| Label |

Element |

Value |

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

To seek a high level of current income consistent with prudent investment risk.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FEES AND EXPENSES

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts on Class A shares if you and your family invest, or agree to invest in the future, at least $100,000 in the John Hancock family of funds. More information about these and other discounts is available from your financial representative and on pages 20 to 22 of the prospectus under "Sales charge reductions and waivers" or pages 141 to 144 of the fund's Statement of Additional Information under "Initial sales charge on Class A shares."

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts on Class A shares if you and your family invest, or agree to invest in the future, at least $100,000 in the John Hancock family of funds.

|

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 100,000

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder fees (%) (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual fund operating expenses (%) (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

September 30, 2017

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

EXPENSE EXAMPLE

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. Please see below a hypothetical example showing the expenses of a $10,000 investment for the time periods indicated and then, except as shown below, assuming you sell all of your shares at the end of those periods. The example assumes a 5% average annual return and that fund expenses will not change over the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

Sold

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

Not Sold

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

PORTFOLIO TURNOVER

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund's performance. During its most recent fiscal year, the fund's portfolio turnover rate was 56% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

56.00%

|

|

| Strategy [Heading] |

rr_StrategyHeading |

PRINCIPAL INVESTMENT STRATEGIES

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in a diversified portfolio of bonds. These may include, but are not limited to, corporate bonds and debentures, mortgage-related and asset-backed securities, and U.S. government and agency securities. Most of these securities are investment-grade, although the fund may invest up to 25% of its net assets in below-investment-grade debt securities (junk bonds) rated as low as CC by Standard & Poor's Ratings Services (S&P) and Ca by Moody's Investors Service, Inc. (Moody's), or their unrated equivalents. The fund contemplates that at least 75% of its net assets will be in investment-grade debt securities and cash and cash equivalents. The fund's investment policies are based on credit ratings at the time of purchase. There is no limit on average maturity.

The manager concentrates on sector allocation, industry allocation, and security selection in making investment decisions. When making sector and industry allocations, the manager uses top-down analysis to try to anticipate shifts in the business cycle. The manager uses bottom-up research to find individual securities that appear comparatively undervalued. The fund may invest in securities of foreign governments and corporations. The fund will not invest more than 10% of its total assets in securities denominated in foreign currencies. Under normal market conditions, the fund does not anticipate investing more than 25% of its total assets in U.S. dollar-denominated foreign securities (excluding Canadian securities).

The fund intends to keep its interest-rate exposure generally in line with its peers. The fund may engage in derivative transactions. Derivatives may be used to reduce risk, obtain efficient market exposure, and/or enhance investment returns, and may include futures contracts on securities and indexes; options on futures contracts, securities, and indexes; interest-rate, foreign currency, and credit default swaps; and foreign currency forward contracts. The fund's investments in U.S. government and agency securities may or may not be supported by the full faith and credit of the United States.

Under normal circumstances, the fund may not invest more than 10% of its assets in cash or cash equivalents (except cash segregated in relation to futures, forward, and options contracts). The fund may trade securities actively.

|

|

| Risk [Heading] |

rr_RiskHeading |

PRINCIPAL RISKS

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Many factors affect performance, and fund shares will fluctuate in price, meaning you could lose money. The fund's investment strategy may not produce the intended results.

During periods of heightened market volatility or reduced liquidity, governments, their agencies, or other regulatory bodies, both within the United States and abroad, may take steps to intervene. These actions, which could include legislative, regulatory, or economic initiatives, might have unforeseeable consequences and could adversely affect the fund's performance or otherwise constrain the fund's ability to achieve its investment objective.

The fund's main risks are listed below in alphabetical order. Before investing, be sure to read the additional descriptions of these risks beginning on page 5 of the prospectus.

Changing distribution levels risk. The fund may cease or reduce the level of its distribution if income or dividends paid from its investments declines.

Credit and counterparty risk. The issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter derivatives contract, or a borrower of fund securities may not make timely payments or otherwise honor its obligations. U.S. government securities are subject to varying degrees of credit risk depending upon the nature of their support. A downgrade or default affecting any of the fund's securities could affect the fund's performance.

Cybersecurity risk. Cybersecurity breaches may allow an unauthorized party to gain access to fund assets, customer data, or proprietary information, or cause a fund or its service providers to suffer data corruption or lose operational functionality. Similar incidents affecting issuers of a fund's securities may negatively impact performance.

