hal-202406300000045012December 31882,828,5152024Q2falsexbrli:sharesiso4217:USDiso4217:USDxbrli:shareshal:Divisionxbrli:purehal:Customers00000450122024-01-012024-06-3000000450122024-07-220000045012us-gaap:ServiceMember2024-04-012024-06-300000045012us-gaap:ServiceMember2023-04-012023-06-300000045012us-gaap:ServiceMember2024-01-012024-06-300000045012us-gaap:ServiceMember2023-01-012023-06-300000045012us-gaap:ProductMember2024-04-012024-06-300000045012us-gaap:ProductMember2023-04-012023-06-300000045012us-gaap:ProductMember2024-01-012024-06-300000045012us-gaap:ProductMember2023-01-012023-06-3000000450122024-04-012024-06-3000000450122023-04-012023-06-3000000450122023-01-012023-06-3000000450122024-06-3000000450122023-12-3100000450122022-12-3100000450122023-06-300000045012hal:CompletionAndProductionMember2024-04-012024-06-300000045012hal:CompletionAndProductionMember2023-04-012023-06-300000045012hal:CompletionAndProductionMember2024-01-012024-06-300000045012hal:CompletionAndProductionMember2023-01-012023-06-300000045012hal:DrillingAndEvaluationMember2024-04-012024-06-300000045012hal:DrillingAndEvaluationMember2023-04-012023-06-300000045012hal:DrillingAndEvaluationMember2024-01-012024-06-300000045012hal:DrillingAndEvaluationMember2023-01-012023-06-300000045012us-gaap:OperatingSegmentsMemberhal:CompletionAndProductionMember2024-04-012024-06-300000045012us-gaap:OperatingSegmentsMemberhal:CompletionAndProductionMember2023-04-012023-06-300000045012us-gaap:OperatingSegmentsMemberhal:CompletionAndProductionMember2024-01-012024-06-300000045012us-gaap:OperatingSegmentsMemberhal:CompletionAndProductionMember2023-01-012023-06-300000045012hal:DrillingAndEvaluationMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300000045012hal:DrillingAndEvaluationMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300000045012hal:DrillingAndEvaluationMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300000045012hal:DrillingAndEvaluationMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300000045012us-gaap:OperatingSegmentsMember2024-04-012024-06-300000045012us-gaap:OperatingSegmentsMember2023-04-012023-06-300000045012us-gaap:OperatingSegmentsMember2024-01-012024-06-300000045012us-gaap:OperatingSegmentsMember2023-01-012023-06-300000045012us-gaap:CorporateAndOtherMember2024-04-012024-06-300000045012us-gaap:CorporateAndOtherMember2023-04-012023-06-300000045012us-gaap:CorporateAndOtherMember2024-01-012024-06-300000045012us-gaap:CorporateAndOtherMember2023-01-012023-06-300000045012srt:MinimumMember2024-01-012024-06-300000045012srt:MaximumMember2024-01-012024-06-300000045012us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2024-01-012024-06-300000045012us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2023-01-012023-06-300000045012srt:NorthAmericaMember2024-04-012024-06-300000045012srt:NorthAmericaMember2023-04-012023-06-300000045012srt:NorthAmericaMember2024-01-012024-06-300000045012srt:NorthAmericaMember2023-01-012023-06-300000045012srt:LatinAmericaMember2024-04-012024-06-300000045012srt:LatinAmericaMember2023-04-012023-06-300000045012srt:LatinAmericaMember2024-01-012024-06-300000045012srt:LatinAmericaMember2023-01-012023-06-300000045012hal:EuropeAfricaCISMember2024-04-012024-06-300000045012hal:EuropeAfricaCISMember2023-04-012023-06-300000045012hal:EuropeAfricaCISMember2024-01-012024-06-300000045012hal:EuropeAfricaCISMember2023-01-012023-06-300000045012hal:MiddleEastAsiaMember2024-04-012024-06-300000045012hal:MiddleEastAsiaMember2023-04-012023-06-300000045012hal:MiddleEastAsiaMember2024-01-012024-06-300000045012hal:MiddleEastAsiaMember2023-01-012023-06-300000045012us-gaap:AccountsReceivableMemberus-gaap:GeographicConcentrationRiskMembercountry:US2024-01-012024-06-300000045012us-gaap:AccountsReceivableMemberus-gaap:GeographicConcentrationRiskMembercountry:MX2024-01-012024-06-300000045012us-gaap:AccountsReceivableMemberus-gaap:GeographicConcentrationRiskMembercountry:US2023-01-012023-12-310000045012us-gaap:AccountsReceivableMemberus-gaap:GeographicConcentrationRiskMembercountry:MX2023-01-012023-12-310000045012us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembercountry:MX2024-01-012024-06-300000045012us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMembercountry:MX2023-01-012023-12-310000045012us-gaap:CommonStockMember2023-12-310000045012us-gaap:AdditionalPaidInCapitalMember2023-12-310000045012us-gaap:TreasuryStockCommonMember2023-12-310000045012us-gaap:RetainedEarningsMember2023-12-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000045012us-gaap:NoncontrollingInterestMember2023-12-310000045012us-gaap:CommonStockMember2024-01-012024-03-310000045012us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000045012us-gaap:TreasuryStockCommonMember2024-01-012024-03-310000045012us-gaap:RetainedEarningsMember2024-01-012024-03-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000045012us-gaap:NoncontrollingInterestMember2024-01-012024-03-3100000450122024-01-012024-03-310000045012us-gaap:CommonStockMember2024-03-310000045012us-gaap:AdditionalPaidInCapitalMember2024-03-310000045012us-gaap:TreasuryStockCommonMember2024-03-310000045012us-gaap:RetainedEarningsMember2024-03-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000045012us-gaap:NoncontrollingInterestMember2024-03-3100000450122024-03-310000045012us-gaap:CommonStockMember2024-04-012024-06-300000045012us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000045012us-gaap:TreasuryStockCommonMember2024-04-012024-06-300000045012us-gaap:RetainedEarningsMember2024-04-012024-06-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000045012us-gaap:NoncontrollingInterestMember2024-04-012024-06-300000045012us-gaap:CommonStockMember2024-06-300000045012us-gaap:AdditionalPaidInCapitalMember2024-06-300000045012us-gaap:TreasuryStockCommonMember2024-06-300000045012us-gaap:RetainedEarningsMember2024-06-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000045012us-gaap:NoncontrollingInterestMember2024-06-300000045012us-gaap:CommonStockMember2022-12-310000045012us-gaap:AdditionalPaidInCapitalMember2022-12-310000045012us-gaap:TreasuryStockCommonMember2022-12-310000045012us-gaap:RetainedEarningsMember2022-12-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000045012us-gaap:NoncontrollingInterestMember2022-12-310000045012us-gaap:CommonStockMember2023-01-012023-03-310000045012us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000045012us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000045012us-gaap:RetainedEarningsMember2023-01-012023-03-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000045012us-gaap:NoncontrollingInterestMember2023-01-012023-03-3100000450122023-01-012023-03-310000045012us-gaap:CommonStockMember2023-03-310000045012us-gaap:AdditionalPaidInCapitalMember2023-03-310000045012us-gaap:TreasuryStockCommonMember2023-03-310000045012us-gaap:RetainedEarningsMember2023-03-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000045012us-gaap:NoncontrollingInterestMember2023-03-3100000450122023-03-310000045012us-gaap:CommonStockMember2023-04-012023-06-300000045012us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000045012us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000045012us-gaap:RetainedEarningsMember2023-04-012023-06-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000045012us-gaap:NoncontrollingInterestMember2023-04-012023-06-300000045012us-gaap:CommonStockMember2023-06-300000045012us-gaap:AdditionalPaidInCapitalMember2023-06-300000045012us-gaap:TreasuryStockCommonMember2023-06-300000045012us-gaap:RetainedEarningsMember2023-06-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000045012us-gaap:NoncontrollingInterestMember2023-06-300000045012us-gaap:FinancialGuaranteeMember2024-06-300000045012us-gaap:EmployeeStockOptionMember2024-04-012024-06-300000045012us-gaap:EmployeeStockOptionMember2023-04-012023-06-300000045012us-gaap:EmployeeStockOptionMember2024-01-012024-06-300000045012us-gaap:EmployeeStockOptionMember2023-01-012023-06-300000045012us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300000045012us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300000045012us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300000045012us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300000045012us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000045012us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000045012us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000045012us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000045012us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000045012us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300000045012hal:VHBMember2024-01-012024-06-300000045012hal:ExecutiveVicePresidentSecretaryAndChiefLegalMember2024-01-012024-06-300000045012hal:VHBMember2024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

or

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______to_______

Commission File Number 001-03492

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 75-2677995 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 3000 North Sam Houston Parkway East, | Houston, | Texas | 77032 |

| (Address of principal executive offices) | (Zip Code) |

(281) 871-2699

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $2.50 per share | HAL | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| | Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| | Non-accelerated Filer | ☐ | Smaller Reporting Company | ☐ |

| | | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

As of July 22, 2024, there were 882,828,515 shares of Halliburton Company common stock, $2.50 par value per share, outstanding.

