| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| DEAR SHAREHOLDERS: |

|

At GPC, we are proud of how our teams have shown resilience and weathered the volatility of recent years, supporting each other while providing automotive and industrial parts and services that keep the world moving. In 2022, we executed on our strategic priorities to accelerate profitable growth, generate strong cash flow, and maintain a disciplined approach to capital allocation. We increased the dividend paid to shareholders by 10% and repurchased 1.6 million shares of our common stock. While our teammates worked tirelessly to serve our customers, your Board remained focused on overseeing the creation and execution of an effective One GPC strategy, while also overseeing progress on our key ESG initiatives. Our focus on both our strategic and ESG priorities were instrumental to our performance in 2022 and ultimately to the creation of long-term value for our shareholders.

The Company has made significant progress in its environmental, social, and governance initiatives. There is incredible momentum and work focused on climate and energy, all of which is outlined in our 2022 Sustainability Report. In 2022, the Company completed a comprehensive measurement of our global carbon footprint, and we have been implementing our carbon emissions abatement strategy in each and every location in which we operate. We look forward to measuring and reporting on our progress in this area on an annual basis. The Company also advanced its long-term diversity, equity, and inclusion strategy focused on people, culture, and the communities in which we operate. To accelerate that effort, the Company established business resource groups that empower teammates to come together with others who share their interests and experiences in order to enhance and develop their leadership skills and networks. We strive to create and maintain the most diverse, equitable and inclusive workplace possible, which includes adding more diverse employees, and once hired, ensuring they feel engaged, included, and valued. Additionally, we are taking action outside of the Company to support organizations focused on advancing racial equality and helping diverse and underserved communities around the world.

Over the last several years, the Board has actively focused on aligning its strengths with the evolving business landscape. This focus has led to the addition of two new independent directors in the past five years, each of whom has added to the experience and diversity of our Board. The Board continues to assess its composition to ensure that it collectively has the skills and diversity needed to provide effective oversight and support strategic planning. In 2022, our Board focused on governance changes to more effectively oversee key initiatives of the Company. Our Board took part in a comprehensive and rigorous evaluation to assess the effectiveness of the Board and its Committees, and one action resulting from such assessment was the split of the Compensation, Nominating and Governance Committee into two separate Committees: the Compensation and Human Capital Committee and the Nominating and ESG Committee. This restructuring was effective on January 1, 2023. The Board believes that having separate Committees to oversee these evolving areas of significant importance will provide enhanced focus and oversight, which will ultimately improve the effectiveness of our Board and help drive long-term shareholder value.

In 2022, we continued to see significant demand for industrial and automotive aftermarket products and services, while also facing a challenging macro-economy, including supply chain disruptions, a tight labor market, and inflationary pressures. We believe our continued focus on our customers; investments across our infrastructure, stores, and digital platforms; and quickly responding to changing customer expectations, enabled us to keep pace with this incredibly fluid business environment. The Board’s engagement with management helped to shape our investment priorities, and our directors continue to provide oversight to help us learn from the challenges of the last several years and keep making the right investments across our business. As we look ahead, we continue to see tremendous opportunities for our business and shareholder value creation, with the ability to deliver positive impact at a global scale.

We hope you will be able to join us for our virtual 2023 Annual Meeting of Shareholders on Monday, May 1, 2023. You will find information about the Meeting, including the matters to be voted on, in the Notice of 2023 Annual Meeting of Shareholders and Proxy Statement. The Meeting will also include a report on the Company’s performance and operations and a question and answer session. On behalf of our 58,000 teammates and our Board, we thank you for your support of Genuine Parts Company.

|

|

|

| |||

| Paul D. Donahue Chairman and CEO

|

John D. Johns Lead Independent Director

|

GENUINE PARTS COMPANY

2999 WILDWOOD PARKWAY

ATLANTA, GEORGIA 30339

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS

MAY 1, 2023

TO THE SHAREHOLDERS OF GENUINE PARTS COMPANY:

The 2023 Annual Meeting of Shareholders of Genuine Parts Company, a Georgia corporation, will be held virtually on Monday, May 1, 2023, at 10:00 a.m. eastern time, for the following purposes:

| (1) | To elect as directors the thirteen nominees named in the attached proxy statement; |

| (2) | To approve, by a non-binding advisory vote, the compensation of the Company’s named executive officers; |

| (3) | To recommend, by a non-binding advisory vote, the frequency of the advisory vote on the compensation of the Company’s executive officers; |

| (4) | To ratify the selection of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2023; and |

| (5) | To act upon such other matters that may properly come before the meeting or any reconvened meeting following any adjournment thereof. |

Information relevant to these matters is set forth in the attached proxy statement. Only holders of record of the Company’s common stock at the close of business on February 22, 2023 will be entitled to vote at the meeting. The live audio webcast of the Annual Meeting will begin promptly at 10:00 a.m. eastern time. Online access to the audio webcast will open 15 minutes prior to the start of the Annual Meeting. We encourage you to access the meeting in advance of the designated start time.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 1, 2023.

We are pleased to announce that we are delivering your proxy materials for the 2023 Annual Meeting of Shareholders via the Internet. Because we are delivering proxy materials via the Internet, the Securities and Exchange Commission requires us to mail a letter to our shareholders notifying them that these materials are available on the Internet and how these materials may be accessed. This letter, which we refer to as our “Notice and Access Letter,” will be mailed to our shareholders on or about March 3, 2023.

Our Notice and Access Letter will instruct you on how to access and review our proxy statement for the 2023 Annual Meeting of Shareholders and our annual report for the fiscal year ended December 31, 2022. It will instruct you on how you may vote your proxy via the Internet, or how you can request a full set of printed proxy materials, including a proxy card to return by mail. If you would like to receive printed proxy materials, you should follow the instructions contained in our Notice and Access Letter. Unless requested, you will not receive printed proxy materials by mail.

To Attend, Vote, and Participate during the virtual Annual Meeting:

To attend and vote your shares during the virtual Annual Meeting, you will need to log-in to meetnow.global/MR2WPTW using: (i) for record holders, the 15-digit control number on your proxy card or (ii) for holders who own shares in street name through brokers, the control number issued to you by Computershare pursuant to the registration process described in the following paragraph. If you do not have a control number, you may log-in as a Guest.

For holders who own shares in street name through brokers, you must request and receive a legal proxy in your name reflecting your holdings of GPC stock from the broker, bank, or other nominee that holds your shares, and then you must submit this by email to legalproxy@computershare.com along with your name and email address. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., eastern time, on April 30, 2023. You will receive a confirmation email from Computershare of your registration and a new control number that you can use to participate in the virtual Annual Meeting. If you do not have the control number that you received directly from Computershare, you may attend as a Guest (non-stockholder) but will not have the option to vote or ask questions during the virtual Annual Meeting.

The 2023 Proxy Statement and the 2022 Annual Report to Shareholders are available at: http://www.proxydocs.com/gpc

|

Atlanta, Georgia March 3, 2023 |

By Order of the Board of Directors,

| |

| JENNIFER L. ELLIS | ||

| YOUR VOTE IS IMPORTANT! |

Vice President - Compliance & | |

| Corporate Secretary |

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE VOTE BY TELEPHONE OR INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD OR COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD PROMPTLY IN THE ENCLOSED BUSINESS REPLY ENVELOPE.

