Exhibit 99.1

GAP INC. REPORTS FIRST QUARTER RESULTS

43% year-over-year sales decline driven by COVID-19 related store closures

First quarter online sales increased 13% year-over-year,

with over 100% year-over-year online sales growth in the month of May

with over 100% year-over-year online sales growth in the month of May

55% percent of North American company-operated fleet currently open

with approximately 90% of fleet offering convenient omni-channel order fulfillment options

with approximately 90% of fleet offering convenient omni-channel order fulfillment options

SAN FRANCISCO – June 4, 2020 – Gap Inc. (NYSE: GPS), the largest specialty apparel company and second largest apparel e-commerce business in the U.S., which operates a portfolio of lifestyle brands, including Old Navy, Gap, Athleta and Banana Republic, reported its financial results for the first quarter of fiscal year 2020, ending May 2.

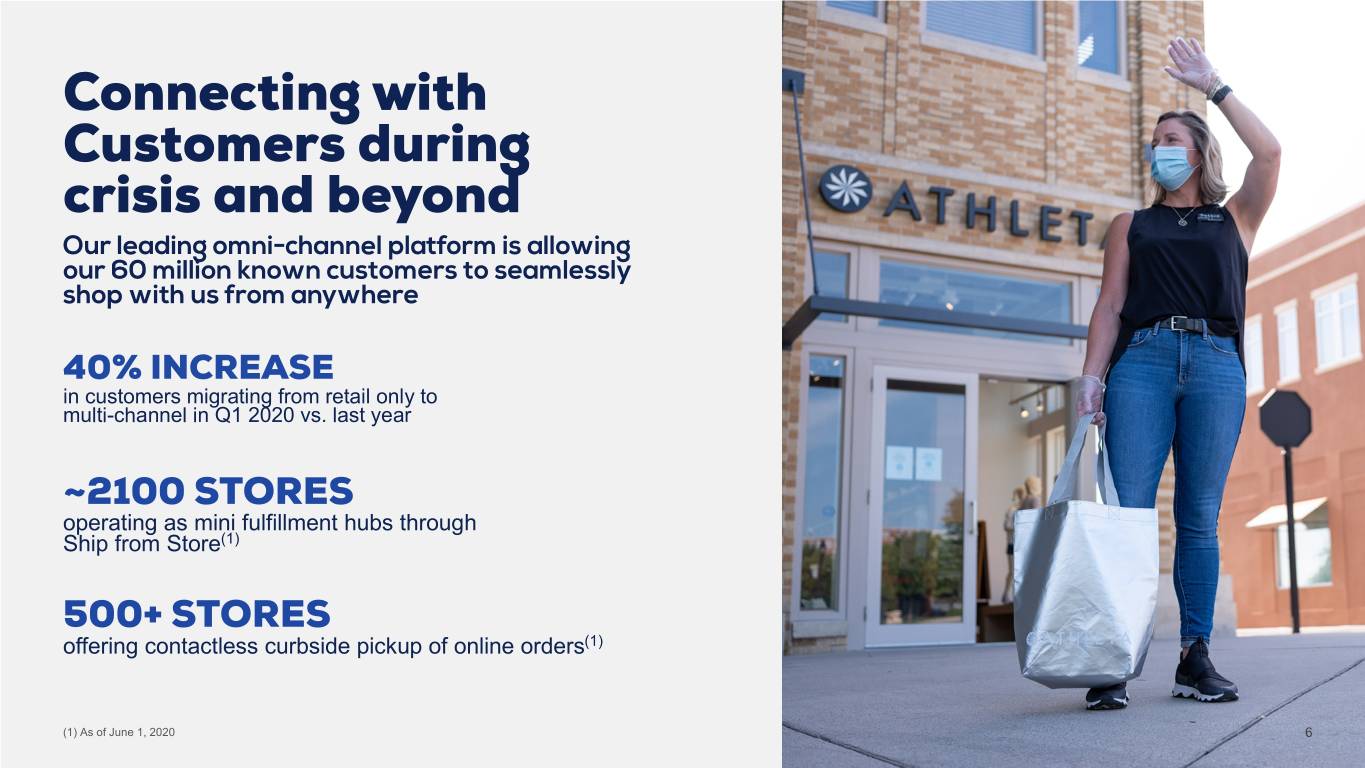

The Company’s first quarter results were impacted by the temporary closure of approximately 90% of its global store fleet starting on March 19. During the quarter, the Company enacted several measures to strengthen its cash position, as well as secured additional financing early in the second quarter, putting the Company in a solid financial position to weather the pandemic. The Company also leveraged its omni capabilities to continue to serve customer demand online through its scaled e-commerce platform.

“Our teams' ability to pivot quickly and lean into our strong online business resulted in an encouraging 40% online sales growth in April. While net sales and stores sales continued to reflect material declines in May as a result of closures, we saw over 100% growth in online sales during the month,” said Sonia Syngal, President and CEO of Gap Inc. “This online momentum, enabled by new omni-capabilities that have expanded the way customers can shop with us, leaves us well-positioned to fuel our brands going forward."

Syngal added, “Today we have more than 1,500 stores open in North America, ahead of plan, and as stay at home restrictions ease in many markets, we expect to have the vast majority of our North American stores re-opened in June. We are optimistic that the actions we've taken will provide a stable foundation as we navigate near-term uncertainty and refashion Gap Inc. for long-term growth.”

