UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-6961

TEGNA INC.

(Exact name of registrant as specified in its charter)

Delaware | 16-0442930 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

7950 Jones Branch Drive, McLean, Virginia | 22107-0150 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (703) 854-7000

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $1.00 per share | The New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K (Check box if no delinquent filers). x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | x | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant based on the closing sales price of the registrant’s Common Stock as reported on The New York Stock Exchange on June 30, 2015, was $7,239,422,726. The registrant has no non-voting common equity.

As of Jan. 31, 2016, 219,720,167 shares of the registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to the registrant’s Annual Meeting of Shareholders to be held on May 5, 2016, is incorporated by reference in Part III to the extent described therein.

INDEX TO TEGNA INC.

2015 FORM 10-K

Item No. | Page | |

1 | ||

1A. | ||

1B. | ||

2 | ||

3 | ||

4 | ||

5 | ||

6 | ||

7 | ||

7A. | ||

8 | ||

9 | ||

9A. | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

15 | ||

2

PART I

ITEM 1.BUSINESS

Overview

Our company is comprised of a dynamic portfolio of media and digital businesses that provide content that matters and brands that deliver. We deliver highly relevant, useful and smart content, when and how people need it, to make the best decisions possible. Our agile and forward-thinking portfolio is comprised of one of the largest, most geographically diverse broadcasters in the U.S. and two leading digital companies, Cars.com and CareerBuilder. Combined, TEGNA’s brands have tremendous reach. Each month, our company reaches more than 90 million people across our broadcast and digital media platforms.

Our high margin operations generate strong and dependable cash flow and we are very disciplined financially. In addition, our strong balance sheet provides us the flexibility to invest in our businesses and to capitalize on opportunities for organic and acquisition-related growth while returning value to shareholders through dividends and share repurchases.

Since 2011, we have followed an ambitious and focused business strategy to transform our company. In all our efforts, our decisions have focused on one goal: to increase shareholder value. Through 2014, we made great progress on this evolution, including through the strategic acquisitions of Cars.com and Belo Corp., which doubled the scale of our Digital and Media Segments.

Fiscal year 2015 was a terrific and historic year for our company. We negotiated several retransmission agreements with major carriers with favorable terms; reached new long-term affiliation agreements with two network broadcast partners; launched new, innovative and expanded products at Cars.com; and developed and deployed a more focused business strategy and direction at CareerBuilder.

During 2015, we also made a number of significant strategic changes to enhance shareholder returns and improve the company. On June 29, 2015, the first day of our fiscal third quarter, we completed the separation of our publishing businesses. Our company was renamed TEGNA Inc. and our stock trades on the New York Stock Exchange under the symbol TGNA. The new publishing company retained the name Gannett Co., Inc. (Gannett) and now trades on the New York Stock Exchange under the symbol GCI. In the fourth quarter of 2015, we also sold Clipper Magazine, Mobestream Media and PointRoll.

After these strategic changes, we now operate the following two reportable segments:

TEGNA Media (Media Segment) - which includes 46 television stations (including one station under service agreements) in 38 markets. We are the largest independent station group of major network affiliates in the top 25 markets, reaching approximately one-third of all television households nationwide (more than 35 million households). We represent the #1 NBC affiliate group, #1 CBS affiliate group and #4 ABC affiliate group (excluding owner-operators). In December, we completed our acquisition of three Sander Media LLC television stations - KGW in Portland, Oregon, WHAS in Louisville, Kentucky and KMSB in Tucson, Arizona - following approval from the Federal Communications Commission. We had serviced these stations under shared service and similar arrangements since December 2013. Each television station

also has a robust digital presence across online, mobile and social, reaching consumers whenever, wherever they are across platforms. About 42 million unique visitors access our Media Segment’s digital properties each month. Social media is now at the core of all we do. Our stations keep viewers informed and engaged throughout the day. In fact, KUSA in Denver had the number one Facebook post of any local news organization during the year, generating 4 million interactions. Along with the advantages associated with our scale, we are ratings leaders well-positioned to continue to take market share. We believe that content comes first, resulting in award-winning local programming and a unique bond with the communities we serve. We continue to make top-notch, innovative programming a priority and invest in local news and other special programming to ensure we stay connected to our audiences and empower them throughout the day.

TEGNA Digital (Digital Segment) - which primarily consists of the Cars.com (formerly Classified Ventures LLC) and CareerBuilder businesses. Cars.com operates a leading online destination for automotive consumers offering credible, objective information about car shopping, selling and servicing. Cars.com has approximately 30 million monthly visits to its web properties and was recently named by comScore as having the number one mobile app in the third party automotive resources category. Cars.com leverages its growing consumer audience to help automotive dealers and marketers more effectively reach car buyers and sellers, as well as those looking for trusted service providers.

In addition, we own a controlling 53% interest in CareerBuilder, a global leader in human capital solutions specializing in Human Resource (HR) software as a service to help companies with every step of the recruitment process. CareerBuilder operates one of the largest job sites in North America, measured both by traffic and revenue, and has a presence in more than 60 markets worldwide. Together, Cars.com and CareerBuilder provide our advertising partners with access to two very important categories - automotive and human capital solutions. Our Digital Segment also includes G/O Digital, a one-stop shop for digital marketing services for local businesses; and Cofactor (also operating as ShopLocal), a digital marketing company that is uniquely positioned to bridge the divide between the online and offline worlds and enable brands to intelligently deliver content everywhere, driving sales locally. As consumers conduct more of their daily lives and day-to-day business online, our digital assets position us well, driving tremendous national and international reach.

In addition to the above reportable segments, our corporate category includes activities that are not directly attributable or allocable to a specific reportable segment. This category primarily consists of broad corporate management functions including legal, human resources, and finance as well as activities and costs not directly attributable to a particular segment.

3

General Company Information

TEGNA (formerly Gannett Co., Inc.) was founded by Frank E. Gannett and associates in 1906 and was incorporated in 1923. We listed shares publicly for the first time in 1967 and reincorporated in Delaware in 1972. Our approximately 220 million outstanding shares of common stock are held by approximately 6,800 shareholders of record as of Dec. 31, 2015. Our headquarters is located at 7950 Jones Branch Drive, McLean, VA, 22107. Our telephone number is (703) 854-7000 and our website home page on the Internet is www.tegna.com. We make our website content available for information purposes only. It should not be relied upon for investment purposes, nor is it incorporated by reference into this Annual Report on Form 10-K (Form 10-K).

