Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-2328

GATX Corporation

(Exact name of registrant as specified in its charter)

| New York | 36-1124040 | |

| (State of incorporation) | (I.R.S. Employer Identification No.) |

| 222 West Adams Street |

| Chicago, Illinois 60606-5314 |

| (Address of principal executive offices, including zip code) |

(312) 621-6200

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of September 30, 2012, 46.9 million common shares were outstanding.

Table of Contents

GATX CORPORATION

FORM 10-Q

QUARTERLY REPORT FOR THE PERIOD ENDED SEPTEMBER 30, 2012

| Item No. |

Page No. | |||||

| Part I – FINANCIAL INFORMATION | ||||||

| Item 1. |

Financial Statements | |||||

| 1 | ||||||

| 2 | ||||||

| 3 | ||||||

| 4 | ||||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||

| 16 | ||||||

| 16 | ||||||

| 17 | ||||||

| 18 | ||||||

| 27 | ||||||

| 29 | ||||||

| 30 | ||||||

| Item 3. |

Quantitative and Qualitative Disclosures about Market Risk | 31 | ||||

| Item 4. |

Controls and Procedures | 31 | ||||

| Part II – OTHER INFORMATION | ||||||

| Item 1. |

Legal Proceedings | 32 | ||||

| Item 1A. |

Risk Factors | 32 | ||||

| Item 6. |

Exhibits | 33 | ||||

| 34 | ||||||

| 35 | ||||||

Table of Contents

PART I – FINANCIAL INFORMATION

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

($ in millions, except share data)

| September 30 2012 |

December 31 2011 |

|||||||

| Assets |

||||||||

| Cash and Cash Equivalents |

$ | 430.6 | $ | 248.4 | ||||

| Restricted Cash |

27.7 | 35.2 | ||||||

| Receivables |

||||||||

| Rent and other receivables |

85.1 | 76.7 | ||||||

| Loans |

28.0 | 30.4 | ||||||

| Finance leases |

241.5 | 334.9 | ||||||

| Less: allowance for losses |

(3.4 | ) | (11.8 | ) | ||||

|

|

|

|

|

|||||

| 351.2 | 430.2 | |||||||

| Operating Assets and Facilities |

||||||||

| Rail (includes $123.0 and $123.5 relating to a consolidated VIE at September 30, 2012 and December 31, 2011, respectively) |

5,911.4 | 5,692.6 | ||||||

| ASC |

386.2 | 374.7 | ||||||

| Portfolio Management |

361.0 | 348.7 | ||||||

| Less: allowance for depreciation (includes $23.3 and $19.2 relating to a consolidated VIE at September 30, 2012 and December 31, 2011, respectively) |

(2,149.8 | ) | (2,056.7 | ) | ||||

|

|

|

|

|

|||||

| 4,508.8 | 4,359.3 | |||||||

| Investments in Affiliated Companies |

532.3 | 513.8 | ||||||

| Goodwill |

90.0 | 90.5 | ||||||

| Other Assets |

184.5 | 180.1 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 6,125.1 | $ | 5,857.5 | ||||

|

|

|

|

|

|||||

| Liabilities and Shareholders’ Equity |

||||||||

| Accounts Payable and Accrued Expenses |

$ | 158.4 | $ | 135.6 | ||||

| Debt |

||||||||

| Commercial paper and borrowings under bank credit facilities |

216.1 | 28.6 | ||||||

| Recourse |

3,347.4 | 3,354.8 | ||||||

| Nonrecourse (includes $37.5 and $45.2 relating to a consolidated VIE at September 30, 2012 and December 31, 2011, respectively) |

133.3 | 149.4 | ||||||

| Capital lease obligations |

11.3 | 14.3 | ||||||

|

|

|

|

|

|||||

| 3,708.1 | 3,547.1 | |||||||

| Deferred Income Taxes |

800.2 | 765.9 | ||||||

| Other Liabilities |

233.0 | 281.6 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

4,899.7 | 4,730.2 | ||||||

| Shareholders’ Equity |

||||||||

| Preferred stock ($1.00 par value, 5,000,000 shares authorized 15,567 and 16,644 shares of Series A and B $2.50 Cumulative Convertible Preferred Stock issued and outstanding as of September 30, 2012 and December 31, 2011, respectively, aggregate liquidation preference of $0.9 and $1.0, respectively) |

* | * | ||||||

| Common stock ($0.625 par value, 120,000,000 authorized, 66,015,245 and 65,775,568 shares issued and 46,892,725 and 46,653,048 shares outstanding as of September 30, 2012 and December 31, 2011, respectively) |

41.1 | 41.1 | ||||||

| Additional paid in capital |

652.7 | 644.4 | ||||||

| Retained earnings |

1,234.5 | 1,171.2 | ||||||

| Accumulated other comprehensive loss |

(142.6 | ) | (169.1 | ) | ||||

| Treasury stock at cost (19,122,520 shares at September 30, 2012 and December 31, 2011) |

(560.3 | ) | (560.3 | ) | ||||

|

|

|

|

|

|||||

| Total Shareholders’ Equity |

1,225.4 | 1,127.3 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders’ Equity |

$ | 6,125.1 | $ | 5,857.5 | ||||

|

|

|

|

|

|||||

| * | Less than $0.1 million. |

The accompanying notes are an integral part of these consolidated financial statements.

1

Table of Contents

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(in millions, except per share data)

| Three Months

Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Gross Income |

||||||||||||||||

| Lease income |

$ | 237.9 | $ | 227.9 | $ | 702.8 | $ | 679.9 | ||||||||

| Marine operating revenue |

79.1 | 70.3 | 166.0 | 138.0 | ||||||||||||

| Asset remarketing income |

7.7 | 16.2 | 44.3 | 33.3 | ||||||||||||

| Other income |

18.7 | 23.5 | 57.8 | 66.3 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Revenues |

343.4 | 337.9 | 970.9 | 917.5 | ||||||||||||

| Share of affiliates’ earnings |

19.1 | 1.8 | 23.3 | 33.9 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Gross Income |

362.5 | 339.7 | 994.2 | 951.4 | ||||||||||||

| Ownership Costs |

||||||||||||||||

| Depreciation |

60.7 | 57.7 | 175.9 | 167.3 | ||||||||||||

| Interest expense, net |

42.9 | 40.9 | 127.1 | 126.9 | ||||||||||||

| Operating lease expense |

32.7 | 31.7 | 96.6 | 99.6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Ownership Costs |

136.3 | 130.3 | 399.6 | 393.8 | ||||||||||||

| Other Costs and Expenses |

||||||||||||||||

| Maintenance expense |

68.6 | 68.5 | 196.9 | 208.6 | ||||||||||||

| Marine operating expense |

51.3 | 50.5 | 108.6 | 98.6 | ||||||||||||

| Selling, general and administrative |

38.6 | 38.5 | 115.6 | 112.3 | ||||||||||||

| Other expense |

16.1 | 8.2 | 39.6 | 32.9 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Other Costs and Expenses |

174.6 | 165.7 | 460.7 | 452.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before Income Taxes |

51.6 | 43.7 | 133.9 | 105.2 | ||||||||||||

| Income Taxes |

(2.2 | ) | 10.8 | 26.3 | 26.0 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income |

$ | 53.8 | $ | 32.9 | $ | 107.6 | $ | 79.2 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Comprehensive Income, net of taxes |

||||||||||||||||

| Foreign currency translation adjustments |

10.8 | (56.4 | ) | 8.7 | (16.9 | ) | ||||||||||

| Unrealized (loss) gain on securities |

— | (0.2 | ) | 0.1 | (0.6 | ) | ||||||||||

| Unrealized gain (loss) on derivative instruments |

0.2 | (1.0 | ) | 13.6 | 6.8 | |||||||||||

| Post-retirement benefit plans |

1.4 | 0.9 | 4.1 | 2.8 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other comprehensive income (loss) |

12.4 | (56.7 | ) | 26.5 | (7.9 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive Income (Loss) |

