Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-6747

THE GORMAN-RUPP COMPANY

(Exact name of Registrant as specified in its charter)

| Ohio | 34-0253990 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 600 South Airport Road, Mansfield, Ohio | 44903 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (419) 755-1011

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Shares, without par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in the definitive proxy statement or information statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☒ | Non-accelerated filer ☐ | Smaller reporting company ☐ | |||

| Emerging growth company ☐ |

(Do not check if smaller reporting company)

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of The Gorman-Rupp Company Common Shares held by non-affiliates and based on the closing sales price as of June 30, 2017 was approximately $450,494,000.

On January 31, 2018, there were 26,106,623 shares of The Gorman-Rupp Company Common Shares, without par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Notice of 2018 Annual Meeting of Shareholders and related Proxy Statement are incorporated by reference into Part III (Items 10-14).

Table of Contents

The Gorman-Rupp Company and Subsidiaries

Annual Report on Form 10-K

For the Year Ended December 31, 2017

i

Table of Contents

PART I

Safe Harbor Statement

In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, The Gorman-Rupp Company provides the following cautionary statement: This Annual Report on Form 10-K contains various forward-looking statements based on assumptions concerning The Gorman-Rupp Company’s operations, future results and prospects. These forward-looking statements are based on current expectations about important economic, political, and technological factors, among others, and are subject to risks and uncertainties, which could cause the actual results or events to differ materially from those set forth in or implied by the forward-looking statements and related assumptions.

Such factors include, but are not limited to: (1) continuation of the current and projected future business environment; (2) highly competitive markets; (3) availability of raw materials; (4) loss of key management; (5) cyber security threats; (6) acquisition performance and integration; (7) compliance with, and costs related to, a variety of import and export laws and regulations; (8) environmental compliance costs and liabilities; (9) exposure to fluctuations in foreign currency exchange rates; (10) conditions in foreign countries in which The Gorman-Rupp Company conducts business; (11) changes in our tax rates and exposure to additional income tax liabilities; (12) impairment in the value of intangible assets, including goodwill; (13) defined benefit pension plan settlement expense; (14) family ownership of common equity; and (15) risks described from time to time in our reports filed with the Securities and Exchange Commission. Except to the extent required by law, we do not undertake and specifically decline any obligation to review or update any forward-looking statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments or otherwise.

| ITEM 1. | BUSINESS |

The Gorman-Rupp Company (“Registrant”, “Gorman-Rupp” or the “Company”) was incorporated in Ohio in 1934. The Company designs, manufactures and globally sells pumps and pump systems for use in water, wastewater, construction, dewatering, industrial, petroleum, original equipment, agriculture, fire protection, heating, ventilating and air conditioning (“HVAC”), military and other liquid-handling applications.

PRODUCTS

The Company operates in one business segment, the manufacture and sale of pumps and pump systems. The following table sets forth, for the years 2015 through 2017, the total net sales, income before income taxes and year-end total assets of the Company.

| (in thousands) | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| Net sales |

$ | 379,389 | $ | 382,071 | $ | 406,150 | ||||||

| Income before taxes |

39,378 | 36,482 | 37,266 | |||||||||

| Total assets |

395,015 | 382,818 | 364,201 | |||||||||

The Company’s product line consists of pump models ranging in size from 1/4” to nearly 15 feet and ranging in rated capacity from less than one gallon per minute to nearly one million gallons per minute. The types of pumps which the Company produces include self-priming centrifugal, standard centrifugal, magnetic drive centrifugal, axial and mixed flow, vertical turbine line shaft, submersible, high pressure booster, rotary gear, diaphragm, bellows and oscillating.

The pumps have drives that range from 1/35 horsepower electric motors up to much larger electric motors or internal combustion engines capable of producing several thousand horsepower. Many of the larger units comprise encased, fully integrated water and wastewater pumping stations. In certain cases, units are designed for the inclusion of customer-supplied drives.

1

Table of Contents

The Company’s larger pumps are sold principally for use in the construction, industrial, water and wastewater handling fields; for flood control; for boosting low residential water pressure; for pumping refined petroleum products, including the ground refueling of aircraft; for fluid control in HVAC applications; and for various agricultural purposes.

The Company’s pumps are also utilized for dewatering purposes. Additionally, pumps manufactured for fire protection are used for sprinkler back-up systems, fire hydrants, stand pipes, fog systems and deluge systems at hotels, banks, factories, airports, schools, public buildings and hundreds of other types of facilities throughout the world.

Many of the Company’s smallest pumps are sold to customers for incorporation into such products as food processing, chemical processing, photo processing, medical and other waste treatment, HVAC equipment, appliances and solar heating.

MARKETING

The Company’s pumps are marketed in the United States and worldwide through a broad network of distributors, through manufacturers’ representatives (for sales to many original equipment manufacturers), through third-party distributor catalogs, direct sales, and by ecommerce. The Company regularly seeks alliances with distributors and other partners to further enhance marketing opportunities. Export sales are made primarily through foreign distributors and representatives. The Company has long-standing relationships with many of the leading independent distributors in the markets it serves and provides specialized training programs to distributors on a regular basis.

During 2017, 2016 and 2015, there were no shipments to any single customer that exceeded 10% of total net sales. Gorman-Rupp continued to actively pursue international business opportunities and, in 2017, shipped its pumps to approximately 150 countries around the world. No sales made to customers in any one foreign country amounted to more than 5% of total net sales for 2017, 2016 or 2015.

Approximately $137.6 million of 2017 sales were shipped outside the United States, as compared to $131.2 million in 2016 and $136.5 million in 2015. International sales represented 36% of total net sales in year 2017 and 34% of total net sales in each of the years 2016 and 2015. See Note 9 to the Consolidated Financial Statements, Business Segment Information. The Company continued its efforts to penetrate international markets principally by its increased global investments and its focus on meeting the world’s water and wastewater pumping needs.

COMPETITION

The pump industry is highly fragmented and therefore Gorman-Rupp competes with a large number of businesses. Numerous pump competitors exist as subsidiaries, divisions or departments within significantly larger corporations. Foreign-sourced pumps have also increasingly penetrated into most of the Company’s domestic markets.

Most commercial and industrial pumps are specifically designed and engineered for a particular customer’s application. The Company believes that proper application, product performance, and quality of delivery and service are its principal methods of competition, and attributes its success to its continued emphasis in these areas. In the sale of products and services, the Company benefits from its large installed base, which requires replacement parts due to the critical application and nature of the products and the conditions under which they operate.

PURCHASING AND PRODUCTION

Substantially all of the materials, supplies, components and accessories used by the Company in the fabrication of its products, including all castings (for which most patterns are made and owned by the Company),

2

Table of Contents

structural steel, bar stock, motors, solenoids, engines, seals, and plastic and elastomeric components are purchased by the Company from other suppliers and manufacturers. No purchases are made under long-term contracts and the Company is not dependent upon a single source for any materials, supplies, components or accessories which are of material importance to its business.

The Company purchases motor components for its large submersible pumps, and motors and engines for its pump systems, from a limited number of suppliers, while motors for its polypropylene bellows pumps and magnetic drive pumps are purchased from several alternative vendors. Products requiring small motors are also sourced from alternative suppliers.

The other production operations of the Company consist of the machining of castings, the cutting, shaping and welding of bar stock and structural members, the design and assembly of electrical control panels, the manufacture of some small motors and a few minor components, and the assembling, painting and testing of its products. Substantially all of the Company’s products are tested prior to shipment.

OTHER ASPECTS

As of December 31, 2017, the Company employed approximately 1,165 persons, of whom approximately 660 were hourly employees. The Company has no collective bargaining agreements, has never experienced a work stoppage and considers its labor relations to be satisfactory.

