0000045012December 31895,051,7422023Q3false00000450122023-01-012023-09-3000000450122023-10-18xbrli:shares0000045012us-gaap:ServiceMember2023-07-012023-09-30iso4217:USD0000045012us-gaap:ServiceMember2022-07-012022-09-300000045012us-gaap:ServiceMember2023-01-012023-09-300000045012us-gaap:ServiceMember2022-01-012022-09-300000045012us-gaap:ProductMember2023-07-012023-09-300000045012us-gaap:ProductMember2022-07-012022-09-300000045012us-gaap:ProductMember2023-01-012023-09-300000045012us-gaap:ProductMember2022-01-012022-09-3000000450122023-07-012023-09-3000000450122022-07-012022-09-3000000450122022-01-012022-09-30iso4217:USDxbrli:shares00000450122023-09-3000000450122022-12-3100000450122021-12-3100000450122022-09-30hal:Division0000045012hal:CompletionAndProductionMember2023-07-012023-09-300000045012hal:CompletionAndProductionMember2022-07-012022-09-300000045012hal:CompletionAndProductionMember2023-01-012023-09-300000045012hal:CompletionAndProductionMember2022-01-012022-09-300000045012hal:DrillingAndEvaluationMember2023-07-012023-09-300000045012hal:DrillingAndEvaluationMember2022-07-012022-09-300000045012hal:DrillingAndEvaluationMember2023-01-012023-09-300000045012hal:DrillingAndEvaluationMember2022-01-012022-09-300000045012hal:CompletionAndProductionMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300000045012hal:CompletionAndProductionMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300000045012hal:CompletionAndProductionMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000045012hal:CompletionAndProductionMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300000045012hal:DrillingAndEvaluationMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300000045012hal:DrillingAndEvaluationMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300000045012hal:DrillingAndEvaluationMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300000045012hal:DrillingAndEvaluationMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300000045012us-gaap:OperatingSegmentsMember2023-07-012023-09-300000045012us-gaap:OperatingSegmentsMember2022-07-012022-09-300000045012us-gaap:OperatingSegmentsMember2023-01-012023-09-300000045012us-gaap:OperatingSegmentsMember2022-01-012022-09-300000045012us-gaap:CorporateAndOtherMember2023-07-012023-09-300000045012us-gaap:CorporateAndOtherMember2022-07-012022-09-300000045012us-gaap:CorporateAndOtherMember2023-01-012023-09-300000045012us-gaap:CorporateAndOtherMember2022-01-012022-09-300000045012srt:MinimumMember2023-01-012023-09-300000045012srt:MaximumMember2023-01-012023-09-300000045012us-gaap:GeographicConcentrationRiskMembercountry:USus-gaap:SalesRevenueNetMember2023-01-012023-09-30xbrli:pure0000045012srt:NorthAmericaMember2023-07-012023-09-300000045012srt:NorthAmericaMember2022-07-012022-09-300000045012srt:NorthAmericaMember2023-01-012023-09-300000045012srt:NorthAmericaMember2022-01-012022-09-300000045012srt:LatinAmericaMember2023-07-012023-09-300000045012srt:LatinAmericaMember2022-07-012022-09-300000045012srt:LatinAmericaMember2023-01-012023-09-300000045012srt:LatinAmericaMember2022-01-012022-09-300000045012hal:EuropeAfricaCISMember2023-07-012023-09-300000045012hal:EuropeAfricaCISMember2022-07-012022-09-300000045012hal:EuropeAfricaCISMember2023-01-012023-09-300000045012hal:EuropeAfricaCISMember2022-01-012022-09-300000045012hal:MiddleEastAsiaMember2023-07-012023-09-300000045012hal:MiddleEastAsiaMember2022-07-012022-09-300000045012hal:MiddleEastAsiaMember2023-01-012023-09-300000045012hal:MiddleEastAsiaMember2022-01-012022-09-300000045012us-gaap:AccountsReceivableMemberus-gaap:GeographicConcentrationRiskMembercountry:US2023-01-012023-09-300000045012us-gaap:AccountsReceivableMembercountry:MXus-gaap:GeographicConcentrationRiskMember2023-01-012023-09-300000045012us-gaap:AccountsReceivableMemberus-gaap:GeographicConcentrationRiskMembercountry:US2022-01-012022-12-310000045012us-gaap:AccountsReceivableMembercountry:MXus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000045012us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembercountry:MX2023-01-012023-09-300000045012us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembercountry:MX2022-01-012022-12-31hal:Customers0000045012us-gaap:CommonStockMember2022-12-310000045012us-gaap:AdditionalPaidInCapitalMember2022-12-310000045012us-gaap:TreasuryStockCommonMember2022-12-310000045012us-gaap:RetainedEarningsMember2022-12-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000045012us-gaap:NoncontrollingInterestMember2022-12-310000045012us-gaap:CommonStockMember2023-01-012023-03-310000045012us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000045012us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000045012us-gaap:RetainedEarningsMember2023-01-012023-03-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000045012us-gaap:NoncontrollingInterestMember2023-01-012023-03-3100000450122023-01-012023-03-310000045012us-gaap:CommonStockMember2023-03-310000045012us-gaap:AdditionalPaidInCapitalMember2023-03-310000045012us-gaap:TreasuryStockCommonMember2023-03-310000045012us-gaap:RetainedEarningsMember2023-03-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000045012us-gaap:NoncontrollingInterestMember2023-03-3100000450122023-03-310000045012us-gaap:CommonStockMember2023-04-012023-06-300000045012us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000045012us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000045012us-gaap:RetainedEarningsMember2023-04-012023-06-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000045012us-gaap:NoncontrollingInterestMember2023-04-012023-06-3000000450122023-04-012023-06-300000045012us-gaap:CommonStockMember2023-06-300000045012us-gaap:AdditionalPaidInCapitalMember2023-06-300000045012us-gaap:TreasuryStockCommonMember2023-06-300000045012us-gaap:RetainedEarningsMember2023-06-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000045012us-gaap:NoncontrollingInterestMember2023-06-3000000450122023-06-300000045012us-gaap:CommonStockMember2023-07-012023-09-300000045012us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000045012us-gaap:TreasuryStockCommonMember2023-07-012023-09-300000045012us-gaap:RetainedEarningsMember2023-07-012023-09-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000045012us-gaap:NoncontrollingInterestMember2023-07-012023-09-300000045012us-gaap:CommonStockMember2023-09-300000045012us-gaap:AdditionalPaidInCapitalMember2023-09-300000045012us-gaap:TreasuryStockCommonMember2023-09-300000045012us-gaap:RetainedEarningsMember2023-09-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000045012us-gaap:NoncontrollingInterestMember2023-09-300000045012us-gaap:CommonStockMember2021-12-310000045012us-gaap:AdditionalPaidInCapitalMember2021-12-310000045012us-gaap:TreasuryStockCommonMember2021-12-310000045012us-gaap:RetainedEarningsMember2021-12-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000045012us-gaap:NoncontrollingInterestMember2021-12-310000045012us-gaap:CommonStockMember2022-01-012022-03-310000045012us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000045012us-gaap:TreasuryStockCommonMember2022-01-012022-03-310000045012us-gaap:RetainedEarningsMember2022-01-012022-03-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310000045012us-gaap:NoncontrollingInterestMember2022-01-012022-03-3100000450122022-01-012022-03-310000045012us-gaap:CommonStockMember2022-03-310000045012us-gaap:AdditionalPaidInCapitalMember2022-03-310000045012us-gaap:TreasuryStockCommonMember2022-03-310000045012us-gaap:RetainedEarningsMember2022-03-310000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000045012us-gaap:NoncontrollingInterestMember2022-03-3100000450122022-03-310000045012us-gaap:CommonStockMember2022-04-012022-06-300000045012us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000045012us-gaap:TreasuryStockCommonMember2022-04-012022-06-300000045012us-gaap:RetainedEarningsMember2022-04-012022-06-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300000045012us-gaap:NoncontrollingInterestMember2022-04-012022-06-3000000450122022-04-012022-06-300000045012us-gaap:CommonStockMember2022-06-300000045012us-gaap:AdditionalPaidInCapitalMember2022-06-300000045012us-gaap:TreasuryStockCommonMember2022-06-300000045012us-gaap:RetainedEarningsMember2022-06-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000045012us-gaap:NoncontrollingInterestMember2022-06-3000000450122022-06-300000045012us-gaap:CommonStockMember2022-07-012022-09-300000045012us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300000045012us-gaap:TreasuryStockCommonMember2022-07-012022-09-300000045012us-gaap:RetainedEarningsMember2022-07-012022-09-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000045012us-gaap:NoncontrollingInterestMember2022-07-012022-09-300000045012us-gaap:CommonStockMember2022-09-300000045012us-gaap:AdditionalPaidInCapitalMember2022-09-300000045012us-gaap:TreasuryStockCommonMember2022-09-300000045012us-gaap:RetainedEarningsMember2022-09-300000045012us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300000045012us-gaap:NoncontrollingInterestMember2022-09-300000045012us-gaap:FinancialGuaranteeMember2023-09-300000045012us-gaap:EmployeeStockOptionMember2023-07-012023-09-300000045012us-gaap:EmployeeStockOptionMember2022-07-012022-09-300000045012us-gaap:EmployeeStockOptionMember2023-01-012023-09-300000045012us-gaap:EmployeeStockOptionMember2022-01-012022-09-300000045012us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300000045012us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-09-300000045012us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300000045012us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300000045012us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000045012us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2022-12-310000045012us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000045012us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000045012hal:SeniorNotesDueWithVariousMaturityDatesMember2023-01-012023-09-300000045012us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300000045012us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000045012hal:SeniorNotesDue2025Member2023-01-012023-09-300000045012hal:SeniorNotesDueIn2025Member2023-09-300000045012hal:SeniorNotesDue2027Member2023-01-012023-09-300000045012hal:SeniorNotesDueIn2027Member2023-09-300000045012hal:SeniorNotesDue2038Member2023-01-012023-09-300000045012hal:SeniorNotesDueIn2038Member2023-09-300000045012hal:SeniorNotesDue2039Member2023-01-012023-09-300000045012hal:SeniorNotesDueIn2039Member2023-09-300000045012hal:SeniorNotesDue2045Member2023-01-012023-09-300000045012hal:SeniorNotesDueIn2045Member2023-09-300000045012hal:SeniorNotesDue2096Member2023-01-012023-09-300000045012hal:SeniorNotesDueIn2096Member2023-09-300000045012hal:OutstandingBalanceOfSeniorNotesDueVariousDatesMember2023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