$ | 66.2 | $ | (23.8 | ) | $ | 134.1 | $ | 71.3 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Per Share Data |

||||||||||||||||

| Basic |

$ | 1.15 | $ | 0.71 | $ | 2.30 | $ | 1.71 | ||||||||

| Average number of common shares (in millions) |

46.9 | 46.5 | 46.8 | 46.4 | ||||||||||||

| Diluted |

1.13 | 0.70 | 2.26 | 1.68 | ||||||||||||

| Average number of common shares and common share equivalents (in millions) |

47.6 | 47.2 | 47.5 | 47.1 | ||||||||||||

| Dividends declared per common share |

$ | 0.30 | $ | 0.29 | $ | 0.90 | $ | 0.87 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

2

Table of Contents

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in millions)

| Nine Months

Ended September 30 |

||||||||

| 2012 | 2011 | |||||||

| Operating Activities |

||||||||

| Net income |

$ | 107.6 | $ | 79.2 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Gains on sales of assets |

(52.0 | ) | (51.2 | ) | ||||

| Depreciation |

184.9 | 176.0 | ||||||

| Deferred income taxes |

31.8 | 18.9 | ||||||

| Share of affiliates’ earnings, net of dividends |

(12.8 | ) | (28.2 | ) | ||||

| Change in income taxes payable |

(9.6 | ) | 11.5 | |||||

| Change in accrued operating lease expense |

(36.6 | ) | (32.5 | ) | ||||

| Employee benefit plans |

0.5 | (4.0 | ) | |||||

| Other |

10.8 | 19.2 | ||||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

224.6 | 188.9 | ||||||

| Investing Activities |

||||||||

| Additions to operating assets and facilities |

(498.1 | ) | (327.7 | ) | ||||

| Loans extended |

(1.0 | ) | (19.1 | ) | ||||

| Investments in affiliates |

(24.3 | ) | (113.2 | ) | ||||

| Other |

— | (0.1 | ) | |||||

|

|

|

|

|

|||||

| Portfolio investments and capital additions |

(523.4 | ) | (460.1 | ) | ||||

| Purchases of leased-in assets |

(1.3 | ) | (61.1 | ) | ||||

| Portfolio proceeds |

260.2 | 108.9 | ||||||

| Proceeds from sales of other assets |

22.5 | 31.5 | ||||||

| Proceeds from sale-leaseback |

71.3 | — | ||||||

| Net decrease in restricted cash |

7.6 | 6.0 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(163.1 | ) | (374.8 | ) | ||||

| Financing Activities |

||||||||

| Net proceeds from issuances of debt (original maturities longer than 90 days) |

312.9 | 545.9 | ||||||

| Repayments of debt (original maturities longer than 90 days) |

(334.5 | ) | (277.1 | ) | ||||

| Net increase in debt with original maturities of 90 days or less |

188.2 | 9.1 | ||||||

| Payments on capital lease obligations |

(3.0 | ) | (18.5 | ) | ||||

| Employee exercises of stock options |

2.9 | 5.1 | ||||||

| Derivative settlements |

(1.4 | ) | (1.1 | ) | ||||

| Dividends |

(43.6 | ) | (42.3 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

121.5 | 221.1 | ||||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents |

(0.8 | ) | 1.3 | |||||

|

|

|

|

|

|||||

| Net increase in Cash and Cash Equivalents during the period |

182.2 | 36.5 | ||||||

| Cash and Cash Equivalents at beginning of period |

248.4 | 78.5 | ||||||

|

|

|

|

|

|||||

| Cash and Cash Equivalents at end of period |

$ | 430.6 | $ | 115.0 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements.

3

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1. Description of Business

GATX Corporation (“GATX” or the “Company”) leases, operates, manages and remarkets long-lived, widely-used assets primarily in the rail and marine markets. GATX also invests in joint ventures that complement existing business activities. Headquartered in Chicago, Illinois, GATX has three financial reporting segments: Rail, American Steamship Company (“ASC”) and Portfolio Management.

NOTE 2. Basis of Presentation

The accompanying unaudited consolidated financial statements of GATX Corporation and its subsidiaries have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by these accounting principles for complete financial statements. In the opinion of management, all adjustments (which are of a normal recurring nature) considered necessary for a fair presentation have been included. Operating results for the nine months ended September 30, 2012, are not necessarily indicative of the results that may be achieved for the entire year ending December 31, 2012. In particular, ASC’s fleet is generally inactive for a significant portion of the first quarter of each year due to the winter conditions on the Great Lakes. In addition, the timing of asset remarketing income is dependent, in part, on market conditions and, therefore, does not occur evenly from period to period. For further information, refer to the consolidated financial statements and footnotes as set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011.

NOTE 3. Investments in Affiliated Companies

Investments in affiliated companies represent investments in and loans to domestic and foreign companies and joint ventures that are in businesses similar to those of GATX, such as lease financing and related services for customers operating rail, marine and industrial equipment assets as well as other business activities.

Operating results for all affiliated companies, assuming GATX held a 100% interest, would be (in millions):

| Three Months Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Revenues |

$ | 163.2 | $ | 165.9 | $ | 506.4 | $ | 502.0 | ||||||||

| Pre-tax income reported by affiliates |

40.2 | 6.7 | 41.6 | 89.2 | ||||||||||||

NOTE 4. Variable Interest Entities

GATX evaluates whether an entity is a variable interest entity (“VIE”) based on the sufficiency of the entity’s equity and whether the equity holders have the characteristics of a controlling financial interest. To determine if it is the primary beneficiary of a VIE, GATX assesses whether it has the power to direct the activities that most significantly impact the economic performance of the VIE and the obligation to absorb losses or the right to receive benefits that may be significant to the VIE. These determinations are both qualitative and quantitative in nature and require certain judgments and assumptions about the VIE’s forecasted financial performance and the volatility inherent in those forecasted results. GATX evaluates new investments for VIE determination and regularly reviews all existing entities for any events that may result in an entity becoming a VIE or GATX becoming the primary beneficiary of an existing VIE.

GATX is the primary beneficiary of a consolidated VIE related to a structured lease financing for a portfolio of railcars because it has the power to direct the significant activities of the VIE through its ownership of the equity interests in the transaction. The risks associated with this VIE are substantially similar to those of GATX’s wholly-owned railcar leasing activities.

4

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The carrying amounts of assets and liabilities of the VIE were (in millions):

| September 30 2012 |

December 31 2011 |

|||||||

| Operating assets, net of accumulated depreciation (a) |

$ | 99.7 | $ | 104.3 | ||||

| Nonrecourse debt |

37.5 | 45.2 | ||||||

| (a) | All operating assets are pledged as collateral on the nonrecourse debt. |

GATX is also involved with other entities determined to be VIEs of which GATX is not the primary beneficiary. These VIEs are primarily leveraged leases and certain investments in railcar and equipment leasing affiliates that have been financed through a mix of equity investments and third party lending arrangements. GATX determined that it is not the primary beneficiary of these VIEs because it does not have the power to direct the activities that most significantly impact the entities’ economic performance. For certain investments in affiliates determined to be VIEs, GATX concluded that power was shared among the affiliate partners based on the terms of the relevant joint venture agreements, which require approval of all partners for significant decisions involving the VIE.

