WASHINGTON, D.C. 20549

(Mark One) |

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2017 |

OR |

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____ |

Commission file number 001-00035 |

|

GENERAL ELECTRIC COMPANY (Exact name of registrant as specified in its charter) |

New York | 14-0689340 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

41 Farnsworth Street, Boston, MA | 02210 | |

(Address of principal executive offices) | (Zip Code) | |

(Registrant’s telephone number, including area code) (617) 443-3000 _______________________________________________ (Former name, former address and former fiscal year, if changed since last report) | ||

Large accelerated filer þ | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company ¨ |

Emerging growth company ¨ | |

Page | |

FORWARD LOOKING STATEMENTS | ||

• | the strategy and portfolio review being undertaken by our new chief executive officer; |

• | our ability to reduce costs as we execute our announced plan to reduce the size of our financial services businesses; |

• | changes in law, economic and financial conditions, including interest and exchange rate volatility, commodity and equity prices and the value of financial assets; |

• | the impact of conditions in the financial and credit markets on the availability and cost of GE Capital funding, and GE Capital’s exposure to counterparties; |

• | pending and future mortgage loan repurchase claims, other litigation claims and the U.S. Department of Justice’s investigation under the Financial Institutions Reform, Recovery and Enforcement Act of 1989 and other investigations in connection with WMC, which may affect our estimates of liability, including possible loss estimates; |

• | our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so; |

• | our ability to convert Industrial earnings into cash and the amount and timing of our cash flows and earnings, which may be impacted by long-term services agreement dynamics, and other conditions, all of which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels; |

• | GE Capital’s ability to pay dividends to GE at the planned level, which may be affected by GE Capital’s cash flows and earnings, claims and investigations relating to WMC, charges that may be required in connection with GE Capital’s run-off insurance operations, and other factors; |

• | our ability to launch new products in a cost-effective manner; |

• | our ability to increase margins through restructuring and other cost reduction measures; |

• | our ability to convert pre-order commitments/wins into orders/bookings; |

• | the price we realize on orders/bookings since commitments/wins are stated at list prices; |

• | customer actions or developments such as early aircraft retirements or reduced energy demand, changes in economic conditions, including oil prices, and other factors that may affect the level of demand and financial performance of the major industries and customers we serve; |

• | the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of Alstom investigative and legal proceedings; |

• | our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures, dispositions and other strategic actions; |

• | our success in completing, including obtaining regulatory approvals and satisfying other closing conditions for, announced transactions, such as our announced plans and transactions to reduce the size of our financial services businesses and to sell our Water and Industrial Solutions businesses; |

• | our success in integrating acquired businesses and operating joint ventures, including Baker Hughes; |

• | our ability to realize revenue and cost synergies from announced transactions, acquired businesses and joint ventures, including Alstom and Baker Hughes; |

• | the impact of potential information technology or data security breaches; and |

• | the other factors that are described in “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016. |

MD&A | ||

• | General Electric or the Company – the parent company, General Electric Company. |

• | GE – the adding together of all affiliates except GE Capital, whose continuing operations are presented on a one-line basis, giving effect to the elimination of transactions among such affiliates. As GE presents the continuing operations of GE Capital on a one-line basis, certain intercompany profits resulting from transactions between GE and GE Capital have been eliminated at the GE level. We present the results of GE in the center column of our consolidated statements of earnings, financial position and cash flows. An example of a GE metric is GE cash from operating activities (GE CFOA). |

• | General Electric Capital Corporation or GECC – predecessor to GE Capital Global Holdings, LLC. |

• | GE Capital Global Holdings, LLC or GECGH – successor of GECC. |

• | GE Capital or Financial Services – refers to GECGH, or its predecessor GECC, and is the adding together of all affiliates of GE Capital giving effect to the elimination of transactions among such affiliates. We present the results of GE Capital in the right-side column of our consolidated statements of earnings, financial position and cash flows. |

• | GE consolidated – the adding together of GE and GE Capital, giving effect to the elimination of transactions between the two. We present the results of GE consolidated in the left-side column of our consolidated statements of earnings, financial position and cash flows. |

• | Industrial – GE excluding the continuing operations of GE Capital. We believe that this provides investors with a view as to the results of our industrial businesses and corporate items. An example of an Industrial metric is Industrial CFOA (Non-GAAP), which is GE CFOA excluding the effects of dividends from GE Capital. |

• | Industrial segment – the sum of our seven industrial reporting segments, without giving effect to the elimination of transactions among such segments and between these segments and our Financial Services segment. This provides investors with a view as to the results of our industrial segments, without inter-segment eliminations and corporate items. An example of an industrial segment metric is industrial segment revenue growth. |

• | Total segment – the sum of our seven industrial segments and one financial services segment, without giving effect to the elimination of transactions between such segments. This provides investors with a view as to the results of all of our segments, without inter-segment eliminations and corporate items. |

• | Verticals or GE Capital Verticals – the adding together of GE Capital businesses that we expect to retain, principally its vertical financing businesses—GE Capital Aviation Services (GECAS), Energy Financial Services (EFS) and Industrial Finance (which includes Healthcare Equipment Finance, Working Capital Solutions and Industrial Financing Solutions)—that relate to the Company’s core industrial domain and other operations, including our run-off insurance activities, and allocated corporate costs. |

MD&A | ||

• | Backlog – unfilled customer orders for products and product services (expected life of contract sales for product services). |

• | Continuing earnings – unless otherwise indicated, we refer to the caption “earnings from continuing operations attributable to GE common shareowners” as continuing earnings or simply as earnings. |

• | Continuing earnings per share (EPS) – unless otherwise indicated, when we refer to continuing earnings per share, it is the diluted per-share amount of “earnings from continuing operations attributable to GE common shareowners”. |

• | Digital revenues – revenues related to internally developed software and associated hardware, including PredixTM and software solutions that improve our customers’ asset performance. In 2016, we reassessed the span of our digital product offerings, which now excludes software-enabled product upgrades. These revenues are largely generated from our operating businesses and are included in their segment results. Revenues of "Non-GE Verticals" refer to GE Digital revenues from customers operating in industries where GE does not have a presence. |

• | Equipment leased to others (ELTO) – rental equipment we own that is available to rent and is stated at cost less accumulated depreciation. |

• | GE Capital Exit Plan – our plan, announced on April 10, 2015, to reduce the size of our financial services businesses through the sale of most of the assets of GE Capital, and to focus on continued investment and growth in our industrial businesses. |

• | Industrial margin – GE revenues and other income excluding GE Capital earnings (loss) from continuing operations (Industrial revenues) minus GE total costs and expenses less GE interest and other financial charges divided by Industrial revenues. |

• | Industrial operating profit margin (Non-GAAP) – Industrial segment profit plus corporate items and eliminations (excluding gains, restructuring, and non-operating pension cost) divided by industrial segment revenues plus corporate items and eliminations (excluding gains and GE-GE Capital eliminations). |

• | Industrial segment gross margin - industrial segment sales less industrial segment cost of sales divided by sales. |

• | Net earnings – unless otherwise indicated, we refer to the caption “net earnings attributable to GE common shareowners” as net earnings. |

• | Net earnings per share (EPS) – unless otherwise indicated, when we refer to net earnings per share, it is the diluted per-share amount of “net earnings attributable to GE common shareowners”. |

• | Non-operating pension cost (Non-GAAP) – comprises the expected return on plan assets, interest cost on benefit obligations and net actuarial gain (loss) amortization for our principal pension plans. |

• | Operating earnings (Non-GAAP) – GE earnings from continuing operations attributable to common shareowners excluding the impact of non-operating pension costs. |

• | Operating earnings per share (Non-GAAP) – unless otherwise indicated, when we refer to operating earnings per share, it is the diluted per-share amount of “operating earnings”. |

• | Operating pension cost (Non-GAAP) – comprises the service cost of benefits earned, prior service cost amortization and curtailment gain (loss) for our principal pension plans. |

• | Organic revenues (Non-GAAP) – revenues excluding the effects of acquisitions, dispositions and translational foreign currency exchange. |

• | Product services – for purposes of the financial statement display of sales and costs of sales in our Statement of Earnings, “goods” is required by SEC regulations to include all sales of tangible products, and “services” must include all other sales, including other services activities. In our MD&A section of this report, we refer to sales under product services agreements and sales of both goods (such as spare parts and equipment upgrades) and related services (such as monitoring, maintenance and repairs) as sales of “product services,” which is an important part of our operations. We refer to “product services” simply as “services” within the MD&A. |

• | Product services agreements – contractual commitments, with multiple-year terms, to provide specified services for products in our Power, Renewable Energy, Oil & Gas, Aviation and Transportation installed base – for example, monitoring, maintenance, service and spare parts for a gas turbine/generator set installed in a customer’s power plant. |

• | Revenues – unless otherwise indicated, we refer to captions such as “revenues and other income” simply as revenues. |

• | Segment profit – refers to the operating profit of the industrial segments and the net earnings of the Financial Services segment. See the Segment Operations section within the MD&A for a description of the basis for segment profits. |

MD&A | ||

• | Industrial segment organic revenues |

• | Operating and non-operating pension cost |

• | Adjusted corporate costs (operating) |

• | Industrial operating earnings and GE Capital earnings (loss) from continuing operations and EPS |

• | Industrial operating + Verticals earnings and EPS |

• | Industrial operating profit and operating profit margin (excluding certain items) |

• | Industrial cash flows from operating activities (Industrial CFOA) and Industrial CFOA excluding deal taxes and GE Pension Plan funding |

MD&A | ||

Power(a) | Aviation | Energy Connections & Lighting(a) | |||

Renewable Energy | Healthcare | ||||

Oil & Gas | Transportation | ||||

Capital | |

(a) | Beginning in the third quarter of 2017, the Energy Connections business within the Energy Connections & Lighting segment is expected to be combined with the Power segment and presented as one reporting segment called Power. |

