Registration No. 002-33043

File No. 811-01512

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-1A

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | [X] |

| Pre-Effective Amendment No. | [ ] |

| Post-Effective Amendment No. 78 | [X] |

and/or

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT | [X] |

| OF 1940 | |

| Amendment No. 62 |

| Oppenheimer capital income Fund |

| (Exact Name of Registrant as Specified in Charter) |

| 6803 South Tucson Way, Centennial, Colorado 80112-3924 |

| (Address of Principal Executive Offices) (Zip Code) |

| Registrant’s Telephone Number, including Area Code: (303) 768-3200 |

| Arthur S. Gabinet, Esq. |

| OFI Global Asset Management, Inc. |

| 225 Liberty Street, 11th Floor, New York, New York 10281-1008 |

| (Name and Address of Agent for Service) |

It is proposed that this filing will become effective (check appropriate box):

| [ ] | immediately upon filing pursuant to paragraph (b) |

| [X] | on December 29, 2014 pursuant to paragraph (b) |

| [ ] | 60 days after filing pursuant to paragraph (a)(1) |

| [ ] | on ______________ pursuant to paragraph (a)(1) |

| [ ] | 75 days after filing pursuant to paragraph (a)(2) |

| [ ] | on _______________ pursuant to paragraph (a)(2) of Rule 485. |

If appropriate, check the following box:

| [ ] | this post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

|

OPPENHEIMER |

|

Capital Income Fund |

Prospectus dated December 29, 2014

NYSE Ticker Symbols |

|

Class A |

OPPEX |

Class B |

OPEBX |

Class C |

OPECX |

Class R |

OCINX |

Class Y |

OCIYX |

Class I |

OCIIX |

Oppenheimer Capital Income Fund is a mutual fund that seeks total return. It invests in equity, debt and other securities.

This prospectus contains important information about the Fund's objective, investment policies, strategies and risks. It also contains important information about how to buy and sell shares of the Fund and other account features. Please read this prospectus carefully before you invest and keep it for future reference about your account.

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved the Fund's securities nor has it determined that this prospectus is accurate or complete. It is a criminal offense to represent otherwise.

|

|

|

THE FUND SUMMARY |

||

|

3 |

||

|

3 |

||

|

4 |

||

|

4 |

||

|

7 |

||

|

8 |

||

|

8 |

||

|

8 |

||

|

8 |

||

|

8 |

Payments to Broker-Dealers and Other Financial Intermediaries |

|

|

MORE ABOUT THE FUND |

||

|

9 |

||

|

19 |

||

|

MORE ABOUT YOUR ACCOUNT |

||

|

21 |

||

|

21 |

||

|

24 |

||

|

26 |

||

|

32 |

||

|

34 |

|

To Summary Prospectus |

THE FUND SUMMARY

Investment Objective. The Fund seeks total return.

Fees and Expenses of the Fund. This table describes the fees and expenses that you may pay if you buy and hold or redeem shares of the Fund. You may qualify for sales charge discounts if you (or you and your spouse) invest, or agree to invest in the future, at least $25,000 in certain funds in the Oppenheimer family of funds. More information about these and other discounts is available from your financial professional and in the section "About Your Account" beginning on page 21 of the prospectus and in the sections "How to Buy Shares" beginning on page 57 and "Appendix A" in the Fund's Statement of Additional Information.

Shareholder Fees |

||||||

(fees paid directly from your investment) |

Class A |

Class B |

Class C |

Class R |

Class Y |

Class I |

Maximum Sales Charge (Load) imposed on purchases (as % of offering price) |

5.75% |

None |

None |

None |

None |

None |

Maximum Deferred Sales Charge (Load) (as % of the lower of original offering price or redemption proceeds) |

None |

5% |

1% |

None |

None |

None |

Annual Fund Operating Expenses 1 |

||||||||||||

(expenses that you pay each year as a percentage of the value of your investment) |

Class A |

Class B |

Class C |

Class R |

Class Y |

Class I |

||||||

Management Fees 2 |

0.55 |

% |

0.55 |

% |

0.55 |

% |

0.55 |

% |

0.55 |

% |

0.55 |

% |

Distribution and/or Service (12b-1) Fees |

0.25 |

% |

1.00 |

% |

1.00 |

% |

0.50 |

% |

None |

None |

||

Acquired Fund Fees and Expenses |

0.02 |

% |

0.02 |

% |

0.02 |

% |

0.02 |

% |

0.02 |

% |

0.02 |

% |

Other Expenses |

||||||||||||

Other Expenses of the Fund |

0.24 |

% |

0.24 |

% |

0.24 |

% |

0.24 |

% |

0.24 |

% |

0.05 |

% |

Other Expenses of the Subsidiary |

0.00 |

% |

0.00 |

% |

0.00 |

% |

0.00 |

% |

0.00 |

% |

0.00 |

% |

Total Annual Fund Operating Expenses |

1.06 |

% |

1.81 |

% |

1.81 |

% |

1.31 |

% |

0.81 |

% |

0.62 |

% |

Fee Waiver and/or Expense Reimbursement 3 |

(0.06 |

)% |

(0.06 |

)% |

(0.06 |

)% |

(0.06 |

)% |

(0.06 |

)% |

(0.06 |

)% |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

1.00 |

% |

1.75 |

% |

1.75 |

% |

1.25 |

% |

0.75 |

% |

0.56 |

% |

Expenses have been restated to reflect current fees.

"Management Fees" reflects the gross management fees paid to the Manager by the Fund and the gross management fee of the Subsidiary for its most recent fiscal year.

After discussions with the Fund's Board, the Manager has contractually agreed to waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund's investments in funds managed by the Manager or its affiliates. This fee waiver and/or expense limitation may not be amended or withdrawn until one year from the date of this prospectus, unless approved by the Fund's Board.

Example. The following Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in a class of shares of the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your expenses would be as follows:

If shares are redeemed |

If shares are not redeemed |

|||||||||||||||||||||||

1 Year |

3 Years |

5 Years |

10 Years |

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||||

Class A |

$ |

672 |

$ |

889 |

$ |

1,123 |

$ |

1,796 |

$ |

672 |

$ |

889 |

$ |

1,123 |

$ |

1,796 |

||||||||

Class B |

$ |

679 |

$ |

869 |

$ |

1,183 |

$ |

1,757 |

$ |

179 |

$ |

569 |

$ |

983 |

$ |

1,757 |

||||||||

Class C |

$ |

279 |

$ |

569 |

$ |

983 |

$ |

2,141 |

$ |

179 |

$ |

569 |

$ |

983 |

$ |

2,141 |

||||||||

Class R |

$ |

128 |

$ |

412 |

$ |

717 |

$ |

1,584 |

$ |

128 |

$ |

412 |

$ |

717 |

$ |

1,584 |

||||||||

Class Y |

$ |

77 |

$ |

254 |

$ |

445 |

$ |

1,000 |

$ |

77 |

$ |

254 |

$ |

445 |

$ |

1,000 |

||||||||

Class I |

$ |

57 |

$ |

193 |

$ |

341 |

$ |

771 |

$ |

57 |

$ |

193 |

$ |

341 |

$ |

771 |

||||||||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 93% of the average value of its portfolio.

