10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

Form 10-K

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2015 |

| or |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-2328

______________________

GATX Corporation

(Exact name of registrant as specified in its charter)

|

| |

New York | 36-1124040 |

(State of incorporation) | (I.R.S. Employer Identification No.) |

222 West Adams Street

Chicago, IL 60606-5314

(Address of principal executive offices, including zip code)

(312) 621-6200

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

Title of each class or series | | Name of each exchange on which registered |

Common Stock | | New York Stock Exchange Chicago Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No þ

-

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

þ Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $2.3 billion as of June 30, 2015.

As of January 31, 2016, 42.1 million common shares were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

|

| |

GATX’s definitive Proxy Statement to be filed on or about March 11, 2016 | PART III |

GATX CORPORATION

2015 FORM 10-K

INDEX

|

| | |

Item No. | | Page No. |

Part I |

| Forward-Looking Statements | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Part II |

Item 5. | | |

Item 6. | | |

Item 7. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

Part III |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

Part IV |

Item 15. | | |

| | |

| | |

| | |

FORWARD-LOOKING STATEMENTS

Forward-looking statements in this report that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements that reflect our current views with respect to, among other things, future events, financial performance and market conditions. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Specific risks and uncertainties include, but are not limited to, (1) inability to maintain our assets on lease at satisfactory rates, (2) weak economic conditions, financial market volatility, and other factors that may decrease demand for our assets and services, (3) decreased demand for portions of our railcar fleet due to adverse changes in commodity prices, including, but not limited to, sustained low crude oil prices, (4) events having an adverse impact on assets, customers, or regions where we have a large investment, (5) operational disruption and increased costs associated with increased railcar assignments following non-renewal of leases, compliance maintenance programs, and other maintenance initiatives, (6) financial and operational risks associated with long-term railcar purchase commitments, (7) reduced opportunities to generate asset remarketing income, (8) changes in railroad efficiency that could decrease demand for railcars, (9) operational and financial risks related to our affiliate investments, including the RRPF affiliates, (10) fluctuations in foreign exchange rates, (11) failure to successfully negotiate collective bargaining agreements with the unions representing a substantial portion of our employees, (12) the impact of new regulatory requirements for tank cars carrying crude, ethanol, and other flammable liquids, (13) deterioration of conditions in the capital markets, reductions in our credit ratings, or increases in our financing costs, (14) asset impairment charges we may be required to recognize, (15) competitive factors in our primary markets, (16) risks related to international operations and expansion into new geographic markets, (17) exposure to damages, fines, and civil and criminal penalties arising from a negative outcome in our pending or threatened litigation, (18) changes in, or failure to comply with, laws, rules, and regulations (19) inability to obtain cost-effective insurance, (20) environmental remediation costs, and (21) inadequate allowances to cover credit losses in our portfolio.

Investors should not place undue reliance on forward-looking statements, which speak only as of the date they are made, and are not guarantees of future performance. The Company undertakes no obligation to publicly update or revise these forward-looking statements.

PART I

Item 1. Business

GENERAL

GATX Corporation ("GATX", "we,""us,""our," and similar terms), a New York corporation founded in 1898, is one of the world's largest railcar lessors, owning fleets in North America, Europe, and Asia. In addition, we operate the largest fleet of US-flagged vessels on the Great Lakes and own and manage marine assets and other long-lived, widely-used assets. We also invest in joint ventures that complement our existing business activities. We report our financial results through four primary business segments: Rail North America, Rail International, American Steamship Company (“ASC”), and Portfolio Management.

The following description of our business should be read in conjunction with the information contained in our Management’s Discussion and Analysis of Financial Condition and Results of Operations included in Item 7 and the consolidated financial statements included in Item 8 of this Annual Report on Form 10-K. For geographic and financial information relating to each of our reportable segments, see "Note 23. Foreign Operations" and "Note 25. Financial Data of Business Segments" included with our consolidated financial statements.

At December 31, 2015, we had total assets of $7.4 billion, comprised largely of railcars. This amount includes $0.5 billion of off-balance sheet assets, primarily railcars that were financed with operating leases.

OPERATIONS

GATX RAIL BUSINESS OVERVIEW

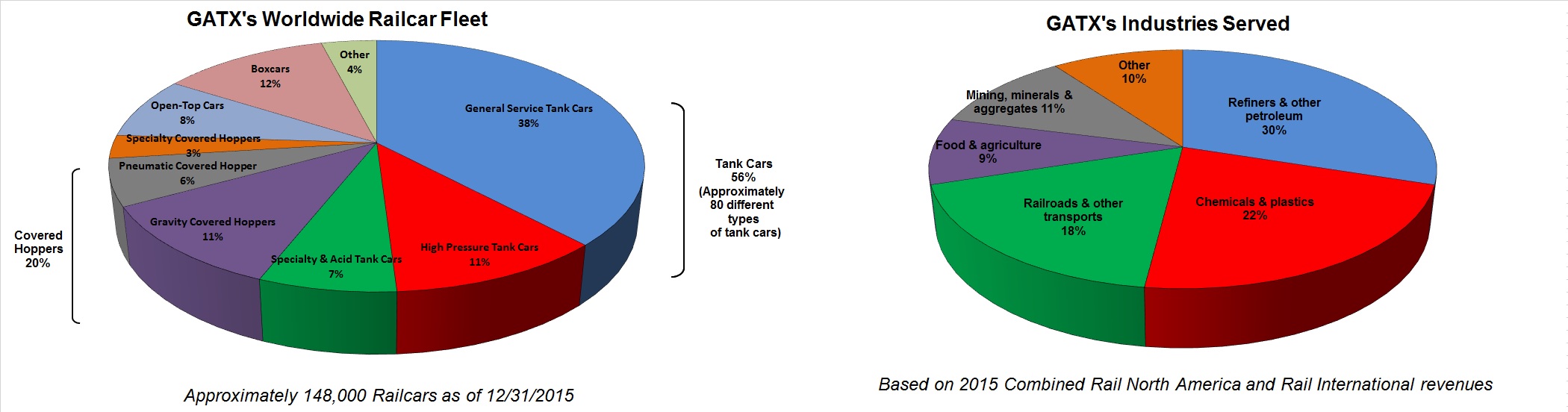

We strive to be recognized as the finest railcar leasing company in the world by our customers, our shareholders, our employees, and the communities where we operate. Our wholly owned fleet of approximately 148,400 railcars is one of the largest railcar lease fleets in the world. With more than a century of rail industry experience, we offer customers leasing, maintenance, asset, financial, and management expertise. We currently lease tank cars, freight cars, and locomotives in North America, tank cars and freight cars in Europe and freight cars in India. We also have an ownership interest in approximately 2,400 railcars through investments in affiliated companies, and we actively manage approximately 600 railcars for other third-party owners. The following table sets forth our worldwide rail fleet data as of December 31, 2015:

|

| | | | | | | | | | | | | | | | | | | | |

| Tank Railcars | | Freight Railcars (1) | | Total Fleet | | Affiliate Railcars | | Managed Railcars | | Total Railcars | | Locomotives |

Rail North America | 60,470 |

| | 64,105 |

| | 124,575 |

| | 2,375 |

| | 590 |

| | 127,540 |

| | 637 |

|

Rail International | 22,456 |

| | 1,394 |

| | 23,850 |

| | — |

| | 7 |

| | 23,857 |

| | — |

|

| 82,926 |

| | 65,499 |

| | 148,425 |

| | 2,375 |

| | 597 |

| | 151,397 |

| | 637 |

|

__________________

(1) Includes approximately 18,400 boxcars in Rail North America.

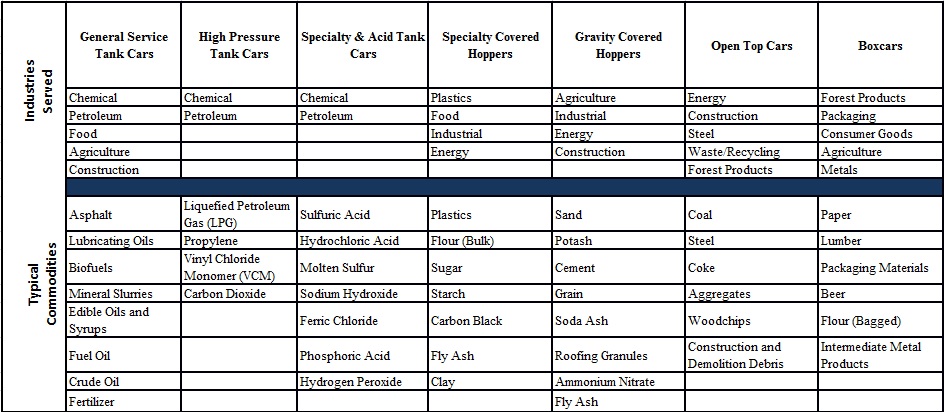

Our rail customers primarily operate in the petroleum, chemical, food/agriculture and transportation industries. Our worldwide railcar fleet consists of diverse railcar types that our customers use to ship approximately 600 different commodities. The following table presents an overview of our railcar types as well as the industries of our customers and the commodities they ship.

