x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Delaware | 16-0442930 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

7950 Jones Branch Drive, McLean, Virginia | 22107-0150 | |

(Address of principal executive offices) | (Zip Code) | |

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $1.00 per share | The New York Stock Exchange | |

Large accelerated filer | x | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Item No. | Page | |

1. | ||

1A. | ||

1B. | ||

2. | ||

3. | ||

4. | ||

5. | ||

6. | ||

7. | ||

7A. | ||

8. | ||

9. | ||

9A. | ||

10. | ||

11. | ||

12. | ||

13. | ||

14. | ||

15. | ||

16. | ||

• | The first trend was a move to embrace a SaaS approach to digital product development. Rather than building all technologies in-house and incurring significant staffing and capital expenses, we began to leverage best-in-class SaaS providers to rapidly enable and iterate on new features and functionalities while augmenting critical components with a small internal team to create unique opportunities and differentiated experiences. This allowed our Media Segment to optimize user experience and create personalized content. |

• | The second key trend is our continued development of products based on the movement of audiences to mobile and off-platform channels such as social and Internet-enabled television services commonly referred to as “over the top” or “OTT”. We have made significant strides engaging consumers based on these new digital content consumption patterns measured by number of Facebook video plays and social interactions according to CrowdTangle and Omniture. |

• | The third trend is around monetization as our Media Segment has effectively optimized its programmatic advertising scale and efficiencies. We believe these key initiatives in 2016 along with the hiring of digital executive leadership have our Media Segment well positioned for an exciting 2017. |

2016 | 2015 | ||||

Media | 4,908 | 5,020 | |||

Digital | 5,014 | 4,785 | |||

Corporate | 199 | 215 | |||

Total | 10,121 | 10,020 | |||

State/District of Columbia | City | Station/web site | Channel/Network | Affiliation Agreement Expires in | Market TV Households (5) | Founded | |

Arizona | Flagstaff | KNAZ-TV: 12news.com | Ch. 2/NBC | 2021 | (6 | ) | 1970 |

Phoenix | KPNX-TV: 12news.com | Ch. 12/NBC | 2021 | 1,890,100 | 1953 | ||

Tucson | KMSB-TV: tucsonnewsnow.com | Ch. 11/FOX | 2019 | 425,860 | 1967 | ||

KTTU-TV(1): tucsonnewsnow.com | Ch. 18/MNTV | 2018 | 425,860 | 1984 | |||

Arkansas | Little Rock | KTHV-TV: thv11.com | Ch. 11/CBS | 2019 | 547,950 | 1955 | |

California | Sacramento | KXTV-TV: abc10.com | Ch. 10/ABC | 2018 | 1,379,770 | 1955 | |

Colorado | Denver | KTVD-TV: my20denver.com | Ch. 20/MNTV | 2018 | 1,630,380 | 1988 | |

KUSA-TV: 9news.com | Ch. 9/NBC | 2021 | 1,630,380 | 1952 | |||

District of Columbia | Washington | WUSA-TV: wusa9.com | Ch. 9/CBS | 2019 | 2,476,680 | 1949 | |

Florida | Jacksonville | WJXX-TV: firstcoastnews.com | Ch. 25/ABC | 2018 | 688,500 | 1989 | |

WTLV-TV: firstcoastnews.com | Ch. 12/NBC | 2021 | 688,500 | 1957 | |||

Tampa-St. Petersburg | WTSP-TV: wtsp.com | Ch. 10/CBS | 2019 | 1,908,590 | 1965 | ||

Georgia | Atlanta | WATL-TV: myatltv.com | Ch. 36/MNTV | 2018 | 2,412,730 | 1954 | |

WXIA-TV: 11alive.com | Ch. 11/NBC | 2021 | 2,412,730 | 1948 | |||

Macon | WMAZ-TV: 13wmaz.com | Ch. 13/CBS | 2019 | 232,910 | 1953 | ||

Idaho | Boise | KTVB-TV(3): ktvb.com | Ch. 7/NBC | 2021 | 270,200 | 1953 | |

Kentucky | Louisville | WHAS-TV: whas11.com | Ch. 11/ABC | 2018 | 662,170 | 1950 | |

Louisiana | New Orleans | WWL-TV: wwltv.com | Ch. 4/CBS | 2019 | 641,620 | 1957 | |

WUPL-TV(4): wupltv.com | Ch. 54/MNTV | 2018 | 641,620 | 1955 | |||

Maine | Bangor | WLBZ-TV: wlbz2.com | Ch. 2/NBC | 2021 | 133,310 | 1954 | |

Portland | WCSH-TV: wcsh6.com | Ch. 6/NBC | 2021 | 383,700 | 1953 | ||

Michigan | Grand Rapids | WZZM-TV: wzzm13.com | Ch. 13/ABC | 2018 | 709,670 | 1962 | |

Minnesota | Minneapolis-St. Paul | KARE-TV: kare11.com | Ch. 11/NBC | 2021 | 1,742,530 | 1953 | |

Missouri | St. Louis | KSDK-TV: ksdk.com | Ch. 5/NBC | 2021 | 1,215,570 | 1947 | |

New York | Buffalo | WGRZ-TV: wgrz.com | Ch. 2/NBC | 2021 | 596,710 | 1954 | |

North Carolina | Charlotte | WCNC-TV: wcnc.com | Ch. 36/NBC | 2021 | 1,189,950 | 1967 | |

Greensboro | WFMY-TV: wfmynews2.com | Ch. 2/CBS | 2019 | 690,050 | 1949 | ||

Ohio | Cleveland | WKYC-TV: wkyc.com | Ch. 3/NBC | 2021 | 1,498,960 | 1948 | |

Oregon | Portland | KGW-TV(2): kgw.com | Ch. 8/NBC | 2021 | 1,143,670 | 1956 | |

South Carolina | Columbia | WLTX-TV: wltx.com | Ch. 19/CBS | 2019 | 400,790 | 1953 | |

Tennessee | Knoxville | WBIR-TV: wbir.com | Ch. 10/NBC | 2021 | 514,610 | 1956 | |

Texas | Abilene-Sweetwater | KXVA-TV: myfoxzone.com | Ch. 15/FOX | 2017 | 113,080 | 2001 | |

Austin | KVUE-TV: kvue.com | Ch. 24/ABC | 2018 | 771,210 | 1971 | ||

Beaumont-Port Arthur | KBMT-TV: 12newsnow.com | Ch. 12/ABC | 2018 | 165,120 | 1961 | ||

Corpus Christi | KIII-TV: kiiitv.com | Ch. 3/ABC | 2018 | 209,760 | 1964 | ||

Dallas/Ft. Worth | WFAA-TV: wfaa.com | Ch. 8/ABC | 2018 | 2,713,380 | 1949 | ||

Houston | KHOU-TV: khou.com | Ch. 11/CBS | 2019 | 2,450,800 | 1953 | ||

San Angelo | KIDY-TV: myfoxzone.com | Ch. 6/FOX | 2017 | 56,680 | 1984 | ||

San Antonio | KENS-TV: kens5.com | Ch. 5/CBS | 2019 | 938,660 | 1950 | ||

Tyler-Longview | KYTX-TV: cbs19.tv | Ch. 19/CBS | 2019 | 265,690 | 2008 | ||

Waco-Temple-College Station | KCEN-TV: kcentv.com | Ch. 9/NBC | 2021 | 357,720 | 1953 | ||

Virginia | Hampton/Norfolk | WVEC-TV: 13newsnow.com | Ch. 13/ABC | 2018 | 717,170 | 1953 | |

Washington | Seattle/Tacoma | KING-TV: king5.com | Ch. 5/NBC | 2021 | 1,808,530 | 1948 | |

KONG-TV: king5.com | Ch. 16/IND | N/A | 1,808,530 | 1997 | |||

Spokane | KREM-TV: krem.com | Ch. 2/CBS | 2019 | 422,550 | 1954 | ||

KSKN-TV: spokanescw22.com | Ch. 22/CW | 2021 | 422,550 | 1983 | |||

(2) | We also own KGWZ-LD, a low power television station in Portland, OR. |

(3) | We also own KTFT-LD (NBC), a low power television station in Twin Falls, ID. |

(4) | We also own WBXN-CA, a Class A television station in New Orleans, LA. |

(5) | Market TV households is number of television households in each market, according to 2016-2017 Nielsen figures. |

(6) | KNAZ weekly audience is reported as part of KPNX. |

DIGITAL |

Cars.com: www.cars.com Headquarters: Chicago, IL |

CareerBuilder: www.careerbuilder.com Headquarters: Chicago, IL |

G/O Digital: www.godigitalmarketing.com Headquarters: Phoenix, AZ |

INVESTMENTS We have non-controlling ownership interests in the following companies: |

4Info: www.4info.com |

Captivate: www.captivate.com |

Gannett Co., Inc.: www.gannett.com |

Kin Community: www.kincommunity.com |

Livestream: www.livestream.com |

RepairPal: www.repairpal.com |

Topix: www.topix.com |

Video Call Center: www.thevideocallcenter.com |

Whistle Sports: www.whistlesports.com |

WinnersView: www.winnersview.com |

TEGNA ON THE NET: News and information about us is available on our web site, www.TEGNA.com. In addition to news and other information about us, we provide access through this site to our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after we file or furnish them electronically to the Securities and Exchange Commission (SEC). Certifications by our Chief Executive Officer and Chief Financial Officer are included as exhibits to our SEC reports (including to this Form 10-K). We also provide access on this web site to our Principles of Corporate Governance, the charters of our Audit, Executive Compensation and Nominating and Public Responsibility Committees and other important governance documents and policies, including our Ethics and Inside Trading Policies. Copies of all of these corporate governance documents are available to any shareholder upon written request made to our Secretary at the headquarters address. We will disclose on this web site changes to, or waivers of, our corporate Ethics Policy. | |

Dividends Paid Per Share | Common Stock Prices | ||||||

Year | Quarter | Low | High | ||||

2016 | First | $0.14 | $21.37 | $25.08 | |||

Second | $0.14 | $21.77 | $24.30 | ||||

Third | $0.14 | $20.16 | $25.00 | ||||

Fourth | $0.14 | $18.02 | $23.25 | ||||

Total 2016 | $0.56 | $18.02 | $25.08 | ||||

2015 | First | $0.20 | $29.62 | $36.56 | |||

Second | $0.20 | $34.27 | $38.01 | ||||

Third | $0.20 | $22.42 | $32.97 | ||||

Fourth | $0.14 | $21.85 | $28.68 | ||||

Total 2015 | $0.74 | $21.85 | $38.01 | ||||

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Program | Approximate Dollar Value of Shares that May Yet Be Repurchased Under the Program | |||||||

