UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Under §240.14a-12

Aerojet Rocketdyne Holdings, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies: | |

2) Aggregate number of securities to which transaction applies: | |

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

4) Proposed maximum aggregate value of transaction: | |

5) Total fee paid: | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid: | |

2) Form, Schedule or Registration Statement No.: | |

3) Filing Party: | |

4) Date Filed: | |

| 222 N. Pacific Coast Highway, Suite 500 El Segundo, CA 90245 | |

March 26, 2019

Dear Stockholder:

You are cordially invited to attend the 2019 Annual Meeting of Stockholders of Aerojet Rocketdyne Holdings, Inc., which will be held at 9:00 a.m. Pacific Time, on May 9, 2019. Our 2019 Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the meeting on the Internet and submit your questions during the meeting by visiting ajrd.onlineshareholdermeeting.com. Details regarding how to attend the meeting online and the business to be presented at the meeting can be found in the accompanying Notice of Annual Meeting and Proxy Statement.

We have elected to take advantage of the Securities and Exchange Commission’s rule that allows us to furnish our proxy materials to our stockholders over the Internet. We believe electronic delivery will expedite the receipt of materials and, by printing and mailing a smaller volume, will reduce the environmental impact of our annual meeting materials and help lower our costs. On or about March 29, 2019 a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) will be mailed to our stockholders. This Notice of Internet Availability will contain instructions on how to access the Notice of Annual Meeting, the Proxy Statement and the Company’s Annual Report for 2018 on Form 10-K (the “2018 Annual Report”) to stockholders online. You will not receive a printed copy of these materials unless you specifically request one. The Notice of Internet Availability contains instructions on how to receive a paper copy of the proxy materials. For those participants who hold shares of the Company’s common stock in the Aerojet Rocketdyne Retirement Savings Plan, you will receive a full set of annual meeting materials and a proxy card by mail.

On behalf of the Board of Directors and the management of Aerojet Rocketdyne Holdings, Inc., I extend our appreciation for your continued support.

Very truly yours,

/s/ Warren G. Lichtenstein

WARREN G. LICHTENSTEIN

Executive Chairman

AEROJET ROCKETDYNE HOLDINGS, INC. NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

DATE | TIME | RECORD DATE | ||

Thursday, May 9, 2019 | 9:00 A.M. Pacific Time | Wednesday, March 13, 2019 | ||

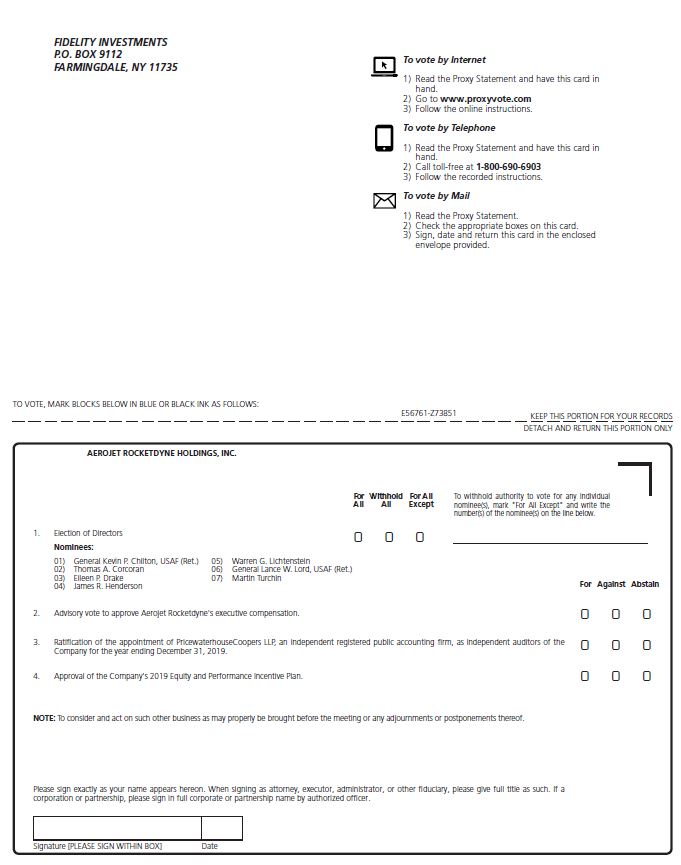

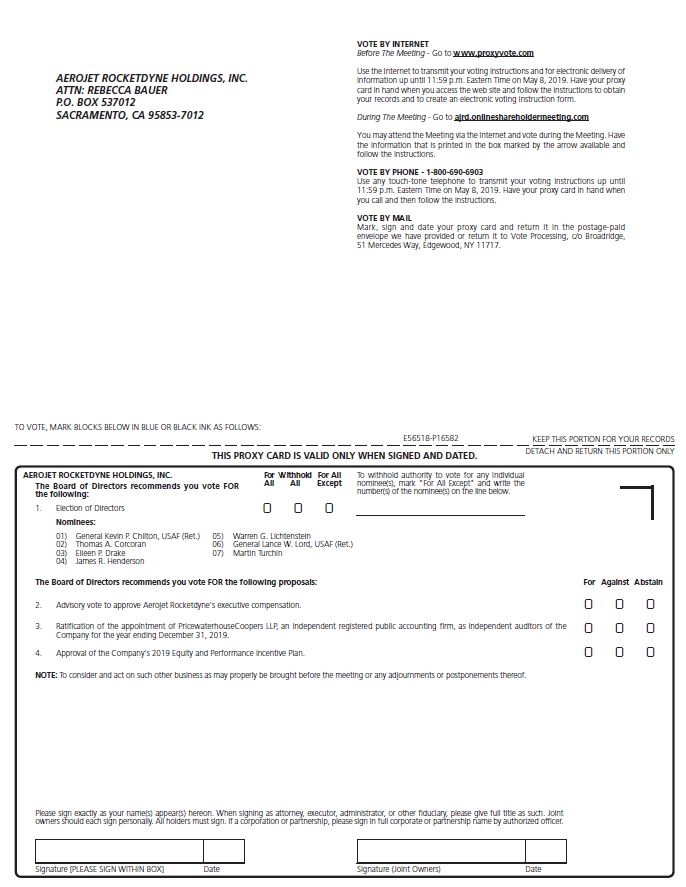

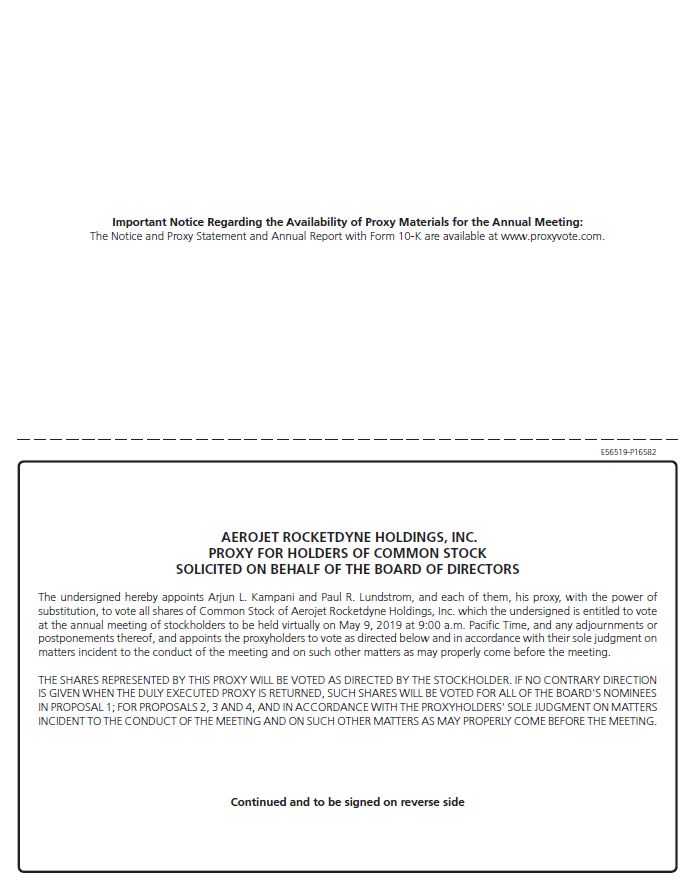

HOW TO CAST YOUR VOTE

It is important that your shares be represented and voted at the meeting. You may vote your shares by voting electronically at the meeting by visiting ajrd.onlineshareholdermeeting.com and following the instructions, by Internet, by telephone or by completing, signing, dating and returning a proxy card which will be mailed to you if you request delivery of a full set of proxy materials. Participants in the Aerojet Rocketdyne Retirement Savings Plan must follow the voting instructions provided by Fidelity Management Trust Company. See details under the heading “How do I vote?” on page 65.

