GD-2014.12.31 10K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File Number 1-3671

GENERAL DYNAMICS CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 13-1673581 |

State or other jurisdiction of incorporation or organization | | IRS Employer Identification No. |

| | |

2941 Fairview Park Drive, Suite 100 Falls Church, Virginia | | 22042-4513 |

Address of principal executive offices | | Zip code |

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of exchange on which registered |

Common stock, par value $1 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ü No ___

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ___ No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No ___

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ü No ___

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K ___

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ü Accelerated Filer __ Non-Accelerated Filer __ Smaller Reporting Company ___

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No ü

The aggregate market value of the voting common equity held by non-affiliates of the registrant was $37,171,450,405 as of June 29, 2014 (based on the closing price of the shares on the New York Stock Exchange).

331,704,599 shares of the registrant’s common stock, $1 par value per share, were outstanding on February 1, 2015.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III incorporates by reference information from certain portions of the registrant’s definitive proxy statement for the 2015 annual meeting of shareholders to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year.

INDEX

|

| | |

PART I | | PAGE |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

PART II | | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

PART III | | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

PART IV | | |

Item 15. | | |

| | |

| | |

PART I

ITEM 1. BUSINESS

BUSINESS OVERVIEW

General Dynamics is an aerospace and defense company that offers a broad portfolio of products and services in business aviation; combat vehicles, weapons systems and munitions; communications and information technology systems and solutions; and shipbuilding. Our management team delivers shareholder returns through disciplined execution of backlog, efficient cash-flow conversion and prudent capital deployment. We manage costs, undertake continuous-improvement initiatives and collaborate across our businesses to achieve our goals of maximizing earnings and cash and creating value for our shareholders.

Incorporated in Delaware in 1952, General Dynamics grew organically and through acquisitions until the early 1990s when we sold nearly all of our divisions except Electric Boat and Land Systems. Starting in the mid-1990s, we began expanding by acquiring combat vehicle-related businesses, information technology product and service companies, additional shipyards and Gulfstream Aerospace Corporation.

We operate globally through four business groups: Aerospace, Combat Systems, Information Systems and Technology and Marine Systems. For selected financial information regarding each of our business groups, see Note Q to the Consolidated Financial Statements in Item 8.

AEROSPACE

Our Aerospace group designs, manufactures and outfits a family of Gulfstream business-jet aircraft, provides aircraft services (including maintenance and repair work, fixed-based operations (FBO) and aircraft management services) and performs aircraft completions for aircraft produced by other original equipment manufacturers (OEMs). With more than 50 years of experience at the forefront of the business-jet market, the Aerospace group is known for:

| |

• | superior aircraft design, quality, performance, safety and reliability; |

| |

• | technologically advanced cockpit and cabin systems; and |

| |

• | industry-leading product service and support. |

The Gulfstream product line includes aircraft across a spectrum of price and performance options in the large- and mid-cabin business-jet market. The varying ranges, speeds and cabin dimensions are well-suited for the needs of a diverse and global customer base. The large-cabin models are manufactured at Gulfstream’s headquarters in Savannah, Georgia, while the mid-cabin models are constructed by a non-U.S. partner. All models are outfitted in the group’s U.S. facilities.

Demand for Gulfstream aircraft is strong across geographic regions and customer types, generating orders from public and private companies, individuals and governments around the world. The Gulfstream brand is recognized globally with non-U.S. customers representing approximately 60 percent of the group’s backlog on December 31, 2014.

We are committed to research and development (R&D) activities that facilitate the introduction of new products and first-to-market enhancements that broaden customer choice, improve aircraft performance and set new standards for customer safety, comfort and in-flight productivity. In 2014, we introduced three new large-cabin business jets, the G500, the G600 and the G650ER. The G500 and G600 are clean-sheet next-generation business jets that optimize the speed, wide-cabin comfort, efficiency and advanced safety technology of the aircraft. At Mach 0.85, the G500 can fly 5,000 nautical miles, and the G600 can fly 6,200

nautical miles. The G500 and G600 are expected to enter into service in 2018 and 2019, respectively. The G650ER is the extended-range sister-ship to the ultra-long range, ultra-large cabin G650. This new aircraft flies farther at faster speeds than any other business jet on the market and can travel 7,500 nautical miles at Mach 0.85. The first G650ER was delivered in the fourth quarter of 2014, ahead of the original 2015 estimate. These three new aircraft demonstrate the success of consistent and disciplined investment in Gulfstream’s product development.

In addition to the new aircraft models, current product enhancement and development efforts include initiatives in advanced avionics, composites, renewable fuels, flight-control systems, acoustics, cabin technologies and vision systems. One recent innovation introduced with the G500 and G600 is the Symmetry Flight Deck that includes 10 touchscreens and active control sidesticks. The active control sidesticks allow the pilot and co-pilot to see and feel each other’s control inputs, enhancing their situational awareness and safety of the flight. We have also introduced several service and support applications including the PlaneBook application, which provides pilots easy and immediate digital access to critical flight information and aircraft-specific documents.

In support of Gulfstream’s growing aircraft portfolio and international customer base, we have invested in a multi-year facilities project at our Savannah campus, which is scheduled to continue through 2017. This expansion consists of constructing new facilities, including the completed purpose-built manufacturing facilities for production of the G500 and G600, and renovating existing infrastructure. This effort follows earlier projects that included a purpose-built G650 manufacturing facility, increased aircraft-service capacity, an improved customer sales and design center and a state-of-the-art paint facility.

The group offers extensive support of the nearly 2,500 Gulfstream aircraft in service with professionals located around the globe. The service network for Gulfstream aircraft continues to evolve to address the demands of the group’s growing international customer base. We operate 11 company-owned service centers, maintain 15 authorized warranty centers and maintenance facilities on six continents, and offer on-call Gulfstream aircraft technicians ready to deploy for urgent customer-service requirements in the Americas. This commitment to superior product support continues to receive industry recognition, including the number-one ranking for the 12th consecutive year in the annual Aviation International News Product Support Survey, as well as the top ranking in the annual Professional Pilot Survey.

Jet Aviation augments our Aerospace portfolio with completions (avionics, interior outfitting and paint) for business-jet customers, as well as custom, complex completions of single- and double-aisle aircraft requiring advanced engineering, design and manufacturing capabilities. In addition, Jet Aviation provides superior maintenance, repair, aircraft management and FBO services to a broad global customer base through a network of facilities across four continents.

A market leader in the business-aviation industry, the Aerospace group is focused on developing innovative first-to-market technologies and products; providing exemplary and timely service to customers globally; and driving efficiencies and reducing costs in the aircraft production, outfitting and service processes.

Revenues for the Aerospace group were 28 percent of our consolidated revenues in 2014, 26 percent in 2013 and 22 percent in 2012. Revenues by major products and services were as follows:

|

| | | | | | | | | | | |

Year Ended December 31 | 2014 | | 2013 | | 2012 |

Aircraft manufacturing, outfitting and completions | $ | 6,983 |

| | $ | 6,378 |

| | $ | 5,317 |

|

Aircraft services | 1,599 |

| | 1,530 |

| | 1,491 |

|

Pre-owned aircraft | 67 |

| | 210 |

| | 104 |

|

Total Aerospace | $ | 8,649 |

| | $ | 8,118 |

| | $ | 6,912 |

|

COMBAT SYSTEMS

Our Combat Systems group is a global leader in systems engineering, spanning design, development, manufacture and support of military vehicles, weapons systems and munitions for the United States and its allies. The group’s product lines include:

| |

• | wheeled combat and tactical vehicles, |

| |

• | main battle tanks and tracked combat vehicles, |

| |

• | weapons systems and munitions, and |

| |

• | maintenance and logistics support and sustainment services. |

The group’s backlog, which reached a historic high in 2014, includes a diverse mix of products supporting domestic and non-U.S. customers. We pursue continuous process improvements to enhance our productivity and improve our operating performance as we deliver on this backlog. We apply our systems-level engineering expertise to develop improvements that advance the utility, safety and mission-effectiveness of our products.