MD&A | KEY PERFORMANCE INDICATORS | |

REVENUES PERFORMANCE |

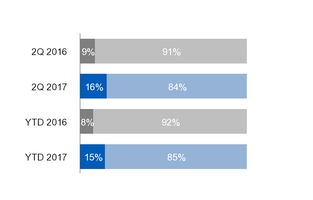

2Q 2017 | YTD 2017 | |

Industrial Segment | (2)% | (1)% |

Industrial Segment Organic* | 2% | 4% |

Capital | (12)% | (9)% |

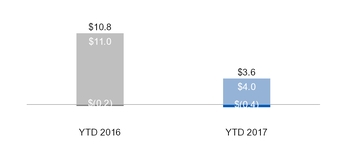

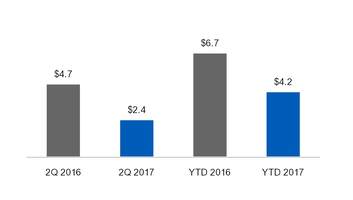

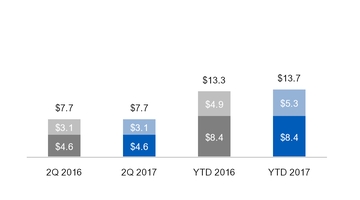

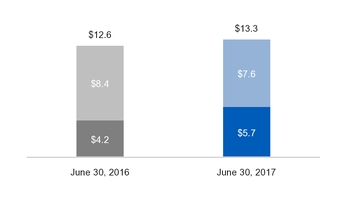

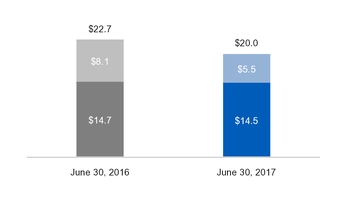

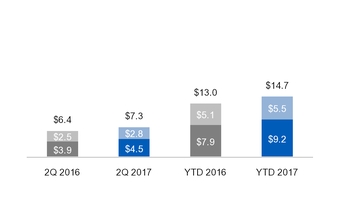

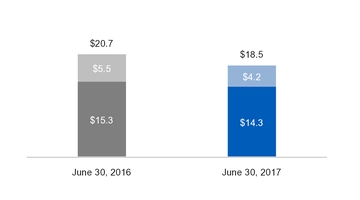

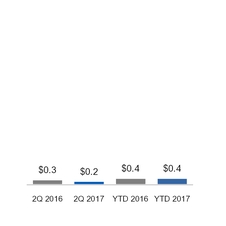

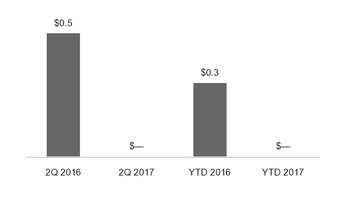

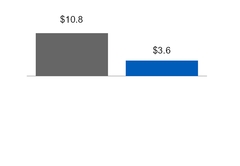

GE CFOA |

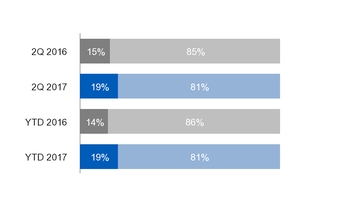

■ ■ Industrial CFOA(a)* ■ ■ GE Capital Dividend |

(a) 2016 included deal taxes of $(0.7) billion related to the sale of our Appliances business and in 2017 included deal taxes of $(0.1) billion related to the Baker Hughes transaction and GE Pension Plan funding of $(0.2) billion. |

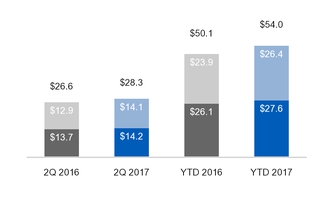

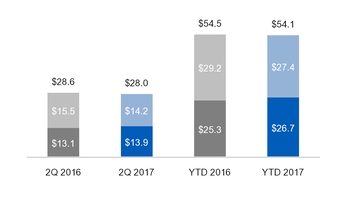

INDUSTRIAL ORDERS |

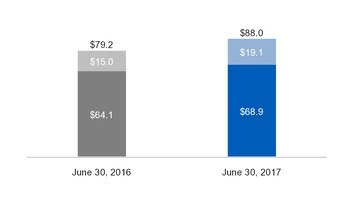

INDUSTRIAL BACKLOG |

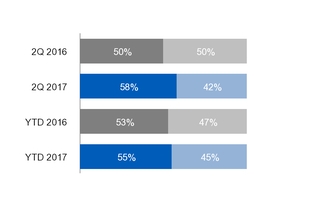

■ ■ Services ■ ■ Equipment |

■ ■ Services ■ ■ Equipment |

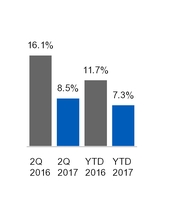

INDUSTRIAL PROFIT & MARGINS |

INDUSTRIAL OPERATING PROFIT & MARGINS (NON-GAAP)(a) |

(a) Excluded gains on disposals, non-operating pension cost, restructuring and other charges and noncontrolling interests |

MD&A | KEY PERFORMANCE INDICATORS | |

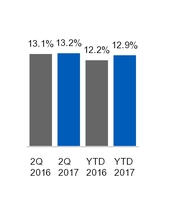

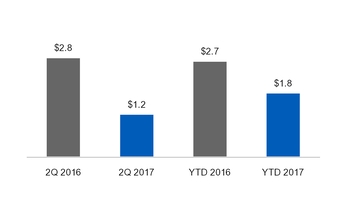

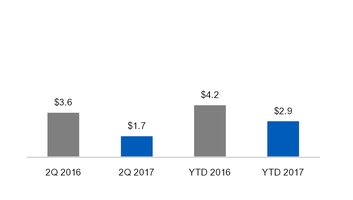

NET EARNINGS |

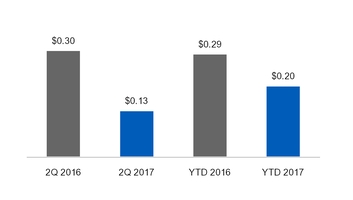

NET EARNINGS PER SHARE |

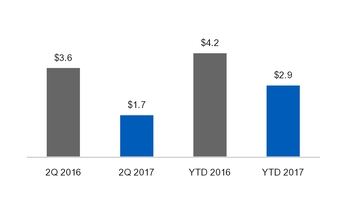

OPERATING EARNINGS (NON-GAAP) |

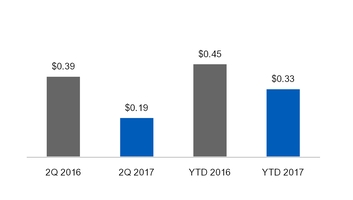

OPERATING EARNINGS PER SHARE (NON-GAAP) |

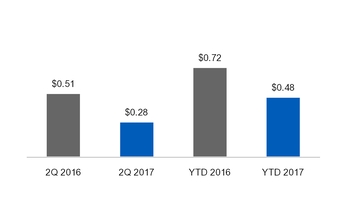

INDUSTRIAL OPERATING + VERTICALS EARNINGS(NON-GAAP) |

INDUSTRIAL OPERATING + VERTICALS EPS (NON-GAAP) |

MD&A | CONSOLIDATED RESULTS | |

• | On January 10, 2017, we completed the acquisition of ServiceMax, a leader in cloud-based field service management (FSM) solutions, for $0.9 billion, net of cash acquired. This acquisition is expected to provide enhanced capabilities to advance our Industrial Internet vision, enabling customers to immediately gain more value from their assets and find greater efficiency in their field service processes. |

• | On April 20, 2017, we completed the acquisition of LM Wind Power, one of the world’s largest wind turbine blade manufacturers for approximately $1.6 billion, net of cash acquired. |

• | On July 3, 2017, we completed the transaction to create Baker Hughes, a GE company (BHGE). Under the terms of the deal, which we announced in October 2016, we combined our Oil & Gas business and Baker Hughes Incorporated (Baker Hughes) to create a new company in which GE holds a 62.5% interest and former Baker Hughes shareholders hold a 37.5% interest. Baker Hughes shareholders also received a cash dividend funded by a $7.4 billion cash contribution from GE. The completion of the transaction followed the approval of Baker Hughes shareholders, regulatory approvals and other customary closing conditions. |

• | In October 2016, we announced our plan to sell our Water & Process Technologies business. In March 2017, we announced an agreement to sell the business for approximately $3.4 billion to Suez Environnement S.A. (Suez), a French-based utility company operating primarily in the water treatment and waste management sectors. The deal is expected to close in the second half of 2017, subject to customary closing conditions and regulatory approval. |

• | In the first quarter of 2017, we classified our Industrial Solutions business within our Energy Connections & Lighting segment as held for sale. We expect to complete the sale of the business by the end of the first quarter of 2018. |

MD&A | CONSOLIDATED RESULTS | |

REVENUES | INDUSTRIAL AND FINANCIAL SERVICES REVENUES | |

COMMENTARY: 2017 - 2016 |

• | Industrial revenues decreased $3.6 billion, or 12%, due to a decrease at Corporate of $3.0 billion as the prior year included a pre-tax gain of $3.1 billion from the sale of our Appliances business to Haier in the second quarter of 2016. The additional decrease in industrial revenues was due to a decrease in industrial segment revenues of approximately $0.6 billion, or 2%, as the net effects of dispositions of $1.2 billion and the effects of a stronger U.S. dollar of $0.2 billion were partially offset by organic revenue* increases of $0.6 billion and the net effects of acquisitions of $0.2 billion. In the second quarter of 2016, the net effects of acquisitions increased industrial revenues $3.2 billion while the net effects of dispositions and a stronger U.S. dollar decreased industrial revenues $1.1 billion and $0.1 billion, respectively. |

• | Financial Services revenues decreased $0.3 billion, or 12%, primarily due to higher impairments, organic revenue declines and lower gains. |

• | Industrial revenues decreased $3.6 billion, or 6%, due to a decrease at Corporate of $3.2 billion as the prior year included a pre-tax gain of $3.1 billion from the sale of our Appliances business to Haier in the second quarter of 2016. The additional decrease in industrial revenues was due to a decrease in industrial segment revenues of approximately $0.4 billion, or 1%, as the net effects of dispositions of $2.8 billion and the effects of a stronger U.S. dollar of $0.3 billion were partially offset by organic revenue* increases of $2.3 billion and the net effects of acquisitions of $0.3 billion. In the first six months of 2016, the net effects of acquisitions increased industrial revenues $6.0 billion while the net effects of dispositions and a stronger U.S. dollar decreased industrial revenues $1.6 billion and $0.7 billion, respectively. |

• | Financial Services revenues decreased $0.5 billion, or 9%, primarily due to organic revenue declines, lower gains and higher impairments. |

MD&A | CONSOLIDATED RESULTS | |

CONTINUING EARNINGS | OPERATING EARNINGS* | |

COMMENTARY: 2017 - 2016 |

▪ | Industrial earnings decreased $2.7 billion, or 54%, due to decreased Corporate gains of $3.1 billion as the prior year included a pre-tax gain of $3.1 billion from the sale of our Appliances business to Haier in the second quarter of 2016, partially offset by decreased restructuring and other costs of $0.6 billion. In addition, industrial segment profit decreased $0.2 billion, or 4%, due to the net effects of dispositions of $0.1 billion and organic operating decreases of $0.1 billion. |

▪ | Interest and other financial charges decreased $0.1 billion while the provision for income taxes increased $0.4 billion. |

▪ | The net effect of acquisitions on our consolidated operating earnings was an insignificant amount in the second quarter of 2017 and a decrease of $0.1 billion in the second quarter of 2016. The net effect of dispositions was a decrease of $2.4 billion in the second quarter of 2017 and a gain of $1.9 billion in the second quarter of 2016. |

