Washington, D.C. 20549

Form 10-K

For the fiscal year ended December 31 , 2023

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

or

Commission File Number 1-2328

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

(Exact name of registrant as specified in its charter)

233 South Wacker Drive

| (State or Other Jurisdiction of incorporation or Organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices, including zip code)

(Registrant's telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| þ | Accelerated filer | ☐ | Emerging growth company | ||||||||||||||

Non-accelerated filer | ☐ | Smaller reporting company | |||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

There were 35.5 million common shares outstanding at January 31, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

| PART III | |||||

GATX CORPORATION

2023 FORM 10-K

INDEX

| Item No. | Page | |||||||

| Part I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 1C. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Part II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Part III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Part IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

FORWARD-LOOKING STATEMENTS

Statements in this report not based on historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and, accordingly, involve known and unknown risks and uncertainties that are difficult to predict and could cause our actual results, performance, or achievements to differ materially from those discussed. Forward-looking statements include statements as to our future expectations, beliefs, plans, strategies, objectives, events, conditions, financial performance, prospects, or future events. In some cases, forward-looking statements can be identified by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "outlook," "continue," "likely," "will," "would", and similar words and phrases. Forward-looking statements are necessarily based on estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Accordingly, you should not place undue reliance on forward-looking statements, which speak only as of the date they are made, and are not guarantees of future performance. We do not undertake any obligation to publicly update or revise these forward-looking statements.

The following factors, in addition to those discussed under "Risk Factors" and elsewhere in this report and in our other filings with the U.S. Securities and Exchange Commission, could cause actual results to differ materially from our current expectations expressed in forward-looking statements:

•a significant decline in customer demand for our transportation assets or services, including as a result of: ◦prolonged inflation or deflation ◦high interest rates ◦weak macroeconomic conditions and world trade policies ◦weak market conditions in our customers' businesses ◦adverse changes in the price of, or demand for, commodities ◦changes in railroad operations, efficiency, pricing and service offerings, including those related to "precision scheduled railroading" or labor strikes or shortages ◦changes in, or disruptions to, supply chains ◦availability of pipelines, trucks, and other alternative modes of transportation ◦changes in conditions affecting the aviation industry, including global conflicts, geographic exposure and customer concentrations ◦customers' desire to buy, rather than lease, our transportation assets ◦other operational or commercial needs or decisions of our customers •inability to maintain our transportation assets on lease at satisfactory rates due to oversupply of assets in the market or other changes in supply and demand •competitive factors in our primary markets, including competitors with significantly lower costs of capital •higher costs associated with increased assignments of our transportation assets following non-renewal of leases, customer defaults, and compliance maintenance programs or other maintenance initiatives •events having an adverse impact on assets, customers, or regions where we have a concentrated investment exposure •financial and operational risks associated with long-term purchase commitments for transportation assets •reduced opportunities to generate asset remarketing income •inability to successfully consummate and manage ongoing acquisition and divestiture activities •reliance on Rolls-Royce in connection with our aircraft spare engine leasing businesses, and the risks that certain factors that adversely affect Rolls-Royce could have an adverse effect on our businesses •potential obsolescence of our assets | •risks related to our international operations and expansion into new geographic markets, including laws, regulations, tariffs, taxes, treaties or trade barriers affecting our activities in the countries where we do business •failure to successfully negotiate collective bargaining agreements with the unions representing a substantial portion of our employees •inability to attract, retain, and motivate qualified personnel, including key management personnel •inability to maintain and secure our information technology infrastructure from cybersecurity threats and related disruption of our business •exposure to damages, fines, criminal and civil penalties, and reputational harm arising from a negative outcome in litigation, including claims arising from an accident involving transportation assets •changes in, or failure to comply with, laws, rules, and regulations •environmental liabilities and remediation costs •operational, functional and regulatory risks associated with climate change, severe weather events and natural disasters, and other environmental, social and governance matters •U.S. and global political conditions and the impact of increased geopolitical tension and wars, including the ongoing war between Russia and Ukraine and resulting sanctions and countermeasures, on domestic and global economic conditions in general, including supply chain challenges and disruptions •prolonged inflation or deflation •fluctuations in foreign exchange rates •deterioration of conditions in the capital markets, reductions in our credit ratings, or increases in our financing costs •the emergence of new variants of COVID-19 or the occurrence of another widespread health crisis and the impact of measures taken in response •inability to obtain cost-effective insurance •changes in assumptions, increases in funding requirements or investment losses in our pension and post-retirement plans •inadequate allowances to cover credit losses in our portfolio •asset impairment charges we may be required to recognize •inability to maintain effective internal control over financial reporting and disclosure controls and procedures | |||||||

1

PART I

Item 1. Business

GENERAL

GATX Corporation ("GATX", "we," "us," "our," and similar terms), a New York corporation founded in 1898, is a leading global railcar lessor, owning fleets in North America, Europe, and India. In addition, through GATX Engine Leasing ("GEL"), our wholly owned aircraft spare engine leasing business, and our joint ventures with Rolls-Royce plc (or affiliates thereof, collectively “Rolls-Royce”), we own one of the largest aircraft spare engine lease portfolios in the world. We report our financial results through three primary business segments: Rail North America, Rail International, and Portfolio Management. Financial results for our tank container leasing business ("Trifleet") are reported in the Other segment.

The following description of our business should be read in conjunction with the information contained in our Management’s Discussion and Analysis of Financial Condition and Results of Operations included in Item 7 and the consolidated financial statements included in Part II, Item 8 of this Form 10-K.

At December 31, 2023, we had total assets of $11.3 billion, composed largely of railcars.

OPERATIONS

GATX RAIL BUSINESS OVERVIEW

Our wholly owned fleet of approximately 148,500 railcars is one of the largest railcar lease fleets in the world. We lease tank cars, freight cars, and locomotives in North America, tank cars and freight cars in Europe, and freight cars in India. The following table sets forth our worldwide rail fleet data as of December 31, 2023:

| Tank Railcars | Freight Railcars | Total Fleet | Managed Railcars | Total Railcars | Locomotives | ||||||||||||||||||||||||||||||

Rail North America | 62,227 | 48,251 | 110,478 | 288 | 110,766 | 523 | |||||||||||||||||||||||||||||

Rail International | 23,878 | 14,143 | 38,021 | 7 | 38,028 | — | |||||||||||||||||||||||||||||

Total | 86,105 | 62,394 | 148,499 | 295 | 148,794 | 523 | |||||||||||||||||||||||||||||

Our rail customers primarily operate in the petroleum, chemical, transportation, and food/agriculture industries. Our worldwide railcar fleet consists of diverse railcar types that our customers use to ship nearly 600 different commodities. The following table presents an overview of our railcar types as well as the industries of our customers and the commodities they ship.

