FY 2013 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

þ | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the Fiscal year ended February 1, 2014 |

|

| |

¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to |

Commission File Number 1-7562

THE GAP, INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 94-1697231 |

(State of Incorporation) | (I.R.S. Employer Identification No.) |

|

| |

Two Folsom Street, San Francisco, California | 94105 |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (415) 427-0100

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Common Stock, $0.05 par value | The New York Stock Exchange |

(Title of class) | (Name of exchange where registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

| | | | | | |

Large accelerated filer þ | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of August 2, 2013 was approximately $14 billion based upon the last price reported for such date in the NYSE-Composite transactions.

The number of shares of the registrant’s common stock outstanding as of March 18, 2014 was 447,001,764.

Documents Incorporated by Reference

Portions of the registrant’s Proxy Statement for the Annual Meeting of Shareholders to be held on May 20, 2014 (hereinafter referred to as the “2014 Proxy Statement”) are incorporated into Part III.

Special Note on Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Words such as “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan,” “project,” and similar expressions also identify forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding the following:

| |

• | optimizing our inventory levels and increasing the efficiency and responsiveness of our supply chain through strategic initiatives; |

| |

• | moving to a global brand structure and pursuing continued international expansion; |

| |

• | our ability to supplement near-term liquidity, if necessary, with our revolving credit facility; |

| |

• | target cash balance and ability to provide for our working capital needs and for unexpected business downturns; |

| |

• | our ability to maintain a strong financial profile with ample liquidity; |

| |

• | developing an omni-channel shopping experience for our customers through the integration of our store and digital shopping channels; |

| |

• | the outcome of proceedings, lawsuits, disputes, and claims; |

| |

• | managing our expenses in a disciplined manner; |

| |

• | delivering operating margin expansion and earnings per share growth; |

| |

• | returning excess cash to shareholders; |

| |

• | growing revenues through new brands, channels, and geographies; |

| |

• | opening additional stores in Asia, with a focus on Gap China, Old Navy China, and Old Navy Japan; |

| |

• | expanding our global outlet presence; |

| |

• | continuing to expand our franchise presence worldwide; |

| |

• | opening additional Athleta stores; |

| |

• | impact of foreign exchange rate fluctuations, including the impact on our net sales and gross margins for foreign subsidiaries; |

| |

• | diluted earnings per share in fiscal 2014; |

| |

• | the number of new store openings and store closings in fiscal 2014; |

| |

• | net square footage change in fiscal 2014; |

| |

• | the number of new franchise stores in fiscal 2014; |

| |

• | operating margin in fiscal 2014; |

| |

• | the effective tax rate in fiscal 2014; |

| |

• | current cash balances and cash flows being sufficient to support our business operations, including growth initiatives and planned capital expenditures; |

| |

• | depreciation and amortization in fiscal 2014; |

| |

• | cash spending for purchases of property and equipment in fiscal 2014; |

| |

• | our plan to increase our dividend in fiscal 2014; |

| |

• | the estimates and assumptions we use in our accounting policies; |

| |

• | the assumptions used to estimate the grant date fair value of stock options issued; |

| |

• | the expected impact of future lease payments associated with our lease loss reserves; |

| |

• | our intention to utilize undistributed earnings of our foreign subsidiaries; |

| |

• | total gross unrecognized tax benefits; |

| |

• | expected payments to International Business Machines Corporation (“IBM”); and |

| |

• | the impact of losses due to indemnification obligations. |

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, without limitation, the following:

| |

• | the risk that the adoption of new accounting pronouncements will impact future results; |

| |

• | the risk that changes in global economic conditions or consumer spending patterns could adversely impact our results of operations; |

| |

• | the highly competitive nature of our business in the United States and internationally; |

| |

• | the risk that we or our franchisees will be unsuccessful in gauging apparel trends and changing consumer preferences; |

| |

• | the risk that if we are unable to manage our inventory effectively, our gross margins will be adversely affected; |

| |

• | the risks to our efforts to expand internationally, including our ability to operate under a global brand structure, foreign exchange, and operating in regions where we have less experience; |

| |

• | the risks to our business, including our costs and supply chain, associated with global sourcing and manufacturing; |

| |

• | the risks associated with importing merchandise from foreign countries, including failure of our vendors to adhere to our Code of Vendor Conduct, could have a negative impact on our reputation or operations; |

| |

• | the risk that trade matters could increase the cost or reduce the supply of apparel available to us and adversely affect our business, financial condition, and results of operations; |

| |

• | the risk that our franchisees’ operation of franchise stores is not directly within our control and could impair the value of our brands; |

| |

• | the risk that we or our franchisees will be unsuccessful in identifying, negotiating, and securing new store locations and renewing, modifying, or terminating leases for existing store locations effectively; |

| |

• | the risk that comparable sales and margins will experience fluctuations; |

| |

• | the risk that changes in our credit profile or deterioration in market conditions may limit our access to the capital markets and adversely impact our financial results or our business initiatives; |

| |

• | the risk that the failure to attract and retain key personnel could have an adverse impact on our results of operations; |

| |

• | the risk that our investments in omni-channel shopping initiatives may not deliver the results we anticipate; |

| |

• | the risk that updates or changes to our information technology (“IT”) systems may disrupt our operations; |

| |

• | the risk that we are subject to data or other security breaches that may result in increased costs, violations of law, significant legal and financial exposure, and a loss of confidence in our security measures, which could have an adverse effect on our results of operations and our reputation; |

| |

• | the risk that natural disasters, public health crises, political crises, or other catastrophic events could adversely affect our operations and financial results, or those of our franchisees or vendors; |

| |

• | the risk that changes in the regulatory or administrative landscape could adversely affect our financial condition, strategies, and results of operations; |

| |

• | the risk that we do not repurchase some or all of the shares we anticipate purchasing pursuant to our repurchase program; and |

| |

• | the risk that we will not be successful in defending various proceedings, lawsuits, disputes, claims, and audits. |

Additional information regarding factors that could cause results to differ can be found in this Annual Report on Form 10-K and our other filings with the U.S. Securities and Exchange Commission (“SEC”).

Future economic and industry trends that could potentially impact net sales and profitability are difficult to predict. These forward-looking statements are based on information as of March 24, 2014, and we assume no obligation to publicly update or revise our forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized.

THE GAP, INC.

2013 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

| | |

| | Page |

PART I |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 1B. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

|

PART II |

| | |

Item 5. | | |

| | |

Item 6. | | |

| | |

Item 7. | | |

| | |

Item 7A. | | |

| | |

Item 8. | | |

| | |

Item 9. | | |

| | |

Item 9A. | | |

| | |

Item 9B. | | |

|

PART III |

| | |

Item 10. | | |

| | |

Item 11. | | |

| | |

Item 12. | | |

| | |

Item 13. | | |

| | |

Item 14. | | |

|

PART IV |

| | |

Item 15. | | |

Part I

Item 1. Business.

General

The Gap, Inc. (Gap Inc., the “Company,” “we,” and “our”) was incorporated in the State of California in July 1969 and was reincorporated under the laws of the State of Delaware in May 1988.

Gap Inc. is a leading global apparel retail company. We offer apparel, accessories, and personal care products for men, women, and children under the Gap, Banana Republic, Old Navy, Piperlime, Athleta, and Intermix brands. Our global portfolio of distinct brands across multiple channels and geographies gives us a competitive advantage in the global retail marketplace. We operate in the specialty, outlet, online, and franchise channels.