|

3 |

Oppenheimer Capital Income Fund |

Principal Investment Strategies. The Fund invests in equity, debt and other securities of domestic and foreign issuers in different capitalization ranges and in developed or developing countries. Under normal market conditions, the Fund invests at least 65% of its total assets in equity and debt securities that are expected to generate income. The percentages of equity and debt securities the Fund holds may vary from time to time. There is no limit on the Fund's investments in foreign securities. The Fund employs multiple strategies: an equity/equity-like strategy, which may include common stocks, convertible bonds, preferred stocks, structured notes and other derivatives like options and futures on equities and equity indices; a high grade fixed income strategy, which may include corporate bonds, government bonds, mortgage-related securities and structured products; and an opportunistic strategy, which seeks asymmetric risk/reward opportunities where the portfolio managers believe the return profile has a low correlation to traditional investment strategies, as well as opportunistically selecting positions to seek total return, income, or capital appreciation. The opportunistic strategy may include convertible bonds, corporate bonds, asset-backed securities, derivatives, such as currency and commodity-linked derivatives, cash and other securities. The opportunistic strategy may also include floating rate loans (sometimes referred to as "adjustable rate loans") that hold a senior position in the capital structure of U.S. and foreign corporations, partnerships or other business entities that, under normal circumstances, allow them to have priority of claim ahead of other obligations of a borrower in the event of liquidation. These investments are referred to as "Senior Loans." Senior Loans may be collateralized or uncollateralized. They typically pay interest at rates that are reset periodically based on a reference benchmark that reflects current interest rates, plus a margin or premium.

Equity Securities. In selecting equity securities, the portfolio manager mainly uses a value-oriented investing style. A security may be undervalued because the market does not yet recognize its potential or the issuer is temporarily out of favor. The Fund seeks to realize gains when other investors recognize the real or prospective worth of the security. Value securities may offer higher than average dividends and the Fund may invest in equity securities to seek both current income and capital growth. The Fund may also invest in equity securities solely for the purpose of seeking dividend yields. The portfolio manager typically looks for securities that can deliver attractive risk-adjusted returns, which may include securities that: have high current income, are believed to have substantial earnings possibilities, have low price/earnings ratios, and have a low price relative to the underlying value of the issuer's assets, earnings, cash flow or other factors.

Debt Securities. In connection with the high grade fixed income strategy, the portfolio manager looks for high current yields and typically searches for corporate and government debt securities that offer: attractive relative value, more income than U.S. treasury obligations, a balance of risk and return, high income potential and portfolio diversification. The Fund may also invest in zero-coupon and stripped securities. In connection with the opportunistic strategy, the portfolio manager looks for high yield, below-investment-grade securities, senior loans and asset-backed securities, among other debt securities, that may offer attractive returns on a risk-adjusted basis, with lower interest rate sensitivity. The Fund can invest up to 40% of its total assets in below-investment-grade securities, also referred to as "junk bonds."

The Fund's debt securities may be rated by a nationally recognized statistical rating organization or may be unrated. "Investment grade" securities are rated in one of the top four rating categories.

Other Securities. In pursuing its strategies, the Fund may also use derivative instruments, including to seek income or returns, or to try to manage market or other investment risks. These derivatives may include options, futures, swaps, "structured" notes, mortgage-related securities, equity-linked debt securities and commodity-linked derivatives. The Fund may also invest in convertible bonds, asset-backed securities, Senior Loans, participation interests in loans, pooled investment entities that invest in loans and currency derivatives, among other types of investments.

The Fund may sell securities that no longer meet the above criteria.

The Fund's holdings may at times differ significantly from the weightings of the indices comprising its reference index (the "Reference Index"). The Fund's Reference Index is a customized weighted index currently comprised of the following underlying broad-based security indices: 65% of the Barclays U.S. Aggregate Bond Index and 35% of the Russell 3000 Index. The Fund is not managed to be invested in the same percentages as those indices comprising the Reference Index.

The Fund has established a Cayman Islands company that is wholly-owned and controlled by the Fund (the "Subsidiary"). The Fund may invest up to 25% of its total assets in the Subsidiary. The Subsidiary invests primarily in commodity-linked derivatives (including commodity futures, financial futures, options and swap contracts) and exchange-traded funds related to gold or other special minerals ("Gold ETFs"). The Subsidiary may also invest in certain fixed-income securities and other investments that may serve as margin or collateral for its derivatives positions. Investments in the Subsidiary are intended to provide the Fund with exposure to commodities market returns within the limitations of the federal tax requirements that apply to the Fund. The Fund applies its investment restrictions and compliance policies and procedures, on a look-through basis, to the Subsidiary. The Fund's investment in the Subsidiary may vary based on the portfolio manager's use of different types of commodity-linked derivatives, fixed-income securities, Gold ETFs, and other investments. Since the Fund may invest a substantial portion of its assets in the Subsidiary, which may hold certain of the investments described in this prospectus, the Fund may be considered to be investing indirectly in those investments through its Subsidiary. Therefore, references in this prospectus to investments by the Fund also may be deemed to include the Fund's indirect investments through the Subsidiary.

Principal Risks. The price of the Fund's shares can go up and down substantially. The value of the Fund's investments may change because of broad changes in the markets in which the Fund invests or because of poor investment selection, which could cause the Fund to underperform other funds with similar investment objectives. There is no assurance that the Fund will achieve its investment objective. When you redeem your shares, they may be worth more or less than what you paid for them. These risks mean that you can lose money by investing in the Fund.

Risks of Investing in Equity Securities. Stocks and other equity securities fluctuate in price. The value of the Fund's portfolio may be affected by changes in the equity markets generally. Equity markets may experience significant short-term volatility and may fall sharply at times. Different markets may behave differently from each other and U.S. equity markets may move in the opposite direction from one or more foreign markets.

The prices of individual equity securities generally do not all move in the same direction at the same time and a variety of factors can affect the price of a particular company's securities. These factors may include, but are not limited to, poor earnings reports, a loss of

|

4 |

Oppenheimer Capital Income Fund |

customers, litigation against the company, general unfavorable performance of the company's sector or industry, or changes in government regulations affecting the company or its industry.

Main Risks of Value Investing. Value investing entails the risk that if the market does not recognize that the Fund's securities are undervalued, the prices of those securities might not appreciate as anticipated. A value approach could also result in fewer investments that increase rapidly during times of market gains and could cause the Fund to underperform funds that use a growth or non-value approach to investing. Value investing has gone in and out of favor during past market cycles and when value investing is out of favor or when markets are unstable, the securities of "value" companies may underperform the securities of "growth" companies.

