As filed with the Securities and Exchange

Commission on September 26, 2013

1933 Act File No. 002-48925

1940 Act File No. 811-02402

|

U.S.

SECURITIES AND EXCHANGE COMMISSION K & L GATES LLP |

APPROXIMATE DATE OF PROPOSED PUBLIC OFFERING: As soon as practicable after the

effective date of this Registration Statement.

It

is proposed that this filing will become effective (check appropriate box):

[ ] immediately upon filing pursuant to paragraph (b) of Rule 485

[X] on October 1, 2013 pursuant to paragraph (b) of Rule 485

[ ] 60 days after filing pursuant to paragraph (a)(1) of Rule 485

[ ] on (date) pursuant to paragraph (a)(1) of Rule 485

[ ] 75 days after filing pursuant to paragraph (a)(2) of Rule 485

[ ] on (date) pursuant to paragraph (a)(2) of Rule 485

If appropriate, check the following box:

[ ] this post-effective amendment designates a new effective date for a previously filed post-effective amendment.

|

|

|

|

John Hancock |

|

PROSPECTUS 10-1-13

|

► Class A: JHNBX |

|

► Class B: JHBBX |

|

► Class C: JHCBX |

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved this fund or determined whether the information in this prospectus is adequate and accurate. Anyone who indicates otherwise is committing a federal crime.

An Income Fund |

Fund summary |

Fund details |

Your account |

||

The summary section is a concise look at the investment objective, fees and expenses, principal investment strategies, principal risks, past performance, and investment management. |

More about topics covered in the summary section, including descriptions of the investment strategies and various risk factors that investors should understand before investing. |

How to place an order to buy, sell, or exchange shares, as well as information about the business policies and any distributions that may be paid. |

||

For more information see back cover

Table of Contents |

|

Fund summary

John Hancock

Bond Fund

Investment objective

To seek a high level of current income consistent with prudent investment risk.

Fees and expenses

This table describes the fees and expenses you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts on Class A shares if you and your family invest, or agree to invest in the future, at least $100,000 in the John Hancock family of funds. More information about these and other discounts is available on pages 17 to 18 of the prospectus under "Sales charge reductions and waivers" or pages 125 to 128 of the fund's statement of additional information under "Initial Sales Charge on Class A Shares."

Shareholder fees (fees paid directly from your investment) |

Class A |

Class B |

Class C |

|

Maximum front-end sales charge (load) on purchases, as a % of purchase price |

4.50% |

None |

None |

|

Maximum deferred sales charge (load) as a % of purchase or sale price, whichever is less |

1.00% |

5.00% |

1.00% |

|

Small account fee (for fund account balances under $1,000) |

$20 |

$20 |

$20 |

|

Annual fund operating expenses (%) (expenses that you pay each year as a percentage of the value of your investment) |

Class A |

Class B |

Class C |

Management fee |

0.47 |

0.47 |

0.47 |

Distribution and service (12b-1) fees |

0.30 |

1.00 |

1.00 |

Other expenses |

0.26 |

0.26 |

0.26 |

Total annual fund operating expenses |

1.03 |

1.73 |

1.73 |

Contractual expense reimbursement1 |

–0.05 |

–0.05 |

–0.05 |

Total annual fund operating expenses after expense reimbursements |

0.98 |

1.68 |

1.68 |

1 |

The advisor has contractually agreed to waive a portion of its management fee and/or reimburse or pay operating expenses of the fund in order to reduce the total annual fund operating expenses for Class A, Class B, and Class C shares by 0.05% of the fund's average daily net assets. These fee waivers and/or reimbursements expire on September 30, 2014, unless renewed by mutual agreement of the fund and the advisor based upon a determination that this is appropriate under the circumstances at that time. |

Expense example

This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. Please see below a hypothetical example showing the expenses of a $10,000 investment in the fund for the time periods indicated (Kept column) and then assuming a redemption of all of your shares at the end of those periods (Sold column). The example assumes a 5% average annual return. The example assumes fund expenses will not change over the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

Expenses ($) |

Class A |

Class B |

Class C |

|||

Shares |

Sold |

Kept |

Sold |

Kept |

Sold |

Kept |

1 Year |

545 |

545 |

671 |

171 |

271 |

171 |

3 Years |

758 |

758 |

840 |

540 |

540 |

540 |

5 Years |

988 |

988 |

1,134 |

934 |

934 |

934 |

10 Years |

1,648 |

1,648 |

1,852 |

1,852 |

2,037 |

2,037 |

Portfolio turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund's performance. During its most recent fiscal year, the fund's portfolio turnover rate was 72% of the average value of its portfolio.

Principal investment strategies

Under normal market conditions, the fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in a diversified portfolio of bonds. These may include, but are not limited to, corporate bonds and debentures, as well as U.S. government and agency securities. Most of these securities are investment grade, although the fund may invest up to 25% of its net assets in debt securities rated, at the time of acquisition, below investment grade (i.e., junk bonds) as low as CC by Standard & Poor's Ratings Services (S&P) and Ca by Moody's Investors Service, Inc. (Moody's), or in unrated securities determined by the fund's investment advisor or subadvisor to be of comparable credit quality. The fund contemplates that at least 75% of the value of its total assets will be in investment-grade debt securities and cash and cash equivalents. There is no limit on the fund's average maturity.

In managing the fund's portfolio, the subadvisor concentrates on sector allocation, industry allocation, and security selection: deciding which types of bonds and industries to emphasize at a given time, and then which individual bonds to buy. When making sector and industry allocations, the subadvisor tries to anticipate shifts in the business cycle, using top-down analysis to determine which sectors and industries may benefit over the next 12 months.

In choosing individual securities, the subadvisor uses bottom-up research to find securities that appear comparatively undervalued. The subadvisor looks at bonds of all quality levels and maturities from many different issuers, potentially including foreign governments and corporations denominated in U.S. dollars or foreign currencies. The fund will not invest more than 10% of its total assets in securities denominated in foreign currencies. It is anticipated that under normal market conditions, the fund will not invest more than 25% of its total assets in U.S. dollar-denominated foreign securities (excluding U.S. dollar-denominated Canadian securities).

The fund intends to keep its exposure to interest-rate movements generally in line with those of its peers. The fund may invest in mortgage-related securities and derivatives, which include futures contracts on securities and indexes; options on futures contracts, securities, and indexes; interest rate, foreign currency, and credit default swaps; and foreign currency forward contracts, in each case, for the purposes of reducing risk, obtaining efficient market exposure, and/or enhancing investment returns. The fund's investments in U.S. government and agency securities may or may not be supported by the full faith and credit of the United States.

Under normal circumstances, the fund may not invest more than 10% of its assets in cash or cash equivalents (except cash segregated in relation to futures, forward, and options contracts).

Principal risks

An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund's shares will go up and down in price, meaning that you could lose money by investing in the fund. Many factors influence a mutual fund's performance.

Instability in the financial markets has led many governments, including the U.S. government, to take a number of unprecedented actions designed to support certain financial institutions and segments of the financial markets that have experienced extreme volatility and, in some cases, a lack of liquidity. Federal, state, and other governments, and their regulatory agencies or self-regulatory organizations, may take actions that affect the regulation of the instruments in which the fund invests, or the issuers of such instruments, in ways that are unforeseeable. Legislation or regulation may also change the way in which the fund itself is regulated. Such legislation or regulation could limit or preclude the fund's ability to achieve its investment objective.