or

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______to_______

Commission File Number 001-03492

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 75-2677995 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 3000 North Sam Houston Parkway East, | Houston, | Texas | 77032 |

| (Address of principal executive offices) | (Zip Code) |

(281) 871-2699

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $2.50 per share | HAL | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| | Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

| | Non-accelerated Filer | ☐ | Smaller Reporting Company | ☐ |

| | | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

As of October 18, 2023, there were 895,051,742 shares of Halliburton Company common stock, $2.50 par value per share, outstanding.

HALLIBURTON COMPANY

Index

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

HALLIBURTON COMPANY

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | Nine Months Ended

September 30 |

| Millions of dollars and shares except per share data | 2023 | 2022 | 2023 | 2022 |

| Revenue: | | | | |

| Services | $ | 4,131 | | $ | 3,923 | | $ | 12,478 | | $ | 10,682 | |

| Product sales | 1,673 | | 1,434 | | 4,801 | | 4,033 | |

| Total revenue | 5,804 | | 5,357 | | 17,279 | | 14,715 | |

| Operating costs and expenses: | | | | |

| Cost of services | 3,349 | | 3,251 | | 10,152 | | 9,084 | |

| Cost of sales | 1,337 | | 1,201 | | 3,900 | | 3,356 | |

| General and administrative | 58 | | 59 | | 166 | | 178 | |

| Impairments and other charges | — | | — | | — | | 366 | |

| SAP S4 upgrade expense | 23 | | — | | 36 | | — | |

| Total operating costs and expenses | 4,767 | | 4,511 | | 14,254 | | 12,984 | |

| Operating income | 1,037 | | 846 | | 3,025 | | 1,731 | |

Interest expense, net of interest income of $26, $31, $93, and $74 | (93) | | (93) | | (264) | | (301) | |

| Loss on Blue Chip Swap transactions | — | | — | | (104) | | — | |

| Loss on early extinguishment of debt | — | | — | | — | | (42) | |

| Other, net | (28) | | (48) | | (129) | | (120) | |

| Income before income taxes | 916 | | 705 | | 2,528 | | 1,268 | |

| Income tax provision | (192) | | (156) | | (533) | | (338) | |

| | | | | |

| | | | | |

| Net income | $ | 724 | | $ | 549 | | $ | 1,995 | | $ | 930 | |

| Net income attributable to noncontrolling interest | (8) | | (5) | | (18) | | (14) | |

| Net income attributable to company | $ | 716 | | $ | 544 | | $ | 1,977 | | $ | 916 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| Basic net income per share | $ | 0.80 | | $ | 0.60 | | $ | 2.19 | | $ | 1.01 | |

| Diluted net income per share | $ | 0.79 | | $ | 0.60 | | $ | 2.19 | | $ | 1.01 | |

| Basic weighted average common shares outstanding | 898 | | 908 | | 901 | | 904 | |

| Diluted weighted average common shares outstanding | 902 | | 910 | | 904 | | 907 | |

| See notes to condensed consolidated financial statements. | | | | |

HAL Q3 2023 FORM 10-Q | 1

HALLIBURTON COMPANY

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | Nine Months Ended

September 30 |

| Millions of dollars | 2023 | 2022 | 2023 | 2022 |

| Net income | $ | 724 | | $ | 549 | | $ | 1,995 | | $ | 930 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Other comprehensive income (loss), net of income taxes | 1 | | (2) | | 3 | | 2 | |

| Comprehensive income | $ | 725 | | $ | 547 | | $ | 1,998 | | $ | 932 | |

| Comprehensive income attributable to noncontrolling interest | (8) | | (6) | | (18) | | (15) | |

| Comprehensive income attributable to company shareholders | $ | 717 | | $ | 541 | | $ | 1,980 | | $ | 917 | |

| See notes to condensed consolidated financial statements. | | | | |

HAL Q3 2023 FORM 10-Q | 2

HALLIBURTON COMPANY

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| Millions of dollars and shares except per share data | September 30,

2023 | December 31,

2022 |

| Assets |

| Current assets: | | |

| Cash and equivalents | $ | 2,036 | | $ | 2,346 | |

Receivables (net of allowances for credit losses of $718 and $731) | 5,124 | | 4,627 | |

| Inventories | 3,336 | | 2,923 | |

| | | |

| | | |

| Other current assets | 1,104 | | 1,056 | |

| Total current assets | 11,600 | | 10,952 | |

Property, plant, and equipment (net of accumulated depreciation of $11,891 and $11,660) | 4,733 | | 4,348 | |

| Goodwill | 2,850 | | 2,829 | |

| Deferred income taxes | 2,517 | | 2,636 | |

| Operating lease right-of-use assets | 1,032 | | 913 | |

| Other assets | 1,710 | | 1,577 | |

| Total assets | $ | 24,442 | | $ | 23,255 | |

| Liabilities and Shareholders’ Equity |

| Current liabilities: | | |

| Accounts payable | $ | 3,238 | | $ | 3,121 | |

| Accrued employee compensation and benefits | 643 | | 634 | |

| Taxes other than income | 332 | | 349 | |

| Income tax payable | 266 | | 294 | |

| Current portion of operating lease liabilities | 248 | | 224 | |

| | |

| Other current liabilities | 692 | | 723 | |

| Total current liabilities | 5,419 | | 5,345 | |

| Long-term debt | 7,783 | | 7,928 | |

| Operating lease liabilities | 869 | | 791 | |

| Employee compensation and benefits | 392 | | 408 | |

| Other liabilities | 790 | | 806 | |

| Total liabilities | 15,253 | | 15,278 | |

| Shareholders’ equity: | | |

Common stock, par value $2.50 per share (authorized 2,000 shares, issued 1,065 and 1,066 shares) | 2,663 | | 2,664 | |

| Paid-in capital in excess of par value | 26 | | 50 | |

| Accumulated other comprehensive loss | (227) | | (230) | |

| Retained earnings | 12,018 | | 10,572 | |

Treasury stock, at cost (170 and 164 shares) | (5,330) | | (5,108) | |

| Company shareholders’ equity | 9,150 | | 7,948 | |

| Noncontrolling interest in consolidated subsidiaries | 39 | | 29 | |

| Total shareholders’ equity | 9,189 | | 7,977 | |

| Total liabilities and shareholders’ equity | $ | 24,442 | | $ | 23,255 | |

| See notes to condensed consolidated financial statements. | | |

HAL Q3 2023 FORM 10-Q | 3

HALLIBURTON COMPANY

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | | | |

| | Nine Months Ended

September 30 | | |

| Millions of dollars | 2023 | 2022 | | |

| Cash flows from operating activities: | | | | |

| Net income | $ | 1,995 | | $ | 930 | | | |

| Adjustments to reconcile net income to cash flows from operating activities: | | | | |

