Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-3671

GENERAL DYNAMICS CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

13-1673581 | |||

| State or other jurisdiction of incorporation or organization |

IRS Employer Identification No. |

| 2941 Fairview Park Drive, Suite 100, Falls Church, Virginia |

22042-4513 | |||

| Address of principal executive offices | Zip code |

Registrant’s telephone number, including area code:

703 876-3000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of exchange on which registered | |||

| Common stock, par value $1.00 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act). Large Accelerated Filer x Accelerated Filer ¨ Non-Accelerated Filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant was approximately $20,125,000,000 as of July 3, 2005 (based on the closing price of the shares on the New York Stock Exchange).

200,144,251 shares of the registrant’s common stock were outstanding at January 29, 2006.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III incorporates information from certain portions of the registrant’s definitive proxy statement for the 2006 annual meeting of shareholders to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year.

Table of Contents

2 General Dynamics 2005 Annual Report

Table of Contents

(Dollars in millions, unless otherwise noted)

BUSINESS OVERVIEW

General Dynamics is a market leader in information systems and technologies; land and expeditionary combat vehicles and systems, armaments and munitions; shipbuilding and marine systems; and business aviation. Incorporated in Delaware, the company employs approximately 72,200 people and has a presence worldwide.

Formed in 1952 through the combination of Electric Boat Company, Consolidated Vultee (CONVAIR) and other companies, General Dynamics grew internally and through acquisitions until the early 1990s, when it sold all of its divisions except Electric Boat and Land Systems. Beginning in 1995, the company expanded those two core defense businesses by purchasing other shipyards and combat vehicle-related businesses. In 1997, to reach a new, growing market, the company began acquiring companies with expertise in information technology products and services, particularly in the command, control, communications, computing, intelligence, surveillance and reconnaissance (C4ISR) arenas. In 1999, the company purchased Gulfstream Aerospace Corporation, a business-jet aircraft and aviation-support-services company. In the last 10 years, General Dynamics has acquired and successfully integrated 40 businesses, including three in 2005.

General Dynamics focuses on creating shareholder value while delivering the best products and services possible to its military, other government and commercial customers. The company emphasizes excellence in program management and continual improvement in all of its operations. General Dynamics values ethical behavior and promotes a culture of integrity throughout all aspects of its businesses. This culture is evident in how the company deals with shareholders, employees, customers, partners and the communities in which it operates.

General Dynamics has four primary business groups – Information Systems and Technology, Combat Systems, Marine Systems and Aerospace – and a small Resources group.

PRODUCTS AND SERVICES

INFORMATION SYSTEMS AND TECHNOLOGY

The Information Systems and Technology group provides systems integration expertise, hardware and software products and support services in three principal markets.

| • | Tactical and strategic mission systems: The group designs, builds and services complex command, control, communications and computing systems for defense customers worldwide, and is a recognized leader in information assurance products and systems for U.S. national security customers. |

| • | Intelligence mission systems: For the U.S. intelligence community, the group provides highly specialized signals and information collection, processing and distribution systems; special-purpose computing; multi-level security; data mining and fusion; special-mission satellites and payloads; and information operations services. |

| • | Network infrastructure and information technology services: The group provides world-class design, development, installation and integration of voice, video and data networks, as well as a full spectrum of information technology (IT) support services (such as staff augmentation and skilled mission support) to military and other government agencies and select commercial customers. |

Acquisitions and new program wins since 1997 have combined to build capabilities that address each of these markets across a wide range of land, sea, air and space platforms. As a result, the group has a broad customer base that includes the U.S. Army, Marine Corps, Air Force, Navy and Coast Guard; the U.S. national security community; and international customers.

Information Systems and Technology’s total revenues have more than doubled over the past three years, reflecting the increasing use of digital, network-centric C4ISR and information-sharing technologies in the U.S. national security community. The U.S. intelligence community’s drive to improve its information-sharing capabilities increasingly requires additional secure, networked communications systems. The company expects that meeting emerging requirements among homeland defense customers to link local, state and federal communities will create another potential growth area for the group.

General Dynamics 2005 Annual Report 3

Table of Contents

Among the key offerings that differentiate the company in these evolving markets are:

| • | technologies that enable on-the-move command, control and communications, which make ground forces more agile and effective, support widely dispersed operations and reduce the size of support infrastructure; |

| • | capabilities to link soldiers, sensors and weapons in real time, as well as the ability for commanders to maintain a clear perspective of the battlefield that can be shared at all levels of command; |

| • | development of “open architecture” mission systems based on open-source software and commercial-off-the-shelf technology that add advanced capabilities to land, sea and airborne platforms at reduced technical risk and cost; |

| • | cost-effective, operationally responsive special-mission satellites, payloads and services; |

| • | information assurance technologies, products, systems and services that ensure the security, integrity and confidentiality of digital communications worldwide; and |

| • | IT services and network infrastructure, from system architecture and design to build-out, maintenance, operations and upgrades. |

Recent examples of the value of these offerings to the company’s customers from among the Information Systems and Technology group’s portfolio of more than 3,000 contracts include the following:

In November, the company successfully demonstrated a new on-the-move voice, video and data communications network known as the Warfighter Information Network-Tactical (WIN-T) for the Army. This demonstration proved, for the first time, that the required technologies and network-management skills exist to support secure, high-speed communication across a dynamic Internet Protocol network of fixed and mobile nodes using ground, airborne and satellite assets. WIN-T is a self-forming, self-healing network, requiring significantly less human involvement than existing systems. The demonstration was a key milestone in the development of WIN-T which, when deployed, will be the principal tactical communications network for the Army.

Information Systems and Technology continued its work on similar network development and deployment programs for international customers as well. The group delivered the first functional brigade set of the new BOWMAN tactical network to the United Kingdom’s Ministry of Defence, which promptly deployed it to support operations in Iraq. In addition, the Royal Dutch Marines awarded the group a contract for a BOWMAN-type system for its ground force, and the Australian Land Forces selected the group for the initial phase of a similar program called the Battlespace Communications System (Land) or “JP 2072.”

In a program designed to provide real-time links among soldiers, sensors and platforms, the Information Systems and Technology group continued its work on the small, lightweight Cluster 5 radios of the Joint Tactical Radio System (JTRS). When deployed in compact configurations ranging from handheld radios to unattended sensors and unmanned aerial vehicles, this technology will enable U.S. forces to communicate more effectively than they can with existing systems.

The company provides systems integration and design agent services for the Navy’s Open Architecture Track Manager (OATM) project, and has taken a leading role in demonstrating the value of an “open architecture” approach to mission systems on several platforms. These include the Navy’s Littoral Combat Ship and the Canadian Defence Forces’ Maritime Helicopter Project. This open architecture approach is designed to facilitate the rapid introduction of emerging technologies to platform-based mission systems at significantly lower cost and risk than is feasible under the legacy approach.

Information Systems and Technology brings its expertise to the homeland security arena as well. For example, it has a contract to provide all site integration, program and construction management for radio access in the New York Statewide Wireless Network (SWN). In addition, Information Systems and Technology is the prime contractor on the Coast Guard’s Rescue 21 communications system, which is designed to provide enhanced command-and-control communications as well as improved search-and-rescue capabilities. The group also provides IT services and other support to homeland security organizations in locations across the country.

In 2005, General Dynamics completed three acquisitions to strengthen the Information Systems and Technology group’s market position. In April, the company acquired privately held MAYA Viz Ltd., a leader in visualization and collaboration technologies that support real-time decision making. In August, General Dynamics purchased Tadpole Computer, Inc., a provider of Unix®-based mobile, secure and battlefield-tested computing platforms for mission-critical military, government and commercial operations. In September, the company acquired Itronix Corporation, further expanding its offerings of wireless, rugged, mobile computing solutions, especially for defense customers. In January 2006, the company acquired privately held FC Business Systems, Inc., which provides a broad spectrum of IT services to a variety of government customers. General Dynamics also has entered into a definitive agreement to acquire Anteon International Corporation, a leading information systems integration company that provides mission, operational and IT enterprise support to the U.S. government. The company expects the Anteon transaction to close in the first half of 2006.