HALLIBURTON COMPANY

Index

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

HALLIBURTON COMPANY

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | Six Months Ended

June 30, |

| Millions of dollars and shares except per share data | 2024 | 2023 | 2024 | 2023 |

| Revenue: | | | | |

| Services | $ | 4,215 | | $ | 4,181 | | $ | 8,361 | | $ | 8,347 | |

| Product sales | 1,618 | | 1,617 | | 3,276 | | 3,128 | |

| Total revenue | 5,833 | | 5,798 | | 11,637 | | 11,475 | |

| Operating costs and expenses: | | | | |

| Cost of services | 3,417 | | 3,404 | | 6,845 | | 6,803 | |

| Cost of sales | 1,293 | | 1,316 | | 2,587 | | 2,563 | |

| General and administrative | 62 | | 54 | | 123 | | 108 | |

| | | | |

| SAP S4 upgrade expense | 29 | | 13 | | 63 | | 13 | |

| Total operating costs and expenses | 4,801 | | 4,787 | | 9,618 | | 9,487 | |

| Operating income | 1,032 | | 1,011 | | 2,019 | | 1,988 | |

Interest expense, net of interest income of $22, $18, $44, and $35 | (92) | | (102) | | (184) | | (203) | |

| Loss on Blue Chip Swap transactions | — | | (104) | | — | | (104) | |

| | | | |

| | | | |

| Other, net | (20) | | (22) | | (128) | | (69) | |

| Income before income taxes | 920 | | 783 | | 1,707 | | 1,612 | |

| Income tax provision | (207) | | (167) | | (385) | | (341) | |

| | | | | |

| | | | | |

| Net income | $ | 713 | | $ | 616 | | $ | 1,322 | | $ | 1,271 | |

| Net income attributable to noncontrolling interest | (4) | | (6) | | (7) | | (10) | |

| Net income attributable to company | $ | 709 | | $ | 610 | | $ | 1,315 | | $ | 1,261 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| Basic net income per share | $ | 0.80 | | $ | 0.68 | | $ | 1.48 | | $ | 1.40 | |

| Diluted net income per share | $ | 0.80 | | $ | 0.68 | | $ | 1.48 | | $ | 1.39 | |

| Basic weighted average common shares outstanding | 884 | | 901 | | 886 | | 902 | |

| Diluted weighted average common shares outstanding | 886 | | 903 | | 888 | | 905 | |

| See notes to condensed consolidated financial statements. | | | | |

HAL Q2 2024 FORM 10-Q | 1

HALLIBURTON COMPANY

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | Six Months Ended

June 30, | |

| Millions of dollars | 2024 | 2023 | 2024 | 2023 | | |

| Net income | $ | 713 | | $ | 616 | | $ | 1,322 | | $ | 1,271 | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other comprehensive income, net of income taxes | — | | 1 | | — | | 2 | | | |

| Comprehensive income | $ | 713 | | $ | 617 | | $ | 1,322 | | $ | 1,273 | | | |

| Comprehensive income attributable to noncontrolling interest | (4) | | (6) | | (8) | | (10) | | | |

| Comprehensive income attributable to company shareholders | $ | 709 | | $ | 611 | | $ | 1,314 | | $ | 1,263 | | | |

| See notes to condensed consolidated financial statements. | | | | | | |

HAL Q2 2024 FORM 10-Q | 2

HALLIBURTON COMPANY

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| Millions of dollars and shares except per share data | June 30,

2024 | December 31,

2023 |

| Assets |

| Current assets: | | |

| Cash and equivalents | $ | 2,138 | | $ | 2,264 | |

Receivables (net of allowances for credit losses of $752 and $742) | 5,327 | | 4,860 | |

| Inventories | 3,282 | | 3,226 | |

| | | |

| | | |

| Other current assets | 1,131 | | 1,193 | |

| Total current assets | 11,878 | | 11,543 | |

Property, plant, and equipment (net of accumulated depreciation of $12,371 and $12,064) | 5,073 | | 4,900 | |

| Goodwill | 2,858 | | 2,850 | |

| Deferred income taxes | 2,420 | | 2,505 | |

| Operating lease right-of-use assets | 1,026 | | 1,088 | |

| Other assets | 1,897 | | 1,797 | |

| Total assets | $ | 25,152 | | $ | 24,683 | |

| Liabilities and Shareholders’ Equity |

| Current liabilities: | | |

| Accounts payable | $ | 3,295 | | $ | 3,147 | |

| Accrued employee compensation and benefits | 619 | | 689 | |

| Income tax payable | 402 | | 390 | |

| Taxes other than income | 294 | | 370 | |

| Current portion of operating lease liabilities | 258 | | 262 | |

| | |

| Other current liabilities | 708 | | 750 | |

| Total current liabilities | 5,576 | | 5,608 | |

| Long-term debt | 7,638 | | 7,636 | |

| Operating lease liabilities | 832 | | 911 | |

| Employee compensation and benefits | 375 | | 408 | |

| Other liabilities | 685 | | 687 | |

| Total liabilities | 15,106 | | 15,250 | |

| Shareholders’ equity: | | |

Common stock, par value $2.50 per share (authorized 2,000 shares, issued 1,065 and 1,065 shares) | 2,663 | | 2,663 | |

| Paid-in capital in excess of par value | — | | 63 | |

| Accumulated other comprehensive loss | (332) | | (331) | |

| Retained earnings | 13,450 | | 12,536 | |

Treasury stock, at cost (182 and 176 shares) | (5,781) | | (5,540) | |

| Company shareholders’ equity | 10,000 | | 9,391 | |

| Noncontrolling interest in consolidated subsidiaries | 46 | | 42 | |

| Total shareholders’ equity | 10,046 | | 9,433 | |

| Total liabilities and shareholders’ equity | $ | 25,152 | | $ | 24,683 | |

| See notes to condensed consolidated financial statements. | | |

HAL Q2 2024 FORM 10-Q | 3

HALLIBURTON COMPANY

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| | Six Months Ended

June 30, |

| Millions of dollars | 2024 | 2023 |

| Cash flows from operating activities: | | |

| Net income | $ | 1,322 | | $ | 1,271 | |

| Adjustments to reconcile net income to cash flows from operating activities: | | |

| Depreciation, depletion, and amortization | 534 | | 486 | |

| | |

| | |

| Changes in assets and liabilities: | | |

| Receivables | (496) | | (337) | |

| | |

| Inventories | (45) | | (318) | |

| Accounts payable | 176 | | 66 | |

| Other operating activities | 77 | | 6 | |

| Total cash flows provided by operating activities | 1,568 | | 1,174 | |

| Cash flows from investing activities: | | |

| Capital expenditures | (677) | | (571) | |

| | |

| Purchases of investment securities | (282) | | (270) | |

| Payments to acquire businesses, net of cash acquired | (22) | | (12) | |

| Sales of investment securities | 123 | | 103 | |

| Proceeds from sales of property, plant, and equipment | 108 | | 90 | |

| | |

| Other investing activities | (24) | | (36) | |

| Total cash flows used in investing activities | (774) | | (696) | |

| Cash flows from financing activities: | | |

| Stock repurchase program | (500) | | (348) | |

| Dividends to shareholders | (302) | | (289) | |

| | |

| | |

| | |

| Other financing activities | (36) | | (7) | |

| Total cash flows used in financing activities | (838) | | (644) | |

| Effect of exchange rate changes on cash | (82) | | (75) | |

| Decrease in cash and equivalents | (126) | | (241) | |

| Cash and equivalents at beginning of period | 2,264 | | 2,346 | |

| Cash and equivalents at end of period | $ | 2,138 | | $ | 2,105 | |

| Supplemental disclosure of cash flow information: | | |

| Cash payments during the period for: | | |

| Interest | $ | 218 | | $ | 228 | |

| Income taxes | $ | 283 | | $ | 388 | |

| See notes to condensed consolidated financial statements. | | |

HAL Q2 2024 FORM 10-Q | 4

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

HALLIBURTON COMPANY

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements were prepared using United States generally accepted accounting principles (U.S. GAAP) for interim financial information and the instructions to Form 10-Q and Regulation S-X. Accordingly, these financial statements do not include all information or notes required by U.S. GAAP for annual financial statements and should be read together with our 2023 Annual Report on Form 10-K.