TABLE OF CONTENTS

| 1 | ||||

| 1 | ||||

| 4 | ||||

| 12 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| Consideration of Last Year’s Advisory Shareholder Vote on Executive Compensation |

30 | |||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 37 | ||||

| Factors Considered in Decisions to Materially Increase or Decrease Compensation |

37 | |||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

ANNUAL MEETING — May 1, 2023

This proxy statement is being furnished to the shareholders of Genuine Parts Company in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Company’s 2023 Annual Meeting of Shareholders to be held on Monday, May 1, 2023, at 10:00 a.m. eastern time and at any reconvened meeting following any adjournment thereof. The Annual Meeting will be held virtually. To access the virtual meeting, go to meetnow.global/MR2WPTW and enter a valid control number found on your proxy card, notice of internet availability, or an email previously received from Computershare. If you do not have a control number, you may access the meeting as a Guest.

The live audio webcast of the Annual Meeting will begin promptly at 10:00 a.m. eastern time. Online access to the audio webcast will open 15 minutes prior to the start of the Annual Meeting. We encourage you to access the meeting in advance of the designated start time.

We have designed the format of the Annual Meeting to ensure that our shareholders are afforded the same rights and opportunities to participate as they would at an in-person meeting. After the business portion of the Annual Meeting concludes and the meeting is adjourned, we will hold a Q&A session during which we intend to answer questions submitted during the meeting that are pertinent to the Company, as time permits, and in accordance with our Ground Rules for Conduct of the Shareholder Meeting. On the day of and during the Annual Meeting, you can view our Ground Rules for Conduct of the Shareholder Meeting and submit any questions on meetnow.global/MR2WPTW. Answers to any questions not addressed during the meeting will be posted following the meeting on the investor page of our website. Questions and answers will be grouped by topic, and substantially similar questions will be answered only once. To promote fairness, efficiently use the Company’s resources, and ensure all shareholder questions are able to be addressed, we will respond to no more than three questions from any single shareholder.

Beginning one hour prior to and during the Annual Meeting, we will have support available to assist shareholders with any technical difficulties they may have accessing or hearing the virtual meeting. If you encounter any technical difficulty during the virtual meeting, please call 888-724-2416 (U.S.) or +1 781-575-2748 (international) for assistance.

We anticipate that our Notice and Access Letter will first be mailed, and that this proxy statement and the Company’s 2022 annual report to the shareholders, including consolidated financial statements for the year ended December 31, 2022 will first be made available to our shareholders, on or about March 3, 2023.

VOTING

Shareholders of record can simplify their voting and reduce the Company’s costs by voting their shares via telephone or the Internet. Instructions for voting via telephone or the Internet are set forth on the proxy card. The telephone and Internet voting procedures are designed to authenticate votes cast by use of a personal identification number. These procedures enable shareholders to appoint a proxy to vote their shares and to confirm that their instructions have been properly recorded. If your shares are held in the name of a bank or broker (in “street name”), the availability of telephone and Internet voting will depend on the voting processes of the applicable bank or broker; therefore, it is recommended that you follow the voting instructions on the form you receive from your bank or broker. If you do not choose to vote by telephone or the Internet, please mark your choices on the proxy card and then date, sign and return the proxy card at your earliest opportunity.

All proxies properly voted by telephone or the Internet and all properly executed written proxy cards that are delivered to the Company (and not later revoked) will be voted in accordance with instructions given in the proxy. When voting on the election of directors, you may (1) vote FOR all nominees listed in this proxy statement, (2) WITHHOLD AUTHORITY to vote for all nominees, or (3) WITHHOLD AUTHORITY to vote for one or more nominees but vote FOR the other nominees. When voting on the approval of the compensation of the Company’s named executive officers and the ratification of the selection of independent auditors, you may vote FOR or AGAINST the proposal or you may ABSTAIN from voting. When voting on the frequency of advisory vote on executive compensation, you may recommend that a vote should occur (1) EVERY YEAR, (2) EVERY TWO YEARS, (3) EVERY THREE YEARS, or (4) you may ABSTAIN from voting.

|

2023 Proxy Statement | 1 |

Voting

To vote your shares during the virtual Annual Meeting, you will need to log-in to meetnow.global/MR2WPTW using: (i) for record holders, the 15-digit control number on your proxy card or (ii) for holders who own shares in street name through brokers, the control number issued to you by Computershare pursuant to the registration process described in the following paragraph. If you do not have a control number, you may log-in as a Guest.

For holders who own shares in street name through brokers, you must request and receive a legal proxy in your name reflecting your holdings of GPC stock from the broker, bank, or other nominee that holds your shares, and then you must submit this by email to legalproxy@computershare.com along with your name and email address. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., eastern time, on April 30, 2023. You will receive a confirmation email from Computershare of your registration and a new control number that you can use to participate in the virtual Annual Meeting. If you do not have the control number that you received directly from Computershare, you may attend as a Guest (non-stockholder) but will not have the option to vote or ask questions during the virtual Annual Meeting.

If a signed proxy card is received which does not specify a vote or an abstention, the shares represented by that proxy card will be voted FOR all nominees to the Board of Directors listed in this proxy statement, FOR the proposal to approve the compensation of the Company’s named executive officers, for an advisory vote on executive compensation to occur EVERY YEAR, and FOR the ratification of the selection of independent auditors for the fiscal year ending December 31, 2023. The Company is not aware, as of the date hereof, of any matters to be voted upon at the Annual Meeting other than those stated in this proxy statement and the accompanying Notice of 2023 Annual Meeting of Shareholders. If any other matters are properly brought before the Annual Meeting, the enclosed proxy card gives discretionary authority to the persons named as proxies to vote the shares represented thereby in their discretion.

If you hold your shares in street name and you do not instruct your bank or brokerage firm in accordance with their directions how to vote your shares prior to the date of the Annual Meeting, your bank or brokerage firm cannot vote your shares (referred to as “broker non-votes”) on the following proposals: “Proposal 1 — Election of Directors,” “Proposal 2 — Advisory Vote on Executive Compensation,” and “Proposal 3 — Advisory Vote on Frequency of Advisory Shareholder Vote on Executive Compensation,” and such shares will be considered “broker non-votes” and will not affect the outcome of these votes. However, your bank or brokerage firm may vote your shares in its discretion on “Proposal 4 — Ratification of Selection of Independent Auditors” if you do not provide voting instructions.

A shareholder of record who submits a proxy pursuant to this solicitation may revoke it at any time prior to its exercise at the Annual Meeting. Such revocation may be by delivery of written notice to the Corporate Secretary of the Company at the Company’s address shown above, by delivery of a proxy bearing a later date (including a later vote by telephone or the Internet), or by voting in person at the Annual Meeting. Street name holders may revoke their proxies prior to the Annual Meeting by following the procedures specified by their bank or brokerage firm.

Only holders of record of the Company’s common stock at the close of business on the record date for the Annual Meeting, which is February 22, 2023, are entitled to vote at the Annual Meeting. Persons who hold shares of common stock in street name as of the record date may vote at the Annual Meeting only if they hold a valid proxy from their bank or brokerage firm. At the close of business on February 22, 2023, the Company had 140,808,951 shares of common stock outstanding and entitled to vote at the Annual Meeting.

On each proposal presented for a vote at the Annual Meeting, each shareholder is entitled to one vote per share of common stock held as of the record date. A quorum for the purposes of all matters to be voted on shall consist of shareholders representing, in person or by proxy, a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting. Shares represented at the Annual Meeting that are abstained or withheld from voting and broker non-votes will be considered present for purposes of determining a quorum at the Annual Meeting. If less than a majority of the outstanding shares of common stock are represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting to another date, time or place to allow for the solicitation of additional proxies or other measures to obtain a quorum.

