UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of The

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Under Rule 14a-12 | |

GenCorp Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials: | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

|

2001 Aerojet Road Rancho Cordova, CA 95742 |

February 7, 2014

Dear Shareholder:

You are cordially invited to attend the 2014 Annual Meeting of Shareholders of GenCorp Inc., which will be held on March 20, 2014 at 9:00 a.m. Eastern time, at the Omni Berkshire Place, 21 East 52nd Street, New York, New York. Details of the business to be presented at the meeting can be found in the accompanying Notice of Annual Meeting and Proxy Statement.

We have elected to take advantage of the Securities and Exchange Commission’s rule that allows us to furnish our proxy materials to our shareholders over the Internet. We believe electronic delivery will expedite the receipt of materials and, by printing and mailing a smaller volume, will reduce the environmental impact of our annual meeting materials and help lower our costs. On or about February 7, 2014, a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) will be mailed to our shareholders. This Notice contains instructions on how to access the Notice of Annual Meeting, Proxy Statement and Annual Report to Shareholders online. You will not receive a printed copy of these materials, unless you specifically request one. The Notice of Internet Availability contains instructions on how to receive a paper copy of the proxy materials. For those participants who hold shares of GenCorp’s common stock in the GenCorp Retirement Savings Plan, you will receive a full set of annual meeting materials and a proxy card by mail.

On behalf of the Board of Directors and the management of GenCorp Inc., I extend our appreciation for your continued support.

Very truly yours,

/s/ Warren G. Lichtenstein

WARREN G. LICHTENSTEIN

Chairman of the Board

|

2001 Aerojet Road Rancho Cordova, CA 95742 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| TIME: |

9:00 a.m. Eastern time on Thursday, March 20, 2014 | |

| PLACE: |

The Omni Berkshire Place, 21 East 52nd Street, New York, New York | |

| ITEMS OF BUSINESS: |

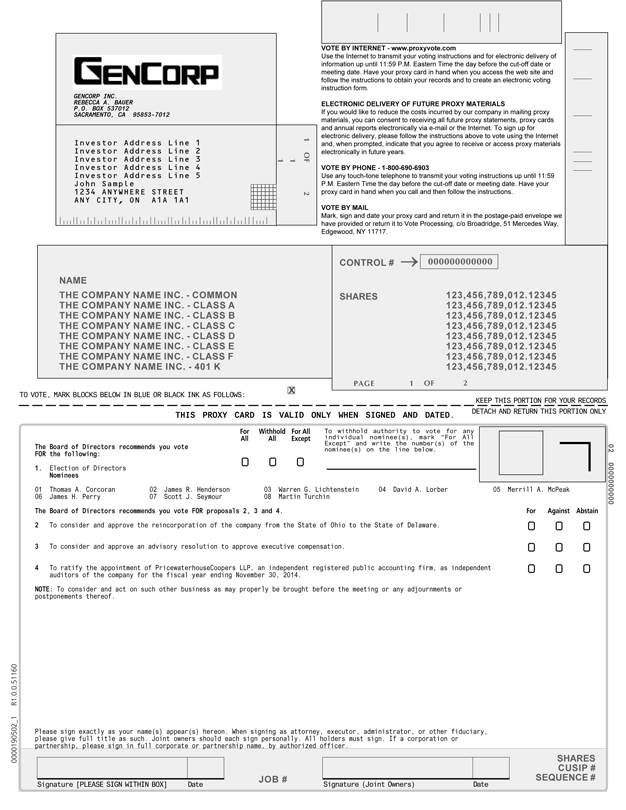

1. To elect eight directors to our Board of Directors to serve until the 2015 annual meeting of shareholders and until their respective successors have been duly elected and qualified; | |

| 2. To consider and approve the reincorporation of the Company from the State of Ohio to the State of Delaware; | ||

| 3. To consider and approve an advisory resolution to approve executive compensation; | ||

| 4. To ratify the appointment of PricewaterhouseCoopers LLP, an independent registered public accounting firm, as independent auditors of the Company for the fiscal year ending November 30, 2014; and | ||

| 5. To consider and act on such other business as may properly be brought before the meeting or any adjournments or postponements thereof. | ||

| RECORD DATE: |

You are entitled to vote at the 2014 Annual Meeting if you were a shareholder of record at the close of business on January 22, 2014. | |

| ANNUAL MEETING ADMISSION: |

In addition to a form of valid photo identification, you must bring evidence of your ownership of GenCorp common stock (which, if you are a beneficial holder, can be obtained from your bank, broker or other record holder of your shares) in order to be admitted. | |

| PROXY VOTING: |

It is important that your shares be represented and voted at the meeting. You may vote your shares by voting in person at the meeting, by Internet, by telephone or by completing, signing, dating and returning a proxy card which will be mailed to you if you request delivery of a full set of proxy materials. Participants in the GenCorp Retirement Savings Plan must follow the voting instructions provided by Fidelity Management Trust Company. See details under the heading “How do I vote?” | |

| INSPECTION OF LIST OF SHAREHOLDERS OF RECORD: |

A list of the shareholders of record as of the record date will be available for inspection at the Annual Meeting. | |

By Order of the Board of Directors,

/s/ KATHLEEN E. REDD

Vice President,

Chief Financial Officer and Assistant Secretary

|

2001 Aerojet Road Rancho Cordova, CA 95742 |

PROXY STATEMENT

FOR THE 2014 ANNUAL MEETING OF SHAREHOLDERS

To Be Held On March 20, 2014

GENERAL INFORMATION

The Board of Directors (the “Board”) of GenCorp Inc., an Ohio corporation (“GenCorp” or the “Company”) solicits the enclosed proxy for use at the Company’s 2014 annual meeting of shareholders (the “Annual Meeting”) to be held at the Omni Berkshire Place, 21 East 52nd Street, New York, New York on March 20, 2014 at 9:00 a.m. Eastern time.

FREQUENTLY ASKED QUESTIONS

WHY DID I RECEIVE THIS PROXY STATEMENT?

The Board is soliciting your proxy to vote at the Annual Meeting because you were a shareholder of the Company’s common stock, par value $0.10 per share (“Common Stock”), at the close of business (5:00 p.m. Eastern time) on January 22, 2014, (the “Record Date”) and therefore you are entitled to vote at the Annual Meeting. This Proxy Statement contains information about the matters to be voted on at the meeting and the voting process, as well as information about the Company’s Board of Directors (“Directors”) and executive officers.

We are providing you with a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) and access to these proxy materials in connection with the solicitation by the Board of the Company to be used at the Annual Meeting and at any adjournment or postponement. The Notice of Internet Availability will be sent to shareholders of record and beneficial shareholders starting on or around February 7, 2014. The Proxy materials, including the Notice of Annual Meeting, Proxy Statement, and 2013 Annual Report, will be made available to shareholders on the Internet on February 7, 2014. For those participants who hold shares of GenCorp’s Common Stock in the GenCorp Retirement Savings Plan, you will receive a full set of annual meeting materials and a proxy card for those shares.

WHY DID I RECEIVE A NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS THIS YEAR INSTEAD OF A FULL SET OF PROXY MATERIALS?

Pursuant to the rules of the Securities and Exchange Commission (the “SEC”), we are providing access to the Company’s proxy materials over the Internet rather than printing and mailing them to all shareholders. We believe electronic delivery will expedite the receipt of these materials, reduce the environmental impact of our annual meeting materials and will help lower our costs. Therefore, the Notice of Internet Availability will be mailed to shareholders (or e-mailed, in the case of shareholders that have previously requested to receive proxy materials electronically) starting on or around February 7, 2014. The Notice of Internet Availability will provide instructions as to how shareholders may access and review the proxy materials on the website referred to in the Notice of Internet Availability or, alternatively, how to request that a copy of the proxy materials, including a proxy card, be sent to them by mail. The Notice of Internet Availability will also provide voting instructions. In addition, shareholders may request to receive the proxy materials in printed form by mail or electronically by e-mail on an ongoing basis for future shareholder meetings. Please note that, while our proxy materials are available at www.proxyvote.com referenced in the Notice of Internet Availability, no other information contained on the website is incorporated by reference in or considered to be a part of this Proxy Statement.

1

WHY DID I RECEIVE MORE THAN ONE NOTICE OF INTERNET AVAILABILITY?

You may receive multiple Notices of Internet Availability if you hold your shares of GenCorp’s Common Stock in multiple accounts (such as through a brokerage account). If you hold your shares of GenCorp’s Common Stock in multiple accounts you should vote your shares as described in each separate Notice of Internet Availability you receive.

IF GENCORP IS UTILIZING NOTICE OF INTERNET AVAILABILILTY, WHY DID I RECEIVE A FULL SET OF ANNUAL MEETING MATERIALS AND A PROXY CARD?