Gap Inc. has Company-operated stores in the United States, Canada, the United Kingdom, France, Ireland, Japan, Italy, China, Hong Kong, and beginning in March 2014, Taiwan. We also have franchise agreements with unaffiliated franchisees to operate Gap, Banana Republic, and Old Navy stores throughout Asia, Australia, Eastern Europe, Latin America, the Middle East, and Africa. Under these agreements, third parties operate, or will operate, stores that sell apparel and related products under our brand names. We have grown our franchise store base to 375 stores in 41 countries as of the end of fiscal 2013. Our products are also available to customers online through Company-owned websites and through the use of third parties that provide logistics and fulfillment services. Most of the products sold under our brand names are designed by us and manufactured by independent sources. We also sell products that are designed and manufactured by branded third parties, especially at our Piperlime and Intermix brands.

Gap. Founded in 1969, Gap is our flagship brand and remains one of the most iconic apparel brands in the marketplace today. The brand stands for casual, American style and offers classic apparel at accessible price points to help customers express their individuality.

Gap entered the children’s apparel market in 1986 with GapKids and in 1989 with babyGap. Maternity apparel was later added to the collection. In 1998, we launched GapBody, which offers loungewear, sleepwear, intimates, and active apparel for women. Today, Gap products are available globally in our specialty and outlet stores, online, and in franchise stores.

Banana Republic. Banana Republic is a global apparel and accessories brand that focuses on delivering modern, covetable workplace style for both men and women. The brand offers versatile workwear that can be styled for any occasion - from desk to dinner. Banana Republic also partners with notable fashion designers to offer exclusive limited-edition collections inspired by the designers' distinct styles and trends.

Acquired in 1983 with two stores, Banana Republic has evolved to offer collections that include apparel, handbags, shoes, jewelry, personal care products, and eyewear for men and women at higher price points than Gap. Today, customers can purchase Banana Republic products globally in our specialty and outlet stores, online, and in franchise stores.

Old Navy. Old Navy opened its first store in 1994, making current American essentials accessible to every family. The brand offers customers on-trend clothing and accessories, as well as updated basics for adults and children at great prices in a unique and energizing shopping environment. Customers can purchase Old Navy products in stores and online, which includes online-exclusive items such as a plus-size line. In July 2012, the brand opened its first store outside of North America in Odaiba, Japan. In March 2014, the brand opened its first store in Shanghai, China and its first franchise location in the Philippines.

Piperlime. Launched in 2006, Piperlime offers a mix of private-label and branded apparel and accessories, as well as leading brands in shoes and handbags. The brand inspires customers with a fresh and unique mix of products, brands, and price points, as well as favorite picks and tips on how to wear the season's trends from famous guest editors. Customers can shop online and in the brand's store, which opened in the SoHo neighborhood of New York in September 2012.

Athleta. Acquired in September 2008, Athleta is Gap Inc.’s premier fitness and lifestyle brand in the rapidly growing women's active apparel market. Athleta offers high-quality, stylish, and functional apparel, footwear, and accessories across a wide variety of sports and fitness activities, including crossover apparel and casualwear. Customers can purchase Athleta products online, in stores, and through catalogs.

Intermix. Acquired in December 2012, Intermix is known for its tasteful mixing of luxury and contemporary fashion and offers the most coveted existing and up-and-coming designer brands. In addition to its array of seasonal must-haves, Intermix also offers exclusive designer product. Customers can shop in stores in the United States and Canada, and online.

All sales to customers are tendered for cash, debit cards, credit cards, or personal checks. We also issue and redeem gift cards through our brands. Gap, Banana Republic, and Old Navy each have a private label credit card program and a co-branded credit card program through which frequent customers receive benefits. Private label and co-branded credit cards are provided by a third-party financing company.

The range of merchandise displayed in each store varies depending on the selling season and the size and location of the store. Stores are generally open seven days per week (where permitted by law) and most holidays.

We ended fiscal 2013 with 3,539 Company-operated and franchise store locations. For more information on the number of stores by brand and region, see the table in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Part II, Item 7 of this Form 10-K.

Certain financial information about international operations is set forth under the heading "Segment Information" in Note 17 of Notes to Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K.

Merchandise Vendors

We purchase private label and non-private label merchandise from over 1,000 vendors. Our vendors have factories in about 40 countries. No vendor accounted for more than 5 percent of the dollar amount of our total fiscal 2013 purchases. Of our merchandise purchased during fiscal 2013, approximately 98 percent of purchases, by dollar value, were from factories outside the United States, while the remaining 2 percent of all purchases were from domestic factories. Approximately 28 percent of our purchases, by dollar value, were from factories in China. Product cost increases or events causing disruption of imports from China or other foreign countries, including the imposition of additional import restrictions or vendors potentially failing due to political, financial, or regulatory issues, could have an adverse effect on our operations. Substantially all of our foreign purchases of merchandise are negotiated and paid for in U.S. dollars. Also see the sections entitled “Risk Factors—Our business, including our costs and supply chain, is subject to risks associated with global sourcing and manufacturing," "Risk Factors—Risks associated with importing merchandise from foreign countries, including failure of our vendors to adhere to our Code of Vendor Conduct, could harm our business,” and “Risk Factors—Trade matters may disrupt our supply chain” in Item 1A of this Form 10-K.

Seasonal Business

Our business follows a seasonal pattern, with sales peaking over a total of about eight weeks during the end-of-year holiday period.

Brand Building

Our ability to develop and evolve our existing brands is a key to our success. We believe our distinct brands are among our most important assets. With the exception of Piperlime and Intermix, virtually all aspects of brand development, from product design and distribution to marketing, merchandising and shopping environments, are controlled by Gap Inc. employees. With respect to Piperlime and Intermix, we control all aspects of brand development except for product design related to third-party products. We continue to invest in our brands and enhance the customer experience through significant investments in marketing, enhancement of our online shopping sites, international expansion, remodeling of existing stores, and continued focus on customer service.

Trademarks and Service Marks

Gap, GapKids, babyGap, GapBody, Banana Republic, Old Navy, Piperlime, Athleta, and Intermix trademarks and service marks, and certain other trademarks, have been registered, or are the subject of pending trademark applications, with the United States Patent and Trademark Office and with the registries of many foreign countries and/or are protected by common law.

Franchising

We have franchise agreements with unaffiliated franchisees to operate Gap, Banana Republic, and Old Navy stores in a number of countries throughout Asia, Australia, Eastern Europe, Latin America, the Middle East, and Africa. Under these agreements, third parties operate, or will operate, stores that sell apparel and related products under our brand names. We continue to increase the number of countries in which we enter into these types of arrangements as part of our strategy to expand internationally. For additional information on risks related to our franchise business, see the sections entitled “Risk Factors—Our efforts to expand internationally may not be successful” and “Risk Factors—Our franchise business is subject to certain risks not directly within our control that could impair the value of our brands” in Item 1A of this Form 10-K.

Inventory

The nature of the retail business requires us to carry a significant amount of inventory, especially prior to peak holiday selling season when we, along with other retailers, generally build up inventory levels. We maintain a large part of our inventory in distribution centers. We review our inventory levels in order to identify slow-moving merchandise and broken assortments (items no longer in stock in a sufficient range of sizes or colors) and we primarily use promotions and markdowns to clear merchandise. Also see the sections entitled “Risk Factors—We must successfully gauge apparel trends and changing consumer preferences to succeed” and "Risk Factors—If we are unable to manage our inventory effectively, our gross margins could be adversely affected" in Item 1A of this Form 10-K.

Competitors

The global apparel retail industry is highly competitive. We compete with local, national, and global apparel retailers. We are also faced with competition in European, Japanese, Chinese, and Canadian markets from established regional and national chains, and our franchisees face significant competition in the markets in which they operate. Also see the section entitled “Risk Factors—Our business is highly competitive” in Item 1A of this Form 10-K.

