UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File No. 1-2691

AMERICAN AIRLINES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 13-1502798 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

4333 Amon Carter Blvd.

Fort Worth, Texas 76155

(Address of principal executive offices, including zip code)

(817) 963-1234

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Exchange on Which Registered | |

| NONE |

NONE |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ¨ No x

American Airlines, Inc. is a wholly-owned subsidiary of AMR Corporation, and there is no market for the registrant’s common stock. As of February 13, 2013, 1,000 shares of the registrant’s common stock were outstanding.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (Amendment No. 1) amends the Annual Report on Form 10-K of American Airlines, Inc. (American or the Company) for the fiscal year ended December 31, 2012, which the Company originally filed with the Securities and Exchange Commission (the SEC) on February 20, 2013 (the Original Filing). The Company is filing this Amendment No. 1 to provide the information required pursuant to instruction G(3) to Form 10-K for Part III, Items 10, 11, 12, 13, and 14 of the Original Filing. Part IV of the Original Filing has been amended to contain currently dated certifications as required by Rules 12b-15, 15d-14(a), and 15d-14(b) under the Securities Exchange Act of 1934 (the Exchange Act) with respect to this Amendment No. 1. Additionally, this Amendment No. 1 corrects certain technical and formatting errors within its Interactive Data File included in the Original Filing as Exhibit 101.

This Amendment No. 1 speaks as of the original filing date of the Original Filing and reflects only the changes to the cover page, Items 10, 11, 12, 13, and 14 of Part III, Item 15 of Part IV, the signature page, and Exhibits 31.1, 31.2, 32, and 101. No other information included in the Original Filing, including the information set forth in Part I and Part II, has been modified or updated in any way. The Company has made no attempt in this Amendment No. 1 to modify or update the disclosures presented in the Original Filing other than as noted above. Also, this Amendment No. 1 does not reflect events occurring after the filing of the Original Filing. Accordingly this Amendment No. 1 should be read in conjunction with Original Filing.

Additional Information and Where To Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The proposed merger transaction between AMR Corporation (“AMR”) (the parent company of American) and US Airways Group, Inc. (alone or together with its subsidiaries, US Airways Group) will be submitted to the stockholders of US Airways Group for their consideration. AMR has filed with the SEC a registration statement on Form S-4, which includes a preliminary proxy statement of US Airways Group and also constitutes a prospectus of AMR. US Airways Group expects to file with the SEC a definitive proxy statement on Schedule 14A, and AMR and US Airways Group also plan to file other documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS OF US AIRWAYS GROUP ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC (INCLUDING THE DEFINITIVE PROXY STATEMENT/PROSPECTUS) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the preliminary proxy statement/prospectus and other documents containing important information about AMR and US Airways Group (including the definitive proxy statement/prospectus), once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by US Airways Group, when and if available, can be obtained free of charge on US Airways Group’s website at www.usairways.com or by directing a written request to US Airways Group, Inc., 111 West Rio Salado Parkway, Tempe, Arizona 85281, Attention: Vice President, Legal Affairs. Copies of the documents filed with the SEC by AMR, when and if available, can be obtained free of charge on AMR’s website at www.aa.com or by directing a written request to AMR Corporation, P.O. Box 619616, MD 5675, Dallas/Fort Worth International Airport, Texas 75261-9616, Attention: Investor Relations or by emailing investor.relations@aa.com.

US Airways Group, AMR and certain of their respective directors, executive officers and certain members of management may be deemed to be participants in the solicitation of proxies from the stockholders of US Airways Group in connection with the proposed transaction. Information about the directors and executive officers of US Airways Group is set forth in its Annual Report on Form 10-K/A, which was filed with the SEC on April 15, 2013, and the preliminary proxy statement/prospectus related to the proposed transaction, which was filed with the SEC on April 15, 2013. Information about the directors and executive officers of AMR is set forth in its Annual Report on Form 10-K/A, which was filed with the SEC on April 15, 2013, and the preliminary proxy statement/prospectus related to the proposed transaction, which was filed with the SEC on April 15, 2013. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation may also be included in the definitive proxy statement/prospectus and other relevant materials when and if filed with the SEC in connection with the proposed transaction.

Forward-Looking Information

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “forecast” and other similar words. These forward-looking statements are based on AMR’s and US Airways Group’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. The following factors, among others, could cause actual results and financial position and timing of certain events to differ materially from those described in the forward-looking statements: failure of a proposed transaction to be implemented; the challenges and costs of closing, integrating, restructuring and achieving anticipated synergies; the ability to retain key

1

employees; AMR’s operations and financial condition, including changes in capacity, revenues, and costs; future financing plans and needs; the amounts of its unencumbered assets and other sources of liquidity; fleet plans; overall economic and industry conditions; plans and objectives for future operations; regulatory approvals and actions; and the impact on AMR of its results of operations in recent years and the sufficiency of its financial resources to absorb that impact; and other economic, business, competitive, and/or regulatory factors affecting the businesses of US Airways Group and AMR generally, including those set forth in the filings of US Airways Group and AMR with the SEC, especially in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of their respective annual reports on Form 10-K and quarterly reports on Form 10-Q, their current reports on Form 8-K and other SEC filings, including the registration statement and the proxy statement/prospectus related to the proposed transaction. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements. Neither AMR nor US Airways Group assumes any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements except as required by law.

PART III

Explanatory Note. American is a wholly-owned subsidiary of AMR. The members of the board of directors of AMR described below are also members of the board of American. The named executive officers of AMR described below are also the named executive officers of American. References to “AMR” below mean and include AMR and American unless other noted.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors

Set forth below is a brief biography of each of the current members of AMR’s board of directors.

Thomas W. Horton (Age 51). Director since 2011. Mr. Horton was named chairman and chief executive officer of AMR and American, in November 2011, and also continues to serve as president of AMR and American. Previously, Mr. Horton served as executive vice president—finance and planning and chief financial officer of AMR and American starting in March 2006 upon returning to American from AT&T. He was promoted to president in July 2010. At AT&T, he served as vice chairman and chief financial officer. Mr. Horton initially joined American in 1985 and held a range of senior financial positions with American. From 1998 to 2000, he was vice president responsible for the airline’s Europe business, based in London. In January 2000, Mr. Horton became senior vice president and chief financial officer of AMR. Mr. Horton serves on the board of directors of Qualcomm Incorporated. He therefore brings to the board extensive and unique company and industry experience. Since he is responsible for, and familiar with, AMR’s day-to-day operations and implementation of AMR’s strategy, his insights into AMR’s performance and the airline industry are critical to board discussions and AMR’s success.

John W. Bachmann (Age 74). Director since 2001. Mr. Bachmann began his career at Edward Jones, one of the world’s largest retail brokerage firms, in 1959. He has served in many capacities at the firm, including as its managing partner from 1980 to 2003. He has been senior partner at Edward Jones since January 2004. With his long history at Edward Jones and as its leader for many years, Mr. Bachmann has extensive financial, capital markets, strategic, and executive leadership experience. He is also senior council board member of the U.S. Chamber of Commerce. He previously served as a director of the Monsanto Company and the National Association of Securities Dealers. His experience as a director and member of board committees of these and other companies provides important insights into corporate governance and board functions. He is a resident of St. Louis, Missouri, one of AMR’s important markets. His background and experience make him an effective member of AMR’s board of directors and its audit and diversity committees, and a strong chairman of the audit committee.

