United States Securities and exchange commission

Washington, D.C. 20549

Form 10-K

(Mark One)

[X]Annual Report Pursuant to Section 13 or 15(d) of the securities exchange act of 1934.

For the fiscal year ended March 31, 2019

or

[ ]Transition report pursuant to section 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from __________________ to _________________

|

|

|

|

|

Commission |

Registrant, State of Incorporation Address and Telephone Number |

I.R.S. Employer Identification No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

1-11255 |

AMERCO |

88-0106815 |

|

|

(A Nevada Corporation) |

|

|

|

5555 Kietzke Lane, Ste. 100 |

|

|

|

Reno, Nevada 89511 |

|

|

|

Telephone (775) 688-6300 |

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

Common stock, $0.25 par value |

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [X] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [ ]

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of AMERCO common stock held by non-affiliates on September 28, 2018 was $3,167,360,502. The aggregate market value was computed using the closing price for the common stock trading on NASDAQ on such date. Shares held by executive officers, directors and persons owning directly or indirectly more than 5% of the outstanding common stock have been excluded from the preceding number because such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

19,607,788 shares of AMERCO Common Stock, $0.25 par value, were outstanding at May 24, 2019.

Documents incorporated by reference: portions of AMERCO’s definitive proxy statement for the 2019 annual meeting of stockholders, to be filed within 120 days after AMERCO’s fiscal year ended March 31, 2019, are incorporated by reference into Part III of this report.

|

|

|

|

|

|

PART I |

|

|

Item 1. |

Business |

1 |

|

Item 1A. |

Risk Factors |

7 |

|

Item 1B. |

Unresolved Staff Comments |

12 |

|

Item 2. |

Properties |

12 |

|

Item 3. |

Legal Proceedings |

12 |

|

Item 4. |

13 |

|

|

|

|

|

|

|

PART II |

|

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

13 |

|

Item 6. |

Selected Financial Data |

15 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 |

|

Item 7A. |

37 |

|

|

38 |

||

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

38 |

|

Item 9A. |

Controls and Procedures |

38 |

|

Item 9B. |

Other Information |

41 |

|

|

|

|

|

|

PART III |

|

|

Item 10. |

41 |

|

|

Item 11. |

41 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

41 |

|

Item 14. |

41 |

|

|

|

|

|

|

|

PART IV |

|

|

Item 15. |

41 |

|

|

Item 16. |

Form 10-K Summary |

49 |

Item 1. Business

Company Overview

We are North America’s largest “do-it-yourself” moving and storage operator through our subsidiary U-Haul International, Inc. (“U-Haul”). U-Haul is synonymous with “do-it-yourself” moving and storage and is a leader in supplying products and services to help people move and store their household and commercial goods. Our primary service objective is to “provide a better and better product and service to more and more people at a lower and lower cost.” Unless the context otherwise requires, the terms “AMERCO,” “Company,” “we,” “us,” or “our” refer to AMERCO, a Nevada corporation, and all of its legal subsidiaries, on a consolidated basis.

We were founded in 1945 as a sole proprietorship under the name "U-Haul Trailer Rental Company" and have rented trailers ever since. Starting in 1959, we rented trucks on a one-way and in-town basis exclusively through independent U-Haul® dealers. In 1973, we began developing our network of U-Haul® managed retail stores, through which we rent our trucks and trailers, self-storage units and portable moving and storage units and sell moving and self-storage products and services to complement our independent dealer network.

We rent our distinctive orange and white U-Haul® trucks and trailers as well as offer self-storage units through a network of 1,981 Company-operated retail moving stores and over 20,000 independent U-Haul® dealers. We also sell U-Haul® brand boxes, tape and other moving and self-storage products and services to “do-it-yourself” moving and storage customers at all of our distribution outlets and through our uhaul.com® and eMove® websites.

We believe U-Haul® is the most convenient supplier of products and services addressing the needs of the United States and Canada’s “do-it-yourself” moving and storage markets. Our broad geographic coverage throughout the United States and Canada and our extensive selection of U-Haul® brand moving equipment rentals, self-storage units, portable moving and storage units and related moving and storage products and services provide our customers with convenient “one-stop” shopping.

Since 1945, U-Haul® has incorporated sustainable practices into its everyday operations. We believe that our basic business premise of equipment sharing helps reduce greenhouse gas emissions and reduces the inventory of total large capacity vehicles. We continue to look for ways to reduce waste within our business and are dedicated to manufacturing reusable components and recyclable products. We believe that our commitment to sustainability, through our products and services and everyday operations has helped us to reduce our impact on the environment.

Through Repwest Insurance Company (“Repwest”) and ARCOA Risk Retention Group ("ARCOA"), our property and casualty insurance subsidiaries, we manage the property, liability and related insurance claims processing for U-Haul®. Oxford Life Insurance Company (“Oxford”), our life insurance subsidiary, sells life insurance, Medicare supplement insurance, annuities and other related products to the senior market.

Available Information

AMERCO® and U-Haul® are each incorporated in Nevada. The internet address for U-Haul is uhaul.com. On AMERCO’s investor relations website, amerco.com, we post the following filings as soon as practicable after they are electronically filed with or furnished to the United States Securities and Exchange Commission (“SEC”): our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K, proxy statements related to meetings of our stockholders, and any amendments to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We also use our investor relations website as a means of disclosing material information and for complying with our disclosure obligations under Regulation FD. All such filings on our website are available free of charge. Additionally, you will find these materials on the SEC’s website at sec.gov.

Our customers are primarily “do-it-yourself” household movers. U-Haul® moving equipment is specifically designed, engineered and manufactured for the “do-it-yourself” household mover. These “do-it-yourself” movers include individuals and families moving their belongings from one home to another, college students moving their belongings, vacationers and sports enthusiasts needing extra space or having special towing needs, people trying to save on home furniture and home appliance delivery costs, and “do-it-yourself” home remodeling and gardening enthusiasts who need to transport materials.

As of March 31, 2019, our rental fleet consisted of approximately 167,000 trucks, 120,000 trailers and 43,000 towing devices. This equipment and our U-Haul brand of self-moving products and services are available through our network of managed retail moving stores and independent U-Haul dealers. Independent U-Haul dealers receive rental equipment from the Company, act as rental agents and are paid a commission based on gross revenues generated from their U-Haul® rentals.

Our rental truck chassis are engineered by domestic truck manufacturers. These chassis are joined with the U-Haul® designed and manufactured van boxes primarily at U-Haul® operated manufacturing and assembly facilities strategically located throughout the United States. U-Haul® rental trucks feature our proprietary Lowest DeckSM, which provides our customers with extra ease of loading. The loading ramps on our trucks are the widest in the industry, which reduce the effort needed to move belongings. Our trucks are fitted with convenient, padded rub rails with tie downs on every interior wall. Our Gentle Ride SuspensionSM helps our customers safely move delicate and prized possessions. Also, the engineers at our U-Haul Technical Center determined that the softest ride in our trucks was at the front of the van box. Consequently, we designed the part of the van box that hangs over the front cab of the truck to be the location for our customers to place their most fragile items during their move. We call this area Mom’s Attic®.