Economic and market events risk. Events in the U.S. and global financial markets, including actions taken by the U.S. Federal Reserve or foreign central banks to stimulate or stabilize economic growth, may at times result in unusually high market volatility, which could negatively impact performance. Reduced liquidity in credit and fixed-income markets could adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates rise or economic conditions deteriorate.

Fixed-income securities risk. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or duration of the bonds held by a fund, the more sensitive it will likely be to interest-rate fluctuations. An issuer may not make all interest payments or repay all or any of the principal borrowed. Changes in a security's credit quality may adversely affect fund performance.

Foreign securities risk. Less information may be publicly available regarding foreign issuers. Foreign securities may be subject to foreign taxes and may be more volatile than U.S. securities. Currency fluctuations and political and economic developments may adversely impact the value of foreign securities.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase a fund's volatility and could produce disproportionate losses, potentially more than the fund's principal investment. Risks of these transactions are different from and possibly greater than risks of investing directly in securities and other traditional instruments. Under certain market conditions, derivatives could become harder to value or sell and may become subject to liquidity risk (i.e., the inability to enter into closing transactions). Derivatives and other strategic transactions that the fund intends to utilize include: credit default swaps; foreign currency forward contracts; foreign currency swaps; futures contracts; interest-rate swaps; and options. Foreign currency forward contracts, futures contracts, options, and swaps generally are subject to counterparty risk. In addition, swaps may be subject to interest-rate and settlement risk, and the risk of default of the underlying reference obligation. Derivatives associated with foreign currency transactions are subject to currency risk.

High portfolio turnover risk. Trading securities actively and frequently can increase transaction costs (thus lowering performance) and taxable distributions.

Liquidity risk. The extent (if at all) to which a security may be sold or a derivative position closed without negatively impacting its market value may be impaired by reduced market activity or participation, legal restrictions, or other economic and market impediments. Liquidity risk may be magnified in rising interest rate environments due to higher than normal redemption rates. Widespread selling of fixed-income securities to satisfy redemptions during periods of reduced demand may adversely impact the price or salability of such securities. Periods of heavy redemption could cause the fund to sell assets at a loss or depressed value, which could negatively affect performance. Redemption risk is heightened during periods of declining or illiquid markets.

Lower-rated and high-yield fixed-income securities risk. Lower-rated and high-yield fixed-income securities (junk bonds) are subject to greater credit quality risk, risk of default, and price volatility than higher-rated fixed-income securities, may be considered speculative, and can be difficult to resell.

Mortgage-backed and asset-backed securities risk. Mortgage-backed and asset-backed securities are subject to different combinations of prepayment, extension, interest-rate, and other market risks.

Sector risk. When a fund focuses its investments in certain sectors of the economy, its performance may be driven largely by sector performance and could fluctuate more widely than if the fund were invested more evenly across sectors.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

Many factors affect performance, and fund shares will fluctuate in price, meaning you could lose money.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

PAST PERFORMANCE

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following information illustrates the variability of the fund's returns and provides some indication of the risks of investing in the fund by showing changes in the fund's performance from year to year compared with a broad-based market index. Past performance (before and after taxes) does not indicate future results. All figures assume dividend reinvestment. Performance information is updated daily, monthly, and quarterly and may be obtained at our website, jhinvestments.com, or by calling 800-225-5291, Monday to Thursday, 8:00 A.M.—7:00 P.M., and Friday, 8:00 A.M.—6:00 P.M., Eastern time (Class A, Class B, and Class C shares), or 888-972-8696 between 8:30 A.M. and 5:00 P.M., Eastern time, on most business days (Class I, Class R2, Class R4, and Class R6 shares).

A note on performance

Class A shares commenced operations on November 9, 1973. Class R6 shares commenced operations on September 1, 2011; Class R2 shares commenced operations on March 1, 2012; Class R4 shares commenced operations on March 27, 2015. Returns shown prior to a class's commencement date are those of Class A shares that have been recalculated to reflect the gross fees and expenses of that class. Returns for Class R2, Class R4, and Class R6 shares would have been substantially similar to returns of Class A shares because each share class is invested in the same portfolio of securities and returns would differ only to the extent that expenses of the classes are different.