10/1/16 - 10/31/16 | — | — | — | $478,143,186 | |||||||

11/1/16 - 11/30/16 | 143,428 | $21.47 | 143,428 | $475,063,548 | |||||||

12/1/16 - 12/31/16 | 354,193 | $22.29 | 354,193 | $467,169,358 | |||||||

Total Fourth Quarter 2016 | 497,621 | $22.05 | 497,621 | $467,169,358 | |||||||

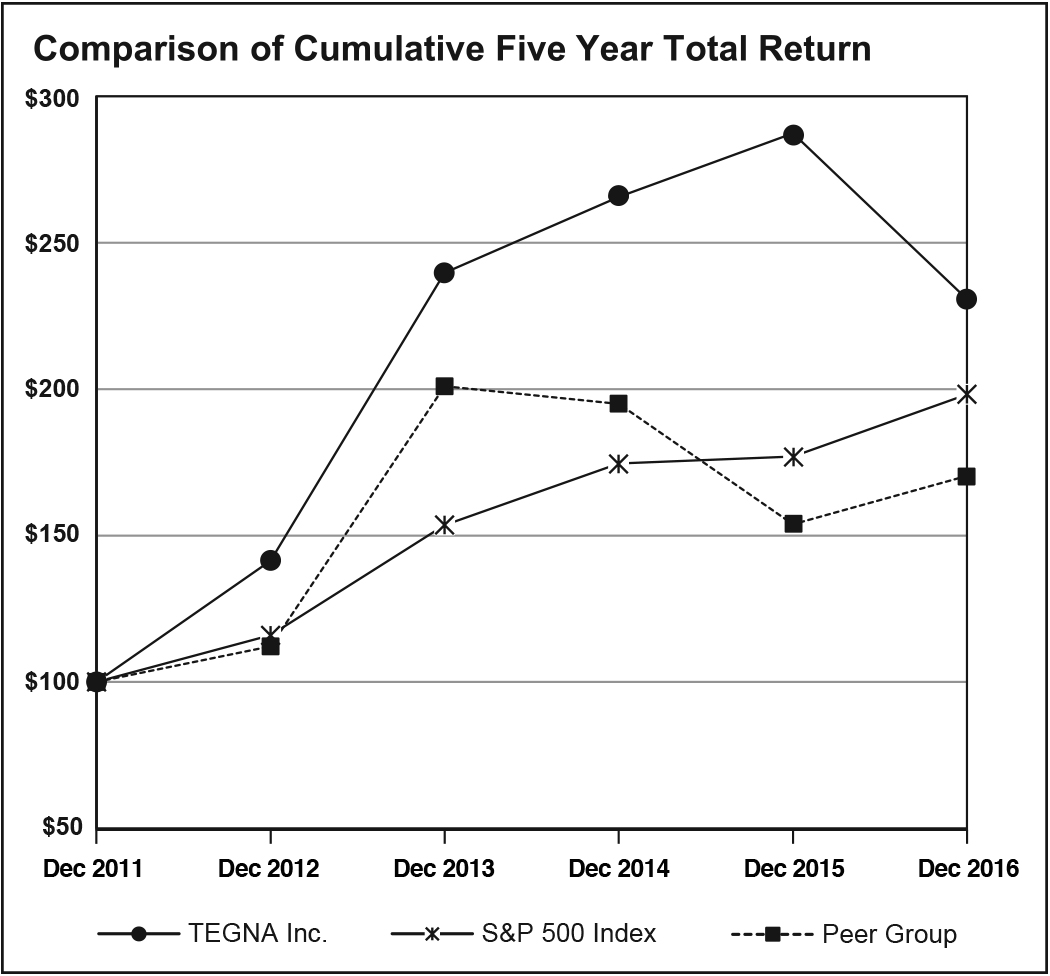

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||

TEGNA Inc. | $ | 100 | $ | 141.43 | $ | 239.70 | $ | 265.70 | $ | 287.36 | $ | 230.73 | ||||||

S&P 500 Index | $ | 100 | $ | 116.00 | $ | 153.57 | $ | 174.60 | $ | 177.01 | $ | 198.18 | ||||||

Peer Group | $ | 100 | $ | 112.13 | $ | 200.96 | $ | 194.96 | $ | 153.84 | $ | 170.34 | ||||||

In millions of dollars | |||||||||||

2016 | Change | 2015 | Change | 2014 | |||||||

Operating revenues: | |||||||||||

Media | $ | 1,934 | 15% | $ | 1,682 | (1%) | $ | 1,692 | |||

Digital | 1,408 | 3% | 1,369 | 47% | 934 | ||||||

Total | $ | 3,341 | 10% | $ | 3,051 | 16% | $ | 2,626 | |||

Operating expenses: | |||||||||||

Cost of revenues | $ | 1,039 | 13% | $ | 923 | (3%) | $ | 955 | |||

Selling, general and admin. expenses | 1,094 | 2% | 1,068 | 39% | 767 | ||||||

Depreciation | 90 | (1%) | 91 | 6% | 86 | ||||||

Amortization of intangible assets | 115 | 1% | 114 | 73% | 66 | ||||||

Asset impairment and facility consolidation charges (gains) | 32 | *** | (59 | ) | *** | 45 | |||||

Total | $ | 2,369 | 11% | $ | 2,138 | 11% | $ | 1,919 | |||

Operating income | $ | 972 | 6% | $ | 913 | 29% | $ | 707 | |||

Non-operating expense | $ | (260 | ) | (10%) | $ | (290 | ) | *** | $ | 283 | |

Provision for income taxes | $ | 217 | 7% | $ | 202 | (14%) | $ | 234 | |||

Net income attributable to noncontrolling interests | $ | (51 | ) | (19%) | $ | (63 | ) | (7%) | $ | (68 | ) |

Net income from continuing operations attributable to TEGNA | $ | 444 | 24% | $ | 357 | (48%) | $ | 688 | |||

Earnings from continuing operations per share - basic | $ | 2.05 | 29% | $ | 1.59 | (48%) | $ | 3.04 | |||

Earnings from continuing operations per share - diluted | $ | 2.02 | 29% | $ | 1.56 | (47%) | $ | 2.97 | |||

Note: Numbers may not sum due to rounding. | |||||||||||

2016 | 2015 | 2014 | |

Payroll costs | 35.8% | 41.1% | 41.0% |

In millions of dollars, except per share amounts | |||||||||||

2016 | Change | 2015 | Change | 2014 | |||||||

Net income from continuing operations attributable to TEGNA Inc. | $ | 444 | 24% | $ | 357 | (48%) | $ | 688 | |||

Per basic share | $ | 2.05 | 29% | $ | 1.59 | (48%) | $ | 3.04 | |||

Per diluted share | $ | 2.02 | 29% | $ | 1.56 | (47%) | $ | 2.97 | |||

In millions of dollars | |||||||||||

2016 | Change | 2015 | Change | 2014 | |||||||

Operating revenues | $ | 1,934 | 15% | $ | 1,682 | (1%) | $ | 1,692 | |||

Operating expenses | |||||||||||

Operating expenses (a) | 1,045 | 18% | 886 | 4% | 851 | ||||||

Depreciation | 52 | 2% | 51 | (2%) | 52 | ||||||

Amortization of intangible assets | 22 | —% | 22 | (24%) | 29 | ||||||

Asset impairment and facility consolidation charges | 9 | 13% | 8 | (43%) | 14 | ||||||

Operating expenses(a) | 1,127 | 16% | 968 | 2% | 945 | ||||||

Operating income | $ | 806 | 13% | $ | 714 | (4%) | $ | 747 | |||

Note: Numbers may not sum due to rounding. (a) Our 2016 operating expenses include special items of $19 million primarily related to severance expenses associated with our voluntary retirement program. Our 2015 operating expenses include a $13 million gain on the sale of a building. | |||||||||||

In millions of dollars | ||||||||||||

2016 | Change | 2015 | Change | 2014 | ||||||||

Core (Local & National) | $ | 1,053 | (2%) | $ | 1,072 | 3 | % | $ | 1,046 | |||

Political | 155 | *** | 21 | (87%) | $ | 159 | ||||||

Retransmission (a) | 582 | 30% | 449 | 24 | % | $ | 362 | |||||

Digital | 126 | 12% | 113 | 15 | % | $ | 98 | |||||

Other | 18 | (33%) | 27 | 0 | % | $ | 27 | |||||

Total | $ | 1,934 | 15% | $ | 1,682 | (1%) | $ | 1,692 | ||||

(a) Reverse compensation to network affiliates is included as part of programming costs and therefore is excluded from this line. | ||||||||||||

In millions of dollars | |||||||||||

2016 | Change | 2015 | Change | 2014 | |||||||

Operating revenues | $ | 1,408 | 3% | $ | 1,369 | 47% | $ | 934 | |||

Operating expenses | |||||||||||

Operating expenses | 1,027 | 3% | 993 | 38% | 722 | ||||||

Depreciation | 36 | 9% | 33 | 44% | 23 | ||||||

Amortization of intangible assets | 93 | 1% | 92 | *** | 37 | ||||||

Asset impairment and facility consolidation charges | 21 | (5%) | 22 | (29%) | 31 | ||||||

Operating expenses | 1,177 | 3% | 1,139 | 40% | 814 | ||||||

Operating income | $ | 230 | —% | $ | 229 | 91% | $ | 120 | |||

• | Severance charges primarily related to a voluntary retirement program at our Media Segment (which includes payroll and related benefit costs); |

• | Non-cash asset impairment and facility consolidation charges primarily associated with goodwill, operating assets, and an operating lease; |

• | Non-operating costs primarily associated with the anticipated spin-off of our Cars.com business unit, strategic review of CareerBuilder, acquisition related costs and equity method investment impairments; |

• | Impact of special items on our net income attributable to noncontrolling interests; and |

• | Special tax benefit related to the release of a portion of our capital loss valuation allowance due to the sale of certain deferred compensation plan investments. |

• | Costs associated with workforce restructuring; |

• | Non-cash asset impairment and facility consolidation charges primarily related to reducing the carrying value of certain assets to fair value, a goodwill impairment charge, and shut down costs associated with our former BLiNQ business; |

• | Gains on building sales, primarily from the sale of our corporate headquarters building; |

• | Non-operating items related to the spin-off of our former publishing businesses, a gain related to the sale of Gannett Healthcare Group, and other miscellaneous non-operating expenses; and |

• | Special tax benefit primarily related to the restructuring of our legal entities in advance of the spin-off of our publishing businesses. |

In millions of dollars (except per share amounts) | Special Items | |||||||||||||||||||||||||||

Fiscal Year Ended Dec. 31, 2016 | GAAP measure | Severance expense | Asset impairment and facility consolidation charges | Other non-operating items and equity investment impairments | Impact of special items attributable to NCI | Special tax benefit | Non-GAAP measure | |||||||||||||||||||||

Operating expenses | $ | 2,369.1 | $ | (25.9 | ) | $ | (32.1 | ) | $ | — | $ | — | $ | — | $ | 2,311.1 | ||||||||||||

Operating income | 972.1 | 25.9 | 32.1 | — | — | — | 1,030.1 | |||||||||||||||||||||

Equity loss in unconsolidated investments, net | (7.2 | ) | — | — | 3.9 | — | — | (3.3 | ) | |||||||||||||||||||

Other non-operating expense (income) | (20.4 | ) | — | — | 29.1 | — | — | 8.7 | ||||||||||||||||||||

Total non-operating expense | (259.6 | ) | — | — | 33.0 | — | — | (226.6 | ) | |||||||||||||||||||

Income before income taxes | 712.5 | 25.9 | 32.1 | 33.0 | — | — | 803.5 | |||||||||||||||||||||

Provision for income taxes | 217.0 | 9.8 | 12.5 | (1.8 | ) | (0.3 | ) | 3.3 | 240.5 | |||||||||||||||||||

Net income from continuing operations attributable to TEGNA | 444.2 | 16.1 | 19.7 | 34.8 | (0.4 | ) | (3.3 | ) | 510.9 | |||||||||||||||||||