First Quarter 2020 Results

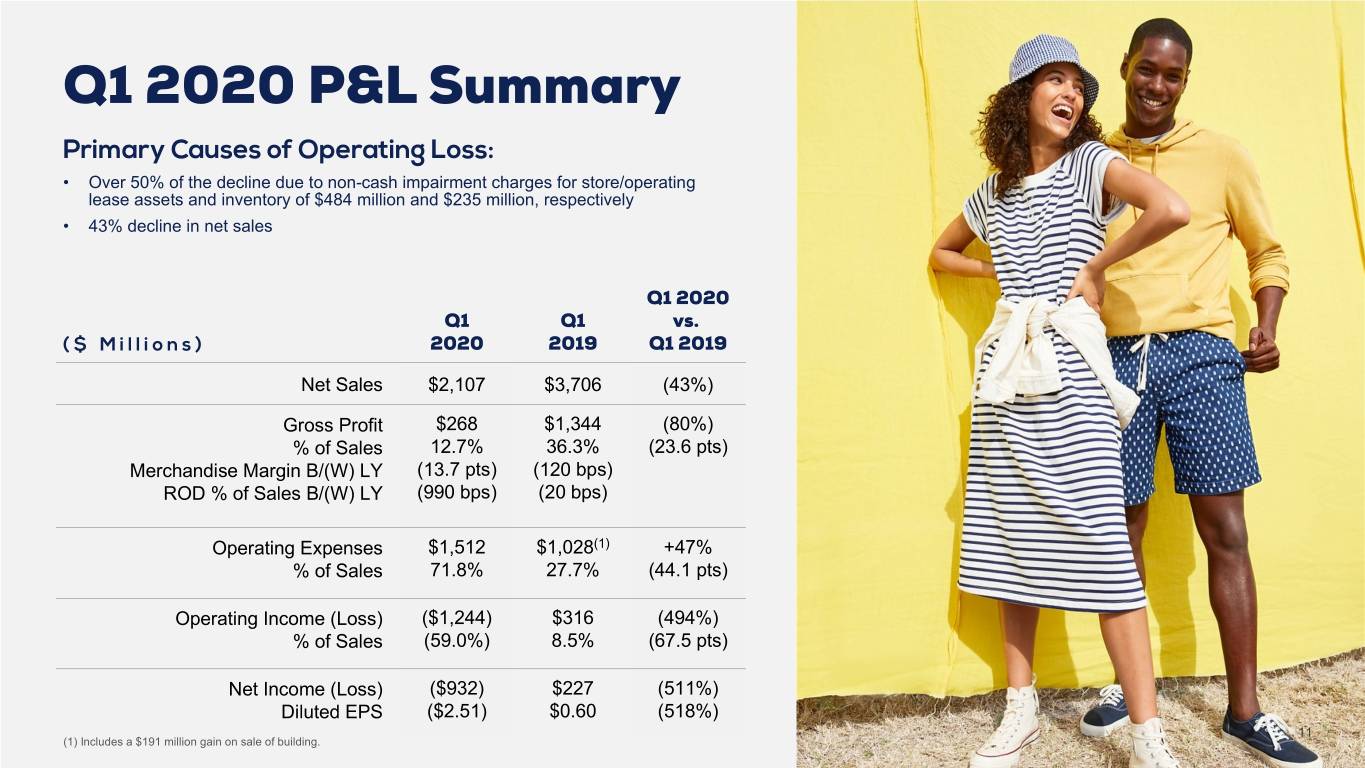

The Company noted first quarter results reflect the significant impacts of the global pandemic, including lost sales and corresponding merchandise margin from the temporary store closures, a non-cash impairment charge of $484 million related to the Company’s store assets and operating lease assets, as well as a $235 million non-cash inventory impairment charge.

The Company’s first quarter fiscal year 2020 net sales were down 43% year-over-year, as solid momentum in the first 35 days of the quarter was more than offset by meaningful deceleration in demand after temporary store closures beginning in mid-March. In response, the Company continued to serve customer demand online through its scaled e-commerce platform, which at over $4 billion in net sales in fiscal year 2019, represented about one quarter of the Company’s sales for that fiscal year. The Company’s first quarter 2020 online sales channel increased 13% compared to the first quarter fiscal year 2019, with the Company noting continued acceleration of online growth following the end of the quarter.

The Company’s first quarter 2020 store sales decreased 61% compared to the first quarter fiscal 2019, driven by temporary store closures.

Additionally, the Company is not providing comparable sales results for the quarter because the metric is not meaningful as a result of temporary store closures in the period. Instead, the Company has provided net sales which consists of store sales and online sales, by brand. Store sales primarily include sales made at Company-operated and franchise stores. Online sales primarily include sales made through the Company’s online e-commerce channels, including ship-from-store sales, buy online pick-up in store sales, and order-in-store sales. First quarter net sales details appear in the tables at the end of this press release.