| Depreciation, depletion, and amortization | 742 | | 704 | | | |

| Impairments and other charges | — | | 366 | | | |

| | | | |

| | | | | |

| Changes in assets and liabilities: | | | | |

| Receivables | (522) | | (1,153) | | | |

| Inventories | (413) | | (561) | | | |

| | | | |

| Accounts payable | 137 | | 807 | | | |

| Other operating activities | 109 | | (14) | | | |

| Total cash flows provided by operating activities | 2,048 | | 1,079 | | | |

| Cash flows from investing activities: | | | | |

| Capital expenditures | (980) | | (661) | | | |

| | | | |

| Purchases of investment securities | (301) | | (10) | | | |

| Proceeds from sales of property, plant, and equipment | 136 | | 157 | | | |

| Sales of investment securities | 112 | | — | | | |

| | | | |

| | | | |

| Other investing activities | (91) | | (64) | | | |

| Total cash flows used in investing activities | (1,124) | | (578) | | | |

| Cash flows from financing activities: | | | | |

| Stock repurchase program | (546) | | (46) | | | |

| Dividends to shareholders | (433) | | (327) | | | |

| | | | |

| Payments on long-term borrowings | (150) | | (1,242) | | | |

| | | | |

| Other financing activities | 2 | | 160 | | | |

| Total cash flows used in financing activities | (1,127) | | (1,455) | | | |

| Effect of exchange rate changes on cash | (107) | | (113) | | | |

| Decrease in cash and equivalents | (310) | | (1,067) | | | |

| Cash and equivalents at beginning of period | 2,346 | | 3,044 | | | |

| Cash and equivalents at end of period | $ | 2,036 | | $ | 1,977 | | | |

| Supplemental disclosure of cash flow information: | | | | |

| Cash payments during the period for: | | | | |

| Interest | $ | 355 | | $ | 384 | | | |

| Income taxes | $ | 528 | | $ | 276 | | | |

| See notes to condensed consolidated financial statements. | | | | |

HAL Q3 2023 FORM 10-Q | 4

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

HALLIBURTON COMPANY

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements were prepared using generally accepted accounting principles for interim financial information and the instructions to Form 10-Q and Regulation S-X. Accordingly, these financial statements do not include all information or notes required by generally accepted accounting principles for annual financial statements and should be read together with our 2022 Annual Report on Form 10-K.

Our accounting policies are in accordance with United States generally accepted accounting principles. The preparation of financial statements in conformity with these accounting principles requires us to make estimates and assumptions that affect:

•the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements; and

•the reported amounts of revenue and expenses during the reporting period.

Ultimate results could differ from our estimates.

In our opinion, the condensed consolidated financial statements included herein contain all adjustments necessary to present fairly our financial position as of September 30, 2023 and the results of our operations for the three and nine months ended September 30, 2023 and 2022, and our cash flows for the nine months ended September 30, 2023 and 2022. Such adjustments are of a normal recurring nature. In addition, certain reclassifications of prior period balances have been made to conform to the current period presentation.

The results of our operations for the three and nine months ended September 30, 2023 may not be indicative of results for the full year.

Note 2. Business Segment Information

We operate under two divisions, which form the basis for the two operating segments we report: the Completion and Production segment and the Drilling and Evaluation segment. Our equity in earnings and losses of unconsolidated affiliates that are accounted for using the equity method of accounting are included within cost of services and cost of sales on our statements of operations, which is part of operating income of the applicable segment.

HAL Q3 2023 FORM 10-Q | 5

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

The following table presents information on our business segments.

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | Nine Months Ended

September 30 | |

| Millions of dollars | 2023 | 2022 | 2023 | 2022 | | |

| Revenue: | | | | | | |

| Completion and Production | $ | 3,487 | | $ | 3,136 | | $ | 10,372 | | $ | 8,400 | | | |

| Drilling and Evaluation | 2,317 | | 2,221 | | 6,907 | | 6,315 | | | |

| Total revenue | $ | 5,804 | | $ | 5,357 | | $ | 17,279 | | $ | 14,715 | | | |

| Operating income: | | | | | | |

| Completion and Production | $ | 746 | | $ | 583 | | $ | 2,119 | | $ | 1,378 | | | |

| Drilling and Evaluation | 378 | | 325 | | 1,123 | | 905 | | | |

| Total operations | 1,124 | | 908 | | 3,242 | | 2,283 | | | |

| Corporate and other (a) | (64) | | (62) | | (181) | | (186) | | | |

| SAP S4 upgrade expense | (23) | | — | | (36) | | — | | | |

| Impairments and other charges (b) | — | | — | | — | | (366) | | | |

| Total operating income | $ | 1,037 | | $ | 846 | | $ | 3,025 | | $ | 1,731 | | | |

| Interest expense, net of interest income | (93) | | (93) | | (264) | | (301) | | | |

| Loss on Blue Chip Swap transactions (c) | — | | — | | (104) | | — | | | |

| Loss on early extinguishment of debt | — | | — | | — | | (42) | | | |

| Other, net | (28) | | (48) | | (129) | | (120) | | | |

| Income before income taxes | $ | 916 | | $ | 705 | | $ | 2,528 | | $ | 1,268 | | | |

| | | | | | | |

| (a) | Includes certain expenses not attributable to a business segment, such as costs related to support functions, corporate executives, and operating lease assets, and also includes amortization expense associated with intangible assets recorded as a result of acquisitions. | | |

| (b) | For the nine months ended September 30, 2022, the amount includes a $136 million charge attributable to Completions and Production, a $195 million charge attributable to Drilling and Evaluation, and a $35 million charge attributable to Corporate and other. |

| (c) | The Central Bank of Argentina maintains currency controls that limit our ability to access U.S. dollars in Argentina and remit cash from our Argentine operations. Our execution of certain trades, known as Blue Chip Swaps, which effectively results in a parallel U.S. dollar exchange rate, resulted in a $104 million pre-tax loss during the nine months ended September 30, 2023. | | |

| | | |

| |

Note 3. Revenue

Revenue is recognized based on the transfer of control or our customers' ability to benefit from our services and products in an amount that reflects the consideration we expect to receive in exchange for those services and products. Most of our service and product contracts are short-term in nature. In recognizing revenue for our services and products, we determine the transaction price of purchase orders or contracts with our customers, which may consist of fixed and variable consideration. We also assess our customers' ability and intention to pay, which is based on a variety of factors, including our historical payment experience with, and the financial condition of, our customers. Payment terms and conditions vary by contract type, although terms generally include a requirement of payment within 20 to 60 days. Other judgments involved in recognizing revenue include an assessment of progress towards completion of performance obligations for certain long-term contracts, which involve estimating total costs to determine our progress towards contract completion and calculating the corresponding amount of revenue to recognize.

Disaggregation of revenue

We disaggregate revenue from contracts with customers into types of services or products, consistent with our two reportable segments, in addition to geographical area. Based on the location of services provided and products sold, 45% of our consolidated revenue was from the United States for both the nine months ended September 30, 2023 and 2022. No other country accounted for more than 10% of our revenue.

HAL Q3 2023 FORM 10-Q | 6

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

The following table presents information on our disaggregated revenue.

| | | | | | | | | | | | | | |

| Three Months Ended

September 30 | Nine Months Ended

September 30 |

| Millions of dollars | 2023 | 2022 | 2023 | 2022 |

| Revenue by segment: | | | | |

| Completion and Production | $ | 3,487 | | $ | 3,136 | | $ | 10,372 | | $ | 8,400 | |

| Drilling and Evaluation | 2,317 | | 2,221 | | 6,907 | | 6,315 | |

| Total revenue | $ | 5,804 | | $ | 5,357 | | $ | 17,279 | | $ | 14,715 | |

| Revenue by geographic region: | | | | |

| North America | $ | 2,608 | | $ | 2,635 | | $ | 8,069 | | $ | 6,986 | |

| Latin America | 1,048 | | 841 | | 2,957 | | 2,252 | |

| Europe/Africa/CIS | 734 | | 639 | | 2,094 | | 2,034 | |

| Middle East/Asia | 1,414 | | 1,242 | | 4,159 | | 3,443 | |

| Total revenue | $ | 5,804 | | $ | 5,357 | | $ | 17,279 | | $ | 14,715 | |

Contract balances

We perform our obligations under contracts with our customers by transferring services and products in exchange for consideration. The timing of our performance often differs from the timing of our customer’s payment, which results in the recognition of receivables and deferred revenue. Deferred revenue represents advance consideration received from customers for contracts where revenue is recognized on future performance of service. Deferred revenue, as well as revenue recognized during the period relating to amounts included as deferred revenue at the beginning of the period, was not material to our condensed consolidated financial statements.