Employees

As of February 1, 2014, we had a workforce of approximately 137,000 employees, which includes a combination of part-time and full-time employees. We also hire seasonal employees, primarily during the peak end-of-year holiday period.

To remain competitive in the apparel retail industry, we must attract, develop, and retain skilled employees in our design, merchandising, marketing, and other functions. Competition for such personnel is intense. Our success is dependent to a significant degree on the continued contributions of key employees. Also see the section entitled “Risk Factors—The failure to attract and retain key personnel could have an adverse impact on our results of operations” in Item 1A of this Form 10-K.

Available Information

We make available on our website, www.gapinc.com, under “Investors, Financial Information, SEC Filings,” free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we electronically file or furnish them to the SEC.

Our Board of Directors Committee Charters (Audit and Finance, Compensation and Management Development, and Governance and Nominating Committees) and Corporate Governance Guidelines are also available on our website under “Investors, Governance.” Our Code of Business Conduct can be found on our website under “Investors, Corporate Compliance, Code of Business Conduct.” Any amendments and waivers to the code will also be available on the website.

Executive Officers of the Registrant

The following are our executive officers:

Name, Age, Position, and Principal Occupation:

Michelle Banks, 50, Executive Vice President, General Counsel, Corporate Secretary, and Chief Compliance Officer since March 2011; Senior Vice President, General Counsel, Corporate Secretary, and Chief Compliance Officer from March 2008 to March 2011; Senior Vice President and General Counsel from November 2006 to March 2008; Vice President from March 2005 to November 2006.

Jack Calhoun, 49, Global President, Banana Republic since November 2012; President, Banana Republic North America from 2007 to November 2012; Executive Vice President, Merchandising and Marketing, Banana Republic North America from 2003 to 2007.

John T. (Tom) Keiser, 48, Executive Vice President, Global Product Operations since November 2013; Executive Vice President and Chief Information Officer from January 2010 to November 2013; Executive Vice President and Chief Information Officer of The Limited Brands, Inc., an apparel company, from 2006 to 2009; Senior Vice President, INSIGHT Program of The Limited Brands, Inc. from 2004 to 2006.

Stefan Larsson, 39, Global President, Old Navy since October 2012; Head of Global Sales, H&M Hennes & Mauritz AB, an apparel company, from 2010 to 2012; Head of Global Expansion, H&M Hennes & Mauritz AB from 2009 to 2010; Head of Operations, Global Expansion, H&M Hennes & Mauritz AB from 2007 to 2009; Regional Manager, U.S. West Coast, H&M Hennes & Mauritz AB from 2005 to 2007.

Glenn Murphy, 52, Chairman and Chief Executive Officer since August 2007; Chief Executive Officer of Shoppers Drug Mart Corporation, a drug store chain, from 2001 to 2007.

Art Peck, 58, President, Growth, Innovation and Digital division since November 2012; President, Gap North America from February 2011 to November 2012; Executive Vice President of Strategy and Operations from May 2005 to February 2011; President, Gap Inc. Outlet from October 2008 to February 2011; Acting President, Gap Inc. Outlet from February 2008 to October 2008; Senior Vice President of The Boston Consulting Group, a business consulting firm, from 1982 to 2005.

Sabrina Simmons, 50, Executive Vice President and Chief Financial Officer since January 2008; Executive Vice President, Corporate Finance from September 2007 to January 2008; Senior Vice President, Corporate Finance and Treasurer from March 2003 to September 2007; Vice President and Treasurer from September 2001 to March 2003.

Stephen Sunnucks, 56, Global President, Gap since November 2012; President, Gap Inc. International from April 2011 to November 2012; President, Gap Inc. Europe and International Strategic Alliances from April 2009 to April 2011; President, Gap Inc. Europe from June 2005 to April 2009.

Sonia Syngal, 44, Executive Vice President, Global Supply Chain since November 2013; Senior Vice President, Old Navy International from February 2013 to November 2013; Senior Vice President and Managing Director, Europe from May 2011 to February 2013; Senior Vice President and General Manager, International Outlets from January 2010 to May 2011; Vice President of Global Production, Supply Chain - Outlet from July 2006 to January 2010; Vice President, Corporate Sourcing from July 2004 to July 2006.

Item 1A. Risk Factors.

Our past performance may not be a reliable indicator of future performance because actual future results and trends may differ materially depending on a variety of factors, including but not limited to the risks and uncertainties discussed below. In addition, historical trends should not be used to anticipate results or trends in future periods.

Global economic conditions and the impact on consumer spending patterns could adversely impact our results of operations.

The Company’s performance is subject to global economic conditions and their impact on levels of consumer spending worldwide. Some of the factors influencing consumer spending include high levels of unemployment, higher consumer debt levels, reductions in net worth based on market declines and uncertainty, home foreclosures and reductions in home values, fluctuating interest rates and credit availability, government austerity measures, fluctuating fuel and other energy costs, fluctuating commodity prices, and general uncertainty regarding the overall future economic environment. Consumer purchases of discretionary items, including our merchandise, generally decline during periods when disposable income is adversely affected or there is economic uncertainty.

Adverse economic changes in any of the regions in which we and our franchisees sell our products could reduce consumer confidence, and thereby could negatively affect earnings and have a material adverse effect on our results of operations. In challenging and uncertain economic environments, we cannot predict whether or when such circumstances may improve or worsen, or what impact, if any, such circumstances could have on our business, results of operations, cash flows, and financial position.

Our business is highly competitive.

The global apparel retail industry is highly competitive. We and our franchisees compete with local, national, and global department stores, specialty and discount store chains, independent retail stores, and online businesses that market similar lines of merchandise. We face a variety of competitive challenges including:

| |

• | anticipating and quickly responding to changing apparel trends and customer demands; |

| |

• | attracting customer traffic both in stores and online; |

| |

• | competitively pricing our products and achieving customer perception of value; |

| |

• | maintaining favorable brand recognition and effectively marketing our products to customers in several diverse market segments and geographic locations; |

| |

• | developing innovative, high-quality products in sizes, colors, and styles that appeal to customers of varying age groups and tastes; and |

| |

• | sourcing merchandise efficiently. |

If we or our franchisees are not able to compete successfully in the United States or internationally, our results of operations would be adversely affected.

We must successfully gauge apparel trends and changing consumer preferences to succeed.

Our success is largely dependent upon our ability to gauge the tastes of our customers and to provide merchandise that satisfies customer demand in a timely manner. However, lead times for many of our design and purchasing decisions may be long, which makes it more difficult for us to respond rapidly to new or changing apparel trends or consumer acceptance of our products. The global apparel retail business fluctuates according to changes in consumer preferences, dictated in part by apparel trends and season. To the extent we misjudge the market for our merchandise or the products suitable for local markets or fail to execute trends and deliver product to market as timely as our competitors, our sales will be adversely affected, and the markdowns required to move the resulting excess inventory will adversely affect our operating results.

If we are unable to manage our inventory effectively, our gross margins could be adversely affected.

Fluctuations in the global apparel retail markets impacts the levels of inventory owned by apparel retailers, as merchandise usually must be ordered well in advance of the season and frequently before apparel trends are confirmed by customer purchases. In addition, the nature of the global apparel retail business requires us to carry a significant amount of inventory, especially prior to the peak holiday selling season when we build up our inventory levels. We must enter into contracts for the purchase and manufacture of merchandise well in advance of the applicable selling season. As a result, we are vulnerable to demand and pricing shifts and to suboptimal selection and timing of merchandise purchases. In the past, we have not always predicted our customers’ preferences and acceptance levels of our trend items with accuracy. If sales do not meet expectations, too much inventory may cause excessive markdowns and, therefore, lower than planned margins.