Our distinctive trailers are also manufactured at these same U-Haul® operated manufacturing and assembly facilities. These trailers are well suited to the low profile of many of today’s newly manufactured automobiles. Our engineering staff is committed to making our trailers easy to tow, safe, aerodynamic and fuel efficient.

To provide our self-move customers with added value, our rental trucks and trailers are designed with fuel efficiency in mind. Many of our trucks are fitted with fuel economy gauges, another tool that assists our customers in conserving fuel. To help make our rental equipment more reliable, we routinely perform extensive preventive maintenance and repairs.

We also provide customers with equipment to transport their vehicles. We provide two towing options: auto transport, in which all four wheels are off the ground, and a tow dolly, in which the front wheels of the towed vehicle are off the ground.

To help our customers load their boxes and larger household appliances and furniture, we offer several accessory rental items. Our utility dolly has a lightweight design and is easy to maneuver. Another rental accessory is our four wheel dolly, which provides a large, flat surface for moving dressers, wall units, pianos and other large household items. U-Haul® appliance dollies provide the leverage needed to move refrigerators, freezers, washers and dryers easily and safely. These utility, furniture and appliance dollies, along with the low decks and the wide loading ramps on U-Haul® trucks and trailers, are designed for easy loading and unloading of our customers’ belongings.

The total package U-Haul® offers to the “do-it-yourself” household mover doesn’t end with trucks, trailers and accessory rental items. Our moving supplies include a wide array of affordably priced U-Haul® brand boxes, tape and packing materials. We also provide specialty boxes for dishes, computers and sensitive electronic equipment, as well as tape, security locks, and packing supplies. U-Haul® brand boxes are specifically sized to make loading easier.

We estimate that U-Haul® is North America’s largest seller and installer of hitches and towing systems. In addition to towing U-Haul® equipment, these hitching and towing systems can tow jet skis, motorcycles, boats, campers and horse trailers. Each year, more than one million customers visit our locations for expertise on complete towing systems, trailer rentals and the latest in towing accessories.

U-Haul® has one of North America’s largest propane refilling networks, with over 1,100 locations providing this convenient service. We employ trained, certified personnel to refill propane cylinders and alternative fuel vehicles. Our network of propane dispensing locations is one of the largest automobile alternative refueling networks in North America.

Our self-storage business was a natural outgrowth of our self-moving operations. Conveniently located U-Haul® self-storage rental facilities provide clean, dry and secure space for storage of household and commercial goods. Storage units range in size from 6 square feet to over 1,000 square feet. As of March 31, 2019, we operate 1,631 self-storage locations in the United States and Canada, with nearly 697,000 rentable storage units comprising 60.7 million square feet of rentable storage space. Our self-storage centers feature a wide array of security measures, ranging from electronic property access control gates to individually alarmed storage units. At many centers, we offer climate-controlled storage units to protect temperature sensitive goods such as video tapes, albums, photographs and precious wood furniture.

Another extension of our strategy to make “do-it-yourself” moving and storage easier is our U-Box® program. A U-Box® portable moving and storage unit is delivered to a location of our customer’s choosing either by the customers themselves through the use of a U-Box® trailer, with the assistance of a Moving Helper or by Company personnel. Once the U-Box® portable moving and storage unit is filled, it can be stored at the customer’s location, or taken to one of our Company operated locations, a participating independent dealer, or moved to a location of the customer’s choice.

Additionally, we offer moving and storage protection packages such as Safemove® and Safetow®. These programs provide moving and towing customers with a damage waiver, cargo protection and medical and life insurance coverage. Safestor® provides protection for storage customers from loss on their goods in storage. Safestor Mobile® provides protection for customers stored belongings when using our U-Box® portable moving and storage units. For our customers who desire additional coverage over and above the standard Safemove® protection, we also offer our Safemove Plus® product. This package provides the rental customer with a layer of primary liability protection.

We believe that through our website, uhaul.com, we have aggregated the largest network of customers and independent businesses in the self-moving and self-storage industry. In particular, our Moving Helper program connects “do-it-yourself” movers with thousands of independent service providers in the United States and Canada to assist our customers in packing, loading, unloading, cleaning and performing other services.

Through the U-Haul Storage Affiliates® program, independent storage businesses can join one of the world’s largest self-storage reservation systems. Self-storage customers making a reservation through uhaul.com® can access all of the U-Haul self-storage centers and all of our independent storage affiliate partners for even greater convenience to meet their self-storage needs. For the independent storage operator, our network gives them access to products and services allowing them to compete with larger operators more cost effectively.

We own numerous trademarks and service marks that contribute to the identity and recognition of our Company and its products and services. Certain of these marks are integral to the conduct of our business, a loss of any of which could have a material adverse affect on our business. We consider the trademark “U-Haul®” to be of material importance to our business in addition, but not limited to, the U.S. trademarks and service marks “AMERCO®”, “eMove®”, “Gentle Ride SuspensionSM”, “In-Town®”, “Lowest DecksSM”, “Moving made Easier®”, “Make Moving Easier®”, “Mom’s Attic®”, “Moving Help®”, “Moving Helper®”, “Safemove®”, “Safemove Plus®”, “Safestor®”, “Safestor Mobile®”, “Safetow®”, “U-Box®”, “uhaul.com®”, “U-Haul Investors Club®”, “U-Haul Truck Share®”, “U-Haul Truck Share 24/7®“ “U-Note®”, “WebSelfStorage®”, and “U-Haul Smart Mobility Center®”, among others, for use in connection with the moving and storage business.

Description of Operating Segments

AMERCO’s three reportable segments are:

Financial information for each of our operating segments is included in the Notes to Consolidated Financial Statements as part of Item 8: Financial Statements and Supplementary Data of this Annual Report on Form 10-K.

Moving and Storage Operating Segment

Moving and Storage operating segment (“Moving and Storage”) consists of the rental of trucks, trailers, portable moving and storage units, specialty rental items and self-storage spaces primarily to the household mover as well as sales of moving supplies, towing accessories and propane. Operations are conducted under the registered trade name U-Haul® throughout the United States and Canada.

Net revenue from Moving and Storage was approximately 94.0%, 91.3% and 90.8% of consolidated net revenue in fiscal 2019, 2018 and 2017, respectively.

Within our truck and trailer rental operation, we are focused on expanding our independent dealer network to provide added convenience for our customers. U-Haul® maximizes vehicle utilization by managing distribution of the truck and trailer fleets among the 1,981 Company-operated stores and 20,000 independent dealers. Utilizing its proprietary reservations management system, our centers and dealers electronically report their inventory in real-time, which facilitates matching equipment to customer demand. Over half of all U-Move® rental revenue originated from our operated centers.

At our owned and operated retail stores we are implementing new initiatives to improve customer service. These initiatives include improving management of our rental equipment to provide our retail centers with the right type of rental equipment, at the right time and at the most convenient location for our customers, effectively marketing our broad line of self-moving related products and services, expanding accessibility to provide more convenience to our customers, and enhancing our ability to properly staff locations during our peak hours of operations by attracting and retaining “moonlighters” (part-time U-Haul® employees with full-time jobs elsewhere) during our peak hours of operation. As of April 2017, U-Haul expanded it’s offering of U-Haul Truck Share 24/7® to our entire network in the United States and Canada. U-Haul currently has several U.S. Patents pending on its U-Haul Truck Share 24/7® system.