Transaction price allocated to remaining performance obligations

Remaining performance obligations represent firm contracts for which work has not been performed and future revenue recognition is expected. We have elected the practical expedient permitting the exclusion of disclosing remaining performance obligations for contracts that have an original expected duration of one year or less. We have some long-term contracts related to software and integrated project management services such as lump sum turnkey contracts. For software contracts, revenue is generally recognized over time throughout the license period when the software is considered to be a right to access our intellectual property. For lump sum turnkey projects, we recognize revenue over time using an input method, which requires us to exercise judgment. Revenue allocated to remaining performance obligations for these long-term contracts is not material.

Receivables

As of September 30, 2023, 34% of our net trade receivables were from customers in the United States and 12% were from customers in Mexico. As of December 31, 2022, 38% of our net trade receivables were from customers in the United States and 11% were from customers in Mexico. Receivables from our primary customer in Mexico accounted for approximately 10% and 9% of our total receivables as of September 30, 2023 and December 31, 2022, respectively. While we have experienced payment delays from our primary customer in Mexico, the amounts are not in dispute and we have not historically had, and we do not expect, any material write-offs due to collectability of receivables from this customer. No other country or single customer accounted for more than 10% of our net trade receivables at those dates.

We have risk of delayed customer payments and payment defaults associated with customer liquidity issues. We routinely monitor the financial stability of our customers and employ an extensive process to evaluate the collectability of outstanding receivables. This process, which involves a high degree of judgment utilizing significant assumptions, includes analysis of our customers’ historical time to pay, financial condition and various financial metrics, debt structure, credit ratings, and production profile, as well as political and economic factors in countries of operations and other customer-specific factors.

HAL Q3 2023 FORM 10-Q | 7

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

Note 4. Inventories

Inventories consisted of the following:

| | | | | | | | |

| Millions of dollars | September 30,

2023 | December 31,

2022 |

| Finished products and parts | $ | 2,100 | | $ | 1,859 | |

| Raw materials and supplies | 1,099 | | 953 | |

| Work in process | 137 | | 111 | |

| Total inventories | $ | 3,336 | | $ | 2,923 | |

Note 5. Accounts Payable

Effective January 1, 2023, we adopted new supplier finance program disclosure requirements contained in guidance issued by the Financial Accounting Standards Board (ASU 2022-04, "Disclosure of Supplier Finance Program Obligations"), other than the roll-forward disclosure, which we will adopt at the beginning of 2024.

We have agreements with third parties that allow our participating suppliers to finance payment obligations from us with designated third-party financial institutions who act as our paying agent. We have generally extended our payment terms with suppliers to 90 days. A participating supplier may request a participating financial institution to finance one or more of our payment obligations to such supplier prior to the scheduled due date thereof at a discounted price. We are not required to provide collateral to the financial institutions.

Our obligations to participating suppliers, including amounts due and scheduled payment dates, are not impacted by the suppliers’ decisions to finance amounts due under these financing arrangements. Our outstanding payment obligations under these agreements were $320 million as of September 30, 2023, and $273 million as of December 31, 2022, and are included in accounts payable on the condensed consolidated balance sheets.

Note 6. Income Taxes

During the three months ended September 30, 2023, we recorded a total income tax provision of $192 million on a pre-tax income of $916 million, resulting in an effective tax rate of 21.0% for the quarter. During the three months ended September 30, 2022, we recorded a total income tax provision of $156 million on a pre-tax income of $705 million, resulting in an effective tax rate of 22.2% for the quarter.

During the nine months ended September 30, 2023, we recorded a total income tax provision of $533 million on a pre-tax income of $2.5 billion, resulting in an effective tax rate of 21.1% for the period. During the nine months ended September 30, 2022, we recorded a total income tax provision of $338 million on a pre-tax income of $1.3 billion, resulting in an effective tax rate of 26.6% for the period. The effective tax rate for the nine months ended September 30, 2023 was lower than the nine months ended September 30, 2022 primarily due to the impact on our effective tax rate for the first nine months of 2022 of the decision to sell our Russian operations and a corresponding increase in the valuation allowance on foreign tax credits.

Internal Revenue Service Notice of Proposed Adjustment

Our tax returns are subject to review by the taxing authorities in the jurisdictions where we file tax returns. In most cases we are no longer subject to examination by tax authorities for years before 2010. The only significant operating jurisdiction that has tax filings under review or subject to examination by the tax authorities is the United States. The United States federal income tax filings for tax years 2016 through 2021 are currently under review or remain open for review by the U.S. Internal Revenue Service. As of September 30, 2023, the primary unresolved issue for the IRS audit relates to the classification of the $3.5 billion ordinary deduction that we claimed for the termination fee we paid to Baker Hughes in the second quarter of 2016 for which the Company has received a Notice of Proposed Adjustment from the IRS on September 28, 2023. We regularly assess the likelihood of adverse outcomes resulting from tax examinations to determine the adequacy of our tax reserves, and we believe our income tax reserves are appropriately provided for all open tax years. We do not expect a final resolution of this issue in the next 12 months. Based on the information currently available, we do not anticipate a significant increase or decrease to our tax contingencies for this issue within the next 12 months.

HAL Q3 2023 FORM 10-Q | 8

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

Note 7. Shareholders’ Equity

The following tables summarize our shareholders’ equity activity for the three and nine months ended September 30, 2023 and September 30, 2022, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Millions of dollars | Common Stock | Paid-in Capital in Excess of Par Value | Treasury Stock | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interest in Consolidated Subsidiaries | Total |

| Balance at December 31, 2022 | $ | 2,664 | | $ | 50 | | $ | (5,108) | | $ | 10,572 | | $ | (230) | | $ | 29 | | $ | 7,977 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 651 | | — | | 4 | | 655 | |

| Other comprehensive income | — | | — | | — | | — | | 1 | | — | | 1 | |

Cash dividends ($0.16 per share) | — | | — | | — | | (145) | | — | | — | | (145) | |

| Stock repurchase program | — | | — | | (100) | | — | | — | | — | | (100) | |

| Stock plans (a) | — | | (50) | | 113 | | (3) | | — | | — | | 60 | |

| Other | — | | — | | — | | — | | — | | (3) | | (3) | |

| Balance at March 31, 2023 | $ | 2,664 | | $ | — | | $ | (5,095) | | $ | 11,075 | | $ | (229) | | $ | 30 | | $ | 8,445 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 610 | | — | | 6 | | 616 | |

| Other comprehensive income | — | | — | | — | | — | | 1 | | — | | 1 | |

Cash dividends ($0.16 per share) | — | | — | | — | | (144) | | — | | — | | (144) | |

| Stock repurchase program | — | | — | | (250) | | — | | — | | — | | (250) | |

| Stock plans (a) | (1) | | — | | 144 | | (82) | | — | | — | | 61 | |

| Other | — | | — | | — | | — | | — | | (2) | | (2) | |

| Balance at June 30, 2023 | $ | 2,663 | | $ | — | | $ | (5,201) | | $ | 11,459 | | $ | (228) | | $ | 34 | | $ | 8,727 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 716 | | — | | 8 | | 724 | |

| Other comprehensive income | — | | — | | — | | — | | 1 | | — | | 1 | |

Cash dividends ($0.16 per share) | — | | — | | — | | (144) | | — | | — | | (144) | |

| Stock repurchase program | — | | — | | (200) | | — | | — | | — | | (200) | |

| Stock plans (a) | — | | 26 | | 71 | | (13) | | — | | — | | 84 | |

| Other | — | | — | | — | | — | | — | | (3) | | (3) | |

| Balance at September 30, 2023 | $ | 2,663 | | $ | 26 | | $ | (5,330) | | $ | 12,018 | | $ | (227) | | $ | 39 | | $ | 9,189 | |

| | | | | | | | |

| (a) | In the first, second, and third quarters of 2023, we issued common stock from treasury shares for stock options exercised, restricted stock grants, and purchases under our employee stock purchase plan. As a result, additional paid in capital was reduced to zero as of the end of each period, which resulted in a reduction of retained earnings by $3 million, $82 million, and $13 million respectively. Future issuances from treasury shares could similarly impact additional paid in capital and retained earnings. |