RAIL NORTH AMERICA

Rail North America is comprised of our wholly owned operations in the United States, Canada, and Mexico, as well as an affiliate investment. Rail North America primarily provides railcars pursuant to full-service leases under which it maintains the railcars, pays ad valorem taxes and property insurance, and provides administrative and other ancillary services. These railcars have estimated useful economic lives of 27 to 42 years and an average age of approximately 20 years. Rail North America has a large and diverse customer base, serving approximately 800 customers. In 2015, no single customer accounted for more than 6% of Rail North America’s total lease revenue, and the top ten customers combined accounted for approximately 24% of Rail North America’s total lease revenue. Rail North America leases railcars for terms that generally range from four to ten years, although leases may be for longer or shorter terms depending on market conditions. The average remaining lease term of the North American fleet was approximately four years as of December 31, 2015. Rail North America’s primary competitors are Union Tank Car Company, American Railcar Leasing, Trinity Industries Leasing Company, the CIT Group, Wells Fargo Rail, The Andersons, Inc., and SMBC Rail Services, LLC. Rail North America competes on the basis of customer relationships, lease rate, maintenance capabilities, customer service, engineering expertise, and availability of railcars.

Rail North America purchases new railcars from a number of manufacturers, including Trinity Industries, National Steel Car Ltd., The Greenbrier Companies, Freightcar America, and American Railcar Industries, Inc. We also acquire railcars in the secondary market.

During 2014, we acquired more than 18,500 boxcars from General Electric Railcar Services Corporation for approximately $340 million (the "Boxcar Fleet"). In 2011, we entered into an agreement to acquire 12,500 newly built railcars from Trinity Rail Group, LLC ("Trinity"), a subsidiary of Trinity Industries, over a five-year period. As of December 31, 2015, we have received customer commitments to lease 12,400 railcars from this agreement, of which 10,100 have been delivered. In 2014, we entered into a new long-term supply agreement with Trinity that will take effect in mid-2016, upon the scheduled expiration of the 2011 supply agreement. Under the terms of that agreement, we may order up to 8,950 newly built railcars over a four-year period from March, 2016 through March, 2020. We may order either tank or freight cars; however, we expect that the majority of the order will be for tank cars. In January 2017, as part of the agreement, either party may initiate a review of the contract pricing if it no longer reflects market rates. This review could result in modifications to the agreement, including termination.

Rail North America also owns a fleet of locomotives, consisting of 611 older four-axle and 26 six-axle locomotives as of December 31, 2015. Locomotive customers are primarily Class I, regional, and short-line railroads and industrial users. Lease terms vary from month-to-month to 15 years. As of December 31, 2015, the average remaining lease term of the locomotive fleet was approximately seven years. Rail North America's primary competitors in locomotive leasing are Wells Fargo Rail, CIT Group Inc., and Progress Rail Services Corporation. Competitive factors in the market include equipment condition, availability, customer service, and pricing.

Rail North America also remarkets rail assets, including assets managed for third parties and an affiliate. Remarketing activities generate fees and gains which may contribute significantly to Rail North America’s segment profit.

Maintenance

Rail North America operates an extensive network of maintenance facilities in the United States and Canada dedicated to performing timely, efficient, and high quality maintenance for customers. Services include interior cleaning of railcars, routine maintenance and general repairs to the car body and safety appliances, regulatory compliance work, wheelset replacements, exterior blast and painting, and car stenciling. To the extent possible, railcar maintenance is scheduled in a manner that minimizes the amount of time the car is out of service. Rail North America’s maintenance network consists of:

| |

• | Six major maintenance facilities that can complete all types of maintenance services. |

| |

• | Five field maintenance facilities that primarily focus on routine cleaning, repair, and regulatory compliance services. |

| |

• | Six customer-dedicated sites operating solely within specific customer facilities that offer services tailored to the needs of our customers’ fleets. |

| |

• | Twenty mobile unit locations that travel to many track-side field locations to provide spot repairs and interior cleaning services, thus avoiding the need to send a railcar to a major maintenance facility. |

The maintenance network is supplemented by a number of preferred third-party maintenance facilities. In certain cases, we have entered into fixed-capacity contracts with these third parties under which Rail North America has secured access to maintenance capacity. In 2015, third-party maintenance facilities accounted for approximately 45% of Rail North America’s maintenance costs (excluding the cost of repairs performed by railroads).

In 2015, wholly owned and third-party maintenance facilities performed approximately 79,000 service events, including multiple independent service events for the same car.

Our maintenance activities are substantially dedicated to servicing our wholly owned railcar fleet pursuant to the provisions of our lease contracts. Additionally, our customers periodically require services that are not included in the full-service lease agreement, such as repair of railcar damage and, as noted below, we provide maintenance services to one of our affiliates. Revenue earned from these types of maintenance services is recorded in other revenue.

Affiliates

Adler Funding LLC ("Adler") is a 12.5% owned railcar leasing partnership that was formed in 2010 with UniCredit Bank AG, Sperber Rail Holdings Inc., and LBT Holding Corporation. Rail North America provides lease, maintenance and asset remarketing services to Adler, for which it receives a base service fee and a performance-based asset remarketing fee. As of December 31, 2015, Adler owned approximately 2,400 railcars in North America consisting primarily of freight cars with an average age of approximately twelve years.

Southern Capital Corporation LLC (“SCC”) was a 50% owned joint venture with the Kansas City Southern Railroad, formed in 1996. During 2014 and 2015, SCC sold substantially all of its remaining railcars and locomotives.

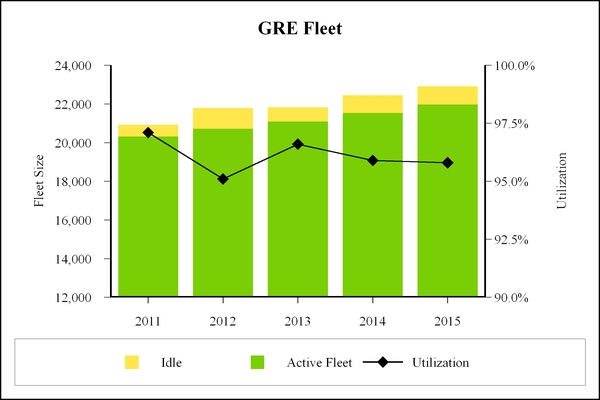

RAIL INTERNATIONAL

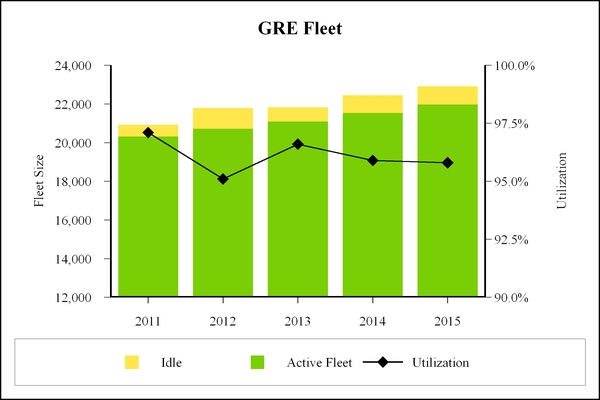

Rail International is comprised of our wholly owned European operations ("GATX Rail Europe" or "GRE") and a wholly owned railcar leasing business in India ("Rail India"), as well as one development stage affiliate in China. GRE leases railcars to customers throughout Europe pursuant to full-service leases under which it maintains the railcars and provides value-adding services according to customer requirements. These railcars have estimated useful lives of 35 to 40 years and an average age of approximately 18 years. GRE has a diverse customer base with approximately 250 customers. In 2015, two customers each accounted for more than 10% of GRE's total lease revenue and the top ten customers combined accounted for approximately 65% of GRE's total lease revenue. GRE's lease terms generally range from one to ten years and as of December 31, 2015, the average remaining lease term of the European fleet was approximately two years. GRE competes principally on the basis of customer relationships, lease rate, maintenance expertise, and availability of railcars. Its primary competitors are VTG Aktiengesellschaft, the Ermewa Group, Nacco, a subsidiary of CIT Group Inc, Wascosa AG, and On Rail.

GRE acquires new railcars primarily from Astra Rail Industries S.R.L., Legios Loco a.s., and Feldbinder Spezialfahrzeugwerke GmbH. Additionally, GRE's Ostróda, Poland maintenance facility assembles several hundred tank cars each year. As of December 31, 2015, GRE has a firm commitment to acquire approximately 300 newly manufactured railcars to be delivered in 2016.

