2 0 2 3 P R O X Y S T A T E M E N T

Notice of Annual Meeting of Shareholders

to be held on April 28, 2023

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2 0 2 3 P R O X Y S T A T E M E N T

Notice of Annual Meeting of Shareholders

to be held on April 28, 2023

March 17, 2023

Dear Shareholders:

On behalf of the Board of Directors, I invite you to attend GATX Corporation’s 2023 Annual Meeting of Shareholders on Friday, April 28, 2023 at 9:00 a.m. Central Time. This year’s annual meeting will be a virtual meeting of shareholders. You will be able to attend the annual meeting online, vote your shares electronically, and submit your questions during the annual meeting by visiting https://meetnow.global/MMQAVCG. Enclosed you will find a notice setting forth the items we expect to address at the meeting, our Proxy Statement, a form of proxy, and a copy of our 2022 annual report to our shareholders.

In 2022, GATX’s net income from continuing operations was $155.9 million, or $4.35 per diluted share.1 Each of our business units contributed to our strong financial results for the year. Rail North America’s segment profit increased $35.9 million, or over 12%, from the prior year and exceeded expectations as we took advantage of strong demand for existing assets and a favorable railcar leasing environment. Our commercial team did an excellent job achieving higher renewal lease rates while maintaining over 99% fleet utilization. We continued to improve the efficiency of our maintenance network, completing the vast majority of repair work at our owned facilities. We continued to optimize our fleet by selectively selling railcars into a robust secondary market, generating $104.6 million in remarketing income for the full year.

Our Rail International businesses performed well despite supply chain disruptions partially relating to the Russia/Ukraine conflict that delayed new car deliveries in Europe and India. Demand for railcars in both regions was strong, and Rail Europe continued to experience increases in renewal lease rates compared to expiring rates. In Portfolio Management, the Rolls-Royce and Partners Finance affiliates performed better than we anticipated as long-haul, international air traffic, which remains below pre-pandemic levels, improved from a year ago.

Notwithstanding rising asset prices, we continued to find a number of attractive opportunities to grow our global asset base in 2022. In Rail North America, we invested more than $815 million and entered into a new six-year railcar supply agreement that enhances our ability to meet customer needs. Despite delivery delays internationally, we invested over $176 million at Rail Europe and almost $68 million at Rail India. In the fourth quarter, we increased our direct investment in aircraft spare engines through GATX Engine Leasing by acquiring five additional engines for nearly $150 million. In total, our 2022 investment volume was over $1.2 billion.

Your vote is very important. Whether or not you plan to attend the virtual annual meeting, please ensure that your shares are represented at the meeting by promptly voting and submitting your proxy by internet or telephone or by signing and returning your proxy card in the enclosed envelope. On behalf of the Board of Directors and management, I would like to thank you for your continued support of GATX.

| Sincerely, | ||

|

President and Chief Executive Officer |

Important Notice Regarding the Availability of Proxy Materials

for the Shareholders’ Meeting to be held on April 28, 2023.

The Company’s Proxy Statement for the 2023 Annual Meeting of Shareholders, the Annual Report to Shareholders for the year ended December 31, 2022, and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, are available at: www.envisionreports.com/GATX.

| 1 | These results are calculated in accordance with GAAP and include $61.8 million of tax adjustments and other items. For a reconciliation of net income, diluted earnings per share and return on equity, excluding tax adjustments and other items (non-GAAP), to net income, diluted earnings per share, and return on equity calculated in accordance with GAAP, as well as for information regarding why we believe these non-GAAP measures present useful information to investors, please see Exhibit B to this Proxy Statement. |

| Notice of Annual Meeting of Shareholders |

GATX 2023 Annual Meeting of Shareholders

| Date: Friday, April 28, 2023 |

Items of Business:

• Election of 8 Directors

• Adoption of Advisory Resolution to Approve Executive Compensation

• Adoption of Advisory Resolution Regarding Frequency of Future Advisory Votes on Executive Compensation

• Ratification of Independent Registered Public Accounting Firm

| |||

| Time: 9:00 a.m. Central Time |

||||

| Place: The annual meeting will be held as a live audio webcast at

Record Date: Close of business on March 3, 2023

|

Advance Voting Methods and Deadlines

Internet and telephone voting are available 24 hours a day, seven days a week up to these deadlines:

| • | Registered Shareholders—closing of the polls at the virtual annual meeting |

| • | Beneficial Owners—11:59 p.m. Eastern Time on April 27, 2023 (after which voting is available online at the virtual annual meeting if properly registered in advance) |

| • | Participants in GATX 401(k) Plans—8:00 a.m. Eastern Time on April 26, 2023 |

|

|

|

|

| |||||||||||

| Go to the website identified on the proxy card

• Enter the Control Number printed on the proxy card

• Follow the instructions on the screen. |

Call the toll-free number identified on the proxy card

• Enter the Control Number printed on the proxy card

• Follow the recorded instructions. |

Mark your selections on the enclosed proxy card

• Date and sign your name exactly as it appears on the proxy card

• Promptly mail the proxy card in the enclosed postage-paid envelope

Return promptly to ensure that it is received before the deadlines stated above. |

You can vote online at the virtual annual meeting

• Follow the instructions on the meeting website: |

By Order of the Board of Directors,

Executive Vice President, General Counsel and

Corporate Secretary

Table of Contents

| GATX CORPORATION - 2023 Proxy Statement | i |

TABLE OF CONTENTS

| ii | GATX CORPORATION - 2023 Proxy Statement |

Proxy Summary

The Board of Directors (the “Board”) of GATX Corporation (“GATX”, the “Company”, “we”, “us”, or “our”) is soliciting proxies for use at the Company’s Annual Meeting of Shareholders to be held on Friday, April 28, 2023 (the “Annual Meeting”). This Proxy Statement and accompanying proxy card are being mailed to shareholders on or about March 17, 2023.

This summary includes information found elsewhere in this Proxy Statement and does not contain all of the information you should consider in voting. Please read this Proxy Statement carefully before voting your shares.

Annual Meeting of Shareholders

When g April 28, 2023, 9:00 a.m. Central Time

Where g The meeting will be held virtually via a live audio

webcast at https://meetnow.global/MMQAVCG

You may vote if you were a shareholder of record at the close of business on March 3, 2023. We hope that you will be able to attend the Annual Meeting virtually, but if you cannot do so, it is important that your shares be represented.

We urge you to read the Proxy Statement carefully and to vote your shares in accordance with the Board’s recommendations by internet or telephone or by signing and returning the enclosed proxy card in the postage-paid envelope provided, whether or not you plan to virtually attend the Annual Meeting.

Voting Recommendations of the Board

| Item | Description | For | Against | Page | ||||

|

1

|

Election of directors

|

|

19 | |||||

|

2

|

Adoption of advisory resolution approving our executive compensation

|

|

29 | |||||

|

3

|

Adoption of advisory resolution selecting EVERY YEAR as the frequency of future votes on executive compensation

|

|

30 | |||||

|

4

|

Ratification of independent registered public accounting firm

|

|

73 | |||||

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting.

Voting at the Annual Meeting (page 82)

If your shares are registered in your name with our transfer agent, you may vote virtually at the Annual Meeting. If you hold your shares through a broker, bank, or other nominee, you will not be able to vote virtually at the Annual Meeting unless you first obtain a legal proxy from your nominee. For further information, please see How do I vote? on page 82.