4 General Dynamics 2005 Annual Report

Table of Contents

Net sales for the Information Systems and Technology group were 37 percent of the company’s consolidated net sales in 2005, 35 percent in 2004 and 30 percent in 2003. Net sales by major products and services were as follows:

| Year Ended December 31 | 2005 | 2004 | 2003 | ||||||

| Tactical and strategic mission systems |

$ | 3,912 | $ | 2,966 | $ | 2,221 | |||

| Intelligence mission systems |

2,110 | 2,006 | 1,314 | ||||||

| Network infrastructure and IT services |

1,804 | 1,750 | 1,313 | ||||||

| $ | 7,826 | $ | 6,722 | $ | 4,848 | ||||

COMBAT SYSTEMS

The Combat Systems group is a leading supplier of land and expeditionary combat systems around the world, providing tracked and wheeled armored combat vehicles, armament systems and ammunition to the U.S. military and its allies. The group supplies, supports and enhances existing products and develops new combat systems for the future. Specific Combat Systems product lines include the development, manufacture and support of the following:

| • | a full spectrum of wheeled armored combat vehicles, |

| • | tracked main battle tanks and infantry fighting vehicles, |

| • | guns and ammunition-handling systems, |

| • | ammunition and ordnance, |

| • | reactive armor and protection systems, |

| • | mobile bridge systems, |

| • | chemical and biohazard detection products, and |

| • | radomes and other complex composite components for aerospace systems. |

Among its key offerings, Combat Systems produces the Army’s Stryker wheeled infantry combat vehicle, a focal point of the Army’s .ongoing transformation. The rapid development and deployment of this program, which progressed from design to fielding in just four years, demonstrates the Combat Systems group’s ability to anticipate and quickly respond to evolving customer needs.

The ability of U.S. Stryker Brigade Combat Teams to cover great distances rapidly and engage in combat operations immediately upon arrival has significantly enhanced the Army’s operational flexibility and tactical agility. In support of Operation Iraqi Freedom, Army personnel drove 310 Stryker vehicles more than six million miles in less than two years with an operational readiness rate above 95 percent. Stryker vehicle configurations include carriers for mortars, engineer squads, infantry squads, command groups and fire support teams; as well as a nuclear, biological and chemical reconnaissance vehicle; an anti-tank guided missile vehicle; a medical evacuation variant; and a Mobile Gun System featuring a 105mm cannon mounted on a low-profile turret integrated into the Stryker chassis.

General Dynamics also produces the United States’ main battle tank, the Abrams, which has been highly effective in both open and urban Iraqi terrain. The M1A2, with its System Enhancement Package (SEP), is the latest, most technologically advanced Abrams configuration. It is a fully digital platform with an enhanced command-and-control system, second-generation thermal sights and improved armor. The SEP configuration integrates new information technologies to improve soldier warfighting capability with enhanced digital features, including color maps and displays, high-density computer memory, increased microprocessing speed and improved communications capabilities.

Combat Systems is completing the development of the Marine Corps’ Expeditionary Fighting Vehicle (EFV). The EFV’s breakthrough design provides excellent cross-country mobility, lethal firepower, high speed on water and land, extensive information and communications networking, and enhanced crew protection and survivability. These attributes are designed to provide the Marine Corps with greater lethality and operational ability. Low-rate initial production is expected to begin in 2007. The company anticipates production of more than 1,000 units for the Marines through 2020, as well as additional vehicles for international sales.

The company’s European business is a recognized combat systems integrator with manufacturing and production sites in Austria, Germany, Spain and Switzerland, and has customers in more than 30 countries. General Dynamics continues to grow this business through the design, manufacture and marketing of light- and medium-weight tracked and wheeled tactical vehicles, amphibious bridge systems, artillery systems, light weapons, ammunition and propellants. Among the group’s successes in 2005 were contracts with several European customers, including agreements to provide Pandur II armored combat vehicles to the Portuguese army and navy, self-propelled howitzers to the Spanish army, Duro III wheeled armored vehicles to the German armed forces, and Eagle IV armored patrol vehicles to the Danish army.

The Combat Systems group is involved in numerous efforts to bring advanced technologies into the current force and to help the Department of Defense achieve its transformation objectives. The group is a key participant in the development of manned and unmanned ground vehicles and key technologies for Future Combat Systems (FCS), the Army’s largest development program. The Army plans to begin FCS vehicle production in 2010 and expects to integrate several mature FCS technologies into the current force beginning in 2008. In addition, the Marine Corps has selected the group to develop and produce the Expeditionary Fire Support System (EFSS), a

General Dynamics 2005 Annual Report 5

Table of Contents

120mm mortar system that can be internally transported by the V22 Osprey. The group also leads the consortium that is developing highly advanced robotic ground vehicles to expand the Army’s capabilities while reducing risk to soldiers.

The Combat Systems group provides solutions to new and emerging threats faced by U.S. forces around the world. For example, the group produces chemical and biological detection systems for the U.S. government, including the Joint Biological Point Detection System (JBPDS), the first deployed near-real-time biological detection capability. In addition, the group has provided solutions to protect against improvised explosive devices (IED) to the Army, Marines and Department of Homeland Security.

Combat Systems is a leader in the field of high-performance armament systems. This includes weapons carried on most U.S. fighter aircraft, such as high-speed Gatling guns and the Hydra-70 (70mm) family of rockets, as well as individual and crew-served weapons, including the M2 heavy machine gun and the MK19 grenade launcher. Combat Systems manufactures precision metal and composite components, and designs and produces shaped-charge warheads and control actuation systems. In addition, Combat Systems is a major manufacturer of large- and medium-caliber ammunition, bomb bodies and propellant. In 2005 the group was selected as a second source for up to 500 million rounds per year of critical small-caliber ammunition, such as 7.62mm and .50-caliber ammunition and the 5.56mm ammunition fired by the M-16 family of weapons. The group also provides demilitarization services for more than 50 types of munitions.

In February 2006, the company entered into a definitive agreement to acquire SNC Technologies, Inc., an ammunition system integrator that supplies small-, medium- and large-caliber ammunition and related products to armed forces and law enforcement agencies in North America and around the world. The company expects the transaction to close in the second quarter of 2006.

Net sales for the Combat Systems group were 24 percent of the company’s consolidated net sales in 2005, 23 percent in 2004 and 24 percent in 2003. Net sales by major products and services were as follows:

| Year Ended December 31 | 2005 | 2004 | 2003 | ||||||

| Medium armored vehicles and related products |

$ | 1,610 | $ | 1,295 | $ | 1,228 | |||

| Main battle tanks and related products |

931 | 819 | 799 | ||||||

| Engineering and development |

864 | 763 | 639 | ||||||

| Munitions and propellant |

615 | 525 | 406 | ||||||

| Rockets and missile components |

324 | 335 | 278 | ||||||

| Armament systems |

129 | 133 | 145 | ||||||

| Aerospace components and other |

548 | 537 | 512 | ||||||

| $ | 5,021 | $ | 4,407 | $ | 4,007 | ||||

MARINE SYSTEMS

The Marine Systems group designs, builds and supports submarines and a variety of ships for the Navy and commercial customers. These sophisticated platforms and capabilities include:

| • | the Virginia-class attack submarine, |

| • | Trident ballistic-missile submarine conversion (SSGN), |

| • | surface warfare ships [DDG-51, DD(X), LCS], |

| • | auxiliary and combat-logistics ships (T-AKE), |

| • | commercial tankers, |

| • | engineering design support and |

| • | overhaul, repair and life-cycle support services. |

Marine Systems leads the development of the Navy’s new fast-attack Virginia-class submarine and shares construction of these submarines with a teaming partner. In September 2005, the first of the Virginia-class submarines deployed for its initial mission considerably earlier than scheduled, due in large part to innovative production processes pioneered by the group. The Virginia-class submarine is an agile multi-mission platform with stealth, firepower, endurance, and advanced network and communication capabilities. In addition, the group is converting four Trident ballistic-missile submarines to SSGN submarines. The SSGN is a multi-mission submarine optimized for conventional tactical strike and special operations support, important capabilities for potential future engagements around the world. The group delivered the first of the four SSGNs, USS Ohio, to the Navy in December 2005.