Rail India began operations in 2012 as the first company registered to lease railcars under the Indian Railways Wagon Leasing Scheme. In 2015, Rail India focused on pursuing investment opportunities in new and existing flat wagons, and developing relationships with customers, suppliers and the Indian Railways. As of December 31, 2015 Rail India owned 777 railcars with estimated useful lives of 20-25 years. Rail India's lease terms, all of which are net leases, generally range from two to ten years and as of December 31, 2015, the average remaining lease term of the Indian fleet was approximately five years. In 2016, Rail India expects to continue to pursue investment opportunities and grow its fleet of wagons.

Maintenance

GRE operates maintenance facilities in Hannover, Germany and Ostróda, Poland that perform significant repairs, regulatory compliance and modernization work for owned railcars. These service centers are supplemented by a number of third-party repair facilities, which in 2015 accounted for approximately 43% of GRE's fleet repair costs.

Similar to our Rail North America segment, Rail International's customers periodically require maintenance services that are not included in the full-service lease agreement. For GRE, these services are generally related to the repair of damages by customers and railways. Revenue earned from these maintenance activities is recorded in other revenue.

In India, all railcar maintenance is performed by the Indian Railways or an authorized third party provider.

Rail International Affiliates

In 2012, IMC-GATX Financial Leasing (Shanghai) Co., Ltd. (“IMC-GATX China”) was established as a 50% owned China-based joint venture between us and IMC Pan Asia Alliance Group (“IMC”). IMC is a well-established shipping enterprise with experience operating in China and was also our partner in a marine joint venture until we sold our interest in 2015. The primary objective of IMC-GATX China is to establish a rail leasing business in China, if that market develops.

We previously owned a 37.5% interest in Ahaus Alstätter Eisenbahn Cargo AG (“AAE”), a Switzerland-based freight railcar leasing affiliate. During 2013, we sold our interest to our partner, Ahaus Alstätter Eisenbahn Holding AG.

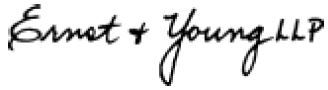

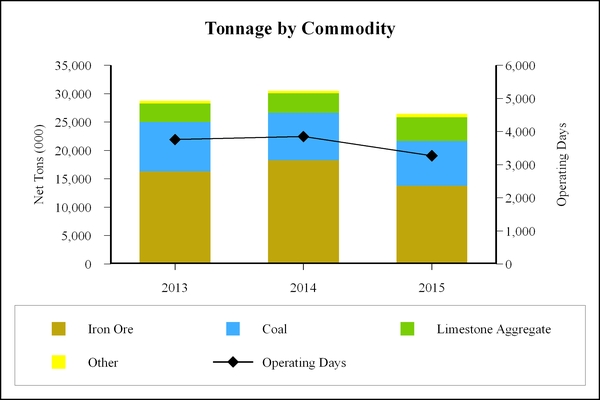

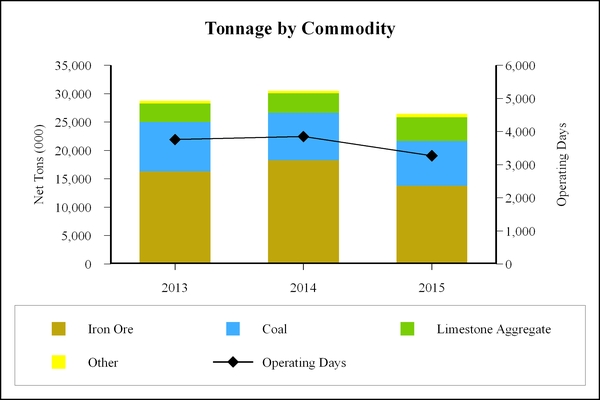

ASC

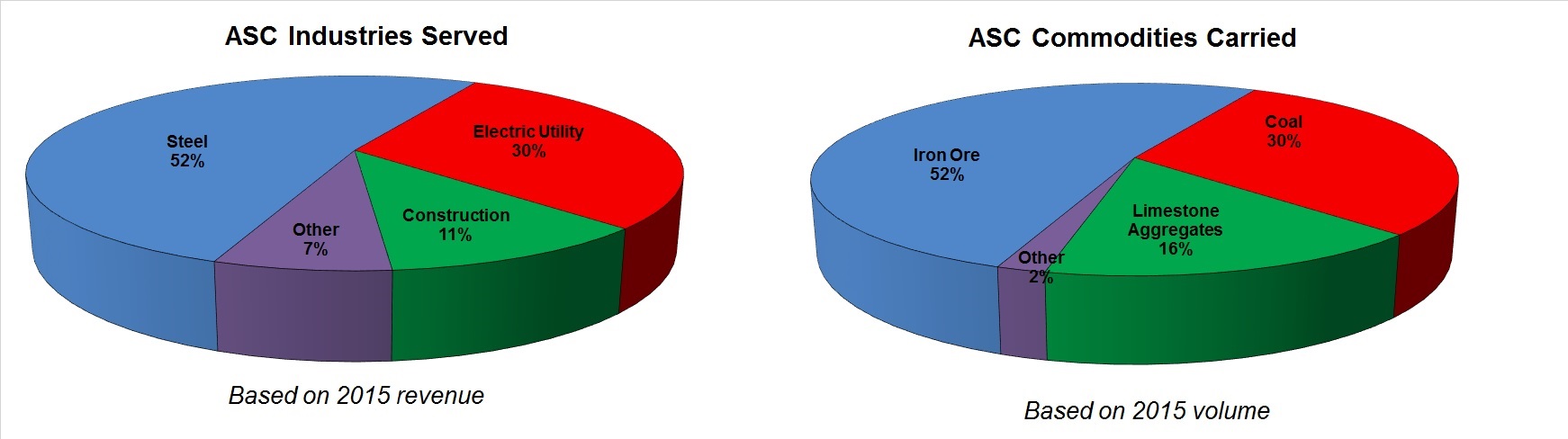

ASC operates the largest fleet of US-flagged vessels on the Great Lakes and strives to attain the highest levels of delivery efficiency, safety and environmental stewardship. ASC provides waterborne transportation of dry bulk commodities such as iron ore, coal, limestone aggregates, and metallurgical limestone, which serve end markets that include steel making, domestic automobile manufacturing, electricity generation, and non-residential construction. Customer service, primarily in the form of scheduling flexibility, reliability, and operating safety, is key to ASC’s success. ASC’s sailing season generally runs from April 1 through December 31; however, depending on customer demand and weather conditions, certain vessels may commence operations during March and continue to operate into January of the following year.

At December 31, 2015, ASC’s fleet consisted of 17 vessels with a net book value of $236.5 million and $6.8 million of off-balance sheet assets. All ships are environmentally and operationally compliant. Fourteen of the vessels are diesel powered, have an average age of 38 years, and estimated useful lives of 65 years. Two steam powered vessels were built in the 1940s and 1950s and have estimated remaining useful lives of four years. The other vessel in ASC's fleet is a diesel-powered articulated tug-barge built in 2012, which is leased by ASC under an operating lease that expires in 2017. Sixteen of ASC’s vessels are generally available for both service contract and spot business; the remaining vessel is dedicated to a time charter agreement that is scheduled to expire following the 2018 sailing season. ASC’s vessels operate exclusively in the fresh water of the Great Lakes and as a result, with proper maintenance and periodic refurbishment, may achieve extended service well beyond the useful life estimates.

All of ASC’s vessels are equipped with self-unloading equipment, enabling them to discharge dry bulk cargo without assistance from shore-side equipment or personnel. This equipment enables the vessels to operate twenty-four hours a day, seven days a week. ASC’s vessels are capable of transporting and unloading almost any free flowing, dry bulk commodity. In 2015, ASC served 26 customers with the top five customers comprising 85% of total revenue.

The following table sets forth ASC's fleet as of December 31, 2015:

|

| | | | |

Great Lakes Vessels | | Length (feet) | | Capacity (gross tons) |

M/V American Spirit | | 1004' | | 62,400 |

M/V Burns Harbor | | 1000' | | 80,900 |

M/V Indiana Harbor | | 1000' | | 80,900 |

M/V Walter J. McCarthy, Jr | | 1000' | | 80,900 |

M/V American Century | | 1000' | | 78,850 |

M/V American Integrity | | 1000' | | 78,850 |

M/V St. Clair | | 770' | | 44,800 |

M/V American Mariner | | 730' | | 37,300 |

M/V H. Lee White | | 704' | | 35,400 |

M/V John J. Boland | | 680' | | 34,000 |

M/V Adam E. Cornelius | | 680' | | 29,200 |

M/V Buffalo | | 634'-10" | | 24,300 |

M/V Sam Laud | | 634'-10" | | 24,300 |

M/V American Courage | | 634'-10" | | 23,800 |

Str. American Victory | | 730' | | 26,300 |

Str. American Valor | | 767' | | 25,500 |

Ken Boothe and Lakes Contender (articulated tug-barge) | | 740' | | 34,000 |

ASC’s vessels operate pursuant to customer contracts that stipulate freight volume and may also be supplemented with additional spot volume opportunities. In 2015, ASC operated 13 vessels and carried 26.5 million net tons of cargo. The number of vessels deployed by ASC in any given year is dependent on customer volume requirements.