Net income from continuing operations per share - diluted | $ | 2.02 | $ | 0.07 | $ | 0.09 | $ | 0.16 | $ | — | $ | (0.02 | ) | $ | 2.33 | |||||||||||||

Note: Totals may not sum due to rounding. | ||||||||||||||||||||||||||||

In millions of dollars (except per share amounts) | Special Items | |||||||||||||||||||||||||||

Fiscal Year Ended Dec. 31, 2015 | GAAP measure | Severance expense | Asset impairment and facility consolidation charges | Gain on sale of Corporate HQ building, net and other building sale gain | Other non-operating items | Special tax benefit | Non-GAAP measure | |||||||||||||||||||||

Operating expenses | $ | 2,137.8 | $ | (7.6 | ) | $ | (31.0 | ) | $ | 102.6 | $ | — | $ | — | $ | 2,201.8 | ||||||||||||

Operating income | 913.2 | 7.6 | 31.0 | (102.6 | ) | — | — | 849.2 | ||||||||||||||||||||

Other non-operating expense | (11.5 | ) | — | — | — | 10.3 | — | (1.2 | ) | |||||||||||||||||||

Total non-operating expense | (290.2 | ) | — | — | — | 10.3 | — | (279.9 | ) | |||||||||||||||||||

Income before income taxes | 622.9 | 7.6 | 31.0 | (102.6 | ) | 10.3 | — | 569.2 | ||||||||||||||||||||

Provision for income taxes | 202.3 | 2.9 | 9.2 | (39.7 | ) | (2.3 | ) | 3.3 | 175.7 | |||||||||||||||||||

Net income from continuing operations attributable to TEGNA | 357.5 | 4.7 | 21.9 | (62.9 | ) | 12.6 | (3.3 | ) | 330.3 | |||||||||||||||||||

Net income from continuing operations per share - diluted | $ | 1.56 | $ | 0.02 | $ | 0.10 | $ | (0.27 | ) | $ | 0.05 | $ | (0.01 | ) | $ | 1.44 | ||||||||||||

Note: Totals may not sum due to rounding. | ||||||||||||||||||||||||||||

In millions of dollars, except per share amounts | |||||||

2016 | Change | 2015 | |||||

Adjusted operating expenses | $ | 2,311 | 5% | $ | 2,202 | ||

Adjusted operating income | 1,030 | 21% | 849 | ||||

Adjusted equity loss in unconsolidated investments, net | (3 | ) | (40%) | (5 | ) | ||

Adjusted other non-operating expense (income), net | 9 | *** | (1 | ) | |||

Adjusted total non-operating expense | (227 | ) | (19%) | (280 | ) | ||

Adjusted income before income taxes | 803 | 41% | 569 | ||||

Adjusted provision for income taxes | 241 | 37% | 176 | ||||

Adjusted net income from continuing operations attributable to TEGNA | 511 | 55% | 330 | ||||

Adjusted net income from continuing operations per share - diluted | $ | 2.33 | 62% | $ | 1.44 | ||

In millions of dollars | |||||||

2016 | Change | 2015 | |||||

Net income from continuing operations attributable to TEGNA (GAAP basis) | $ | 444 | 24% | $ | 357 | ||

Net income attributable to noncontrolling interests | 51 | (19%) | 63 | ||||

Provision for income taxes | 217 | 7% | 202 | ||||

Interest expense | 232 | (15%) | 274 | ||||

Equity loss in unconsolidated investments, net | 7 | 40% | 5 | ||||

Other non-operating expense, net | 20 | 67% | 12 | ||||

Operating income (GAAP basis) | $ | 972 | 6% | $ | 913 | ||

Severance expense | 26 | *** | 8 | ||||

Asset impairment and facility consolidation charges | 32 | 3% | 31 | ||||

Gain on sale of Corporate HQ building, net and other building sale gain | — | *** | (103 | ) | |||

Adjusted operating income (non-GAAP basis) | $ | 1,030 | 21% | $ | 849 | ||

Depreciation | 90 | (1%) | 91 | ||||

Amortization of intangible assets | 115 | 1% | 114 | ||||

Adjusted EBITDA (non-GAAP basis) | $ | 1,235 | 17% | $ | 1,054 | ||

Note: Numbers may not sum due to rounding. | |||||||

Starting in the second quarter of 2016, we revised the method for computing Adjusted EBITDA to no longer treat non-cash rent as a reconciling item. Our 2015 Adjusted EBITDA was updated to conform to this new method that resulted in a reduction for the twelve months ended Dec. 31, 2015 by $1.6 million. | |||||||

Our strong operating cash flows enabled our Board of Directors to approve two key capital allocation initiatives following the spin-off of our publishing businesses in 2015. First, we began paying a regular quarterly cash dividend of $0.14 per share. We paid dividends totaling $122 million in 2016 and $168 million in 2015 (excluding the special spin-off distribution of our publishing businesses). Second, in 2015, our Board of Directors also approved an $825 million share repurchase program to be completed over a three-year period ending June 2018. See the “Capital stock” section below for more information on the share repurchase program.

As of December 31, 2016, our total long-term debt was $4.04 billion. Cash and cash equivalents as of December 31, 2016 totaled $77 million.

Our operations have historically generated strong positive cash flow which, along with bank revolving credit availability, has provided adequate liquidity to meet our internal investment requirements, as well as acquisitions. Our financial and operating performance, as well as our ability to generate sufficient cash flow to maintain compliance with credit facility covenants, are subject to certain risk factors; see Item 1A - Risk Factors for further discussion.

In millions of dollars | |||||||||

2016 | 2015 | 2014 | |||||||

Cash and cash equivalents at beginning of year | $ | 129 | $ | 118 | $ | 469 | |||

Operating activities: | |||||||||

Net income | 488 | 523 | 1,130 | ||||||

Non-cash adjustments | 291 | 195 | (163 | ) | |||||

Changes in working capital | (61 | ) | (65 | ) | (123 | ) | |||

Other, net | (34 | ) | (2 | ) | 4 | ||||

Net cash flows from operating activities | 683 | 651 | 848 | ||||||

Net cash (used for) provided by investing activities | (273 | ) | 217 | (1,662 | ) | ||||

Net cash (used for) provided by financing activities | (462 | ) | (858 | ) | 464 | ||||

Net change in cash and cash equivalents | (52 | ) | 11 | (351 | ) | ||||

Cash and cash equivalents at end of year | $ | 77 | $ | 129 | $ | 118 | |||

• | On April 1, 2016 our unsecured notes bearing a fixed rate of 10% became due, and therefore, we made a debt maturity payment of approximately $203 million (comprised of principal and accrued interest). The payment was made using borrowings from our revolving credit facility. |

• | On September 30, 2016, we borrowed $300 million under a new four-year term loan due in 2020. The interest rate on the term loan is equal to the same interest rates as borrowings under the Amended and Restated Competitive Advance and Revolving Credit Agreement discussed below. Both the revolving credit agreement and the term loan are guaranteed by a majority of our wholly-owned material domestic subsidiaries. We used substantially all of the proceeds from the new term loan to repay a portion of the outstanding obligation under our revolving credit facility. |

• | On November 1, 2016, we redeemed the remaining $70 million of 7.125% unsecured notes due in September 2018 at par, using available cash on hand. This redemption will result in a total net reduction of interest expense of approximately $5 million over the next two years. |

• | As of December 31, 2016, we had unused borrowing capacity of $844 million under our revolving credit facility. |

In thousands of dollars | |||

2017 (1) | $ | 646 | |

2018 (1) | 646 | ||

2019 | 700,000 | ||

2020 (2) | 1,612,100 | ||

2021 | 350,000 | ||

Thereafter | 1,415,000 | ||

Total | $ | 4,078,392 | |

Contractual obligations | Payments due by period | ||||||||||||||

In millions of dollars | Total | 2017 | 2018-19 | 2020-21 | Thereafter | ||||||||||

Long-term debt (1) | $ | 4,078 | $ | 132 | $ | 821 | $ | 1,710 | $ | 1,415 | |||||

Interest payments (2) | 1,182 | 184 | 350 | 232 | 416 | ||||||||||

Operating leases (3) | 259 | 43 | 61 | 37 | 118 | ||||||||||

Purchase obligations (4) | 165 | 71 | 69 | 19 | 6 | ||||||||||

Programming contracts (5) | 1,356 | 377 | 767 | 211 | 1 | ||||||||||

Other noncurrent liabilities (6) | 112 | 54 | 12 | 12 | 34 | ||||||||||

Total | $ | 7,152 | $ | 861 | $ | 2,080 | $ | 2,221 | $ | 1,990 | |||||

(1) | Long-term debt includes scheduled principal payments only. See Note 7 to the consolidated financial statements for further information. |

(2) | We have $635 million of outstanding borrowings under our revolving credit facility as of Dec. 31, 2016. We have not included estimated interest payments since payments into and out of the credit facility change daily. Interest on the senior notes is based on the stated cash coupon rate and excludes the amortization of debt issuance discount. The term loan interest rates are based on the actual rates as of Dec. 31, 2016. |

(3) | See Note 13 to the consolidated financial statements. |

(4) | Includes purchase obligations related to capital projects, interactive marketing agreements and other legally binding commitments. Amounts which we are liable for under purchase orders outstanding at Dec. 31, 2016, are reflected in the Consolidated Balance Sheets as accounts payable and accrued liabilities and are excluded from the table above. |

(5) | Programming contracts include television station commitments to purchase programming to be produced in future years. This also includes amounts related to our network affiliation agreements. |

(6) | Other noncurrent liabilities consist of both unfunded and under-funded postretirement benefit plans. Unfunded plans include the TEGNA Supplemental Executive Retirement Plan and the TEGNA Retiree Welfare Plan. Employer contributions, which equal the expected benefit payments, are reflected in the table above over the next ten-year period. Our under-funded plans include the TEGNA Retirement Plan and the G.B. Dealey Retirement Plan (merged into the TEGNA Retirement Plan effective Dec. 31, 2015). We expect contributions to the TEGNA Retirement Plan in 2017 of $22.3 million. TEGNA Retirement Plan contributions beyond the next fiscal year are excluded due to uncertainties regarding significant assumptions involved in estimating these contributions, such as interest rate levels as well as the amount and timing of invested asset returns. |

Stock repurchases | Repurchases made in fiscal year | ||||||||

In millions | 2016 | 2015 | 2014 | ||||||

Number of shares purchased | 7.0 | 9.6 | 2.7 | ||||||

Dollar amount purchased | $ | 162 | $ | 271 | $ | 76 | |||

In millions of dollars | |||

Segment | Goodwill Balance | ||

Media | $ | 2,579 | |

Digital | $ | 1,488 | |

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

Page | |

FINANCIAL STATEMENTS | |

OTHER INFORMATION | |

SUPPLEMENTARY DATA | |

TEGNA Inc. CONSOLIDATED BALANCE SHEETS | ||||||

In thousands of dollars | ||||||

Dec. 31, | ||||||

Assets | 2016 | 2015 | ||||

Current assets | ||||||

Cash and cash equivalents | $ | 76,920 | $ | 129,200 | ||

Trade receivables, net of allowances of $9,837 and $9,092, respectively | 595,893 | 556,351 | ||||