The carrying amounts and maximum exposure to loss with respect to VIEs that GATX does not consolidate were (in millions):

| September 30, 2012 | December 31, 2011 | |||||||||||||||

| Net Carrying Amount |

Maximum Exposure to Loss |

Net Carrying Amount |

Maximum Exposure to Loss |

|||||||||||||

| Investments in affiliates |

$ | 91.3 | $ | 91.3 | $ | 72.2 | $ | 72.2 | ||||||||

| Leveraged leases |

— | — | 78.5 | 78.5 | ||||||||||||

| Other investment |

0.7 | 0.7 | 0.9 | 0.9 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 92.0 | $ | 92.0 | $ | 151.6 | $ | 151.6 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

NOTE 5. Fair Value Disclosure

The following tables set forth GATX’s assets and liabilities measured at fair value on a recurring basis (in millions):

| September

30, 2012 |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

|||||||||||||

| Assets |

||||||||||||||||

| Interest rate derivatives (a) |

$ | 11.4 | $ | — | $ | 11.4 | $ | — | ||||||||

| Available for sale equity securities and warrants |

3.4 | 3.4 | — | — | ||||||||||||

| Liabilities |

||||||||||||||||

| Interest rate derivatives (a) |

1.0 | — | 1.0 | — | ||||||||||||

| Interest rate derivatives (b) |

0.3 | — | 0.3 | — | ||||||||||||

| Foreign exchange rate derivatives (b) |

0.9 | — | 0.9 | — | ||||||||||||

5

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

| December 31, 2011 |

Quoted Prices in Active Markets for Identical Assets (Level 1) |

Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

|||||||||||||

| Assets |

||||||||||||||||

| Interest rate derivatives (a) |

$ | 15.3 | $ | — | $ | 15.3 | $ | — | ||||||||

| Foreign exchange rate derivatives (b) |

2.1 | — | 2.1 | — | ||||||||||||

| Available for sale equity securities and warrants |

2.9 | 2.9 | — | — | ||||||||||||

| Liabilities |

||||||||||||||||

| Interest rate derivatives (a) |

2.1 | — | 2.1 | — | ||||||||||||

| Interest rate derivatives (b) |

0.3 | — | 0.3 | — | ||||||||||||

| (a) | Designated as hedges |

| (b) | Not designated as hedges |

Available for sale equity securities are valued based on quoted prices on an active exchange. Warrants are valued based on the fair value of the underlying securities. Derivatives are valued using a pricing model with inputs (such as yield curves and credit spreads) that are observable in the market or can be derived principally from or corroborated by observable market data.

Derivative instruments

Fair Value Hedges — GATX uses interest rate swaps to convert fixed rate debt to floating rate debt and to manage the fixed to floating rate mix of its debt obligations. For fair value hedges, changes in fair value of both the derivative and the hedged item are recognized in earnings as interest expense. As of September 30, 2012 and December 31, 2011, GATX had three instruments outstanding with an aggregate notional amount of $350.0 million for each period. As of September 30, 2012, these derivatives had maturities ranging from 2012-2015.

Cash Flow Hedges — GATX uses interest rate swaps to convert floating rate debt to fixed rate debt and to manage the fixed to floating rate mix of its debt obligations. GATX also uses interest rate swaps and Treasury rate locks to hedge its exposure to interest rate risk on existing and anticipated transactions. As of September 30, 2012 and December 31, 2011, GATX had 12 instruments outstanding with an aggregate notional amount of $99.1 million and 11 instruments outstanding with an aggregated notional amount of $73.4 million, respectively. As of September 30, 2012, these derivatives had maturities ranging from 2012-2019. Within the next 12 months, GATX expects to reclassify $6.9 million ($4.4 million after-tax) of net losses on previously terminated derivatives from accumulated unrealized loss on derivative instruments to earnings. Amounts are reclassified when interest and operating lease expense attributable to the hedged transactions affect earnings.

Non-designated Derivatives — GATX does not hold or issue derivative financial instruments for purposes other than hedging, although certain derivatives are not designated as accounting hedges. Changes in the fair value of these derivatives are recognized in earnings immediately.

Certain of GATX’s derivative instruments contain credit risk provisions that could require GATX to make immediate payment on net liability positions in the event that GATX defaulted on certain outstanding debt obligations. The aggregate fair value of all derivative instruments with credit risk related contingent features that are in a liability position as of September 30, 2012, was $1.3 million. GATX is not required to post any collateral on its derivative instruments and does not expect the credit risk provisions to be triggered.

In the event that a counterparty fails to meet the terms of the interest rate swap agreement or a foreign exchange contract, GATX’s exposure is limited to the fair value of the swap if in GATX’s favor. GATX manages the credit risk of counterparties by transacting only with institutions that the Company considers financially sound and by avoiding concentrations of risk with a single counterparty. GATX considers the risk of non-performance by a counterparty to be remote.

6

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The income statement and other comprehensive income impacts of GATX’s derivative instruments were (in millions):

| Derivative Designation |

Location of Gain (Loss) Recognized |

Three Months

Ended September 30 |

Nine Months

Ended September 30 |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||||

| Fair value hedges (a) | Interest expense | $ | (1.3 | ) | $ | 0.4 | $ | (3.9 | ) | $ | (0.3 | ) | ||||||

| Cash flow hedges | Other comprehensive income (loss) (effective portion) | 0.3 | 0.8 | 1.0 | (5.1 | ) | ||||||||||||

| Cash flow hedges | Interest expense (effective portion reclassified from accumulated unrealized loss on derivative instruments) | (1.1 | ) | (2.1 | ) | (4.1 | ) | (6.0 | ) | |||||||||

| Cash flow hedges | Operating lease expense (effective portion reclassified from accumulated unrealized loss on derivative instruments) | (0.4 | ) | (0.4 | ) | (1.1 | ) | (1.2 | ) | |||||||||

| Non-designated | Other expense | (2.1 | ) | 2.6 | (0.6 | ) | 2.3 | |||||||||||

| (a) | Equally offsetting the amount recognized in interest expense was the fair value adjustment relating to the underlying debt. |

Other Financial Instruments

The carrying amounts of cash and cash equivalents, restricted cash, rent and other receivables, accounts payable, and commercial paper and bank credit facilities approximate fair value due to the short maturity of those instruments. The fair values of investment funds (which are accounted for under the cost method) are based on the best information available and may include quoted investment fund values. The fair values of loans and fixed and floating rate debt were estimated based on discounted cash flow analyses using interest rates currently offered for loans with similar terms to borrowers of similar credit quality. The inputs used in estimating each of these fair values are significant observable inputs and therefore are classified in Level 2 of the fair value hierarchy.

The following table sets forth the carrying amounts and fair values of GATX’s other financial instruments as of (in millions):

| September 30, 2012 | December 31, 2011 | |||||||||||||||

| Carrying Amount |

Fair Value |

Carrying Amount |

Fair Value |

|||||||||||||

| Assets |

||||||||||||||||

| Investment funds |

$ | 2.5 | $ | 5.8 | $ | 2.7 | $ | 7.4 | ||||||||

| Loans |

28.0 | 28.5 | 30.4 | 30.7 | ||||||||||||

| Liabilities |

||||||||||||||||

| Recourse fixed rate debt |

$ | 2,661.4 | $ | 2,830.0 | $ | 2,627.2 | $ | 2,754.9 | ||||||||

| Recourse floating rate debt |

686.0 | 683.6 | 727.6 | 714.8 | ||||||||||||

| Nonrecourse debt |

133.3 | 142.2 | 149.4 | 159.3 | ||||||||||||

NOTE 6. Commercial Commitments

In connection with certain investments or transactions, GATX has entered into various commercial commitments, such as guarantees and standby letters of credit, which could potentially require performance in the event of demands by third parties. Similar to GATX’s balance sheet investments, these guarantees expose GATX to credit, market and equipment risk; accordingly, GATX evaluates its commitments and other contingent obligations using techniques similar to those used to evaluate funded transactions.

7

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The following table shows GATX’s commercial commitments as of (in millions):

| September 30 | December 31 | |||||||

| 2012 | 2011 | |||||||

| Affiliate guarantees |

$ | 42.0 | $ | 42.0 | ||||

| Asset residual value guarantees |

35.3 | 33.9 | ||||||

| Lease payment guarantees |

42.4 | 47.0 | ||||||

| Performance bonds |

1.3 | 1.3 | ||||||

| Standby letters of credit |

9.6 | 9.8 | ||||||

|

|

|

|

|

|||||

| Total commercial commitments (a) |

$ | 130.6 | $ | 134.0 | ||||

|

|

|

|

|

|||||

| (a) | At September 30, 2012 and December 31, 2011, the carrying values of liabilities on the balance sheet for commercial commitments were $6.7 million and $6.4 million, respectively. The expirations of these commitments range from 2013 to 2022. GATX is not aware of any event that would require it to satisfy any of these commitments. |

Affiliate guarantees generally represent GATX’s guarantee of repayment of a portion of the financing utilized by the affiliate to acquire or lease-in assets. These guarantees are in lieu of making direct equity investments in the affiliate and reduce the affiliate’s financing costs. GATX is not aware of any event that would require it to satisfy these guarantees and expects the affiliates to generate sufficient cash flow to satisfy their financing obligations.