Governments or their agencies may also acquire distressed assets from financial institutions and acquire ownership interests in those institutions. The implications of government ownership and disposition of these assets are unclear, and such a program may have positive or negative effects on the liquidity, valuation, and performance of the fund's portfolio holdings. Furthermore, volatile financial markets can expose the fund to greater market and liquidity risk and potential difficulty in valuing portfolio instruments held by the fund.

The fund's main risk factors are listed below in alphabetical order. Before investing, be sure to read the additional descriptions of these risks beginning on page 6 of the prospectus.

Active management risk. The subadvisor's investment strategy may fail to produce the intended result.

Changing distribution levels risk. The distribution amounts paid by the fund generally depend on the amount of income and/or dividends paid by the fund's investments.

Credit and counterparty risk. The issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter derivatives contract, or a borrower of a fund's securities may be unable or unwilling to make timely principal, interest, or settlement payments, or otherwise honor its obligations. U.S. government securities are subject to varying degrees of credit risk depending upon the nature of their support. Funds that invest in fixed-income securities are subject to varying degrees of risk that the issuers of the securities will have their credit rating downgraded or will default, potentially reducing a fund's share price and income level.

Economic and market events risk. Events in the financial markets have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. In addition, reduced liquidity in credit and fixed-income markets may adversely affect issuers worldwide.

Fixed-income securities risk. Fixed-income securities are affected by changes in interest rates and credit quality. A rise in interest rates typically causes bond prices to fall. The longer the average maturity or average duration of the bonds held by the fund, the more sensitive the fund is likely to be to interest-rate changes. There is the possibility that the issuer of the security will not repay all or a portion of the principal borrowed and will not make all interest payments.

Foreign securities risk. As compared to U.S. companies, there may be less publicly available information relating to foreign companies. Foreign securities may be subject to foreign taxes. The value of foreign securities is subject to currency fluctuations and adverse political and economic developments.

Hedging, derivatives, and other strategic transactions risk. Hedging and other strategic transactions may increase the volatility of a fund and, if the transaction is not successful, could result in a significant loss to a fund. The use of derivative instruments could produce disproportionate gains or losses, more than the principal amount invested. Investing in derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments and, in a down market, could become harder to value or sell at a fair price. The following is a list of certain derivatives and other strategic transactions in which the fund intends to invest and the main risks associated with each of them:

Credit default swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, risk of default of the underlying reference obligation, and risk of disproportionate loss are the principal risks of engaging in transactions involving credit default swaps.

Foreign currency forward contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency forward contracts.

Foreign currency swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency swaps.

Futures contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving futures contracts. Counterparty risk does not apply to exchange-traded futures.

Interest-rate swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving interest-rate swaps.

Options. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving options. Counterparty risk does not apply to exchange-traded options.

Lower-rated fixed-income securities risk and high-yield securities risk. Lower-rated fixed-income securities and high-yield fixed-income securities (commonly known as junk bonds) are subject to greater credit quality risk and risk of default than higher-rated fixed-income securities. These securities may be considered speculative and the value of these securities can be more volatile due to increased sensitivity to adverse issuer, political, regulatory, market, or economic developments and can be difficult to resell.

Mortgage-backed and asset-backed securities risk. Different types of mortgage-backed securities and asset-backed securities are subject to different combinations of prepayment, extension, interest-rate, and/or other market risks.

Sector investing risk. Because the fund may focus on a single sector of the economy, its performance depends in large part on the performance of that sector. As a result, the value of your investment may fluctuate more widely than it would in a fund that is diversified across sectors.

Past performance

The following performance information in the bar chart and table below illustrates the variability of the fund's returns and provides some indication of the risks of investing in the fund by showing changes in the fund's performance from year to year. However, past performance (before and after taxes) does not indicate future results. All figures assume dividend reinvestment. Performance for the fund is updated daily, monthly, and quarterly and may be obtained at our website: www.jhinvestments.com/FundPerformance, or by calling 800-225-5291, Monday–Thursday, between 8:00 A.M. and 7:00 P.M. , and on Fridays between 8:00 A.M. and 6:00 P.M. , Eastern time.

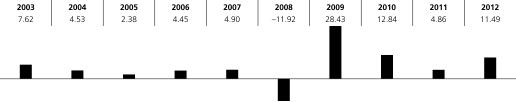

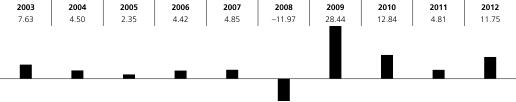

Calendar year total returns. These do not include sales charges and would have been lower if they did. Calendar year total returns are shown only for Class A shares and would be different for other share classes.

Average annual total returns. Performance of a broad-based market index is included for comparison.

After-tax returns. These are shown only for Class A shares and would be different for other classes. They reflect the highest individual federal marginal income-tax rates in effect as of the date provided and do not reflect any state or local taxes. Your actual after-tax returns may be different. After-tax returns are not relevant to shares held in an IRA, 401(k), or other tax-advantaged investment plan.

Calendar year total returns—Class A (%)

Year-to-date total return. The fund's total return for the six months ended June 30, 2013, was –1.35%.

Best quarter: Q3 '09, 11.00%

Worst quarter: Q4 '08, –7.29%

Average annual total returns (%) |

1 Year |

5 Year |

10 Year |

As of 12-31-12 |

|||

Class A before tax |

6.46 |

7.34 |

6.04 |

After tax on distributions |

4.72 |

5.15 |

4.05 |

After tax on distributions, with sale |

4.15 |

4.94 |

3.96 |

Class B before tax |

5.72 |

7.28 |

5.93 |

Class C before tax |

9.64 |

7.58 |

5.79 |

Barclays Government/Credit Bond Index (reflects no deduction for fees, expenses or taxes) |

4.82 |

6.06 |

5.25 |

Investment management

Investment advisor John Hancock Advisers, LLC

Subadvisor John Hancock Asset Management a division of Manulife Asset Management (US) LLC

Portfolio management

Jeffrey N. Given, CFA |

Howard C. Greene, CFA |

Purchase and sale of fund shares

The minimum initial investment requirement for Class A and Class C shares of the fund is $1,000, except for group investments, which is $250. There are no subsequent investment requirements. Purchases of Class B shares are closed to new and existing investors except by exchange from Class B shares of another John Hancock fund or through dividend and/or capital gains reinvestment. You may redeem shares of the fund on any business day through our website: jhinvestments.com; by mail: Investment Operations, John Hancock Signature Services, Inc., P.O. Box 55913, Boston, Massachusetts 02205-5913; or by telephone: 800-225-5291.

Taxes

The fund's distributions are taxable, and will be taxed as ordinary income and/or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account. Withdrawals from such tax-deferred arrangements may be subject to tax at a later date.

Payments to broker-dealers and other financial intermediaries

If you purchase the fund through a broker-dealer or other financial intermediary (such as a bank, registered investment advisor, financial planner, or retirement plan administrator), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

Fund details |

Principal investment strategies

The Board of Trustees can change the fund's strategy without shareholder approval. The fund will provide written notice to shareholders at least 60 days prior to a change in its 80% investment policy.