ONLINE | BY PHONE | BY MAIL | ||

Vote online at www.proxyvote.com. You may also vote online during the meeting at ajrd.onlineshareholdermeeting.com | Vote by phone by calling 1-800-690-6903 | If you have received a printed version of these proxy materials you may vote by mail using the postage-paid envelope provided | ||

HOW TO ATTEND THE MEETING

• | Attend the 2019 annual meeting of stockholders (the “Annual Meeting”) online at ajrd.onlineshareholdermeeting.com. |

• | The Annual Meeting will begin at 9:00 a.m. Pacific Time on Thursday, May 9, 2019. |

• | To participate in the meeting, you will need the control number included on your Notice of Internet Availability, on your proxy card, or on the instructions that accompanied your proxy materials. |

• | The record date for the Annual Meeting is Wednesday, March 13, 2019. This means you are entitled to receive notice of the meeting and vote shares at the meeting if you were a stockholder of record as of the close of business on Wednesday, March 13, 2019. |

ITEMS OF BUSINESS

1. | To elect the seven directors named in the Proxy Statement to our Board of Directors to serve until the 2020 annual meeting of stockholders and until their respective successors have been duly elected and qualified; |

2. | To consider and approve an advisory vote to approve Aerojet Rocketdyne’s executive compensation; |

3. | To ratify the appointment of PricewaterhouseCoopers LLP, an independent registered public accounting firm, as independent auditors of the Company for the year ending December 31, 2019; |

4. | To Approve the Company’s 2019 Equity and Performance Incentive Plan; |

5. | To consider and act on such other business as may properly be brought before the meeting or any adjournments or postponements thereof. |

By Order of the Board of Directors,

/s/ Arjun L. Kampani

ARJUN L. KAMPANI

Vice President,

General Counsel and Secretary

Important Notice Regarding the Availability of proxy materials for the 2019 Annual Meeting of Stockholders to be held on May 9, 2019: The Proxy Statement and the Company’s 2018 Annual Report are available at www.proxyvote.com |

TABLE OF CONTENTS | ||

Page | ||

PROXY STATEMENT SUMMARY

This summary highlights selected information that is provided in more detail throughout this Proxy Statement. For additional information about these topics, refer to the discussions contained throughout this document and in the Company’s 2018 Annual Report. You should read the full Proxy Statement before casting your vote. This Proxy Statement contains certain non-GAAP (accounting principles generally accepted in the United States of America) financial measures, which are identified with asterisks. For more information on these non-GAAP financial measures, see Appendix A.

Annual Stockholders’ Meeting | |

Time: May 9, 2019, 9:00 a.m. Pacific Time | Record Date: You are entitled to vote if you were a shareholder of record at the close of business on March 13, 2019. |

Place: Online at ajrd.onlineshareholdermeeting.com | |

Voting Matters and Board Recommendations | ||

Proposals | Board Vote Recommendation | Page Reference |

Proposal 1: Election of Directors | FOR each Director Nominee | |

Proposal 2: Advisory Vote to Approve Aerojet Rocketdyne’s Executive Compensation | FOR | |

Proposal 3: Ratification of the Appointment of Independent Auditors | FOR | |

Proposal 4: Approval of the Company’s 2019 Equity and Performance Incentive Plan | FOR | |

1

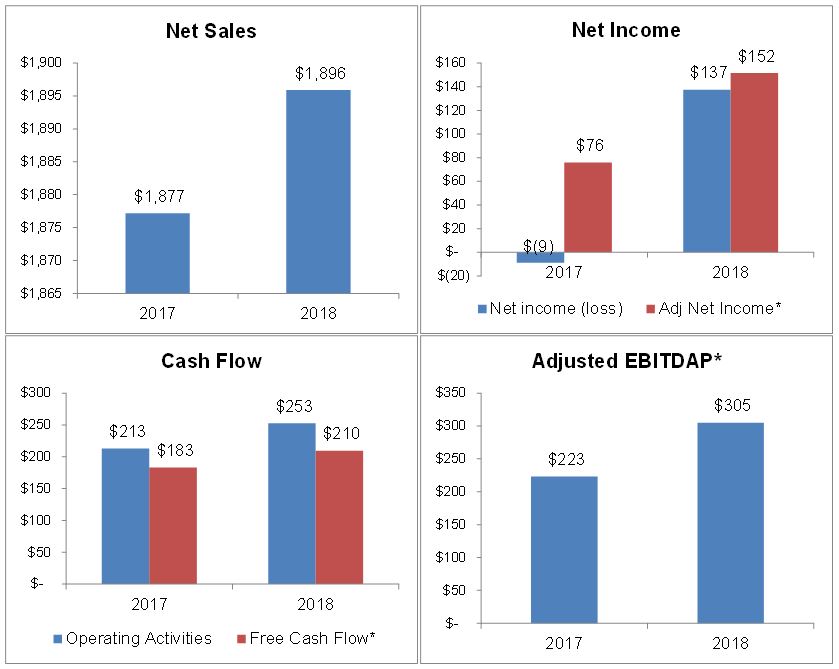

2018 Performance Highlights |

Net sales were impacted by the adoption of new revenue recognition guidance effective January 1, 2018.

• | Net sales in 2018 would have been $1,910 million under the previous revenue guidance. |

• | Increase of $126 million in defense programs primarily driven by increased deliveries on the Standard Missile and PAC-3 programs. |

• | Decrease of $95 million in space programs primarily driven by cost growth and performance issues on the Commercial Crew Development program and lower deliveries on the Atlas V program. |

Net income increased primarily due to:

• | Decrease of $45 million in income taxes. |

• | One-time benefit of $43 million from increased recoverability of environmental remediation costs. |

• | Improved contract performance resulting in an increase of $22 million in favorable changes in contract estimates. |

• | Decrease of $16 million in retirement benefits expense. |

Cash flow provided by operating activities increased primarily due to:

• | Improved operating results. |

• | Decrease in retirement benefit cash funding. |

(In millions)

* These are non-GAAP financial measures. For more information, see Appendix A - Use of Non-GAAP Financial Measures.

2

2018 Executive Compensation Highlights |

We have designed our executive compensation program pertaining to the named executive officers (“NEOs”) to attract and retain highly qualified executive officers and to directly link pay to performance. In 2018 our strategic goals continued to be focused on improving our financial performance, which resulted in the Organization & Compensation Committee maintaining the same performance measures within our annual incentive plan as in the previous year. Specifically, the Committee used the following measures for our NEOs within our 2018 annual incentive plan:

• | Adjusted earnings before interest, taxes, depreciation, amortization and pension expense (“EBITDAP”); |

• | Cash flow from operations; |

• | Aerojet Rocketdyne bookings; and |

• | Certain other goals that include individual performance and accomplishments of each NEO. |

The Organization & Compensation Committee also granted NEOs 2018 equity-based compensation in the same form as was granted in 2017, consisting of stock appreciation rights (“SARs”) (25% of award) and performance-based restricted stock (75% of award). The performance-based restricted stock vesting is subject to achievement of performance targets based on the following three metrics: revenue; adjusted EBITDAP; and return on invested capital (“ROIC”). In addition, the 2018 equity-based compensation included two additional components of awards consisting of service-based restricted stock and stock price performance-based restricted stock.

Board of Director Nominees and Committees |

Committee Membership | |||||

Name | Age(1) | Director Since | Audit | Corporate Governance & Nominating | Organization & Compensation |

Kevin P. Chilton | 64 | 2018 | |||

Thomas A. Corcoran | 74 | 2008 | M | M | |

Eileen P. Drake | 52 | 2015 | |||

James R. Henderson | 61 | 2008 | C | C | |

Warren G. Lichtenstein | 53 | 2008 | |||

Lance W. Lord | 72 | 2015 | M | M | |

Merrill A. McPeak(2) | 82 | 2013 | M | C | |

Martin Turchin | 77 | 2008 | M | M | |

M = Committee Member C = Committee Chairman | |||||

(1) | Age as of December 31, 2018. |

(2) | Gen. McPeak will retire from the Board in 2019 and is not a nominee. |

3

PROPOSAL 1: ELECTION OF DIRECTORS

The Company’s Second Amended and Restated Bylaws (the “Bylaws”) provide that the entire Board of Directors (the “Board”) of Aerojet Rocketdyne Holdings, Inc., a Delaware corporation (“Aerojet Rocketdyne” or the “Company”) shall consist of one or more Directors, the total number thereof to be authorized first by the incorporator of the Company, and thereafter authorized by resolution of the Board by the affirmative vote of a majority of the Company’s directors (“Directors”) then in office. The Board has fixed the number of Directors to serve on the Board at seven.

The Board has proposed the following nominees for election as Directors at the Annual Meeting: Kevin P. Chilton; Thomas A. Corcoran; Eileen P. Drake; James R. Henderson; Warren G. Lichtenstein; Lance W. Lord and Martin Turchin. Each nominee elected as a Director will continue in office until the next annual meeting of stockholders at which their successor has been elected and qualified, or until his/her resignation, removal from office, or death, whichever is earlier.

Each nominee receiving a plurality of the affirmative votes cast at the Annual Meeting will be elected to the Board. Abstentions and broker non-votes will not count either in favor of, or against, the election of a nominee.

Director Qualifications and Experience |

The Board, acting through the Corporate Governance & Nominating Committee, seeks a Board that, as a whole, possesses the experience, skills, background and qualifications appropriate to function effectively in light of the Company’s current and evolving business circumstances. The Corporate Governance & Nominating Committee reviews the size of the Board, the tenure of its Directors and their skills, backgrounds and experiences in determining the slate of nominees and whether to seek one or more new candidates. The Corporate Governance & Nominating Committee seeks directors with established records of significant accomplishments in business and areas relevant to the Company’s strategies. With respect to the nomination of continuing Directors for re-election, the individual’s contributions to the Board are also considered.