The Marine Systems group also is working on a joint Defense Advanced Research Projects Agency (DARPA)/Navy submarine initiative to reduce future submarine costs. As part of this initiative, called Tango Bravo, the group has been tasked with developing and demonstrating three new technologies: an external weapon-launch system, a shaftless propulsion system and ship infrastructure reduction.

The Marine Systems group is the lead designer and producer of Arleigh Burke-class guided-missile destroyers (DDG-51), one of the world’s most advanced surface combatants. Under the Navy’s plan, the company will augment the 26 company-built destroyers already in the fleet by delivering nine more DDGs through 2010, when the Navy plans to transition to construction of the next-generation destroyer [DD(X)]. The company, the Navy and other industry members are now designing this revolutionary multi-mission destroyer. Following the completion of a multi-year initial design and systems-engineering phase, in September 2005 the company received one of two contracts to perform transition work leading to detailed design and construction of the ship. In November 2005, the Department of Defense authorized the DD(X) program’s entry into the final

6 General Dynamics 2005 Annual Report

Table of Contents

development phase prior to ship construction. This crucial milestone also authorized the Navy to pursue an initial production quantity of up to eight ships under a two-lead-ship strategy. The Congress continued its support of the program by fully funding the Navy’s 2006 DD(X) budget requirements. Recognizing the long-term value of two surface-combatant builders to the Navy, the Congress stipulated that the ships be procured at two separate shipyards.

Marine Systems leads one of two industry teams competitively awarded contracts for the design and construction of the Navy’s Littoral Combat Ship (LCS), a key element of the Navy’s plan to address asymmetric maritime threats. As part of the group’s industry team, the Information Systems and Technology group is developing the ship’s core computing infrastructure and electronics. The team’s first high-speed LCS trimaran is now under construction at a teammate’s Alabama facility. Delivery to the Navy is scheduled for October 2007. The multi-mission LCS platform is intended for defense against terrorist swarm boats, mines and submarine threats in coastal areas.

The group’s auxiliary ships support the U.S. military’s forward presence and combat operations by delivering essential military equipment, ammunition, food, fuel, parts and supplies to U.S. forces around the world. In support of the Navy’s global logistics requirements, Marine Systems is leading the innovation of at-sea replenishment through the design and construction of the Lewis and Clark-class (T-AKE) dry cargo/ammunition ship. The first new Navy combat-logistics ship design in almost 20 years, T-AKE is optimized for efficient cargo transfer and is the first modern Navy ship to incorporate proven commercial marine technologies, such as integrated electric-drive propulsion. Integrated electric-drive propulsion is designed to minimize T-AKE operations and maintenance costs over an expected 40-year life. In May, the group launched the first T-AKE, which is scheduled for delivery to the Navy in mid-2006.

The group also designs and manufactures commercial ships, including double-hull oil tankers. The company delivered the third tanker in a four-ship contract to its customer in November, and the fourth tanker is scheduled for completion in 2006.

In addition, the Marine Systems group provides ship and submarine repair and other comprehensive support services to the Navy and commercial customers in a variety of locations throughout the United States and around the globe. Internationally, the group provides key U.S. allies essential program management, planning and design support for submarine and surface-ship construction programs.

Net sales for the Marine Systems group were 22 percent of the company’s consolidated net sales in 2005, 25 percent in 2004 and 26 percent in 2003. Net sales by major products and services were as follows:

| Year Ended December 31 | 2005 | 2004 | 2003 | ||||||

| Nuclear submarines |

$ | 2,396 | $ | 2,432 | $ | 2,256 | |||

| Surface combatants |

1,008 | 1,002 | 973 | ||||||

| Auxiliary and commercial ships |

598 | 576 | 638 | ||||||

| Repair and other services |

693 | 716 | 404 | ||||||

| $ | 4,695 | $ | 4,726 | $ | 4,271 | ||||

AEROSPACE

The Aerospace group designs, develops, manufactures and services a comprehensive fleet of advanced business-jet aircraft. Corporations, private individuals and government users alike rely on these aircraft to fulfill a wide range of requirements. The Aerospace group is known for superior aircraft design, safety, quality and reliability; technologically advanced onboard systems; on-time aircraft delivery; and industry-leading product support.

Since acquiring Gulfstream Aerospace Corporation in 1999, General Dynamics has implemented a strategy of continuous, stable investment in the development of new aircraft models and technological innovations to keep Gulfstream aircraft at the leading edge of business aviation. As a result, the group has revamped and expanded its entire aircraft product line to address additional elements of the business-jet market and introduced new technologies that enhance the reputation of Gulfstream aircraft as powerful business tools.

In the past four years, the group’s product line has increased from two to six aircraft, offering more options at various price and performance points to business-jet customers than ever before. Four of the new aircraft – the G350, G450, G500 and G550 – share the same pilot type rating as the GV, resulting in significant cost efficiencies for multiple-aircraft fleet operators from both a training and a maintenance perspective.

Investment in new technologies, such as the Enhanced Vision System (EVS) and air-to-ground communications capabilities, has accelerated, helping to ensure that Gulfstream aircraft distinguish themselves from the competition. In 2005, the Aerospace group leased a 100,000-square-foot building that will be dedicated in 2006 as the Gulfstream Research and Development Center. It will centralize the company’s research and development efforts in advanced avionics and cabin technologies, enhanced vision systems, and sonic-boom suppression. In addition, the group has continued its commitment to customer service, providing award-winning responsive support that helps maintain its outstanding record of aircraft safety, reliability and availability.

General Dynamics 2005 Annual Report 7

Table of Contents

With six aircraft models available at varying combinations of range, speed and cabin dimensions, the group competes aggressively and effectively in the mid-size to ultra-long-range market sectors.

In 2005, the Aerospace group achieved a number of important milestones that continued to distinguish its products and services from its competition. In cooperation with Israel Aircraft Industries (IAI), the company produced, tested and certified its newest business-jet aircraft, the mid-size, high-speed G150, which replaces the G100. Certified by both the Israel Civil Aviation Authority and the U.S. Federal Aviation Administration (FAA) in November, the G150 offers an entirely new cabin design that can accommodate up to eight passengers. With four passengers onboard, the G150 can fly 2,950 nautical miles nonstop, farther than any other business-jet aircraft in its class.

The company continues to enhance the position of its products outside the United States. In 2005, the European Aviation Safety Agency (EASA) and the Joint Aviation Authorities (JAA) validated the Gulfstream G350 and G500. This enabled the aircraft to be certified and registered by two agencies with extensive European and international membership, broadening the market appeal of each. In the Asia-Pacific region, the company has seen a marked increase in demand for Gulfstream aircraft, driven by corporate globalization and the growing popularity of international air charter services. In the Middle East, historically a strong Gulfstream market, aircraft sales continue to grow.

Because the high altitude capability, range, endurance, reliability and efficiency of Gulfstream aircraft are ideal for meeting a variety of mission requirements, the company remains a leading provider of aircraft for government special-mission applications. In 2005, the company delivered one aircraft to the Japanese Coast Guard for a special search-and-rescue mission; one to the National Center for Atmospheric Research; one to the Israeli Ministry of Defense; and one each to the Army and Navy. A German government agency also ordered a G550 for high-altitude research.

In 2005, the FAA certified the company’s ultra-high-speed broadband multi-link (BBML) system. This advanced technology enables customers to access the Internet at altitudes up to 51,000 feet at connection speeds similar to those typically found in corporate offices. Gulfstream’s BBML service is up to 10 times faster than other widely used in-flight connections. Video conferencing and voice-over-Internet-protocol capabilities are in development and are expected to be offered as options in 2006.