Other receivables | 25,953 | 18,738 | ||||

Prepaid expenses and other current assets | 91,922 | 94,262 | ||||

Current discontinued operations assets | — | 6,608 | ||||

Total current assets | 790,688 | 805,159 | ||||

Property and equipment | ||||||

Land | 74,747 | 76,089 | ||||

Buildings and improvements | 293,244 | 272,862 | ||||

Equipment, furniture and fixtures | 633,559 | 604,839 | ||||

Construction in progress | 13,192 | 30,395 | ||||

Total | 1,014,742 | 984,185 | ||||

Less accumulated depreciation | (564,726 | ) | (525,866 | ) | ||

Net property and equipment | 450,016 | 458,319 | ||||

Intangible and other assets | ||||||

Goodwill | 4,067,529 | 3,919,726 | ||||

Indefinite-lived and amortizable intangible assets, less accumulated amortization of $324,416 and $220,662, respectively | 3,013,432 | 3,065,107 | ||||

Investments and other assets | 221,060 | 256,990 | ||||

Noncurrent discontinued operation assets | — | 657 | ||||

Total intangible and other assets | 7,302,021 | 7,242,480 | ||||

Total assets | $ | 8,542,725 | $ | 8,505,958 | ||

TEGNA Inc. CONSOLIDATED BALANCE SHEETS | ||||||

In thousands of dollars, except par value and share amounts | ||||||

Dec. 31, | ||||||

Liabilities and equity | 2016 | 2015 | ||||

Current liabilities | ||||||

Accounts payable | $ | 120,911 | $ | 124,654 | ||

Accrued liabilities | ||||||

Compensation | 103,590 | 115,679 | ||||

Interest | 42,413 | 49,835 | ||||

Other | 194,497 | 131,301 | ||||

Dividends payable | 30,178 | 31,033 | ||||

Income taxes | 13,478 | 15,742 | ||||

Deferred revenue | 113,468 | 132,650 | ||||

Current portion of long-term debt | 646 | 646 | ||||

Current discontinued operations liabilities | — | 5,243 | ||||

Total current liabilities | 619,181 | 606,783 | ||||

Income taxes | 22,644 | 18,191 | ||||

Deferred income taxes | 929,184 | 883,141 | ||||

Long-term debt | 4,042,749 | 4,169,016 | ||||

Pension liabilities | 187,290 | 178,844 | ||||

Other noncurrent liabilities | 142,407 | 168,573 | ||||

Total noncurrent liabilities | 5,324,274 | 5,417,765 | ||||

Total liabilities | 5,943,455 | 6,024,548 | ||||

Redeemable noncontrolling interests | 46,265 | 24,666 | ||||

Commitments and contingent liabilities (see Note 13) | ||||||

Equity | ||||||

TEGNA Inc. shareholders’ equity | ||||||

Common stock, par value $1: Authorized, 800,000,000 shares: Issued, 324,418,632 shares | 324,419 | 324,419 | ||||

Additional paid-in capital | 473,742 | 539,505 | ||||

Retained earnings | 7,384,556 | 7,111,129 | ||||

Accumulated other comprehensive loss | (161,573 | ) | (130,951 | ) | ||

Less treasury stock at cost, 109,930,832 shares and 104,664,452 shares, respectively | (5,749,726 | ) | (5,652,131 | ) | ||

Total TEGNA Inc. shareholders’ equity | 2,271,418 | 2,191,971 | ||||

Noncontrolling interests | 281,587 | 264,773 | ||||

Total equity | 2,553,005 | 2,456,744 | ||||

Total liabilities, redeemable noncontrolling interests and equity | $ | 8,542,725 | $ | 8,505,958 | ||

TEGNA Inc. CONSOLIDATED STATEMENTS OF INCOME | ||||||||||

In thousands of dollars, except per share amounts | ||||||||||

Fiscal years ended | Dec. 31, 2016 | Dec. 31, 2015 | Dec. 28, 2014 | |||||||

Operating Revenues: | ||||||||||

Media | $ | 1,933,579 | $ | 1,682,144 | $ | 1,691,866 | ||||

Digital | 1,407,619 | 1,368,801 | 934,275 | |||||||

Total | 3,341,198 | 3,050,945 | 2,626,141 | |||||||

Operating expenses: | ||||||||||

Cost of revenues, exclusive of depreciation | 1,038,667 | 923,336 | 954,990 | |||||||

Selling, general and administrative expenses, exclusive of depreciation | 1,093,837 | 1,068,221 | 766,854 | |||||||

Depreciation | 89,531 | 90,803 | 85,866 | |||||||

Amortization of intangible assets | 114,959 | 114,284 | 65,971 | |||||||

Asset impairment and facility consolidation charges (gains) (see Note 12) | 32,130 | (58,857 | ) | 44,961 | ||||||

Total | 2,369,124 | 2,137,787 | 1,918,642 | |||||||

Operating income | 972,074 | 913,158 | 707,499 | |||||||

Non-operating (expense) income | ||||||||||

Equity (loss) income in unconsolidated investments, net (see Note 5) | (7,170 | ) | (5,064 | ) | 151,462 | |||||

Interest expense | (232,013 | ) | (273,629 | ) | (272,668 | ) | ||||

Other non-operating items | (20,439 | ) | (11,529 | ) | 404,403 | |||||

Total | (259,622 | ) | (290,222 | ) | 283,197 | |||||

Income before income taxes | 712,452 | 622,936 | 990,696 | |||||||

Provision for income taxes | 216,979 | 202,314 | 234,471 | |||||||

Income from continuing operations | 495,473 | 420,622 | 756,225 | |||||||

Income (loss) from discontinued operations, net of tax | (7,474 | ) | 102,064 | 374,235 | ||||||

Net Income | 487,999 | 522,686 | 1,130,460 | |||||||

Net income attributable to noncontrolling interests | (51,302 | ) | (63,164 | ) | (68,289 | ) | ||||

Net income attributable to TEGNA Inc. | $ | 436,697 | $ | 459,522 | $ | 1,062,171 | ||||

Earnings from continuing operations per share - basic | $ | 2.05 | $ | 1.59 | $ | 3.04 | ||||

Earnings (loss) from discontinued operations per share - basic | (0.03 | ) | 0.45 | 1.65 | ||||||

Net income per share - basic | $ | 2.02 | $ | 2.04 | $ | 4.69 | ||||

Earnings from continuing operations per share - diluted | $ | 2.02 | $ | 1.56 | $ | 2.97 | ||||

Earnings from discontinued operations per share - diluted | (0.03 | ) | 0.44 | 1.61 | ||||||

Net income per share - diluted | $ | 1.99 | $ | 2.00 | $ | 4.58 | ||||

Weighted average number of common shares outstanding: | ||||||||||

Basic shares | 216,358 | 224,688 | 226,292 | |||||||

Diluted shares | 219,681 | 229,721 | 231,907 | |||||||

Dividends declared per share | $ | 0.56 | $ | 0.68 | $ | 0.80 | ||||

TEGNA Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | ||||||||||

In thousands of dollars | ||||||||||

Fiscal years ended | Dec. 31, 2016 | Dec. 31, 2015 | Dec. 28, 2014 | |||||||

Net income | $ | 487,999 | $ | 522,686 | $ | 1,130,460 | ||||

Redeemable noncontrolling interests (income not available to shareholders) | (4,511 | ) | (1,796 | ) | (3,420 | ) | ||||

Other comprehensive income (loss), before tax: | ||||||||||

Foreign currency translation adjustments | (15,938 | ) | (8,235 | ) | (43,766 | ) | ||||

Pension and other postretirement benefit items: | ||||||||||

Recognition of previously deferred post-retirement benefit plan costs | 8,068 | 32,533 | 42,407 | |||||||

Actuarial loss arising during the period | (21,337 | ) | (40,069 | ) | (428,496 | ) | ||||

Interim remeasurement of post-retirement benefits liability | — | 79,184 | — | |||||||

Other | — | (355 | ) | (10,279 | ) | |||||

Pension and other postretirement benefit items | (13,269 | ) | 71,293 | (396,368 | ) | |||||

Unrealized (losses) gains on available for sale investment during the period | (11,346 | ) | 3,311 | — | ||||||

Other comprehensive (loss) income before tax | (40,553 | ) | 66,369 | (440,134 | ) | |||||

Income tax effect related to components of other comprehensive income (loss) | 5,066 | (28,289 | ) | 147,718 | ||||||

Other comprehensive (loss) income, net of tax | (35,487 | ) | 38,080 | (292,416 | ) | |||||

Comprehensive income | 448,001 | 558,970 | 834,624 | |||||||

Comprehensive income attributable to noncontrolling interests, net of tax | (39,284 | ) | (55,099 | ) | (57,167 | ) | ||||

Comprehensive income attributable to TEGNA Inc. | $ | 408,717 | $ | 503,871 | $ | 777,457 | ||||

TEGNA Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||||

In thousands of dollars | ||||||||||

Fiscal years ended | Dec. 31, 2016 | Dec. 31, 2015 | Dec. 28, 2014 | |||||||

Cash flows from operating activities | ||||||||||

Net income | $ | 487,999 | $ | 522,686 | $ | 1,130,460 | ||||

Adjustments to reconcile net income to operating cash flows: | ||||||||||

Depreciation | 89,531 | 140,954 | 185,868 | |||||||

Amortization of intangible assets | 114,959 | 121,290 | 79,856 | |||||||

Stock-based compensation | 17,590 | 26,344 | 33,882 | |||||||

Provision for deferred income taxes | 16,535 | 100,202 | 1,200 | |||||||

Pension expense (benefit), net of contributions | 3,257 | (122,376 | ) | (111,194 | ) | |||||

Equity loss (income) in unconsolidated investees, net | 7,170 | (5,743 | ) | (167,319 | ) | |||||

Gain on Cars.com acquisition, net of tax | — | — | (285,860 | ) | ||||||

Other, including losses (gains) on sale of assets and impairments | 42,067 | (65,496 | ) | 100,159 | ||||||

Changes in operating assets and liabilities: | ||||||||||

Decrease (increase) in trade receivables | (32,046 | ) | 32,787 | (1,514 | ) | |||||

Decrease (increase) in inventories | — | 1,807 | 10,032 | |||||||

Increase (decrease) in accounts payable | (1,506 | ) | (57,643 | ) | 66,740 | |||||

Increase (decrease) in interest and taxes payable | (7,771 | ) | (46,411 | ) | (193,274 | ) | ||||

Increase (decrease) in deferred revenue | (20,004 | ) | 4,822 | (5,353 | ) | |||||

Changes in other assets and liabilities, net | (34,352 | ) | (1,992 | ) | 3,857 | |||||

Net cash flows from operating activities | 683,429 | 651,231 | 847,540 | |||||||

Cash flows from investing activities | ||||||||||

Purchase of property and equipment | (94,796 | ) | (118,767 | ) | (150,354 | ) | ||||

Payments for acquisitions, net of cash acquired | (206,078 | ) | (53,656 | ) | (1,990,877 | ) | ||||

Payments for investments | (20,797 | ) | (33,715 | ) | (7,026 | ) | ||||

Proceeds from investments | 39,954 | 12,402 | 180,809 | |||||||

Proceeds from sale of businesses and assets | 8,441 | 411,012 | 305,347 | |||||||

Net cash (used for) provided by investing activities | (273,276 | ) | 217,276 | (1,662,101 | ) | |||||