2

| General-Service Tank Cars | High-Pressure Tank Cars | Specialty Tank Cars | Specialty/Pneumatic Covered Hoppers | Gravity Covered Hoppers | Open-Top Cars | Boxcars | Flatcars/Intermodal Railcars | |||||||||||||||||||

| Principal Industries Served | Petroleum/Bio-fuels | Petroleum | Chemical | Plastics | Agriculture | Energy | Food | Automotive | ||||||||||||||||||

| Chemical | Chemical | Petroleum | Food | Energy | Steel | Consumer Goods | Manufactured Goods | |||||||||||||||||||

| Food | Mining | Industrial | Industrial | Construction | Forest Products | Consumer Goods | ||||||||||||||||||||

| Agriculture | Construction | Forest Products | Packaging | Energy | ||||||||||||||||||||||

| Construction | Food | Construction | Steel | |||||||||||||||||||||||

| Principal Commodities | Petroleum Products | Liquefied Petroleum Gas Products | Sulfuric Acid | Plastics | Fertilizer | Coal | Packaged Food and Beverages | Vehicles | ||||||||||||||||||

| Fertilizer Products | Propylene | Molten Sulfur | Flour | Grain | Metals and Related | Paper and Packaging | Packaged Goods | |||||||||||||||||||

| Ethanol/ Bio-fuels | Vinyl Chloride Monomer | Hydrochloric Acid | Sugar | Sand | Aggregates | Lumber and Building Products | Lumber | |||||||||||||||||||

| Edible Oils and Syrups | Miscellaneous Chemicals | Caustic Soda | Starch | Cement, Granules | Coke | Mixed Freight | Steel Products | |||||||||||||||||||

| Chemicals | Phosphoric Acid | Carbon Black | Soda Ash | Waste | Mixed Freight | |||||||||||||||||||||

Approximately 148,500 Railcars as of 12/31/2023

3

Based on 2023 Combined Rail North America and Rail International Revenues

RAIL NORTH AMERICA

Rail North America is composed of our operations in the United States, Canada, and Mexico. Rail North America primarily provides railcars pursuant to full-service leases under which it maintains the railcars, pays ad valorem taxes, and provides other ancillary services. These railcars have estimated economic useful lives of 27 to 45 years and an average age of approximately 18 years. Rail North America has a large and diverse customer base, serving approximately 840 customers. In 2023, no single customer accounted for more than 5% of Rail North America’s total lease revenue, and the top ten customers combined accounted for approximately 23% of Rail North America’s total lease revenue. Rail North America leases railcars for terms that generally range from one to ten years, which vary based on railcar type, lease structure, and market conditions. The average remaining lease term of the North American fleet was approximately 38 months as of December 31, 2023. Rail North America’s primary competitors in railcar leasing are Union Tank Car Company, Wells Fargo Rail, CIT Rail, Trinity Industries Leasing Company, and American Industrial Transport. Rail North America competes primarily on the basis of availability of railcars, maintenance capabilities, lease rate, lease structures, customer relationships, and engineering expertise.

Rail North America purchases new railcars from a number of manufacturers, including Trinity Rail Group, LLC ("Trinity"), a subsidiary of Trinity Industries, Inc., The Greenbrier Companies, Inc. (“Greenbrier”) and its subsidiaries, National Steel Car Ltd., and FreightCar America, Inc. We also acquire used railcars in the secondary market.

In 2022, we entered into a new long-term railcar supply agreement with Trinity to purchase 15,000 newly built railcars through 2028, with an option to order up to an additional 500 railcars each year from 2023 to 2028. The agreement enables us to order a broad mix of tank and freight cars. Trinity will deliver 6,000 tank cars (1,200 per year) from 2024 through 2028. The remaining 9,000 railcars, which can be a mix of freight and tank cars, will be ordered at a rate of 1,500 railcars per order year from 2023 to 2028 and delivered under a schedule to be determined. At December 31, 2023, 2,995 railcars have been ordered pursuant to the terms of the agreement, of which 890 have been delivered.

In 2018, we amended a long-term supply agreement with Trinity to extend the term to December 2023, and we agreed to purchase 4,800 tank cars (1,200 per year) beginning in January 2020 and continuing through 2023. At December 31, 2023, all 4,800 railcars have been ordered pursuant to the amended terms of the agreement, of which 4,621 railcars have been delivered. The remaining railcars covered under this agreement are expected to be delivered by early 2024.

In 2018, we entered into a multi-year railcar supply agreement with American Railcar Industries, Inc. ("ARI"), pursuant to which we agreed to purchase 7,650 newly built railcars. The order encompasses a mix of tank and freight cars to be delivered over a five-year period, beginning in April 2019 and ending in December 2023. ARI's railcar manufacturing business was acquired by a subsidiary of Greenbrier on July 26, 2019, and such subsidiary assumed all of ARI's obligations under our long-term supply agreement. As of December 31, 2023, all 7,650 railcars have been ordered, of which 7,271 railcars have been delivered. All railcars covered under this agreement are expected to be delivered by early 2024.

4

Rail North America also owns a fleet of locomotives, consisting of 493 four-axle and 30 six-axle locomotives as of December 31, 2023. Locomotive customers are primarily regional and short-line railroads and industrial users. Lease terms vary from month-to-month to ten years. As of December 31, 2023, the average remaining lease term of the locomotive fleet was approximately 26 months. Rail North America's primary competitors in locomotive leasing are Wells Fargo Rail, CIT Rail, and Progress Rail Services Corporation. Competitive factors in the market include availability of locomotives, lease rates, customer service, and maintenance.

Rail North America also sells existing railcars and the associated leases, and these remarketing activities may generate gains which could contribute significantly to Rail North America’s segment profit.

Maintenance

Rail North America operates an extensive network of maintenance facilities in the United States and Canada dedicated to performing safe, timely, efficient, and high-quality railcar maintenance services for customers. Services include interior cleaning of railcars, routine maintenance and general repairs to the car body and safety appliances, regulatory compliance work, wheelset replacements, interior blast and lining, exterior blast and painting, and car stenciling. To the extent possible, railcar maintenance is scheduled in a manner that minimizes the amount of time the car is out of service.

At December 31, 2023, Rail North America’s maintenance network consisted of:

•Six major maintenance facilities that can complete nearly all types of maintenance services.

•One smaller maintenance facility with more limited capabilities.

•One customer-dedicated site operating within a customer facility that offers services tailored to the needs of our customer's fleet.

•Two locations (one servicing railcars and one servicing locomotives) with mobile units that travel to field locations to provide services tailored to the needs of our customers' fleets.

The maintenance network is supplemented by a number of preferred third-party maintenance providers and railroads. In 2023, third-party maintenance network expenses accounted for approximately 19% of Rail North America’s total maintenance network expenses, excluding repairs performed by the railroads. In 2023, wholly owned and third-party maintenance facilities performed approximately 30,000 service events, including multiple independent service events for the same railcar.

Our maintenance activities are dedicated to servicing our wholly owned railcar fleet pursuant to the provisions of our lease contracts. This may include services that are not included in the full-service lease agreement, such as repairs of railcar damage or other customer-specific requirements. Revenue earned from these types of maintenance services is recorded in other revenue. We may also perform maintenance and repair activities on railcars owned by third parties.

Affiliates

GATX is a co-founder of and, as of December 31, 2023, owns a 12.9 % share in, the RailPulse LLC ("RailPulse") joint venture. RailPulse owners include Genesee & Wyoming Inc., Trinity Industries, Inc., Watco Companies, LLC, Union Pacific Railroad Company, Norfolk Southern Railway Company, Greenbrier Leasing, LLC, Railroad Development Corporation, and Bunge North America, Inc. The RailPulse joint venture was formed to create an industry-wide telematics platform to enable the use of telematics devices to gather data and enhance rail safety and the value proposition for rail shippers across North America. As of December 31, 2023, RailPulse executed a soft launch that provided its member firms, and customers of those firms, early access to the platform. The financial results of RailPulse are not currently material to GATX.