ASC’s primary competitors on the Great Lakes are Interlake Steamship Company, Great Lakes Fleet, Inc., Grand River Navigation, Central Marine Logistics, and VanEnkevort Tug and Barge. ASC principally competes on the basis of service capabilities, customer relationships, and price.

The United States shipping industry is subject to the Jones Act, which requires all commercial vessels transporting goods between US ports to be built, owned, operated and manned by US citizens, and registered under the US flag.

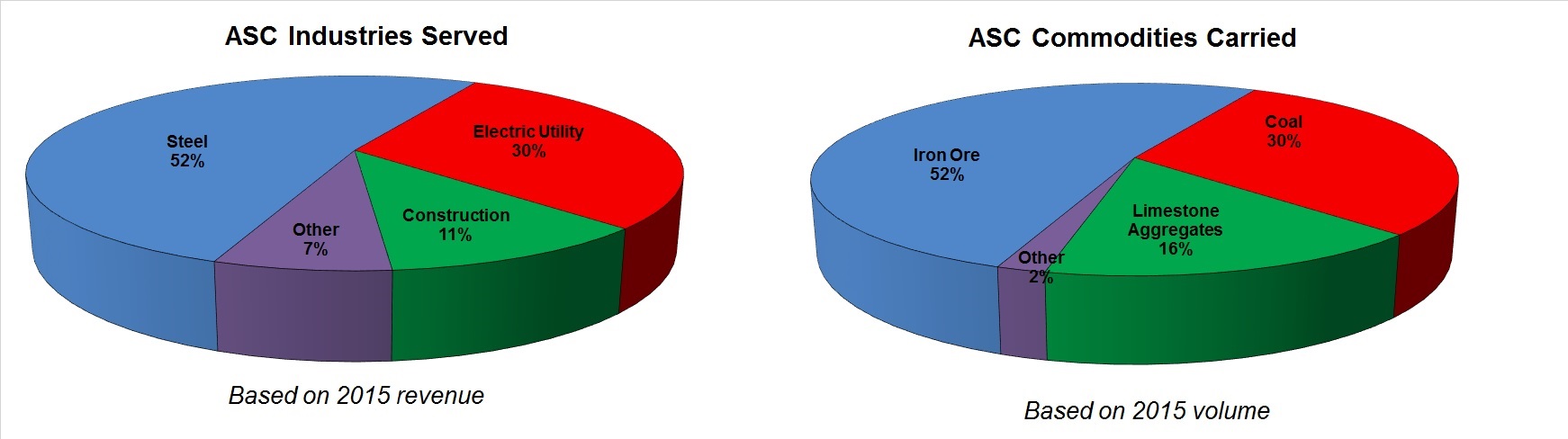

PORTFOLIO MANAGEMENT

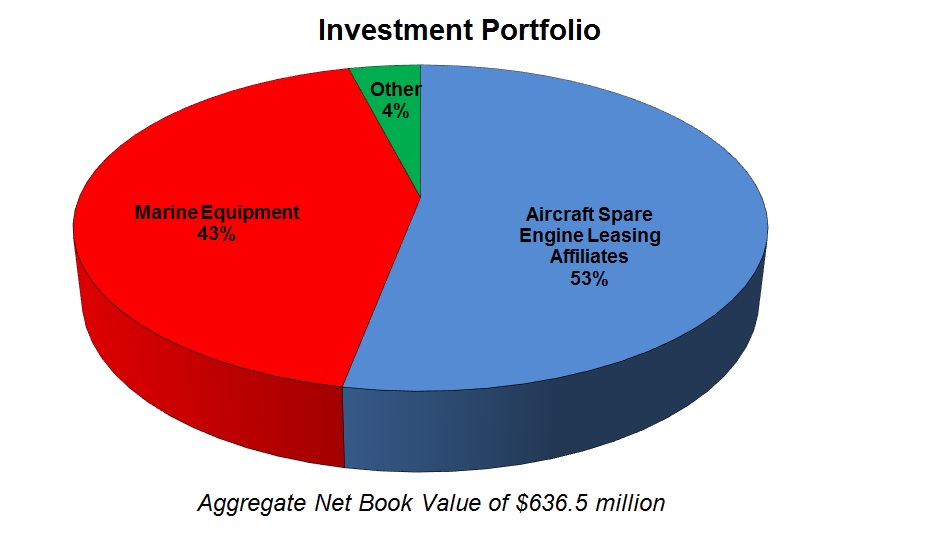

Portfolio Management has historically generated leasing, marine operating, asset remarketing, and management fee income through a collection of diversified wholly owned assets and joint venture investments. In addition, Portfolio Management's segment profit is significantly impacted by the contribution of the Rolls-Royce & Partners Finance companies. In 2015, we made the decision to exit the majority of our marine investments within our Portfolio Management segment, including six chemical parcel tankers, a number of inland marine vessels, and our 50% interest in the Cardinal Marine joint venture. Certain marine investments were sold during 2015, and additional sales are expected to be completed in 2016. See the Portfolio Management section in Part II, Item 7 of this Form 10-K for further details. Management believes that selling these investments at this time will provide favorable returns and eliminate the future risk of continuing to hold these investments in markets that have become more volatile. Subsequent to the sales of these marine investments, segment profit will be driven primarily by the Rolls-Royce & Partners Finance entities and, to a lesser extent, by certain retained marine investments.

The following table sets forth the approximate net book value of Portfolio Management’s assets as of December 31 (in millions):

|

| | | | | | | | | | | |

| Owned Assets | | Affiliate Investments | | Managed Assets |

2015 | $ | 301.4 |

| | $ | 335.1 |

| | $ | 71.0 |

|

2014 | 474.6 |

| | 338.7 |

| | 64.1 |

|

2013 | 536.0 |

| | 320.9 |

| | 125.3 |

|

Owned and Managed Assets

Portfolio Management's wholly owned portfolio consists of assets subject to operating and finance leases, marine assets operating in pooling arrangements, and secured loans. As of December 31, 2015, $103.4 million of the owned assets were held for sale. Upon completion of the sales of the marine investments described above, Portfolio Management's remaining owned assets will consist primarily of five liquefied gas carrying vessels.

Portfolio Management also manages portfolios of assets for third parties which generate fee and residual sharing income through portfolio administration and remarketing of these assets.

Affiliates

Portfolio Management has historically held investments in affiliated companies, primarily aircraft spare engine leasing and shipping operations.

The Rolls-Royce & Partners Finance companies (collectively the “RRPF affiliates”) are a collection of fifteen 50% owned domestic and foreign joint ventures with Rolls-Royce plc (or affiliates thereof, collectively “Rolls-Royce”), a leading manufacturer of commercial aircraft jet engines. The RRPF affiliates are primarily engaged in two business activities: lease financing of aircraft spare engines to a diverse group of commercial aircraft operators worldwide and sale-leaseback financing of aircraft spare engines to Rolls-Royce for use in their engine maintenance programs. As of December 31, 2015, the RRPF affiliates, in aggregate, owned 436 engines, of which 224 were on lease to Rolls-Royce. Aircraft engines are generally depreciated over a useful life of 25 years when new and, depending on actual hours of usage and with proper maintenance, may achieve extended service well beyond the useful life estimates. As of December 31, 2015, the average age of these engines was approximately 11 years. Lease terms vary but typically range from 7 to 10 years. Rolls-Royce acts as manager for each of the RRPF affiliates and also performs substantially all required maintenance activities.

Cardinal Marine Investments LLC (“Cardinal Marine”) was a 50% owned marine joint venture with IMC Holdings, a subsidiary of IMC. IMC is a leading Asia-focused integrated maritime and industrial solutions provider with diversified interests in dry and liquid bulk shipping, ship and crew management, offshore and marine engineering, oil and gas assets, and services and logistics. Cardinal Marine owns five chemical parcel tankers (each with 45,000 dead weight tons (“dwt”) carrying capacity) that operate under a pooling arrangement with IMC's other chemical tankers in support of the movement of liquid bulk chemicals in the Middle East Gulf/Far East and US Gulf/Far East trades. In 2015, we sold our interest in this joint venture to our partner, IMC Holdings.

Intermodal Investment Funds V and VII were each 50% owned joint ventures with DVB Bank SE. The affiliates were formed to finance shipping containers, which were on direct finance leases to third parties. In 2014, we sold our investments in these joint ventures.

Somargas II Private Limited (“Somargas”) and Singco Gas Pte, Limited (“Singco”) were 35% and 50% owned joint ventures with IM Skaugen ASA (“Skaugen”). Somargas owned six liquid petroleum gas/ethylene vessels (each with 8,500 - 10,000 cubic meters (“cbm”) carrying capacity) and Singco owned four liquid petroleum gas/ethylene/LNG vessels (each with 10,000 cbm carrying capacity). In 2013, we sold our interests in Singco and Somargas to Skaugen. In connection with the sale, we received five of the vessels. The vessels continue to operate under a pooling arrangement with Skaugen.