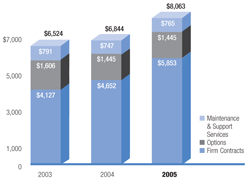

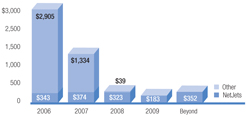

Net sales for the Aerospace group were 16 percent of the company’s consolidated net sales in 2005 and 2004 and 18 percent in 2003. Net sales by major products and services were as follows:

| Year Ended December 31 | 2005 | 2004 | 2003 | ||||||

| New aircraft |

$ | 2,730 | $ | 2,288 | $ | 2,081 | |||

| Aircraft services |

484 | 446 | 408 | ||||||

| Pre-owned aircraft |

219 | 278 | 457 | ||||||

| $ | 3,433 | $ | 3,012 | $ | 2,946 | ||||

8 General Dynamics 2005 Annual Report

Table of Contents

RESOURCES

The Resources group comprises a coal mining business and an aggregates operation that mines sand, stone and gravel for construction use. Net sales were $269 in 2005, $252 in 2004 and $256 in 2003. This represented approximately 1 percent of the company’s consolidated net sales in 2005 and 2004 and 2 percent in 2003.

For additional discussion of the company’s business groups, including significant program wins in 2005, see Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in Part II, Item 7, of this Annual Report on Form 10-K. For information on the revenues, operating earnings and identifiable assets attributable to each of the company’s business groups, see Note R to the Consolidated Financial Statements contained in Part II, Item 8, of this Annual Report on Form 10-K.

COMPETITION

Several factors sustain General Dynamics’ ability to compete successfully in all of its markets. These include the technical excellence, reliability and cost competitiveness of the company’s products and services; its reputation for integrating complex systems and delivering them on schedule; the successful management of the company’s businesses and customer relationships; and a strong company-wide focus on professional ethics.

DEFENSE MARKET

The U.S. government contracts with numerous domestic and foreign companies for defense products and services. General Dynamics competes in this arena against other defense contractors. At times the company has teaming and subcontracting relationships with some of its competitors. Key competitive factors in this market include technological innovation, low-cost production, performance and market knowledge.

The Information Systems and Technology group competes with a host of companies, from large defense companies to smaller niche competitors with specialized technologies. The Combat Systems group competes with both domestic and foreign businesses. The Marine Systems group’s market has only one other primary competitor, Northrop Grumman Corporation, with which it also cooperates on several programs, including the Virginia-class submarine and DD(X) destroyer. The Navy’s LCS program has expanded competition to include another large defense company seeking a role as a prime contractor.

BUSINESS-JET AIRCRAFT MARKET

The business-jet aircraft market is divided into segments based on aircraft range, price and cabin size. Gulfstream has at least one competitor for each of its six products, with proportionately more competitors for the shorter-range aircraft. The key competitive factors include aircraft safety and performance, service quality and timeliness, innovative marketing programs, and price. An important discriminator is technological innovation: business-jet companies that offer next-generation technologies can gain a competitive edge. The company believes that it competes effectively on all these criteria.

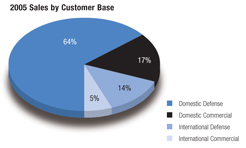

CUSTOMERS

In 2005, 67 percent of the company’s net sales were to the U.S. government; 17 percent were to U.S. commercial customers; 11 percent were directly to international defense customers; and the remaining 5 percent were to international commercial customers.

U. S. GOVERNMENT

The company’s primary customer is the U.S. government, particularly the Department of Defense. General Dynamics is also developing increasingly strong ties with additional U.S. customers throughout the national security community, including intelligence, homeland security and first-responder agencies at both the federal and state level. The company derives approximately two-thirds of its revenues from the U.S. government, either as a prime contractor or as a subcontractor, and expects that its business mix will remain in this range for the foreseeable future.

The company’s net sales to the U.S. government were as follows:

| Year Ended December 31 | 2005 | 2004 | 2003 | |||||||||

| Direct |

$ | 13,617 | $ | 12,473 | $ | 10,405 | ||||||

| Foreign Military Sales * |

587 | 382 | 502 | |||||||||

| Total U.S. government |

$ | 14,204 | $ | 12,855 | $ | 10,907 | ||||||

| Percent of total net sales |

67 | % | 67 | % | 67 | % | ||||||

| * | In addition to its direct international sales, the company sells to foreign governments through the Foreign Military Sales (FMS) program. Under the FMS program, the company contracts with and is paid by the U.S. government, and the U.S. government assumes the risk of collection from the foreign government customer. |

The company performs its U.S. government business under both cost-reimbursement and fixed-price contracts. Contracts for research, engineering, prototypes, repair and maintenance are often cost-reimbursement arrangements. Under cost-reimbursement contracts, the customer reimburses the company for allowable costs and, based on the terms of the contract, pays a fixed fee and/or an incentive- or award-based fee. The company’s production contracts are fixed-price in most cases. In these instances, the company agrees to perform a specific scope of work for a fixed amount. In 2005, cost-reimbursement and fixed-price contracts accounted for approximately 46 percent and 54 percent, respectively, of the company’s government business.

General Dynamics 2005 Annual Report 9

Table of Contents

Cost-reimbursement and fixed-price contracts each present advantages and disadvantages. Cost-reimbursement contracts generally involve lower risk for the company. They may include fee schedules that prompt the customer to award increased payments when the company satisfies certain performance criteria. However, not all costs are recoverable under these types of contracts. In addition, the government has the right to object to costs, and this could increase the company’s risk. Fixed-price contracts offer the company greater profit potential, if the company can complete the work for less than the contract amount. However, on fixed-price contracts the company generally absorbs cost overruns that might occur.

U. S. COMMERCIAL

The company’s commercial sales were $3,667 in 2005, $3,028 in 2004 and $2,910 in 2003. These sales represented approximately 17 percent of the company’s consolidated net sales in 2005, 16 percent in 2004 and 18 percent in 2003. The majority of these sales are for Gulfstream aircraft, primarily to FORTUNE 500® corporations and large, privately held companies. Customers from a wide range of industries operate the aircraft.

INTERNATIONAL

The company’s direct (non-FMS) sales to defense and commercial customers outside the United States were $3,373 in 2005, $3,236 in 2004 and $2,511 in 2003. These sales represented approximately 16 percent of the company’s consolidated net sales in 2005, 17 percent in 2004 and 15 percent in 2003.

General Dynamics’ overseas subsidiaries conduct most of the company’s direct international defense sales. The company has an operating presence around the world, including subsidiary operations in Australia, Austria, Canada, Germany, Mexico, Spain, Switzerland and the United Kingdom. General Dynamics’ overseas subsidiaries are committed to developing long-term relationships in their respective countries and have distinguished themselves as principal regional suppliers. International commercial sales are primarily exports of business-jet aircraft.

For information regarding sales and assets by geographic region, see Note R to the Consolidated Financial Statements contained in Part II, Item 8, of this Annual Report on Form 10-K.

SUPPLIERS

The company depends on suppliers and subcontractors for raw materials and components. These supply networks can experience price fluctuations. Raw materials, particularly steel, have recently experienced cost growth, which can put pressure on pricing. The company has not experienced, and does not foresee, any difficulty in obtaining the materials, components or supplies necessary for its business operations.

RESEARCH AND DEVELOPMENT

The company conducts independent research and development (R&D) activities as part of its normal business operations. Over the past three years, the majority of company-sponsored R&D expenditures was in the defense business. In accordance with government regulations, the company recovers a significant portion of these expenditures through overhead charges to U.S. government contracts. In the commercial sector, the Aerospace group R&D activities support primarily product enhancement and development programs for Gulfstream aircraft. The company also conducts R&D activities under U.S. government contracts to develop products for large development and technology programs.