RAIL INTERNATIONAL

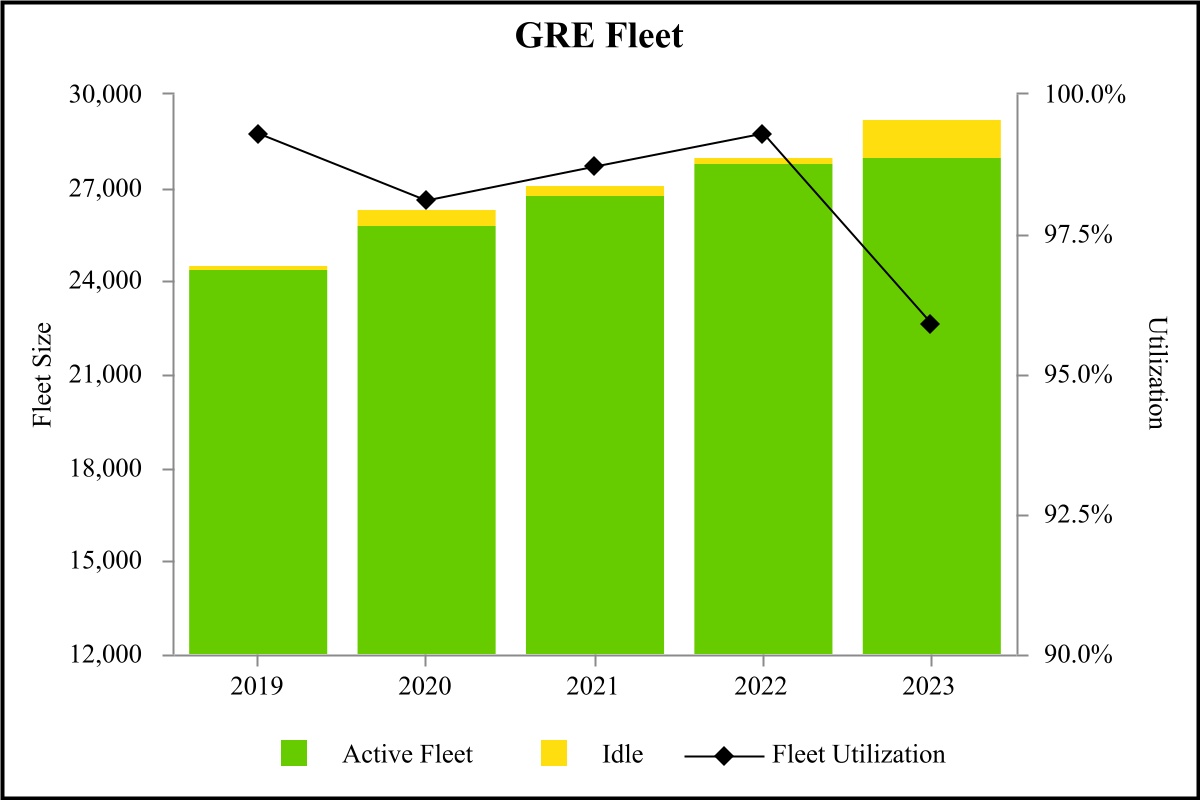

Rail International is composed of our operations in Europe ("GATX Rail Europe" or "GRE"), India ("Rail India"), and until January 31, 2023, Russia ("Rail Russia"). GRE primarily leases railcars to customers throughout Europe pursuant to full-service leases under which it maintains the railcars and provides value-added services according to customer requirements. As of December 31, 2023, GRE owned 29,216 railcars with estimated useful lives of 35 to 39 years and an average age of approximately 17 years. GRE has a diverse customer base with approximately 260 customers. In 2023, one customer accounted for approximately 19% of GRE's total lease revenue and the top ten customers combined accounted for approximately 49% of GRE's total lease revenue. GRE's lease terms generally range from one to ten years and as of December 31, 2023, the average remaining lease term of the European fleet was approximately 21 months. GRE's primary competitors are VTG Aktiengesellschaft, the Ermewa Group, Wascosa AG, and Touax. GRE competes principally on the basis of availability of railcars, customer relationships, lease rate, lease structure, engineering, and maintenance expertise.

5

GRE acquires new railcars primarily from Gök Yapi San. Tic. a.s., Greenbrier-Astra Rail (Wagony Swidnica sp. z.o.o and Astra Rail Industries S.A.), Duro Dakovic, and Tatravagonka a.s. Additionally, GRE's Ostróda, Poland maintenance facility assembles tank cars each year. As of December 31, 2023, GRE had commitments to acquire from third parties, primarily from Gök Yapi San. Tic. a.s., Greenbrier-Astra Rail, Duro Dakovic and Tatravagonka a.s., 1,184 newly manufactured railcars to be delivered in 2024.

As of December 31, 2023, Rail India owned 8,805 railcars with estimated useful lives of 15 to 30 years. Rail India's leases are net leases, under which the lessee assumes responsibility for maintenance of the railcars, and have terms generally ranging from four to fourteen years. As of December 31, 2023, the average remaining lease term of the Indian fleet was approximately 67 months. Rail India has a customer base of fifteen customers in the automotive, container, steel, cement, and bulk commodities transport sector, as well as one customer in the public sector. As of December 31, 2023, Rail India had entered into contracts to acquire 1,297 railcars to be delivered in 2024, the majority of which have committed leases in place with customers.

In 2022, after a thorough strategic review, we decided to exit Rail Russia due to the impacts of the Russia/Ukraine conflict on our business and the business risks associated with the geopolitical environment resulting from that conflict. In the first quarter of 2023, we sold Rail Russia. See "Note 10. Asset Impairments and Assets Held for Sale" in Part II, Item 8 of this Form 10-K for further information.

Maintenance

GRE operates a maintenance facility in Ostróda, Poland that assembles railcars for GRE's fleet and performs significant repairs, regulatory compliance, and modernization work for our owned railcars. This facility is supplemented by an extensive network of third-party repair facilities. The third-party facilities accounted for approximately 71% of GRE's total maintenance network expenses in 2023.

Similar to our Rail North America segment, GRE's customers periodically require maintenance services that are not included in the full-service lease agreement. These services are generally related to the repair of railcar damage caused by customers and railways, as well as customer-specific requirements. Revenue earned from these maintenance activities is recorded in other revenue.

In India, all railcar maintenance is performed by Indian Railways or third-parties authorized by Indian Railways, in accordance with regulatory requirements.

PORTFOLIO MANAGEMENT

Portfolio Management is composed primarily of the Rolls-Royce & Partners Finance joint ventures (collectively the "RRPF affiliates") that lease aircraft spare engines and GATX Engine Leasing ("GEL"), our wholly owned aircraft spare engine leasing business.

Affiliates

The RRPF affiliates are a group of 50% owned domestic and foreign joint ventures with Rolls-Royce, a leading manufacturer of commercial aircraft jet engines. The RRPF affiliates are primarily engaged in two business activities: leasing of aircraft spare engines to a diverse group of commercial aircraft operators worldwide and leasing of aircraft spare engines to Rolls-Royce for use in their engine maintenance programs. As of December 31, 2023, the RRPF affiliates, in aggregate, owned 399 engines, of which 200 were on lease to Rolls-Royce. Aircraft engines have an estimated economic useful life of 20 to 30 years. As of December 31, 2023, the average age of these engines was approximately 13 years. Lease terms vary, but typically range from 3 to 12 years. Seconded Rolls-Royce employees act as manager for each of the RRPF affiliates and also performs substantially all required maintenance activities.

Owned Assets

GEL is our wholly owned entity that invests directly in aircraft spare engines. As of December 31, 2023, GEL owned 29 aircraft spare engines, with 14 on long-term leases with airline customers and 15 employed in an engine capacity agreement with Rolls-Royce for use in its engine maintenance program. The long-term leases with airline customers have lease terms that generally range from 7 to 9 years. The RRPF affiliates manage all leases of GEL's aircraft spare engines. These aircraft spare engines have an estimated economic useful life of 20 to 25 years. As of December 31, 2023, the average age of these engines was approximately 4 years.

Historically, Portfolio Management had marine assets (the "Specialized Gas Vessels") that were utilized to transport pressurized gases and chemicals, such as liquefied petroleum gas and ethylene, primarily on short-term spot contracts and medium-term charters

6

and contracts of affreightment for major oil and chemical customers worldwide. In 2022, we made the decision to sell the Specialized Gas Vessels. GATX sold two of the vessels in 2022 and the remaining three vessels in 2023. See "Portfolio Management" in Part II, Item 7 of this Form 10-K for more detail.