TRADEMARKS, PATENTS AND RESEARCH ACTIVITIES

Patents, trademarks, licenses and research and development activities are not material to our businesses taken as a whole.

SEASONAL NATURE OF BUSINESS

ASC’s fleet is inactive for a significant portion of the first quarter of each year due to the winter conditions on the Great Lakes.

CUSTOMER BASE

GATX, taken as a whole, is not dependent upon a single customer nor does it have any significant customer concentrations. Segment concentrations, if material, are described above.

EMPLOYEES AND EMPLOYEE RELATIONS

As of December 31, 2015, we employed 2,253 persons, of whom approximately 42% were union workers covered by collective bargaining agreements.

See "Note 15. Concentrations" in Part II, Item 8 of this Form 10-K for additional information about our employees and concentration of labor force.

ENVIRONMENTAL MATTERS

Our operations, facilities and properties are subject to extensive federal, state, local, and foreign environmental laws and regulations. These laws cover discharges to waters; air emissions; toxic substances; the generation, handling, storage, transportation, and disposal of waste and hazardous materials; and the investigation and remediation of contamination. These laws have the effect of increasing the cost and liability associated with leasing and operating assets, and violations can result in significant fines, penalties, or other liabilities. Environmental risks and compliance with applicable environmental laws and regulations are inherent in rail operations, which frequently involve transporting chemicals and other hazardous materials.

We are subject to, and may from time to time continue to be subject to, environmental cleanup and enforcement actions in the US and in the foreign countries in which we operate. In particular, the federal Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), also known as the Superfund law, generally imposes joint and several liability for investigation, cleanup and enforcement costs on current and former owners and operators of a site, without regard to fault or the legality of the original conduct. Accordingly, we have been and may, in the future, be named as a potentially responsible party under CERCLA and other federal, state, local, and foreign laws or regulations for all or a portion of the costs to investigate and clean up sites at which certain contaminants may have been discharged or released by us, our current lessees, former owners or lessees of properties, or other third parties. Environmental remediation and other environmental costs are accrued when considered probable and amounts can be reasonably estimated. As of December 31, 2015, environmental costs were not material to our financial position, results of operations or cash flows. For further discussion, see "Note 24. Legal Proceedings and Other Contingencies" in Part II, Item 8 of this Form 10-K.

EXECUTIVE OFFICERS OF THE REGISTRANT

The following information regarding our executive officers is included in Part I in lieu of inclusion in our definitive Proxy Statement:

|

| | | | |

Name | Offices Held | Position Held Since | | Age |

Brian A. Kenney | Chairman, President and Chief Executive Officer | 2005 | | 56 |

Robert C. Lyons | Executive Vice President and Chief Financial Officer | 2012 | | 52 |

James F. Earl | Executive Vice President and President, Rail International | 2012 | | 59 |

Thomas A. Ellman | Executive Vice President and President, Rail North America | 2013 | | 47 |

Deborah A. Golden | Executive Vice President, General Counsel and Corporate Secretary | 2012 | | 61 |

Niyi A. Adedoyin | Senior Vice President and Chief Information Officer | 2016 | | 48 |

Michael T. Brooks | Senior Vice President, Operations and Technology | 2013 | | 46 |

James M. Conniff | Senior Vice President, Human Resources | 2014 | | 58 |

Curt F. Glenn | Senior Vice President, Portfolio Management | 2007 | | 61 |

William M. Muckian | Senior Vice President, Controller and Chief Accounting Officer | 2007 | | 56 |

Paul F. Titterton | Senior Vice President and Chief Commercial Officer | 2015 | | 40 |

Eric D. Harkness | Vice President, Treasurer and Chief Risk Officer | 2012 | | 43 |

Jeffery R. Young | Vice President and Chief Tax Officer | 2015 | | 53 |

| |

• | Mr. Kenney has served as Chairman, President and Chief Executive Officer since 2005. Previously, Mr. Kenney served as President from 2004 to 2005, Senior Vice President, Finance and Chief Financial Officer from 2002 to 2004, Vice President, Finance and Chief Financial Officer from 1999 to 2002, Vice President, Finance from 1998 to 1999, Vice President and Treasurer from 1997 to 1998, and Treasurer from 1995 to 1996. |

| |

• | Mr. Lyons has served as Executive Vice President and Chief Financial Officer since June 2012. Previously, Mr. Lyons served as Senior Vice President and Chief Financial Officer from 2007 to June 2012, Vice President and Chief Financial Officer from 2004 to 2007, Vice President, Investor Relations from 2000 to 2004, Project Manager, Corporate Finance from 1998 to 2000, and Director of Investor Relations from 1996 to 1998. |

| |

• | Mr. Earl has served as Executive Vice President and President, Rail International since June 2012. In addition, Mr. Earl has served as the Chief Executive Officer of American Steamship Company since June 2012. Previously, Mr. Earl served as Executive Vice President and Chief Operating Officer from 2006 to June 2012, Executive Vice President — Rail from 2004 to 2006, Executive Vice President — Commercial at Rail from 2001 to 2004 and in a variety of increasingly responsible positions in the GATX Capital Rail Group from 1988 to 2001. |

| |

• | Mr. Ellman has served as Executive Vice President and President, Rail North America since June 2013. Previously, Mr. Ellman served as Senior Vice President and Chief Commercial Officer from November 2011 to June 2013, Vice President and Chief Commercial Officer from 2006 to November 2011. Prior to re-joining GATX in 2006, Mr. Ellman served as Senior Vice President and Chief Risk Officer and Senior Vice President, Asset Management of GE Equipment Services, Railcar Services and held various positions at GATX in the GATX Rail Finance Group. |

| |

• | Ms. Golden has served as Executive Vice President, General Counsel and Corporate Secretary since June 2012. Previously, Ms. Golden served as Senior Vice President, General Counsel and Corporate Secretary from 2007 to June 2012. Ms. Golden joined GATX in 2006 as Vice President, General Counsel and Corporate Secretary. Prior to joining GATX, Ms. Golden served as Vice President and General Counsel of Midwest Generation, LLC from 2004 to 2005, Deputy General Counsel, State of Illinois, Office of the Governor from 2003 to 2004 and Assistant General Counsel with Ameritech Corporation/SBC Communications, Inc. from 1997 to 2001. |

| |

• | Mr. Adedoyin was elected Senior Vice President and Chief Information Officer in January 2016. Previously, Mr. Adedoyin served as Vice President and Chief Information Officer from 2013 to 2016 and Senior Director, IT Strategy and Project Management Office from 2008 to 2013. |

| |

• | Mr. Brooks has served as Senior Vice President, Operations and Technology since June 2013. Previously, Mr. Brooks served as Senior Vice President and Chief Information Officer from November 2008 to June 2013. Prior to joining GATX, Mr. Brooks served as Chief Information Officer and Vice President of the retail division of Constellation Energy and held various consulting roles of increasing responsibility with Accenture and Oracle Corporation. |

| |

• | Mr. Conniff has served as Senior Vice President, Human Resources since December 2014. Previously, Mr. Conniff served as Vice President, Human Resources since 2014 and Senior Director, Benefits and Employee Services since 2008. Mr. Conniff joined GATX in 1981 and has held a variety of positions in finance and human resources. |

| |

• | Mr. Glenn has served as Senior Vice President, Portfolio Management since 2007. Previously, Mr. Glenn served as Vice President, Portfolio Management from 2006 to 2007 and as a GATX Corporation Vice President since 2004 and Executive Vice President of Portfolio Management since 2003. Prior to that, Mr. Glenn served as Senior Vice President and Chief Financial Officer of the GATX Capital Division of GATX Financial Corporation from 2000 to 2003 and in a variety of increasingly responsible positions at GATX Capital from 1980 to 2000. |

| |

• | Mr. Muckian has served as Senior Vice President, Controller and Chief Accounting Officer since 2007. Previously, Mr. Muckian served as Vice President, Controller and Chief Accounting Officer from 2002 to 2007, Controller and Chief Accounting Officer from 2000 to 2002, and Director of Taxes of GATX from 1994 to 2000. |

| |

• | Mr. Titterton was elected Senior Vice President and Chief Commercial Officer in April 2015. Previously, Mr. Titterton served as Vice President and Chief Commercial Officer from June 2013 to April 2015, Vice President and Group Executive, Fleet Management, |

Marketing and Government Affairs from December 2011 to June 2013, Vice President and Executive Director, Fleet Management from 2008 to 2011, and in a variety of increasingly responsible positions since joining the company in 1997.

| |

• | Mr. Harkness has served as Vice President, Treasurer and Chief Risk Officer since October 2012. Previously, Mr. Harkness served as Vice President, Chief Risk Officer from September 2010 to October 2012 and Senior Investment Risk Officer from 2007 to September 2010. Prior to joining GATX, Mr. Harkness served in a variety of positions of increasing responsibility in the financial services industry. |

| |

• | Mr. Young was elected Vice President and Chief Tax Officer in January 2015. Previously, Mr. Young served as Vice President of Tax from 2007 to January 2015 and as Director of Tax from 2003 to 2007. Prior to joining GATX, Mr. Young spent twenty years in a variety of tax related positions in public accounting and the financial services industry. |

AVAILABLE INFORMATION

We make available free of charge at our website, www.gatx.com, our most recent annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (the "1934 Act"), as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the US Securities and Exchange Commission (“SEC”). Charters for the Audit Committee, Compensation Committee and Governance Committee of the Board of Directors, the Corporate Governance Guidelines, the Code of Business Conduct and Ethics and the Code of Ethics for Senior Company Officers are posted under Corporate Governance in the Investor Relations section of our website, and are available in print upon request by any shareholder. Within the time period prescribed by SEC and New York Stock Exchange regulations, we will post on our website any amendment to the Code of Ethics for Senior Company Officers and the Code of Business Conduct and Ethics or any waivers thereof. The information on our website is not incorporated by reference into this report.

Item 1A. Risk Factors

Investors should consider the risk factors described below as well as other information contained in this filing or our other filings with the US Securities and Exchange Commission before investing in our securities. If any of the events described in the risk factors below occur, our business, financial condition and results of operations could be adversely affected.

We may be unable to maintain assets on lease at satisfactory rates due to decreases in customer demand, oversupply of railcars in the market, or other changes in supply and demand.

Our profitability depends on our ability to lease assets at satisfactory rates and to re-lease assets upon lease expiration. Circumstances such as excess capacity in particular railcar types or generally in the marketplace, decreases in customer demand for our railcars, economic downturns, changes in customer behavior, or other changes in supply or demand can adversely affect asset utilization rates and lease rates. Economic uncertainty or a decline in customer demand for our assets could cause customers to request shorter lease terms and lower lease rates, which may result in a decrease in our asset utilization rate and reduced revenues. Alternatively, customers may seek to lock-in relatively low lease rates for longer terms, which may result in an adverse impact on current or future revenues.

Weak economic conditions in the US or other parts of the world and other factors may decrease customer demand for our assets and services and negatively impact our business and results of operations.

We rely on continued demand from our customers to lease our railcars and locomotives. Demand for these assets and services depends on the markets for our customers’ products and services and the strength and growth of their businesses. Some of our customers operate in cyclical markets, such as the steel, energy, chemical, and construction industries, which are susceptible to macroeconomic downturns and may experience significant changes in demand over time. Weakness in certain sectors of the economy in the United States and other parts of the world may make it more difficult for us to lease certain types of railcars that are either returned at the end of a lease term or returned as a result of a customer bankruptcy or default.

Additional factors, such as changes in harvest or production volumes, changes in supply chains, choices in types of transportation assets, availability of substitutes and other operational needs may also influence customer demand for our assets. Demand for our marine assets and shipping services also depends on the factors discussed above. Significant declines in customer demand for our assets and services could adversely affect our financial performance.

In many cases, demand for our assets also depends on our customers’ desire to lease, rather than buy, the assets. Tax and accounting considerations, interest rates, and operational flexibility, among other factors, may influence a customer’s decision to lease or buy assets. We have no control over these external considerations, and changes in these factors, including anticipated changes to lease accounting rules, could negatively impact demand for our assets held for lease.

Adverse changes in the price of, or demand for, crude oil or other commodities could reduce demand for our railcars and have a negative impact on our results of operations.

Adverse changes in commodity prices or reduced demand for commodities could reduce customer demand for various types of railcars in our fleet. A significant decrease in the price of a commodity may cause producers of that commodity to cut their production levels. A significant increase in the price of a commodity could cause our customers to switch to less expensive alternatives that are not delivered by rail. In each case, these changes in customer behavior can reduce demand for the portions of our fleet that are used to transport the commodity.

Demand for railcars that are used to transport crude oil and related products, including commodities used in drilling operations and the commodities produced by such operations, is dependent on the demand for these commodities. While only about 1.7% of our worldwide fleet is engaged in direct crude-by-rail service, approximately 21% of our North American fleet is leased to petroleum-related customers, making them an important source of our worldwide revenue. Sustained low oil prices could cause oil producers to curtail the drilling of new wells or cease production at certain existing wells that are uneconomical to operate at current crude price levels. Reduced oil drilling activity could result in decreased demand for our railcars used to transport the commodities used in drilling operations, such as frac sand and fracking chemicals, and the commodities produced by such operations, including crude oil and refined products such as gasoline, diesel fuel, petrochemicals and liquefied petroleum gas. A significant and sustained decrease in the price of crude oil and related products could reduce customer demand for our railcars and negatively impact revenue and our results of operations.

Demand for railcars that are used to transport ethanol and other renewable fuels may be affected by government subsidies and mandates, which may be enacted, changed, or eliminated from time to time. It is possible that the reduction or elimination of current US mandates for ethanol blending in motor fuels could reduce the production of ethanol, which would reduce demand for portions of our tank car fleet and negatively impact our revenue and profitability.

Events that negatively affect certain assets, customers, or geographic regions could have a negative impact on our results of operations.

We generally derive our revenues from a variety of asset types, customers, industries, and geographic locations. However, from time to time we could have a large investment in a particular asset type, a large revenue stream associated with a particular customer or industry, or a large number of customers located in a particular geographic region. Decreased demand from a discrete event impacting a specific asset type, customer, or industry, or region in which we have a concentrated exposure could negatively impact our results of operations.

A significant decrease in lease renewals by our customers or a significant increase in the number of tank cars requiring compliance-based maintenance could negatively impact operations and substantially increase our costs.

Decreases in customer demand for our railcars could increase the number of leases that are not renewed upon expiration and could cause some customers to default, resulting in the early return of railcars. Railcars that are returned by our customers often must undergo maintenance and service work before being leased to new customers. A significant increase in the number of railcars requiring maintenance may negatively affect our operations and substantially increase maintenance and other related costs. In addition, low demand for certain types of railcars in our fleet may make those railcars more difficult to lease to new customers if they are returned at the end of their existing leases or following a customer default, which could negatively affect our results of operations.

We also perform a variety of government or industry-mandated maintenance programs on our full-service tank cars based on their service time. These compliance programs are cyclical in nature, and as a result, we can face significant increases in the volume of tank cars requiring extensive maintenance in any given year. A significant increase in the number of tank cars requiring maintenance may negatively impact our operations and substantially increase maintenance and other related costs. In addition, while we have contracted with third party maintenance providers to assist with these compliance procedures to the extent our demand exceeds our owned maintenance capacity, high demand faced by these providers from other tank car owners may constrain our access to the providers or may substantially increase our costs.

Our long-term railcar purchase commitments could subject us to material operational and financial risks.

Unlike some of our competitors in the railcar leasing market, we do not manufacture railcars. In order to obtain committed access to a supply of newly built railcars on competitive terms, we regularly enter into long-term supply agreements with manufacturers to purchase significant numbers of newly built railcars over a multi-year period. Some of these agreements may provide for flexibility in the pricing, timing, and quantity of our purchasing commitments, while other agreements may provide no such flexibility. Therefore, if economic conditions weaken during the term of a long-term supply agreement, it is possible that we may be required to continue to accept delivery of, and pay for, new railcars at times when it may be difficult for us to lease such railcars and our financing costs may be high, which could negatively affect our revenues and profitability.

Soft market conditions and declines in asset values may reduce opportunities for us to generate remarketing income.

We utilize our extensive knowledge and experience to remarket rail assets in order to optimize the composition of our fleet, and these activities generate income that contributes significantly to Rail North America’s segment profit. Reduced demand for our assets due to adverse market conditions could reduce opportunities for us to generate remarketing income. A significant or prolonged decline in the secondary market for our assets could adversely affect our financial performance.

We have significant financial exposure related to the performance of our aircraft engine leasing affiliate investments.

GATX and Rolls-Royce plc (“Rolls Royce”) each own 50% of fifteen domestic and foreign joint venture entities (collectively, the “RRPF affiliates”) that own and lease aircraft engines to Rolls-Royce and owners and operators of commercial aircraft. These investments expose us to various risks associated with the commercial aviation industry, including geographic exposure and customer concentrations unique to that industry. The financial results of the RRPF affiliates depend heavily on the performance of Rolls-Royce, as Rolls-Royce is both a major customer of, and a critical supplier of maintenance services to, the RRPF affiliates. The RRPF affiliates contribute significantly to our profit. If the financial or operating performance of the RRPF affiliates deteriorates, our results of operations and cash flows could be negatively affected.

Fluctuations in foreign exchange rates and interest rates could negatively impact our results of operations.