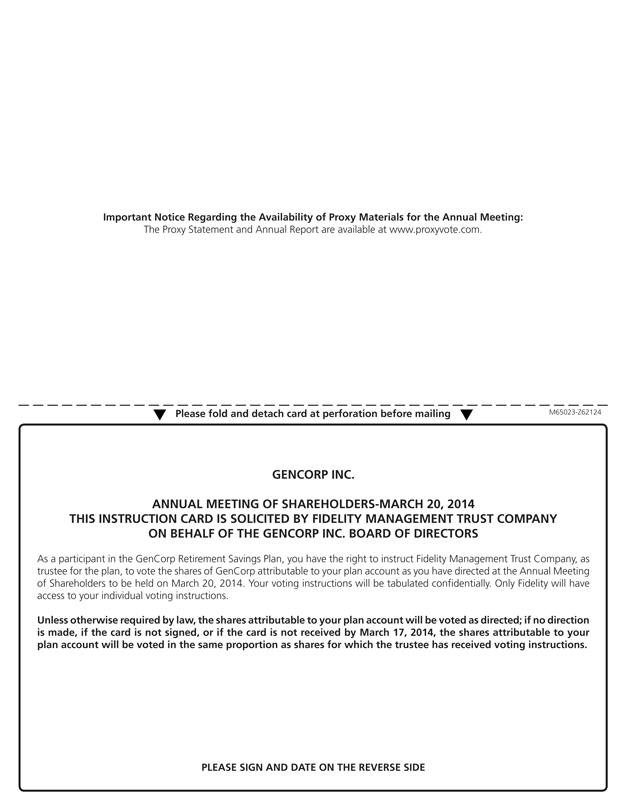

For those participants who hold shares of GenCorp’s Common Stock in the GenCorp Retirement Savings Plan, you will receive a full set of annual meeting materials and proxy card for those shares. Fidelity Management Trust Company, (the “Trustee”), is not utilizing Notice of Internet Availability for the GenCorp Retirement Savings Plan participants.

WHAT AM I VOTING ON?

You are voting on the following items of business at the Annual Meeting:

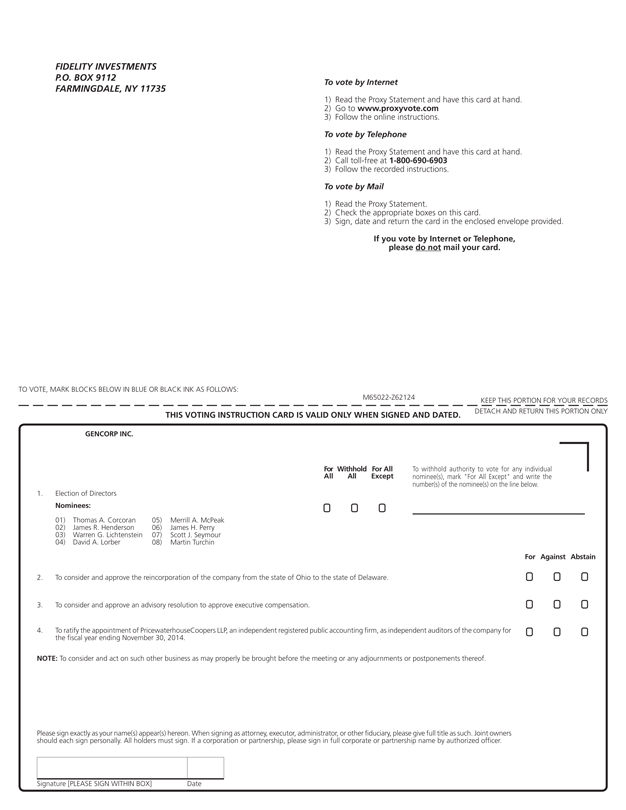

| • | To elect eight directors to our Board of Directors (the Board’s nominees are: Thomas A. Corcoran; James R. Henderson; Warren G. Lichtenstein; David A. Lorber; Merrill A. McPeak; James H. Perry; Scott J. Seymour; and Martin Turchin) to serve until the 2015 annual meeting of shareholders and until their respective successors have been duly elected and qualified (“Proposal 1”); |

| • | To consider and approve the Company’s reincorporation from the State of Ohio to the State of Delaware (“Proposal 2”); |

| • | To consider and approve an advisory resolution to approve executive compensation (“Proposal 3”); |

| • | To ratify the appointment of PricewaterhouseCoopers LLP (“PwC”), an independent registered public accounting firm, as independent auditors of the Company for the fiscal year ending November 30, 2014 (“Proposal 4”); and |

| • | Any other matter that may properly be brought before the Annual Meeting. |

WHO IS ENTITLED TO VOTE?

Shareholders of record as of the Record Date are entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote.

WHAT ARE THE VOTING RECOMMENDATIONS OF THE BOARD?

The Board recommends that you vote your shares “FOR” each of the Board’s eight nominees standing for election to the Board; “FOR” approval of the reincorporation of the Company from the State of Ohio to the State of Delaware; “FOR” the advisory resolution to approve executive compensation; and “FOR” the ratification of PwC, an independent registered public accounting firm, as independent auditors of the Company.

HOW DO I VOTE?

It is important that your shares are represented at the Annual Meeting whether or not you attend the meeting in person. To make sure that your shares are represented, we urge you to vote as soon as possible.

SHARES HELD IN THE GENCORP RETIREMENT SAVINGS PLAN

Please follow the voting instructions provided by Fidelity Management Trust Company, the Trustee. You may sign, date and return a voting instruction card to the Trustee or submit voting instructions by

2

telephone or the Internet. If you provide voting instructions by mail, telephone, or the Internet, the Trustee will vote your shares as you have directed (or not vote your shares, if that is your direction). If you do not provide voting instructions, the Trustee will vote your shares in the same proportion as shares for which the Trustee has received voting instructions. You must submit voting instructions to the Trustee by no later than March 17, 2014 at 11:59 p.m. Eastern time in order for your shares to be voted as you have directed by the Trustee at the Annual Meeting. GenCorp Retirement Savings Plan participants may not vote their Plan shares in person at the Annual Meeting.

SHARES HELD BY YOU, YOUR BROKER, BANK OR OTHER HOLDER OF RECORD

You may vote in several different ways:

In person at the Annual Meeting

You may vote in person at the Annual Meeting. You may also be represented by another person at the meeting by executing a proxy properly designating that person. If you are the beneficial owner of shares held in “street name,” you must obtain a legal proxy from your broker, bank or other holder of record and present it to the inspectors of election with your ballot to be able to vote at the meeting.

By telephone

You may vote by calling the toll-free telephone number indicated on your proxy card. Easy-to-follow voice prompts allow you to vote your shares and confirm that your voting instructions have been properly recorded.

By Internet

You may vote by going to the Internet web site indicated on your proxy card. Confirmation that your voting instructions have been properly recorded will be provided.

By mail

You may vote by completing, signing, dating and returning a proxy card which will be mailed to you if you request delivery of a full set of proxy materials. A postage-paid envelope will be provided along with the proxy card.

Telephone and Internet voting for shareholders of record will be available until 11:59 p.m. Eastern time on March 19, 2014. A mailed proxy card must be received by March 19, 2014 in order to be voted at the Annual Meeting. The availability of telephone and Internet voting for beneficial owners of other shares held in “street name” will depend on your broker, bank or other holder of record and we recommend that you follow the voting instructions on the Notice of Internet Availability that you receive from them.

If you are mailed a set of proxy materials and a proxy card or voting instruction card and you choose to vote by telephone or by Internet, you do not have to return your proxy card or voting instruction card. However, even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance so that your vote will be counted if you later decide not to attend the meeting.

MAY I ATTEND THE MEETING?

All shareholders and properly appointed proxy holders may attend the Annual Meeting. Shareholders who plan to attend must present valid photo identification. If you hold your shares in a brokerage account, please also bring proof of your share ownership, such as a broker’s statement showing that you owned shares of the Company on the Record Date or a legal proxy from your broker or nominee. A legal proxy is required if you hold your shares in a brokerage account and you plan to vote in person at the Annual

3

Meeting. Shareholders of record will be verified against an official list available at the Annual Meeting. The Company reserves the right to deny admittance to anyone who cannot adequately show proof of share ownership as of the Record Date.

WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A SHAREHOLDER OF RECORD AND AS A BENEFICIAL OWNER?

If your shares are registered directly in your name with GenCorp’s transfer agent, Computershare Shareowner Services, LLC, you are considered a “shareholder of record” or a “registered shareholder” of those shares. In this case, your Notice of Internet Availability has been sent to you directly by Broadridge Financial Solutions, Inc. If your shares are held in a stock brokerage account or by a bank, trust or other nominee or custodian, including shares you may own as a participant in the Company’s Retirement Savings Plan, you are considered the “beneficial owner” of those shares, which are held in “street name.” A Notice of Internet Availability has been forwarded to you by or on behalf of your broker, bank, trustee or other holder who is considered the shareholder of record of those shares. As the beneficial owner, you have the right to direct your broker, bank, trustee or other holder of record as to how to vote your shares by following their instructions for voting.

WHAT ARE BROKER NON-VOTES AND HOW ARE THEY COUNTED?

Broker non-votes occur when nominees, such as brokers and banks holding shares on behalf of the beneficial owners, are prohibited from exercising discretionary voting authority for beneficial owners who have not provided voting instructions at least ten days before the Annual Meeting. If no instructions are given within that time frame, the nominees may vote those shares on matters deemed “routine” by the New York Stock Exchange (“NYSE”). On non-routine matters such as Proposal Nos. 1 through 3, nominees cannot vote without instructions from the beneficial owner, resulting in so-called “broker non-votes.” Broker non-votes are not counted for the purposes of determining the number of shares present in person or represented by proxy on a voting matter. For these reasons, please promptly vote by telephone, or Internet, or sign, date and return the voting instruction card your broker or nominee has enclosed, in accordance with the instructions on the card.

MAY I CHANGE MY VOTE?

If you are a shareholder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by:

| • | Returning a later-dated, signed proxy card; |

| • | Sending written notice of revocation to the Company, c/o the Secretary; |

| • | Submitting a new, proper proxy by telephone, Internet or paper ballot, after the date of the earlier voted proxy; or |

| • | Attending the Annual Meeting and voting in person. |

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described above.

WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL?

