Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

TEGNA Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

Table of Contents

|

March 26, 2021 |

Dear Fellow Shareholders:

Howard D. Elias |

David T. Lougee |

|||||

|

Key Financial and Strategic Highlights:

• 28% revenue growth to $2.9 billion

• GAAP net income of $483 million, up 69% year-over-year

• $1.0 billion Adjusted EBITDA in 2020, Adjusted EBITDA margin of 34.9%

• 28% subscription revenue growth

• Record political revenue of $446 million, up 91% from 2018

• $741 million of free cash flow; 21.3% free cash flow as a percentage of revenue for 2019-2020

• Repriced approximately 35% of paid subscribers at leading Big Four affiliate rates

• Executed nearly $1.6 billion in refinancings to lower interest expense, extend maturities and increase capital flexibility

• Reached a net leverage of 3.95x and have no upcoming debt maturities until 2024

|

||||||

2020 was an exceptional year at TEGNA, all the more remarkable against the backdrop of a global pandemic and the broader economic challenges it engendered.

Much of our success in 2020 results from prudent strategic decisions by the Board, focused execution by management and the character and resilience of our employees. At the onset of the COVID-19 pandemic, TEGNA prioritized the health and safety of our employees, implementing new practices for those in our buildings and those reporting from the field. We also made thoughtful decisions about how we support our broader communities, leveraging our advertising team’s outreach to help businesses make informed decisions, and our partnerships with local nonprofits to address pressing community needs.

This commitment to our people and our communities drives the fundamental health of our business. We ended 2020 with record total company and political advertising revenue, Adjusted EBITDA, and free cash flow, and exceeded full-year 2020 guidance provided prior to the COVID-19 pandemic for all key financial metrics. The financing and expense management decisions we made throughout the year strengthened an already-strong balance sheet, increased our capital flexibility, and extended our history of prudently returning capital to shareholders through a robust dividend and our recently resumed share repurchase program.

Our 2020 financial performance reflects the strength of our underlying business and the resilience of our long-term strategy. It also demonstrates the value of a thoughtfully constructed and engaged Board of Directors with a keen sense of accountability to shareholders. TEGNA’s Board regularly and rigorously assesses its own composition, performance, and practices. We also engage extensively with our shareholders for their perspective on our oversight, management of the business, and priorities. In 2020, after extensive shareholder engagement on whether and how our environmental, social and governance (“ESG”) practices strengthen our business and protect shareholder value, we enhanced our ESG reporting by adopting the Sustainability Accounting Standards Board’s (“SASB”) reporting guidelines for our industry. We will extend that initiative in 2021 through a gap analysis of how our reporting aligns with the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”), then develop an action plan to prudently manage our environmental impact.

TEGNA’s long-standing commitment to Diversity, Equity and Inclusion (“DE&I”) stems from a belief that our content, newsrooms, and leadership should fully reflect the communities we serve. In the past year we took additional, proactive steps to address and combat systemic racism, including signing the CEO Action for Diversity & Inclusion pledge, launching a Diversity & Inclusion Working Group, and appointing a Chief Diversity Officer. To underscore the pervasiveness of our commitment, we also amended the charter of each Board committee to identify specific areas of diversity-related oversight for such committee. We also have developed and adopted DE&I goals for 2025 that include increasing Black, Indigenous and People of Color (BIPOC) representation in our content teams, content leadership and management roles.

In the final analysis, ours is a business that does well by doing good. As we reflect on our accomplishments this past year, we are particularly proud of the empowering stories, in-depth investigations and trusted news we continued to provide to our audiences when they needed it most. Together with the rest of the Board and management team, we look forward to building on 2020’s significant progress in 2021 and beyond.

Thank you for your continued support.

|

| |

| Howard D. Elias Board Chair |

Dave Lougee President and Chief Executive Officer |

Table of Contents

|

Notice of Annual Meeting of Shareholders

| To Our Shareholders:

The 2021 Annual Meeting of Shareholders of TEGNA Inc. will be held for the following purposes:

|

MEETING INFORMATION

DATE: May 7, 2021

TIME: 8:00 a.m.

LOCATION:

Via a live webcast at: www.cesonlineservices.com/tgna21_vm There is no physical location for the Annual Meeting.

| |||

|

|

to consider and act upon a proposal to elect twelve director nominees to the Company’s Board

| |||

|

|

to consider and act upon a Company proposal to ratify the appointment of

| |||

|

|

to consider and act upon a Company proposal to approve, on an advisory basis, the compensation of our named executive officers; | |||

|

|

to consider and act upon a Company proposal regarding the elimination of supermajority voting provisions; and

| |

|

|

to transact such other business, if any, as may properly come before the Annual Meeting or any adjournment or postponement of the meeting. |

Your Board of Directors unanimously recommends that you vote FOR all twelve nominees listed on the enclosed GOLD proxy card or voting instruction form and FOR all other Company proposals.

Please note that Standard General L.P. and certain of its affiliates (collectively, “Standard General”) have notified us that they intend to nominate four persons for election as directors to the Board at the Annual Meeting. You may receive solicitation materials from Standard General, including a proxy statement and White proxy card. We are not responsible for the accuracy of any information provided by or relating to Standard General or its nominees contained in solicitation materials filed or disseminated by or on behalf of Standard General or any other statements that Standard General may make. Standard General chooses which shareholders receive its proxy solicitation materials.

The Board does not endorse any Standard General nominee and unanimously recommends that you vote “FOR” the election of all twelve nominees proposed by the Board using the GOLD proxy card or voting instruction form. Our Board strongly urges you not to vote using any White proxy card sent to you by Standard General. Please note that voting to “withhold” with respect to any Standard General nominee on a White proxy card sent to you by Standard General is not the same as voting for your Board’s nominees, because a vote to “withhold” with respect to a Standard General nominee on its White proxy card will revoke any GOLD proxy you may have previously submitted. To support the Board’s nominees, you should vote FOR the Board’s nominees on the GOLD proxy card and disregard, and not return, any White proxy card sent to you by Standard General. If you have previously submitted a White proxy card sent to you by Standard General, you can revoke that proxy and vote for our Board’s nominees by using the enclosed GOLD proxy card or voting instruction card which will automatically revoke your prior proxy. Only the latest validly executed proxy that you submit will be counted.

We have enclosed the annual report, proxy statement (together with the notice of Annual Meeting), and proxy card or voting instruction form. For specific instructions on how to vote your shares, please refer to the instructions on the proxy card or voting instruction form to vote by Internet, telephone, or by mail. Due to ongoing delays in the postal system, we are encouraging shareholders to submit their proxies electronically – by telephone or by Internet – whenever possible.

The Board of Directors has set the close of business on March 12, 2021 as the record date to determine the shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

By Action of the Board of Directors,

Akin S. Harrison

Senior Vice President, General Counsel and Secretary

Tysons, Virginia

March 26, 2021

Table of Contents

|

Notice of Annual Meeting of Shareholders |

Your Vote Is Important. Please vote by proxy TODAY to ensure that your shares are represented at the Annual Meeting whether or not you currently plan to attend. You do not need to attend the meeting to vote if you vote your shares before the meeting. If you are a record holder, you may vote your shares by mail, telephone or the Internet. If you later decide to attend the meeting, your vote will revoke any proxy previously submitted. If your shares are held by a broker, bank or other nominee, you must follow the instructions provided by your broker, bank or other nominee to vote your shares and you may not vote your shares by ballot at the meeting unless you obtain a “legal proxy” from the broker, bank or other nominee that holds your shares giving you the right to vote the shares at the meeting. Please review “Questions and Answers about the Proxy Materials and the Annual Meeting” beginning on page x of the Proxy Statement for information about attending and voting at the Annual Meeting.

If you hold your shares through a broker, bank, or other nominee and that nominee has also provided you with Standard General’s proxy materials, the nominee will only be able to vote your shares with respect to any proposals at the Annual Meeting if you have instructed them how to vote. Please instruct your broker, bank, or other nominee how to vote your shares using the enclosed GOLD voting instruction card form. Please promptly mark, sign, date and return the GOLD voting instruction form to your broker, bank, or other nominee. Many brokers, banks, or other nominees also permit voting via the Internet or by telephone – please follow the simple directions on the enclosed GOLD voting instruction form.