Cash flows from financing activities | ||||||||||

(Payments of) proceeds from borrowings under revolving credit facilities, net | (85,000 | ) | 80,000 | 640,000 | ||||||

Proceeds from borrowings | 300,000 | 200,000 | 666,732 | |||||||

Debt repayments | (352,590 | ) | (587,509 | ) | (537,490 | ) | ||||

Payments of debt issuance and financing costs | (1,684 | ) | (7,619 | ) | (10,548 | ) | ||||

Dividends paid | (121,639 | ) | (167,508 | ) | (181,328 | ) | ||||

Repurchases of common stock | (161,891 | ) | (271,030 | ) | (75,815 | ) | ||||

Net settlement of stock for tax withholding and proceeds from stock option exercises | (20,352 | ) | (6,841 | ) | 331 | |||||

Distributions to noncontrolling membership interests | (18,840 | ) | (24,783 | ) | (22,072 | ) | ||||

Deferred payments for acquisitions | (437 | ) | (9,136 | ) | (15,687 | ) | ||||

Cash transferred to the Gannett Co., Inc. business | — | (63,365 | ) | — | ||||||

Net cash (used for) provided by financing activities | (462,433 | ) | (857,791 | ) | 464,123 | |||||

Effect of currency exchange rate change | — | — | (281 | ) | ||||||

(Decrease) increase in cash and cash equivalents | (52,280 | ) | 10,716 | (350,719 | ) | |||||

Cash and cash equivalents from continuing operations, beginning of year | 129,200 | 110,305 | 455,023 | |||||||

Cash and cash equivalents from discontinued operations, beginning of year | — | 8,179 | 14,180 | |||||||

Balance of cash and cash equivalents at beginning of year | 129,200 | 118,484 | 469,203 | |||||||

Cash and cash equivalents from continuing operations, end of year | 76,920 | 129,200 | 110,305 | |||||||

Cash and cash equivalents from discontinued operations, end of year | — | — | 8,179 | |||||||

Balance of cash and cash equivalents at end of year | $ | 76,920 | $ | 129,200 | $ | 118,484 | ||||

Supplemental cash flow information: | ||||||||||

Cash paid for income taxes, net of refunds | $ | 206,271 | $ | 105,581 | $ | 207,038 | ||||

Cash paid for interest | $ | 225,462 | $ | 265,174 | $ | 242,190 | ||||

Non-cash investing and financing activities | ||||||||||

Non-monetary exchange of investment for acquisition | $ | — | $ | (34,403 | ) | $ | — | |||

Assets-held-for-sale proceeds | $ | — | $ | — | $ | 146,428 | ||||

Escrow deposit disbursement related to London Broadcasting Company television stations acquisition | $ | — | $ | — | $ | (134,908 | ) | |||

Capital expenditures | $ | — | $ | — | $ | (11,520 | ) | |||

TEGNA Inc. CONSOLIDATED STATEMENTS OF EQUITY | ||||||||||||||||||||||

In thousands of dollars, except per share data | ||||||||||||||||||||||

TEGNA Inc. Shareholders’ Equity | ||||||||||||||||||||||

Common stock | Additional paid-in capital | Retained earnings | Accumulated other comprehensive income (loss) | Treasury stock | Noncontrolling Interests | Total | ||||||||||||||||

Balance at Dec. 29, 2013 | $ | 324,419 | $ | 552,368 | $ | 7,720,903 | $ | (494,055 | ) | $ | (5,410,537 | ) | $ | 201,695 | $ | 2,894,793 | ||||||

Net Income | 1,062,171 | 68,289 | 1,130,460 | |||||||||||||||||||

Redeemable noncontrolling interest | (3,420 | ) | (3,420 | ) | ||||||||||||||||||

Other comprehensive loss, net of tax | (284,714 | ) | (7,702 | ) | (292,416 | ) | ||||||||||||||||

Total comprehensive income | 834,624 | |||||||||||||||||||||

Dividends declared: $0.80 per share | (180,705 | ) | (180,705 | ) | ||||||||||||||||||

Distributions to noncontrolling membership shareholders | (22,072 | ) | (22,072 | ) | ||||||||||||||||||

Treasury stock acquired | (75,815 | ) | (75,815 | ) | ||||||||||||||||||

Stock-based awards activity | (52,988 | ) | 47,127 | (5,861 | ) | |||||||||||||||||

Stock-based compensation | 33,882 | 33,882 | ||||||||||||||||||||

Tax benefit from settlement of stock awards | 12,437 | 12,437 | ||||||||||||||||||||

Other activity | 707 | (286 | ) | (2,431 | ) | (2,010 | ) | |||||||||||||||

Balance at Dec. 28, 2014 | $ | 324,419 | $ | 546,406 | $ | 8,602,369 | $ | (778,769 | ) | $ | (5,439,511 | ) | $ | 234,359 | $ | 3,489,273 | ||||||

Net Income | 459,522 | 63,164 | 522,686 | |||||||||||||||||||

Redeemable noncontrolling interest | (1,796 | ) | (1,796 | ) | ||||||||||||||||||

Other comprehensive income (loss), net of tax | 44,349 | (6,269 | ) | 38,080 | ||||||||||||||||||

Total comprehensive income | 558,970 | |||||||||||||||||||||

Dividends declared: $0.68 per share | (153,022 | ) | (153,022 | ) | ||||||||||||||||||

Distributions to noncontrolling membership shareholders | (23,550 | ) | (23,550 | ) | ||||||||||||||||||

Spin-off of Publishing businesses | (1,797,740 | ) | 603,469 | (1,194,271 | ) | |||||||||||||||||

Treasury stock acquired | (271,030 | ) | (271,030 | ) | ||||||||||||||||||

Stock-based awards activity | (52,436 | ) | 42,620 | (9,816 | ) | |||||||||||||||||

Stock-based compensation | 26,344 | 26,344 | ||||||||||||||||||||

Tax benefit from settlement of stock awards | 20,439 | 20,439 | ||||||||||||||||||||

Other activity | (1,248 | ) | 15,790 | (1,135 | ) | 13,407 | ||||||||||||||||

Balance at Dec. 31, 2015 | $ | 324,419 | $ | 539,505 | $ | 7,111,129 | $ | (130,951 | ) | $ | (5,652,131 | ) | $ | 264,773 | $ | 2,456,744 | ||||||

Net Income | 436,697 | 51,302 | 487,999 | |||||||||||||||||||

Redeemable noncontrolling interests | (4,511 | ) | (4,511 | ) | ||||||||||||||||||

Other comprehensive loss, net of tax | (27,980 | ) | (7,507 | ) | (35,487 | ) | ||||||||||||||||

Total comprehensive income | 448,001 | |||||||||||||||||||||

Dividends declared: $0.56 per share | (120,784 | ) | (120,784 | ) | ||||||||||||||||||

Adjustments related to the spin-off of Publishing businesses (see Note 8 and Note 10) | (42,486 | ) | (2,642 | ) | (45,128 | ) | ||||||||||||||||

Distributions to noncontrolling membership shareholders | (18,840 | ) | (18,840 | ) | ||||||||||||||||||

Treasury stock acquired | (161,891 | ) | (161,891 | ) | ||||||||||||||||||

Stock-based awards activity | (84,648 | ) | 64,296 | (20,352 | ) | |||||||||||||||||

Stock-based compensation | 17,590 | 17,590 | ||||||||||||||||||||

Other activity | 1,295 | (3,630 | ) | (2,335 | ) | |||||||||||||||||

Balance at Dec. 31, 2016 | $ | 324,419 | $ | 473,742 | $ | 7,384,556 | $ | (161,573 | ) | $ | (5,749,726 | ) | $ | 281,587 | $ | 2,553,005 | ||||||

• | All excess tax benefits and tax deduction shortfalls will be recognized as income tax benefit or expense in the income statement (under the prior guidance these amounts were generally recognized in additional paid-in capital on the balance sheet). The tax effects of exercised or vested awards will be treated as discrete items in the reporting period in which they occur. This guidance was applied prospectively beginning in the first quarter of 2016. The adoption of this element of the accounting standard reduced our income tax provision for the year ended December 31, 2016, by $6.4 million and the tax rate for the same period by approximately one percentage point, resulting in an increase to basic and diluted EPS of approximately $0.03. The reduction to the tax provision predominantly occurred in the first quarter of 2016 in connection with the settlement of performance share unit awards and the fourth quarter of 2016 in connection with the settlement of restricted stock units. |

• | The guidance updated the classification in the Statement of Cash Flows in two areas: 1) excess tax benefits will now be classified along with other income tax cash flows as an operating activity (under prior guidance it was separated from operating activities and presented as a financing activity), and 2) cash paid by an employer to taxing authorities when directly withholding shares for tax withholding purposes will be classified as a financing activity (prior to our adoption of the new guidance, we classified such payments as cash outflow from operating activities). Changes to the classification of the Consolidated Statement of Cash Flows were made on a retrospective basis, wherein each period presented was adjusted to reflect the effects of applying the new guidance. |

Year ended Dec. 31, 2016 | ||||||||||||

Previous Accounting Method | As Currently Reported | Effect of Accounting Change | ||||||||||

Change in other assets and liabilities, net | $ | (63,359 | ) | $ | (34,352 | ) | $ | 29,007 | ||||

Net cash flow from operating activities | $ | 654,422 | $ | 683,429 | $ | 29,007 | ||||||

Net settlement of stock for tax withholding and proceeds from stock option exercises | $ | 8,655 | $ | (20,352 | ) | $ | (29,007 | ) | ||||

Net cash used for financing activities | $ | (433,426 | ) | $ | (462,433 | ) | $ | (29,007 | ) | |||

Year ended Dec. 31, 2015 | ||||||||||||

Previous Accounting Method | As Currently Reported | Effect of Accounting Change | ||||||||||

Change in other assets and liabilities, net | $ | (40,117 | ) | $ | (1,992 | ) | $ | 38,125 | ||||

Net cash flow from operating activities | $ | 613,106 | $ | 651,231 | $ | 38,125 | ||||||

Net settlement of stock for tax withholding and proceeds from stock option exercises | $ | 31,284 | $ | (6,841 | ) | $ | (38,125 | ) | ||||

Net cash used for financing activities | $ | (819,666 | ) | $ | (857,791 | ) | $ | (38,125 | ) | |||

Year ended Dec. 28, 2014 | ||||||||||||

Previous Accounting Method | As Currently Reported | Effect of Accounting Change | ||||||||||

Change in other assets and liabilities, net | $ | (22,484 | ) | $ | 3,857 | $ | 26,341 | |||||

Net cash flow from operating activities | $ | 821,199 | $ | 847,540 | $ | 26,341 | ||||||

Net settlement of stock for tax withholding and proceeds from stock option exercises | $ | 26,672 | $ | 331 | $ | (26,341 | ) | |||||

Net cash used for financing activities | $ | 490,464 | $ | 464,123 | $ | (26,341 | ) | |||||