Directors are elected by a plurality of the votes cast at the Annual Meeting. Votes cast for a nominee will be counted in favor of election. Abstentions and broker non-votes will not count either in favor of, or against, election of a nominee. Proxies cannot be voted for a greater number of persons than the number of Directors set by the Board for election. Proposal 2 will require a two-thirds vote of the outstanding shares.

4

Proposals 3 and 4 will require the affirmative vote of a majority of all of the votes cast. Abstentions and broker non-votes will have the effect of negative votes with respect to Proposal 2. Abstentions and broker non-votes will have no effect on the outcome of the vote on Proposals 3 and 4.

DO SHAREHOLDERS HAVE CUMULATIVE VOTING RIGHTS WITH RESPECT TO THE ELECTION OF DIRECTORS?

No. Shareholders do not have cumulative voting rights with respect to the election of Directors.

WHAT CONSTITUTES A QUORUM?

As of the Record Date, 61,288,298 shares of Common Stock were outstanding. A majority of the outstanding shares entitled to vote at the Annual Meeting, represented in person or by proxy, will constitute a quorum. Shares represented by a proxy that directs that the shares abstain from voting or that a vote be withheld on a matter and broker “non-votes” will be included at the Annual Meeting for quorum purposes. Shares represented by proxy as to which no voting instructions are given as to matters to be voted upon will be included at the Annual Meeting for quorum purposes.

WHAT IS THE COMPANY’S INTERNET ADDRESS?

The Company’s Internet address is www.GenCorp.com. You can access this Proxy Statement and the Company’s 2013 Annual Report on Form 10-K at this Internet address. The Company’s filings with the SEC are available free of charge via a link from this address. Copies are also available in print to any shareholder or other interested person who requests it by writing to Secretary, GenCorp Inc., 2001 Aerojet Road, Rancho Cordova, California 95742.

WHY IS GENCORP PROPOSING TO REINCORPORATE IN DELAWARE?

We believe that reincorporation from the State of Ohio to the State of Delaware (the “Reincorporation”) will give us more flexibility, clarity and predictability with respect to our corporate, legal and governance affairs and that the Company and its shareholders would benefit from such advantages. The Delaware General Corporation Law of the State of Delaware (“DGCL”) is frequently revised and updated to accommodate changing legal and business needs and is more comprehensive, widely used and interpreted than other state corporate laws, including the Ohio General Corporation Law (“OGCL”).

In addition, Delaware courts (such as the Court of Chancery and the Delaware Supreme Court) are highly regarded for their considerable expertise in dealing with corporate legal issues and for producing a substantial body of case law construing the DGCL, which provides businesses with a greater degree of predictability than most, if not all, other jurisdictions provide. Because the judicial system is based largely on legal precedents, the abundance of Delaware case law should serve to facilitate corporate governance by our officers and directors by allowing the Board and management to make corporate decisions and take corporate actions with greater assurance as to the validity and consequences of those decisions and actions.

The Reincorporation also may enable the Company to attract and retain more easily qualified candidates willing to serve on the Board and in management because many such candidates are already familiar with Delaware corporate law, including provisions relating to director and officer indemnification, from their past business experience. In addition, Delaware law provides more predictability than Ohio law with respect to the liability of directors and officers, including what constitutes an actionable breach of fiduciary duties.

As the Company plans for the future, we believe that it is essential to be able to draw upon well-established principles of corporate governance in making legal and business decisions. The prominence and predictability of Delaware corporate law provide a reliable foundation on which the Company’s governance decisions can be based.

5

HOW WILL THE REINCORPORATION BE ACCOMPLISHED, AND WHAT WILL THE EFFECTS BE ON THE COMPANY?