▪ | Foreign exchange adversely affected industrial operating earnings by $0.1 billion as a result of both translational and transactional impacts related to remeasurement and mark-to-market charges on open hedges. |

▪ | Financial Services losses decreased $0.4 billion, or 71%, primarily due to lower treasury and headquarters operation expenses associated with the GE Capital Exit Plan. |

▪ | Earnings per share amounts for the second quarter of 2017 were positively impacted by the reduction in number of outstanding common shares compared to the second quarter of 2016. The average number of shares outstanding used to calculate second quarter 2017 earnings per share was 5% lower than in the second quarter of 2016 as a result of previously disclosed actions, primarily ongoing share buyback activities over the last 12 months funded in large part by dividends from GE Capital. |

▪ | Industrial earnings decreased $2.9 billion, or 42%, due to decreased Corporate gains of $3.2 billion as the prior year included a pre-tax gain of $3.1 billion from the sale of our Appliances business to Haier in the second quarter of 2016, partially offset by decreased restructuring and other costs of $0.3 billion and an increase in industrial segment profit of $0.1 billion, or 2%, as organic operating increases of $0.4 billion were partially offset by the net effects of dispositions of $0.2 billion. |

▪ | Interest and other financial charges decreased $0.2 billion while the provision for income taxes increased $0.4 billion. |

▪ | The net effect of acquisitions on our consolidated operating earnings was a decrease of $0.1 billion in 2017 and $0.2 billion in 2016. The net effect of dispositions on consolidated net earnings was a decrease of $2.6 billion in 2017 and a gain of $1.9 billion in 2016. |

▪ | Foreign exchange adversely affected industrial operating earnings by $0.2 billion as a result of both translational and transactional impacts related to remeasurement and mark-to-market charges on open hedges. |

▪ | Financial Services losses decreased $1.3 billion, or 85% primarily due to lower treasury and headquarters operation expenses, lower preferred dividend expenses associated with the January 2016 preferred equity exchange, and lower restructuring expenses associated with the GE Capital Exit Plan. |

▪ | Earnings per share amounts for 2017 were positively impacted by the reduction in number of outstanding common shares compared to 2016. The average number of shares outstanding used to calculate 2017 earnings per share was 5% lower than in 2016 as a result of previously disclosed actions, primarily ongoing share buyback activities over the last 12 months funded in large part by dividends from GE Capital. |

MD&A | SEGMENT OPERATIONS | |

SUMMARY OF OPERATING SEGMENTS | |||||||||||||||||

Three months ended June 30 | Six months ended June 30 | ||||||||||||||||

(In millions) | 2017 | 2016 | V% | 2017 | 2016 | V% | |||||||||||

Revenues | |||||||||||||||||

Power | $ | 6,969 | $ | 6,639 | 5 | % | $ | 13,058 | $ | 11,843 | 10 | % | |||||

Renewable Energy | 2,457 | 2,094 | 17 | % | 4,501 | 3,763 | 20 | % | |||||||||

Oil & Gas | 3,108 | 3,219 | (3) | % | 6,110 | 6,533 | (6 | )% | |||||||||

Aviation | 6,532 | 6,511 | — | % | 13,336 | 12,774 | 4 | % | |||||||||

Healthcare | 4,700 | 4,525 | 4 | % | 8,990 | 8,708 | 3 | % | |||||||||

Transportation | 1,071 | 1,240 | (14) | % | 2,110 | 2,222 | (5 | )% | |||||||||

Energy Connections & Lighting(a) | 3,210 | 4,401 | (27) | % | 5,957 | 8,657 | (31 | )% | |||||||||

Total industrial segment revenues | 28,047 | 28,630 | (2) | % | 54,063 | 54,499 | (1 | )% | |||||||||

Capital | 2,446 | 2,771 | (12) | % | 5,127 | 5,656 | (9 | )% | |||||||||

Total segment revenues | 30,493 | 31,401 | (3) | % | 59,190 | 60,155 | (2 | )% | |||||||||

Corporate items and eliminations | (935 | ) | 2,093 | (1,972 | ) | 1,184 | |||||||||||

Consolidated revenues | $ | 29,558 | $ | 33,494 | (12) | % | $ | 57,219 | $ | 61,339 | (7 | )% | |||||

Segment profit (loss) | |||||||||||||||||

Power | $ | 1,031 | $ | 1,140 | (10) | % | $ | 1,827 | $ | 1,714 | 7 | % | |||||

Renewable Energy | 160 | 128 | 25 | % | 267 | 211 | 27 | % | |||||||||

Oil & Gas | 155 | 320 | (52) | % | 361 | 628 | (43 | )% | |||||||||

Aviation | 1,492 | 1,348 | 11 | % | 3,176 | 2,872 | 11 | % | |||||||||

Healthcare | 826 | 782 | 6 | % | 1,469 | 1,413 | 4 | % | |||||||||

Transportation | 203 | 273 | (26) | % | 359 | 437 | (18 | )% | |||||||||

Energy Connections & Lighting(a) | 80 | 131 | (39) | % | 109 | 162 | (33 | )% | |||||||||

Total industrial segment profit | 3,947 | 4,122 | (4) | % | 7,568 | 7,437 | 2 | % | |||||||||

Capital | (172 | ) | (600 | ) | 71 | % | (219 | ) | (1,492 | ) | 85 | % | |||||

Total segment profit (loss) | 3,775 | 3,523 | 7 | % | 7,349 | 5,944 | 24 | % | |||||||||

Corporate items and eliminations | (1,583 | ) | 974 | (3,592 | ) | (597 | ) | ||||||||||

GE interest and other financial charges | (637 | ) | (567 | ) | (1,200 | ) | (1,007 | ) | |||||||||

GE provision for income taxes | (218 | ) | (629 | ) | (361 | ) | (793 | ) | |||||||||

Earnings (loss) from continuing operations attributable to GE common shareowners | 1,338 | 3,300 | (59) | % | 2,196 | 3,548 | (38 | )% | |||||||||

Earnings (loss) from discontinued operations, net of taxes | (146 | ) | (541 | ) | 73 | % | (385 | ) | (849 | ) | 55 | % | |||||

Less net earnings attributable to | |||||||||||||||||

noncontrolling interests, discontinued operations | 7 | 3 | 7 | 3 | |||||||||||||

Earnings (loss) from discontinued operations, | |||||||||||||||||

net of tax and noncontrolling interest | (152 | ) | (544 | ) | 72 | % | (392 | ) | (852 | ) | 54 | % | |||||

Consolidated net earnings (loss) attributable to the GE common shareowners | $ | 1,185 | $ | 2,756 | (57) | % | $ | 1,804 | $ | 2,695 | (33 | )% | |||||

(a) | Beginning in the third quarter of 2017, the Energy Connections business within the Energy Connections & Lighting segment is expected to be combined with the Power segment and presented as one reporting segment called Power. |

MD&A | SEGMENT OPERATIONS | |

• | Interest and other financial charges, income taxes and GE preferred stock dividends are excluded in determining segment profit (which we sometimes refer to as “operating profit”) for the industrial segments. |

• | Interest and other financial charges, income taxes and GE Capital preferred stock dividends are included in determining segment profit (which we sometimes refer to as “net earnings”) for the Capital segment. |

• | The translational foreign exchange impact is included within Foreign Exchange. |

• | The transactional impact of foreign exchange hedging is included in operating cost within Productivity and in other income within Other. |

MD&A | SEGMENT OPERATIONS | |

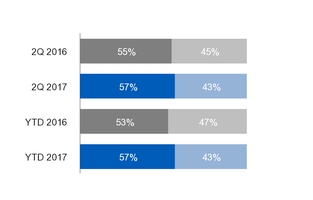

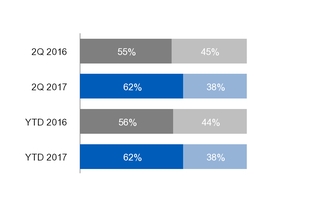

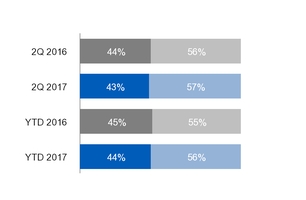

INDUSTRIAL SEGMENT EQUIPMENT & SERVICES REVENUES |

INDUSTRIAL SEGMENT PROFIT |

■ ■ Services ■ ■ Equipment | |

2017 – 2016 COMMENTARY: THREE MONTHS ENDED JUNE 30 |

• | Industrial segment revenues decreased $0.6 billion, or 2%, driven by decreases at Energy Connections & Lighting primarily due to the sale of the Appliances business in the second quarter of 2016, Transportation, and Oil & Gas primarily due to market conditions, and an unfavorable foreign exchange impact, partially offset by increases at Renewable Energy, Power and Healthcare. |

• | Industrial segment profit decreased $0.2 billion, or 4%, driven primarily by lower earnings at Oil & Gas, Power, and Transportation, as well as the effects of the sale of Appliances in the second quarter of 2016, partially offset by higher earnings at Aviation. |

• | Industrial segment margin decreased 30 bps to 14.1% in 2017 from 14.4% in 2016 driven by the effects of price and business mix, partially offset by positive cost productivity. The decrease in industrial segment margin reflects decreases at Oil & Gas, Transportation, Power and the sale of Appliances in the second quarter of 2016, offset by increases at Aviation, Renewable Energy and Healthcare. |

2017 – 2016 COMMENTARY: SIX MONTHS ENDED JUNE 30 |

• | Industrial segment revenues decreased $0.4 billion, or 1%, driven by decreases at Energy Connections & Lighting primarily due to the sale of the Appliances business in the second quarter of 2016, Oil & Gas primarily due to market conditions, and Transportation, and an unfavorable foreign exchange impact, partially offset by increases at Power, Renewable Energy, Aviation and Healthcare. |

• | Industrial segment profit increased $0.1 billion, or 2%, driven primarily by higher earnings at Aviation and Power, partially offset by lower earnings at Oil & Gas as well as an unfavorable foreign exchange impact and the effects of the sale of Appliances in the second quarter of 2016. |

• | Industrial segment margin increased 40 bps to 14.0% in 2017 from 13.6% in 2016 driven by positive cost productivity, partially offset by negative business mix. The increase in industrial segment margin reflects increases at Aviation, Renewable Energy and Healthcare, offset by decreases at Oil & Gas, Transportation, Power and the sale of Appliances in the second quarter of 2016. |