All of our Directors bring to our Board a wealth of executive leadership experience derived from their service as executives and, in some cases, chief executive officers of large corporations. They also bring extensive board experience. The process undertaken by the Corporate Governance & Nominating Committee in recommending qualified director candidates is described in the Director Nominations section on page 17.

Set forth below are the names and ages of the nominees for Directors and their principal occupations at present and for the past five years, as well as their particular experience, qualifications, attributes or skills that led the Board to conclude that the person should serve as a Director for the Company. There are, to the knowledge of the Company, no agreements or understandings by which these individuals were so selected. No family relationships exist between any Directors or executive officers, as such term is defined in Item 402 of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The information concerning the nominees set forth below is given as of December 31, 2018.

4

GENERAL KEVIN P. CHILTON USAF (Ret.) | ||

Age: 64 | ||

Director since 2018 | ||

Gen. Chilton has served as president of Chilton & Associates LLC, an aerospace, cyber and nuclear consulting company, since 2011, when he retired from the U.S. Air Force after over 34 years of service completing his career as the Commander, U.S. Strategic Command, where he was responsible for the plans and operations for all U.S. forces conducting strategic nuclear deterrence, space and cyberspace operations. From 2006 to 2007, Gen. Chilton served as Commander of Air Force Space Command, where he was responsible for all Air Force space and nuclear ICBM programs. From 1998 to 2006, Gen. Chilton held a number of positions in the Department of Defense including: Commander of the 9th Reconnaissance Wing; Commander of the 8th Air Force; Deputy Director of Politico-Military Affairs, Asia-Pacific and Middle East; Deputy Director of Programs; and acting Assistant Vice Chief of Staff of the Air Force. From 1987 to 1998, he served as a National Aeronautics and Space Administration (“NASA”) Astronaut, participating in three space shuttle flights and as Deputy Program Manager for Operations for the International Space Station Program. Gen. Chilton is also a distinguished graduate of the U.S. Air Force Academy, with a Bachelor of Science degree in Engineering Science; a Columbia University Guggenheim Fellow with a Master of Science degree in Mechanical Engineering; and a distinguished graduate of the U.S. Air Force pilot training and test pilot schools. Gen. Chilton also was awarded an honorary Doctor of Laws degree from Creighton University. | ||

Current and Former Public Company Directorships | ||

• | CenturyLink, Inc. - Audit Committee, Risk & Security Committee (Chair) |

• | Anadarko Petroleum Corporation - Audit Committee until 2017 |

• | Level 3 Communications, Inc. - Audit Committee, Classified Business and Security Committee (Chair) until 2017 |

• | Orbital ATK, Inc. - Audit Committee, Markets & Technology Committee until 2017 |

• | Orbital Sciences Corporation - Audit Committee, Markets & Technology until 2015 |

Other Service |

• | Air Force Academy Falcon Foundation, Trustee |

• | Pikes Peak or Bust Rodeo Foundation, Trustee |

• | Cobham Advanced Electronic Solutions, Director - Compensation Committee (Chair) |

• | Lawrence Livermore National Laboratories Board of Governors, Member |

• | Sandia National Laboratory Board of Managers, Member |

• | Air Force Academy Association of Graduates, Former Director |

• | The Aerospace Corporation, Former Director |

• | Shafer Corporation, Former Director |

Attributes, Skills and Qualifications |

• | Extensive career as a senior military officer with the United States Air Force and as a NASA Astronaut |

• | Significant public company board experience |

5

THOMAS A. CORCORAN | ||

Age: 74 | ||

Director since 2008 | ||

Committee Memberships: | ||

Organization & Compensation Committee | ||

Corporate Governance & Nominating Committee | ||

Mr. Corcoran has been President of Corcoran Enterprises, LLC, a management consulting company, since 2001. He also served as Senior Advisor of The Carlyle Group, a private investment firm, from 2001 to 2017. Mr. Corcoran has held a number of senior executive positions, including President and Chief Executive Officer (“CEO”) of Gemini Air Cargo, Inc. from 2001 to 2004; President and CEO of Allegheny Teledyne Incorporated from 1999 to 2000; and President and Chief Operating Officer (“COO”) of Lockheed Martin Corporation’s Electronic Systems and Space & Strategic Missiles sectors from 1993 to 1999. Mr. Corcoran was also elected a corporate officer and rose to the number two position in G.E. Aerospace as Vice President (“VP”) and General Manager of G.E. Aerospace Operations in 1990, after beginning his career with General Electric Company in 1967. Mr. Corcoran has been a director of numerous private and public companies. | ||

Current and Former Company Directorships | ||

• | L3 Technologies, Inc. - Audit & Ethics Committee, Compensation Committee |

• | ARINC, Inc. until 2013 |

Other Service |

• | American Ireland Fund, Director |

• | Stevens Institute of Technology, Board of Trustees |

• | Worcester Polytechnic Institute, Trustee Emeritus |

Attributes, Skills and Qualifications |

• | Considerable industry knowledge gained from extensive experience as a senior executive in the aerospace industry |

• | Significant public company board experience, including service as a director of a Fortune 500 company |

6

EILEEN P. DRAKE | |

Age: 52 | |

Director since 2015 | |

Ms. Drake has served as CEO and President of the Company since June 2015. Immediately prior to these roles, she served as the Company’s COO from March 2015 to June 2015. Before joining the Company, Ms. Drake held several senior positions with United Technologies Corporation (“UTC”), a multinational manufacturing conglomerate, from 2003 to 2015, including President of Pratt & Whitney AeroPower’s auxiliary power unit and small turbojet propulsion business from 2012 to 2015. From 1996 to 2003, Ms. Drake managed production operations at both the Ford Motor Company and Visteon Corporation where she was Ford’s product line manager for steering systems and plant manager of Visteon’s fuel system operation. Ms. Drake also served on active duty for seven years as a U.S. Army aviator and airfield commander of Davison Army Airfield in Fort Belvoir, Virginia. She is a distinguished military graduate of the U.S. Army Aviation Officer School and received a Master of Business Administration from Butler University and a Bachelor of Arts from The College of New Rochelle. She also holds commercial and private pilot licenses in both fixed-wing and rotary-wing aircraft. | |

Current and Former Public Company Directorships | |

• | Woodward, Inc. |

Other Service |

• | Aerospace Industries Association, Board of Governors - Executive Committee & Finance Committee |

Attributes, Skills and Qualifications |

• | Considerable aerospace and defense industry knowledge and operational expertise |

• | Public company board experience |

7

JAMES R. HENDERSON | |

Age: 61 | |

Director since 2008 | |

Committee Memberships: | |

Corporate Governance & Nominating Committee (Chairman) | |

Audit Committee (Chairman) | |

Mr. Henderson has served as CEO of Armor Express, a private designer and manufacturer of body armor solutions, since 2018. From 2016 to 2018, Mr. Henderson served as CEO of Steel Connect, Inc. (formerly known as ModusLink Global Solutions, Inc.) (“Steel Connect”), a private supply-chain management company. From 2013 to 2014, Mr. Henderson served as Acting CEO of School Specialty, Inc., a company that provides education-related products, programs and services. Prior to these positions, Mr. Henderson served a number of roles with Steel Partners LLC, a subsidiary of Steel Partners Holdings L.P. (“SPLP”), and its affiliates from 1999 until 2011. Mr. Henderson’s positions included Managing Director and operating partner of Steel Partners LLC, and CEO, President and COO, and VP of Operations of SPLP’s predecessor entity, WebFinancial Corporation. From 2011 to 2012, Mr. Henderson served as CEO of Point Blank Enterprises, Inc., the successor business to Point Blank Solutions, Inc. (“Point Blank”), where he had previously served as CEO. On April 14, 2010, Point Blank and certain of its subsidiaries filed voluntary petitions for relief under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware. The Chapter 11 petitions are being jointly administered under the caption “In re Point Blank Solutions, Inc., et. al.” Case No. 10-11255, which case is ongoing. | |

Current and Former Public Company Directorships | |

• | School Specialty, Inc., until 2018 |

• | Aviat Networks Inc., until 2016 |

• | RELM Wireless Corporation (n/k/a BK Technologies, Inc.), until 2015 (Chairman) |

• | DGT Holdings Corp., until 2011 |

• | Point Blank Solutions, Inc. until 2011 (Chairman) |

• | SL Industries, Inc., until 2010 |

Other Service |

• | Armor Express, Director |

• | Easton Development Company, LLC (Company subsidiary), Manager of the Board of Managers |