Stephen M. Bennett (Age 59). Director since 2011. Mr. Bennett has served as chairman of the board (since October 2011) and president and chief executive officer (since July 2012) of Symantec Corporation, one of the world’s largest software companies providing security, storage, and systems management solutions. From 2000 until his retirement in December 2007, Mr. Bennett was president

2

and chief executive officer of Intuit, Inc., a provider of innovative business and financial management solutions. Prior to Intuit, Mr. Bennett held several significant leadership positions at General Electric Company for more than 23 years, including executive vice president and member of the board of directors for GE Capital, the financial services subsidiary of General Electric. Mr. Bennett has served as a director of Symantec since 2010 and also serves as a director of Qualcomm Incorporated. Mr. Bennett brings to AMR’s board of directors extensive leadership, consumer industry, and technical experience through his former role as chief executive officer of Intuit, executive management positions at General Electric, and service on technology boards. His background and experience make him an effective member of AMR’s board of directors.

Armando M. Codina (Age 66). Director since 1995. Since January 1, 2011, Mr. Codina has been the chairman and chief executive officer of Codina Partners, LLC, a real estate investment and development firm based in Coral Gables, Florida. Mr. Codina formed Codina Partners in 2009 and through this entity and its affiliates is engaged in multiple real estate development and investment activities. Previously, he led the growth of Codina Group, a large South Florida-based commercial real estate firm, for 26 years as its founder, chairman, and chief executive officer. In 2006, Codina Group merged with Florida East Coast Industries (FECI) and became FECI’s full-service real estate business, Flagler Development Group. He served as Flagler’s chairman, chief executive officer, and president until September 2008, and as its chairman until December 2010. Prior to founding Codina Group, he served as president of Professional Automated Services, Inc., which provided data processing services to physicians. Mr. Codina’s extensive experience in commercial real estate and business provides significant insight into the real estate, business, strategic, and other issues AMR faces. He is also a director of The Home Depot, Inc., and he previously served as a director of Bell South Corporation, General Motors Corporation, Merrill Lynch & Co., Inc., and FECI. His experience as a director and member of board committees of these and other companies provides important insights into corporate governance and board functions. His deep roots in Florida also provide important perspective of one of AMR’s largest and most important markets. His background and experience make him an effective member of AMR’s board of directors and its nominating/corporate governance committee, and a strong lead director.

Alberto Ibargüen (Age 69). Director since 2008. Mr. Ibargüen has served as president and chief executive officer of the John S. and James L. Knight Foundation since July 2005. In this role, he has led the foundation’s support of journalism and civic advancement in 26 U.S. communities. Previously, Mr. Ibargüen served as chairman of Miami Herald Publishing Co. from 1998 to 2005, a Knight Ridder subsidiary, and as publisher of The Miami Herald and of El Nuevo Herald. He therefore brings extensive media, philanthropic, strategic, and executive leadership experience to AMR’s board of directors. He is a director of PepsiCo, Inc., AOL Inc., and the World Wide Web Foundation (based in Switzerland). He previously served as a director of NCL Corporation Ltd. and on the advisory committee of the Public Company Accounting Oversight Board. He is also a former chairman of the board of the Public Broadcasting Service and the Newseum in Washington, D.C. His experience as a director and member of board committees of these and other companies provides important insights into corporate governance and board functions. He is a resident of Miami, Florida, one of AMR’s largest and most important markets. His background and experience make him an effective member of AMR’s board of directors and its audit and diversity committees.

Ann M. Korologos (Age 71). Director since 1990. Mrs. Korologos has held several important posts in the U.S. government, including U.S. Secretary of Labor from 1987 to 1989, and Under Secretary of the U.S. Department of Interior and Assistant Secretary of the Treasury before that. She most recently served as chairman of the board of trustees of RAND Corporation, an international public policy research organization, from April 2004 to April 2009. From September 1989 until May 1990, Mrs. Korologos served as chairman of the President’s Commission on Aviation Security and Terrorism. She has served as chairman emeritus of The Aspen Institute since August 2004, where she has served on its board of trustees since 1989. She also was senior adviser for Benedetto, Gartland & Company from 1996 to 2005. With her leadership roles in political, financial, and other fields, Mrs. Korologos brings to AMR’s board of directors extensive public policy, financial, strategic, and executive leadership experience.

3

Mrs. Korologos is also a director of Harman International Industries, Incorporated, Host Hotels & Resorts, Inc. (formerly, Host Marriott Corporation), Vulcan Materials Company, Kellogg Company, and Michael Kors Holdings Limited. Her experience as a director and member of board committees of these and other companies provides important insights into corporate governance and board functions. She is also a resident of Washington, D.C., one of AMR’s most important markets. Her background and experience make her an effective member of the board and its diversity committee.

Michael A. Miles (Age 73). Director since 2000. Since 1995, Mr. Miles has been a special limited partner and a member of the advisory board of Forstmann Little & Co., a New York-based private equity firm. Previously, he was chairman and chief executive officer of Philip Morris Companies Inc. from 1991 until his retirement in 1994, and he served as chairman and chief executive officer of Kraft Foods, Inc. before that. With roles at these and other companies, he brings extensive business, financial, strategic, and executive leadership experience to AMR’s board of directors. Mr. Miles is also a director of Time Warner Inc., and he previously served as a director of Citadel Broadcasting Corporation and Dell Inc. His experience as a director and member of board committees of these and other companies provides important insights into corporate governance and board functions. He also resides in the Chicago area, one of AMR’s largest and most important markets. His background and experience make him an effective member of AMR’s board of directors and its compensation committee and a strong chairman of that committee.

Philip J. Purcell (Age 69). Director since 2000. Mr. Purcell became president and chief operating officer of Dean Witter Discover & Co. in 1982. He became chairman and chief executive officer of Dean Witter Discover in 1986 until it acquired Morgan Stanley Group, Inc. in 1997. He then served as chairman and chief executive officer of Morgan Stanley until he retired in July 2005. Mr. Purcell has been the president of private equity firm Continental Investors, LLC since January 2006. With his leadership roles at major financial services companies and a private equity firm, Mr. Purcell has extensive financial, capital markets, strategic, and executive leadership experience. He also previously served as a director of the New York Stock Exchange (the NYSE), including as its vice chairman during 1995 and 1996. His experience as a chairman and director of these and other companies provides important insights into corporate governance and board functions. He also resides in the Chicago area, one of AMR’s largest and most important markets. His background and experience make him an effective member of AMR’s board of directors and its compensation and nominating/corporate governance committees.

Ray M. Robinson (Age 65). Director since 2005. Mr. Robinson started his career at AT&T in 1968, and prior to his retirement in 2003, he held several executive positions, including president of the Southern Region, its largest region, president and chief executive officer of AT&T Tridom, vice president of operations for AT&T Business Customer Care, senior vice president of AT&T Outbound Services, and vice president of AT&T Public Relations. Since 2003, Mr. Robinson has served as chairman of Citizens Trust Bank of Atlanta, Georgia, the largest African American-owned bank in the Southeastern U.S. and the nation’s second largest. With his numerous executive leadership positions, Mr. Robinson has extensive technology, banking, communications, strategic, and executive leadership experience. Mr. Robinson is also a director of Aaron’s, Inc., Acuity Brands, Inc., Avnet, Inc., and RailAmerica Inc., and he previously served as a director of ChoicePoint Inc. His experience as a director and member of board committees of these and other companies provides important insights into corporate governance and board functions. He resides in the Atlanta, Georgia area, an important business center, where he has been vice chairman of the East Lake Community Foundation since November 2003. His background and experience make him an effective member of AMR’s board of directors and its audit and nominating/corporate governance committees.