Questions and Answers (page 82)

We encourage you to review the Questions and Answers about the Annual Meeting beginning on page 82 for answers to common questions about the rules and procedures surrounding the proxy and annual meeting process.

| GATX CORPORATION - 2023 Proxy Statement | 1 |

PROXY SUMMARY

CORPORATE GOVERNANCE (PAGE 11)

GATX is committed to strong corporate governance, which promotes the long-term interests of shareholders and strengthens Board and management accountability. Highlights of our corporate governance practices include:

|

✓

|

Annual Election of Directors | ✓ | Annual CEO Succession Planning by Full Board | |||

|

✓

|

Majority Voting for Directors | ✓ | Risk Oversight by Full Board and Committees | |||

|

✓

|

Resignation Policy for Directors who Fail to Receive a Majority Vote | ✓ | Annual Board and Committee Self-Evaluations | |||

|

✓

|

7 of 8 Director Nominees are Independent | ✓ | No Poison Pill | |||

|

✓

|

Diversity of Experience and Skills Among Directors | ✓ | Anti-Hedging/Anti-Pledging Policies for Directors, Officers, and Employees | |||

|

✓

|

Regular Director Skills Assessment and Board Succession Planning | ✓ | Share Ownership Requirements for Directors and Executive Officers | |||

|

✓

|

Independent Board Chair | ✓ | Clawback Policy for Equity Awards and Incentive Compensation | |||

|

✓

|

Independent Audit, Compensation, and Governance Committees | ✓ | Annual “Say-on-Pay” Advisory Vote | |||

|

✓

|

Executive Sessions of Independent Directors After Each Board Meeting | ✓ | Active Shareholder Engagement Program | |||

DIRECTOR NOMINEES (PAGE 22)

The following table provides summary information about each director nominee (with age shown as of Annual Meeting date):

| Name | Age | Director Since |

Principal Occupation | Committee Memberships1 |

Other Public Company | |||||

| Diane M. Aigotti* |

58 | 2016 | Retired; Former Executive Vice President, Managing Director and Chief Financial Officer, Ryan Specialty Group, LLC |

A, G | 0 | |||||

| Anne L. Arvia* |

60 | 2009 | Retired; Former Executive Vice President, Banking The Auto Club Trust |

A (Chair) | 0 | |||||

| Robert C. Lyons |

59 | 2022 | President and Chief Executive Officer, GATX Corporation |

None | 1 | |||||

| James B. Ream* |

67 | 2008 | Retired; Former Senior Vice President – Operations, American Airlines |

CH, C, G | 0 | |||||

| Adam L. Stanley* |

49 | 2019 | Chief Experience Officer, Teach for America |

A, G | 0 | |||||

| David S. Sutherland* |

73 | 2007 | Retired; Former President and Chief Executive Officer, IPSCO, Inc. |

C (Chair) | 2 | |||||

| Stephen R. Wilson* |

74 | 2014 | Retired; Former Chairman, President and Chief Executive Officer, CF Industries Holdings, Inc. |

A, C | 0 | |||||

| Paul G. Yovovich* |

69 | 2012 | President, Lake Capital | C, G (Chair) | 0 |

| * | Independent Director |

| 1 | A = Audit Committee; C = Compensation Committee; G = Governance Committee; CH = Board Chair |

| 2 | GATX CORPORATION - 2023 Proxy Statement |

PROXY SUMMARY

EXECUTIVE COMPENSATION (PAGE 31)

We encourage you to review the Compensation Discussion and Analysis beginning on page 31 for information about our executive compensation program.

OUR EXECUTIVE COMPENSATION PROGRAM SUPPORTS OUR LONG-TERM FOCUS THROUGH INDUSTRY CYCLES

GATX is in the business of owning and leasing long-lived transportation assets. We are the leading global railcar lessor, leasing railcars in North America, Europe, and India. Most of our railcar leases are service-intensive leases under which we provide maintenance, engineering, administrative, and a variety of other value-added services. Railcar leasing accounted for a substantial majority of our 2022 revenues.

| • | The Railcar Leasing Market is Highly Cyclical. The railcar leasing market in which GATX operates can be highly cyclical. For example, swings in railcar supply in North America typically result in significant volatility in industry-wide railcar utilization and lease rates over time. In addition, many of our rail customers also operate in cyclical markets, such as the chemical, fertilizer, food/agricultural, refined petroleum, transportation, and construction industries. This cyclical demand, combined with changing macroeconomic conditions, may also contribute to volatility in railcar utilization and lease rates. |

| • | We Manage Our Business With a Long-Term View. Most of our operating assets typically have economic useful lives of 20 to 40 years. We proactively manage our business with a long-term view, which includes buying, leasing, maintaining, and selling long-lived assets into constantly changing business conditions over decades. It is critical that we make disciplined investment decisions that match the long lives of our assets. Through multiple industry and economic cycles, we have maintained a long-term focus on investing while executing numerous strategic initiatives to enhance our competitive advantage. |

| • | Our Strategy Varies Depending on Position in Market Cycle. Our strategy of emphasizing asset growth and returns at different points in the railcar leasing market cycle enables GATX to generate strong long-term shareholder return. |

| — | In stronger railcar markets, we focus on increasing lease rates and lengthening lease terms to lock in attractive lease revenue as long as possible. At the same time, we may be more selective when making new railcar investments due to high railcar prices unless we identify assets that will earn correspondingly higher lease rates over the asset’s life. |

| — | Conversely, in weaker markets, when railcar prices tend to be lower, we seek to increase railcar investments. We also reduce lease rates to maintain asset utilization and shorten lease terms to position us to capture value when lease rates improve. |

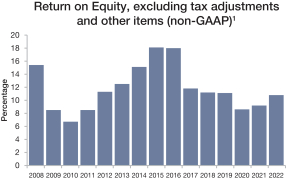

| • | Our Executive Compensation Program Supports This Long-Term Cyclical Approach and Strategy. Our executive compensation program is designed and managed by our Compensation Committee to motivate and retain management through each stage of the business cycle, including in both strong and weak railcar leasing markets. The Committee sets goals intended to align executive compensation with the appropriate achievement of our dual goals of growth and return at various points in the business cycle. Reflecting this focus, our Compensation Committee uses net income, excluding tax adjustments and other items (non-GAAP), as the performance measure in our annual incentive plan and three-year average “LTI-adjusted return on equity” (non-GAAP)1 and three-year cumulative investment volume as the performance measures in our long-term incentive plans. The Committee recognizes that our growth, investment and returns will differ at various points in the cycle and sets the performance goals for each of these measures with the intent of focusing management on achieving results that will have the biggest impact on our ability to generate long-term shareholder value in light of where we are in the business cycle. |

| 1 | LTI-adjusted return on equity (non-GAAP) is calculated as GAAP net income divided by shareholders’ equity, excluding accumulated other comprehensive loss. |

| GATX CORPORATION - 2023 Proxy Statement | 3 |

PROXY SUMMARY

STRONG 2022 FINANCIAL AND OPERATIONAL RESULTS

| • | Leasing Market Strengthened Throughout the Year. In 2022, we executed our strategic priorities and capitalized on an improving leasing market to deliver strong financial and operating results. At Rail North America, which accounted for 71% of our 2022 revenues, we increased lease rates across most car types and achieved strong lease renewal success rates while maintaining high fleet utilization. We further optimized our diverse railcar fleet by selling railcars in the secondary market at attractive prices and entered into a multi-year railcar supply agreement to add 15,000 newly-built railcars. Despite macroeconomic challenges and supply chain disruptions, our international railcar and tank container leasing businesses took advantage of strong asset demand and achieved high fleet utilization and improved lease rates. In Portfolio Management, we increased our direct investment in aircraft spare engines, while our Rolls-Royce and Partners Finance joint ventures delivered higher than expected operating income as international air travel continued to improve from pandemic levels. By executing on our dual growth and return strategies in a gradually improving leasing market, we delivered against key metrics in our compensation plans and produced diluted earnings per share (GAAP) of $4.35 and diluted earnings per share, excluding tax adjustments and other items (non-GAAP), of $6.07.1 |

| • | Positive Total Shareholder Return Despite Challenging Macroeconomic Environment. Despite challenging macroeconomic conditions in 2022, we executed our strategic priorities and delivered strong financial results, including a total shareholder return of 4.2% during a year of significant U.S. stock market decline, as illustrated below.2 |