Our accounting policies are in accordance with U.S. GAAP. The preparation of financial statements in conformity with these accounting principles requires us to make estimates and assumptions that affect:

•the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements; and

•the reported amounts of revenue and expenses during the reporting period.

Ultimate results could differ from our estimates.

In our opinion, the condensed consolidated financial statements included herein contain all adjustments necessary to present fairly our financial position as of June 30, 2024 and the results of our operations for the three and six months ended June 30, 2024 and 2023, and our cash flows for the six months ended June 30, 2024 and 2023. Such adjustments are of a normal recurring nature. In addition, certain reclassifications of prior period balances have been made to conform to the current period presentation.

The results of our operations for the three and six months ended June 30, 2024 may not be indicative of results for the full year.

Note 2. Business Segment Information

We operate under two divisions, which form the basis for the two operating segments we report: the Completion and Production segment and the Drilling and Evaluation segment. Our equity in earnings and losses of unconsolidated affiliates that are accounted for using the equity method of accounting are included within cost of services and cost of sales on our statements of operations, which is part of operating income of the applicable segment.

HAL Q2 2024 FORM 10-Q | 5

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

The following table presents information on our business segments.

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | Six Months Ended

June 30, | |

| Millions of dollars | 2024 | 2023 | 2024 | 2023 | | |

| Revenue: | | | | | | |

| Completion and Production | $ | 3,401 | | $ | 3,476 | | $ | 6,774 | | $ | 6,885 | | | |

| Drilling and Evaluation | 2,432 | | 2,322 | | 4,863 | | 4,590 | | | |

| Total revenue | $ | 5,833 | | $ | 5,798 | | $ | 11,637 | | $ | 11,475 | | | |

| Operating income: | | | | | | |

| Completion and Production | $ | 723 | | $ | 707 | | $ | 1,411 | | $ | 1,373 | | | |

| Drilling and Evaluation | 403 | | 376 | | 801 | | 745 | | | |

| Total operations | 1,126 | | 1,083 | | 2,212 | | 2,118 | | | |

| Corporate and other (a) | (65) | | (59) | | (130) | | (117) | | | |

| SAP S4 upgrade expense | (29) | | (13) | | (63) | | (13) | | | |

| | | | | | |

| Total operating income | $ | 1,032 | | $ | 1,011 | | $ | 2,019 | | $ | 1,988 | | | |

| Interest expense, net of interest income | (92) | | (102) | | (184) | | (203) | | | |

| Loss on Blue Chip Swap transactions (b) | — | | (104) | | — | | (104) | | | |

| | | | | | |

| | | | | | |

| Other, net (c) | (20) | | (22) | | (128) | | (69) | | | |

| Income before income taxes | $ | 920 | | $ | 783 | | $ | 1,707 | | $ | 1,612 | | | |

| | | | | | | |

| (a) | Includes certain expenses not attributable to a business segment, such as costs related to support functions, corporate executives, and operating lease assets, and also includes amortization expense associated with intangible assets recorded as a result of acquisitions. | | |

| |

| (b) | The Central Bank of Argentina maintains currency controls that limit our ability to access U.S. dollars in Argentina and remit cash from our Argentine operations. Our execution of certain trades, known as Blue Chip Swaps, which effectively results in a parallel U.S. dollar exchange rate, resulted in a $104 million pre-tax loss during the three and six months ended June 30, 2023. | | |

| |

| (c) | During the six months ended June 30, 2024, Halliburton incurred a charge of $82 million primarily due to the impairment of an investment in Argentina and currency devaluation in Egypt. | | |

Note 3. Revenue

Revenue is recognized based on the transfer of control or our customers’ ability to benefit from our services and products in an amount that reflects the consideration we expect to receive in exchange for those services and products. Most of our service and product contracts are short-term in nature. In recognizing revenue for our services and products, we determine the transaction price of purchase orders or contracts with our customers, which may consist of fixed and variable consideration. We also assess our customers’ ability and intention to pay, which is based on a variety of factors, including our historical payment experience with, and the financial condition of, our customers. Payment terms and conditions vary by contract type, although terms generally include a requirement of payment within 20 to 60 days. Other judgments involved in recognizing revenue include an assessment of progress towards completion of performance obligations for certain long-term contracts, which involve estimating total costs to determine our progress towards contract completion and calculating the corresponding amount of revenue to recognize.

Disaggregation of revenue

We disaggregate revenue from contracts with customers into types of services or products, consistent with our two reportable segments, in addition to geographical area. Based on the location of services provided and products sold, 41% and 46% of our consolidated revenue was from the United States for the six months ended June 30, 2024 and 2023, respectively. No other country accounted for more than 10% of our revenue for those periods.

HAL Q2 2024 FORM 10-Q | 6

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

The following table presents information on our disaggregated revenue.

| | | | | | | | | | | | | | |

| Three Months Ended

June 30, | Six Months Ended

June 30, |

| Millions of dollars | 2024 | 2023 | 2024 | 2023 |

| Revenue by segment: | | | | |

| Completion and Production | $ | 3,401 | | $ | 3,476 | | $ | 6,774 | | $ | 6,885 | |

| Drilling and Evaluation | 2,432 | | 2,322 | | 4,863 | | 4,590 | |

| Total revenue | $ | 5,833 | | $ | 5,798 | | $ | 11,637 | | $ | 11,475 | |

| Revenue by geographic region: | | | | |

| North America | $ | 2,481 | | $ | 2,696 | | $ | 5,027 | | $ | 5,461 | |

| Latin America | 1,097 | | 994 | | 2,205 | | 1,909 | |

| Europe/Africa/CIS | 757 | | 698 | | 1,486 | | 1,360 | |

| Middle East/Asia | 1,498 | | 1,410 | | 2,919 | | 2,745 | |

| Total revenue | $ | 5,833 | | $ | 5,798 | | $ | 11,637 | | $ | 11,475 | |

Contract balances

We perform our obligations under contracts with our customers by transferring services and products in exchange for consideration. The timing of our performance often differs from the timing of our customers’ payment, which results in the recognition of receivables and deferred revenue. Deferred revenue represents advance consideration received from customers for contracts where revenue is recognized on future performance of service. Deferred revenue, as well as revenue recognized during the period relating to amounts included as deferred revenue at the beginning of the period, was not material to our condensed consolidated financial statements.

Transaction price allocated to remaining performance obligations

Remaining performance obligations represent firm contracts for which work has not been performed and future revenue recognition is expected. We have elected the practical expedient permitting the exclusion of disclosing remaining performance obligations for contracts that have an original expected duration of one year or less. We have some long-term contracts related to software and integrated project management services such as lump sum turnkey contracts. For software contracts, revenue is generally recognized over the duration of the contract period when the software is considered to be a right to access our intellectual property. For lump sum turnkey projects, we recognize revenue over time using an input method, which requires us to exercise judgment. Revenue allocated to remaining performance obligations for these long-term contracts is not material.

Receivables

As of June 30, 2024, 31% of our net trade receivables was from customers in the United States and 13% was from customers in Mexico. As of December 31, 2023, 33% of our net trade receivables was from customers in the United States and 9% was from customers in Mexico. Receivables from our primary customer in Mexico accounted for approximately 11% and 6% of our total receivables as of June 30, 2024 and December 31, 2023, respectively. While we have experienced payment delays from our primary customer in Mexico, the amounts are not in dispute and we have not historically had, and we do not expect any material write-offs due to collectability of receivables from this customer. No country other than the United States and Mexico or single customer accounted for more than 10% of our net trade receivables at those dates.

We have risk of delayed customer payments and payment defaults associated with customer liquidity issues. We routinely monitor the financial stability of our customers and employ an extensive process to evaluate the collectability of outstanding receivables. This process, which involves judgment and estimates, includes analysis of our customers’ historical time to pay, financial condition and various financial metrics, debt structure, credit ratings, and production profile, as well as political and economic factors in countries of operations and other customer-specific factors.