Although the Company owns a number of patents, and several of them are important to its business, Gorman-Rupp believes that the business of the Company is not materially dependent upon any one or more patents. The Company’s patents, trademarks and other intellectual property are adequate for its business purposes.

The backlog of orders at December 31, 2017 was $114.0 million compared to $98.8 million at December 31, 2016, an increase of 15.4%. Approximately 95% of the Company’s backlog of unfilled orders is scheduled to be shipped during 2018, with the remainder principally during the first half of 2019. The increase in backlog from 2016 is due primarily to an improvement in overall business conditions with notable increases in the fire protection, municipal and construction markets.

AVAILABLE INFORMATION

The Company maintains a website accessible through its internet address of www.gormanrupp.com. Gorman-Rupp makes available free of charge on or through www.gormanrupp.com its Annual Report to Shareholders, its annual reports on Form 10-K, its quarterly reports on Form 10-Q, and its current reports on Form 8-K, and any amendments to those reports, as soon as reasonably practicable after those reports (and any amendments) are electronically filed with or furnished to the Securities and Exchange Commission (“Commission”). However, the information contained on the Company’s website is not a part of this Form 10-K or any other report filed with or furnished to the Commission.

A paper copy of the Company’s Form 10-K is also available free of charge upon written request to the Company’s Corporate Secretary.

| ITEM 1A. | RISK FACTORS |

Gorman-Rupp’s business and financial performance are subject to various risks and uncertainties, some of which are beyond its control. In addition to the risks discussed elsewhere in this Form 10-K, the following risks and uncertainties could materially adversely affect the Company’s business, prospects, financial condition, results of operations, liquidity and access to capital markets. These risks could cause the Company’s actual results to differ materially from its historical experience and from expected results discussed in forward-looking statements made by the Company related to conditions or events that it anticipates may occur in the future.

3

Table of Contents

Continuation of current and projected future business environment

The overall pump industry is cyclical in nature, and some of its business activity is related to general business conditions in the durable goods and capital equipment markets. Demand for most of the Company’s products and services is affected by the level of new capital investment and planned maintenance expenditures by its customers. The level of such investment and expenditures by our customers depends, in turn, on factors such as general economic conditions, availability of credit, economic conditions within their respective industries and expectations of future market behavior. Volatility in prices of commodities such as oil and agricultural products can negatively affect the levels of investment and expenditures of certain customers and result in postponement of capital spending decisions or the delay or cancellation of existing orders which may negatively impact the Company’s sales.

Highly competitive markets

Gorman-Rupp sells products in highly competitive markets. Maintaining and improving the Company’s competitive position requires periodic investment in manufacturing, engineering, quality standards, marketing, customer service and support, and distribution networks. Even with such investment, the Company may not be successful in maintaining its competitive position. The Company’s competitors may develop products that are superior to its products, or may develop methods of more efficiently and effectively providing products and services, or may adapt more quickly to new technologies or evolving customer requirements. Pricing pressures may require the Company to adjust the prices of its products downward to stay competitive. The Company may not be able to compete successfully with its existing competitors or with new competitors. Failure to compete successfully could reduce the Company’s sales, operating margins and overall financial performance.

Availability of raw materials

The Company could be adversely affected by raw material price volatility and any inability of suppliers to meet quality and delivery requirements. Additionally, raw material and energy expenses are substantive drivers of costs in the manufacture of pumps and changes in these costs are often unpredictable. The Company may not be able to pass along any increased material costs to customers for competitive or other reasons. While the Company manufactures certain parts and components used in its products, the Company’s business requires substantial amounts of raw materials, parts and components that are purchased from suppliers. The availability and prices of raw materials, parts and components may be subject to curtailment or change due to, among other things, suppliers’ allocations to other purchasers, interruptions in production by suppliers, changes in exchange rates and prevailing price levels. Any change in the availability of, or increases in the price for, these raw materials, parts and components could materially affect our business, financial condition, results of operations or cash flows.

Loss of key management

The Company’s success depends to a significant extent on the continued service of its executive management team and the ability to recruit, hire and retain other key management personnel to support the Company’s growth and operational initiatives and replace executives who retire or resign. Failure to retain key management and attract and retain other highly-skilled personnel could limit the Company’s global growth and operational initiatives, or may result in inefficient and ineffective management and operations, which could harm the Company’s revenues, operations and product development efforts and could eventually result in a decrease in profitability.

Cyber security threats

Increased global information technology security threats and more sophisticated and targeted computer crime pose a risk to the security of Gorman-Rupp’s systems and networks and to the confidentiality, availability, and

4

Table of Contents

integrity of its data. While the Company attempts to mitigate these risks by employing a number of measures, including employee training, comprehensive monitoring of its networks and systems, and the deployment of backup and protective systems, the Company’s systems, networks, proprietary information, products, solutions and services remain potentially vulnerable to advanced persistent threats. Depending on their nature and scope, such threats could potentially lead to damages or destruction including, but not limited to, the compromising of confidential information relating to customer, supplier, or employee data, improper use of the Company’s systems and networks, manipulation and destruction of data, defective products, production downtimes and operational disruptions which, in turn, could adversely affect Gorman-Rupp’s reputation, competitiveness, and results of operations.

Acquisition performance and integration

The Company’s historical growth has depended, and its future growth is likely to continue to depend, in part on its acquisition strategy and the successful integration of acquired businesses into existing operations. The Company intends to continue to seek additional acquisition opportunities that have the potential to support and strengthen its operations. The Company cannot assure it will be able to successfully identify suitable acquisition opportunities, prevail against competing potential acquirers, negotiate appropriate acquisition terms, obtain financing that may be needed to consummate such acquisitions, complete proposed acquisitions, successfully integrate acquired businesses into existing operations or expand into new markets. In addition, the Company cannot assure that any acquisition, once successfully integrated, will perform as planned, be accretive to earnings, or prove to be beneficial to the Company’s operations and cash flows.

Compliance with, and costs related to, a variety of import and export laws and regulations

The Company is subject to a variety of laws regarding international operations, including regulations issued by the U.S. Department of Commerce Bureau of Industry and Security and various foreign governmental agencies. Actual or alleged violations of import-export laws could result in enforcement actions and financial penalties. The Company cannot predict the nature, scope or effect of future regulatory requirements to which our international operations and trading practices might be subject or the manner in which existing laws might be administered or interpreted. Future regulations could limit the countries in which certain of our products may be manufactured or sold or could restrict our access to, and increase the cost of obtaining, products from foreign sources.

Environmental compliance costs and liabilities

The Company’s operations and properties are subject to various, and increasingly numerous, domestic and foreign environmental laws and regulations which can impose operating and financial sanctions for violations. Moreover, environmental and sustainability initiatives, practices, rules and regulations are under increasing scrutiny of both governmental and non-governmental bodies and may require changes in operational practices, standards and expectations and, in turn, increase the Company’s compliance costs. Periodically, the Company has incurred, and expects to continue to incur, operating and capital costs to comply with environmental requirements. The Company monitors its environmental responsibilities, together with trends in the related laws, and believes it is in substantial compliance with current regulations. If the Company is required to incur increased compliance costs or violates environmental laws or regulations, future environmental compliance expenditures or liabilities could have a material adverse effect on our financial condition, results of operations or cash flows.

Exposure to fluctuations in foreign currency exchange rates

The Company is exposed to fluctuations in foreign currency exchange rates, particularly with respect to the Euro, Canadian Dollar, South African Rand and the British Pound. Any significant change in the value of these currencies could affect the Company’s ability to sell products competitively and control its cost structure, which could have a material effect on its financial condition, results of operations or cash flows.