Dr. Judith Rodin (Age 68). Director since 1997. Dr. Rodin has served as president of The Rockefeller Foundation since March 2005. The foundation, founded in 1913, supports efforts to combat global social, economic, health, and environmental challenges. From 1994 to 2004, Dr. Rodin led the University of Pennsylvania through a period of significant growth as its president. Before that, at Yale University, she chaired the Department of Psychology, served as dean of the Graduate School of Arts and

4

Sciences and provost, and she was a faculty member for 22 years. As the leader of important philanthropic and higher learning institutions, Dr. Rodin has extensive educational, philanthropic, strategic, and executive leadership experience. Dr. Rodin is also a director of Citigroup Inc. and Comcast Corporation. Her experience as a director and member of board committees of these and other companies provides important insights into corporate governance and board functions. She is a resident of New York City, one of AMR’s most important markets. Her background and experience make her an effective member of AMR’s board of directors and its compensation committee.

Matthew K. Rose (Age 54). Director since 2004. Mr. Rose has been chairman and chief executive officer of BNSF Railway Company, one of the largest freight rail systems in North America, since 2000. He has also served as the chairman and chief executive officer of its parent, Burlington Northern Santa Fe, LLC (a subsidiary of Berkshire Hathaway Inc.) or its predecessors since 2002, and served as its president until November 2010. Before serving as its chairman, Mr. Rose held several leadership positions there and at its predecessors, including president and chief executive officer from 2000 to 2002, president and chief operating officer from 1999 to 2000, and senior vice president and chief operations officer from 1997 to 1999. As the chairman and chief executive officer of a major transportation company, Mr. Rose brings to AMR’s board of directors extensive business, financial, strategic, and executive leadership experience in the transportation industry. He is also a director of AT&T Inc., and he previously served as a director of Centex Corporation. His experience as a director and member of board committees of these and other companies provides important insights into corporate governance and board functions. He lives in the Dallas-Fort Worth area, where AMR’s headquarters, principal hub, and largest employee base are located. His background and experience make him an effective member of AMR’s board of directors and its compensation committee.

Roger T. Staubach (Age 71). Director since 2001. Mr. Staubach founded The Staubach Company, a large commercial real estate firm until its merger with Jones Lang LaSalle Incorporated in July 2008. He has served as a director and as executive chairman, Americas, of Jones Lang LaSalle Incorporated since the merger with The Staubach Company. Prior to that, he served as executive chairman of The Staubach Company from July 2007 to July 2008, and chairman and chief executive officer from 1982 to June 2007. A graduate of the U.S. Naval Academy in 1965, Mr. Staubach served four years as an officer in the U.S. Navy, and he played professional football from 1969 to 1979 with the Dallas Cowboys. Through his service as chairman and/or chief executive officer of two large commercial real estate firms, Mr. Staubach has extensive real estate, business, strategic, and executive leadership experience. Mr. Staubach is also a director of Cinemark Holdings, Inc. and Cyrus One, Inc., and he previously served as a director of McLeod USA Incorporated. His experience as a director of these and other companies provides important insights into corporate governance and board functions. He lives in the Dallas-Fort Worth area, where AMR’s headquarters, principal hub, and largest employee base are located. His background and experience make him an effective member of AMR’s board of directors and the diversity committee, and a strong chairman of that committee.

Executive Officers

Set forth below is a brief biography of each of AMR’s current executive officers. Information relating to Mr. Horton, AMR’s chairman and chief executive officer, is set forth above under “Directors”.

Daniel P. Garton (Age 55). Mr. Garton was named president and chief executive officer of AMR Eagle Holding Corporation, a wholly-owned subsidiary of AMR (AMR Eagle), in June 2010. He is also an executive vice president of AMR and American. Mr. Garton served as executive vice president—marketing of American from September 2002 to June 2010. He served as executive vice president—customer services of American from January 2000 to September 2002 and senior vice president—customer Services of American from 1998 to January 2000. Prior to that, he served as president of AMR Eagle from 1995 to 1998. Except for two years as senior vice president and chief financial officer of Continental Airlines between 1993 and 1995, he has been with AMR in various management positions since 1984.

5

Isabella D. Goren (Age 53). Ms. Goren was named senior vice president and chief financial officer of AMR and American in July 2010. She served as senior vice president—customer relationship marketing from March 2006 to July 2010. Prior to that, she served as vice president—interactive marketing and reservations from July 2003 to March 2006, and as vice president—customer services planning from October 1998 to July 2003. She has been with AMR in various management positions since 1986.

Gary F. Kennedy (Age 57). Mr. Kennedy was elected senior vice president and general counsel of AMR and American in January 2003. He is also the chief compliance officer of AMR and American. He served as vice president—corporate real estate of American from 1996 to January 2003. Prior to that, he served as an attorney and in various management positions at American since 1984.

James B. Ream (Age 57). Mr. Ream was named senior vice president of operations of American in January 2012. He previously served as American’s senior vice president of maintenance and engineering starting December 2009. Before that, Mr. Ream was president and chief executive officer of Express Jet Airlines, Inc. beginning in 2001, having been president and chief operating officer of Continental Express Airlines prior to that. He began his airline management career in 1987 as a financial analyst with American.

There are no family relationships among the directors or executive officers of AMR.

Other than the voluntary petitions for relief under the Bankruptcy Code filed by AMR and certain of its direct and indirect domestic subsidiaries (the Debtors) in the U.S. Bankruptcy Court for the Southern District of New York (the Bankruptcy Court) and jointly administered as Case No. 11-15463 (SHL), as described more fully in Part I, Item 1 of the Original Filing (the Chapter 11 Cases), none of the directors or executive officers has been a general partner or executive officer of a debtor in, or personally the subject of, a bankruptcy or similar proceeding during the past ten years.

Section 16(a) Beneficial Ownership Reporting Compliance

Because American does not have a class of equity securities registered pursuant to Section 12 of the Exchange Act, no reports are required to be filed under Section 16(a) of the Exchange Act.

Standards of Business Conduct for Employees and Directors

AMR has adopted a written code of ethics (the Standards of Business Conduct) that applies to all of the American employees. AMR designed the Standards of Business Conduct to help employees resolve ethical issues in an increasingly complex business environment. The standards apply to all of American’s employees, including the chief executive officer and president, chief financial officer, general counsel and chief compliance officer, controller, treasurer, corporate secretary, and general auditor. They cover several topics, including conflicts of interest, full, fair, accurate, timely, and understandable disclosure in SEC filings, confidentiality of information, and accountability for adherence to the Standards of Business Conduct, as well as prompt internal reporting of violations and compliance with laws and regulations. A copy of the Standards of Business Conduct is available on the Investor Relations section of AMR’s website located at www.aa.com/investorrelations by clicking on the “Corporate Governance” link.

AMR’s board of directors has adopted a Code of Ethics and Conflicts of Interest Policy. It is designed to help the directors recognize and resolve ethical issues and to identify and avoid conflicts of interest. A copy of the Code of Ethics and Conflicts of Interest Policy is available on the Investor Relations section of AMR’s website located at www.aa.com/investorrelations by clicking on the

6

“Corporate Governance” link. AMR may post amendments or waivers of the provisions of the Standards of Business Conduct and the Code of Ethics and Conflicts of Interest Policy for any director or executive officer on this website.

Audit Committee

American, as a wholly-owned subsidiary of AMR, does not have an audit committee.

ITEM 11. EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

This section provides an overview and analysis of the material elements and objectives of AMR’s executive compensation program for 2012.

AMR’s named executive officers for 2012 were:

7

| • | Thomas W. Horton, chairman, president, and chief executive officer of AMR and American; |

| • | Daniel P. Garton, president and chief executive officer of AMR Eagle and executive vice president of AMR and American; |

| • | Isabella D. Goren, senior vice president and chief financial officer of AMR and American; |

| • | Gary F. Kennedy, senior vice president, general counsel, and chief compliance officer of AMR and American; and |

| • | James B. Ream, senior vice president of operations of American. |

Please read this section with the “Executive Compensation” section that follows.