Our self-moving related products and services, such as boxes, pads and insurance, help our customers have a better moving experience and help them to protect their belongings from potential damage during the moving process. We are committed to providing a complete line of products selected with the “do-it-yourself” moving and storage customer in mind.

Our self-storage business operations consist of the rental of self-storage units, portable moving and storage units, sales of self-storage related products, the facilitation of sales of services, and the management of self-storage facilities owned by others.

U-Haul® is one of the largest North American operators of self-storage and has been a leader in the self-storage industry since 1974. U-Haul® operates nearly 697,000 rentable storage units, comprising 60.7 million square feet of rentable storage space with locations in 50 states and 10 Canadian provinces. Our owned and managed self-storage facility locations range in size up to 309,000 square feet of storage space, with individual storage units in sizes ranging from 6 square feet to over 1,000 square feet.

The primary market for storage units is the storage of household goods. We believe that our self-storage services provide a competitive advantage through such things as Max Security, an electronic system that monitors the storage facility 24 hours a day, climate control in select units, individually alarmed units, extended hours access, and an internet-based customer reservation and account management system.

Moving Help® and U-Haul Storage Affiliates® on uhaul.com are online marketplaces that connect consumers to independent Moving Help® service providers and thousands of independent Self-Storage Affiliates. Our network of customer-rated Moving Help® and affiliates provide pack and load help, cleaning help, self-storage and similar services all over the United States and Canada. Our goal is to further utilize our web-based technology platform to increase service to consumers and businesses in the moving and storage market.

Compliance with environmental requirements of federal, state and local governments significantly affects our business. Our truck and trailer rental business is subject to regulation by various federal, state and foreign governmental entities. Specifically, the U.S. Department of Transportation and various state, federal and Canadian agencies exercise broad powers over our motor carrier operations, safety, and the generation, handling, storage, treatment and disposal of waste materials. In addition, our storage business is also subject to federal, state and local laws and regulations relating to environmental protection and human health and safety. Environmental laws and regulations are complex, change frequently and could become more stringent in the future.

Moving and Storage business is seasonal and our results of operations and cash flows fluctuate significantly from quarter to quarter. Historically, revenues have been stronger in the first and second fiscal quarters due to the overall increase in moving activity during the spring and summer months. The fourth fiscal quarter is generally our weakest.

Property and Casualty Insurance Operating Segment

Our Property and Casualty Insurance operating segment (“Property and Casualty Insurance”) provides loss adjusting and claims handling for U-Haul through regional offices across the United States and Canada. Property and Casualty Insurance also underwrites components of the Safemove®, Safetow®, Safemove Plus®, Safestore Mobile® and Safestor® protection packages to U-Haul customers. We attempt to price our products to be a good value to our customers. The business plan for Property and Casualty Insurance includes offering property and casualty products in other U-Haul related programs.

Net revenue from Property and Casualty Insurance was approximately 1.9%, 2.0% and 2.0% of consolidated net revenue in fiscal 2019, 2018 and 2017, respectively.

Life Insurance Operating Segment

Life Insurance provides life and health insurance products primarily to the senior market through the direct writing and reinsuring of life insurance, Medicare supplement and annuity policies.

Net revenue from Life Insurance was approximately 4.1%, 6.7% and 7.2% of consolidated net revenue in fiscal 2019, 2018 and 2017, respectively.

Employees

As of March 31, 2019, we employed over 30,000 people throughout the United States and Canada with approximately 99% of these employees working within Moving and Storage and approximately 54% of these employees working on a part-time basis.

Sales and Marketing

We promote U-Haul® brand awareness through direct and co-marketing arrangements. Our direct marketing activities consist of web-based initiatives, print and social media as well as trade events, movie and television cameos of our rental fleet and boxes, and industry and consumer communications. We believe that our rental equipment is our best form of advertisement. We support our independent U-Haul® dealers through marketing U-Haul® moving and self-storage rentals, products and services.

Our marketing plan focuses on maintaining our leadership position in the “do-it-yourself” moving and storage industry by continually improving the ease of use and economy of our rental equipment, by providing added convenience to our retail centers, through independent U-Haul dealers, and by expanding the capabilities of our U-Haul websites.

A significant driver of rental transaction volume is our utilization of an online reservation and sales system, through uhaul.com and our 24-hour 1-800-GO-U-HAUL telephone reservations system. These points of contact are prominently featured and are a major driver of customer lead sources.

Moving and Storage Operating Segment

The truck rental industry is highly competitive and includes a number of significant national, regional and local competitors. Generally speaking, we consider there to be two distinct users of rental trucks: commercial and “do-it-yourself” residential users. We primarily focus on the “do-it-yourself” residential user. Within this segment, we believe the principal competitive factors are convenience of rental locations, availability of quality rental moving equipment, breadth of essential products and services, and total cost to the user. Our major national competitors in both the in-town and one-way moving equipment rental market include Avis Budget Group, Inc. and Penske Truck Leasing. We have numerous competitors throughout the United States and Canada who compete with us in the in-town market.

The self-storage market is large and very fragmented. We believe the principal competitive factors in this industry are convenience of storage rental locations, cleanliness, security and price. Our largest competitors in the self-storage market are Public Storage Inc., Extra Space Storage, Inc., CubeSmart and Life Storage, Inc.

Insurance Operating Segments

The insurance industry is highly competitive. In addition, the marketplace includes financial services firms offering both insurance and financial products. Some of the insurance companies are owned by stockholders and others are owned by policyholders. Many competitors have been in business for a longer period of time or possess substantially greater financial resources and broader product portfolios than our insurance companies. We compete in the insurance business based upon price, product design, and services rendered to agents and policyholders.

Financial Data of Segment and Geographic Areas

For financial data of our segments and geographic areas please see Note 21, Financial Information by Geographic Area, and Note 21A, Consolidating Financial Information by Consolidating Industry Segment, of our Notes to Consolidated Financial Statements.

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K (“Annual Report”), contains “forward-looking statements” regarding future events and our future results of operations. We may make additional written or oral forward-looking statements from time to time in filings with the SEC or otherwise. We believe such forward-looking statements are within the meaning of the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. Such statements may include, but are not limited to, estimates of capital expenditures, plans for future operations, products or services, financing needs and plans, our perceptions of our legal positions and anticipated outcomes of government investigations and pending litigation against us, liquidity and the availability of financial resources to meet our needs, goals and strategies, plans for new business, storage occupancy, growth rate assumptions, pricing, costs, and access to capital and leasing markets the impact of our compliance with environmental laws and cleanup costs, our used vehicle disposition strategy, the sources and availability of funds for our rental equipment and self-storage expansion and replacement strategies and plans, our plan to expand our U-Haul storage affiliate program, that additional leverage can be supported by our operations and business, the availability of alternative vehicle manufacturers, our estimates of the residual values of our equipment fleet, our plans with respect to off-balance sheet arrangements, our plans to continue to invest in the U-Box® program, the impact of interest rate and foreign currency exchange rate changes on our operations, the sufficiency of our capital resources and the sufficiency of capital of our insurance subsidiaries as well as assumptions relating to the foregoing. The words “believe,” “expect,” “anticipate,” “plan,” “may,” “will,” “could,” “estimate,” “project” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made.

Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Factors that could significantly affect results include, without limitation, the risk factors enumerated below under the heading “Risk Factors” and other factors described in this Annual Report or the other documents we file with the SEC. These factors, the following disclosures, as well as other statements in this Annual Report and in the Notes to Consolidated Financial Statements, could contribute to or cause such risks or uncertainties, or could cause our stock price to fluctuate dramatically. Consequently, the forward-looking statements should not be regarded as representations or warranties by us that such matters will be realized. We assume no obligation to update or revise any of the forward-looking statements, whether in response to new information, unforeseen events, changed circumstances or otherwise, except as required by law.

Item 1A. Risk Factors

The following discussion of risk factors should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) and the Consolidated Financial Statements and related notes. These risk factors may be important in understanding this Annual Report or elsewhere.

We operate in a highly competitive industry.

The truck rental industry is highly competitive and includes a number of significant national, regional and local competitors. We believe the principal competitive factors in this industry are convenience of rental locations, availability of quality rental moving equipment, breadth of essential services and products and total cost. Financial results for the Company can be adversely impacted by aggressive pricing from our competitors. Some of our competitors may have greater financial resources than we have. We cannot assure you that we will be able to maintain existing rental prices or implement price increases. Moreover, if our competitors reduce prices and we are not able or willing to do so as well, we may lose rental volume, which would likely have a materially adverse effect on our results of operations. Numerous potential competitors are working to establish paradigm shifting technologies from self-driving vehicles to ride-hailing services and other technologies that connect riders with vehicles.

The self-storage industry is large and highly fragmented. We believe the principal competitive factors in this industry are convenience of storage rental locations, cleanliness, security and price. Competition in the market areas in which we operate is significant and affects the occupancy levels, rental rates and operating expenses of our facilities. Competition might cause us to experience a decrease in occupancy levels, limit our ability to raise rental rates or require us to offer discounted rates that would have a material effect on results of operations and financial condition. Entry into the self-storage business may be accomplished through the acquisition of existing facilities by persons or institutions with the required initial capital. Development of new self-storage facilities is more difficult however, due to land use, zoning, environmental and other regulatory requirements. The self-storage industry has in the past experienced overbuilding in response to perceived increases in demand. We cannot assure you that we will be able to successfully compete in existing markets or expand into new markets.

We are highly leveraged.

As of March 31, 2019, we had total debt outstanding of $4,210.2 million and total undiscounted operating and ground lease commitments of $148.0 million. Although we believe, based on existing information, that additional leverage can be supported by our operations and revenues, our existing debt could impact us in the following ways among other considerations:

- require us to allocate a considerable portion of cash flows from operations to debt service and lease payments;

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

- limit our ability to obtain additional financing; and

- place us at a disadvantage compared to our competitors who may have less debt.

Our ability to make payments on our debt and leases depends upon our ability to maintain and improve our operating performance and generate cash flow. To some extent, this is subject to prevailing economic and competitive conditions and to certain financial, business and other factors, some of which are beyond our control. If we are unable to generate sufficient cash flow from operations to service our debt and meet our other cash needs, including our leases, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or restructure or refinance our indebtedness and leases. If we must sell our assets, it may negatively affect our ability to generate revenue. In addition, we may incur additional debt or leases that would exacerbate the risks associated with our indebtedness.

Uncertainty regarding LIBOR may adversely impact our indebtedness under our credit and loan facilities.

On July 27, 2017, the United Kingdom’s Financial Conduct Authority, which regulates LIBOR, announced that it intends to phase out LIBOR by the end of 2021. It is unclear if at that time whether or not LIBOR will cease to exist or if new methods of calculating LIBOR will be established such that it continues to exist after 2021. In addition, in April 2018, the Federal Reserve System, in conjunction with the Alternative Reference Rates Committee, announced the replacement of LIBOR with a new index, calculated by short-term repurchase agreements collateralized by U.S. Treasury securities, called the Secured Overnight Financing Rate (“SOFR”). At this time, it is not possible to predict whether SOFR will attain market traction as a LIBOR replacement. Additionally, the future of LIBOR at this time is uncertain. Potential changes, or uncertainty related to such potential changes, may adversely affect the market for LIBOR-based securities, including our portfolio of LIBOR-indexed, floating-rate debt securities, or the cost of our borrowings. In addition, changes or reforms to the determination or supervision of LIBOR may result in a sudden or prolonged increase or decrease in reported LIBOR, which could have an adverse impact on the market for LIBOR-based securities, including the value of the LIBOR-indexed, floating-rate debt securities in our portfolio, or the cost of our borrowings. Additionally, if LIBOR ceases to exist, we may need to renegotiate our credit and loan facilities extending beyond 2021 that utilize LIBOR as a factor in determining the interest rate and certain of our existing credit facilities to replace LIBOR with the new standard that is established. The potential effect of the phase-out or replacement of LIBOR on our cost of capital and net investment income cannot yet be determined.

Economic conditions, including those related to the credit markets, may adversely affect our industry, business and results of operations.

Consumer and commercial spending is generally affected by the health of the economy, which places some of the factors affecting the success of our business beyond our control. Our businesses, although not as traditionally cyclical as some, could experience significant downturns in connection with or in anticipation of, declines in general economic conditions. In times of declining consumer spending we may be driven, along with our competitors, to reduce pricing which would have a negative impact on gross profit. We cannot predict if another downturn in the economy will occur, which could result in reduced revenues and working capital.

Should credit markets in the United States tighten or if interest rates increase significantly, we may not be able to refinance existing debt or find additional financing on favorable terms, if at all. If one or more of the financial institutions that support our existing credit facilities fails or opts not to continue to lend to us, we may not be able to find a replacement, which would negatively impact our ability to borrow under credit facilities. If our operating results were to worsen significantly and our cash flows or capital resources prove inadequate, or if interest rates increase significantly, we could face liquidity problems that could materially and adversely affect our results of operations and financial condition.

Our fleet rotation program can be adversely affected by financial market conditions.

To meet the needs of our customers, U-Haul maintains a large fleet of rental equipment. Our rental truck fleet rotation program is funded internally through operations and externally from debt and lease financing. Our ability to fund our routine fleet rotation program could be adversely affected if financial market conditions limit the general availability of external financing. This could lead us to operate trucks longer than initially planned and/or reduce the size of the fleet, either of which could materially and negatively affect our results of operations.

Another important aspect of our fleet rotation program is the sale of used rental equipment. The sale of used equipment provides us with funds that can be used to purchase new equipment. Conditions may arise that could lead to the decrease in demand and/or resale values for our used equipment. This could have a material adverse effect on our financial results, which could result in substantial losses on the sale of equipment and decreases in cash flows from the sales of equipment.

We obtain our rental trucks from a limited number of manufacturers.

Over the last twenty years, we purchased the majority of our rental trucks from Ford Motor Company and General Motors Corporation. Our fleet can be negatively affected by issues our manufacturers may face within their own supply chain. Also, it is possible that our suppliers may face financial difficulties or organizational changes which could negatively impact their ability to accept future orders or fulfill existing orders. The cost of acquiring new rental trucks could increase materially and negatively affect our ability to rotate new equipment into the fleet. Although we believe that we could contract with alternative manufacturers for our rental trucks, we cannot guarantee or predict how long that would take. In addition, termination of our existing relationship with these suppliers could have a material adverse effect on our business, financial condition or results of operations for an indefinite period of time.