5

Table of Contents

Conditions in foreign countries in which the Company conducts business

In 2017, 36% of the Company’s sales were to customers outside the United States. The Company expects its international and export sales to continue to be a significant portion of its revenue and it has placed a particular emphasis on increasing its growth and presence internationally. The Company’s sales from international operations and export sales are subject, in varying degrees, to risks inherent to doing business outside the United States. These risks include the following, some of which are further addressed in our other Risk Factors:

| • | Possibility of unfavorable circumstances arising from host country laws or regulations; |

| • | Currency exchange rate fluctuations and restrictions on currency repatriation; |

| • | Potential negative consequences from changes to taxation policies; |

| • | Disruption of operations from labor and political disturbances; |

| • | Changes in tariff and trade barriers and import and export licensing requirements; |

| • | Increased costs and risks of developing, staffing and simultaneously managing a number of global operations as a result of distance as well as language and cultural differences; and |

| • | Insurrections, armed conflicts, terrorism or war. |

Any of these events could have an adverse impact on the Company’s business and operations.

Changes in our tax rates and exposure to additional income tax liabilities

Our future effective income tax rates could be unfavorably affected by various factors, including changes in the tax rates as well as rules and regulations in jurisdictions in which we generate income. During the fourth quarter of 2017 the Company recorded, on a provisional basis, the transitional impact of the U.S. Tax Cuts and Jobs Act (“Tax Act”) that was enacted on December 22, 2017. Given the significant complexity of the Tax Act, and potential future guidance from the U.S. Treasury, the Securities and Exchange Commission and the Financial Accounting Standards Board, these estimates may be adjusted in 2018. In addition, the amount of income taxes we pay is subject to ongoing audits by U.S. federal, state and local tax authorities and by non-U.S. authorities. If these audits result in assessments different from amounts recorded, our future financial results may include unfavorable adjustments.

Impairment in the value of intangible assets, including goodwill

The Company’s total assets reflect goodwill from acquisitions, representing the excess cost over the fair value of the identifiable net assets acquired, including other indefinite-lived and finite-lived intangible assets. Goodwill and other indefinite-lived intangible assets are not amortized but are reviewed annually for impairment as of October 1 or whenever events or changes in circumstances indicate there may be a possible permanent loss of value using either a quantitative or qualitative analysis. Finite-lived assets are reviewed for impairment whenever events or changes in circumstances indicate the carrying amount may not be recovered through future net cash flows generated by the assets. If future operating performance at one or more of the Company’s reporting units were to fall significantly below forecast levels or if market conditions for one or more of its acquired businesses were to decline, the Company could be required to incur a non-cash charge to operating income for impairment. Any impairment in the value of these assets could have an adverse non-cash impact on the Company’s reported results of operations.

In 2017 and 2016, the Company recorded pre-tax non-cash goodwill and other intangible impairment charges of $4.1 million and $1.8 million, respectively, related to the Company’s Bayou City Pump Company reporting unit. There was no goodwill or other intangible impairment charges recorded in 2015. See Note 8 to the Consolidated Financial Statements, Goodwill and Other Intangible Assets.

6

Table of Contents

The Company’s annual impairment analysis concluded that the fair value of the Company’s National Pump Company reporting (“National”) unit exceeded its carrying value be approximately 7%. A sensitivity analysis was performed for the National reporting unit, assuming a hypothetical 50 basis point decrease in the expected long-term growth rate or a hypothetical 50 basis point increase in the weighted average cost of capital, and both scenarios independently yielded an estimated fair value for the National reporting unit slightly above carrying value. While the result of this test indicated that no impairment existed at National, if recently depressed U.S. agricultural conditions continue for an extended time, the agricultural market’s growth and profitability assumptions may reduce National’s indicated fair value in the future, which could result in an impairment charge. See Note 8 to the Consolidated Financial Statements, Goodwill and Other Intangible Assets.

Defined benefit pension plan settlement expense

The Company sponsors a defined benefit pension plan covering certain domestic employees and accrues amounts for funding of its obligations under the plan. The defined benefit pension plan allows eligible retiring employees to receive a lump-sum distribution for benefits earned in lieu of annual payments and most of the Company’s retirees historically have elected this option. Under applicable accounting rules, if the lump-sum distributions made for a plan year exceed an actuarially-determined threshold of the total of the service cost and interest cost for the plan year, the Company at such point would be required to recognize for that year’s results of operations settlement expense for the resulting unrecognized actuarial loss. The Company has been required to make such adjustments in some prior years, and, if such non-cash adjustments are necessary in future periods, they may negatively impact the Company’s operating results.

In 2017 and 2015, the Company recorded pre-tax non-cash pension settlement charges of $4.0 million and $3.8 million, respectively, driven by lump-sum distributions discussed above. There was no pension settlement charge recorded in 2016. See Note 7 to the Consolidated Financial Statements, Pensions and Other Postretirement Benefits.

Family ownership of common equity

A substantial percentage of the Company’s Common Shares is held by various members of the Gorman and Rupp families and their affiliates. These family holdings historically have not been frequently traded; therefore, the Common Shares, in part because of these circumstances, generally have a history of relatively low volume trading experiences on the NYSE.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

The Company’s corporate headquarters are located in Mansfield, Ohio. The production operations of the Company are conducted at several locations throughout the United States and other countries as set forth below. The Company is a lessee under a number of operating leases for certain real properties, none of which is material to its operations.

7

Table of Contents

The Company’s principal production operations are:

| United States |

||||

| Mansfield (two) and Bellville, Ohio |

Royersford, Pennsylvania (two) | Olive Branch, Mississippi | ||

| Toccoa, Georgia | Glendale, Arizona | Lubbock, Texas | ||

| Other Countries |

||||

| St. Thomas, Ontario, Canada |

County Westmeath, Ireland | Culemborg, The Netherlands* | ||

| Johannesburg, South Africa |

Namur, Belgium | |||

| * | Leased property |

The Company owns a facility in Dallas, Texas comprising a training center and warehouse. In addition, the Company leases a warehouse facility in Jebal Ali, Dubai.

Gorman-Rupp considers its plants, machinery and equipment to be well maintained, in good operating condition and adequate for the present uses and business requirements of the Company.

| ITEM 3. | LEGAL PROCEEDINGS |

For more than fifteen years, numerous business entities in the pump and fluid-handling industries, as well as a multitude of companies in many other industries, have been targeted in a series of lawsuits in several jurisdictions by various individuals seeking redress to claimed injury as a result of the entities’ alleged use of asbestos in their products. Since 2001, the Company and some of its subsidiaries have been involved in this mass-scaled litigation, typically as one of many co-defendants in a particular proceeding. The allegations in the lawsuits involving the Company and/or its subsidiaries have been vague, general and speculative. Most of these lawsuits have been dismissed without advancing beyond the early stage of discovery, some as a result of nominal monetary settlements recommended for payment by the Company’s insurers. The claims and related legal expenses generally have been covered by the Company’s insurance, subject to applicable deductibles and limitations. Accordingly, this series of lawsuits has not, cumulatively or individually, had a material adverse impact on the Company’s consolidated results of operations, liquidity or financial condition, nor is it expected to have any such impact in the future, based on the current knowledge of the Company.

In addition, the Company and/or its subsidiaries are parties in a small number of legal proceedings arising in the ordinary course of business. Management does not currently believe that these proceedings will materially impact the Company’s consolidated results of operations, liquidity or financial condition.

| ITEM 4. | MINE SAFETY DISCLOSURE |

Not applicable.

8

Table of Contents

EXECUTIVE OFFICERS OF THE REGISTRANT

The following table sets forth certain information with respect to the executive officers of the Company as of January 31, 2018:

| Name |

Age | Office | Date Elected to Executive Office Position | |||||

| James C. Gorman |

93 | Chairman | 1989 | |||||

| Jeffrey S. Gorman |

65 | President and Chief Executive Officer | 1998 | |||||

| James C. Kerr |

55 | Chief Financial Officer | 2017 | |||||

| Brigette A. Burnell |

42 | General Counsel and Corporate Secretary | 2014 | |||||

Mr. J. C. Gorman served as the Company’s President from 1964 until 1989, and as Chief Executive Officer from 1964 until 1996. He has served as a Director of the Company continuously since 1946.