HAL Q3 2023 FORM 10-Q | 9

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Millions of dollars | Common Stock | Paid-in Capital in Excess of Par Value | Treasury Stock | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interest in Consolidated Subsidiaries | Total |

| Balance at December 31, 2021 | $ | 2,665 | | $ | 32 | | $ | (5,511) | | $ | 9,710 | | $ | (183) | | $ | 15 | | $ | 6,728 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 263 | | — | | 1 | | 264 | |

| Other comprehensive income | — | | — | | — | | — | | 5 | | — | | 5 | |

Cash dividends ($0.12 per share) | — | | — | | — | | (108) | | — | | — | | (108) | |

| | | | | | | | |

| Stock plans (a) | — | | (32) | | 261 | | (85) | | — | | — | | 144 | |

| | | | | | | |

| Balance at March 31, 2022 | $ | 2,665 | | $ | — | | $ | (5,250) | | $ | 9,780 | | $ | (178) | | $ | 16 | | $ | 7,033 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 109 | | — | | 8 | | 117 | |

| Other comprehensive loss | — | | — | | — | | — | | (1) | | — | | (1) | |

Cash dividends ($0.12 per share) | — | | — | | — | | (109) | | — | | — | | (109) | |

| Stock plans (a) | — | | — | | 277 | | (163) | | — | | — | | 114 | |

| Other | — | | — | | — | | — | | — | | (6) | | (6) | |

| Balance at June 30, 2022 | $ | 2,665 | | $ | — | | $ | (4,973) | | $ | 9,617 | | $ | (179) | | $ | 18 | | $ | 7,148 | |

| Comprehensive income (loss): | | | | | | | |

| Net income | — | | — | | — | | 544 | | — | | 5 | | 549 | |

| Other comprehensive loss | — | | — | | — | | — | | (2) | | — | | (2) | |

Cash dividends ($0.12 per share) | — | | — | | — | | (110) | | — | | — | | (110) | |

| | | | | | | |

| Stock plans (a) | (1) | | 32 | | 55 | | (27) | | — | | — | | 59 | |

| Other | — | | — | | — | | — | | — | | 1 | | 1 | |

| Balance at September 30, 2022 | $ | 2,664 | | $ | 32 | | $ | (4,918) | | $ | 10,024 | | $ | (181) | | $ | 24 | | $ | 7,645 | |

| | | | | | | | |

| (a) | In the first, second, and third quarters of 2022, we issued common stock from treasury shares for stock options exercised, restricted stock grants and purchases under our employee stock purchase plan. As a result, additional paid in capital was reduced to zero as of the end of each period, which resulted in a reduction of retained earnings by $85 million, $163 million, and $27 million respectively. Future issuances from treasury shares could similarly impact additional paid in capital and retained earnings. |

Our Board of Directors has authorized a program to repurchase our common stock from time to time. We purchased 5.1 million shares of our common stock under the program during the three months ended September 30, 2023 for approximately $200 million. Approximately $4.3 billion remained authorized for repurchases as of September 30, 2023. From the inception of this program in February of 2006 through September 30, 2023, we repurchased approximately 247 million shares of our common stock for a total cost of approximately $9.8 billion.

Accumulated other comprehensive loss consisted of the following:

| | | | | | | | | | | |

| Millions of dollars | September 30,

2023 | December 31,

2022 |

| Cumulative translation adjustments | $ | (83) | | $ | (84) | |

| Defined benefit and other postretirement liability adjustments | (102) | | (101) | |

| | | |

| Other | (42) | | (45) | |

| Total accumulated other comprehensive loss | $ | (227) | | $ | (230) | |

| | | |

| |

Note 8. Commitments and Contingencies

The Company is subject to various legal or governmental proceedings, claims or investigations, including personal injury, property damage, environmental, intellectual property, commercial, tax, and other matters arising in the ordinary course of business, the resolution of which, in the opinion of management, will not have a material adverse effect on our consolidated results of operations or consolidated financial position. There is inherent risk in any legal or governmental proceeding, claim or investigation, and no assurance can be given as to the outcome of these proceedings.

HAL Q3 2023 FORM 10-Q | 10

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

Guarantee arrangements

In the normal course of business, we have in place agreements with financial institutions under which approximately $2.4 billion of letters of credit, bank guarantees, or surety bonds were outstanding as of September 30, 2023. Some of the outstanding letters of credit have triggering events that would entitle a bank to require cash collateralization. None of these off-balance sheet arrangements either has, or is likely to have, a material effect on our condensed consolidated financial statements.

Note 9. Income per Share

Basic income or loss per share is based on the weighted average number of common shares outstanding during the period. Diluted income per share includes additional common shares that would have been outstanding if potential common shares with a dilutive effect had been issued. Antidilutive securities represent potentially dilutive securities which are excluded from the computation of diluted income or loss per share as their impact was antidilutive.

A reconciliation of the number of shares used for the basic and diluted income per share computations is as follows:

| | | | | | | | | | | | | | |

| Three Months Ended

September 30 | Nine Months Ended

September 30 |

| Millions of shares | 2023 | 2022 | 2023 | 2022 |

| Basic weighted average common shares outstanding | 898 | | 908 | | 901 | | 904 | |

| Dilutive effect of awards granted under our stock incentive plans | 4 | | 2 | | 3 | | 3 | |

| Diluted weighted average common shares outstanding | 902 | | 910 | | 904 | | 907 | |

| | | | |

| Antidilutive shares: | | | | |

| Options with exercise price greater than the average market price | 11 | | 15 | | 13 | | 15 | |

| | | | |

| Total antidilutive shares | 11 | | 15 | | 13 | | 15 | |

Note 10. Fair Value of Financial Instruments

The carrying amount of cash and equivalents, receivables, and accounts payable, as reflected in the condensed consolidated balance sheets, approximates fair value due to the short maturities of these instruments.

The carrying amount and fair value of our total debt, including short-term borrowings and current maturities of long-term debt, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Millions of dollars | Level 1 | Level 2 | Total fair value | Carrying value | | Level 1 | Level 2 | Total fair value | Carrying value |

| Total debt | $ | 6,760 | | $ | 386 | | $ | 7,146 | | $ | 7,783 | | | $ | 6,539 | | $ | 917 | | $ | 7,456 | | $ | 7,928 | |

In the first nine months of 2023, the fair value of our debt decreased as a result of $150 million in debt repurchases, as discussed in Note 11. Debt and higher debt yields, primarily driven by an increase in U.S. Treasury rates.

Our debt categorized within level 1 on the fair value hierarchy is calculated using quoted prices in active markets for identical liabilities with transactions occurring on the last two days of period-end. Our debt categorized within level 2 on the fair value hierarchy is calculated using significant observable inputs for similar liabilities where estimated values are determined from observable data points on our other bonds and on other similarly rated corporate debt or from observable data points of transactions occurring prior to two days from period-end and adjusting for changes in market conditions. Differences between the periods presented in our level 1 and level 2 classification of our long-term debt relate to the timing of when third party market transactions on our debt are executed. We have no debt categorized within level 3 on the fair value hierarchy.

HAL Q3 2023 FORM 10-Q | 11

| | | | | |

| Part I. Item 1 | Notes to Condensed Consolidated Financial Statements |

Note 11. Debt

In August of 2023, we repurchased $150 million aggregate principal amount of various maturities of our outstanding debt, including: $15 million of our 3.8% senior notes due November 2025, $14 million of our 6.75% notes due February 2027, $21 million of our 6.7% senior notes due September 2038, $32 million of our 7.45% senior notes due September 2039, $60 million of our 5.0% senior notes due November 2045, and $8 million of our 7.6% senior debentures due August 2096. We used cash on hand to fund these repurchases, which included the principal amount, a net premium and accrued interest. The remaining principal balance ($4.5 billion in the aggregate) of each of these debt instruments remains outstanding.

HAL Q3 2023 FORM 10-Q | 12

| | | | | | | | |

| | Part I. Item 2 | Executive Overview |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) should be read in conjunction with the condensed consolidated financial statements included in "Item 1. Financial Statements" contained herein.

EXECUTIVE OVERVIEW

Organization

We are one of the world's largest providers of products and services to the energy industry. We help our customers maximize value throughout the lifecycle of the reservoir - from locating hydrocarbons and managing geological data, to drilling and formation evaluation, well construction and completion, and optimizing production throughout the life of the asset. Activity levels within our operations are significantly impacted by spending on upstream exploration, development, and production programs by major, national, and independent oil and natural gas companies. We report our results under two segments, the Completion and Production segment and the Drilling and Evaluation segment.