A substantial amount of our shares is owned by a small contingent of stockholders.

Willow Grove Holdings LP, directly and through controlled entities (“WGHLP”), owns 8,309,584 shares of AMERCO common stock, and together with Edward J. Shoen and Mark V. Shoen, owns 8,361,731 shares (approximately 42.6%) of AMERCO common stock. The general partner of WGHLP controls the voting and disposition decisions with respect to the common stock of AMERCO owned by WGHLP, and is managed by Edward J. Shoen (the Chairman of the Board of Directors and Chief Executive Officer of AMERCO) and his brother, Mark V. Shoen. Accordingly, Edward J. Shoen and Mark V. Shoen are in a position to significantly influence our business and policies, including the approval of certain significant transactions, the election of the members of our Board of Directors (the “Board”) and other matters submitted to our stockholders. There can be no assurance that their interests will not conflict with the interests of our other stockholders.

In addition, 1,084,571 shares (approximately 5.5%) of AMERCO common stock are owned under our Employee Stock Ownership Plan (“ESOP”). Each ESOP participant is entitled to vote the shares allocated to himself or herself in their discretion. In the event an ESOP participant does not vote his or her shares, such shares shall be voted by the ESOP trustee, in the ESOP trustee’s discretion.

Our operations subject us to numerous environmental regulations and the possibility that environmental liability in the future could adversely affect our operations.

Compliance with environmental requirements of federal, state and local governments significantly affects our business. Among other things, these requirements regulate the discharge of materials into the air, land and water and govern the use and disposal of hazardous substances. Under environmental laws or common law principles, we can be held liable for hazardous substances that are found on real property we have owned or operated. We are aware of issues regarding hazardous substances on some of our real estate and we have put in place a remediation plan at each site where we believe such a plan is necessary. See Note 18, Contingencies, of the Notes to Consolidated Financial Statements. We regularly make capital and operating expenditures to stay in compliance with environmental laws. In particular, we have managed a testing and removal program since 1988 for our underground storage tanks. Despite these compliance efforts, the risk of environmental liability is part of the nature of our business.

Environmental laws and regulations are complex, change frequently and could become more stringent in the future. We cannot assure you that future compliance with these regulations, future environmental liabilities, the cost of defending environmental claims, conducting any environmental remediation or generally resolving liabilities caused by us or related third parties will not have a material adverse effect on our business, financial condition or results of operations.

We operate in a highly regulated industry and changes in existing regulations or violations of existing or future regulations could have a material adverse effect on our operations and profitability.

Our truck and trailer rental business is subject to regulation by various federal, state and foreign governmental entities. Specifically, the U.S. Department of Transportation and various state, federal and Canadian agencies exercise broad powers over our motor carrier operations, safety, and the generation, handling, storage, treatment and disposal of waste materials. In addition, our storage business is also subject to federal, state and local laws and regulations relating to environmental protection and human health and safety. The failure to comply with these laws and regulations may adversely affect our ability to sell or rent such property or to use the property as collateral for future borrowings. Compliance with changing regulations could substantially impair real property and equipment productivity and increase our costs. In addition, the Federal government may institute some regulation that limits carbon emissions by setting a maximum amount of carbon individual entities can emit without penalty. This would likely affect everyone who uses fossil fuels and would disproportionately affect users in the highway transportation industries. While there are too many variables at this time to assess the impact of the various proposed federal and state regulations that could affect carbon emissions, many experts believe these proposed rules could significantly affect the way companies operate in their businesses.

Our operations can be limited by land-use regulations. Zoning choices enacted by individual municipalities in the United States and Canada may limit our ability to serve certain markets with our products and services.

Our insurance companies are heavily regulated by state insurance departments and the National Association of Insurance Commissioners (“NAIC”). These insurance regulations are primarily in place to protect the interests of our policyholders and not our investors. Changes in these laws and regulations could increase our costs, inhibit new sales, or limit our ability to implement rate increases.

A significant portion of our revenues are generated through third-parties.

Our business plan relies upon a network of independent dealers strategically located throughout the United States and Canada. As of March 31, 2019 we had over 20,000 independent equipment rental dealers. In fiscal 2019, less than half of all U-Move® rental revenue originated through this network.

Our inability to maintain this network or its current cost structure could inhibit our ability to adequately serve our customers and may negatively affect our results of operations and financial position.

We face liability risks associated with the operation of our rental fleet, sales of our products and operation of our locations.

The business of renting moving and storage equipment to customers exposes us to liability claims including property damage, personal injury and even death. Likewise, the operation of our moving and storage centers along with the sale of our related moving supplies, towing accessories and installation, and refilling of propane tanks may subject us to liability claims. We seek to limit the occurrence of such events through the design of our equipment, communication of its proper use, exhaustive repair and maintenance schedules, extensive training of our personnel, proactive risk management assessments and by providing our customers with online resources for the proper use of products and services. Regardless, accidents still occur and we manage the financial risk of these events through third party insurance carriers. While these excess loss insurance policies are available today at reasonable costs, this could change and could negatively affect our results of operations and financial position.

Terrorist attacks could negatively impact our operations and profitability and may expose us to liability and reputational damage.

Terrorist attacks may negatively affect our operations and profitability. Such attacks may damage our facilities and it is also possible that our rental equipment could be involved in a terrorist attack. Although we carry excess of loss insurance coverage, it may prove to be insufficient to cover us for acts of terror using our rental equipment. Moreover, we may suffer reputational damage that could arise from a terrorist attack which utilizes our rental equipment. The consequences of any terrorist attacks or hostilities are unpredictable and difficult to quantify. We seek to minimize these risks through our operational processes and procedures; however, we may not be able to foresee events that could have an adverse effect on our operations.

We are highly dependent upon our automated systems and the Internet for managing our business.

Our information systems are largely Internet-based, including our point-of-sale reservation system, payment processing and telephone systems. While our reliance on this technology lowers our cost of providing service and expands our abilities to better serve customers, it exposes us to various risks including natural and man-made disasters, terrorist attacks and cyber-attacks. We have put into place extensive security protocols, backup systems and alternative procedures to mitigate these risks. However, disruptions or breaches, detected or undetected by us, for any period of time in any portion of these systems could adversely affect our results of operations and financial condition and inflict reputational damage.

In addition, the provision of service to our customers and the operation of our networks and systems involve the storage and transmission of proprietary information and sensitive or confidential data, including personal information of customers, employees and others. Our information technology systems may be susceptible to computer viruses, attacks by computer hackers, malicious insiders, or catastrophic events. Hackers, acting individually or in coordinated groups, may also launch distributed denial of service attacks or ransom or other coordinated attacks that may cause service outages or other interruptions in our business and access to our data. In addition, breaches in security could expose us, our customers, or the individuals affected, to a risk of loss or misuse of proprietary information and sensitive or confidential data. The techniques used to obtain unauthorized access, disable or degrade service or sabotage systems change frequently, may be difficult to detect for a long time and often are not recognized until launched against a target. As a result, we may be unable to anticipate these techniques or to implement adequate preventative measures.