Stock Performance

| 1 | For a reconciliation of diluted earnings per share (EPS), excluding tax adjustments and other items (non-GAAP), to diluted EPS calculated in accordance with GAAP, as well as for information regarding why we believe this non-GAAP measure presents useful information to investors, please see Exhibit B to this Proxy Statement. |

| 2 | Total shareholder return calculation presented on an annualized basis and assumes dividends are reinvested. |

| 4 | GATX CORPORATION - 2023 Proxy Statement |

PROXY SUMMARY

| • | Strong 2022 Financial and Operational Results. Set forth below is a summary of our key financial and operational achievements during 2022 (dollars in millions, except for per share amounts): |

| 1 | Reflects continuing operations only. |

| 2 | For a reconciliation of net income, diluted earnings per share (EPS) and return on equity (ROE), excluding tax adjustments and other items (non-GAAP), to net income, diluted EPS, and ROE calculated in accordance with GAAP, as well as for information regarding why we believe these non-GAAP measures present useful information to investors, please see Exhibit B to this Proxy Statement. |

| 3 | Operational data in the charts relates to our Rail North America segment. |

| 4 | Excludes boxcars. |

| GATX CORPORATION - 2023 Proxy Statement | 5 |

PROXY SUMMARY

THE CHART ABOVE ILLUSTRATES THE FOLLOWING KEY ACHIEVEMENTS DURING 2022:

|

Strong Earnings |

• Net income of $155.9 million (net income, excluding tax adjustments and other items (non-GAAP), of $217.7 million).1

• Diluted earnings per share of $4.35 (diluted earnings per share, excluding tax adjustments and other items (non-GAAP), of $6.07).1

• Return on equity of 7.7% (return on equity, excluding tax adjustments and other items (non-GAAP), of 10.8%).1

| |

|

Excellent Operating Performance |

• Capitalized on market conditions by investing over $1.2 billion in attractively priced, long-lived transportation assets.

• Achieved railcar fleet utilization of over 99% across our rail businesses (excluding boxcars).

• Achieved high renewal success rates for our railcar fleets, which resulted in lower fleet churn and reduced maintenance expense incurred in preparing railcars for new customers.

• Continued to increase the percentage of railcar service events performed in Rail North America’s wholly-owned network of shops, where we believe safety, quality, delivery, and cost metrics are superior.

• Further optimized our North American rail fleet through selective divestitures and scrapping.

• Continued expansion and diversification of the railcar fleets at GATX Rail Europe and GATX Rail India.

• Entered into a new long-term railcar supply agreement to purchase 15,000 newly built railcars through 2028, providing GATX with guaranteed access to high-quality, modern, and cost-advantaged railcars in North America.

• Invested $150 million directly in aircraft spare engines, capitalizing on the opportunity to add attractive assets to our wholly-owned portfolio.

• Invested over $42 million in tank containers at Trifleet, further expanding our global transportation asset base.

| |

|

Returned Cash to Shareholders |

• Increased our dividend for the 12th consecutive year to $2.08 (annualized) per share, completing our 104th year of uninterrupted dividends.

• Returned over $123 million to shareholders through share repurchases and dividends.

|

| 1 | Our 2022 financial results calculated in accordance with GAAP include $61.8 million of tax adjustments and other items. For a reconciliation of net income, diluted earnings per share and return on equity, excluding tax adjustments and other items (non-GAAP), to net income, diluted earnings per share, and return on equity calculated in accordance with GAAP, as well as for information regarding why we believe these non-GAAP measures present useful information to investors, please see Exhibit B to this Proxy Statement. |

| 6 | GATX CORPORATION - 2023 Proxy Statement |

PROXY SUMMARY

OUR 2022 EXECUTIVE COMPENSATION PROGRAM REFLECTED OUR PAY FOR PERFORMANCE PHILOSOPHY

| • | Substantial Majority of 2022 Pay Aligned with Performance. We design our pay programs to reward executives for positive Company performance and align with shareholder interests by having a significant portion of compensation composed of performance-based and long-term incentive awards. As shown in the charts below, 83% of our current Chief Executive Officer’s (“CEO’s”) 2022 total target compensation and approximately 67% of the 2022 total target compensation for our other currently serving named executive officers listed in the 2022 Summary Compensation table (our “NEOs”) on page 55 were tied to annual and long-term incentives based on Company performance relative to objective, quantifiable financial goals or, with respect to stock options, will only have value if our stock price increases. |

Note: The percentages in the charts above reflect the base salary and incentive targets in effect for the currently serving NEOs for 2022, and thus are not intended to match amounts shown in the Summary Compensation Table or the Grant of Plan-Based Awards Table on pages 55 and 57, respectively.

| • | Rigorous Incentive Targets. Our Compensation Committee carefully considered the market conditions affecting our business and set performance goals that we determined would be appropriately rigorous and difficult to achieve. Annual incentive awards for our NEOs are determined by comparing the Company’s actual performance against our budgeted net income for the year. Long-term incentives in the form of performance shares are earned based on achievement of two equally weighted measures of the three-year average LTI-adjusted return on equity (non-GAAP) (return measure) and the three-year cumulative investment volume (growth measure). Please see Compensation Discussion & Analysis – Performance Measures, Goal Setting, and Pay-for-Performance Alignment on page 42 for more information about how the Compensation Committee establishes our annual and long-term performance measures. |

| • | Market Data Considered in Designing Competitive Compensation Program. Our Compensation Committee also reviewed market compensation levels and program design to provide a frame of reference for comparison in designing and setting competitive 2022 executive compensation commensurate with market, Company, and NEO performance, and the need to retain executive officers of outstanding ability and potential. |

| GATX CORPORATION - 2023 Proxy Statement | 7 |

PROXY SUMMARY

FREQUENCY OF FUTURE SAY-ON-PAY VOTES (PAGE 30)

Each year, we offer shareholders the opportunity to cast an advisory vote on our executive compensation (“say-on-pay”). This year, as required by U.S. Securities and Exchange Commission (“SEC”) rules, we are asking shareholders to cast an advisory vote on the frequency of future say-on-pay votes. Under SEC rules, say-on-pay votes may be held every one, two, or three years. We have been conducting annual say-on-pay votes since 2011, and our Board is recommending that shareholders vote to approve continuing the same frequency of EVERY YEAR for future say-on-pay votes.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (PAGE 73)

We ask that our shareholders ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for 2023. Below is summary information about Ernst & Young LLP’s fees for services provided in 2022 and 2021.

| Type of Fees | 2022 ($) |

2021 ($) | ||||

| Audit Fees |

2,920,000 | 2,799,000 | ||||

| Audit-Related Fees |

147,000 | 140,000 | ||||

| Tax Fees |

43,000 | 67,000 | ||||

| All Other Fees |

5,200 | 3,000 | ||||

| TOTAL Fees |

3,115,200 | 3,009,000 | ||||

| 8 | GATX CORPORATION - 2023 Proxy Statement |

SUSTAINABILITY AND CORPORATE CITIZENSHIP

Sustainability and Corporate Citizenship

|

AT GATX, OUR MISSION IS TO PROVIDE INNOVATIVE, UNPARALLELED SERVICE THAT ENABLES OUR CUSTOMERS TO TRANSPORT WHAT MATTERS SAFELY AND SUSTAINABLY WHILE CHAMPIONING THE WELL-BEING OF OUR EMPLOYEES AND COMMUNITIES. |

||||||||

We are committed to growing our business in a sustainable and socially responsible manner, and we demonstrate our commitment through our programs and initiatives. Our Environmental, Social and Governance (“ESG”) Committee, a multi-functional team, meets periodically to develop, assess, and prioritize ESG topics that are important to our business and our stakeholders and to continually improve both the measurement and transparency of our ESG disclosures and practices. The Governance Committee of GATX’s Board has primary oversight responsibility for our ongoing and developing ESG efforts. We maintain a Sustainability page on our website (www.gatx.com) to highlight our environmental and social responsibility accomplishments and provide key performance data to our stakeholders.1