Attributes, Skills and Qualifications |

• | Extensive business experience advising and managing public companies |

• | Significant public company board experience |

8

WARREN G. LICHTENSTEIN | |

Age: 53 | |

Director since 2008 | |

Mr. Lichtenstein has served as the Company’s Executive Chairman since 2016, and previously served as the Chairman of the Board from 2013 to 2016. He has served on the boards of more than twenty public companies in his career and held a number of chairman or executive chairman titles. Mr. Lichtenstein has served as the interim CEO of Steel Connect (formerly known as ModusLink Global Solutions, Inc.) since December 2018 and previously from March 2016 until June 2016. Mr. Lichtenstein also served as Chairman of the Board of Steel Connect from March 2013 until June 2016, at which time he was appointed Executive Chairman. Mr. Lichtenstein served as Chairman and CEO of Steel Partners Holdings GP Inc., the general partner of SPLP, from 2009 to 2013, and has served as its Executive Chairman since February 2013. Mr. Lichtenstein is the founder of Steel Partners and has been associated with SPLP and its predecessors and affiliates since 1990. | |

Current and Former Public Company Directorships | |

• | Steel Connect, Inc., Executive Chairman and Interim CEO |

• | Steel Partners Holdings GP Inc., Executive Chairman |

• | Steel Excel Inc. (a subsidiary of SPLP), Chairman (went private in 2017) |

• | Handy & Harman Ltd. (a subsidiary of SPLP) (went private in 2017) |

• | SL Industries, Inc., Director (acquired by SPLP in 2016) |

Other Service |

• | Steel Partners Foundation, Director |

• | Federal Law Enforcement Foundation, Director |

Attributes, Skills and Qualifications |

• | Extensive business experience in corporate finance, managing private investment funds and advising a diverse group of public companies |

• | Significant public company board experience |

• | Significant operation experience in manufacturing, space, defense, banking and steel business systems |

9

GENERAL LANCE W. LORD USAF (Ret.) | |

Age: 72 | |

Director since 2015 | |

Committee Memberships: | |

Audit Committee | |

Organization & Compensation Committee | |

Since retiring from the U.S. Air Force in 2006 after 37 years of military service, Gen. Lord has been a Senior Associate of The Four Star Group, LLC, a private aerospace and defense advisory and consulting group, since 2008, and a Senior Associate of HF GlobalNET, LLC, a private communication network company, since 2014. In 2010, Gen. Lord founded L2 Aerospace, LLC, an innovative company to shape and influence the business competition in the dynamic and emerging commercial, civil and defense aerospace markets. While in the military, Gen. Lord held a number of significant posts, including Commander, Air Force Space Command, from 2002 to 2006, during which time he was responsible for the development, acquisition and operation of Air Force space and missile weapon systems. In that position, he led more than 39,700 personnel who provided space and intercontinental ballistic missile combat capabilities to the North American Aerospace Defense Command and U.S. Strategic Command. Gen. Lord also received several prestigious military decorations in his career, including the Distinguished Service Medal and Legion of Merit. He is also the 2014 recipient of the American Astronautical Society’s Military Astronautics Award. | |

Current and Former Public Company Directorships | |

• | Frequency Electronics Corporation - Audit Committee, Compensation Committee |

Other Service |

• | L2 Aerospace, LLC, Executive Chairman |

• | Association of Air Force Missileers, President |

• | Von’s Vision, Executive Board Member |

• | Iridium Corporation, Government Advisory Board Member |

• | Challenger Learning Center, Emeritus Member of Board of Advisors |

• | Falcon Foundation, Trustee |

• | Sletten Construction Company, Director |

• | Marotta Controls Corporation, Director |

• | Boneal Company, Director |

• | Measured Risk, LLC, Director |

• | USO Colorado Springs, Board of Advisors Former Chairman |

Attributes, Skills and Qualifications |

• | Extensive career as a senior military officer with the United States Air Force |

• | Significant public company board experience |

10

MARTIN TURCHIN | |

Age: 77 | |

Director since 2008 | |

Committee Memberships: | |

Audit Committee | |

Corporate Governance & Nominating Committee | |

Mr. Turchin has been a non-executive Vice Chairman of CBRE Group, Inc. (“CBRE”), the world’s largest real estate services company, since 2003. Prior to this role, Mr. Turchin held senior positions with numerous real estate firms, serving as a Vice Chairman of a subsidiary of Insignia Financial Group from 1996 to 2003; a principal and Vice Chairman of Edward S. Gordon Company from 1985 to 1996, and in various positions with Kenneth E. Laub & Company, Inc., a real estate company where he was involved in real estate acquisition, financing, leasing and consulting, from 1971 to 1985. Mr. Turchin holds a Bachelor of Science degree from City College of the University of New York and a Juris Doctor degree from St. John’s Law School. | |

Current and Former Public Company Directorships | |

• | Boston Properties, Inc. - Audit Committee |

Other Service |

• | Eastern Development Company, LLC (a Company subsidiary), Manager of the Board of Managers |

• | Turchin Family Charitable Foundation, Trustee |

Attributes, Skills and Qualifications |

• | Extensive experience and expertise in the real estate industry |

• | Significant public company board experience |

The Board unanimously recommends that stockholders vote FOR each of these nominees as Directors by executing and returning the proxy card or voting by one of the other ways indicated thereon. Proxies solicited by the Board will be so voted unless stockholders specify otherwise. |

11

INFORMATION CONCERNING THE BOARD OF DIRECTORS AND ITS COMMITTEES

Voting for Directors |

The Company has no provision for cumulative voting in the election of Directors. Therefore, holders of the Company’s common stock (“Common Stock”) are entitled to cast one vote for each share held on the Record Date for each of the candidates for election. Directors are elected by a plurality of the votes cast at the Annual Meeting; however, the Board has adopted a majority vote policy. Pursuant to such policy, in an uncontested election, any nominee for Director who receives a greater number of votes “withheld” for his election than votes “for” such election (a “Majority Withheld Vote”) shall promptly tender his resignation after such election for consideration by the Corporate Governance & Nominating Committee. In determining its recommendation to the Board, the Corporate Governance & Nominating Committee will consider all factors deemed relevant by its members. These factors may include the underlying reasons why stockholders “withheld” votes for election from such Director (if ascertainable), the length of service and qualifications of the Director whose resignation has been tendered, the Director’s contributions to the Company, whether by accepting such resignation the Company will no longer be in compliance with any applicable law, rule, regulation or governing document and whether or not accepting the resignation is in the best interests of the Company and our stockholders. Within 90 days thereafter, the Board, taking into account the recommendation of the Corporate Governance & Nominating Committee and such additional information and factors that the Board believes to be relevant, must determine whether to accept or reject the resignation. The Director that tendered the resignation shall not participate in the consideration or determination of whether to accept such resignation. The Board shall disclose by press release its decision to accept or reject the resignation and, if applicable, the reasons for rejecting the resignation. If a majority of the Corporate Governance & Nominating Committee members receive a Majority Withheld Vote at the same election, then the independent Directors who did not receive a Majority Withheld Vote will appoint a committee of independent Directors to consider the resignation offers and recommend to the Board whether to accept or reject them.

Votes cast for a nominee will be counted in favor of election. Abstentions and broker non-votes will not count either in favor of, or against, election of a nominee. It is the intention of the persons named in the accompanying form of proxy to vote for the election of the Board’s nominees, unless authorization to do so is withheld. Proxies cannot be voted for a greater number of persons than the number of Directors set by the Board for election. If, prior to the Annual Meeting, a nominee becomes unable to serve as a Director for any reason, the proxy holders reserve the right to substitute another person of their choice in such nominee’s place and stead. It is not anticipated that any nominee will be unavailable for election at the Annual Meeting.

Meetings of the Board |

The Board held seven meetings during 2018. All of the Directors who served during 2018 attended at least 75% of the regularly scheduled and special meetings of the Board and Board committees on which they served and to which they were invited in 2018. All of the Board’s nominees for election at the Annual Meeting are expected to attend the Annual Meeting. All of the Directors nominated for election at the 2018 annual meeting of stockholders were present at such meeting.

Meetings of Non-Employee Directors |

Non-employee Directors (consisting of all Directors other than Mr. Lichtenstein and Ms. Drake), all of whom are independent, meet in executive session as part of each regularly scheduled Board meeting. The presiding Director position at each such executive session is rotated in alphabetical order among the non-employee Directors.

12

Board Leadership Structure |

The Company determines the most suitable leadership structure pursuant to its Certificate of Incorporation, the Bylaws and corporate governance guidelines. At least annually, as part of the Board’s self-evaluation process, the Board evaluates the Company’s leadership structure to confirm that it provides the optimal structure for the Company and its stockholders.

In February 2007, the Board made a decision to separate the positions of Chairman of the Board from CEO and President. Prior to February 2007, the position of Chairman of the Board and the position of CEO and President were historically held by the same person.

In June 2016, the Board decided to create an Executive Chairman of the Board (“Executive Chairman”) role. Currently, Warren Lichtenstein is our Executive Chairman and Eileen Drake is our CEO and President. We believe this structure is the most advantageous for the Company at this time as Mr. Lichtenstein’s financial acumen, knowledge of the Company and business contacts are valuable as an executive in a management capacity.

Pursuant to the Company’s corporate governance guidelines, the duties of the Executive Chairman include, among other things, supporting the CEO and President in implementing and executing Company strategy.

All of the Company’s other Directors are independent, including the chair and members of each of the Company’s Audit Committee, Corporate Governance & Nominating Committee and Organization & Compensation Committee. While the Board has not formally appointed a lead independent Director, the Board believes that the current composition of the Board and the functioning of the independent Directors effectively maintain oversight of the Company’s management. However, the Board recognizes that there is no single, generally accepted approach to providing corporate leadership, and the Company’s leadership structure may change in the future as circumstances warrant.