OTHER

Trifleet owns and manages tank containers that are leased to a diverse base of approximately 300 customers in the chemical, industrial gas, energy, food, cryogenic and pharmaceutical industries, and tank container operators. These tank containers have estimated useful lives of 15 to 25 years and an average age of approximately 7 years. Trifleet's lease terms generally range from one to five years and as of December 31, 2023, the average remaining lease term was approximately 29 months. Trifleet manages tank containers on behalf of a limited number of third-party container investors under long-term agreements. Under these agreements, Trifleet earns fees for managing these investor-owned fleets, and provides various services, including the sourcing of new containers and customers, leasing and remarketing of tank containers, and arranging inspection and maintenance services. Trifleet's primary competitors are Exsif, Eurotainer, Seaco, Raffles, and CS Leasing.

Trifleet acquires new tank containers primarily from China International Marine Containers (Group) Ltd. ("CIMC"), Jingjiang Asian-Pacific Logistics Equipment Co., Ltd. ("JJAP"), and Nantong Tank Container Co., Ltd. ("NT Tank"). As of December 31, 2023, Trifleet had commitments to acquire from third-parties, primarily from CIMC, 300 newly manufactured tank containers to be delivered in 2024.

TRADEMARKS AND PATENTS

Patents, trademarks, and licenses are not material to our businesses taken as a whole.

SEASONAL NATURE OF BUSINESS

GATX's business is not materially impacted by seasonality of operations.

CUSTOMER BASE

GATX, taken as a whole, is not dependent upon a single customer nor does it have any significant customer concentrations. Segment concentrations, if material, are described above.

See "Note 14. Concentrations" in Part II, Item 8 of this Form 10-K for additional information.

HUMAN CAPITAL

The strength of our workforce is a significant contributor to our success. To facilitate talent attraction and retention, we endeavor to make GATX a diverse, inclusive, and safe workplace with opportunities for our employees to grow and develop in their careers. This is supported by fair compensation, a range of benefits, health and wellness offerings, and programs that build connections between our employees and their communities.

Employees and Employee Relations

As of December 31, 2023, we employed 2,020 persons globally, of whom approximately 36 % were union workers covered by collective bargaining agreements. The hourly employees at our U.S. service centers are represented by the United Steelworkers. Employees at three of Rail North America's Canadian service centers are represented by Unifor and the Employee Shop Committee of Rivière-des-Prairies. Certain employees of GATX Rail Europe are represented by one union in Poland.

See "Note 14. Concentrations" in Part II, Item 8 of this Form 10-K for additional information about our employees and concentration of labor force.

7

Diversity and Inclusion

GATX is committed to fostering a diverse and inclusive environment where employees feel valued and welcomed to be their best personally and professionally. In recent years, GATX has committed to strengthening its culture of diversity and inclusion through a variety of projects and processes, including:

•a hiring process that reaches across diverse talent pools, seeks to ensure that all candidates receive fair consideration, and aims to mitigate unconscious bias;

•diverse candidate slates for management and managerial talent pool positions;

•interviewer slates designed to have diverse voices involved in the selection process;

•a consistent methodology for evaluating candidates to maintain focus on job-related criteria;

•actively fostering diversity by engaging in the recruitment, promotion, and development of talent across all pools;

•conducting an annual compensation analysis that seeks to achieve pay equity across gender, race, and ethnicity for professional, managerial, and executive level positions;

•the implementation of a regular employee engagement survey;

•a Day of Understanding for employees in North America that includes workshops, panels, and speakers on diversity and inclusion;

•diversity and inclusion training tailored for leaders and salaried and hourly employees; and

•employee resource groups dedicated to enhancing our diverse and inclusive culture, including resource groups supporting women, racially and ethnically diverse employees, and the LGBTQ+ community.

GATX's diversity and inclusion efforts are led by the Head of Diversity, Equity, and Inclusion ("DEI"), who reports directly to GATX’s Chief Human Resources Officer and provides periodic updates to GATX’s Board of Directors.

Talent Development and Retention

We champion learning and career growth for our employees, as we believe the talent and efforts of our employees drive the success of our business. We believe the long tenure of many GATX employees is an attestation to the organization's culture and career opportunities. With training for emerging leaders and people managers, as well as a wide array of e-learning options, employees are supported with a multi-pronged approach to learning. Managers receive training on topics such as managing in a hybrid work environment, performance management, and goal-setting. Maintenance staff have access to certification programs that enable their career progression, and career success profiles provide transparency into what it takes to be successful at GATX as an individual contributor and also as a leader. Our talent development programs are designed to provide employees with the resources they need to help achieve their career goals, build management skills, and lead their organizations, as well as to broaden representation in leadership pipelines.

Compensation and Benefits

GATX provides comprehensive compensation and benefits programs to support our employees’ overall well-being. In addition to offering competitive salaries, GATX provides employees with annual bonuses, stock awards, a matched 401(k) plan, comprehensive health insurance, prescription drug coverage, health savings accounts, and paid time off. Our retirement program includes pension plans, a health reimbursement account, and pre-65 medical plan for employees retiring from the company. Other benefits include life, disability, and accident insurance; paid parental leave; identity theft coverage; flexible time off; adoption assistance; tuition reimbursement; and telecommuting flexibility.

Safety

GATX strives to maintain the highest levels of safety by fostering a culture that makes safety a top priority. GATX utilizes a continuous improvement methodology to identify safety risks and hazards and drive improvement initiatives.

We continue to strive to ensure that our railcar maintenance facility employees and inspectors, who are essential workers in the rail industry, can safely perform their jobs every day.

8

GATX continues to be recognized as a Responsible Care Partner by the American Chemistry Council and the Chemical Industry Association of Canada ("CIAC") and is an active participant in the Transportation Community Awareness and Emergency Response initiative, a national outreach effort assisting communities to prepare for and respond to possible hazardous materials transportation incidents. In 2023, our Hearne, Texas facility was awarded the 2022 Facility Excellence Award from the American Chemical Council, and an employee at our Red Deer, Alberta facility was awarded the 2022 TRANSCAER Regional Service Award from CIAC. Additionally, GATX offers training on the proper use of our equipment and on regulations that impact our business. We hold training events at customer locations across North America through the use of our TankTrainer™ mobile classroom.

Community Commitment

We believe that building connections between our employees and their communities creates a more meaningful, fulfilling, and productive workplace. GATX has a long history of supporting causes in communities where our employees live and work, establishing a company culture that values strong corporate citizenship. Every year, our local offices organize and encourage employees to volunteer and give back through programs that focus on addressing the needs of underserved populations and building vibrant communities. Highlights from 2023 included:

•Employees in Chicago, Illinois and Hearne, Texas helped create life-changing wishes in partnership with their local Make-A-Wish chapters. Further, over the last 27 years, GATX and its employees have donated more than $5 million to Make-A-Wish Illinois through corporate contributions and employee giving and fundraising.

•In Chicago, Illinois, employees participated in a service day with Big Shoulders Fund, which provides support to inner-city schools, to clean, beautify, and prepare schools for the new school year. Further, GATX employees mentor students year-round.

•Employees across Europe joined charity runs to bring awareness to various social causes, including promoting healthy lifestyles, funding medical research, and supporting sick and disabled children.

•In Red Deer, Alberta, employees volunteered at the annual Red Deer River Cleanup, which promotes the protection, preservation, and sustainability of the area's waterways. The team cleaned the Red Deer River shoreline and surrounding area, and GATX donated supplies for the cleanup as well as reusable shopping bags for all volunteers.