We believe that investing in our people, in our communities, and in operating our business sustainably and ethically will drive long-term value for GATX and its shareholders. Our ESG priorities center on four foundational pillars:

|

OUR ETHICS AND INTEGRITY |

OUR PEOPLE | |||||||

| • Committing to operate our business consistent with the highest standards of honest and ethical behavior

• Championing a company-wide ethics and compliance program intended to provide our employees with resources and regular training to assist them in doing their jobs in an ethical manner while empowering them to raise questions and concerns without fear of retaliation

|

• Protecting the health and safety of our employees is our highest priority

• Fostering a diverse and inclusive workplace through our policies and programs

• Investing in our employees through training, professional development, benefit programs, and education

|

|

OUR ENVIRONMENT |

OUR COMMUNITIES | |||||||

| • Striving for the highest levels of asset quality and safety

• Implementing sustainable policies and practices designed to reduce energy use, decrease waste, increase recycling, and lower water consumption in our operations

• Assessing business, operational, and strategic risks associated with climate change and reporting on key environmental data

|

• Investing in safety training and civic engagement initiatives to support the communities where we live and work

• Encouraging employee involvement in their local communities through volunteer projects and fundraising campaigns

|

| 1 | Nothing on our website shall be deemed incorporated by reference into this Proxy Statement. |

| GATX CORPORATION - 2023 Proxy Statement | 9 |

SUSTAINABILITY AND CORPORATE CITIZENSHIP

2022 KEY INITIATIVES AND ACCOMPLISHMENTS

| Health and Safety |

||

|

✓ We continued to ensure that our railcar maintenance facility employees and inspectors, who are essential workers in the rail industry, could safely perform their jobs every day with our practices to minimize COVID-19 risks to our employees, their families, and the communities in which we operate.

✓ In addition to being recognized as a Responsible Care® Partner by the American Chemistry Council and the Chemical Industry Association of Canada, we continued our active participation in the Transportation Community Awareness and Emergency Response (TRANSCAER®) initiative, a national outreach effort assisting communities to prepare for and respond to a possible hazardous materials transportation incident. In 2022, we actively participated in TRANSCAER activities and played a leading role in sourcing parts and other materials for the railcar we donated to TRANSCAER for training purposes in 2021.

✓ Our repair facilities maintained relationships with first responders in the communities where we operate to train and coordinate response plans in the event of any incident involving our railcars or our facilities. We offered training across North America on the proper use of railcars and related equipment through our TankTrainer mobile classroom, a tank car outfitted for instruction.

✓ We continued to focus on further enhancing our training and standardized work procedures and employed other operational practices to improve our employees’ safety. As a result of these enhanced measures, we reduced both days away, restricted, or transferred and total recordable incident rates in our Rail North America business from last year.

|

||

| Our People |

||

|

✓ Our hiring initiatives are designed to mitigate unconscious bias in the recruitment process by broadening candidate slates, creating interviewer panels with diverse voices in the selection process, and relying upon a consistent job-related criteria and methodology to evaluate talent.

✓ We follow a talent management process that includes hiring, promoting, and developing diverse talent in order to increase diverse representation in the organization.

✓ Our Head of Diversity, Equity and Inclusion (“DEI”) continues to oversee and help direct our diversity and inclusion efforts.

✓ We supported employees in building the skills and capacity to work in an inclusive manner by hosting a Day of Understanding for all employees, which included workshops, panels, and speakers on diversity and inclusion.

✓ Throughout the year, we offered DEI training sessions to employees that were targeted to their positions.

✓ We sought to ensure gender, racial, and ethnicity pay equity for professional to executive level positions by conducting an annual compensation analysis.

✓ We administered an employee engagement survey, which included specific questions on diversity and inclusion, to help us assess engagement levels across the organization and in diverse groups. |

| Our Environment | ||||

|

✓ We continue to make significant investments in railcars globally, resulting in the ability to transport more goods by rail versus roads, which lowers carbon emissions and reduces highway noise and congestion.

✓ In 2022, GATX continued to publish Scope 1 and Scope 2 greenhouse gas emissions for all our facilities globally and continued to assess our full value chain impacts on the environment in an effort to identify opportunities to reduce those impacts.

✓ GATX also published our SASB report, which discloses metrics related to relevant ESG factors.

✓ We pursued programs to reduce the amount of waste sent to landfills by eliminating, reducing, reusing, or recycling various waste streams.

|

||||

| Our Communities | ||||

|

✓ GATX has a long history of supporting the communities where our employees live and work. For example, in recognition of our ongoing efforts in and around Waycross, Georgia, where we operate a maintenance facility, GATX received the Waycross-Ware Development Authority’s ‘Helping Hands’ award.

✓ GATX employees held a successful 2022 employee giving campaign and fundraiser for Make-A-Wish Illinois. We have partnered with Make-A-Wish Illinois for over 25 years and provided more than $5 million to help Make-A-Wish Illinois grant wishes to children with critical illnesses. Since 2008, GATX has been the largest corporate partner to the organization.

✓ GATX collaborated with Kansas City Southern, Canadian Pacific, North American Strategy for Competitiveness (NASCO), and Rotary clubs across North America on the successful ‘Save the Monarch Butterfly 60,000 Tree’ campaign. The campaign reached its goals of promoting environmental conservation and awareness and raising funds to plant 60,000 Oyamel trees, a critical habitat for the monarch population. GATX contributed a boxcar custom wrap for the awareness campaign as well as a monetary donation.

✓ Through our partnership with Big Shoulders Fund, which provides support to inner-city schools in Chicago, employees in Chicago participated in a companywide service day to clean, beautify, and ready schools for the new school year. Further, GATX employees have mentored Big Shoulders students since 2016. |

| 10 | GATX CORPORATION - 2023 Proxy Statement |

Proxy Statement

CORPORATE GOVERNANCE

Board of Directors

The Board of Directors provides oversight, strategic direction, and counsel to management regarding the business, affairs, and long-term interests of GATX and our shareholders. Its responsibilities include the following:

| • | reviewing and approving our major financial objectives, strategic and operating plans, strategic transactions with third parties, and other significant actions |

| • | overseeing the conduct of our business |

| • | assessing business risks to evaluate whether any changes to our business, strategy, or risk management practices may be warranted |

| • | overseeing our processes for maintaining the integrity of our financial statements and other public disclosures |

| • | overseeing compliance with law and ethical standards |

GATX has a long-standing commitment to strong corporate governance and ethical standards. Demonstrating this commitment, the Board has adopted the GATX Corporate Governance Guidelines, Code of Business Conduct and Ethics, and Code of Ethics for Senior Company Officers, as well as charters for each of the Board’s committees. These documents constitute the foundation of our corporate governance structure and are available on our website (www.gatx.com) in the Investor Relations section under “Governance.”

The Board and its committees meet throughout the year on an established schedule and hold special meetings from time to time as appropriate. Following each meeting, the Board’s independent directors meet in executive sessions without the Chief Executive Officer or other members of management present. The independent Chair of the Board serves as Chair of the executive sessions of the Board.

The Board met nine times during 2022, and each director attended at least 75% of the meetings of the Board and the committees on which he or she served during the year. We encourage all directors to attend the 2023 Annual Meeting of Shareholders, and in 2022 all directors then serving on the Board attended the annual meeting.