Board Role in Risk Oversight |

Management has the primary responsibility for identifying and managing the risks facing the Company, subject to the oversight of the Board. The Board strives to effectively oversee the Company’s enterprise-wide risk management in a way that balances managing risks while enhancing the long-term value of the Company for the benefit of stockholders. The Board understands that its focus on effective risk oversight is critical to setting the Company’s tone and culture towards effective risk management.

To administer its oversight function, the Board seeks to understand the Company’s risk philosophy by having discussions with management to establish a mutual understanding of the Company’s overall appetite for risk. The Company’s Board maintains an active dialogue with management about existing risk management processes and how management identifies, assesses and manages the Company’s most significant risk exposures. The Company’s Board receives frequent updates from management about the Company’s most significant risks so as to enable it to evaluate whether management is responding appropriately.

The Board relies on each of its committees to help oversee the risk management responsibilities relating to the functions performed by such committees.

• | The Audit Committee periodically reviews and discusses with management the Company’s guidelines and policies with respect to the process by which the Company undertakes risk assessment and risk management including discussion of the Company’s major financial and compliance risk exposures and the steps management has taken to monitor and control such exposures. The Audit Committee also reviews and assists the Board in overseeing the Company’s compliance with legal and regulatory requirements, including the effectiveness of the Company’s corporate Ethics and Compliance Program. |

• | The Organization & Compensation Committee helps the Board identify the Company’s exposure to any risks potentially created by our compensation programs and practices. |

• | The Corporate Governance & Nominating Committee periodically reviews and advises the Board regarding significant matters of public policy, including proposed actions by foreign and domestic governments that may significantly affect the Company. |

13

Each of these committees is required to regularly report on its actions and to make recommendations to the Board, including recommendations to assist the Board with its overall risk oversight function. The Board retains oversight responsibility for all subject matters not specifically assigned to a committee, including risks presented by the Company’s business strategy, competition, regulation, general industry trends and capital structure.

The Organization & Compensation Committee believes that the Company’s compensation policies and practices are structured to discourage inappropriate risk taking by our executives and that none of the Company’s compensation policies and practices are reasonably likely to have a material adverse effect on the Company. The Company believes that its compensation plans effectively balance risk and reward and are generally uniform in design and operation throughout the Company.

Determination of Independence of Directors |

The Board has determined that to be considered independent, a Director may not have a direct or indirect material relationship with the Company. A material relationship is one which impairs or inhibits, or has the potential to impair or inhibit, a Director’s exercise of critical and disinterested judgment on behalf of the Company and its stockholders.

In making its assessment of independence, the Board:

• | Considers any and all material relationships not merely from the standpoint of the Director, but also from that of persons or organizations with which the Director has or has had an affiliation, or those relationships which may be material, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, among others; |

• | The Board also considers whether a Director was an employee of the Company within the last three years; |

• | The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent” Director, including those set forth in pertinent listing standards of the New York Stock Exchange (“NYSE”) as in effect from time to time. |

The NYSE’s listing standards require that all listed companies have a majority of independent directors. For a director to be “independent” under the NYSE listing standards, the board of directors of a listed company must affirmatively determine that the director has no material relationship with the company, or its subsidiaries or affiliates, either directly or as a partner, stockholder or officer of an organization that has a relationship with the company or its subsidiaries or affiliates. In accordance with the NYSE listing standards, the Board has affirmatively determined that each of the Board’s current Directors and nominees for Director, other than Mr. Lichtenstein and Ms. Drake, have no material relationships with the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company and are “independent” by the NYSE listing standards. In addition, during his term of service, former Director James H. Perry was determined to be “independent” by the NYSE listing standards.

14

Board Committees |

The Board maintains three standing committees: the Audit Committee; the Corporate Governance & Nominating Committee; and the Organization & Compensation Committee. Assignments to, and chairs of, the standing committees are recommended by the Corporate Governance & Nominating Committee and approved by the Board. All committees report on their activities to the Board. Each standing committee operates under a charter approved by the Board. The charters for each of the standing committees are posted on the Company’s website at www.AerojetRocketdyne.com and are available in print to any stockholder or interested party who sends a written request to Secretary, Aerojet Rocketdyne Holdings, Inc., 222 N. Pacific Coast Highway, Suite 500, El Segundo, California 90245. In addition, non-standing committees of the Board include the Authorization Committee (which was disbanded December 12, 2018) and the Benefits Management Committee.

The following table provides the membership of each standing committee of the Board in 2018:

Name | Audit | Corporate Governance & Nominating | Organization & Compensation |

Kevin P. Chilton | |||

Thomas A. Corcoran | M | M | |

James R. Henderson | M | C | |

Lance W. Lord | M | M | |

Merrill A. McPeak(1) | M | C | |

James H. Perry(2) | C | M | |

Martin Turchin | M | M | |

M = Committee Member C = Committee Chairman | |||

(1) | Gen. McPeak is not standing for re-election at the Annual Meeting. |

(2) | Mr. Perry resigned from the Board effective November 16, 2018. Mr. Henderson was appointed Chairman of the Audit Committee following Mr. Perry’s departure effective December 12, 2018. |

15

Following are the descriptions of each of the three standing committees and the number of meetings held by each in 2018:

Audit Committee | Number of meetings in 2018: 6 |

Roles and Responsibilities

• | reviews and evaluates the scope of the audits to be performed by, the adequacy of services performed by, and the fees and compensation of, the independent auditors; |

• | reviews the Company’s disclosure of the “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and annual audited and quarterly financial statements with management and with the Company’s independent auditors and recommends to the Board to include the financial statements in the Company’s Annual Reports on Form 10-K or the Company’s Quarterly Reports on Form 10-Q, as applicable; |

• | approves in advance all audit and permitted non-audit services to be provided by the independent auditors; |

• | reviews and considers matters that may have a bearing upon continuing audit or independence; prepares the report of the Audit Committee to be included in the Company’s Proxy Statement; |

• | appoints and terminates the independent auditors of the Company; |

• | reviews and evaluates the scope and appropriateness of the Company’s internal audit function, internal audit plans and system of internal controls; |

• | reviews and evaluates with management and independent auditors their judgment about the Company’s selection or application of accounting principles, practices and financial reporting; |

• | receives periodic reports from management, legal counsel, the Company’s corporate Ethics and Compliance Office and third parties as determined by the Committee; and |

• | reviews and oversees the Company’s compliance with legal and regulatory requirements, including the effectiveness of the Company’s corporate Ethics and Compliance Program. |

The Audit Committee is a separately designated standing committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board has determined that each member of the Audit Committee meets all applicable independence and financial literacy requirements under the NYSE listing standards. The Board has also determined that Mr. Henderson is an “audit committee financial expert” under the applicable rules promulgated pursuant to the Exchange Act.

Corporate Governance & Nominating Committee | Number of meetings in 2018: 4 |

Roles and Responsibilities

• | periodically reviews and makes recommendations to the Board concerning the criteria for selection and retention of Directors, the composition of the Board (including the Chairman of the Board), the structure and function of Board committees and the retirement policy of Directors; |

• | assists in identifying, screening and recommending to the Board qualified candidates to serve as Directors of the Company and considers and makes recommendations to the Board concerning Director nominations submitted by stockholders; |

• | periodically reviews and advises the Board regarding significant matters of public policy, including proposed actions by foreign and domestic governments that may significantly affect the Company; and |

• | reviews and advises the Board regarding adoption or amendment of major Company policies and programs relating to matters of public policy. |

The Board has determined that each member of the Corporate Governance & Nominating Committee meets all applicable independence requirements under the NYSE listing standards.

16

Organization & Compensation Committee | Number of meetings in 2018: 9 |

Roles and Responsibilities

• | reviews and approves the total compensation of the CEO and President and the Executive Chairman; |

• | administers the Company’s deferred compensation plan, the Aerojet Rocketdyne 2018 Equity and Performance Incentive Plan (the “2018 Incentive Plan”) and the Aerojet Rocketdyne Amended and Restated 2009 Equity and Performance Incentive Plan (the “2009 Incentive Plan”); |

• | periodically reviews the organization of the Company and its management, including major changes in the organization of the Company and the responsibility of management as proposed by the CEO and President; |

• | monitors executive development and succession planning; |

• | reviews the effectiveness and performance of senior management, and reviews and makes recommendations to the Board concerning the appointment and removal of officers; |

• | periodically reviews the compensation philosophy, policies and practices of the Company and makes recommendations to the Board concerning proposed major changes, as appropriate; |

• | annually reviews changes in the Company’s employee benefit, savings and retirement plans and reports thereon to the Board; |

• | approves, and in some cases recommends to the Board for approval, the compensation of executive officers of the Company, although the Organization & Compensation Committee delegates to the CEO and President the right to establish the salaries and annual incentive compensation of the other officers of the Company; and |

• | periodically reviews and makes recommendations to the Board regarding the compensation and benefits for Directors. |

The Board has determined that each member of the Organization & Compensation Committee meets all applicable independence requirements under the NYSE and the Securities and Exchange Commission (the “SEC”) listing standards. In making its determination, the Board considered all factors specifically relevant to determining whether a Director has a relationship to the Company which is material to that Director’s ability to be independent from management in connection with the duties of an Organization & Compensation Committee member, including but not limited to, (i) the source of the Director’s compensation, including any consulting, advisory or other compensatory fees paid by the Company; and (ii) whether the Director has an affiliate relationship with the Company.