The vote required for (1) the election of directors, (2) the advisory vote on executive compensation, and (3) the ratification of the selection of independent auditors is the affirmative vote of a majority of the shares of common stock outstanding and entitled to vote on such proposal which are represented at the Annual Meeting. Because

| 2 |

|

2023 Proxy Statement |

Voting

votes withheld and abstentions will be considered as present and entitled to vote at the Annual Meeting but will not be voted “for” these proposals, they will have the same effect as votes “against” these proposals. The vote required to determine the frequency of advisory shareholder vote on executive compensation is a plurality of votes cast, which means that the frequency option that receives the most affirmative votes of all the votes cast is the one that will be deemed approved by the shareholders. Abstentions will not affect the outcome of this proposal.

Although the advisory vote on executive compensation and the frequency of the advisory vote on executive compensation are non-binding as provided by law, the Company’s Board of Directors will review the results of the vote and take it into consideration when making future determinations concerning executive compensation.

|

2023 Proxy Statement | 3 |

PROPOSAL 1 ELECTION OF DIRECTORS

The Board of Directors of the Company currently consists of thirteen directors. The Board has approved the recommendation of its Nominating and ESG Committee to nominate the thirteen director nominees named below, each of whom, if elected, will serve as directors until the 2024 Annual Meeting and the election and qualification of their successors.

In the event that any nominee is unable to serve (which is not anticipated), the Board of Directors may:

| • | designate a substitute nominee, in which case persons designated as proxies will cast votes for the election of such substitute nominee; |

| • | allow the vacancy to remain open until a suitable candidate is located and nominated; or |

| • | adopt a resolution to decrease the size of the Board. |

If any incumbent director nominee in an uncontested election should fail to receive the required affirmative vote of the holders of a majority of the shares entitled to vote which are represented at the Annual Meeting, under Georgia law, the director remains in office as a “holdover” director until until his or her successor is elected and qualified or until there is a decrease in the number of directors serving on the Board of Directors. Our Amended and Restated Articles of Incorporation further provide that a director shall serve on the Board of Directors until his or her successor is elected and qualified or until his or her earlier resignation, retirement, disqualification, removal from office or death. If the director resigns, the Board of Directors may:

| • | immediately fill the resulting vacancy; |

| • | allow the vacancy to remain open until a suitable candidate is located and appointed; or |

| • | adopt a resolution to decrease the size of the Board. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF ALL OF THE DIRECTOR NOMINEES.

Set forth below is certain information about each of the thirteen director nominees, including the experience, qualifications, attributes and skills that our Board believes makes them well qualified to serve as directors. Information about our director independence requirements, our director nominating process, our board leadership structure, a Board Matrix, and other corporate governance matters can be found in the “Corporate Governance” section.

| 4 |

|

2023 Proxy Statement |

Proposal 1 Election of Directors

NOMINEES FOR DIRECTOR

| Elizabeth W. Camp |

Background | Qualifications | ||

|

Financial Expert

Director Since 2015

Independent Director

Age 71

Committee • Audit |

Elizabeth W. Camp is President and Chief Executive Officer of DF Management, Inc., a private investment and commercial real estate management company, a position she has held since 2000. Previously, Ms. Camp served in various capacities, including President and Chief Executive Officer of Camp Oil Company for 16 years. Ms. Camp serves as an independent director of Synovus Financial Corp. and is a member of its Risk Committee. Ms. Camp also serves as a director of CoreCard Corporation where she serves on the Audit and Compensation Committees.

|

Ms. Camp has over 30 years of leadership experience in various executive roles, most recently as President and Chief Executive Officer of an investment and commercial real estate management company. Ms. Camp also currently serves as an independent director at Synovus Financial Corp. where she has chaired its Audit Committee and its Compensation Committee, and has served as Lead Independent Director. She serves as a current member of the Synovus Risk Committee. Ms. Camp also currently serves as an independent director at CoreCard Corporation, a public company engaged in digital credit card processing, where she serves as a member of its Audit Committee and Compensation Committee. Her previous experience as a tax attorney at large accounting and law firms in the Washington D.C. area also benefits the Company in the financial, accounting, tax, and legal areas. Ms. Camp’s background as an executive officer and director and her expertise in accounting, tax and legal matters have provided expertise in management, governance, and auditing, as well as leadership skills to our Board and Audit Committee.

| ||

| Richard Cox, Jr. |

Background | Qualifications | ||

|

Director Since 2020

Independent Director

Age 54

Committee • Audit |

Mr. Cox is Senior Vice President - Reservation Sales and Customer Care at Delta Airlines, a position he has held since August 2022. Prior to joining Delta, Mr. Cox served as Chief Information Officer for Cox Enterprises and had been in that role since 2019. Mr. Cox joined Cox Automotive, a subsidiary of Cox Enterprises, in 2013, where he held several leadership positions including Vice President of Client Performance and Vice President of Business Operations and Customer Care. In 2018, the Mayor of Atlanta requested Cox Enterprises to allow Mr. Cox to serve as the city’s Chief Operating Officer as an executive on-loan. For 15 months, Mr. Cox provided executive oversight and directed internal operations for the city’s departments and agencies. Prior to joining Cox Automotive, Mr. Cox was CEO and President of Jones International University and prior to that, he served as Vice President of Customer Experience at Orbitz Worldwide, a leading online travel company. Mr. Cox began his career at Worldspan, a travel technology and content provider, and held several positions during his 11-year tenure at Worldspan. |

Mr. Cox has over two decades of experience in technology and business operations. His experience at Delta Airlines, Cox Automotive, Orbitz, and Worldspan in a variety of leadership roles are highly valuable to the Company. During Mr. Cox’s tenure as the city of Atlanta’s COO, he led the city through the largest cyber attack of a U.S. municipality and successfully implemented the largest- ever citywide shift to the cloud. Mr. Cox’s understanding of cyber and IT risk as well as data privacy is instrumental as a member of the Audit Committee. His significant experience in information technology, the automotive business, and his expertise in strategy, operations, customer care, analytics, business intelligence, security and technical services makes him a valuable asset to our board.

| ||

|

2023 Proxy Statement | 5 |

Proposal 1 Election of Directors

| Paul D. Donahue |

Background | Qualifications | ||

|

Chairman

Director Since 2012

Age 66

Committee • Executive |

Paul D. Donahue is Chairman and Chief Executive Officer of the Company. In April of 2019 the Board of Directors appointed him as Chairman and in May of 2016, he was named Chief Executive Officer. From January of 2012 until May of 2016 he served as President of the Company. He served as President of the Company’s U.S. Automotive Parts Group from July, 2009 to February 1, 2016. Mr. Donahue served as Executive Vice President of the Company from August 2007 until his appointment as President. In addition, between 2004 and 2007, Mr. Donahue served as President and Chief Operating Officer of S. P. Richards Company, a former wholly-owned subsidiary of the Company. Mr. Donahue is a Director of Truist Financial Corporation and serves as a member of the Truist Compensation and Human Capital Committee as well as the Trust Committee.

|

Mr. Donahue has 20 years of successful operating and management experience with the Company, which has included extensive involvement with numerous operating divisions within the Company. Prior to joining the Company, Mr. Donahue spent 24 years with a publicly traded consumer products manufacturer. While there, he successfully held a number of sales, marketing, operations and executive positions. Mr. Donahue’s proven leadership and experience have contributed to the success of the Company and are beneficial to our Board. His experience and knowledge gained from his service on the Truist Board and Committees also brings great value to our Board.