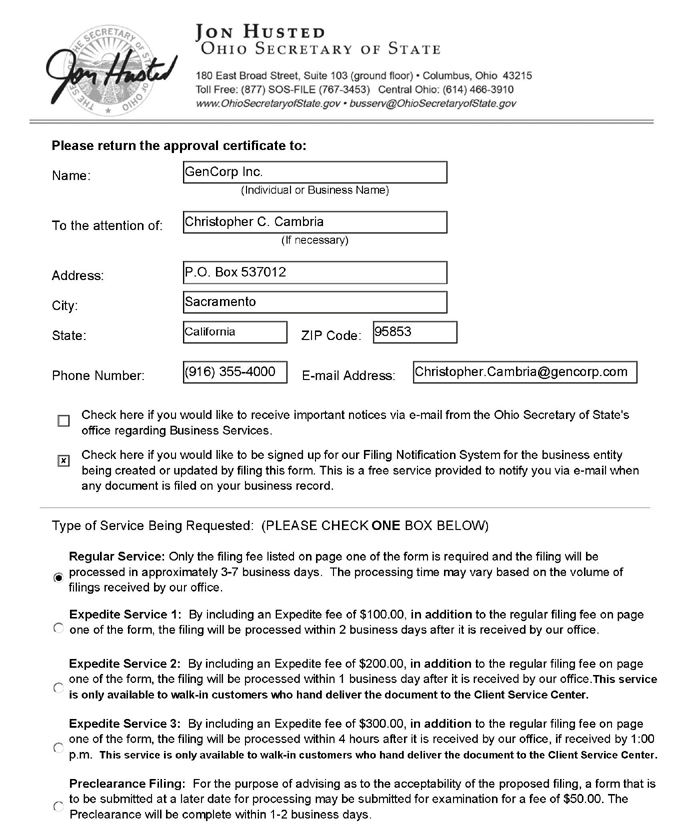

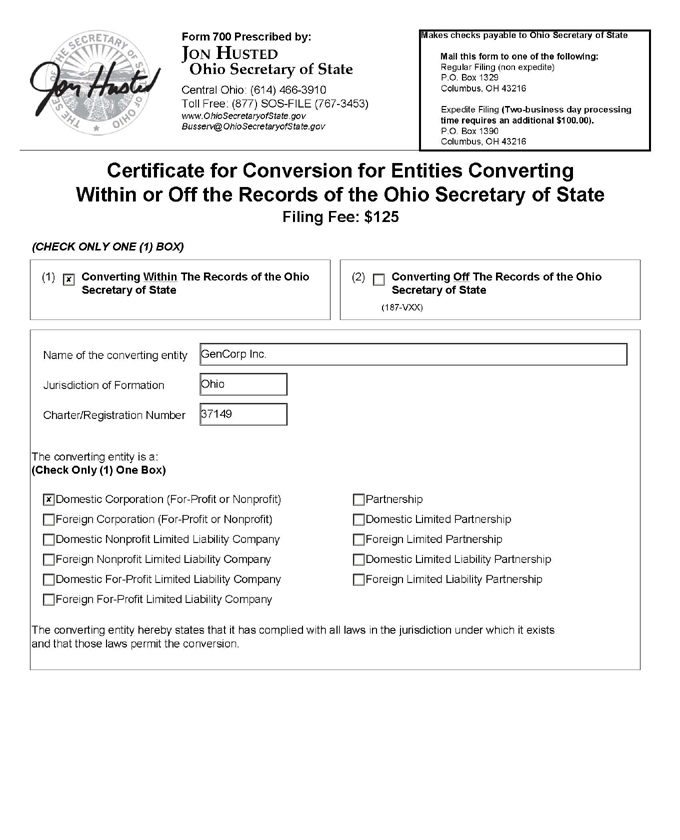

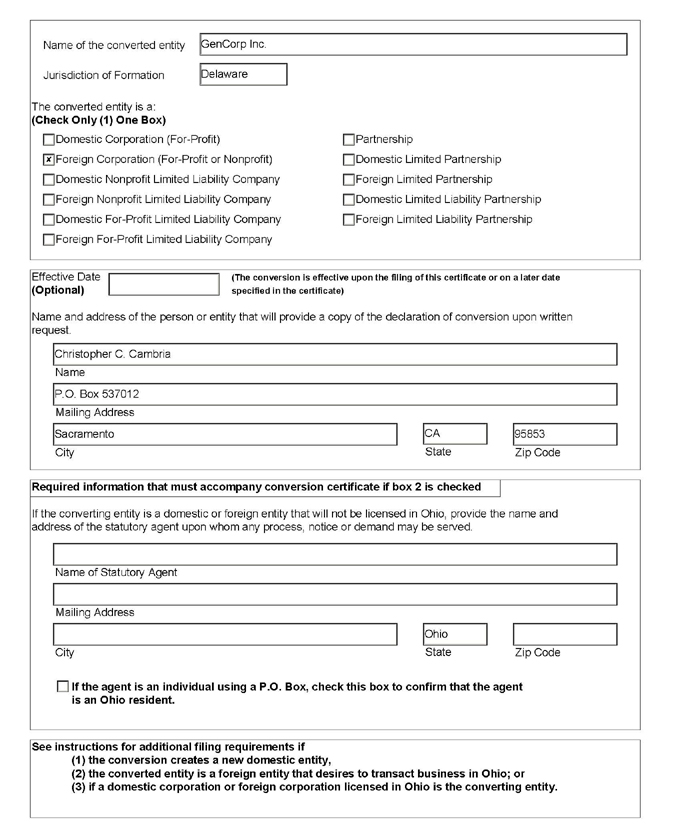

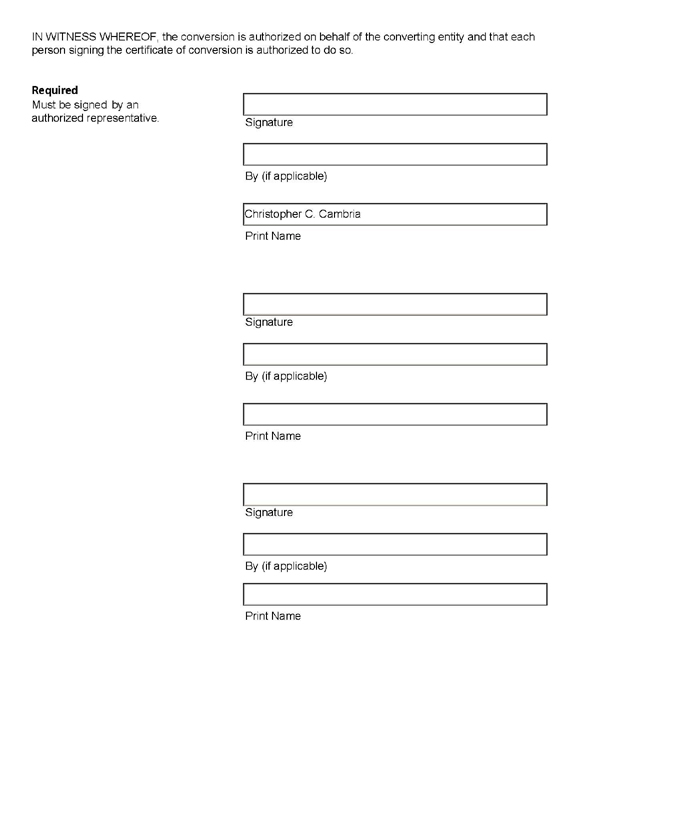

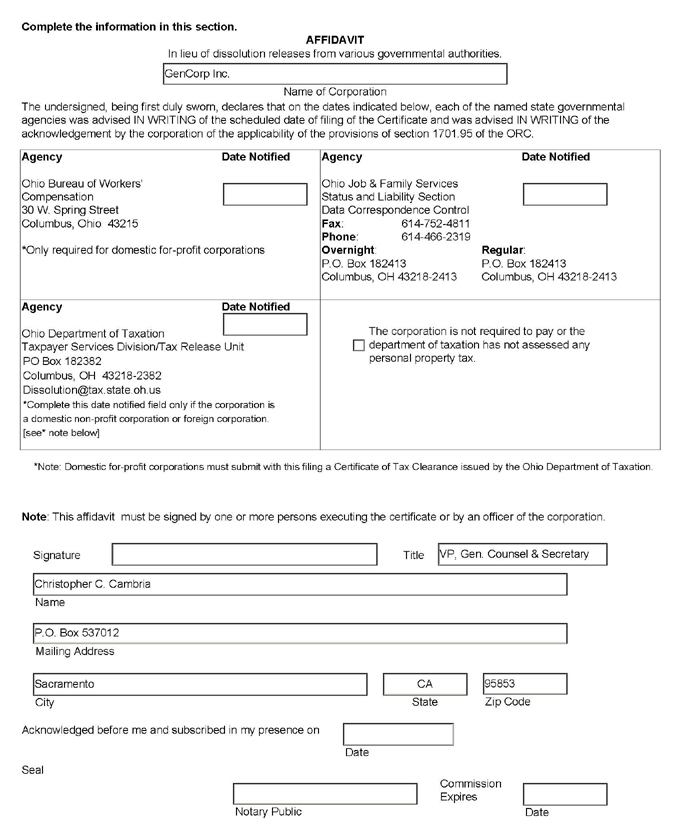

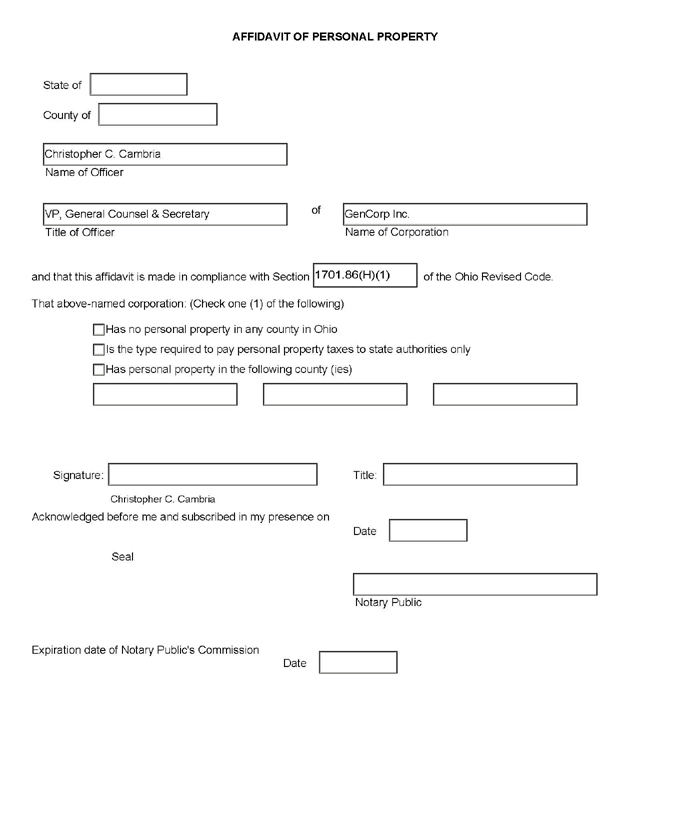

We are incorporated in Ohio and, as such, our corporation is currently governed by Ohio law. As a result of the Reincorporation, we will be incorporated in Delaware and our corporation will be governed by Delaware law. The Reincorporation will be effected by a plan of conversion, which will provide that we will: (1) file with the Secretary of State of the State of Ohio a certificate of conversion, and (2) file with the Secretary of State of the State of Delaware (i) a certificate of conversion and (ii) a certificate of incorporation. The plan of conversion, the Ohio certificate of conversion, the Delaware certificate of conversion and the Delaware certificate of incorporation will be substantially in the forms appended to this Proxy Statement as Appendix A, Appendix B, Appendix C and Exhibit A to Appendix A, respectively.

In the Reincorporation, each outstanding share of our Common Stock will automatically be converted into one share of common stock of GenCorp Inc., a Delaware corporation into which we will be deemed converted upon the completion of the Reincorporation (“GenCorp (Delaware)”). Outstanding options to purchase shares of our Common Stock and other equity awards relating to our Common Stock likewise will become options to purchase the same number of shares of common stock or equity awards, as applicable, of GenCorp (Delaware), with no change in the exercise price or other terms or provisions of the options or equity awards. Your proportional percentage ownership of the Company will remain unchanged and will not be affected in any way by Reincorporation.

Our business, directors, officers, employees, assets and liabilities and the location of our offices will remain unchanged by the Reincorporation. Following the Reincorporation, our name will continue to be “GenCorp Inc.” and our shares of Common Stock will continue to be listed on the New York Stock Exchange under the symbol “GY.”

WHO MUST APPROVE THE DELAWARE REINCORPORATION?

The affirmative vote of the holders of at least two-thirds of our outstanding Common Stock is required to approve the Reincorporation in Delaware.

HOW WILL THE REINCORPORATION AFFECT MY RIGHTS AS A SHAREHOLDER?

Your rights as a shareholder currently are governed by Ohio law and the provisions of our Articles of Incorporation, as amended, and our Amended Code of Regulations (the “Code of Regulations”). As a result of the Reincorporation, you will become a shareholder of GenCorp (Delaware) with rights governed by Delaware law and the provisions of the certificate of incorporation and the bylaws of GenCorp (Delaware), which differ in certain respects from your current rights. These important differences are discussed and summarized in this Proxy Statement under “Proposal 2 — Approval of the Reincorporation of the Company from the State of Ohio to the State of Delaware — Rights of our Shareholders Prior to and After the Reincorporation from Ohio to Delaware.” Forms of GenCorp (Delaware)’s certificate of incorporation and bylaws are appended to this Proxy Statement as Exhibits A and B to Appendix A.

WILL GENCORP (DELAWARE) HAVE NEW “ANTI-TAKEOVER” PROTECTION?

Generally, no. The Reincorporation is not being proposed for anti-takeover reasons. In fact, the statutory anti-takeover provisions available to Delaware companies are generally believed to be less extensive than those available to Ohio companies. For a discussion of possible anti-takeover effects of the Reincorporation, see “Proposal 2 — Approval of the Reincorporation of the Company from the State of Ohio to the State of Delaware — Possible Anti-Takeover Effect of Provisions.”

6

WHO WILL MANAGE GENCORP (DELAWARE)?

The current directors and officers of the Company will become the directors and officers of GenCorp (Delaware).

SHOULD I SEND IN MY STOCK CERTIFICATES?

No. Please do not send us your stock certificates. Following the Reincorporation, stock certificates previously representing our common stock may be delivered in effecting sales (through a broker or otherwise) of shares of GenCorp (Delaware) common stock. It will not be necessary for you to exchange your existing stock certificates for stock certificates of GenCorp (Delaware), and if you do so, it will be at your own cost.

WHAT ARE THE TAX CONSEQUENCES OF THE REINCORPORATION TO ME?

The Reincorporation is intended to be a tax-free reorganization under the Internal Revenue Code of 1986, as amended (the “Code”). Assuming the Reincorporation qualifies as a reorganization, no gain or loss will be recognized to the holders of our capital stock as a result of consummation of the Reincorporation, and no gain or loss will be recognized by us. Generally, you will have the same basis in and holding period with respect to the GenCorp (Delaware) common stock received by you pursuant to the Reincorporation as you have in the shares of our Common Stock held by you as of immediately prior to the time the Reincorporation is consummated. See also “Proposal 2 — Approval of the Reincorporation of the Company from the State of Ohio to the State of Delaware — Certain Federal Income Tax Consequences.”

WILL ANY OTHER MATTERS BE VOTED ON?