Asset residual value guarantees represent GATX’s commitment to third parties that an asset or group of assets will be worth a specified amount at the end of a lease term. GATX earns an initial fee for providing these asset value guarantees, which is amortized into income over the guarantee period. Upon disposition of the assets, GATX receives a share of any proceeds in excess of the amount guaranteed. Such residual sharing gains are recorded in asset remarketing income. If, at the end of the lease term, the net realizable value of the asset is less than the guaranteed amount, any liability resulting from GATX’s performance pursuant to the residual value guarantee will be reduced by the value realized from disposition of the asset. Asset residual value guarantees include those related to assets of affiliated companies.

Lease payment guarantees represent GATX’s guarantee of third-party lease payments to financial institutions. Any liability resulting from GATX’s performance pursuant to these guarantees will be reduced by the value realized from the underlying asset or group of assets.

GATX and its subsidiaries are also parties to standby letters of credit and performance bonds primarily related to workers’ compensation and general liability insurance coverages. No material claims have been made against these obligations. At September 30, 2012, GATX does not expect any material losses to result from these off balance sheet instruments since performance is not anticipated to be required.

NOTE 7. Share-Based Compensation

In the first nine months of 2012, GATX granted 350,200 stock appreciation rights (“SARs”), 63,380 restricted stock units, 76,780 performance shares and 15,420 phantom stock units. For the three and nine months ended September 30, 2012, total share-based compensation expense was $3.0 million and $9.1 million, respectively, and related tax benefits were $1.1 million and $3.4 million, respectively. For the three and nine months ended September 30, 2011, total share-based compensation expense was $2.0 million and $6.9 million, respectively, and related tax benefits were $0.8 million and $2.6 million, respectively.

8

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The weighted average estimated fair value of GATX’s 2012 SAR awards and underlying assumptions thereof are noted in the table below. The vesting period for the 2012 SAR grant is 3 years, with 1/3 vesting after each year.

| 2012 | ||||

| Weighted average estimated fair value |

$ | 18.48 | ||

| Quarterly dividend rate |

$ | 0.29 | ||

| Expected term of SAR, in years |

4.7 | |||

| Risk free interest rate |

1.0 | % | ||

| Dividend yield |

2.7 | % | ||

| Expected stock price volatility |

43.3 | % | ||

| Present value of dividends |

$ | 5.37 | ||

NOTE 8. Income Taxes

GATX’s effective tax rate was 20% for the nine months ended September 30, 2012, compared to 25% for the nine months ended September 30, 2011. GATX’s effective tax rate in any period is driven by the mix of pre-tax income, including share of affiliates’ earnings, among domestic and foreign jurisdictions which are taxed at different rates. The effective rate for both the current and prior periods reflects the impact of $20.9 million of losses and $11.0 million of gains, respectively, related to certain interest rate swaps at GATX’s European Rail affiliate, AAE Cargo A.G. (“AAE”), which were taxed at the Swiss statutory rate of approximately 10%. Additionally, in the current year, tax benefits of $15.5 million were recognized in connection with the close of a federal tax audit, a $4.6 million deferred tax benefit was recognized in connection with a reduction in the statutory tax rates of the United Kingdom and a $0.7 million deferred tax expense was recognized in connection with an increase in the statutory tax rates of Canada. In the prior year, a $4.1 million deferred tax benefit was recognized in connection with a reduction in the statutory tax rates of the United Kingdom. Excluding the effect of the AAE interest rate swaps and tax adjustments from each period, the effective tax rates for each of the first nine months of 2012 and 2011 was 31%.

As of September 30, 2012, GATX’s gross liability for unrecognized tax benefits totaled $4.7 million, which, if fully recognized, would decrease income tax expense by $4.7 million ($3.2 million net of federal tax). Subject to the completion of certain audits or the expiration of the applicable statute of limitations, the Company believes it is reasonably possible that within the next 12 months, unrecognized foreign tax benefits of $0.4 million may be recognized.

NOTE 9. Pension and Other Post-Retirement Benefits

The components of pension and other post-retirement benefit costs for the three months ended September 30, 2012 and 2011, were as follows (in millions):

| 2012 Pension Benefits |

2011 Pension Benefits |

2012 Retiree Health and Life |

2011 Retiree Health and Life |

|||||||||||||

| Service cost |

$ | 1.5 | $ | 1.4 | $ | 0.1 | $ | 0.1 | ||||||||

| Interest cost |

4.9 | 5.2 | 0.5 | 0.6 | ||||||||||||

| Expected return on plan assets |

(7.4 | ) | (8.4 | ) | — | — | ||||||||||

| Amortization of: |

||||||||||||||||

| Unrecognized prior service credit |

(0.3 | ) | (0.3 | ) | — | — | ||||||||||

| Unrecognized net actuarial loss (gains) |

2.5 | 1.8 | — | (0.1 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net costs (a) |

$ | 1.2 | $ | (0.3 | ) | $ | 0.6 | $ | 0.6 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

9

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The components of pension and other post-retirement benefit costs for the nine months ended September 30, 2012 and 2011, were as follows (in millions):

| 2012 Pension Benefits |

2011 Pension Benefits |

2012 Retiree Health and Life |

2011 Retiree Health and Life |

|||||||||||||

| Service cost |

$ | 4.5 | $ | 4.1 | $ | 0.2 | $ | 0.2 | ||||||||

| Interest cost |

14.8 | 15.6 | 1.5 | 1.7 | ||||||||||||

| Expected return on plan assets |

(22.2 | ) | (25.0 | ) | — | — | ||||||||||

| Amortization of: |

||||||||||||||||

| Unrecognized prior service credit |

(0.8 | ) | (0.8 | ) | (0.1 | ) | (0.1 | ) | ||||||||

| Unrecognized net actuarial loss (gain) |

7.5 | 5.4 | (0.1 | ) | (0.2 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net costs (a) |

$ | 3.8 | $ | (0.7 | ) | $ | 1.5 | $ | 1.6 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | The amounts reported herein are based on estimated annual costs. Actual annual costs for the year ending December 31, 2012, may differ from these estimates. |

NOTE 10. Earnings Per Share

Basic earnings per share were computed by dividing net income available to common shareholders by the weighted average number of shares of common stock outstanding during each period. Shares issued or reacquired during the period, if applicable, were weighted for the portion of the period that they were outstanding. Diluted earnings per share give effect to potentially dilutive securities, including convertible preferred stock and equity compensation awards.

The following table sets forth the computation of basic and diluted net income per common share (in millions, except per share amounts):

| Three Months

Ended September 30 |

Nine Months

Ended September 30 |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Numerator: |

||||||||||||||||

| Net income |

$ | 53.8 | $ | 32.9 | $ | 107.6 | $ | 79.2 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator: |

||||||||||||||||

| Weighted average shares outstanding - basic |

46.9 | 46.5 | 46.8 | 46.4 | ||||||||||||

| Effect of dilutive securities: |

||||||||||||||||

| Equity compensation plans |

0.6 | 0.6 | 0.6 | 0.6 | ||||||||||||

| Convertible preferred stock |

0.1 | 0.1 | 0.1 | 0.1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares outstanding - diluted |

47.6 | 47.2 | 47.5 | 47.1 | ||||||||||||

| Basic earnings per share |

$ | 1.15 | $ | 0.71 | $ | 2.30 | $ | 1.71 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted earnings per share |

$ | 1.13 | $ | 0.70 | $ | 2.26 | $ | 1.68 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

NOTE 11. Legal Proceedings and Other Contingencies

Various legal actions, claims, assessments and other contingencies arising in the ordinary course of business are pending against GATX and certain of its subsidiaries. These matters are subject to many uncertainties, and it is possible that some of these matters could ultimately be decided, resolved or settled adversely. For a discussion of these matters, please refer to Note 22 to the Company’s consolidated financial statements as set forth in GATX’s Annual Report on Form 10-K for the year ended December 31, 2011. Except as noted below, there have been no material changes or developments in these matters.