Our portfolio of military vehicles, produced at our operations in North America and Europe, includes heavy, medium and light wheeled vehicles and heavy and medium tracked vehicles. This extensive product line allows us to be agile in providing tailored solutions to our customers.

The group has a market-leading position in the light armored vehicle (LAV) market. We have a $10 billion contract with an international customer to provide wheeled armored vehicles through 2028. This contract includes vehicle production and contractor logistics support.

We offer several products in the medium wheeled vehicle segment, including the Stryker combat vehicle. Stryker has proven itself as one of the most versatile combat-tested vehicles in the U.S. Army inventory, combining agility and firepower into a deployable and responsive combat support vehicle. There are currently 10 variants of the Stryker, including the M1127 Reconnaissance Vehicle and the M1133 Medical Evacuation Vehicle. The Army is planning to convert all nine of its Stryker Brigade Combat Teams to the double-V-hulled configuration, which significantly improves protection for soldiers from improvised explosive devices (IEDs). In addition to the Stryker program, we are modernizing approximately 600 LAV III combat vehicles for the Canadian government and have delivered numerous Piranha and Pandur armored vehicles to various foreign governments.

Leveraging our prior experience in the light wheeled vehicle market, the group is under contract with U.S. Special Operations Command to produce the Ground Mobility Vehicle (GMV) and the Internally-Transportable Vehicle (ITV), a narrow version of the GMV. We are also delivering the Foxhound vehicle to the U.K. Ministry of Defence (MoD), and the Eagle vehicle to Germany.

We continue to support the evolving needs of the U.S. Army and Marine Corps with technology upgrades to the Abrams main battle tank family of vehicles. The group is currently upgrading Abrams tanks with the System Enhancement Package (SEP) that provides a digital platform with an enhanced command-and-control system, new power generation and distribution systems, second-generation thermal sights and improved armor.

Our position in the medium tracked vehicle segment grew in 2014 with a 10-year contract to build the Specialist Vehicle (SV) for the U.K. MoD. SV is the next generation of armoured fighting vehicles in the United Kingdom. The contract positions us as a leading provider of the U.K.’s combat vehicles.

With our large installed base of vehicles worldwide, we are positioned for future modernization programs, as well as opportunities for support and sustainment services. For example, we are under contract with the Marine Corps to reset Cougar vehicles. In addition, with the expertise gained from our engineering and production programs across our product portfolio, we are well-qualified to participate in future combat vehicle development programs.

Complementing these military-vehicle offerings, the group designs, develops and produces a comprehensive array of weapons systems across the battle spectrum. For ground forces, we manufacture M2/M2-A1 heavy machine guns and MK19/ MK47 grenade launchers. The group also produces legacy and next-generation weapons systems for shipboard applications, including the Navy’s Phalanx Close-In Weapon System (CIWS), multiple subsystems for the Littoral Combat Ship (LCS), and DDG-1000 destroyer firepower mission modules. For airborne platforms, we produce weapons for U.S. and non-U.S. fighter aircraft, including high-speed Gatling guns for all U.S. fixed-wing military aircraft. The group is also a significant supplier of composite structures and aircraft components.

Our munitions portfolio covers the full breadth of naval, air and ground forces applications across all calibers and weapons platforms for the U.S. government and its allies. The group maintains a market-leading position in the supply of Hydra-70 rockets, large-caliber tank ammunition, medium-caliber ammunition, mortar and artillery projectiles, tactical missile aerostructures and high-performance warheads, military propellants, and conventional bombs and bomb cases.

The Combat Systems group emphasizes operational execution and business optimization initiatives as the group delivers on our backlog. As part of these efforts, the group has undertaken restructuring activities to ensure we remain competitively positioned for the future. In an environment of dynamic threats and evolving customer needs, the group remains agile and focused on innovation, affordability and speed-to-market to deliver on our current programs and to secure new opportunities.

Revenues for the Combat Systems group were 18 percent of our consolidated revenues in 2014, 19 percent in 2013 and 24 percent in 2012. Revenues by major products and services were as follows:

|

| | | | | | | | | | | |

Year Ended December 31 | 2014 | | 2013 | | 2012 |

Wheeled combat vehicles | $ | 2,852 |

| | $ | 2,709 |

| | $ | 3,930 |

|

Weapons systems and munitions | 1,635 |

| | 1,761 |

| | 1,950 |

|

Tanks and tracked vehicles | 526 |

| | 595 |

| | 792 |

|

Engineering and other services | 719 |

| | 767 |

| | 799 |

|

Total Combat Systems | $ | 5,732 |

| | $ | 5,832 |

| | $ | 7,471 |

|

INFORMATION SYSTEMS AND TECHNOLOGY

Our Information Systems and Technology group provides technologies, products and services that address a wide range of military, federal/civilian and commercial information-systems requirements. The group’s leadership in this market results from decades of domain expertise, incumbency on high-priority programs and continuous innovation to deliver solutions that meet our customers’ needs. We provide full-spectrum support for the design, development, integration, production and sustainment of:

| |

• | information technology (IT) solutions and mission support services, and |

| |

• | mobile communication systems and intelligence, surveillance and reconnaissance (ISR) solutions. |

IT solutions and mission support services: We provide professional and technical services to the U.S. defense and intelligence communities, the Departments of Homeland Security and Health and Human Services, other federal/civilian agencies, and commercial and non-U.S. customers. The group’s technical support personnel and domain specialists help customers meet critical planning, staffing, technology and operational needs.

The group designs, builds and operates large-scale, secure IT networks and systems for U.S. government customers, commercial wireless network providers, and federal, state and local public safety agencies. We work closely with our customers to ensure their network infrastructures are secure, efficient, scalable and cost-effective. We are also at the forefront of cloud and virtualization technologies and services. For example, the group is implementing the Department of Defense’s (DoD) largest enterprise-wide email infrastructure and a virtual desktop environment for the intelligence community.

As a leading provider in the U.S. healthcare IT market, we support government civilian and military health systems, providing critical services in support of healthcare reform and medical benefits programs. Our offerings include data management, analytics, fraud prevention and detection software, process automation and program management solutions for public and commercial health systems. We are operating customer contact centers for the Centers for Medicare & Medicaid Services, responding to consumer inquiries about key Medicare and Affordable Care Act programs.

Mobile communication systems and ISR solutions: We design, build, deploy and support solutions for customers in the U.S. defense, intelligence and homeland security communities, and U.S. allies. Our offerings include secure communications systems, command and control solutions, signals and information collection, processing and distribution systems; imagery sensors; and cyber security, information assurance, and encryption products, systems and services.

We integrate and manufacture secure communications systems for customers in the DoD, the intelligence community, federal/civilian and public safety agencies, and for non-U.S. customers. These solutions, which include fixed and mobile ground, radio and satellite communications systems and antenna technologies, improve our customers’ ability to communicate, collaborate and access vital information.

The group is delivering a modern, secure network to the U.S. Army, known as the Soldier’s Network, which provides tactical voice and data communications to soldiers anywhere on the battlefield. We are the prime contractor for Warfighter Information Network-Tactical (WIN-T), the Army’s backbone mobile communications network, and we are the prime contractor on many of the Army’s core tactical radio programs, including the AN/PRC-154A Rifleman and AN/PRC-155 two-channel Manpack radios. We are developing and deploying the Mobile User Objective System (MUOS) communication waveform and ground system, which will help provide the satellite link to soldiers on the ground so they can access voice, video and data communications in the most remote locations.