Net sales by brand for the first quarter 2020 compared to the first quarter 2019 were as follows:

• | Old Navy Global: Net sales were down 42%; store sales were down 60% with online sales up 20%. Since the onset of the COVID-19 pandemic, Old Navy has seen a meaningful acceleration in its digital business. The Company noted it expects the off-mall, strip real estate that makes up approximately 75% of the fleet to be an advantage as customers return to stores and expects traffic in these locations to ramp up more quickly than other formats. |

• | Gap Global: Net sales were down 50%; store sales were down 64% with online sales down 5%. Prior to the onset of the pandemic, Gap brand performance continued to be pressured by inconsistent execution of product and marketing messages. However, the Company noted the brand did experience steady improvements in its online performance throughout the quarter, attributable to the Company’s strategy to migrate customers online as the brand’s fleet rationalization efforts continue. |

• | Banana Republic Global: Net sales were down 47%; store sales were down 61% with online sales down 2%. While the move to casual fashion during the stay-at-home requirements has benefited other brands in Gap Inc.’s portfolio, this shift left Banana Republic disadvantaged in its product mix. As a result, Banana Republic is taking aggressive action to adjust to consumer preferences and improve inventory mix. |

• | Athleta: Net sales were down 8%; store sales were down 50% with online sales up 49%. Customer response to Athleta was strong given the values-driven active and lifestyle space the brand participates in as well as the brand’s deep customer engagement through its powerful omni-channel model. |

Gross margin was 12.7%, reflecting a $235 million non-cash inventory impairment charge, rent and occupancy deleverage associated with store closures, and increased promotional activity. As previously disclosed, beginning in April, the Company suspended rent payments for closed stores. While the Company remains in active and ongoing discussions with its landlords, it noted that first quarter gross margin reflects the cost of rent payments, which are being accrued for accounting purposes.

Operating loss was $1.2 billion. This reflects the decline in gross margin, as well as a non-cash impairment charge of $484 million related to the Company’s stores to reduce the carrying amount of the store assets and the corresponding operating lease assets to their fair values, which have dramatically declined as a result of the pandemic. The Company noted that as part of its ongoing specialty fleet optimization efforts, the Company has undertaken a strategic review of its real estate portfolio to further advance its long-term strategic priorities that include a smaller, healthier fleet, particularly as it relates to its Gap brand and Banana Republic specialty fleets.

The effective tax rate was 26.0% for the first quarter of fiscal year 2020. The first quarter effective tax rate reflects benefits associated with the enactment of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, offset by the impact of the Company’s geographical mix of pre-tax earnings.

Diluted loss per share was $2.51.

Balance Sheet

The Company ended first quarter fiscal year 2020 with $2.2 billion in merchandise inventory, down about 1% year over year. Excluding Pack & Hold Inventory that is being held for introduction into the marketplace in the summer of 2021 and will be included in the second quarter ending inventory balance, the Company expects second quarter ending inventory to be down low to mid-single digits.

Short-term debt increased from $0 to $500 million, reflecting the Company’s full drawdown of its revolving credit facility. Long-term debt remained unchanged at $1.25 billion.

Early in the second quarter, the Company issued $2.250 billion of senior secured notes. A portion of the proceeds of the notes will be used to redeem the previously issued $1.250 billion unsecured notes due April 2021. The Company also repaid the outstanding $500 million borrowed under its prior revolving credit facility. In addition, the Company secured a $1.868 billion asset-based revolving credit facility that replaced its existing unsecured revolving credit facility. As of today’s earnings release, the $1.868 billion has not been accessed and remains available for Company use. The Company currently believes this new capital structure provides sufficient liquidity to navigate the COVID-19 pandemic.

The Company ended the quarter with 3,911 store locations in 42 countries, of which 3,313 were Company-operated.