Under normal market conditions, the fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in a diversified portfolio of bonds. These may include, but are not limited to, corporate bonds and debentures, as well as U.S. government and agency securities. Most of these securities are investment grade, although the fund may invest up to 25% of its net assets in debt securities rated, at the time of acquisition, below investment-grade as low as CC by S&P and Ca by Moody's, or in unrated securities determined by the fund's investment advisor or subadvisor to be of comparable credit quality. The fund contemplates that at least 75% of the value of its total assets will be in investment-grade debt securities and cash and cash equivalents. There is no limit on the fund's average maturity.

In managing the fund's portfolio, the subadvisor concentrates on sector allocation, industry allocation, and security selection: deciding which types of bonds and industries to emphasize at a given time, and then which individual bonds to buy. When making sector and industry allocations, the subadvisor tries to anticipate shifts in the business cycle, using top-down analysis to determine which sectors and industries may benefit over the next 12 months.

In choosing individual securities, the subadvisor uses bottom-up research to find securities that appear comparatively undervalued. The subadvisor looks at bonds of all quality levels and maturities from many different issuers, potentially including foreign governments and corporations denominated in U.S. dollars or foreign currencies. The fund will not invest more than 10% of its total assets in securities denominated in foreign currencies. It is anticipated that under normal market conditions, the fund will not invest more than 25% of its total assets in U.S. dollar-denominated foreign securities (excluding U.S. dollar-denominated Canadian securities).

The fund intends to keep its exposure to interest-rate movements generally in line with those of its peers. The fund may invest in mortgage-related securities and derivatives, which include futures contracts on securities and indexes; options on futures contracts, securities, and indexes; interest rate, foreign currency, and credit default swaps; and foreign currency forward contracts, in each case, for the purposes of reducing risk, obtaining efficient market exposure, and/or enhancing investment returns. The fund's investments in U.S. government and agency securities may or may not be supported by the full faith and credit of the United States.

Under normal circumstances, the fund may not invest more than 10% of its assets in cash or cash equivalents (except cash segregated in relation to futures, forward, and options contracts).

The fund may trade securities actively, which could increase its transaction costs (thus lowering performance) and increase your taxable distributions.

Temporary defensive investing

For liquidity and flexibility, the fund may place up to 20% of its net assets (plus any borrowings for investment purposes) in investment-grade short-term securities. In abnormal circumstances, the fund may temporarily invest extensively in investment-grade short-term securities, cash, or cash equivalents for the purpose of:

meeting redemption requests,

making other anticipated cash payments, or

protecting the fund in the event the subadvisor determines that market, economic, political, or other conditions warrant a defensive posture.

To the extent that the fund is in a defensive position, its ability to achieve its investment goal will be limited.

Principal risks of investing

Below are descriptions of the main factors that may play a role in shaping the fund's overall risk profile. The descriptions appear in alphabetical order, not in order of importance. For further details about fund risks, including additional risk factors that are not discussed in this prospectus because they are not considered primary factors, see the fund's Statement of Additional Information (SAI).

Active management risk

A fund that relies on the manager's ability to pursue the fund's investment objective is subject to active management risk. The manager will apply investment techniques and risk analyses in making investment decisions for a fund and there can be no guarantee that these will produce the desired results. A fund generally does not attempt to time the market and instead generally stays fully invested in the relevant asset class, such as domestic equities or foreign equities. Notwithstanding its benchmark, a fund may buy securities not included in its benchmark or hold securities in very different proportions from its benchmark. To the extent a fund invests in those securities, its performance depends on the ability of the manager to choose securities that perform better than securities that are included in the benchmark.

Changing distribution levels risk

The distribution amounts paid by the fund generally depend on the amount of income and/or dividends paid by the fund's investments. The fund may not be able to pay distributions or may have to reduce its distribution level if the amount of such income and/or dividends paid from its investments declines. Therefore, distribution rates and income amounts can change at any time.

Credit and counterparty risk

This is the risk that the issuer or guarantor of a fixed-income security, the counterparty to an over-the-counter (OTC) derivatives contract (see "Hedging, derivatives, and other strategic transactions risk"), or a borrower of a fund's securities will be unable or unwilling to make timely principal, interest, or settlement payments, or to otherwise honor its obligations. Credit risk associated with investments in fixed-income securities relates to the ability of the issuer to make scheduled payments of principal and interest on an obligation. A fund that invests in fixed-income securities is subject to varying degrees of risk that the issuers of the securities will have their credit ratings downgraded or will default, potentially reducing the fund's share price and income level. Nearly all fixed-income securities are subject to some credit risk, which may vary depending upon whether the issuers of the securities are corporations, domestic, or foreign governments, or their subdivisions or instrumentalities. U.S. government securities are subject to varying degrees of credit risk depending upon whether the securities are supported by the full faith and credit of the United States, supported by the ability to borrow from the U.S. Treasury, supported only by the credit of the issuing U.S. government agency, instrumentality, or corporation, or otherwise supported by the United States. For example, issuers of many types of U.S. government securities (e.g., the Federal Home Loan Mortgage Corporation (Freddie Mac), Federal National Mortgage Association (Fannie Mae), and Federal Home Loan Banks), although chartered or sponsored by Congress, are not funded by congressional appropriations, and their fixed-income securities, including asset-backed and mortgage-backed securities, are neither guaranteed nor insured by the U.S. government. An agency of the U.S. government has placed Fannie Mae and Freddie Mac into conservatorship, a statutory process with the objective of returning the entities to normal business operations. It is unclear what effect this conservatorship will have on the securities issued or guaranteed by Fannie Mae or Freddie Mac. As a result, these securities are subject to more credit risk than U.S. government securities that are supported by the full faith and credit of the United States (e.g., U.S. Treasury bonds). When a fixed-income security is not rated, a subadvisor may have to assess the risk of the security itself. Asset-backed securities, whose principal and interest payments are supported by pools of other assets, such as credit card receivables and automobile loans, are subject to further risks, including the risk that the obligors of the underlying assets default on payment of those assets.

Funds that invest in below-investment-grade securities, also called junk bonds (e.g., fixed-income securities rated Ba or lower by Moody's Investor Service, Inc. (Moody's) or BB or lower by Standard & Poor's Rating Services (S&P)), at the time of investment, or determined by a subadvisor to be of comparable quality to securities so rated, are subject to increased credit risk. The sovereign debt of many foreign governments, including their subdivisions and instrumentalities, falls into this category. Below-investment-grade securities offer the potential for higher investment returns than higher-rated securities, but they carry greater credit risk: their issuers' continuing ability to meet principal and interest payments is considered speculative, they are more susceptible to real or perceived adverse economic and competitive industry conditions, and they may be less liquid than higher-rated securities.

In addition, a fund is exposed to credit risk to the extent it makes use of OTC derivatives (such as forward foreign currency contracts and/or swap contracts) and engages to a significant extent in the lending of fund securities or the use of repurchase agreements. OTC derivatives transactions can be closed out with the other party to the transaction. If the counterparty defaults, a fund will have contractual remedies, but there is no assurance that the counterparty will be able to meet its contractual obligations or that, in the event of default, a fund will succeed in enforcing them. A fund, therefore, assumes the risk that it may be unable to obtain payments owed to it under OTC derivatives contracts or that those payments may be delayed or made only after the fund has incurred the costs of litigation. While the subadvisor intends to monitor the creditworthiness of contract counterparties, there can be no assurance that the counterparty will be in a position to meet its obligations, especially during unusually adverse market conditions.