Executive Summary

On November 29, 2011, AMR and the other Debtors filed voluntary petitions for relief under chapter 11 (Chapter 11) of title 11 of the U.S. Code, 11 U.S.C. sections 101, et seq, as amended (the Bankruptcy Code). Because of the bankruptcy filings, AMR’s executive compensation program in fiscal year 2012 varied significantly from the program AMR used in previous years. The information provided below provides a description of AMR’s executive compensation processes, programs, and decisions during 2012, but does not in many cases fully take into account the impact of the Chapter 11 Cases, as much of the impact of the Chapter 11 Cases is not yet known.

On February 13, 2013, AMR Corporation entered into an Agreement and Plan of Merger (the Merger Agreement) with US Airways Group, Inc. (alone or together with its subsidiaries, US Airways Group) and AMR Merger Sub, Inc., a wholly-owned subsidiary of AMR Corporation, providing for the merger of AMR Merger Sub, Inc. with and into US Airways Group, with US Airways Group continuing as the surviving entity in such merger as a direct wholly-owned subsidiary of AMR Corporation (the Merger). The execution and delivery of the Merger Agreement has been approved by the Bankruptcy Court; however, certain transactions contemplated thereby are to be effected pursuant to the plan of reorganization proposed by the Debtors under Chapter 11 pursuant to which, among other things, the Debtors will emerge from the Chapter 11 Cases and the Merger will be consummated (the Plan), which has been filed with and remains subject to confirmation by the Bankruptcy Court in accordance with the requirements of the Bankruptcy Code. The transactions to be effected pursuant to the Plan are subject to consummation, which is subject to other events or conditions, including approval of the Merger by the stockholders of US Airways Group. Actions AMR has taken or plans to take in 2013 pursuant to or in contemplation of the Merger impact some of its executive compensation programs or policies in effect in 2012 and prior years. AMR has briefly described the impact of those actions below where appropriate or possible.

Historically, AMR’s executive compensation program has been designed to support its business strategy, link pay with performance, promote long-term growth, and align its leaders’ decisions with the long-term interests of its stockholders. Due to circumstances relating to AMR’s continued restructuring under Chapter 11, during 2012:

| • | AMR did not increase the base salary of any of its named executive officers; |

| • | AMR did not grant any stock-based compensation or other long-term incentive awards; |

| • | AMR did not make any payments under the financial component of AMR’s 2012 Annual Incentive Plan (the AMR 2012 AIP); and |

8

| • | AMR did not distribute any stock that vested in 2012 under outstanding stock-based awards to its named executive officers. |

Since AMR Corporation, the parent of American, was in Chapter 11 for all of 2012, it did not hold an annual meeting of stockholders. Therefore it did not have an advisory vote on executive compensation in 2012.

AMR’s Compensation Objectives and Philosophy

The principal objectives of AMR’s executive compensation program are to:

| • | provide compensation that enables it to attract, motivate, reward, and retain talented leaders; |

| • | reward achievement of its goals; |

| • | sustain a pay-for-performance approach in which variable or “at risk” compensation is a substantial portion of each leader’s compensation; and |

| • | align its compensation programs with the interests of its stockholders and other stakeholders through long-term stock-based incentives. |

Due to circumstances relating to the Chapter 11 Cases, in 2012 AMR determined to suspend all stock-based compensation and other long-term incentive compensation programs and freeze the base salaries of its five named executive officers. AMR initially approved the AMR 2012 AIP that included a financial component and an operational component, but AMR later cancelled the AMR 2012 AIP, and no payment was made under the financial component of the AMR 2012 AIP. While AMR and its compensation committee recognized that these actions would lead to further substantial loss of compensation opportunities for its named executive officers, AMR also recognized that, due to their essential role in the restructuring, it would be appropriate to normalize their compensation later in AMR’s restructuring subject to any requirements arising in connection with the Chapter 11 Cases. AMR encouraged its named executive officers to continue their employment during its restructuring based on the prospect that their compensation might be appropriately addressed in the near future, but without any assurances as to what that might be.

The Process AMR Uses to Determine Compensation

As American is a wholly-owned subsidiary of AMR, the American board of directors does not have a compensation committee. The compensation decisions for the named executive officers described below are approved by the compensation committee of the AMR board of directors.

Since the compensation committee decided not to increase base salaries or grant stock-based compensation or other long-term incentive awards in 2012, AMR did not conduct a formal annual compensation review in 2012 as in prior years. Instead, AMR retained Towers Watson, a consultant with substantial experience with executive compensation practices of airlines and other Debtors during the course of the Chapter 11 Cases, to review its compensation program in the context of the Chapter 11 Cases. During 2012, Towers Watson worked closely with Mr. Horton, as well as American’s senior vice president of people and other members of American’s executive compensation team, and updated and supplemented some of the compensation information AMR used in its 2011 annual compensation review.

Also, in connection with Mr. Horton’s promotion to chief executive officer and chairman, in January 2012 the compensation committee reviewed his compensation with assistance from its independent consultant, Meridian Compensation Partners (Meridian), and one of AMR’s compensation consultants, Deloitte LLP. While the data presented suggested Mr. Horton’s compensation was below market, Mr. Horton declined to accept an increase in his compensation.

9

The Primary Components of AMR’s Compensation Program

AMR’s executive compensation program has principally consisted of the following components:

| • | base salary; |

| • | short-term incentive compensation; |

| • | long-term incentive compensation; and |

| • | retirement benefits. |

In addition, as is customary in the airline industry, AMR provides unlimited personal flight and other perquisites both during and following employment of its named executive officers. AMR describes these further in the tables and footnotes following this Compensation Discussion and Analysis.

Due to circumstances relating to the continuing Chapter 11 Cases, the compensation of AMR’s named executive officers during 2012 did not include any stock-based or long-term incentive compensation, or any meaningful short-term incentive compensation, and their base salaries were not increased to offset the loss of such incentive compensation opportunities. While recognizing the substantial reduction in their total compensation and the potential impact on AMR’s ability to retain its key executives, AMR’s compensation committee decided not to address the loss of such compensation until greater progress could be made in AMR’s restructuring under Chapter 11.

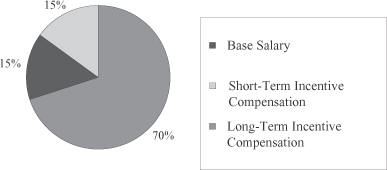

Prior to AMR’s Chapter 11 filings, however, it generally allocated compensation to its named executive officers as follows:

General Compensation Allocation

Base Salary

AMR’s compensation committee continues to believe it is important to provide a secure, consistent amount of cash compensation. Prior to the commencement of the Chapter 11 Cases in 2011, the committee established base salary levels that reflected each officer’s position, qualifications, and experience. In 2012, in recognition of AMR’s ongoing restructuring efforts, none of the named executive officers received a base salary increase.

Short-Term Incentive Compensation—The AMR Annual Incentive Plan

All employees of American, including the named executive officers (other than Mr. Garton), participated in the AMR 2012 AIP. The AMR 2012 AIP pays cash incentives upon the achievement of customer service and financial goals. The customer service component of the AMR 2012 AIP provides for payments of up to $100 per month for each person if AMR achieves one or more of its customer service targets for any fiscal quarter. AMR’s employees (including the named executive officers other than Mr. Garton) can also earn awards annually under the financial component of the AMR 2012 AIP. Under this component, awards are paid as a percentage of base salary, customarily called “bonus,” if American has at least a 5% pre-tax earnings margin. The financial component under American’s annual incentive plan has not been paid since 2001. AMR’s compensation committee determines the percentage of base salary that each named executive officer is eligible to receive. Although the compensation committee initially approved the establishment of the AMR 2012 AIP, it subsequently cancelled the AMR

10

2012 AIP in its entirety in September 2012, and no payments were made under its financial component. Each eligible employee, including AMR’s named executive officers (other than Mr. Garton), earned $633 under the overall customer service component of the AMR 2012 AIP prior to its termination.