Cash Flow

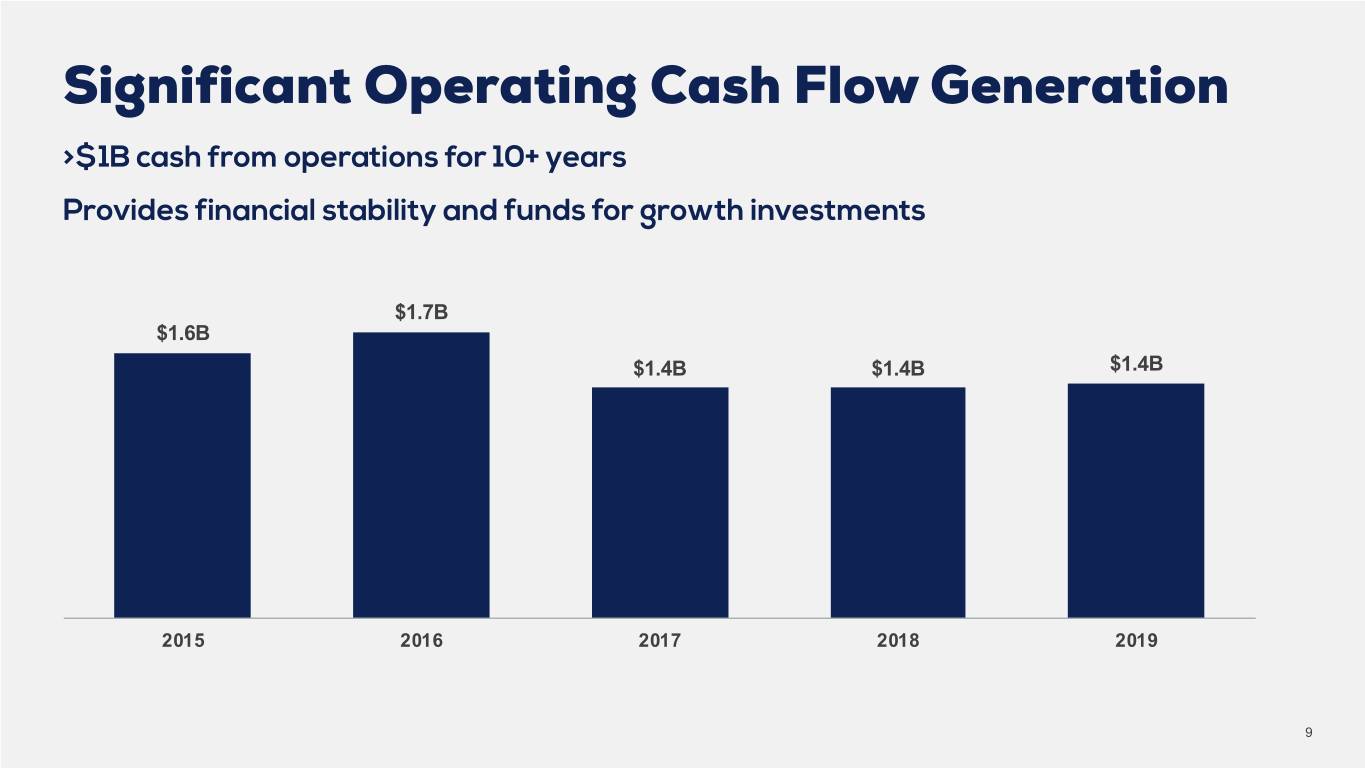

The Company ended first quarter fiscal year 2020 with $1.1 billion in cash, cash equivalents, and short-term investments compared to $1.7 billion at the beginning of the quarter. Cash flow performance was impacted by the sales decline caused by the pandemic, partially offset by $500 million borrowed during the quarter under the Company’s unsecured revolving credit facility.

The Company’s first quarter cash flow was negatively impacted by the temporary closure of its stores due to the COVID-19 pandemic, while still incurring the vast majority of its merchandise costs, store payroll and other operating expenses. Following North American store closures on March 19th, the Company executed several measures to strengthen its cash position including realigning inventory purchases to expected demand, reducing expenses, suspending rent payments, extending payment terms, reducing headcount across its corporate functions, reducing capital expenditures, deferring its previously declared first quarter dividend, suspending its quarterly cash dividend and share repurchases for the remainder of the fiscal year and securing new financing arrangements. Following these actions, the Company believes it is in a solid financial position to navigate through the continuing crisis and continue investing in its business.