Economic and market events risk

Events in the financial sector have resulted, and may continue to result, in an unusually high degree of volatility in the financial markets, both domestic and foreign. These events have included, but are not limited to, the U.S. government's placement of Fannie Mae and Freddie Mac under conservatorship, the bankruptcy filings of Lehman Brothers, Chrysler, and General Motors, the sale of Merrill Lynch to Bank of America, the U.S. government support of American International Group and Citigroup, the sale of Wachovia to Wells Fargo, reports of credit and liquidity issues involving certain money market mutual funds, emergency measures by the U.S. and foreign governments banning short selling, measures to address U.S. federal and state budget deficits, debt crises in the eurozone, and S&P's downgrade of U.S. long-term sovereign debt. Both domestic and foreign equity markets have been experiencing increased volatility and turmoil, with issuers that have exposure to the real estate, mortgage, and credit markets particularly affected, and it is uncertain whether or for how long these conditions will continue.

In addition to the unprecedented volatility in financial markets, the reduced liquidity in credit and fixed-income markets may adversely affect many issuers worldwide. This reduced liquidity may result in less money being available to purchase raw materials, goods, and services from emerging markets, which may, in turn, bring down the prices of these economic staples. It may also result in emerging-market issuers having more difficulty obtaining financing, which may, in turn, cause a decline in their stock prices. These events and possible continuing market volatility may have an adverse effect on the fund.

Fixed-income securities risk

Fixed-income securities are generally subject to two principal types of risk: (1) interest-rate risk and (2) credit quality risk.

Interest-rate risk. Fixed-income securities are affected by changes in interest rates. When interest rates decline, the market value of fixed-income securities generally can be expected to rise. Conversely, when interest rates rise, the market value of fixed-income securities generally can be expected to decline. The longer the duration or maturity of a fixed-income security, the more susceptible it is to interest-rate risk.

Credit quality risk. Fixed-income securities are subject to the risk that the issuer of the security will not repay all or a portion of the principal borrowed and will not make all interest payments. If the credit quality of a fixed-income security deteriorates after a fund has purchased the security, the market value of the security may decrease and lead to a decrease in the value of the fund's investments. Funds that may invest in lower-rated fixed-income securities, commonly referred to as junk securities, are riskier than funds that may invest in higher-rated fixed-income securities. Additional information on the risks of investing in investment-grade fixed-income securities in the lowest rating category and lower-rated fixed-income securities is set forth below.

Investment-grade fixed-income securities in the lowest rating category risk. Investment-grade fixed-income securities in the lowest rating category (such as Baa by Moody's or BBB by S&P and comparable unrated securities) involve a higher degree of risk than fixed-income securities in the higher rating categories. While such securities are considered investment-grade quality and are deemed to have adequate capacity for payment of principal and interest, such securities lack outstanding investment characteristics and have speculative characteristics as well. For example, changes in economic conditions or other circumstances are more likely to lead to a weakened capacity to make principal and interest payments than is the case with higher-grade securities.

Prepayment of principal. Many types of debt securities, including floating-rate loans, are subject to prepayment risk. Prepayment risk occurs when the issuer of a security can repay principal prior to the security's maturity. Securities subject to prepayment risk can offer less potential for gains when the credit quality of the issuer improves.

Foreign securities risk

Funds that invest in securities traded principally in securities markets outside the United States are subject to additional and more varied risks, as the value of foreign securities may change more rapidly and extremely than the value of U.S. securities. The securities markets of many foreign countries are relatively small, with a limited number of companies representing a small number of industries. Additionally, issuers of foreign securities may not be subject to the same degree of regulation as U.S. issuers. Reporting, accounting, and auditing standards of foreign countries differ, in some cases significantly, from U.S. standards. There are generally higher commission rates on foreign portfolio transactions, transfer taxes, higher custodial costs, and the possibility that foreign taxes will be charged on dividends and interest payable on foreign securities, some or all of which may not be reclaimable. In the event of nationalization, expropriation, or other confiscation, the fund could lose its entire investment in a foreign security.

Currency risk. Currency risk is the risk that fluctuations in exchange rates may adversely affect the U.S. dollar value of a fund's investments. Currency risk includes both the risk that currencies in which a fund's investments are traded, or currencies in which a fund has taken an active investment position, will decline in value relative to the U.S. dollar and, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged. Currency rates in foreign countries may fluctuate significantly for a number of reasons, including the forces of supply and demand in the foreign exchange markets, actual or perceived changes in interest rates, and intervention (or the failure to intervene) by U.S. or foreign governments or central banks, or by currency controls or political developments in the United States or abroad. Certain funds may engage in proxy hedging of currencies by entering into derivative transactions with respect to a currency whose value is expected to correlate to the value of a currency the fund owns or wants to own. This presents the risk that the two currencies may not move in relation to one another as expected. In that case, the fund could lose money on its investment and also lose money on the position designed to act as a proxy hedge. Certain funds may also take active currency positions and may cross-hedge currency exposure represented by their securities into another foreign currency. This may result in a fund's currency exposure being substantially different than that suggested by its securities investments. All funds with foreign currency holdings and/or that invest or trade in securities denominated in foreign currencies or related derivative instruments may be adversely affected by changes in foreign currency exchange rates. Derivative foreign currency transactions (such as futures, forwards, and swaps) may also involve leveraging risk, in addition to currency risk. Leverage may disproportionately increase a fund's portfolio losses and reduce opportunities for gain when interest rates, stock prices, or currency rates are changing.

Hedging, derivatives, and other strategic transactions risk

The ability of a fund to utilize hedging, derivatives, and other strategic transactions successfully will depend in part on its subadvisor's ability to predict pertinent market movements and market risk, counterparty risk, credit risk, interest-rate risk, and other risk factors, none of which can be assured. The skills required to successfully utilize hedging and other strategic transactions are different from those needed to select a fund's securities. Even if the subadvisor only uses hedging and other strategic transactions in a fund primarily for hedging purposes or to gain exposure to a particular securities market, if the transaction is not successful, it could result in a significant loss to a fund. The amount of loss could be more than the principal amount invested. These transactions may also increase the volatility of a fund and may involve a small investment of cash relative to the magnitude of the risks assumed, thereby magnifying the impact of any resulting gain or loss. For example, the potential loss from the use of futures can exceed a fund's initial investment in such contracts. In addition, these transactions could result in a loss to a fund if the counterparty to the transaction does not perform as promised.

A fund may invest in derivatives, which are financial contracts with a value that depends on, or is derived from, the value of underlying assets, reference rates, or indexes. Derivatives may relate to bonds, interest rates, currencies or currency exchange rates, and related indexes. A fund may use derivatives for many purposes, including for hedging, and as a substitute for direct investment in securities or other assets. Derivatives may be used in a way to efficiently adjust the exposure of a fund to various securities, markets, and currencies without a fund actually having to sell existing investments and make new investments. This generally will be done when the adjustment is expected to be relatively temporary or in anticipation of effecting the sale of fund assets and making new investments over time. Further, since many derivatives have a leverage component, adverse changes in the value or level of the underlying asset, reference rate, or index can result in a loss substantially greater than the amount invested in the derivative itself. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. When a fund uses derivatives for leverage, investments in that fund will tend to be more volatile, resulting in larger gains or losses in response to market changes. To limit leverage risk, a fund may segregate assets determined to be liquid or, as permitted by applicable regulation, enter into certain offsetting positions to cover its obligations under derivative instruments. For a description of the various derivative instruments the fund may utilize, refer to the SAI.