•Employees in Colton, California partnered with the Southern California Mountains Foundation to remove more than 5,000 pounds of trash from the Bailey Canyon Trail.

SUSTAINABILITY

We are committed to growing our business in a sustainable and socially responsible manner, and we demonstrate our commitment through our programs and initiatives. Our Environmental, Social and Governance ("ESG") Committee, a multi-functional team, meets periodically to develop, assess, and prioritize ESG topics that are important to our business and our stakeholders and to continually improve both the measurement and transparency of our ESG disclosures and practices. The Governance Committee of GATX’s Board of Directors has primary oversight responsibility for our ongoing and developing ESG efforts. We maintain a Sustainability page on our website (www.gatx.com) to highlight our environmental and social responsibility accomplishments and provide key performance data to our stakeholders. Beginning in 2021, GATX has issued an annual Sustainability Accounting Standards Board ("SASB") report, which can be found on our website, that discloses metrics related to relevant ESG factors. Nothing on our website shall be deemed incorporated by reference into this Form 10-K.

ENVIRONMENTAL MATTERS

Our operations, facilities, and properties are subject to extensive federal, state, local, and foreign environmental laws and regulations. These laws cover discharges to waters; air emissions; toxic substances; the generation, handling, storage, transportation, and disposal of waste and hazardous materials; and the investigation and remediation of contamination. These laws have the effect of increasing the cost and liability associated with leasing and operating assets, and violations can result in significant fines, penalties, or other liabilities. Environmental risks and compliance with applicable environmental laws and regulations are inherent in the use of rail and other transportation assets, which can involve transporting chemicals and other hazardous materials.

9

We are subject to, and may from time to time continue to be subject to, environmental cleanup and enforcement actions in the United States and in the foreign countries in which we operate. In particular, the federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), also known as the Superfund law, generally imposes joint and several liability for investigation, cleanup, and enforcement costs on current and former owners and operators of a site, without regard to fault or the legality of the original conduct. Accordingly, we have been and may, in the future, be named as a potentially responsible party under CERCLA and other federal, state, local, and foreign laws or regulations for all or a portion of the costs to investigate and clean up sites at which certain contaminants may have been discharged or released by us, our current lessees, former owners or lessees of properties, or other third parties. Environmental remediation and other environmental costs are accrued when considered probable and amounts can be reasonably estimated. As of December 31, 2023, environmental costs were not material to our financial position, results of operations, or cash flows. For further discussion, see "Note 23. Legal Proceedings and Other Contingencies" in Part II, Item 8 of this Form 10-K.

We recognize that climate change, including related regulatory action, has the potential to impact our leasing businesses and maintenance operations. GATX continues to evaluate and assess business, operational, and strategic risks associated with climate change and reports on key environmental data. In 2023, GATX continued annual publication of Scope 1 and Scope 2 greenhouse gas emissions and worked on assessing our full value chain impacts on the environment in an effort to identify opportunities to reduce those impacts.

10

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following information regarding our executive officers is included in Part I in lieu of inclusion in our definitive Proxy Statement:

Name | Offices Held | Position Held Since | Age | |||||||||||

Robert C. Lyons | President and Chief Executive Officer | 2022 | 60 | |||||||||||

| Thomas A. Ellman | Executive Vice President and Chief Financial Officer | 2018 | 55 | |||||||||||

Brian L. Glassberg | Executive Vice President, General Counsel and Corporate Secretary | 2022 | 49 | |||||||||||

| Kim Nero | Executive Vice President and Chief Human Resources Officer | 2021 | 49 | |||||||||||

Paul F. Titterton | Executive Vice President and President, Rail North America | 2022 | 48 | |||||||||||

| Niyi A. Adedoyin | Senior Vice President and Chief Information Officer | 2016 | 56 | |||||||||||

| Kevin J. Hillesland | Senior Vice President, Structured Finance | 2023 | 60 | |||||||||||

Jennifer M. McManus | Senior Vice President, Controller and Chief Accounting Officer | 2020 | 44 | |||||||||||

| Geoffrey D. Phillips | Senior Vice President, Operations | 2023 | 55 | |||||||||||

| John M. Sbragia | Senior Vice President, Engineering and Quality | 2023 | 53 | |||||||||||

| Jennifer L. Van Aken | Senior Vice President, Treasurer and Chief Risk Officer | 2020 | 49 | |||||||||||

| Jeffery R. Young | Senior Vice President and Chief Tax Officer | 2018 | 61 | |||||||||||

Robert A. Zmudka | Senior Vice President and Chief Commercial Officer | 2018 | 56 | |||||||||||

•Mr. Lyons was elected President and Chief Executive Officer and as a director effective April 2022. Previously, Mr. Lyons served as Executive Vice President and President, Rail North America from 2018 to April 2022, Executive Vice President and Chief Financial Officer from 2012 to August 2018, Senior Vice President and Chief Financial Officer from 2007 to 2012, Vice President and Chief Financial Officer from 2004 to 2007, Vice President, Investor Relations from 2000 to 2004, Project Manager, Corporate Finance from 1998 to 2000, and Director of Investor Relations from 1996 to 1998. Mr. Lyons has served as a director of Packaging Corporation of America since 2011.

•Mr. Ellman was elected Executive Vice President and Chief Financial Officer effective August 2018. Previously, Mr. Ellman served as Executive Vice President and President, Rail North America from 2013 to August 2018, Senior Vice President and Chief Commercial Officer from 2011 to 2013, and Vice President and Chief Commercial Officer from 2006 to 2011. Prior to re-joining GATX in 2006, Mr. Ellman served as Senior Vice President and Chief Risk Officer and Senior Vice President, Asset Management of GE Equipment Services, Railcar Services and held various positions at GATX in the GATX Rail Finance Group.

•Mr. Glassberg was elected Executive Vice President, General Counsel and Corporate Secretary effective December 2022. Since joining GATX in October 2011, Mr. Glassberg has served in various leadership roles within the law department, including as Deputy General Counsel from April 2021 to November 2022 and Associate General Counsel from March 2015 to March 2021. Prior to joining GATX, Mr. Glassberg was an associate in the corporate department of the Washington, DC and Chicago, IL offices of Latham & Watkins, LLP.

•Ms. Nero was elected Executive Vice President and Chief Human Resources Officer effective May 2021. Prior to joining GATX, Ms. Nero served as Vice President, Human Resources at Ferrara Candy Company from May 2017 to April 2021. Prior to that, she held positions in sales and then went on to lead global human resources functions in the financial, pharmaceutical, consumer packaged goods, and manufacturing industries at Discover, EVRAZ, Eli Lilly, and SC Johnson Wax.

•Mr. Titterton was elected Executive Vice President and President, Rail North America effective April 2022. Previously, Mr. Titterton served as Senior Vice President and Chief Operating Officer, Rail North America from 2018 to April 2022, Senior Vice President and Chief Commercial Officer, Rail North America from 2015 to 2018, Vice President and Chief Commercial Officer from 2013 to 2015, Vice President and Group Executive, Fleet Management, Marketing and Government Affairs from 2011 to 2013, Vice President and Executive Director, Fleet Management from 2008 to 2011, and in a variety of positions of increasing responsibility since joining the company in 1997.

11

•Mr. Adedoyin was elected Senior Vice President and Chief Information Officer effective January 2016. Previously, Mr. Adedoyin served as Vice President and Chief Information Officer from 2013 to January 2016 and Senior Director, IT Strategy and Project Management Office from 2008 to 2013.

•Mr. Hillesland was elected Senior Vice President, Structured Finance, effective August 2023. Previously, Mr. Hillesland served as Vice President and Executive Director, Structured Finance from November 2017 to August 2023. Since joining GATX in 1994, Mr. Hillesland has held leadership positions with increasing responsibility across corporate finance, rail, portfolio investments, and structured finance.