PLEASE NOTE: Due to continuing delays in the postal system, we encourage all shareholders to vote electronically – by Internet or telephone – whenever possible.

As part of our precautions regarding COVID-19, the Annual Meeting will be held online via a live webcast, at 8:00 a.m. Eastern Time, on May 7, 2021, at www.cesonlineservices.com/tgna21_vm. To participate in the Annual Meeting, you must pre-register at www.cesonlineservices.com/tgna21_vm by 5:00 p.m. Eastern Time, on May 6, 2021.

| INTERNET | TELEPHONE | ONLINE | ||||

|

|

|

|

| |||

| Access the website indicated on the enclosed GOLD proxy card or voting instruction form. |

Call the number indicated on the enclosed GOLD proxy card or voting instruction form. |

Sign, date and return the enclosed GOLD proxy card or voting instruction form in the postage-paid envelope provided. |

Attend the virtual meeting via live webcast at www.cesonlineservices.com/ tgna21_vm and vote by ballot online. | |||

|

If you have questions about how to vote your shares or need additional copies of the proxy materials, please call the firm assisting us with the solicitation of proxies:

INNISFREE M&A INCORPORATED

Shareholders may call: 1(877) 687-1865 (toll-free from the U.S. and Canada), or +1(412) 232-3651 (from other countries)

Banks & Brokers may call: (212) 750-5833 (collect)

|

This Notice of Annual Meeting and Proxy Statement is first being delivered to shareholders on or about March 26, 2021.

Table of Contents

Table of Contents

|

Actions We Took in 2020 To Protect Our Business and Our Stakeholders

Actions Related To Employee Safety

Invested in Initiatives to Enhance Safety At Work

The Company prioritized the health and safety of our employees during COVID-19 by quickly moving employees to remote work and implementing safety and other guidelines for news production employees. For employees who were required to be at our television stations, we invested in modifications to the buildings and other offices based on the Centers for Disease Control and Prevention’s workplace guidelines, including improved HVAC filtration systems, touchless restrooms, additional signage, and many other modifications to continue operating in a safe and sustainable way. We also:

| • | Moved quickly to protect our employees and newsrooms by transitioning to a majority remote environment; |

| • | Maintained our focus on effective and engaging reporting; |

| • | Found innovative ways to deliver trusted news and inspirational content that both informed and brought hope to our audiences in response to the changing COVID-19 environment; and |

| • | Utilized a measured approach to thoughtfully allow a limited return to stations. |

Expanded Employee Benefits to Facilitate Work-from-Home Shift

To enable and improve the work-from-home experience, we deployed more than 1,100 laptops, expanded our video conferencing and VPN capabilities, added IP-based intercoms for production staff, and provided equipment for at home studios. To help employees manage stress and receive support for family care needs while balancing time at work, we made additional mental health and back-up care resources available to employees and their families. We:

| • | Enhanced and communicated the availability of employee mental health benefits, including the ability to consult with medical providers remotely; |

| • | Provided each Company employee with access to Care.com; and |

| • | Paid each non-bonus eligible employee a one-time special bonus of $1,000 prior to Thanksgiving. |

Actions Related to Executive and Director Compensation

Implemented Salary Reduction Plan to Avoid Layoffs during 2020

During the second quarter of 2020, the Company implemented several temporary compensation actions, including

| • | a 25% temporary salary reduction for our CEO, Mr. Lougee, and a 25% fee reduction for each of the Company’s directors; and |

| • | a 20% temporary salary reduction for senior executives, including each of our NEOs other than Mr. Lougee; and |

Coupled with the Company’s decision to limit non-essential expenses, these temporary salary actions taken in the second quarter of 2020 enabled the Company to finish 2020 without making any COVID-related layoffs.

Adopted Performance Scorecard to Measure “Resiliency”

With respect to performance measurement, the Leadership Development and Compensation Committee created a performance scorecard that focused on measuring “resiliency” in order to evaluate how the Company and the management team handled the many challenges created by the pandemic. The scorecard highlighted the Company’s 2020 performance in four key areas: Content, Employees, Community and Business/Strategic. The scorecard is discussed in more detail in our Compensation Discussion & Analysis section beginning on page 24 of this Proxy Statement.

| 2021 PROXY STATEMENT | | | i |

Table of Contents

|

Responding to COVID-19 |

Actions Related To Our Communities

Partnered with Local Nonprofits to Raise Funds for COVID-19 Relief Efforts

TEGNA stations, through virtual telethons, benefit concerts, fundraising drives and awareness campaigns, helped raise more than $66 million for local relief efforts, from supporting frontline healthcare workers to helping ensure families impacted by COVID-19 do not go hungry. In 2020, 36 percent of TEGNA Foundation’s Community Grants directly supported COVID-19 relief efforts.

Doubled Employee Match for Charitable Contributions

In response to the unprecedented impacts of COVID-19 and the social justice movement of 2020, in June, the TEGNA Foundation doubled its employee matching gift program, offering employees a 2:1 match for their donations to the causes and nonprofits most meaningful to them. More than 1,000 unique charities were reached through employee giving, and employee donations combined with the TEGNA Foundation’s matches totaled more than $1.9 million.

| ii |

| | 2021 PROXY STATEMENT |

Table of Contents

|

TEGNA Inc.

This summary highlights information about TEGNA Inc. (“TEGNA” or the “Company”) and the upcoming 2021 annual meeting of shareholders (the “Annual Meeting”). Please review the complete Proxy Statement and TEGNA’s annual report for the fiscal year ended December 31, 2020 (the “2020 Annual Report”) before you vote. The Proxy Statement and the 2020 Annual Report will first be mailed or released to shareholders on or about March 26, 2021.

ANNUAL MEETING OF SHAREHOLDERS

| • Time and Date:

• Record Date:

• Admission: |

8:00 a.m. ET on May 7, 2021

March 12, 2021

You are entitled to attend the Annual Meeting if you were a TEGNA shareholder as of the close of business on the record date. If you plan to attend the meeting, you must register in advance by following the procedures described in “Questions and Answers about the Proxy Materials and the Annual Meeting” beginning on page x and abide by the agenda and procedures for the Annual Meeting (which will be available on the virtual Annual Meeting site). If your shares are held by a broker, bank or other holder of record in “street name” (including shares held in certain TEGNA employee benefit plans), you must also provide proof of your ownership of the shares as of the record date in order to attend the meeting. See “Questions and Answers About the Proxy Materials and Annual Meeting – What must I do if I want to attend the Annual Meeting?” on page xi of this Proxy Statement for additional information and instructions.

|

Company Strategy

TEGNA’s commitment to financial discipline, superior execution and innovative content and marketing solutions creates a compelling long term value proposition.

| 2021 PROXY STATEMENT | | | iii |

Table of Contents

|

2021 Proxy Statement Summary: Performance Highlights |

Performance Highlights

TEGNA achieved record financial results in 2020, creating substantial value for shareholders, and is well positioned for growth into the future.

Highlights of our 2020 performance included:

Total revenues. Total company revenue was $2.9 billion, up 28 percent year-over-year and up 33% relative to the full year 2018.

Record political advertising revenues. The company generated record political advertising revenue of $446 million, up 91 percent relative to full year 2018.

Strong subscription revenue growth. Subscription revenue of $1.3 billion was up 28% year-over-year.

GAAP net income. Our GAAP Net Income was $483 million, up 69 percent year-over-year, with 19% growth compared to 2018.

Adjusted EBITDA. Company Adjusted EBITDA totaled a record $1 billion (representing net income attributable to TEGNA before income taxes, interest expense, equity income, other non-operating items, special items, depreciation and amortization).

Distribution agreement renewals. The company repriced approximately 35 percent of its paid subscribers.

Debt refinancing and paydown. Executed nearly $1.6 billion in refinancings to lower interest expense, extend maturities and increase capital flexibility; reduced net leverage to 3.95x.