| ||

| Gary P. Fayard |

Background | Qualifications | ||

|

Financial Expert

Director Since 2014

Independent Director

Age 70

Committee • Audit |

Gary P. Fayard is a cattle farmer and previously was Executive Vice President and Chief Financial Officer of the Coca-Cola Company from 2003 until his retirement in May, 2014. Mr. Fayard joined the Coca-Cola Company in 1994 as Vice President and Controller. He was promoted to the role of Senior Vice President and Chief Financial Officer in 1999. He has served as a director on numerous for-profit and not-for-profit boards, including service on the Coca-Cola Enterprises, Inc. board from 2001 until 2009, service on the Coca-Cola FEMSA board from 2003 to 2016, and currently serves on the board of directors of Monster Beverage Corporation and is a member of its Audit, Compensation, and Nominating and Corporate Governance Committees. |

Mr. Fayard brings to the Board a wealth of financial, accounting, and auditing knowledge as the former CFO of one of America’s largest corporations. Additionally, as a Director and Audit Committee member on numerous for-profit and not-for-profit boards, he has had direct exposure to a wide variety of businesses and industries. He is also a former partner at a major public accounting firm. Mr. Fayard’s financial background and broad business exposure make him a significant contributor to our Board and Audit Committee.

| ||

| 6 |

|

2023 Proxy Statement |

Proposal 1 Election of Directors

| P. Russell Hardin |

Background | Qualifications | ||

|

Director Since 2017

Independent Director

Age 66

Committee • Nominating and ESG (Chair) |

P. Russell Hardin is President of the Robert W. Woodruff Foundation, the Joseph B. Whitehead Foundation, the Lettie Pate Evans Foundation and the Lettie Pate Whitehead Foundation. These foundations manage approximately $11 billion in assets and distribute approximately $400 million in grants each year, which support Georgia’s institutions in the areas of education, health, human welfare, the environment, community and economic development, philanthropy and volunteerism, and the arts. Mr. Hardin joined the Foundation’s staff in 1988 and was named President in 2006. Prior to his work at the Foundation, Mr. Hardin practiced law with the Atlanta firm of King & Spalding. | Mr. Hardin offers the Board extensive experience in the areas of finance, philanthropy, governance, and law. Mr. Hardin’s leadership at the Robert W. Woodruff Foundation and related foundations, as well as his service as trustee of Northwestern Mutual Life Insurance and a director on the Truist Bank Atlanta Advisory Council bring financial, governance and management expertise that contribute to both the Board and as Chair of the Nominating and ESG Committee.

| ||

| John R. Holder |

Background | Qualifications | ||

|

Director Since 2011

Independent Director

Age 68

Committee • Compensation and Human Capital |

John R. Holder is Chairman and Chief Executive Officer of Holder Properties, a commercial and residential real estate development, leasing, and management company based in Atlanta. Mr. Holder has held the position of Chairman since 1989 and Chief Executive Officer since 1980. He is also a director of Oxford Industries, Inc. and is a member of its Audit Committee.

|

Mr. Holder brings to the Board his strategic leadership in the growth of Holder Properties, which has been involved in the development of over 110 commercial buildings valued in excess of $3 billion, as well as his extensive involvement in the areas of financial and marketing management. His service as the Chairman and CEO of Holder Properties, together with various board affiliations, including as director and Audit Committee member of publicly traded Oxford, Industries, Inc., an apparel company, have given him leadership experience, business acumen and financial literacy that is beneficial to our Board and Compensation and Human Capital Committee. | ||

|

2023 Proxy Statement | 7 |

Proposal 1 Election of Directors

| Donna W. Hyland |

Background | Qualifications | ||

|

Director Since 2015

Independent Director

Age 62

Committee • Compensation and Human Capital (Chair) |

Donna W. Hyland is President and Chief Executive Officer of Children’s Healthcare of Atlanta and has served in that role since June 2008. Prior to that role, she was the Chief Operating Officer of Children’s Healthcare of Atlanta from January 2003 to May 2008 and the Chief Financial Officer from February 1998 to December 2002. She serves as a director of Cousins Properties, Inc. and serves as Chair of its Audit Committee and as a member of its Compensation and Human Capital and Executive Committees.

|

Ms. Hyland offers our board extensive knowledge of the health care industry as President and Chief Executive Officer of Children’s Healthcare of Atlanta. Her previous experience as COO and CFO of Children’s, as well as her experience on many non-profit boards brings a wide range of business and accounting experience to our board. Ms. Hyland also serves as a director at Cousins Properties, Inc., a publicly traded real estate company, and additionally serves as Chair and a financial expert on the Cousins’ Audit Committee and as a member of its Compensation, Succession, Nominating, and Governance Committee. Ms. Hyland’s service as a financial expert on a public company audit committee provides a wealth of experience that she has brought to our Board.

| ||

| John D. Johns |

Background | Qualifications | ||

|

Director Since 2002

Independent Director (Lead)

Age 71

Committee • Executive • Compensation and Human Capital |

John D. Johns is a Senior Advisor to Blackstone, Inc. and previously was Chairman of DLI North America Inc., the North American regional headquarters for Dai-ichi Life Holdings until his retirement in 2020. Dai-ichi Life is a global life insurance group headquartered in Tokyo, Japan. Its principal U.S. operation is Protective Life Corporation in Birmingham, Alabama. Mr. Johns served as CEO of Protective from 2002 to 2017 and as Executive Chairman through 2019. Prior to joining Protective in 1993, Mr. Johns was General Counsel of Sonat Inc. (a diversified energy company) and a partner at the law firm, Maynard, Cooper and Gale.

|

Mr. Johns brings experience in running every aspect of a large life insurance company, including his positions as Chairman and CEO as well as previous experience as COO, CFO, and also as a lawyer in private practice and General Counsel of a large publicly-traded energy company. Mr. Johns also serves as a director of The Southern Company, a utility holding company, and Chairs its Compensation and Talent Development Committee and is a member of its Finance Committee. Mr. Johns is also on the board of Regions Financial Corporation, a bank holding company, where he serves as Chair of its Risk Committee and a member of its Executive Committee and Technology Committee. He brings a wealth of diverse experience to our Board as its lead independent director, and as a member of the Executive Committee and Compensation and Human Capital Committee. | ||

| 8 |

|

2023 Proxy Statement |

Proposal 1 Election of Directors

| Jean-Jacques Lafont |

Background | Qualifications | ||

|

Director Since 2020

Age 63 |

Jean-Jacques Lafont is the Co-Founder and Executive Chairman of Alliance Automotive Group, an entity that was acquired by the Company in 2017. Prior to his current role as Executive Chairman, Mr. Lafont was Chief Executive Officer of Alliance Automotive Group. Mr. Lafont co-founded Alliance Automotive Group in 1991 and spent 30 years building that business from the ground up. Prior to founding Alliance Automotive Group, Mr. Lafont spent six years working for Hewlett Packard Europe in various management roles.

|

Mr. Lafont is an industry veteran having spent over 30 years in the automotive aftermarket industry. Mr. Lafont has a deep understanding of the sales, operations, finance, strategic planning, and global sourcing aspects of the automotive aftermarket landscape in Europe and is highly beneficial to the strategic planning function of the Board, especially as it relates to the global automotive business. Mr. Lafont is also Non-Executive Chairman of the Supervisory Board of BME, a leading European building materials, sanitary and plumbing products distributor recently acquired by Blackstone. Mr. Lafont brings a wealth of international experience to our Board.

| ||

| Robert C. “Robin” Loudermilk, Jr. |

Background | Qualifications | ||

|

Director Since 2010

Independent Director

Age 63

Committee • Nominating and ESG |

Robert C. “Robin” Loudermilk, Jr. is President and Chief Executive Officer of The Loudermilk Companies, LLC, a real estate management company, a position he has held since January 1, 2012. Previously he served as President of Aaron’s Inc., a furniture, electronics and home appliance retailer from 1997 through November 2011 and as Chief Executive Officer of Aaron’s Inc. from 2008 through November 2011. He also served in various other positions at Aaron’s Inc., including service as the Chief Operating Officer from 1997 until 2008. Mr. Loudermilk also previously served as a director of Aaron’s Inc. |