MD&A | SEGMENT OPERATIONS | POWER | |

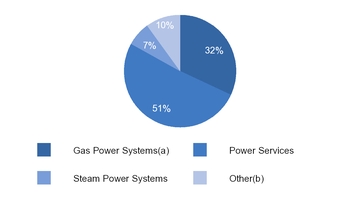

2017 YTD SUB-SEGMENT REVENUES |

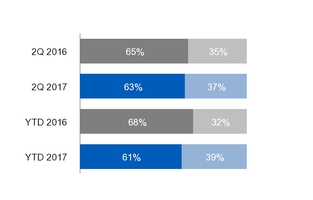

EQUIPMENT/SERVICES REVENUES |

(a) Includes Distributed Power (b) Includes Water & Process Technologies and GE Hitachi Nuclear |

■ ■ Services ■ ■ Equipment |

ORDERS |

BACKLOG |

■ ■ Services ■ ■ Equipment |

■ ■ Services ■ ■ Equipment |

UNIT SALES | ||||||

2Q 2016 | 2Q 2017 | V | YTD 2016 | YTD 2017 | V | |

Gas Turbines | 26 | 21 | (5) | 39 | 41 | 2 |

MD&A | SEGMENT OPERATIONS | POWER | |

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

■ ■ Services ■ ■ Equipment |

SEGMENT REVENUES & PROFIT WALK: | ||||||

THREE MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 6.6 | $ | 1.1 | ||

Volume | 0.4 | 0.1 | ||||

Price | (0.1 | ) | (0.1 | ) | ||

Foreign Exchange | — | — | ||||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | (0.1 | ) | |||

Productivity | N/A | — | ||||

Other | — | — | ||||

June 30, 2017 | $ | 7.0 | $ | 1.0 | ||

SIX MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 11.8 | $ | 1.7 | ||

Volume | 1.3 | 0.2 | ||||

Price | (0.1 | ) | (0.1 | ) | ||

Foreign Exchange | (0.1 | ) | — | |||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | (0.3 | ) | |||

Productivity | N/A | 0.2 | ||||

Other | 0.1 | 0.1 | ||||

June 30, 2017 | $ | 13.1 | $ | 1.8 | ||

COMMENTARY: 2017 - 2016 |

• | The increase in revenues was driven by higher equipment volume, primarily at Gas Power Systems as a result of extended scope including higher balance of plant as well as six more Heat Recovery Steam Generator shipments than in the prior year, partially offset by five fewer gas turbine shipments and lower prices. |

• | The decrease in profit was due to lower prices, an unfavorable business mix due to higher equipment volume versus services volume and negative variable cost productivity, partially offset by positive base cost productivity and higher overall volume. |

• | The increase in revenues was driven by higher equipment volume, primarily at Gas Power Systems as a result of extended scope including higher balance of plant as well as two more gas turbine shipments and 29 more Heat Recovery Steam Generator shipments than in the prior year. Revenue also increased due to increased other income including a reduction in foreign exchange transactional losses, partially offset by lower prices and the effects of a stronger U.S. dollar versus the euro. |

• | The increase in profit was due to positive base cost productivity on higher volume as well as increased other income including a reduction in foreign exchange transactional losses, partially offset by an unfavorable business mix due to higher equipment volume versus services volume, negative variable cost productivity and lower prices. |

MD&A | SEGMENT OPERATIONS | RENEWABLE ENERGY | |

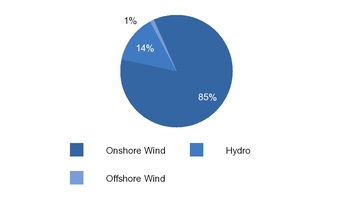

2017 YTD SUB-SEGMENT REVENUES |

EQUIPMENT/SERVICES REVENUES |

■ ■ Services ■ ■ Equipment |

ORDERS |

BACKLOG |

■ ■ Services ■ ■ Equipment |

■ ■ Services ■ ■ Equipment |

UNIT SALES | ||||||

2Q 2016 | 2Q 2017 | V | YTD 2016 | YTD 2017 | V | |

Wind Turbines | 856 | 757 | (99) | 1,524 | 1,324 | (200) |

MD&A | SEGMENT OPERATIONS | RENEWABLE ENERGY | |

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

■ ■ Services ■ ■ Equipment |

SEGMENT REVENUES & PROFIT WALK: | ||||||

THREE MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 2.1 | $ | 0.1 | ||

Volume | 0.3 | — | ||||

Price | — | — | ||||

Foreign Exchange | — | — | ||||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | — | ||||

Productivity | N/A | — | ||||

Other | 0.1 | — | ||||

June 30, 2017 | $ | 2.5 | $ | 0.2 | ||

SIX MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 3.8 | $ | 0.2 | ||

Volume | 0.6 | — | ||||

Price | (0.1 | ) | (0.1 | ) | ||

Foreign Exchange | 0.1 | — | ||||

(Inflation)/Deflation | N/A | 0.1 | ||||

Mix | N/A | — | ||||

Productivity | N/A | (0.2 | ) | |||

Other | 0.2 | 0.2 | ||||

June 30, 2017 | $ | 4.5 | $ | 0.3 | ||

COMMENTARY: 2017 - 2016 |

• | The increase in revenues was primarily driven by higher volume due to higher equipment sales at Hydro and increased repowering projects at Onshore Wind. In addition, while there were 99 fewer wind turbine shipments than in the prior year, megawatts shipped increased by 8%. Revenue also increased due to increased other income including a reduction in foreign exchange transactional losses. |

• | The increase in profit was due to material deflation and increased other income including a reduction in foreign exchange transactional losses. These increases were partially offset by negative cost productivity. |

• | The increase in revenues was primarily driven by higher volume due to higher equipment sales at Hydro and increased repowering projects at Onshore Wind. In addition, while there were 200 fewer wind turbine shipments than in the prior year, megawatts shipped increased by 4%. Revenue also increased due to the effects of a weaker U.S. dollar versus the Brazilian real and increased other income including a reduction in foreign exchange transactional losses, partially offset by lower prices. |

• | The increase in profit was due to material deflation and increased other income including a reduction in foreign exchange transactional losses. These increases were partially offset by negative cost productivity and lower prices. |

MD&A | SEGMENT OPERATIONS | OIL & GAS | |

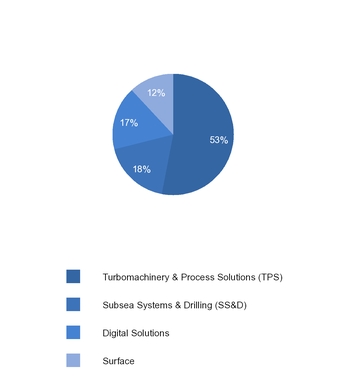

2017 YTD SUB-SEGMENT REVENUES |

EQUIPMENT/SERVICES REVENUES |

■ ■ Services ■ ■ Equipment |

ORDERS |

BACKLOG |

■ ■ Services ■ ■ Equipment |

■ ■ Services ■ ■ Equipment |

MD&A | SEGMENT OPERATIONS | OIL & GAS | |

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

■ ■ Services ■ ■ Equipment |

SEGMENT REVENUES & PROFIT WALK: | ||||||

THREE MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 3.2 | $ | 0.3 | ||

Volume | (0.1 | ) | — | |||

Price | (0.1 | ) | (0.1 | ) | ||

Foreign Exchange | — | — | ||||

(Inflation)/Deflation | N/A | 0.1 | ||||

Mix | N/A | — | ||||

Productivity | N/A | (0.2 | ) | |||

Other | 0.1 | 0.1 | ||||

June 30, 2017 | $ | 3.1 | $ | 0.2 | ||

SIX MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 6.5 | $ | 0.6 | ||

Volume | (0.3 | ) | — | |||

Price | (0.2 | ) | (0.2 | ) | ||

Foreign Exchange | (0.1 | ) | — | |||

(Inflation)/Deflation | N/A | 0.1 | ||||

Mix | N/A | — | ||||

Productivity | N/A | (0.2 | ) | |||

Other | 0.1 | 0.1 | ||||

June 30, 2017 | $ | 6.1 | $ | 0.4 | ||

COMMENTARY: 2017 - 2016 |

• | The decrease in revenues was primarily driven by negative market conditions which resulted in lower prices as well as lower equipment volume primarily in Subsea & Drilling. |

• | The decrease in operating profit was primarily market driven resulting in lower prices. Despite the effects of restructuring actions, profit decreased due to negative variable cost productivity. These decreases were partially offset by material deflation and increased other income including a reduction in foreign exchange transactional losses. |

• | The decrease in revenues was primarily driven by negative market conditions that resulted in lower equipment volume in Subsea & Drilling and Turbomachinery & Process Solutions. Revenues also decreased due to lower prices and the effects of a stronger U.S. dollar versus the euro and the pound sterling, partially offset by increased other income including a reduction in foreign exchange transactional losses. |

• | The decrease in operating profit was primarily market driven resulting in lower prices. Despite the effects of restructuring actions and an increase in earnings in our long-term service contracts, profit decreased due to negative variable cost productivity. These decreases were partially offset by material deflation and increased other income including a reduction in foreign exchange transactional losses. |

MD&A | SEGMENT OPERATIONS | AVIATION | |

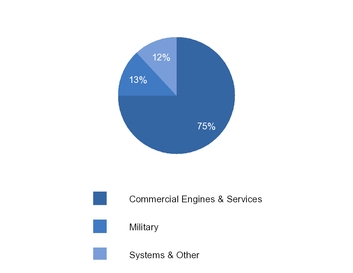

2017 YTD SUB-SEGMENT REVENUES |

EQUIPMENT/SERVICES REVENUES |

■ ■ Services ■ ■ Equipment |

ORDERS |

BACKLOG |

■ ■ Services ■ ■ Equipment |

■ ■ Services ■ ■ Equipment |

UNIT SALES | ||||||||||||||||||

2Q 2016 | 2Q 2017 | V | YTD 2016 | YTD 2017 | V | |||||||||||||

Commercial Engines | 724 | 651 | (73 | ) | 1,401 | 1282 | (119 | ) | ||||||||||

LEAP Engines(a) | 11 | 93 | 82 | 11 | 174 | 163 | ||||||||||||

Military Engines | 151 | 137 | (14 | ) | 302 | 257 | (45 | ) | ||||||||||

Spares Rate(b) | $ | 19.0 | $ | 21.6 | $ | 2.6 | $ | 18.1 | $ | 21.6 | $ | 3.5 | ||||||

(a) LEAP engines are a subset of commercial engines (b) Commercial externally shipped spares and spares used in time & material shop visits in millions of dollars per day | ||||||||||||||||||

MD&A | SEGMENT OPERATIONS | AVIATION | |

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

■ ■ Services ■ ■ Equipment |

SEGMENT REVENUES & PROFIT WALK: | ||||||

THREE MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 6.5 | $ | 1.3 | ||

Volume | — | — | ||||

Price | — | — | ||||

Foreign Exchange | — | — | ||||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | — | ||||