Risks of Investing in Debt Securities. Debt securities may be subject to interest rate risk, duration risk, credit risk, credit spread risk, extension risk, reinvestment risk, prepayment risk and event risk. Interest rate risk is the risk that when prevailing interest rates fall, the values of already-issued debt securities generally rise; and when prevailing interest rates rise, the values of already-issued debt securities generally fall, and they may be worth less than the amount the Fund paid for them. When interest rates change, the values of longer-term debt securities usually change more than the values of shorter-term debt securities. Risks associated with rising interest rates are heightened given that interest rates in the U.S. are at, or near, historic lows. Duration risk is the risk that longer-duration debt securities will be more volatile and more likely to decline in price in a rising interest rate environment than shorter-duration debt securities. Credit risk is the risk that the issuer of a security might not make interest and principal payments on the security as they become due. If an issuer fails to pay interest or repay principal, the Fund's income or share value might be reduced. Adverse news about an issuer or a downgrade in an issuer's credit rating, for any reason, can also reduce the market value of the issuer's securities. "Credit spread" is the difference in yield between securities that is due to differences in their credit quality. There is a risk that credit spreads may increase when the market expects lower-grade bonds to default more frequently. Widening credit spreads may quickly reduce the market values of the Fund's lower-rated and unrated securities. Some unrated securities may not have an active trading market or may trade less actively than rated securities, which means that the Fund might have difficulty selling them promptly at an acceptable price. Extension risk is the risk that an increase in interest rates could cause principal payments on a debt security to be repaid at a slower rate than expected. Extension risk is particularly prevalent for a callable security where an increase in interest rates could result in the issuer of that security choosing not to redeem the security as anticipated on the security's call date. Such a decision by the issuer could have the effect of lengthening the debt security's expected maturity, making it more vulnerable to interest rate risk and reducing its market value. Reinvestment risk is the risk that when interest rates fall the Fund may be required to reinvest the proceeds from a security's sale or redemption at a lower interest rate. Callable bonds are generally subject to greater reinvestment risk than non-callable bonds. Prepayment risk is the risk that the issuer may redeem the security prior to the expected maturity or that borrowers may repay the loans that underlie these securities more quickly than expected, thereby causing the issuer of the security to repay the principal prior to the expected maturity. The Fund may need to reinvest the proceeds at a lower interest rate, reducing its income. Event risk is the risk that an issuer could be subject to an event, such as a buyout or debt restructuring, that interferes with its ability to make timely interest and principal payments and cause the value of its debt securities to fall.

Fixed-Income Market Risks. The fixed-income securities market can be susceptible to increases in volatility and decreases in liquidity. Liquidity may decline unpredictably in response to overall economic conditions or credit tightening. During times of reduced market liquidity, the Fund may not be able to readily sell bonds at the prices at which they are carried on the Fund's books and could experience a loss. If the Fund needed to sell large blocks of bonds to meet shareholder redemption requests or to raise cash, those sales could further reduce the bonds' prices, particularly for lower-rated and unrated securities. An unexpected increase in redemptions by Fund shareholders-which may be triggered by general market turmoil or an increase in interest rates-could cause the Fund to sell its holdings at a loss or at undesirable prices.

Economic and other market developments can adversely affect fixed-income securities markets in the United States, Europe and elsewhere. At times, participants in debt securities markets may develop concerns about the ability of certain issuers of debt securities to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt securities to facilitate an orderly market. Those concerns may impact the market price or value of those debt securities and may cause increased volatility in those debt securities or debt securities markets. Under some circumstances, as was the case during the latter half of 2008 and early 2009, those concerns could cause reduced liquidity in certain debt securities markets. A lack of liquidity or other adverse credit market conditions may hamper the Fund's ability to sell the debt securities in which it invests or to find and purchase suitable debt instruments.

Risks of Below-Investment-Grade Securities. Below-investment-grade debt securities (also referred to as "junk" bonds), whether rated or unrated, may be subject to greater price fluctuations than investment-grade securities, increased credit risk and a greater risk that the issuer might not be able to pay interest and principal when due, especially during times of weakening economic conditions or rising interest rates. The market for below-investment-grade securities may be less liquid and therefore these securities may be harder to value or sell at an acceptable price, especially during times of market volatility or decline.

Because the Fund can invest up to 40% of its assets in below-investment-grade securities, the Fund's credit risks are greater than those of funds that buy only investment-grade securities. This restriction is applied at the time of purchase and the Fund may continue to hold a security whose credit rating has been downgraded or, in the case of an unrated security, after the Fund's Sub-Adviser has changed its assessment of the security's credit quality. As a result, credit rating downgrades or other market fluctuations may cause the Fund's holdings of below-investment-grade securities to exceed, at times significantly, this restriction for an extended period of time. Credit rating downgrades of a single issuer or related similar issuers whose securities the Fund holds in significant amounts could substantially and unexpectedly increase the Fund's exposure to below-investment-grade securities and the risks associated with them, especially liquidity and default risk. If the Fund has more than 40% of its total assets invested in below-investment-grade securities, the Sub-Adviser will not purchase additional below-investment-grade securities until the level of holdings in those securities no longer exceeds the restriction.

Risks of Senior Loans. In addition to the risks typically associated with debt securities, such as credit and interest rate risk, Senior Loans are also subject to the risk that a court could subordinate a Senior Loan, which typically holds a senior position in the capital structure of a borrower, to presently existing or future indebtedness or take other action detrimental to the holders of Senior Loans. Senior Loans usually have mandatory and optional prepayment provisions. If a borrower prepays a Senior Loan, the Fund will have to reinvest the proceeds in other Senior Loans or securities that may pay lower interest rates.

|

5 |

Oppenheimer Capital Income Fund |

Senior Loans are subject to the risk that the value of the collateral, if any, securing a loan may decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate. In the event of a default, the Fund may have difficulty collecting on any collateral and would not have the ability to collect on any collateral for an uncollateralized loan. In addition, any collateral may be found invalid or may be used to pay other outstanding obligations of the borrower. The Fund's access to collateral, if any, may be limited by bankruptcy, other insolvency laws, or by the type of loan the fund has purchased. As a result, a collateralized Senior Loan may not be fully collateralized and can decline significantly in value.

Loan investments are often issued in connection with highly leveraged transactions. Such transactions include leveraged buyout loans, leveraged recapitalization loans, and other types of acquisition financing. These obligations are subject to greater credit risks than other investments including a greater possibility that the borrower may default or enter bankruptcy.

Due to restrictions on transfers in loan agreements and the nature of the private syndication of Senior Loans including, for example, the lack of publicly-available information, some Senior Loans are not as easily purchased or sold as publicly-traded securities. Some Senior Loans and other Fund investments are illiquid, which may make it difficult for the Fund to value them or dispose of them at an acceptable price when it wants to. Direct investments in Senior Loans and, to a lesser degree, investments in participation interests in or assignments of Senior Loans may be limited. Investments in Senior Loans are expected to be less affected by changes in interest rates than fixed-rate securities.

Main Risks of Mortgage-Related Securities. The Fund can buy interests in pools of residential or commercial mortgages in the form of "pass-through" mortgage securities. They may be issued or guaranteed by the U.S. government, or its agencies and instrumentalities, or by private issuers. Mortgage-related securities issued by private issuers are not U.S. government securities, and are subject to greater credit risks than mortgage-related securities that are U.S. government securities. Private-issuer mortgage-backed securities are also subject to interest rate risk, and the market for private-issuer mortgage-backed securities may be volatile at times and may be less liquid than the markets for other types of securities. In addition, a substantial portion of the Fund's assets may be subject to "forward roll" transactions (also referred to as "mortgage dollar rolls") at any given time, which subject the Fund to the risk that market value of the mortgage-related securities involved might decline, and that the counterparty might default in its obligations.