Reconciliations of the following non-GAAP financial measures to the Company’s results as reported under accounting principles generally accepted in the United States may be found in the Company’s Form 10-K, filed March 1, 2021: adjusted EBITDA – page 33.

| iv |

| | 2021 PROXY STATEMENT |

Table of Contents

|

2021 Proxy Statement Summary: Voting Matters and Board Recommendations |

Voting Matters and Board Recommendations

| Voting Matter

|

Voting Standard

|

Board Vote

|

See

| |||||

| Proposal 1 | Election of Directors | Twelve nominees receiving greatest number of votes cast | FOR ALL NOMINEES LISTED ON THE GOLD PROXY CARD |

1 | ||||

| Proposal 2 | Ratification of Appointment of Independent Registered Public Accounting Firm | Majority of the shares of common stock present in person or represented by proxy. | FOR | 23 | ||||

| Proposal 3 | Approval, on an Advisory Basis, of the Compensation of our Named Executive Officers | Majority of the votes that could be cast by the shareholders present in person or represented by proxy. | FOR | 62 | ||||

| Proposal 4 | Approval of a Company proposal regarding Elimination of Supermajority Voting Provisions | 80% of the voting power of the Company’s outstanding shares of capital stock entitled to vote generally in the election of directors. | FOR | 63 | ||||

You may receive solicitation materials from Standard General, including a White proxy card. Our Board of Directors does not endorse any of the Standard General nominees and unanimously recommends that you not sign or return the White proxy card sent to you by Standard General. If you previously have signed a White proxy card sent to you by Standard General, you can revoke it by using the enclosed GOLD proxy card to vote by Internet or by telephone, or by signing, dating and returning the enclosed GOLD proxy card in the postage-paid envelope provided. Only your last dated proxy will count.

| 2021 PROXY STATEMENT | | | v |

Table of Contents

|

2021 Proxy Statement Summary: Snapshot of 2021 Director Nominees |

Snapshot of 2021 Director Nominees

Director Nominees

The Board of Directors has nominated the director candidates below. All director nominees have stated that they are willing to serve if elected. Personal information about each director nominee is available beginning on page 2 of this Proxy Statement.

| Name & Principal Occupation

|

Age

|

Director

|

Diversity1 Identifier

|

Status

|

Committee Memberships

| |||||||||||||||||

| Gina L. Bianchini Founder and CEO, Mighty Networks |

48 | 2018 | W | Independent |

Nominating and Governance | |||||||||||||||||

| Howard D. Elias Chair of TEGNA; President, Services and Digital, Dell Technologies |

63 | 2008 | W | Independent | Executive (Chair); Leadership Development and Compensation | |||||||||||||||||

| Stuart J. Epstein Chief Financial Officer, DAZN Group |

58 | 2018 | W | Independent | Audit (financial expert) | |||||||||||||||||

| Lidia Fonseca EVP and Chief Digital and Technology Officer, Pfizer Inc. |

52 | 2014 | L | Independent | Audit; Leadership Development and Compensation | |||||||||||||||||

| Karen H. Grimes Retired Partner, Senior Managing Director and Equity Portfolio Manager, Wellington Management Company |

64 | 2020 | W | Independent | Audit (financial expert) | |||||||||||||||||

| David T. Lougee President and CEO, TEGNA Inc. |

62 | 2017 | W | Executive | Executive | |||||||||||||||||

| Scott K. McCune Founder, MS&E Ventures; Former Vice President of Global Media and Integrated Marketing, The Coca-Cola Company |

64 | 2008 | W | Independent | Audit; Executive; Leadership Development and Compensation (Chair) | |||||||||||||||||

| Henry W. McGee Senior Lecturer, Harvard Business School; Former President, HBO Home Entertainment |

68 | 2015 | B | Independent |

Executive; Nominating and Governance (Chair); Public Policy and Regulation | |||||||||||||||||

| Susan Ness Principal, Susan Ness Strategies; Former FCC Commissioner |

72 | 2011 | W | Independent |

Executive; Nominating and Governance; Public Policy and Regulation (Chair) | |||||||||||||||||

| Bruce P. Nolop Retired CFO, E*Trade Financial Corporation |

70 | 2015 | W | Independent | Audit (financial expert) (Chair); Executive | |||||||||||||||||

| Neal Shapiro President and CEO, public television company WNET |

63 | 2007 | W | Independent |

Nominating and Governance; Public Policy and Regulation | |||||||||||||||||

| Melinda C. Witmer Founder, LookLeft Media; Former Executive Vice President, Chief Video & Content Officer; Time Warner Cable |

59 | 2017 | W | Independent | Leadership Development and Compensation; Public Policy and Regulation | |||||||||||||||||

| 1 | B – Black or African American; L – Latino; W – White or Caucasian. |

| vi |

| | 2021 PROXY STATEMENT |

Table of Contents

|

2021 Proxy Statement Summary: Information About Directors |

Information About Directors

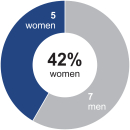

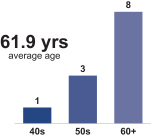

Our Board members have a diverse set of qualifications, skills and experiences and also reflect diversity of age, tenure, gender and race/ethnicity. The Board regularly evaluates its composition to ensure that the skills and experience of the directors as a whole enhance the ability of the Board to provide independent oversight of management as they execute on strategic initiatives to create sustainable stockholder value.

Since 2017, the Company has undergone a Board refreshment process to ensure our directors’ expertise aligns with TEGNA’s strategic evolution. During this period, we added four independent directors with deep expertise in media, technology, social/digital, and capital markets and transactional experience, supplementing the existing skills and experience of our Board. In late 2020, the Nominating and Governance Committee also retained an executive search firm to assist it in building a diverse pipeline of potential Board members.

| Gender Diversity | Racial & Ethnic Diversity | |

|

|

| |

| Age | Tenure | |

|

|

| |

| 2021 PROXY STATEMENT | | | vii |

Table of Contents

|

2021 Proxy Statement Summary: Information About Directors |

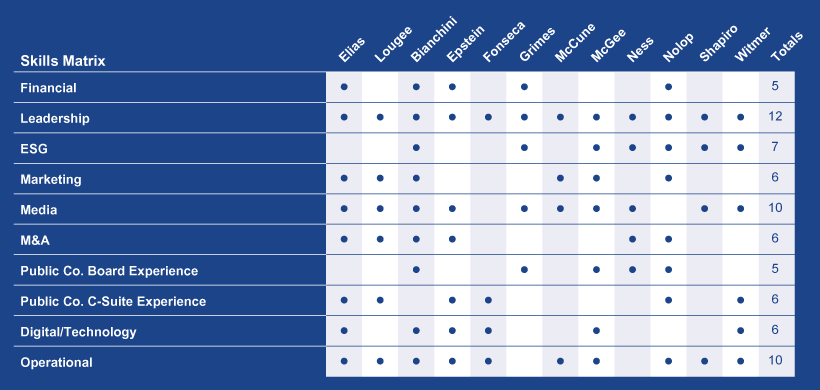

Director Skills Matrix

See the director nominee biographies beginning on Page 2 of this Proxy Statement for further detail. The absence of a “●” for a particular skill does not mean that the director does not possess that qualification, skill, or experience. We look to each director to be knowledgeable in these areas; however, the mark indicates that the item is a particularly prominent qualification, skill or experience that the director brings to the Board.