Upon consolidation, we translate the financial results of certain subsidiaries from their local currency to the US dollar, which exposes us to foreign exchange rate fluctuations. As exchange rates vary, the translated operating results of foreign subsidiaries may differ materially from period to period. We also have gains and losses on foreign currency transactions, which could vary based on fluctuations in exchange rates and the timing of the transactions and their settlement. In addition, fluctuations in foreign exchange rates can affect the demand and price for services we provide both domestically and internationally, and could negatively impact our results of operations. We also face risks associated with fluctuations in interest rates. We may seek to limit our exposure to foreign exchange rate and interest rate risk with currency or interest rate derivatives, which may or may not be effective. A material and unexpected change in interest rates or foreign exchange rates could negatively affect our financial performance.

Many of our employees are represented by unions, and failure to successfully negotiate collective bargaining agreements may result in strikes, work stoppages, or substantially higher labor costs.

A significant portion of our employees are represented by labor unions and work under collective bargaining agreements that cover a range of workplace matters, such as wages, health and welfare benefits, and work rules. We have generally been successful in negotiating acceptable agreements with the unions without experiencing material work stoppages. However, if we fail to negotiate acceptable new agreements, our business could be disrupted by strikes or lockouts. We could also incur increased operating costs due to higher wages or benefits paid to union workers. Business disruptions or higher operating costs could both have an adverse effect on our financial position, results of operations, or cash flows.

Changes in railroad efficiency may adversely affect demand for our railcars.

Railroad infrastructure investments that improve efficiency or declines in rail traffic due to decreased demand could increase the average speed at which railroads can operate their trains, which may reduce the number of railcars needed for railroads to haul the same amount of cargo. Adverse weather conditions, railroad mergers, and increases in rail traffic could result in slower transit times making rail transportation less attractive to shippers versus other modes of transport. In each case, these changes could reduce demand for our railcars and negatively impact revenue and our results of operations.

New rules in the US and Canada applicable to tank cars carrying crude oil, ethanol, and other flammable liquids could negatively impact our tank car fleet in flammable liquids service.

Recently adopted legislation and regulations in the US and Canada established new design standards for tank cars used to transport various flammable liquids, including crude oil and ethanol. Existing tank cars in flammables service that were built prior to the adoption of the new design standards must be modified or removed from service between May, 2017, and May, 2029, depending on the type of car, the type of commodity carried, and whether the car is used in the US, Canada, or both countries. We have a fleet of approximately 125,000 railcars in North America, including approximately 13,900 tank cars currently used to transport flammable liquids that are affected by the new rules, of which approximately 4,300 are moving crude oil and ethanol. Over 90% of our affected tank cars have a compliance deadline of 2023 or later. We expect to modify some of the most modern of our affected cars tank cars to comply with the new standards. However, for the majority of the affected cars, we currently anticipate retiring, redeploying, or selling them rather than performing retrofits. The additional costs to modify certain tank cars and the cost of retiring tank cars early could have an adverse impact on our business and results of operations.

Deterioration of conditions in the global capital markets or negative changes in our credit ratings may limit our ability to secure financing and may increase our borrowing costs.

We rely largely on banks and capital markets to fund our operations and contractual commitments, including the issuance of long-term debt instruments and commercial paper. These markets can experience high levels of volatility and access to capital can be limited for an extended period of time. In addition to conditions in the capital markets, changes in our financial performance or credit ratings or ratings outlook, as determined by rating agencies such as Standard & Poor’s and Moody’s Investors Service, could cause us to incur increased borrowing costs or to have greater difficulty accessing public and private markets for secured and unsecured debt. If we are unable to secure financing on acceptable terms, our other sources of funds, including available cash, bank facilities, cash flow from operations, and portfolio proceeds, may not be adequate to fund our operations and contractual commitments.

We may incur future asset impairment charges.

We review long-lived assets and joint venture investments for impairment regularly, or when circumstances indicate the carrying value of an asset or investment may not be recoverable. Among other circumstances, the following may change our estimates of the cash flows we expect our long-lived assets or joint venture investments will generate, which could require us to recognize asset impairment charges:

| |

• | A weak economic environment or challenging market conditions |

| |

• | New laws, rules or regulations affecting our assets, or changes to existing laws, rules or regulations |

| |

• | Events related to particular customers or asset types |

| |

• | Asset or portfolio sale decisions by management |

Competition could result in decreased profitability.

We operate in a highly competitive business environment. In certain cases, our competitors are larger than we are and have greater financial resources, higher credit ratings, and a lower cost of capital. These factors may enable our competitors to offer leases to customers at lower rates than we can provide, thus negatively impacting our profitability, asset utilization and investment volume.

Risks related to our international operations and expansion into new geographic markets could adversely affect our business, financial condition, and operating results.

We generate a significant amount of our net income outside the United States. In recent years, we have increased our focus on international rail growth and expansion into select emerging markets as a means to grow and diversify earnings. Our foreign operations and international expansion strategy are subject to the following risks associated with international operations:

| |

• | Noncompliance with US laws affecting operations outside of the United States, such as the Foreign Corrupt Practices Act |

| |

• | Noncompliance with a variety of foreign laws and regulations |

| |

• | Failure to properly implement changes in tax laws and the interpretation of those laws |

| |

• | Failure to develop and maintain data management practices that comply with laws related to cybersecurity, privacy, data localization, and data protection |

| |

• | Fluctuations in currency values |

| |

• | Sudden changes in foreign currency exchange controls |

| |

• | Discriminatory or conflicting fiscal policies |

| |

• | Difficulties enforcing contractual rights or foreclosing to obtain the return of our assets in certain jurisdictions |

| |

• | Uncollectible accounts and longer collection cycles that may be more prevalent in foreign countries |

| |

• | Ineffective or delayed implementation of appropriate controls, policies, and processes across our diverse operations and employee base |

| |

• | Imposition of sanctions against countries where we operate or specific companies or individuals with whom we do business |

| |

• | Nationalization or confiscation of assets by foreign governments, and imposition of additional or new tariffs, quotas, trade barriers, and similar restrictions on our operations outside the United States |

We have been and may continue to be involved in various types of litigation.

The nature of our business and our assets potentially exposes us to significant personal injury and property damage claims and litigation, environmental claims, or other types of lawsuits inside and outside the US. Customers may use certain types of our railcars to transport crude oil and other hazardous materials, and an accident involving a railcar carrying such materials could lead to litigation and subject us to significant liability, particularly where the accident involves serious personal injuries or the loss of life. Our failure to maintain railcars in compliance with governmental regulations and industry rules could also expose us to fines and claims for personal injury, property damage, and environmental damage. In some jurisdictions, an accident can give rise to both civil and criminal liabilities for us and, in some cases, our employees. In the event of an unfavorable outcome, we could be subject to substantial damages, including criminal penalties and fines, and our employees who are named as criminal defendants in any such litigation may be subject to incarceration and fines. A substantial adverse judgment against us could have a material effect on our financial position, results of operations, cash flows, and reputation.

Our rail and marine assets and operations are subject to various laws, rules, and regulations. If these laws rules, and regulations change or we fail to comply with them, it could have a significant negative effect on our business and profitability.

Our rail and marine operations are subject to various laws, rules, and regulations administered by authorities in jurisdictions where we do business. In North America, our railcar and locomotive fleet and operations are subject to safety, operations, maintenance, and mechanical standards, rules, and regulations enforced by various federal and state agencies and industry organizations, including the US Department of Transportation, the Federal Railroad Administration, the Pipeline and Hazardous Materials Safety Administration of the US Department of Transportation, Transport Canada, and the Association of American Railroads. State and provincial agencies regulate some health and safety matters related to rail operations not otherwise preempted by federal law. Our business and railcar and locomotive fleet may be adversely impacted by new rules or regulations, or changes to existing rules or regulations, which could require additional maintenance or substantial modification or refurbishment of our railcars, or could make certain types of railcars inoperable or obsolete or require them to be phased out prior to the end of their useful lives. In addition, violations of these rules and regulations can result in substantial fines and penalties, including potential limitations on operations or forfeitures of assets.

Similarly, our marine assets and operations are subject to rules and regulations relating to safety, US citizen ownership requirements, emissions, ballast discharges, and other environmental and operational matters enforced by various federal and state agencies, including the Maritime Administration of the US Department of Transportation, the US Coast Guard, and the US Environmental Protection Agency. If we fail to comply with these rules and regulations, we could be prohibited from operating or leasing marine assets in the US market, and under certain circumstances, could incur severe fines and penalties, including potential limitations on operations or forfeitures of assets.

In addition, our foreign operations are subject to the jurisdiction of authorities in countries where we do business. If we fail to comply with these laws, rules, and regulations, or if they change in the future, the use of our assets could be restricted, or the economic value of our assets may be reduced. These restrictions or reductions could lead to loss of revenue or cause us to incur significant expenses to comply with laws, rules, and regulations, thereby increasing operating expenses. Certain changes to or actions by authorities under existing laws, rules, and regulations, or actions, could result in the obsolescence of various assets or impose compliance costs that are significant enough to render those assets economically obsolete.

We may not be able to obtain cost-effective insurance.