HAL Q2 2024 FORM 10-Q | 7

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

Note 4. Inventories

Inventories consisted of the following:

| | | | | | | | |

| Millions of dollars | June 30,

2024 | December 31,

2023 |

| Finished products and parts | $ | 2,063 | | $ | 2,069 | |

| Raw materials and supplies | 1,070 | | 1,021 | |

| Work in process | 149 | | 136 | |

| Total inventories | $ | 3,282 | | $ | 3,226 | |

Note 5. Accounts Payable

Effective January 1, 2023, we adopted new supplier finance program disclosure requirements contained in guidance issued by the Financial Accounting Standards Board (ASU 2022-04, “Disclosure of Supplier Finance Program Obligations”). The standards update also includes a prospective annual requirement to disclose a rollforward of the amount of the supplier finance program obligations during the annual reporting period. We will include the rollforward disclosure in our Annual Report on Form 10-K for the year ending December 31, 2024, as required.

We have agreements with third parties that allow our participating suppliers to finance payment obligations from us with designated third-party financial institutions who act as our paying agent. We have generally extended our payment terms with suppliers to 90 days. A participating supplier may request a participating financial institution to finance one or more of our payment obligations to such supplier prior to the scheduled due date thereof at a discounted price. We are not required to provide collateral to the financial institutions.

Our obligations to participating suppliers, including amounts due and scheduled payment dates, are not impacted by the suppliers’ decisions to finance amounts due under these financing arrangements. Our outstanding payment obligations under these agreements were $302 million as of June 30, 2024, and $322 million as of December 31, 2023, and are included in accounts payable on the condensed consolidated balance sheets.

Note 6. Income Taxes

During the three months ended June 30, 2024, we recorded a total income tax provision of $207 million on a pre-tax income of $920 million, resulting in an effective tax rate of 22.5% for the quarter. During the three months ended June 30, 2023, we recorded a total income tax provision of $167 million on a pre-tax income of $783 million, resulting in an effective tax rate of 21.3% for the quarter.

During the six months ended June 30, 2024, we recorded a total income tax provision of $385 million on a pre-tax income of $1.7 billion, resulting in an effective tax rate of 22.6% for the period. During the six months ended June 30, 2023, we recorded a total income tax provision of $341 million on a pre-tax income of $1.6 billion, resulting in an effective tax rate of 21.1% for the period.

Our tax returns are subject to review by the taxing authorities in the jurisdictions where we file tax returns. In most cases we are no longer subject to examination by tax authorities for years before 2012. The only significant operating jurisdiction that has tax filings under review or subject to examination by the tax authorities is the United States. The United States federal income tax filings for tax years 2016 through 2023 are currently under review or remain open for review by the Internal Revenue Service (the IRS).

As of June 30, 2024, the primary unresolved issue for the IRS audit for 2016 relates to the classification of the $3.5 billion ordinary deduction that we claimed for the termination fee we paid to Baker Hughes in the second quarter of 2016 for which we received a Notice of Proposed Adjustment (NOPA) from the IRS on September 28, 2023. We regularly assess the likelihood of adverse outcomes resulting from tax examinations to determine the adequacy of our tax reserves, and we believe our income tax reserves are appropriately provided for all open tax years. We do not expect a final resolution of this issue in the next twelve months.

Based on the information currently available, we do not anticipate a significant increase or decrease to our tax contingencies within the next twelve months.

HAL Q2 2024 FORM 10-Q | 8

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

Note 7. Shareholders’ Equity

The following tables summarize our shareholders’ equity activity for the three and six months ended June 30, 2024 and June 30, 2023, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Millions of dollars | Common Stock | Paid-in Capital in Excess of Par Value | Treasury Stock | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interest in Consolidated Subsidiaries | Total |

| Balance at December 31, 2023 | $ | 2,663 | | $ | 63 | | $ | (5,540) | | $ | 12,536 | | $ | (331) | | $ | 42 | | $ | 9,433 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 606 | | — | | 3 | | 609 | |

| Other comprehensive income (loss) | — | | — | | — | | — | | (1) | | 1 | | — | |

Cash dividends ($0.17 per share) | — | | — | | — | | (151) | | — | | — | | (151) | |

| Stock repurchase program | — | | — | | (250) | | — | | — | | — | | (250) | |

| Stock plans (a) | (1) | | (63) | | 108 | | (3) | | — | | — | | 41 | |

| Other | — | | — | | — | | — | | — | | — | | — | |

| Balance at March 31, 2024 | $ | 2,662 | | $ | — | | $ | (5,682) | | $ | 12,988 | | $ | (332) | | $ | 46 | | $ | 9,682 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 709 | | — | | 4 | | 713 | |

| Other comprehensive income (loss) | — | | — | | — | | — | | — | | — | | — | |

Cash dividends ($0.17 per share) | — | | — | | — | | (151) | | — | | — | | (151) | |

| Stock repurchase program | — | | — | | (250) | | — | | — | | — | | (250) | |

| Stock plans (a) | 1 | | — | | 151 | | (96) | | — | | — | | 56 | |

| Other | — | | — | | — | | — | | — | | (4) | | (4) | |

| Balance at June 30, 2024 | $ | 2,663 | | $ | — | | $ | (5,781) | | $ | 13,450 | | $ | (332) | | $ | 46 | | $ | 10,046 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

| (a) | In the first quarter and second quarter of 2024, we issued common stock from treasury shares for stock options exercised, restricted stock grants, performance shares under our performance unit program, and purchases under our employee stock purchase plan. As a result, additional paid in capital was reduced to zero, which resulted in a reduction of retained earnings by $3 million and $96 million. Future issuances from treasury shares could similarly impact additional paid in capital and retained earnings. |

HAL Q2 2024 FORM 10-Q | 9

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Millions of dollars | Common Stock | Paid-in Capital in Excess of Par Value | Treasury Stock | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interest in Consolidated Subsidiaries | Total |

| Balance at December 31, 2022 | $ | 2,664 | | $ | 50 | | $ | (5,108) | | $ | 10,572 | | $ | (230) | | $ | 29 | | $ | 7,977 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 651 | | — | | 4 | | 655 | |

| Other comprehensive income | — | | — | | — | | — | | 1 | | — | | 1 | |

Cash dividends ($0.16 per share) | — | | — | | — | | (145) | | — | | — | | (145) | |

| Stock repurchase program | — | | — | | (100) | | — | | — | | — | | (100) | |

| Stock plans (a) | — | | (50) | | 113 | | (3) | | — | | — | | 60 | |

| Other | — | | — | | — | | — | | — | | (3) | | (3) | |

| Balance at March 31, 2023 | $ | 2,664 | | $ | — | | $ | (5,095) | | $ | 11,075 | | $ | (229) | | $ | 30 | | $ | 8,445 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 610 | | — | | 6 | | 616 | |

| Other comprehensive income | — | | — | | — | | — | | 1 | | — | | 1 | |

Cash dividends ($0.16 per share) | — | | — | | — | | (144) | | — | | — | | (144) | |

| Stock repurchase program | — | | — | | (250) | | — | | — | | — | | (250) | |

| Stock plans (a) | (1) | | — | | 144 | | (82) | | — | | — | | 61 | |

| Other | — | | — | | — | | — | | — | | (2) | | (2) | |

| Balance at June 30, 2023 | $ | 2,663 | | $ | — | | $ | (5,201) | | $ | 11,459 | | $ | (228) | | $ | 34 | | $ | 8,727 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

| (a) | In the first quarter and second quarter of 2023, we issued common stock from treasury shares for stock options exercised, restricted stock grants, performance shares under our performance unit program, and purchases under our employee stock purchase plan. As a result, additional paid in capital was reduced to zero, which resulted in a reduction of retained earnings by $3 million and $82 million, respectively. Future issuances from treasury shares could similarly impact additional paid in capital and retained earnings. |

Our Board of Directors has authorized a program to repurchase our common stock from time to time. We repurchased 6.9 million shares of our common stock under the program during the three months ended June 30, 2024 for approximately $250 million. Approximately $3.6 billion remained authorized for repurchases under the program as of June 30, 2024. From the inception of this program in February of 2006 through June 30, 2024, we repurchased approximately 267 million shares of our common stock for a total cost of approximately $10.6 billion. We repurchased 8.1 million shares of our common stock under the program during the three months ended June 30, 2023 for approximately $250 million.

Accumulated other comprehensive loss consisted of the following:

| | | | | | | | | | | |

| Millions of dollars | June 30,

2024 | December 31,

2023 |

| Cumulative translation adjustments | $ | (83) | | $ | (84) | |

| Defined benefit and other postretirement liability adjustments | (210) | | (207) | |

| | | |

| Other | (39) | | (40) | |

| Total accumulated other comprehensive loss | $ | (332) | | $ | (331) | |

| | | |

| |

Note 8. Commitments and Contingencies

The Company is subject to various legal or governmental proceedings, claims or investigations, including personal injury, property damage, environmental, intellectual property, commercial, tax, and other matters arising in the ordinary course of business, the resolution of which, in the opinion of management, will not have a material adverse effect on our consolidated results of operations or consolidated financial position. There is inherent risk in any legal or governmental proceeding, claim or investigation, and no assurance can be given as to the outcome of these proceedings.