We have key strategic initiatives designed to optimize our inventory levels and increase the efficiency and responsiveness of our supply chain, including our seamless inventory and responsive supply chain initiatives. Aspects of seamless inventory include more timely matching of product supply and demand across markets and channels to reduce stranded inventory. Aspects of responsive supply chain include more vendor fabric platforming, product demand testing, and in-season rapid response to demand. These initiatives involve significant systems and operational changes and we have limited experience operating in this manner. If we are unable to implement these initiatives successfully, we may not realize the return on our investments that we anticipate, and our operating results could be adversely affected.

Our efforts to expand internationally may not be successful.

Our current strategies include moving to a global brand structure and pursuing continued international expansion in a number of countries around the world through a number of channels. Beginning in fiscal 2013, we combined all channels and geographies under one global leader for each of the Gap, Banana Republic, and Old Navy brands. Each global brand president oversees their brand's specialty, outlet, online, and franchise operations. In addition, we currently plan to open additional Old Navy stores outside of North America, open additional Gap stores in China, open additional international outlet stores, and continue to grow online sales internationally. We have limited experience operating in some of these locations. In many of these locations, we face major, established competitors. In addition, in many of these locations, the real estate, employment and labor, transportation and logistics, regulatory, and other operating requirements differ dramatically from those in the places where we have experience. Moreover, consumer tastes and trends may differ in many of these locations, and as a result, the sales of our products may not be successful or result in the margins we anticipate. If our international expansion plans are unsuccessful or do not deliver an appropriate return on our investments, our operations and financial results could be materially, adversely affected.

In addition, we are exposed to foreign currency exchange rate risk with respect to our sales, profits, assets, and liabilities generated or incurred outside the U.S. Although we use instruments to hedge certain foreign currency risks, these measures may not succeed in offsetting all of the negative impact of foreign currency rate movements and generally only delay the impact of adverse foreign currency rate movements on our business and financial results.

Our business, including our costs and supply chain, is subject to risks associated with global sourcing and manufacturing.

Independent third parties manufacture all of our products for us. As a result, we are directly impacted by increases in the cost of those products.

If we experience significant increases in demand or need to replace an existing vendor, there can be no assurance that additional manufacturing capacity will be available when required on terms that are acceptable to us or that any vendor would allocate sufficient capacity to us in order to meet our requirements. In addition, for any new manufacturing source, we may encounter delays in production and added costs as a result of the time it takes to train our vendors in our methods, products, quality control standards, and environmental, labor, health, and safety standards. Moreover, in the event of a significant disruption in the supply of the fabrics or raw materials used by our vendors in the manufacture of our products, our vendors might not be able to locate alternative suppliers of materials of comparable quality at an acceptable price. Any delays, interruption, or increased costs in the manufacture of our products could result in lower sales and net income. In addition, certain countries represent a larger portion of our global sourcing. For example, approximately 28 percent of our merchandise, by dollar value, is purchased from China. Accordingly, any delays in production and added costs in this country could have a more significant impact on our results of operations.

Because independent vendors manufacture all of our products outside of our principal sales markets, third parties must transport our products over large geographic distances. Delays in the shipment or delivery of our products due to the availability of transportation, work stoppages, port strikes, infrastructure congestion, or other factors, and costs and delays associated with transitioning between vendors, could adversely impact our financial performance. Manufacturing delays or unexpected demand for our products may require us to use faster, but more expensive, transportation methods such as aircraft, which could adversely affect our gross margins. In addition, the cost of fuel is a significant component in transportation costs, so increases in the price of petroleum products can adversely affect our gross margins.

Risks associated with importing merchandise from foreign countries, including failure of our vendors to adhere to our Code of Vendor Conduct, could harm our business.

We purchase nearly all merchandise from third-party vendors in many different countries and we require those vendors to adhere to a Code of Vendor Conduct which includes environmental, labor, health, and safety standards. From time to time, contractors or their subcontractors may not be in compliance with these standards or applicable local laws. Although we have implemented policies and procedures to facilitate our compliance with laws and regulations relating to doing business in foreign markets and importing merchandise into various countries, there can be no assurance that suppliers and other third parties with whom we do business will not violate such laws and regulations or our policies. Significant or continuing noncompliance with such standards and laws by one or more vendors could have a negative impact on our reputation, could subject us to liability, and could have an adverse effect on our results of operations.

Trade matters may disrupt our supply chain.

Trade restrictions, including increased tariffs or quotas, embargoes, safeguards, and customs restrictions against apparel items, as well as U.S. or foreign labor strikes, work stoppages, or boycotts, could increase the cost or reduce the supply of apparel available to us and adversely affect our business, financial condition, and results of operations. We cannot predict whether any of the countries in which our merchandise currently is manufactured or may be manufactured in the future will be subject to additional trade restrictions imposed by the United States and other foreign governments, including the likelihood, type, or effect of any such restrictions. In addition, we face the possibility of anti-dumping or countervailing duties lawsuits from U.S. domestic producers. We are unable to determine the impact of the changes to the quota system or the impact that potential tariff lawsuits could have on our global sourcing operations. Our sourcing operations may be adversely affected by trade limits or political and financial instability, resulting in the disruption of trade from exporting countries, significant fluctuation in the value of the U.S. dollar against foreign currencies, restrictions on the transfer of funds, and/or other trade disruptions.

Our franchise business is subject to certain risks not directly within our control that could impair the value of our brands.

We enter into franchise agreements with unaffiliated franchisees to operate stores in many countries around the world. Under these agreements, third parties operate, or will operate, stores that sell apparel and related products under our brand names. The effect of these arrangements on our business and results of operations is uncertain and will depend upon various factors, including the demand for our products in new markets internationally and our ability to successfully identify appropriate third parties to act as franchisees, distributors, or in a similar capacity. In addition, certain aspects of these arrangements are not directly within our control, such as franchisee financial stability and the ability of these third parties to meet their projections regarding store locations, store openings, and sales. Other risks that may affect these third parties include general economic conditions in specific countries or markets, foreign exchange rates, changes in diplomatic and trade relationships, restrictions on the transfer of funds, and political instability. Moreover, while the agreements we have entered into and plan to enter into in the future provide us with certain termination rights, the value of our brands could be impaired to the extent that these third parties do not operate their stores in a manner consistent with our requirements regarding our brand identities and customer experience standards. Failure to protect the value of our brands, or any other harmful acts or omissions by a franchisee, could have an adverse effect on our results of operations and our reputation.

The market for prime real estate is competitive.

Our ability to effectively obtain real estate - to open new stores, distribution centers, and corporate offices nationally and internationally - depends on the availability of real estate that meets our criteria for traffic, square footage, co-tenancies, lease economics, demographics, and other factors. We also must be able to effectively renew our existing store leases. In addition, from time to time, we may seek to downsize, consolidate, reposition, or close some of our real estate locations, which in most cases requires a modification of an existing store lease. Failure to secure adequate new locations or successfully modify existing locations, or failure to effectively manage the profitability of our existing fleet of stores, could have a material adverse effect on our results of operations.

Additionally, the economic environment may at times make it difficult to determine the fair market rent of real estate properties within the United States and internationally. This could impact the quality of our decisions to exercise lease options at previously negotiated rents and the quality of our decisions to renew expiring leases at negotiated rents. Any adverse effect on the quality of these decisions could impact our ability to retain real estate locations adequate to meet our targets or efficiently manage the profitability of our existing fleet of stores and could have a material adverse effect on our results of operations.

We experience fluctuations in our comparable sales and margins.