Viareggio Derailment

On June 29, 2009, a train consisting of fourteen liquefied petroleum gas (“LPG”) tank cars owned by GATX Rail Austria GmbH (an indirect subsidiary of the Company, “GATX Rail Austria”) and its subsidiaries derailed while passing through the city of Viareggio, Italy. Five tank cars overturned and one of the overturned cars was punctured by a peg or

10

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

obstacle along the side of the track, resulting in a release of LPG, which subsequently ignited. Thirty-two people died and others were injured in the fire, which also resulted in property damage. The LPG tank cars were leased to FS Logistica S.p.A., a subsidiary of the Italian state-owned railway, Ferrovie dello Stato S.p.A (the “Italian Railway”). On June 28, 2012, the Public Prosecutors of Lucca (“Public Prosecutors”) formally notified GATX Rail Austria and two of its subsidiaries (collectively, “GRA”), as well as several maintenance and supervisory employees (the “Employees”), that they had concluded their investigation of the Viareggio accident and intend to charge GRA and the Employees with various negligence-based crimes related to the accident, all of which are punishable under Italian law by incarceration, damages and fines. Similar notices were issued to, among others, four Italian Railway companies and eighteen of their employees. The Public Prosecutor’s report asserts that a crack in one of the tank car’s axles broke, causing the derailment and resulting in a tank car rupture and release of LPG, after the car hit an obstacle on the side of the track placed there by the Italian Railway. The report alleges that the crack was detectible at the time of final inspection but was overlooked by the Employees at the Jungenthal Waggon GmbH workshop (a subsidiary of GATX Rail Austria). The Company believes that GRA and its Employees acted diligently and properly with respect to applicable legal and industry standards and will present numerous scientific and technical defenses to the Public Prosecutor’s report in the forthcoming proceedings. With respect to claims for personal injuries and property damages, the Company and its subsidiaries maintain insurance for such losses, and the Company’s insurers are working cooperatively with the insurer for the Italian Railway to adjust and settle these claims. These joint settlement efforts have resolved the majority of asserted civil damage claims related to the accident, and joint efforts to resolve the remaining civil claims are ongoing. In addition to settling civil claims, the Company’s insurers have been providing reimbursement for legal defense costs, including the costs of criminal defense. Recently, one of the Company’s eleven insurers notified the Company that, with respect to its layer of coverage, it will not reimburse the costs of criminal defense, and the Company is engaged in insurance coverage discussions with that insurer to attempt resolution of the issue. The Company cannot predict the outcome of those discussions or the amount of criminal defense costs that ultimately may not be reimbursed by that insurer. Additionally, the Company cannot predict the outcome of the foregoing legal proceedings or what other legal proceedings, if any, may be initiated against GRA or its personnel, and, therefore, cannot reasonably estimate the amount or range of loss (including criminal defense costs) that may ultimately be incurred in connection with this accident. Accordingly, the Company has not established any accruals with respect to this matter.

Litigation Accruals

The Company has recorded accruals totaling $1.9 million at September 30, 2012, for losses related to those litigation matters that the Company believes to be probable and for which an amount of loss can be reasonably estimated. However, the Company cannot determine a reasonable estimate of the maximum possible loss or range of loss for these matters given that they are at various stages of the litigation process and each case is subject to the inherent uncertainties of litigation (such as the strength of the Company’s legal defenses and the availability of insurance recovery). Although the maximum amount of liability that may ultimately result from any of these matters cannot be predicted with absolute certainty, management expects that none of the matters for which the Company has recorded an accrual, when ultimately resolved, will have a material adverse effect on GATX’s consolidated financial position or liquidity. It is possible, however, that the ultimate resolution of one or more of these matters could have a material adverse effect on the Company’s results of operations in a particular quarter or year if such resolution results in liability that materially exceeds the accrued amount.

In addition, other litigation matters are pending for which the Company has not recorded any accruals because the Company’s potential liability for those matters is not probable or cannot be reasonably estimated based on currently available information. For those matters where the Company has not recorded an accrual but a loss is reasonably possible, the Company cannot determine a reasonable estimate of the maximum possible loss or range of loss for these matters given that they are at various stages of the litigation process and each case is subject to the inherent uncertainties of litigation (such as the strength of the Company’s legal defenses and the availability of insurance recovery). Although the maximum amount of liability that may ultimately result from any of these matters cannot be predicted with absolute certainty, management expects that none of the matters for which the Company has not recorded an accrual, when ultimately resolved, will have a material adverse effect on GATX’s consolidated financial position or liquidity. It is possible, however, that the ultimate resolution of one or more of these matters could have a material adverse effect on the Company’s results of operations in a particular quarter or year if such resolution results in a significant liability for the Company.

Environmental

The Company’s operations are subject to extensive federal, state and local environmental regulations. GATX’s operating procedures include practices to protect the environment from the risks inherent in full service railcar leasing, which involves maintaining railcars used by customers to transport chemicals and other hazardous materials. Additionally, some of GATX’s real estate holdings, including previously owned properties, are or have been used for industrial or transportation-related purposes or leased to commercial or industrial companies whose activities might have resulted in discharges on the property. As a result, GATX is subject to

11

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

environmental cleanup and enforcement actions. In particular, the federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), also known as the Superfund law, as well as similar state laws, impose joint and several liability for cleanup and enforcement costs on current and former owners and operators of a site without regard to fault or the legality of the original conduct. If there are other potentially responsible parties (“PRPs”), GATX generally contributes to the cleanup of these sites through cost-sharing agreements with terms that vary from site to site. Costs are typically allocated based on the relative volumetric contribution of material, the period of time the site was owned or operated, and/or the portion of the site owned or operated by each PRP. GATX has been notified that it is a PRP, among many PRPs, for study and cleanup costs at three Superfund sites for which investigation and remediation payments have yet to be determined.

At the time a potential environmental issue is identified, initial accruals for environmental liability are established when such liability is probable and a reasonable estimate of the associated costs can be made. Costs are estimated based on the type and level of investigation and/or remediation activities that the Company’s internal environmental staff (and where appropriate, independent consultants) have determined to be necessary to comply with applicable laws and regulations. Activities include surveys and environmental studies of potentially contaminated sites as well as costs for remediation and restoration of sites determined to be contaminated. In addition, GATX has provided indemnities for potential environmental liabilities to buyers of divested companies. In these instances, accruals are based on the scope and duration of the respective indemnities together with the extent of known contamination. Estimates are periodically reviewed and adjusted as required to reflect additional information about facility or site characteristics or changes in regulatory requirements. GATX conducts a quarterly environmental contingency analysis, which considers a combination of factors including independent consulting reports, site visits, legal reviews, analysis of the likelihood of participation in and the ability of other PRPs to pay for cleanup, and historical trend analyses. GATX does not believe that a liability exists for known environmental risks beyond what has been provided for in its environmental accrual.

GATX is involved in administrative and judicial proceedings and other voluntary and mandatory cleanup efforts at 17 sites, including the Superfund sites, at which it is contributing to the cost of performing the study or cleanup, or both, of alleged environmental contamination. As of September 30, 2012, GATX has recorded accruals of $15.9 million for remediation and restoration costs that the Company believes to be probable and for which the amount of loss can be reasonably estimated. These amounts are included in other liabilities on GATX’s balance sheet. GATX’s environmental liabilities are not discounted.

The Company did not materially change its methodology for identifying and calculating environmental liabilities in the last three years. Currently, no known trends, demands, commitments, events or uncertainties exist that are reasonably likely to occur and materially affect the methodology or assumptions described above.