The Information Systems and Technology group provides many of these capabilities to non-U.S. public agencies and commercial customers. For the Canadian Department of National Defence, we developed, deployed and continue to modernize and support the Canadian Army’s fully integrated, secure combat voice and data network. We leveraged this experience to deliver the U.K. MoD’s Bowman tactical communication system, for which we currently provide ongoing support and capability upgrades.

In command-and-control systems, we have a 50-year legacy of providing advanced fire-control systems for U.S. Navy submarine programs and we are developing and integrating commercial off-the-shelf software and hardware upgrades to improve the tactical control capabilities for several submarine classes. Capitalizing on this expertise, we developed the combat and seaframe control systems and we are the lead systems

integrator for the Navy’s Independence-variant LCS and the electronic systems for the Navy’s Joint High Speed Vessel (JHSV).

Information Systems and Technology provides ISR solutions for classified programs. Our expertise includes multi-intelligence ground systems and large-scale, high-performance data and signal processing. We deliver high-reliability, long-life sensors and payloads designed to perform in the most extreme environments, including space payloads and undersea sensor and power systems.

The group offers comprehensive cyber security-related products and services to help customers protect their networks from internal and external threats and prevent data breaches. For more than 45 years we have developed information assurance technologies that are integral to defending critical information, including a widely deployed Type 1 network encryptor. We also support the DoD’s Cyber Crime Center and the Department of Homeland Security’s National Cybersecurity Protection System.

The group is well-positioned to continue meeting the needs of our diverse customer base in an increasingly competitive market. We are improving the group’s performance and competitive position by optimizing the size of the business, harmonizing capabilities throughout the portfolio and developing innovative solutions to meet evolving customer requirements. Consistent with this focus, in 2014 we announced the consolidation of two businesses in the group to form General Dynamics Mission Systems in an effort to be more efficient and responsive to our customers. The consolidation was effective in January 2015.

Revenues for the Information Systems and Technology group were 30 percent of our consolidated revenues in 2014 and 33 percent in 2013 and 2012. Revenues by major products and services were as follows:

|

| | | | | | | | | | | |

Year Ended December 31 | 2014 | | 2013 | | 2012 |

Mobile communication systems | $ | 2,771 |

| | $ | 3,657 |

| | $ | 3,425 |

|

IT solutions and mission support services | 4,549 |

| | 4,734 |

| | 4,545 |

|

ISR solutions | 1,839 |

| | 1,877 |

| | 2,047 |

|

Total Information Systems and Technology | $ | 9,159 |

| | $ | 10,268 |

| | $ | 10,017 |

|

MARINE SYSTEMS

Our Marine Systems group designs, builds and supports submarines and surface ships for the U.S. Navy and Jones Act ships for commercial customers. We are one of two primary shipbuilders for the Navy. The group’s diverse portfolio of platforms and capabilities includes:

| |

• | nuclear-powered submarines; |

| |

• | auxiliary and combat-logistics ships; |

| |

• | commercial product carriers and containerships; |

| |

• | design and engineering support; and |

| |

• | overhaul, repair and lifecycle support services. |

Our work for the Navy includes the construction of new ships and the design and development of next-generation platforms to help meet evolving missions and maintain desired fleet size. Approximately 95 percent of the group’s revenues are for major Navy ship-construction programs awarded under large, multi-ship contracts that span several years. These programs include Virginia-class nuclear-powered submarines, Arleigh Burke-class (DDG-51) and Zumwalt-class (DDG-1000) guided-missile destroyers, and Mobile Landing Platform (MLP) auxiliary support ships.

The Virginia-class submarine includes capabilities for open-ocean and littoral missions. These stealthy boats are well-suited for a variety of global assignments, including intelligence gathering, special-operations missions and sea-based missile launch. The Navy is procuring Virginia-class submarines in multi-boat blocks. In 2014, we received a contract for the construction of 10 submarines in the fourth block of the program, bringing the number of boats under contract to 28. The group has delivered 11 of these boats in conjunction with an industry partner that shares in the construction. The remaining 17 boats under contract are scheduled for delivery through 2023.

We are the lead designer and producer of DDG-51s, managing the design, modernization and lifecycle support of these ships. As the only active destroyer in the Navy’s global surface fleet, DDG-51s are multi-mission combatants that offer defense against a wide range of threats, including ballistic missiles. We currently have construction contracts for seven DDG-51s scheduled for delivery through 2022.

The group is one of the Navy's contractors involved in development and construction of the DDG-1000 platform. These ships are equipped with numerous technological enhancements, including a low radar profile, an integrated power system and advanced gun systems that provide a three-fold increase in range over current naval surface gun weapons. Deliveries of the three ships in the program are scheduled through 2019.

MLP ships serve as floating transfer stations, improving the Navy’s ability to deliver equipment and cargo to areas without adequate port access. The group has delivered the first two ships in the program, and construction is underway on two additional ships scheduled for delivery in 2015 and 2018. The third and fourth ships are configured as Afloat Forward Staging Bases (AFSB), designed to facilitate a variety of missions in support of mine countermeasures and special operations, providing significant new capabilities to the customer.

In addition to these ship construction programs, we are advancing new technologies and naval platforms with our customers. These design and engineering efforts include the development of the next-generation ballistic-missile submarine to replace the Ohio class of ballistic-missile submarines. In conjunction with these efforts, the group is leading the design of the Common Missile Compartment under joint development for the U.S. Navy and the U.K. Royal Navy.

Marine Systems provides comprehensive ship and submarine overhaul, repair and lifecycle support services to extend the service life and maximize the value of these ships. We conduct surface-ship repair operations in four locations with full-service maintenance and repair shipyards on both U.S. Coasts. We also provide extensive submarine repair services in a variety of U.S. locations and convert decommissioned submarines to moored training platforms. In support of allied navies, we offer program management, planning, engineering and design support for submarine and surface-ship construction programs.

Beyond its work for the Navy, Marine Systems is advancing commercial shipbuilding technology with the design and production of liquefied natural gas (LNG)-powered and LNG-conversion-ready ships for commercial customers that meet the Jones Act requirement for ships carrying cargo between U.S. ports to be built in U.S. shipyards. Currently, we have construction contracts for 10 ships scheduled for delivery through 2017. Construction is underway on five ships, with all 10 expected to be at various stages of construction by the end of 2015. We anticipate that the age of the Jones Act fleet and environmental regulations that impose more stringent emission control limits will continue to provide additional commercial shipbuilding opportunities.

To further the group’s goals of operating efficiency, innovation, affordability for the customer and continuous improvement, we make strategic investments in our business, often in cooperation with the Navy and local governments. In addition, Marine Systems leverages its design and engineering expertise across

its shipyards to improve program execution and generate cost savings. This knowledge-sharing enables the group to use resources more efficiently and drive process improvements. We are well-positioned to continue to fulfill the ship-construction and support requirements of our customers.

Revenues for the Marine Systems group were 24 percent of our consolidated revenues in 2014, 22 percent in 2013 and 21 percent in 2012. Revenues by major products and services were as follows:

|

| | | | | | | | | | | |

Year Ended December 31 | 2014 | | 2013 | | 2012 |

Nuclear-powered submarines | $ | 4,310 |

| | $ | 3,697 |

| | $ | 3,601 |

|

Surface combatants | 1,084 |

| | 1,139 |

| | 1,152 |

|

Auxiliary and commercial ships | 640 |

| | 499 |

| | 746 |

|

Repair and other services | 1,278 |

| | 1,377 |

| | 1,093 |

|

Total Marine Systems | $ | 7,312 |

| | $ | 6,712 |

| | $ | 6,592 |

|

CUSTOMERS

In 2014, 58 percent of our revenues were from the U.S. government, 17 percent were from U.S. commercial customers, 14 percent were from non-U.S. commercial customers and the remaining 11 percent were from non-U.S. defense customers.