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements for our annual stockholders’ meetings and amendments to those reports are available free of charge on our investor website, www.investors.tegna.com as soon as reasonably practical after we electronically file the material with, or furnish it to, the Securities and Exchange Commission (SEC). In addition, copies of our annual reports will be made available, free of charge, upon written request. The SEC also maintains a website at www.sec.gov that contains reports, proxy statements and other information regarding SEC registrants, including TEGNA Inc.

Business Segments

We operate two business segments: Media and Digital. We organize our business segments based on management and internal reporting structure, the nature of products and services offered by the segments, and the financial information that is evaluated regularly by our chief operating decision maker. Financial information for each of our reportable segments can be found under Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8 “Financial Statements and Supplementary Data” of this Form 10-K.

Media Segment

In 2015, our Media Segment generated net revenues of $1.7 billion, which represented 55% of our total consolidated net revenues. We have a presence in almost one-third of U.S. television households with a total market reach of more than 35 million households. Our station portfolio includes 46 full-power stations including one station we service through services arrangements. Today we are more diversified by region and network affiliation and are now a leading company in the industry. Other than the three major networks (ABC, CBS, and NBC) themselves, we are the largest owner of stations affiliated with each of these three major networks in the top 25 markets.

The primary sources of our Media Segment’s revenues are: 1) core advertising which includes local and national non-political advertising; 2) political advertising revenues which are driven by elections and peak in even years (e.g. 2016, 2014) and particularly in the second half of those years; 3) retransmission revenues representing fees paid by satellite and cable operators and telecommunications companies to carry our television signals on their systems; 4) digital revenues which encompass digital marketing services and advertising on the stations’ websites and tablet and mobile products; and 5) payments by advertisers to television stations for other services, such as production of programming from third parties and production of advertising material.

The advertising revenues generated by a station’s local news programs make up a significant part of its total revenues. Advertising rates are influenced by the demand for advertising time. This demand is influenced by a variety of factors, including the size and demographics of the local population, the concentration of businesses, local economic conditions in general, and the popularity of the station’s programming. As the market fluctuates with supply and demand, so does the station’s pricing. Almost all national advertising is placed through independent advertising representatives. Local advertising time is sold by each station’s own sales force.

Generally, a network provides programs to its affiliated television stations and sells on its own behalf commercial advertising for certain of the available advertising spots within the network programs. Our television stations also produce local programming such as news, sports, and entertainment.

Broadcast affiliates and their network partners continue to have the broadest appeal in terms of household viewership, viewing time, and audience reach. The overall reach of events such as the Olympics and NFL Football, along with our extensive local news and non-news programming, continues to surpass the reach in viewership of individual cable channels. Our ratings and reach are driven by the quality of programs we and our network partners produce and by the strong local connections we have to our communities, which give us a unique position among the numerous program choices viewers have, regardless of platform.

4

Strategy: Our Media Segment’s quality and scale drives its success. Our television stations empower the people we serve, delivering highly relevant, useful and smart content. We expect our wide geographic footprint to serve us well throughout the 2016 election cycle. Media has stations in key swing states, such as Colorado, Florida, Ohio, North Carolina and Virginia, and we anticipate record-breaking political advertising spending in 2016. We also anticipate record-setting Olympic advertising spending which benefits Media as the number one independent NBC affiliate group.

Media renegotiated several new retransmission agreements with major carriers such as DISH and DIRECTV/AT&T U-verse in 2015, and we expect our content and scale will allow us to grow market share and secure further retransmission fee revenue growth in the future. A gap remains between the value we provide and the fees that we are currently receiving from many carriers. We expect that we will continue to close that gap over the coming years.

Media has also recently executed long-term network affiliation agreements with CBS and NBC. Media’s entire portfolio of CBS, NBC and ABC stations is now under long-term agreements. Additionally, there are several initiatives underway that we expect to contribute to additional revenue and cash flow growth in the coming years to offset the impact of rising network affiliation fees.

The Media Segment continues to focus on increasing engagement on all platforms with local customers, including digital marketing services and advertising on the stations’ desktop, tablet and mobile products. In 2015, we modernized our technology infrastructure. By doing this, we gained the benefit of both lowering our digital technology costs while significantly improving our customer experiences. We introduced new customer-facing product platforms and improved our internal systems, which help our teams deliver outstanding customer experiences. We introduced a new mobile app platform to many of our stations on September 1 and launched a beta release of our new mobile web/web content management system. Customers can also consume our content on our recently launched Roku and NewsOn app channels. We introduced new on-air tools to weave social media into our broadcasts while our journalists created mobile video capturing more news in real-time. On the internal systems front, we built a portal called TegnaVision for our station groups to more easily share digital video. During the year, we built a new data warehouse and implemented-state-of-the-art social media analytics tools. These enhancements will give our local stations real time insight into what people are talking about in their communities.

Digital growth continues to accelerate for our television stations as content remains in high demand and product improvements continue to be favorably received by consumers. In 2015, total unique visitors and page views were up 13% and 14%, respectively, on a pro forma basis. Usage of our mobile and tablet apps, as well as mobile web, grew significantly in 2015 and now accounts for almost two-thirds of the total digital page views. Digital video plays in 2015 increased 25% as video continues to be highly desired on all platforms. Product enhancements to both the desktop and mobile digital products occur every year and are part of a continuous cycle of improving the customer experience and increasing consumer engagement.

The Media Segment is positioned to maximize engagement through social media. The synergistic relationship between social media and television is strong and we continue to explore ways to socially engage consumers on all screens for all types of programs, from major sporting events such as the Super Bowl and March Madness, to signature television events such as the Grammys or Academy Awards. Our social media reach grew over 40% in 2015 and now totals over 12 million followers on Twitter and Facebook. Within the Media Segment, social media consumers resulted in over 800 million referrals during 2015, a 125% increase over 2014.