Unaudited | |||

In thousands of dollars | 2014 | ||

Total revenues | $ | 2,987,058 | |

Net income attributable to TEGNA Inc. | $ | 754,851 | |

In thousands of dollars | |||||||||

Gross | Accumulated Amortization | Net | |||||||

Dec. 31, 2016 | |||||||||

Goodwill | $ | 4,067,529 | $ | — | $ | 4,067,529 | |||

Indefinite-lived intangibles: | |||||||||

Television station FCC licenses | 1,191,950 | — | 1,191,950 | ||||||

Trade names | 925,171 | — | 925,171 | ||||||

Amortizable intangible assets: | |||||||||

Customer relationships | 929,852 | (210,691 | ) | 719,161 | |||||

Other | 290,875 | (113,725 | ) | 177,150 | |||||

Total | $ | 7,405,377 | $ | (324,416 | ) | $ | 7,080,961 | ||

Dec. 31, 2015 | |||||||||

Goodwill | $ | 3,919,726 | $ | — | $ | 3,919,726 | |||

Indefinite-lived intangibles: | |||||||||

Television station FCC licenses | 1,191,950 | — | 1,191,950 | ||||||

Trade names | 925,019 | — | 925,019 | ||||||

Amortizable intangible assets: | |||||||||

Customer relationships | 903,652 | (145,398 | ) | 758,254 | |||||

Other | 265,148 | (75,264 | ) | 189,884 | |||||

Total | $ | 7,205,495 | $ | (220,662 | ) | $ | 6,984,833 | ||

In thousands of dollars | |||

2017 | $ | 114,557 | |

2018 | $ | 111,789 | |

2019 | $ | 107,234 | |

2020 | $ | 101,906 | |

2021 | $ | 90,498 | |

In thousands of dollars | |||||||||

Media | Digital | Total | |||||||

Goodwill | |||||||||

Gross balance at Dec. 28, 2014 | $ | 2,578,601 | $ | 1,503,141 | $ | 4,081,742 | |||

Accumulated impairment losses | — | (166,971 | ) | (166,971 | ) | ||||

Net balance at Dec. 28, 2014 | $ | 2,578,601 | $ | 1,336,170 | $ | 3,914,771 | |||

Acquisitions & adjustments | 817 | 25,667 | 26,484 | ||||||

Dispositions | — | (252 | ) | (252 | ) | ||||

Impairment | — | (8,000 | ) | (8,000 | ) | ||||

Foreign currency exchange rate changes | — | (13,277 | ) | (13,277 | ) | ||||

Balance at Dec. 31, 2015 | $ | 2,579,418 | $ | 1,340,308 | $ | 3,919,726 | |||

Gross balance at Dec. 31, 2015 | 2,579,418 | 1,515,279 | 4,094,697 | ||||||

Accumulated impairment losses | — | (174,971 | ) | (174,971 | ) | ||||

Net balance at Dec. 31, 2015 | $ | 2,579,418 | $ | 1,340,308 | $ | 3,919,726 | |||

Acquisitions & adjustments | — | 176,775 | 176,775 | ||||||

Impairment | — | (15,218 | ) | (15,218 | ) | ||||

Foreign currency exchange rate changes | — | (13,754 | ) | (13,754 | ) | ||||

Balance at Dec. 31, 2016 | $ | 2,579,418 | $ | 1,488,111 | $ | 4,067,529 | |||

Gross balance at Dec. 31, 2016 | 2,579,418 | 1,678,300 | 4,257,718 | ||||||

Accumulated impairment losses | — | (190,189 | ) | (190,189 | ) | ||||

Net balance at Dec. 31, 2016 | $ | 2,579,418 | $ | 1,488,111 | $ | 4,067,529 | |||

In thousands of dollars | ||||||

Dec. 31, 2016 | Dec. 31, 2015 | |||||

Cash value life insurance | $ | 64,134 | $ | 68,332 | ||

Deferred compensation investments | 52,273 | 77,199 | ||||

Equity method investments | 19,970 | 27,824 | ||||

Available for sale investment | 16,744 | 28,090 | ||||

Deferred debt issuance cost | 9,856 | 13,620 | ||||

Other long-term assets | 58,083 | 41,925 | ||||

Total | $ | 221,060 | $ | 256,990 | ||

In thousands of dollars | |||||||||

2016 | Current | Deferred | Total | ||||||

Federal | $ | 189,900 | $ | 25,854 | $ | 215,754 | |||

State and other | 13,107 | (12,077 | ) | 1,030 | |||||

Foreign | 1,537 | (1,342 | ) | 195 | |||||

Total | $ | 204,544 | $ | 12,435 | $ | 216,979 | |||

In thousands of dollars | |||||||||

2015 | Current | Deferred | Total | ||||||

Federal | $ | 114,161 | $ | 76,816 | $ | 190,977 | |||

State and other | 12,795 | (2,247 | ) | 10,548 | |||||

Foreign | 1,849 | (1,060 | ) | 789 | |||||

Total | $ | 128,805 | $ | 73,509 | $ | 202,314 | |||

In thousands of dollars | |||||||||

2014 | Current | Deferred | Total | ||||||

Federal | $ | 139,710 | $ | 51,245 | $ | 190,955 | |||

State and other | 23,114 | 20,232 | 43,346 | ||||||

Foreign | 1,100 | (930 | ) | 170 | |||||

Total | $ | 163,924 | $ | 70,547 | $ | 234,471 | |||

In thousands of dollars | |||||||||

2016 | 2015 | 2014 | |||||||

Domestic | $ | 667,556 | $ | 568,534 | $ | 927,453 | |||

Foreign | (6,406 | ) | (8,762 | ) | (5,046 | ) | |||

Total | $ | 661,150 | $ | 559,772 | $ | 922,407 | |||

2016 | 2015 | 2014 | ||||

U.S. statutory tax rate | 35.0 | % | 35.0 | % | 35.0 | % |

Increase (decrease) in taxes resulting from: | ||||||

State taxes (net of federal income tax benefit) | 2.8 | 3.2 | 2.4 | |||

Domestic Manufacturing Deduction | (2.8 | ) | (2.0 | ) | (1.6 | ) |

Uncertain tax positions, settlements and lapse of statutes of limitations | (0.3 | ) | (0.2 | ) | (0.3 | ) |

Net deferred tax write offs and deferred tax rate adjustments | (1.2 | ) | (1.6 | ) | (0.3 | ) |

Non-deductible transactions costs | 0.5 | 0.5 | 0.7 | |||

Loss on sale of subsidiary | — | — | (12.6 | ) | ||

Non-deductible goodwill | — | 0.4 | 3.0 | |||

Net excess benefits on share-based payments | (1.0 | ) | — | — | ||

Other, net | (0.2 | ) | 0.8 | (0.9 | ) | |

Effective tax rate | 32.8 | % | 36.1 | % | 25.4 | % |

In thousands of dollars | ||||||

Dec. 31, 2016 | Dec. 31, 2015 | |||||

Liabilities | ||||||

Accelerated depreciation | $ | 80,101 | $ | 55,783 | ||

Accelerated amortization of deductible intangibles | 667,015 | 663,545 | ||||

Partnership investments including impairments | 309,515 | 282,784 | ||||

Other | 7,570 | 9,057 | ||||

Total deferred tax liabilities | 1,064,201 | 1,011,169 | ||||

Assets | ||||||

Accrued compensation costs | 32,361 | 28,119 | ||||

Pension and postretirement medical and life | 78,318 | 73,470 | ||||

Loss carryforwards | 197,812 | 184,117 | ||||

Other | 36,465 | 26,735 | ||||

Total deferred tax assets | 344,956 | 312,441 | ||||

Valuation allowance | 209,939 | 184,413 | ||||

Total net deferred tax (liabilities) | $ | (929,184 | ) | $ | (883,141 | ) |

In thousands of dollars | |||||||||

2016 | 2015 | 2014 | |||||||

Change in unrecognized tax benefits | |||||||||

Balance at beginning of year | $ | 19,491 | $ | 58,886 | $ | 57,324 | |||

Additions based on tax positions related to the current year | 213 | 6,095 | 12,426 | ||||||

Additions for tax positions of prior years | 162 | 853 | 868 | ||||||

Reductions for tax positions of prior years | (1,214 | ) | (24,858 | ) | (4,563 | ) | |||

Settlements | — | — | (129 | ) | |||||

Reductions for transfers to Gannett Co., Inc. | — | (18,804 | ) | — | |||||

Reductions due to lapse of statutes of limitations | (1,352 | ) | (2,681 | ) | (7,040 | ) | |||

Balance at end of year | $ | 17,300 | $ | 19,491 | $ | 58,886 | |||

Dec. 31, 2016 | Dec. 31, 2015 | |||||

Unsecured floating rate term loan due quarterly through August 2018 | $ | 52,100 | $ | 83,700 | ||

VIE unsecured floating rate term loans due quarterly through December 2018 | 1,292 | 1,938 | ||||

Unsecured floating rate term loan due quarterly through June 2020 | 140,000 | 180,000 | ||||

Unsecured floating rate term loan due quarterly through September 2020 | 285,000 | — | ||||

Borrowings under revolving credit agreement expiring June 2020 | 635,000 | 720,000 | ||||

Unsecured notes bearing fixed rate interest at 10% due April 2016 | — | 193,429 | ||||

Unsecured notes bearing fixed rate interest at 7.125% due September 2018 | — | 70,000 | ||||

Unsecured notes bearing fixed rate interest at 5.125% due October 2019 | 600,000 | 600,000 | ||||

Unsecured notes bearing fixed rate interest at 5.125% due July 2020 | 600,000 | 600,000 | ||||

Unsecured notes bearing fixed rate interest at 4.875% due September 2021 | 350,000 | 350,000 | ||||

Unsecured notes bearing fixed rate interest at 6.375% due October 2023 | 650,000 | 650,000 | ||||

Unsecured notes bearing fixed rate interest at 5.50% due September 2024 | 325,000 | 325,000 | ||||

Unsecured notes bearing fixed rate interest at 7.75% due June 2027 | 200,000 | 200,000 | ||||

Unsecured notes bearing fixed rate interest at 7.25% due September 2027 | 240,000 | 240,000 | ||||

Total principal long-term debt | 4,078,392 | 4,214,067 | ||||

Debt issuance costs | (27,615 | ) | (31,800 | ) | ||

Other (fair market value adjustments and discounts) | (7,382 | ) | (12,605 | ) | ||

Total long-term debt | 4,043,395 | 4,169,662 | ||||

Less current portion of long-term debt maturities of VIE loans | 646 | 646 | ||||

Long-term debt, net of current portion | $ | 4,042,749 | $ | 4,169,016 | ||

In thousands of dollars | |||

2017 (1) | $ | 646 | |

2018 (1) | 646 | ||

2019 | 700,000 | ||

2020 (2) | 1,612,100 | ||

2021 | 350,000 | ||

Thereafter | 1,415,000 | ||

Total | $ | 4,078,392 | |

In thousands of dollars | |||||||||

2016 | 2015 | 2014 | |||||||

Service cost—benefits earned during the period | $ | 816 | $ | 920 | $ | 812 | |||

Interest cost on benefit obligation | 26,111 | 23,800 | 23,558 | ||||||

Expected return on plan assets | (26,764 | ) | (31,464 | ) | (28,697 | ) | |||

Amortization of prior service costs | 670 | 673 | 599 | ||||||

Amortization of actuarial loss | 7,615 | 6,335 | 4,003 | ||||||

Total pension expense for company-sponsored retirement plans | $ | 8,448 | $ | 264 | $ | 275 | |||