Please note that after-tax returns (shown for Class A shares only) reflect the highest individual federal marginal income-tax rate in effect as of the date provided and do not reflect any state or local taxes. Your actual after-tax returns may be different. After-tax returns are not relevant to shares held in an IRA, 401(k), or other tax-advantaged investment plan. After-tax returns for other share classes would vary. The returns for Class A shares have been adjusted to reflect the reduction in the maximum sales charge from 4.50% to 4.00%, effective February 3, 2014.

|

|

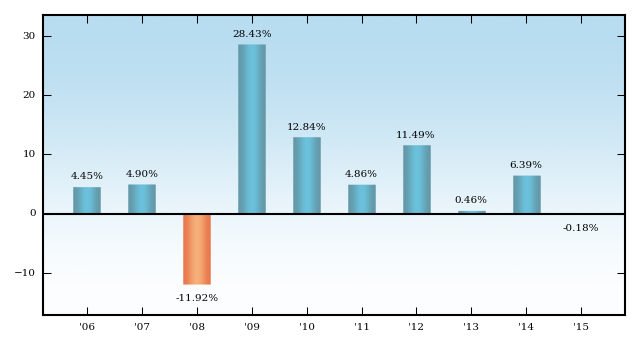

| Bar Chart [Heading] |

rr_BarChartHeading |

Calendar year total returns (%)—Class A (sales charges are not reflected in the bar chart and returns would have been lower if they were)

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

sales charges are not reflected in the bar chart and returns would have been lower if they were

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Year-to-date total return. The fund's total return for the six months ended June 30, 2016, was 5.10%.

Best quarter: Q3 '09, 11.00%

Worst quarter: Q4 '08, –7.29%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average annual total returns (%)—as of 12/31/15

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

Please note that after-tax returns (shown for Class A shares only) reflect the highest individual federal marginal income-tax rate in effect as of the date provided and do not reflect any state or local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns are not relevant to shares held in an IRA, 401(k), or other tax-advantaged investment plan.

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past performance (before and after taxes) does not indicate future results.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following information illustrates the variability of the fund's returns and provides some indication of the risks of investing in the fund by showing changes in the fund's performance from year to year compared with a broad-based market index.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

Please note that after-tax returns (shown for Class A shares only)

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

jhinvestments.com

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

by calling 800-225-5291, Monday to Thursday, 8:00 A.M.—7:00 P.M., and Friday, 8:00 A.M.—6:00 P.M., Eastern time (Class A, Class B, and Class C shares), or 888-972-8696 between 8:30 A.M. and 5:00 P.M., Eastern time, on most business days (Class I, Class R2, Class R4, and Class R6 shares).

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.55%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.25%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.51%

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Class A |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

4.00%

|

|

| Maximum Deferred Sales Charge (as a percentage) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[1] |

| Small account fee (for fund account balances under $1,000) ($) |

rr_ShareholderFeeOther |

$ 20

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.43%

|

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.30%

|

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Additional other expenses |

rr_Component2OtherExpensesOverAssets |

0.20%

|

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

0.20%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.93%

|

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.05%)

|

[2] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

0.88%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 486

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

680

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

889

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,493

|

|

| Annual Return 2006 |

rr_AnnualReturn2006 |

4.45%

|

|

| Annual Return 2007 |

rr_AnnualReturn2007 |

4.90%

|

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(11.92%)

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

28.43%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

12.84%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

4.86%

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

11.49%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

0.46%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

6.39%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(0.18%)

|

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

Year-to-date total return. The fund's total return for the six months ended June 30, 2016, was 5.10%.

|

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

5.10%

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Jun. 30, 2016

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best quarter: Q3 '09, 11.00%

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

11.00%

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Sep. 30, 2009

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst quarter: Q4 '08, –7.29%

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(7.29%)

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2008

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(4.18%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.66%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.29%

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Class A | after tax on distributions |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(5.57%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

1.86%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

3.29%

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Class A | after tax on distributions, with sale |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(2.35%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

2.08%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

3.29%

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Class B |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge (as a percentage) |

rr_MaximumDeferredSalesChargeOverOther |

5.00%

|

|

| Small account fee (for fund account balances under $1,000) ($) |

rr_ShareholderFeeOther |

$ 20

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.43%

|

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Additional other expenses |

rr_Component2OtherExpensesOverAssets |

0.20%

|

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

0.20%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.63%

|

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.05%)

|

[2] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

1.58%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 661

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

809

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,082

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,742

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

161

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

509

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

882

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,742

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(5.69%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.46%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.13%