Mr. Loudermilk offers extensive knowledge of the real estate industry, as founder and CEO of a real estate management company in Atlanta. He also has over 25 years of experience working with a public company in various positions, including CEO, and over 10 years as an experienced senior executive. Mr. Loudermilk’s operational, financial and management expertise and expansive knowledge of a multi-store retail business are a significant contribution to the Board and Nominating and ESG Committee. | ||

| Wendy B. Needham |

Background | Qualifications | ||

|

Financial Expert

Director Since 2003

Independent Director

Age 70

Committee • Executive • Audit (Chair) |

Wendy B. Needham was Managing Director, Global Automotive Research for Credit Suisse First Boston, an investment banking firm, from August 2000 to June 2003, and a Principal, Automotive Research, for Donaldson, Lufkin and Jenrette from 1994 to 2000. Ms. Needham previously served as a director of Asahi Tec.

|

Ms. Needham offers extensive knowledge and understanding of the U.S. and international auto industries as a former managing director of global automotive research at a global financial services company. Throughout her career she analyzed the financial performance and strategies of public companies in the global auto industry and brings this experience to bear as the Chair of the Company’s Audit Committee and member of the Executive Committee.

| ||

|

2023 Proxy Statement | 9 |

Proposal 1 Election of Directors

| Juliette W. Pryor |

Background | Qualifications | ||

|

Director Since 2021

Independent Director

Age 58

Committee • Nominating and ESG |

Juliette W. Pryor is General Counsel and Corporate Secretary of Albertsons Companies, a Fortune 100 grocery retailer, which operates over 2,000 stores and includes a network of 22 distribution centers and 20 manufacturing facilities in its operations. Ms. Pryor began in this role in June of 2020 and is responsible for the company’s legal, compliance, and government affairs functions. From 2016 to June 2020, Ms. Pryor served as General Counsel and Corporate Secretary for Cox Enterprises, a $20 billion family-owned conglomerate that operates in the communications, media and automotive sectors. Ms. Pryor previously worked at US Foods, Inc., where from 2005-2016 she led the legal, compliance, enterprise risk management, workforce safety, food safety, governance, government affairs and public policy functions. At different points during her tenure at US Foods, Ms. Pryor also held interim lead responsibility for human resources, diversity and inclusion and corporate communications. Before US Foods, Ms. Pryor served as General Counsel for telecom start up e.spire Communications and began her career in private practice with Skadden Arps, advising global clients on complex, international commercial transactions, in the energy, media, and telecom sectors. | Ms. Pryor is a skilled public and private company c-suite executive with 25+ years of business experience. Ms. Pryor has deep experience in the board room of multiple corporations, providing key leadership in IPOs, multi-billion-dollar divestitures and acquisitions, corporate restructurings, and entity transformations. Her knowledge and experience in the legal, compliance, regulatory, audit, human resources, public policy, diversity and inclusion, and corporate governance areas combined with her wealth of expertise in retail, distribution and automotive services make her a valuable addition to our board. | ||

| E. Jenner Wood, III |

Background | Qualifications | ||

|

Director Since 2014

Independent Director

Age 71

Committee • Compensation and Human Capital |

E. Jenner Wood, III was Corporate Executive Vice President of SunTrust Banks, Inc. until his retirement in December of 2016. He was Chairman, President and Chief Executive Officer of the Atlanta Division of SunTrust Bank from April 2014 to October 2015 and served as a Corporate Executive Vice President of SunTrust Banks, Inc. from 2005 through his retirement in December of 2016. Mr. Wood is a member of the Board of Directors and Compensation and Talent Development Committee of The Southern Company and also serves as Chair of its Finance Committee. Mr. Wood is lead independent director of Oxford Industries and also is a member of its Nominating, Compensation, and Governance Committee as well as its Executive Committee. Mr. Wood also serves as the Chairman of the Robert W. Woodruff Foundation, the Joseph B. Whitehead Foundation, the Lettie Pate Evans Foundation and the Jesse Parker Williams Foundation, and also serves as a Trustee of the Sartain Lanier Family Foundation and Emory University. | Mr. Wood’s professional career includes over 20 years in executive management positions with SunTrust Banks, Inc. and its various affiliates and 40 years of experience in the areas of banking and investment management generally. Mr. Wood has served as a director on the Board of Southern Company since 2012 and currently serves on its Compensation and Management Succession Committee. Mr. Wood is the lead independent director at Oxford Industries, Inc. and also serves on its Nominating, Compensation, and Governance Committee. Mr. Wood’s insights with respect to financial matters and the financial services industry, including the retail and business aspects of banking operations, together with his extensive experience on the boards of directors and committees of public and private companies, make him a valuable asset to our Board and our Compensation and Human Capital Committee. | ||

| 10 |

|

2023 Proxy Statement |

Proposal 1 Election of Directors

Board Matrix

| EXPERIENCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

| Finance/Accounting |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

| ||||||||||||||||||||||||||||||||||

| Distribution/Supply Chain |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

||||||||||||||||||||||||||||||||||||||||

| Automotive |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

||||||||||||||||||||||||||||||||||||||||

| Government/Regulatory |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

| |||||||||||||||||||||||||||||||

| Legal |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

||||||||||||||||||||||||||||||||||||||||

| CEO/Leadership |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

| |||||||||||||||||||

| Technology |

|

● |

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| International |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

||||||||||||||||||||||||||||||||||||||||

| Public Co. Board(s) |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

| |||||||||||||||||||||||||||||||

| Independent |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

| |||||||||||||||||||

| TENURE/AGE/GENDER/DIVERSITY |

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| Years on the Board |

|

8 |

|

|

3 |

|

|

11 |

|

|

9 |

|

|

6 |

|

|

12 |

|

|

8 |

|

|

21 |

|

|

3 |

|

|

13 |

|

|

20 |

|

|

2 |

|

|

9 |

| |||||||||||||

| Age |

|

71 |

|

|

54 |

|

|

65 |

|

|

70 |

|

|

65 |

|

|

67 |

|

|

61 |

|

|

70 |

|

|

62 |

|

|

62 |

|

|

69 |

|

|

58 |

|

|

70 |

| |||||||||||||

| Gender |

|

F |

|

|

M |

|

|

M |

|

|

M |

|

|

M |

|

|

M |

|

|

F |

|

|

M |

|

|

M |

|

|

M |

|

|

F |

|

|

F |

|

|

M |

| |||||||||||||

| Gender/Race/Ethnicity/Nationality |

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

|

● |

|

||||||||||||||||||||||||||||||||||

|

2023 Proxy Statement | 11 |

CORPORATE GOVERNANCE

Independent Directors

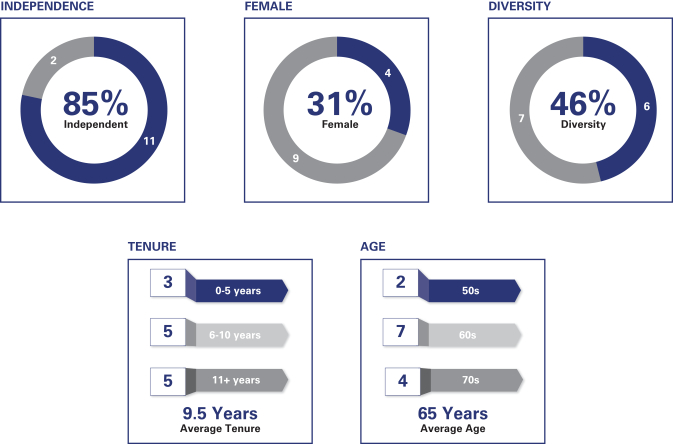

The Company’s common stock is listed on the New York Stock Exchange under the symbol “GPC.” The NYSE requires that a majority of the directors, and all of the members of certain committees of the board of directors be “independent directors,” as defined in the NYSE corporate governance standards. Generally, a director does not qualify as an independent director if the director (or in some cases, members of the director’s immediate family) has, or in the past three years has had, certain material relationships or affiliations with the Company, its external or internal auditors, or other companies that do business with the Company. The Board has affirmatively determined that eleven of the thirteen director nominees have no direct or indirect material relationships with the Company that would impair their independence and therefore are independent directors according to the NYSE rules and the Company’s Corporate Governance Guidelines.