Mr. J. S. Gorman was elected President and Chief Executive Officer effective May 1, 1998, after having served as Senior Vice President since 1996. Mr. J. S. Gorman also held the position of General Manager of the Mansfield Division from 1989 through 2005. He served as Assistant General Manager from 1986 to 1988; and he held the office of Corporate Secretary from 1982 to 1990. He has served as a Director of the Company continuously since 1989.

Mr. Kerr was elected Chief Financial Officer effective January 1, 2017 and previously served as Vice President of Finance from July 18, 2016 to December 31, 2016. Mr. Kerr previously served as both Executive Vice President and Chief Financial Officer from 2006 to 2015 and Vice President, Controller from 1998 to 2006 for Jo-Ann Stores.

Ms. Burnell was elected General Counsel effective May 1, 2015 and was elected Corporate Secretary effective May 1, 2014. Ms. Burnell previously served as Corporate Counsel effective May 1, 2014. Ms. Burnell joined the Company as Corporate Attorney on January 2, 2014. Ms. Burnell previously served as Corporate Counsel of Red Capital Group from 2011 to 2013 advising the company on legal matters in all areas of business, after having served as an Associate at Jones Day from 2002 to 2011.

Mr. J. S. Gorman is the son of Mr. J. C. Gorman. There are no other family relationships among any of the Executive Officers and Directors of the Company.

9

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

MARKET INFORMATION

The following tables set forth the high and low sale prices and dividends per share for the Company’s Common Shares as reported by the New York Stock Exchange (“NYSE”) for the periods indicated:

| Sales Price of Common Shares | Dividends Per Share |

|||||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||||||||||

| High | Low | High | Low | |||||||||||||||||||||

| First quarter |

$ | 33.44 | $ | 29.25 | $ | 27.92 | $ | 21.09 | $ | 0.115 | $ | 0.105 | ||||||||||||

| Second quarter |

31.66 | 23.55 | 31.73 | 24.68 | 0.115 | 0.105 | ||||||||||||||||||

| Third quarter |

33.29 | 25.06 | 29.59 | 25.14 | 0.115 | 0.105 | ||||||||||||||||||

| Fourth quarter |

33.50 | 29.48 | 34.45 | 22.30 | 0.125 | 0.115 | ||||||||||||||||||

The Company’s Common Stock is listed on the NYSE under the ticker symbol “GRC”. On May 16, 2017, the Company moved its stock exchange listing to the NYSE from the NYSE MKT. On February 1, 2018, there were approximately 7,600 shareholders, of which 1,600 were registered holders of Common Shares.

The Company currently expects to continue its exceptional history of paying regular quarterly dividends and increased annual dividends. However, any future dividends will be reviewed individually and declared by our Board of Directors at its discretion, dependent on our assessment of the Company’s financial condition and business outlook at the applicable time.

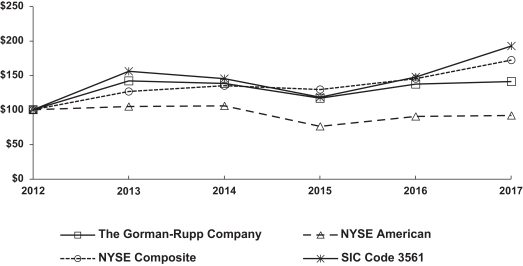

PERFORMANCE GRAPH

Set forth below is a line graph comparing the yearly percentage change in the cumulative total shareholder return, including reinvested cash dividends, on the Company’s common shares against the cumulative total return of each of the NYSE Composite and the NYSE American, as well as a peer group index for the period of five fiscal years commencing January 1, 2013 and ending December 31, 2017. The issuers in the peer group SIC Code Index were selected on a line-of-business basis by reference to SIC Code 3561— Pumps and Pumping Equipment. The SIC Code Index is composed of the following issuers: Ampco-Pittsburgh Corp., Colfax Corp., Flowserve Corp., The Gorman-Rupp Company, Graco Inc., Idex Corp., ITT Corp., and Xylem Inc. The graph assumes that the value of the investment in the Company’s Common Stock, in each index, and in the peer group (including reinvestment of dividends) was $100 on 12/31/2012 and tracks it through 12/31/2017.

10

Table of Contents

Comparison of 5-Year Cumulative Total Shareholder Return Among The Gorman-Rupp Company,

NYSE Composite Index, NYSE American Index and SIC Code 3561

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among The Gorman-Rupp Company, the NYSE American Index,

the NYSE Composite Index and SIC Code 3561

*$100 invested on 12/31/12 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||||||||||||||

| The Gorman-Rupp Company |

100.00 | 141.84 | 137.89 | 116.49 | 137.07 | 140.48 | ||||||||||||||||||

| NYSE American |

100.00 | 104.47 | 105.23 | 75.69 | 89.97 | 91.27 | ||||||||||||||||||

| NYSE Composite |

100.00 | 126.28 | 134.81 | 129.29 | 144.73 | 171.83 | ||||||||||||||||||

| SIC Code 3561 |

100.00 | 155.48 | 144.87 | 117.71 | 147.01 | 192.44 | ||||||||||||||||||

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

11

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

Five-Year Summary of Selected Financial Data

(Thousands of dollars, except per share amounts)

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Operating Results |

||||||||||||||||||||

| Net sales |

$379,389 | $382,071 | $406,150 | $434,925 | $391,665 | |||||||||||||||

| Gross profit |

98,745 | 92,025 | 92,580 | 107,559 | 93,655 | |||||||||||||||

| Income taxes |

12,823 | 11,599 | 12,157 | 17,593 | 14,173 | |||||||||||||||

| Net income |

26,555 | 24,883 | 25,109 | 36,141 | 30,104 | |||||||||||||||

| Depreciation and amortization |

15,053 | 15,529 | 15,282 | 14,615 | 13,588 | |||||||||||||||

| Interest expense |

17 | 20 | 122 | 134 | 146 | |||||||||||||||

| Return on net sales (%) |

7.0 | 6.5 | 6.2 | 8.3 | 7.7 | |||||||||||||||

| Sales dollars per employee |

327.9 | 313.2 | 318.5 | 340.6 | 315.6 | |||||||||||||||

| Income dollars per employee |

23.0 | 20.4 | 19.7 | 28.3 | 24.3 | |||||||||||||||

| Financial Position |

||||||||||||||||||||

| Current assets |

$227,934 | $203,900 | $189,391 | $200,709 | $189,289 | |||||||||||||||

| Current liabilities |

45,696 | 49,352 | 43,460 | 64,346 | 60,760 | |||||||||||||||

| Working capital |

182,238 | 154,548 | 145,931 | 136,363 | 128,529 | |||||||||||||||

| Current ratio |

5.0 | 4.1 | 4.4 | 3.1 | 3.1 | |||||||||||||||

| Property, plant and equipment, net |

$117,071 | $122,067 | $129,887 | $133,964 | $131,189 | |||||||||||||||

| Capital additions |

7,754 | 6,877 | 8,260 | 13,278 | 21,015 | |||||||||||||||

| Total assets |

395,015 | 382,818 | 364,201 | 380,904 | 355,638 | |||||||||||||||

| Equity |

325,495 | 302,888 | 287,021 | 281,967 | 264,140 | |||||||||||||||

| Dividends paid |

12,268 | 11,218 | 10,599 | 9,715 | 8,662 | |||||||||||||||

| Average number of employees |

1,157 | 1,220 | 1,275 | 1,277 | 1,241 | |||||||||||||||

| Shareholder Information |

||||||||||||||||||||

| Earnings per share |

$ 1.02 | $ 0.95 | $ 0.96 | $ 1.38 | $ 1.15 | |||||||||||||||

| Cash dividends per share |

0.470 | 0.430 | 0.405 | 0.370 | 0.330 | |||||||||||||||

| Equity per share at December 31 |

12.47 | 11.61 | 11.00 | 10.74 | 10.06 | |||||||||||||||

| Average number of shares outstanding |

26,100,865 | 26,087,721 | 26,192,072 | 26,256,824 | 26,249,324 | |||||||||||||||

Summary of Quarterly Results of Operations

(Thousands of dollars, except per share amounts)