| viii |

| | 2021 PROXY STATEMENT |

Table of Contents

|

2021 Proxy Statement Summary: Corporate Governance Highlights |

Corporate Governance Highlights

| Board and Governance Practices

u 11 of 12 directors are independent

u Board gender diversity – 5 female directors (42% of Board)

u All Standing Board Committees are fully independent: Audit, Leadership Development and Compensation, Nominating and Governance, Public Policy and Regulation

u Independent Board Chair enhances oversight of management

u All directors stand for election annually

u One-vote-per-share capital structure with all shareholders entitled to vote for director nominees

u Majority voting standard for uncontested director elections with a director resignation policy

u No shareholder rights plan (poison pill) in place

u Annual review by the Board of TEGNA’s major risks with certain oversight delegated to Board committees

u Clear CEO and executive officer succession plan

Board Refreshment and Evaluation

u Ongoing board refreshment process that has resulted in our Board adding 4 independent directors since 2017, the transition of the Board Chair role in 2018 and a low average tenure of our existing directors

u Robust director nominee selection process

u Annual board performance evaluation |

Social Responsibility Practices

u Public Policy and Regulation Committee provides independent oversight of sustainability, environmental matters and social responsibility

u Enhanced reporting of environmental, social and governance (“ESG”) disclosures, including adoption of the SASB Media and Entertainment framework

u Announced that we will be conducting a Task Force on Climate Related Financial Disclosures (TCFD) gap analysis in order to develop goals and set action plans for Scope 1 and Scope 2 greenhouse gas emissions

u Focus on diversity and inclusion initiatives, including appointing a new Chief Diversity Officer

u The Board adopted specific areas of oversight for each Board committee regarding how the Company approaches diversity

u We have established multi-year goals to increase Black, Indigenous and People of Color representation in content teams, news leadership and management roles

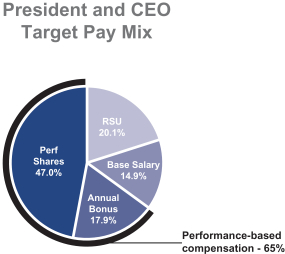

Executive Compensation Practices

u A significant percentage of the compensation we provide to our NEOs is performance-based.

u Maximum annual bonus payouts and performance share payouts are capped at 200% of target. |

u Compensation recoupment (“clawback”) policy covering restatements and misconduct applicable to all current and former executive officers

u Hedging and pledging of TEGNA securities by TEGNA employees and directors is prohibited

u All new change-in-control arrangements are “double trigger”

Shareholder Engagement

u TEGNA maintains a long-standing shareholder engagement program, involving year-round active dialogue and the participation of its independent directors; shareholder feedback is shared with the full Board

u During 2020 and early 2021, the Company actively reached out to shareholders representing, in the aggregate, approximately 54% of our outstanding shares in order to understand their viewpoints concerning a variety of topics

u Several changes implemented in response to feedback gathered during shareholder engagement in recent years, including adoption of proxy access, changes to executive compensation program and enhancements to ESG reporting

Director Engagement

u 8 full Board meetings in 2020; overall attendance at all of the meetings of the Board and Board committees was 95%

u Frequent meetings of non-management directors in executive session without any TEGNA officer present (5 in 2020)

u Directors prohibited from serving on more than 3 other public company boards |

| 2021 PROXY STATEMENT | | | ix |

Table of Contents

|

2021 Proxy Statement Summary: Questions and Answers about the Proxy Materials and Annual Meeting |

Questions and Answers about the

Proxy Materials and Annual Meeting

Why am I receiving these proxy materials?

These proxy materials are being furnished to you in connection with the solicitation of proxies by our Board of Directors for the 2021 Annual Meeting of Shareholders to be held virtually on May 7, 2021 at 8:00 a.m. ET. This Proxy Statement furnishes you with the information you need to vote, whether or not you attend the Annual Meeting.

What items will be voted on at the annual meeting?

Shareholders will vote on the following items if each is properly presented at the Annual Meeting.

| TEGNA Board’s

|

More Information

| |||||

| Proposal 1 | Election of Directors | FOR ALL NOMINEES LISTED ON THE GOLD PROXY CARD |

1 | |||

| Proposal 2 | Ratification of Appointment of Independent Registered Public Accounting Firm | FOR | 23 | |||

| Proposal 3 | Approval, on an Advisory Basis, of the Compensation of the Named Executive Officers | FOR | 62 | |||

| Proposal 4 | Approval of a Company proposal regarding Elimination of Supermajority Voting Provisions | FOR | 63 | |||

What are the Board’s voting recommendations on each item?

Your Board of Directors recommends that you vote FOR ALL the nominees listed in Proposal 1 and FOR Proposals 2 through 4 using the enclosed GOLD proxy card or voting instruction form. Due to ongoing delays in the postal system, we are encouraging all shareholders to vote electronically—by Internet or by telephone—whenever possible. The Board of Directors urges you not to sign, return or vote any WHITE proxy card that may be sent to you by Standard General, even as a protest vote, as only your latest-dated proxy card will be counted. If you have previously voted using a proxy card sent to you by Standard General, you can revoke it at any time prior to the annual meeting by voting using the enclosed GOLD proxy card.

Have other candidates been nominated for election as directors at the Annual Meeting in opposition to the Board’s nominees?

Yes. Standard General, a Company shareholder, has notified us that it intends to nominate four persons for election as directors to the Board at the Annual Meeting. You may receive solicitation materials from Standard General, including a proxy statement and a WHITE proxy card. The Board does not endorse any Standard General nominee and unanimously recommends that you vote “FOR” the election of all twelve nominees proposed by the Board using the GOLD proxy card or voting instruction form. The Board strongly urges you not to sign or return any WHITE proxy card sent to you by Standard General. If you have previously submitted a WHITE proxy card sent to you by Standard General, you can vote for our Board’s nominees by using the enclosed GOLD proxy card or voting instruction form which will automatically revoke your prior proxy. Any later-dated WHITE proxy card that you may send to Standard General will revoke your proxy, including GOLD proxies that

| x |

| | 2021 PROXY STATEMENT |

Table of Contents

|

2021 Proxy Statement Summary: Questions and Answers about the Proxy Materials and Annual Meeting |

you have voted FOR our Board’s nominees, and we strongly urge you not to vote using any WHITE proxy cards sent to you by Standard General. Only the latest-dated, validly executed proxy that you submit will be counted.

What must I do if I want to attend the Annual Meeting?

Attendance at the Annual Meeting or any adjournment or postponement thereof will be limited to shareholders of the Company as of the close of business March 12, 2021, which is the record date for the Annual Meeting (the “Record Date”), and guests of the Company. You will not be able to attend the Annual Meeting in person at a physical location. In order to attend the virtual meeting, you will need to pre-register by 5:00 p.m. Eastern Time on May 6, 2021. To pre-register for the meeting, please follow these instructions:

| • | Shareholders of Record. Shareholders of record as of the Record Date may register to participate in the Annual Meeting remotely by visiting the website www.cesonlineservices.com/tgna21_vm. Please have your proxy card, or Notice, containing your control number available and follow the instructions to complete your registration request. After registering, shareholders will receive a confirmation email with a link and instructions for accessing the virtual Annual Meeting. Requests to register to participate in the Annual Meeting remotely must be received no later than 5:00 p.m., Eastern Time, on May 6, 2021. |

| • | Beneficial Owner of Shares Held in Street Name. Shareholders whose shares are held through a broker, bank or other nominee as of the Record Date may register to participate in the Annual Meeting remotely by visiting the website: www.cesonlineservices.com/tgna21_vm. Please have your Voting Instruction Form, Notice, or other communication containing your control number available and follow the instructions to complete your registration request. After registering, stockholders will receive a confirmation email with a link and instructions for accessing the virtual Annual Meeting. Requests to register to participate in the Annual Meeting remotely must be received no later than 5:00 p.m., Eastern Time, on May 6, 2021. |

Who may vote at the Annual Meeting?

If you owned Company stock at the close of business on the Record Date, then you may attend and vote online during the virtual Annual Meeting. You will need to follow the instructions set forth above in order to register for the Annual Meeting.