The use of derivative instruments may involve risks different from, or potentially greater than, the risks associated with investing directly in securities and other more traditional assets. In particular, the use of derivative instruments exposes a fund to the risk that the counterparty to an OTC derivatives contract will be unable or unwilling to make timely settlement payments or otherwise to honor its obligations. OTC derivatives transactions typically can only be closed out with the other party to the transaction, although either party may engage in an offsetting transaction that puts that party in the same economic position as if it had closed out the transaction with the counterparty or may obtain the other party's consent to assign the transaction to a third party. If the counterparty defaults, the fund will have contractual remedies, but there is no assurance that the counterparty will meet its contractual obligations or that, in the event of default, the fund will succeed in enforcing them. For example, because the contract for each OTC derivatives transaction is individually negotiated with a specific counterparty, a fund is subject to the risk that a counterparty may interpret contractual terms (e.g., the definition of default) differently than the fund when the fund seeks to enforce its contractual rights. If that occurs, the cost and unpredictability of the legal proceedings required for the fund to enforce its contractual rights may lead it to decide not to pursue its claims against the counterparty. The fund, therefore, assumes the risk that it may be unable to obtain payments owed to it under OTC derivatives contracts or that those payments may be delayed or made only after the fund has incurred the costs of litigation. While a subadvisor intends to monitor the creditworthiness of counterparties, there can be no assurance that a counterparty will meet its obligations, especially during unusually adverse market conditions. To the extent a fund contracts with a limited number of counterparties, the fund's risk will be concentrated and events that affect the creditworthiness of any of those counterparties may have a pronounced effect on the fund. Derivatives also are subject to a number of other risks, including market risk and liquidity risk. Since the value of derivatives is calculated and derived from the value of other assets, instruments, or references, there is a risk that they will be improperly valued. Derivatives also involve the risk that changes in their value may not correlate perfectly with the assets, rates, or indexes they are designed to hedge or closely track. Suitable derivatives transactions may not be available in all circumstances. The fund is also subject to the risk that the counterparty closes out the derivatives transactions upon the occurrence of certain triggering events. In addition, a subadvisor may determine not to use derivatives to hedge or otherwise reduce risk exposure. A detailed discussion of various hedging and other strategic transactions appears in the SAI. The following is a list of certain derivatives and other strategic transactions in which the fund intends to invest and the main risks associated with each of them:

Credit default swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, risk of default of the underlying reference obligation, and risk of disproportionate loss are the principal risks of engaging in transactions involving credit default swaps.

Foreign currency forward contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency forward contracts.

Foreign currency swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), foreign currency risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving foreign currency swaps.

Futures contracts. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving futures contracts. Counterparty risk does not apply to exchange-traded futures.

Interest-rate swaps. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), interest-rate risk, and risk of disproportionate loss are the principal risks of engaging in transactions involving interest-rate swaps.

Options. Counterparty risk, liquidity risk (i.e., the inability to enter into closing transactions), and risk of disproportionate loss are the principal risks of engaging in transactions involving options. Counterparty risk does not apply to exchange-traded options.

Lower-rated fixed-income securities risk and high-yield securities risk

Lower-rated fixed-income securities are defined as securities rated below investment grade (such as, Ba and below by Moody's, and BB and below by S&P) (also called junk bonds). The general risks of investing in these securities are as follows:

Risk to principal and income. Investing in lower-rated fixed-income securities is considered speculative. While these securities generally provide greater

income potential than investments in higher-rated securities, there is a greater risk that principal and interest payments

will not be made. Issuers of these securities may even go into default or become bankrupt.

Price volatility. The price of lower-rated fixed-income securities may be more volatile than securities in the higher-rated categories. This volatility may increase during periods of economic uncertainty or change. The price of these securities is affected more than higher-rated fixed-income securities by the market's perception of their credit quality, especially during times of adverse publicity. In the past, economic downturns or increases in interest rates have, at times, caused more defaults by issuers of these securities and may do so in the future. Economic downturns and increases in interest rates have an even greater effect on highly leveraged issuers of these securities.

Liquidity. The market for lower-rated fixed-income securities may have more limited trading than the market for investment-grade fixed-income

securities. Therefore, it may be more difficult to sell these securities, and these securities may have to be sold at prices

below their market value in order to meet redemption requests or to respond to changes in market conditions.

Dependence on subadvisor's own credit analysis. While a subadvisor may rely on ratings by established credit rating agencies, it will also supplement such ratings with its own independent review of the credit quality of the issuer. Therefore, the assessment of the credit risk of lower-rated fixed-income securities is more dependent on the subadvisor's evaluation than the assessment of the credit risk of higher-rated securities.

Additional risks regarding lower-rated corporate fixed-income securities. Lower-rated corporate fixed-income securities (and comparable unrated securities) tend to be more sensitive to individual corporate developments and changes in economic conditions than higher-rated corporate fixed-income securities. Issuers of lower-rated corporate fixed-income securities may also be highly leveraged, increasing the risk that principal and income will not be repaid.

Additional risks regarding lower-rated foreign government fixed-income securities. Lower-rated foreign government fixed-income securities are subject to the risks of investing in foreign countries described under "Foreign securities risk." In addition, the ability and willingness of a foreign government to make payments on debt when due may be affected by the prevailing economic and political conditions within the country. Emerging-market countries may experience high inflation, interest rates, and unemployment, as well as exchange-rate trade difficulties and political uncertainty or instability. These factors increase the risk that a foreign government will not make payments when due.

Mortgage-backed and asset-backed securities risk

Mortgage-backed securities. Mortgage-backed securities represent participating interests in pools of residential mortgage loans, which are guaranteed by the U.S. government, its agencies, or instrumentalities. However, the guarantee of these types of securities relates to the principal and interest payments, and not to the market value of such securities. In addition, the guarantee only relates to the mortgage-backed securities held by the fund and not the purchase of shares of the fund.

Mortgage-backed securities are issued by lenders, such as mortgage bankers, commercial banks, and savings and loan associations. Such securities differ from conventional debt securities, which provide for the periodic payment of interest in fixed amounts (usually semiannually) with principal payments at maturity or on specified dates. Mortgage-backed securities provide periodic payments which are, in effect, a "pass-through" of the interest and principal payments (including any prepayments) made by the individual borrowers on the pooled mortgage loans. A mortgage-backed security will mature when all the mortgages in the pool mature or are prepaid. Therefore, mortgage-backed securities do not have a fixed maturity and their expected maturities may vary when interest rates rise or fall.

When interest rates fall, homeowners are more likely to prepay their mortgage loans. An increased rate of prepayments on the fund's mortgage-backed securities will result in an unforeseen loss of interest income to the fund as the fund may be required to reinvest assets at a lower interest rate. Because prepayments increase when interest rates fall, the prices of mortgage-backed securities do not increase as much as other fixed-income securities when interest rates fall.

When interest rates rise, homeowners are less likely to prepay their mortgage loans. A decreased rate of prepayments lengthens the expected maturity of a mortgage-backed security. Therefore, the prices of mortgage-backed securities may decrease more than prices of other fixed-income securities when interest rates rise.