Any of these occurrences could result in disruptions in our operations, the loss of existing or potential customers, damage to our brand and reputation, and litigation and potential liability for the Company. In addition, the cost and operational consequences of implementing further data or system protection measures could be significant and our efforts to deter, identify, mitigate and/or eliminate any security breaches may not be successful.

A.M. Best financial strength ratings are crucial to our life insurance business.

In June 2018, A.M. Best affirmed the financial strength rating for Oxford and Christian Fidelity Life Insurance Company (“CFLIC”) of A- with a stable outlook and affirmed the financial strength rating for North American Insurance Company (“NAI”) of B++ with a stable outlook. Financial strength ratings are important external factors that can affect the success of Oxford’s business plans. Accordingly, if Oxford’s ratings, relative to its competitors, are not maintained or do not continue to improve, Oxford may not be able to retain and attract business as currently planned, which could adversely affect our results of operations and financial condition.

We may incur losses due to our reinsurers’ or counterparties’ failure to perform under existing contracts or we may be unable to secure sufficient reinsurance or hedging protection in the future.

We use reinsurance and derivative contracts to mitigate our risk of loss in various circumstances; primarily at Repwest and for Moving and Storage. These agreements do not release us from our primary obligations and therefore we remain ultimately responsible for these potential costs. We cannot provide assurance that these reinsurers or counterparties will fulfill their obligations. Their inability or unwillingness to make payments to us under the terms of the contracts may have a material adverse effect on our financial condition and results of operations.

At December 31, 2018, Repwest reported $2.3 million of reinsurance recoverables, net of allowances and $94.9 million of reserves and liabilities ceded to reinsurers. Of this, Repwest’s largest exposure to a single reinsurer was $60.6 million.

Recent changes to U.S. tax laws may adversely affect our financial condition or results of operations and create the risk that we may need to adjust our accounting for these changes.

The Tax Cuts and Jobs Act (“Tax Reform Act”) made significant changes to U.S. tax laws and includes numerous provisions that affect businesses, including ours. For instance, as a result of lower corporate tax rates, the Tax Reform Act tends to reduce both the value of deferred tax assets and the amount of deferred tax liabilities. It also limits interest expense deductions and the amount of net operating losses that can be used each year and alters the expensing of capital expenditures. Other provisions have international tax consequences for businesses like ours that operate internationally. The Tax Reform Act is unclear in certain respects and will require interpretations and implementing regulations by the IRS, as well as state tax authorities, and the Tax Reform Act could be subject to amendments and technical corrections, any of which could lessen or increase the adverse (and positive) impacts of the Tax Reform Act. The accounting treatment of these tax law changes was complex, and some of the changes affected both current and future periods. Others primarily affected future periods. As discussed elsewhere in this Annual Report, our analysis and computations of the tax effects of the Tax Reform Act on us was complete as of December 22, 2018.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Company, through its legal subsidiaries, owns property, plant and equipment that are utilized in the manufacturing, repair and rental of U-Haul® equipment and storage space, as well as providing office space for us. Such facilities exist throughout the United States and Canada. We also manage storage facilities owned by others. We operate 1,981 U-Haul® retail centers of which 488 U-Haul branded locations are managed for subsidiaries of WGHLP and Mercury, and 11 manufacturing and assembly facilities. We also operate over 141 fixed-site repair facilities located throughout the United States and Canada. These facilities are used primarily for the benefit of Moving and Storage.

Item 3. Legal Proceedings

Litigation

On July 1, 2014, a 100-pound propane cylinder exploded while in use on a food truck in Philadelphia, Pennsylvania. The explosion killed two people and injured eleven. Following the incident, the injured parties and their estates filed a number of lawsuits in the Philadelphia Court of Common Pleas against U-Haul and its subsidiary, U-Haul Co. of Pennsylvania (“UHPA”), alleging that UHPA improperly filled propane cylinders that were overdue for periodic requalification and offered such cylinders for transportation, which allegedly caused the deaths and injuries. One plaintiff also sued AMERCO. All U-Haul defendants denied the allegations. The parties reached agreements to settle the civil cases by April 2018. We have paid a total of $27.9 million, representing our self-insured retention and attorney’s fees for all related civil matters.

In June 2018, following the resolution of the civil claims, the United States Attorney's Office for the Eastern District of Pennsylvania filed an initial 6-count indictment and a superseding 7-count indictment against UHPA. In January 2019, the U.S. Attorney's Office agreed to dismiss Counts 1 through 5 alleging UHPA improperly filled propane cylinders that were overdue for periodic requalification and offering such cylinders for transportation. UHPA entered a guilty plea with respect to Counts 6 and 7 relating to a failure to properly train UHPA employees dispensing propane and documentation thereof. On May 7, 2019, the United States District Court for the Eastern District of Pennsylvania accepted the plea agreement and imposed a $1 million fine and two years of probation on UHPA. UHPA was also ordered to pay $800 in associated court fees.

Compliance with environmental requirements of federal, state and local governments may significantly affect Real Estate’s business operations. Among other things, these requirements regulate the discharge of materials into the air, land and water and govern the use and disposal of hazardous substances. Real Estate is aware of issues regarding hazardous substances on some of its properties. Real Estate regularly makes capital and operating expenditures to stay in compliance with environmental laws and has put in place a remedial plan at each site where it believes such a plan is necessary. Since 1988, Real Estate has managed a testing and removal program for underground storage tanks.

Based upon the information currently available to Real Estate, compliance with the environmental laws and its share of the costs of investigation and cleanup of known hazardous waste sites are not expected to result in a material adverse effect on AMERCO’s financial position or results of operations.

Other

We are named as a defendant in various other litigations and claims arising out of the normal course of business. In management’s opinion, none of these other matters will have a material effect on our financial position and results of operations.

Item 4. Mine Safety Disclosure

Not applicable.

Part ii

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

As of May 9, 2019, there were approximately 2,800 holders of record of our common stock. We derived the number of our stockholders using internal stock ledgers and utilizing Mellon Investor Services Stockholder listings. AMERCO’s common stock is listed on the NASDAQ Global Select Market under the trading symbol “UHAL”.

Dividends

AMERCO® does not have a formal dividend policy. The Board periodically considers the advisability of declaring and paying dividends to common stockholders in light of existing circumstances.

The following table lists the dividends that have been declared and issued since July 2017.

|

Declared Date |

|

Per Share Amount |

|

Record Date |

|

Dividend Date |

|

|

|

|

|

|

|

|

|

March 6, 2019 |

$ |

0.50 |

|

March 21, 2019 |

|

April 4, 2019 |

|

December 5, 2018 |

|

0.50 |

|

December 20, 2018 |

|

January 7, 2019 |

|

August 23, 2018 |

|

0.50 |

|

September 10, 2018 |

|

September 24, 2018 |

|

June 6, 2018 |

|

0.50 |

|

June 21, 2018 |

|

July 5, 2018 |

|

March 8, 2018 |

|

0.50 |

|

March 23, 2018 |

|

April 6, 2018 |

|

December 6, 2017 |

|

0.50 |

|

December 21, 2017 |

|

January 5, 2018 |

|

July 5, 2017 |

|

1.00 |

|

July 20, 2017 |

|

August 3, 2017 |

See Note 20, Statutory Financial Information of Insurance Subsidiaries, of the Notes to Consolidated Financial Statements for a discussion of certain statutory restrictions on the ability of the insurance subsidiaries to pay dividends to AMERCO.