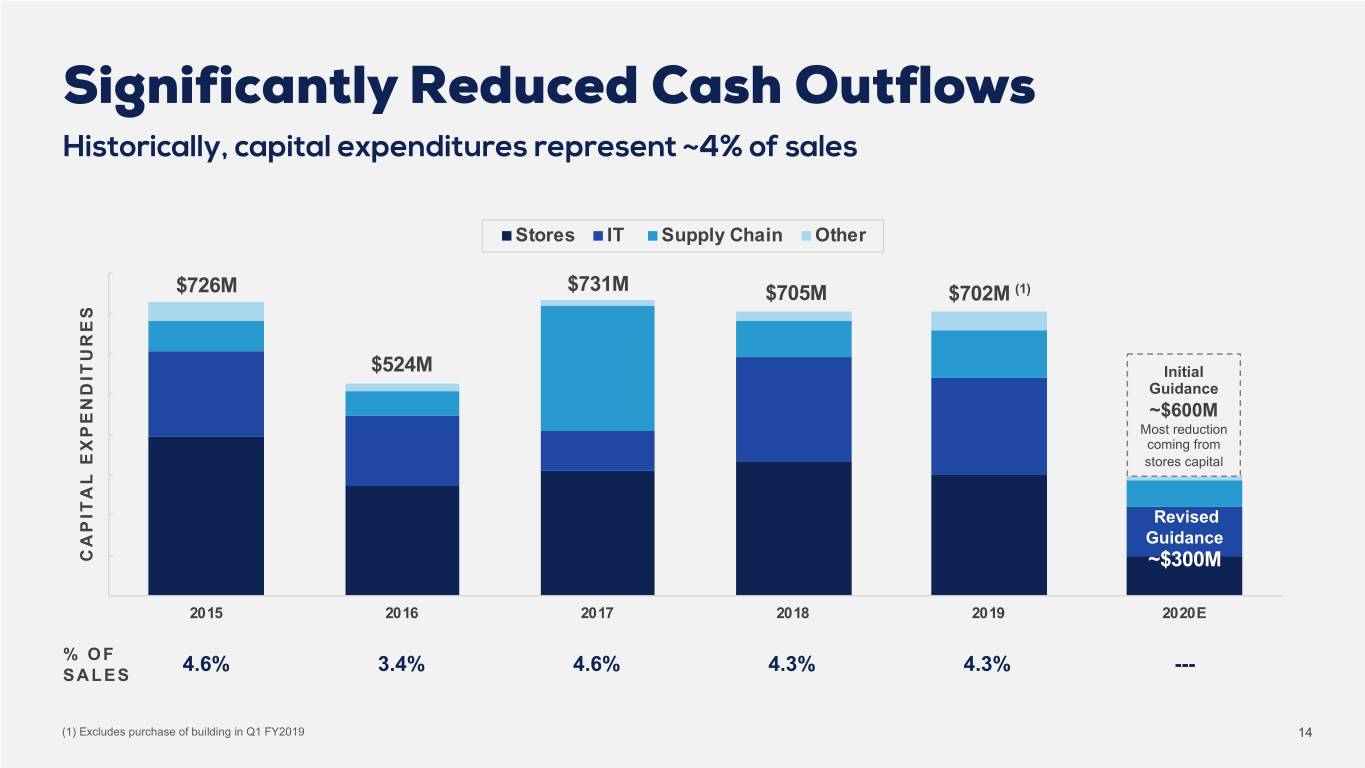

Year-to-date free cash flow, defined as net cash from operating activities less purchases of property and equipment, was negative $1.1 billion compared with negative $136 million last year. Year-to-date capital expenditures were $122 million compared to $165 million last year. The variance in year-over-year free cash flow was due to the change in operating cash flow, caused by the sales decline as a result of the pandemic.

As part of the Company’s response to the COVID-19 pandemic, the Company plans to reduce its capital expenditures for the fiscal year by approximately 50%, and now expects capital spending to be approximately $300 million for fiscal year 2020, which includes about $30 million of expansion costs related to its Ohio distribution center.

Please see the reconciliation of free cash flow, a non-GAAP financial measure, in the tables at the end of this press release.

2020 Financial Outlook and Second Quarter Business Update

Beginning May 9, 2020 the Company started to reopen stores in select states and countries in accordance with official COVID-19 recommendations provided by the World Health Organization (WHO), Centers for Disease Control (CDC), Public Health Agency of Canada, and local government guidelines, as well as the Retail Industry Leaders Association (RILA) and in partnership with industry peers to implement a number of health and safety measures that will support its teams and customers with a safe and seamless shopping experience.

“While we are pleased that store traffic and productivity is exceeding expectations, particularly at Old Navy and Athleta, we continue to plan conservatively as significant uncertainty remains ahead.” said Katrina O’Connell, EVP and CFO Gap Inc. “We intend to lean into our best-in-class supply chain and advantaged omni-channel capabilities to respond as customer demand becomes clearer.”

Given the high level of uncertainty in the current environment, the Company is not providing fiscal year net sales or earnings outlooks at this time.

Webcast and Conference Call Information

Tina Romani, Senior Director of Investor Relations at Gap Inc., will host a summary of the Company’s first quarter fiscal year 2020 results during a conference call and webcast from approximately 2:00 p.m. to 3:00 p.m. Pacific Time today. Ms. Romani will be joined by Sonia Syngal, Gap Inc. President and Chief Executive Officer, and Katrina O’Connell, Gap Inc. Executive Vice President and Chief Financial Officer.

The conference call can be accessed by calling 1-855-5000-GPS or 1-855-500-0477 (participant passcode: 1771676). International callers may dial 1-323-794-2078. The webcast can be accessed at the Investors section of www.gapinc.com.

Forward-Looking Statements

This press release and related conference call and webcast contain forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Words such as “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan,” “project,” and similar expressions also identify forward-looking statements. Forward-looking statements include statements regarding the following: impact of off-mall, strip real estate, including traffic; continued rationalization of our store fleet, including a smaller, healthier fleet, particularly as it relates to Gap brand and Banana Republic specialty fleets; inventory levels at the end of the second quarter and through the rest of fiscal year 2020; use of proceeds from the $2.250 billion senior secured notes; new capital structure providing sufficient liquidity to navigate the COVID-19 pandemic; capital expenditures for fiscal year 2020; the timing of store reopenings in North America; the expectation of outsized sales growth in our online channel; ongoing discussions and negotiations with our landlords, and impact of any resulting resolutions; renegotiating our existing leases while simultaneously executing store closure plans; maintaining inventory flexibility and responsiveness while navigating uncertain retail environment; the benefit of holding select Summer and Fall inventory until next year’s selling season; considering new store openings, largely for Athleta and Old Navy; impact to gross margin