HAL Q2 2024 FORM 10-Q | 10

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

Guarantee arrangements

In the normal course of business, we have agreements with financial institutions under which approximately $2.6 billion of letters of credit, bank guarantees, or surety bonds were outstanding as of June 30, 2024. Some of the outstanding letters of credit have triggering events that would entitle a bank to require cash collateralization; however, none of these triggering events have occurred. As of June 30, 2024, we had no material off-balance sheet liabilities and were not required to make any material cash distributions to our unconsolidated subsidiaries.

Note 9. Income per Share

Basic income or loss per share is based on the weighted average number of common shares outstanding during the period. Diluted income per share includes additional common shares that would have been outstanding if potential common shares with a dilutive effect had been issued. Antidilutive securities represent potentially dilutive securities which are excluded from the computation of diluted income or loss per share as their impact was antidilutive.

A reconciliation of the number of shares used for the basic and diluted income per share computations is as follows:

| | | | | | | | | | | | | | |

| Three Months Ended

June 30, | Six Months Ended

June 30, |

| Millions of shares | 2024 | 2023 | 2024 | 2023 |

| Basic weighted average common shares outstanding | 884 | | 901 | | 886 | | 902 | |

| Dilutive effect of awards granted under our stock incentive plans | 2 | | 2 | | 2 | | 3 | |

| Diluted weighted average common shares outstanding | 886 | | 903 | | 888 | | 905 | |

| | | | |

| Antidilutive shares: | | | | |

| Options with exercise price greater than the average market price | 10 | | 13 | | 10 | | 14 | |

| | | | |

| Total antidilutive shares | 10 | | 13 | | 10 | | 14 | |

Note 10. Fair Value of Financial Instruments

The carrying amount of cash and equivalents, receivables, and accounts payable, as reflected in the condensed consolidated balance sheets, approximates fair value due to the short maturities of these instruments.

The carrying amount and fair value of our total debt is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Millions of dollars | Level 1 | Level 2 | Total fair value | Carrying value | | Level 1 | Level 2 | Total fair value | Carrying value |

| Total debt | $ | 7,352 | | $ | 99 | | $ | 7,451 | | $ | 7,638 | | | $ | 7,419 | | $ | 378 | | $ | 7,797 | | $ | 7,636 | |

In the first half of 2024, the fair value of our total debt decreased as a result of higher bond yields.

Our debt categorized within level 1 on the fair value hierarchy is calculated using quoted prices in active markets for identical liabilities with transactions occurring on the last two days of period-end. Our debt categorized within level 2 on the fair value hierarchy is calculated using significant observable inputs for similar liabilities where estimated values are determined from observable data points on our other bonds and on other similarly rated corporate debt or from observable data points of transactions occurring prior to two days from period-end and adjusting for changes in market conditions. Differences between the periods presented in our level 1 and level 2 classification of our long-term debt relate to the timing of when third party market transactions on our debt are executed. We have no debt categorized within level 3 on the fair value hierarchy.

Note 11. Subsequent Event

During July of 2024, we entered into a credit default swap (CDS) with a third-party financial institution. The CDS is related to a borrowing provided by the financial institution to one of our primary customers in Mexico, and a portion of the proceeds are expected to be utilized by this customer to pay certain of our outstanding receivables. The notional amount of the CDS could be as much as $260 million, and will reduce on a monthly basis over the 24-month term. We do not expect that the fair value of this derivative liability will be material to our consolidated financial statements.

HAL Q2 2024 FORM 10-Q | 11

| | | | | | | | |

| | Part I. Item 2 | Executive Overview |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Management's Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with the condensed consolidated financial statements included in “Item 1. Financial Statements” contained herein.

EXECUTIVE OVERVIEW

Organization

We are one of the world’s largest providers of products and services to the energy industry. We help our customers maximize asset value throughout the lifecycle of the reservoir from locating hydrocarbons and managing geological data, to drilling and formation evaluation, well construction and completion, and optimizing production throughout the life of the asset. Activity levels within our operations are significantly impacted by spending on upstream exploration, development, and production programs by major, national, and independent oil and natural gas companies. We report our results under two segments, the Completion and Production segment and the Drilling and Evaluation segment.

•Completion and Production delivers cementing, stimulation, specialty chemicals, intervention, pressure control, artificial lift, and completion products and services. The segment consists of Artificial Lift, Cementing, Completion Tools, Multi-Chem, Pipeline and Process Services, Production Enhancement, and Production Solutions.

•Drilling and Evaluation provides field and reservoir modeling, drilling, fluids, evaluation, and precise wellbore placement solutions that enable customers to model, measure, drill, and optimize their well construction activities. The segment consists of Baroid, Drill Bits and Services, Halliburton Project Management, Landmark Software and Services, Sperry Drilling, Testing and Subsea, and Wireline and Perforating.

The business operations of our segments are organized around four primary geographic regions: North America, Latin America, Europe/Africa/CIS, and Middle East/Asia. We have manufacturing operations in various locations, the most significant of which are in the United States, Malaysia, Singapore, and the United Kingdom. With approximately 49,000 employees, we operate in more than 70 countries around the world, and our corporate headquarters is in Houston, Texas.

Our value proposition is to collaborate and engineer solutions to maximize asset value for our customers. We work to achieve strong cash flows and returns for our shareholders by delivering technology and services that improve efficiency, increase recovery, and maximize production for our customers. Our strategic priorities are to:

- International: Allocate our capital to the highest return opportunities and increase our international growth in both onshore and offshore markets.

- North America: Maximize value by, among other things, utilizing our premium low-emissions Zeus electric fracturing systems, as well as automated and intelligent fracturing technologies, to drive higher margins through better pricing and increased efficiency.

- Digital: Continue to drive differentiation and efficiencies through the deployment and integration of digital and automation technologies, both internally and for our customers.

- Capital efficiency: Maintain our capital expenditures at approximately 6% of revenue while focusing on technological advancements and process changes that reduce our manufacturing and maintenance costs and improve how we move equipment and respond to market opportunities.

- Shareholder returns: Return over 50% of annual free cash flow to shareholders through dividends and share repurchases.

- Sustainability and energy mix transition: Continue to:

• Leverage the participants in Halliburton Labs to gain insight into developing value chains in the energy mix transition;

• Develop and deploy solutions to help lower the carbon intensity of our customers' businesses;

• Develop technologies and solutions to lower our emissions; and

• Participate in carbon capture, utilization, and storage, hydrogen, and geothermal projects globally.

HAL Q2 2024 FORM 10-Q | 12

| | | | | | | | |

| | Part I. Item 2 | Executive Overview |

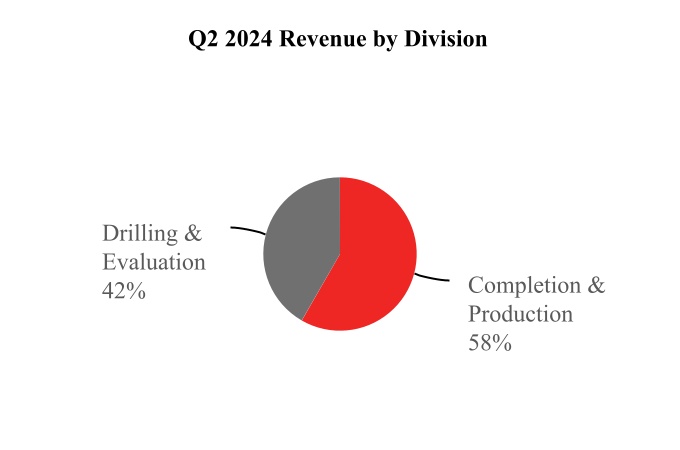

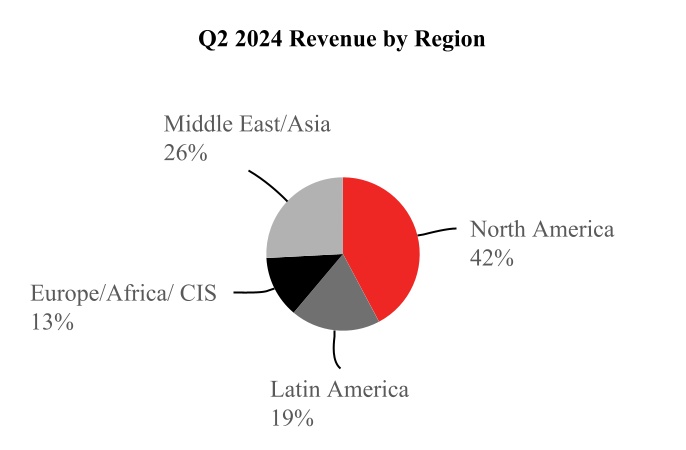

The following charts depict the revenue split between our two operating segments and our four primary geographic regions for the three months ended June 30, 2024.