•Ms. McManus was elected Senior Vice President, Controller and Chief Accounting Officer effective January 2020. Previously Ms. McManus served as Senior Director, Investor Relations and Accounting Research, Policy & Planning since May 2017 and Director, Accounting Research, Policy & Planning from June 2015 to May 2017. Prior to joining GATX, Ms. McManus held various positions of increasing responsibility with Hyatt Hotels Corporation, Tribune Company, and in public accounting.

•Mr. Phillips was elected Senior Vice President, Operations, effective August 2023. Previously Mr. Phillips served as Vice President and Group Executive, Operations from April 2022 to August 2023 and as Vice President and Executive Director, North American Rail Services & Logistics from January 2016 to March 2022. Since joining GATX in 1996, Mr. Phillips has held leadership positions with increasing responsibility across finance, business development, customer experience, operations, and rail services and logistics.

•Mr. Sbragia was elected Senior Vice President, Engineering and Quality, effective August 2023. Previously, Mr. Sbragia served as Vice President and Group Executive, Engineering and Quality from April 2022 to August 2023 and as Vice President, Railcar Engineering & Quality Assurance from March 2012 to March 2022. Since joining GATX in 1998, Mr. Sbragia has held leadership positions in engineering and quality with increasing responsibility.

•Ms. Van Aken was elected Senior Vice President, Treasurer, and Chief Risk Officer effective September 2020. Previously Ms. Van Aken served as Vice President, Financial Planning & Analysis from 2019 to 2020, Senior Director, Financial Planning & Analysis from 2018 to 2019, Assistant Treasurer, Corporate Finance from 2016 to 2018, Director, Investment Risk Management from 2015 to 2016, Director, Investor Relations from 2010 to 2015, Director, Corporate Finance from 2009 to 2010, and Manager, Corporate Finance from 2006 to 2009. Prior to joining GATX, Ms. Van Aken held a number of positions of increasing responsibility in the financial services industry.

•Mr. Young was elected Senior Vice President and Chief Tax Officer effective August 2018. Previously, Mr. Young served as Vice President and Chief Tax Officer from 2015 to August 2018, Vice President of Tax from 2007 to 2015, and as Director of Tax from 2003 to 2007. Prior to joining GATX, Mr. Young spent twenty years in a variety of tax related positions of increasing responsibility in public accounting and the financial services industry.

•Mr. Zmudka was elected Senior Vice President and Chief Commercial Officer effective August 2018. Previously, Mr. Zmudka served as Vice President and Group Executive, North American Sales & Marketing from 2010 to August 2018, Vice President and Executive Director, Strategic Sales from 2007 to 2010, and Vice President, National Accounts from 2006 to 2007. Mr. Zmudka joined GATX in 1989 and worked in various sales and fleet portfolio roles before being promoted to Vice President, Regional Sales in 2001.

12

AVAILABLE INFORMATION

We make available free of charge at our website, www.gatx.com, our most recent annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (the “1934 Act”), as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the U.S. Securities and Exchange Commission (“SEC”). The SEC maintains a website that contains reports, proxy, and other information that we have filed with the SEC. The SEC website may be found at http://www.sec.gov. Charters for the Audit Committee, Compensation Committee and Governance Committee of the Board of Directors, the Corporate Governance Guidelines, the Code of Business Conduct and Ethics and the Code of Ethics for Senior Company Officers are posted under Corporate Governance in the Investor Relations section of our website, and are available in print upon request by any shareholder. Within the time period prescribed by SEC and New York Stock Exchange regulations, we will post on our website any amendment to the Code of Ethics for Senior Company Officers and the Code of Business Conduct and Ethics or any waivers thereof. The information on our website is not incorporated by reference into this report.

Item 1A. Risk Factors

Investors should consider the risk factors described below as well as other information contained in this filing or our other filings with the U.S. Securities and Exchange Commission before investing in our securities. If any of the events described in the risk factors below occur, our business, financial condition and results of operations could be materially adversely affected.

Business, Operational and Industry Risks

We depend on continued demand from our customers to lease or use our transportation assets and services at satisfactory rates. A significant decline in customer demand could negatively impact our business and financial performance.

Our profitability depends on our ability to lease assets at satisfactory rates and to re-lease assets upon lease expiration. Customer demand for our transportation assets and services can be adversely affected by various economic and other factors, including:

•Prolonged inflation or deflation

•High interest rates

•Weak macroeconomic conditions and world trade policies

•Weak market conditions in our customers’ businesses

•Adverse changes in the price of, or demand for, commodities

•Changes in railroad operations, efficiency, safety, pricing and service offerings, including those related to “precision scheduled railroading” or labor strikes or shortages

•Changes in, or disruptions to, supply chains

•Availability of pipelines, trucks, and other alternative modes of transportation

•Changes in conditions affecting the aviation industry, including geographic exposure and customer concentrations

•Other operational or commercial needs or decisions of our customers

Demand for our railcars and other transportation assets is dependent on the strength and growth of our customers’ businesses. Some of our customers operate in cyclical or fluctuating markets, such as the steel, energy, chemical, transportation, and construction industries, which are susceptible to macroeconomic downturns and may experience significant changes in demand over time. Weakness in certain sectors of the economy in the United States and other parts of the world may make it more difficult for us to lease our transportation assets or to lease them on profitable terms.

Adverse changes in commodity prices or reduced demand for commodities could reduce customer demand for various types of assets in our fleet. A significant decrease in the price of a commodity may cause producers of that commodity to reduce their production levels. A significant increase in the price of a commodity could cause our customers to switch to less expensive alternatives. In either case, these changes in customer behavior can reduce demand for the portions of our fleet that are used to transport the commodity. In addition, demand for transportation assets used to transport certain commodities, including ethanol and other renewable fuels, may be affected by government subsidies and mandates, which may be enacted, changed, or eliminated from time to time, while demand for transportation assets used to transport fossil fuels or that directly or indirectly require consumption of fossil fuels for operation may be affected by government policies and mandates with respect to climate change and carbon emissions.

The availability and relative cost of alternative modes of transportation and changes in customer transportation preferences also could reduce demand for our assets. For example, technological innovations in the trucking industry and patterns in U.S. economic growth that favor truck over rail could result in a modal shift away from rail and reduce customer demand for our rail assets. Demand

13

for our other transportation assets and related services is also influenced by many of the factors discussed above. For example, aircraft spare engine leasing is influenced by airline and lessee profitability, patterns in global air travel, reliability and durability of engine types, world trade policies, geopolitical tensions or conflict, technological advances, and price and other competitive factors. A significant decline in customer demand for our assets and services could adversely affect our financial performance.

In many cases, demand for our transportation assets also depends on our customers’ desire to lease, rather than buy, the assets. Tax and accounting considerations, interest rates, and operational flexibility, among other factors, may influence a customer’s decision to lease or buy assets. We have no control over these external considerations, and changes in these factors could negatively impact demand for our transportation assets held for lease.

A significant change in pricing and/or service offerings by North American railroads or poor operating conditions could reduce demand for our rail assets and negatively impact our financial performance.

Our North American rail asset leasing business is impacted by the operations of the railroads, particularly the largest rail systems known as the “Class I railroads”, most of which are utilizing some form of major operational transformation under the umbrella term of “precision scheduled railroading” or “PSR”. If PSR results in substantial increases in train velocity or decreases in dwell time for rail assets, the resulting excess supply of railcars and/or locomotives may adversely impact the demand for our rail assets. Alternatively, if PSR results in increased pricing and/or reduced service frequency, safety and quality, the value proposition of rail freight for shippers relative to alternative modes of transportation could be reduced. Apart from PSR, other factors such as adverse weather conditions, railroad mergers, labor strikes or shortages, poor service to shippers, other disruptions to railroad operations, and increases in rail traffic could result in slower transit times making rail transportation less attractive to shippers versus other modes of transport. Each of these cases could reduce demand for our rail assets and decreased fleet utilization due to modal shift away from rail, all of which could negatively impact revenue and our results of operations.