U.S. GOVERNMENT

Our primary customer is the U.S. Department of Defense (DoD). We also contract with other U.S. government customers, including the intelligence community, the Departments of Homeland Security and Health and Human Services and first-responder agencies. Our revenues from the U.S. government were as follows:

|

| | | | | | | | | | | |

Year Ended December 31 | 2014 | | 2013 | | 2012 |

DoD | $ | 14,516 |

| | $ | 15,441 |

| | $ | 17,217 |

|

Non-DoD | 2,750 |

| | 2,790 |

| | 2,382 |

|

Foreign Military Sales (FMS)* | 689 |

| | 1,032 |

| | 1,206 |

|

Total U.S. government | $ | 17,955 |

| | $ | 19,263 |

| | $ | 20,805 |

|

Percent of total revenues | 58 | % | | 62 | % | | 67 | % |

* In addition to our direct non-U.S. sales, we sell to non-U.S. governments through the FMS program. Under the FMS program, we contract with and are paid by the U.S. government, and the U.S. government assumes the risk of collection from the non-U.S. government customer.

We perform our U.S. government business under fixed-price, cost-reimbursement and time-and-materials contracts. Our production contracts are primarily fixed-price. Under these contracts, we agree to perform a specific scope of work for a fixed amount. Contracts for research, engineering, repair and maintenance and other services are typically cost-reimbursement or time-and-materials. Under cost-reimbursement contracts, the customer reimburses contract costs and pays a fixed, incentive or award-based fee. These fees are determined by our ability to achieve targets set in the contract, such as cost, quality, schedule and performance. Under time-and-materials contracts, the customer pays a fixed hourly rate for direct labor and generally reimburses us for the cost of materials.

In our U.S. government business, fixed-price contracts accounted for 53 percent in 2014, 54 percent in 2013 and 56 percent in 2012; cost-reimbursement contracts accounted for 43 percent in 2014, 42 percent in 2013 and 39 percent in 2012; and time-and-materials contracts accounted for 4 percent in 2014 and 2013 and 5 percent in 2012.

Each of these contract types presents advantages and disadvantages. Fixed-price contracts typically have higher fee levels as we assume more risk. These types of contracts offer additional profits when we complete the work for less than the contract amount. Cost-reimbursement contracts generally subject us to lower risk.

Accordingly, the negotiated fees are usually lower than fees earned on fixed-price contracts. Additionally, not all costs are allowable under these types of contracts, and the government reviews the costs we charge. Under time-and-materials contracts, our profit may vary if actual labor-hour costs vary significantly from the negotiated rates. Also, because these contracts can provide little or no fee for managing material costs, the content mix can impact profit margin rates.

U.S. COMMERCIAL

Our U.S. commercial revenues were $5.3 billion in 2014, $5.4 billion in 2013 and $3.8 billion in 2012. This represented approximately 17 percent of our consolidated revenues in 2014, 18 percent in 2013 and 12 percent in 2012. The majority of these revenues are for business-jet aircraft and services where our customer base consists of individuals and public and privately held companies across a wide range of industries.

NON-U.S.

Our direct revenues from non-U.S. government and commercial customers were $7.6 billion in 2014, $6.3 billion in 2013 and $6.4 billion in 2012. This represented approximately 25 percent of our consolidated revenues in 2014, 20 percent in 2013 and 21 percent in 2012.

We conduct business with government customers around the world with operations in Australia, Canada, Germany, Mexico, Spain, Switzerland and the United Kingdom. Our non-U.S. defense subsidiaries are committed to maintaining long-term relationships with their respective governments and have established themselves as principal regional suppliers and employers.

Our non-U.S. commercial business consists primarily of business-jet aircraft exports and worldwide aircraft services. The market for business-jet aircraft and related services outside North America has expanded significantly in recent years. While the installed base of aircraft is concentrated in North America, orders from non-U.S. customers represent a significant segment of our aircraft business with approximately 60 percent of total backlog on December 31, 2014.

For a discussion of the risks associated with conducting business in locations outside the United States, see Risk Factors contained herein. For information regarding revenues and assets by geographic region, see Note Q to the Consolidated Financial Statements in Item 8.

COMPETITION

Several factors determine our ability to compete successfully in the defense and business-aviation markets. While customers’ evaluation criteria vary, the principal competitive elements include:

| |

• | the technical excellence, reliability, safety and cost competitiveness of our products and services; |

| |

• | our ability to innovate and develop new products and technologies that improve mission performance and adapt to dynamic threats; |

| |

• | successful program execution and on-time delivery of complex, integrated systems; |

| |

• | our global footprint and accessibility to customers; |

| |

• | the reputation and customer confidence derived from our past performance; and |

| |

• | the successful management of customer relationships. |

DEFENSE MARKET COMPETITION

The U.S. government contracts with numerous domestic and non-U.S. companies for products and services. We compete against other large-platform and system-integration contractors as well as smaller companies that specialize in a particular technology or capability. Outside the U.S., we compete with global defense contractors’ exports and the offerings of private and state-owned defense manufacturers. Our Combat Systems group competes with a large number of domestic and non-U.S. businesses. Our Information Systems and Technology group competes with many companies, from large defense companies to small niche competitors with specialized technologies or expertise. Our Marine Systems group has one primary competitor with which it also partners on the Virginia-class submarine program. The operating cycle of many of our major platform programs can result in sustained periods of program continuity when we perform successfully.

We are involved in teaming and subcontracting relationships with some of our competitors. Competitions for major defense programs often require companies to form teams to bring together a spectrum of capabilities to meet the customer’s requirements. Opportunities associated with these programs include roles as the program’s integrator, overseeing and coordinating the efforts of all participants on a team, or as a provider of a specific component or subsystem.

BUSINESS-JET AIRCRAFT MARKET COMPETITION

The Aerospace group has several competitors for each of its Gulfstream products. Key competitive factors include aircraft safety, reliability and performance; comfort and in-flight productivity; service quality, global footprint and responsiveness; technological and new-product innovation; and price. We believe that Gulfstream competes effectively in all of these areas.

The Aerospace group competes worldwide in the business-jet aircraft services business primarily on the basis of price, quality and timeliness. In our maintenance, repair and FBO businesses, the group competes with several other large companies as well as a number of smaller companies, particularly in the maintenance business. In our completions business, the group competes with other OEMs, as well as several third-party providers.

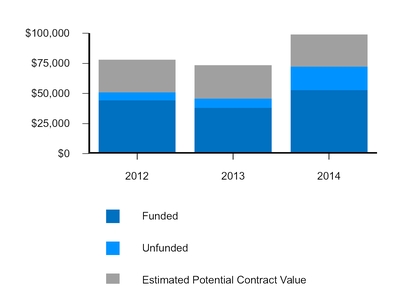

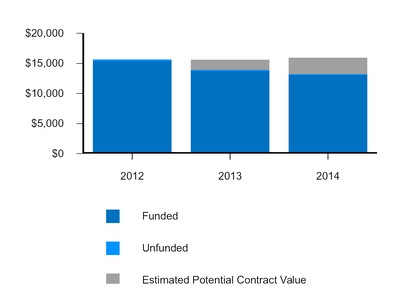

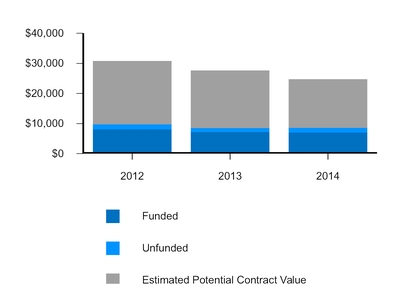

BACKLOG

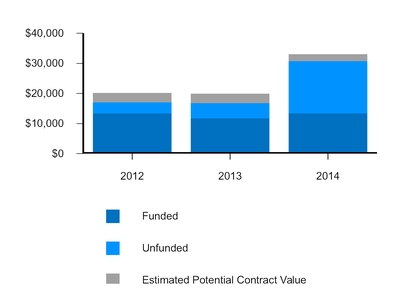

Our total backlog represents the estimated remaining value of work to be performed under firm contracts and includes funded and unfunded portions. For additional discussion of backlog, see Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7.

