subject to certain restrictions until February 2014; and 4,000 shares of stock subject to certain restrictions until February 2015. |

| (15) | Includes 115,000 shares that may be acquired upon the exercise of options exercisable within the next 60 days; 9,533 shares of stock subject to certain restrictions until February 2013; and 9,534 shares of stock subject to certain restrictions until February 2014; and 5,000 shares of stock subject to certain restrictions until February 2015. |

| (16) | Includes 90,000 shares that may be acquired upon the exercise of options exercisable within the next 60 days; 4,333 shares of stock subject to certain restrictions until February 2013; and 7,322 shares of stock subject to certain restrictions until February 2014; and 1,000 shares of stock subject to certain restrictions until February 2015. |

| (17) | Includes 124 shares owned indirectly by Mr. Farley’s spouse, as to which beneficial ownership is disclaimed. |

| (18) | Includes 13,000 shares that may be acquired upon the exercise of options exercisable within the next 60 days; 7,525 shares of stock subject to certain restrictions until February 2013; 2,000 shares of stock subject to certain restrictions until April 2013 and 7,334 shares of stock subject to certain restrictions until February 2014; and 4,000 shares of stock subject to certain restrictions until February 2015. |

| (19) | Includes 7,236 shares of stock subject to certain restrictions until February 2013; 3,036 shares of stock subject to certain restrictions until February 2014; and 1,682 shares of stock subject to certain restrictions until February 2015. |

| (20) | Includes 1,352,250 shares that may be acquired upon the exercise of options exercisable within the next 60 days and 265,639 shares of stock subject to certain restrictions until various times in 2013, 2014 and 2015 as noted above. Includes 8,804,753 shares as to which the current executive officers and directors disclaim beneficial ownership, as described in the preceding footnotes. |

15

Table of Contents

Compensation Discussion and Analysis