Mr. Garton participated in the AMR Eagle Annual Incentive Plan, which is described in the section entitled “Executive Compensation—Short-Term and Long-Term Incentives” beginning on page 18.

Long-Term Incentive Compensation—Performance Shares, SARs, and Deferred Shares

Long-term incentive compensation has historically been a critical and substantial component of AMR’s executive compensation program prior to the commencement of the Chapter 11 Cases. AMR typically designed its long-term incentive compensation to align leaders’ compensation to the interests of its stockholders and used long-term incentive compensation as an important retention tool by awarding shares that only vested if the recipient remained with AMR for a period of time. AMR’s compensation committee used performance shares, stock appreciation rights (SARs), and deferred shares in an effort to achieve these goals. As stated above, as a result of the Chapter 11 Cases, AMR determined to suspend all stock-based compensation and other long-term incentive compensation programs and, accordingly, AMR’s compensation committee did not approve any stock-based compensation in 2012 due to the continuing Chapter 11 Cases and did not approve any long-term incentive compensation for its named executive officers in lieu of stock-based compensation. However, to best preserve the value of AMR’s business enterprise in contemplation of completing the Merger and combining the two airlines, with the assistance of Towers Watson, in February 2013 AMR agreed to employee protection, severance, and other compensation programs as part of the Merger Agreement. AMR’s compensation committee, together with its consultant, Meridian, reviewed and analyzed the proposed changes to its compensation program. In addition, the proposed changes were shared and discussed with US Airways Group and the Official Committee of Unsecured Creditors of AMR (and its compensation consultant) to reach a mutual agreement that was incorporated in the Merger Agreement.

Below is a summary of each equity-based instrument that AMR’s compensation committee awarded to AMR’s named executive officers prior to the commencement of the Chapter 11 Cases, why AMR’s compensation committee chose to pay each type of award, and when and how each type of award vested. As stated above, AMR’s compensation committee did not approve any long-term incentive compensation awards in 2012 due to the continuing Chapter 11 Cases, and the information provided below does not take into account the impact of the Chapter 11 Cases on awards made in prior years. In accordance with the Merger Agreement, none of the outstanding equity-based awards will be assumed if the Merger is consummated. The discussion of outstanding equity awards below is qualified in its entirety by the treatment of such awards in the Chapter 11 Cases.

Performance Shares. In 2011 and prior years, AMR’s compensation committee used performance shares to reward AMR’s named executive officers when AMR’s stock performed better than the stock of its primary competitors. Performance shares are contractual rights to receive shares of AMR’s common stock at the end of a three-year measurement period. The actual number of performance shares ultimately distributed to the named executive officers was based on AMR’s total stockholder return (TSR) compared to that of its primary competitors over that three-year period. AMR’s compensation committee selected the airlines used to determine its relative TSR, based on their market capitalization, revenue, and airline seat capacity and determined the percentages of the original award to be paid based on AMR’s relative TSR rank during the measurement period. AMR’s compensation committee did not approve any performance share awards in 2012 due to the continuing Chapter 11 Cases.

SARs. In 2011 and prior years, AMR’s compensation committee awarded SARs to AMR’s named executive officers. AMR’s SARs are contractual rights to receive shares of AMR’s common stock over a ten-year exercise period. Since they provide compensation only if the market value of AMR’s common stock appreciates from the date of grant, SARs would reward AMR’s executives for its stock price appreciation during that period. AMR’s compensation committee did not approve any SAR awards in 2012 due to the continuing Chapter 11 Cases.

11

Deferred Shares. Prior to the Chapter 11 Cases, AMR’s compensation committee each year also awarded deferred shares to AMR’s named executive officers. Deferred shares are contractual rights to receive shares of AMR’s common stock upon the completion of three years of service following the grant date. Since deferred shares are not subject to the achievement of performance objectives, the value of the deferred shares at the time of vesting would depend entirely on the value of AMR’s common stock at that time. AMR’s compensation committee believed that deferred shares were important for the long-term retention of AMR’s named executive officers because they provided a guaranteed award for their continued service through the three-year service period. AMR’s compensation committee did not approve any deferred share awards in 2012 due to the continuing Chapter 11 Cases.

Flight Perquisites and Other Benefits

The named executive officers also participate in a variety of health and welfare and other benefits that AMR provides to its U.S.-based employees. AMR’s compensation committee believes it is important to provide a limited number of additional perquisites and benefits to AMR’s named executive officers to attract and retain them. For example, as is common in the airline industry, AMR provides unlimited personal flight privileges on American and American Eagle Airlines, Inc., an indirectly wholly-owned subsidiary of AMR (American Eagle), in any available class of service. Instead of providing automobile lease payments, club memberships, financial planning fees, and other perquisites other companies often provide to their executives, AMR provides personal allowances to its named executive officers. AMR describes these and other perquisites in footnote (e) to the “Executive Compensation—Fiscal Year 2010, 2011, and 2012 Summary Compensation Table” beginning on page 16. No changes were made to the perquisites and benefits offered to AMR’s named executive officers in 2012.

Post-Employment and Change in Control Benefits

The information below does not fully take into account the impact of the Chapter 11 Cases.

Following their employment with AMR, AMR’s named executive officers are eligible for the post-employment benefits, perquisites, and privileges that AMR generally provides to all of its salaried employees. These include severance, pro-rated incentive compensation and equity distributions, and a limited number of other benefits. AMR also provides other post-employment perquisites to them, such as unlimited personal flight privileges on American and American Eagle in any available class of service. AMR’s compensation committee has determined that it is important to provide these post-termination benefits, perquisites, and privileges to AMR’s named executive officers to attract and retain them. AMR describes these benefits further in the narrative discussion under the section entitled “Executive Compensation—Post-Employment Compensation” beginning on page 25.

AMR’s named executive officers also participate in the AMR Retirement Benefit Plan of American Airlines, Inc. for Agents, Management, Specialists, Support Personnel, and Officers (the AMR Retirement Benefit Plan). This is a defined benefit plan that provides compensation to all of AMR’s eligible employees during their retirement. As part of the Chapter 11 Cases, all benefits under the AMR Retirement Benefit Plan were frozen for all employees, including AMR’s named executive officers, as of October 31, 2012.

AMR also offers eligible employees (including its named executive officers) the SuperSaver 401K Capital Accumulation Plan for Employees of Participating AMR Corporation Subsidiaries, a defined contribution plan (the AMR SuperSaver Plan), to help them plan for their retirement. Eligible employees who are not accruing additional benefits under the AMR Retirement Benefit Plan are eligible to receive dollar-for-dollar employer matching contributions under the AMR SuperSaver Plan, up to 5.5% of eligible earnings. Mr. Ream is not eligible to receive additional accruals under the AMR Retirement Benefit Plan. Since he returned to American in 2009, he has instead received matching contributions

12

under the AMR SuperSaver Plan. Effective upon the freeze of benefit accruals under the AMR Retirement Benefit Plan on October 31, 2012, AMR began making matching contributions under the AMR SuperSaver Plan to the accounts of the other named executive officers and AMR’s other eligible employees, up to 5.5% of eligible earnings.