Retransmission consent and affiliation agreements: Pursuant to Federal Communications Commission (FCC) rules, every three years a local television station must elect to either (1) require cable and/or direct broadcast satellite operators to carry the station’s signal or (2) require such cable and satellite operators to negotiate retransmission consent agreements to secure carriage. At present, we have retransmission consent agreements with the majority of cable operators and satellite providers for carriage of our television stations. We also have retransmission agreements with major telecommunications companies. Revenue from television retransmission fees has increased steadily in the last several years, better reflecting the value of the content that our Media Segment provides. While core advertising still represents a majority of Media Segment revenues (approximately 65% in 2015), the contribution from retransmission revenues continues to grow. In 2015, we completed retransmission negotiations with several significant operators. These are multi-year agreements that provide us with significant and steady revenue streams. Retransmission revenues are expected to grow significantly in 2016 and beyond.

Of our 46 stations, 40 have affiliation agreements with one of the four major networks. Programming fees are paid to our network partners who, in turn, provide us with prime time, sports and network news programming, which we then distribute in the local markets in which we operate. CBS and NBC affiliation agreements were just renewed with expiration dates in 2019 and 2021 respectively. The renewed affiliation agreements include our original TEGNA stations as well as our more recently acquired stations.

Programming and production: The costs of locally produced and purchased syndicated programming is a significant portion of television operating expenses. Syndicated programming costs are determined based on several market factors, including demand from the independent and affiliated stations within the market. In recent years, our television stations have expanded our locally produced news and entertainment programming in an effort to provide programs that distinguish the stations from the competition, to increase locally responsible programming, and to be more cost effective. Due to our scale, we provide stations additional resources from other markets to cover our major breaking news stories which give us a competitive advantage.

5

From our successful negotiations of renewed retransmission agreements and the creation of original, innovative programming to expanded coverage and increased focus on our communities, we had a very strong year in 2015. We kicked off significant efforts to transform our content and connect with audiences in new, powerful ways. With increased alignment between our digital and linear television properties as well as increased focus on station-to-station content sharing, we delivered more cross-platform reporting than ever before.

For example, in January 2015, in response to the Ferguson, Missouri riots, Media started a campaign to improve the dialogue between police and their respective communities. Using the hashtag #startswithtrust, Media stations combined special on-air reports with social media outreach to tell the story in their local community. The campaign was designed to open an honest dialogue about the issue. Stations aired special Town Halls, told impactful stories and conducted meaningful interviews in an effort to not just report on the issue but improve communities. When tragedy struck the AME Methodist Church in Charleston, South Carolina, our Columbia station, WLTX, dominated the story, benefiting from Media resources in Charlotte, Atlanta and Jacksonville. Our teams produced an hour-long dedication to the victims and encouraged South Carolinians to perform nine simple acts of kindness to honor the nine victims. The community rallied around the effort taking to social media to share their acts of kindness via the hashtag #lovenothate.

Our investigative reporting was also a big focus this year. Statewide investigations across our Texas stations became standard practice. We found success with multiple investigations that ran across our Media stations, including an investigation into our country’s 911 system and an investigation revealing the backlog of untested sexual assault kits. Both efforts generated a tremendous response. Our investigation hashtag #can911findme generated over 1.7M social media mentions and our untested sexual assault kits investigation led the Vice President, Attorney General and District Attorney for Manhattan to pledge $80 million to help clear the backlog.

Our Media Segment received substantial recognition and honors this year. We were the most recognized station group for excellence in local news. Our stations received 84 Edward R. Murrow awards including the national Murrow for overall excellence. In addition, our stations won the National Association of Broadcasters Service to America Award, six Investigative Reporters and Editors awards, three Alfred I. duPont-Columbia University awards, a Peabody Award, eight Salute to Excellence awards from the National Association of Black Journalists, 44 awards from the National Association of Press Photographers and many more. All of this recognizes the quality journalism and commitment to localism our stations deliver day-in and day-out.

Competition: Our Media Segment competes for audience share and advertising revenues primarily with other local television broadcasters (including network-affiliated and independent) and with other advertising media, such as radio broadcasters, multichannel video programming distributors (MVPDs), newspapers, magazines, direct mail and Internet media. Other sources of competition for our media stations include home video and audio recorders and players, direct broadcast satellite, low power television, Internet radio, video offerings (both wire line and wireless) of telephone companies as well as developing video services. Our stations compete for audience share and audience composition within their respective Designated Market Area (DMA) which is largely driven by program popularity. Our share of the DMA has a direct effect on the rates we are able to charge advertisers. MVPDs can also increase competition by bringing additional cable network channels and content into the DMA.

The advertising industry is dynamic and rapidly evolving. Our stations compete in the emerging local electronic media space, which includes the Internet or Internet-enabled devices, handheld wireless devices such as mobile phones and tablets, social media platforms, digital spectrum opportunities associated with digital television transmission (DTV) and Internet-enabled (“over-the-top” or “OTT”) television services. The technology that enables consumers to receive news and information continues to evolve.

Regulation: Our television stations are operated under the authority of the FCC, the Communications Act of 1934, as amended (Communications Act), and the rules and policies of the FCC (FCC Regulations).

Television broadcast licenses generally are granted for periods of eight years. They are renewable upon application to the FCC and usually are renewed except in rare cases in which a petition to deny, a complaint or an adverse finding as to the licensee’s qualifications results in loss of the license. We believe we are in substantial compliance with all applicable provisions of the Communications Act and FCC Regulations.

FCC Regulations also limit the concentration of broadcasting control and regulate network and local programming practices. FCC Regulations governing media ownership limit, or in some cases prohibit, the common ownership or control of most communications media serving common market areas (for example, television and radio; television and daily newspapers; or radio and daily newspapers). FCC Regulations permit common ownership of two television stations in the same market in certain defined circumstances, including situations where at least one of the commonly owned stations is outside the market’s top four rated stations at the time of acquisition and, at least, eight independent media “voices” remain after the acquisition. The Communications Act includes a national ownership cap for broadcast television stations which prohibits any one person or entity from having, in the aggregate, market reach of more than 39% of all U.S. television households. The market reach of stations that broadcast on UHF channels is discounted by 50% (the UHF discount). Our 45 television stations (excluding the station we currently service under a services arrangement) reach approximately 24% of U.S. television households, after applying the UHF discount. The FCC has proposed a repeal of the UHF discount and that proceeding remains pending. Without applying the UHF discount, our national reach would be approximately 32%.