The independent directors and director nominees for election at the 2023 Annual Meeting of Shareholders are: Elizabeth W. Camp, Richard Cox, Jr., Gary P. Fayard, P. Russell Hardin, John R. Holder, Donna W. Hyland, John D. Johns, Robert C. “Robin” Loudermilk, Wendy B. Needham, Juliette W. Pryor, and E. Jenner Wood.

Mr. Richard Cox, Jr., a director since 2020, joined Delta Air Lines, Inc. (“Delta”) in August 2022, where he currently serves as Senior Vice President — Reservation Sales and Customer Care. The Company has a long-standing and ordinary course vendor relationship with Delta and, in connection therewith, maintains automotive parts and supply locations on-site at multiple Delta facilities to better serve Delta’s ground vehicles. This relationship was reviewed and considered by the Board and was determined to be immaterial since (i) the amounts involved in this relationship did not exceed the greater of $1 million or 2% of Delta’s consolidated gross revenues, (ii) the Company has had a long-standing relationship with Delta prior to Mr. Cox joining the Company’s Board of Directors in 2020 and (iii) Mr. Cox became a director of the Company in 2020 prior to his joining Delta in 2022.

Governance Highlights — Restructuring of Board Committees

Our Board is committed to creating long-term value for our shareholders while operating in an ethical, environmentally sensitive and socially responsible manner. In 2022, our Board took part in a comprehensive and rigorous evaluation to assess the effectiveness of the Board and its Committees. The process was facilitated by a third-party advisor to preserve integrity and anonymity of the Board members and the Company’s senior executives who also participated in the evaluation. The third-party advisor met with each director and several of the Company’s senior leaders who interact frequently with the Board to obtain and compile responses to the evaluation, which included feedback regarding, among other topics, Board performance, Board priorities, Board interactions with management, Board discussion topics, agendas and processes, Board composition, and Board and Committee overall effectiveness.

The results of the evaluation for 2022 were presented to the Board by the third-party advisor, who also served as a facilitator for related discussions, which resulted in several proposed changes to increase the effectiveness of the Board, its Committees and its members as well as to drive clarity on key areas of focus. For example, there was broad agreement that management development and succession planning, as well as Board composition and recruiting, may be better addressed through a division of responsibilities at the Committee-level. Similarly, continued prioritization of ESG matters was determined to be an imperative that could be enhanced even further by segmenting that oversight function to a separate Committee. As a result, the Board determined to split the Compensation, Nominating and Governance Committee into two separate Committees: the Compensation and Human Capital Committee and the Nominating and ESG Committee. This restructuring became effective on January 1, 2023.

As part of its evaluation of how best to affect the Committee restructuring, the Board determined that the new Compensation and Human Capital Committee should retain the compensation oversight responsibilities previously exercised by the Compensation, Nominating and Governance Committee. In addition, this new Committee will discharge the Board’s responsibilities to oversee the Board’s development and succession plans for the CEO, other executive officers and senior management positions, as well as the Company’s strategies and policies related to human capital management, including diversity and inclusion.

Similarly, the Board concluded that the new Nominating and ESG Committee should retain the nominating and corporate governance responsibilities previously exercised by the Compensation, Nominating and Governance

| 12 |

|

2023 Proxy Statement |

Corporate Governance

Committee. In addition, this new Committee will discharge the Board’s responsibilities to oversee the Company’s strategies, policies and programs with respect to ESG matters.

The Board believes that having separate Committees to oversee these areas of significant importance will provide the appropriate support and resources, including enhanced focus and oversight, for these crucial and evolving matters. Going forward, pursuant to Company’s Corporate Governance Guidelines, the Board will continue to conduct rigorous annual evaluations to determine, among other matters, whether the Board and its Committees are functioning effectively. The Nominating and ESG Committee is responsible for overseeing this self-evaluation process. Similarly, the Audit Committee, the Nominating and ESG Committee and the Compensation and Human Capital Committee are also required, pursuant to the Company’s Corporate Governance Guidelines, to conduct an annual self-evaluation.

Other highlights of our robust corporate governance practices include:

| • | Eleven of thirteen directors are independent. |

| • | The Board has added four new directors in the last five years. |

| • | 31% of the Board is comprised of women and 46% of the Board is diverse. |

| • | All Board Committees are composed exclusively of independent directors. |

| • | We have a Lead Independent Director, elected by the independent members of the Board, who is available for consultation and direct communication with our shareholders. |

| • | Independent directors met in executive sessions chaired by the Lead Independent Director at all regularly scheduled Board meetings in 2022. |

| • | All of our directors are elected annually. |

| • | We have a majority vote requirement for uncontested director elections. |

| • | We do not have a poison pill. |

| • | Our executive officers and directors are all subject to robust stock ownership requirements. |

| • | We have instituted anti-hedging and pledging policies applicable to our directors and executive officers. |

| • | We have a Board-adopted Human Rights Policy. |

| • | We have a Board-adopted Political Contributions Policy. |

| • | We conduct annual, proactive shareholder engagement on ESG topics. |

| • | We have exceptionally high meeting attendance by our directors. |

Corporate Governance Guidelines and Committee Charters

The Board of Directors has adopted Corporate Governance Guidelines that give effect to the NYSE’s requirements related to corporate governance and various other corporate governance matters. The Company’s Corporate Governance Guidelines, as well as the charters of the Compensation and Human Capital Committee, the Nominating and ESG Committee and the Audit Committee, are available on the Company’s website at www.genpt.com.

Non-Management Director Meetings and Lead Independent Director

Pursuant to the Company’s Corporate Governance Guidelines, the Company’s non-management directors meet separately from the other directors in scheduled executive sessions at least four times annually and at such other times as may be scheduled by the Chairman of the Board or by the lead independent director or as may be requested by any non-management director.

The independent directors serving on the Company’s Board of Directors re-appointed John D. Johns to serve as the Board’s lead independent director in April of 2022, and he has served in this role since April of 2017. As the lead independent director, Mr. Johns presides at all meetings of non-management and independent directors and serves as a liaison between the Chief Executive Officer and the non-management and independent directors. During 2022, the independent directors held four meetings without management present. Mr. Johns presided over all of these meetings.

|

2023 Proxy Statement | 13 |

Corporate Governance

Board Leadership Structure

The Board has strong governance structures and processes in place to ensure the independence of the Board. The Company’s Corporate Governance Guidelines allow the independent directors flexibility to split up or combine the roles of Chairman and CEO. The directors annually review the Board’s leadership structure to determine the structure that is in the best interests of the Company and its shareholders. In 2019, the Board appointed Mr. Donahue, the Company’s Chief Executive Officer to serve as Chairman of the Board. In his position as CEO, Mr. Donahue has primary responsibility for the day-to-day operations of the Company and provides consistent leadership on the Company’s key strategic objectives. In his role as Chairman of the Board, he sets the strategic priorities for the Board (with input from the lead independent director), presides over its meetings and communicates its strategic findings and guidance to management. The Board believes that the combination of these two roles provides more consistent communication and coordination throughout the organization, which results in a more effective and efficient implementation of corporate strategy. The Board further believes that this leadership structure — a combined Chairman of the Board and Chief Executive Officer — is important in unifying the Company’s strategy behind a single vision. In addition, the deep involvement of the CEO in every aspect of the business allows him the opportunity to identify risks the Company may be facing and, in his role as Chairman, is able to facilitate the Board’s oversight of such risks. The Board believes that this leadership structure is currently the most effective structure for the Company and is in the best interests of its shareholders at this time.