AMR’s named executive officers are also eligible to participate in AMR’s Supplemental Executive Retirement Plan (the AMR Non-Qualified Plan). The AMR Non-Qualified Plan is designed to address limits on benefits AMR can pay or contribute under the AMR Retirement Benefit Plan and AMR SuperSaver Plan pursuant to the Employee Retirement Income Security Act of 1974, as amended (ERISA). Like the AMR Retirement Benefit Plan, as of October 31, 2012, the defined benefits portion of the AMR Non-Qualified Plan was frozen for AMR’s named executive officers.

For further details regarding AMR’s retirement plans, see the sections entitled “Compensation Discussion and Analysis—Executive Compensation—2012 Nonqualified Deferred Compensation Table” beginning on page 25 and “Compensation Discussion and Analysis—Executive Compensation—2012 Pension Benefits Table” beginning on page 22 and the accompanying narrative discussion and footnotes that follow those tables.

Under the terms of AMR’s long-term incentive awards granted before the Chapter 11 Cases, outstanding awards vest following a transaction that is considered a change in control under those awards. The AMR Non-Qualified Plan also provides for payments upon a qualifying change in control. The Merger does not constitute a change in control for purposes of these outstanding long-term incentive awards or the AMR Non-Qualified Plan.

Prior to the commencement of the Chapter 11 Cases, AMR also entered into executive termination benefit agreements with its named executive officers for terminations associated with a change in control (the AMR Existing Severance Agreements). AMR’s compensation committee believes it is important to provide severance and other benefits following a change in control for several reasons. The airline industry may undergo further consolidation and economic challenges, and these agreements are common in the industry. The AMR Existing Severance Agreements encourage AMR’s named executive officers to work for the best interests of the stockholders during a potential change in control by guaranteeing some financial security if their employment is terminated after a change in control. Finally, these agreements help AMR attract senior leaders. The AMR Existing Severance Agreements have a “double trigger,” meaning that for the benefits to be paid, the change in control must be followed by a termination of the applicable employee’s employment. The double trigger is intended to encourage the leader to remain with AMR for a period of time following a change in control to help smooth the transition to new management. The Merger does not constitute a change in control for purposes of the AMR Existing Severance Agreements, and the above description of those agreements does not take into account the impact of the Chapter 11 Cases on these prepetition executory contracts or the waivers described below.

In connection with the Merger and as contemplated by the Merger Agreement, AMR plans to enter into severance agreements with each of its named executive officers (the AMR Merger Severance Agreements). As further described in the subsection entitled “Merger Agreement” directly below, these agreements will only be effective upon the consummation of the Merger (the Closing), and AMR’s named executive officers will waive their rights under the AMR Existing Severance Agreements in exchange for their rights under the AMR Merger Severance Agreements.

Merger Agreement

As described above, on February 13, 2013, AMR entered into the Merger Agreement with US Airways Group. Actions AMR has taken or plans to take pursuant to or in connection with the Merger in 2013 impact some of its executive compensation programs or policies in effect in 2012 and prior years. AMR has described the impact below where appropriate.

13

Because of the nature of any merger transaction of this magnitude, including the necessity for a smooth transition, the employment uncertainty and insecurity faced by AMR’s named executive officers, and the critical role each plays in the maintenance and preservation of AMR’s enterprise value, the Merger Agreement requires that the following employee compensation and benefit arrangements applicable to AMR’s named executive officers be implemented to assure that the Merger will be effected as seamlessly as possible.

In connection with the entry into the Merger Agreement, on February 13, 2013, AMR entered into a letter agreement with Mr. Horton governing his continued service to AMR, as renamed American Airlines Group Inc. (alone or together with its subsidiaries, AAG), following the Merger. Pursuant to this letter agreement, Mr. Horton’s employment with American will end effective upon the Closing. Effective as of the Closing, Mr. Horton will serve as chairman of the board of AAG until the earlier of (i) one year after the Closing, (ii) the day immediately prior to the first annual meeting of stockholders of AAG (which will in no event occur prior to May 1, 2014), and (iii) the election of a new chairman by the affirmative vote of at least 75% of the members of the board of directors (rounded up to the next full director), which must include at least one director who was designated as a director by AMR pursuant to the Merger Agreement. Effective upon the Closing, Mr. Horton will receive a severance payment equal to $9,937,500 in cash and $9,937,500 in shares of common stock of AAG. In addition, Mr. Horton will continue to receive lifetime flight and other travel privileges to which he is currently entitled, as well as an office and office support for a period of two years after the Closing. In determining the form and amount of compensation, AMR’s board of directors agreed that the amount to be paid is reasonable and appropriate given, among other things, Mr. Horton’s long service to AMR, the success of the restructuring, and the value created for AMR’s financial stakeholders pursuant to the Merger and restructuring.

The letter agreement with Mr. Horton will become binding on AMR upon its approval by the Bankruptcy Court. These arrangements are subject to the occurrence of the Merger and will terminate if the Merger does not occur.

| • | 2013 Short-Term Incentive Plan. AMR will reinstate AMR’s 2013 short-term incentive plan (AMR STI) for 2013. Eighty percent of the AMR STI will be based on 2013 pre-tax profit margin (excluding restructuring expenses, change in control transaction expenses, and other extraordinary items). The target performance objective will be a pre-tax profit margin of two percent, with the minimum performance threshold being a positive pre-tax margin and the maximum performance objective being a pre-tax margin of four percent. The remainder of the AMR STI will be based on one or more operational performance metrics to be determined by AMR’s compensation committee. Under the AMR STI, AMR’s named executive officers (other than Mr. Horton) will have an opportunity to earn 100% of base salary at target and 200% of base salary at maximum. Between the minimum, target, and maximum objectives, awards will be earned and payable on a straight-line interpolated basis. |

| • | 2013 Equity Awards. AMR will award long-term incentive awards (the 2013 Equity Awards) in the form of stock-settled restricted stock units (RSUs), which awards will be granted under the new American Airlines Group Inc. 2013 Incentive Award Plan to be effected pursuant to the Plan (the AAG 2013 IAP). The amount to be awarded to AMR’s named executive officers is consistent with and not more than the 2013 equity awards granted to the named executive officers of US Airways Group. Under the AAG 2013 IAP, the 2013 Equity Awards will vest in equal amounts in April of 2014, 2015, and 2016. A pro rata amount will vest upon any termination of employment other than a termination of employment for cause or resignation by the executive without good reason. |

| • | Alignment Awards. AMR will award additional stock-settled RSUs to its named executive officers (other than Mr. Horton), which awards will be granted under the AAG |

14

| 2013 IAP in an amount equal to 1.5 times the long-term incentive value awarded AMR’s executive vice presidents in 2011 (the AMR Alignment Awards). One-third of the AMR Alignment Awards will vest on each of (i) the date on which the Closing occurs, (ii) 12 months after the date on which the Closing occurs, and (iii) 24 months after the date on which the Closing occurs. The AMR Alignment Awards will fully vest on a termination of employment for which the executive becomes entitled to severance under the AMR Merger Severance Agreements, or vest pro rata upon a termination as a result of retirement, death, or disability. |

| • | Severance Arrangements. AMR expects to enter into AMR Merger Severance Agreements with each named executive officer (other than Mr. Horton). The agreements will be contingent on the Closing. The AMR Merger Severance Agreements are similar to the terms of the severance agreements covering similarly-situated US Airways Group executives. Under the AMR Merger Severance Agreements, if the executive is terminated without cause or resigns for good reason within two years of the Closing, he or she will be entitled to a severance payment equal to two times the sum of his or her (i) annual base salary, (ii) target short-term incentive award, and (iii) target long-term incentive award under an applicable long-term incentive program in effect on the termination date or a target award that would become payable to a similarly situated US Airways Group employee under a US Airways Group Long-Term Incentive Performance Program. In addition, all of his or her AMR Alignment Awards and a pro rata amount of the 2013 Equity Awards will vest. The period of exercisability of any outstanding vested options or SARs will be extended for up to 18 months (but not beyond the original expiration date). Further, if the executive is eligible for continued medical coverage pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (COBRA), under AMR’s plans, he or she will receive a lump sum payment equal to the cost of two years’ of such coverage for the executive and his or her covered dependents and, under separate arrangements, the executive will become fully vested in his or her accrued benefits under the AMR Retirement Benefit Plan and the AMR Non-Qualified Plan. |

| • | Flight Privileges. Consistent with the treatment of flight privileges for similarly situated executives of US Airways Group, each of AMR’s named executive officers will be entitled to continuation of flight privileges he or she currently possesses following the Closing for his or her lifetime. |