•Completion and Production delivers cementing, stimulation, intervention, pressure control, artificial lift, specialty chemicals, and completion products and services. The segment consists of Production Enhancement, Cementing, Completion Tools, Production Solutions, Artificial Lift, Multi-Chem, and Pipeline and Process Services.

•Drilling and Evaluation provides field and reservoir modeling, drilling, fluids, evaluation, and precise wellbore placement solutions that enable customers to model, measure, drill, and optimize their well construction activities. The segment consists of Baroid, Sperry Drilling, Wireline and Perforating, Drill Bits and Services, Landmark Software and Services, Testing and Subsea, and Project Management.

The business operations of our segments are organized around four primary geographic regions: North America, Latin America, Europe/Africa/CIS, and Middle East/Asia. We have manufacturing operations in various locations, the most significant of which are in the United States, Malaysia, Singapore, and the United Kingdom. With approximately 48,000 employees, we operate in more than 70 countries around the world, and our corporate headquarters is in Houston, Texas.

Our value proposition is to collaborate and engineer solutions to maximize asset value for our customers. We work to achieve strong cash flows and returns for our shareholders by delivering technology and services that improve efficiency, increase recovery, and maximize production for our customers. Our strategic priorities are to:

- International: Allocate our capital to the highest return opportunities and increase our international growth in both onshore and offshore markets.

- North America: Drive better pricing, increased efficiency, and higher margin through utilization of our automated and intelligent fracturing technologies and increased market penetration of our premium low-emissions electronic fracturing equipment.

- Digital: Continue to drive differentiation and efficiencies through the deployment and integration of digital and automation technologies, both internally and for our customers.

- Capital efficiency: Maintain our capital expenditures in the range of 5-6% of revenue while focusing on technological advancements and process changes that reduce our manufacturing and maintenance costs and improve how we move equipment and respond to market opportunities.

- Sustainability and energy mix transition: Continue to:

• Leverage the increasing number of participants in and scope of Halliburton Labs to gain insight into developing value chains in the energy mix transition;

• Develop and deploy solutions to help oil and gas operators lower their emissions while also using our existing technologies in renewable energy applications;

• Develop technologies and solutions to lower our own emissions; and

• Grow our participation in the entire life cycle of carbon capture and storage, hydrogen, and geothermal projects globally.

HAL Q3 2023 FORM 10-Q | 13

| | | | | | | | |

| | Part I. Item 2 | Executive Overview |

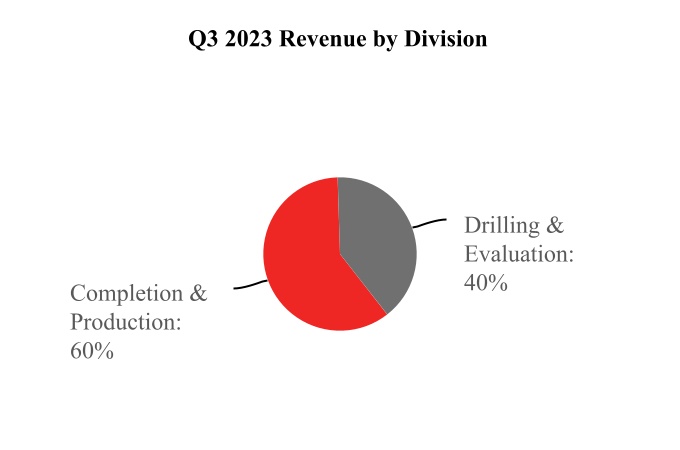

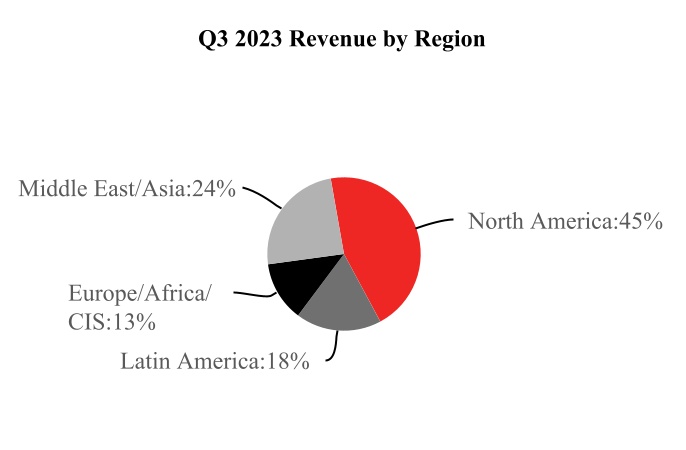

The following charts depict the revenue split between our two operating segments and our four primary geographic regions for the quarter ended September 30, 2023.

Market conditions

Commodity price volatility continued during the third quarter of 2023 driven by inflationary pressures, changes to OPEC+ production levels, supply chain shortages, demand uncertainty, recessionary fears, and geopolitical conflicts. On June 4, 2023, Saudi Arabia announced it would reduce July production by 1 million barrels per day and subsequently announced the reduction would extend through the end of 2023.

During the third quarter of 2023, the West Texas Intermediate (WTI) crude oil price averaged approximately $82 per barrel and the Brent crude oil price averaged approximately $87 per barrel. Both of these prices were more than 10% above the average price per barrel during the second quarter of 2023 but remained well below the average price per barrel of $93 and $101 respectively, as compared to the third quarter of 2022. The average Henry Hub natural gas price during the third quarter of 2023 was $2.59 per million BTU, which is also an increase from the average price during the second quarter of 2023, but well below the average price of $7.99 during the third quarter of 2022. While U.S. land rig counts generally increased throughout 2022, they have generally decreased throughout 2023. Pricing and U.S. land rig counts continued to contribute to softness in the market for energy services generally in North America and particularly in gas basins during the third quarter of 2023. The United States Energy Information Administration (EIA)'s October 2023 forecast has Brent crude oil spot price averaging $93 per barrel for the fourth quarter of 2023, a $13 per barrel increase over the price they forecast last quarter.

Globally, we continue to be impacted by increased supply chain lead times for the supply of select raw materials. We monitor market trends and work to mitigate cost impacts through economies of scale in global procurement, technology modifications, and efficient sourcing practices. Also, while we have been impacted by inflationary cost increases, primarily related to chemicals, cement, and logistics costs, we generally try to pass much of those increases on to our customers and we believe we have effective solutions to minimize the operational impact.

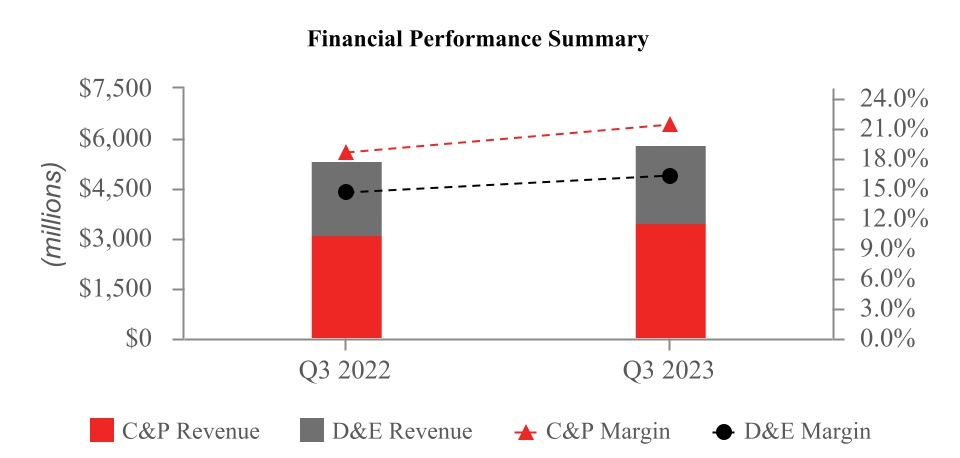

Financial results

The following graph illustrates our revenue and operating margins for each operating segment for the third quarter of 2022 and 2023.

HAL Q3 2023 FORM 10-Q | 14

| | | | | | | | |

| | Part I. Item 2 | Executive Overview |

During the third quarter of 2023, we generated total company revenue of $5.8 billion, an 8% increase as compared to the third quarter of 2022. We recorded operating income of $1.0 billion during the third quarter of 2023 compared to operating income of $846 million during the third quarter of 2022. Our Completion and Production segment revenue increased 11% in the third quarter of 2023 as compared to the third quarter of 2022, primarily due to improved stimulation activity internationally, higher completion tool sales globally, and increased cementing activity in the Eastern Hemisphere. Our Drilling and Evaluation segment revenue increased 4% in the third quarter of 2023 as compared to the third quarter of 2022, driven primarily by improvements in fluids and wireline activity globally and higher drilling services internationally.