As noted earlier, the independent directors have appointed Mr. Johns as the Board’s lead independent director, which provides balance to the Board’s structure. Our lead independent director is responsible for facilitating Board involvement in material matters of the Company, ensuring that the Board is addressing major strategic and operational initiatives, reviewing information to be provided to the Board, consulting with directors, the CEO, and Company management, representing the Board in consultations and direct communications with our shareholders and other key stakeholders, as well as presiding at executive sessions of the Board. With a supermajority of independent directors, all Board Committees composed entirely of independent directors, and a lead independent director to oversee all meetings of the non-management directors, the Company’s Board of Directors is comfortable that its current leadership structure provides for an appropriate balance that best serves the Company and its shareholders. The Board of Directors periodically reviews its leadership structure to ensure that it remains the optimal structure for the Company.

Director Nominating Process

Shareholders may recommend a director nominee by writing to the Corporate Secretary specifying the nominee’s name and the other required information as set forth in the Company’s By-laws. The By-laws require, among other things, that the shareholder making the nomination: (1) notify us in writing no later than the close of business on the 90th day and no earlier than the close of business on the 120th day prior to the first anniversary of the date of the Company’s notice of annual meeting sent to shareholders in connection with the previous year’s annual meeting; (2) include certain information about the nominee, including his or her name, occupation and Company share ownership; (3) include certain information about the shareholder proponent and the beneficial owner, if any on whose behalf the nomination is made, including such person or entity’s name, address, Company share ownership and certain other information regarding the relationship between the shareholder and beneficial owner, if applicable, and any derivative or hedging positions in Company securities; and (4) update the required information as of the record date and after any subsequent change. The notice must comply with all requirements of the By-laws and, if the nomination is to be included in next year’s proxy statement, the requirements of Exchange Act Rule 14a-18 must be timely received by the Corporate Secretary at Genuine Parts Company, 2999 Wildwood Parkway, Atlanta, Georgia 30339.

The Company’s By-laws provide that whenever the Board of Directors solicits proxies with respect to the election of directors at an annual meeting of shareholders, subject to certain requirements, a shareholder, or a group of up to 20 shareholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years can require the Company to include in its proxy materials for such annual meeting director nominations for up to the greater of (i) 20% of the number of directors up for election, rounding down to nearest whole number, or (ii) two directors. Shareholder requests to include shareholder nominees in the Company’s proxy materials for the 2024 annual meeting of shareholders must be received by the Corporate Secretary no

| 14 |

|

2023 Proxy Statement |

Corporate Governance

earlier than October 5, 2023 and no later than November 4, 2023 and must satisfy the requirements specified in the Company’s By-laws.

The Company’s Board of Directors has established the following process for the identification and selection of candidates for director. The Nominating and ESG Committee, in consultation with the Chairman of the Board, annually reviews the appropriate experience, skills, background and characteristics required of Board members in the context of the current membership of the Board to determine whether the Board would be enhanced by the addition of one or more directors. This review includes, among other relevant factors in the context of the perceived needs of the Board at that time, issues of experience, reputation, background, judgment, diversity and skills. With regard to diversity, the Board and the Nominating and ESG Committee believe that sound governance of the Company in an increasingly complex international marketplace requires a wide range of viewpoints. As a result, to ensure the Board benefits from diverse perspectives, in any formal search for board candidates the Board shall consider candidates who reflect diverse backgrounds, including diversity of gender and race and/or ethnicity, and in cases where a search firm is retained by the Committee, the Committee will direct the search firm to include in its initial slate of candidates qualified candidates who reflect diverse backgrounds, including diversity of gender and race and/or ethnicity.

If the Nominating and ESG Committee determines that adding a new director is advisable, the Committee initiates a search, working with other directors, management and, if it deems appropriate or necessary, a search firm retained to assist in the search. If a search firm is retained, the Committee will require that the slate of candidates presented must include gender and racially/ethnically diverse candidates. The Nominating and ESG Committee considers all appropriate candidates proposed by management, directors and shareholders. Information regarding potential candidates is presented to the Nominating and ESG Committee, and the Committee evaluates the candidates based on the needs of the Board at that time. Potential candidates are evaluated according to the same criteria, regardless of whether the candidate was recommended by shareholders, the Nominating and ESG Committee, another director, Company management, a search firm or another third party. The Nominating and ESG Committee then submits any recommended candidate(s) to the full Board of Directors for approval and recommendation to the shareholders for election at the Company’s annual meeting of shareholders.

The Company’s Board of Directors is composed of individuals with diverse experience at policy-making levels in a variety of businesses, as well as in non-profit organizations, in areas that are relevant to the Company’s operations and activities. The Board views diversity broadly to include, among other things, differences in backgrounds, qualifications, experiences, viewpoint, geographic location, education, skills and expertise, professional and industry experience, and personal characteristics, including age, gender identity, ethnicity, nationality, race, and sexual orientation. The Board believes that a variety and balance of perspectives on the Board results in more thoughtful and robust deliberations, and ultimately, better decisions. Each director was nominated for election at the 2023 Annual Meeting of Shareholders on the basis of the unique experience, background, qualifications, attributes and skills that he or she brings to the Board, as well as how those factors blend with those of the others on the Board as a whole.

Diversity, Equity, and Inclusion

Developing our people and sustaining our culture are important priorities for our Company. We promote a diverse, inclusive, and innovative culture that encourages and embraces change, diverse ideas, and perspectives. We strive to ensure our teammates reflect our global and diverse customer base. The Company is committed to creating a welcoming environment where all teammates have opportunities to grow and feel a sense of belonging, regardless of gender, sex, race, color, religion, national origin, age, disability, veteran status, sexual orientation, gender expression or experiences. The Company has taken several actions to improve inclusion in our recruiting process, which includes how we advertise job openings, develop position requirements, conduct interviews, and evaluate candidates, and also has developed initiatives to ensure we are developing and supporting our teammates, once they are hired. To support our talent initiatives and priorities, recruitment, training, talent development and succession planning is discussed regularly by management and the Nominating and ESG Committee as well as the Compensation and Human Capital Committee.

To further advance our commitment to DEI, in 2021 we hired a Director of DEI and strengthened our equal employment opportunity policies. In addition, we established a formal DEI Leadership Council composed of

|

2023 Proxy Statement | 15 |

Corporate Governance

representatives from throughout the organization. The Company’s goal is to increase diversity at all levels using internal advancement and promotion as well as external recruitment.