AMR’s compensation committee and board of directors believe the arrangements described above are reasonable and appropriate in the context of the Merger and to preserve the integrity and value of AMR’s enterprise in contemplation of the Merger. Further, these arrangements take into account the treatment of similarly-situated executives of US Airways Group to encourage a smooth and orderly integration following the Closing and to maximize value. Meridian, AMR’s compensation committee’s independent consultant, reviewed the arrangements and concurred. Also, in the Chapter 11 Cases, the Official Committee of Unsecured Creditors of AMR, after a thorough review, including by its retained compensation experts, fully supports implementation of these arrangements and also believes they are reasonable and appropriate.

Recoupment Policy

AMR’s recoupment policy allows it to recoup compensation paid to AMR’s chief executive officer and each of his direct reports if AMR restates its financial statements due to that officer’s intentional misconduct. The recoupment policy applies to annual incentive or equity compensation awards to the extent the awards were paid due to metrics impacted by the misstated financial information.

15

Stock Ownership Guidelines

Effective March 2011, AMR’s compensation committee adopted stock ownership guidelines for its chief executive officer, its president, and its executive and senior vice presidents. Due to the Chapter 11 Cases, AMR’s compensation committee has suspended compliance with these guidelines.

Consideration of Tax and Accounting Consequences in Determining Compensation

Typically, AMR considers tax and accounting consequences when reviewing compensation awards to its named executive officers. While AMR believes these considerations are important, AMR believes it should balance the tax and accounting considerations against both the need to retain executive talent and AMR’s long-term strategies and goals.

Compensation Committee Report

As stated above, American’s board of directors does not have a compensation committee.

Compensation Committee Interlocks and Insider Participation

As stated above, American’s board of directors does not have a compensation committee.

Executive Compensation

Fiscal Year 2010, 2011, and 2012 Summary Compensation Table

The following table contains information regarding compensation paid to AMR’s named executive officers during 2012. The table does not take into account the impact of the Chapter 11 Cases, but some of the potential effects resulting from the Chapter 11 Cases are summarized in the footnotes. Also, the table does not reflect compensation for Mr. Ream in 2010 or 2011 since he was not a named executive officer in those years.

| Name and Principal Position |

Year | Salary ($) |

Bonus ($) |

Stock Awards(a) ($) |

Options Awards(b) ($) |

Non-Equity Incentive Plan Compensation(c) ($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings(d) ($) |

All

Other Compensation(e) ($) |

Total ($) |

|||||||||||||||||||||||||||

| Thomas W. Horton |

2012 | 618,135 | 0 | 0 | 0 | 633 | 1,092,937 | 37,458 | 1,749,163 | |||||||||||||||||||||||||||

| Chairman, President, and Chief |

2011 | 618,135 | 0 | 2,220,421 | 441,045 | 83 | 871,138 | 31,978 | 4,182,800 | |||||||||||||||||||||||||||

| Executive Officer, |

2010 | 618,135 | 0 | 1,831,548 | 661,628 | 467 | 553,539 | 30,305 | 3,695,621 | |||||||||||||||||||||||||||

| AMR and American |

||||||||||||||||||||||||||||||||||||

| Isabella D. Goren |

2012 | 540,385 | 0 | 0 | 0 | 633 | 771,956 | 36,823 | 1,349,797 | |||||||||||||||||||||||||||

| Senior Vice President and Chief |

2011 | 508,007 | 0 | 883,694 | 175,511 | 83 | 561,082 | 31,939 | 2,160,316 | |||||||||||||||||||||||||||

| Financial Officer |

2010 | 423,993 | 0 | 912,643 | 329,848 | 467 | 316,129 | 28,571 | 2,011,650 | |||||||||||||||||||||||||||

| AMR and American |

||||||||||||||||||||||||||||||||||||

| Gary F. Kennedy |

2012 | 522,000 | 0 | 0 | 0 | 633 | 817,644 | 37,414 | 1,377,691 | |||||||||||||||||||||||||||

| Senior Vice President, General Counsel, and Chief Compliance |

2011 | 522,000 | 0 | 883,694 | 175,511 | 83 | 682,007 | 29,894 | 2,293,189 | |||||||||||||||||||||||||||

| Officer, AMR and American |

2010 | 502,543 | 0 | 912,643 | 329,848 | 467 | 403,457 | 30,568 | 2,179,526 | |||||||||||||||||||||||||||

| Daniel P. Garton |

2012 | 530,478 | 0 | 0 | 0 | 0 | 1,112,837 | 34,282 | 1,677,597 | |||||||||||||||||||||||||||

| President and Chief Executive Officer, AMR Eagle, Executive |

2011 | 530,478 | 0 | 1,639,078 | 308,187 | 0 | 892,917 | 31,708 | 3,402,368 | |||||||||||||||||||||||||||

| Vice President, AMR and American |

2010 | 530,478 | 0 | 1,353,982 | 458,222 | 250 | 535,950 | 29,208 | 2,908,090 | |||||||||||||||||||||||||||

| James B. Ream |

2012 | 569,800 | 0 | 0 | 0 | 633 | 15,060 | 56,054 | 641,547 | |||||||||||||||||||||||||||

| Senior Vice President of Operations, American |

||||||||||||||||||||||||||||||||||||

16

| (a) | AMR did not grant any stock awards in 2012 due to the continuing Chapter 11 Cases. The amounts shown for 2011 and 2010 were not actually paid to AMR’s named executive officers. As required by the rules of the SEC, the amounts instead represent the aggregate grant date fair value of the performance shares and deferred shares awarded to each of them in 2010 and 2011. The grant date fair value of the performance share and career performance share awards for those years is based on AMR’s estimate on the grant date of the probable outcome of meeting the performance conditions of these awards. See note 10 to the AMR 2012 consolidated financial statements included in AMR’s annual report on Form 10-K for the years ended December 31, 2011 and 2012, respectively, for the assumptions AMR used to determine the aggregate grant date fair value of these awards. The aggregate grant date fair values of the 2010/2012 performance share awards assuming AMR meets the highest level (or 175%) of the performance conditions of these awards are: Mr. Horton ($1,766,274), Ms. Goren ($880,425), Mr. Garton ($1,221,230), Mr. Kennedy ($880,425). The aggregate grant date fair values of the 2011/2013 performance share awards assuming AMR meets the highest level (or 175%) of the performance conditions of these awards are: Mr. Horton ($1,749,129), Ms. Goren ($696,082), Mr. Garton ($1,222,317), Mr. Kennedy ($696,082). The amounts reported do not include any reduction in the value of the awards for the possibility of forfeiture or as a result of the Chapter 11 Cases. |