Board Independence

The Board has adopted the GATX Director Independence Standard set forth in Exhibit A to this Proxy Statement to evaluate the independence of directors and director nominees and to ensure compliance with the independence standards required by the New York Stock Exchange (“NYSE”) for listed companies. In accordance with this standard, and considering all relevant facts and circumstances, the Board has made an affirmative determination that none of the following directors has a material relationship with GATX other than in his or her capacity as a member of the Board and that all of the following directors are independent: Diane M. Aigotti, Anne L. Arvia, James B. Ream, Adam L. Stanley, David S. Sutherland, Stephen R. Wilson, and Paul G. Yovovich.

Board Leadership Structure

Our By-Laws afford the Board flexibility to separate or combine the positions of Chair of the Board and Chief Executive Officer based on particular circumstances. When the two positions are combined (or the Chair is not otherwise independent), then the independent directors designate an independent Lead Director to provide leadership to the non-management members of the Board and to work with the Chair and Chief Executive Officer and the other Board members to provide effective and independent oversight of our management and affairs. The Company would notify shareholders of any change in the Board’s leadership structure in our proxy statements, unless we are required to disclose earlier.

| GATX CORPORATION - 2023 Proxy Statement | 11 |

CORPORATE GOVERNANCE

Likewise, our Board is structured to promote independence whether or not its Chair is a member of executive management. The entire Board, with the exception of Robert C. Lyons, currently consists of independent directors, and the Audit, Compensation, and Governance Committees also are composed entirely of independent directors. The independent directors on the Board meet after each Board meeting in executive sessions that are not attended by Mr. Lyons or other members of management.

Prior to Brian A. Kenney’s retirement as President and Chief Executive Officer at the close of the 2022 annual meeting, he served as both Chair of the Board and Chief Executive Officer and James B. Ream served as independent Lead Director. Mr. Kenney was succeeded as President and Chief Executive Officer by Mr. Lyons, who was also elected as a director at that meeting.

As part of these succession planning discussions, the Board evaluated its leadership structure and concluded that, following his retirement as CEO, Mr. Kenney would continue to serve on the Board as its non-executive Chair (and Mr. Ream would continue to serve as Lead Director to provide independent oversight) for a transitional period ending October 31, 2022. Effective November 1, 2022, the Board appointed Mr. Ream to serve as the independent Chair of the Board following Mr. Kenney’s retirement from the Board. The Board made this decision based on its belief that with a newly-appointed Chief Executive Officer it is in the best interests of our shareholders to have a separate, independent Chair because this leadership structure more closely aligns with current governance practices and promotes effective independent Board oversight.

As Board Chair, Mr. Ream serves an important role in our governance structure, as he did as Lead Director, with expanded roles and responsibilities that include, among other things:

| • | presiding at all shareholder and Board meetings, including executive sessions of the independent directors |

| • | attending the meetings of all Board committees |

| • | calling Board meetings and meetings of the independent directors |

| • | establishing Board meeting schedules and agendas in consultation with the Chief Executive Officer |

| • | serving as the Board’s principal liaison with the Chief Executive Officer |

| • | interviewing all director candidates and making recommendations to the Governance Committee |

| • | determining the composition and leadership of the Board’s committees |

| • | representing the Board in our shareholder engagements and outreach meetings |

Board Committees

| Director*

|

Board of

|

Audit

|

Compensation

|

Governance

| ||||

| Diane M. Aigotti |

● |

● |

● | |||||

| Anne L. Arvia |

● |

C |

||||||

| Robert C. Lyons |

● |

|||||||

| James B. Ream |

C |

● |

● | |||||

| Adam L. Stanley |

● |

● |

● | |||||

| David S. Sutherland |

● |

C |

||||||

| Stephen R. Wilson |

● |

● |

● |

|||||

| Paul G. Yovovich |

● |

● |

C | |||||

|

Number of 2022 meetings

|

9

|

7

|

5

|

5

|

| * | In the table above, “C” means Chair. |

| 12 | GATX CORPORATION - 2023 Proxy Statement |

CORPORATE GOVERNANCE

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Governance Committee. Each committee is composed of directors determined by the Board to be independent in accordance with the listing standards of the NYSE. Mr. Ream serves as Chair of the Board and also as a member of the Governance and Compensation Committees and attends all meetings of all Board committees. The principal responsibilities of each of these committees are described generally below and in detail in their respective committee charters, which are available on our website (www.gatx.com) in the Investor Relations section under “Governance.”

Audit Committee

The Board has determined that each member of the Audit Committee has accounting or related financial management expertise and is “financially literate,” as that term is used in the listing standards of the NYSE. In addition, the Board has determined that each of Diane M. Aigotti, Anne L. Arvia, and Stephen R. Wilson qualifies as an “audit committee financial expert,” as that term is defined by SEC rules. All members of the Audit Committee satisfy the NYSE’s independence standards applicable to audit committee members.

The Audit Committee’s functions include the appointment, retention, compensation, and oversight of our independent registered public accounting firm. The Audit Committee also reviews any related party transactions and assists the Board in oversight of:

| • | the integrity of our financial statements |

| • | our compliance with legal and regulatory requirements |

| • | our guidelines, policies, and procedures with respect to risk assessment and risk management |

| • | the independent registered public accounting firm’s qualifications and independence with respect to services performed, including non-audit fees and services |

| • | the performance of our internal audit function and the independent registered public accounting firm |

| • | our cybersecurity risks, controls and procedures |

The Audit Committee maintains free and open communication, and meets separately at each regularly scheduled committee meeting, with our independent registered public accounting firm, our internal auditor, and management.

Compensation Committee

The Compensation Committee’s functions include:

| • | conducting an annual evaluation of the Chief Executive Officer’s performance |

| • | annually setting the Chief Executive Officer’s compensation level and reviewing and approving compensation levels of our other senior officers |

| • | establishing and administering our incentive compensation plans, equity-based plans, and other bonus plans, including granting awards and approving payouts under our plans |

| • | annually reviewing the corporate goals and objectives relating to compensation of our Chief Executive Officer and other senior officers |

| • | periodically reviewing and making recommendations to the Board regarding the compensation of our non-management directors |

| • | evaluating the qualifications and independence of the Compensation Committee’s independent compensation consultant |

Pay Governance LLC (“Pay Governance”) served as the Compensation Committee’s independent compensation consultant during 2022. In addition to providing advice on various aspects of GATX’s compensation plans, programs, and policies, Pay Governance also advises the Compensation Committee periodically on current trends and best practices and reviews the agendas and supporting materials with management and the Compensation Committee Chair in advance of each committee meeting. A Pay Governance representative attends all Compensation Committee

| GATX CORPORATION - 2023 Proxy Statement | 13 |

CORPORATE GOVERNANCE

meetings, including executive sessions at which management is not present, and meets independently with the Compensation Committee as appropriate. In addition, Pay Governance provides specific recommendations for the Chief Executive Officer’s compensation and advice on the recommendations made by the Chief Executive Officer with respect to the compensation of other executives.

Governance Committee

The Governance Committee’s functions include:

| • | identifying individuals qualified to become Board members and recommending to the Board a slate of director nominees for election at each annual meeting of shareholders |

| • | ensuring that all of the Board committees have the benefit of qualified and experienced independent directors |

| • | regularly reviewing a matrix of director profiles and skills to ensure a diversity of relevant experience, fresh perspective, skills, backgrounds, and other attributes on the Board |

| • | developing and overseeing an effective set of corporate governance policies and procedures designed to ensure that GATX adheres to strong corporate governance and ethical standards and complies with all applicable legal and regulatory requirements |

| • | overseeing the evaluation of the Board’s performance and effectiveness, including the directors’ attendance and contributions to Board deliberations, and making such recommendations to the Board as may be appropriate |

| • | overseeing ESG matters and receiving periodic reports from management on related strategic initiatives |

Annual Board and Committee Evaluations

The Board conducts an evaluation of its performance and effectiveness on an annual basis. The purpose of the evaluation is to obtain the directors’ feedback on the Board’s performance and identify ways to enhance its effectiveness. As part of the evaluation, each director receives a written questionnaire developed by the Governance Committee to solicit input on the Board’s performance, effectiveness, composition, priorities, and culture. Using the questionnaire as a guide, the Governance Committee Chair conducts personal interviews with all directors to obtain their feedback and discuss any other issues or concerns they may have. The Governance Committee Chair compiles the collective views and comments of the directors and then reports the results of the evaluation to the full Board.