In North America, revenue remained flat in the third quarter of 2023, as compared to the third quarter of 2022, driven by a decline in pressure pumping services in North America land partially offset by increased activity across multiple product service lines in the U.S. Gulf of Mexico, and higher wireline activity in North America land. The North America average rig count decreased 13% in the third quarter of 2023 as compared to the third quarter of 2022.

Internationally, revenue increased 17% in the third quarter of 2023, as compared to the third quarter of 2022, largely driven by improved stimulation activity, higher completion tool sales and increased fluids activity across all regions. Also improving were testing services and wireline activity across the regions and cementing activity in the Eastern Hemisphere. These improvements were partially offset by lower project management activity across all regions. The international average rig count increased 11% in the third quarter of 2023 as compared to the third quarter of 2022.

Sustainability and Energy Advancement

We continue to pursue our strategic initiatives around advancing cleaner, affordable energy, and supporting sustainable energy advancements using innovation and technology to decarbonize both our and our customers' operations. This includes the continued development and deployment of solutions designed to help oil and gas operators lower their environmental impact while also using our existing technologies in sustainable energy applications.

Halliburton Labs, our clean energy accelerator, continues to provide us insight into developing value chains in the energy mix transition and opportunities to assist early stage companies to enable them to achieve scaling milestones. Halliburton Labs had 25 participants and alumni as of the end of the third quarter of 2023.

Our operating performance and liquidity are described in more detail in "Liquidity and Capital Resources" and “Business Environment and Results of Operations.”

HAL Q3 2023 FORM 10-Q | 15

| | | | | | | | |

| | Part I. Item 2 | Liquidity and Capital Resources |

LIQUIDITY AND CAPITAL RESOURCES

As of September 30, 2023, we had $2.0 billion of cash and equivalents, compared to $2.3 billion of cash and equivalents at December 31, 2022.

Significant sources and uses of cash during the first nine months of 2023

Sources of cash:

•Cash flows from operating activities were $2.0 billion. This included a negative impact from the primary components of our working capital (receivables, inventories, and accounts payable) of a net $798 million, primarily associated with increased receivables and inventory.

Uses of cash:

•Capital expenditures were $980 million.

•We paid $546 million for the repurchase of 16.1 million shares of our common stock.

•We paid $433 million of dividends to our shareholders.

•In August of 2023, we repurchased $150 million aggregate principal amount of various series of our outstanding debt.

Future sources and uses of cash

We manufacture most of our own equipment, which provides us with some flexibility to increase or decrease our capital expenditures based on market conditions. We currently expect capital spending for 2023 to be within our target of approximately 5-6% of revenue. We believe this level of spend will allow us to invest in our key strategic areas. However, we will continue to maintain capital discipline and monitor the rapidly changing market dynamics, and we may adjust our capital spend accordingly.

While we maintain focus on liquidity and debt reduction, we are also focused on providing cash returns to our shareholders. Our quarterly dividend rate is $0.16 per common share, or approximately $144 million. In January of 2023, our Board of Directors approved a capital return framework with a goal of returning at least 50% of our annual free cash flow to shareholders through dividends and share repurchases and we expect our returns to shareholders will be in line with our capital return framework for 2023.

We may utilize share repurchases as part of our capital return framework. Our Board of Directors has authorized a program to repurchase our common stock from time to time. We repurchased 5.1 million shares of common stock during the third quarter of 2023 under this program. Approximately $4.3 billion remained authorized for repurchases as of September 30, 2023 and may be used for open market and other share purchases.

During the second quarter of 2023, we began our migration to SAP S4 and expect to complete by the end of 2025. The total project investment is estimated to cost approximately $250 million and we have spent $36 million to date. We believe the new system will provide important efficiency benefits, cost savings, enhanced visibility to our operations, and advanced analytics that will benefit us and our customers.

Other factors affecting liquidity

Financial position in current market. As of September 30, 2023, we had $2.0 billion of cash and equivalents and $3.5 billion of available committed bank credit under a revolving credit facility with an expiration date of April 27, 2027. We believe we have a manageable debt maturity profile, with approximately $475 million coming due beginning in 2025 through 2027. Furthermore, we have no financial covenants or material adverse change provisions in our bank agreements, and our debt maturities extend over a long period of time. We believe our cash on hand, cash flows generated from operations, and our available credit facility will provide sufficient liquidity to address the challenges and opportunities of the current market and our global cash needs, including capital expenditures, working capital investments, shareholder returns, if any, and contingent liabilities.

HAL Q3 2023 FORM 10-Q | 16

| | | | | | | | |

| | Part I. Item 2 | Liquidity and Capital Resources |

Guarantee agreements. In the normal course of business, we have agreements with financial institutions under which approximately $2.4 billion of letters of credit, bank guarantees, or surety bonds were outstanding as of September 30, 2023. Some of the outstanding letters of credit have triggering events that would entitle a bank to require cash collateralization; however, none of these triggering events have occurred. As of September 30, 2023, we had no material off-balance sheet liabilities and were not required to make any material cash distributions to our unconsolidated subsidiaries.

Credit ratings. Our credit ratings with Standard & Poor’s (S&P) remain BBB+ for our long-term debt and A-2 for our short-term debt, with a stable outlook. In July our long-term debt rating with Moody’s Investors Service (Moody's) was upgraded to A3 from Baa1 and the short-term debt rating remained P-2, with a stable outlook.

Customer receivables. In line with industry practice, we bill our customers for our services in arrears and are, therefore, subject to our customers delaying or failing to pay our invoices. In weak economic environments, we may experience increased delays and failures to pay our invoices due to, among other reasons, a reduction in our customers’ cash flow from operations and their access to the credit markets, as well as unsettled political conditions.

Receivables from our primary customer in Mexico accounted for approximately 10% of our total receivables as of September 30, 2023. While we have experienced payment delays from our primary customer in Mexico, the amounts are not in dispute and we have not historically had, and we do not expect, any material write-offs due to collectability of receivables from this customer.

HAL Q3 2023 FORM 10-Q | 17

| | | | | | | | |

| | Part I. Item 2 | Business Environment and Results of Operations |

BUSINESS ENVIRONMENT AND RESULTS OF OPERATIONS

We operate in more than 70 countries throughout the world to provide a comprehensive range of services and products to the energy industry. Our revenue is generated from the sale of services and products to major, national, and independent oil and natural gas companies worldwide. The industry we serve is highly competitive with many substantial competitors in each segment of our business. Based upon the location of the services provided and products sold, 45% of our consolidated revenue was from the United States for both the nine months ended September 30, 2023 and 2022. No other country accounted for more than 10% of our revenue.

Activity within our business segments is significantly impacted by spending on upstream exploration, development, and production programs by our customers. Also impacting our activity is the status of the global economy, which impacts oil and natural gas consumption.

Some of the more significant determinants of current and future spending levels of our customers are oil and natural gas prices and our customers' expectations about future prices, global oil supply and demand, completions intensity, the world economy, the availability of capital, government regulation, and global stability, which together drive worldwide drilling and completions activity. Additionally, during 2023, we generally expect that many of our customers in North America will continue their strategy of operating within their cash flows and generating returns rather than prioritizing production growth. Lower oil and natural gas prices usually translate into lower exploration and production budgets and lower rig count, while the opposite is usually true for higher oil and natural gas prices. Our financial performance is therefore significantly affected by oil and natural gas prices and worldwide rig activity, which are summarized in the tables below.

The table below shows the average prices for WTI crude oil, United Kingdom Brent crude oil, and Henry Hub natural gas.