As of the date of this Proxy Statement, our management knows of no other matter that will be presented for consideration at the Annual Meeting other than those matters discussed in this Proxy Statement. If any other matters properly come before the Annual Meeting and call for a vote of the shareholders, validly executed proxies in the enclosed form will be voted in accordance with the recommendation of the Board.

WHO IS SOLICITING PROXIES UNDER THIS PROXY STATEMENT?

The Company has retained Okapi Partners LLC (“Okapi”) for a fee of $10,000 plus reimbursement of out-of-pocket expenses as its proxy solicitor to solicit proxies on its behalf in connection with the Annual Meeting. The cost of soliciting proxies in the enclosed form will be borne by the Company. Okapi may solicit proxies from individuals, banks, brokers, custodians, nominees, other institutional holders and other fiduciaries.

ARE THERE DISSENTER’S OR APPRAISAL RIGHTS?

The Company’s shareholders are not entitled to dissenter’s or appraisal rights under Ohio law in connection with any of the Items of Business, including with respect to Proposal 2.

WHO SHOULD I CALL IF I HAVE ANY QUESTIONS?

If you have any questions, or need assistance voting, please contact the Company’s proxy solicitor:

Okapi Partners LLC

Shareholders Call Toll Free: (877) 259-6290

Banks and Brokers Call Collect: (212) 297-0720

Shareholders who wish to receive a separate written copy of this Proxy Statement, or the Company’s Annual Report on Form 10-K, now or in the future, should submit their written request to Secretary, GenCorp Inc., 2001 Aerojet Road, Rancho Cordova, California 95742.

7

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Amended Code of Regulations provides for a Board of not less than seven or more than seventeen Directors, and authorizes the Board to determine from time to time the number of Directors within that range that will constitute the Board by the affirmative vote of a majority of the members then in office. The Board has fixed the number of Directors to be elected at the Annual Meeting at eight.

The Board has proposed the following nominees for election as Directors at the Annual Meeting: Thomas A. Corcoran; James R. Henderson; Warren G. Lichtenstein; David A. Lorber; Merrill A. McPeak; James H. Perry; Scott J. Seymour; and Martin Turchin. Each nominee elected as a Director will continue in office until the next annual meeting of shareholders at which their successor has been elected, or until his resignation, removal from office, or death, whichever is earlier.

The Board recommends a vote FOR the election of these nominees as Directors.

Director Qualifications and Experience

The Board, acting through the Corporate Governance & Nominating Committee, seeks a Board that, as a whole, possesses the experience, skills, background and qualifications appropriate to function effectively in light of the Company’s current and evolving business circumstances. The Corporate Governance & Nominating Committee reviews the size of the Board, the tenure of its Directors and their skills, backgrounds and experiences in determining the slate of nominees and whether to seek one or more new candidates. The Committee seeks directors with established records of significant accomplishments in business and areas relevant to the Company’s strategies. With respect to the nomination of continuing Directors for re-election, the individual’s contributions to the Board are also considered.

All of our Directors bring to our Board a wealth of executive leadership experience derived from their service as executives and, in some cases, chief executive officers of large corporations. They also bring extensive board experience. The process undertaken by the Corporate Governance & Nominating Committee in recommending qualified director candidates is described in the Director Nominations section on page 18.

Set forth below are the names and ages of the nominees for Directors and their principal occupations at present and for the past five years, as well as their particular experience, qualifications, attributes or skills that led the Board to conclude that the person should serve as a Director for the Company. There are, to the knowledge of the Company, no agreements or understandings by which these individuals were so selected. No family relationships exist between any Directors or executive officers, as such term is defined in Item 402 of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The information concerning the nominees set forth below is given as of December 31, 2013.

THOMAS A. CORCORAN

Director since 2008

Mr. Corcoran has been a Senior Advisor of The Carlyle Group, a private equity investment firm, and the President of Corcoran Enterprises, LLC, a management consulting company, since 2001. Previously Mr. Corcoran was also the President and Chief Executive Officer (“CEO”) of Gemini Air Cargo, Inc., a cargo airline owned by The Carlyle Group, from 2001 to 2004. Prior to that, Mr. Corcoran was President and CEO of Allegheny Teledyne Incorporated, a diversified business from 1999 to 2000. Prior to that, Mr. Corcoran was President and Chief Operating Officer (“COO”) of Lockheed Martin’s Electronics and Space Sectors from 1993 to 1999. Mr. Corcoran began his career in 1967 at General Electric Company in various positions. In 1990, Mr. Corcoran was elected a corporate officer and rose to the number two position in G.E. Aerospace as Vice President and General Manager of G.E. Aerospace Operations. Mr. Corcoran is a

8

director with L-3 Communications Holdings, Inc. (and member of the Audit Committee). Mr. Corcoran was a Director with Force Protection, Inc., REMEC, Inc., United Industrial Corporation, ONPATH Technologies, Inc. (Chairman), LaBarge, Inc. (Audit Committee member), ARINC, Inc., Aer Lingus, Ltd. based in Dublin, Ireland and Serco, Ltd. based in Surry, UK. Mr. Corcoran serves as a director of American Ireland Fund, is on the board of trustees of Stevens Institute of Technology and is a trustee emeritus at Worcester Polytechnic Institute. Mr. Corcoran brings to the Board considerable industry knowledge gained from extensive experience as a senior executive in the aerospace industry. Mr. Corcoran also brings to the Board significant public company board experience, including service as a director of a Fortune 500 company. Mr. Corcoran currently serves as a member of the Organization & Compensation Committee and as a member of the Corporate Governance & Nominating Committee. Age 69.

JAMES R. HENDERSON

Director since 2008

Mr. Henderson was a Managing Director and operating partner of Steel Partners LLC, a subsidiary of Steel Partners Holdings L.P., a global diversified holding company that owns and operates businesses and has significant interests in leading companies in a variety of industries, including diversified industrial products, energy, defense, banking, insurance, and food products and services, until April 2011. He was associated with Steel Partners LLC and its affiliates from August 1999 until April 2011. Mr. Henderson served as a director of DGT Holdings Corp., a manufacturer of proprietary high-voltage power conversion subsystems and components, from November 2003 until December 2011. Mr. Henderson also served as a director of SL Industries, Inc. (“SLI”), a company that designs, manufactures and markets power electronics, motion control, power protection, power quality electromagnetic and specialized communication equipment, from January 2002 to March 2010. Mr. Henderson was an Executive Vice President of SP Acquisition Holdings, Inc. (“SPAH”), a company formed for the purpose of acquiring one or more businesses or assets, from February 2007 until October 2009. He was a director of Angelica Corporation, a provider of healthcare linen management services, from August 2006 to August 2008. Mr. Henderson was a director and CEO of the predecessor entity of Steel Partners Holdings L.P., WebFinancial Corporation (“WebFinancial”), from June 2005 to April 2008, President and COO from November 2003 to April 2008, and was the Vice President of Operations from September 2000 to December 2003. He was also the CEO of WebBank, a wholly-owned subsidiary of Steel Partners Holdings L.P., from November 2004 to May 2005. He was a director of ECC International Corp., a manufacturer and marketer of computer controlled simulators for training personnel to perform maintenance and operation procedures on military weapons, from December 1999 to September 2003 and was acting CEO from July 2002 to March 2003. He served as the Chairman of the Board of Point Blank Solutions, Inc. (“Point Blank”), a designer and manufacturer of protective body armor, from August 2008 until October 2011, CEO from June 2009 until October 2011, and was Acting CEO from April 2009 to May 2009. Mr. Henderson was also the CEO and Chairman of the Board of Directors of certain subsidiaries of Point Blank. On April 14, 2010, Point Blank and certain of its subsidiaries filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware. The Chapter 11 petitions are being jointly administered under the caption “In re Point Blank Solutions, Inc., et. al.” Case No. 10-11255, which case is ongoing. He has served as the CEO of Point Blank Enterprises, Inc., the successor to the business of Point Blank, from October 2011 to September 2012. Mr. Henderson serves as a Manager of the Board of Managers of Easton Development Company, LLC, a subsidiary of GenCorp, and since July 2013 has served as Chairman and interim CEO of School Specialty, Inc., a company that provides education-related products, programs and services. Mr. Henderson’s substantial experience advising and managing public companies provides the Board with well-developed leadership skills and ability to promote the best interests of shareholders. Mr. Henderson currently serves as the Chairman of the Corporate Governance & Nominating Committee and as a member of the Audit Committee. Age 56.