from lower depreciation and amortization expense in fiscal year 2020 and on an annualized basis; net savings from corporate headquarters reductions in fiscal year 2020 and on an annualized basis; store operating costs; cash burn in the second quarter; benefits from capital and expense actions; sales trends through fiscal year 2020; impact of store reopenings on sales, operating leverage, and impairments, especially related to inventory; continued online growth; gross and operating margin trends through fiscal year 2020; fulfillment costs in the second quarter.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause the Company’s actual results to differ materially from those in the forward-looking statements. These factors include, without limitation, the following risks, any of which could have an adverse effect on the Company’s financial condition, results of operations, and reputation: the risk that additional information may arise during the Company’s close process or as a result of subsequent events that would require the Company to make adjustments to its financial information; the overall global economic environment and risks associated with the COVID-19 pandemic; the risk that we or our franchisees will be unsuccessful in gauging apparel trends and changing consumer preferences; the highly competitive nature of our business in the United States and internationally; the risk that changes in global economic conditions or consumer spending patterns could adversely impact our results of operations; engaging in or seeking to engage in strategic transactions that are subject to various risks and uncertainties; the risk that failure to maintain, enhance and protect our brand image could have an adverse effect on our results of operations; the risk that the failure to manage key executive succession and retention and to continue to attract qualified personnel could have an adverse impact on our results of operations; the risk that our investments in customer, digital, and omni-channel shopping initiatives may not deliver the results we anticipate; the risk that if we are unable to manage our inventory effectively, our gross margins will be adversely affected; the risks to our business, including our costs and supply chain, associated with global sourcing and manufacturing; the risk that we are subject to data or other security breaches that may result in increased costs, violations of law, significant legal and financial exposure, and a loss of confidence in our security measures, which could have an adverse effect on our results of operations and our reputation; the risk that a failure of, or updates or changes to, our information technology systems may disrupt our operations; the risks to our efforts to expand internationally, including our ability to operate in regions where we have less experience; the risk that we or our franchisees will be unsuccessful in identifying, negotiating, and securing new store locations and renewing, modifying, or terminating leases for existing store locations effectively; the risks to our reputation or operations associated with importing merchandise from foreign countries, including failure of our vendors to adhere to our Code of Vendor Conduct; the risk that our franchisees’ operation of franchise stores is not directly within our control and could impair the value of our brands; the risk that trade matters could increase the cost or reduce the supply of apparel available to us and adversely affect our business, financial condition, and results of operations; the risk that foreign currency exchange rate fluctuations could adversely impact our financial results; the risk that comparable sales and margins will experience fluctuations; the risk that changes in our credit profile or deterioration in market conditions may limit our access to the capital markets and adversely impact our financial position or our business initiatives; the risk that changes in the regulatory or administrative landscape could adversely affect our financial condition and results of operations; the risk that natural disasters, public health crises (similar to and including the ongoing COVID-19 pandemic), political crises, negative global climate patterns, or other catastrophic events could adversely affect our operations and financial results, or those of our franchisees or vendors; the risk that reductions in income and cash flow from our credit card arrangement related to our private label and co-branded credit cards could adversely affect our operating results and cash flows; the risk that the adoption of new accounting pronouncements will impact future results; the risk that we do not repurchase some or all of the shares we anticipate purchasing pursuant to our repurchase program; and the risk that we will not be successful in defending various proceedings, lawsuits, disputes, and claims. .

Additional information regarding factors that could cause results to differ can be found in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on April 23, 2020, as well as the Company’s subsequent filings with the Securities and Exchange Commission.

These forward-looking statements are based on information as of June 4, 2020. The Company assumes no obligation to publicly update or revise its forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

About Gap Inc.

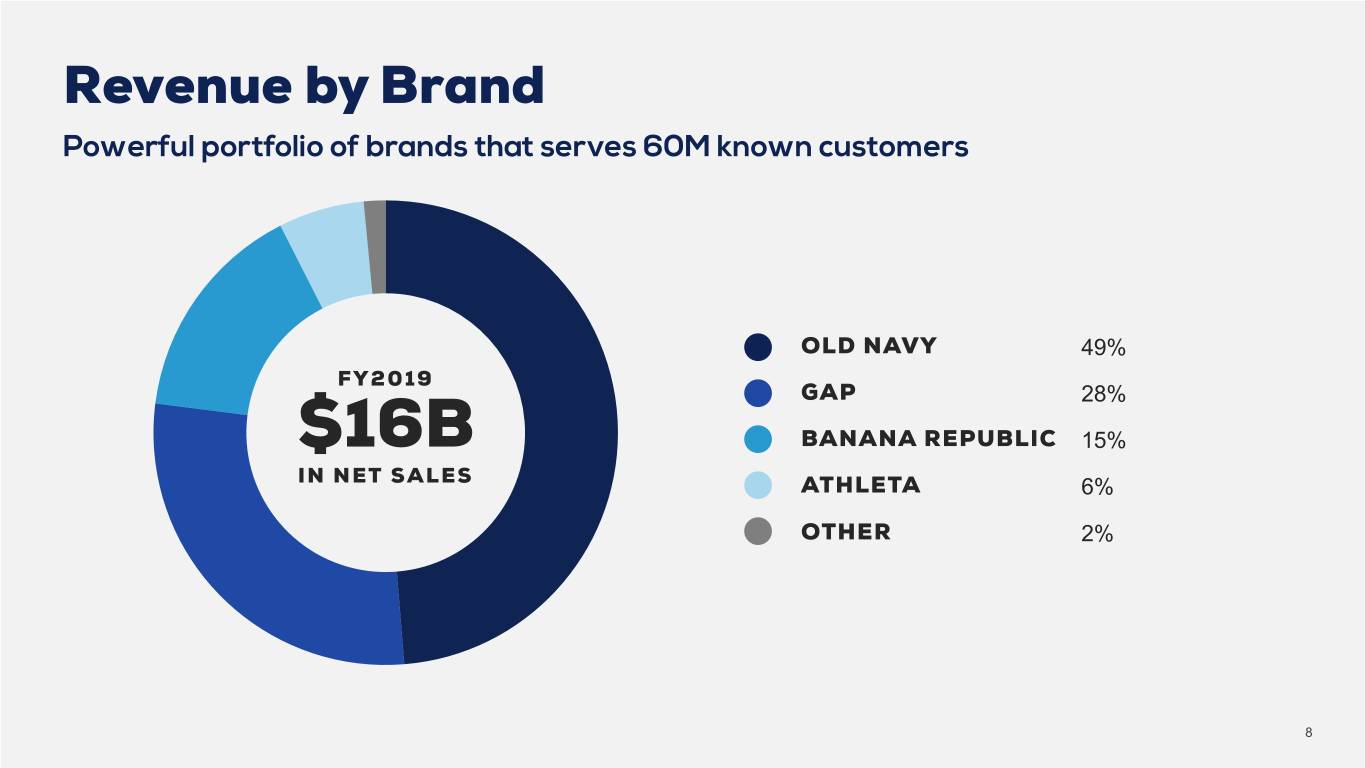

Gap Inc. is a leading global retailer offering clothing, accessories, and personal care products for men, women, and children under the Old Navy, Gap, Banana Republic, Athleta, Intermix, Janie and Jack, and Hill City brands. Fiscal year 2019 net sales were $16.4 billion. Gap Inc. products are available for purchase in more than 90 countries worldwide through Company-operated stores, franchise stores, and e-commerce sites. For more information, please visit www.gapinc.com.