From time to time, the Board forms special committees to address specific matters.

Director Nominations |

The Corporate Governance & Nominating Committee identifies potential Director candidates through a variety of means, including recommendations from members of the Corporate Governance & Nominating Committee, the Board, management and stockholders. The Corporate Governance & Nominating Committee also may retain the services of a consultant to assist in identifying candidates. The Corporate Governance & Nominating Committee will consider nominations submitted by stockholders. A stockholder who would like to recommend a nominee should write to the Chairman of the Corporate Governance & Nominating Committee, c/o Secretary, Aerojet Rocketdyne Holdings, Inc., 222 N. Pacific Coast Highway, Suite 500, El Segundo, California 90245. Any such recommendation must meet all of the requirements contained in the Bylaws and include (i) all information relating to the person that is required to be disclosed in solicitations of proxies for the election of directors or is otherwise required, pursuant to Section 14(a) of the Exchange Act; and (ii) the candidate’s signed consent to be named in the Proxy Statement as a nominee and to serve as a Director if elected.

Such nominations must be received by the Chairman of the Corporate Governance & Nominating Committee no later than the close of business on February 9, 2020, nor earlier than the close of business on January 10, 2020.

17

The Company’s Bylaws contain advance notice provisions that a stockholder must follow if he, she or it intends to make a director nomination before a meeting of stockholders. These advance notice provisions provide, among other things that:

• | for an annual meeting of stockholders, written notice of a stockholder’s intention to make business proposals or nominate persons for election to the Board must be delivered to the Company not later than the ninetieth (90th) day or earlier than the one hundred twentieth (120th) day prior to the first anniversary of the preceding year’s annual meeting. If an annual meeting of stockholders is held more than thirty (30) days before or more than seventy (70) days after the first anniversary of the preceding year’s annual meeting, notice by the stockholder must be delivered (i) not earlier than one hundred twenty (120) days prior to such annual meeting; and (ii) not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement is first made of the date of the annual meeting; and |

• | if the Company has called a special meeting for the purpose of electing one or more directors to the Board, written notice of a stockholder’s intention to nominate persons for election to the Board before such special meeting must be delivered to the Company (i) not earlier than the one hundred twentieth (120th) day; and (ii) not later than the close of business on the later of the ninetieth (90th) day prior to such special meeting or the tenth (10th) day following the day on which public announcement is first made of the date of the special meeting and of the nominees proposed by the Board to be elected at such meeting. |

The Corporate Governance & Nominating Committee seeks to create a Board that is, as a whole, strong in its collective knowledge and diversity of skills and experience and background with respect to accounting and finance, management and leadership, business judgment, industry knowledge and corporate governance. Although the Corporate Governance & Nominating Committee does not have a formal diversity policy relating to the identification and evaluation of nominees, the Corporate Governance & Nominating Committee, in addition to reviewing a candidate’s qualifications and experience in light of the needs of the Board and the Company at that time, reviews candidates in the context of the current composition of the Board and the evolving needs of the Company’s businesses.

Communications with Directors |

Stockholders and other interested parties may communicate with the Board or individual Directors by mail addressed to: Chairman of the Corporate Governance & Nominating Committee, c/o Secretary, Aerojet Rocketdyne Holdings, Inc., 222 N. Pacific Coast Highway, Suite 500, El Segundo, California 90245. The Secretary may initially review communications to the Board or individual Directors and transmit a summary to the Board or individual Directors, but has discretion to exclude from transmittal any communications that are, in the reasonable judgment of the Secretary, inappropriate for submission to the intended recipient(s). Examples of communications that would be considered inappropriate for submission to the Board or a Director include, without limitation, customer complaints, solicitations, commercial advertisements, communications that do not relate directly or indirectly to the Company’s business or communications that relate to improper or irrelevant topics.

Compensation Committee Interlocks and Insider Participation |

The Organization & Compensation Committee is composed entirely of non-employee independent Directors. As of December 31, 2018, the members of the Organization & Compensation Committee included Merrill A. McPeak (Chairman), Thomas A. Corcoran and Lance W. Lord. Mr. Perry was a member of the Organization & Compensation Committee before his retirement from the Board on November 16, 2018. All non-employee independent Directors on the Organization & Compensation Committee participate in decisions regarding the compensation of the CEO and President. None of the Company’s executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of the Company’s Organization & Compensation Committee. In addition, none of the Company’s executive officers serve as a member of the Organization & Compensation Committee of any entity that has one or more of its executive officers serving as a member of the Company’s Board.

18

DIRECTOR COMPENSATION

The compensation of the Company’s non-employee Directors is determined by the Board upon the recommendations made by the Organization & Compensation Committee. The Director compensation program for non-employee Directors was updated by the Company in November 2017 after evaluation of the recommendations by Korn Ferry (formerly “Korn Ferry Hay Group”), the company that was retained by the Organization & Compensation Committee as outside consultants to assess the overall compensation structure for its non-employee Directors. Specifically, the Organization & Compensation Committee requested that Korn Ferry measure the Company’s Director compensation (in total and by pay component) against similarly sized U.S. companies in the aerospace and defense industry based on information disclosed in recent SEC filings, and in the broader general industry, using both proprietary compensation surveys and its knowledge of industry practices. Director pay was benchmarked at the median level. In November 2017, Korn Ferry recommended and the Organization & Compensation Committee approved certain changes to the Director compensation program for non-employee Directors to maintain competitiveness and aid in director recruitment. These changes were effective beginning November 15, 2017. The Director compensation program is more fully described below.

Director Compensation Components |

Annual Retainer Fees and Stock Awards

Annual fees and awards under our Director compensation program for non-employee Directors are summarized below:

Component | Annual Amount ($) | ||

Annual retainer | $ | 70,000 | |

Members of each of the Corporate Governance & Nominating Committee, and the Organization & Compensation Committee | 7,500 | ||

Chairmen of the Corporate Governance & Nominating Committee, and the Organization & Compensation Committee* | 10,000 | ||

Members of the Audit Committee | 10,000 | ||

Chairman of the Audit Committee* | 15,000 | ||

Members of a long-term special committee | 5,000 | ||

Members of a limited purpose special committee | 3,250 | ||

Managers on the Board of Managers of Easton Development Company, LLC | 15,000 | ||

Annual award of restricted stock | 100,000 | ||

* Committee chairmen also receive the committee membership retainer.

Non-employee Directors are given a choice to receive all such Director fees in cash or to receive all or a portion, but no less than 50%, of such fees in the form of fully vested Company Common Stock, calculated based on the closing price of the Common Stock as reported in the NYSE Composite Transactions (or if such information in such source is unavailable, a source providing similar information selected by the Company) as of the applicable Director pay date, pursuant to the 2009 Incentive Plan and the 2018 Incentive Plan. If a non-employee Director elects for any year to receive all or a portion of such fees in the form of fully vested Common Stock, an additional grant of restricted shares of Common Stock will be given equal in value to 50% of the amount of fees paid in fully vested Common Stock vesting on the earlier of the Director’s retirement from service from the Board or one year from the date of grant. Non-employee Directors and the Executive Chairman also have a choice to defer all or a portion of fully vested and restricted shares of Common Stock. Distribution of deferred stock can be made in a single payment or at least two but no more than 10 annual installments, with a choice to begin distribution 30 days following retirement from the Board, on a date specified by the participant, or upon attainment of an age specified by the participating Director.

19

In May 2018, each non-employee Director received $100,000 worth of equity compensation pursuant to the 2018 Incentive Plan. This grant consisted of 3,588 restricted shares of Common Stock for each non-employee Director. These awards vest in 50% increments on the six-month and twelve-month anniversaries of the grant date. In October 2018, Gen. Chilton received $50,000 worth of equity compensation upon election to the Board. This grant consisted of 1,652 restricted shares of Common Stock which vest in 50% increments on the six-month and twelve-month anniversaries of the grant date. All restricted shares of Common Stock may be voted, but ownership may not transfer until such shares are vested. Unless otherwise approved by the Board, unvested shares will be forfeited in the event of a voluntary resignation or refusal to stand for re-election.

Non-employee Directors also receive 500 shares of restricted stock upon their initial election to the Board.

Other

The Aerojet Rocketdyne Foundation matches employee and Director gifts to accredited, non-profit colleges, universities, secondary and elementary public or private schools located in the United States. Gifts made are matched dollar for dollar up to $1,000 per calendar year.

Non-employee Directors may also elect to participate in the same health benefits programs at the same cost as offered to all of the Company’s employees. The Company also reimburses Directors for reasonable travel and other expenses incurred in attending Board and Committee meetings.