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Class C |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge (as a percentage) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

|

| Small account fee (for fund account balances under $1,000) ($) |

rr_ShareholderFeeOther |

$ 20

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.43%

|

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00%

|

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Additional other expenses |

rr_Component2OtherExpensesOverAssets |

0.20%

|

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

0.20%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.63%

|

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.05%)

|

[2] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

1.58%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 261

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

509

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

882

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,929

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

161

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

509

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

882

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 1,929

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(1.84%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.79%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.99%

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Class I |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge (as a percentage) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Small account fee (for fund account balances under $1,000) ($) |

rr_ShareholderFeeOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.43%

|

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Additional other expenses |

rr_Component2OtherExpensesOverAssets |

0.18%

|

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

0.18%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.61%

|

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.05%)

|

[2] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

0.56%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 57

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

190

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

335

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 757

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.14%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

4.91%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

6.15%

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Class R2 |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge (as a percentage) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Small account fee (for fund account balances under $1,000) ($) |

rr_ShareholderFeeOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.43%

|

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

0.25%

|

[3] |

| Additional other expenses |

rr_Component2OtherExpensesOverAssets |

0.09%

|

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

0.34%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

1.02%

|

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.05%)

|

[2] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

0.97%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 99

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

320

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

558

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,243

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.25%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

4.54%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.72%

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Class R4 |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge (as a percentage) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Small account fee (for fund account balances under $1,000) ($) |

rr_ShareholderFeeOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.43%

|

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

0.10%

|

[3] |

| Additional other expenses |

rr_Component2OtherExpensesOverAssets |

0.09%

|

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

0.19%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.87%

|

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.15%)

|

[2],[4] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

0.72%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 74

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

263

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

468

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 1,059

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.04%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

4.65%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.88%

|

|

| (John Hancock Bond Fund - Classes A, B, C, I, R2, R4 and R6) | (John Hancock Bond Fund) | Class R6 |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge (as a percentage) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Small account fee (for fund account balances under $1,000) ($) |

rr_ShareholderFeeOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.43%

|

|

| Distribution and service (Rule 12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Service plan fee |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Additional other expenses |

rr_Component2OtherExpensesOverAssets |

0.09%

|

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

0.09%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.52%

|

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.07%)

|

[2] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

0.45%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 46

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

160

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

284

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 646

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.25%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

5.01%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

6.22%

|

|

| (John Hancock Bond Fund - Class NAV) | (John Hancock Bond Fund) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

INVESTMENT OBJECTIVE

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

To seek a high level of current income consistent with prudent investment risk.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

FEES AND EXPENSES

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses you may pay if you buy and hold shares of the fund.

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder fees (%) (fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual fund operating expenses (%) (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

September 30, 2017

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

EXPENSE EXAMPLE

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. Please see below a hypothetical example showing the expenses of a $10,000 investment for the time periods indicated and then assuming you sell all of your shares at the end of those periods. The example assumes a 5% average annual return and that fund expenses will not change over the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

PORTFOLIO TURNOVER

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund's performance. During its most recent fiscal year, the fund's portfolio turnover rate was 56% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

56.00%

|

|

| Strategy [Heading] |

rr_StrategyHeading |

PRINCIPAL INVESTMENT STRATEGIES

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in a diversified portfolio of bonds. These may include, but are not limited to, corporate bonds and debentures, mortgage-related and asset-backed securities, and U.S. government and agency securities. Most of these securities are investment-grade, although the fund may invest up to 25% of its net assets in below-investment-grade debt securities (junk bonds) rated as low as CC by Standard & Poor's Ratings Services (S&P) and Ca by Moody's Investors Service, Inc. (Moody's), or their unrated equivalents. The fund contemplates that at least 75% of its net assets will be in investment-grade debt securities and cash and cash equivalents. The fund's investment policies are based on credit ratings at the time of purchase. There is no limit on average maturity.

The manager concentrates on sector allocation, industry allocation, and security selection in making investment decisions. When making sector and industry allocations, the manager uses top-down analysis to try to anticipate shifts in the business cycle. The manager uses bottom-up research to find individual securities that appear comparatively undervalued. The fund may invest in securities of foreign governments and corporations. The fund will not invest more than 10% of its total assets in securities denominated in foreign currencies. Under normal market conditions, the fund does not anticipate investing more than 25% of its total assets in U.S. dollar-denominated foreign securities (excluding Canadian securities).