The recorded accruals represent the Company’s best estimate of all costs for remediation and restoration of affected sites, without reduction for anticipated recoveries from third parties, and include both asserted and unasserted claims. However, the Company is unable to provide a reasonable estimate of the maximum potential loss associated with these sites because cleanup costs cannot be predicted with certainty. Various factors beyond the Company’s control can impact the amount of loss the Company will ultimately incur with respect to these sites, including the extent of corrective actions that may be required; evolving environmental laws and regulations; advances in environmental technology, the extent of other parties’ participation in cleanup efforts; developments in periodic environmental analyses related to sites determined to be contaminated, and developments in environmental surveys and studies of potentially contaminated sites. As a result, future charges associated with these sites could have a significant effect on results of operations in a particular quarter or year if the costs materially exceed the accrued amount as individual site studies and remediation and restoration efforts proceed. However, management believes it is unlikely that the ultimate cost to GATX for any of these sites, either individually or in the aggregate, will have a material adverse effect on its financial position or liquidity.

12

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 12. Financial Data of Business Segments

GATX leases, operates, manages and remarkets long-lived, widely-used assets primarily in the rail and marine markets. GATX also invests in joint ventures that complement existing business activities. Headquartered in Chicago, Illinois, GATX has three financial reporting segments: Rail, American Steamship Company (“ASC”) and Portfolio Management.

Rail is principally engaged in leasing tank and freight railcars and locomotives. Rail provides railcars primarily pursuant to full-service leases, under which it maintains the railcars, and pays ad valorem taxes and insurance. Rail also offers net leases for railcars and most of its locomotives, in which case the lessee is responsible for maintenance, insurance and taxes.

ASC owns and operates the largest fleet of U.S. flagged self-unloading vessels on the Great Lakes, providing waterborne transportation of dry bulk commodities for a range of industrial customers.

Portfolio Management focuses on maximizing the value of its existing portfolio of wholly-owned and managed assets, which includes identifying opportunities to remarket certain assets. Portfolio Management also seeks to maximize value from its joint ventures and to selectively invest in domestic marine and container related assets.

Segment profit is an internal performance measure used by the Chief Executive Officer to assess the performance of each segment in a given period. Segment profit includes all revenues and GATX’s share of affiliates’ earnings attributable to the segments as well as ownership and operating costs that management believes are directly associated with the maintenance or operation of the revenue earning assets. Operating costs include maintenance costs, marine operating costs and other operating costs such as litigation, asset impairment charges, provisions for losses, environmental costs and asset storage costs. Segment profit excludes selling, general and administrative expenses, income taxes and certain other amounts not allocated to the segments.

GATX allocates debt balances and related interest expense to each segment based upon a pre-determined fixed recourse leverage level expressed as a ratio of recourse debt (including off balance sheet debt) to equity. The leverage levels for Rail, ASC and Portfolio Management are set at 4:1, 1.5:1 and 3:1, respectively. Management believes that by utilizing this leverage and interest expense allocation methodology, each operating segment’s financial performance reflects appropriate risk-adjusted borrowing costs.

13

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The following tables depict the profitability, financial position and capital expenditures of each of GATX’s business segments for the three and nine months ended September 30, 2012 and 2011 (in millions):

| Rail | ASC | Portfolio Management |

Other | GATX Consolidated |

||||||||||||||||

| Three Months Ended September 30, 2012 |

||||||||||||||||||||

| Profitability |

||||||||||||||||||||

| Revenues |

$ | 245.2 | $ | 80.2 | $ | 17.8 | $ | 0.2 | $ | 343.4 | ||||||||||

| Share of affiliates’ earnings |

4.3 | — | 14.8 | — | 19.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total gross income |

249.5 | 80.2 | 32.6 | 0.2 | 362.5 | |||||||||||||||

| Ownership costs |

114.9 | 7.1 | 12.5 | 1.8 | 136.3 | |||||||||||||||

| Other costs and expenses |

71.1 | 59.9 | 5.1 | (0.1 | ) | 136.0 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Segment profit (loss) |

$ | 63.5 | $ | 13.2 | $ | 15.0 | $ | (1.5 | ) | 90.2 | ||||||||||

| SG&A |

38.6 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| Income before income taxes |

$ | 51.6 | ||||||||||||||||||

| Capital Expenditures |

||||||||||||||||||||

| Portfolio investments and capital additions |

$ | 123.3 | $ | 0.3 | $ | 6.3 | $ | 1.7 | $ | 131.6 | ||||||||||

| Selected Balance Sheet Data at September 30, 2012 |

||||||||||||||||||||

| Investments in affiliated companies |

$ | 126.2 | $ | — | $ | 406.1 | $ | — | $ | 532.3 | ||||||||||

| Identifiable assets |

$ | 4,553.4 | $ | 290.6 | $ | 815.1 | $ | 466.0 | $ | 6,125.1 | ||||||||||

| Three Months Ended September 30, 2011 |

||||||||||||||||||||

| Profitability |

||||||||||||||||||||

| Revenues |

$ | 242.6 | $ | 71.3 | $ | 23.7 | $ | 0.3 | $ | 337.9 | ||||||||||

| Share of affiliates’ earnings |

(2.0 | ) | — | 3.8 | — | 1.8 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total gross income |

240.6 | 71.3 | 27.5 | 0.3 | 339.7 | |||||||||||||||

| Ownership costs |

111.8 | 5.6 | 12.1 | 0.8 | 130.3 | |||||||||||||||

| Other costs and expenses |

65.8 | 57.2 | 3.9 | 0.3 | 127.2 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Segment profit (loss) |

$ | 63.0 | $ | 8.5 | $ | 11.5 | $ | (0.8 | ) | 82.2 | ||||||||||

| SG&A |

38.5 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| Income before income taxes |

$ | 43.7 | ||||||||||||||||||

| Capital Expenditures |

||||||||||||||||||||

| Portfolio investments and capital additions |

$ | 133.8 | $ | 3.3 | $ | 62.1 | $ | 0.8 | $ | 200.0 | ||||||||||

| Selected Balance Sheet Data at December 31, 2011 |

||||||||||||||||||||

| Investments in affiliated companies |

$ | 163.0 | $ | — | $ | 384.5 | $ | — | $ | 547.5 | ||||||||||

| Identifiable assets |

$ | 4,448.6 | $ | 286.3 | $ | 862.0 | $ | 159.6 | $ | 5,756.5 | ||||||||||

14

Table of Contents

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

| Rail | ASC | Portfolio Management |

Other | GATX Consolidated |

||||||||||||||||

| Nine Months Ended September 30, 2012 |

||||||||||||||||||||

| Profitability |

||||||||||||||||||||

| Revenues |

$ | 736.0 | $ | 169.2 | $ | 65.0 | $ | 0.7 | $ | 970.9 | ||||||||||

| Share of affiliates’ earnings |

(12.2 | ) | — | 35.5 | — | 23.3 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total gross income |

723.8 | 169.2 | 100.5 | 0.7 | 994.2 | |||||||||||||||

| Ownership costs |

342.9 | 15.9 | 37.0 | 3.8 | 399.6 | |||||||||||||||

| Other costs and expenses |

209.2 | 124.0 | 11.9 | — | 345.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Segment profit (loss) |

$ | 171.7 | $ | 29.3 | $ | 51.6 | $ | (3.1 | ) | 249.5 | ||||||||||

| SG&A |

115.6 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| Income before income taxes |

$ | 133.9 | ||||||||||||||||||

| Capital Expenditures |

||||||||||||||||||||

| Portfolio investments and capital additions |

$ | 443.9 | $ | 11.7 | $ | 62.8 | $ | 5.0 | $ | 523.4 | ||||||||||

| Nine Months Ended September 30, 2011 |

||||||||||||||||||||

| Profitability |

||||||||||||||||||||

| Revenues |

$ | 717.1 | $ | 142.2 | $ | 57.2 | $ | 1.0 | $ | 917.5 | ||||||||||

| Share of affiliates’ earnings |

13.4 | — | 20.5 | — | 33.9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total gross income |

730.5 | 142.2 | 77.7 | 1.0 | 951.4 | |||||||||||||||

| Ownership costs |

341.3 | 13.5 | 36.1 | 2.9 | 393.8 | |||||||||||||||

| Other costs and expenses |

217.9 | 110.8 | 10.6 | 0.8 | 340.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Segment profit (loss) |

$ | 171.3 | $ | 17.9 | $ | 31.0 | $ | (2.7 | ) | 217.5 | ||||||||||

| SG&A |

112.3 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| Income before income taxes |

$ | 105.2 | ||||||||||||||||||

| Capital Expenditures |

||||||||||||||||||||

| Portfolio investments and capital additions |

$ | 290.1 | $ | 15.9 | $ | 151.4 | $ | 2.7 | $ | 460.1 | ||||||||||

15

Table of Contents

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This document contains statements that may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are subject to the safe harbor provisions of those sections and the Private Securities Litigation Reform Act of 1995. Some of these statements may be identified by words like “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict,” “project” or other similar words. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those described in GATX’s Annual Report on Form 10-K for the year ended December 31, 2011, and other filings with the SEC, and that actual results or developments may differ materially from those in the forward-looking statements.