The yield of mortgage-backed securities is based on the average life of the underlying pool of mortgage loans. The actual life of any particular pool may be shortened by unscheduled or early payments of principal and interest. Principal prepayments may result from the sale of the underlying property, or the refinancing or foreclosure of underlying mortgages. The occurrence of prepayments is affected by a wide range of economic, demographic, and social factors and, accordingly, it is not possible to accurately predict the average life of a particular pool. The actual prepayment experience of a pool of mortgage loans may cause the yield realized by the fund to differ from the yield calculated on the basis of the average life of the pool. In addition, if the fund purchases mortgage-backed securities at a premium, the premium may be lost in the event of early prepayment, which may result in a loss to the fund.

Prepayments tend to increase during periods of falling interest rates, while during periods of rising interest rates, prepayments are likely to decline. Monthly interest payments received by a fund have a compounding effect, which will increase the yield to shareholders as compared to debt obligations that pay interest semiannually. Because of the reinvestment of prepayments of principal at current rates, mortgage-backed securities may be less effective than U.S. Treasury bonds of similar maturity at maintaining yields during periods of declining interest rates. Also, although the value of debt securities may increase as interest rates decline, the value of these pass-through type of securities may not increase as much, due to their prepayment feature.

Collateralized mortgage obligations (CMOs). A fund may invest in mortgage-backed securities called CMOs. CMOs are issued in separate classes with different stated maturities. As the mortgage pool experiences prepayments, the pool pays off investors in classes with shorter maturities first. By investing in CMOs, a fund may manage the prepayment risk of mortgage-backed securities. However, prepayments may cause the actual maturity of a CMO to be substantially shorter than its stated maturity.

Asset-backed securities. Asset-backed securities include interests in pools of debt securities, commercial or consumer loans, or other receivables. The value of these securities depends on many factors, including changes in interest rates, the availability of information concerning the pool and its structure, the credit quality of the underlying assets, the market's perception of the servicer of the pool, and any credit enhancement provided. In addition, asset-backed securities have prepayment risks similar to mortgage-backed securities.

Sector investing risk

When a fund's investments are focused in a particular sector of the economy, they are not as diversified as the investments of most mutual funds and are far less diversified than the broad securities markets. This means that such funds tend to be more volatile than other mutual funds, and the values of their investments tend to go up and down more rapidly. In addition, a fund that invests in a particular sector is particularly susceptible to the impact of market, economic, regulatory, and other factors affecting that sector.

Who's who

The following are the names of the various entities involved with the fund's investment and business operations, along with brief descriptions of the role each entity performs.

Trustees

Oversee the fund's business activities and retain the services of the various firms that carry out the fund's operations.

Investment advisor

Manages the fund's business and investment activities.

John Hancock Advisers, LLC

601 Congress Street

Boston, MA 02210-2805

Founded in 1968, the advisor is a wholly owned subsidiary of John Hancock Life Insurance Company (U.S.A.), which in turn is a subsidiary of Manulife Financial Corporation.

The advisor administers the business and affairs of the fund and retains and compensates the investment subadvisor to manage the assets of the fund. John Hancock is one of the most recognized and respected names in the financial services industry. The advisor's parent company has been helping individuals and institutions work toward their financial goals since 1862. The advisor offers investment solutions managed by leading institutional money managers, taking a disciplined team approach to portfolio management and research, leveraging the expertise of seasoned investment professionals. As of June 30, 2013, the advisor had total assets under management of approximately $22.8 billion.

The advisor does not itself manage any of the fund's portfolio assets but has ultimate responsibility to oversee the subadvisor and recommend its hiring, termination, and replacement. In this connection, the advisor: (i) monitors the compliance of the subadvisor with the investment objectives and related policies of the fund, (ii) reviews the performance of the subadvisor, and (iii) reports periodically on such performance to the Board of Trustees.

The fund relies on an order from the Securities and Exchange Commission (SEC) permitting the advisor, subject to Board approval, to appoint a subadvisor or change the terms of a subadvisory agreement without obtaining shareholder approval. The fund, therefore, is able to change subadvisors or the fees paid to a subadvisor from time to time without the expense and delays associated with obtaining shareholder approval of the change. This order does not, however, permit the advisor to appoint a subadvisor that is an affiliate of the advisor or the fund (other than by reason of serving as a subadvisor to the fund), or to increase the subadvisory fee of an affiliated subadvisor, without the approval of the shareholders.

Management fee

The fund pays the advisor a management fee for its services to the fund. The fee is stated as an annual percentage of the current value of the net assets of the fund determined in accordance with the following schedule, and that rate is applied to the average daily net assets of the fund.

Average daily net assets |

Annual rate |

First $500 million |

0.500% |

Next $500 million |

0.475% |

Next $500 million |

0.450% |

Next $500 million |

0.450% |

Next $500 million |

0.400% |

Excess over $2.5 billion |

0.350% |

During its most recent fiscal year, the fund paid the investment advisor a management fee equal to 0.42% of average daily net assets (including any waivers and/or reimbursements).

Out of these fees, the investment advisor in turn pays the fees of the subadvisor.

The basis for the Trustees' approval of the advisory fees, and of the investment advisory agreement overall, including the subadvisory agreement, is discussed in the fund's most recent shareholder report for the period ended May 31.

Additional information about fund expenses

The fund's annual operating expenses will likely vary throughout the period and from year to year. The fund's expenses for the current fiscal year may be higher than the expenses listed in the fund's "Annual fund operating expenses" table, for some of the following reasons: (i) a significant decrease in average net assets may result in a higher advisory fee rate if advisory fee breakpoints are not achieved; (ii) a significant decrease in average net assets may result in an increase in the expense ratio because certain fund expenses do not decrease as asset levels decrease; or (iii) fees may be incurred for extraordinary events such as fund tax expenses.

The advisor has contractually agreed to waive a portion of its management fee and/or reimburse expenses for certain funds of the John Hancock funds complex, including the fund (the participating portfolios). The waiver equals, on an annualized basis, 0.0100% of that portion of the aggregate net assets of all the participating portfolios that exceeds $75 billion but is less than or equal to $125 billion; 0.0125% of that portion of the aggregate net assets of all the participating portfolios that exceeds $125 billion but is less than or equal to $150 billion; and 0.0150% of that portion of the aggregate net assets of all the participating portfolios that exceeds $150 billion. The amount of the reimbursement is calculated daily and allocated among all the participating portfolios in proportion to the daily net assets of each fund. This arrangement may be amended or terminated at any time by the advisor upon notice to the funds and with the approval of the Board of Trustees.

Subadvisor

Handles the fund's day-to-day portfolio management.

John Hancock Asset Management a division of Manulife Asset Management (US) LLC

101 Huntington Avenue

Boston, MA 02199

John Hancock Asset Management a division of Manulife Asset Management (US) LLC provides investment advisory services to individual and institutional investors. John Hancock Asset Management a division of Manulife Asset Management (US) LLC is a wholly owned subsidiary of John Hancock Life Insurance Company (U.S.A.) (a subsidiary of Manulife Financial Corporation) and, as of June 30, 2013, had total assets under management of approximately $147.1 billion.

Following are brief biographical profiles of the leaders of the fund's investment management team in alphabetical order. These managers share portfolio management responsibilities. For more about these individuals, including information about their compensation, other accounts they manage, and any investments they may have in the fund, see the SAI.