Competition could result in decreased profitability.

We operate in a highly competitive business environment. In certain cases, our competitors are larger than we are and have greater financial resources, higher credit ratings, and a lower cost of capital, while some of our competitors manufacture railcars for their own leasing businesses. These factors may enable our competitors to offer leases or services to customers at lower rates than we can provide, thus negatively impacting our profitability, asset utilization, and investment volume.

A significant decrease in lease renewals of our transportation assets by our customers or a significant increase in the number of compliance-based maintenance events could negatively impact operations and substantially increase our costs.

Decreases in customer demand for our transportation assets could increase the number of leases that are not renewed upon expiration, resulting in the return of such assets by our customers. Returned transportation assets often must undergo maintenance and service work before being leased to new customers. A significant increase in the number of leased assets requiring maintenance may negatively affect our operations and substantially increase maintenance and other related costs.

We also perform a variety of government or industry-mandated maintenance programs on our fleet of transportation assets. These compliance programs are cyclical in nature, and as a result, we can face significant increases in the number of maintenance events in any given year. A significant increase in maintenance events or severe constraints in the repair networks may negatively impact our operations and substantially increase maintenance and other related costs as a result of increased volume or the need to utilize higher cost third party maintenance providers. In addition, while we rely on third party maintenance providers to assist with these compliance procedures for our transportation assets, high demand faced by these providers from other asset owners may constrain our access to the providers or may substantially increase our costs.

Events that negatively affect certain assets, customers, or geographic regions could have a negative impact on our results of operations.

We generally derive our revenues from a variety of asset types, customers, industries, and geographic locations. However, from time to time we could have a large investment in a particular asset type, a large revenue stream associated with a particular customer or industry, or a large number of customers located in a particular geographic region. Decreased demand from a discrete event impacting a specific asset type, customer, industry, or region in which we have a concentrated exposure could negatively impact our results of operations.

14

Our long-term railcar purchase commitments could subject us to material operational and financial risks.

Unlike some of our competitors in the railcar leasing market, we do not manufacture railcars. In order to obtain committed access to a supply of newly built railcars on competitive terms, we regularly enter into long-term supply agreements with manufacturers to purchase significant numbers of newly built railcars over a multi-year period. Some of these agreements may provide for flexibility in the pricing, timing, and quantity of our purchasing commitments, while other agreements may provide no such flexibility. Therefore, if economic conditions weaken during the term of a long-term supply agreement, it is possible that we may be required to continue to accept delivery of, and pay for, new railcars at times when it may be difficult for us to lease such railcars at reasonable rates, or at all. Furthermore, we may be required to take delivery of railcars at points when our financing costs may be high. These factors could negatively affect our revenues and profitability. In addition, if tariffs, labor interruptions or shortages, trade disputes, commodity prices, geopolitical tensions, inflation, supply chain disruptions, or other factors lead to higher prices for steel or other raw materials used to manufacture railcars, we may be required to pay higher prices to purchase new railcars, which could adversely affect our ability to profitably lease those railcars to customers.

Soft market conditions and declines in asset values may reduce opportunities for us to generate remarketing income.

We utilize our extensive knowledge and experience to remarket transportation assets in order to optimize the composition of our fleets, and these activities generate income that contributes significantly to segment profit. Reduced demand for our assets could reduce opportunities for us to generate remarketing income. A significant or prolonged decline in the secondary market for our assets could adversely affect our financial performance.

We may not be able to successfully consummate and manage ongoing acquisition and divestiture activities, which could have an adverse impact on our financial statements.

From time to time, we may acquire other businesses and, based on an evaluation of our business portfolio, divest existing businesses. These acquisitions and divestitures may present financial, managerial, and operational challenges, including diversion of management attention from existing businesses, difficulty with integrating or separating personnel and financial and other systems, increased expenses and costs, assumption of liabilities and indemnities, increased compliance risks, and potential disputes with the buyers or sellers or third parties. In addition, we may be required to incur asset impairment charges (including charges related to goodwill and other intangible assets) in connection with acquired businesses, which may reduce our profitability. If we are unable to consummate such transactions, we will not receive the expected benefits, and alternative favorable opportunities to invest or divest may not be available to us. If we cannot successfully integrate and grow acquisitions and achieve contemplated revenue synergies and cost savings, or are unable to complete a divestiture, our financial results could be adversely affected.

We rely on Rolls-Royce in connection with our aircraft spare engine leasing businesses, and certain factors that adversely affect Rolls-Royce could have an adverse effect on those businesses.

GATX and Rolls-Royce plc. (“Rolls-Royce”) each own 50% of domestic and foreign joint venture entities (collectively, the “RRPF affiliates” or “RRPF”) that own and lease aircraft spare engines to Rolls-Royce and owners and operators of commercial aircraft. In addition, GATX directly invests in Rolls-Royce aircraft spare engines through its wholly owned subsidiary, GATX Engine Leasing Ltd. (“GEL”), and places some of these engines on long-term leases with airline operators, with an RRPF entity serving as the asset manager. For other engines, GEL also provides Rolls-Royce with access to aircraft spare engine capacity to support Rolls-Royce’s engine maintenance program for its customers. Rolls-Royce is therefore a major customer of the RRPF affiliates and of GEL, as well as a critical supplier of aircraft spare engines and commercial, technical, and maintenance services to GATX and the RRPF affiliates. A deterioration in (1) the performance of services provided by Rolls-Royce or RRPF, or (2) the durability and reliability of Rolls-Royce engines, or (3) the financial condition, creditworthiness or liquidity of Rolls-Royce or RRPF could negatively impact GATX’s financial performance or, in the case of GEL, its operational performance.

Our transportation assets may become obsolete.

In addition to changes in laws, rules, and regulations that may make transportation assets obsolete, changes in the preferred method our customers use to ship their products, changes in demand for particular products, or a shift by customers toward purchasing assets rather than leasing them may adversely impact us. Our customers’ industries are driven by dynamic market forces and trends, which are influenced by economic and political factors. Changes in our customers' markets may significantly affect demand for our transportation assets.

15

Risks related to our international operations and expansion into new geographic markets could adversely affect our business, financial condition, and operating results.

We generate a significant amount of our net income outside the United States. In recent years, we have increased our focus on international growth and expansion into select emerging markets as a means to grow and diversify earnings.

Our foreign operations and international expansion strategy are subject to the following risks associated with international operations:

•Unforeseen developments and conditions, including terrorism, war, epidemics, and international tensions and conflicts

•Supply chain disruptions

•Inability to access railcar, tank container or component supply

•Imposition of sanctions against countries where we operate or specific companies or individuals with whom we do business, or retaliatory sanctions by such countries on companies in the U.S. or in other countries in which we operate

•Nationalization or confiscation of assets by foreign governments, and imposition of additional or new tariffs, quotas, trade barriers, regulations, and similar restrictions on our operations outside the United States

•Inflation or deflation

•Fluctuations in currency values

•Sudden changes in foreign currency exchange controls

•Noncompliance with U.S. laws affecting operations outside of the United States, such as the Foreign Corrupt Practices Act

•Noncompliance with a variety of foreign laws and regulations

•Failure to properly implement changes in tax laws and the interpretation of those laws

•Failure to develop and maintain data management practices that comply with laws related to cybersecurity, privacy, data localization, and data protection

•Discriminatory or conflicting fiscal or trade policies

•Difficulties enforcing contractual rights or foreclosing to obtain the return of our assets in certain jurisdictions

•Uncollectible accounts and longer collection cycles that may be more prevalent in foreign countries

•Ineffective or delayed implementation of appropriate controls, policies, and processes across our diverse operations and employee base

Many of our employees are represented by unions, and failure to successfully negotiate collective bargaining agreements may result in strikes, work stoppages, or substantially higher labor costs.