Market conditions

Oil prices strengthened in the second quarter of 2024 as increased demand and OPEC+ production cuts tightened the oil market. While easing inflationary pressure has reduced macroeconomic uncertainty, risks associated with trade tensions and geopolitical unrest in the Middle East and the Russia-Ukraine conflict continue to be major sources of volatility for the oil and natural gas markets.

During the second quarter of 2024, the U.S. active rig count declined to its lowest level since the first quarter of 2022 as both oil and gas basins saw declines. The international rig count declined in the second quarter of 2024 from the first quarter of 2024 driven by Latin America, the Middle East, and Africa, after a sequential increase in the first quarter of 2024.

Globally, we continue to be impacted by extended supply chain lead times for the supply of select raw materials. We monitor market trends and work to mitigate cost impacts through economies of scale in global procurement, technology modifications, and efficient sourcing practices. Also, while we have been impacted by inflationary cost increases, primarily related to chemicals, cement, and logistics costs, we generally try to pass much of those increases on to our customers and we believe we have effective solutions to minimize their operational impact.

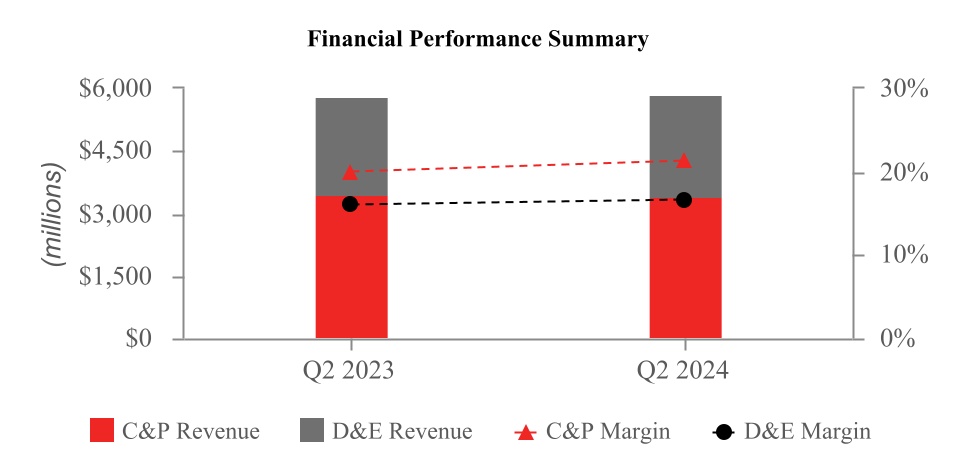

Financial results

The following graph illustrates our revenue and operating margins for each operating segment for the second quarter of 2023 and 2024.

During the second quarter of 2024, we generated total company revenue of $5.8 billion, flat as compared to the second quarter of 2023. We reported operating income of $1.0 billion in the second quarter of 2024, an increase of 2% when compared to the second quarter of 2023. Our Completion and Production segment revenue decreased 2% in the second quarter of 2024 as compared to the second quarter of 2023. The decrease in revenue was primarily driven by lower pressure pumping services in U.S. land, partially offset by improved completion tool sales in the Eastern Hemisphere. Operating income for the segment increased due to international activity growth for pressure pumping services and completion tool sales.

HAL Q2 2024 FORM 10-Q | 13

| | | | | | | | |

| | Part I. Item 2 | Executive Overview |

Our Drilling and Evaluation segment revenue increased 5% in the second quarter of 2024 as compared to the second quarter of 2023, primarily due to increased drilling services in U.S. land and the Middle East and improved testing services in Latin America and the Middle East. Partially offsetting these improvements were lower drilling-related services in Africa.

Our North America revenue decreased 8% in the second quarter of 2024, as compared to the second quarter of 2023. This decline was primarily driven by decreased pressure pumping services and lower artificial lift activity in U.S. land. Partially offsetting these declines were increased completion tool sales in the Gulf of Mexico and higher drilling services in U.S. land.

Internationally, revenue increased 8% in the second quarter of 2024, as compared to the second quarter of 2023, largely driven by improved pressure pumping services and increased well intervention services in the regions and higher drilling services in the Middle East. Partially offsetting these improvements were decreased fluid services and lower wireline activity in Middle East/Asia and lower drilling-related services in Africa.

Our operating performance and liquidity are described in more detail in “Liquidity and Capital Resources” and “Business Environment and Results of Operations.”

Sustainability and Energy Mix Transition

In 2021, we announced our target to achieve a 40% reduction in our Scope 1 and 2 emissions by 2035 from the 2018 baseline. At the same time, we support our customers in their emissions reduction efforts by continuously developing and deploying goods and services that are accretive to their goals as well as ours. As the energy mix transition unfolds, we seek to apply our expertise and resources in growth sectors adjacent to our traditional oilfield services space, including carbon capture, utilization, and storage, hydrogen, and geothermal. Finally, we will continue to focus on accelerating the success of clean tech start-ups via Halliburton Labs, which also allows us to participate in the energy mix transition at relatively low risk by investing our expertise, resources, and team without a significant outlay of capital while we learn where we can strategically engage new markets. As of June 30, 2024, Halliburton Labs had 33 participating companies and alumni.

HAL Q2 2024 FORM 10-Q | 14

| | | | | | | | |

| | Part I. Item 2 | Liquidity and Capital Resources |

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2024, we had $2.1 billion of cash and equivalents, compared to $2.3 billion of cash and equivalents at December 31, 2023.

Significant sources and uses of cash during the first six months of 2024

Sources of cash:

•Cash flows from operating activities were $1.6 billion. Working capital, which consists of receivables, inventories, and accounts payable, had a negative impact of $365 million, primarily due to increased receivables.

Uses of cash:

•Capital expenditures were $677 million.

•We repurchased 13.9 million shares of our common stock for $500 million.

•We paid $302 million of dividends to our shareholders.

Future sources and uses of cash

We manufacture most of our own equipment, which provides us with some flexibility to increase or decrease our capital expenditures based on market conditions. We currently expect capital spending for 2024 to be approximately 6% of revenue. We believe this level of spend will allow us to invest in our key strategic technologies, including the construction and deployment of our Zeus electric fracturing systems in North America, our iStar Intelligent Drilling and Logging Platform, and our iCruise Intelligent Rotary Steerable System. We will continue to maintain capital discipline and monitor the rapidly changing market dynamics, and we may adjust our capital spend accordingly.

While we maintain focus on liquidity and debt reduction, we are also focused on providing cash returns to our shareholders. Our quarterly dividend rate is $0.17 per common share, or approximately $151 million. In 2023, our Board approved a capital return framework with a goal of returning at least 50% of our annual free cash flow to shareholders through dividends and share repurchases and we expect our returns to shareholders will be in line with our capital return framework for 2024.

We may utilize share repurchases as part of our capital return framework. Our Board of Directors has authorized a program to repurchase our common stock from time to time. We repurchased 6.9 million shares of common stock during the second quarter of 2024 under this program. Approximately $3.6 billion remained authorized for repurchases as of June 30, 2024 and may be used for open market and other share purchases.

During 2023, we began our migration to SAP S4, which we expect to complete by the end of 2025. During the six months ended June 30, 2024, we incurred $63 million in expense on our SAP S4 migration. The total project investment is estimated to cost approximately $250 million, of which we have incurred $114 million to date. We believe the new system will provide important efficiency benefits, cost savings, enhanced visibility to our operations, and advanced analytics that will benefit us and our customers.

Other factors affecting liquidity

Financial position in current market. As of June 30, 2024, we had $2.1 billion of cash and equivalents and $3.5 billion of available committed bank credit under a revolving credit facility with an expiration date of April 27, 2027. We believe we have a manageable debt maturity profile, with approximately $472 million coming due beginning in 2025 through 2027. Furthermore, we have no financial covenants or material adverse change provisions in our bank agreements, and our debt maturities extend over a long period of time. We believe our cash on hand, cash flows generated from operations, and our available credit facility will provide sufficient liquidity to address the challenges and opportunities of the current market and our expected global cash needs, including capital expenditures, working capital investments, shareholder returns, if any, debt repurchases, if any, and scheduled interest and principal payments.