| (b) | AMR did not grant any options or SARs in 2012 due to the continuing Chapter 11 Cases. The amounts shown for 2011 and 2010 were not actually paid to its named executive officers. As required by the rules of the SEC, the amounts instead represent the aggregate grant date fair value of the SARs granted to each of them in 2010 and 2011 determined in accordance with ASC Topic 718. See note 10 to the consolidated financial statements included in AMR’s annual report on Form 10-K for the years ended December 31, 2011 and 2012, respectively, for the assumptions it used to determine the aggregate grant date fair value of these awards for those years. These amounts do not include any reduction in the value of the awards for the possibility of forfeiture or as a result of the Chapter 11 Cases. |

| (c) | The amounts shown are payments earned under the customer service component of the 2012 AMR AIP through September 2012, when the AMR 2012 AIP was terminated. AMR made no payments in 2010, 2011, or 2012 under the financial component of the AMR annual incentive plan or the AMR Eagle annual incentive plan because AMR did not meet the minimum performance level required to earn a payout. |

| (d) | The amounts shown for the officers are the change in the actuarial present value of the accumulated benefit under both the AMR Retirement Benefit Plan and the AMR Non-Qualified Plan from January 1 to December 31 of each year. The present value of the accumulated benefits increased from December 31, 2011 to December 31, 2012 because the discount rate decreased from 5.2% at December 31, 2011 to 4.2% at December 31, 2012. For Mr. Horton, the amounts also include additional years of credited service under the AMR Non-Qualified Plan. There were no above-market or preferential earnings on non-qualified deferred compensation. The change in actuarial present value of the accumulated benefit under both the AMR Retirement Benefit Plan and the AMR Non-Qualified Plan has not been reduced for the possibility that the benefits will not be paid in full as a result of the Chapter 11 Cases in November 2011. The amounts reflect that the benefit accruals under the AMR Retirement Benefit Plan and the AMR Non-Qualified Plan were frozen as of October 31, 2012. The amount shown for Mr. Ream is the change in the actuarial present value of the accumulated benefit under the AMR Retirement Benefit Plan he earned for his seven years of service until he resigned from American in 1994. Mr. Ream does not have a defined benefit in the AMR Non-Qualified Plan. |

| (e) | The amounts shown include a personal allowance of $27,000 paid each year to AMR’s named executive officers. The amounts also include the estimated aggregate incremental cost to AMR of providing perquisites and other personal benefits to its named executive officers. As is customary in the airline industry, AMR provides them and their spouses or companions and dependent children unlimited personal air travel on American and American Eagle in any available class of service. However, they are required to pay all taxes and fees associated with the air travel. The amounts shown include AMR’s estimated aggregate incremental cost for the air travel AMR provided them in 2012, including the estimated cost of incremental fuel, catering, and insurance, but exclude the associated fees and taxes they paid. Amounts in this column also include reimbursement for: (i) the cost of one annual medical exam, (ii) the premium for a term life insurance policy (with a policy amount equal to the base salary of the named executive officer), (iii) a portion of the premium for long-term disability insurance, and (iv) broker fees associated with the exercise of stock options by the named executive officer. Each AMR named executive officer and his or her spouse were also provided an Admirals Club® membership (American’s travel clubs located at large U.S. and international airports), and airport parking. Some of them were provided access to events or venues sponsored by AMR or received reduced cost air travel on other airlines, at no incremental cost to AMR. For Mr. Ream, the amounts also include matching contributions AMR made to his AMR SuperSaver Plan account and the defined contribution portion of the AMR Non-Qualified Plan of $11,250 and $14,423, respectively. |

Fiscal Year 2012 Grants of Plan-Based Awards Table

The table below lists each grant or award made in 2012 to AMR’s named executive officers under its equity and non-equity incentive plans. AMR did not grant any equity-incentive awards in 2012 to its named executive officers, so the table does not reflect any such awards.

17

| Name |

Grant Date |

Estimated Future Payouts Under Non-Equity Incentive Plan Awards(a) |

Estimated Future Payouts Under Equity Incentive Plan Awards |

All Other Stock Awards: Number of Shares of Stock or Units (#) |

All Other Option Awards: Number of Securities Underlying Options (#) |

Exercise or Base Price of Option Awards ($/Sh) |

Grant Date Fair Value of Stock and Option Awards ($) |

|||||||||||||||||||||||||||||||||||||

| Threshold ($) |

Target ($) |

Maximum ($) |

Threshold (#) |

Target (#) |

Maximum (#) |

|||||||||||||||||||||||||||||||||||||||

| Horton |

— | — | 900 | 900 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Goren |

— | — | 900 | 900 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Garton (b) |

— | — | 5,305 | 15,914 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Kennedy |

— | — | 900 | 900 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| Ream |

— | — | 900 | 900 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||

| (a) | The amounts shown for AMR’s named executive officers (other than Mr. Garton) are the target and maximum amounts each could have earned under the overall customer service component of the AMR 2012 AIP prior to its termination. As reported in the Summary Compensation Table, AMR’s named executive officers (other than Mr. Garton) earned $633 under the overall customer service component of the AMR 2012 AIP. The AMR 2012 AIP was terminated in September 2012. There will be no future payout under the AMR 2012 AIP. As president of American Eagle, Dan Garton did not participate in the AMR 2012 AIP. |

| (b) | The amount shown was not actually paid to Mr. Garton. The amount instead is the payment AMR would have made to Mr. Garton if American Eagle had met the minimum payment level of the AMR Eagle Annual Incentive Plan. Since American Eagle did not meet the threshold for payment under the AMR Eagle Annual Incentive Plan in 2012, no amount was actually paid to Mr. Garton. |

Discussion regarding Fiscal Year 2010, 2011 and 2012 Summary Compensation Table and Fiscal Year 2012 Grants of Plan-Based Awards Table

As stated above, on November 29, 2011, the Debtors filed the Chapter 11 Cases. The information provided below does not fully take into account the impact of the Chapter 11 Cases. Due to the Chapter 11 Cases, AMR did not grant any equity-based awards to its named executive officers in 2012, and, in accordance with the terms of the Merger Agreement, AMR will not assume any of the outstanding awards upon emergence from the Chapter 11 Cases.

Short-Term and Long-Term Incentives. As stated above, AMR did not grant any long-term or equity incentive awards to its named executive officers in 2012 due to the continuing Chapter 11 Cases.

AMR’s compensation committee approved in January 2012 the AMR 2012 AIP for all eligible employees of American. As president of American Eagle, Mr. Garton did not participate in that plan. The AMR 2012 AIP was a short term non-equity incentive plan that included a financial component and an operational component. In connection with AMR’s restructuring efforts, AMR cancelled the AMR 2012 AIP in September 2012. No payment was earned or made under the financial component of the AMR 2012 AIP. A total of $633 was earned and paid to all of the named executive officers in 2012, based on the achievement of quarterly overall operational results under the overall operational component of the AMR 2012 AIP. Due to its cancellation in September 2012, there are no remaining overall amounts earned or unearned under the AMR 2012 AIP.

Mr. Garton participated in the AMR Eagle Annual Incentive Plan in 2012. No other named executive officer participated in the AMR Eagle Annual Incentive Plan. The AMR Eagle Annual Incentive Plan provides cash payments upon the achievement of pre-tax earnings targets at AMR Eagle. For Mr. Garton, the actual dollar amount paid under the AMR Eagle Annual Incentive Plan is capped at a maximum of 3% of base salary. AMR Eagle did not meet the pre-tax earnings targets, so no amounts were paid to him or earned under the plan in 2012.

Employment Agreement with Mr. Horton. To encourage Mr. Horton to return to American in 2006, AMR entered into an employment agreement with him. Under the employment agreement, Mr. Horton was entitled to an annual base

18