In thousands of dollars | ||||||

Dec. 31, 2016 | Dec. 31, 2015 | |||||

Change in benefit obligations | ||||||

Benefit obligations at beginning of year | $ | 586,624 | $ | 566,224 | ||

Service cost | 816 | 920 | ||||

Interest cost | 26,111 | 23,800 | ||||

Actuarial loss (gain) | 17,755 | (12,514 | ) | |||

Gross benefits paid | (38,532 | ) | (34,401 | ) | ||

Adjustment due to spin-off of publishing businesses | 13,639 | 42,595 | ||||

Benefit obligations at end of year | $ | 606,413 | $ | 586,624 | ||

Change in plan assets | ||||||

Fair value of plan assets at beginning of year | $ | 400,193 | $ | 387,626 | ||

Actual return on plan assets | 21,316 | (725 | ) | |||

Employer contributions | 5,191 | 12,008 | ||||

Gross benefits paid | (38,532 | ) | (34,401 | ) | ||

Transfers | — | 35,685 | ||||

Fair value of plan assets at end of year | $ | 388,168 | $ | 400,193 | ||

Funded status at end of year | $ | (218,245 | ) | $ | (186,431 | ) |

Amounts recognized in Consolidated Balance Sheets | ||||||

Accrued benefit cost—current | $ | (30,955 | ) | $ | (7,587 | ) |

Accrued benefit cost—noncurrent | $ | (187,290 | ) | $ | (178,844 | ) |

In thousands of dollars | |||||||||

Fair Value of Plan Assets | Benefit Obligation | Funded Status | |||||||

TRP | $ | 388,168 | $ | 502,922 | $ | (114,754 | ) | ||

SERP (a) | — | 102,856 | (102,856 | ) | |||||

All other | — | 635 | (635 | ) | |||||

Total | $ | 388,168 | $ | 606,413 | $ | (218,245 | ) | ||

In thousands of dollars | ||||||

Dec. 31, 2016 | Dec. 31, 2015 | |||||

Accumulated benefit obligation | $ | 601,430 | $ | 576,333 | ||

Fair value of plan assets | $ | 388,168 | $ | 400,193 | ||

In thousands of dollars | ||||||

Dec. 31, 2016 | Dec. 31, 2015 | |||||

Projected benefit obligation | $ | 606,413 | $ | 586,624 | ||

Fair value of plan assets | $ | 388,168 | $ | 400,193 | ||

In thousands of dollars | ||||||

Dec. 31, 2016 | Dec. 31, 2015 | |||||

Net actuarial losses | $ | (204,761 | ) | $ | (184,808 | ) |

Prior service cost | (2,717 | ) | (3,367 | ) | ||

Amounts in accumulated other comprehensive income (loss) | $ | (207,478 | ) | $ | (188,175 | ) |

In thousands of dollars | |||

2016 | |||

Current year actuarial loss | $ | (23,203 | ) |

Amortization of previously deferred actuarial loss | 7,615 | ||

Amortization of previously deferred prior service costs | 670 | ||

Adjustment due to spin-off of publishing businesses | (4,386 | ) | |

Total | $ | (19,304 | ) |

2016 | 2015 | 2014 | |

Discount rate | 4.46% | 4.19% | 4.84% |

Expected return on plan assets | 7.00% | 8.00% | 8.00% |

Rate of compensation increase | 3.00% | 3.00% | 3.00% |

Dec. 31, 2016 | Dec. 31, 2015 | |

Discount rate | 4.12% | 4.46% |

Rate of compensation increase | 3.00% | 3.00% |

Target Allocation | Allocation of Plan Assets | |||||

2017 | 2016 | 2015 | ||||

Equity securities | 60 | % | 59 | % | 58 | % |

Debt securities | 25 | 34 | 35 | |||

Other | 15 | 7 | 7 | |||

Total | 100 | % | 100 | % | 100 | % |

In thousands of dollars | |||

2017 | $ | 62,588 | |

2018 | $ | 36,675 | |

2019 | $ | 38,514 | |

2020 | $ | 38,030 | |

2021 | $ | 38,272 | |

2022-2026 | $ | 196,925 | |

• | We play no part in the management of plan investments or any other aspect of plan administration. |

• | Assets contributed to the multi-employer plan by one employer may be used to provide benefits to employees of other participating employers. |

• | If a participating employer stops contributing to the plan, the unfunded obligations of the plan may be borne by the remaining participating employers. |

• | If we choose to stop participating in some of our multi-employer plans, we may be required to pay those plans an amount based on the unfunded status of the plan, referred to as withdrawal liability. |

Company Owned Assets | ||||||||||||

In thousands of dollars | ||||||||||||

Fair value measurement as of Dec. 31, 2016 | ||||||||||||

Level 1 | Level 2 | Level 3 | Total | |||||||||

Assets: | ||||||||||||

Deferred compensation investments | $ | 28,558 | $ | — | $ | — | $ | 28,558 | ||||

Available for sale investment | 16,744 | — | — | 16,744 | ||||||||

Total | $ | 45,302 | $ | — | $ | — | $ | 45,302 | ||||

Deferred compensation investments valued using net asset value as a practical expedient: | ||||||||||||

Interest in registered investment companies | $ | 10,140 | ||||||||||

Fixed income fund | 13,575 | |||||||||||

Total investments at fair value | $ | 69,017 | ||||||||||

In thousands of dollars | ||||||||||||

Fair value measurement as of Dec. 31, 2015 | ||||||||||||

Level 1 | Level 2 | Level 3 | Total | |||||||||

Assets: | ||||||||||||

Deferred compensation investments | $ | 27,770 | $ | — | $ | — | $ | 27,770 | ||||

Available for sale investment | 28,090 | — | — | 28,090 | ||||||||

Total | $ | 55,860 | $ | — | $ | — | $ | 55,860 | ||||

Deferred compensation investments valued using net asset value as a practical expedient: | ||||||||||||

Interest in registered investment companies | $ | 36,114 | ||||||||||

Fixed income fund | 13,315 | |||||||||||

Total investments at fair value | $ | 105,289 | ||||||||||

Pension Plan Assets | ||||||||||||

In thousands of dollars | ||||||||||||

Fair value measurement as of Dec. 31, 2016 | ||||||||||||

Level 1 | Level 2 | Level 3 | Total | |||||||||

Assets: | ||||||||||||

Cash and other | $ | 2,206 | $ | — | $ | — | $ | 2,206 | ||||

Corporate stock | 60,730 | — | — | 60,730 | ||||||||

Total | $ | 62,936 | $ | — | $ | — | $ | 62,936 | ||||

Pension plan investments valued using net asset value as a practical expedient: | ||||||||||||

Common collective trust - equities | $ | 167,647 | ||||||||||

Common collective trust - fixed income | 127,043 | |||||||||||

Hedge funds | 14,754 | |||||||||||

Partnership/joint venture interests | 8,985 | |||||||||||

Interest in registered investment companies | 6,803 | |||||||||||

Total fair value of plan assets | $ | 388,168 | ||||||||||

In thousands of dollars | ||||||||||||

Fair value measurement as of Dec. 31, 2015 | ||||||||||||

Level 1 | Level 2 | Level 3 | Total | |||||||||

Assets: | ||||||||||||

Cash and other | $ | 1,098 | $ | — | $ | — | $ | 1,098 | ||||

Corporate stock | 58,291 | — | — | 58,291 | ||||||||

Corporate bonds | — | 99 | — | 99 | ||||||||

Total | $ | 59,389 | $ | 99 | $ | — | $ | 59,488 | ||||

Pension plan investments valued using net asset value as a practical expedient: | ||||||||||||

Common collective trust - equities | $ | 172,046 | ||||||||||

Common collective trust - fixed income | 135,914 | |||||||||||

Hedge funds | 14,290 | |||||||||||

Partnership/joint venture interests | 11,796 | |||||||||||

Interest in registered investment companies | 6,659 | |||||||||||

Total fair value of plan assets | $ | 400,193 | ||||||||||

In thousands, except per share amounts | |||||||||

2016 | 2015 | 2014 | |||||||

Income from continuing operations attributable to TEGNA Inc. | $ | 444,171 | $ | 357,458 | $ | 687,936 | |||

Income from discontinued operations, net of tax | (7,474 | ) | 102,064 | 374,235 | |||||

Net income attributable to TEGNA Inc. | $ | 436,697 | $ | 459,522 | $ | 1,062,171 | |||

Weighted average number of common shares outstanding - basic | 216,358 | 224,688 | 226,292 | ||||||

Effect of dilutive securities | |||||||||

Restricted stock | 1,424 | 2,236 | 2,624 | ||||||

Performance Share Units | 997 | 1,867 | 1,999 | ||||||

Stock options | 902 | 930 | 992 | ||||||

Weighted average number of common shares outstanding - diluted | 219,681 | 229,721 | 231,907 | ||||||

Earnings from continuing operations per share - basic | $ | 2.05 | $ | 1.59 | $ | 3.04 | |||

Earnings from discontinued operations per share - basic | (0.03 | ) | 0.45 | 1.65 | |||||

Earnings per share - basic | $ | 2.02 | $ | 2.04 | $ | 4.69 | |||

Earnings from continuing operations per share - diluted | $ | 2.02 | $ | 1.56 | $ | 2.97 | |||

Earnings from discontinued operations per share - diluted | (0.03 | ) | 0.44 | 1.61 | |||||

Earnings per share - diluted | $ | 1.99 | $ | 2.00 | $ | 4.58 | |||

PSUs Granted During | 2016 | 2015 | 2014 |

Expected term | 3 yrs. | 3 yrs. | 3 yrs. |

Expected volatility | 39.60% | 32.00% | 39.32% |

Risk-free interest rate | 1.31% | 1.10% | 0.78% |

Expected dividend yield | 2.19% | 2.51% | 2.70% |

In thousands, except per share amounts | |||||||||

2016 | 2015 | 2014 | |||||||

Restricted stock and RSUs | $ | 10,607 | $ | 8,438 | $ | 8,604 | |||

PSUs | 6,983 | 10,363 | 7,517 | ||||||

Stock options | — | 857 | 662 | ||||||

Total stock-based compensation | $ | 17,590 | $ | 19,658 | $ | 16,783 | |||

2016 Restricted Stock and RSU Activity | Shares | Weighted average fair value | |||

Unvested at beginning of year | 2,126,526 | $ | 21.55 | ||

Granted | 616,743 | $ | 25.08 | ||

Settled | (1,277,444 | ) | $ | 19.22 | |

Canceled | (322,404 | ) | $ | 22.27 | |

Unvested at end of year | 1,143,421 | $ | 25.66 | ||

2015 Restricted Stock and RSU Activity | Shares | Weighted average fair value | |||

Unvested at beginning of year | 3,577,598 | $ | 16.97 | ||

Granted | 491,690 | $ | 31.78 | ||

Settled | (1,485,735 | ) | $ | 14.66 | |

Canceled | (532,524 | ) | $ | 19.28 | |

Adjustment due to spin-off of Publishing (a) | 75,497 | ||||

Unvested at end of year (a) | 2,126,526 | $ | 21.55 | ||

2014 Restricted Stock and RSU Activity | Shares | Weighted average fair value | |||

Unvested at beginning of year | 4,193,985 | $ | 13.92 | ||

Granted | 1,048,516 | $ | 27.26 | ||

Settled | (1,263,702 | ) | $ | 15.92 | |

Canceled | (401,201 | ) | $ | 16.13 | |

Unvested at end of year | 3,577,598 | $ | 16.97 | ||

2016 PSUs Activity | Target number of shares | Weighted average fair value | |||

Unvested at beginning of year | 1,385,940 | $ | 29.21 | ||

Granted | 392,589 | $ | 30.69 | ||

Settled | (687,125 | ) | $ | 20.12 | |

Canceled | (72,454 | ) | $ | 34.96 | |

Unvested at end of year | 1,018,950 | $ | 35.60 | ||

2015 PSUs Activity | Target number of shares | Weighted average fair value | |||

Unvested at beginning of year | 2,100,115 | $ | 20.95 | ||

Granted | 285,458 | $ | 39.47 | ||

Settled | (925,640 | ) | $ | 14.23 | |

Canceled | (123,621 | ) | $ | 29.84 | |

Adjustment due to spin-off of Publishing (a) | 49,628 | ||||

Unvested at end of year (a) | 1,385,940 | $ | 29.21 | ||

2014 PSUs Activity | Target number of shares | Weighted average fair value | |||

Unvested at beginning of year | 1,760,488 | $ | 16.92 | ||

Granted | 436,340 | $ | 37.31 | ||

Canceled | (96,713 | ) | $ | 21.41 | |

Unvested at end of year | 2,100,115 | $ | 20.95 | ||

In thousands of dollars | ||||||||||||

2016 | Retirement Plans | Foreign Currency Translation | Other | Total | ||||||||