The fund intends to keep its interest-rate exposure generally in line with its peers. The fund may engage in derivative transactions. Derivatives may be used to reduce risk, obtain efficient market exposure, and/or enhance investment returns, and may include futures contracts on securities and indexes; options on futures contracts, securities, and indexes; interest-rate, foreign currency, and credit default swaps; and foreign currency forward contracts. The fund's investments in U.S. government and agency securities may or may not be supported by the full faith and credit of the United States.

Under normal circumstances, the fund may not invest more than 10% of its assets in cash or cash equivalents (except cash segregated in relation to futures, forward, and options contracts). The fund may trade securities actively.

|

|

| Risk [Heading] |

rr_RiskHeading |

PRINCIPAL RISKS

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Many factors affect performance, and fund shares will fluctuate in price, meaning you could lose money. The fund's investment strategy may not produce the intended results.

During periods of heightened market volatility or reduced liquidity, governments, their agencies, or other regulatory bodies, both within the United States and abroad, may take steps to intervene. These actions, which could include legislative, regulatory, or economic initiatives, might have unforeseeable consequences and could adversely affect the fund's performance or otherwise constrain the fund's ability to achieve its investment objective.

The fund's main risks are listed below in alphabetical order. Before investing, be sure to read the additional descriptions of these risks beginning on page 5 of the prospectus.

Changing distribution levels risk. The fund may cease or reduce the level of its distribution if income or dividends paid from its investments declines.

Credit and counterparty risk. The issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter derivatives contract, or a borrower of fund securities may not make timely payments or otherwise honor its obligations. U.S. government securities are subject to varying degrees of credit risk depending upon the nature of their support. A downgrade or default affecting any of the fund's securities could affect the fund's performance.

Cybersecurity risk. Cybersecurity breaches may allow an unauthorized party to gain access to fund assets, customer data, or proprietary information, or cause a fund or its service providers to suffer data corruption or lose operational functionality. Similar incidents affecting issuers of a fund's securities may negatively impact performance.

Economic and market events risk. Events in the U.S. and global financial markets, including actions taken by the U.S. Federal Reserve or foreign central banks to stimulate or stabilize economic growth, may at times result in unusually high market volatility, which could negatively impact performance. Reduced liquidity in credit and fixed-income markets could adversely affect issuers worldwide. Banks and financial services companies could suffer losses if interest rates rise or economic conditions deteriorate.

Fixed-income securities risk. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or duration of the bonds held by a fund, the more sensitive it will likely be to interest-rate fluctuations. An issuer may not make all interest payments or repay all or any of the principal borrowed. Changes in a security's credit quality may adversely affect fund performance.

Foreign securities risk. Less information may be publicly available regarding foreign issuers. Foreign securities may be subject to foreign taxes and may be more volatile than U.S. securities. Currency fluctuations and political and economic developments may adversely impact the value of foreign securities.

Hedging, derivatives, and other strategic transactions risk. Hedging, derivatives, and other strategic transactions may increase a fund's volatility and could produce disproportionate losses, potentially more than the fund's principal investment. Risks of these transactions are different from and possibly greater than risks of investing directly in securities and other traditional instruments. Under certain market conditions, derivatives could become harder to value or sell and may become subject to liquidity risk (i.e., the inability to enter into closing transactions). Derivatives and other strategic transactions that the fund intends to utilize include: credit default swaps; foreign currency forward contracts; foreign currency swaps; futures contracts; interest-rate swaps; and options. Foreign currency forward contracts, futures contracts, options, and swaps generally are subject to counterparty risk. In addition, swaps may be subject to interest-rate and settlement risk, and the risk of default of the underlying reference obligation. Derivatives associated with foreign currency transactions are subject to currency risk.

High portfolio turnover risk. Trading securities actively and frequently can increase transaction costs (thus lowering performance) and taxable distributions.

Liquidity risk. The extent (if at all) to which a security may be sold or a derivative position closed without negatively impacting its market value may be impaired by reduced market activity or participation, legal restrictions, or other economic and market impediments. Liquidity risk may be magnified in rising interest rate environments due to higher than normal redemption rates. Widespread selling of fixed-income securities to satisfy redemptions during periods of reduced demand may adversely impact the price or salability of such securities. Periods of heavy redemption could cause the fund to sell assets at a loss or depressed value, which could negatively affect performance. Redemption risk is heightened during periods of declining or illiquid markets.

Lower-rated and high-yield fixed-income securities risk. Lower-rated and high-yield fixed-income securities (junk bonds) are subject to greater credit quality risk, risk of default, and price volatility than higher-rated fixed-income securities, may be considered speculative, and can be difficult to resell.