9

WARREN G. LICHTENSTEIN

Director since 2008

Mr. Lichtenstein has served as the Chairman of the Board of the general partner of Steel Partners Holdings L.P. since July 15, 2009, and as CEO from July 15, 2009 until February 26, 2013, at which time he became the Executive Chairman. He is also the Chairman and CEO of Steel Partners LLC and has been associated with Steel Partners LLC and its affiliates since 1990. He is a Co-Founder of Steel Partners Japan Strategic Fund (Offshore), L.P., a private investment partnership investing in Japan, and Steel Partners China Access I LP, a private equity partnership investing in China. In 1993, he also co-founded Steel Partners II, L.P., a private investment partnership that is now a wholly-owned subsidiary of Steel Partners Holdings L.P. He has served as Chairman of the Board of Handy & Harman Ltd., a diversified manufacturer of engineered niche industrial products, since July 2005. He has served as Chairman of the Board of ModusLink Global Solutions, Inc. since March 2013. He has served as a director of SLI since March 2010. He previously served as a director (formerly Chairman of the Board) of SLI from January 2002 to May 2008 and served as CEO from February 2002 to August 2005. Mr. Lichtenstein served as the Chairman of the Board, President and CEO of SPAH from February 2007 until October 2009. Mr. Lichtenstein has served as a director (currently Chairman of the Board) of Steel Excel Inc., a company whose business currently consists of a sports-related segment and an oilfield services segment, since October 2010. He served as a director of WebFinancial from 1996 to June 2005, as Chairman and CEO from December 1997 to June 2005 and as President from December 1997 to December 2003. From May 2001 to November 2007, Mr. Lichtenstein served as a director (formerly Chairman of the Board) of United Industrial Corporation, a company principally focused on the design, production and support of defense systems, which was acquired by Textron Inc. He served as a director of KT&G Corporation, South Korea’s largest tobacco company, from March 2006 to March 2008. Mr. Lichtenstein served as a director of Layne Christensen Company, a provider of products and services for the water, mineral, construction and energy markets, from January 2004 to October 2006. Mr. Lichtenstein is qualified to serve as a director due to his expertise in corporate finance, record of success in managing private investment funds and his service as a director of, and advisor to, a diverse group of public companies. Mr. Lichtenstein currently serves as the Chairman of the Board and a member of the Organization & Compensation Committee. Age 48.

DAVID A. LORBER

Director since 2006

Mr. Lorber is a Co-Founder and Portfolio Manager for FrontFour Capital Group LLC, a hedge fund since 2007. Mr. Lorber is also a Co-Founder and Principal of FrontFour Capital Corp. Previously, Mr. Lorber was a Senior Investment Analyst at Pirate Capital LLC, a hedge fund from 2003 to 2006. Prior to that, Mr. Lorber was an Analyst at Vantis Capital Management LLC, a money management firm and hedge fund from 2001 to 2003 and an Associate at Cushman & Wakefield, Inc. Mr. Lorber also serves as a Director of Ferro Corporation. Mr. Lorber served as a Director of Fisher Communications Inc. and of Huntingdon Capital Corp. and as a Trustee of IAT Air Cargo Facilities Income Fund. Mr. Lorber brings to the Board significant financial and investment industry experience and experience as a public company director. Mr. Lorber currently serves as Chairman of the Organization & Compensation Committee and as a member of the Audit Committee. Age 35.

MERRILL A. McPEAK

Director since 2013

General McPeak (USAF, retired) was Chief of Staff of the U.S. Air Force and a member of the Joint Chiefs of Staff from October 1990 until October 1994. During this period, he was the senior officer responsible for organization, training and equipage of a combined active duty, National Guard, Reserve and civilian work force of over 850,000 people serving at 1,300 locations in the United States and abroad. As a

10

member of the Joint Chiefs of Staff, he and the other service chiefs were military advisors to the Secretary of Defense, the National Security Council and the President of the United States. Following retirement from active service, General McPeak began a second career in business. Since 1995, General McPeak has been President of McPeak and Associates, a management consulting firm that is active as an investor, advisor and director of early development stage companies. A subsidiary, Lost Wingman Press, recently published Hangar Flying; book one of a planned three-volume memoir. General McPeak has long service as a director of public companies, including Tektronix, Inc. and Trans World Airlines, Inc. He was for several years Chairman of ECC International Corp. His current public company directorships include Lion Biotechnologies, Inc. (f/k/a Genesis Biopharma) (since 2011, and for which he was acting CEO from January to July 2013) focused on immunology for treatment of Stage IV metastatic melanoma, Research Solutions, Inc. (f/k/a Derycz Scientific) (since 2010), publishing and distributing scientific journal articles, Miller Energy Resources (since 2010), engaged in oil and gas exploration and production, and DGT Holdings Corp. (since 2005), a real estate business. He previously served as a director of Mosquito Consolidated Gold (Chairman, 2011-2012), Point Blank Solutions, Inc. (2008-2011), MathStar, Inc. (2005-2010), QPC Lasers (Vice Chairman, 2006-2009), and Gigabeam Corp. (2004-2009). From 2003 to 2012, General McPeak was Chairman of Ethicspoint, Inc., a Portland, Oregon-based startup that became a leading provider of risk management and compliance software-as-a-service. In February 2012, Ethicspoint was bought by a private equity firm, merged with other companies and rebranded as NAVEX Global. General McPeak remains a board member of NAVEX Global. He also currently serves as Chairman of Coast Plating, Inc., a Los Angeles-based, privately held provider of metal processing and finishing services, primarily to the aerospace industry. General McPeak received a Bachelor of Arts degree in economics from San Diego State College and a Master of Science degree in international relations from George Washington University. In 1992, San Diego State University honored General McPeak with its first ever Lifetime Achievement Award. In 1995, George Washington University gave him its Distinguished Alumni Award, the “George.” He was among the initial seven inductees to the Oregon Aviation Hall of Honor. He is a member of the Council on Foreign Relations, New York City. In 2008 and 2009, General McPeak was a national co-chairman of Obama for President. In 2011, he became Chairman of the American Battle Monuments Commission, the federal agency that oversees care and maintenance of 24 cemeteries abroad that constitute the final resting place for almost 125,000 American war dead. General McPeak will bring to the Board extensive experience in management consulting and a successful military career, including his position as Chief of Staff of the U.S. Air Force and a member of the Joint Chiefs of Staff. General McPeak currently serves as a member of the Organization & Compensation Committee and as a member of the Corporate Governance & Nominating Committee. Age 77.

JAMES H. PERRY

Director since 2008

Mr. Perry, until his retirement in 2008, served as Vice President of United Industrial Corporation, which, through its wholly-owned subsidiary AAI Corporation, designs, produces and supports aerospace and defense systems, from 1998 to 2007, as Chief Financial Officer (“CFO”) from 1995 to 2007, as Treasurer from 1994 to 2005, and as Controller from 2005 to 2007. Mr. Perry served as CFO of AAI Corporation from 2000 to 2007, as Treasurer from 2000 to 2005, and as Vice President from 1997 to 2007. Mr. Perry, a certified public accountant, held various positions in the Assurance practice of Ernst & Young LLP, a global leader in assurance, tax, transaction and advisory services, from 1987 to 1994. Mr. Perry’s qualifications which encompass his executive leadership skills in the aerospace and defense industry and experience as a certified public accountant including his tenure with a major accounting firm servicing numerous publically traded companies provides the Board with sophisticated financial expertise and oversight. Mr. Perry currently serves as Chairman of the Audit Committee. Age 52.

11

SCOTT J. SEYMOUR

Director since 2010

Mr. Seymour has served as President and CEO of the Company since January 2010. He served as President of Aerojet Rocketdyne, Inc. (“Aerojet Rocketdyne,” f/k/a Aerojet-General Corporation) from January 2010 until August 2012. Prior to that, Mr. Seymour had served as a consultant to Northrop Grumman Corporation, a global defense and technology company (“Northrop”), since March 2008. Mr. Seymour joined Northrop in 1983. Prior to becoming a consultant in March 2008, Mr. Seymour most recently served as Corporate Vice President and President of Integrated Systems Sector of Northrop from 2002 until March 2008. Mr. Seymour also served as Vice President, Air Combat Systems, Vice President and B-2 Program Manager and Vice President, Palmdale Operations, of Northrop, from 1998 to 2001, 1996 to 1998 and 1993 to 1996, respectively. Prior to joining Northrop, Mr. Seymour was involved in the manufacture and flight-testing of F-14A, EF-111A and F/A-18A aircraft for each of Grumman Aerospace Corporation and McDonnell Aircraft Company. Mr. Seymour is a member of the National Museum United States Air Force Board of Managers and the Board of the Air Warrior Courage Foundation. He is also a member of the Florida Institute of Technology Board of Trustees and a director of the Astronauts Memorial Foundation. Mr. Seymour serves as a Manager of the Board of Managers of Easton Development Company, LLC, a subsidiary of GenCorp. Mr. Seymour’s extensive experience as a senior executive provides the Board with significant operational expertise and an in-depth knowledge of the aerospace and defense industry. Age 63.

MARTIN TURCHIN

Director since 2008

Mr. Turchin is a Vice-Chairman of CB Richard Ellis, the world’s largest real estate services company, a position he has held since 2003. Previously, Mr. Turchin served as a Vice-Chairman of a subsidiary of Insignia Financial Group, a real estate brokerage, consulting and management firm from 1996 to 2003. Prior to that, Mr. Turchin was a principal and Vice-Chairman of Edward S. Gordon Company, a real estate brokerage, consulting and management firm from 1985 to 1996. Mr. Turchin has been a director of Boston Properties, a real estate investment trust, for more than ten years. Mr. Turchin held various positions with Kenneth E. Laub & Company, Inc., a real estate company, where he was involved in real estate acquisition, financing, leasing and consulting from 1971 to 1985. Mr. Turchin also serves as a trustee for the Turchin Family Charitable Foundation. Mr. Turchin serves as a Manager of the Board of Managers of Easton Development Company, LLC, a subsidiary of GenCorp. Mr. Turchin’s considerable experience in the real estate industry and service as a director of public companies provides the board with valuable expertise in real estate matters and experience in advising companies. Mr. Turchin currently serves as a member of the Audit Committee and as a member of the Corporate Governance & Nominating Committee. Age 72.

The Board unanimously recommends that shareholders vote FOR each of these nominees as Directors by executing and returning the proxy card or voting by one of the other ways indicated thereon. Proxies solicited by the Board will be so voted unless shareholders specify otherwise.