If you hold shares through a bank, broker, or other intermediary, you must provide a valid legal proxy, executed in your favor, from the holder of record if you wish to vote those shares at the Annual Meeting. Otherwise, as a beneficial shareholder, you must provide voting instructions to your broker, bank, or other nominee by the deadline provided in the proxy materials you receive from your broker, bank, or other nominee in order for your shares to be voted by such nominee on your behalf. A broker non-vote occurs when shares held by a broker are not voted with respect to a particular proposal because the broker does not have discretionary authority to vote on the matter and has not received voting instructions from its clients. In uncontested situations, under NYSE rules, brokers are permitted to exercise discretionary voting authority on “routine” matters, but beneficial shareholders must provide voting instructions with respect to non-routine matters. However, the rules of the NYSE governing brokers’ discretionary authority do not permit brokers to exercise discretionary authority regarding any of the proposals to be voted on at the Annual Meeting, whether “routine” or not, in contested elections where brokers provide competing proxy materials. Therefore, and subject to brokers providing such competing materials to beneficial owners, your broker would not have the authority to vote on any item considered at the Annual Meeting without your instruction.

Participants in the TEGNA 401(k) Saving Plan may not vote their plan shares by ballot at the Annual Meeting. For additional information on voting of plan shares held in the TEGNA 401(k) Savings Plan, see the question entitled “How do I vote my shares in the Company’s Dividend Reinvestment and 401(k) Plans?” on page xiii below.

At the close of business on the Record Date, we had approximately 220,626,646 shares of common stock outstanding and entitled to vote. Each share is entitled to one vote on each proposal.

What constitutes a quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the Record Date will constitute a quorum to conduct business. Shares held by an intermediary, such as a banker or a broker, that are

| 2021 PROXY STATEMENT | | | xi |

Table of Contents

|

2021 Proxy Statement Summary: Questions and Answers about the Proxy Materials and Annual Meeting |

voted by the intermediary on any or all matters will be treated as shares present for purposes of determining the presence of a quorum. Abstentions and any broker non-votes (defined above) will be counted for the purpose of determining the existence of a quorum.

What is the difference between holding shares as a shareholder of record and as a beneficial owner of shares held in street name?

| • | Shareholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare, you are considered the shareholder of record with respect to those shares, and the proxy materials are being sent directly to you by the Company. |

| • | Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the proxy materials are being forwarded to you by your bank, broker or other intermediary. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. |

If I am a shareholder of record of Company shares, how do I vote?

If you are a shareholder of record, you may vote by proxy via the Internet or by telephone by following the instructions provided in the enclosed proxy card. You may also vote by signing, dating and returning the enclosed proxy card in the postage-paid envelope provided. However, due to ongoing delays in the postal system, we are encouraging shareholders to vote electronically—by telephone or by Internet—whenever possible.

Shareholders of record may also attend the Annual Meeting and vote in person by ballot.

Even if you currently plan to attend the Annual Meeting, we encourage you to vote by proxy TODAY to ensure that your shares are represented at the Annual Meeting. Your vote by ballot at the Annual Meeting will revoke any proxies previously submitted.

If I am a beneficial owner of shares held in street name, how do I vote?

As described above, as a beneficial shareholder, you may vote by proxy by following the instructions provided to you by your bank, broker or other intermediary on the voting instruction form. You must provide your voting instructions to your broker, bank, or other nominee by the deadline provided in the proxy materials you receive from your broker, bank, or other nominee in order for your shares to be voted. Due to ongoing delays in the postal system, we are encouraging shareholders to vote electronically—by telephone or by Internet—whenever possible.

If you are a beneficial owner of shares held in street name and you wish to attend the Annual Meeting and vote by ballot, you will need to provide a legal proxy, in PDF or Image file format, from the organization that holds your shares giving you the right to vote your shares.

Will I be able to ask questions at the Annual Meeting?

Questions submitted during the Annual Meeting pertinent to meeting matters will be answered during the meeting, subject to time constraints. Additional information regarding the ability of shareholders to ask questions during the Annual Meeting will be included in the rules of conduct that will be available on the virtual Annual Meeting website.

Can I change or revoke my vote?

Yes. If you deliver a proxy by mail, by telephone or via the Internet, you have the right to revoke your proxy in writing (by mailing another proxy bearing a later date), by phone (by another call at a later time), via the Internet (by voting online at a later time), by attending the virtual Annual Meeting and voting by ballot, or by notifying the Company before the Annual Meeting that you want to revoke your proxy. Submitting your vote by mail, telephone or via the Internet will not affect your right to vote by ballot if you decide to attend the Annual Meeting.

| xii |

| | 2021 PROXY STATEMENT |

Table of Contents

|

2021 Proxy Statement Summary: Questions and Answers about the Proxy Materials and Annual Meeting |

In addition, if you have already voted using the White proxy card, you can revoke that proxy and vote for our Board’s nominees by using the enclosed GOLD proxy card or voting instruction form. Only the latest-dated, validly executed proxy that you submit will be counted.

What are the votes required to adopt the proposals?

Each share of our common stock outstanding on the Record Date is entitled to one vote on each of the director nominees and one vote on each other matter. The director nominees will be elected by the vote of a plurality of the votes cast at the Annual Meeting. The “plurality of votes cast” means that the twelve director nominees receiving the greatest number of “FOR” votes cast will be elected. Ratification of the selection of our independent registered public accounting firm and the non-binding advisory vote to adopt the resolution to approve the Company’s executive compensation program described in this Proxy Statement requires the affirmative vote of the majority of the shares of common stock present or represented by proxy and entitled to vote at the meeting. Approval of the binding Company proposal to eliminate supermajority voting provisions requires the affirmative vote of the holders of eighty percent (80%) of the voting power of the outstanding shares of capital stock entitled to vote generally in the election of directors. Abstentions, if any, will have no effect on the election of any director, but will have the same effect as votes “against” each of the other three proposals.

How do I vote my shares in the Company’s Dividend Reinvestment and 401(k) Plans?

If you participate in the Company’s Dividend Reinvestment Plan, your shares of stock in that plan can be voted in the same manner as shares held of record. If you do not give instructions, your shares held in the Dividend Reinvestment Plan will not be voted. If you participate in the TEGNA 401(k) Savings Plan (the “401(k) Plan”), only the trustee for the 401(k) Plan may vote the shares on your behalf. Please direct the trustee(s) how to vote your shares by using the enclosed voting instruction form. All shares in the 401(k) Plan for which no instructions are received will be voted in the same proportion as instructions provided to the trustee by other 401(k) Plan participants.

How do I submit a shareholder proposal or nominate a director for election at the 2022 Annual Meeting?

To be eligible for inclusion in the proxy materials for the Company’s 2022 Annual Meeting, a shareholder proposal must be submitted in writing to TEGNA Inc., 8350 Broad Street, Suite 2000, Tysons, Virginia 22102, Attn: Secretary and must be received by November 26, 2021. A shareholder who wishes to present a proposal or nomination at the Company’s 2022 Annual Meeting, but who does not request that the Company solicit proxies for the proposal or nomination, must submit the proposal or nomination to the Company at the same address no earlier than January 7, 2022 and no later than January 27, 2022. The Company’s By-laws require that any proposal or nomination must contain specific information in order to be validly submitted for consideration.

Can shareholders and other interested parties communicate directly with our Board?

Yes. The Company invites shareholders and other interested parties to communicate directly and confidentially with the full Board of Directors, the Chair of the Board or the non-management directors as a group by writing to the Board of Directors, the Chair or the Non-Management Directors, TEGNA Inc., 8350 Broad Street, Suite 2000, Tysons, Virginia 22102, Attn: Secretary. The Secretary will forward such communications to the intended recipient and will retain copies for the Company’s records.

How can I obtain a shareholder list?

We will make available a list of shareholders of record as of the Record Date for inspection by shareholders for any purpose germane to the 2021 Annual Meeting from April 27 through May 7, 2021 at our headquarters located at 8350 Broad Street, Tysons, VA 22102. Due to the fact that the normal business hours of our headquarters have been affected due to the

| 2021 PROXY STATEMENT | | | xiii |

Table of Contents

|

2021 Proxy Statement Summary: Questions and Answers about the Proxy Materials and Annual Meeting |

COVID-19 pandemic, if you wish to inspect the list, please submit your request, along with proof of ownership, by email to shareholderlist@tegna.com. The list will also be available electronically on the meeting website during the live webcast of the 2021 Annual Meeting.