Specific factors that might cause actual results to differ from expectations include, but are not limited to, (1) general economic, market, regulatory and political conditions affecting the rail, marine and other industries served by GATX and its customers; (2) competitive factors in GATX’s primary markets, including lease pricing and asset availability; (3) lease rates, utilization levels and operating costs in GATX’s primary operating segments; (4) conditions in the capital markets or changes in GATX’s credit ratings and financing costs; (5) risks related to compliance with, or changes to, laws, rules and regulations applicable to GATX and its rail, marine and other assets; (6) costs associated with maintenance initiatives; (7) operational and financial risks associated with long-term railcar purchase commitments; (8) changes in loss provision levels within GATX’s portfolio; (9) conditions affecting certain assets, customers or regions where GATX has a large investment; (10) impaired asset charges that may result from changing market conditions or portfolio management decisions implemented by GATX; (11) opportunities for remarketing income; (12) labor relations with unions representing GATX employees; and (13) the outcome of pending or threatened litigation.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis, judgment, belief or expectation only as of the date hereof. GATX has based these forward-looking statements on information currently available and disclaims any intention or obligation to update or revise these forward-looking statements to reflect subsequent events or circumstances.

This “Management’s Discussion and Analysis of Financial Condition and Results of Operations” is based on financial data derived from the financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and certain other financial data that is prepared using non-GAAP components. For a reconciliation of these non-GAAP components to the most comparable GAAP components, see “Non-GAAP Financial Measures” at the end of this Item.

GATX Corporation leases, operates, manages and remarkets long-lived, widely-used assets primarily in the rail and marine markets. GATX also invests in affiliates that complement existing business activities. Headquartered in Chicago, Illinois, GATX has three financial reporting segments: Rail, American Steamship Company (“ASC”) and Portfolio Management.

Operating results for the nine months ended September 30, 2012 are not necessarily indicative of the results that may be achieved for the entire year ending December 31, 2012. For further information, refer to GATX’s Annual Report on Form 10-K for the year ended December 31, 2011.

16

Table of Contents

DISCUSSION OF OPERATING RESULTS

Net income was $107.6 million for the first nine months of 2012 compared to net income of $79.2 million for the first nine months of 2011. Results for the first nine months of 2012 and 2011 include benefits from Tax Adjustments and Other Items of $0.7 million and $13.9 million, respectively. Net income was $53.8 million for the third quarter of 2012 compared to net income of $32.9 million for the third quarter of 2011. Results for the third quarter of 2012 and 2011 include benefits from Tax Adjustments and Other Items of $18.2 million and $1.3 million, respectively. Details of the Tax Adjustments and Other Items can be found under Non-GAAP Financial Measures at the end of this Item 2.

Total investment volume was $523.4 million for the first nine months of 2012 compared to $460.1 million for the first nine months of 2011.

The following table presents a financial summary of GATX’s financial reporting segments (in millions, except per share data):

| Three Months Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Gross Income |

||||||||||||||||

| Rail |

$ | 249.5 | $ | 240.6 | $ | 723.8 | $ | 730.5 | ||||||||

| ASC |

80.2 | 71.3 | 169.2 | 142.2 | ||||||||||||

| Portfolio Management |

32.6 | 27.5 | 100.5 | 77.7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total segment gross income |

362.3 | 339.4 | 993.5 | 950.4 | ||||||||||||

| Other |

0.2 | 0.3 | 0.7 | 1.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Consolidated Gross Income |

$ | 362.5 | $ | 339.7 | $ | 994.2 | $ | 951.4 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Segment Profit |

||||||||||||||||

| Rail |

$ | 63.5 | $ | 63.0 | $ | 171.7 | $ | 171.3 | ||||||||

| ASC |

13.2 | 8.5 | 29.3 | 17.9 | ||||||||||||

| Portfolio Management |

15.0 | 11.5 | 51.6 | 31.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Segment Profit |

91.7 | 83.0 | 252.6 | 220.2 | ||||||||||||

| Less: |

||||||||||||||||

| Selling, general and administrative expenses |

38.6 | 38.5 | 115.6 | 112.3 | ||||||||||||

| Unallocated interest expense, net |

1.8 | 0.8 | 4.0 | 3.1 | ||||||||||||

| Other income and expense, including eliminations |

(0.3 | ) | — | (0.9 | ) | (0.4 | ) | |||||||||

| Income taxes |

(2.2 | ) | 10.8 | 26.3 | 26.0 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Consolidated Net Income |

$ | 53.8 | $ | 32.9 | $ | 107.6 | $ | 79.2 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic earnings per share |

$ | 1.15 | $ | 0.71 | $ | 2.30 | $ | 1.71 | ||||||||

| Diluted earnings per share |

$ | 1.13 | $ | 0.70 | $ | 2.26 | $ | 1.68 | ||||||||

Return on Equity

The following table presents GATX’s return on equity (“ROE”) for the trailing twelve months ended September 30:

| 2012 | 2011 | |||||||

| ROE |

11.7 | % | 8.8 | % | ||||

| ROE, excluding Tax Adjustments and Other Items |

11.5 | % | 7.1 | % | ||||

17

Table of Contents

Segment profit is an internal performance measure used by the Chief Executive Officer to assess the performance of each segment in a given period. Segment profit includes all revenues and GATX’s share of affiliates’ earnings attributable to the segments as well as ownership and operating costs that management believes are directly associated with the maintenance or operation of the revenue earning assets. Operating costs include maintenance costs, marine operating costs, and other operating costs such as litigation, asset impairment charges, provisions for losses, environmental costs and asset storage costs. Segment profit excludes selling, general and administrative expenses, income taxes and certain other amounts not allocated to the segments. These amounts are discussed below in Other.

GATX allocates debt balances and related interest expense to each segment based upon a pre-determined fixed recourse leverage level expressed as a ratio of recourse debt (including off balance sheet debt) to equity. The leverage levels for Rail, ASC and Portfolio Management are set at 4:1, 1.5:1 and 3:1, respectively. Management believes that by utilizing this leverage and interest expense allocation methodology, each operating segment’s financial performance reflects appropriate risk-adjusted borrowing costs.

Rail

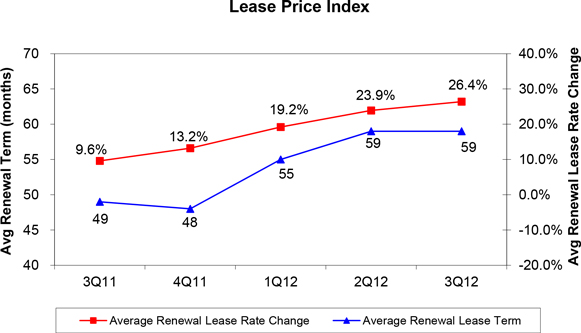

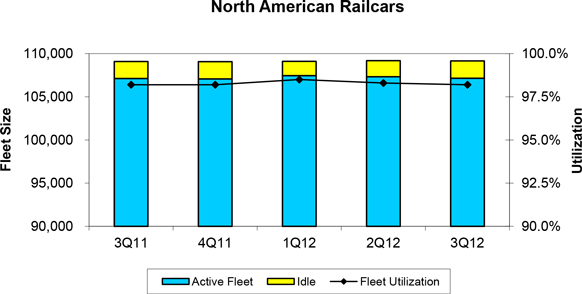

In the third quarter of 2012, lease rate pricing and demand for tank railcars remained strong. Rail’s utilization in North America was 98.2%, compared to 98.3% at the end of the second quarter and 98.2% at September 30, 2011. The average lease renewal rate on cars in the GATX Lease Price Index (the “LPI”, see definition below) increased 26.4% from the weighted average expiring lease rate, compared to increases of 23.9% for the second quarter of 2012 and 9.6% for the third quarter of 2011.