Research and development expenditures were as follows:

| Year Ended December 31 | 2005 | 2004 | 2003 | ||||||

| Company–sponsored |

$ | 344 | $ | 326 | $ | 276 | |||

| Customer–sponsored |

206 | 194 | 229 | ||||||

| $ | 550 | $ | 520 | $ | 505 | ||||

10 General Dynamics 2005 Annual Report

Table of Contents

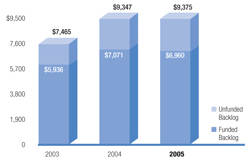

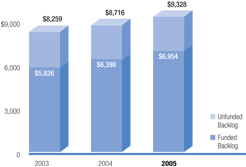

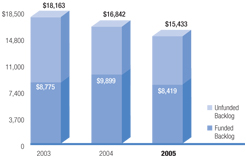

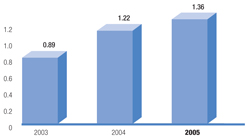

BACKLOG

The company’s total backlog represents the estimated remaining sales value of work to be performed under firm contracts and includes funded and unfunded portions. For additional discussion of backlog, see Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in Part II, Item 7, of this Annual Report on Form 10-K.

Summary backlog information for each business group follows:

| 2005 Total Backlog Not Expected to be Completed in 2006 | |||||||||||||||||||||

| December 31 | 2005 | 2004 | |||||||||||||||||||

| Funded | Unfunded | Total | Funded | Unfunded | Total | ||||||||||||||||

| Information Systems and Technology |

$ | 6,960 | $ | 2,415 | $ | 9,375 | $ | 7,071 | $ | 2,276 | $ | 9,347 | $ | 3,897 | |||||||

| Combat Systems |

6,954 | 2,374 | 9,328 | 6,398 | 2,318 | 8,716 | 5,083 | ||||||||||||||

| Marine Systems |

8,419 | 7,014 | 15,433 | 9,899 | 6,943 | 16,842 | 11,053 | ||||||||||||||

| Aerospace |

5,853 | 2,210 | 8,063 | 4,652 | 2,192 | 6,844 | 4,735 | ||||||||||||||

| Resources |

165 | 65 | 230 | 200 | 58 | 258 | 120 | ||||||||||||||

| $ | 28,351 | $ | 14,078 | $ | 42,429 | $ | 28,220 | $ | 13,787 | $ | 42,007 | $ | 24,888 | ||||||||

REGULATORY MATTERS

U . S . GOVERNMENT DEFENSE CONTRACTS

U.S. government contracts are subject to procurement laws and regulations. The Federal Acquisition Regulation (FAR) governs the majority of the company’s contracts. The FAR mandates uniform policies and procedures for U.S. government acquisitions and purchased services. Also, there can be agency-specific acquisition regulations that provide implementing language for, or that supplement, the FAR. For example, the Department of Defense implements the FAR through the Defense Federal Acquisition Regulation supplement (DFARs). For all federal government entities, the FAR regulates the phases of any products or services acquisition, including:

| • | acquisition planning, |

| • | competition requirements, |

| • | contractor qualifications, |

| • | protection of source selection and vendor information, and |

| • | acquisition procedures. |

The FAR also guides government agencies in the management phase of contracts after the award. For example, FAR language regulates the conditions under which the government can terminate a contract. This can occur at the government’s convenience or for default. If a contract is terminated for the convenience of the government, a contractor is entitled to receive payments for its allowable costs. Generally, this includes the proportionate share of fees or earnings for the work already done. If a contract is terminated for default, in most cases the government pays for only the work it has accepted. In addition, the FAR subjects the company to audits and other reviews by the government. These reviews cover issues such as cost, performance, accounting and general business practices relating to its contracts. Such reviews may result in a government adjustment of the company’s contract-related costs and fees. Failure to comply with procurement laws or regulations can also result in civil, criminal or administrative proceedings. These might involve fines, penalties, suspension of payments, or suspension or debarment from government contracting or subcontracting for a period of time.

INTERNATIONAL

The company’s international sales are subject to U.S. and foreign government regulations and procurement policies and practices. They are also subject to regulations relating to import-export control, investments, exchange controls and repatriation of earnings. Other factors can affect international sales, such as currency exchange fluctuations, and political and economic risks.

BUSINESS-JET AIRCRAFT

The Aerospace group is subject to FAA regulation in the United States and other similar aviation regulatory authorities throughout the world. For an aircraft to be manufactured and sold, the model must receive a type certificate from the appropriate aviation authority, and each individual aircraft must receive a certificate of airworthiness. Aviation authorities can require changes to a specific aircraft, or model type, for safety reasons if they believe the plane does not meet their standards. Maintenance facilities must be licensed by aviation authorities as well.

General Dynamics 2005 Annual Report 11

Table of Contents

ENVIRONMENTAL

General Dynamics is subject to a variety of federal, state, local and foreign environmental laws and regulations. These cover the discharge, treatment, storage, disposal, investigation and remediation of certain materials, substances and wastes. The company assesses regularly its compliance status and management of environmental matters.

Operating and maintenance costs associated with environmental compliance and management of contaminated sites are a normal, recurring part of the company’s operations. Historically, these costs have not been significant relative to total operating costs or cash flows. Often they are allowable costs under the company’s contracts with the U.S. government. Based on information currently available to the company, and current U.S. government policies relating to allowable costs, the company does not expect continued environmental compliance to have a material impact on its results of operations, financial condition or cash flows.

Under existing U.S. environmental laws, there is a concept known as a Potentially Responsible Party (PRP), a designation determined by the U.S. Environmental Protection Agency or a state environmental agency. If a company is designated a PRP, it is potentially liable to the government or third parties for the full cost of remediating contamination at the relevant site. In cases where the company has been designated a PRP, generally it seeks to mitigate these environmental liabilities by obtaining the relevant insurance vehicles and by pursuing appropriate cost-recovery actions. In the unlikely event that the company is required to fully fund the remediation of a site, the current statutory framework would allow the company to pursue contributions from other PRPs. For additional information relating to the impact of environmental controls, see Note O to the Consolidated Financial Statements contained in Part II, Item 8, of this Annual Report on Form 10-K.

INTELLECTUAL PROPERTY

The company is a leader in the development of innovative products, manufacturing technologies and systems-integration practices. In addition to owning a large portfolio of proprietary intellectual property, the company licenses certain intellectual property rights of third parties. The U.S. government has licenses to the company’s patents developed in the performance of government contracts, and it may use or authorize others to use the inventions covered by the company’s patents. Although these intellectual property rights are important to the operation of the company’s business, no existing patent, license or other intellectual property right is of such importance that its loss or termination would, in the opinion of management, have a material impact on the company’s business.

AVAILABLE INFORMATION

The company files several types of reports with the Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. These reports include an annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Free copies of these reports are made available as soon as practicable on the company’s website (http://www.generaldynamics.com) and through the General Dynamics investor relations office at (703) 876-3195.

These reports also can be obtained at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information on the operation of the Public Reference Room is available by calling the SEC at (800) SEC-0330. The SEC maintains a website (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

12 General Dynamics 2005 Annual Report

Table of Contents

An investment in General Dynamics’ common stock or debt securities is subject to risks and uncertainties. Investors should consider the following factors, in addition to the other information contained or incorporated by reference in this Annual Report on Form 10-K, before deciding to purchase the company’s securities.

Because three of General Dynamics’ four major business groups serve the defense market, the company’s sales are highly concentrated with the U.S. government. The customer relationship with the U.S. government involves certain risks that are unique. In addition to the U.S. government, the company’s defense businesses rapidly have expanded their sales to international customers in recent years, which has exposed the company to a different set of risks. The Aerospace group’s market presents its own risks that are largely tied to U.S. and global economic conditions. Despite the varying nature of the defense, international and business-aviation operations and the markets they serve, each shares some common risks, such as the ongoing development of high-technology products and the price, availability and quality of materials and suppliers.