| Quarter Ended 2017 | Net Sales | Gross Profit | Net Income | Earnings per Share |

||||||||||||

| First quarter |

$ 92,603 | $21,195 | $ 5,065 | $0.19 | ||||||||||||

| Second quarter |

97,872 | 26,145 | 7,848 | 0.30 | ||||||||||||

| Third quarter |

93,976 | 26,199 | 5,702 | 0.22 | ||||||||||||

| Fourth quarter |

94,938 | 25,206 | 7,940 | 0.31 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$379,389 | $98,745 | $26,555 | $1.02 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Quarter Ended 2016 | Net Sales | Gross Profit | Net Income | Earnings per Share |

||||||||||||

| First quarter |

$100,257 | $22,897 | $ 6,282 | $0.24 | ||||||||||||

| Second quarter |

96,265 | 23,240 | 6,620 | 0.25 | ||||||||||||

| Third quarter |

91,346 | 22,670 | 6,927 | 0.27 | ||||||||||||

| Fourth quarter |

94,203 | 23,218 | 5,054 | 0.19 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$382,071 | $92,025 | $24,883 | $0.95 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

12

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

(Amounts in tables in thousands of dollars)

Executive Overview

The following discussion of Results of Operations includes certain non-GAAP financial data, and measures such as adjusted earnings before interest, taxes, depreciation and amortization and adjusted earnings per share amounts which exclude non-cash pension settlement charges in 2017 and 2015 and non-cash impairment charges in 2017 and 2016 relating to goodwill and other intangible assets. Management utilizes these adjusted financial data and measures to assess comparative operations against those of prior periods without the distortion of non-comparable factors. The Gorman-Rupp Company believes that these non-GAAP financial data and measures will be useful to investors as well as to assess the continuing strength of the Company’s underlying operations from period to period. Provided below is a reconciliation of adjusted earnings per share amounts and adjusted earnings before interest, taxes, depreciation and amortization.

| 2017 | 2016 | 2015 | ||||||||||

| Adjusted earnings per share: |

||||||||||||

| Reported earnings per share – GAAP basis |

$1.02 | $0.95 | $0.96 | |||||||||

| Plus pension settlement charge |

0.10 | - | 0.10 | |||||||||

| Plus goodwill impairment and other intangible asset charges |

0.10 | 0.05 | - | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP adjusted earnings per share |

$1.22 | $1.00 | $1.06 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted earnings before interest, taxes, depreciation and amortization: |

||||||||||||

| Reported net income – GAAP basis |

$26,555 | $24,883 | $25,109 | |||||||||

| Plus interest |

17 | 20 | 122 | |||||||||

| Plus income taxes |

12,823 | 11,599 | 12,157 | |||||||||

| Plus depreciation and amortization |

15,053 | 15,529 | 15,282 | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP earnings before interest, taxes, depreciation and amortization |

54,448 | 52,031 | 52,670 | |||||||||

| Plus pension settlement charge |

4,031 | - | 3,783 | |||||||||

| Plus goodwill impairment and other intangible asset charges |

4,098 | 1,800 | - | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP adjusted earnings before interest, taxes, depreciation and amortization |

$62,577 | $53,831 | $56,453 | |||||||||

|

|

|

|

|

|

|

|||||||

The Gorman-Rupp Company is a leading designer, manufacturer and international marketer of pumps and pump systems for use in diverse water, wastewater, construction, dewatering, industrial, petroleum, original equipment, agriculture, fire protection, heating, ventilating and air conditioning (HVAC), military and other liquid-handling applications. The Company attributes its success to long-term product quality, applications and performance combined with timely delivery and service, and continually seeks to develop initiatives to improve performance in these key areas.

Gorman-Rupp actively pursues growth opportunities through organic growth, international business expansion and acquisitions.

We regularly invest in training for our employees, in new product development and in modern manufacturing equipment, technology and facilities all designed to increase production efficiency and capacity and drive growth by delivering innovative solutions to our customers. We believe that the diversity of our markets is a major contributor to the generally stable financial growth we have produced over the past 80 plus years.

13

Table of Contents

The Company places a strong emphasis on cash flow generation and having excellent liquidity and financial flexibility. This focus has afforded us the ability to reinvest our cash resources and preserve a strong balance sheet to position us for future acquisition and product development opportunities. The Company had no bank debt as of December 31, 2017. The $137.4 million of aggregate cash generated by operating activities over the past three years was utilized primarily to pay dividends, fund the Company’s defined benefit pension plan, purchase productivity-enhancing capital equipment, entirely repay acquisitions-related short-term debt and fund growth-oriented acquisitions. The Company’s cash position increased $22.1 million during 2017 to $79.7 million at December 31, 2017.

The Company generated $62.6 million in adjusted earnings before interest, taxes, depreciation and amortization during 2017. From these earnings, the Company invested $7.8 million primarily in machinery and equipment and returned $12.3 million in dividends to shareholders.

Capital additions for 2018 are presently planned to be in the range of $10-$15 million primarily for building expansion and machinery and equipment purchases, and are expected to be financed through internally-generated funds and existing lines of credit.

Net sales for the year ended December 31, 2017 were $379.4 million compared to $382.1 million for 2016, a decrease of 0.7% or $2.7 million. Excluding sales from the PCCP project of $0.7 million in 2017 and $9.9 million in 2016, net sales in 2017 increased 1.8% or $6.5 million. Domestic sales, excluding PCCP, increased $0.1 million while international sales increased 4.9% or $6.4 million.

Gross profit was $98.7 million for 2017, resulting in gross margin of 26.0%, compared to gross profit of $92.0 million and gross margin of 24.1% for 2016. Gross margin included a non-cash pension settlement charge of $2.6 million or 70 basis points in 2017 which did not occur in 2016. Excluding the non-cash pension settlement charge, gross margin increased by 260 basis points due principally to favorable sales mix.

SG&A was $56.8 million and 15.0% of net sales for 2017 compared to $54.5 million and 14.3% of net sales for 2016. SG&A included a non-cash pension settlement charge of $1.4 million or 40 basis points in 2017 which did not occur last year. SG&A included a gain on the sale of property, plant and equipment of $1.0 million or 30 basis points in 2016. Excluding these items, SG&A decreased slightly compared to last year and as a percentage of sales was flat.

Operating income was $37.9 million, resulting in operating margin of 10.0% for the 2017, compared to operating income of $35.7 million and operating margin of 9.3% for 2016. In 2017, operating income included non-cash impairment charges of $4.1 million or 100 basis points and a non-cash pension settlement charge of $4.0 million or 110 basis points. In 2016, operating income included a non-cash impairment charge of $1.8 million or 50 basis points and a gain on the sale of property, plant and equipment of $0.6 million or 20 basis points. Excluding these items, operating income improved $9.1 million or 250 basis points due principally to improved gross margin.

Net income was $26.6 million for 2017 compared to $24.9 million in 2016, and earnings per share were $1.02 and $0.95 for the respective periods. Earnings per share for 2017 included non-cash impairment charges of $0.10 per share and a non-cash pension settlement charge of $0.10 per share. Earnings per share for 2016 included a non-cash impairment charge of $0.05 per share.