Our success depends in part on our ability to improve sales, in particular at our largest brands. A variety of factors affect comparable sales or margins, including apparel trends, competition, current economic conditions, the timing of new merchandise releases and promotional events, changes in our merchandise mix, the success of marketing programs, foreign currency fluctuations, and weather conditions. These factors may cause our comparable sales results to differ materially from prior periods and from expectations. Our comparable sales, including the associated comparable online sales, have fluctuated significantly in the past on an annual, quarterly, and monthly basis. Over the past 24 months, our reported monthly comparable sales have ranged from an increase of 10 percent in July 2012 to a decrease of 3 percent in September 2013. Over the past five years, our reported gross margins have ranged from a high of 40.3 percent in fiscal 2009 to a low of 36.2 percent in fiscal 2011. In addition, over the past five years, our reported operating margins have ranged from a high of 13.4 percent in fiscal 2010 to a low of 9.9 percent in fiscal 2011.

Our ability to deliver strong comparable sales results and margins depends in large part on accurately forecasting demand and apparel trends, selecting effective marketing techniques, providing an appropriate mix of merchandise for our broad and diverse customer base, managing inventory effectively, using effective pricing strategies, and optimizing store performance. Failure to meet the expectations of investors, securities analysts, or credit rating agencies in one or more future periods could reduce the market price of our common stock and cause our credit ratings to decline.

Changes in our credit profile or deterioration in market conditions may limit our access to the capital markets and adversely impact our financial results or our business initiatives.

In the first quarter of fiscal 2011, given favorable market conditions and our history of generating consistent and strong operating cash flow, we made the strategic decision to issue debt. In April 2011, we issued $1.25 billion aggregate principal amount of 5.95 percent notes due April 12, 2021. As a result, we have additional costs that include interest payable semiannually on the notes. We also entered into a 15 billion Japanese yen ($147 million as of February 1, 2014), four-year term loan due January 2018.

Our cash flows from operations are the primary source of funds for these debt service payments. In this regard, we have generated annual cash flow from operations in excess of $1 billion per year for the past decade and ended fiscal 2013 with $1.5 billion of cash and cash equivalents on our balance sheet. We are also able to supplement near-term liquidity, if necessary, with our $500 million revolving credit facility. We continue to target a cash balance of about $1.2 billion, which provides not only for our working capital needs, but also a reserve for unexpected business downturns. However, if our cash flows from operations decline significantly, we may be required to reprioritize our business initiatives to ensure that we can continue to service or refinance our debt with favorable rates and terms. In addition, any future reduction in our long-term senior unsecured credit ratings could result in reduced access to the credit and capital markets and higher interest costs on future financings.

We remain committed to maintaining a strong financial profile with ample liquidity.

For further information on our debt and credit facilities, see Part II, Item 8, Financial Statements and Supplementary Data, Notes 5 and 6 of Notes to Consolidated Financial Statements of this Form 10-K.

The failure to attract and retain key personnel could have an adverse impact on our results of operations.

Our ability to anticipate and effectively respond to changing apparel trends depends in part on our ability to attract and retain key personnel in our design, merchandising, marketing, and other functions. In addition, several of our strategic initiatives, including our technology initiatives and supply chain initiatives require that we hire and/or develop employees with appropriate experience. Competition for this personnel is intense, and we cannot be sure that we will be able to attract and retain a sufficient number of qualified personnel in future periods. If we are unable to retain, attract, and motivate talented employees with the appropriate skill sets, or if changes to our organizational structure, operating results, or business model adversely affect morale or retention, we may not achieve our objectives and our results of operations could be adversely impacted. In addition, the loss of one or more of our key personnel or the inability to effectively identify a suitable successor to a key role in our senior management positions could have a material adverse effect on our business.

Our investments in omni-channel shopping initiatives may not deliver the results we anticipate.

One of our strategic priorities is to further develop an omni-channel shopping experience for our customers through the integration of our store and digital shopping channels. Examples of our recent omni-channel initiatives include our ship-from-store and reserve-in-store programs, in which store inventory can be used to satisfy online demand. We continue to explore additional ways to develop an omni-channel shopping experience, including further digital integration and customer personalization. These initiatives involve significant investments in IT systems and significant operational changes. In addition, our competitors are also investing in omni-channel initiatives, some of which may be more successful than our initiatives. If the implementation of our omni-channel initiatives is not successful, or we do not realize the return on our omni-channel investments that we anticipate, our operating results would be adversely affected.

Updates or changes to our IT systems may disrupt operations.

We continue to evaluate and implement upgrades and changes to our IT systems, some of which are significant. Upgrades involve replacing existing systems with successor systems, making changes to existing systems, or cost-effectively acquiring new systems with new functionality. We are aware of inherent risks associated with replacing these systems, including accurately capturing data and system disruptions, and believe we are taking appropriate action to mitigate the risks through testing, training, and staging implementation, as well as ensuring appropriate commercial contracts are in place with third-party vendors supplying or supporting our IT initiatives. However, there can be no assurances that we will successfully launch these systems as planned or that they will occur without disruptions to our operations. IT system disruptions, if not anticipated and appropriately mitigated, or failure to successfully implement new or upgraded systems, could have a material adverse effect on our results of operations.

We are subject to data security risks, which could have an adverse effect on our results of operations and consumer confidence in our security measures.

As part of our normal operations, we receive and maintain confidential information about our customers, our employees, and other third parties. Our business employs systems and websites that allow for the secure storage and transmission of proprietary or confidential information regarding our customers, employees, job applicants, and others, including credit card information and personal identification information. Security breaches could expose us to a risk of loss or misuse of this information, litigation, and potential liability. Despite our safeguards and security processes and protections, we may not have the resources or technical sophistication to anticipate or prevent rapidly evolving types of cyber-attacks. Attacks may be targeted at us, our customers, or others who have entrusted us with information. Actual or anticipated attacks may cause us to incur increasing costs, including costs to deploy additional personnel and protection technologies, train employees, and engage third-party experts and consultants. Advances in computer capabilities, new technological discoveries, or other developments may result in the technology used by us to protect transaction or other data being breached or compromised. In addition, data and security breaches can also occur as a result of non-technical issues, including intentional or inadvertent breach by our employees or by persons with whom we have commercial relationships that result in the unauthorized release of personal or confidential information. Any compromise or breach of our security could result in a violation of applicable privacy and other laws, significant legal and financial exposure, and a loss of consumer confidence in our security measures, which could have an adverse effect on our results of operations and our reputation.

Our results could be adversely affected by natural disasters, public health crises, political crises, or other catastrophic events.

Natural disasters, such as hurricanes, tornadoes, floods, earthquakes, and other adverse weather and climate conditions; unforeseen public health crises, such as pandemics and epidemics; political crises, such as terrorist attacks, war, and other political instability; or other catastrophic events, such as disasters occurring at our vendors' manufacturing facilities, whether occurring in the United States or internationally, could disrupt our operations, the operations of our franchisees, or the operations of one or more of our vendors. In particular, these types of events could impact our product supply chain from or to the impacted region and could impact our ability or the ability of our franchisees or other third parties to operate our stores or websites. In addition, these types of events could negatively impact consumer spending in the impacted regions or depending upon the severity, globally. Disasters occurring at our vendors’ manufacturing facilities could impact our reputation and our customers’ perception of our brands. To the extent any of these events occur, our operations and financial results could be adversely affected.

Changes in the regulatory or administrative landscape could adversely affect our financial condition and results of operations.