Mortgage-backed and asset-backed securities risk. Mortgage-backed and asset-backed securities are subject to different combinations of prepayment, extension, interest-rate, and other market risks.

Sector risk. When a fund focuses its investments in certain sectors of the economy, its performance may be driven largely by sector performance and could fluctuate more widely than if the fund were invested more evenly across sectors.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

Many factors affect performance, and fund shares will fluctuate in price, meaning you could lose money.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

PAST PERFORMANCE

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following information illustrates the variability of the fund's returns and provides some indication of the risks of investing in the fund by showing changes in the fund's performance from year to year compared with a broad-based market index. Past performance (before and after taxes) does not indicate future results. All figures assume dividend reinvestment. Performance information is updated daily, monthly, and quarterly and may be obtained at our website, jhinvestments.com, or by calling 800-344-1029 between 8:00 A.M. and 7:00 P.M., Eastern time, on most business days.

A note on performance

Class A shares commenced operations on November 9, 1973. Class NAV shares commenced operations on August 31, 2015. Returns shown prior to the commencement date of Class NAV shares are those of Class A shares that have been recalculated to reflect the gross fees and expenses of Class NAV shares. Returns for Class NAV shares would have been substantially similar to returns of Class A shares because both share classes are invested in the same portfolio of securities and returns would differ only to the extent that expenses of the classes are different.

Please note that after-tax returns reflect the highest individual federal marginal income-tax rate in effect as of the date provided and do not reflect any state or local taxes. Your actual after-tax returns may be different. After-tax returns are not relevant to shares held in an IRA, 401(k), or other tax-advantaged investment plan.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

Calendar year total returns (%)—Class NAV

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

Year-to-date total return. The fund's total return for the six months ended June 30, 2016, was 5.32%.

Best quarter: Q3 '09, 11.16%

Worst quarter: Q4 '08, –7.17%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

Average annual total returns (%)—as of 12/31/15

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

Please note that after-tax returns reflect the highest individual federal marginal income-tax rate in effect as of the date provided and do not reflect any state or local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns are not relevant to shares held in an IRA, 401(k), or other tax-advantaged investment plan.

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

Past performance (before and after taxes) does not indicate future results.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following information illustrates the variability of the fund's returns and provides some indication of the risks of investing in the fund by showing changes in the fund's performance from year to year compared with a broad-based market index.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

jhinvestments.com

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

800-344-1029

|

|

| (John Hancock Bond Fund - Class NAV) | (John Hancock Bond Fund) | Barclays U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.55%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.25%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.51%

|

|

| (John Hancock Bond Fund - Class NAV) | (John Hancock Bond Fund) | Class NAV |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| Maximum Cumulative Sales Charge Over Other |

rr_MaximumCumulativeSalesChargeOverOther |

none

|

|

| Maximum Deferred Sales Charge (as a percentage) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

|

| Management fee |

rr_ManagementFeesOverAssets |

0.43%

|

|

| Other Expenses Over Assets |

rr_OtherExpensesOverAssets |

0.07%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.50%

|

|

| Contractual expense reimbursement |

rr_FeeWaiverOrReimbursementOverAssets |

(0.05%)

|

[5] |

| Total annual fund operating expenses after expense reimbursements |

rr_NetExpensesOverAssets |

0.45%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 46

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

155

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

275

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

$ 623

|

|

| Annual Return 2006 |

rr_AnnualReturn2006 |

5.00%

|

|

| Annual Return 2007 |

rr_AnnualReturn2007 |

5.44%

|

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(11.47%)

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

29.15%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

13.47%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

5.40%

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

12.05%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

0.92%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

6.86%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

0.26%

|

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

Year-to-date total return. The fund's total return for the six months ended June 30, 2016, was 5.32%.

|

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

5.32%

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Jun. 30, 2016

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best quarter: Q3 '09, 11.16%

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

11.16%

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Sep. 30, 2009

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst quarter: Q4 '08, –7.17%

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(7.17%)

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2008

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.26%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

5.01%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

6.25%

|

|

| (John Hancock Bond Fund - Class NAV) | (John Hancock Bond Fund) | Class NAV | after tax on distributions |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(1.26%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.17%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.23%

|

|

| (John Hancock Bond Fund - Class NAV) | (John Hancock Bond Fund) | Class NAV | after tax on distributions, with sale |

|

|

|

| Prospectus: |

rr_ProspectusTable |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.16%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.09%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.05%

|

|

|

|