The Company’s backlog of orders was $114.0 million at December 31, 2017 compared to $98.8 million at December 31, 2016, an increase of 15.4%. The increase in backlog was primarily due to increases in the fire protection, municipal and construction markets principally driven by improved economic conditions both domestically and internationally.

On January 25, 2018, the Board of Directors authorized the payment of a quarterly dividend of $0.125 per share, representing the 272nd consecutive quarterly dividend to be paid by the Company. During 2017, the

14

Table of Contents

Company again paid increased dividends and thereby attained its 45th consecutive year of increased dividends. These consecutive years of increases continue to position Gorman-Rupp in the top 50 of all U.S. public companies with respect to number of years of increased dividend payments. The dividend yield at December 31, 2017 was 1.5%.

The Company currently expects to continue its exceptional history of paying regular quarterly dividends and increased annual dividends. However, any future dividends will be reviewed individually and declared by our Board of Directors at its discretion, dependent on our assessment of the Company’s financial condition and business outlook at the applicable time.

Outlook

Overall business conditions have continued to improve during 2017 and we are optimistic about our incoming order rate as we enter 2018. However, we continue to experience some softness in the agriculture and certain oil and gas driven markets. Increased emphasis on infrastructure improvements at both the federal and state levels coupled with the newly enacted U.S. tax legislation could be additional positive factors over the next several years. The Company remains focused on operational efficiencies and will continue to manage expenses closely. Our underlying fundamentals remain strong and we remain well positioned to drive long-term growth. Our strong balance sheet provides us with the flexibility to continue to evaluate acquisition opportunities and new product development that we expect will help add value to our operations over the longer-term.

On December 22, 2017, the U.S. Tax Cuts and Jobs Act (the “Tax Act”) was enacted. The Tax Act reduces the federal corporate tax rate on U.S. earnings to 21% and moves from a global taxation regime to a modified territorial regime. As part of the Tax Act, U.S. companies are required to pay a tax on historical earnings generated offshore that have not been repatriated to the U.S. Companies are required to re-measure their deferred tax assets and liabilities to reflect the lower federal base rate of 21%. These transitional impacts resulted in a provisional net tax expense of $0.4 million for the fourth quarter of 2017, comprised of an estimated repatriation tax expense of $2.0 million (which includes U.S. repatriation taxes and foreign withholding taxes) and a net deferred tax benefit of approximately $1.6 million. The provisional estimates are based on the Company’s initial analysis of the Tax Act. Given the significant complexity of the Tax Act, anticipated guidance from the U. S. Treasury about implementing the Tax Act, and the potential for additional guidance from the Securities and Exchange Commission or the Financial Accounting Standards Board related to the Tax Act, these estimates may be adjusted during 2018. The Company’s preliminary estimate of its future effective tax rate attributable to the Tax Act is between 23% and 26%. The Company continues to evaluate the impact of the Tax Act, and will update its estimates as appropriate.

Results of Operations – 2017 Compared to 2016:

In 2017, due primarily to the continued decreased demand for barge pumps for the marine transportation market driven by low oil prices and overcapacity of inland barges, the Bayou City Pump Company (“Bayou”) reporting unit recorded pre-tax non-cash goodwill and intangible asset impairment charges of $4.1 million. In 2016, due primarily to the prolonged downturn in the oil and gas industry, the Bayou reporting unit recorded a pre-tax non-cash goodwill impairment charge of $1.8 million. There were no impairment charges recorded in 2015. See Note 8, Goodwill and Other Intangible Assets.

In 2017, due to increased employee retirements and related lump sum pension payments, the Company recorded a U.S. GAAP-required and actuarially-determined $4.0 million non-cash pension settlement charge. The value of lump sum pension payments was less in 2016 and a non-cash pension settlement charge was not required.

Net Sales

| Year Ended December 31, | ||||||||||||||||

| 2017 | 2016 | $ Change | % Change | |||||||||||||

| Net sales |

$ | 379,389 | $ | 382,071 | $ | (2,682) | (0.7)% | |||||||||

15

Table of Contents

Net sales for the year ended December 31, 2017 were $379.4 million compared to $382.1 million for 2016, a decrease of 0.7% or $2.7 million. Excluding sales from the PCCP project of $0.7 million in 2017 and $9.9 million in 2016, net sales in 2017 increased 1.8% or $6.5 million. Domestic sales, excluding PCCP, increased $0.1 million while international sales increased 4.9% or $6.4 million.

Sales in our larger water markets, excluding PCCP, decreased 0.4% or $1.1 million in 2017 compared to 2016. Sales in the construction market increased $10.4 million due primarily to sales to rental market customers, and sales of repair parts increased $2.4 million. These increases were offset by decreased sales in the municipal market decreased $7.3 million principally driven by decreased shipments attributable to flood control projects. In addition, sales in the fire protection market decreased $4.2 million principally due to market softness in the Middle East, and sales in the agriculture market decreased $2.4 million principally due to low farm income and competitive pricing pressure.

Sales in our non-water markets increased 6.9% or $7.6 million in 2017 compared to 2016. Sales increased $7.7 million in the industrial market driven by an increase in oil and gas drilling activity. Sales in the OEM market increased $2.5 million primarily related to power generation equipment and new customers associated with transportation and alternative energy applications. These increases were partially offset by decreased shipments of $2.6 million in the petroleum market driven by challenging market conditions.

International sales were $137.6 million in 2017 compared to $131.2 million in 2016. International sales represented 36% and 34% of total sales for the Company in each of the years 2017 and 2016, respectively. International sales increased in the construction and industrial markets and continued to be softer in the fire protection market due to sluggish economic conditions in the Middle East.

Cost of Products Sold and Gross Profit

| Year Ended December 31, | ||||||||||||||||

| 2017 | 2016 | $ Change | % Change | |||||||||||||

| Cost of products sold |

$ | 280,644 | $ | 290,046 | $ | (9,402) | (3.2)% | |||||||||

| % of Net sales |

74.0% | 75.9% | ||||||||||||||

| Gross margin |

26.0% | 24.1% | ||||||||||||||

Gross profit was $98.7 million for 2017, resulting in gross margin of 26.0%, compared to gross profit of $92.0 million and gross margin of 24.1% for 2016. Gross margin included a non-cash pension settlement charge of $2.6 million or 70 basis points in 2017 which did not occur in 2016. Excluding the non-cash pension settlement charge, gross margin increased by 260 basis points due principally to favorable sales mix.

Selling, General and Administrative Expenses (SG&A)

| Year Ended December 31, | ||||||||||||||||

| 2017 | 2016 | $ Change | % Change | |||||||||||||

| Selling, general and administrative expenses | $ | 56,789 | $ | 54,528 | $ | 2,261 | 4.1% | |||||||||

| % of Net sales |

15.0% | 14.3% | ||||||||||||||

SG&A was $56.8 million and 15.0% of net sales for 2017 compared to $54.5 million and 14.3% of net sales for 2016. SG&A included a non-cash pension settlement charge of $1.4 million or 40 basis points in 2017 which did not occur last year. SG&A included a gain on the sale of property, plant and equipment of $1.0 million or 30 basis points in 2016. Excluding these items, SG&A decreased slightly compared to last year and as a percentage of sales was flat.

16

Table of Contents

Operating Income

| Year Ended December 31, | ||||||||||||||||

| 2017 | 2016 | $ Change | % Change | |||||||||||||

| Operating income |

$ | 37,858 | $ | 35,697 | $ | 2,161 | 6.1% | |||||||||

| % of Net sales |

10.0% | 9.3% | ||||||||||||||

Operating income was $37.9 million, resulting in operating margin of 10.0% for 2017, compared to operating income of $35.7 million and operating margin of 9.3% for 2016. In 2017, operating margin included non-cash impairment charges of $4.1 million or 100 basis points and a non-cash pension settlement charge of $4.0 million or 110 basis points. In 2016, operating margin included a non-cash impairment charge of $1.8 million or 50 basis points and a gain on the sale of property, plant and equipment of $0.6 million or 20 basis points. Excluding these items, operating income improved $9.1 million or 250 basis points due principally to improved gross margin.

Net Income

| Year Ended December 31, | ||||||||||||||||

| 2017 | 2016 | $ Change | % Change | |||||||||||||

| Income before income taxes |

$39,378 | $36,482 | $2,896 | 7.9% | ||||||||||||

| % of Net sales |

10.4% | 9.6% | ||||||||||||||

| Income taxes |

$12,823 | $11,599 | $1,224 | 10.6% | ||||||||||||

| Effective tax rate |

32.6% | 31.8% | ||||||||||||||

| Net income |

$26,555 | $24,883 | $1,672 | 6.7% | ||||||||||||

| % of Net sales |

7.0% | 6.5% | ||||||||||||||

| Earnings per share |

$ 1.02 | $ 0.95 | $ 0.07 | 7.4% | ||||||||||||

The increase in net income in 2017 compared to 2016 was due primarily to improved gross margin partially offset by a non-cash pension settlement charge in 2017 of $2.7 million, net of income taxes, and non-cash impairment charges of $2.7 million, net of income taxes. Net income in 2016 included a non-cash impairment charge of $1.2 million, net of income taxes. The effective tax rate in 2017 included $0.4 million net impact of the Tax Act enacted on December 22, 2017.

Earnings per share for 2017 included non-cash impairment charges of $0.10 per share and a non-cash pension settlement charge of $0.10 per share. Earnings per share for 2016 included a non-cash impairment charge of $0.05 per share partially offset by a gain on the sale of property, plant and equipment of $0.02 per share.

Results of Operations – 2016 Compared to 2015:

In 2016, due primarily to the decreased demand for barge pumps for the marine transportation market driven by low oil prices and overcapacity of inland barges, the Bayou reporting unit recorded a pre-tax non-cash goodwill impairment charge of $1.8 million. There was no goodwill impairment charge recorded in 2015. See Note 8, Goodwill and Other Intangible Assets.

In 2015, due to increased employee retirements and related lump sum pension payments, the Company recorded a U.S. GAAP-required and actuarially-determined $3.8 million non-cash pension settlement charge. The value of lump sum pension payments was less in 2016 and a non-cash pension settlement charge was not required.

Net Sales

| Year Ended December 31, | ||||||||||||||||

| 2016 | 2015 | $ Change | % Change | |||||||||||||

| Net sales |

$ | 382,071 | $ | 406,150 | $ | (24,079) | (5.9)% | |||||||||

17

Table of Contents

Net sales for the year ended December 31, 2016 were $382.1 million compared to $406.2 million for 2015, a decrease of 5.9% or $24.1 million. Excluding sales from the PCCP project of $9.9 million in 2016 and $37.7 million in 2015, net sales in 2016 increased 1.0% or $3.7 million. Domestic sales, excluding PCCP, increased 3.9% or $9.0 million and international sales decreased 3.9% or $5.3 million. Of the total decrease in net sales in 2016, approximately $0.9 million was due to unfavorable foreign currency translation.

Sales in our larger water markets, excluding PCCP, increased 3.6% or $9.1 million in 2016 compared to 2015. Sales in the municipal market, excluding PCCP, increased $15.1 million driven by increased shipments attributable to other flood control projects, clean water and wastewater applications. Sales in the construction market increased $2.7 million due primarily to sales to rental businesses and sales to new customers. However, sales decreased $3.7 million in the fire protection market largely due to market softness domestically and in the Middle East, and $2.3 million in the agriculture market principally due to wet weather conditions in many domestic locations and decreased farm income. In addition, sales of repair parts decreased $2.8 million.

Sales decreased 4.6% or $5.4 million in non-water markets for 2016 compared to 2015. Increased sales of $3.2 million in the OEM market related to power generation equipment and services were offset by a decrease of $7.7 million in the industrial market largely attributable to the slowdown in oil and gas production.

International sales were $131.2 million in 2016 compared to $136.5 million in 2015. International sales represented 34% of total sales for the Company in each of the years 2016 and 2015. Sales continued to be somewhat softer in Europe and in the Middle East due to sluggish economic conditions primarily affecting the fire protection and OEM markets.

Cost of Products Sold and Gross Profit

| Year Ended December 31, | ||||||||||||||||

| 2016 | 2015 | $ Change | % Change | |||||||||||||

| Cost of products sold |

$ | 290,046 | $ | 313,570 | $ | (23,524) | (7.5)% | |||||||||

| % of Net sales |

75.9% | 77.2% | ||||||||||||||

| Gross margin |

24.1% | 22.8% | ||||||||||||||

The gross margin increase in 2016 compared to 2015 was due principally to favorable sales mix changes, most notably within the municipal market and lower LIFO inventory expense of 50 basis points. Also, a non-cash pension settlement charge of 60 basis points was recognized in 2015 which did not recur in 2016. Conversely, health care expenses increased 30 basis points in 2016 primarily due to higher claims.

Selling, General and Administrative Expenses (SG&A)

| Year Ended December 31, | ||||||||||||||||

| 2016 | 2015 | $ Change | % Change | |||||||||||||

| Selling, general and administrative expenses |

$ | 54,528 | $ | 56,189 | $ | (1,661) | (3.0)% | |||||||||

| % of Net sales |

14.3% | 13.8% | ||||||||||||||

The increase in SG&A expenses as a percentage of net sales in 2016 compared to 2015 was due principally to loss of leverage due to lower sales volume and increased professional services fees of approximately 30 basis points related largely to costs incurred in connection with acquired businesses during the previous two years. Offsetting these variances were a gain on the sale of property, plant and equipment in 2016 of 30 basis points and a non-cash pension settlement charge of 30 basis points in 2015 which did not recur in 2016.

18

Table of Contents

Operating Income

| Year Ended December 31, | ||||||||||||||||

| 2016 | 2015 | $ Change | % Change | |||||||||||||

| Operating income |

$ | 35,697 | $ | 36,391 | $ | (694) | (1.9)% | |||||||||

| % of Net sales |

9.3% | 9.0% | ||||||||||||||

The change in operating margin was impacted by the variances mentioned above, including a non-cash goodwill impairment charge in 2016 of 50 basis points and a non-cash pension settlement charge totaling 90 basis points in 2015 which did not recur in 2016.

Net Income

| Year Ended December 31, | ||||||||||||||||

| 2016 | 2015 | $ Change | % Change | |||||||||||||

| Income before income taxes |

$36,482 | $37,266 | $(784) | (2.1)% | ||||||||||||

| % of Net sales |

9.6% | 9.2% | ||||||||||||||

| Income taxes |

$11,599 | $12,157 | $(558) | (4.6)% | ||||||||||||

| Effective tax rate |

31.8% | 32.6% | ||||||||||||||

| Net income |

$24,883 | $25,109 | $(226) | (0.9)% | ||||||||||||

| % of Net sales |

6.5% | 6.2% | ||||||||||||||

| Earnings per share |

$ 0.95 | $ 0.96 | $(0.01) | (1.0)% | ||||||||||||

The decreases in net income and earnings per share in 2016 compared to 2015 were due primarily to sales volume decreases and a non-cash goodwill impairment charge in 2016 of $1.2 million, net of income taxes. These unfavorable variances were offset by a gain on the sale of property, plant and equipment, lower LIFO inventory expense and lower pension expense due to a pension settlement charge of $2.5 million, net of income taxes, in 2015 which did not recur in 2016. The decrease in the effective tax rate between the two periods was due primarily to changes in the estimated domestic production activities deduction and the impact of more income in jurisdictions with lower tax rates.