Balance at beginning of year | $ | (116,496 | ) | $ | (20,129 | ) | $ | 5,674 | $ | (130,951 | ) | |

Other comprehensive loss before reclassifications | (13,143 | ) | (8,431 | ) | (11,346 | ) | (32,920 | ) | ||||

Adjustment due to spin-off of publishing businesses | (2,642 | ) | — | — | (2,642 | ) | ||||||

Amounts reclassified from AOCL | 4,940 | — | — | 4,940 | ||||||||

Balance at end of year | $ | (127,341 | ) | $ | (28,560 | ) | $ | (5,672 | ) | $ | (161,573 | ) |

In thousands of dollars | ||||||||||||

2015 | Retirement Plans | Foreign Currency Translation | Other | Total | ||||||||

Balance at beginning of year | $ | (1,172,245 | ) | $ | 391,113 | $ | 2,363 | $ | (778,769 | ) | ||

Other comprehensive income (loss) before reclassifications | 23,094 | (1,966 | ) | 3,311 | 24,439 | |||||||

Spin-off publishing businesses | 1,012,745 | (409,276 | ) | — | 603,469 | |||||||

Amounts reclassified from AOCL | 19,910 | — | — | 19,910 | ||||||||

Balance at end of year | $ | (116,496 | ) | $ | (20,129 | ) | $ | 5,674 | $ | (130,951 | ) | |

In thousands of dollars | ||||||||||||

2014 | Retirement Plans | Foreign Currency Translation | Other | Total | ||||||||

Balance at beginning of year | $ | (923,595 | ) | $ | 427,177 | $ | 2,363 | $ | (494,055 | ) | ||

Other comprehensive loss before reclassifications | (276,219 | ) | (36,064 | ) | — | (312,283 | ) | |||||

Amounts reclassified from AOCL | 27,569 | — | — | 27,569 | ||||||||

Balance at end of year | $ | (1,172,245 | ) | $ | 391,113 | $ | 2,363 | $ | (778,769 | ) | ||

In thousands of dollars | |||||||||

2016 | 2015 | 2014 | |||||||

Amortization of prior service cost | $ | 96 | $ | 1,176 | $ | (4,082 | ) | ||

Amortization of actuarial loss | 7,972 | 31,357 | 46,489 | ||||||

Total reclassifications, before tax | 8,068 | 32,533 | 42,407 | ||||||

Income tax effect | (3,128 | ) | (12,623 | ) | (14,838 | ) | |||

Total reclassifications, net of tax | $ | 4,940 | $ | 19,910 | $ | 27,569 | |||

Business segment financial information In thousands of dollars | |||||||||

2016 | 2015 | 2014 | |||||||

Operating revenues | |||||||||

Media | $ | 1,933,579 | $ | 1,682,144 | $ | 1,691,866 | |||

Digital | 1,407,619 | 1,368,801 | 934,275 | ||||||

Total | $ | 3,341,198 | $ | 3,050,945 | $ | 2,626,141 | |||

Operating income | |||||||||

Media (2) | $ | 806,411 | $ | 714,237 | $ | 747,020 | |||

Digital (2) | 230,121 | 229,386 | 119,908 | ||||||

Corporate (1) (2) | (64,458 | ) | (68,418 | ) | (71,256 | ) | |||

Net gain on sale of corporate building | — | 89,892 | — | ||||||

Unallocated (4) | — | (51,939 | ) | (88,173 | ) | ||||

Total | $ | 972,074 | $ | 913,158 | $ | 707,499 | |||

Depreciation, amortization, asset impairment and facility consolidation charges (gains) | |||||||||

Media (2) | $ | 82,639 | $ | 81,665 | $ | 94,129 | |||

Digital (2) | 150,382 | 146,907 | 91,967 | ||||||

Corporate (1) (2) | 3,599 | (82,342 | ) | 10,702 | |||||

Total | $ | 236,620 | $ | 146,230 | $ | 196,798 | |||

Equity (losses) income in unconsolidated investments, net | |||||||||

Media | $ | (3,906 | ) | $ | (2,794 | ) | $ | (1,667 | ) |

Digital | (2,322 | ) | (2,151 | ) | 154,370 | ||||

Corporate | (942 | ) | (119 | ) | (1,241 | ) | |||

Total | $ | (7,170 | ) | $ | (5,064 | ) | $ | 151,462 | |

Capital expenditures | |||||||||

Media | $ | 39,136 | $ | 52,141 | $ | 42,147 | |||

Digital | 54,017 | 44,903 | 38,549 | ||||||

Corporate (1) | 1,643 | 790 | 1,556 | ||||||

Total | $ | 94,796 | $ | 97,834 | $ | 82,252 | |||

Identifiable assets | |||||||||

Media | $ | 4,786,050 | $ | 4,799,375 | |||||

Digital | 3,649,347 | 3,529,124 | |||||||

Corporate (1) | 107,328 | 170,194 | |||||||

Total (3) | $ | 8,542,725 | $ | 8,498,693 | |||||

(1) | Corporate amounts represent those not directly related to our two business segments. |

(2) | Operating income for Media and Digital Segments includes pre-tax net asset impairment and facility consolidation charges (gains) for each year presented. See Note 12. |

(3) | Total of business segment identifiable assets exclude assets recorded in discontinued operations on the consolidated balance sheets of $7.3 million at Dec. 31, 2015. |

(4) | Unallocated expenses represent certain expenses that historically were allocated to the former Publishing Segment but that could not be allocated to discontinued operations as they were not clearly and specifically identifiable to the spun-off businesses. |

2016 | Pre-Tax Amount | ||||

Asset impairment and facility consolidation charges: | |||||

Goodwill - Digital | $ | 15,218 | |||

Other: | |||||

Media | 8,633 | ||||

Digital | 5,915 | ||||

Corporate | 2,364 | ||||

Total asset impairment and facility consolidation charges against operations | $ | 32,130 | |||

2015 | Pre-Tax Amount | ||||

Asset impairment and facility consolidation charges (gains): | |||||

Goodwill - Digital | $ | 8,000 | |||

Other intangibles - Digital | 900 | ||||

Other: | |||||

Media | 8,078 | ||||

Digital | 13,095 | ||||

Corporate | 962 | ||||

Gain on sale of corporate headquarters | (89,892 | ) | |||

Total asset impairment and facility consolidation charges (gains) against operations | $ | (58,857 | ) | ||

2014 | Pre-Tax Amount | ||||

Asset impairment and facility consolidation charges: | |||||

Goodwill - Digital | $ | 30,271 | |||

Other intangibles - Digital | 971 | ||||

Other - Media | 13,719 | ||||

Total asset impairment and facility consolidation charges against operations | $ | 44,961 | |||

In thousands of dollars | |||||||||

Operating Leases | Program Broadcast Contracts | Purchase Obligations | |||||||

2017 | $ | 42,971 | $ | 376,623 | $ | 70,881 | |||

2018 | 35,764 | 431,104 | 53,043 | ||||||

2019 | 25,172 | 336,191 | 15,460 | ||||||

2020 | 19,255 | 210,960 | 10,387 | ||||||

2021 | 18,236 | 535 | 8,557 | ||||||

Thereafter | 117,111 | 944 | 6,352 | ||||||

Total | $ | 258,509 | $ | 1,356,357 | $ | 164,680 | |||

In thousands | Year ended Dec. 31, 2015 | ||||||||

Publishing | Other | Total | |||||||

Operating revenues | $ | 1,400,006 | $ | 191,025 | $ | 1,591,031 | |||

Income (loss) from discontinued operations, before income taxes | 169,220 | (36,068 | ) | 133,152 | |||||

Provision for income taxes | 43,735 | (12,647 | ) | 31,088 | |||||

Income (loss) from discontinued operations, net of tax | 125,485 | (23,421 | ) | 102,064 | |||||

In thousands | Year ended Dec. 28, 2014 | ||||||||

Publishing | Other | Total | |||||||

Operating revenues | $ | 3,133,861 | $ | 248,172 | $ | 3,382,033 | |||

Income (loss) from discontinued operations, before income taxes | 372,549 | (7,185 | ) | 365,364 | |||||

Provision for income taxes | (11,817 | ) | 2,946 | (8,871 | ) | ||||

Income (loss) from discontinued operations, net of tax | 384,366 | (10,131 | ) | 374,235 | |||||

In thousands | Year ended Dec. 31, 2015 | ||||||||

Publishing | Other | Total | |||||||

Depreciation | $ | 49,542 | $ | 725 | $ | 50,267 | |||

Amortization | 7,008 | — | 7,008 | ||||||

Capital expenditures | (20,252 | ) | (681 | ) | (20,933 | ) | |||

Payments for acquisitions, net of cash acquired | (28,668 | ) | — | (28,668 | ) | ||||

Payments for investments | (2,000 | ) | — | (2,000 | ) | ||||

Proceeds from investments | 12,402 | — | 12,402 | ||||||

In thousands | Year ended Dec. 28, 2014 | ||||||||

Publishing | Other | Total | |||||||

Depreciation | $ | 99,029 | $ | 973 | $ | 100,002 | |||

Amortization | 13,885 | — | 13,885 | ||||||

Capital expenditures | (79,168 | ) | (454 | ) | (79,622 | ) | |||

Payments for acquisitions, net of cash acquired | (113 | ) | — | (113 | ) | ||||

Payments for investments | (2,500 | ) | — | (2,500 | ) | ||||

Proceeds from investments | 18,629 | — | 18,629 | ||||||

In thousands of dollars, except per share amounts | Fiscal Year (1) | ||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||

Operating revenue | $ | 3,341,198 | $ | 3,050,945 | $ | 2,626,141 | $ | 1,603,123 | $ | 1,631,987 | |||||

Operating expenses | 2,369,124 | 2,137,787 | 1,918,642 | 1,292,263 | 1,284,352 | ||||||||||

Operating income | 972,074 | 913,158 | 707,499 | 310,860 | 347,635 | ||||||||||

Non-operating (expense) income | |||||||||||||||

Equity (loss) income in unconsolidated investments, net | (7,170 | ) | (5,064 | ) | 151,462 | 21,055 | 11,001 | ||||||||