Laws and regulations at the local, state, federal, and international levels frequently change, and the ultimate cost of compliance cannot be precisely estimated. In addition, we cannot predict the impact that may result from changes in the regulatory or administrative landscape. Any changes in regulations, the imposition of additional regulations, or the enactment of any new or more stringent legislation that impacts employment and labor, trade, product safety, transportation and logistics, health care, tax, privacy, operations, or environmental issues, among others, could have an adverse impact on our financial condition and results of operations.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We have Company-operated stores in the United States, Canada, the United Kingdom, France, Ireland, Japan, Italy, China, Hong Kong, and beginning in March 2014, Taiwan. As of February 1, 2014, our Company-operated stores aggregated approximately 37.2 million square feet. Almost all of these stores are leased, with one or more renewal options after our initial term. Economic terms vary by type of location.

We own approximately 1.2 million square feet of corporate office space located in San Francisco, San Bruno, and Rocklin, California, of which approximately 476,000 square feet is leased to and occupied by others. We lease approximately 1.1 million square feet of corporate office space located in San Francisco, Rocklin, Petaluma, Pleasanton, and Los Angeles, California; New York, New York; Albuquerque, New Mexico; and Toronto, Ontario, Canada. We also lease regional offices in North America and in various international locations. We own approximately 8.6 million square feet of distribution space located in Fresno, California; Fishkill, New York; Groveport, Ohio; Gallatin, Tennessee; Brampton, Ontario, Canada; and Rugby, England. Of the 8.6 million square feet of owned distribution space, 100,000 square feet is leased to others. We lease approximately 1.8 million square feet of distribution space located in Phoenix, Arizona; Grove City and Obetz, Ohio; Erlanger and Hebron, Kentucky; Bolton and Mississauga, Ontario, Canada; and Stafford, England. Third-party logistics companies provide logistics services to us through distribution warehouses in Chiba, Japan; Shanghai and Hong Kong, China; and Edison, New Jersey.

Item 3. Legal Proceedings.

As a multinational company, we are subject to various proceedings, lawsuits, disputes, and claims (“Actions”) arising in the ordinary course of our business. Many of these Actions raise complex factual and legal issues and are subject to uncertainties. Actions filed against us from time to time include commercial, intellectual property, customer, employment, and data privacy claims, including class action lawsuits. The plaintiffs in some Actions seek unspecified damages or injunctive relief, or both. Actions are in various procedural stages and some are covered in part by insurance.

We cannot predict with assurance the outcome of Actions brought against us. Accordingly, developments, settlements, or resolutions may occur and impact income in the quarter of such development, settlement, or resolution. However, we do not believe that the outcome of any current Action would have a material effect on our Consolidated Financial Statements.

Item 4. Mine Safety Disclosures.

Not applicable.

Part II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The principal market on which our stock is traded is the New York Stock Exchange. The number of holders of record of our stock as of March 18, 2014 was 7,545. The table below sets forth the market prices and dividends declared and paid for each of the fiscal quarters in fiscal 2013 and 2012.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Market Prices | | Dividends Declared and Paid |

| | Fiscal 2013 | | Fiscal 2012 | | Fiscal Year |

| | High | | Low | | High | | Low | | 2013 | | 2012 |

1st Quarter | | $ | 39.13 |

| | $ | 31.19 |

| | $ | 28.77 |

| | $ | 18.53 |

| | $ | 0.15 |

| | $ | 0.125 |

|

2nd Quarter | | $ | 46.56 |

| | $ | 38.28 |

| | $ | 30.17 |

| | $ | 25.02 |

| | 0.15 |

| | 0.125 |

|

3rd Quarter | | $ | 46.53 |

| | $ | 36.13 |

| | $ | 37.85 |

| | $ | 29.39 |

| | 0.20 |

| | 0.125 |

|

4th Quarter | | $ | 42.45 |

| | $ | 36.39 |

| | $ | 36.15 |

| | $ | 29.84 |

| | 0.20 |

| | 0.125 |

|

| | | | | | | | | | $ | 0.70 |

| | $ | 0.50 |

|

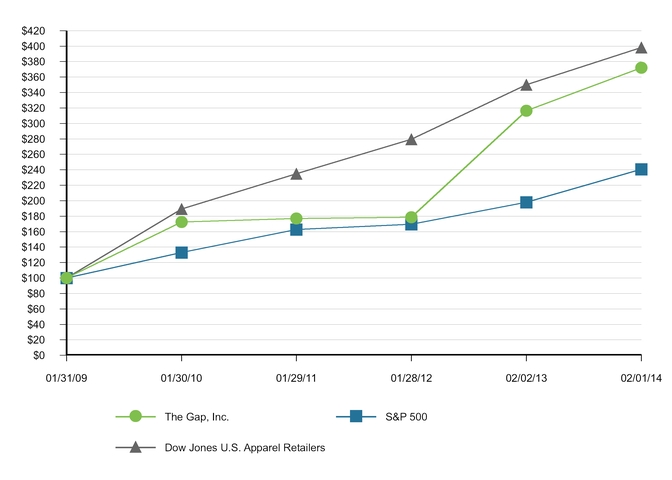

Stock Performance Graph

The graph below compares the percentage changes in our cumulative total stockholder return on our common stock for the five-year period ended February 1, 2014, with (i) the cumulative total return of the Dow Jones U.S. Retail Apparel Index and (ii) the S&P 500 Index. The total stockholder return for our common stock assumes quarterly reinvestment of dividends.

TOTAL RETURN TO STOCKHOLDERS

(Assumes $100 investment on 1/31/2009)

Total Return Analysis

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | 1/31/2009 | | 1/30/2010 | | 1/29/2011 | | 1/28/2012 | | 2/2/2013 | | 2/1/2014 |

The Gap, Inc. | | $ | 100.00 |

| | $ | 172.47 |

| | $ | 176.93 |

| | $ | 178.62 |

| | $ | 316.37 |

| | $ | 372.05 |

|

S&P 500 | | $ | 100.00 |

| | $ | 133.14 |

| | $ | 162.67 |

| | $ | 169.54 |

| | $ | 197.98 |

| | $ | 240.58 |

|

Dow Jones U.S. Apparel Retailers | | $ | 100.00 |

| | $ | 189.38 |

| | $ | 234.92 |

| | $ | 279.66 |

| | $ | 350.19 |

| | $ | 398.21 |

|

Source: Research Data Group, Inc. (415) 643-6000 (www.researchdatagroup.com)

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The following table presents information with respect to purchases of common stock of the Company made during the thirteen weeks ended February 1, 2014 by The Gap, Inc. or any affiliated purchaser, as defined in Exchange Act Rule 10b-18(a)(3):

|

| | | | | | | | | | | | |

| | Total Number of Shares Purchased | | Average Price Paid Per Share Including Commissions | | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | | Maximum Number (or approximate dollar amount) of Shares that May Yet be Purchased Under the Plans or Programs (1) |

Month #1 (November 3 - November 30) | | — |

| | $ | — |

| | — |

| | $1,100 million |

Month #2 (December 1 - January 4) | | 978,875 |

| | $ | 38.83 |

| | 978,875 |

| | $1,062 million |

Month #3 (January 5 - February 1) | | 2,553,323 |

| | $ | 37.60 |

| | 2,553,323 |

| | $966 million |

Total | | 3,532,198 |

| | $ | 37.94 |

| | 3,532,198 |

| | |

__________

| |

(1) | On January 3, 2013, we announced that the Board of Directors approved a $1 billion share repurchase authorization. This authorization was fully utilized by the end of January 2014. On November 21, 2013, we announced that the Board of Directors approved a new $1 billion share repurchase authorization. This authorization has no expiration date. |

Item 6. Selected Financial Data.