The company depends on the U.S. government for a significant portion of its sales. In each of the past three years, approximately 67 percent of the company’s net sales were to the U.S. government. U.S. defense spending has historically been cyclical. Defense budgets have received their strongest support when perceived threats to national security raise the level of concern over the country’s safety. As these threats subside, spending on the military tends to decrease. Accordingly, while Department of Defense funding has grown rapidly over the past few years, there is no assurance that this trend will continue. Rising budget deficits, the cost of the Global War on Terrorism and increasing costs for domestic programs continue to put pressure on all areas of discretionary spending, which could ultimately impact the defense budget. Wartime support for defense spending could wane if the country’s troop deployments in support of operations in Iraq and Afghanistan are reduced.

A decrease in U.S. government defense spending or changes in spending allocation could result in one or more of the company’s programs being reduced, delayed or terminated. Reductions in the company’s existing programs, unless offset by other programs and opportunities, could adversely affect its ability to sustain and grow its future sales and earnings.

U.S. government contracts generally are not fully funded at inception and are subject to termination. The company’s U.S. government sales are funded by customer budgets, which operate on an October-to-September fiscal year. In February of each year, the President of the United States presents to the Congress the budget for the upcoming fiscal year. This budget proposes funding levels for every federal agency and is the result of months of policy and program reviews throughout the Executive branch. From February through September of each year, the appropriations and authorization committees of Congress review the President’s budget proposals and establish the funding levels for the upcoming fiscal year in appropriations and authorization legislation. Once these levels are enacted into law, the Executive Office of the President administers the funds to the agencies.

There are two primary risks associated with this process. First, the process may be delayed or disrupted. Changes in congressional schedules, negotiations for program funding levels or unforeseen world events can interrupt the funding for a program or contract. This, in fact, occurred during the 2006 budget process, in which the defense appropriations bill was not approved until three months into the 2006 fiscal year, delaying contract orders that would have been awarded in 2005. Second, funds for multi-year contracts can be changed in subsequent years in the appropriations process.

In addition, the U.S. government has increasingly relied on indefinite delivery, indefinite quantity (IDIQ) contracts and other procurement vehicles that are subject to a competitive bidding and funding process even after the award of the basic contract, adding an additional element of uncertainty to future funding levels. Delays in the funding process or changes in funding can impact the timing of available funds or can lead to changes in program content or termination at the government’s convenience. The loss of anticipated funding or the termination of multiple or large programs could have an adverse effect on the company’s future sales and earnings.

The Aerospace group is subject to changing customer demand or preferences for business aircraft. The Aerospace group’s business-jet market is influenced in part by the capital goods sector and the demand for business-aviation products by U.S. and foreign businesses, the U.S. and other governments, and high-net-worth individuals. The group’s future results depend on a number of factors, some of which are beyond the company’s control. These factors include general economic conditions and price and demand pressures in the market. A severe downturn in these market factors could adversely affect the sales and profitability of the company’s Aerospace group.

The company’s earnings and margins depend on its ability to perform under its contracts. The company’s contracts require management to make various assumptions and projections about the outcome of future events over a period of several years. These projections can include future labor productivity and availability, the nature and complexity of the work to be performed, the cost and availability of materials, the impact of delayed performance, and the timing of product deliveries. If there is a significant change in one or more of these assumptions, circumstances or estimates, or if the company is unable to control the costs incurred in performing under these contracts, the profitability of one or more of these contracts may be adversely affected.

General Dynamics 2005 Annual Report 13

Table of Contents

The company’s earnings and margins depend on subcontractor performance and raw material and component availability and pricing. The company relies on subcontractors and other companies to provide raw materials, major components and subsystems for its products or to perform a portion of the services that the company provides to its customers. Occasionally, the company relies on only one or two sources of supply, which, if disrupted, could have an adverse effect on the company’s ability to meet its commitments to customers. The company depends on these subcontractors and vendors to fulfill their contractual obligations in a timely and satisfactory manner in full compliance with customer requirements. If one or more of the company’s subcontractors or suppliers is unable to satisfactorily provide on a timely basis the agreed-upon supplies or perform the agreed-upon services, the company’s ability to perform its obligations as a prime contractor may be adversely affected.

International sales and operations are subject to greater risks that sometimes are associated with doing business in foreign countries. The company’s international business may pose greater risks than its business in the United States because in some countries there is increased potential for changes in economic, legal and political environments. The company’s international business is also sensitive to changes in a foreign government’s national priorities and budgets. International transactions frequently involve increased financial and legal risks arising from foreign exchange rate variability and differing legal systems and customs in other countries. In addition, some international customers require contractors to agree to offset programs that may require in-country purchases or manufacturing or financial support arrangements as a condition to awarding contracts. The contracts may include penalties in the event the company fails to perform in accordance with the offset requirements. An unfavorable event or trend in any one or more of these factors could adversely affect the company’s sales and earnings associated with its international business.

The company’s future success will depend, in part, on its ability to develop new technologies and maintain a qualified workforce to meet the needs of its customers. Virtually all of the products produced and sold by General Dynamics are highly engineered and require sophisticated manufacturing and system integration techniques and capabilities. Both the commercial and government markets in which the company operates are characterized by rapidly changing technologies. The product and program needs of the company’s government and commercial customers change and evolve regularly. Accordingly, the company’s future performance in part depends on its ability to identify emerging technological trends, develop and manufacture competitive products, and bring those products to market quickly at cost-effective prices. In addition, because of the highly specialized nature of its business, the company must be able to hire and retain the skilled and appropriately qualified personnel necessary to perform the services required by the company’s customers. If the company is unable to develop new products that meet customers’ changing needs or successfully attract and retain qualified personnel, future sales and earnings may be adversely affected.

Developing new technologies entails significant risks and uncertainties that may not be covered by indemnity or insurance. While the company maintains insurance for some business risks, it is not possible to obtain coverage to protect against all operational risks and liabilities. The company generally seeks indemnification where the U.S. government is permitted to extend indemnification under applicable law. In addition, the company generally seeks limitation of potential liability related to the sale and use of its homeland security products and services through qualification by the Department of Homeland Security under the SAFETY Act provisions of the Homeland Security Act of 2002. The company may elect to provide products or services even in instances where it is unable to obtain such indemnification or qualification.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are based on management’s expectations, estimates, projections and assumptions. Words such as “expects,” “anticipates,” “plans,” “believes,” “scheduled,” “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These include but are not limited to projections of revenues, earnings, segment performance, cash flows, contract awards, aircraft production, deliveries and backlog stability. Forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors, including, without limitation, the risk factors discussed in this section.

All forward-looking statements speak only as of the date of this report or, in the case of any document incorporated by reference, the date of that document. All subsequent written and oral forward-looking statements attributable to the company or any person acting on the company’s behalf are qualified by the cautionary statements in this section. The company does not undertake any obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this report.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

14 General Dynamics 2005 Annual Report

Table of Contents

The company believes its main facilities are adequate for its present needs and, as supplemented by planned improvements and construction, expects them to remain adequate for the foreseeable future. A summary of floor space at the main facilities of the Information Systems and Technology, Combat Systems, Marine Systems and Aerospace business groups as of December 31, 2005, follows*:

| (Square feet in millions) | Company- owned Facilities |

Leased Facilities |

Government- owned Facilities |

Total | ||||

| Information Systems and Technology: |

||||||||

| Scottsdale, AZ (Office/Lab/Factory/Warehouse) |

1.5 | — | — | 1.5 | ||||

| Northern VA (Office/Lab) |

— | 1.1 | — | 1.1 | ||||

| Pittsfield, MA (Lab) |

— | — | 0.9 | 0.9 | ||||

| Taunton, MA (Office/Factory) |

0.2 | 0.4 | — | 0.6 | ||||

| Bloomington, MN (Office) |

— | 0.5 | — | 0.5 | ||||

| Needham, MA (Office/Lab) |

0.5 | — | — | 0.5 | ||||

| Santa Clara, CA (Office/Factory) |

— | 0.4 | — | 0.4 | ||||

| Catawba, NC (Office) |

0.1 | 0.2 | — | 0.3 | ||||

| Gilbert, AZ (Office/Factory) |

0.1 | 0.2 | — | 0.3 | ||||

| Kilgore, TX (Office/Plant) |

0.3 | — | — | 0.3 | ||||

| Ontario, Canada (Office/Plant) |

0.2 | 0.1 | — | 0.3 | ||||

| Ypsilanti, MI (Hangar/Office) |

— | 0.3 | — | 0.3 | ||||

| Ann Arbor, MI (Office) |

— | 0.2 | — | 0.2 | ||||

| Calgary, Canada (Office) |

— | 0.2 | — | 0.2 | ||||

| McLeansville, NC (Office) |

— | 0.2 | — | 0.2 | ||||

| Alberta, Canada (Office) |

— | 0.1 | — | 0.1 | ||||

| Annapolis Junction, MD (Warehouse/Office) |

— | 0.1 | — | 0.1 | ||||

| East Sussex, U.K. (Office) |

— | 0.1 | — | 0.1 | ||||

| Florham Park, NJ (Office) |

— | 0.1 | — | 0.1 | ||||

| Lexington Park, MD (Office) |

— | 0.1 | — | 0.1 | ||||

| Richardson, TX (Office/Warehouse) |

— | 0.1 | — | 0.1 | ||||

| San Antonio, TX (Office) |

— | 0.1 | — | 0.1 | ||||

| South Wales, U.K. (Office) |

— | 0.1 | — | 0.1 | ||||

| Tallin, Estonia (Office) |

0.1 | — | — | 0.1 | ||||

| Combat Systems: |

||||||||

| Lima, OH (Plant) |

— | — | 1.6 | 1.6 | ||||

| Camden, AR (Office/Plant) |

0.9 | 0.5 | — | 1.4 | ||||

| Marion, VA (Office/Plant) |

0.9 | 0.1 | — | 1.0 | ||||

| Murcia, Spain (Plant) |

— | — | 1.0 | 1.0 | ||||

| Trubia, Spain (Plant) |

— | — | 1.0 | 1.0 | ||||

| Palencia, Spain (Plant) |

— | — | 0.9 | 0.9 | ||||

| Granada, Spain (Plant) |

— | — | 0.7 | 0.7 | ||||

| Marion, IL (Office/Plant) |

— | 0.7 | — | 0.7 | ||||

| Vienna, Austria (Office/Plant) |

— | 0.7 | — | 0.7 | ||||

| Ontario, Canada (Office/Plant) |

0.4 | 0.2 | — | 0.6 | ||||

| Sterling Heights, MI (Office/Warehouse) |

0.6 | — | — | 0.6 | ||||

| Garland, TX (Office/Plant) |

0.5 | — | — | 0.5 | ||||

| Kaiserslautern, Germany (Office/Plant) |

0.5 | — | — | 0.5 | ||||

| Oviedo, Spain (Plant) |

— | — | 0.5 | 0.5 | ||||

| Saco, ME (Office/Plant) |

0.5 | — | — | 0.5 | ||||

| St. Marks, FL (Office/Plant) |

0.4 | — | — | 0.4 | ||||

| Sevilla, Spain (Office/Plant) |

— | — | 0.4 | 0.4 | ||||

| Kreuzlingen, Switzerland (Office/Plant) |

0.3 | — | — | 0.3 | ||||

| La Coruna, Spain (Plant) |

— | — | 0.3 | 0.3 | ||||

| Red Lion, PA (Office/Plant) |

0.3 | — | — | 0.3 | ||||

| * | The Resources group operates two underground coal mines in Illinois and several stone quarries, as well as sand and gravel pits and yards, for its aggregates business in Illinois and Indiana. Coal preparation and rail loading facilities located at each mine are sufficient for its output. |

General Dynamics 2005 Annual Report 15

Table of Contents

| (Square feet in millions) | Company- owned Facilities |

Leased Facilities |

Government- owned Facilities |

Total | ||||

| Combat Systems (continued): |

||||||||

| Scranton, PA (Plant) |

— | 0.3 | — | 0.3 | ||||

| Anniston, AL (Plant/Warehouse) |

— | — | 0.2 | 0.2 | ||||

| Burlington, VT (Office/Plant) |

— | 0.2 | — | 0.2 | ||||

| Charlotte, NC (Office/Plant) |

— | 0.2 | — | 0.2 | ||||

| Lincoln, NE (Office/Plant) |

0.2 | — | — | 0.2 | ||||

| Westminster, MD (Office/Plant) |

— | 0.2 | — | 0.2 | ||||

| Woodbridge, VA (Office) |

— | 0.2 | — | 0.2 | ||||

| Shelby Township, MI (Office/Plant) |

— | 0.1 | — | 0.1 | ||||

| Marine Systems: |

||||||||

| Groton, CT (Shipyard) |

2.9 | — | — | 2.9 | ||||

| Quonset Point, RI (Plant/Warehouse) |

0.3 | 1.1 | — | 1.4 | ||||

| Brunswick, ME (Office/Plant/Warehouse) |

1.1 | 0.2 | — | 1.3 | ||||

| Bath, ME (Shipyard) |

1.1 | — | — | 1.1 | ||||

| San Diego, CA (Shipyard) |

0.8 | 0.2 | — | 1.0 | ||||

| Mexicali, Mexico (Office/Warehouse) |

— | 0.2 | — | 0.2 | ||||

| Aerospace: |

||||||||

| Savannah, GA (Office/Factory) |

1.4 | 0.2 | — | 1.6 | ||||

| Dallas, TX (Service/Completion Center) |

0.2 | 0.1 | — | 0.3 | ||||

| Long Beach, CA (Service/Completion Center) |

0.3 | — | — | 0.3 | ||||

| Appleton, WI (Service/Completion Center) |

0.1 | 0.1 | — | 0.2 | ||||

| Mexicali, Mexico (Factory) |

— | 0.2 | — | 0.2 | ||||

| Brunswick, GA (Service/Completion Center) |

— | 0.1 | — | 0.1 | ||||

| Las Vegas, NV (Service Center) |

— | 0.1 | — | 0.1 | ||||

| London, England (Service Center) |

— | 0.1 | — | 0.1 | ||||

| Minneapolis, MN (Service Center) |

— | 0.1 | — | 0.1 | ||||

| West Palm Beach, FL (Service Center) |

— | 0.1 | — | 0.1 | ||||

| Westfield, MA (Service Center) |

0.1 | — | — | 0.1 | ||||

For information relating to legal proceedings, see Note O to the Consolidated Financial Statements contained in Part II, Item 8, of this Annual Report on Form 10-K.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of the company’s security holders during the fourth quarter of the year ended December 31, 2005.

16 General Dynamics 2005 Annual Report

Table of Contents

ITEM 5. MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The company’s common stock is listed on the New York Stock Exchange.

The high and low sales prices of the company’s common stock and the cash dividends declared with respect to the company’s common stock for each quarterly period during the two most recent fiscal years are included in the Supplementary Data contained in Part II, Item 8, of this Annual Report on Form 10-K.

As of January 29, 2006, there were approximately 153,000 holders of the company’s common stock.

For information regarding securities authorized for issuance under the company’s equity compensation plans, see Note P to the Consolidated Financial Statements contained in Part II, Item 8, of this Annual Report on Form 10-K.