Equity Ownership Guidelines for Non-Employee Directors

In October 2007, the Board adopted equity ownership guidelines that were subsequently revised in November 2013 under which non-employee Directors are required to own equity in the Company in an amount equal to $275,000. On February 28, 2019, the equity ownership guidelines were revised to require non-employee Directors to own equity in the Company in an amount equal to five times their annual retainer. In calculating the amount of equity owned by a Director, the Board looks at the value of Common Stock owned by such Director (restricted stock and stock owned outright), the value of any phantom stock owned by such Director as part of the Deferred Compensation Plan for Non-Employee Directors, if any and the value of any vested “in the money” options or SARs (i.e. market value of Company stock in excess of the strike price for the stock option or SAR). Directors have five years from the date of their election to the Board to meet the thresholds set forth in these equity ownership guidelines. The Board routinely reviews these guidelines and considers adjustments when appropriate, including adjustments for material fluctuations in the Company’s stock price.

As of December 31, 2018, most of the non-employee Directors held equity in the Company equal in market value to the guidelines in place at the time and those that do not meet the requirements are in the transition period set forth in the guidelines and are anticipated to meet the guidelines by the end of the transition period. The following table shows the current status of equity ownership for each non-employee Director as of December 31, 2018.

Name | Value of Equity Ownership* | Date of Election | Years as a Director | ||||

Kevin P. Chilton | $ | 101,498 | 10/30/2018 | 0.2 | |||

Thomas A. Corcoran | 4,097,283 | 09/24/2008 | 10.3 | ||||

James R. Henderson | 3,967,849 | 03/05/2008 | 10.8 | ||||

Lance W. Lord | 970,727 | 02/02/2015 | 3.9 | ||||

Merrill A. McPeak | 2,390,460 | 03/27/2013 | 5.8 | ||||

Martin Turchin | 4,880,958 | 03/05/2008 | 10.8 | ||||

* Value is based on the stock price on December 31, 2018, of $35.23.

Compensation of Executive Chairman |

Mr. Lichtenstein was appointed as our Executive Chairman on June 24, 2016. Mr. Lichtenstein received no compensation or equity grants in 2017 or 2018. Further, he does not participate in the compensation programs that are provided to our other executive officers. On August 19, 2016, the Board upon the recommendation of the Advisory and the Organization & Compensation Committees, approved a compensation package for Mr. Lichtenstein to cover his compensation as Executive Chairman for a period of two years. The components and

20

details of Mr. Lichtenstein’s compensation are as provided in the Company’s 2018 Proxy Statement filed with the SEC on March 29, 2018.

On February 28, 2019, the Board upon the recommendation of the Advisory and Organization & Compensation Committees, approved the following grants pursuant to the Company’s 2018 Incentive Plan to Mr. Lichtenstein:

(i) | 49,158 shares of time-based restricted stock vesting in 1/3 increments on February 28, 2020, February 28, 2021 and February 28, 2022 (subject to continued service through each such date), having an aggregate grant date fair value of approximately $1.8 million; |

(ii) | 200,000 stock appreciation rights with a grant price of $37.25 exercisable on February 28, 2022 (subject to continued service through such date) and expiring on February 28, 2026 having an aggregate grant date fair value of approximately $2.6 million; and |

(iii) | an option to purchase 91,229 shares of the Company’s Common Stock with a grant price of $37.25 exercisable on February 28, 2022 (subject to continued service through such date) and expiring on February 28, 2026 having an aggregate grant date fair value of approximately $1.2 million. |

The aforementioned grants were determined reasonable compensation for Mr. Lichtenstein’s continued service as our Executive Chairman based on his skills and experience and are intended to cover Mr. Lichtenstein’s compensation, in lieu of salary, for the period from August 2018 until December 2018 during which he did not receive any compensation, and for his continued service through the end of 2019.

Equity Ownership Guidelines for the Executive Chairman

The Organization & Compensation Committee has share ownership guidelines that apply to executive officers which apply to the Executive Chairman. Under these guidelines, the Executive Chairman is expected to have equity in the Company equal in aggregate market value to six times the CEO base salary. See Executive Stock Ownership Guidelines on page 41 for an explanation of how equity ownership is calculated for the Executive Chairman. Mr. Lichtenstein’s value of equity ownership as of December 31, 2018 was $24,589,685.

2018 DIRECTOR COMPENSATION TABLE | |||||||||||||||

The following table sets forth information regarding compensation earned or paid to each non-employee Director who served on the Board in 2018. Employee Directors are not compensated for services as a Director. | |||||||||||||||

Name | Fees Earned or Paid ($)(1) | Stock Awards ($)(2)(3) | Option Awards ($)(2)(3) | All Other Compensation ($) | Total ($) | ||||||||||

Kevin P. Chilton | $ | 17,472 | $ | 73,856 | $ | — | $ | — | $ | 91,328 | |||||

Thomas A. Corcoran | 89,924 | 144,928 | — | 2,000 | 236,852 | ||||||||||

James R. Henderson | 117,432 | 158,695 | — | — | 276,127 | ||||||||||

Lance W. Lord | 87,425 | 121,772 | — | — | 209,197 | ||||||||||

Merrill A. McPeak | 94,913 | 147,436 | — | — | 242,349 | ||||||||||

James H. Perry | 107,427 | 167,062 | — | — | 274,489 | ||||||||||

Martin Turchin | 102,438 | 151,198 | — | — | 253,636 | ||||||||||

21

(1) | The amounts reported in this column for each non-employee Director reflect the dollar amount of the Board and Committee fees paid in 2018. Non-employee Directors have a choice to receive all or a portion of their Director fees in fully vested Common Stock of the Company, in which the number of shares is determined by the closing price of the Common Stock as of the applicable pay date. If a Director elects to receive fees in Common Stock, an additional grant of restricted shares of Common Stock are given in an amount equal in value to 50% of the amount of fees paid in fully vested Common Stock. This additional grant is reported in the “Stock Awards” column. Non-employee Directors and the Executive Chairman also have a choice to defer all or a portion of fully vested and restricted shares of Common Stock. Distribution of deferred stock can be made in a single payment or at least two but no more than 10 annual installments, with a choice to begin distribution 30 days following retirement from the Board, on a date specified by the participant, or upon attainment of an age specified by the participating Director. The following table shows Director fees that were paid in fully vested Common Stock in 2018. |

Name | Grant Date | Fully Vested Stock Awards (#) | Grant Date Fair Value ($) | |||

Kevin P. Chilton | 11/15/2018 | 486 | $ | 17,472 | ||

Total | 486 | 17,472 | ||||

Thomas A. Corcoran | 02/15/2018 | 634 | 17,492 | |||

05/15/2018 | 1,345 | 37,485 | ||||

08/15/2018 | 483 | 17,475 | ||||

11/15/2018 | 486 | 17,472 | ||||

Total | 2,948 | 89,924 | ||||

James R. Henderson | 02/15/2018 | 634 | 17,492 | |||

05/15/2018 | 2,332 | 64,993 | ||||

08/15/2018 | 483 | 17,475 | ||||

11/15/2018 | 486 | 17,472 | ||||

Total | 3,935 | 117,432 | ||||

Lance W. Lord | 02/15/2018 | 317 | 8,746 | |||

05/15/2018 | 627 | 17,474 | ||||

08/15/2018 | 241 | 8,719 | ||||

11/15/2018 | 243 | 8,736 | ||||

Total | 1,428 | 43,675 | ||||

Merrill A. McPeak | 02/15/2018 | 634 | 17,492 | |||

05/15/2018 | 1,524 | 42,474 | ||||

08/15/2018 | 483 | 17,475 | ||||

11/15/2018 | 486 | 17,472 | ||||

Total | 3,127 | 94,913 | ||||

James H. Perry | 02/15/2018 | 634 | 17,492 | |||

05/15/2018 | 1,973 | 54,988 | ||||

08/15/2018 | 483 | 17,475 | ||||

11/15/2018 | 486 | 17,472 | ||||

Total | 3,576 | 107,427 | ||||

Martin Turchin | 02/15/2018 | 634 | 17,492 | |||

05/15/2018 | 1,794 | 49,999 | ||||

08/15/2018 | 483 | 17,475 | ||||

11/15/2018 | 486 | 17,472 | ||||

Total | 3,397 | 102,438 | ||||

22

(2) | The amounts reported in these columns for each non-employee Director reflect the grant date fair value of stock awards in 2018. A description of these awards can be found under the section entitled Long-Term Equity Incentive Awards on page 36. A discussion of the assumptions used in calculating these values may be found in Note 9(d) in the audited financial statements in the Company’s 2018 Annual Report. The following table shows each grant of restricted shares of Common Stock granted during 2018 to each non-employee Director who served as a Director in 2018, and the aggregate grant date fair value for each award. |