Investor Relations Contact:

Tina Romani

(415) 427-5264

Investor_relations@gap.com

Media Relations Contact:

Sandy Goldberg

(415) 427-3022

Press@gap.com

The Gap, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

UNAUDITED

($ in millions) | May 2, 2020 | May 4, 2019 | |||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 1,028 | $ | 941 | |||

Short-term investments | 51 | 272 | |||||

Merchandise inventory | 2,217 | 2,242 | |||||

Other current assets | 920 | 757 | |||||

Total current assets | 4,216 | 4,212 | |||||

Property and equipment, net | 2,945 | 3,129 | |||||

Operating lease assets | 4,851 | 5,732 | |||||

Other long-term assets | 698 | 547 | |||||

Total assets | $ | 12,710 | $ | 13,620 | |||

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

Current liabilities: | |||||||

Revolving credit facility | $ | 500 | $ | — | |||

Accounts payable | 971 | 994 | |||||

Accrued expenses and other current liabilities | 1,051 | 882 | |||||

Current portion of operating lease liabilities | 886 | 929 | |||||

Income taxes payable | 23 | 26 | |||||

Total current liabilities | 3,431 | 2,831 | |||||

Long-term liabilities: | |||||||

Long-term debt | 1,250 | 1,249 | |||||

Long-term operating lease liabilities | 5,331 | 5,597 | |||||

Lease incentives and other long-term liabilities | 381 | 372 | |||||

Total long-term liabilities | 6,962 | 7,218 | |||||

Total stockholders' equity | 2,317 | 3,571 | |||||

Total liabilities and stockholders' equity | $ | 12,710 | $ | 13,620 | |||

The Gap, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

UNAUDITED

13 Weeks Ended | |||||||

($ and shares in millions except per share amounts) | May 2, 2020 | May 4, 2019 | |||||

Net sales | $ | 2,107 | $ | 3,706 | |||

Cost of goods sold and occupancy expenses | 1,839 | 2,362 | |||||

Gross profit | 268 | 1,344 | |||||

Operating expenses | 1,512 | 1,028 | |||||

Operating income (loss) | (1,244 | ) | 316 | ||||

Interest, net | 15 | 14 | |||||

Income (loss) before income taxes | (1,259 | ) | 302 | ||||

Income taxes | (327 | ) | 75 | ||||

Net income (loss) | $ | (932 | ) | $ | 227 | ||

Weighted-average number of shares - basic | 372 | 379 | |||||

Weighted-average number of shares - diluted | 372 | 381 | |||||

Earnings (loss) per share - basic | $ | (2.51 | ) | $ | 0.60 | ||

Earnings (loss) per share - diluted | $ | (2.51 | ) | $ | 0.60 | ||

The Gap, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

UNAUDITED

13 Weeks Ended | |||||||

($ in millions) | May 2, 2020 (a) | May 4, 2019 (a) | |||||

Cash flows from operating activities: | |||||||

Net income (loss) | $ | (932 | ) | $ | 227 | ||

Depreciation and amortization | 130 | 138 | |||||

Impairment of operating lease assets | 360 | — | |||||

Impairment of store assets | 124 | — | |||||

Gain on sale of building | — | (191 | ) | ||||

Change in merchandise inventory | (79 | ) | (83 | ) | |||

Change in income taxes payable, net of receivables and other tax-related items | (322 | ) | 36 | ||||

Other, net | (221 | ) | (98 | ) | |||

Net cash provided by (used for) operating activities | (940 | ) | 29 | ||||

Cash flows from investing activities: | |||||||

Purchases of property and equipment | (122 | ) | (165 | ) | |||

Purchase of building | — | (343 | ) | ||||

Proceeds from sale of building | — | 220 | |||||

Purchases of short-term investments | (59 | ) | (69 | ) | |||

Proceeds from sales and maturities of short-term investments | 297 | 86 | |||||

Purchase of Janie and Jack | — | (69 | ) | ||||

Net cash provided by (used for) investing activities | 116 | (340 | ) | ||||

Cash flows from financing activities: | |||||||

Proceeds from revolving credit facility | 500 | — | |||||

Proceeds from issuances under share-based compensation plans | 6 | 10 | |||||

Withholding tax payments related to vesting of stock units | (7 | ) | (19 | ) | |||

Repurchases of common stock | — | (50 | ) | ||||

Cash dividends paid | — | (92 | ) | ||||

Net cash provided by (used for) financing activities | 499 | (151 | ) | ||||

Effect of foreign exchange rate fluctuations on cash, cash equivalents, and restricted cash | (8 | ) | — | ||||

Net decrease in cash, cash equivalents, and restricted cash | (333 | ) | (462 | ) | |||

Cash, cash equivalents, and restricted cash at beginning of period | 1,381 | 1,420 | |||||

Cash, cash equivalents, and restricted cash at end of period | $ | 1,048 | $ | 958 | |||

__________

(a) | For the thirteen weeks ended May 2, 2020 and May 4, 2019, total cash, cash equivalents, and restricted cash includes $20 million and $17 million, respectively, of restricted cash primarily recorded in other long-term assets on the Condensed Consolidated Balance Sheets. |

The Gap, Inc.