How can I obtain a copy of the Company’s 2020 Annual Report?

A copy of our 2020 Annual Report, which includes the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, accompanies this Proxy Statement. If you need additional copies, please contact the firm assisting us with the solicitation of proxies, Innisfree M&A Incorporated TOLL-FREE at 1(877) 687-1865 (from the U.S. and Canada), or +1(412) 232-3651 (from other countries).

You may also obtain a copy without charge by writing to: TEGNA Inc., 8350 Broad Street, Suite 2000, Tysons, Virginia 22102, Attn: Secretary. Our 2020 Annual Report and 2020 Form 10-K are also available through the Company’s website at www.tegna.com. The Company’s Annual Report and Form 10-K are not proxy soliciting materials.

How can I obtain an additional proxy card or voting instruction form?

If you lose, misplace, or otherwise need to obtain a proxy card or voting instruction form:

| • | If you are a shareholder of record, please contact Innisfree M&A Incorporated, the Company’s proxy solicitor, toll free at (877) 687-1865 (from the U.S. and Canada) or +1(412) 232-3651 (from other countries); or |

| • | If you are the beneficial owner of shares held indirectly through a broker, bank, or other nominee, contact your account representative at that organization. |

What happens if the meeting is postponed or adjourned?

If the meeting is postponed or adjourned, your proxy will still be good and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted. See “Can I change or revoke my vote?” above.

Who pays for the cost of proxy preparation and solicitation?

Our Board is responsible for the solicitation of proxies for the Annual Meeting. All costs of the solicitation of proxies will be borne by us. We pay for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks, trusts or nominees for forwarding proxy materials to street name holders.

In addition, our directors, officers, and employees may solicit proxies by telephone or other means of communication personally. Our directors, officers and employees will receive no additional compensation for these services other than their regular compensation. Appendix A sets forth information relating to certain of our directors, officers and employees who are considered “participants” in this proxy solicitation under the rules of the SEC by reason of their positions or because they may be soliciting proxies on our behalf.

If you have questions about how to vote your shares or need

additional copies of the proxy materials, please call the firm assisting

us with the solicitation of proxies:

INNISFREE M&A INCORPORATED

Shareholders may call:

1(877) 687-1865 (toll-free from the U.S. and Canada), or

+1(412) 232-3651 (from other countries)

Banks & Brokers may call:

(212) 750-5833 (collect)

| xiv |

| | 2021 PROXY STATEMENT |

Table of Contents

|

2021 Proxy Statement Summary: Background of the Solicitation |

Background of the Solicitation

During the 2020 proxy season, Standard General engaged in an unsuccessful campaign to replace five members of the Board and have shareholders elect five Standard General-selected nominees—including Soohyung Kim, Standard General’s managing partner, and Colleen B. Brown—to the Board of Directors, the background for which is presented in our proxy statement for the Company’s 2020 annual meeting of shareholders (the “2020 Annual Meeting”). Standard General’s 2020 slate of nominees also included Mr. Lawrence Wert, whose nomination was subsequently withdrawn due to conflicts of interest caused by a publicly available non-compete covenant in his existing employment agreement with Tribune Media Company that would have restricted his service on the Board, which Standard General failed to diligence prior to his nomination.

Immediately after the conclusion of the 2020 Annual Meeting, Howard D. Elias, the Chair of the Board, reached out to Mr. Kim to emphasize the Company’s desire to have a constructive relationship with Standard General as it seeks to have with all its shareholders. Shortly thereafter, Dave Lougee, the President and Chief Executive Officer of the Company, and Mr. Elias had a call with Mr. Kim to reiterate this desire.

On June 4, 2020, Standard General filed with the SEC Amendment No. 6 to the beneficial ownership report on Schedule 13D (the “Schedule 13D”) relating to its interest in the Company, reporting beneficial ownership of 9.9% of the Company’s outstanding common stock, a reduction from the 11.8% beneficial ownership previously reported on April 24, 2020. The reduction resulted from Standard General’s irrevocable waiver and cancellation of its rights with respect to swap transactions covering an aggregate of 4,000,000 shares of the Company’s outstanding common stock, pursuant to which Standard General elected to have the swap counterparty deliver to Standard General shares of the Company’s common stock upon settlement or exercise of such swap transaction. On June 11, 2020, Standard General filed with the SEC Amendment No. 7 to the Schedule 13D, reporting a further decrease in its beneficial ownership of the Company’s outstanding common stock to 8.1% as a result of sales of the Company’s common stock and cash settlement of certain cash swap transactions.

Following the 2020 Annual Meeting, the Company continued to engage with shareholders on its business, corporate strategies and initiatives, corporate performance and prospects and various governance enhancements, including soliciting shareholder input on ESG matters, human capital management, diversity and inclusion and executive compensation. The Company’s initiatives with respect to such matters are discussed in more depth elsewhere in this Proxy Statement. In 2020, the Company appointed a Chief Diversity Officer to partner with organizational leaders to develop and execute the Company’s diversity strategy, launched a Diversity & Inclusion Working Group and established multi-year diversity and inclusion goals. In addition, the Board adopted specific areas of oversight to strengthen accountability on diversity for each of the Leadership Development and Compensation, Nominating and Governance, Public Policy and Regulatory and Audit Committees of the Board. The Company also decided to submit for shareholder approval a Board-recommended proposal to eliminate the supermajority voting provisions in the Company’s organizational documents. The Company continued to focus on its operations and delivering substantial value to shareholders, achieving record total revenue, political advertising revenue, subscription revenue and net income in 2020, which exceeded full-year 2020 guidance provided prior to the COVID-19 pandemic for all key financial metrics.

As part of its shareholder engagement efforts, representatives of the Company made several attempts to engage with Standard General, including seeking to schedule individual meetings with Standard General to solicit suggestions and feedback on the Company’s operations and strategic plan, given that Standard General remained a significant shareholder of the Company. Aside from a telephonic meeting in August 2020 regarding the Company’s earnings for the second quarter ended June 30, 2020, where Mr. Kim stated that the Company should consider making a large acquisition in an adjacent business, Standard General did not elect to engage with the Company on these meetings. In fact, in early January 2021, Mr. Elias and Mr. Lougee sent a year-end shareholder letter to all of the Company’s large shareholders, including Mr. Kim. Mr. Kim responded to the letter, indicating that he would contact Mr. Lougee the following week, but never did.

On January 19, 2021, two days before the expiration of the advance notice period for shareholder nominations in connection with the 2021 Annual Meeting under the Company’s by-laws (the “Nomination Period”), a representative of Fried, Frank, Harris, Shriver & Jacobson LLP, Standard General’s outside counsel (“Fried Frank”), contacted Akin S. Harrison, Senior Vice President, General Counsel and Secretary of the Company, and asked for various shareholder nominee materials, including a directors’ and officers’ questionnaire and representation agreement, noting that Standard General had not yet decided whether to nominate candidates but wanted the materials in case it chose to do so. In sending these nomination documents to

| 2021 PROXY STATEMENT | | | xv |

Table of Contents

|

2021 Proxy Statement Summary: Background of the Solicitation |

Standard General’s counsel, Mr. Harrison reiterated that the Company had previously invited Standard General to meet with the Company and that the Company was still willing to do so.

On January 20, 2021, the last day of the Nomination Period, Standard General submitted a notice of nomination of four nominees—Ms. Brown, Adonis Hoffman, Carlos Salas and Elizabeth Tumulty—for election to the Board at the 2021 Annual Meeting. As noted above, prior to its notice of nomination, Standard General never indicated it would be nominating director candidates at the 2021 Annual Meeting, and none of these nominees were previously identified to the Company.

On January 21, 2021, Standard General filed with the SEC Amendment No. 8 to the Schedule 13D, reporting beneficial ownership of 7.6% of the Company’s outstanding common stock and the submission of its notice of nomination to the Company.