Guarantee agreements. In the normal course of business, we have agreements with financial institutions under which approximately $2.6 billion of letters of credit, bank guarantees, or surety bonds were outstanding as of June 30, 2024. Some of the outstanding letters of credit have triggering events that would entitle a bank to require cash collateralization; however, none of these triggering events have occurred. As of June 30, 2024, we had no material off-balance sheet liabilities and were not required to make any material cash distributions to our unconsolidated subsidiaries.

HAL Q2 2024 FORM 10-Q | 15

| | | | | | | | |

| | Part I. Item 2 | Liquidity and Capital Resources |

During the fourth quarter of 2023, we entered into a CDS with a third-party financial institution. The CDS is related to a borrowing provided by the financial institution to one of our primary customers in Mexico, and a portion of the proceeds were utilized by this customer to pay certain of our outstanding receivables. The notional amount of the CDS, which was $248 million at the end of June 2024, will continue to reduce on a monthly basis over its remaining 20-month term.

Credit ratings. Our credit ratings with Standard & Poor’s (S&P) remain BBB+ for our long-term debt and A-2 for our short-term debt, with a positive outlook. Our credit ratings with Moody's Investors Service (Moody's) remain A3 for our long-term debt and P-2 for our short-term debt, with a stable outlook.

Customer receivables. In line with industry practice, we bill our customers for our services in arrears and are, therefore, subject to our customers delaying or failing to pay our invoices. In weak economic environments, we may experience increased delays and failures to pay our invoices due to, among other reasons, a reduction in our customers’ cash flow from operations and their access to the credit markets, as well as unsettled political conditions.

Receivables from our primary customer in Mexico accounted for approximately 11% of our total receivables as of June 30, 2024. While we have experienced payment delays from our primary customer in Mexico, the amounts are not in dispute and we have not historically had, and we do not expect any material write-offs due to collectability of receivables from this customer.

HAL Q2 2024 FORM 10-Q | 16

| | | | | | | | |

| | Part I. Item 2 | Business Environment and Results of Operations |

BUSINESS ENVIRONMENT AND RESULTS OF OPERATIONS

We operate in more than 70 countries throughout the world to provide a comprehensive range of services and products to the energy industry. Our revenue is generated from the sale of services and products to major, national, and independent oil and natural gas companies worldwide. The industry we serve is highly competitive with many substantial competitors in each segment of our business. During the first six months of 2024, based on the location of the services provided and products sold, 41% of our consolidated revenue was from the United States, compared to 46% of our consolidated revenue from the United States in the first six months of 2023. No other country accounted for more than 10% of our revenue for those periods.

Activity within our business segments is significantly impacted by spending on upstream exploration, development, and production programs by our customers. Also impacting our activity is the status of the global economy, which impacts oil and natural gas consumption.

Some of the more significant determinants of current and future spending levels of our customers are oil and natural gas prices and our customers’ expectations about future prices, global oil supply and demand, completions intensity, the world economy, the availability of capital, government regulation, and global stability, which together drive worldwide drilling and completions activity. Additionally, during 2024, we generally expect that many of our customers in North America will continue their strategy of operating within their cash flows and generating returns rather than prioritizing production growth. Lower oil and natural gas prices usually translate into lower exploration and production budgets and lower rig count, while the opposite is usually true for higher oil and natural gas prices. Our financial performance is therefore significantly affected by oil and natural gas prices and worldwide rig activity, which are summarized in the tables below.

The table below shows the average prices for West Texas Intermediate (WTI) crude oil, United Kingdom Brent crude oil, and Henry Hub natural gas.

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | Year Ended

December 31, |

| | 2024 | 2023 | 2023 | |

Oil price - WTI (1) | $ | 82.72 | | $ | 73.76 | | $ | 77.64 | | |

Oil price - Brent (1) | 84.65 | | 78.32 | | 82.47 | | |

Natural gas price - Henry Hub (2) | 2.08 | | 2.16 | | 2.54 | | |

| | | | | |

| (1) | Oil price measured in dollars per barrel. | |

| (2) | Natural gas price measured in dollars per million British thermal units (Btu), or MMBtu. | |

The historical average rig counts based on the weekly Baker Hughes rig count data were as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | Six Months Ended

June 30, | Year Ended

December 31, |

| 2024 | 2023 | 2024 | 2023 | 2023 |

| U.S. Land | 583 | | 699 | | 593 | | 722 | | 669 | |

| U.S. Offshore | 20 | | 20 | | 20 | | 18 | | 18 | |

| Canada | 136 | | 117 | | 172 | | 169 | | 177 | |

| North America | 739 | | 836 | | 785 | | 909 | | 864 | |

| International | 963 | | 959 | | 964 | | 937 | | 948 | |

| Worldwide total | 1,702 | | 1,795 | | 1,749 | | 1,846 | | 1,812 | |

HAL Q2 2024 FORM 10-Q | 17

| | | | | | | | |

| | Part I. Item 2 | Business Environment and Results of Operations |

Business outlook

As we consider the balance of 2024, we remain positive on the oil and natural gas markets and continue to see strength across our portfolio. We expect strong oil and natural gas demand growth for the rest of 2024 as concerns about a potential economic slowdown ease. We believe long-term demand growth will be driven by economic expansion, energy security concerns, and population growth. Oil and natural gas continue to demonstrate their critical roles in the global economy in meeting this long term demand, and necessitate sustained capital investment in existing and new sources of production. To meet this growing demand, production will be needed from conventional, unconventional, deep-water, shallow-water, and short and long-cycle projects. Capital discipline by major oil and natural gas producers continues to underpin a more durable and less volatile upstream spending cycle versus prior cycles.

As noted above, rig counts and, as a result, service activity in North America continued to decline in the second quarter of 2024. Consequently, we expect our revenues in North America to decline in 2024 as compared to 2023. Nevertheless, we expect our international business to deliver about 10% revenue growth for the full year. and we remain confident that over the longer run investment in upstream activity will grow (including in North America) in order to meet growing demand for oil and natural gas and that demand for our products and services will grow accordingly.

HAL Q2 2024 FORM 10-Q | 18

| | | | | |

| Part I. Item 2 | Results of Operations in 2024 Compared to 2023 (QTD) |

RESULTS OF OPERATIONS IN 2024 COMPARED TO 2023

Three Months Ended June 30, 2024 Compared with Three Months Ended June 30, 2023

| | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | Favorable | | | Percentage |

| Millions of dollars | 2024 | 2023 | (Unfavorable) | | | Change |

| Revenue: | | | | | | |

| By operating segment: | | | | | | |

| Completion and Production | $ | 3,401 | | $ | 3,476 | | $ | (75) | | | | (2) | % |

| Drilling and Evaluation | 2,432 | | 2,322 | | 110 | | | | 5 | |

| Total revenue | $ | 5,833 | | $ | 5,798 | | $ | 35 | | | | 1 | % |

| By geographic region: | | | | | | |

| North America | $ | 2,481 | | $ | 2,696 | | $ | (215) | | | | (8) | % |

| Latin America | 1,097 | | 994 | | 103 | | | | 10 | |

| Europe/Africa/CIS | 757 | | 698 | | 59 | | | | 8 | |

| Middle East/Asia | 1,498 | | 1,410 | | 88 | | | | 6 | |

| Total revenue | $ | 5,833 | | $ | 5,798 | | $ | 35 | | | | 1 | % |

| | | | | | |

| Operating income: | | | | | | |

| By operating segment: | | | | | | |

| Completion and Production | $ | 723 | | $ | 707 | | $ | 16 | | | | 2 | % |

| Drilling and Evaluation | 403 | | 376 | | 27 | | | | 7 | |

| Total operations | 1,126 | | 1,083 | | 43 | | | | 4 | |

| Corporate and other | (65) | | (59) | | (6) | | | | (10) | % |

| SAP S4 upgrade expense | (29) | | (13) | | (16) | | | | n/m |

| | | | | | |

| Total operating income | $ | 1,032 | | $ | 1,011 | | $ | 21 | | | | 2 | % |

| n/m = not meaningful | | | | | | |

Operating Segments

Completion and Production

Completion and Production revenue in the second quarter of 2024 was $3.4 billion, a decrease of $75 million, or 2%, when compared to the second quarter of 2023. Operating income in the second quarter of 2024 was $723 million, an increase of $16 million, or 2%, when compared to the second quarter of 2023. The decrease in revenue was primarily driven by lower pressure pumping services in U.S. land, partially offset by improved completion tool sales in the Eastern Hemisphere. Operating income for the segment increased due to international activity growth for pressure pumping services and completion tool sales.