Summary backlog information for each of our business groups follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2014 Total Backlog Not Expected to Be Completed in 2015 |

December 31 | 2014 | | 2013 | |

| Funded | | Unfunded | | Total | | Funded | | Unfunded | | Total | |

Aerospace | $ | 13,115 |

| | $ | 117 |

| | $ | 13,232 |

| | $ | 13,785 |

| | $ | 158 |

| | $ | 13,943 |

| | $ | 6,931 |

|

Combat Systems | 19,292 |

| | 506 |

| | 19,798 |

| | 5,451 |

| | 1,113 |

| | 6,564 |

| | 15,060 |

|

Information Systems and Technology | 7,070 |

| | 1,539 |

| | 8,609 |

| | 7,253 |

| | 1,267 |

| | 8,520 |

| | 2,229 |

|

Marine Systems | 13,452 |

| | 17,319 |

| | 30,771 |

| | 11,795 |

| | 5,063 |

| | 16,858 |

| | 24,518 |

|

Total backlog | $ | 52,929 |

| | $ | 19,481 |

| | $ | 72,410 |

| | $ | 38,284 |

| | $ | 7,601 |

| | $ | 45,885 |

| | $ | 48,738 |

|

RESEARCH AND DEVELOPMENT

To foster innovative product development and evolution, we conduct sustained R&D activities as part of our normal business operations. In the commercial sector, most of our Aerospace group’s R&D activities support Gulfstream’s product enhancement and development programs. In our U.S. defense businesses, we conduct customer-sponsored R&D activities under government contracts and company-sponsored R&D. In accordance with government regulations, we recover a portion of company-sponsored R&D expenditures through overhead charges to U.S. government contracts. For more information on our company-sponsored R&D activities, including our expenditures for the past three years, see Note A to the Consolidated Financial Statements in Item 8.

INTELLECTUAL PROPERTY

We develop technology, manufacturing processes and systems-integration practices. In addition to owning a large portfolio of proprietary intellectual property, we license some intellectual property rights to and from others. The U.S. government holds licenses to many of our patents developed in the performance of U.S. government contracts, and it may use or authorize others to use the inventions covered by these patents. Although these intellectual property rights are important to the operation of our business, no existing patent, license or other intellectual property right is of such importance that its loss or termination would have a material impact on our business.

EMPLOYEES

On December 31, 2014, our subsidiaries had 99,500 employees, approximately one-fifth of whom work under collective agreements with various labor unions and worker representatives. Agreements covering approximately 2 percent of total employees are due to expire in 2015. Historically, we have negotiated successor labor agreements without any significant disruption to operating activities.

RAW MATERIALS, SUPPLIERS AND SEASONALITY

We depend on suppliers and subcontractors for raw materials, components and subsystems. These supply networks can experience price fluctuations and capacity constraints, which can put pressure on our costs. Effective management and oversight of suppliers and subcontractors is an important element of our successful performance. We attempt to mitigate these risks with our suppliers by entering into long-term agreements and leveraging company-wide agreements to achieve economies of scale, and by negotiating flexible pricing terms in our customer contracts. We have not experienced, and do not foresee, significant difficulties in obtaining the materials, components or supplies necessary for our business operations.

Our business is not seasonal in nature. The receipt of contract awards, the availability of funding from the customer, the incurrence of contract costs and unit deliveries are all factors that influence the timing of our revenues. In the U.S., these factors are influenced by the federal government’s budget cycle based on its October-to-September fiscal year. Outside the U.S., work for many of our government customers is weighted toward the end of the calendar year.

REGULATORY MATTERS

U.S. GOVERNMENT CONTRACTS

U.S. government contracts are subject to procurement laws and regulations. The Federal Acquisition Regulation (FAR) and the Cost Accounting Standards (CAS) govern the majority of our contracts. The FAR mandates uniform policies and procedures for U.S. government acquisitions and purchased services. Also, individual agencies can have acquisition regulations that provide implementing language for the FAR or that supplement the FAR. For example, the DoD implements the FAR through the Defense Federal

Acquisition Regulation Supplement (DFARS). For all federal government entities, the FAR regulates the phases of any product or service acquisition, including:

| |

• | competition requirements, |

| |

• | contractor qualifications, |

| |

• | protection of source selection and vendor information, and |

In addition, the FAR addresses the allowability of our costs, while the CAS address how those costs should be allocated to contracts. The FAR subjects us to audits and other government reviews covering issues such as cost, performance and accounting practices relating to our contracts.

NON-U.S. REGULATORY

Our non-U.S. revenues are subject to the applicable foreign government regulations and procurement policies and practices, as well as U.S. policies and regulations. We are also subject to regulations governing investments, exchange controls, repatriation of earnings and import-export control.

BUSINESS-JET AIRCRAFT

The Aerospace group is subject to Federal Aviation Administration (FAA) regulation in the U.S. and other similar aviation regulatory authorities internationally, including the Civil Aviation Administration of Israel (CAAI), the European Aviation Safety Agency (EASA) and the Civil Aviation Administration of China (CAAC). For an aircraft to be manufactured and sold, the model must receive a type certificate from the appropriate aviation authority and each aircraft must receive a certificate of airworthiness. Aircraft outfitting and completions also require approval by the appropriate aviation authority, which often is accomplished through a supplemental type certificate. Aviation authorities can require changes to a specific aircraft or model type before granting approval. Maintenance facilities and charter operations must be licensed by aviation authorities as well.

ENVIRONMENTAL

We are subject to a variety of federal, state, local and foreign environmental laws and regulations. These laws and regulations cover the discharge, treatment, storage, disposal, investigation and remediation of certain materials, substances and wastes. We are directly or indirectly involved in environmental investigations or remediation at some of our current and former facilities and at third-party sites that we do not own but where we have been designated a Potentially Responsible Party (PRP) by the U.S. Environmental Protection Agency or a state environmental agency. As a PRP, we potentially are liable to the government or third parties for the cost of remediating contamination. In cases where we have been designated a PRP, generally we seek to mitigate these environmental liabilities through available insurance coverage and by pursuing appropriate cost-recovery actions. In the unlikely event we are required to fully fund the remediation of a site, the current statutory framework would allow us to pursue contributions from other PRPs. We regularly assess our compliance status and management of environmental matters.

Operating and maintenance costs associated with environmental compliance and management of contaminated sites are a normal, recurring part of our operations. Historically, these costs have not been material. Environmental costs often are recoverable under our contracts with the U.S. government. Based on information currently available and current U.S. government policies relating to cost recovery, we do not expect continued compliance with environmental regulations to have a material impact on our results of operations, financial condition or cash flows. For additional information relating to the impact of environmental matters, see Note N to the Consolidated Financial Statements in Item 8.

AVAILABLE INFORMATION

We file reports and other information with the Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. These reports and information include an annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy statements. Free copies of these items are made available on our website (www.generaldynamics.com) as soon as practicable and through the General Dynamics investor relations office at (703) 876-3583.

These items also can be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. Information on the operation of the Public Reference Room is available by calling the SEC at (800) SEC-0330. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information.

ITEM 1A. RISK FACTORS

An investment in our common stock or debt securities is subject to risks and uncertainties. Investors should consider the following factors, in addition to the other information contained in this Annual Report on Form 10-K, before deciding whether to purchase our securities.