Asset-Backed Securities Risk. The Fund can buy asset backed securities, which are fractional interests in pools of loans and are collateralized by the loans, other assets or receivables. They are typically issued by trusts and special purpose corporations that pass the income from the underlying pool to the purchasers. These securities are subject to the risk of default by the issuer as well as by the borrowers of the underlying loans in the pool, and to interest rate and prepayment risks.

Risks of Foreign Investing. Foreign securities are subject to special risks. Foreign issuers are usually not subject to the same accounting and disclosure requirements that U.S. companies are subject to, which may make it difficult for the Fund to evaluate a foreign company's operations or financial condition. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency and in the value of any income or distributions the Fund may receive on those securities. The value of foreign investments may be affected by exchange control regulations, foreign taxes, higher transaction and other costs, delays in the settlement of transactions, changes in economic or monetary policy in the United States or abroad, expropriation or nationalization of a company's assets, or other political and economic factors.

Risks of Developing and Emerging Markets. The economies of developing or emerging market countries may be more dependent on relatively few industries that may be highly vulnerable to local and global changes. The governments of developing and emerging market countries may also be more unstable than the governments of more developed countries and those countries are more likely to experience instability resulting from rapid changes or developments in social, political and economic conditions. These countries generally have less developed securities markets or exchanges, and less developed legal and accounting systems. Securities may be more difficult to sell at an acceptable price and may be more volatile than securities in countries with more mature markets. The value of developing or emerging market currencies may fluctuate more than the currencies of countries with more mature markets. Investments in developing or emerging market countries may be subject to greater risks of government restrictions, including confiscatory taxation, expropriation or nationalization of a company's assets, restrictions on foreign ownership of local companies and restrictions on withdrawing assets from the country. Investments in securities of issuers in developing or emerging market countries may be considered speculative.

Risks of Small- and Mid-Sized Companies. The stock prices of small- and mid-sized companies may be more volatile and their securities may be more difficult to sell than those of larger companies. They may not have established markets, may have fewer customers and product lines, may have unseasoned management or less management depth and may have more limited access to financial resources. Smaller companies may not pay dividends or provide capital gains for some time, if at all.

Risks of Commodity-Linked Investments. Commodity-linked investments are considered speculative and have substantial risks, including the risk of loss of a significant portion of their principal value. Prices of commodities and commodity-linked investments may fluctuate significantly over short periods due to a variety of factors, including for example agricultural, economic and regulatory developments. These risks may make commodity-linked investments more volatile than other types of investments.

Risks Of Investments In The Fund's Wholly-Owned Subsidiary. The Subsidiary is not registered under the Investment Company Act of 1940 and is not subject to its investor protections (except as otherwise noted in this prospectus). As an investor in the Subsidiary, the Fund does not have all of the protections offered to investors by the Investment Company Act of 1940. However, the Subsidiary is wholly-owned and controlled by the Fund and managed by the Manager and the Sub-Adviser. Therefore, the Fund's ownership and control of the Subsidiary make it unlikely that the Subsidiary would take actions contrary to the interests of the Fund or its shareholders.

Changes in the laws of the Cayman Islands (where the Subsidiary is organized) could prevent the Subsidiary from operating as described in this prospectus and could negatively affect the Fund and its shareholders. For example, the Cayman Islands currently does not impose certain taxes on exempted companies like the Subsidiary, including income and capital gains tax, among others. If Cayman Islands laws were changed to require such entities to pay Cayman Islands taxes, the investment returns of the Fund would likely decrease.

The Fund has requested a private letter ruling from the Internal Revenue Service confirming that income from the Fund's investment in the Subsidiary constitutes "qualifying income" for purposes of the tax rules. Currently, the Internal Revenue Service has suspended the granting of private letter rulings, pending further internal discussion. As a result, there can be no assurance that the Internal Revenue

|

6 |

Oppenheimer Capital Income Fund |

Service will grant the private letter ruling requested. If the Internal Revenue Service does not grant the private letter ruling request, there is a risk that the Internal Revenue Service could assert that the annual net profit realized by the Subsidiary and imputed for income tax purposes to the Fund will not be considered "qualifying income" for purposes of the Fund remaining qualified as a regulated investment company for federal income tax purposes.

Risks of Derivative Investments. Derivatives may involve significant risks. Derivatives may be more volatile than other types of investments, may require the payment of premiums, may increase portfolio turnover, may be illiquid, and may not perform as expected. Derivatives are subject to counterparty risk and the Fund may lose money on a derivative investment if the issuer or counterparty fails to pay the amount due. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund's initial investment. As a result of these risks, the Fund could realize little or no income or lose money from its investment, or a hedge might be unsuccessful. In addition, under new rules enacted and currently being implemented under financial reform legislation, certain over-the-counter derivatives are (or soon will be) required to be executed on a regulated market and/or cleared through a clearinghouse. It is unclear how these regulatory changes will affect counterparty risk, and entering into a derivative transaction with a clearinghouse may entail further risks and costs.

Risks of Leverage. Leverage may be created when an investment exposes the Fund to a risk of loss that exceeds the amount invested. Certain derivatives and other investments provide the potential for investment gain or loss that may be several times than the value of the underlying security, index or other investment.

Who is the Fund Designed For? The Fund is designed primarily for investors seeking total return. Those investors should be willing to assume the risks of short-term share price fluctuations that are typical for a fund that has substantial investments in equity securities. Although the Fund seeks total return, it is not designed for investors needing an assured level of current income. The Fund is not a complete investment program. You should carefully consider your own investment goals and risk tolerance before investing in the Fund.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

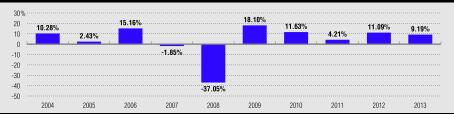

The Fund's Past Performance. The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund's

performance (for Class A shares) from calendar year to calendar year and by showing how the Fund's average annual returns for the periods of time shown in

the table compare with those of a broad measure of market performance and those of the Reference Index, which has characteristics

of those markets in which the Fund can invest. The Fund's past investment performance (before and after taxes) is not necessarily

an indication of how the Fund will perform in the future. More recent performance information is available by calling the

toll-free number on the back of this prospectus and on the Fund's website:

https://www.oppenheimerfunds.com/fund/CapitalIncomeFund

Sales charges and taxes are not included and the returns would be lower if they were. During the period shown, the highest return for a calendar quarter was 11.94% (2nd Qtr 09) and the lowest return was -24.23% (4th Qtr 08). For the period from January 1, 2014 to September 30, 2014 the cumulative return before sales charges and taxes was 4.11%.

The following table shows the average annual total returns for each class of the Fund's shares. After-tax returns are calculated using the highest individual federal marginal income tax rates and do not reflect the impact of state or local taxes. Your actual after-tax returns, depending on your individual tax situation, may differ from those shown and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for only one class and after-tax returns for other classes will vary.