Rail entered 2012 with leases on approximately 20,000 railcars in North America scheduled to expire during the year, of which approximately 3,700 remained at the end of the third quarter. The majority of year-to-date expirations were renewed with existing customers. In the current strong lease rate environment, as evidenced by the LPI, Rail is highly focused on lengthening lease terms. Lease terms on renewals for cars in the LPI averaged 59 months in the current quarter, consistent with the prior quarter and up from 49 months in the third quarter of 2011. While utilization is high for most railcar types, demand across freight car types is inconsistent, with coal cars particularly weak. Leases on approximately 200 coal cars are scheduled to expire during the remainder of 2012, a portion of which are unlikely to be renewed.

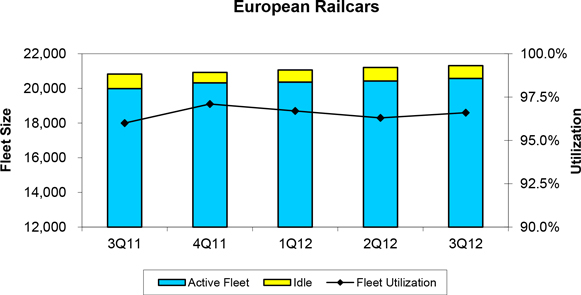

In Europe, Rail has experienced modest improvements in lease rate pricing and has increased its wholly-owned tank car fleet through investments in new railcars. At the end of the third quarter of 2012, fleet utilization was 96.6% compared to 96.3% at the end of the second quarter and 96.0% at September 30, 2011. Demand for tank cars serving the petroleum markets is solid; however, demand for railcars serving the chemical markets has softened. GATX’s European Rail affiliate, AAE Cargo A.G. (“AAE”), which serves freight car markets, is experiencing relatively stable operating results; however, fleet utilization remains much lower than historical norms due to ongoing weakness in the European economy.

During the first nine months of 2012, Rail’s investment volume was $443.9 million, compared to $290.1 million in 2011. Year-to-date, Rail has acquired approximately 4,300 railcars, including railcars delivering under a five-year supply agreement. Also, during the second quarter, GATX entered the Indian railcar leasing market with an agreement to purchase newly manufactured railcars, which are expected to deliver and be placed on lease beginning in the fourth quarter.

18

Table of Contents

Components of Rail’s operating results are outlined below (in millions):

| Three Months Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Gross Income |

||||||||||||||||

| Lease income |

$ | 220.8 | $ | 212.1 | $ | 651.1 | $ | 632.8 | ||||||||

| Asset remarketing income |

6.6 | 8.0 | 29.8 | 22.7 | ||||||||||||

| Other income |

17.8 | 22.5 | 55.1 | 61.6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Revenues |

245.2 | 242.6 | 736.0 | 717.1 | ||||||||||||

| Affiliate earnings |

4.3 | (2.0 | ) | (12.2 | ) | 13.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 249.5 | 240.6 | 723.8 | 730.5 | |||||||||||||

| Ownership Costs |

||||||||||||||||

| Depreciation |

51.1 | 49.6 | 151.8 | 146.4 | ||||||||||||

| Interest expense, net |

32.4 | 30.8 | 97.0 | 96.1 | ||||||||||||

| Operating lease expense |

31.4 | 31.4 | 94.1 | 98.8 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 114.9 | 111.8 | 342.9 | 341.3 | |||||||||||||

| Other Costs and Expenses |

||||||||||||||||

| Maintenance expense |

60.9 | 61.8 | 182.1 | 196.4 | ||||||||||||

| Other costs |

10.2 | 4.0 | 27.1 | 21.5 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 71.1 | 65.8 | 209.2 | 217.9 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Segment Profit |

$ | 63.5 | $ | 63.0 | $ | 171.7 | $ | 171.3 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

GATX Lease Price Index

The LPI is an internally generated business indicator that measures general lease rate pricing on renewals within GATX’s North American rail fleet. The index reflects the weighted average lease rate for a select group of railcar types that GATX believes to be representative of its overall North American fleet. The average renewal lease rate change reflects the percentage change between the weighted average renewal lease rate and the weighted average expiring lease rate for railcars in the LPI. The average renewal term reflects the weighted average renewal lease term in months for railcars in the LPI.

19

Table of Contents

Rail’s Fleet Data

The following table summarizes certain fleet data for railcars in North America for the quarters indicated:

| September 30 2011 |

December 31 2011 |

March 31 2012 |

June 30 2012 |

September 30 2012 |

||||||||||||||||

| Beginning balance |

108,764 | 109,091 | 109,070 | 109,116 | 109,187 | |||||||||||||||

| Cars added |

1,069 | 972 | 1,223 | 1,385 | 858 | |||||||||||||||

| Cars scrapped |

(602 | ) | (696 | ) | (544 | ) | (591 | ) | (544 | ) | ||||||||||

| Cars sold |

(140 | ) | (297 | ) | (633 | ) | (723 | ) | (339 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ending balance |

109,091 | 109,070 | 109,116 | 109,187 | 109,162 | |||||||||||||||

| Utilization rate at quarter end |

98.2 | % | 98.2 | % | 98.5 | % | 98.3 | % | 98.2 | % | ||||||||||

| Average active railcars |

106,984 | 107,121 | 107,328 | 107,452 | 107,224 | |||||||||||||||

The following table summarizes certain fleet data for railcars in Europe for the quarters indicated:

| September 30 2011 |

December 31 2011 |

March 31 2012 |

June 30 2012 |

September 30 2012 |

||||||||||||||||

| Beginning balance |

20,675 | 20,828 | 20,927 | 21,064 | 21,209 | |||||||||||||||

| Cars added |

200 | 368 | 304 | 273 | 355 | |||||||||||||||

| Cars scrapped or sold |

(47 | ) | (269 | ) | (167 | ) | (128 | ) | (250 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ending balance |

20,828 | 20,927 | 21,064 | 21,209 | 21,314 | |||||||||||||||

| Utilization rate at quarter end |

96.0 | % | 97.1 | % | 96.7 | % | 96.3 | % | 96.6 | % | ||||||||||

| Average active railcars |

19,881 | 20,112 | 20,356 | 20,386 | 20,490 | |||||||||||||||

20

Table of Contents

The following table summarizes certain fleet data for locomotives in North America for the quarters indicated:

| September 30 2011 |

December 31 2011 |

March 31 2012 |

June 30 2012 |

September 30 2012 |

||||||||||||||||

| Beginning balance |

572 | 572 | 572 | 576 | 549 | |||||||||||||||

| Locomotives added |

5 | — | 4 | 16 | 7 | |||||||||||||||

| Locomotives scrapped or sold |

(5 | ) | — | — | (43 | ) | (2 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ending balance |

572 | 572 | 576 | 549 | 554 | |||||||||||||||

| Utilization rate at quarter end |

95.9 | % | 98.1 | % | 94.3 | % | 98.5 | % | 99.1 | % | ||||||||||

| Average active locomotives |

560 | 561 | 552 | 531 | 545 | |||||||||||||||

Rail’s Lease Income

Components of Rail’s lease income are outlined below (in millions):

| Three Months Ended September 30 |

Nine Months

Ended September 30 |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| North America — railcars |

$ | 172.2 | $ | 161.6 | $ | 506.9 | $ | 484.8 | ||||||||

| North America — locomotives |

8.5 | 9.1 | 25.1 | 26.7 | ||||||||||||

| Europe |

40.1 | 41.4 | 119.1 | 121.3 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 220.8 | $ | 212.1 | $ | 651.1 | $ | 632.8 | |||||||||

|

|

|

|

|

|

|

|

|