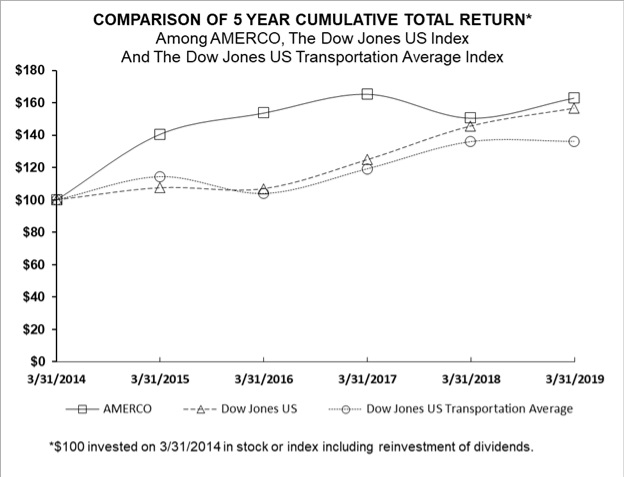

The following graph compares the cumulative total stockholder return on the Company’s common stock for the period March 31, 2014 through March 31, 2019 with the cumulative total return on the Dow Jones US Total Market and the Dow Jones US Transportation Average. The comparison assumes that $100 was invested on March 31, 2014 in the Company’s common stock and in each of the comparison indices. The graph reflects the value of the investment based on the closing price of the common stock trading on NASDAQ on March 31, 2015, 2016, 2017, 2018 and 2019.

|

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERCO |

$ |

100 |

$ |

141 |

$ |

154 |

$ |

165 |

$ |

151 |

$ |

163 |

|

Dow Jones US Total Market |

|

100 |

|

108 |

|

107 |

|

125 |

|

146 |

|

157 |

|

Dow Jones US Transportation Average |

|

100 |

|

114 |

|

104 |

|

119 |

|

136 |

|

136 |

Item 6.Selected Financial Data

The following selected financial data should be read in conjunction with the MD&A, and the Consolidated Financial Statements and related notes in this Annual Report.

Listed below is selected financial data for AMERCO and consolidated subsidiaries for each of the last five years:

|

|

Years Ended March 31, |

|||||||||

|

|

|

2019 |

|

2018 |

|

2017 |

|

2016 |

|

2015 |

|

|

|

(In thousands, except share and per share data) |

||||||||

|

Summary of Operations: |

|

|

|

|

|

|

|

|

|

|

|

Self-moving equipment rentals |

$ |

2,653,497 |

$ |

2,479,742 |

$ |

2,362,833 |

$ |

2,297,980 |

$ |

2,146,391 |

|

Self-storage revenues |

|

367,276 |

|

323,903 |

|

286,886 |

|

247,944 |

|

211,136 |

|

Self-moving and self-storage products and service sales |

|

264,146 |

|

261,557 |

|

253,073 |

|

251,541 |

|

244,177 |

|

Property management fees |

|

29,148 |

|

29,602 |

|

29,075 |

|

26,533 |

|

25,341 |

|

Life insurance premiums |

|

63,488 |

|

154,703 |

|

163,579 |

|

162,662 |

|

156,103 |

|

Property and casualty insurance premiums |

|

60,853 |

|

57,100 |

|

52,334 |

|

50,020 |

|

46,456 |

|

Net investment and interest income |

|

110,934 |

|

110,473 |

|

102,276 |

|

86,617 |

|

84,728 |

|

Other revenue |

|

219,365 |

|

184,034 |

|

171,711 |

|

152,171 |

|

160,199 |

|

Total revenues |

|

3,768,707 |

|

3,601,114 |

|

3,421,767 |

|

3,275,468 |

|

3,074,531 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

1,981,180 |

|

1,807,056 |

|

1,567,181 |

|

1,469,260 |

|

1,478,675 |

|

Commission expenses |

|

288,408 |

|

276,705 |

|

267,230 |

|

262,627 |

|

249,642 |

|

Cost of sales |

|

162,142 |

|

160,489 |

|

152,485 |

|

144,990 |

|

146,072 |

|

Benefits and losses |

|

100,277 |

|

185,311 |

|

182,710 |

|

167,436 |

|

158,760 |

|

Amortization of deferred policy acquisition costs |

|

28,556 |

|

24,514 |

|

26,218 |

|

23,272 |

|

19,661 |

|

Lease expense |

|

33,158 |

|

33,960 |

|

37,343 |

|

49,780 |

|

79,798 |

|

Depreciation, net gains on disposals (a) |

|

554,043 |

|

543,247 |

|

449,025 |

|

291,235 |

|

279,107 |

|

Net gains on disposal of real estate |

|

(44) |

|

(195,414) |

|

(3,590) |

|

(545) |

|

(942) |

|

Total costs and expenses |

|

3,147,720 |

|

2,835,868 |

|

2,678,602 |

|

2,408,055 |

|

2,410,773 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from operations |

|

620,987 |

|

765,246 |

|

743,165 |

|

867,413 |

|

663,758 |

|

Other components of net periodic benefit costs |

|

(1,013) |

|

(927) |

|

(902) |

|

(787) |

|

(734) |

|

Interest expense |

|

(142,445) |

|

(126,706) |

|

(113,406) |

|

(97,715) |

|

(97,525) |

|

Fees and amortization on early extinguishment of debt |

|

– |

|

– |

|

(499) |

|

– |

|

(4,081) |

|

Pretax earnings |

|

477,529 |

|

637,613 |

|

628,358 |

|

768,911 |

|

561,418 |

|

Income tax benefit (expense) |

|

(106,672) |

|

152,970 |

|

(229,934) |

|

(279,910) |

|

(204,677) |

|

Earnings available to common shareholders |

$ |

370,857 |

$ |

790,583 |

$ |

398,424 |

$ |

489,001 |

$ |

356,741 |

|

Basic and diluted earnings per common share |

$ |

18.93 |

$ |

40.36 |

$ |

20.34 |

$ |

24.95 |

$ |

18.21 |

|

Weighted average common shares outstanding: Basic and diluted |

|

19,592,048 |

|

19,588,889 |

|

19,586,606 |

|

19,596,110 |

|

19,586,633 |

|

Cash dividends declared and accrued Common stock |

|

39,180 |

|

39,175 |

|

39,171 |

|

97,960 |

|

19,594 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

$ |

7,933,971 |

$ |

6,816,741 |

$ |

5,957,735 |

$ |

5,017,511 |

$ |

4,107,637 |

|

Total assets |

|

11,891,713 |

|

10,747,422 |

|

9,405,840 |

|

8,109,288 |

|

6,855,600 |

|

Notes, loans and leases payable, net |

|

4,163,323 |

|

3,513,076 |

|

3,262,880 |

|

2,647,396 |

|

2,174,294 |

|

Stockholders' equity |

|

3,692,389 |

|

3,408,708 |

|

2,619,744 |

|

2,251,406 |

|

1,884,359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Net gains were ($27.0) million, ($11.8) million, ($32.5) million, ($98.2) million and ($73.7) million for fiscal 2019, 2018, 2017, 2016 and 2015, respectively. |