Performance information for Class I shares will be provided after those shares have one full calendar year of performance.

|

7 |

Oppenheimer Capital Income Fund |

Average Annual Total Returns for the periods ended December 31, 2013 |

||||||

1 Year |

5 Years |

10 Years |

||||

Class A Shares (inception 12/1/70) |

||||||

Return Before Taxes |

2.92 |

% |

9.45 |

% |

2.36 |

% |

Return After Taxes on Distributions |

1.48 |

% |

8.34 |

% |

1.02 |

% |

Return After Taxes on Distributions and Sale of Fund Shares |

1.62 |

% |

7.09 |

% |

1.62 |

% |

Class B Shares (inception 8/17/93) |

3.04 |

% |

9.39 |

% |

2.44 |

% |

Class C Shares (inception 11/01/95) |

7.19 |

% |

9.79 |

% |

2.10 |

% |

Class R Shares (inception 3/01/01) |

7.71 |

% |

10.33 |

% |

2.58 |

% |

Class Y Shares (inception 1/28/11) |

9.38 |

% |

8.18 |

% |

N/A |

|

Russell 3000 Index |

33.55 |

% |

18.71 |

% |

7.88 |

% |

(reflects no deduction for fees, expenses or taxes) |

15.88 |

% 1 |

||||

Barclays U.S. Aggregate Bond Index |

(2.02 |

)% |

4.44 |

% |

4.55 |

% |

(reflects no deduction for fees, expenses or taxes) |

3.32 |

% 1 |

||||

Reference Index |

9.38 |

% |

10.38 |

% |

6.00 |

% |

(reflects no deduction for fees, expenses or taxes) |

7.80 |

% 1 |

||||

As of 01/31/2011.

Investment Adviser. OFI Global Asset Management, Inc. (the "Manager") is the Fund's investment adviser. OppenheimerFunds, Inc. (the "Sub-Adviser") is its sub-adviser.

Portfolio Managers. Michelle Borré, CFA, has been lead portfolio manager of the Fund since April 2009 and Vice President of the Fund since May 2009. Krishna Memani has been a Vice President of the Fund since March 2009 and portfolio manager of the Fund since April 2009.

Purchase and Sale of Fund Shares. You can buy most classes of Fund shares with a minimum initial investment of $1,000. Traditional and Roth IRA, Asset Builder Plan, Automatic Exchange Plan and government allotment plan accounts may be opened with a minimum initial investment of $500. For wrap fee-based programs, salary reduction plans and other retirement plans and accounts, there is no minimum initial investment. Once your account is open, subsequent purchases may be made in any amount. For Class I shares, the minimum initial investment is $5 million per account. The Class I share minimum initial investment will be waived for retirement plan service provider platforms.

Shares may be purchased through a financial intermediary or the Distributor and redeemed through a financial intermediary or the Transfer Agent on days the New York Stock Exchange is open for trading. Shareholders may purchase or redeem shares by mail, through the website at www.oppenheimerfunds.com or by calling 1.800.225.5677.

Share transactions may be paid by check, by Federal Funds wire or directly from or into your bank account.

Class B shares are no longer offered for new purchases. Any investments for existing Class B share accounts will be made in

Class A shares of Oppenheimer Money Market Fund.

Taxes. Fund distributions are subject to Federal income tax as ordinary income or as capital gains and they may also be subject to state or local taxes, unless your shares are held in a tax-deferred account (in which case you may be taxed later, upon withdrawal of your investment from such account).

Payments to Broker-Dealers and Other Financial Intermediaries. If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund, the Sub-Adviser, or their related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

|

8 |

Oppenheimer Capital Income Fund |

MORE ABOUT THE FUND

About the Fund's Investments

The allocation of the Fund's portfolio among different types of investments will vary over time and the Fund's portfolio might not always include all of the different types of investments described below. The Statement of Additional Information contains additional information about the Fund's investment policies and risks.

The Fund's Principal Investment Strategies and Risks. The following strategies and types of investments are the ones that the Fund considers to be the most important in seeking to achieve its investment objective and the following risks are those the Fund expects its portfolio to be subject to as a whole.

Common Stock. Common stock represents an ownership interest in a company. It ranks below preferred stock and debt securities in claims for dividends and in claims for assets of the issuer in a liquidation or bankruptcy. Common stocks may be exchange-traded or over-the-counter securities. Over-the-counter securities may be less liquid than exchange-traded securities.

Preferred Stock.

Preferred stock has a set dividend rate and ranks ahead of common stocks and behind debt securities in claims for dividends and for assets of the issuer in a liquidation or bankruptcy. The dividends on preferred stock may be cumulative (they remain a liability of the company until paid) or non-cumulative. The fixed dividend rate of preferred stocks may cause their prices to behave more like those of debt securities. When interest rates rise, the value of preferred stock having a fixed dividend rate tends to fall.

Convertible Securities. The Fund may also buy securities convertible into common stock. A convertible security is one that can be converted into or exchanged for a set amount of common stock of an issuer within a particular period of time at a specified price or according to a price formula. Convertible securities offer the Fund the ability to participate in stock market movements while also seeking some current income. Convertible debt securities pay interest and convertible preferred stocks pay dividends until they mature or are converted, exchanged or redeemed. The right to dividends payments on a company's preferred stock is usually subordinate to the rights of its debt securities. Preferred stock dividends may be cumulative (they remain a liability of the company until paid) or non-cumulative. Most convertible securities will vary, to some extent, with changes in the price of the underlying common stock and are therefore subject to the risks of that stock. The Sub-Adviser considers some convertible securities to be "equity equivalents" because of the significant impact of their conversion feature on the prices of those securities. In addition, convertible securities may be subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value may change based on changes in the issuer's credit rating or the market's perception of the issuer's creditworthiness. Some convertible preferred stocks have a mandatory conversion feature or a call feature that allows the issuer to redeem the stock on or prior to a mandatory conversion date. Those features could diminish the potential for capital appreciation on the investment.

Convertible Preferred Stock.

Some convertible preferred stocks have a mandatory conversion feature or a call feature that allows the issuer to redeem the stock on or prior to a mandatory conversion date. Those features could diminish the potential for capital appreciation on the investment.

Rights and Warrants. Rights and warrants provide the option to purchase equity securities at a specific price during a specific period of time.

Risks of Small- and Mid-Sized Companies. Small- and mid-sized companies may be either established or newer companies, including "unseasoned" companies that have been in operation for less than three years. While smaller companies might offer greater opportunities for gain than larger companies, they also may involve greater risk of loss. They may be more sensitive to changes in a company's earnings expectations and may experience more abrupt and erratic price movements. Smaller companies' securities often trade in lower volumes and in many instances, are traded over-the-counter or on a regional securities exchange, where the frequency and volume of trading is substantially less than is typical for securities of larger companies traded on national securities exchanges. Therefore, the securities of smaller companies may be subject to wider price fluctuations and it might be harder for the Fund to dispose of its holdings at an acceptable price when it wants to sell them. Small- and mid-sized companies may not have established markets for their products or services and may have fewer customers and product lines. They may have more limited access to financial resources and may not have the financial strength to sustain them through business downturns or adverse market conditions. Since small- and mid-sized companies typically reinvest a high proportion of their earnings in their business, they may not pay dividends for some time, particularly if they are newer companies. Smaller companies may have unseasoned management or less depth in management skill than larger, more established companies. They may be more reliant on the efforts of particular members of their management team and management changes may pose a greater risk to the success of the business. Securities of small, unseasoned companies may be particularly volatile, especially in the short term, and may have very limited liquidity. It may take a substantial period of time to realize a gain on an investment in a small- or mid-sized company, if any gain is realized at all.

Debt Securities. The Fund may invest in debt securities, including securities issued or guaranteed by the U.S. government, or its agencies and instrumentalities, or foreign sovereigns, and foreign and domestic corporate bonds, notes and debentures. The Fund may select debt securities for their income possibilities or to help cushion fluctuations in the value of its portfolio. Debt securities may be subject to the following risks:

|

9 |

Oppenheimer Capital Income Fund |

Interest Rate Risk. Interest rate risk is the risk that rising interest rates, or an expectation of rising interest rates in the near future, will cause the values of the Fund's investments in debt securities to decline. The values of debt securities usually change when prevailing interest rates change. When interest rates rise, the values of outstanding debt securities generally fall, and those securities may sell at a discount from their face amount. When interest rates rise, the decrease in values of outstanding debt securities may not be offset by higher income from new investments. When interest rates fall, the values of already-issued debt securities generally rise. However, when interest rates fall, the Fund's investments in new securities may be at lower yields and may reduce the Fund's income. The values of longer-term debt securities usually change more than the values of shorter-term debt securities when interest rates change; thus, interest rate risk is usually greater for securities with longer maturities or durations. "Zero-coupon" or "stripped" securities may be particularly sensitive to interest rate changes. Risks associated with rising interest rates are heightened given that interest rates in the U.S. are at, or near, historic lows. Interest rate changes may have different effects on the values of mortgage-related securities because of prepayment and extension risks.

Duration Risk. Duration risk is the risk that longer-duration debt securities are more likely to decline in price than shorter-duration debt securities, in a rising interest-rate environment. Duration is a measure of the price sensitivity of a debt security or portfolio to interest rate changes. "Effective duration" attempts to measure the expected percentage change in the value of a bond or portfolio resulting from a change in prevailing interest rates. The change in the value of a bond or portfolio can be approximated by multiplying its duration by a change in interest rates. For example, if a bond has an effective duration of three years, a 1% increase in general interest rates would be expected to cause the bond's value to decline about 3% while a 1% decrease in general interest rates would be expected to cause the bond's value to increase 3%. The duration of a debt security may be equal to or shorter than the full maturity of a debt security.

Credit Risk. Credit risk is the risk that the issuer of a security might not make interest and principal payments on the security as they become due. U.S. government securities generally have lower credit risks than securities issued by private issuers or certain foreign governments. If an issuer fails to pay interest, the Fund's income might be reduced, and if an issuer fails to repay principal, the value of the security might fall and the Fund could lose the amount of its investment in the security. The extent of this risk varies based on the terms of the particular security and the financial condition of the issuer. A downgrade in an issuer's credit rating or other adverse news about an issuer, for any reason, can reduce the market value of that issuer's securities.

Credit Spread Risk. Credit spread risk is the risk that credit spreads (i.e., the difference in yield between securities that is due to differences in their credit quality) may increase when the market expects lower-grade bonds to default more frequently. Widening credit spreads may quickly reduce the market values of the Fund's lower-rated and unrated securities. Some unrated securities may not have an active trading market or may trade less actively than rated securities, which means that the Fund might have difficulty selling them promptly at an acceptable price.

Extension Risk. Extension risk is the risk that, if interest rates rise rapidly, repayments of principal on certain debt securities may occur at a slower rate than expected, and the expected maturity of those securities could lengthen as a result. Securities that are subject to extension risk generally have a greater potential for loss when prevailing interest rates rise, which could cause their values to fall sharply. Extension risk is particularly prevalent for a callable security where an increase in interest rates could result in the issuer of that security choosing not to redeem the security as anticipated on the security's call date. Such a decision by the issuer could have the effect of lengthening the debt security's expected maturity, making it more vulnerable to interest rate risk and reducing its market value.

Reinvestment Risk. Reinvestment risk is the risk that when interest rates fall, the Fund may be required to reinvest the proceeds from a security's sale or redemption at a lower interest rate. Callable bonds are generally subject to greater reinvestment risk than non-callable bonds.

Prepayment Risk. Certain fixed-income securities (in particular mortgage-related securities) are subject to the risk of unanticipated prepayment. Prepayment risk is the risk that, when interest rates fall, the issuer will redeem the security prior to the security's expected maturity, or that borrowers will repay the loans that underlie these fixed-income securities more quickly than expected, thereby causing the issuer of the security to repay the principal prior to expected maturity. The Fund may need to reinvest the proceeds at a lower interest rate, reducing its income. Securities subject to prepayment risk generally offer less potential for gains when prevailing interest rates fall. If the Fund buys those securities at a premium, accelerated prepayments on those securities could cause the Fund to lose a portion of its principal investment. The impact of prepayments on the price of a security may be difficult to predict and may increase the security's price volatility. Interest-only and principal-only securities are especially sensitive to interest rate changes, which can affect not only their prices but can also change the income flows and repayment assumptions about those investments.

Event Risk. If an issuer of debt securities is the subject of a buyout, debt restructuring, merger or recapitalization that increases its debt load, it could interfere with its ability to make timely payments of interest and principal and cause the value of its debt securities to fall.

Fixed-Income Market Risks. The fixed-income securities market can be susceptible to unusual volatility and illiquidity. Volatility and illiquidity may be more pronounced in the case of lower-rated and unrated securities. Liquidity can decline unpredictably in response to overall economic conditions or credit tightening. Increases in volatility and decreases in liquidity may be caused by a rise in interest rates (or the expectation of a rise in interest rates), which are at or near historic lows in the U.S. and in other countries. During times of reduced market liquidity, the Fund may not be able to readily sell bonds at the prices at which they are carried on the Fund's books. If the Fund needed to sell large blocks of bonds to meet shareholder redemption requests or to raise cash, those sales could further reduce the bonds' prices. An unexpected increase in Fund redemption requests, which may be triggered by market turmoil or an increase in interest rates, could cause the Fund to sell its holdings at a loss or at undesirable prices. Similarly, the prices of the Fund's holdings could be adversely affected if an investment account managed similarly to that of the Fund were to experience significant redemptions and those accounts were required to sell its holdings at an inopportune time. The liquidity of an issuer's securities may decrease as result of a decline in an issuer's credit rating, the occurrence of an event that causes counterparties to avoid transacting with the issuer, or an increase in the issuer's cash outflows. A lack of liquidity or other adverse credit market conditions may hamper the Fund's ability to sell the debt securities in which it invests or to find and purchase suitable debt instruments.

Economic and other market developments can adversely affect fixed-income securities markets in the United States, Europe and elsewhere. At times, participants in debt securities markets may develop concerns about the ability of certain issuers of debt securities to make timely principal and interest payments, or they may develop concerns about the ability of financial institutions that make markets in certain debt

|

10 |

Oppenheimer Capital Income Fund |

securities to facilitate an orderly market. Those concerns may impact the market price or value of those debt securities and may cause increased volatility in those debt securities or debt securities markets. Under some circumstances, as was the case during the latter half of 2008 and early 2009, those concerns could cause reduced liquidity in certain debt securities markets.