NON-GAAP FINANCIAL MEASURES

UNAUDITED

FREE CASH FLOW

Free cash flow is a non-GAAP financial measure. We believe free cash flow is an important metric because it represents a measure of how much cash a company has available for discretionary and non-discretionary items after the deduction of capital expenditures as we require regular capital expenditures to build and maintain stores and purchase new equipment to improve our business and infrastructure. We use this metric internally, as we believe our sustained ability to generate free cash flow is an important driver of value creation. However, this non-GAAP financial measure is not intended to supersede or replace our GAAP results.

13 Weeks Ended | |||||||

($ in millions) | May 2, 2020 | May 4, 2019 | |||||

Net cash provided by (used for) operating activities | $ | (940 | ) | $ | 29 | ||

Less: Purchases of property and equipment (a) | (122 | ) | (165 | ) | |||

Free cash flow | $ | (1,062 | ) | $ | (136 | ) | |

__________

(a) | Excludes purchase of building in the first quarter of fiscal 2019. |

The Gap, Inc.

NET SALES RESULTS

UNAUDITED

The following table details the Company’s first quarter net sales (unaudited):

($ in millions) | Old Navy Global | Gap Global | Banana Republic Global | Other (3) | Total | |||||||||||||||

13 Weeks Ended May 2, 2020 | ||||||||||||||||||||

U.S. (1) | $ | 949 | $ | 311 | $ | 245 | $ | 256 | $ | 1,761 | ||||||||||

Canada | 77 | 34 | 24 | — | 135 | |||||||||||||||

Europe | — | 54 | 3 | — | 57 | |||||||||||||||

Asia | 1 | 108 | 12 | — | 121 | |||||||||||||||

Other regions | 11 | 17 | 5 | — | 33 | |||||||||||||||

Total | $ | 1,038 | $ | 524 | $ | 289 | $ | 256 | $ | 2,107 | ||||||||||

($ in millions) | Old Navy Global | Gap Global | Banana Republic Global (2) | Other (4) | Total | |||||||||||||||

13 Weeks Ended May 4, 2019 | ||||||||||||||||||||

U.S. (1) | $ | 1,641 | $ | 608 | $ | 487 | $ | 286 | $ | 3,022 | ||||||||||

Canada | 128 | 69 | 47 | 1 | 245 | |||||||||||||||

Europe | — | 121 | 3 | — | 124 | |||||||||||||||

Asia | 10 | 233 | 26 | — | 269 | |||||||||||||||

Other regions | 20 | 21 | 5 | — | 46 | |||||||||||||||

Total | $ | 1,799 | $ | 1,052 | $ | 568 | $ | 287 | $ | 3,706 | ||||||||||

__________

(1) | U.S. includes the United States, Puerto Rico, and Guam. |

(2) | Banana Republic Global fiscal year 2019 net sales include Janie and Jack brand beginning March 4, 2019. |

(3) | Primarily consists of net sales for the Athleta, Intermix and Hill City brands. Beginning in fiscal year 2020, Janie and Jack net sales are also included. Net sales for Athleta for the thirteen weeks ended May 2, 2020 were $205 million. |

(4) | Primarily consists of net sales for the Athleta, Intermix, and Hill City brands as well as a portion of income related to our credit card agreement. Net sales for Athleta for the thirteen weeks ended May 4, 2019 were $233 million. |

The Gap, Inc.

REAL ESTATE

Store count, openings, closings, and square footage for our stores are as follows:

February 1, 2020 | 13 Weeks Ended May 2, 2020 | May 2, 2020 | ||||||||||||

Store Locations | Store Locations Opened | Store Locations Closed (1) | Store Locations | Square Feet (millions) | ||||||||||

Old Navy North America | 1,207 | 4 | 3 | 1,208 | 19.5 | |||||||||

Old Navy Asia | 17 | — | 17 | — | — | |||||||||

Gap North America | 675 | — | 8 | 667 | 7.1 | |||||||||

Gap Asia | 358 | 5 | 2 | 361 | 3.2 | |||||||||

Gap Europe | 137 | — | 7 | 130 | 1.1 | |||||||||

Banana Republic North America | 541 | — | 2 | 539 | 4.5 | |||||||||

Banana Republic Asia | 48 | 1 | 3 | 46 | 0.2 | |||||||||

Athleta North America | 190 | 1 | — | 191 | 0.8 | |||||||||

Intermix North America | 33 | — | — | 33 | 0.1 | |||||||||

Janie and Jack North America | 139 | — | 1 | 138 | 0.2 | |||||||||

Company-operated stores total | 3,345 | 11 | 43 | 3,313 | 36.7 | |||||||||

Franchise | 574 | 29 | 5 | 598 | N/A | |||||||||

Total | 3,919 | 40 | 48 | 3,911 | 36.7 | |||||||||

__________

(1) | This represents stores permanently closed not stores temporarily closed as a result of COVID-19. |