Immediately after, and in light of, the receipt of Standard General’s notice of nomination and the filing of Amendment No. 8, Mr. Elias sent an email to Mr. Kim requesting a telephonic meeting, which request was not answered. The Company continued to follow up on such request, and after repeated attempts, Mr. Kim responded two weeks after Mr. Elias’ invitation to meet, indicating that he would not be available for a meeting, but Amit Thakrar, an analyst who was “running point” on Standard General’s investment in the Company, would attend such meeting.

On February 11, 2021, Mr. Elias and Mr. Lougee met telephonically with Mr. Thakrar to discuss Standard General’s investment thesis for the Company, its rationale for nominating directors to the Board and the selection process for such nominees. Aside from a comment that the Company improve its shareholder nominee interview and evaluation process, Mr. Thakrar was unable to provide further information regarding the purpose of the nomination notice or Standard General’s plans with respect to the 2021 Annual Meeting. Mr. Thakrar did not articulate concerns or make any suggestions with respect to the Company’s operations or strategic plans.

Following receipt of the notice of nominations, the Board and the Nominating and Governance Committee of the Board (the “Committee”) determined to consider and review each of the proposed nominees and conduct interviews of each candidate. The Committee also determined to request that Russell Reynolds Associates (“Russell Reynolds”), who had previously been engaged in connection with Board development efforts, also review and interview each candidate directly to further enhance the Committee’s assessment of the nominations.

Beginning on February 25, 2021, at the request of the Board and the Committee, Russell Reynolds sought to perform background checks on each of Standard General’s nominees. In addition, Russell Reynolds also interviewed Standard General’s candidates and, where available, their references.

Between February 23 and March 1, 2021, members of the Committee and the Board interviewed and evaluated each of Standard General’s nominees except Mr. Hoffman, whose scheduled interview was subsequently postponed at Mr. Hoffman’s request. Mr. Hoffman asked that his interview and background check be postponed while he considered whether he had actual or potential conflicts that could interfere with service on the Board and whether he wished to move forward with his nomination.

On March 2, 2021, Standard General filed with the SEC Amendment No. 9 to the Schedule 13D, reporting an increase in its beneficial ownership of the Company’s outstanding common stock to 9.2% as a result of purchases of the Company’s common stock in connection with the settlement of certain swap agreements in respect of the Company’s common stock in cash and common stock.

On March 4, 2021, Standard General filed with the SEC Amendment No. 10 to the Schedule 13D, reporting that Mr. Hoffman informed Standard General that he had chosen to withdraw from consideration as a nominee. Mr. Hoffman also sent a letter to the Board on the same day, apprising the Board that he was withdrawing his candidacy due to conflicts of interest as well as discomfort in working with Mr. Lougee due to an incident in 2014 in which he said Mr. Lougee mistook him for a hotel car valet after an industry event that they had both attended.

Also on March 4, 2021, the Board and the Committee each concluded that none of the Standard General nominees would provide the Board with experience or industry expertise that it didn’t already possess. The Board of Directors determined, upon the recommendation of the Committee, that the appointment of each of Standard General’s nominees would not be in the best interest of the Company’s shareholders. Mr. Elias notified Standard General of the Board’s conclusion on March 10, 2021.

| xvi |

| | 2021 PROXY STATEMENT |

Table of Contents

|

2021 Proxy Statement Summary: Background of the Solicitation |

Immediately after receipt of Mr. Hoffman’s letter, the Board commenced an inquiry into the 2014 incident and Mr. Lougee’s conduct, including through meetings and interviews between Mr. Lougee and Mr. Harrison, Mr. Elias, the full Board and representatives of Ropes & Gray LLP, who was engaged by the Company to conduct such inquiry. In addition, Jeffery Newman, the Chief Human Resources Officer of the Company, completed a full review of Mr. Lougee’s personnel file. The Board did not uncover any further allegations or evidence of similar conduct by Mr. Lougee.

On March 8, 2021, Standard General sent a letter to the Board, stating that Mr. Hoffman had shared with them an account of the 2014 incident, which purported to reveal “Mr. Lougee’s deeply-ingrained racial biases,” and asking that the Board promptly engage in an investigation into Mr. Lougee’s conduct and his behavior towards other members of minority groups. Also on March 8, 2021, the Company issued a letter to its stakeholders from the Chairman of the Board and the Chairman of the Committee, on behalf of the Board, and an e-mail communication to its employees from Mr. Lougee regarding these matters.

On March 9, 2021, Standard General filed with the SEC Amendment No. 11 to the Schedule 13D, reporting a decrease in its beneficial ownership of the Company’s outstanding common stock to 7.9% as a result of sales of the Company’s common stock.

On March 16, 2021, the Company received a demand from Standard General to inspect its shareholder list materials pursuant to Section 220 of the Delaware General Corporation Law, as amended (the “220 Demand”). On March 19, 2021, the Company provided Standard General with its response to the 220 Demand.

On March 17, 2021, Standard General filed with the SEC Amendment No. 12 to the Schedule 13D, reporting a decrease in its beneficial ownership of the Company’s outstanding common stock to 7.0% as a result of sales of the Company’s common stock.

Also on March 17, 2021, Standard General filed its preliminary proxy statement for the 2021 Annual Meeting.

Subsequently, Standard General sent further communications to the Company, including a letter to the Board, which it also issued as a press release and filed as soliciting material with the SEC, relating to diversity, equity and inclusion-related matters and the 2014 incident concerning Mr. Hoffman.

| 2021 PROXY STATEMENT | | | xvii |

Table of Contents

|

Proposal 1—Election of Directors

(Proposal 1 on the proxy card)

The Board of Directors is currently composed of twelve directors. The Board of Directors held eight meetings during 2020. Each director attended at least 95% of the meetings of the Board and its committees on which he or she served that were held during the period for which he or she served as a director or committee member, as applicable, during 2020. All directors then serving on the Board virtually attended the 2020 Annual Meeting in accordance with the Company’s policy that all directors attend the Annual Meeting, except for Ms. Bianchini, due to a scheduling error. Ms. Bianchini has attended all other annual meetings since joining the Board in 2018.

Nominees elected to our Board at the 2021 Annual Meeting will serve one-year terms expiring at the Company’s 2022 Annual Meeting of Shareholders. The Board, upon the recommendation of its Nominating and Governance Committee, has nominated the following individuals: Gina L. Bianchini, Howard D. Elias, Stuart J. Epstein, Lidia Fonseca, Karen H. Grimes, David T. Lougee, Scott K. McCune, Henry W. McGee, Susan Ness, Bruce P. Nolop, Neal Shapiro and Melinda C. Witmer. The Board believes that each of the nominees will be available and able to serve as a director. Each of the nominees has consented to being named in this Proxy Statement and to serve on the Board, if elected. If any nominee becomes unable or unwilling to serve, the Board may do one of three things: recommend a substitute nominee, reduce the number of directors to eliminate the vacancy, or fill the vacancy later. The shares represented by all valid proxies may be voted for the election of a substitute if one is nominated.

Under the Company’s By-laws, the 2021 director nominees will be elected by the vote of a plurality of the votes cast at the Annual Meeting. The “plurality of votes cast” means that the twelve director nominees receiving the greatest number of “FOR” votes cast will be elected.

| The Company’s Board of Directors unanimously recommends that you use the GOLD proxy card to vote “FOR” the election of each of the Board’s nominees to serve as directors of the Company until the Company’s 2022 Annual Meeting and until their successors are elected and qualified. The Board does not endorse any Standard General nominee.

|

The Board strongly urges you not to sign or return any White proxy card sent to you by Standard General. If you have previously submitted a White proxy card sent to you by Standard General, you can vote for the Board’s nominees and on the other matters to be voted on at the Annual Meeting by using the enclosed GOLD proxy card or voting instruction form, which will automatically revoke your prior proxy.

In addition to the information set forth below, Appendix A sets forth information relating to the Company’s directors, the Board’s nominees for election as directors and certain of the Company’s officers who are considered “participants” in our solicitation under the rules of the SEC by reason of their positions as directors, nominees or because they will be soliciting proxies on our behalf.