Investment risks can be market-wide as well as unique to a specific industry or company. The market risks faced by an investor in our stock are similar to the uncertainties faced by investors in a broad range of industries. There are some risks that apply more specifically to our business.

Our revenues are concentrated with the U.S. government. This customer relationship involves some specific risks. In addition, our sales to non-U.S. customers expose us to different financial and legal risks. Despite the varying nature of our U.S. and non-U.S. defense and business-aviation operations and the markets they serve, each group shares some common risks, such as the ongoing development of high-technology products and the price, availability and quality of commodities and subsystems.

The U.S. government provides a significant portion of our revenues. Approximately 60 percent of our revenues are from the U.S. government. U.S. defense spending is driven by threats to national security. While the country has been under an elevated threat level for more than a decade, competing demands for federal funds are pressuring various areas of spending. Defense investment accounts (budgets for procurement and research and development) remain under pressure. Decreases in U.S. government defense spending, including investment accounts, or changes in spending allocation could result in one or more of our programs being reduced, delayed or terminated, which could impact our financial performance.

For additional information relating to the U.S. defense budget, see the Business Environment section of Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7.

U.S. government contracts are not always fully funded at inception, and any funding is subject to disruption or delay. Our U.S. government revenues are funded by agency budgets that operate on an October-to-September fiscal year. Early each calendar year, the President of the United States presents to the Congress the budget for the upcoming fiscal year. This budget proposes funding levels for every federal agency and is the result of months of policy and program reviews throughout the Executive branch. For the remainder of the year, the appropriations and authorization committees of the Congress review the President’s budget proposals and establish the funding levels for the upcoming fiscal year. Once these levels are enacted into law, the Executive Office of the President administers the funds to the agencies.

There are two primary risks associated with the U.S. government budget cycle. First, the annual process may be delayed or disrupted, which has occurred in recent years. For example, changes in congressional schedules due to elections or other legislative priorities, or negotiations for program funding levels can interrupt the process. If the annual budget is not approved by the beginning of the government fiscal year, portions of the U.S. government can shut down or operate under a continuing resolution that maintains spending at prior-year levels, which can impact funding for our programs and timing of new awards. Second, the Congress typically appropriates funds on a fiscal-year basis, even though contract performance may extend over many years. Future revenues under existing multi-year contracts are conditioned on the continuing availability of congressional appropriations. Changes in appropriations in subsequent years may impact the funding available for these programs. Delays or changes in funding can impact the timing of available funds or lead to changes in program content.

Our U.S. government contracts are subject to termination rights by the customer. U.S. government contracts generally permit the government to terminate a contract, in whole or in part, for convenience. If a contract is terminated for convenience, a contractor usually is entitled to receive payments for its allowable costs and the proportionate share of fees or earnings for the work performed. The government may also terminate a contract for default in the event of a breach by the contractor. If a contract is terminated for default, the government in most cases pays only for the work it has accepted. The termination of multiple or large programs could have a material adverse effect on our future revenues and earnings.

Government contractors are subject to audit by the U.S. government. Numerous U.S. government agencies routinely audit and review government contractors. These agencies review a contractor’s performance under its contracts and compliance with applicable laws, regulations and standards. The U.S. government also reviews the adequacy of, and a contractor’s compliance with, its internal control systems and policies, including the contractor’s purchasing, property, estimating, material, earned value management and accounting systems. In some cases, audits may result in delayed payments or contractor costs not being reimbursed or subject to repayment. If an audit or investigation were to result in allegations against a contractor of improper or illegal activities, civil or criminal penalties and administrative sanctions could result, including termination of contracts, forfeiture of profits, suspension of payments, fines, and suspension or prohibition from doing business with the U.S. government. In addition, reputational harm could result if allegations of impropriety were made. In some cases, audits may result in disputes with the respective government agency that can result in negotiated settlements, arbitration or litigation.

Our Aerospace group is subject to changing customer demand for business aircraft. The business-jet market is driven by the demand for business-aviation products and services by business, individual and government customers in the United States and around the world. The Aerospace group’s results also depend on other factors, including general economic conditions, the availability of credit and trends in capital goods markets. In addition, if customers default on existing contracts and the contracts are not replaced, the group’s anticipated revenues and profitability could be reduced materially as a result.

Earnings and margins depend on our ability to perform on our contracts. When agreeing to contractual terms, our management team makes assumptions and projections about future conditions and events. The accounting for our contracts and programs requires assumptions and estimates about these conditions and events. These projections and estimates assess:

| |

• | the productivity and availability of labor, |

| |

• | the complexity of the work to be performed, |

| |

• | the cost and availability of materials and components, and |

If there is a significant change in one or more of these circumstances, estimates or assumptions, or if the risks under our contracts are not managed adequately, the profitability of contracts could be adversely affected. This could affect earnings and margins materially.

Earnings and margins depend in part on subcontractor and vendor performance. We rely on other companies to provide materials, components and subsystems for our products. Subcontractors also perform some of the services that we provide to our customers. We depend on these subcontractors and vendors to meet our contractual obligations in full compliance with customer requirements and applicable law. Misconduct by subcontractors, such as a failure to comply with procurement regulations or engaging in unauthorized activities, may harm our future revenues and earnings. We manage our supplier base carefully to avoid customer issues. However, we sometimes rely on only one or two sources of supply that, if disrupted, could have an adverse effect on our ability to meet our customer commitments. Our ability to perform our obligations may be materially adversely affected if one or more of these suppliers is unable to provide the agreed-upon supplies, perform the agreed-upon services in a timely and cost-effective manner or engages in misconduct or other improper activities.

Sales and operations outside the U.S. are subject to different risks that may be associated with doing business in foreign countries. In some countries there is increased chance for economic, legal or political changes, and procurement procedures may be less robust or mature, which may complicate the contracting process. Our non-U.S. business may be sensitive to changes in a foreign government’s budgets, leadership and national priorities. Non-U.S. transactions can involve increased financial and legal risks arising from foreign exchange-rate variability and differing legal systems. Our non-U.S. business is subject to U.S. and foreign laws and regulations, including laws and regulations relating to import-export controls, technology transfers, the Foreign Corrupt Practices Act and certain other anti-corruption laws, and the International Traffic in Arms Regulations (ITAR). An unfavorable event or trend in any one or more of these factors or a failure to comply with U.S. or foreign laws could result in administrative, civil or criminal liabilities, including suspension or debarment from government contracts or suspension of our export privileges and could materially adversely affect revenues and earnings associated with our non-U.S. business.

In addition, some non-U.S. government customers require contractors to enter into letters of credit, performance or surety bonds, bank guarantees and other similar financial arrangements. We may also be required to agree to specific in-country purchases, manufacturing agreements or financial support arrangements, known as offsets, that require us to satisfy certain requirements or face penalties. Offset requirements may extend over several years and could require us to establish joint ventures with local companies. If we do not satisfy these financial or offset requirements, our future revenues and earnings may be materially adversely affected.

Our future success depends in part on our ability to develop new products and technologies and maintain a qualified workforce to meet the needs of our customers. Many of the products and services we provide involve sophisticated technologies and engineering, with related complex manufacturing and system integration processes. Our customers’ requirements change and evolve regularly. Accordingly, our future performance depends in part on our ability to continue to develop, manufacture and provide innovative products and services and bring those offerings to market quickly at cost-effective prices. Due to the highly specialized nature of our business, we must hire and retain the skilled and qualified personnel necessary to perform the services required by our customers. If we were unable to develop new products that meet

customers’ changing needs or successfully attract and retain qualified personnel, our future revenues and earnings may be materially adversely affected.