The following table provides information about the company’s fourth quarter repurchases of equity securities that are registered pursuant to Section 12 of the Exchange Act:

| Period | Total Number of Shares Purchased* |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Program |

Maximum Number of Shares that May Yet Be Purchased Under the Program | |||||

| 10/03/05 – 10/30/05 |

237,500 | $ | 115.50 | 3,690,100 | 2,309,900 | ||||

| 10/31/05 – 11/27/05 |

382,500 | 115.90 | 4,072,600 | 1,927,400 | |||||

| 11/28/05 – 12/31/05 |

750,500 | 114.41 | 4,823,100 | 1,176,900 | |||||

| Total |

1,370,500 | $ | 115.01 | 4,823,100 | 1,176,900 | ||||

| * | On February 5, 2003, the company’s board of directors authorized management to repurchase up to 6 million shares. The company has repurchased an aggregate of 4,823,100 shares of common stock in the open market pursuant to this repurchase program. Unless terminated earlier by resolution of the board of directors, the program will expire when an aggregate of 6 million shares has been repurchased. |

For additional information relating to the company’s repurchases of its common stock during the past three years, see Financial Condition, Liquidity and Capital Resources–Financing Activities–Share Repurchases contained in Part II, Item 7, of this Annual Report on Form 10-K.

The company did not make any unregistered sales of equity securities in 2005.

General Dynamics 2005 Annual Report 17

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA

The following table presents summary selected historical financial data derived from the audited Consolidated Financial Statements and other company information for each of the five years presented. The following information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the audited Consolidated Financial Statements and the Notes thereto.

| (Dollars and shares in millions, except per share and employee amounts) | 2005 | 2004 | 2003 | 2002 | 2001 | |||||||||||||||

| Summary of Operations |

||||||||||||||||||||

| Net sales |

$ | 21,244 | $ | 19,119 | $ | 16,328 | $ | 13,658 | $ | 11,874 | ||||||||||

| Operating earnings |

2,197 | 1,944 | 1,442 | 1,570 | 1,467 | |||||||||||||||

| Interest expense, net |

(118 | ) | (148 | ) | (98 | ) | (45 | ) | (56 | ) | ||||||||||

| Provision for income taxes, net |

632 | 583 | 368 | 530 | 475 | |||||||||||||||

| Earnings from continuing operations |

1,468 | 1,205 | 979 | 1,042 | 931 | |||||||||||||||

| Discontinued operations, net of tax |

(7 | ) | 22 | 25 | (125 | ) | 12 | |||||||||||||

| Net earnings |

1,461 | 1,227 | 1,004 | 917 | 943 | |||||||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic: |

||||||||||||||||||||

| Continuing operations |

7.31 | 6.04 | 4.95 | 5.17 | 4.63 | |||||||||||||||

| Discontinued operations |

(0.03 | ) | 0.11 | 0.13 | (0.62 | ) | 0.06 | |||||||||||||

| Net earnings |

7.28 | 6.15 | 5.08 | 4.55 | 4.69 | |||||||||||||||

| Diluted: |

||||||||||||||||||||

| Continuing operations |

7.25 | 5.98 | 4.91 | 5.14 | 4.59 | |||||||||||||||

| Discontinued operations |

(0.03 | ) | 0.11 | 0.13 | (0.62 | ) | 0.06 | |||||||||||||

| Net earnings |

7.22 | 6.09 | 5.04 | 4.52 | 4.65 | |||||||||||||||

| Cash dividends declared per common share |

1.60 | 1.44 | 1.28 | 1.20 | 1.12 | |||||||||||||||

| Sales per employee |

299,400 | 283,200 | 276,000 | 260,100 | 249,800 | |||||||||||||||

| Financial Position |

||||||||||||||||||||

| Cash and equivalents |

$ | 2,331 | $ | 976 | $ | 861 | $ | 327 | $ | 439 | ||||||||||

| Total assets |

19,591 | 17,544 | 16,183 | 11,731 | 11,069 | |||||||||||||||

| Short- and long-term debt |

3,291 | 3,297 | 4,043 | 1,471 | 1,978 | |||||||||||||||

| Shareholders’ equity |

8,145 | 7,189 | 5,921 | 5,199 | 4,528 | |||||||||||||||

| Book value per share |

40.69 | 35.76 | 29.91 | 25.87 | 22.56 | |||||||||||||||

| Other Information |

||||||||||||||||||||

| Funded backlog |

$ | 28,351 | $ | 28,220 | $ | 24,827 | $ | 21,113 | $ | 19,105 | ||||||||||

| Total backlog |

42,429 | 42,007 | 40,631 | 28,731 | 26,538 | |||||||||||||||

| Shares outstanding |

200.2 | 201.0 | 198.0 | 201.0 | 200.7 | |||||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||

| Basic |

200.8 | 199.6 | 197.8 | 201.4 | 201.1 | |||||||||||||||

| Diluted |

202.4 | 201.5 | 199.2 | 202.9 | 202.9 | |||||||||||||||

| Active employees |

72,200 | 70,000 | 65,200 | 53,200 | 50,800 | |||||||||||||||

| Note: | Prior year amounts have been reclassified for discontinued operations. |

18 General Dynamics 2005 Annual Report

Table of Contents

(Dollars in millions, except per share amounts or unless otherwise noted)

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(For an overview of the company’s business groups, including a discussion of products and services provided, see the Business discussion contained in Part I, Item 1, of this Annual Report on Form 10-K.)

MANAGEMENT OVERVIEW

General Dynamics is a market leader in mission-critical information systems and technologies; land and expeditionary combat systems, armaments and munitions; shipbuilding and marine systems; and business aviation. The company is comprised of four primary business groups — Information Systems and Technology, Combat Systems, Marine Systems and Aerospace — and a smaller Resources group. General Dynamics’ primary customers are the U.S. military, other government organizations, the armed forces of allied nations, and a diverse base of corporate and individual buyers of business aircraft.The company operates in two primary markets — defense and business aviation. The majority of the company’s revenues derive from contracts with the U.S. military.

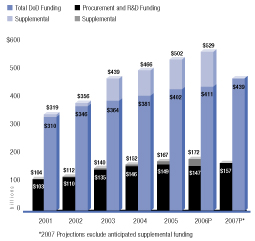

The current Administration’s desire to modernize U.S. military forces coupled with the U.S. military’s engagement in the Global War on Terrorism has driven steady Department of Defense funding increases since 2001. For fiscal year 2006, the Congress appropriated $411 billion for the Department of Defense, a 33 percent increase in funding since 2001. This amount includes $147 billion for procurement and research and development (R&D) activities, an increase of 43 percent since 2001. Procurement and R&D budgets, also known as investment accounts, provide the majority of the company’s revenues and, over the past several years, these budget lines have enjoyed sustained increases that demonstrate continued administration and congressional support. For fiscal year 2007, the President has requested that the Congress appropriate $439 billion for the Department of Defense, a 7 percent increase over the 2006 funding. This includes $157 billion for procurement and R&D, an increase of 7 percent over 2006 investment funds. In addition, the President’s 2007-2011 future year defense program (FYDP) anticipates investment funding growing at a nearly 5 percent compound annual growth rate, led by 9 percent compound annual procurement growth.

During this wartime era, defense budgets have evolved to include not only the President’s initial budget submission, but also supplemental funds requested over the course of the fiscal year. For fiscal year 2006, the Congress has been asked to provide at least $118 billion in supplemental funding, which, if approved, will bring total defense funding for fiscal year 2006 to over $525 billion, an approximately 65 percent increase since 2001. Approximately 20 percent, or $25 billion, of the 2006 supplemental funding request is anticipated for additional investment funding.

Looking ahead, the defense budget top line is expected to continue to grow, albeit at a somewhat more moderate rate. Supplemental funding to support ongoing conflicts, in part, is linked to levels of deployed troops and conflict intensity and will likely decrease with a reduction of hostilities. While this introduces some variability into the overall level of future defense spending, based on the recently approved and proposed defense budgets, the company expects the levels of funding available for its programs will likely continue to grow in 2006 and 2007.

The importance of many of the companies programs to the future of the U.S. military was highlighted in the 2005 Department of Defense Quadrennial Defense Review. This strategic document emphasized some core departmental missions, including pursuing the Global War on Terrorism, enhancing homeland defense efforts and encouraging the spread of democratic institutions worldwide. The review highlighted many strategic priorities that are supported by General Dynamics’ products and services, including increasing special operations forces, improving intelligence-gathering capabilities, accelerating the production of littoral combat ships and increasing submarine procurement.