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30 | Year Ended

December 31 |

| | 2023 | 2022 | 2022 | |

Oil price - WTI (1) | $ | 82.30 | | $ | 93.18 | | $ | 96.04 | | |

Oil price - Brent (1) | 86.66 | | 100.71 | | 100.78 | | |

Natural gas price - Henry Hub (2) | 2.59 | | 7.99 | | 6.45 | | |

| | | | | |

| (1) | Oil price measured in dollars per barrel. | |

| (2) | Natural gas price measured in dollars per million British thermal units (Btu), or MMBtu. | |

The historical average rig counts based on the weekly Baker Hughes rig count data were as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30 | Nine Months Ended

September 30 | Year Ended

December 31 |

| 2023 | 2022 | 2023 | 2022 | 2022 |

| U.S. Land | 630 | | 744 | | 691 | | 690 | | 708 | |

| U.S. Offshore | 19 | | 17 | | 18 | | 16 | | 15 | |

| Canada | 188 | | 199 | | 175 | | 171 | | 175 | |

| North America | 837 | | 960 | | 884 | | 877 | | 898 | |

| International | 951 | | 857 | | 942 | | 832 | | 851 | |

| Worldwide total | 1,788 | | 1,817 | | 1,826 | | 1,709 | | 1,749 | |

HAL Q3 2023 FORM 10-Q | 18

| | | | | | | | |

| | Part I. Item 2 | Business Environment and Results of Operations |

Business outlook

According to the EIA October 2023 "Short Term Energy Outlook", the Brent spot price is expected to average $93 per barrel for the fourth quarter of 2023, a 5% increase when compared to the Q4 2022 price of $88 per barrel. According to EIA, the WTI prices are expected to average $88 per barrel in the fourth quarter of 2023, a 6% increase when compared to the Q4 2022 price of $83 per barrel. The EIA's full year 2024 average projection for Brent and WTI oil prices is $88 per barrel and $83 per barrel, respectively, resulting in a 4% increase in each price, when compared to the full year 2023.

The EIA October 2023 “Short Term Energy Outlook” projects Henry Hub natural gas prices to average $2.95 per MMBtu during the fourth quarter of 2023, a 47% decrease when compared to the Q4 2022 price of $5.55 per MMBtu. The EIA's full year 2024 average projection for Henry Hub natural gas prices is $3.24 per MMBtu resulting in a 26% increase when compared to the full year 2023 price of $2.58 per MMBtu.

Per OPEC's 2023 World Oil Outlook 2045 report, oil demand for 2024 is projected to grow by 2.2 million barrels per day. The EIA expected crude oil production for 2024 is 13.16 million barrels per day, a 3% increase when compared to 2023.

We continue to expect that oil and gas demand will grow over the next several years, despite the actions taken by central banks in an attempt to control inflation by increasing interest rates and the resulting concern about a potential economic slowdown. We believe the demand will be driven by economic expansion, energy security concerns, and population growth. Oil and gas continues to demonstrate its critical role in the global economy and meeting long term demand requires sustained capital investment. We believe many years of increased investment in existing and new sources of production is the only solution to increase supply and that production will be needed from conventional and unconventional, deep-water and shallow-water, and short and long-cycle projects.

We expect that upstream investment around development activity will remain strong in 2024 and for the foreseeable future, and that demand for our products and services will grow accordingly. We expect lower North America Land activity for the fourth quarter of 2023 due to seasonality and the holidays and we expect that our international results will deliver high teens year-on-year growth.

HAL Q3 2023 FORM 10-Q | 19

| | | | | |

| Part I. Item 2 | Results of Operations in 2023 Compared to 2022 (QTD) |

RESULTS OF OPERATIONS IN 2023 COMPARED TO 2022

Three Months Ended September 30, 2023 Compared with Three Months Ended September 30, 2022

| | | | | | | | | | | | | | | |

| Three Months Ended

September 30 | Favorable | | Percentage |

| Millions of dollars | 2023 | 2022 | (Unfavorable) | | Change |

| Revenue: | | | | | |

| By operating segment: | | | | | |

| Completion and Production | $ | 3,487 | | $ | 3,136 | | $ | 351 | | | 11 | % |

| Drilling and Evaluation | 2,317 | | 2,221 | | 96 | | | 4 | |

| Total revenue | $ | 5,804 | | $ | 5,357 | | $ | 447 | | | 8 | % |

| By geographic region: | | | | | |

| North America | $ | 2,608 | | $ | 2,635 | | $ | (27) | | | (1) | % |

| Latin America | 1,048 | | 841 | | 207 | | | 25 | |

| Europe/Africa/CIS | 734 | | 639 | | 95 | | | 15 | |

| Middle East/Asia | 1,414 | | 1,242 | | 172 | | | 14 | |

| Total revenue | $ | 5,804 | | $ | 5,357 | | $ | 447 | | | 8 | % |

| | | | | |

| Operating income: | | | | | |

| By operating segment: | | | | | |

| Completion and Production | $ | 746 | | $ | 583 | | $ | 163 | | | 28 | % |

| Drilling and Evaluation | 378 | | 325 | | 53 | | | 16 | |

| Total operations | 1,124 | | 908 | | 216 | | | 24 | |

| Corporate and other | (64) | | (62) | | (2) | | | (3) | % |

| SAP S4 upgrade expense | (23) | | — | | (23) | | | n/m |

| | | | | |

| Total operating income | $ | 1,037 | | $ | 846 | | $ | 191 | | | 23 | % |

| n/m = not meaningful | | | | | |

Operating Segments

Completion and Production

Completion and Production revenue in the third quarter of 2023 was $3.5 billion, an increase of $351 million, or 11%, when compared to the third quarter of 2022. Operating income in the third quarter of 2023 was $746 million, an increase of $163 million, or 28%, when compared to the third quarter of 2022. These results were driven by increased stimulation activity internationally, higher completion tool sales globally, and improved cementing activity in the Eastern Hemisphere. Improved pricing and higher efficiencies were offset by lower stimulation activity in North America land.

Drilling and Evaluation

Drilling and Evaluation revenue in the third quarter of 2023 was $2.3 billion, an increase of $96 million, or 4%, when compared to the third quarter of 2022. Operating income in the third quarter of 2023 was $378 million, an increase of $53 million, or 16%, when compared to the third quarter of 2022. These results were driven by improvements in fluids and wireline activity globally and higher drilling services internationally. These improvements were partially offset by lower project management activity in Saudi Arabia.

Geographic Regions

North America

North America revenue in the third quarter of 2023 was $2.6 billion, or relatively flat compared to the third quarter of 2022. Improvements across multiple product service lines in the U.S. Gulf of Mexico, and higher wireline activity in North America land, were offset by lower pressure pumping services and drilling-related activity in North America land.

HAL Q3 2023 FORM 10-Q | 20

| | | | | |

| Part I. Item 2 | Results of Operations in 2023 Compared to 2022 (QTD) |

Latin America

Latin America revenue in the third quarter of 2023 was $1.0 billion, a 25% increase compared to the third quarter of 2022, due to increased completion tool sales and higher well construction activity in Brazil, higher pressure pumping services and increased fluids activity in Argentina, and improved activity across multiple product service lines in Mexico and Colombia. Partially offsetting these improvements were lower well construction services and decreased project management in Suriname.

Europe/Africa/CIS

Europe/Africa/CIS revenue in the third quarter of 2023 was $734 million, a 15% increase compared to the third quarter of 2022. This increase was primarily driven by improved activity across multiple product service lines in Africa, higher well construction activity in Norway, and with increased completion tool sales, higher software sales, and improved cementing activity in Europe and Nigeria. These increases were partially offset by lower fluids and testing activity in Europe and decreased wireline and well intervention services in Norway.

Middle East/Asia

Middle East/Asia revenue in the third quarter of 2023 was $1.4 billion, a 14% increase compared to the third quarter of 2022, resulting from increased wireline activity, higher completion tool sales, and improved testing and drilling-related services in Saudi Arabia, along with increased well construction services in the United Arab Emirates, and higher cementing and fluids activity in Indonesia. Partially offsetting these improvements was lower project management activity in Saudi Arabia.

Other Operating Items

SAP S4 Upgrade Expense. As previously mentioned, in the second quarter of 2023 we began our migration to SAP S4, which we expect to complete by the end of 2025. During the third quarter of 2023, we recognized $23 million of expense on our SAP S4 migration.

Nonoperating Items

Effective tax rate. During the three months ended September 30, 2023, we recorded a total income tax provision of $192 million on a pre-tax income of $916 million, resulting in an effective tax rate of 21.0% for the quarter. During the three months ended September 30, 2022, we recorded a total income tax provision of $156 million on a pre-tax income of $705 million, resulting in an effective tax rate of 22.2% for the quarter.

Internal Revenue Service Notice of Proposed Adjustment. We are subject to taxes in the United States and in numerous jurisdictions where we operate or where our subsidiaries are organized. Our tax returns are routinely subject to examination by the taxing authorities in the jurisdictions where we file tax returns. In most cases we are no longer subject to examination by tax authorities for years before 2010. The only significant operating jurisdiction that has tax filings under review or subject to examination by the tax authorities is the United States. Our United States federal income tax filings for tax years 2016 through 2021, including carry back of 2016 net operating losses to 2014, are currently under review or remain open for review by the Internal Revenue Service (the IRS).