||||||||||

Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations

We begin this MD&A with the overall strategy of AMERCO, followed by a description of, and strategy related to, our operating segments to give the reader an overview of the goals of our businesses and the direction in which our businesses and products are moving. We then discuss our critical accounting policies and estimates that we believe are important to understanding the assumptions and judgments incorporated in our reported financial results. Next, we discuss our results of operations for fiscal 2019 compared with fiscal 2018, and for fiscal 2018 compared with fiscal 2017, which are followed by an analysis of liquidity changes in our balance sheets and cash flows, and a discussion of our financial commitments in the sections entitled Liquidity and Capital Resources and Disclosures about Contractual Obligations and Commercial Commitments. We conclude this MD&A by discussing our outlook for fiscal 2020.

This MD&A should be read in conjunction with the other sections of this Annual Report, including Item 1: Business, Item 6: Selected Financial Data and Item 8: Financial Statements and Supplementary Data. The various sections of this MD&A contain a number of forward-looking statements, as discussed under the caption, Cautionary Statements Regarding Forward-Looking Statements, all of which are based on our current expectations and could be affected by the uncertainties and risk factors described throughout this Annual Report and particularly under the section Item 1A: Risk Factors. Our actual results may differ materially from these forward-looking statements.

AMERCO has a fiscal year that ends on the 31st of March for each year that is referenced. Our insurance company subsidiaries have fiscal years that end on the 31st of December for each year that is referenced. They have been consolidated on that basis. Our insurance companies’ financial reporting processes conform to calendar year reporting as required by state insurance departments. Management believes that consolidating their calendar year into our fiscal year financial statements does not materially affect the presentation of financial position or results of operations. We disclose all material events, if any, occurring during the intervening period. Consequently, all references to our insurance subsidiaries’ years 2018, 2017 and 2016 correspond to fiscal 2019, 2018 and 2017 for AMERCO.

Overall Strategy

Our overall strategy is to maintain our leadership position in the North American “do-it-yourself” moving and storage industry. We accomplish this by providing a seamless and integrated supply chain to the “do-it-yourself” moving and storage market. As part of executing this strategy, we leverage the brand recognition of U-Haul with our full line of moving and self-storage related products and services and the convenience of our broad geographic presence.

Our primary focus is to provide our customers with a wide selection of moving rental equipment, convenient self-storage rental facilities and portable moving and storage units and related moving and self-storage products and services. We are able to expand our distribution and improve customer service by increasing the amount of moving equipment and storage units and portable moving and storage units available for rent, expanding the number of independent dealers in our network and expanding and taking advantage of our eMove capabilities.

Property and Casualty Insurance is focused on providing and administering property and casualty insurance to U-Haul and its customers, its independent dealers and affiliates.

Life Insurance is focused on long-term capital growth through direct writing and reinsuring of life, Medicare supplement and annuity products in the senior marketplace.

Description of Operating Segments

AMERCO’s three reportable segments are:

- Moving and Storage, comprised of AMERCO, U-Haul, and Real Estate and the subsidiaries of U-Haul and Real Estate;

- Property and Casualty Insurance, comprised of Repwest and its subsidiaries and ARCOA; and

- Life Insurance, comprised of Oxford and its subsidiaries.

See Note 1, Basis of Presentation, Note 21, Financial Information by Geographic Area, and Note 21A, Consolidating Financial Information by Industry Segment, of the Notes to Consolidated Financial Statements included in Item 8: Financial Statements and Supplementary Data, of this Annual Report.

Moving and Storage Operating Segment

Moving and Storage consists of the rental of trucks, trailers, portable moving and storage units, specialty rental items and self-storage spaces primarily to the household mover as well as sales of moving supplies, towing accessories and propane. Operations are conducted under the registered trade name U-Haul® throughout the United States and Canada.

With respect to our truck, trailer, specialty rental items and self-storage rental business, we are focused on expanding our dealer network, which provides added convenience for our customers and expanding the selection and availability of rental equipment to satisfy the needs of our customers.

U-Haul® brand self-moving related products and services, such as boxes, pads and tape allow our customers to, among other things, protect their belongings from potential damage during the moving process. We are committed to providing a complete line of products selected with the “do-it-yourself” moving and storage customer in mind.

uhaul.com® is an online marketplace that connects consumers to our operations as well as independent Moving Help® service providers and thousands of independent Self-Storage Affiliates. Our network of customer-rated affiliates and service providers furnish pack and load help, cleaning help, self-storage and similar services throughout the United States and Canada. Our goal is to further utilize our web-based technology platform to increase service to consumers and businesses in the moving and storage market.

Since 1945, U-Haul has incorporated sustainable practices into its everyday operations. We believe that our basic business premise of equipment sharing helps reduce greenhouse gas emissions and reduces the inventory of total large capacity vehicles. We continue to look for ways to reduce waste within our business and are dedicated to manufacturing reusable components and recyclable products. We believe that our commitment to sustainability, through our products and services and everyday operations has helped us to reduce our impact on the environment.

Property and Casualty Insurance Operating Segment

Property and Casualty Insurance provides loss adjusting and claims handling for U-Haul through regional offices in the United States and Canada. Property and Casualty Insurance also underwrites components of the Safemove®, Safetow®, Safemove Plus®, Safestor® and Safestor Mobile® protection packages to U-Haul® customers. We continue to focus on increasing the penetration of these products into the moving and storage market. The business plan for Property and Casualty Insurance includes offering property and casualty products in other U-Haul® related programs.

Life Insurance Operating Segment

Life Insurance provides life and health insurance products primarily to the senior market through the direct writing and reinsuring of life insurance, Medicare supplement and annuity policies.

Critical Accounting Policies and Estimates

Our financial statements have been prepared in accordance with the generally accepted accounting principles (“GAAP”) in the United States. The methods, estimates and judgments we use in applying our accounting policies can have a significant impact on the results we report in our financial statements. Note 3, Accounting Policies, of the Notes to Consolidated Financial Statements in Item 8: Financial Statements and Supplementary Data, in this Annual Report summarizes the significant accounting policies and methods used in the preparation of our consolidated financial statements and related disclosures. Certain accounting policies require us to make difficult and subjective judgments and assumptions, often as a result of the need to estimate matters that are inherently uncertain.

Following is a detailed description of the accounting policies that we deem most critical to us and that require management’s most difficult and subjective judgments. These estimates are based on historical experience, observance of trends in particular areas, information and valuations available from outside sources and on various other assumptions that are believed to be reasonable under the circumstances and which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual amounts may differ from these estimates under different assumptions and conditions, and such differences may be material.

We also have other policies that we consider key accounting policies, such as revenue recognition; however, these policies do not meet the definition of critical accounting estimates, because they do not generally require us to make estimates or judgments that are difficult or subjective. The accounting policies that we deem most critical to us, and involve the most difficult, subjective or complex judgments include the following: