10-K

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| þ

|

Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2014

or

| ¨

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period

from

to

96 South George Street, Suite 520

York, Pennsylvania 17401

(Address of principal executive offices)

(717) 225-4711

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

| Commission file number |

|

Exact name of registrant as

specified in its charter |

|

IRS Employer

Identification No. |

|

State or other jurisdiction of

incorporation or organization |

| 1-03560 |

|

P. H. Glatfelter Company |

|

23-0628360 |

|

Pennsylvania |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of Each Class |

|

Name of Each Exchange on which registered |

| Common Stock, par value $.01 per share |

|

New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ¨ No þ.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ.

Indicate by check mark whether the

registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and

(2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨.

Indicate by check mark if disclosure

of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting

company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. þ Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated

filer ¨ Small reporting company (Do not check if a smaller reporting company).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes ¨ No þ.

Based on the closing price as of June 30, 2014, the aggregate market value of the Common Stock of the Registrant held by non-affiliates was $1,123 million.

Common Stock outstanding on February 25, 2015 totaled 43,095,572 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated by reference in this Annual Report on Form 10-K:

Portions of the registrant’s Proxy Statement to be dated on or about April 2, 2015 are incorporated by reference to Part III.

P. H. GLATFELTER COMPANY

ANNUAL REPORT ON FORM 10-K

For the Year Ended

DECEMBER 31, 2014

Table of Contents

PART I

We make regular filings with the Securities and Exchange Commission (SEC), including this Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. These filings are available,

free of charge, on our website, www.glatfelter.com, and the SEC website at www.sec.gov. We also provide copies of our SEC filings at no charge upon request to Investor Relations at (717) 225-2719, ir@glatfelter.com, or by mail to

Investor Relations, 96 South George Street, Suite 520, York, PA, 17401. In this filing, unless the context indicates otherwise, the terms “we,” “us,” “our,” “the Company,” or “Glatfelter” refer to P.

H. Glatfelter Company and subsidiaries.

Overview Glatfelter began operations in 1864, and we believe we are one of the world’s leading manufacturers of

specialty papers and fiber-based engineered materials. Headquartered in York, Pennsylvania, we own and operate manufacturing facilities located in Pennsylvania, Ohio, Canada, Germany, the United Kingdom, France, and the Philippines and we have sales

and distribution offices in Russia and China.

Acquisitions Over the past several years, we have

completed several acquisitions that have diversified our revenue, expanded our geographic footprint and enhanced our asset base. These transactions include the April 30, 2013, $211 million acquisition of Dresden Papier GmbH

(“Dresden”), a leading supplier of non-woven wall covering products. Revenue from the sale of non-woven wall covering products totaled $150.0 million and $97.7 million, in 2014 and 2013, respectively.

On October 1, 2014, we acquired Spezialpapierfabrik Oberschmitten GmbH (“SPO”) for $8.0 million. SPO is a producer of highly

technical papers for a wide range of capacitors used in consumer and industrial products; insulation papers for cables and transformers; and materials for industrial power inverters, electromagnetic current filters and electric rail traction.

SPO’s annual sales total approximately $33 million.

Products Our three business units manufacture a

wide array of specialty papers and fiber-based engineered materials including:

| |

• |

|

Composite Fibers with revenue from the sale of single-serve coffee and tea filtration papers, nonwoven wall covering materials, metallized and self

adhesive labeling papers, composite

|

| |

|

laminates, and technical specialties including substrates for electrical applications such as batteries and capacitors. |

| |

• |

|

Advanced Airlaid Materials with revenue from the sale of airlaid non-woven fabric-like materials used in feminine hygiene and adult incontinence products,

baby wipes, cleaning pads and wipes, food pads, napkins, and tablecloths, and |

| |

• |

|

Specialty Papers with revenue from the sale of papers for carbonless and other forms, book publishing, envelopes, and engineered products such as papers

for digital imaging, packaging, casting, release, transfer, playing card, postal, FDA-compliant food and beverage applications, and other niche specialty applications. |

The global growth markets served by the Composite Fibers and Advance Airlaid Materials business units are characterized by attractive growth rates

as the result of new and emerging products and markets, changing end-user preferences and evolving demographics. Specialty Papers serves more mature market segments, many of which are in decline.

As a result of our strategy to diversify sources of revenue and invest in growth businesses, revenue generated from Composite Fibers and Advanced

Airlaid Materials is expected to represent an increasingly greater proportion of total revenue. Combined, these two business units comprised 50% of consolidated revenue in 2014 compared with 30% in 2006.

Consolidated net sales and the relative net sales contribution of each of our business units for the past three years are summarized below:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dollars in thousands |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Net sales |

|

$ |

1,802,415 |

|

|

$ |

1,722,615 |

|

|

$ |

1,577,788 |

|

| Business unit contribution |

|

|

|

|

|

|

|

|

|

|

|

|

| Composite Fibers |

|

|

34.3 |

% |

|

|

32.9 |

% |

|

|

27.7 |

% |

| Advanced Airlaid Materials |

|

|

15.6 |

|

|

|

15.6 |

|

|

|

15.6 |

|

| Specialty Papers |

|

|

50.1 |

|

|

|

51.5 |

|

|

|

56.7 |

|

| Total |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

Our strategies are focused on growing revenues, in part, by leveraging leading positions in key global growth

markets including the single-serve coffee and tea, non-woven wall covering materials and the hygiene products markets. To ensure we are best positioned to serve these markets, we have made investments to increase production capacity and intend to

make additional investments in the future.

GLATFELTER 2014 FORM

10-K 1

In addition to leveraging our leading positions, our focus on product innovation is a critical

component of our business strategy. During 2014, 2013 and 2012, we invested $12.3 million, $12.2 million and $10.9 million, respectively, in new product development activities. In each of the past three years, in excess of 50% of net sales were

generated from products developed, enhanced or improved within the past five years.

Other key elements to our success include margin

expansion, driven by cost reduction and continuous improvement initiatives; the generation of strong and reliable cash flows; and strategic investments to improve our returns on invested capital. In addition, the strength of our balance sheet and

generation of cash flows has allowed us to pursue strategic actions such as the Dresden and SPO acquisitions, a $50 million investment to expand capacity in Composite Fibers, share repurchase programs and increase our dividend. These actions and our

disciplined approach to capital expenditures has resulted in the generation of returns on invested capital that exceed our cost of capital.

We have a demonstrated ability to establish leading market positions through the successful acquisition and integration of complementary businesses. Since 2006, we have successfully completed and integrated six

acquisitions. Our acquisition strategy complements our long-term strategy of driving growth in our markets.

Our Business

Units We manage our company as three distinct business units: Composite Fibers; Advanced Airlaid Materials; and Specialty Papers. Net tons sold by each business unit for the past three years were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short tons |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Composite Fibers |

|

|

157,336 |

|

|

|

133,570 |

|

|

|

90,300 |

|

| Advanced Airlaid Materials |

|

|

99,667 |

|

|

|

96,098 |

|

|

|

90,332 |

|

| Specialty Papers |

|

|

802,877 |

|

|

|

800,151 |

|

|

|

789,201 |

|

| Total |

|

|

1,059,880 |

|

|

|

1,029,819 |

|

|

|

969,833 |

|

Composite Fibers Our Composite Fibers business unit serves customers globally

and focuses on higher value-added products in the following markets:

| |

• |

|

Food & Beverage paper primarily used for single-serve coffee and tea products; |

| |

• |

|

Non-woven wall covering base materials used by the world’s largest wallpaper manufacturers; |

| |

• |

|

Metallized products used in the labeling of bottles, packaging innerliners, gift wrap, self-adhesive labels and other consumer product applications;

|

| |

• |

|

Composite Laminates papers used in production of decorative laminates, furniture, and flooring applications; and |

| |

• |

|

Technical Specialties a diverse line of special paper products used in batteries, capacitors, adhesive tapes and other highly-engineered applications.

|

During 2013, we completed the acquisition of Dresden a leading global supplier of nonwoven wallpaper base materials.

Dresden has a preeminent position in nonwoven wallpaper materials – as both the cost and quality leader because of its innovative products, proprietary manufacturing techniques, and long-standing customer relationship. It produces products with

superior performance and characteristics such as dry strip-ability, higher tear resistance, and no material shrinkage or expansion when wet. As a result, nonwovens are increasingly the product of choice for wallpaper installers and design

professionals in Europe and Russia, with growth potential in Asia. The acquisition of Dresden added another industry-leading nonwovens product line to our Composite Fibers business, and broadened our relationship with leading producers of consumer

and industrial products.

We believe this business unit maintains a market leadership position in the single-serve coffee and tea

markets and nonwoven wallpaper materials markets. Composite Fibers’ revenue composition by market consisted of the following for the years indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

| In thousands |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Food & beverage |

|

$ |

296,304 |

|

|

$ |

302,738 |

|

|

$ |

265,423 |

|

| Wall covering |

|

|

149,957 |

|

|

|

97,698 |

|

|

|

– |

|

| Metallized |

|

|

80,839 |

|

|

|

83,949 |

|

|

|

87,720 |

|

| Composite laminates |

|

|

38,159 |

|

|

|

39,296 |

|

|

|

44,613 |

|

| Technical specialties and other |

|

|

52,592 |

|

|

|

42,679 |

|

|

|

38,984 |

|

| Total |

|

$ |

617,851 |

|

|

$ |

566,360 |

|

|

$ |

436,740 |

|

We believe many of the market segments served by Composite Fibers, particularly single-serve coffee and tea,

nonwoven wallpaper materials and electrical products present attractive growth opportunities by capitalizing on evolving consumer preferences, expanding into new or emerging geographic markets, and by gaining market share through quality product and

service offerings. Many of this business’ papers are technically sophisticated and, in the case of single serve-coffee and tea products, are extremely lightweight and require specialized fibers. Our engineering capabilities, specifically

designed papermaking equipment, use of specialized fibers and customer orientation positions us well to compete in these global markets.

2

The primary raw materials used in the production of our lightweight papers are abaca pulp, wood

pulp and synthetic fibers. Abaca pulp is a specialized pulp with limited sources of availability. Our abaca pulp production process, fulfilled by our Philippine mill, provides a unique advantage to our Composite Fibers business unit. Sufficient

quantities of abaca pulp and its source fiber are required to support growth in this business unit. In the event the supply of abaca fiber becomes constrained or when production demands exceed the capacity of the Philippines mill, alternative

sources and/or substitute fibers are used to meet customer demands.

The Composite Fibers business unit is comprised of four paper

making facilities (Germany, France and England), a non-woven wall cover base mill (Germany), metallizing operations (Wales and Germany) and a pulp mill (the Philippines) with the following combined attributes:

|

|

|

|

|

| Production

Capacity (short tons) |

|

Principal Raw Material (“PRM”) |

|

Estimated Annual

Quantity of PRM (short

tons) |

| 153,500 lightweight and other |

|

Abaca pulp |

|

17,200 |

|

|

Wood pulp |

|

91,600 |

|

|

Synthetic fiber |

|

26,900 |

| 28,100 metallized |

|

Base stock |

|

26,800 |

| 17,600 abaca pulp |

|

Abaca fiber |

|

26,900 |

Composite Fibers’ lightweight products are produced using highly specialized inclined wire paper machine

technology and we believe we currently maintain approximately 25% of the global inclined wire capacity.

In addition to critical raw

materials, the cost to produce Composite Fibers’ products is influenced by energy. Although the business unit generates all of its steam needed for production, in 2014, it purchased 75% of its electricity.

In Composite Fibers’ markets, competition is product line specific as the necessity for technical expertise and specialized manufacturing

equipment limits the number of companies offering multiple product lines. The following chart summarizes key competitors by market segment:

|

|

|

| Market segment |

|

Competitor |

| Single serve coffee & tea |

|

Ahlstrom, Purico, MB Papeles and Zhejiang Kan |

| Nonwoven wallcovering |

|

Ahlstrom, Technocell, Neu Kaliss, Goznak and Neenah Paper |

| Composite laminates |

|

PdM, a division of Schweitzer-Maudit, Purico, MB Papeles and Oi feng |

| Metallized |

|

AR Metallizing, Torras Papel Novelis, Vaassen, Galileo Nanotech, and Wenzhou Protec Vacuum Metallizing Co. |

Our strategy in Composite Fibers is focused on:

| |

• |

|

Capitalizing on growing global markets in food & beverage, nonwoven wall covering materials, and electrical products; |

| |

• |

|

maximizing capacity utilization provided by the investment in state-of-the-art inclined wire technology to support consistent growth of key markets;

|

| |

• |

|

enhancing product mix across all of the business unit’s markets by utilizing new product and new business development capabilities;

|

| |

• |

|

implementing continuous improvement methodologies to increase productivity, reduce costs and expand capacity; and |

| |

• |

|

ensuring readily available access to specialized raw material requirements to support projected growth. |

As part of our commitment to realizing the growth potential of certain of this business unit’s markets, in 2013 we completed a $50 million

investment to expand our inclined wire capacity by nearly 20%, or approximately 10,500 short tons. We converted a flat wire machine in Gernsbach, Germany into a state-of-the-art inclined wire machine. Production of saleable products from the new

machine began in the second quarter of 2013.

In addition, the acquisition of SPO furthers our strategy of capitalizing on the

fast-growing electrical market by broadening our electrical papers platform and know-how.

Advanced Airlaid

Materials is a leading global supplier of highly absorbent cellulose-based airlaid non-woven materials used to manufacture consumer and industrial products for growing global end-user markets. These products include:

Advanced Airlaid

Materials serves customers who are industry leading consumer product companies for feminine hygiene and adult incontinence products. Advanced Airlaid Materials holds leading market share positions in many of

GLATFELTER 2014 FORM

10-K 3

the markets it serves, excels in building long-term customer relationships through superior quality and customer service programs, and has a well-earned reputation for innovation and its ability

to quickly bring new products to market.

Advanced Airlaid Materials’ revenue composition by market consisted of the following for

the years indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

| In thousands |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Feminine hygiene |

|

$ |

216,836 |

|

|

$ |

219,222 |

|

|

$ |

197,792 |

|

| Adult incontinence |

|

|

17,586 |

|

|

|

5,046 |

|

|

|

6,959 |

|

| Wipes |

|

|

16,002 |

|

|

|

15,186 |

|

|

|

13,562 |

|

| Home care |

|

|

15,401 |

|

|

|

14,857 |

|

|

|

14,527 |

|

| Other |

|

|

15,848 |

|

|

|

14,085 |

|

|

|

13,442 |

|

| Total |

|

$ |

281,673 |

|

|

$ |

268,396 |

|

|

$ |

246,282 |

|

The feminine hygiene category accounted for 77% of Advanced Airlaid Material’s revenue in 2014. The majority

of sales of this product are to a small group of large, leading global consumer products companies. This market is considered to be more growth oriented driven by population growth in certain geographic regions, consumer preferences, and

suppliers’ ability to provide innovative products. In developing regions, demand is also influenced by increases in disposable income and cultural preferences. During 2014, sales to the adult incontinence market increased substantially compared

with previous years reflecting this unit’s success developing and bringing to market products in support of its customers’ growth initiatives.

The Advanced Airlaid Materials business unit operates state-of-the-art facilities in Falkenhagen, Germany and Gatineau, Canada. The Falkenhagen location operates three multi-bonded production lines and three

proprietary single-lane festooners. The Gatineau location consists of two airlaid production lines employing multi-bonded and thermal-bonded airlaid technologies and two proprietary single-lane festooners.

The business unit’s two facilities operate with the following combined attributes:

|

|

|

|

|

|

|

| Airlaid Production

Capacity (short tons) |

|

Principal Raw Material (“PRM”) |

|

Estimated Annual

Quantity of PRM

(short tons) |

|

| 107,000 |

|

Fluff pulp |

|

|

73,900 |

|

In addition to the cost of critical raw materials, the cost to produce multi-bonded and thermal-bonded airlaid

materials is impacted by energy. Advanced Airlaid Materials purchases substantially all of the electricity and natural gas used in its operations. Approximately 90% of this business unit’s revenue is earned under contracts with pass-through

provisions directly related to the price of key raw material costs.

Advanced Airlaid Materials continues to be a technology and

product innovation leader in technically

demanding segments of the airlaid market, most notably feminine hygiene. We believe that its facilities are among the most modern and flexible airlaid facilities in the world, allowing it to

produce at industry leading operating rates. Its proprietary single-lane festooning technology provides product packaging which supports efficiency optimization by the customers converting processes. This business unit’s in-house technical

expertise, combined with significant capital investment requirements and rigorous customer expectations creates large barriers to entry for new competitors.

The following summarizes this business unit’s key competitors:

|

|

|

| Market segment |

|

Competitor |

| Airlaid products |

|

Georgia-Pacific LLC, Duni AB, Fitesa, McAirlaid’s GmbH, Domtar |

The global markets served by this business unit are characterized by attractive growth opportunities. To take

advantage of this, our strategy is focused on:

| |

• |

|

maintaining and expanding relationships with customers that are market-leading consumer product companies; |

| |

• |

|

capitalizing on our product and process innovation capabilities; |

| |

• |

|

expanding geographic reach of markets served; |

| |

• |

|

optimizing the use of existing production capacity; and |

| |

• |

|

employing continuous improvement methodologies and initiatives to reduce costs, improve efficiencies and create capacity. |

Specialty Papers Our North America-based Specialty Papers business unit focuses on producing papers for the

following markets:

| |

• |

|

Carbonless & non-carbonless forms papers for credit card receipts, multi-part forms, security papers and other end-user applications;

|

| |

• |

|

Engineered products for digital imaging, packaging, casting, release, transfer, playing card, postal, FDA-compliant food and beverage applications, and

other niche specialty applications; |

| |

• |

|

Envelope and converting papers primarily utilized for transactional and direct mail envelopes; and |

| |

• |

|

Book publishing papers for the production of high-quality hardbound books and other book publishing needs.

|

4

The market segments in which Specialty Papers competes continue to undergo significant changes in

response to declining demand resulting in excess capacity. As a result, over the past several years, certain producers have closed, or announced plans to reduce, production capacity due to a supply/demand imbalance. In addition, foreign producers

have been increasing the volume of product imported into the U.S. creating additional imbalance.

This business unit produces both

commodity products and higher-value-added specialty products. Specialty Papers’ revenue composition by market consisted of the following for the years indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

| In thousands |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Carbonless & forms |

|

$ |

376,959 |

|

|

$ |

369,618 |

|

|

$ |

372,950 |

|

| Engineered products |

|

|

194,189 |

|

|

|

184,913 |

|

|

|

187,724 |

|

| Envelope & converting |

|

|

183,194 |

|

|

|

175,928 |

|

|

|

174,781 |

|

| Book publishing |

|

|

144,744 |

|

|

|

153,054 |

|

|

|

155,925 |

|

| Other |

|

|

3,805 |

|

|

|

4,346 |

|

|

|

3,397 |

|

| Total |

|

$ |

902,891 |

|

|

$ |

887,859 |

|

|

$ |

894,777 |

|

Although many of the markets served by Specialty Papers are mature and, in many instances, declining, we have been

successful at maintaining this unit’s shipments through new product and new business development initiatives while leveraging the flexibility of our operating assets to efficiently respond to changing customer demands. In each of the past ten

years, our flexible asset base, new product development capabilities and superior customer service offerings have allowed us to outperform the broader uncoated free sheet market in terms of shipping volumes.

We believe we are one of the leading suppliers of carbonless and book publishing papers in the United States. Although the markets for these

products are declining, we have been successful in executing our strategy to replace this lost volume with products such as envelope papers, business forms, and other value-added specialty products. Specialty Papers also produces paper that is

converted into specialized envelopes in a wide array of colors, finishes and end-uses. While this market is also declining, we have leveraged our customer service capabilities to grow our market share in each of the last several years.

Specialty Papers’ highly technical engineered products include digital imaging, packaging, casting, release, transfer, playing card, postal,

FDA-compliant food and beverage applications, and other niche specialty applications. Such products comprise an array of distinct business niches that are in a continuous state of evolution. Many of these products are utilized for demanding,

specialized customer and end-user applications. Some of our products are new and higher growth while others are more mature and further along in the product life cycle. Because many of these

products are technically complex and involve substantial customer-supplier development collaboration, they typically command higher per ton prices and generally exhibit greater pricing stability relative to commodity grade paper products.

The Specialty Papers business unit operates two integrated pulp and paper making facilities with the following combined attributes:

|

|

|

|

|

| Uncoated Production Capacity (short tons) |

|

Principal Raw Material (“PRM”) |

|

Estimated Annual

Quantity of PRM (short

tons) |

| 820,000 |

|

Pulpwood |

|

2,250,000 |

| |

|

Wood- and other pulps |

|

708,000 |

This business unit’s pulp mills have a combined pulp making capacity of 615,000 tons of bleached pulp per

year. The principal raw material used to produce pulp is pulpwood, including both hardwoods and softwoods. Pulpwood is obtained from a variety of locations including the states of Pennsylvania, Maryland, Delaware, New Jersey, New York, West

Virginia, Virginia, Kentucky, Ohio and Tennessee. To protect our sources of pulpwood, we actively promote conservation and forest management among suppliers and woodland owners.

The Spring Grove facility includes five uncoated paper machines as well as an off-line combi-blade coater and a Specialty Coater (“S-Coater”), which together provide annual production capacity for coated paper of approximately 65,000 tons. The Chillicothe facility operates four paper machines producing uncoated and carbonless paper.

Two of the machines have built-in coating capability which along with three additional coaters at the facility provide annual coated capacity of approximately 126,000 tons. Since uncoated paper is used in producing coated paper, this is not

additional capacity.

In addition to critical raw materials, the cost to produce Specialty Papers’ products is influenced by

energy. Although the business unit generates all of its steam needed for production at both facilities and generates more power than it consumes at the Spring Grove, PA facility, it purchased approximately 25% of its electricity needed for the

Chillicothe, OH mill in 2014. The facilities’ source of fuel is primarily coal and, to a lesser extent, natural gas. As discussed more fully under “Environmental Matters”, to comply with new air quality regulations we will be

implementing modifications that will convert certain boilers to burn natural gas rather than coal.

GLATFELTER 2014 FORM

10-K 5

In Special Papers’ markets, competition is product line specific due to, in certain instances,

the necessity for technical expertise and specialized manufacturing. The following chart summarizes key competitors by market segment:

|

|

|

| Market segment |

|

Competitor |

| Carbonless paper |

|

Appvion, Inc., and to a lesser extent, Fibria Celulose, Koehler Paper, Mitsubishi Paper, Nekoosa Coated Products and Asia Pulp and Paper Co. |

| Engineered products |

|

Specialty papers divisions of International Paper, Domtar Corp., Packaging Corp, and Sappi Limited, among others. |

| Envelope & converting |

|

Domtar and International Paper |

| Book publishing |

|

Domtar Corp., North Pacific Paper (NORPAC), Resolute Forest and others |

Customer service, product performance, technological advances and product pricing are important competitive

factors with respect to all our products. We believe our reputation in these areas continues to be excellent.

To be successful in the

market environment in which Specialty Papers operates, our strategy is focused on:

| |

• |

|

employing our new product and new business development capabilities to meet changing customer demands and ensure optimal utilization of capacity;

|

| |

• |

|

leveraging our flexible operating platform to optimize product mix by shifting production among facilities to more closely match output with changing demand

trends; |

| |

• |

|

aggressively employing methodologies to manage pressures on margins presented by more mature markets; |

| |

• |

|

utilizing ongoing continuous improvement methodologies to ensure operational efficiencies; and |

| |

• |

|

maintaining superior customer service. |

Additional financial information for each of our business units is included in Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and in Item 8 –

Financial Statements and Supplementary Data, Note 24 including geographic revenue and long-lived asset financial information.

Balance Sheet We are focused on prudent financial management and

maintaining a strong balance sheet. This includes:

| |

• |

|

aggressively managing working capital to enhance cash flow from operations; |

| |

• |

|

making disciplined capital expenditure decisions; and |

| |

• |

|

monetizing the value of our timberland assets as opportunities develop. |

The success of these actions positions us with the flexibility to pursue strategic opportunities that will benefit our shareholders.

Concentration of Customers For each of the past three years, no single customer represented more than 10% of our

consolidated net sales. However, as discussed in Item 1A Risk Factors, one customer accounted for the majority of Advanced Airlaid Materials net sales in 2014, 2013 and 2012.

Capital Expenditures Our business is capital intensive and requires extensive expenditures for new and enhanced

equipment. These capital investments are necessary to support growth strategies, research and development initiatives, environmental compliance, and for normal upgrades or replacements. Capital expenditures totaled $66.0 million, $103.0 million and

$58.8 million, in 2014, 2013 and 2012, respectively. For 2015, capital expenditures are estimated to be $120 million to $130 million including approximately $40 million related to compliance with certain environmental matters discussed below.

Environmental Matters We are subject to various federal, state and local laws and regulations intended

to protect the environment as well as human health and safety. At various times, we have incurred significant costs to comply with these regulations and we could incur additional costs as new regulations are developed or regulatory priorities

change.

We will incur material capital costs to comply with new air quality regulations including the U.S. EPA Best Available

Retrofit Technology rule (BART; otherwise known as the Regional Haze Rule) and the Boiler Maximum Achievable Control Technology rule (Boiler MACT). These rules will require process modifications and/or installation of air pollution controls on

boilers at two of our facilities. We have begun converting or replacing four coal-fired boilers to natural gas and upgrading site infrastructure to accommodate the new boilers, including connecting to gas

6

pipelines. The total cost of these projects is estimated at $85 million to $90 million. However, the amount of capital spending ultimately incurred may differ, and the difference could be

material. We expect to incur the majority of expenditures in 2015 and 2016. Enactment of new environmental laws or regulations or changes in existing laws or regulations could significantly change our estimates. For a discussion of other

environmental matters, see Item 8 – Financial Statements and Supplementary Data – Note 23.

Employees As of December 31, 2014, we employed 4,610 people worldwide, of which 68% are unionized. The United

Steelworkers International Union and the Office and Professional Employees International Union represents approximately 1,570 hourly employees at our Chillicothe, OH and Spring Grove, PA facilities under labor contracts expiring in August 2016 for

Chillicothe and January 2017 for Spring Grove. Hourly employees at each of our international locations are represented by various unions or works councils. We consider the overall relationship with our employees to be satisfactory.

Other Available Information The Corporate Governance page of our corporate web site includes our Governance

Principles and Code of Business Conduct, and biographies of our Board of Directors and Executive Officers. In addition, the website includes the charters for the Audit, Compensation, Finance, and Nominating and Corporate Governance Committees of the

Board of Directors. The Corporate Governance page also includes the Code of Business Ethics for the CEO and Senior Financial Officers of Glatfelter, our “whistle-blower” policy and other related material. We satisfy the disclosure

requirement for any future amendments to, or waivers from, our Code of Business Conduct or Code of Business Ethics for the CEO and Senior Financial Officers by posting such information on our website. We will provide a copy of the Code of Business

Conduct or Code of Business Ethics for the CEO and Senior Financial Officers, without charge, to any person who requests one, by contacting Investor Relations at (717) 225-2719, ir@glatfelter.com or by mail to 96 South George Street,

Suite 520, York, PA, 17401.

Our business and

financial performance may be adversely affected by a weak global economic environment or downturns in the target markets that we serve.

Adverse global economic conditions could impact our target markets resulting in decreased demand for our products.

Approximately $125 million of our annual revenue is earned from shipments to customers located in Ukraine, Russia and members of the Commonwealth of Independent States (also known as “CIS”). Uncertain

geo-political and economic conditions in this region, oil prices, and weak currencies have and may continue to cause significant volatility in demand for our products as well as our customers buying patterns.

Approximately 20% of our net sales in 2014 were shipped to customers in western Europe, the demand for which, in many cases, is dependent on

economic conditions in this area, or to the extent such customers do business outside of Europe, in other regions of the world.

Our

results could be adversely affected if economic conditions weaken or fail to improve. In the event of significant currency weakening in the countries into which our products are sold, demand for or pricing of our products could be adversely

impacted. Also, there may be periods during which demand for our products is insufficient to enable us to operate our production facilities in an economical manner. As a result, we may be forced to take machine downtime. The economic environment may

also cause customer insolvencies which may result in their inability to satisfy their financial obligations to us. These conditions are beyond our ability to control and may have a significant impact on our sales and results of operations.

Foreign currency exchange rate fluctuations could adversely affect our results of operations.

As we diversify our business and expand our global footprint, an increasing proportion of our revenue is generated outside of the United States.

We own and operate manufacturing facilities in Canada, Germany, France, the United Kingdom and the Philippines. Currently, the majority of our business is transacted in U.S. dollars; however, an increasing portion of business is transacted in Euros,

British Pound Sterling, Canadian dollars or Philippine Peso. Our euro denominated revenue exceeds euro expenses by approximately €120

million. With respect

GLATFELTER 2014 FORM

10-K 7

to the British Pound Sterling, Canadian dollar, and Philippine Peso, we have greater outflows than inflows of these currencies, although to a lesser degree. As a result, particularly with

respect to the euro, we are exposed to changes in currency exchange rates and such changes could be significant.

Economic weakness,

the potential inability of certain European countries to continue to service their sovereign debt obligations, and the related actions of this region’s central banks has caused, and could continue to cause, the value of the euro to weaken. As a

result, our operating results could be negatively impacted. In the event that one or more European countries were to replace the euro with another currency, business may be adversely affected until stable exchange rates are established.

Our ability to maintain our products’ price competitiveness is reliant, in part, on the relative strength of the currency in which the

product is denominated compared to the currency of the market into which it is sold and the functional currency of our competitors. Changes in the rate of exchange of foreign currencies in relation to the U.S. dollar, and other currencies, may

adversely impact our results of operations and our ability to offer products in certain markets at acceptable prices. For example, approximately $125 million of our annual revenue is earned from shipments to customers located in Ukraine, Russia and

members of the CIS. Although these sales are denominated in euros, a significant weakening of the customers’ local currencies could adversely affect our customers’ credit risk and our revenue and results of operation.

The cost of raw materials and energy used to manufacture our products could increase and the availability of certain raw materials could

become constrained.

We require access to sufficient and reasonably priced quantities of pulpwood, purchased pulps, pulp

substitutes, abaca fiber, synthetic fibers, and certain other raw materials.

Our Specialty Papers’ locations are vertically

integrated manufacturing facilities that can generate approximately 85% of their annual pulp requirements.

Our Philippine mill

purchases abaca fiber to produce abaca pulp a key fiber used to manufacture paper for single-serve coffee, tea and technical specialty products at our Gernsbach, Scaër, and Lydney facilities. At certain times, the supply of abaca fiber has been

constrained due to factors such as weather related damage to the source crop as well

as decisions by land owners to produce alternative crops in lieu of those used to produce abaca fiber.

Our Advanced Airlaid Materials business unit requires access to sufficient quantities of fluff pulp, the supply of which is subject to availability of certain softwoods. Softwood availability can be limited by many

factors, including weather in regions where softwoods are abundant.

The cost of many of our production materials, including petroleum

based chemicals and freight charges, are influenced by the cost of oil. In addition, coal is a principal source of fuel for both the Spring Grove and Chillicothe facilities. Natural gas is used as a source of fuel at Chillicothe and our Composite

Fibers and Advanced Airlaid Materials business units’ facilities.

Government rules, regulations and policies have an impact on

the cost of certain energy sources, particularly for our European operations. We currently benefit from a number of government sponsored programs designed to mitigate the cost of electricity to larger industrial consumers of power related to

initiatives such as green energy or renewable energy sources. As the political environment changes, any reduction in the extent of government sponsored incentives may adversely affect the cost ultimately borne by our operations.

Although we have contractual cost pass-through arrangements with certain Advanced Airlaid Materials’ customers, we may not be able to fully

pass increased raw materials or energy costs on to all customers if the market will not bear the higher price or if existing agreements with our customers limit price increases. If price adjustments significantly trail increases in raw materials or

energy prices, our operating results could be adversely affected.

Our industry is highly competitive and increased competition

could reduce our sales and profitability.

Specialty Papers The global markets in which we

compete have been adversely affected by capacity exceeding the demand for products, increased imports from foreign competitors and by uncoated free sheet demand which has been declining by 3% to 4% per year. As a result, the industry has taken

steps to reduce capacity. However, slowing demand or increased competition could force us to lower our prices or to offer additional services at a higher cost to us, which could reduce our gross margins and net income. The greater financial

resources of certain of our competitors may enable them to commit larger amounts of capital in response to changing market conditions. Certain competitors may also

8

have the ability to develop product or service innovations that could put us at a competitive disadvantage.

There have been periods of supply/demand imbalance in our industry which have caused pulp prices and our products’ selling prices to be volatile. The timing and magnitude of price increases or decreases in

these markets have generally varied by region and by product type. A sustained period of weak demand or excess supply would likely adversely affect pulp prices and our products’ selling prices. This could have a material adverse affect on our

operating and financial results.

Some of the other factors that may adversely affect our ability to compete in Specialty Papers

markets in which we participate include:

| |

• |

|

the entry of new competitors into the markets we serve; |

| |

• |

|

the prevelance of imported product, particularly uncoated free sheet, into the U.S.; |

| |

• |

|

the willingness of commodity-based producers to enter our markets when they are unable to compete or when demand softens in their traditional markets;

|

| |

• |

|

the aggressiveness of our competitors’ pricing strategies, which could force us to decrease prices in order to maintain market share;

|

| |

• |

|

our failure to anticipate and respond to changing customer preferences; |

| |

• |

|

the impact of electronic-based substitutes for certain of our products such as carbonless and forms, book publishing, and envelope papers;

|

| |

• |

|

the impact of replacement or disruptive technologies; |

| |

• |

|

changes in end-user preferences; |

| |

• |

|

our inability to develop new, improved or enhanced products; |

| |

• |

|

our inability to maintain the cost efficiency of our facilities; and |

| |

• |

|

the cost of regulatory environmental compliance requirements.

|

Composite Fibers and Advanced Airlaid Materials The global

markets in which we compete, although growing, are not as large as the markets for Specialty Papers. As a result, our ability to compete is more sensitive to and may be adversely impacted by the following:

| |

• |

|

the entry of new competitors into the markets we serve; |

| |

• |

|

the aggressiveness of our competitors’ pricing strategies, which could force us to decrease prices in order to maintain market share;

|

| |

• |

|

our failure to anticipate and respond to changing customer preferences; and |

| |

• |

|

technological advances or changes that impact production of our products. |

The impact of any significant changes as noted or otherwise may result in our inability to effectively compete in the markets in which we operate,

and as a result our sales and operating results would be adversely affected.

We may not be able to develop new products

acceptable to our customers.

Our business strategy is market focused and includes investments in developing new products to

meet the changing needs of our customers and to maintain our market share. Our success will depend, in part on our ability to develop and introduce new and enhanced products that keep pace with introductions by our competitors and changing customer

preferences. If we fail to anticipate or respond adequately to these factors, we may lose opportunities for business with both current and potential customers. The success of our new product offerings will depend on several factors, including our

ability to:

| |

• |

|

anticipate and properly identify our customers’ needs and industry trends; |

| |

• |

|

price our products competitively; |

| |

• |

|

develop and commercialize new products and applications in a timely manner; |

| |

• |

|

differentiate our products from our competitors’ products; and |

| |

• |

|

invest efficiently in research and development activities. |

Our inability to develop new products could adversely impact our business and ultimately harm our profitability.

GLATFELTER 2014 FORM

10-K 9

We are subject to substantial costs and potential liability for environmental matters.

We are subject to various environmental laws and regulations that govern our operations, including discharges into the

environment, and the handling and disposal of hazardous substances and wastes. We are also subject to laws and regulations that impose liability and clean-up responsibility for releases of hazardous substances into the environment. To comply with

environmental laws and regulations, we have incurred, and will continue to incur, substantial capital and operating expenditures. The Clean Air Act, and similar regulations, will impose significant compliance costs or require significant capital

expenditures. Compliance with the Clean Air Act will require process modifications and/or installation of air pollution controls on boilers at two of our facilities, as well as connecting to gas pipelines. Because of the complexities of this

initiative, our inability to successfully complete all aspects of the project could adversely impact the expenditures required or our results of operations.

We anticipate that environmental regulation of our operations will continue to become more burdensome and that capital and operating expenditures necessary to comply with environmental regulations will continue,

and perhaps increase, in the future. Because environmental regulations are not consistent worldwide, our ability to compete globally may be adversely affected by capital and operating expenditures required for environmental compliance. In addition,

we may incur obligations to remove or mitigate any adverse effects on the environment, such as air and water quality, resulting from mills we operate or have operated. Potential obligations include compensation for the restoration of natural

resources, personal injury and property damages. See Item 1 – Environmental Matters for an additional discussion of expected costs to comply with environmental regulations.

We continue to have exposure to potential liability for remediation and other costs related to the presence of polychlorinated biphenyls in the

lower Fox River on which our former Neenah, Wisconsin mill was located. There can be no assurance that we will not be required to provide significant contributions to fund remediation efforts in the near term and/or ultimately pay material amounts

to resolve our liability in the Fox River matter. We have financial reserves for environmental matters, including the Fox River site, but we cannot be certain that those reserves will be adequate to provide for future obligations related to these

matters, that our share of costs and/or damages

for these matters will not exceed our available resources, or that such obligations will not have a long-term, material adverse effect on our consolidated financial position, liquidity or results

of operations.

Our environmental issues are complex and should be reviewed in the context set forth in more detail in Item 8

– Financial Statements and Supplementary Data – Note 23.

The Advanced Airlaid Materials business unit generates a

substantial portion of its revenue from one customer serving the hygiene products market, the loss of which could have a material adverse effect on our results of operations.

Advanced Airlaid Materials generates the majority of its net sales of hygiene products from one customer. The loss of this customer could have a

material adverse effect on their operating results. In addition, sales to the feminine hygiene market accounted for 77% of Advanced Airlaid Materials’ net sales in 2014 and sales are concentrated within a small group of large customers. A

decline in sales of hygiene products could have a material adverse effect on this unit’s operating results. Our ability to effectively compete could be affected by technological advances which may introduce alternative or substitute products

into this market segment. Customers in the airlaid non-woven fabric material market, including the hygiene market, may also switch to less expensive products, change preferences or otherwise reduce demand for Advanced Airlaid Material’s

products, thus reducing the size of the markets in which it currently sells its products. Any of the foregoing could have a material adverse effect on our financial performance and business prospects.

Our operations may be impaired and we may be exposed to potential losses and liability as a result of natural disasters, acts of terrorism

or sabotage or similar events.

If we have a catastrophic loss or unforeseen operational problem at any of our facilities, we

could suffer significant lost production which could impair our ability to satisfy customer demands.

Natural disasters, such as

earthquakes, hurricanes, typhoons, flooding or fire, and acts of terrorism or sabotage affecting our operating activities and major facilities could materially and adversely affect our operations, operating results and financial condition.

In addition, we own and maintain three dams in York County, Pennsylvania, that were built to ensure a steady

10

supply of water for the operation of our facility in Spring Grove which is a primary manufacturing location for our envelope papers and engineered products. Each of these dams is classified as

“high hazard” by the Commonwealth of Pennsylvania because they are located in close proximity to inhabited areas. Any sudden failure of a dam, including as a result of natural disaster or act of terrorism or sabotage, would endanger

occupants and residential, commercial and industrial structures, for which we could be liable. The failure of a dam could also be extremely disruptive and result in damage to or the shutdown of our Spring Grove mill. Any losses or liabilities

incurred due to the failure of one of our dams may not be fully covered by our insurance policies or may substantially exceed the limits of our policies, and could materially and adversely affect our operating results and financial condition.

In addition, many of our papermaking operations require a reliable and abundant supply of water. Such mills rely on a local water body

or water source for their water needs and, therefore, are particularly impacted by drought conditions or other natural or manmade interruptions to its water supplies. At various times and for differing periods, each of our mills has had to modify

operations due to water shortages, water clarity, or low flow conditions in its principal water supplies. Any interruption or curtailment of operations at any of our paper mills due to drought or low flow conditions at the principal water source or

another cause could materially and adversely affect our operating results and financial condition.

Our pulp mill in Lanao del Norte on

the Island of Mindanao in the Republic of the Philippines is located along the Pacific Rim, one of the world’s hazard belts. By virtue of its geographic location, this mill is subject to, among similar types of natural disasters discussed

above, cyclones, typhoons, and volcanic activity. Moreover, the area of Lanao del Norte has been a target of suspected terrorist activities. The most common bomb targets in Lanao del Norte to date have been power transmission towers. Our pulp mill

in Mindanao is located in a rural portion of the island and is susceptible to attacks or power interruptions. The Mindanao mill supplies the abaca pulp that is used by our Composite Fibers business unit to manufacture our paper for single serve

coffee and tea products and certain technical specialties products. Any interruption, loss or extended curtailment of operations at our Mindanao mill could affect our ability to meet customer demands for our products and materially affect our

operating results and financial condition.

We have operations in a potentially politically and economically unstable location.

Our pulp mill in the Philippines is located in a region that is unstable and subject to political unrest. As discussed above,

our Philippine pulp mill produces abaca pulp, a significant raw material used by our Composite Fibers business unit, and is currently our main provider of abaca pulp. There are limited suitable alternative sources of readily available abaca pulp in

the world. In the event of a disruption in supply from our Philippine mill, there is no guarantee that we could obtain adequate amounts of abaca pulp from alternative sources at a reasonable price or at all. As a consequence, any civil disturbance,

unrest, political instability or other event that causes a disruption in supply could limit the availability of abaca pulp and would increase our cost of obtaining abaca pulp. Such occurrences could adversely impact our sales volumes, revenues and

operating results.

Our international operations pose certain risks that may adversely impact sales and earnings.

We have significant operations and assets located in Canada, Germany, France, the United Kingdom, and the Philippines. Our

international sales and operations are subject to a number of unique risks, in addition to the risks in our domestic sales and operations, including differing protections of intellectual property, trade barriers, labor unrest, exchange controls,

regional economic uncertainty, differing (and possibly more stringent) labor regulation, risk of governmental expropriation, domestic and foreign customs and tariffs, differing regulatory environments, difficulty in managing widespread operations

and political instability. These factors may adversely affect our future profits. Also, in some foreign jurisdictions, we may be subject to laws limiting the right and ability of entities organized or operating therein to pay dividends or remit

earnings to affiliated companies unless specified conditions are met. Any such limitations would restrict our flexibility in using funds generated in those jurisdictions.

We are subject to cyber-security risks related to unauthorized or malicious access to sensitive customer, vendor, company or employee information as well as to the technology that supports our operations and

other business processes.

Our business operations rely upon secure systems for mill operations, data capture, processing,

storage and

GLATFELTER 2014 FORM

10-K 11

reporting. Although we maintain appropriate data security and controls, our information technology systems, and those of our third party providers, could become subject to cyber attacks. Systems

such as ours are inherently exposed to cyber-security risks and potential for attacks. The result of such attacks could result in a breach of data security and controls. Such a breach of our network, systems, applications or data could result in

operational disruptions or damage or information misappropriation including, but not limited to, interruption to systems availability, denial of access to and misuse of applications required by our customers to conduct business with us, denial of

access to the applications we use to plan our operations, procure materials, manufacture and ship products and account for orders, theft of intellectual knowhow and trade secrets, and inappropriate disclosure of confidential company, employee,

customer or vendor information, could stem from such incidents.

Any of these operational disruptions and/or misappropriation of

information could adversely affect our results of operations, create negative publicity and could have a material effect on our business.

In the event any of the above risk factors impact our business in a material way or in combination during the same period, we may be unable to generate sufficient cash flow to simultaneously fund our

operations, finance capital expenditures, satisfy obligations and make dividend payments on our common stock.

In addition to

debt service obligations, our business is capital intensive and requires significant expenditures to support growth strategies, research and development initiatives, environmental compliance, and for normal upgrades or replacements. We expect to

meet all of our near and long-term cash needs from a combination of operating cash flow, cash and cash equivalents, our existing credit facility and other long-term debt. If we are unable to generate sufficient cash flow from these sources, we could

be unable to meet our near and long-term cash needs or make dividend payments.

| ITEM 1B |

UNRESOLVED STAFF COMMENTS |

None.

We own substantially all

of the land and buildings comprising our manufacturing facilities located in Pennsylvania; Ohio; Canada; the United Kingdom;

Germany; France; and the Philippines; as well as substantially all of the equipment used in our manufacturing and related operations. Certain of our operations are under lease arrangements

including our metallized paper production facility located in Caerphilly, Wales, office and warehouse space in Moscow, Russia, Souzou, China and our corporate offices located in York, Pennsylvania. All of our properties, other than those that are

leased, are free from any material liens or encumbrances. We consider all of our buildings to be in good structural condition and well maintained and our properties to be suitable and adequate for present operations.

We are involved

in various lawsuits that we consider to be ordinary and incidental to our business. The ultimate outcome of these lawsuits cannot be predicted with certainty; however, except with respect to the Fox River matter referred to below, we do not expect

such lawsuits, individually or in the aggregate, will have a material adverse effect on our consolidated financial position, liquidity or results of operations.

We are one of several defendants in a significant environmental matter relating to contamination in the Fox River and Bay of Green Bay in Wisconsin. For a discussion this matter, see Item 8 – Financial

Statements and Supplementary Data – Note 23.

EXECUTIVE OFFICERS

The following table sets forth certain information with respect to our executive officers and senior management as of February 27, 2015.

|

|

|

|

|

|

|

| Name |

|

Age |

|

|

Office with the Company |

| Dante C. Parrini |

|

|

50 |

|

|

Chairman and Chief Executive Officer |

| John P. Jacunski |

|

|

49 |

|

|

Executive Vice President and Chief Financial Officer |

| Christopher W. Astley |

|

|

42 |

|

|

Senior Vice President & Business Unit President, Advanced Airlaid Materials |

| Brian E. Janki |

|

|

42 |

|

|

Senior Vice President & Business Unit President, Specialty Papers |

| Martin Rapp |

|

|

55 |

|

|

Senior Vice President & Business Unit President, Composite Fibers |

| William T. Yanavitch II |

|

|

54 |

|

|

Senior Vice President, Human Resources and Administration |

| David C. Elder |

|

|

46 |

|

|

Vice President, Finance |

| Kent K. Matsumoto |

|

|

55 |

|

|

Vice President, General Counsel and Corporate Secretary |

| Mark A. Sullivan |

|

|

60 |

|

|

Vice President, Global Supply Chain and Information Technology |

12

Officers are elected to serve at the pleasure of the Board of Directors. Except in the case of

officers elected to fill a new position or a vacancy occurring at some other date, officers are generally elected at the organizational meeting of the Board of Directors held immediately after the annual meeting of shareholders.

Dante C. Parrini became Chief Executive Officer effective January 1, 2011 and Chairman of the Board in May 2011. Prior to this, he was

Executive Vice President and Chief Operating Officer, a position he held since February 2005. Mr. Parrini joined us in 1997 and has previously served as Senior Vice President and General Manager, a position he held beginning in January 2003 and

prior to that as Vice President responsible for Sales and Marketing.

John P. Jacunski was promoted to Executive Vice President

and Chief Financial Officer in February 2014. He joined us in October 2003 and served as Vice President and Corporate Controller. In July 2006 he was promoted to Senior Vice President and Chief Financial Officer. Mr. Jacunski was previously

Vice President and Chief Financial Officer at WCI Steel, Inc. from June 1999 to October 2003. Prior to joining WCI, Mr. Jacunski was with KPMG, an international accounting and consulting firm, where he served in various capacities.

Christopher W. Astley was named Senior Vice President & Business Unit President, Advanced Airlaid Materials in January 2015. He

joined us in August 2010 as Vice President, Corporate Strategy and was promoted to Senior Vice President in February 2014. Prior to joining us, he was an entrepreneur leading a privately held business from 2004 until 2010. Prior to that

Mr. Astley held positions with Accenture, a global management consulting firm, and The Coca-Cola Company.

Brian E. Janki

serves as Senior Vice President & Business Unit President, Specialty Papers. Prior to joining us in August 2013 Mr. Janki was employed by Greif as their Vice President & General Manager, Rigid Industrial Packaging &

Services. During his twelve years with Greif, Mr. Janki held leadership positions including profit/loss responsibilities for two business units, global responsibility for supply chain and sourcing, and transformational assignments including

global oversight of the implementation of the Greif Business System.

Martin Rapp serves as Senior Vice President & Business Unit President, Composite

Fibers. Mr. Rapp joined us in August 2006 and has lead the Composite Fibers business unit since that time. Prior to this, he was Vice President and General Manager of Avery Dennison’s Roll Materials Business in Central and Eastern Europe

since August 2002.

William T. Yanavitch II was promoted to Senior Vice President Human Resources and Administration in February

2014. Since joining us in July 2000, he has served as Vice President, Human Resources. Prior to joining us he worked for Dentsply International and Gould Pumps Inc. in various leadership capacities.

David C. Elder was promoted to Vice President, Finance in December 2011 and continues as our Chief Accounting Officer. Prior to his

promotion, he was our Vice President, Corporate Controller, a position held since joining Glatfelter in January 2006. Mr. Elder was previously Corporate Controller for YORK International Corporation.

Kent K. Matsumoto was appointed Vice President, General Counsel and Corporate Secretary in October 2013. Mr. Matsumoto joined us in

June 2012 as Assistant General Counsel and also served as interim General Counsel from March 2013 to October 2013. From July 2008 until February 2012, he was Associate General Counsel for Wolters Kluwer.

Mark A. Sullivan has served as Vice President, Global Supply Chain and Information Technology since his promotion in November 2012.

Mr. Sullivan joined us in December 2003 as Chief Procurement Officer and he was appointed Vice President, Global Supply Chain in February 2005. Prior to joining Glatfelter, his experience included a broad array of operations and supply chain

management responsibilities during twenty years with the DuPont Company.

| ITEM 4 |

MINE SAFETY DISCLOSURES |

Not

Applicable

GLATFELTER 2014 FORM

10-K 13

PART II

| ITEM 5 |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Common Stock Prices and Dividends Declared Information

The following table shows the high and low prices of our common stock traded on the New York Stock Exchange under the symbol “GLT” and the dividend declared per share for each quarter during the past two

years:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarter |

|

High |

|

|

Low |

|

|

Dividend |

|

| 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

| Fourth |

|

$ |

27.18 |

|

|

$ |

21.38 |

|

|

$ |

0.11 |

|

| Third |

|

|

27.19 |

|

|

|

21.94 |

|

|

|

0.11 |

|

| Second |

|

|

27.54 |

|

|

|

24.07 |

|

|

|

0.11 |

|

| First |

|

|

32.00 |

|

|

|

26.52 |

|

|

|

0.11 |

|

| 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

| Fourth |

|

$ |

29.25 |

|

|

$ |

25.01 |

|

|

$ |

0.10 |

|

| Third |

|

|

28.21 |

|

|

|

25.13 |

|

|

|

0.10 |

|

| Second |

|

|

26.44 |

|

|

|

21.53 |

|

|

|

0.10 |

|

| First |

|

|

23.66 |

|

|

|

17.11 |

|

|

|

0.10 |

|

As of February 25, 2015, we had 1,115 shareholders of record.

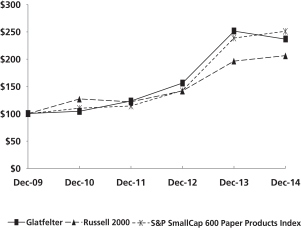

STOCK PERFORMANCE GRAPH

The following graph compares the cumulative 5-year total return of our common stock with the cumulative total returns of both a peer group and a broad market index. We compare our stock performance to the S&P

Small Cap 600 Paper Products index comprised of us, Clearwater Paper Corp., Kapstone Paper & Packaging Corp., Neenah Paper Inc., Schweitzer-Mauduit International and Wausau Paper Corp. In addition, the chart includes a comparison to the

Russell 2000, which we believe is an appropriate benchmark index for stocks such as ours. The following graph assumes that the value of the investment in our common stock, in each index, and in the peer group (including reinvestment of dividends)

was $100 on December 31, 2009 and charts it through December 31, 2014.

14

| ITEM 6 |

SELECTED FINANCIAL DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of or for the year ended December 31

Dollars in thousands, except per share |

|

|

2014 |

|

|

|

2013 (1) |

|

|

|

2012 |

|

|

|

2011 |

|

|

|

2010 (4) |

|

| Net sales |

|

$ |

1,802,415 |

|

|

$ |

1,722,615 |

|

|

$ |

1,577,788 |

|

|

$ |

1,603,154 |

|

|

$ |

1,455,331 |

|

| Energy and related sales, net |

|

|

7,927 |

|

|

|

3,153 |

|

|

|

7,000 |

|

|

|

9,344 |

|

|

|

10,653 |

|

| Total revenue |

|

|

1,810,342 |

|

|

|

1,725,768 |

|

|

|

1,584,788 |

|

|

|

1,612,498 |

|

|

|

1,465,984 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

69,246 |

|

|

$ |

67,158 |

|

|

$ |

59,379

|

(2)

|

|

$ |

42,694

|

(3)

|

|

$ |

54,434

|

(5)

|

|

|

|

|

|

|

| Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

1.60 |

|

|

$ |

1.56 |

|

|

$ |

1.39 |

|

|

$ |

0.94 |

|

|

$ |

1.19 |

|

| Diluted |

|

|

1.57 |

|

|

|

1.52 |

|

|

|

1.36 |

|

|

|

0.93 |

|

|

|

1.17 |

|

|

|

|

|

|

|

| Total assets |

|

$ |

1,561,504 |

|

|

$ |

1,678,410 |

|

|

$ |

1,242,985 |

|

|

$ |

1,136,925 |

|

|

$ |

1,341,747 |

|

| Total debt |

|

|

404,612 |

|

|

|

442,325 |

|

|

|

250,000 |

|

|

|

227,000 |

|

|

|

333,022 |

|

| Shareholders’ equity |

|

|

649,109 |

|

|

|

684,476 |

|

|

|

539,679 |

|

|

|

490,404 |

|

|

|

552,442 |

|

|

|

|

|

|

|

| Cash dividends declared per common share |

|

|

0.44 |

|

|

|

0.40 |

|

|

|

0.36 |

|

|

|

0.36 |

|

|

|

0.36 |

|

| Depreciation, depletion and amortization |

|

|

70,555 |

|

|

|

68,196 |

|

|

|

69,500 |

|

|

|

69,313 |

|

|

|

65,839 |

|

| Capital expenditures |

|

|

66,046 |

|

|

|

103,047 |

|

|

|

58,752 |

|

|

|

64,491 |

|

|

|

36,491 |

|