We manage our exposure to risk, in part, by purchasing insurance. There is no guarantee that cost-effective insurance will consistently be available. If insurance coverage becomes prohibitively expensive, we could be forced to reduce our coverage amount and increase the amount of self-insured risk we retain, thereby increasing our exposure to uninsured adverse judgments and other losses and liabilities that could have a material effect on our financial position, results of operations and cash flows.

We are subject to extensive environmental regulations and the costs of remediation may be material.

We are subject to extensive federal, foreign, state, and local environmental laws and regulations concerning, among other things, the discharge of hazardous materials and remediation of contaminated sites. In addition, some of our properties, including those previously owned or leased, have been used for industrial purposes, which may have resulted in discharges onto these properties. Environmental liability can extend to previously owned or operated properties in addition to properties we currently own or use. Additionally, we could incur substantial costs, including cleanup costs, fines and costs arising out of third-party claims for property or natural resource damage and personal injury as a result of violations of or liabilities under environmental laws and regulations in connection with our or our lessees’ current or historical operations. Under some environmental laws in the United States and certain other countries, the owner of a leased railcar may be liable for environmental damage, cleanup or other costs in the event of a spill or discharge of material from a railcar without regard to the owner's fault. We routinely assess environmental liabilities, including our potential obligations and commitments for remediation of contaminated sites and the possible amount of recoveries from other responsible parties. Due to the regulatory complexities, risk of unidentified contaminants on our properties and the potential liability for the operations of our lessees, it is possible environmental and remediation costs may be materially different from the costs we have estimated.

The fair market value of our long-lived assets may differ from the value of those assets reflected in our financial statements.

Our assets primarily consist of long-lived assets such as railcars, marine vessels, and other equipment. The carrying value of these assets in our financial statements may sometimes differ from their fair market value. These valuation differences may be positive or negative and could be material based on market conditions and demand for certain assets.

Our assets may become obsolete.

In addition to changes in laws, rules, and regulations that may make assets obsolete, changes in the preferred method our customers use to ship their products, changes in demand for particular products, or a shift by customers toward purchasing assets rather than leasing them may adversely impact us. Our customers' industries are driven by dynamic market forces and trends, which are influenced by economic and political factors. Changes in our customers' markets may significantly affect demand for our rail and marine assets. A reduction in customer demand or change in customers' preferred method of product transportation could result in the economic obsolescence of the assets leased by those customers.

Unfavorable conditions on the Great Lakes could impact business operations, which could result in increases in costs and decreases in revenues.

The success of our ASC subsidiary depends on the efficiency of its operations on the Great Lakes. Disruptions at the Sault St. Marie locks or severe weather conditions, such as high wind and ice formation, could cause significant business interruptions or shortened sailing seasons. Additionally, low water levels and vessel draft restrictions may restrict the volume that ASC's vessels can transport per trip. These conditions could negatively impact our results of operations through increased operating costs or decreased revenues.

We are subject to the inherent risks of our affiliate investments.

We are indirectly exposed to risks through our ownership interests in affiliates, as our affiliates may experience many of the same risks discussed in this "Risk Factors" section. Rolls-Royce manages our RRPF affiliates, and we sometimes retain third parties to manage assets we own directly, such as our ocean-going vessels. Poor business or financial results of these affiliates, or the third parties who manage, operate, or invest along with us in these affiliates, could negatively impact our financial results. Additionally, when a third party manages or operates an affiliate or asset, we may not have control over operational matters related to the affiliate or asset, which could result in actions that have an adverse economic impact on the affiliate, the asset, or GATX or could expose GATX to potential liability.

We may be affected by climate change or market or regulatory responses to climate change.

Changes in laws, rules, and regulations, or actions by authorities under existing laws, rules, or regulations, to address greenhouse gas emissions and climate change could negatively impact our customers and business. For example, restrictions on emissions could significantly increase costs for our customers whose production processes require significant amounts of energy. Customers' increased costs could reduce their demand to lease our assets. In addition, railcars in our fleet that are used to carry fossil fuels, such as coal and petroleum, could see reduced demand if new government regulations mandate a reduction in fossil fuel consumption. New government regulations could also increase our marine and other operating costs and compliance with those regulations could be costly. Potential consequences of laws, rules, or regulations addressing climate change could have an adverse effect on our financial position, results of operations, and cash flows.

A small number of shareholders could significantly influence our business.

Five shareholders collectively control more than 50% of our outstanding common stock. Accordingly, a small number of shareholders could affect matters that require shareholder approval, such as the election of directors and the approval of significant business transactions.

Changes to assumptions used to calculate post-retirement costs, increases in funding requirements, and investment losses in pension funds could adversely affect our results of operations.

We calculate our pension and other post-retirement costs using various assumptions, such as discount rates, long-term return on plan assets, salary increases, health care cost trend rates, and other factors. Changes to any of these assumptions could adversely affect our financial position and results of operations. Periods of low interest rates reduce the discount rate we use to calculate our funding obligations, which may increase our funding requirements. Additionally, changes to laws, regulations, or rules could require us to increase funding requirements or to compensate for investment losses in pension plan assets. If we were forced to increase contributions to our pension plans, our financial position, results of operations, and cash flows could be negatively affected.

Changes in the mix of earnings in the US and foreign countries could adversely affect our effective tax rate.

We are subject to taxes in the United States and various foreign jurisdictions. As a result, our effective tax rate could be adversely affected by changes in the mix of earnings in the United States and foreign countries with differing statutory tax rates. Our effective tax rate could also be adversely affected by changes in tax laws, material audit assessments, or legislative changes that impact statutory tax rates, which could include an impact on previously-recorded deferred tax assets and liabilities.

Our allowance for losses may be inadequate.

Our allowance for losses on reservable assets may not be adequate to cover credit losses in our portfolio if unexpected adverse changes occur in macroeconomic conditions or if discrete events adversely affect specific customers, industries, or markets. If the credit quality of our customer base materially deteriorates, it may require us to incur additional credit losses and our financial position or results of operations could be negatively impacted.

We cannot predict with certainty the impact that inflation or deflation will have on our financial results.

The timing and duration of the effects of inflation are unpredictable and depend on market conditions and economic factors. Inflation in lease rates as well as inflation in residual values for rail and marine assets has historically benefited our financial results. However, these benefits may be offset by increases in the costs for goods and services we purchase, including salaries and wages, health care costs, supplies, utilities, maintenance and repair services, and materials, as well as increased financing costs. Significant increases in our cost of goods and services could adversely impact our financial performance. Conversely, a period of prolonged deflation could negatively impact our lease rate pricing, residual values, and asset remarketing opportunities. These negative impacts of deflation may be offset by decreases to our costs for goods and services, including those listed above.

We could be adversely affected by United States and global political conditions, including acts or threats of terrorism or war.

We may be adversely affected by national and international political developments, instability, and uncertainties, including political unrest and threats of terrorist attacks, which could lead to the following:

| |

• | Legislation or regulatory action directed toward improving the security of railcars and marine vessels against acts of terrorism, which could affect the construction or operation of railcars and marine vessels |

| |

• | A decrease in demand for rail and marine services |

| |

• | Lower utilization of rail and marine equipment |

| |

• | Lower rail lease and marine charter rates |

| |

• | Impairments of rail and marine assets or capital market disruption, which may raise our financing costs or limit our access to capital |

| |

• | Liability or losses resulting from acts of terrorism involving our assets |

| |

• | A downturn in the commercial aviation industry, which could lead to adverse financial results for our RRPF affiliates. |

Depending upon the severity, scope, and duration of these circumstances, the impact on our financial position, results of operations, and cash flows could be material.

We rely on technology in all aspects of our business operations. If we are unable to adequately maintain and secure our IT infrastructure from cybersecurity threats and related disruptions, our business could be negatively impacted.

We rely on our IT infrastructure to process, transmit, and store electronic information that is critical to all aspects of our business operations, including employee and customer information. All IT systems are vulnerable to security threats, such as hacking, viruses, malicious software, and other unlawful attempts to disrupt or gain access to these systems. Although we have taken steps to mitigate these risks, we may not be able to prevent breaches of our IT infrastructure, some of which is managed by third parties. Breaches of our IT infrastructure could lead to disruptions in our business, potentially including the theft, destruction, loss, misappropriation, or release of confidential employee and customer information stored on our IT systems or confidential data or other business information and subject us to potential lawsuits or other material legal liabilities. These disruptions could adversely affect our operations, financial position, and results of operations.

Our internal control over financial accounting and reporting may not detect all errors or omissions in the financial statements.

If we fail to maintain adequate internal controls over financial accounting, we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 and related regulations. Although management has concluded that adequate internal control procedures are in place, no system of internal control provides absolute assurance that the financial statements are accurate and free of error.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Information regarding the general character of our properties is included in Item 1, “Business” of this Form 10-K.

As of December 31, 2015, our locations of operations were as follows:

|

| | |

| GATX Headquarters | |

| | |

| Chicago, Illinois | |

| | |

Rail North America |

| | |