A significant portion of our employees are represented by labor unions and work under collective bargaining agreements that cover a range of workplace matters, such as wages, health and welfare benefits, and work rules. If we fail to negotiate acceptable labor agreements, our business could be disrupted by strikes or lockouts. We could also incur increased operating costs due to higher wages or benefits paid to union workers. Business disruptions or higher operating costs could both have an adverse effect on our financial position, results of operations, or cash flows.

We operate in a challenging market for talent, and our failure to attract, retain and motivate qualified personnel, including key management personnel, could adversely impact our ability to execute our strategy.

Our success depends on the strength of our workforce (many of whom are longstanding GATX employees) and therefore on our ability to attract, develop, engage and retain employee talent, including successors to members of senior management. Achieving this objective may be difficult due to many factors, including fluctuations in global economic and industry conditions, competitors’ hiring practices and the effectiveness of our compensation programs. The market for both hourly and professional employees has been, and remains, very competitive. Difficulties in recruiting and motivating qualified personnel, including skilled labor; the unexpected loss of such individuals resulting in the depletion of our institutional knowledge base; or our inability to successfully transition key roles could hinder our ability to execute our strategy and adversely impact our business and results of operations.

16

Information Technology Risks

We rely on technology in all aspects of our business operations. If we are unable to adequately maintain and secure our information technology (“IT”) infrastructure from cybersecurity threats and related disruptions, our business could be negatively impacted.

We rely on our IT Infrastructure (defined below) to process, transmit, and store electronic information that is used in all aspects of our business operations, including employee and customer information. We own and manage certain aspects of our IT infrastructure, but we also rely on third parties for a range of IT systems and related products and services, including but not limited to, cloud computing services (such third-party systems and our IT infrastructure, collectively, our “IT Infrastructure”). We and certain of our third-party providers collect, maintain and process data about customers, employees, business partners and others, including personally identifiable information, as well as confidential and proprietary information belonging to our business, including trade secrets (such data and information, collectively, “Confidential Information”). We face numerous and evolving cybersecurity risks that threaten the confidentiality, integrity and availability of our IT Infrastructure and Confidential Information. These risks have continued to increase in recent years in their frequency and levels of sophistication and intensity by sophisticated and organized groups and individuals with a wide range of motives and expertise. The implementation of remote and hybrid work options for our employees and employees of our third-party IT suppliers has led to a substantial increase in remote access to our networks and systems. All IT systems are vulnerable to cybersecurity threats and other unlawful attempts to disrupt or gain access to these systems, and these vulnerabilities may be increased by remote computing assets and additional security vulnerabilities that are present in many public, non-corporate and home networks. We and our third-party providers are regularly subject to attempted cyber intrusions, hacks and ransomware attacks, and we expect these incidents to accelerate and become increasingly sophisticated in using techniques and tools - including artificial intelligence - that circumvent security controls, evade detection and remove forensic evidence. While we have invested significant expense and effort in the protection of our Confidential Information and IT Infrastructure, the steps we have taken to mitigate these risks may not be effective to prevent breaches of our IT Infrastructure. Breaches of our IT Infrastructure could lead to disruptions in our business, potentially including the theft, destruction, loss, misappropriation, or release of Confidential Information stored on our IT Infrastructure and subject us to potential lawsuits, including class actions, other material legal liabilities, reputational damage, lost customers or significant costs associated with incident response, system restoration or remediation, applicable filings and notifications, and future compliance. These disruptions could adversely affect our operations, financial position, and results of operations. There can be no assurance that our cybersecurity risk management program and processes, including our policies, controls, or procedures, will be fully implemented, complied with, or effective in protecting our systems and information. While we maintain insurance to mitigate our exposure to these risks, our insurance policies, which carry retention and coverage limits, may not be adequate to reimburse us for losses caused by security breaches or other cybersecurity events, and we cannot guarantee that applicable insurance will be available to us in the future on economically reasonable terms or at all.

We also are subject to an evolving body of federal, state and foreign laws, regulations, guidelines and principles regarding data privacy, data protection and data security. Many jurisdictions in which we conduct business have passed or proposed laws and regulations dealing with the collection, processing, storage, transfer and/or use of personal information, some of which include potential fines and penalties based on worldwide revenue. We could incur substantial costs related to ongoing compliance with, and substantial penalties or litigation or reputational damage related to violations of, such laws and regulations.

Legal and Regulatory Risks

We have been, and may continue to be, involved in various types of litigation, including claims for personal injury, property damage, environmental damage, and other claims arising from an accident involving our railcars or other transportation assets.

The nature of our business and assets potentially exposes us to significant personal injury and property damage claims and litigation, environmental claims, or other types of lawsuits inside and outside the U.S. For example, some of our customers use certain types of our transportation assets to transport flammable liquids and other hazardous materials, and an accident involving such transportation assets could lead to litigation and subject us to significant liability. Similarly, if we fail to meet our obligations to maintain our assets in compliance with governmental regulations and industry rules, we could be subject to fines, penalties, and claims for such failure as well as any resulting personal injury or property damage. In some jurisdictions, an accident can give rise to both civil and criminal liabilities for us and, in some cases, our employees. In the event of an unfavorable outcome, we could be subject to substantial penalties or monetary damages, including criminal penalties and fines, and our employees who are named as criminal defendants in any such litigation may be subject to incarceration and fines. A substantial adverse judgment against us could have a material effect on our financial position, results of operations, cash flows, and reputation.

17

Our transportation assets and operations are subject to various laws, rules, and regulations. If these laws, rules, and regulations change or we fail to comply with them, it could have a significant negative effect on our business and profitability.

Our fleets of transportation assets and related operations are subject to various U.S. and non-U.S. laws, rules, and regulations administered by authorities in jurisdictions where we do business, including the Association of American Railroads. Such laws, rules, and regulations could be changed in ways that would require us to modify our business models and objectives, impose requirements for additional maintenance or substantial modification or refurbishment of our assets, or otherwise affect our returns on investments by restricting existing activities and products, subjecting them to escalating costs or prohibiting them outright. Violations of these laws, rules, and regulations can result in substantial fines and penalties, including potential limitations on operations or forfeiture of assets, and reputational damage.

We are subject to extensive environmental regulations and the costs of remediation may be material.

We are subject to extensive federal, foreign, state, and local environmental laws and regulations concerning, among other things, the discharge of hazardous materials and remediation of contaminated sites. In addition, some of our properties, including those previously owned or leased, have been used for industrial purposes, which may have resulted in discharges onto these properties. Environmental liability can extend to previously owned or operated properties in addition to properties we currently own or use. Additionally, we could incur substantial costs, including cleanup costs, fines, and costs arising out of third-party claims for property or natural resource damage and personal injury as a result of violations of or liabilities under environmental laws and regulations in connection with our or our lessees’ current or historical operations. Under some environmental laws in the United States and certain other countries, the owner of a leased asset may be liable for environmental damage, cleanup or other costs in the event of a spill or discharge of material from such asset without regard to the owner’s fault. Governments or regulators may change the legislative or regulatory frameworks within which we operate, including environmental laws and regulations, without providing us any recourse to address any adverse effects such changes may have on our business. Due to the regulatory complexities, risk of unidentified contaminants on our properties, and the potential liability for our operations as well as those of our lessees, it is possible environmental and remediation costs may be materially greater than the costs we have estimated.

We may be affected by climate change or market or regulatory responses to climate change.