Productivity | N/A | 0.2 | ||||

Other | — | — | ||||

June 30, 2017 | $ | 6.5 | $ | 1.5 | ||

SIX MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 12.8 | $ | 2.9 | ||

Volume | 0.5 | 0.1 | ||||

Price | 0.1 | 0.1 | ||||

Foreign Exchange | — | — | ||||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | (0.1 | ) | |||

Productivity | N/A | 0.3 | ||||

Other | — | — | ||||

June 30, 2017 | $ | 13.3 | $ | 3.2 | ||

COMMENTARY: 2017 - 2016 |

• | Revenues remained flat as an increase in services volume including an increase in the commercial spares shipment rate, was offset by a decrease in equipment volume. Equipment volume decreased primarily due to 73 fewer Commercial engine shipments and 14 fewer Military engine shipments, partially offset by higher valued commercial shipments including 82 more LEAP engine shipments than in the prior year. |

• | The increase in profit was mainly driven by positive cost productivity which more than offset negative LEAP margin impact. |

• | The increase in revenues was primarily due to higher services volume including an increase in the commercial spares shipment rate as well as military spare parts shipments, and higher prices. Equipment revenue decreased primarily due to 119 fewer Commercial engine shipments and 45 fewer Military engine shipments, partially offset by higher valued commercial shipments including 163 more LEAP engine shipments than in the prior year. |

• | The increase in profit was mainly driven by positive cost productivity, higher services volume and higher prices for Commercial Engines & Services, partially offset by unfavorable business mix due to negative LEAP margin impact. |

MD&A | SEGMENT OPERATIONS | HEALTHCARE | |

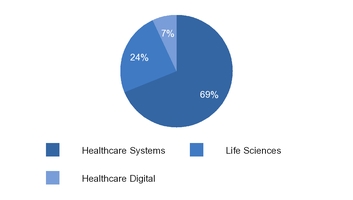

2017 YTD SUB-SEGMENT REVENUES |

EQUIPMENT/SERVICES REVENUES |

■ ■ Services ■ ■ Equipment |

ORDERS |

BACKLOG |

■ ■ Services ■ ■ Equipment |

■ ■ Services ■ ■ Equipment |

MD&A | SEGMENT OPERATIONS | HEALTHCARE | |

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

■ ■ Services ■ ■ Equipment |

SEGMENT REVENUES & PROFIT WALK: | ||||||

THREE MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 4.5 | $ | 0.8 | ||

Volume | 0.3 | 0.1 | ||||

Price | (0.1 | ) | (0.1 | ) | ||

Foreign Exchange | — | — | ||||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | — | ||||

Productivity | N/A | 0.1 | ||||

Other | — | — | ||||

June 30, 2017 | $ | 4.7 | $ | 0.8 | ||

SIX MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 8.7 | $ | 1.4 | ||

Volume | 0.5 | 0.1 | ||||

Price | (0.1 | ) | (0.1 | ) | ||

Foreign Exchange | (0.1 | ) | — | |||

(Inflation)/Deflation | N/A | (0.1 | ) | |||

Mix | N/A | — | ||||

Productivity | N/A | 0.3 | ||||

Other | — | — | ||||

June 30, 2017 | $ | 9.0 | $ | 1.5 | ||

COMMENTARY: 2017 - 2016 |

• | The increase in revenues was due to higher services and equipment volume driven by Healthcare Systems and Life Sciences, partially offset by lower prices at Healthcare Systems. |

• | The increase in profit was mainly due to positive cost productivity driven by cost savings resulting from previous restructuring actions, as well as higher volume, partially offset by lower prices at Healthcare Systems. |

• | The increase in revenues was due to higher services and equipment volume driven by Healthcare Systems and Life Sciences, partially offset by lower prices at Healthcare Systems and the effects of a stronger U.S. dollar versus the euro and the Chinese renminbi. |

• | The increase in profit was mainly due to positive cost productivity driven by cost savings resulting from previous restructuring actions, as well as higher volume, partially offset by lower prices at Healthcare Systems and inflation. |

MD&A | SEGMENT OPERATIONS | TRANSPORTATION | |

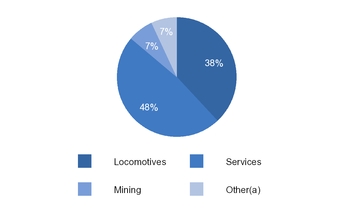

2017 YTD SUB-SEGMENT REVENUES |

EQUIPMENT/SERVICES REVENUES |

(a) Includes Marine, Stationary, Drilling and Digital |

■ ■ Services ■ ■ Equipment |

ORDERS |

BACKLOG |

■ ■ Services ■ ■ Equipment |

■ ■ Services ■ ■ Equipment |

UNIT SALES | ||||||

2Q 2016 | 2Q 2017 | V | YTD 2016 | YTD 2017 | V | |

Locomotives | 222 | 120 | (102) | 378 | 277 | (101) |

MD&A | SEGMENT OPERATIONS | TRANSPORTATION | |

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

■ ■ Services ■ ■ Equipment |

SEGMENT REVENUES & PROFIT WALK: | ||||||

THREE MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 1.2 | $ | 0.3 | ||

Volume | (0.2 | ) | — | |||

Price | — | — | ||||

Foreign Exchange | — | — | ||||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | — | ||||

Productivity | N/A | — | ||||

Other | — | — | ||||

June 30, 2017 | $ | 1.1 | $ | 0.2 | ||

SIX MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 2.2 | $ | 0.4 | ||

Volume | (0.1 | ) | — | |||

Price | — | — | ||||

Foreign Exchange | — | — | ||||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | — | ||||

Productivity | N/A | (0.1 | ) | |||

Other | — | — | ||||

June 30, 2017 | $ | 2.1 | $ | 0.4 | ||

COMMENTARY: 2017 - 2016 |

• | The decrease in revenues was due to lower locomotive equipment volume as a result of decreased North America shipments, partially offset by increased international shipments. |

• | The decrease in profit was driven by lower volume and negative cost productivity. |

• | The decrease in revenues was due to lower locomotive equipment volume as a result of decreased North America shipments, partially offset by increased international shipments. |

• | The decrease in profit was driven by negative cost productivity and lower volume, partially offset by a favorable business mix. |

MD&A | SEGMENT OPERATIONS | ENERGY CONNECTIONS & LIGHTING | |

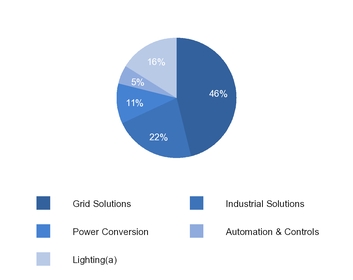

2017 YTD SUB-SEGMENT REVENUES |

EQUIPMENT/SERVICES REVENUES |

(a) Includes Current, powered by GE |

■ ■ Services ■ ■ Equipment |

ORDERS |

BACKLOG |

■ ■ Services ■ ■ Equipment |

■ ■ Services ■ ■ Equipment |

MD&A | SEGMENT OPERATIONS | ENERGY CONNECTIONS & LIGHTING | |

SEGMENT REVENUES | SEGMENT PROFIT | SEGMENT PROFIT MARGIN | ||

■ ■ Services ■ ■ Equipment |

SEGMENT REVENUES & PROFIT WALK: | ||||||

THREE MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 4.4 | $ | 0.1 | ||

Volume | (1.1 | ) | (0.1 | ) | ||

Price | — | — | ||||

Foreign Exchange | (0.1 | ) | — | |||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | — | ||||

Productivity | N/A | 0.1 | ||||

Other | — | — | ||||

June 30, 2017 | $ | 3.2 | $ | 0.1 | ||

SIX MONTHS | ||||||

Revenues | Profit | |||||

June 30, 2016 | $ | 8.7 | $ | 0.2 | ||

Volume | (2.6 | ) | (0.2 | ) | ||

Price | (0.1 | ) | (0.1 | ) | ||

Foreign Exchange | (0.1 | ) | — | |||

(Inflation)/Deflation | N/A | — | ||||

Mix | N/A | — | ||||

Productivity | N/A | 0.2 | ||||

Other | — | — | ||||

June 30, 2017 | $ | 6.0 | $ | 0.1 | ||

COMMENTARY: 2017 - 2016 |

• | The decrease in revenues was mainly due to the Appliances disposition in June 2016 as well as lower GE Lighting revenues driven by declines in traditional lighting product. Energy Connections revenues remained flat as increased volume at Grid Solutions was offset by a decrease at Power Conversion. Revenues also decreased due to the effects of a stronger U.S. dollar versus the pound sterling and the euro. |

• | The decrease in profit was due to lower volume driven by the Appliances disposition in June 2016, partially offset by increases across Energy Connections, Current, and GE Lighting due to positive cost productivity including the effects of classifying Industrial Solutions as a business held for sale in the first quarter of 2017. |

• | The decrease in revenues was mainly due to the Appliances disposition in June 2016 as well as lower GE Lighting revenues driven by declines in traditional lighting product. Energy Connections remained flat as increased volume at Grid Solutions was offset by a decrease at Power Conversion. Revenues also decreased due to lower prices and the effects of a stronger U.S. dollar versus the pound sterling and the euro. |

• | The decrease in profit was due to lower volume driven by the Appliances disposition in June 2016, as well as lower prices, partially offset by increases across Energy Connections, Current, and GE Lighting due to positive cost productivity including the effects of classifying Industrial Solutions as a business held for sale in the first quarter of 2017. |

MD&A | SEGMENT OPERATIONS | CAPITAL | |

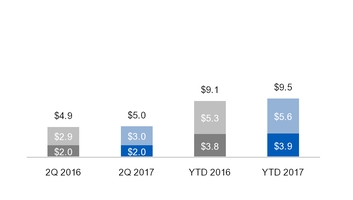

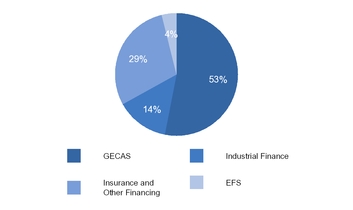

2017 YTD SUB-SEGMENT REVENUES |

SEGMENT REVENUES |

SEGMENT PROFIT (LOSS)(a) |

■ ■ Verticals ■ ■ Other Continuing |

■ ■ Verticals ■ ■ Other Continuing |

(a) Includes interest and other financial charges and income taxes |

SIGNIFICANT TRENDS & DEVELOPMENTS |

• | As of March 30, 2017, GE Capital’s non-US activities are no longer subject to consolidated supervision by the U.K.’s Prudential Regulation Authority (PRA). This completes GE Capital’s global exit from consolidated supervision, having had its designation as a Systemically Important Financial Institution (SIFI) removed in June 2016. |

• | GE Capital paid common dividends of $2.0 billion and $4.0 billion to GE in the three months and six months ended June 30, 2017, respectively. |