Each of the Board’s committees conducts its own evaluation using the same process as the Board evaluation. The Chair of each committee conducts personal interviews with the other committee members and, after compiling the results, presents a report to the committee and the full Board.

Each year, the Governance Committee Chair conducts a personal interview with each Board member to gather in-depth perspectives and candid insight about Board performance and effectiveness. The Chair of each committee follows the same process to obtain feedback from committee members on the committee’s performance and effectiveness.

Retirement and Resignation Policies

The Board has a retirement policy for directors, included in our Corporate Governance Guidelines, under which a director is expected to retire from the Board and not stand for re-election at the first annual meeting of shareholders after he or she reaches the age of 75. However, the Governance Committee and the Board may waive that policy in any particular case for good reason. Under this policy, Stephen R. Wilson and David S. Sutherland are expected to retire in 2024 and 2025, respectively, absent the Board’s waiver of the policy for good reason.

| 14 | GATX CORPORATION - 2023 Proxy Statement |

CORPORATE GOVERNANCE

If a director’s principal position changes, he or she is required to offer to resign from the Board as of the date of change in position. The Governance Committee then recommends to the Board whether to accept the resignation after assessing the situation based on the individual circumstances. Likewise, each director is expected to tender his or her resignation when nominated for election to the Board, and that resignation will become effective only if the director receives more votes AGAINST his or her election than FOR votes and the Governance Committee, or other duly authorized committee of the Board, decides to accept the resignation.

Board Refreshment and Diversity

The Board, led by the Governance Committee, regularly evaluates its own composition and succession plans in light of the Company’s evolving business and strategic needs. The focus of this process is to ensure that the Board is composed of directors who possess a wide variety of relevant skills, professional experience, and backgrounds, bring diverse viewpoints and perspectives, and effectively represent the long-term interests of shareholders. The Governance Committee also considers a candidate’s gender, race, ethnicity, age and other individual qualities and attributes that contribute to an active, effective Board. The Board believes that new ideas and perspectives are critical to a forward-looking and strategic Board, as are the extensive experience and deep understanding of our business and industry that long-serving directors possess. Accordingly, in its board refreshment and succession planning process, the Board considers both the benefits of continuity and fresh perspectives that new directors can bring.

In considering potential director candidates, the Governance Committee and Board take into account, among other factors, the needs of the Board and the Company in light of the overall composition of the Board with a view to achieving a balance of the skills, experience, and attributes that would be beneficial to the Board’s oversight role. For more information, see Director Criteria and Nomination Process on page 19.

The Governance Committee is currently and actively searching for qualified candidates with diverse backgrounds, including such factors as gender, race and ethnicity, and has retained an internationally-recognized search firm to assist with this process. The Governance Committee has emphasized the importance of diversity and has sought the inclusion and prioritization of diverse candidates for consideration, with a goal of further increasing diversity on the Board.

Succession Planning

The Board regularly reviews long-term and emergency succession plans for the Chief Executive Officer and for other senior management positions. In addition, the Board ensures that directors have repeated and substantial opportunities to engage with possible succession candidates. In assessing and evaluating possible Chief Executive Officer candidates, the independent directors (with the assistance of a recruiting firm with a nationally recognized succession planning practice in connection with the 2022 leadership transition) identify the key skills, experience, and attributes they believe are required to be an effective Chief Executive Officer in light of the Company’s business strategies, opportunities, and challenges. The Board also considers its own leadership structure as part of this succession planning process.

As previously noted, these activities resulted in the independent directors’ unanimous decision to separate the roles of Chair of the Board and Chief Executive Officer and to elect Mr. Lyons to succeed Mr. Kenney as President and Chief Executive Officer effective April 22, 2022, and Mr. Ream to succeed Mr. Kenney as Chair of the Board effective November 1, 2022. The Board believes the smooth and successful nature of this 2022 leadership transition is a testament to the effectiveness of its robust succession planning process.

As part of these long-term succession planning efforts, we have also implemented organizational changes to some of our other senior leadership positions in recent years in order to enhance our growth efforts and further drive the excellent performance our shareholders expect.

| GATX CORPORATION - 2023 Proxy Statement | 15 |

CORPORATE GOVERNANCE

Risk Oversight

|

FULL BOARD

While management is responsible for managing risk, the Board and its committees play a role in overseeing our risk management practices and programs. We have internal processes and an internal control environment that facilitates identification and management of risk and regular communication with the Board. These include an enterprise risk management program, regular internal management disclosure committee meetings, codes of business conduct and ethics, a strong ethics and compliance program, and a comprehensive internal and external audit process. The Board implements its risk oversight function both as a whole and through delegation to Board committees, which meet regularly and report back to the Board. |

||||||||

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

|

Audit Committee |

Compensation Committee |

Governance Committee |

||||||||||||||||||

| Plays a key role in the Board’s risk oversight process, particularly in relation to risks that could have a financial impact, such as financial reporting, taxes, accounting, disclosure, internal controls, legal matters, cybersecurity, and our ethics and compliance programs.

Discusses our risk assessment and risk management guidelines and policies with management, the internal auditors, and the independent registered public accounting firm.

Receives regular reports from management and discusses steps taken by management to monitor and control risk exposures.

Reviews all of our annual and quarterly financial reports, including any disclosure therein of risk factors affecting us and our business.

Receives quarterly reports from management regarding cybersecurity matters, including but not limited to cybersecurity events, threats, controls, cybersecurity projects, compliance, cybersecurity awareness training and updates to the cybersecurity heat map.

Provides regular reports to the Board on its risk oversight activities and any issues identified thereby.

|

Manages risks associated with personnel and compensation issues, including executive compensation.

Receives regular reports from the independent compensation consultant and management concerning our compensation plans, policies, and practices.

Sets performance goals under our annual and long-term incentive plans and oversees our compensation plans, policies, and practices.

Provides regular reports to the Board on its oversight of compensation-related risks.

Together with the Compensation Committee’s independent consultant, provides input to our human resources staff in conjunction with their annual assessment of potential risks that may be created by our compensation plans, policies, and practices. The assessment conducted for 2022 found that our compensation plans, policies, and practices did not create risks that would be reasonably likely to have a material adverse effect on GATX. In reaching this conclusion, we considered the mix of compensation paid to employees, as well as the risk control and mitigation features of our plans, including appropriate performance measures and targets, incentive plan payout maximums, our compensation clawback policy, and mandatory stock retention requirements for our executive officers.

|

Manages risks associated with governance issues, such as the independence of the Board, Board effectiveness and organization, corporate governance, and director succession planning.

Reviews the skills and experience of the directors on a regular basis to ensure the diversity of relevant experience necessary for an effective Board.

Maintains corporate governance guidelines and procedures designed to assure compliance with all applicable legal and regulatory requirements and governance standards.

Oversees environmental, social, and governance matters, including but not limited to receiving regular reports from management on environmental risks and opportunities and ESG disclosures.