Jeffrey N. Given, CFA

Vice President and Portfolio Manager

Joined fund team in 2006

Began business career in 1993

Howard C. Greene, CFA

Senior Vice President and Senior Portfolio Manager

Joined fund team in 2002

Began business career in 1979

Custodian

Holds the fund's assets, settles all portfolio trades, and collects most of the valuation data required for calculating the fund's net asset value.

State Street Bank and Trust Company

Lafayette Corporate Center

Two Avenue de Lafayette

Boston, MA 02111

Principal distributor

Markets the fund and distributes shares through selling brokers, financial planners, and other financial representatives.

John Hancock Funds, LLC

601 Congress Street

Boston, MA 02210-2805

Transfer agent

Handles shareholder services, including recordkeeping and statements, distribution of dividends, and processing of buy and sell requests.

John Hancock Signature Services, Inc.

P.O. Box 55913

Boston, MA 02205-5913

Financial highlights

These tables detail the financial performance of each share class described in this prospectus, including total return information showing how much an investment in the fund has increased or decreased each period (assuming reinvestment of all dividends and distributions). Certain information reflects financial results for a single fund share.

The financial statements of the fund as of May 31, 2013, have been audited by PricewaterhouseCoopers LLP (PwC), the fund's independent registered public accounting firm. The report of PwC, along with the fund's financial statements in the fund's annual report for the fiscal year ended May 31, 2013, has been incorporated by reference into the SAI. Copies of the fund's most recent annual report are available upon request.

Bond Fund Class A Shares |

|||||||||||

Per share operating performance |

Period ended |

5-31-13 |

5-31-12 |

5-31-11 |

5-31-10 |

5-31-09 |

|||||

Net asset value, beginning of period |

$15.86 |

$15.86 |

$15.00 |

$12.96 |

$14.31 |

||||||

Net investment income1 |

0.63 |

0.72 |

0.81 |

0.97 |

0.87 |

||||||

Net realized and unrealized gain (loss) on investments |

0.61 |

0.08 |

0.92 |

2.05 |

(1.34 |

) |

|||||

Total from investment operations |

1.24 |

0.80 |

1.73 |

3.02 |

(0.47 |

) |

|||||

Less distributions |

|||||||||||

From net investment income |

(0.70 |

) |

(0.79 |

) |

(0.87 |

) |

(0.98 |

) |

(0.88 |

) |

|

From net realized gain |

(0.03 |

) |

(0.01 |

) |

— |

— |

— |

||||

Total distributions |

(0.73 |

) |

(0.80 |

) |

(0.87 |

) |

(0.98 |

) |

(0.88 |

) |

|

Net asset value, end of period |

$16.37 |

$15.86 |

$15.86 |

$15.00 |

$12.96 |

||||||

Total return (%)2,3 |

7.93 |

5.21 |

11.78 |

23.83 |

(3.02 |

) |

|||||

Ratios and supplemental data |

|||||||||||

Net assets, end of period (in millions) |

$1,434 |

$1,061 |

$912 |

$819 |

$686 |

||||||

Ratios (as a percentage of average net assets): |

|||||||||||

Expenses before reductions |

1.03 |

1.06 |

1.05 |

1.08 |

1.16 |

4 |

|||||

Expenses net of fee waivers and credits |

0.98 |

1.02 |

1.05 |

1.07 |

1.16 |

4 |

|||||

Net investment income |

3.84 |

4.63 |

5.24 |

6.71 |

6.71 |

||||||

Portfolio turnover (%) |

72 |

76 |

73 |

88 |

90 |

||||||

1 |

Based on the average daily shares outstanding. |

2 |

Does not reflect the effect of sales charges, if any. |

3 |

Total returns would have been lower had certain expenses not been reduced during the applicable periods shown. |

4 |

Includes the impact of proxy expenses, which amounted to 0.03% of average net assets. |

Bond Fund Class B Shares |

|||||||||||

Per share operating performance |

Period ended |

5-31-13 |

5-31-12 |

5-31-11 |

5-31-10 |

5-31-09 |

|||||

Net asset value, beginning of period |

$15.86 |

$15.86 |

$15.00 |

$12.95 |

$14.31 |

||||||

Net investment income1 |

0.51 |

0.61 |

0.70 |

0.86 |

0.77 |

||||||

Net realized and unrealized gain (loss) on investments |

0.61 |

0.08 |

0.92 |

2.07 |

(1.34 |

) |

|||||

Total from investment operations |

1.12 |

0.69 |

1.62 |

2.93 |

(0.57 |

) |

|||||

Less distributions |

|||||||||||

From net investment income |

(0.58 |

) |

(0.68 |

) |

(0.76 |

) |

(0.88 |

) |

(0.79 |

) |

|

From net realized gain |

(0.03 |

) |

(0.01 |

) |

— |

— |

— |

||||

Total distributions |

(0.61 |

) |

(0.69 |

) |

(0.76 |

) |

(0.88 |

) |

(0.79 |

) |

|

Net asset value, end of period |

$16.37 |

$15.86 |

$15.86 |

$15.00 |

$12.95 |

||||||

Total return (%)2,3 |

7.18 |

4.48 |

11.00 |

23.05 |

(3.77 |

) |

|||||

Ratios and supplemental data |

|||||||||||

Net assets, end of period (in millions) |

$44 |

$37 |

$28 |

$25 |

$28 |

||||||

Ratios (as a percentage of average net assets): |

|||||||||||

Expenses before reductions |

1.73 |

1.76 |

1.75 |

1.78 |

1.86 |

4 |

|||||

Expenses net of fee waivers and credits |

1.68 |

1.72 |

1.75 |

1.77 |

1.86 |

4 |

|||||

Net investment income |

3.15 |

3.92 |

4.53 |

6.01 |

5.96 |

||||||

Portfolio turnover (%) |

72 |

76 |

73 |

88 |

90 |

||||||

Bond Fund Class C Shares |

|||||||||||

Per share operating performance |

Period ended |

5-31-13 |

5-31-12 |

5-31-11 |

5-31-10 |

5-31-09 |

|||||

Net asset value, beginning of period |

$15.87 |

$15.86 |

$15.00 |

$12.96 |

$14.31 |

||||||

Net investment income1 |

0.51 |

0.61 |

0.70 |

0.86 |

0.78 |

||||||

Net realized and unrealized gain (loss) on investments |

0.60 |

0.09 |

0.92 |

2.06 |

(1.34 |

) |

|||||

Total from investment operations |

1.11 |

0.70 |

1.62 |

2.92 |

(0.56 |

) |

|||||

Less distributions |

|||||||||||

From net investment income |

(0.58 |

) |

(0.68 |

) |

(0.76 |

) |

(0.88 |

) |

(0.79 |

) |

|

From net realized gain |

(0.03 |

) |

(0.01 |

) |

— |

— |

— |

||||

Total distributions |

(0.61 |

) |

(0.69 |

) |

(0.76 |

) |

(0.88 |

) |

(0.79 |

) |

|

Net asset value, end of period |

$16.37 |

$15.87 |

$15.86 |

$15.00 |

$12.96 |

||||||

Total return (%)2,3 |

7.11 |

4.55 |

11.00 |

22.98 |

(3.70 |

) |

|||||

Ratios and supplemental data |

|||||||||||

Net assets, end of period (in millions) |

$195 |

$116 |

$71 |

$40 |

$26 |

||||||

Ratios (as a percentage of average net assets): |

|||||||||||

Expenses before reductions |

1.72 |

1.77 |

1.75 |

1.78 |

1.86 |

4 |

|||||

Expenses net of fee waivers and credits |

1.67 |

1.72 |

1.75 |

1.77 |

1.86 |

4 |

|||||

Net investment income |

3.12 |

3.91 |

4.50 |

5.98 |

6.02 |

||||||

Portfolio turnover (%) |

72 |

76 |

73 |

88 |

90 |

||||||

1 |

Based on the average daily shares outstanding. |

2 |

Does not reflect the effect of sales charges, if any. |

3 |

Total returns would have been lower had certain expenses not been reduced during the applicable periods shown. |