• | We test future policy benefit reserves associated with our run-off insurance activities for premium deficiencies annually. We have recently experienced elevated claim experience for a portion of our long-term care insurance products, which may result in a deficiency in reserves plus future premiums compared to future benefit payments. Should such a deficiency exist, we would record a charge to earnings in the second half of 2017 upon completion of this review. See Note 11 of the consolidated financial statements for further information. |

MD&A | SEGMENT OPERATIONS | CAPITAL | |

COMMENTARY: 2017 - 2016 | ||

• | Within Capital, Verticals net earnings increased $0.1 billion, or 20%, due to core increases ($0.1 billion), partially offset by lower gains. |

• | Other Capital losses decreased $0.3 billion, or 32%, primarily associated with the GE Capital Exit Plan as follows: |

• | Lower headquarters operation expenses of $0.2 billion |

• | Lower treasury operation expenses of $0.1 billion reflecting lower excess interest expense, including costs associated with the May 2016 debt tender and derivative activities that reduce or eliminate interest rate, currency or market risk between financial assets and liabilities. |

• | Within Capital, Verticals net earnings increased $0.1 billion, or 14%, due to core increases ($0.2 billion) and lower impairments ($0.1 billion), partially offset by lower gains ($0.1 billion). |

• | Other Capital losses decreased $1.1 billion, or 47%, primarily associated with the GE Capital Exit Plan as follows: |

• | Lower treasury operation expenses of $0.5 billion reflecting lower excess interest expense, including costs associated with the February and May 2016 debt tenders and derivative activities that reduce or eliminate interest rate, currency or market risk between financial assets and liabilities. |

• | Lower headquarters operation expenses of $0.4 billion. |

• | Lower preferred dividend expenses of $0.2 billion associated with the January 2016 preferred equity exchange. |

MD&A | CORPORATE ITEMS AND ELIMINATIONS | |

CORPORATE ITEMS AND ELIMINATIONS | ||||||||||||||

REVENUES AND OPERATING PROFIT (COST) | ||||||||||||||

Three months ended June 30 | Six months ended June 30 | |||||||||||||

(In millions) | 2017 | 2016 | 2017 | 2016 | ||||||||||

Revenues | ||||||||||||||

Gains (losses) on disposals | $ | — | $ | 3,129 | $ | 2 | $ | 3,188 | ||||||

Eliminations and other | (935 | ) | (1,036 | ) | (1,973 | ) | (2,004 | ) | ||||||

Total Corporate Items and Eliminations | $ | (935 | ) | $ | 2,093 | $ | (1,972 | ) | $ | 1,184 | ||||

Operating profit (cost) | ||||||||||||||

Gains (losses) on disposals | $ | — | $ | 3,129 | $ | 2 | $ | 3,188 | ||||||

Restructuring and other charges | (709 | ) | (1,188 | ) | (1,728 | ) | (1,874 | ) | ||||||

Principal retirement plans(a) | (551 | ) | (479 | ) | (1,085 | ) | (947 | ) | ||||||

Eliminations and other | (323 | ) | (487 | ) | (780 | ) | (964 | ) | ||||||

Total Corporate Items and Eliminations | $ | (1,583 | ) | $ | 974 | $ | (3,592 | ) | $ | (597 | ) | |||

CORPORATE COSTS | ||||||||||||||

Three months ended June 30 | Six months ended June 30 | |||||||||||||

(In millions) | 2017 | 2016 | 2017 | 2016 | ||||||||||

Total Corporate Items and Eliminations | $ | (1,583 | ) | $ | 974 | $ | (3,592 | ) | $ | (597 | ) | |||

Less: non-operating pension cost | (560 | ) | (511 | ) | (1,138 | ) | (1,023 | ) | ||||||

Total Corporate costs (operating)* | $ | (1,023 | ) | $ | 1,485 | $ | (2,454 | ) | $ | 426 | ||||

Less: restructuring and other charges | (709 | ) | (1,188 | ) | (1,728 | ) | (1,874 | ) | ||||||

Less: gains (losses) on disposals | $ | — | 3,129 | 2 | 3,188 | |||||||||

Adjusted total corporate costs (operating)* | $ | (314 | ) | $ | (456 | ) | $ | (728 | ) | $ | (887 | ) | ||

(a) | Included non-operating pension cost* of $0.6 billion and $0.5 billion in the three months ended June 30, 2017 and 2016, respectively, and $1.1 billion and $1.0 billion in the six months ended June 30, 2017 and 2016, respectively, which includes expected return on plan assets, interest costs and non-cash amortization of actuarial gains and losses. |

• | $3.1 billion of lower gains due to the nonrecurrence of the sale of our Appliances business to Haier in the second quarter of 2016. |

• | $3.1 billion of lower gains due to the nonrecurrence of the sale of our Appliances business to Haier in the second quarter of 2016, and |

• | $0.1 billion of higher costs associated with our principal retirement plans, including the effects of lower discount rates. |

• | $0.5 billion of lower restructuring and other charges, and |

• | $0.1 billion of lower corporate structural costs. |

MD&A | CORPORATE ITEMS AND ELIMINATIONS | |

• | $3.2 billion of lower gains due to the nonrecurrence of a $3.1 billion gain from the sale of our Appliances business to Haier in the second quarter of 2016 and a $0.1 billion gain from the sale of two floors in 30 Rockefeller Plaza, New York City in the first quarter of 2016. |

• | $3.2 billion of lower gains due to the nonrecurrence of a $3.1 billion gain from the sale of our Appliances business to Haier in the second quarter of 2016 and a $0.1 billion gain from the sale of two floors in 30 Rockefeller Plaza, New York City in the first quarter of 2016, and |

• | $0.1 billion of higher costs associated with our principal retirement plans, including the effects of lower discount rates. |

• | $0.2 billion of lower corporate structural costs, and |

• | $0.1 billion of lower restructuring and other charges. |

RESTRUCTURING & OTHER CHARGES | ||||||||||||||||

Three months ended June 30 | Six months ended June 30 | |||||||||||||||

(In billions) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

Workforce reductions | $ | 0.2 | $ | 0.4 | $ | 0.7 | $ | 0.6 | ||||||||

Plant closures & associated costs and other asset write-downs | 0.3 | 0.6 | 0.5 | 0.7 | ||||||||||||

Acquisition/disposition net charges | 0.2 | 0.1 | 0.4 | 0.4 | ||||||||||||

Other | — | 0.1 | 0.1 | 0.2 | ||||||||||||

Total | $ | 0.7 | $ | 1.2 | $ | 1.7 | $ | 1.9 | ||||||||

MD&A | CORPORATE ITEMS AND ELIMINATIONS | |

COSTS | |||||||||||||||

Three months ended June 30 | Six months ended June 30 | ||||||||||||||

(In billions) | 2017 | 2016 | 2017 | 2016 | |||||||||||

Power | $ | 0.1 | $ | 0.3 | $ | 0.5 | $ | 0.5 | |||||||

Renewable Energy | 0.1 | 0.1 | 0.2 | 0.2 | |||||||||||

Oil & Gas | 0.1 | 0.4 | 0.2 | 0.5 | |||||||||||

Aviation | — | — | — | 0.1 | |||||||||||

Healthcare | 0.1 | 0.1 | 0.1 | 0.3 | |||||||||||

Transportation | — | 0.1 | 0.1 | 0.2 | |||||||||||

Energy Connections & Lighting | 0.1 | 0.1 | 0.3 | 0.2 | |||||||||||

Total | $ | 0.6 | $ | 1.2 | $ | 1.4 | $ | 1.9 | |||||||

MD&A | OTHER CONSOLIDATED INFORMATION | |

PROVISION (BENEFIT) FOR INCOME TAXES |

• | The consolidated income tax rate was 1% and 12% for the quarters ended June 30, 2017 and 2016, respectively. |

• | The second quarter 2017 consolidated tax rate reflects a 104% tax rate on $0.2 billion of pre-tax loss at GE Capital and a 13% tax rate on $1.7 billion of pre-tax income at GE. |

• | The second quarter 2016 consolidated tax rate reflects a 27% tax rate on $0.6 billion of pre-tax loss at GE Capital and a 14% tax rate on $4.4 billion of pre-tax income at GE. |

• | The consolidated tax provision includes $0.2 billion and $0.6 billion for GE (excluding GE Capital) for the second quarters of 2017 and 2016, respectively. |

• | Consolidated income tax expense was insignificant in the second quarter of 2017 and $0.5 billion for the second quarter of 2016. The decrease in tax expense is primarily due to the decrease in pre-tax income taxed at above the average tax rate primarily from the non-repeat of the Appliances disposition and a larger benefit from global activities, partially offset by a smaller adjustment in the second quarter of 2017 compared to the second quarter of 2016 to bring the tax rate in-line with the lower projected full-year rate and the non-repeat of deductible stock loss. |

MD&A | OTHER CONSOLIDATED INFORMATION | |

• | The consolidated tax rate was 1% in the first six months of 2017 compared to 7% in the first six months of 2016. |

• | The first six months of 2017 consolidated tax rate reflects a 99% tax rate on $0.3 billion of pre-tax loss at GE Capital and a 14% tax rate on $2.7 billion of pre-tax income at GE. |

• | The first six months of 2016 consolidated tax rate reflects a 32% tax rate on $1.6 billion of pre-tax loss at GE Capital and a 14% tax rate on $5.6 billion of pre-tax income at GE. |

• | The consolidated tax provision includes $0.4 billion and $0.8 billion for GE (excluding GE Capital) for the first six months of 2017 and 2016, respectively. |

• | Consolidated income tax expense was insignificant for the first six months of 2017 compared to $0.3 billion for the first six months of 2016. The decrease in tax expense is primarily due to the decrease in pre-tax income taxed at above the average tax rate primarily from the non-repeat of the Appliances disposition and a larger benefit from global activities. This decrease was partially offset by the adjustment to increase the 2017 year-to-date rate to be in-line with the higher projected full-year rate compared to the decrease in the 2016 year-to-date rate to be in-line with the lower projected full-year rate and the non-repeat of deductible stock loss. |

MD&A | STATEMENT OF FINANCIAL POSITION | |

JUNE 30, 2017

• | Cash and equivalents decreased $4.1 billion. GE Cash and equivalents increased $3.7 billion due to the issuance of long-term debt, primarily to fund acquisitions, of $8.6 billion, long-term intercompany loans from GE Capital of $4.1 billion and common dividends from GE Capital of $4.0 billion. The increase was partially offset by payments of dividends to shareowners of $4.2 billion, treasury stock net purchases of $2.7 billion (cash basis), business acquisitions of $2.6 billion, net PP&E additions of $1.4 billion, the settlement of the remaining portion of a 2016 short-term loan from GE Capital of $1.3 billion and cash used for industrial operating activities of $0.4 billion. GE Capital Cash and equivalents decreased $7.8 billion primarily driven by $13.0 billion net repayments of debt, $4.2 billion in payments of dividends to shareowners, long-term intercompany loans to GE of $4.1 billion, partially offset by $5.0 billion in maturities of liquidity investments, $2.8 billion in net collections of financing receivables, $2.2 billion related to cash collections from discontinued operations, $1.8 billion of proceeds from borrowings assumed by the buyer in a business disposition and $1.3 billion settlement of the remaining portion of a 2016 short-term loan to GE. See the Statement of Cash Flows section for additional information. |