Provides regular reports to the Board on its risk oversight activities.

|

| 16 | GATX CORPORATION - 2023 Proxy Statement |

CORPORATE GOVERNANCE

Anti-Hedging, Anti-Pledging Policies

In addition to prohibiting our directors, officers, and employees from trading in GATX stock while in possession of material non-public information, our Insider Trading Policy also prohibits certain transactions in GATX stock that may create the potential for the interests of a director, officer, or employee to diverge from the interests of GATX and its shareholders. In particular, our policy prohibits directors, officers, and employees from engaging in hedging transactions, including short sales, transactions in publicly traded options involving GATX stock, and use of financial instruments such as prepaid variable forwards, equity swaps, collars, and exchange funds. The policy also prohibits directors, officers, and employees from holding GATX stock in a margin account or pledging GATX stock as collateral for a loan.

Related Party Transactions

Related Party Transactions Approval Policy

We recognize that transactions with related parties present a heightened risk of real or perceived conflicts of interest and, therefore, may raise questions as to whether those transactions are consistent with the best interests of GATX and its shareholders. Accordingly, we have a formal, written policy that requires all related party transactions to be reviewed and approved by the Audit Committee. A “related party transaction” means any transaction (or series of transactions) valued at over $120,000 in which GATX is a participant and in which any “related party” has or will have a direct or indirect material interest. Our policy defines a “related party” to include all of our directors and executive officers, holders of more than 5% of our voting stock, and the immediate family members of those persons.

Under our policy, the Audit Committee will approve a related party transaction only if it determines that the transaction is in, or not inconsistent with, the best interests of GATX and our shareholders, including, for example, situations where:

| • | the transaction may enable us to obtain products or services of a nature, quantity, or quality, or on other terms, that are not readily available from alternative sources |

| • | the transaction is on “arm’s length” terms comparable to the terms on which we provide products or services to unrelated third parties or to our employees generally |

Upon completion of its review, the Audit Committee will approve or disapprove the related party transaction. In approving any related party transaction, the Audit Committee also will make a determination that the transaction does not constitute a conflict of interest under our Code of Business Conduct and Ethics.

Director and Officer Indemnification and Insurance Arrangements

As required by our By-Laws, we indemnify our directors and officers to the fullest extent permitted by the New York Business Corporation Law. In addition, we have entered into indemnification agreements with each member of the Board that contractually obligate us to provide this indemnification to our directors.

As permitted by the New York Business Corporation Law and our By-Laws, we maintain insurance policies that provide liability protection to our directors and officers for claims for which they may not be indemnified by the Company. These insurance policies also provide reimbursement to GATX for indemnification payments we make on behalf of our directors and officers, subject to the conditions and exclusions specified in the policies.

Shareholder Engagement

We believe that understanding issues of importance to our shareholders is critical for us to address their interests in a meaningful and effective way. It is also a tenet of good corporate governance. In that light, we engage with our

| GATX CORPORATION - 2023 Proxy Statement | 17 |

CORPORATE GOVERNANCE

shareholders on a regular basis to discuss a range of topics, including our performance, strategy, executive compensation, and corporate governance. Dialogue and engagement with our shareholders help us understand how they view us, set goals and expectations for our performance, and identify emerging issues that may affect our strategies, corporate governance, compensation practices, or other aspects of our operations.

Our shareholder outreach and engagement program takes many forms and is a year-round activity. We participate in numerous investor conferences, analyst meetings, and investor road shows. We also provide investors with access to our executive officers in an effort to provide a full perspective on business operations, market conditions, and our long-term strategy. We communicate with shareholders through various media, including our annual report and SEC filings, Proxy Statement, press releases, and our website. We hold conference calls for our quarterly earnings releases and other major corporate events which are open to all.

In 2022, we contacted our largest shareholders, representing more than 85% of our outstanding shares, and offered them the opportunity to meet with members of our Board and management to discuss a range of issues. Frequently discussed topics included our business strategy, financial and operating performance, competitive environment, capital allocation priorities, enterprise risk management, executive compensation, and other ESG matters such as climate risk.

During our interactions with shareholders, we hear a diverse range of views. In general, our investors appreciate our transparency and the willingness of our senior executives and members of the Board to engage with, and listen to, shareholders.

Communication with the Board

GATX shareholders and other interested parties may, at any time, communicate directly with the Board, any of our directors individually (including the Chair of the Board), or our non-management directors as a group through the office of our Corporate Secretary as follows:

| • | by mail addressed to the Board, any director, or the non-management directors as a group, c/o the Corporate Secretary, GATX Corporation, 233 South Wacker Drive, Chicago, Illinois 60606-7147 |

| • | electronically by sending an e-mail to contactboard@gatx.com |

| • | anonymously through our hotline vendor, Convercent, by internet at www.convercent.com/report or by telephone at (800) 461-9330 |

Our Corporate Secretary will review communications received by any of these methods and forward the communication promptly to the Board, individual directors, the Board Chair, or the non-management directors as a group, as appropriate, depending on the subject matter and facts and circumstances described in the communication.

Communications that are not related to the duties and responsibilities of the Board, are patently frivolous, or are otherwise considered to be improper for submission to the intended recipient(s) will not be forwarded.

| 18 | GATX CORPORATION - 2023 Proxy Statement |

PROPOSAL 1: ELECTION OF DIRECTORS

Director Criteria and Nomination Process

Each year, the Board nominates a slate of director candidates for election at the Annual Meeting of Shareholders. The Board has delegated the process for screening potential director candidates to the Governance Committee with input from the Chair of the Board and the Chief Executive Officer. When the Governance Committee determines that it is desirable to add a director or fill a vacancy on the Board, it will identify one or more individuals qualified to become directors and recommend them to the Board. In identifying qualified individuals, the Governance Committee generally retains a third-party search firm for this purpose. In evaluating individuals for potential membership on the Board, the Governance Committee gives due consideration to the following criteria:

| • | the highest level of personal and professional ethics, integrity, and values |

| • | an inquisitive and objective perspective |

| • | broad experience at the policy-making level in business, finance, accounting, government, or education |

| • | expertise and experience relevant to GATX and complementary to the background and experience of other Board members, so that an optimal balance and diversity of Board members may be achieved and maintained |

| • | broad business and social perspective and mature judgment |

| • | the overall diversity of the Board, including with respect to gender, race and ethnicity |

| • | commitment to serve on the Board for an extended period of time to ensure continuity and to develop knowledge about the Company’s business |

| • | demonstrated ability to communicate freely with management and the other directors, as well as the ability and disposition to meaningfully participate in a collegial decision-making process |

| • | willingness to devote the required time and effort to carry out the duties and responsibilities of a Board member |

| • | independence from any particular constituency, and the ability to represent the best interests of all shareholders and to appraise objectively the performance of management |

Nominees are selected so that the Board represents a diversity of viewpoints, professional experiences, education, skills, backgrounds, and other individual qualities and attributes, including gender, race and ethnicity, that contribute to an active, effective Board.

| GATX CORPORATION - 2023 Proxy Statement | 19 |

ELECTION OF DIRECTORS

Director Demographics, Experience, Qualifications, and Skills

The Governance Committee is responsible for recommending to the full Board a slate of director nominees who collectively have the complementary experience, qualifications, skills, and attributes to guide the Company and function effectively as a Board. We believe that each of the nominees satisfies the criteria for membership set forth above and has key skills and attributes that are important to an effective board. Each of the nominees, other than Mr. Lyons, is also independent of the Company and management. See Board Independence on page 11.

Listed below are certain demographics and key experiences, qualifications, and skills of our director nominees that the Governance Committee believes are relevant and important in light of GATX’s business and structure.