Following the financial crisis, the Federal Reserve has sought to stabilize the economy by keeping the federal funds rate at or near zero percent. The Federal Reserve has also purchased large quantities of securities issued or guaranteed by the U.S. government, its agencies or instrumentalities, pursuant to its monetary stimulus program known as "quantitative easing". As the Federal Reserve tapers its securities purchases pursuant to quantitative easing or raises the federal funds rate, there is a risk that interest rates may rise and cause fixed-income investors to move out of fixed-income securities, which may also increase redemptions in fixed-income mutual funds.

In addition, although the fixed-income securities markets have grown significantly in the last few decades, regulations and business practices have led some financial intermediaries to curtail their capacity to engage in trading (i.e., "market making") activities for certain debt securities. As a result, dealer inventories of fixed-income securities, which provide an indication of the ability of financial intermediaries to make markets in fixed-income securities, are at or near historic lows relative to market size. Because market makers help stabilize the market through their financial intermediary services, further reductions in dealer inventories could have the potential to decrease liquidity and increase volatility in the fixed-income securities markets.

Credit Quality. The Fund may invest in securities that are rated or unrated. "Investment-grade" securities are those rated within the four highest rating categories by nationally recognized statistical rating organizations such as Moody's or Standard & Poor's (or, in the case of unrated securities, determined by the investment adviser to be comparable to securities rated investment-grade). "Below-investment-grade" securities are those that are rated below those categories, which are also referred to as "junk bonds." While securities rated within the fourth highest category by Standard & Poor's (meaning BBB+, BBB or BBB-) or by Moody's (meaning Baa1, Baa2 or Baa3) are considered "investment-grade," they have some speculative characteristics. If two or more nationally recognized statistical rating organizations have assigned different ratings to a security, the investment adviser uses the highest rating assigned.

Credit ratings evaluate the expectation that scheduled interest and principal payments will be made in a timely manner. They do not reflect any judgment of market risk. Ratings and market value may change from time to time, positively or negatively, to reflect new developments regarding the issuer. Rating organizations might not change their credit rating of an issuer in a timely manner to reflect events that could affect the issuer's ability to make timely payments on its obligations. In selecting securities for its portfolio and evaluating their income potential and credit risk, the Fund does not rely solely on ratings by rating organizations but evaluates business, economic and other factors affecting issuers as well. Many factors affect an issuer's ability to make timely payments, and the credit risk of a particular security may change over time. The investment adviser also may use its own research and analysis to assess those risks. If a bond is insured, it will usually be rated by the rating organizations based on the financial strength of the insurer. The rating categories are described in an Appendix to the Statement of Additional Information.

Unrated Securities. Because the Fund purchases securities that are not rated by any nationally recognized statistical rating organization, the investment adviser may internally assign ratings to those securities, after assessing their credit quality and other factors, in categories similar to those of nationally recognized statistical rating organizations. There can be no assurance, nor is it intended, that the investment adviser's credit analysis process is consistent or comparable with the credit analysis process used by a nationally recognized statistical rating organization. Unrated securities are considered "investment-grade" or "below-investment-grade" if judged by the investment adviser to be comparable to rated investment-grade or below-investment-grade securities. The investment adviser's rating does not constitute a guarantee of the credit quality. In addition, some unrated securities may not have an active trading market or may trade less actively than rated securities, which means that the Fund might have difficulty selling them promptly at an acceptable price.

In evaluating the credit quality of a particular security, whether rated or unrated, the investment adviser will normally take into consideration a number of factors such as, if applicable, the financial resources of the issuer, the underlying source of funds for debt service on a security, the issuer's sensitivity to economic conditions and trends, any operating history of the facility financed by the obligation, the degree of community support for the financed facility, the capabilities of the issuer's management, and regulatory factors affecting the issuer or the particular facility.

A reduction in the rating of a security after the Fund buys it will not require the Fund to dispose of the security. However, the investment adviser will evaluate such downgraded securities to determine whether to keep them in the Fund's portfolio.

Risks of Below-Investment-Grade Securities. Below-investment-grade securities (also referred to as "junk bonds") generally have higher yields than securities rated in the higher rating categories but also have higher risk profiles. Below-investment-grade securities are considered to be speculative and entail greater risk with respect to the ability of the issuer to timely repay principal and pay interest or dividends in accordance with the terms of the obligation and may have more credit risk than investment-grade rated securities, especially during times of weakening economic conditions or rising interest rates. These additional risks mean that the Fund may not receive the anticipated level of income from these securities, and the Fund's net asset value may be affected by declines in the value of lower-grade securities. The major risks of below-investment-grade securities include:

Prices of below-investment-grade securities are subject to extreme price fluctuations, even under normal market conditions. Adverse changes in an issuer's industry and general economic conditions may have a greater impact on the prices of below-investment-grade securities than on the prices of higher-rated fixed-income securities.

Below-investment-grade securities may be issued by less creditworthy issuers and may be more likely to default than investment-grade securities. Issuers of below-investment-grade securities may have more outstanding debt relative to their assets than issuers of higher-grade securities. Issuers of below-investment-grade securities may be unable to meet their interest or principal payment obligations because of an economic downturn, specific issuer developments, or the unavailability of additional financing.

In the event of an issuer's bankruptcy, claims of other creditors may have priority over the claims of below-investment-grade securities holders.

Below-investment-grade securities may be less liquid than higher rated fixed-income securities, even under normal market conditions. There are fewer dealers in the below-investment-grade securities market and there may be significant differences in the prices quoted by

|

11 |

Oppenheimer Capital Income Fund |

the dealers. Because they are less liquid, judgment may play a greater role in valuing certain of the Fund's securities than is the case with securities trading in a more liquid market.

Below-investment-grade securities typically contain redemption provisions that permit the issuer of the securities containing such provisions to redeem the securities at its discretion. If the issuer redeems below-investment-grade securities, the Fund may have to invest the proceeds in securities with lower yields and may lose income.

Below-investment-grade securities markets may be more susceptible to real or perceived adverse credit, economic, or market conditions than higher rated securities.

The Fund can invest up to 40% of its total assets in below-investment-grade securities. This restriction is applied at the time of purchase and the Fund may continue to hold a security whose credit rating has been downgraded or, in case of an unrated security, after the Fund's Sub-Adviser has changed its assessment of the security's credit quality. As a result, credit rating downgrades or other market fluctuations may cause the Fund's holdings of below-investment-grade securities to exceed, at times significantly, this restriction for an extended period of time. Credit rating downgrades of a single issuer or related similar issuers whose securities the Fund holds in significant amounts could substantially and unexpectedly increase the Fund's exposure to below-investment-grade securities and the risks associated with them, especially liquidity and default risk. If the Fund has more than 40% of its total assets invested in below-investment-grade securities, the Sub-Adviser will not purchase additional below-investment-grade securities until the level of holdings in those securities no longer exceeds the restriction.

U.S. Government Securities. The Fund may invest in securities issued or guaranteed by the U.S. government or its agencies and instrumentalities. Some of those securities are directly issued by the U.S. Treasury and are backed by the full faith and credit of the U.S. government. "Full faith and credit" means that the taxing power of the U.S. government is pledged to the payment of interest and repayment of principal on a security.