• | Investment securities decreased $4.3 billion, primarily due to maturities of liquidity portfolio investments at GE Capital. See Note 3 to the consolidated financial statements for additional information. |

• | Contract assets increased $3.8 billion, primarily due to adjustments driven by lower forecasted cost to complete the contracts and timing of billings relative to revenue recognition on our long-term equipment and service contracts. |

• | Assets of businesses held for sale increased $2.4 billion, primarily due to the classification of our Industrial Solutions business, within our Energy Connections & Lighting segment, as held for sale in the first quarter of 2017. See Note 2 to the consolidated financial statements for additional information. |

• | Assets of discontinued operations decreased $7.0 billion, primarily due to the disposition of businesses at GE Capital. See Note 2 to the consolidated financial statements for additional information. |

• | Borrowings decreased $1.8 billion, primarily due to net repayment of debt at GE Capital of $13.0 billion, partially offset by the issuance of long-term debt at GE of $8.6 billion, primarily to fund acquisitions, and the effects of currency exchange of $2.5 billion. See Note 10 to the consolidated financial statements for additional information. |

• | Liabilities of discontinued operations decreased $3.2 billion, primarily driven by the disposition of businesses at GE Capital. See Note 2 to the consolidated financial statements for additional information. |

• | Common stock held in treasury increased $2.6 billion, primarily due to treasury stock purchases of $3.6 billion (book basis), partially offset by treasury stock issuances of $1.0 billion. |

MD&A | FINANCIAL RESOURCES AND LIQUIDITY | |

June 30, 2017 (in billions) | GE | GE Capital | Consolidated(a) | ||||||

External debt | $ | 81.9 | $ | 54.7 | $ | 134.4 | |||

Debt assumed by GE from GE Capital | (52.3 | ) | 52.3 | — | |||||

Intercompany loans | 4.1 | (4.1 | ) | — | |||||

Total intercompany payable (receivable) between GE and GE Capital | (48.2 | ) | 48.2 | — | |||||

Debt adjusted for assumed debt and intercompany loans | $ | 33.7 | $ | 102.9 | $ | 134.4 | |||

(a) | Includes $2.2 billion elimination of other intercompany borrowings between GE and GE Capital. |

MD&A | FINANCIAL RESOURCES AND LIQUIDITY | |

CASH AND EQUIVALENTS | ||||||||

(In billions) | June 30, 2017 | June 30, 2017 | ||||||

GE(a) | $ | 14.2 | U.S. | $ | 9.8 | |||

GE Capital(b) | 29.8 | Non-U.S.(c) | 34.3 | |||||

(a) | At June 30, 2017, $4.4 billion of GE cash and equivalents was held in countries with currency controls that may restrict the transfer of funds to the U.S. or limit our ability to transfer funds to the U.S. without incurring substantial costs. These funds are available to fund operations and growth in these countries and we do not currently anticipate a need to transfer these funds to the U.S. |

(b) | At June 30, 2017, GE Capital cash and equivalents of about $0.4 billion were primarily in insurance entities and were subject to regulatory restrictions. |

(c) | Of this amount at June 30, 2017, $4.8 billion is held outside of the U.S. and is available to fund operations and other growth of non-U.S. subsidiaries; it is also available to fund our needs in the U.S. on a short-term basis through short-term loans, without being subject to U.S. tax. Under the Internal Revenue Code, these loans are permitted to be outstanding for 30 days or less and the total of all such loans is required to be outstanding for less than 60 days during the year. If we were to repatriate this cash, we would be subject to additional U.S. income taxes and foreign withholding taxes. |

COMMERCIAL PAPER | |||||||

(In billions) | GE | GE Capital | |||||

Average commercial paper borrowings during the second quarter of 2017 | $ | 16.0 | $ | 5.0 | |||

Maximum commercial paper borrowings outstanding during the second quarter of 2017 | 19.6 | 5.1 | |||||

MD&A | FINANCIAL RESOURCES AND LIQUIDITY | |

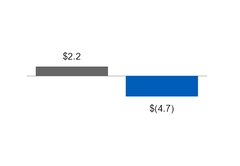

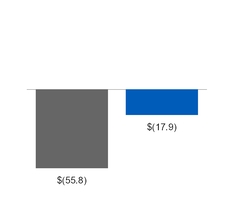

OPERATING CASH FLOWS | INVESTING CASH FLOWS | FINANCING CASH FLOWS | |||||

2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

MD&A | FINANCIAL RESOURCES AND LIQUIDITY | |

• | GE Capital paid common dividends to GE totaling $4.0 billion in 2017 compared to $11.0 billion in 2016. |

• | Cash used for industrial operating activities amounted to $0.4 billion and $0.2 billion in 2017 and 2016, respectively, primarily due to the following: |

• | Net income plus depreciation and deferred income taxes of $3.4 billion in 2017 compared to $6.6 billion in 2016, which included an after-tax gain of $1.8 billion from the sale of Appliances. |

• | Cash used for working capital of $0.6 billion and $1.9 billion in 2017 and 2016, respectively. The decrease was primarily due to reduction in inventory build, partially offset by an increase in cash used for accounts payable. |

• | An increase in contract assets of $3.2 billion and $2.4 billion in 2017 and 2016, respectively, primarily due to adjustments driven by lower forecasted cost to complete the contracts and timing of billings relative to revenue recognition on our long-term equipment and service contracts. |

• | See Note 21 to the consolidated financial statements for further information regarding cash sources and uses as well as non-cash adjustments to net income reported as All other operating activities. |

• | Business acquisition activities of $2.6 billion, primarily driven by the acquisition of LM Wind Power for $1.6 billion (net of cash acquired) and ServiceMax for $0.9 billion (net of cash acquired) in 2017. |

• | The sale of our Appliances business for proceeds of $4.8 billion in 2016. |

• | This is partially offset by the funding of a joint venture at our Aviation business of $0.3 billion in 2016. |

• | Net repurchases of GE treasury shares of $2.7 billion and $14.3 billion in 2017 and 2016, respectively. |

• | A net increase in borrowings of $11.7 billion in 2017, mainly driven by the issuance of long-term debt of $8.6 billion, primarily to fund acquisitions, and long-term loans from GE Capital to GE of $4.1 billion, partially offset by the settlement of the remaining portion of a 2016 short-term loan from GE Capital to GE of $1.3 billion, compared to a net increase in borrowings of $5.5 billion in 2016, primarily driven by a short-term loan from GE Capital to GE of $5.0 billion. |

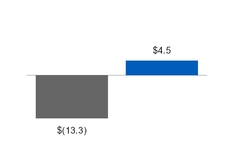

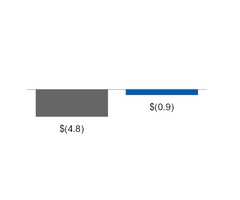

OPERATING CASH FLOWS | INVESTING CASH FLOWS | FINANCING CASH FLOWS | |||||

2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

MD&A | FINANCIAL RESOURCES AND LIQUIDITY | |

• | Lower income tax payments of $1.1 billion and a general increase in cash generated from earnings of continuing operations. |

• | These increases were partially offset by a net decrease in cash collateral received from counterparties on derivative contracts of $0.5 billion. |

• | Net proceeds from the sales of our discontinued operations of $0.8 billion in 2017 compared to $42.9 billion in 2016. |

• | Investments and maturities of $6.8 billion related to interest bearing deposits reflecting maturities of $10.4 billion and investments of $3.6 billion in 2016. |

• | Net cash received from derivative settlements of $0.1 billion in 2017 compared to $1.0 billion in 2016. |

• | These decreases were partially offset by the following increases: |

• | Investment securities of $10.7 billion related to investments of $5.7 billion in 2016 and maturities of $5.0 billion in 2017. |

▪ | Long-term loans from GE Capital to GE of $4.1 billion, partially offset by the settlement of the remaining portion of a 2016 short-term loan from GE Capital to GE of $1.3 billion in 2017 compared to a short-term loan from GE Capital to GE of $5.0 billion in 2016. |

• | Higher net collections of financing receivables of $1.6 billion in 2017. |

• | A general reduction in funding related to discontinued operations. |

• | Lower net repayments of borrowings of $13.0 billion compared to $44.5 billion in 2016. |

• | GE Capital paid common dividends to GE totaling $4.0 billion compared to $11.0 billion in 2016. |

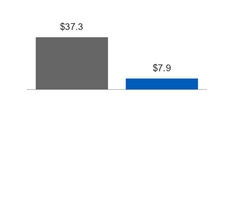

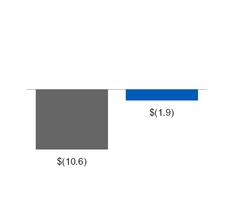

OPERATING CASH FLOWS | INVESTING CASH FLOWS | FINANCING CASH FLOWS | |||||

2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

• | Lower cash paid for income taxes in 2017. |

• | The sale of bank deposits of $16.5 billion resulting in net cash paid in conjunction with the sale of GE Capital Bank's U.S. online deposit platform during 2016. |

• | Reduction in funding from continuing operations (primarily our treasury operations). |

• | Sale of bank deposits for $0.5 billion resulting in net cash paid related to our Consumer platform during 2017. |

MD&A | FINANCIAL RESOURCES AND LIQUIDITY | |

• | Debt issued of $1.8 billion by a discontinued business sold during the first quarter of 2017. |

• | Lower repayment of borrowings and bank deposit activity of $0.7 billion. |

• | GE Capital dividends to GE, |

• | GE Capital working capital solutions to optimize GE cash management, |

• | GE Capital enabled GE industrial orders, and |

• | Aircraft engines, power equipment, renewable energy equipment and healthcare equipment manufactured by GE that are installed on GE Capital investments, including leased equipment. |

• | Expenses related to parent-subsidiary pension plans, |

• | Buildings and equipment leased between GE and GE Capital, including sale-leaseback transactions, |

• | Information technology (IT) and other services sold to GE Capital by GE |

• | Settlements of tax liabilities, and |

• | Various investments, loans and allocations of GE corporate overhead costs. |

MD&A | FINANCIAL RESOURCES AND LIQUIDITY | |

MD&A | CRITICAL ACCOUNTING ESTIMATES | |

MD&A | OTHER ITEMS | |

MD&A | OTHER ITEMS | |

MD&A | OTHER ITEMS | |

MD&A | SUPPLEMENTAL INFORMATION | |

• | Industrial segment organic revenues |

• | Operating and non-operating pension cost |

• | Adjusted corporate costs (operating) |

• | Industrial operating earnings and GE Capital earnings (loss) from continuing operations and EPS |