Individual Directors’ Profiles

| Robert C. (CEO) |

James B. Ream |

Diane M. Aigotti |

Anne L. Arvia |

Adam L. Stanley |

David S. Sutherland |

Stephen R. Wilson |

Paul G. Yovovich | |||||||||

|

KNOWLEDGE, SKILLS AND EXPERIENCE

| ||||||||||||||||

|

Tenure*

|

1 | 14 | 6 | 13 | 3 | 15 | 8 | 10 | ||||||||

|

Age*

|

59 | 67 | 58 | 60 | 49 | 73 | 74 | 69 | ||||||||

|

BUSINESS/OPERATIONS

| ||||||||||||||||

|

Rail & Other Transportation

|

✓ | ✓ | ✓ | |||||||||||||

|

Air Transportation

|

✓ | ✓ | ✓ | |||||||||||||

|

Strategy

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Sales/Business Development

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Operations

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Supply Chain

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

|

Raw Materials

|

✓ | ✓ | ✓ | ✓ | ||||||||||||

|

Customer Viewpoints

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

International/Emerging Markets

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Joint Ventures

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

FINANCE/TRANSACTIONS

| ||||||||||||||||

|

M&A

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Capital Markets/Debt & Equity

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

LEGAL/ACCOUNTING/OTHER RISK/RELATED EXPERIENCE

| ||||||||||||||||

|

Risk Management

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Accounting & Financial Controls

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Information Technology & Data

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Cybersecurity

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

Human Capital & Talent Development

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Diversity, Equity & Inclusion

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

|

Legal

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

Regulatory, Governance & Public Affairs

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||

| 20 | GATX CORPORATION - 2023 Proxy Statement |

ELECTION OF DIRECTORS

| Robert C. (CEO) |

James B. Ream |

Diane M. Aigotti |

Anne L. Arvia |

Adam L. Stanley |

David S. Sutherland |

Stephen R. Wilson |

Paul G. Yovovich | |||||||||

|

DEMOGRAPHICS

| ||||||||||||||||

|

RACE/ETHNICITY

| ||||||||||||||||

|

Black or African American

|

✓ | |||||||||||||||

|

White or Caucasian

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

|

GENDER

| ||||||||||||||||

|

Male

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||

|

Female

|

✓ | ✓ | ||||||||||||||

|

Other

|

||||||||||||||||

| * | As of Annual Meeting date. |

| GATX CORPORATION - 2023 Proxy Statement | 21 |

ELECTION OF DIRECTORS

Shareholder Recommendation and Nomination of Directors

The Board also will consider any candidates who may be recommended by shareholders. The Board conducts such inquiry into each candidate’s background, qualifications, and independence as it believes is necessary or appropriate under the circumstances and regardless of whether the candidate was recommended by shareholders or by others. Any recommendations of director candidates by shareholders should be submitted to the Governance Committee, c/o the Corporate Secretary, GATX Corporation, 233 South Wacker Drive, Chicago, Illinois 60606-7147. In order to be considered, the recommendation must be received not more than 120 and not less than 90 days prior to the first anniversary of the preceding year’s annual meeting and must include all information required by the proxy rules, applicable law, and our By-Laws.

Nominees for Election to the Board of Directors

Our Board is currently composed of eight directors, all of whom are standing for re-election for a term of one year, to serve until the 2024 Annual Meeting of Shareholders or until their successors are elected and duly qualified.

All director nominees have consented to serve on the Board, if elected. At the time of the Annual Meeting, if any director nominee is unable or declines to serve, the proxies may be voted for any other person who may be nominated by the Board to fill the vacancy, or the size of the Board may be reduced accordingly.

Please see below for information on the age (as of Annual Meeting date) and other background of each of the eight director nominees, as well as each individual’s specific experience, qualifications, and skills that led the Board to conclude that such individual should serve on the Board in light of the Company’s business and leadership structure.

The Board of Directors recommends that you vote FOR each director nominee named below.

| Diane M. Aigotti

| ||

|

Years of Service: 6

Age: 58

Board Committees: Audit, Governance

Ms. Aigotti served as Executive Vice President, Managing Director and Chief Financial Officer of Ryan Specialty Group, LLC from January 2010 to March 2021. Prior to joining Ryan Specialty Group, Ms. Aigotti served as Senior Vice President, Chief Risk Officer and Treasurer of Aon plc (f/k/a Aon Corp.) from 2000 to 2008. Earlier in her career, she served as the Vice President of Finance at The University of Chicago Hospitals and Health System from 1998 to 2000 and as Budget Director for the City of Chicago from 1995 to 1997. She also serves on the board of OneDigital Health and Benefits, Inc., which provides consulting and technology solutions to employers for their employees’ health and welfare benefits. The Board has determined that Ms. Aigotti qualifies as an Audit Committee Financial Expert. | |

Specific Qualifications, Attributes, Skills, and Experience

| • | Extensive financial expertise, including in capital markets transactions, financial reporting, and internal controls |

| • | Deep understanding of the insurance industry gained through her experience as the Chief Financial Officer of a large global insurance organization |

| • | Substantial expertise in key areas such as financial planning and reporting, operations, risk management, treasury management, mergers and acquisitions, information technology, and tax and regulatory compliance enables her to provide valuable insights on issues critical to the Board’s oversight of our business, strategy, and operations |

| 22 | GATX CORPORATION - 2023 Proxy Statement |

ELECTION OF DIRECTORS

| Anne L. Arvia

| ||

|

Years of Service: 13

Age: 60

Board Committees: Audit (Chair)

Ms. Arvia has been a strategic bank advisor since May 2022. Previously, she served as Executive Vice President, Banking and Financial Services, The Auto Club Group and President, CEO, The Auto Club Trust, from September 2018 to April 2022, and as Acting President, USAA Bank from November 2016 to May 2017 and USAA Bank’s Senior Vice President and Managing Director from August 2015 to December 2017. Before joining USAA, Ms. Arvia was President, Nationwide Direct Distribution from August 2012 to July 2015, President of Nationwide Retirement Plans from November 2009 to August 2012, and Chief Executive Officer of Nationwide Bank, a unit of Nationwide Mutual Insurance Company, from 2006 to November 2009. Prior to joining Nationwide, she served as President and Chief Executive Officer of ShoreBank, a community development and environmental bank, from 2001 to August 2006. She joined ShoreBank in 1991 as Assistant Controller and was named Chief Financial Officer in 1998. Prior to that she was an Auditing Manager at Crowe LLP. The Board has determined that Ms. Arvia qualifies as an Audit Committee Financial Expert. | |

Specific Qualifications, Attributes, Skills, and Experience

| • | Deep understanding of auditing, accounting standards, and financial reporting rules and regulations |

| • | Qualified as a Certified Public Accountant and an Audit Committee Financial Expert |

| • | Wealth of experience in investment, operations, risk management, and financial matters gained through her many years of senior management experience in the financial services sector |

| Robert C. Lyons

| ||

|

Years of Service: 1

Age: 59

President and Chief Executive Officer

Mr. Lyons was elected as President and Chief Executive Officer and as a director of GATX Corporation in April 2022, after having served as our Executive Vice President and President, Rail North America since August 2018. Previously, Mr. Lyons served as our Executive Vice President and Chief Financial Officer from 2012 to August 2018, Senior Vice President and Chief Financial Officer from 2007 to 2012, Vice President and Chief Financial Officer from 2004 to 2007, Vice President, Investor Relations from 2000 to 2004, Project Manager, Corporate Finance from 1998 to 2000, and Director of Investor Relations from 1996 to 1998. Mr. Lyons has served as a director of Packaging Corporation of America since 2011 and is a member of its Audit Committee. | |

Specific Qualifications, Attributes, Skills, and Experience

| • | Deep knowledge of our core railcar leasing business gained through his leadership role as President of Rail North America |

| • | Substantial transportation industry experience including in aircraft spare engine leasing |

| • | Extensive expertise in capital market transactions, mergers and acquisitions, expansion of asset portfolios, operations, and business strategy |

| • | Strategic leadership skills and expertise consistently demonstrated in various roles during his long tenure at GATX |

| GATX CORPORATION - 2023 Proxy Statement | 23 |

ELECTION OF DIRECTORS

| James B. Ream

| ||

|