Drilling and Evaluation

Drilling and Evaluation revenue in the second quarter of 2024 was $2.4 billion, an increase of $110 million, or 5%, when compared to the second quarter of 2023. Operating income in the second quarter of 2024 was $403 million, an increase of $27 million, or 7%, when compared to the second quarter of 2023. These results were primarily driven by increased drilling services in U.S. land and the Middle East and improved testing services in Latin America and the Middle East. Partially offsetting these improvements were lower drilling-related services in Africa.

HAL Q2 2024 FORM 10-Q | 19

| | | | | |

| Part I. Item 2 | Results of Operations in 2024 Compared to 2023 (QTD) |

Geographic Regions

North America

North America revenue in the second quarter of 2024 was $2.5 billion, an 8% decrease compared to the second quarter of 2023. This decline was primarily driven by decreased pressure pumping services and lower artificial lift activity in U.S. land. Partially offsetting these declines were increased completion tool sales in the Gulf of Mexico and higher drilling services in U.S. land.

Latin America

Latin America revenue in the second quarter of 2024 was $1.1 billion, a 10% increase compared to the second quarter of 2023. This increase was primarily driven by higher stimulation activity and improved wireline services in Argentina and Mexico, increased testing services in Mexico and the Caribbean, and improved project management activity in Ecuador. Partially offsetting these improvements were lower well construction activity, decreased software sales, and lower project management activity in Mexico, along with lower completion tool sales in Brazil.

Europe/Africa/CIS

Europe/Africa/CIS revenue in the second quarter of 2024 was $757 million, an 8% increase compared to the second quarter of 2023. This increase was primarily driven by higher well construction activity, increased wireline services, and improved project management activity in Norway and increased completion tool sales in the region. Partially offsetting these increases was lower well construction activity in Africa.

Middle East/Asia

Middle East/Asia revenue in the second quarter of 2024 was $1.5 billion, a 6% increase compared to the second quarter of 2023. This increase was primarily driven by higher drilling services in Saudi Arabia and Qatar, improved well construction activity in United Arab Emirates, improved project management activity in Kuwait, and increased completion tool sales in Saudi Arabia. Partially offsetting these improvements were decreased fluid services in Saudi Arabia, lower project management activity in Iraq, Saudi Arabia, and Asia, along with decreased wireline activity across the region.

Other Operating Items

SAP S4 Upgrade Expense. During 2023, we began our migration to SAP S4, which we expect to complete by the end of 2025. During the second quarter of 2024, we recognized $29 million of expense on our SAP S4 migration. During the second quarter of 2023, we recognized $13 million of expense on our SAP S4 migration.

Nonoperating Items

Argentina Blue Chip Swap. The Central Bank of Argentina maintains currency controls that limit our ability to access U.S. dollars in Argentina and remit cash from our Argentine operations. The execution of certain trades known as Blue Chip Swaps, effectively results in a parallel U.S. dollar exchange rate. During the three months ended June 30, 2023, we entered into Blue Chip Swap transactions, which resulted in a $104 million pre-tax loss on investment.

Income Tax Provision. During the three months ended June 30, 2024, we recorded a total income tax provision of $207 million on a pre-tax income of $920 million, resulting in an effective tax rate of 22.5% for the quarter. During the three months ended June 30, 2023, we recorded a total income tax provision of $167 million on a pre-tax income of $783 million, resulting in an effective tax rate of 21.3% for the quarter.

Pillar Two. The Organization for Economic Co-operation and Development enacted model rules for a new global minimum tax framework, also known as Pillar Two, and certain governments globally have enacted, or are in the process of enacting, legislation considering these model rules. These rules did not have a material impact on our taxes for the three months ended June 30, 2024.

HAL Q2 2024 FORM 10-Q | 20

| | | | | |

| Part I. Item 2 | Results of Operations in 2024 Compared to 2023 (QTD) |

Internal Revenue Service Notice of Proposed Adjustment. We are subject to taxes in the United States and in numerous jurisdictions where we operate or where our subsidiaries are organized. Our tax returns are routinely subject to examination by the taxing authorities in the jurisdictions where we file tax returns. In most cases we are no longer subject to examination by tax authorities for years before 2012. The only significant operating jurisdiction that has tax filings under review or subject to examination by the tax authorities is the United States. Our United States federal income tax filings for tax years 2016 through 2023, including carry back of 2016 net operating losses to 2014, are currently under review or remain open for review by the IRS.

On September 28, 2023, we received a NOPA from the IRS covering our 2016 U.S. tax return. The NOPA proposed an adjustment to reclassify approximately 95% of the $3.5 billion termination fee paid to Baker Hughes in 2016 from an ordinary expense deduction to a capital loss. The termination fee was paid to Baker Hughes under the merger agreement after antitrust regulators in multiple jurisdictions failed to approve our proposed merger. It is common commercial practice to include a termination fee in a merger agreement to compensate the target for damages incurred when the acquisition does not go forward. The IRS’s long-understood position at the time of the payment had been to treat such payments as an ordinary and necessary business expense. We strongly disagree with the proposed adjustment on both a factual and legal basis, and we plan to vigorously contest it.

We expect that resolving this dispute will take substantial time. In December 2023, we initiated the IRS administrative appeals process, which may take more than twelve months to complete. Failing a resolution through that process, the matter would ultimately be resolved by the United States federal courts.

We regularly assess the likelihood of adverse outcomes resulting from tax examinations to determine the adequacy of our tax reserves, and we believe our income tax reserves are appropriately provided for all open tax years. We cannot assure you that the matter will be determined in our favor or against us, and if the matter is ultimately determined unfavorably to us, it could have a material adverse impact on our results of operations and cash flows. Based on tax attributes currently available, we estimate that, should the IRS's position prevail through its appellate process and subsequent litigation, the proposed adjustment could result in cash taxes due of approximately $650 million (plus interest thereon in the case of amounts due for previous tax years). Our estimates are calculated under current tax law and on the bases of our assumptions regarding taxable income and loss and other tax attributes over the relevant period, which law could change and which assumptions could and likely will differ materially from actual results. In any event, no payment of any additional tax is currently required, nor do we anticipate that the proposed adjustment would materially and adversely impact our ability to meet our expected uses of cash, including future capital expenditures, working capital investments, and scheduled debt repayments, or our ability to return cash to shareholders, even if a final determination of the matter is reached that is adverse to us.

HAL Q2 2024 FORM 10-Q | 21

| | | | | |

| Part I. Item 2 | Results of Operations in 2024 Compared to 2023 (YTD) |

Six Months Ended June 30, 2024 Compared with Six Months Ended June 30, 2023

| | | | | | | | | | | | | | | |

| Six Months Ended

June 30, | Favorable | | Percentage |

| Millions of dollars | 2024 | 2023 | (Unfavorable) | | Change |

| Revenue: | | | | | |

| By operating segment: | | | | | |

| Completion and Production | $ | 6,774 | | $ | 6,885 | | $ | (111) | | | (2) | % |

| Drilling and Evaluation | 4,863 | | 4,590 | | 273 | | | 6 | |

| Total revenue | $ | 11,637 | | $ | 11,475 | | $ | 162 | | | 1 | % |

| By geographic region: | | | | | |

| North America | $ | 5,027 | | $ | 5,461 | | $ | (434) | | | (8) | % |

| Latin America | 2,205 | | 1,909 | | 296 | | | 16 | |

| Europe/Africa/CIS | 1,486 | | 1,360 | | 126 | | | 9 | |

| Middle East/Asia | 2,919 | | 2,745 | | 174 | | | 6 | |

| Total revenue | $ | 11,637 | | $ | 11,475 | | $ | 162 | | | 1 | % |

| | | | | |

| Operating income: | | | | | |

| By operating segment: | | | | | |

| Completion and Production | $ | 1,411 | | $ | 1,373 | | $ | 38 | | | 3 | % |

| Drilling and Evaluation | 801 | | 745 | | 56 | | | 8 | |

| Total operations | $ | 2,212 | | $ | 2,118 | | $ | 94 | | | 4 | |

| Corporate and other | (130) | | (117) | | (13) | | | (11) | % |

| SAP S4 upgrade expense | (63) | | (13) | | (50) | | | n/m |

| | | | | |