6

The FCC commenced a new review of its ownership rules in 2014, as it is required to do every four years. The FCC has proposed to retain the local television ownership rule and proposed a modest relaxation of the newspaper/broadcast rule. Also in 2014, the FCC determined that certain joint sales agreements (JSAs) between television stations will be treated as attributable ownership interests. We are party to only one JSA which would have an insignificant impact on our overall attributable ownership interest. The FCC has proposed disclosure of shared services agreements and local news agreements. We are also party to a transition services agreement, which is similar to a shared services agreement though more limited, with a third party that owns a television station in Tucson, where we also own a television station. The current chair of the FCC has stated that he expects the ownership review commenced in 2014 to be completed by mid-2016. We are unable to predict whether or how the FCC’s rules in this area may change.

Congress has adopted legislation requiring the FCC to make changes to the rules concerning negotiation of retransmission consent agreements (which govern cable and satellite operators’ carriage of our signals). In 2015, the FCC adopted new rules required by the STELA Reauthorization Act of 2014 that prohibit same-market television broadcast stations from coordinating or jointly negotiating for retransmission consent unless they are under common ownership control. Congress also has directed the FCC to commence a rulemaking to “review its totality of the circumstances test for good faith [retransmission consent] negotiations.” The Commission has commenced the required proceeding to review the “totality of the circumstances” test for good faith retransmission consent negotiations, which proceeding is ongoing. We cannot predict what, if any, additional changes to the rules governing retransmission consent negotiations may be adopted. Separately, the FCC has sought comment on a proposal to eliminate the network non-duplication and syndicated exclusivity protection rules, which may permit cable operators, direct broadcast satellite systems, or other distributors classified by the FCC as MVPDs to import out-of-market television stations with duplicating programming during a retransmission consent dispute or otherwise. If these or other changes are adopted and favor MVPDs’ leverage against broadcasters in retransmission consent negotiations, such changes could adversely impact our revenue from retransmission and advertising.

Congress has authorized the FCC to conduct a voluntary incentive auction to reallocate certain spectrum currently occupied by television broadcast stations to mobile wireless broadband services, along with a related “repacking” of the television spectrum for remaining television stations. The repacking may entail television stations moving to different channels, having smaller service areas, and/or accepting additional interference. Congress has required that the FCC make “all reasonable efforts” to preserve the coverage area and population served of full-power and Class A television stations. The legislation authorizing the repacking establishes a $1.75 billion fund for reimbursement of costs incurred by stations which will be required to change channels in the repacking. Initial applications for stations that wish to remain eligible to bid to relinquish some or all of their current spectrum rights - either by going off the air, moving frequency bands, or sharing a channel - were due on January 12, 2016, at which point the “quiet period” under the FCC’s auction anti-collusion rules commenced. During the quiet period - which continues until the FCC publicly announces the auction results

- broadcast television licensees eligible to participate in the reverse-auction phase of the incentive auction are prohibited from directly or indirectly communicating with each other or with forward-auction applicants regarding licensees’ bids or bidding strategies in the incentive auction. The incentive auction is currently scheduled to commence in March 2016. We have performed a comprehensive review of our markets with respect to the opportunities presented by the auction. We have submitted initial applications for certain of our stations. However, we are unable to provide further details due to the above mentioned FCC rules. It is still too early to predict the likelihood, timing or outcome of any additional FCC regulatory action in this regard or the ultimate impact, if any, of the incentive auction and repacking upon our business.

In December 2014, the FCC proposed to expand the definition of MVPD to include certain “over-the-top” distributors of video programming that stream content to consumers over the Internet. If the FCC adopts this proposal, it could result in changes to how our stations’ signals are distributed, as well as how our video programming competitors reach viewers. We are unable to predict at this time whether the FCC will adopt this proposal or what the effect on our retransmission and advertising revenues will be, if any.

Digital Segment

Our Digital Segment is comprised of four business units including; Cars.com, CareerBuilder, G/O Digital and Cofactor. In 2015, our Digital Segment generated net revenues of $1.4 billion, which represented 45% of our total consolidated net revenues.

In October 2014, we acquired the remaining 73% interest we did not already own in Cars.com. Cars.com is a leading independent research site for car shoppers with approximately 30 million visits per month and nearly 900,000 visits per month across mobile devices. Independent automotive research sites have become an integral part of the car shopping process. Today, nearly all consumers visit a third-party site such as Cars.com to gather vehicle and dealership information and build confidence in the decision-making process. Recent research shows that approximately a third of all vehicles sold in the U.S. were both researched and found on Cars.com. Cars.com offers credible and easy-to-understand information from consumers and experts providing car buyers greater control over the shopping process. Leveraging its growing audience, Cars.com informs digital marketing strategies through consumer insights and innovative products, helping automotive dealers and manufacturers more effectively reach in-market car shoppers.

Cars.com generates revenues through online subscription advertising products targeting car dealerships and national advertisers through its own direct sales force as well as its affiliate sales channels. Cars.com hosts approximately 4.5 million vehicle listings at any given time and serves almost 21,000 customers that are primarily franchise and independent car dealers in all 50 states. In January 2015, Cars.com expanded into the area of service, introducing a solution that provides information about reputable certified repair shops and allows consumers to get estimates on potential vehicle repairs.

7

CareerBuilder offers a wide array of solutions that help employers around the world match the right candidate to the right opportunity. CareerBuilder built the world’s first and only pre-hire platform, providing everything from high-powered sourcing and mass job distribution to labor market analysis, workflow and automatic candidate relationship management - all in one place. Through its technology, constant innovation and customer care delivered at every touch point, CareerBuilder is helping employers hire the best talent, faster. Revenues are generated by both our own sales force, by providing recruitment solutions, workforce analytics, and human resource related consulting services, and through sales of employment advertising placed with CareerBuilder's owners' affiliated media organizations.