Voting for Directors

The Company has no provision for cumulative voting in the election of Directors. Therefore, holders of Common Stock are entitled to cast one vote for each share held on the Record Date for each of the candidates for election. Directors are elected by a plurality of the votes cast at the Annual Meeting; however, the Board has adopted a majority vote policy. Pursuant to such policy, in an uncontested election, any nominee for Director who receives a greater number of votes “withheld” for his election than votes “for” such election (a “Majority Withheld Vote”) shall promptly tender his resignation after such election for consideration by the Corporate Governance & Nominating Committee. In determining its recommendation

12

to the Board, the Corporate Governance & Nominating Committee will consider all factors deemed relevant by its members. These factors may include the underlying reasons why shareholders “withheld” votes for election from such Director (if ascertainable), the length of service and qualifications of the Director whose resignation has been tendered, the Director’s contributions to the Company, whether by accepting such resignation the Company will no longer be in compliance with any applicable law, rule, regulation or governing document, and whether or not accepting the resignation is in the best interests of the Company and our shareholders. Within 90 days thereafter, the Board, taking into account the recommendation of the Corporate Governance & Nominating Committee and such additional information and factors that the Board believes to be relevant, must determine whether to accept or reject the resignation. The Director that tendered the resignation shall not participate in the consideration or determination of whether to accept such resignation. The Board shall disclose by press release its decision to accept or reject the resignation and, if applicable, the reasons for rejecting the resignation. If a majority of the Corporate Governance & Nominating Committee members receive a Majority Withheld Vote at the same election, then the independent Directors who did not receive a Majority Withheld Vote will appoint a committee of independent Directors to consider the resignation offers and recommend to the Board whether to accept or reject them.

Votes cast for a nominee will be counted in favor of election. Abstentions and broker non-votes will not count either in favor of, or against, election of a nominee. It is the intention of the persons named in the accompanying form of proxy to vote for the election of the Board’s nominees, unless authorization to do so is withheld. Proxies cannot be voted for a greater number of persons than the number of Directors set by the Board for election. If, prior to the Annual Meeting, a nominee becomes unable to serve as a Director for any reason, the proxy holders reserve the right to substitute another person of their choice in such nominee’s place and stead. It is not anticipated that any nominee will be unavailable for election at the Annual Meeting.

Retirement Policy

On January 30, 2013, the Board approved the elimination of the mandatory retirement policy for Directors.

Meetings of the Board

The Board held 10 meetings during fiscal 2013. All of the Directors who served during fiscal 2013 attended at least 75% of the regularly scheduled and special meetings of the Board and Board committees on which they served and to which they were invited in fiscal 2013. All of the Board’s nominees for election at the Annual Meeting are expected to attend the Annual Meeting. All of the Directors nominated for election at the 2013 annual meeting of shareholders were present at such meeting.

Meetings of Non-Employee Directors

Non-employee Directors (consists of all Directors other than Mr. Seymour), all of whom are independent, meet in executive session as part of each regularly scheduled Board meeting. In 2013, the Chairman of the Board presided at all such executive sessions. In the event of the Chairman’s absence, another non-employee Director is chosen to preside.

Board Leadership Structure

In February 2007, as part of its ongoing commitment to corporate governance, the Board made a decision to separate the positions of Chairman of the Board and CEO. Prior to February 2007, the positions of Chairman of the Board and CEO were historically held by the same person. In March 2007, the Company’s shareholders approved the Board’s recommendations to amend the Company’s Amended Code of Regulations (as amended from time to time, the “Code of Regulations”) to allow the Board the flexibility

13

to choose whether to elect a non-executive Chairman, who would not be an officer of the Company, or have one person serve in both capacities. Since March 2007, the Board has appointed a non-executive to serve as Chairman of the Board.

Pursuant to the Company’s corporate governance guidelines, the duties of the non-executive Chairman of the Board include:

| • | preparing the agenda for Board meetings in consultation with the CEO; |

| • | presiding over all meetings of the shareholders and Board, including all executive sessions of the independent Directors; |

| • | serving as liaison between the CEO and the Board; |

| • | collaborating with senior management to provide timely information to the Board; and |

| • | collaborating with the Organization & Compensation Committee to review the performance of the CEO. |

As directors continue to have increasingly more oversight responsibilities, the Company believes it is beneficial to have an independent Chairman whose sole responsibility is leading the Board, leaving the CEO’s main focus on the Company’s business goals and promoting both short-term and long-term growth.

Pursuant to the Code of Regulations and the Company’s corporate governance guidelines, the Board determines the leadership structure of the Company. As part of the Board’s annual self-evaluation process, the Board evaluates the Company’s leadership structure to ensure that it provides the optimal structure for the Company and shareholders. At this time, the Board believes the current leadership structure, with Mr. Seymour serving as CEO and Mr. Lichtenstein serving as Chairman of the Board, is the most advantageous for the Company. However, the Board recognizes that there is no single, generally accepted approach to providing corporate leadership, and the Company’s leadership structure may change in the future as circumstances warrant.

Board Role in Risk Oversight

Management has the primary responsibility for identifying and managing the risks facing the Company, subject to the oversight of the Board. The Board strives to effectively oversee the Company’s enterprise-wide risk management in a way that balances managing risks while enhancing the long-term value of the Company for the benefit of the shareholders. The Board of Directors understands that its focus on effective risk oversight is critical to setting the Company’s tone and culture towards effective risk management. To administer its oversight function, the Board seeks to understand the Company’s risk philosophy by having discussions with management to establish a mutual understanding of the Company’s overall appetite for risk. The Company’s Board of Directors maintains an active dialogue with management about existing risk management processes and how management identifies, assesses and manages the Company’s most significant risk exposures. The Company’s Board receives frequent updates from management about the Company’s most significant risks so as to enable it to evaluate whether management is responding appropriately.

The Board of Directors relies on each of its committees to help oversee the risk management responsibilities relating to the functions performed by such committees. The Audit Committee periodically discusses with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. The Organization & Compensation Committee helps the Board to identify the Company’s exposure to any risks potentially created by our compensation programs and practices. The Corporate Governance & Nominating Committee oversees risks relating to the Company’s corporate compliance programs and assists the Board and management in promoting an organizational culture that encourages commitment to ethical

14

conduct and a commitment to compliance with the law. Each of these committees is required to regularly report on its actions and to make recommendations to the Board, including recommendations to assist the Board with its overall risk oversight function. The Board retains oversight responsibility for all subject matters not specifically assigned to a committee, including risks presented by the Company’s business strategy, competition, regulation, general industry trends, and capital structure.

Determination of Independence of Directors

The Board has determined that to be considered independent, a Director may not have a direct or indirect material relationship with the Company. A material relationship is one which impairs or inhibits, or has the potential to impair or inhibit, a Director’s exercise of critical and disinterested judgment on behalf of the Company and its shareholders. In making its assessment of independence, the Board considers any and all material relationships not merely from the standpoint of the Director, but also from that of persons or organizations with which the Director has or has had an affiliation, or those relationships which may be material, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, among others. The Board also considers whether a Director was an employee of the Company within the last five years. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent” Director, including those set forth in pertinent listing standards of the NYSE as in effect from time to time. The NYSE’s listing standards require that all listed companies have a majority of independent directors. For a director to be “independent” under the NYSE listing standards, the board of directors of a listed company must affirmatively determine that the director has no material relationship with the company, or its subsidiaries or affiliates, either directly or as a partner, shareholder or officer of an organization that has a relationship with the company or its subsidiaries or affiliates. In accordance with the NYSE listing standards, the Board has affirmatively determined that each of the Board’s nominees, other than Mr. Seymour, have no material relationships with the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company.

To determine the independence of its Directors, the Company examined the following NYSE listing standards, which provide that a director is not independent if:

| • | the director is, or has been within the last three years, an employee of the listed Company, or an immediate family member is, or has been within the last three years, an executive officer of the listed Company; |

| • | the director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the listed Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| • | (a) the director is a current partner or employee of a firm that is the listed Company’s internal or external auditor; (b) the director has an immediate family member who is a current partner of such a firm; (c) the director has an immediate family member who is a current employee of such a firm and personally works on the listed Company’s audit; or (d) the director or an immediate family member was within the last three years (but is no longer) a partner or employee of such a firm and personally worked on the listed Company’s audit within that time; |

| • | the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the listed Company’s present executive officers at the same time serves or served on that company’s compensation committee; or |

15

| • | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to or received payments from, the listed Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other listed Company’s consolidated gross revenues. |

Each of the Board’s nominees, other than Mr. Seymour, has been determined to be “independent” by the NYSE listing standards.

Board Committees

The Board maintains three standing committees: the Audit Committee; the Corporate Governance & Nominating Committee; and the Organization & Compensation Committee. In addition, non-standing committees include the Pricing Committee, the Authorization Committee, and the Benefits Management Committee. Assignments to, and chairs of, the committees are recommended by the Corporate Governance & Nominating Committee and approved by the Board. All committees report on their activities to the Board. Each standing committee operates under a charter approved by the Board. The charters for each of the standing committees are posted on the Company’s web site at www.GenCorp.com and are available in print to any shareholder or interested party who requests them by writing to Secretary, GenCorp Inc., 2001 Aerojet Road, Rancho Cordova, California 95742.