The following selected financial data are derived from the Consolidated Financial Statements of the Company. We have also included certain non-financial data to enhance your understanding of our business. The data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and the Company’s Consolidated Financial Statements and related notes in Item 8.

|

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year (number of weeks) |

| | 2013 (52) | | 2012 (53) | | 2011 (52) | | 2010 (52) | | 2009 (52) |

Operating Results ($ in millions) | | | | | | | | | | |

Net sales | | $ | 16,148 |

| | $ | 15,651 |

| | $ | 14,549 |

| | $ | 14,664 |

| | $ | 14,197 |

|

Gross margin | | 39.0 | % | | 39.4 | % | | 36.2 | % | | 40.2 | % | | 40.3 | % |

Operating margin | | 13.3 | % | | 12.4 | % | | 9.9 | % | | 13.4 | % | | 12.8 | % |

Net income | | $ | 1,280 |

| | $ | 1,135 |

| | $ | 833 |

| | $ | 1,204 |

| | $ | 1,102 |

|

Cash dividends paid | | $ | 321 |

| | $ | 240 |

| | $ | 236 |

| | $ | 252 |

| | $ | 234 |

|

Per Share Data (number of shares in millions) | | | | | | | | | | |

Basic earnings per share | | $ | 2.78 |

| | $ | 2.35 |

| | $ | 1.57 |

| | $ | 1.89 |

| | $ | 1.59 |

|

Diluted earnings per share | | $ | 2.74 |

| | $ | 2.33 |

| | $ | 1.56 |

| | $ | 1.88 |

| | $ | 1.58 |

|

Weighted-average number of shares—basic | | 461 |

| | 482 |

| | 529 |

| | 636 |

| | 694 |

|

Weighted-average number of shares—diluted | | 467 |

| | 488 |

| | 533 |

| | 641 |

| | 699 |

|

Cash dividends declared and paid per share | | $ | 0.70 |

| | $ | 0.50 |

| | $ | 0.45 |

| | $ | 0.40 |

| | $ | 0.34 |

|

Balance Sheet Information ($ in millions) | | | | | | | | | | |

Merchandise inventory | | $ | 1,928 |

| | $ | 1,758 |

| | $ | 1,615 |

| | $ | 1,620 |

| | $ | 1,477 |

|

Total assets | | $ | 7,849 |

| | $ | 7,470 |

| | $ | 7,422 |

| | $ | 7,065 |

| | $ | 7,985 |

|

Working capital | | $ | 1,985 |

| | $ | 1,788 |

| | $ | 2,181 |

| | $ | 1,831 |

| | $ | 2,533 |

|

Total long-term debt, less current maturities (1) | | $ | 1,369 |

| | $ | 1,246 |

| | $ | 1,606 |

| | $ | — |

| | $ | — |

|

Stockholders’ equity | | $ | 3,062 |

| | $ | 2,894 |

| | $ | 2,755 |

| | $ | 4,080 |

| | $ | 4,891 |

|

Other Data ($ and square footage in millions) | | | | | | | | | | |

Cash used for purchases of property and equipment | | $ | 670 |

| | $ | 659 |

| | $ | 548 |

| | $ | 557 |

| | $ | 334 |

|

Acquisition of business, net of cash acquired (2) | | $ | — |

| | $ | 129 |

| | $ | — |

| | $ | — |

| | $ | — |

|

Percentage increase (decrease) in comparable sales (3) | | 2 | % | | 5 | % | | (4 | )% | | 2 | % | | (3 | )% |

Number of Company-operated store locations open at year-end | | 3,164 |

| | 3,095 |

| | 3,036 |

| | 3,068 |

| | 3,095 |

|

Number of franchise store locations open at year-end | | 375 |

| | 312 |

| | 227 |

| | 178 |

| | 136 |

|

Number of store locations open at year-end (4) | | 3,539 |

| | 3,407 |

| | 3,263 |

| | 3,246 |

| | 3,231 |

|

Square footage of Company-operated store space at year-end | | 37.2 |

| | 36.9 |

| | 37.2 |

| | 38.2 |

| | 38.8 |

|

Percentage increase (decrease) in square footage of Company-operated store space at year-end | | 0.8 | % | | (0.8 | )% | | (2.6 | )% | | (1.5 | )% | | (1.8 | )% |

Number of employees at year-end | | 137,000 |

| | 136,000 |

| | 132,000 |

| | 134,000 |

| | 135,000 |

|

| |

(1) | In April 2012, we made the first scheduled payment of $40 million related to our $400 million term loan and in August 2012, we repaid the remaining $360 million balance in full. |

| |

(2) | On December 31, 2012, we acquired all of the outstanding capital stock of Intermix, a multi-brand specialty retailer of luxury and contemporary apparel and accessories, for an aggregate purchase price of $129 million. |

| |

(3) | Beginning in fiscal 2011, we report comparable sales including the associated comparable online sales. Comparable sales for fiscal 2010 have been recalculated to include the associated comparable online sales. Comparable sales for fiscal 2009 exclude online sales. |

| |

(4) | Includes Company-operated and franchise store locations. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

We are a global retailer offering apparel, accessories, and personal care products for men, women, and children under the Gap, Banana Republic, Old Navy, Piperlime, Athleta, and Intermix brands. We have Company-operated stores in the United States, Canada, the United Kingdom, France, Ireland, Japan, Italy, China, Hong Kong, and beginning in March 2014, Taiwan. We also have franchise agreements with unaffiliated franchisees to operate Gap, Banana Republic, and Old Navy stores in many other countries around the world. Under these agreements, third parties operate, or will operate, stores that sell apparel and related products under our brand names. In addition, our products are available to customers online through Company-owned websites and through the use of third parties that provide logistics and fulfillment services. Most of the products sold under our brand names are designed by us and manufactured by independent sources. We also sell products that are designed and manufactured by branded third parties, especially at our Piperlime and Intermix brands.

We identify our operating segments according to how our business activities are managed and evaluated. Prior to fiscal 2013, we had two reportable segments: Stores and Direct. The Stores reportable segment included the results of the retail stores for Gap, Old Navy, and Banana Republic. The Direct reportable segment included the results of our online brands, as well as Piperlime, Athleta, and Intermix.

Beginning in fiscal 2013, we combined all channels and geographies under one global leader for each of the Gap, Old Navy, and Banana Republic brands. Each global brand president oversees their brand's specialty, outlet, online, and franchise operations. Our newer brands, Piperlime, Athleta, and Intermix, are managed by the president of our Growth, Innovation, and Digital ("GID") division, who oversees those brands' store and online operations. Each of our brands serves customers through its store and online channels. We have determined that each of our operating segments (Gap Global, Old Navy Global, Banana Republic Global, and GID) share similar economic and other qualitative characteristics and, effective February 3, 2013, we have aggregated the results of our operating segments into one reportable segment.

We are pleased with our fiscal 2013 results. We continued to deliver against our priorities to grow sales with healthy merchandise margins, manage expenses in a disciplined manner, deliver operating margin expansion and earnings per share growth, and return excess cash to shareholders. We used a balanced approach to drive shareholder value even in the face of headwinds from foreign exchange and a shorter fiscal year calendar. We delivered positive comparable sales in each of the four quarters of fiscal 2013. We remained committed to our principle of returning excess cash to shareholders and distributed $1.3 billion through dividends and share repurchases.

As we transitioned to a global brand structure to drive long-term global growth, we opened 190 Company-operated stores, primarily through expansion in Asia, growth of our global outlets, and Athleta stores in the United States. Specifically, we expanded our Gap store base in China, opening 34 stores for a total of 81 specialty and outlet stores, and opened an additional 17 Old Navy stores in Japan for a total of 18 stores. We opened 58 global outlets for a total of 532 outlet stores. We also opened 30 Athleta stores, ending fiscal 2013 with 65 Athleta stores. Our franchisees added 72 new stores and five new markets.