Liquidity and Sources of Capital

Cash and cash equivalents totaled $79.7 million and there was no outstanding bank debt at December 31, 2017. In addition, the Company had $21.8 million available in bank lines of credit after deducting $9.2 million in outstanding letters of credit primarily related to customer orders. The Company was in compliance with its debt covenants, including limits on additional borrowings and maintenance of certain operating and financial ratios, at all times in 2017 and 2016.

Capital expenditures for 2018, which are expected to consist principally of building expansion and machinery and equipment purchases, are estimated to be in the range of $10-$15 million and are expected to be financed through internally generated funds and existing lines of credit. During 2017, 2016 and 2015, the Company financed its capital improvements and working capital requirements principally through internally generated funds.

Free cash flow, a non-GAAP measure for reporting cash flow, is defined by the Company as adjusted earnings before interest, income taxes and depreciation and amortization, less capital expenditures and dividends. The Company believes free cash flow provides investors with an important perspective on cash available for investments, acquisitions and working capital requirements.

19

Table of Contents

The following table reconciles adjusted earnings before interest, income taxes and depreciation and amortization as reconciled above to free cash flow:

| 2017 | 2016 | 2015 | ||||||||||

| Non-GAAP adjusted earnings before interest, taxes, depreciation and amortization | $ 62,577 | $ 53,831 | $ 56,453 | |||||||||

| Less capital expenditures |

(7,754) | (6,877) | (8,260) | |||||||||

| Less cash dividends |

(12,268) | (11,218) | (10,599) | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP free cash flow |

$ 42,555 | $ 35,736 | $ 37,594 | |||||||||

|

|

|

|

|

|

|

|||||||

Financial Cash Flow

| Year Ended December 31, | ||||||||||||

| 2017 | 2016 | 2015 | ||||||||||

| Beginning of period cash and cash equivalents |

$ 57,604 | $ 23,724 | $ 24,491 | |||||||||

| Net cash provided by operating activities |

43,265 | 53,434 | 40,683 | |||||||||

| Net cash used for investing activities |

(10,410) | (8,466) | (11,180) | |||||||||

| Net cash used for financing activities |

(12,268) | (11,218) | (29,090) | |||||||||

| Effect of exchange rate changes on cash |

1,489 | 130 | (1,180) | |||||||||

|

|

|

|

|

|

|

|||||||

| Net increase (decrease) in cash and cash equivalents | 22,076 | 33,880 | (767) | |||||||||

|

|

|

|

|

|

|

|||||||

| End of period cash and cash equivalents |

$ 79,680 | $ 57,604 | $ 23,724 | |||||||||

|

|

|

|

|

|

|

|||||||

The change in cash provided by operating activities in 2017 compared to 2016 was primarily due to a decrease in accounts receivable, more than offset by increased inventories and decreased commissions payable and benefit obligations. The change in cash provided by operating activities in 2016 compared to 2015 was primarily due to reductions in inventories and accounts receivable driven by lower sales volume, partially offset by contributions to the Company’s defined benefit pension plan.

During 2017, investing activities of $10.4 million primarily consisted of a $3.0 million increase in short-term investments and $7.8 million of capital expenditures for machinery and equipment offset by $0.3 million of proceeds from the sale of property, plant and equipment. During 2016, investing activities of $8.5 million primarily consisted of capital expenditures for machinery and equipment, a new operations facility in Africa, and other building improvements totaling $6.9 million as well as a payment for an acquisition, net of cash acquired, of $3.0 million, offset by proceeds from the sale of property, plant, and equipment of $1.4 million. During 2015, investing activities of $11.2 million primarily consisted of capital expenditures for building, building improvements and machinery and equipment totaling $8.3 million as well as payments for acquisitions, net of cash acquired, of $3.4 million, offset by proceeds from the sale of property, plant, and equipment of $0.5 million.

Net cash used for financing activities consisted of dividend payments of $12.3 million, $11.2 million and $10.6 million during 2017, 2016 and 2015, respectively. During 2015, the Company also paid off its $12.0 million of short-term bank borrowings and $1.9 million of assumed acquisition debt and made a privately-arranged market value purchase of Company shares in the amount of $4.6 million from a Rupp family estate.

The Company currently expects to continue its exceptional history of paying regular quarterly dividends and increased annual dividends. However, any future dividends will be reviewed individually and declared by our Board of Directors at its discretion, dependent on our assessment of the Company’s financial condition and business outlook at the applicable time.

20

Table of Contents

Contractual Obligations

Capital commitments in the table below include contractual commitments to purchase machinery and equipment that have been approved by the Board of Directors. The capital commitments do not represent the entire anticipated purchases in the future, but represent only those substantive items for which the Company is contractually obligated as of December 31, 2017. Also, the Company has some operating leases for certain offices, manufacturing facilities, land, office equipment and automobiles. Rental expenses relating to these leases were $0.9 million in 2017, $1.1 million in 2016 and $1.0 million in 2015.

The following table summarizes the Company’s contractual obligations at December 31, 2017:

| Payment Due By Period | ||||||||||||||||||||

| Total | Less than 1 Year |

1-3 Years |

3-5 Years |

More than 5 Years |

||||||||||||||||

| Capital commitments |

$2,070 | $2,070 | $ - | $ - | $ - | |||||||||||||||

| Operating leases |

1,557 | 825 | 677 | 46 | 9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$3,627 | $2,895 | $677 | $46 | $ 9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Critical Accounting Policies

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States. When more than one accounting principle, or the method of its application, is generally accepted, management selects the principle or method that is appropriate in the Company’s specific circumstances. Application of these accounting principles requires management to make estimates about the future resolution of existing uncertainties; as a result, actual results could differ from these estimates.

In preparing these consolidated financial statements, management has made its best estimates and judgments of the amounts and disclosures included in the consolidated financial statements, giving due regard to materiality. The Company does not believe there is a great likelihood that materially different amounts would be reported under different conditions or using different assumptions pertaining to the accounting policies described below.

Revenue Recognition

Substantially all of the Company’s revenues from product sales are recognized when all of the following criteria are met: persuasive evidence of a sale arrangement exists, the price is fixed or determinable, product delivery has occurred or services have been rendered, there are no further obligations to customers and collectability is probable. Product delivery occurs when the risks and rewards of ownership and title pass, which usually occurs upon shipment to the customer.

The Company adopted, effective January 1, 2018, the new revenue guidance in ASU 2014-09 pursuant to the modified retrospective method. Any adjustment to the opening balance of retained earnings is not expected to be material. See Note 1 to the Consolidated Financial Statements, Summary of Significant Accounting Policies.

Allowance for Doubtful Accounts

The Company evaluates the collectability of its accounts receivable based on a combination of factors. In circumstances where the Company is aware of a specific customer’s inability to meet its financial obligations to the Company (e.g., bankruptcy filings, substantial downgrading of credit scores), the Company records a specific allowance for bad debts against amounts due to reduce the net recognized receivable to the amount the Company reasonably believes will be collected. For all other customers, the Company recognizes allowances for bad debts

21

Table of Contents

based on the length of time the receivables are past due. If circumstances change (e.g., an unexpected material adverse change in a large customer’s ability to meet its financial obligations), the Company’s estimates of the recoverability of amounts due could be reduced by a material amount. Historically, the Company’s collection history has been good.

Inventories and Related Allowance

Inventories are valued at the lower of cost or market value and have been reduced by an allowance for excess and obsolete inventories. The estimated allowance is based on a variety of factors, including historical inventory usage and management evaluations. Historically, the Company has not experienced substantive write-offs due to obsolescence. The Company uses the last-in, first-out (LIFO) method for the majority of its inventories.

Product Warranties

A liability is established for estimated future warranty and service claims based on historical claims experience and specific product failures.

Pension Plan and Other Postretirement Benefit Plans