CareerBuilder serves both U.S. and international customers. Through its websites and partnerships, CareerBuilder has a presence in more than 60 countries worldwide, including Europe, Canada, Asia, Australia and South America. In 2015, U.S. customers accounted for 89% and international customers accounted for 11% of CareerBuilder’s net revenue.

G/O Digital is a one-stop-shop for local businesses looking to connect with media consumers through digital marketing, including via search, social and email advertising. During 2015, we continued to successfully scale and grow this business, by developing a central advertising sales force and offering cross-platform marketing campaigns to leading local advertisers in multiple markets.

Cofactor is a leader in turnkey local, at scale interactive marketing that enables brands and retailers to engage shoppers with personalized ad content on any device or channel to drive local store traffic and sales. Cofactor offers a complete suite of innovative digital advertising solutions to connect with shoppers along the path to purchase, driving measurable in-store sales and return on investment. Cofactor partners with the nation’s top retailers and brands, including CVS, Kohl’s, Lowe’s, Publix, Procter & Gamble, Staples, The Home Depot and Walgreens, to deliver localized ad content to shoppers at national scale through online circulars, display advertising, search, social media, video and mobile.

Strategy: The Digital Segment is driving significant growth as our businesses meet evolving consumer demand. For example, Cars.com has added to its offerings for car dealers, buyers, and sellers increasing Cars.com’s standing within the increasingly crucial advertising vertical. Cars.com continues to be a leader in products and service innovation. Beyond this, Cars.com launched RepairPal Certified, connecting car owners and dealership service departments, and Event Positions, which helps promote dealership events to an in-market audience during a specific timeframe. More recently, we launched Lot Insights, a first-of-its-kind tool in the industry which uses geo-fencing to measure the influence that Cars.com has in connecting customers and online shopping to dealerships and an in-store experience. These products are already contributing to revenue growth and more products will launch in the coming years that will continue to better serve our buyer and seller customers.

Also driving growth at Cars.com is an increase in digital automotive advertising, reflecting trends in consumer behavior, as car shoppers increasingly turn to digital to research vehicles before purchase. Cars.com is well-positioned to take advantage of shifting consumer and dealer trends. We offer industry-leading automotive advertising solutions as well as a user-friendly and innovative vehicle search platform. With approximately 17.5 million new cars sold across the U.S. in 2015, Cars.com is taking advantage of a healthy demand for automobiles, increased digital advertising spending, greater dealer penetration and continued innovation across its product offerings.

CareerBuilder is transforming into a global HR software-as-a-service (SaaS) leader, combining its advertising products with software and analytics to create a single unified solution for recruiters. The SaaS platform is in addition to CareerBuilder's existing product line, and not a departure from the core business. CareerBuilder has rapidly grown its SaaS product offering, achieving revenues of $149 million in 2015, up 30% from 2014.

Competition: Our Digital Segment faces significant competition from other websites offering integrated Internet products and services, networking websites and e-commerce websites. Several competitors offer online services and/or content in a manner similar to us that competes for the attention of the users of our offerings and advertisers. Specifically, Cars.com competes for a share of total digital advertising spend in the U.S. automotive market. The digital automotive industry is constantly evolving with new competitors entering the market as barriers to entry are relatively low. In recent years, dealers have shifted an increasing portion of their advertising budgets to new entrants with niche advertising products. Dealers also continue to invest in search engine marketing to drive traffic directly to their own websites, bypassing third-party sites while still investing in traditional media such as television, radio and newspapers. Cars.com has maintained its leadership position through its award-winning site and through innovative new products for its advertisers. In the current competitive climate, the need to innovate and to connect an advertiser’s investment to eventual sales at a local level will be of increasing importance.

For CareerBuilder, the market for online recruitment solutions is highly competitive with a multitude of online and offline competitors. Competitors include other employment related websites, general classified advertising websites, professional networking and social networking websites, traditional media companies, Internet portals, search engines and blogs. The barriers to entry into the online recruitment market are relatively low and new competitors continue to emerge. Recent trends include the rising popularity of professional and social media networking websites and job aggregation sites which have gained traction with employer advertisers. The number of niche job boards targeting specific industry verticals has also continued to increase. CareerBuilder’s ability to maintain its existing customer base while generating new customers depends, to a significant degree, on the quality of its services, pricing, product innovation and reputation among customers and potential customers.

8

For G/O Digital, the market for digital marketing services is highly competitive and fragmented. On a local level, we face increased competition from a wide range of companies offering similar tools and systems for managing and optimizing advertising campaigns.

For Cofactor, the market for digital store promotions is highly competitive and evolving as digital media transforms demand for marketing programs. Cofactor anticipates continued benefits from growth in online-influenced offline retail sales. The scale of Cofactor’s proprietary retail database and its established distribution partnerships is a source of advantage in this space. Cofactor enables delivery of all types of promotional content to any digitally connected device across all platforms, a key factor with the continued surge in mobile and social usage among consumers.

Regulation and legislation (impacting Digital Segment businesses and digital operations associated with Media businesses): The U.S. Congress has passed legislation which regulates certain aspects of the Internet, including content, copyright infringement, taxation, access charges, liability for third party activities and jurisdiction. Federal, state, local and foreign governmental organizations have enacted and also are considering other legislative and regulatory proposals that would regulate the Internet. Areas of potential regulation include, but are not limited to, user privacy, data security, and intellectual property ownership. With respect to user privacy, the legislative and regulatory proposals could regulate behavioral advertising, which specifically refers to the use of user behavioral data for the creation and delivery of more relevant, targeted Internet advertisements. With respect to our international operations, we are also closely monitoring developments regarding regulations relating to the transfer of personal data from Europe to the U.S. Some of our digital properties utilize certain aspects of user behavioral and personal data in their advertising solutions to customers.

Employees

At the end of 2015, TEGNA and its subsidiaries employed approximately 10,000 full-time and part-time people, including 2,800 at CareerBuilder.