Our Board regularly reviews the Company’s Board leadership structure, how the structure is functioning and whether the structure continues to be in the best interest of our shareholders. Our Board has determined that having an independent director serve as the Chair of the Board is currently the best leadership structure for the Company. Separating the positions of Chair and CEO allows the CEO to focus on executing the Company’s strategic plan and managing the Company’s operations and performance and permits improved communications between the Board, the CEO and other senior leaders of the Company.

| 2021 PROXY STATEMENT | | | 1 |

Table of Contents

|

Proposal 1—Election of Directors: Information about the TEGNA Nominees |

The duties of the Chair of the Board include:

| • | presiding over all meetings of the Board and all executive sessions of non-management directors; |

| • | serving as liaison on Board-wide issues between the CEO and the non-management directors, although Company policy also provides that all directors shall have direct and complete access to the CEO at any time as they deem necessary or appropriate, and vice versa; |

| • | in consultation with the CEO, reviewing and approving Board meeting schedules, agendas and materials; |

| • | calling meetings of the non-management directors, if desired; and |

| • | being available when appropriate for consultation and direct communication if requested by shareholders. |

The following director nominees are currently serving on the Board and have been nominated by the Board on the unanimous recommendation of the Nominating and Governance Committee to stand for re-election at the Company’s 2021 Annual Meeting for a one-year term. The principal occupation and business experience of each TEGNA nominee, including the reasons the Board believes each of them should be re-elected to serve another term on the Board, are described below.

|

The Board of Directors recommends that shareholders “FOR” each of the TEGNA nominees by following the voting instructions contained on the enclosed GOLD proxy card. |

|

|

Gina L. Bianchini Founder and CEO, Mighty Networks Age: 48 Director since: 2018 |

TEGNA Committees: • Nominating and Governance

Other Public Company Directorships: • Empower Limited |

| 2 |

| | 2021 PROXY STATEMENT |

Table of Contents

|

Proposal 1—Election of Directors: Information about the TEGNA Nominees |

|

|

Howard D. Elias Chair of TEGNA; Chief Customer Officer and President, Services and Digital, Dell Technologies Age: 63 Director since: 2008 |

TEGNA Committees: • Executive (Chair) • Leadership Development and Compensation |

|

|

Stuart J. Epstein Chief Financial Officer, DAZN Group Age: 58 Director since: 2018 |

TEGNA Committees: • Audit |

| 2021 PROXY STATEMENT | | | 3 |

Table of Contents

|

Proposal 1—Election of Directors: Information about the TEGNA Nominees |

|

|

Lidia Fonseca EVP and Chief Digital and Technology Officer, Pfizer Inc. Age: 52 Director since: 2014 |

TEGNA Committees: • Audit • Leadership Development and Compensation |

|

|

Karen H. Grimes Retired Partner, Senior Managing Director and Equity Portfolio Manager, Wellington Management Company Age: 64 Director since: 2020 |

TEGNA Committees: • Audit

Other Public Company Directorships: • Toll Brothers, Inc. |

| 4 |

| | 2021 PROXY STATEMENT |

Table of Contents

|

Proposal 1—Election of Directors: Information about the TEGNA Nominees |

|

|

David T. Lougee President and CEO, TEGNA Inc. Age: 62 Director since: 2017 |

TEGNA Committees: • Executive |

|

|

Scott K. McCune Founder, MS&E Ventures; Former VP, Global Media and Integrated Marketing, The Coca Cola Company Age: 64 Director since: 2008 |

TEGNA Committees: • Audit • Executive • Leadership Development and Compensation (Chair) |

| 2021 PROXY STATEMENT | | | 5 |

Table of Contents

|

Proposal 1—Election of Directors: Information about the TEGNA Nominees |

|

|

Henry W. McGee Senior Lecturer, Harvard Business School Age: 68 Director since: 2015 |

TEGNA Committees: • Executive • Nominating and Governance (Chair) • Public Policy and Regulation

Other Public Company Directorships: • AmerisourceBergen Corporation |

|

|

Susan Ness Principal, Susan Ness Strategies; Former FCC Commissioner Age: 72 Director since: 2011 |

TEGNA Committees: • Executive • Nominating and Governance • Public Policy and Regulation (Chair) |

| 6 |

| | 2021 PROXY STATEMENT |

Table of Contents

|

Proposal 1—Election of Directors: Information about the TEGNA Nominees |

|

|

Bruce P. Nolop Retired CFO, E*Trade Financial Corporation Age: 70 Director since: 2015 |

TEGNA Committees: • Audit (Chair) • Executive

Other Public Company Directorships: • Marsh & McLennan Companies, Inc. |

|

|

Neal Shapiro President and CEO, public television company WNET Age: 63 Director since: 2007 |

TEGNA Committees: • Nominating and Governance • Public Policy and Regulation |

| 2021 PROXY STATEMENT | | | 7 |

Table of Contents

|

Proposal 1—Election of Directors: Information about the TEGNA Nominees |

|

|

Melinda C. Witmer Founder, LookLeft Media; Former Executive Vice President, Chief Video & Content Officer, Time Warner Cable Age: 59 Director since: 2017 |

TEGNA Committees: • Leadership Development and Compensation • Public Policy and Regulation |

| 8 |

| | 2021 PROXY STATEMENT |

Table of Contents

|

Proposal 1—Election of Directors: Committees of the Board of Directors |

Committees of the Board of Directors

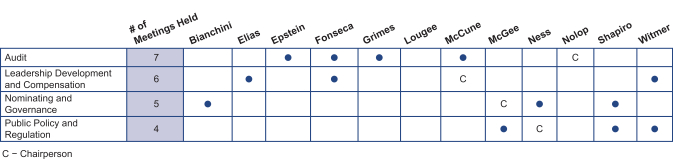

The Board of Directors conducts its business through meetings of the Board and its four standing committees: the Audit Committee, Leadership Development and Compensation Committee, Nominating and Governance Committee and Public Policy and Regulation Committee. The Board also has an Executive Committee (not shown on the chart below) made up of the Board Chair, the CEO and each of the Board committee chairs, that may exercise the authority of the Board between meetings, as required. The chart below shows the current membership and chairperson of each of the standing Board committees and the number of committee meetings held during 2020. Each member of the Audit, Leadership Development and Compensation, Nominating and Governance, and Public Policy and Regulation Committee meets the applicable independence requirements of the SEC and NYSE for service on the Board and each committee on which she or he serves.

Audit Committee

The Audit Committee assists the Board of Directors in its oversight of financial reporting practices and the quality and integrity of the financial reports of the Company, including compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, and the performance of the Company’s internal audit function. The Audit Committee appoints and is responsible for setting the compensation of the Company’s independent registered public accounting firm. The Audit Committee reviews the Company’s independent registered public accounting firm’s qualification, performance and independence on an annual basis.

The Audit Committee also provides oversight of the Company’s internal audit function and oversees the adequacy and effectiveness of the Company’s accounting and financial controls and the guidelines and policies that govern the process by which the Company undertakes financial, accounting and audit risk assessment and risk management. In connection with the Ethics Policy, the Audit Committee has established procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting controls or auditing matters and the confidential, anonymous submission by employees of the Company of any accounting or auditing concerns. In addition, the Committee monitors the Company’s finance- and investment-related diversity and inclusion efforts, including the Company’s investment, procurement and purchasing involving minority-owned businesses.

The Audit Committee members are not professional accountants or auditors, and their role is not intended to duplicate or certify the activities of management and the independent registered public accounting firm, nor can the Committee certify that the independent registered public accounting firm is “independent” under applicable rules.

The Board has determined that each of Bruce P. Nolop, Stuart J. Epstein and Karen H. Grimes is an audit committee financial expert, as that term is defined under SEC rules.

Executive Committee

The Executive Committee may exercise the authority of the Board between Board meetings, except as limited by Delaware law. In 2020, the full board was able to review all items requiring Board oversight or approval, and did not require the Executive Committee to act in its stead.

| 2021 PROXY STATEMENT | | | 9 |

Table of Contents

|

Proposal 1—Election of Directors: Committees of the Board of Directors |

Leadership Development and Compensation Committee