Some securities issued by U.S. government agencies, such as Government National Mortgage Association pass-through mortgage obligations ("Ginnie Maes"), are also backed by the full faith and credit of the U.S. government. Others are supported by the right of the agency to borrow an amount from the U.S. government (for example, "Fannie Mae" bonds issued by the Federal National Mortgage Association and "Freddie Mac" obligations issued by the Federal Home Loan Mortgage Corporation). Others are supported only by the credit of the agency (for example, obligations issued by the Federal Home Loan Banks). In September 2008, the Federal Housing Finance Agency placed the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation into conservatorship. The U.S. Treasury also entered into a secured lending credit facility with those companies and a preferred stock purchase agreement. Under the preferred stock purchase agreement, the Treasury ensures that each company maintains a positive net worth.

Mortgage-Related Securities. The Fund can buy interests in pools of residential or commercial mortgages in the form of "pass-through" mortgage securities. They may be issued or guaranteed by the U.S. government, or its agencies and instrumentalities, or by private issuers. Mortgage-related securities may be issued in different series, each having different interest rates and maturities. The prices and yields of mortgage-related securities are determined, in part, by assumptions about the rate of payments of the underlying mortgages and are subject to the risks of unanticipated prepayment.

Private-Issuer Mortgage-Related Securities. Mortgage-related securities issued by private issuers are not U.S. government securities, and are subject to greater credit risks than mortgage-related securities that are U.S. government securities. Primarily these include multi-class debt or pass-through certificates secured by mortgage loans, which may be issued by banks, savings and loans, mortgage bankers and other non-governmental issuers. Private-issuer mortgage-backed securities may include loans on residential or commercial properties.

Mortgage-related securities issued by private issuers are not U.S. government securities, which makes them subject to greater credit risks than U.S. government securities. Private issuer mortgage-backed securities are subject to the credit risks of the issuers, as well as to interest rate risks, although in some cases they may be supported by insurance or guarantees. The prices and yields of private issuer mortgage-related securities are also subject to prepayment and extension risk. The market for private-issuer mortgage-backed securities may be volatile at times and may be less liquid than the markets for other types of securities.

Forward Rolls. The Fund can enter into "forward roll" transactions (also referred to as "mortgage dollar rolls") with respect to mortgage-related securities. In this type of transaction, the Fund sells a mortgage-related security to a buyer and simultaneously agrees to repurchase a similar security at a later date at a set price. During the period between the sale and the repurchase, the Fund will not be entitled to receive interest and principal payments on the securities that have been sold. The Fund will bear the risk that the market value of the securities might decline below the price at which the Fund is obligated to repurchase them or that the counterparty might default in its obligations.

A substantial portion of the Fund's assets may be subject to forward roll transactions at any given time.

Asset-Backed Securities. Asset-backed securities are fractional interests in pools of loans, receivables or other assets. They are issued by trusts or other special purpose vehicles and are collateralized by the loans, receivables or other assets that make up the pool. The trust or other issuer passes the income from the underlying asset pool to the investor. Neither the Fund nor the Sub-Adviser selects the loans, receivables or other assets that are included in the pools or the collateral backing those pools. Asset-backed securities are subject to interest rate risk and credit risk. These securities are subject to the risk of default by the issuer as well as by the borrowers of the underlying loans in the pool. Certain asset-backed securities are subject to prepayment and extension risks.

Zero-Coupon Securities. The Fund may invest in "zero-coupon" securities, which pay no interest prior to their maturity date or another specified date in the future but are issued at a discount from their face value. Interest rate changes generally cause greater fluctuations in the prices of zero-coupon securities than in interest-paying securities of the same or similar maturities. The Fund may be required to pay a dividend of the imputed income on a zero-coupon security, at a time when it has not actually received the income.

Stripped Securities. "Stripped" securities are the separate income or principal components of a debt security, such as Treasury securities whose coupons have been stripped by a Federal Reserve Bank. Some mortgage-related securities may be stripped, with each component having a different proportion of principal or interest payments. One class might receive all the interest payments, all the principal payments or some proportional amount of interest and principal. Interest rate changes may cause greater fluctuations in the prices of stripped

|

12 |

Oppenheimer Capital Income Fund |

securities than in other debt securities of the same or similar maturities. The market for these securities may be limited, making it difficult for the Fund to sell its holdings at an acceptable price. The Fund may be required to pay out the imputed income on a stripped security as a dividend, at a time when it has not actually received the income.

Special Considerations of Senior Loans. Typically, Senior Loans have higher recoveries than other debt obligations, because in most instances they take preference over subordinated debt obligations and common stock with respect to payment of interest and principal. However, the Fund is subject to the risk that the borrower under a Senior Loan will default on scheduled interest or principal payments. The risk of default will increase in the event of an economic downturn or a substantial increase in interest rates (which will increase the cost of the borrower's debt service as the interest rate on its Senior Loan is upwardly adjusted). The Fund may own a debt obligation of a borrower that is about to become insolvent. The Fund can also purchase debt obligations that are issued in connection with a restructuring of the borrower under bankruptcy laws.

Interest Rates. The Senior Loans in which the Fund invests have floating or adjustable interest rates. For that reason, the Sub-Adviser expects that when interest rates change, the values of Senior Loans will fluctuate less than the values of fixed-rate debt securities, and that the net asset values of the Fund's shares will fluctuate less than the shares of funds that invest mainly in fixed-rate debt obligations. However, the interest rates of some Senior Loans adjust only periodically. Between the times that interest rates on Senior Loans adjust, the interest rates on those Senior Loans may not correlate to prevailing interest rates. That will affect the value of the loans and may cause the net asset values of the Fund's shares to fluctuate.

Prepayment. The Fund has no limits as to the maturity of Senior Loans it may purchase. Senior Loans in general have a stated term of between five and seven years. However, because Senior Loans typically amortize principal over their stated life and frequently are prepaid, their average credit exposure is expected to be two to three years. Senior Loans usually have mandatory and optional prepayment provisions. If a borrower prepays a Senior Loan, the Fund will have to reinvest the proceeds in other Senior Loans or securities that may pay lower interest rates. However, prepayment and facility fees the Fund receives may help reduce any adverse impact on the Fund's yield. Because the interest rates on Senior Loans adjust periodically, the Sub-Adviser believes that the Fund should generally be able to reinvest prepayments in Senior Loans that have yields similar to those that have been prepaid.

Subordination. Senior Loans typically hold the most senior position in a borrower's capital structure. They may include loans that hold the most senior position, loans that hold an equal ranking with other senior debt, or loans that are, in the judgment of the Sub-Adviser, in the category of senior debt of the borrower. Borrowers typically are required contractually to pay the holders of Senior Loans before they pay the holders of subordinated debt, trade creditors, and preferred or common shareholders and give the holders of Senior Loans a claim on some or all of the borrower's assets that is senior to that of subordinated debt, preferred stock and common stock of the borrower in the event that the borrower defaults or becomes bankrupt. Senior Loans are subject to the risk that a court could subordinate a Senior Loan to presently existing or future indebtedness or take other action detrimental to the holders of Senior Loans.

That senior position in the borrower's capital structure typically gives the holders of Senior Loans a claim on some or all of the borrower's assets that is senior to that of subordinated debt, preferred stock and common stock of the borrower in the event that the borrower defaults or becomes bankrupt.