2015 | 2014 | ||||

Media | 5,020 | 5,100 | |||

Digital | 4,785 | 6,080 | |||

Corporate | 215 | 285 | |||

Total company | 10,020 | 11,465 | |||

Approximately 7% of our employees (including subsidiaries) in the U.S. are represented by labor unions. They are represented by 23 local bargaining units, most of which are affiliated with one of four international unions under collective bargaining agreements. These agreements conform generally with the pattern of labor agreements in the broadcasting industry. We do not engage in industry-wide or company-wide bargaining.

Environmental and Sustainability Initiatives

We are committed to protecting the environment and managing our environmental impact responsibly. Environmental risk previously disclosed associated with the printing operations of our former publishing businesses transferred to Gannett in connection with the spin.

Our television stations regularly cover environmental and sustainability issues. Our station in Buffalo, WGRZ, investigated high concentrations of lead in homes. Both the city and the county blamed each other for a lack of testing, which would have identified the problem. As a result of a series of WGRZ stories, the city and county have begun working together to solve the problem, benefiting many Buffalo families. Another example is KPNX in Phoenix, which produced a series of reports on the accidental release by the U.S. Environmental Protection Agency of millions of gallons of toxic waste water from an abandoned mine and its impact on local farmers.

The TEGNA Foundation supports non-profit activities in communities where we do business and contributes to a variety of charitable causes through its Community Grant Program. One of the TEGNA Foundation’s community action grant priorities is environmental conservation.

9

MARKETS WE SERVE

TELEVISION STATIONS AND AFFILIATED DIGITAL PLATFORMS

State/District of Columbia | City | Station/web site | Channel/Network | Affiliation Agreement Expires in | Weekly Audience (5) | Founded | |

Arizona | Flagstaff | KNAZ-TV: 12news.com | Ch. 2/NBC | 2021 | (6 | ) | 1970 |

Phoenix | KPNX-TV: 12news.com | Ch. 12/NBC | 2021 | 1,237,000 | 1953 | ||

Tucson | KMSB-TV: tucsonnewsnow.com | Ch. 11/FOX | 2016 | 208,000 | 1967 | ||

KTTU-TV(1): tucsonnewsnow.com | Ch. 18/MNTV | 2016 | 61,000 | 1984 | |||

Arkansas | Little Rock | KTHV-TV: thv11.com | Ch. 11/CBS | 2019 | 387,000 | 1955 | |

California | Sacramento | KXTV-TV: abc10.com | Ch. 10/ABC | 2018 | 797,000 | 1955 | |

Colorado | Denver | KTVD-TV: my20denver.com | Ch. 20/MNTV | 2016 | 543,000 | 1988 | |

KUSA-TV: 9news.com | Ch. 9/NBC | 2021 | 1,162,000 | 1952 | |||

District of Columbia | Washington | WUSA-TV: wusa9.com | Ch. 9/CBS | 2019 | 1,459,000 | 1949 | |

Florida | Jacksonville | WJXX-TV: firstcoastnews.com | Ch. 25/ABC | 2018 | 391,000 | 1989 | |

WTLV-TV: firstcoastnews.com | Ch. 12/NBC | 2021 | 457,000 | 1957 | |||

Tampa-St. Petersburg | WTSP-TV: wtsp.com | Ch. 10/CBS | 2019 | 1,165,000 | 1965 | ||

Georgia | Atlanta | WATL-TV: myatltv.com | Ch. 36/MNTV | 2016 | 656,000 | 1954 | |

WXIA-TV: 11alive.com | Ch. 11/NBC | 2021 | 1,552,000 | 1948 | |||

Macon | WMAZ-TV: 13wmaz.com | Ch. 13/CBS | 2019 | 185,000 | 1953 | ||

Idaho | Boise | KTVB-TV(3): ktvb.com | Ch. 7/NBC | 2021 | 189,000 | 1953 | |

Kentucky | Louisville | WHAS-TV: whas11.com | Ch. 11/ABC | 2018 | 460,000 | 1950 | |

Louisiana | New Orleans | WWL-TV: wwltv.com | Ch. 4/CBS | 2019 | 516,000 | 1957 | |

WUPL-TV(4): wupltv.com | Ch. 54/MNTV | 2016 | 150,000 | 1955 | |||

Maine | Bangor | WLBZ-TV: wlbz2.com | Ch. 2/NBC | 2021 | 85,000 | 1954 | |

Portland | WCSH-TV: wcsh6.com | Ch. 6/NBC | 2021 | 253,000 | 1953 | ||

Michigan | Grand Rapids | WZZM-TV: wzzm13.com | Ch. 13/ABC | 2018 | 333,000 | 1962 | |

Minnesota | Minneapolis-St. Paul | KARE-TV: kare11.com | Ch. 11/NBC | 2021 | 1,210,000 | 1953 | |

Missouri | St. Louis | KSDK-TV: ksdk.com | Ch. 5/NBC | 2021 | 933,000 | 1947 | |

New York | Buffalo | WGRZ-TV: wgrz.com | Ch. 2/NBC | 2021 | 445,000 | 1954 | |

North Carolina | Charlotte | WCNC-TV: wcnc.com | Ch. 36/NBC | 2021 | 775,000 | 1967 | |

Greensboro | WFMY-TV: wfmynews2.com | Ch. 2/CBS | 2019 | 506,000 | 1949 | ||

Ohio | Cleveland | WKYC-TV: wkyc.com | Ch. 3/NBC | 2021 | 1,077,000 | 1948 | |

Oregon | Portland | KGW-TV(2): kgw.com | Ch. 8/NBC | 2021 | 792,000 | 1956 | |

South Carolina | Columbia | WLTX-TV: wltx.com | Ch. 19/CBS | 2019 | 271,000 | 1953 | |

Tennessee | Knoxville | WBIR-TV: wbir.com | Ch. 10/NBC | 2021 | 377,000 | 1956 | |

Texas | Abilene-Sweetwater | KXVA-TV: myfoxzone.com | Ch. 15/FOX | 2017 | N/A (7) | 2001 | |

Austin | KVUE-TV: kvue.com | Ch. 24/ABC | 2018 | 468,000 | 1971 | ||

Beaumont-Port Arthur | KBMT-TV: 12newsnow.com | Ch. 12/ABC | 2018 | 97,000 | 1961 | ||