• | Industrial operating + Verticals earnings and EPS |

• | Industrial operating profit and operating profit margin (excluding certain items) |

• | Industrial cash flows from operating activities (Industrial CFOA) and Industrial CFOA excluding deal taxes and GE Pension Plan funding |

MD&A | SUPPLEMENTAL INFORMATION | |

INDUSTRIAL SEGMENT ORGANIC REVENUES | |||||||||||||||||

Three months ended June 30 | Six months ended June 30 | ||||||||||||||||

(In millions) | 2017 | 2016 | V% | 2017 | 2016 | V% | |||||||||||

Industrial segment revenues (GAAP) | $ | 28,047 | $ | 28,630 | (2 | )% | $ | 54,063 | $ | 54,499 | (1 | )% | |||||

Adjustments: | |||||||||||||||||

Acquisitions | 218 | 14 | 349 | 16 | |||||||||||||

Business dispositions | — | 1,239 | 10 | 2,795 | |||||||||||||

Currency exchange rates | (162 | ) | — | (270 | ) | — | |||||||||||

Industrial segment organic revenues (Non-GAAP) | $ | 27,992 | $ | 27,376 | 2 | % | $ | 53,973 | $ | 51,688 | 4 | % | |||||

OPERATING AND NON-OPERATING PENSION COST | |||||||||||||

Three months ended June 30 | Six months ended June 30 | ||||||||||||

(In millions) | 2017 | 2016 | 2017 | 2016 | |||||||||

Service cost for benefits earned | $ | 254 | $ | 291 | $ | 543 | $ | 606 | |||||

Prior service cost amortization | 72 | 76 | 145 | 152 | |||||||||

Curtailment loss (gain) | — | (1 | ) | 43 | (1 | ) | |||||||

Operating pension cost (Non-GAAP) | 326 | 366 | 731 | 757 | |||||||||

Expected return on plan assets | (849 | ) | (836 | ) | (1,698 | ) | (1,670 | ) | |||||

Interest cost on benefit obligations | 712 | 735 | 1,429 | 1,469 | |||||||||

Net actuarial loss amortization | 697 | 612 | 1,407 | 1,224 | |||||||||

Non-operating pension cost (Non-GAAP) | 560 | 511 | 1,138 | 1,023 | |||||||||

Total principal pension plans cost (GAAP) | $ | 886 | $ | 877 | $ | 1,869 | $ | 1,780 | |||||

MD&A | SUPPLEMENTAL INFORMATION | |

ADJUSTED CORPORATE COSTS (OPERATING) | |||||||||||||

Three months ended June 30 | Six months ended June 30 | ||||||||||||

(In millions) | 2017 | 2016 | 2017 | 2016 | |||||||||

Total Corporate Items and Eliminations (GAAP) | $ | (1,583 | ) | $ | 974 | $ | (3,592 | ) | $ | (597 | ) | ||

Less: non-operating pension cost (Non-GAAP) | (560 | ) | (511 | ) | (1,138 | ) | (1,023 | ) | |||||

Total Corporate costs (operating) (Non-GAAP) | $ | (1,023 | ) | $ | 1,485 | $ | (2,454 | ) | $ | 426 | |||

Less: restructuring and other charges | (709 | ) | (1,188 | ) | (1,728 | ) | (1,874 | ) | |||||

Less: gains (losses) on disposals | — | 3,129 | 2 | 3,188 | |||||||||

Adjusted total corporate costs (operating) (Non-GAAP) | $ | (314 | ) | $ | (456 | ) | $ | (728 | ) | $ | (887 | ) | |

INDUSTRIAL OPERATING EARNINGS AND GE CAPITAL EARNINGS (LOSS) FROM CONTINUING OPERATIONS AND EPS | |||||||||||||||||

Three months ended June 30 | Six months ended June 30 | ||||||||||||||||

(Dollars in millions; except per-share amounts) | 2017 | 2016 | V% | 2017 | 2016 | V% | |||||||||||

Consolidated earnings (loss) from continuing operations attributable to GE common shareowners (GAAP) | $ | 1,338 | $ | 3,300 | (59 | )% | $ | 2,196 | $ | 3,548 | (38 | )% | |||||

Non-operating pension cost | 560 | 511 | 1,138 | 1,023 | |||||||||||||

Tax effect on non-operating pension cost(a) | (196 | ) | (179 | ) | (398 | ) | (358 | ) | |||||||||

Adjustment: non-operating pension cost (net of tax) | 364 | 332 | 740 | 665 | |||||||||||||

Operating earnings (loss) (Non-GAAP) | 1,702 | 3,632 | (53 | )% | 2,936 | 4,213 | (30 | )% | |||||||||

Less: GE Capital earnings (loss) from continuing operations attributable to GE common shareowners | (172 | ) | (600 | ) | (219 | ) | (1,492 | ) | |||||||||

Industrial operating earnings (loss) (Non-GAAP) | $ | 1,873 | $ | 4,232 | (56 | )% | $ | 3,155 | $ | 5,705 | (45 | )% | |||||

Earnings (loss) per share (EPS) – diluted(b) | |||||||||||||||||

Consolidated EPS from continuing operations attributable to GE common shareowners (GAAP) | $ | 0.15 | $ | 0.36 | (58 | )% | $ | 0.25 | $ | 0.38 | (34 | )% | |||||

Adjustment: non-operating pension cost (net of tax) | 0.04 | 0.04 | 0.08 | 0.07 | |||||||||||||

Operating EPS (Non-GAAP) | 0.19 | 0.39 | (51 | )% | 0.33 | 0.45 | (27 | )% | |||||||||

Less: GE Capital EPS from continuing operations attributable to GE common shareowners (GAAP) | (0.02 | ) | (0.07 | ) | 71 | % | (0.02 | ) | (0.16 | ) | 88 | % | |||||

Industrial operating EPS (Non-GAAP) | $ | 0.21 | $ | 0.46 | (54 | )% | $ | 0.36 | $ | 0.61 | (41 | )% | |||||

(a) | The tax effect on non-operating pension cost was calculated using a 35% U.S. federal statutory tax rate, based on its applicability to such cost. |

(b) | Earnings per share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total. |

MD&A | SUPPLEMENTAL INFORMATION | |

INDUSTRIAL OPERATING + VERTICALS EARNINGS AND EPS | |||||||||||||||||

Three months ended June 30 | Six months ended June 30 | ||||||||||||||||

(Dollars in millions; except per-share amounts) | 2017 | 2016 | V% | 2017 | 2016 | V% | |||||||||||

GE Capital earnings (loss) from continuing operations attributable to GE common shareowners (GAAP) | $ | (172 | ) | $ | (600 | ) | 71 | % | $ | (219 | ) | $ | (1,492 | ) | 85 | % | |

Less: GE Capital other continuing earnings (loss) (Other Capital)(a) | (716 | ) | (1,051 | ) | (1,298 | ) | (2,440 | ) | |||||||||

Verticals earnings(b) | 544 | 452 | 20 | % | 1,079 | 948 | 14 | % | |||||||||

Industrial operating earnings (Non-GAAP) | 1,873 | 4,232 | (56 | )% | 3,155 | 5,705 | (45 | )% | |||||||||

Industrial operating earnings + Verticals earnings (Non-GAAP) | $ | 2,418 | $ | 4,684 | (48 | )% | $ | 4,234 | $ | 6,653 | (36 | )% | |||||

Earnings (loss) per share (EPS) - diluted(c) | |||||||||||||||||

GE Capital EPS from continuing operations attributable to GE common shareowners | $ | (0.02 | ) | $ | (0.07 | ) | 71 | % | $ | (0.02 | ) | $ | (0.16 | ) | 88 | % | |

Less: GE Capital other continuing EPS (Other Capital) | (0.08 | ) | (0.11 | ) | (0.15 | ) | (0.26 | ) | |||||||||

Verticals EPS | $ | 0.06 | $ | 0.05 | 20 | % | $ | 0.12 | $ | 0.10 | 20 | % | |||||

Industrial operating EPS (Non-GAAP) | 0.21 | 0.46 | (54 | )% | 0.36 | 0.61 | (41 | )% | |||||||||

Industrial operating + Verticals EPS (Non-GAAP) | $ | 0.28 | $ | 0.51 | (45 | )% | $ | 0.48 | $ | 0.72 | (33 | )% | |||||

Consolidated EPS from continuing operations attributable to GE common shareowners (GAAP) | $ | 0.15 | $ | 0.36 | (58 | )% | $ | 0.25 | $ | 0.38 | (34 | )% | |||||

Less: non-operating pension cost (net of tax) | (0.04 | ) | (0.04 | ) | (0.08 | ) | (0.07 | ) | |||||||||

Less: Other Capital | (0.08 | ) | (0.11 | ) | (0.15 | ) | (0.26 | ) | |||||||||

Industrial operating + Verticals EPS (Non-GAAP) | $ | 0.28 | $ | 0.51 | (45 | )% | $ | 0.48 | $ | 0.71 | (32 | )% | |||||

(a) | Includes interest on non-Verticals borrowings, restructuring costs and allocations of GE and GE Capital headquarters costs in excess of those allocated to the Verticals. |

(b) | Verticals include businesses expected to be retained (GECAS, Energy Financial Services, Industrial Finance, and run-off insurance activities), including allocated corporate after-tax costs of $25 million in both the three months ended June 30, 2017 and 2016, and $50 million in both the six months ended June 30, 2017 and 2016. |

(c) | Earnings per share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total. |

MD&A | SUPPLEMENTAL INFORMATION | |

INDUSTRIAL OPERATING PROFIT AND OPERATING PROFIT MARGIN (EXCLUDING CERTAIN ITEMS) | |||||||||||||

Three months ended June 30 | Six months ended June 30 | ||||||||||||

(Dollars in millions) | 2017 | 2016 | 2017 | 2016 | |||||||||

Revenues | |||||||||||||

GE total revenues and other income | $ | 27,421 | $ | 30,604 | $ | 52,902 | $ | 55,210 | |||||

Less: GE Capital earnings (loss) from continuing operations | (172 | ) | (600 | ) | (219 | ) | (1,492 | ) | |||||

GE revenues and other income excluding GE Capital earnings (loss) (Industrial revenues) (GAAP) | 27,593 | 31,204 | 53,121 | 56,702 | |||||||||

Less: gains on disposals | — | 3,129 | 2 | 3,188 | |||||||||

Adjusted Industrial revenues (Non-GAAP) | $ | 27,593 | $ | 28,075 | $ | 53,119 | $ | 53,515 | |||||

Costs | |||||||||||||

GE total costs and expenses | $ | 25,883 | $ | 26,756 | $ | 50,441 | $ | 51,069 | |||||