The following table provides the membership and total number of meetings held by each standing committee of the Board in fiscal 2013:

| Name | Audit | Corporate Governance & Nominating |

Organization & Compensation | |||

| Thomas A. Corcoran |

X | X | ||||

| James R. Henderson |

X | X* | ||||

| Warren G. Lichtenstein |

X | |||||

| David A. Lorber |

X | X* | ||||

| Merrill A. McPeak |

X | X | ||||

| James H. Perry |

X* | |||||

| Martin Turchin |

X | X | ||||

| Total meetings in fiscal 2013 |

5 | 2 | 8 |

| * | Committee Chairman |

The Audit Committee is a separately designated standing committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board has determined that each member of the Audit Committee meets all applicable independence and financial literacy requirements under the NYSE listing standards. The Board has also determined that Mr. Perry is an “audit committee financial expert” under the applicable rules promulgated pursuant to the Exchange Act. The Audit Committee reviews and evaluates the scope of the audits to be performed by, the adequacy of services performed by, and the fees and compensation of, the independent auditors. The Audit Committee also reviews the Company’s audited financial statements with management and with the Company’s independent auditors and recommends to the Board to include the audited financial statements in the Annual Report on Form 10-K; approves in advance all audit and permitted non-audit services to be provided by the independent auditors; reviews and considers matters that may have a bearing upon continuing audit or independence; prepares the report of the Audit Committee to be included in the Company’s Proxy Statement; appoints the independent auditors to examine the consolidated financial statements of the Company; reviews and evaluates the scope and appropriateness of the Company’s internal audit function, internal audit plans and system of internal controls; reviews and

16

evaluates the appropriateness of the Company’s selection or application of accounting principles and practices and financial reporting; receives periodic reports from the internal audit and law departments; and reviews and oversees the Company’s compliance with legal and regulatory requirements.

The Corporate Governance & Nominating Committee periodically reviews and makes recommendations to the Board concerning the criteria for selection and retention of Directors, the composition of the Board (including the Chairman of the Board), the structure and function of Board committees, and the retirement policy of Directors. The Corporate Governance & Nominating Committee also assists in identifying, and recommends to the Board, qualified candidates to serve as Directors of the Company and considers and makes recommendations to the Board concerning Director nominations submitted by shareholders. The Corporate Governance & Nominating Committee also periodically reviews and advises the Board regarding significant matters of public policy, including proposed actions by foreign and domestic governments that may significantly affect the Company; reviews and advises the Board regarding adoption or amendment of major Company policies and programs relating to matters of public policy; monitors the proposed adoption or amendment of significant environmental legislation and regulations and advises the Board regarding the impact such proposals may have upon the Company and, where appropriate, the nature of the Company’s response thereto; periodically reviews and advises the Board regarding the status of the Company’s environmental policies and performance under its environmental compliance programs; and periodically reviews and reports to the Board regarding the status of, and estimated liabilities for, environmental remediation. The Board has determined that each member of the Corporate Governance & Nominating Committee meets all applicable independence requirements under the NYSE listing standards.

The Organization & Compensation Committee advises and recommends to the independent Directors the total compensation of the President and CEO. The Organization & Compensation Committee delegated to the President and CEO the final authority to establish the 2013 base salaries of the other executives of the Company within limits previously reviewed by the Organization & Compensation Committee with the President and CEO. The Organization & Compensation Committee also administers the Company’s deferred compensation plan and the GenCorp Amended and Restated 2009 Equity and Performance Incentive Plan (the “2009 Incentive Plan”). The Organization & Compensation Committee periodically reviews the organization of the Company and its management, including major changes in the organization of the Company and the responsibility of management as proposed by the CEO; monitors executive development and succession planning; reviews the effectiveness and performance of senior management and makes recommendations to the Board concerning the appointment and removal of officers; periodically reviews the compensation philosophy, policies and practices of the Company and makes recommendations to the Board concerning major changes, as appropriate; annually reviews changes in the Company’s employee benefit, savings and retirement plans and reports thereon to the Board; and approves, and in some cases recommends to the Board for approval, the compensation of officers, and executives of the Company. The Organization & Compensation Committee also reviews and makes recommendations to the Board regarding the compensation and benefits for Directors. The Board has determined that each member of the Organization & Compensation Committee meets all applicable independence requirements under the NYSE and SEC listing standards. In making its determination, the Board considered all factors specifically relevant to determining whether a director has a relationship to the Company which is material to that director’s ability to be independent from management in connection with the duties of an Organization & Compensation Committee member, including but not limited to, (i) the source of the director’s compensation, including any consulting, advisory or other compensatory fees paid by the Company; and (ii) whether the director has an affiliate relationship with the Company.

From time to time, the Board forms special committees to address specific matters.

17

Director Nominations

The Corporate Governance & Nominating Committee identifies potential director candidates through a variety of means, including recommendations from members of the Corporate Governance & Nominating Committee, the Board, management and shareholders. The Corporate Governance & Nominating Committee also may retain the services of a consultant to assist in identifying candidates. The Corporate Governance & Nominating Committee will consider nominations submitted by shareholders. A shareholder who would like to recommend a nominee should write to the Chairman of the Corporate Governance & Nominating Committee, c/o Secretary, GenCorp Inc., 2001 Aerojet Road, Rancho Cordova, California 95742. Any such recommendation must include (i) the name and address of the candidate; (ii) a brief biographical description, including his or her occupation for at least the last five years, and a statement of the qualifications of the candidate; and (iii) the candidate’s signed consent to serve as a Director if elected and to be named in the Proxy Statement.

Such nominations must be received by the Chairman of the Corporate Governance & Nominating Committee no later than December 1st immediately preceding the date of the annual meeting of shareholders at which the nominee is to be considered for election. Since the date of the Company’s 2013 Proxy Statement, there have been no material changes to the procedures by which shareholders of the Company may recommend nominees to the Board.

The Corporate Governance & Nominating Committee seeks to create a Board that is, as a whole, strong in its collective knowledge and diversity of skills and experience and background with respect to accounting and finance, management and leadership, business judgment, industry knowledge and corporate governance. Although the Corporate Governance & Nominating Committee does not have a formal diversity policy relating to the identification and evaluation of nominees, the Corporate Governance & Nominating Committee, in addition to reviewing a candidate’s qualifications and experience in light of the needs of the Board and the Company at that time, reviews candidates in the context of the current composition of the Board and the evolving needs of the Company’s businesses.

Communications with Directors

Shareholders and other interested parties may communicate with the Board or individual Directors by mail addressed to: Chairman of the Corporate Governance & Nominating Committee, c/o Secretary, 2001 Aerojet Road, Rancho Cordova, California 95742. The Secretary may initially review communications to the Board or individual Directors and transmit a summary to the Board or individual Directors, but has discretion to exclude from transmittal any communications that are, in the reasonable judgment of the Secretary, inappropriate for submission to the intended recipient(s). Examples of communications that would be considered inappropriate for submission to the Board or a Director include, without limitation, customer complaints, solicitations, commercial advertisements, communications that do not relate directly or indirectly to the Company’s business or communications that relate to improper or irrelevant topics.

Compensation Committee Interlocks and Insider Participation

The Organization & Compensation Committee is composed entirely of non-employee independent Directors. As of November 30, 2013, the members of the Organization & Compensation Committee included David A. Lorber (Chairman), Thomas A. Corcoran, Warren G. Lichtenstein and Merrill A. McPeak. All non-employee independent Directors participate in decisions regarding the compensation of the President and CEO. None of the Company’s executive officers serve as a member of the Board or compensation committee of any entity that has one or more of its executive officers serving as a member of the Company’s Organization & Compensation Committee. In addition, none of the Company’s executive officers serve as a member of the Organization & Compensation Committee of any entity that has one or more of its executive officers serving as a member of the Company’s Board.

18

Director Compensation

The compensation of the Company’s non-employee Directors is determined by the Board upon the recommendations made by the Organization & Compensation Committee. The current Director compensation program was implemented by the Company in 2010 after evaluation of the recommendations by Hay Group, Inc. (“Hay Group”) who was retained by the Organization & Compensation Committee as outside consultants to assess the overall compensation structure for its non-employee Directors. Specifically, the Organization & Compensation Committee requested Hay Group to measure the Company’s director compensation (in total and by pay component) against similarly sized U.S. companies in the aerospace/defense industry based on information disclosed in recent SEC filings, and in the broader general industry, using both proprietary compensation surveys and its knowledge of industry practices. The compensation program was re-evaluated in 2011 and determined to be competitive with the current market. Subsequent to the acquisition of the Pratt & Whitney Rocketdyne division (the “Rocketdyne Business”) of the United Technologies Corporation, Hay Group recommended and the Organization & Compensation Committee approved certain changes to the Director compensation program to recognize the increased size, scale and complexity of the new Aerojet Rocketdyne organization. These changes were effective beginning on November 13, 2013. The Director compensation program, including changes effective on November 13, 2013, is more fully described below.

Annual Retainer Fees

Under our Director compensation program effective beginning on April 2010, and for the Company’s most recently ended fiscal year, each non-employee Director will receive an annual retainer fee of $55,000, with the exception of the Chairman of the Board who receives an annual retainer fee of $110,000. Each non-employee Director will receive $5,000 for service on a standing or long-term special committee of the Board and $3,250 for service on a limited-purpose special committee of the Board. Non-employee Directors who served as Chairman of the Organization & Compensation Committee or Corporate Governance & Nominating Committee will receive an additional annual fee of $10,000 and the Chairman of the Audit Committee will receive an additional $15,000. Non-employee Directors who attend Board meetings in excess of six meetings between any two annual meetings of shareholders will receive $2,000 per each additional Board meeting and non-employee Directors who attend meetings of any single standing or long-term special committee meetings held in excess of six meetings between any two annual meetings of shareholders will receive $1,500 per each additional committee meeting. The annual cash compensation for each non-employee Director serving as a Manager on the Board of Managers of Easton Development Company, LLC is $15,000. Effective November 13, 2013, each non-employee Director will receive $7,500 for service on the Corporate Governance & Nominating or the Organization & Compensation Committees, and $10,000 for service on the Audit Committee.