Corpus Christi | KIII-TV: kiiitv.com | Ch. 3/ABC | 2018 | 151,000 | 1964 | ||

Dallas/Ft. Worth | WFAA-TV: wfaa.com | Ch. 8/ABC | 2018 | 1,587,000 | 1949 | ||

Houston | KHOU-TV: khou.com | Ch. 11/CBS | 2019 | 1,532,000 | 1953 | ||

San Angelo | KIDY-TV: myfoxzone.com | Ch. 6/FOX | 2017 | N/A (7) | 1984 | ||

San Antonio | KENS-TV: kens5.com | Ch. 5/CBS | 2019 | 615,000 | 1950 | ||

Tyler-Longview | KYTX-TV: cbs19.tv | Ch. 19/CBS | 2019 | 137,000 | 2008 | ||

Waco-Temple-College Station | KCEN-TV: kcentv.com | Ch. 9/NBC | 2021 | 183,000 | 1953 | ||

Virginia | Hampton/Norfolk | WVEC-TV: 13newsnow.com | Ch. 13/ABC | 2018 | 496,000 | 1953 | |

Washington | Seattle/Tacoma | KING-TV: king5.com | Ch. 5/NBC | 2021 | 1,285,000 | 1948 | |

KONG-TV: king5.com | Ch. 16/IND | N/A | 535,000 | 1997 | |||

Spokane | KREM-TV: krem.com | Ch. 2/CBS | 2019 | 258,000 | 1954 | ||

KSKN-TV: spokanescw22.com | Ch. 22/CW | 2016 | 88,000 | 1983 | |||

(1) | We service this station under service arrangements. |

(2) | We also own KGWZ-LD, a low power television station in Portland, OR. |

(3) | We also own KTFT-LD (NBC), a low power television station in Twin Falls, ID. |

(4) | We also own WBXN-CA, a Class A television station in New Orleans, LA. |

(5) | Weekly audience is number of television households reached, according to the November 2015 Nielsen book. |

(6) | KNAZ weekly audience is reported as part of KPNX. |

(7) | Audience numbers fall below minimum reporting standards. |

We also have one regional news channel, Northwest Cable News (NWCN) in Seattle/Tacoma, WA, and two local news channels, 24/7 NewsChannel in Boise, ID and NewsWatch on Channel 15 in New Orleans, LA. These operations provide news coverage and certain other programming in a comprehensive 24-hour a day format using the resources of our television stations in Texas, Washington, Oregon, Idaho, Louisiana and Arizona.

10

DIGITAL |

Cars.com: www.cars.com Headquarters: Chicago, IL |

CareerBuilder: www.careerbuilder.com Headquarters: Chicago, IL |

Cofactor (also operating as ShopLocal): www.cofactordigital.com; www.shoplocal.com; www.aboutshoplocal.com Headquarters: Chicago, IL |

G/O Digital: www.godigitalmarketing.com Headquarters: Phoenix, AZ |

INVESTMENTS We have non-controlling ownership interests in the following companies: |

4Info: www.4info.com |

Captivate: www.captivate.com |

Livestream: www.livestream.com |

Repair Pal: www.repairpal.com |

Topix: www.topix.com |

Video Call Center: www.thevideocallcenter.com |

Wanderful Media: www.wanderful.com |

Winners View: www.winnersview.com |

TEGNA ON THE NET: News and information about us is available on our web site, www.TEGNA.com. In addition to news and other information about us, we provide access through this site to our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after we file or furnish them electronically to the Securities and Exchange Commission (SEC). Certifications by our Chief Executive Officer and Chief Financial Officer are included as exhibits to our SEC reports (including to this Form 10-K). We also provide access on this web site to our Principles of Corporate Governance, the charters of our Audit, Executive Compensation and Nominating and Public Responsibility Committees and other important governance documents and policies, including our Ethics and Inside Trading Policies. Copies of all of these corporate governance documents are available to any shareholder upon written request made to our Secretary at the headquarters address. We will disclose on this web site changes to, or waivers of, our corporate Ethics Policy. | |

11

Certain factors affecting forward-looking statements

Certain statements in this Annual Report on Form 10-K contain certain forward-looking statements regarding business strategies, market potential, future financial performance and other matters. The words “believe,” “expect,” “estimate,” “could,” “should,” “intend,” “may,” “plan,” “seek,” “anticipate,” “project” and similar expressions, among others, generally identify “forward-looking statements”. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results and events to differ materially from those anticipated in the forward-looking statements.

Our actual financial results may be different from those projected due to the inherent nature of projections. Given these uncertainties, forward-looking statements should not be relied on in making investment decisions. The forward-looking statements contained in this Form 10-K speak only as of the date of its filing. Except where required by applicable law, we expressly disclaim a duty to provide updates to forward-looking statements after the date of this Form 10-K to reflect subsequent events, changed circumstances, changes in expectations, or the estimates and assumptions associated with them. The forward-looking statements in this Form 10-K are intended to be subject to the safe harbor protection provided by the federal securities laws.

ITEM 1A. RISK FACTORS

Following the spin-off of our publishing businesses in June 2015, the size and concentration of our business has changed. An investment in our common stock involves risks and uncertainties and prospective investors should consider carefully the following risk factors before investing in our securities. The risks described below may not be the only risks we face. Additional risks that we do not yet perceive or that we currently believe are immaterial may adversely affect our business and the trading price of our securities.

Changes in economic conditions in the U.S. markets we serve may depress demand for our products and services

We generate a significant portion of our revenues in our Media Segment from the sale of advertising at our television stations. Expenditures by advertisers tend to be cyclical, reflecting overall economic conditions, as well as budgeting and buying patterns. As a result, our operating results depend on the relative strength of the economy in our principal television and digital markets as well as the strength or weakness of regional and national economic factors. A decline in economic conditions in the U.S. could have a significant adverse impact on our businesses and could significantly impact all key advertising revenue categories. In addition, declining economic conditions could adversely affect employment conditions and consumer sentiment, reducing demand for the product offerings of CareerBuilder and Cars.com, which could impair our ability to grow our Digital revenues, which are increasingly important to our overall revenue mix since the separation was completed.