Name | Grant Date | Stock Awards (#) | Grant Date Fair Value ($) | |||||

Kevin P. Chilton | 10/30/2018 | 500 | (A) | $ | 15,130 | |||

10/30/2018 | 1,652 | (C) | 49,990 | |||||

11/15/2018 | 243 | (B) | 8,736 | |||||

Total | 2,395 | 73,856 | ||||||

Thomas A. Corcoran | 02/15/2018 | 317 | (B) | 8,746 | ||||

05/15/2018 | 3,588 | (C) | 99,998 | |||||

05/15/2018 | 672 | (B) | 18,729 | |||||

08/15/2018 | 241 | (B) | 8,719 | |||||

11/15/2018 | 243 | (B) | 8,736 | |||||

Total | 5,061 | 144,928 | ||||||

James R. Henderson | 02/15/2018 | 317 | (B) | 8,746 | ||||

05/15/2018 | 3,588 | (C) | 99,998 | |||||

05/15/2018 | 1,166 | (B) | 32,496 | |||||

08/15/2018 | 241 | (B) | 8,719 | |||||

11/15/2018 | 243 | (B) | 8,736 | |||||

Total | 5,555 | 158,695 | ||||||

Lance W. Lord | 02/15/2018 | 158 | (B) | 4,359 | ||||

05/15/2018 | 3,588 | (C) | 99,998 | |||||

05/15/2018 | 313 | (B) | 8,723 | |||||

08/15/2018 | 120 | (B) | 4,342 | |||||

11/15/2018 | 121 | (B) | 4,350 | |||||

Total | 4,300 | 121,772 | ||||||

Merrill A. McPeak | 02/15/2018 | 317 | (B) | 8,746 | ||||

05/15/2018 | 3,588 | (C) | 99,998 | |||||

05/15/2018 | 762 | (B) | 21,237 | |||||

08/15/2018 | 241 | (B) | 8,719 | |||||

11/15/2018 | 243 | (B) | 8,736 | |||||

Total | 5,151 | 147,436 | ||||||

James H. Perry | 02/15/2018 | 317 | (B) | 8,746 | ||||

05/15/2018 | 3,588 | (C) | 113,381 | (D) | ||||

05/15/2018 | 986 | (B) | 27,480 | |||||

08/15/2018 | 241 | (B) | 8,719 | |||||

11/15/2018 | 243 | (B) | 8,736 | |||||

Total | 5,375 | 167,062 | ||||||

Martin Turchin | 02/15/2018 | 317 | (B) | 8,746 | ||||

05/15/2018 | 3,588 | (C) | 99,998 | |||||

05/15/2018 | 897 | (B) | 24,999 | |||||

08/15/2018 | 241 | (B) | 8,719 | |||||

11/15/2018 | 243 | (B) | 8,736 | |||||

Total | 5,286 | 151,198 | ||||||

(A) | This award vests three years from the grant date on October 30, 2021. |

(B) | These shares vest on the earlier of the Director’s retirement from the Board or the one year anniversaries of the grant date. |

(C) | These equity awards vest in 50% increments on the six-month and twelve-month anniversary of the grant date. |

(D) | The grant date fair value presented here includes the incremental fair value of a modification to accelerate the vesting of 50% of the award to November 16, 2018. The original vesting date was May 15, 2019. |

23

(3) | The following table shows the amount of unvested stock awards and outstanding and unexercised SARs awards as of December 31, 2018, for each non-employee Director who served as a Director in 2018 and the Executive Chairman. |

Name | Unvested Stock Awards | Outstanding and Unexercised SARs and Stock Options | ||

Kevin P. Chilton | 2,395 | — | ||

Thomas A. Corcoran | 3,267 | 7,355 | ||

James R. Henderson | 3,761 | — | ||

Warren G. Lichtenstein | 60,000 | 272,482 | ||

Lance W. Lord | 2,506 | — | ||

Merrill A. McPeak | 3,357 | 7,355 | ||

James H. Perry | — | — | ||

Martin Turchin | 3,492 | 46,201 | ||

24

VOTING SECURITIES AND PRINCIPAL HOLDERS

Security Ownership of Certain Beneficial Owners | ||||

The following table presents beneficial owners of more than 5% of the 78,667,616 shares of the Common Stock outstanding as of March 13, 2019, based on reports on Schedule 13D and Schedule 13G filed with the SEC on or prior to March 13, 2019. | ||||

Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||

BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 | 12,408,504 | (1) | 15.8% | |

GAMCO Investors, Inc. One Corporate Center, Rye, NY 10580 | 8,035,196 | (2) | 10.2% | |

The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 | 8,031,900 | (3) | 10.2% | |

T. Rowe Price Associates, Inc. 100 E. Pratt Street, Baltimore, MD 21202 | 7,194,037 | (4) | 9.1% | |

Steel Partners Holdings L.P. 590 Madison Avenue, 32nd Floor, New York, NY 10022 | 4,180,997 | (5) | 5.3% | |

(1) | BlackRock, Inc. reported sole voting power with respect to 12,266,517 shares and sole dispositive power with respect to the 12,408,504 shares. The foregoing information is according to Amendment No. 9 to a Schedule 13G dated January 24, 2019, and filed with the SEC on January 24, 2019. |

(2) | Includes shares beneficially owned by Mario J. Gabelli and various affiliated entities, including Gabelli Funds, LLC, GAMCO Asset Management Inc., Teton Advisors, Inc., Gabelli Securities, Inc., GGCP, Inc., GAMCO Investors, Inc. and Associated Capital Group, Inc. Gabelli Funds, LLC reported sole voting power and sole dispositive power with respect to 2,844,349 shares. GAMCO Asset Management Inc. reported sole voting power with respect to 3,758,632 shares and sole dispositive power with respect to 4,053,332 shares. Gabelli & Company Investment Advisors, Inc. reported sole voting power and sole dispositive power with respect to 1,000 shares. Teton Advisors, Inc. reported sole voting power and sole dispositive power with respect to 1,128,515 shares. GGCP, Inc. reported sole voting power and sole dispositive power with respect to 8,000 shares. GAMCO Investors, Inc. and Associated Capital Group, Inc. each reported sole voting power and sole dispositive power with respect to 0 shares. All of the foregoing information is according to Amendment No. 54 to a Schedule 13D dated October 30, 2018, and filed with the SEC on November 1, 2018 and is inclusive of an aggregate amount of 163,436 shares issuable upon the conversion of the Company’s 2.25% Senior Convertible Notes held by the reporting entities. |

(3) | The Vanguard Group reported sole voting power with respect to 149,208 shares, shared voting power with respect to 9,787 shares, sole dispositive power with respect to 7,879,140 shares, and shared dispositive power with respect to 152,760. The foregoing information is according to Amendment No. 1 to a Schedule 13G dated February 11, 2019, and filed with the SEC on February 11, 2019. |

(4) | T. Rowe Price Associates, Inc. reported sole voting power with respect to 1,385,347 shares and sole dispositive power with respect to the 7,194,037 shares. The foregoing information is according to a Schedule 13G dated February 14, 2019, and filed with the SEC on February 14, 2019. |

(5) | Consists of shares owned directly by Steel Excel. SPH Group Holdings LLC (“SPHG Holdings”) owns 100% of the outstanding shares of common stock of Steel Excel. SPLP owns 99% of the membership interests of SPH Group LLC (“SPHG”). SPHG is the sole member of SPHG Holdings. Steel Partners Holdings GP Inc. (“Steel Partners GP”) is the general partner of SPLP, the managing member of SPHG and the manager of SPHG Holdings. By virtue of these relationships, each of SPLP, SPHG and Steel Holdings GP may be deemed to beneficially own the shares owned directly by Steel Excel. Each of the foregoing may be deemed to have shared voting and dispositive power with respect to such shares. All of the foregoing information is according to Amendment No. 24 to a Schedule 13D dated December 26, 2017, and filed with the SEC on December 26, 2017. |

25

Security Ownership of Officers and Directors | ||||

The following table lists share ownership of Common Stock by the Company’s current Directors, nominees and executive officers, as well as the number of shares beneficially owned by all of the current Directors and executive officers as a group. Unless otherwise indicated, share ownership is direct. Amounts owned reflect ownership as of March 13, 2019. | ||||

Beneficial Owner | Amount and Nature of Beneficial Ownership(1)(2) | Percent of Class | ||

Non-Employee Directors and the Executive Chairman | ||||

Kevin P. Chilton(3) | 3,533 | * | ||

Thomas A. Corcoran(4) | 112,360 | * | ||

James R. Henderson(5) | 113,513 | * | ||

Warren G. Lichtenstein(6) | 848,329 | 1.1% | ||

Lance W. Lord(7) | 27,879 | * | ||

Merrill A. McPeak(8) | 63,912 | * | ||

Martin Turchin(9) | 118,029 | * | ||

Executive Officers | ||||

Eileen P. Drake(10) | 569,676 | * | ||

Mark A. Tucker | 174,400 | * | ||

Paul R. Lundstrom | 143,812 | * | ||

John D. Schumacher(11) | 117,238 | * | ||

Arjun L. Kampani | 99,271 | * | ||

All Current Directors and Executive Officers as a group (12 persons) | 2,391,952 | 3.0% | ||

* Less than 1.0%

(1) | Includes restricted shares granted under the 1999 Equity and Performance Incentive Plan, the 2009 Incentive Plan, the 2018 Incentive Plan and shares owned outright. |

(2) | Includes shares issuable upon the exercise of stock options that may be exercised within 60 days after March 13, 2019, as follows: Mr. Lichtenstein — 243,546; Ms. Drake — 17,848; Mr. Tucker — 12,594; Mr. Schumacher — 11,610 , and all current Directors and executive officers as a group — 285,598 shares. |