Fiscal 2013 consisted of 52 weeks versus 53 weeks in fiscal 2012. Net sales and operating results for fiscal 2013 reflect the impact of one less selling week as well as the calendar shift, which positively impacted the results of the first quarter of fiscal 2013 and negatively impacted the results of the fourth quarter of 2013. In addition, due to the 53rd week in fiscal 2012, comparable ("Comp") sales for the fiscal year ended February 1, 2014 are compared to the 52-week period ended February 2, 2013.

Financial results for fiscal 2013 are as follows:

| |

• | Net sales for fiscal 2013 increased 3 percent to $16.1 billion compared with $15.7 billion for fiscal 2012. Excluding the impact of foreign exchange, our net sales increased 5 percent for fiscal 2013 compared with fiscal 2012. See Net Sales discussion for impact of foreign exchange. |

| |

• | Online sales for fiscal 2013 increased 21 percent to $2.3 billion compared with $1.9 billion for fiscal 2012 and grew 2 percentage points, as a percentage of total net sales, to 14 percent compared with 12 percent for fiscal 2012. |

| |

• | Comparable sales for fiscal 2013 increased 2 percent compared with a 5 percent increase last year. |

| |

• | Gross profit for fiscal 2013 was $6.3 billion compared with $6.2 billion for fiscal 2012. Gross margin for fiscal 2013 was 39.0 percent compared with 39.4 percent for fiscal 2012. |

| |

• | Operating margin for fiscal 2013 was 13.3 percent compared with 12.4 percent for fiscal 2012. Operating margin is defined as operating income as a percentage of net sales. |

| |

• | Net income for fiscal 2013 was $1.3 billion compared with $1.1 billion for fiscal 2012. Diluted earnings per share increased 18 percent to $2.74 for fiscal 2013 compared with $2.33 for fiscal 2012. |

| |

• | During fiscal 2013, we generated free cash flow of $1.0 billion compared with free cash flow of $1.3 billion for fiscal 2012. Free cash flow is defined as net cash provided by operating activities less purchases of property and equipment. For a reconciliation of free cash flow, a non-GAAP financial measure, from a GAAP financial measure, see Liquidity and Capital Resources section. |

Our business and financial priorities for fiscal 2014 are as follows:

| |

• | manage our expenses in a disciplined manner; |

| |

• | deliver earnings per share growth; and |

| |

• | return excess cash to shareholders. |

In addition to increasing sales within our existing business, we also plan to grow revenues through our newer brands, channels, and geographies, including the following:

| |

• | growing global online sales, driven by continued investments in our omni-channel capabilities; |

| |

• | opening additional stores in Asia with a focus on Gap China, Old Navy China, and Old Navy Japan; |

| |

• | expanding our global outlet presence; |

| |

• | opening additional Athleta stores; and |

| |

• | continuing to expand our franchise presence worldwide. |

In fiscal 2014, we expect foreign exchange rate fluctuations to have a meaningful negative impact on the results of our largest foreign subsidiaries in Canada and Japan. With the continuing depreciation of the Canadian dollar and Japanese yen, we expect net sales in Canadian dollars and Japanese yen translated into U.S. dollars will decrease and negatively impact our total Company net sales growth. In addition, we expect gross margins for our largest foreign subsidiaries to be negatively impacted as our merchandise purchases are primarily in U.S. dollars.

In fiscal 2014, we expect diluted earnings per share to be in the range of $2.90 to $2.95.

Results of Operations

Net Sales

Net sales primarily consist of retail sales from stores and online, and franchise revenues.

See Item 8, Financial Statements and Supplementary Data, Note 17 of Notes to Consolidated Financial Statements for net sales by brand and region.

Comparable Sales

Beginning in fiscal 2013, the Company reports Comp sales by global brand: Gap Global, Old Navy Global, and Banana Republic Global. Fiscal 2012 Comp sales have been conformed to the current year presentation.

The percentage change in Comp sales by global brand and for total Company, including the associated comparable online sales, as compared with the preceding year, is as follows:

|

| | | | | | |

| | Fiscal Year |

| | 2013 | | 2012 |

Gap Global | | 3 | % | | 3 | % |

Old Navy Global | | 2 | % | | 6 | % |

Banana Republic Global | | (1 | )% | | 5 | % |

The Gap, Inc. | | 2 | % | | 5 | % |

Comparable online sales favorably impacted total Company Comp sales by 3 percent and 2 percent in fiscal 2013 and 2012, respectively.

Only Company-operated stores are included in the calculations of Comp sales. Gap and Banana Republic outlet Comp sales are reflected within the respective results of each global brand. The calculation of total Company Comp sales includes the results of Athleta stores and online, Intermix stores and online, and the Piperlime store, but excludes the results of our franchise business and Piperlime online.

A store is included in the Comp sales calculations when it has been open and operated by Gap, Inc. for at least one year and the selling square footage has not changed by 15 percent or more within the past year. A store is included in the Comp sales calculations on the first day it has comparable prior year sales. Stores in which the selling square footage has changed by 15 percent or more as a result of a remodel, expansion, or reduction are excluded from the Comp sales calculations until the first day they have comparable prior year sales.

A store is considered non-comparable (“Non-comp”) when it has been open and operated by Gap, Inc. for less than one year or has changed its selling square footage by 15 percent or more within the past year.

A store is considered “Closed” if it is temporarily closed for three or more full consecutive days or is permanently closed. When a temporarily closed store reopens, the store will be placed in the Comp/Non-comp status it was in prior to its closure. If a store was in Closed status for three or more days in the prior year, the store will be in Non-comp status for the same days the following year.

Online Comp sales are defined as sales through online channels in all countries where we have existing Comp store sales.

Current year foreign exchange rates are applied to both current year and prior year Comp sales to achieve a consistent basis for comparison.

Store Count and Square Footage Information

Net sales per average square foot is as follows:

|

| | | | | | | | | | | | |

| | Fiscal Year |

| | 2013 | | 2012 | | 2011 |

Net sales per average square foot (1) | | $ | 365 |

| | $ | 364 |

| | $ | 337 |

|

__________

| |

(1) | Excludes net sales associated with our online and franchise businesses. |

Store count, openings, closings, and square footage for our stores are as follows:

|

| | | | | | | | | | | | | | | |

| | February 2, 2013 | | Fiscal 2013 | | February 1, 2014 |

| | Number of Store Locations | | Number of Stores Opened | | Number of Stores Closed | | Number of Store Locations | | Square Footage (in millions) |

Gap North America | | 990 |

| | 38 |

| | 60 |

| | 968 |

| | 10.1 |

|

Gap Europe | | 198 |

| | 3 |

| | 8 |

| | 193 |

| | 1.7 |

|

Gap Asia | | 191 |

| | 40 |

| | 3 |

| | 228 |

| | 2.3 |

|

Old Navy North America | | 1,010 |

| | 27 |

| | 33 |

| | 1,004 |

| | 17.2 |

|

Old Navy Asia | | 1 |

| | 17 |

| | — |

| | 18 |

| | 0.2 |

|

Banana Republic North America | | 590 |

| | 21 |

| | 15 |

| | 596 |

| | 5.0 |

|

Banana Republic Asia | | 38 |

| | 6 |

| | 1 |

| | 43 |

| | 0.2 |

|

Banana Republic Europe | | 10 |

| | 1 |

| | — |

| | 11 |

| | 0.1 |

|

Athleta North America | | 35 |

| | 30 |

| | — |

| | 65 |

| | 0.3 |

|