We have made and expect to continue to make investments, including acquisitions and joint ventures, that involve risks and uncertainties. When evaluating potential mergers and acquisitions, we make judgments regarding the value of business opportunities, technologies and other assets and the risks and costs of potential liabilities based on information available to us at the time of the transaction. Whether we realize the anticipated benefits from these transactions depends on multiple factors, including our integration of the businesses involved, the performance of the underlying products, capabilities or technologies, market conditions following the acquisition and acquired liabilities, including some that may not have been identified prior to the acquisition. These factors could materially adversely affect our financial results.

Changes in business conditions may cause goodwill and other intangible assets to become impaired. Goodwill represents the purchase price paid in excess of the fair value of net tangible and intangible assets acquired. Goodwill is not amortized and remains on our balance sheet indefinitely unless there is an impairment. Goodwill is subject to an impairment test on an annual basis and when circumstances indicate that an impairment is more likely than not. Such circumstances include a significant adverse change in the business climate for one of our business groups or a decision to dispose of a business group or a significant portion of a business group. We face some uncertainty in our business environment due to a variety of challenges, including changes in defense spending. We may experience unforeseen circumstances that adversely affect the value of our goodwill or intangible assets and trigger an evaluation of the amount of the recorded goodwill and intangible assets. Future write-offs of goodwill or other intangible assets as a result of an impairment test or any accelerated amortization of other intangible assets could materially adversely affect our results of operations and financial condition.

Our business could be negatively impacted by cyber security events and other disruptions. We face various cyber security threats, including threats to our information technology infrastructure and attempts to gain access to our proprietary or classified information, denial of service attacks, as well as threats to the physical security of our facilities and employees, and threats from terrorist acts. We also design and manage information technology systems for various customers. We generally face the same security threats for these systems as for our own. In addition, we face cyber threats from entities that may seek to target us through our customers, vendors and subcontractors. Accordingly, we maintain information security policies and procedures for managing all systems. We have experienced cyber security threats to our information technology infrastructure and attempts to gain access to our sensitive information, including viruses and attacks by hackers. Such prior events have not had a material impact on our financial condition, results of operations or liquidity. However, future threats could cause harm to our business and our reputation and challenge our eligibility for future work on sensitive or classified systems for U.S. government customers, as well as impact our results of operations materially. Our insurance coverage may not be adequate to cover all the costs related to cyber security attacks or disruptions resulting from such events.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that are based on management’s expectations, estimates, projections and assumptions. Words such as “expects,” “anticipates,” “plans,” “believes,” “scheduled,” “outlook,” “estimates,” “should” and variations of these words and similar expressions are intended to identify forward-looking statements. Examples include projections of revenues, earnings, operating margins, segment performance, cash flows, contract awards, aircraft production, deliveries and backlog. In making these statements we rely on assumptions and analyses based on our experience and perception of historical trends, current conditions and expected future developments as well as other factors we consider appropriate under the circumstances. We believe our estimates and judgments are reasonable based on information available to us at the time. Forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors, including, without limitation, the risk factors discussed in this section.

All forward-looking statements speak only as of the date of this report or, in the case of any document incorporated by reference, the date of that document. All subsequent written and oral forward-looking statements attributable to General Dynamics or any person acting on our behalf are qualified by the cautionary statements in this section. We do not undertake any obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this report. These factors may be revised or supplemented in subsequent reports on SEC Forms 10-Q and 8-K.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We operate in a number of offices, manufacturing plants, laboratories, warehouses and other facilities in the United States and abroad. We believe our facilities are adequate for our present needs and, given planned improvements and construction, expect them to remain adequate for the foreseeable future.

On December 31, 2014, our business groups had primary operations at the following locations:

| |

• | Aerospace – Lincoln and Long Beach, California; West Palm Beach, Florida; Brunswick and Savannah, Georgia; Cahokia, Illinois; Bedford and Westfield, Massachusetts; Las Vegas, Nevada; Teterboro, New Jersey; Dallas and Houston, Texas; Appleton, Wisconsin; Sorocaba, Brazil; Beijing and Hong Kong, China; Dusseldorf, Germany; Mexicali, Mexico; Moscow, Russia; Singapore; Basel, Geneva and Zurich, Switzerland; Dubai, United Arab Emirates; Luton, United Kingdom. |

| |

• | Combat Systems – Anniston, Alabama; East Camden and Hampton, Arkansas; Crawfordsville, St. Petersburg and Tallahassee, Florida; Marion, Illinois; Saco, Maine; Westminster, Maryland; Shelby Township and Sterling Heights, Michigan; Joplin, Missouri; Lincoln, Nebraska; Roxboro, North Carolina; Lima and Springboro, Ohio; Eynon, Red Lion and Scranton, Pennsylvania; Edgefield and Ladson, South Carolina; Garland, Texas; Williston, Vermont; Marion, Virginia; Auburn, Washington; |

Vienna, Austria; Edmonton, London, La Gardeur, St. Augustin and Valleyfield, Canada; Kaiserslautern, Germany; Granada, Sevilla and Trubia, Spain; Kreuzlingen, Switzerland; Oakdale, United Kingdom.

| |

• | Information Systems and Technology – Cullman, Alabama; Phoenix and Scottsdale, Arizona; San Diego and Santa Clara, California; Colorado Springs, Colorado; Lynn Haven and Orlando, Florida; Coralville, Iowa; Lawrence, Kansas; Annapolis Junction and Towson, Maryland; Needham, Pittsfield and Taunton, Massachusetts; Bloomington, Minnesota; Nashua, New Hampshire; Florham Park, New Jersey; Greensboro and Newton, North Carolina; Kilgore, Texas; Sandy, Utah; Arlington, Chantilly, Chesapeake, Fairfax, Herndon, Richmond and Springfield, Virginia; Calgary and Ottawa, Canada; Tallinn, Estonia; Oakdale, St. Leonards and Throckmorton, United Kingdom. |

| |

• | Marine Systems – San Diego, California; Groton and New London, Connecticut; Jacksonville, Florida; Bath and Brunswick, Maine; North Kingstown, Rhode Island; Norfolk, Virginia; Bremerton, Washington; Mexicali, Mexico. |

A summary of floor space by business group on December 31, 2014, follows:

|

| | | | | | | | | | | |

(Square feet in millions) | Company-owned Facilities | | Leased Facilities | | Government-owned Facilities | | Total |

Aerospace | 5.9 |

| | 6.1 |

| | — |

| | 12.0 |

|

Combat Systems | 7.2 |

| | 3.8 |

| | 5.3 |

| | 16.3 |

|

Information Systems and Technology | 2.5 |

| | 9.2 |

| | 0.9 |

| | 12.6 |

|

Marine Systems | 8.0 |

| | 2.2 |

| | — |

| | 10.2 |

|

Total | 23.6 |

| | 21.3 |

| | 6.2 |

| | 51.1 |

|

ITEM 3. LEGAL PROCEEDINGS

For information relating to legal proceedings, see Note N to the Consolidated Financial Statements in Item 8.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