4 |

Includes the impact of proxy expenses, which amounted to 0.03% of average net assets. |

Your account |

|

Choosing a share class

Each share class has its own cost structure, including a Rule 12b-1 plan that allows it to pay fees for the sale, distribution, and service of its shares. Your financial representative can help you decide which share class is best for you. Class A shares are not available to group retirement plans that do not currently hold Class A shares of the fund and that are eligible to invest in Class I shares or any of the R share classes, except as provided below. Such plans generally include, but are not limited to, defined benefit plans, 401(k) plans, 457 plans, 403(b)(7) plans, pension and profit-sharing plans, and nonqualified deferred compensation plans.

Investment in Class A shares by such group retirement plans will be permitted in the following circumstances:

The plan held Class A shares of the fund or any John Hancock fund prior to January 1, 2013;

Class A shares of the fund or any other John Hancock fund were established as an investment option under the plan prior to January 1, 2013, and the fund's representatives have agreed that the plan may invest in Class A shares after that date; and

Class A shares of the fund or any other John Hancock fund were established as a part of an investment model prior to January 1, 2013, and the fund's representatives have agreed that plans utilizing such model may invest in Class A shares after that date.

Class A

A front-end sales charge, as described in the section "How sales charges are calculated."

Distribution and service (Rule 12b-1) fees of 0.30%.

Class C

No front-end sales charge; all your money goes to work for you right away.

Distribution and service (Rule 12b-1) fees of 1.00%.

A 1.00% contingent deferred sales charge (CDSC) on shares sold within one year of purchase.

No automatic conversion to Class A shares, so annual expenses continue at the Class C level throughout the life of your investment.

The maximum amount you may invest in Class C shares with any single purchase is $999,999.99. John Hancock Signature Services, Inc. (Signature Services), the transfer agent for the fund, may accept a purchase request for Class C shares for $1,000,000 or more when the purchase is pursuant to the reinstatement privilege (see "Sales charge reductions and waivers").

Class B (closed)

No front-end sales charge; all your money goes to work for you right away.

Distribution and service (Rule 12b-1) fees of 1.00%.

A CDSC, as described in the section "How sales charges are calculated."

Automatic conversion to Class A shares after eight years, thus reducing future annual expenses.

Class B shares may not be purchased or acquired by any new or existing Class B shareholder, except by exchange from Class B shares of another John Hancock fund or through dividend and/or capital gains reinvestment. Any other investment received by a John Hancock fund that is intended for Class B shares will be rejected. A shareholder owning Class B shares may continue to hold those shares until such shares automatically convert to Class A shares under the fund's existing conversion schedule, or until the shareholder redeems such Class B shares, subject to any applicable CDSC. Existing shareholders will continue to have exchange privileges with Class B shares of other John Hancock funds.

Class B shareholders will no longer be permitted to make automatic investments in Class B shares through the Monthly Automatic Accumulation Program (MAAP). To continue automatic investments, a Class B shareholder must designate a different share class of the same fund or another John Hancock fund for any purchases, provided the shareholder meets the eligibility requirements for that share class. If the Class B shareholder does not designate a different share class, future automatic purchases of Class B shares will be rejected. No new Class B share MAAPs will be established.

Class B shareholders can continue to hold Class B shares in IRA or SIMPLE IRA accounts, but additional contributions must be made to another share class. If a Class B shareholder with a MAAP for an IRA or SIMPLE IRA account did not provide alternative investment instructions by July 1, 2013, subsequent automatic purchases will be rejected.

All other Class B share features, including but not limited to distribution and service fees, CDSC, the reinstatement privilege, and conversion features, will remain unchanged for Class B shares currently held. Accumulation privileges as described below will remain unchanged. Shareholders can continue to include the value of Class B shares of any John Hancock open-end fund currently owned for purposes of qualifying for a reduced Class A share sales charge.

Employer-sponsored retirement plans that currently hold Class B shares and can no longer purchase Class B shares due to the Class B share closure to purchases, may instead purchase Class A shares and pay the applicable Class A sales charge, provided that their recordkeepers can properly assess a sales charge on plan investments, or Class C shares if the plans meet Class C share eligibility requirements and Class C shares are available on their recordkeeper's platform. If the recordkeeper is not able to assess a front-end sales charge on Class A shares, or Class C shares are otherwise not an available or appropriate investment option, only then may such employer-sponsored retirement plans invest in one of the R share classes.

Rule 12b-1 fees

Rule 12b-1 fees will be paid to the fund's distributor, John Hancock Funds, LLC, and may be used by the distributor for expenses relating to the distribution of, and shareholder or administrative services for holders of, the shares of the class and for the payment of service fees that come within Rule 2830(d)(5) of the Conduct Rules of the Financial Industry Regulatory Authority (FINRA).

Because Rule 12b-1 fees are paid out of the fund's assets on an ongoing basis, over time they will increase the cost of your investment and may cost shareholders more than other types of sales charges.

Your broker-dealer or agent may charge you a fee to effect transactions in fund shares.

Other share classes of the fund, which have their own expense structure, may be offered in separate prospectuses.

Additional payments to financial intermediaries

Shares of the fund are primarily sold through financial intermediaries, such as brokers, banks, registered investment advisors, financial planners, and retirement plan administrators. These firms may be compensated for selling shares of the fund in two principal ways:

directly, by the payment

of sales commissions, if any; and indirectly, as a result

of the fund paying Rule 12b-1 fees.

Certain firms may request, and the distributor may agree to make, payments in addition to sales commissions and Rule 12b-1 fees out of the distributor's own resources. These additional payments are sometimes referred to as "revenue sharing." These payments assist in the distributor's efforts to promote the sale of the fund's shares. The distributor agrees with the firm on the methods for calculating any additional compensation, which may include the level of sales or assets attributable to the firm. Not all firms receive additional compensation and the amount of compensation varies. These payments could be significant to a firm. The distributor determines which firms to support and the extent of the payments it is willing to make. The distributor generally chooses to compensate firms that have a strong capability to distribute shares of the fund and that are willing to cooperate with the distributor's promotional efforts.

The distributor hopes to benefit from revenue sharing by increasing the fund's net assets, which, as well as benefiting the fund, would result in additional management and other fees for the advisor and its affiliates. In consideration for revenue sharing, a firm may feature the fund in its sales system or give preferential access to members of its sales force or management. In addition, the firm may agree to participate in the distributor's marketing efforts by allowing the distributor or its affiliates to participate in conferences, seminars, or other programs attended by the intermediary's sales force. Although an intermediary may seek revenue-sharing payments to offset costs incurred by the firm in servicing its clients who have invested in the fund, the intermediary may earn a profit on these payments. Revenue-sharing payments may provide your firm with an incentive to favor the fund.