The Company’s ongoing and future DEI initiatives include:

| • | Increase the recruitment of diverse talent including expanding relationships with Historically Black Colleges and Universities (HBCUs) |

| • | Development, retention and succession planning of employees |

| • | Unconscious bias training to executive and senior leaders, managers and supervisors |

| • | Scholarships to dependents of GPC employees, with HBCU students strongly encouraged to apply |

| • | Alignment of corporate giving with DEI principles and goals |

| • | Collaboration with organizations that support our DEI efforts |

| • | Recruitment and engagement of more diverse independent owners of NAPA stores |

| • | Company-wide supplier diversity program |

| • | Monthly speaker series that highlights diversity awareness |

| • | Establishment and expansion of Business Resource Groups |

Talent Development and Succession Planning

The Compensation and Human Capital Committee oversees the development and implementation of succession plans for the senior management team. The process includes the CEO, President, and Executive Vice President and Chief Human Resources Officer undertaking a full review of performance and development of senior leaders across the organization, and they then present and discuss with the Compensation and Human Capital Committee their evaluations and recommendations for senior management development and succession on a regular basis. The Compensation and Human Capital Committee also assists the Board with oversight of CEO succession planning and the topic is discussed regularly during the executive session of Compensation and Human Capital Committee meetings. While internal candidates are always being trained and developed for potential succession into the CEO role, it is the Company and the Board’s policy, that if an external search firm is ever used for assistance with CEO succession planning, the Committee and/or Board will instruct the search firm to include in its initial slate of candidates qualified people who reflect diverse backgrounds, including diversity of gender and race and/or ethnicity.

Communications with the Board

The Company’s Corporate Governance Guidelines provide for a process by which shareholders or other interested parties may communicate with the Board, a Board committee, the lead independent director, the non-management directors as a group, or individual directors. Shareholders or other interested parties who wish to communicate with the Board, a Board committee or any such other individual director or directors may do so by sending written communications addressed to the Board of Directors, a Board committee or such individual director or directors, c/o Corporate Secretary, Genuine Parts Company, 2999 Wildwood Parkway, Atlanta, Georgia 30339. This information is also available on the Company’s website at www.genpt.com. All communications will be compiled by the Secretary of the Company and forwarded to the members of the Board to whom the communication is directed or, if the communication is not directed to any particular member(s) of the Board, the communication shall be forwarded to all members of the Board of Directors.

| 16 |

|

2023 Proxy Statement |

Corporate Governance

Board Oversight of Risk

The Company’s Board of Directors recognizes that, although risk management is primarily the responsibility of the Company’s management team, the Board plays a critical role in the oversight of risk. The Board believes that an important part of its responsibilities is to assess the major risks the Company faces and review the

|

2023 Proxy Statement | 17 |

Corporate Governance

Company’s options for monitoring, mitigating, and controlling these risks. The Board assumes responsibility for the Company’s overall risk assessment.

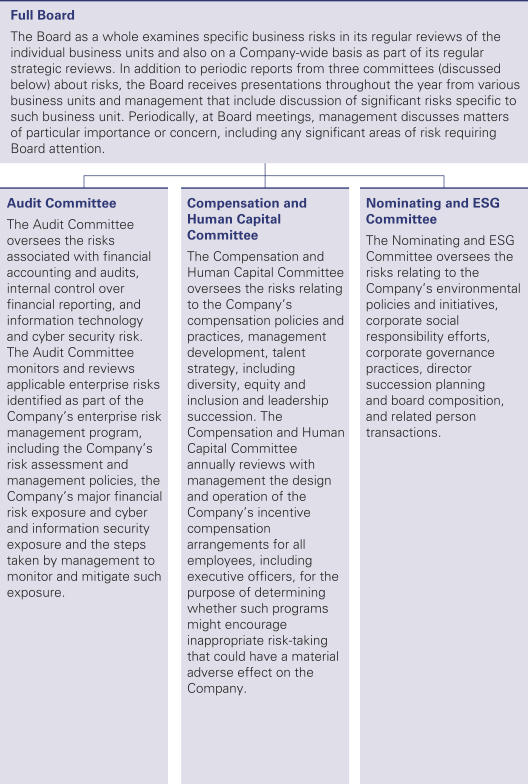

The Board as a whole examines specific business risks in its regular reviews of the individual business units and also on a Company-wide basis as part of its regular strategic reviews. In addition to periodic reports from three committees (discussed below) about risks, the Board receives presentations throughout the year from various business units and management that include discussion of significant risks specific to such business unit. Periodically, at Board meetings, management discusses matters of particular importance or concern, including any significant areas of risk requiring Board attention.

The Audit Committee has specific responsibility for oversight of risks associated with financial accounting and audits, internal control over financial reporting, and information technology and cyber security risk. The Audit Committee monitors and reviews applicable enterprise risks identified as part of the Company’s enterprise risk management program, including the Company’s risk assessment and management policies, the Company’s major financial risk exposure and cyber and information security exposure and the steps taken by management to monitor and mitigate such exposure. The Audit Committee receives regular updates specific to the Company’s cyber security program and IT security risk, including descriptions of mitigation and incident response plans and overviews of awareness and training programs. The full Board receives periodic updates from the Audit Committee Chair on cyber security and IT security risk and mitigation strategies and also receives periodic updates directly from the Chief Information and Digital Officer and Chief Information Security Officer.

The Compensation and Human Capital Committee oversees the risks relating to the Company’s compensation policies and practices, management development, talent strategy, including diversity, equity and inclusion and leadership succession. The Compensation and Human Capital Committee annually reviews with management the design and operation of the Company’s incentive compensation arrangements for all employees, including executive officers, for the purpose of determining whether such programs might encourage inappropriate risk-taking that could have a material adverse effect on the Company. In advance of such review, the Company identifies internal and external factors that comprise the Company’s primary business risks, and management compiles an inventory of incentive compensation arrangements, which are then summarized for the Compensation and Human Capital Committee and reviewed for the purpose of identifying any aspects of such programs that might encourage behaviors that could exacerbate the identified business risks. In conducting this assessment for 2022, the Compensation, Nominating and Governance Committee (which had not yet split off into the Compensation and Human Capital Committee) considered the performance objectives and target levels used in connection with these incentive awards and also the features of the Company’s compensation program that are designed to mitigate compensation-related risk. Based on such assessment, the Compensation, Nominating and Governance Committee concluded that the Company’s compensation policies and practices for its employees are not reasonably likely to have a material adverse effect on the Company.

The Nominating and ESG Committee oversees the risks relating to the Company’s environmental policies and initiatives, corporate social responsibility efforts, corporate governance practices, director succession planning and board composition, and related person transactions.

Code of Conduct and Ethics

The Board of Directors has adopted a Code of Conduct for Employees, Contract and/or Temporary Workers, and Directors and a Code of Conduct for Senior Financial Officers, both of which are available on the Company’s website at www.genpt.com. These Codes of Conduct comply with NYSE and Securities and Exchange Commission (the “SEC”) requirements, including procedures for the confidential, anonymous submission by employees or others of any complaints or concerns about the Company or its accounting, internal accounting controls or auditing matters. The Company will post any amendments to or waivers from the Code of Conduct (to the extent applicable to the Company’s executive officers and directors) on its website.

Supply Chain Responsibility and Human Rights

To help ensure the products we distribute are manufactured and delivered with high ethical standards, our Supplier Code of Conduct and our Human Rights Policy focus on responsible sourcing throughout our supply chain. Our supplier expectations and human rights policy include the Company’s commitment to providing a safe and fair workplace that upholds and respects international human rights standards. These principles are

| 18 |

|

2023 Proxy Statement |

Corporate Governance

applicable to all Company teammates and are approved and monitored by the Company’s executive leadership. For more information on our commitment to uphold Human Rights everywhere we do business, we invite you to view our Human Rights policy at: www.genpt.com.

Anti-Hedging and Anti-Pledging Policies

Pursuant to our Insider Trading Policy, our directors, officers and employees are prohibited from purchasing financial instruments, or otherwise engaging in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of Company common stock, such as prepaid variable forward contracts, equity swaps, collars, forward sale contracts and exchange funds. Additionally, our directors and executive officers are prohibited from pledging Company stock as collateral for a loan.

Environmental & Social Responsibility