EXECUTIVE OFFICERS OF THE COMPANY

All of our executive officers are appointed annually. None of our executive officers was selected pursuant to any arrangement or understanding between the officer and any other person. The name, age, offices and positions of our executives held for at least the past five years as of February 9, 2015, were as follows:

|

| |

| |

Name, Position and Office | Age |

| |

Jason W. Aiken – Senior Vice President and Chief Financial Officer since January 2014; Vice President of the company and Chief Financial Officer of Gulfstream Aerospace Corporation, September 2011 – December 2013; Vice President and Controller of the company, April 2010 – August 2011; Staff Vice President, Accounting of the company, July 2006 – March 2010 | 42 |

| |

|

| |

John P. Casey – Executive Vice President, Marine Systems, since May 2012; Vice President of the company and President of Electric Boat Corporation, October 2003 – May 2012; Vice President of Electric Boat Corporation, October 1996 – October 2003 | 60 |

| |

Larry R. Flynn – Vice President of the company and President of Gulfstream Aerospace Corporation since September 2011; Vice President of the company and Senior Vice President, Marketing and Sales of Gulfstream Aerospace Corporation, July 2008 – September 2011; President, Product Support of Gulfstream Aerospace Corporation, May 2002 – June 2008 | 62 |

| |

Gregory S. Gallopoulos – Senior Vice President, General Counsel and Secretary of the company since January 2010; Vice President and Deputy General Counsel of the company, July 2008 – January 2010; Managing Partner of Jenner & Block LLP, January 2005 – June 2008 | 55 |

| |

Jeffrey S. Geiger – Vice President of the company and President of Electric Boat Corporation since November 2013; Vice President of the company and President of Bath Iron Works Corporation, April 2009 – November 2013; Senior Vice President, Operations and Engineering of Bath Iron Works, March 2008 – March 2009 | 53 |

| |

Robert W. Helm – Senior Vice President, Planning and Development of the company since May 2010; Vice President, Government Relations of Northrop Grumman Corporation, August 1989 – April 2010 | 63 |

| |

S. Daniel Johnson – Executive Vice President, Information Systems and Technology, and President of General Dynamics Information Technology since January 2015; Vice President of the company and President of General Dynamics Information Technology, April 2008 – December 2014; Executive Vice President of General Dynamics Information Technology, July 2006 – March 2008 | 67 |

| |

Kimberly A. Kuryea – Vice President and Controller of the company since September 2011; Chief Financial Officer of General Dynamics Advanced Information Systems, November 2007 – August 2011; Staff Vice President, Internal Audit of the company, March 2004 – October 2007 | 47 |

| |

Joseph T. Lombardo – Executive Vice President, Aerospace, since April 2007; President of Gulfstream Aerospace Corporation, April 2007 – September 2011; Vice President of the company and Chief Operating Officer of Gulfstream Aerospace Corporation, May 2002 – April 2007 | 67 |

| |

Christopher Marzilli – Vice President of the company and President of General Dynamics Mission Systems since January 2015; Vice President of the company and President of General Dynamics C4 Systems, January 2006 – December 2014; Senior Vice President and Deputy General Manager of General Dynamics C4 Systems, November 2003 – January 2006 | 55 |

| |

Phebe N. Novakovic – Chairman and Chief Executive Officer of the company since January 2013; President and Chief Operating Officer of the company, May 2012 – December 2012; Executive Vice President, Marine Systems, May 2010 – May 2012; Senior Vice President, Planning and Development of the company, July 2005 – May 2010; Vice President, Strategic Planning of the company, October 2002 – July 2005 | 57 |

| |

Walter M. Oliver – Senior Vice President, Human Resources and Administration of the company since March 2002; Vice President, Human Resources and Administration of the company, January 2001 – March 2002 | 69 |

| |

Mark C. Roualet – Executive Vice President, Combat Systems, since March 2013; Vice President of the company and President of General Dynamics Land Systems, October 2008 – March 2013; Senior Vice President and Chief Operating Officer of General Dynamics Land Systems, July 2007 – October 2008 | 56 |

| |

Gary L. Whited – Vice President of the company and President of General Dynamics Land Systems since March 2013; Senior Vice President of General Dynamics Land Systems, September 2011 – March 2013; Vice President and Chief Financial Officer of General Dynamics Land Systems, June 2006 – September 2011 | 54 |

PART II

ITEM 5. MARKET FOR THE COMPANY’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is listed on the New York Stock Exchange.

The high and low sales prices of our common stock and the cash dividends declared on our common stock for each quarter of 2013 and 2014 are included in the Supplementary Data contained in Item 8.

On February 1, 2015, there were approximately 13,000 holders of record of our common stock.

For information regarding securities authorized for issuance under our equity compensation plans, see Note O to the Consolidated Financial Statements contained in Item 8.

We did not make any unregistered sales of equity securities in 2014.

The following table provides information about our fourth-quarter repurchases of equity securities that are registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended:

|

| | | | | | | | | | | | | |

Period | | Total Number of Shares Purchased |

| | Average Price Paid per Share |

| | Total Number of Shares Purchased as Part of Publicly Announced Program* |

| | Maximum Number of Shares That May Yet Be Purchased Under the Program* |

|

Pursuant to Share Buyback Program | | | | |

9/28/14-10/26/14 | | 216,000 |

| | $ | 127.60 |

| | 216,000 |

| | 2,394,152 |

|

10/27/14-11/23/14 | | — |

| | $ | — |

| | — |

| | 2,394,152 |

|

11/24/14-12/31/14 | | — |

| | $ | — |

| | — |

| | 2,394,152 |

|

Total | | 216,000 |

| | $ | 127.60 |

| | | | |

* On February 5, 2014, the board of directors authorized management to repurchase 20 million shares of common stock.

For additional information relating to our repurchases of common stock during the past three years, see Financial Condition, Liquidity and Capital Resources – Financing Activities – Share Repurchases contained in Item 7.

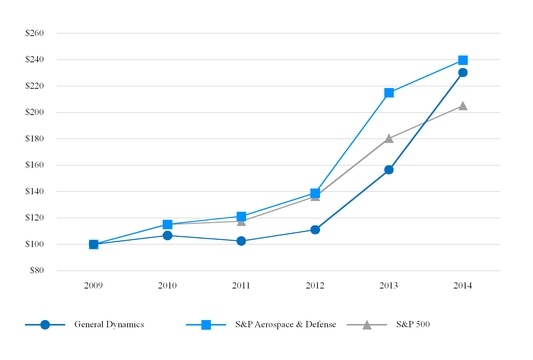

The following performance graph compares the cumulative total return to shareholders on our common stock, assuming reinvestment of dividends, with similar returns for the Standard & Poor’s® 500 Index and the Standard & Poor’s® Aerospace & Defense Index, both of which include General Dynamics.

Cumulative Total Return

Based on Investments of $100 Beginning December 31, 2009

(Assumes Reinvestment of Dividends)

ITEM 6. SELECTED FINANCIAL DATA

The following table presents selected historical financial data derived from the Consolidated Financial Statements and other company information for each of the five years presented. This information should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Consolidated Financial Statements and the Notes thereto.

|

| | | | | | | | | | | | | | | | | | | | |

(Dollars and shares in millions, except per-share and employee amounts) | | | | | | |

| | | | |

| 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Summary of Operations | | | | | | | | | | |

Revenues | | $ | 30,852 |

| | $ | 30,930 |

| | $ | 30,992 |

| | $ | 32,122 |

| | $ | 31,964 |

|

Operating earnings | | 3,889 |

| | 3,689 |

| | 765 |

| | 3,747 |

| | 3,860 |

|

Operating margins | | 12.6 | % | | 11.9 | % | | 2.5 | % | | 11.7 | % | | 12.1 | % |

Interest, net | | (86 | ) | | (86 | ) | | (156 | ) | | (141 | ) | | (157 | ) |

Provision for income tax, net | | 1,129 |

| | 1,125 |

| | 854 |

| | 1,139 |

| | 1,139 |

|

Earnings (loss) from continuing operations | | 2,673 |

| | 2,486 |

| | (381 | ) | | 2,500 |

| | 2,567 |

|

Return on sales (a) | | 8.7 | % | | 8.0 | % | | (1.2 | )% | | 7.8 | % | | 8.0 | % |

Discontinued operations, net of tax | | (140 | ) | | (129 | ) | | 49 |

| | 26 |

| | 57 |

|

Net earnings (loss) | | 2,533 |

| | 2,357 |

| | (332 | ) | | 2,526 |

| | 2,624 |

|

Diluted earnings (loss) per share: | | | | | | | | | | |

Continuing operations (b) | | 7.83 |

| | 7.03 |