Competition from alternative forms of media may impair our ability to grow or maintain revenue levels in core and new businesses

Advertising produces the predominant share of our revenues from our Media Segment, with our stations’ affiliated desktop, mobile and tablet advertising revenues being an important component. Technology, particularly new video formats, streaming and downloading capabilities via the Internet, video-on-demand, personal video recorders and other devices and technologies used in the entertainment industry, continues to evolve rapidly, leading to alternative methods for the delivery and storage of digital content. These technological advancements have driven changes in consumer behavior and have empowered consumers to seek more control over when, where and how they consume news and entertainment, including through so-called “cutting the cord” and other consumption strategies. These innovations may affect our ability to generate television audience, which may make our television stations less attractive to both household audiences and advertisers. This competition may make it difficult for us to grow or maintain our media revenues, which we believe will challenge us to expand the contributions of our online and other digital businesses.

The value of our assets or operations may be diminished if our information technology systems fail to perform adequately or if we are the subject of a data breach or cyber attack

Our information technology systems are critically important to operating our business efficiently and effectively. We rely on our information technology systems to manage our business data, communications, news and advertising content, digital products, order entry, fulfillment and other business processes. The failure of our information technology systems to perform as we anticipate could disrupt our business and could result in transaction errors, processing inefficiencies, late or missed publications, and loss of sales and customers, causing our business and results to be impacted.

Furthermore, attempts to compromise information technology systems occur regularly across many industries and sectors, and we may be vulnerable to security breaches beyond our control. We invest in security resources and technology to protect our data and business processes against risk of data security breaches and cyber attack, but the techniques used to attempt attacks are constantly changing. A breach or successful attack could have a negative impact on our operations or business reputation. We maintain cyber risk insurance, but this insurance may be insufficient to cover all of our losses from any future breaches of our systems.

As has historically been the case in the broadcast sector, loss of or changes in affiliation agreements or retransmission consent agreements could adversely affect operating results for our Media Segment’s stations

Most of our stations have network affiliation agreements with the major broadcast television networks (ABC, CBS, NBC, and Fox). These television networks produce and distribute programming in exchange for each of our stations' commitment to air the programming at specified times and for commercial announcement time during the programming. In most cases, we also make cash payments to the networks.

12

Each of our affiliation agreements has a stated expiration date. If renewed, our network affiliation agreements may be renewed on terms that are less favorable to us. The non-renewal or termination of any of our network affiliation agreements would prevent us from being able to carry programming of the affiliate network. This loss of programming would require us to obtain replacement programming, which may involve higher costs and/or which may not be as attractive to our audiences, resulting in reduced revenues.

In recent years, the networks have streamed their programming on the Internet and other distribution platforms, in some cases within a short period of the original network programming broadcast on local television stations, including those we own. An increase in the availability of network programming on alternative platforms that either bypass or provide less favorable terms to local stations - such as cable channels, the Internet and other distribution vehicles - may dilute the exclusivity and value of network programming originally broadcast by the local stations and could adversely affect the business, financial condition and results of operations of our stations.

Our retransmission consent agreements with major cable, satellite and telecommunications service providers permit them to retransmit our stations’ signals to their subscribers in exchange for the payment of compensation to us. As is the case in the broadcast television industry generally, if we are unable to renegotiate these agreements on favorable terms, or at all, the failure to do so could have an adverse effect on our business, financial condition, and results of operations.

There could be significant liability if the spin-off of the publishing businesses is determined to be a taxable transaction

We received an opinion from outside tax counsel to the effect that the requirements for tax-free treatment under Section 355 of the Internal Revenue Code were satisfied. The opinion relies on certain facts, assumptions, representations and undertakings from TEGNA and Gannett regarding the past and future conduct of the companies’ respective businesses and other matters. If any of these facts, assumptions, representations or undertakings is incorrect or not satisfied, TEGNA and its stockholders may not be able to rely on the opinion of tax counsel and could be subject to significant tax liabilities.

Notwithstanding the opinion of tax counsel, the Internal Revenue Service could determine on audit that the separation is taxable if it determines that any of these facts, assumptions, representations or undertakings were incorrect or have been violated or if it disagrees with the conclusions in the opinion, or for other reasons, including as a result of certain significant changes in the share ownership of TEGNA or Gannett after the separation. If the separation is determined to be taxable for U.S. federal income tax purposes, TEGNA and its stockholders that are subject to U.S. federal income tax could incur significant U.S. federal income tax liabilities.

Gannett or we may fail to perform under various temporary transaction agreements that were executed as part of the separation or we may fail to have necessary systems and services in place when certain of the transaction agreements expire

In connection with the separation, we entered into a separation and distribution agreement and also entered into various other agreements, including a transition services agreement, a tax matters agreement and an employee matters agreement. The separation and distribution agreement, the tax matters agreement and the employee matters agreement determined the allocation of assets and liabilities between the companies following the separation for those respective areas and includes certain indemnifications related to liabilities and obligations. The transition services agreement provides for the performance of certain services by each company for the benefit of the other for a limited period of time after the separation. We will rely on Gannett to satisfy its performance obligations under these agreements. If Gannett is unable to satisfy its obligations under these agreements, we could incur operational difficulties or losses. If we do not have in place our own systems and services, or if we do not have agreements with other providers of these services once certain transaction agreements expire or terminate, we may not be able to operate our business effectively and our profitability may decline.

Volatility in the U.S. credit markets could significantly impact our ability to obtain new financing to fund our operations and strategic initiatives or to refinance our existing debt at reasonable rates as it matures

At December 31, 2015, we had approximately $4.2 billion in debt and approximately $658 million of undrawn additional borrowing capacity under our revolving credit facility that expires in 2020. This debt matures at various times during the years 2016-2027. While our cash flow is expected to be sufficient to pay amounts when due, if operating results deteriorate significantly, a portion of these maturities may need to be refinanced. Access to the capital markets for longer-term financing is unpredictable, and volatile credit markets could make it harder for us to obtain debt financings generally.

Changes in the regulatory environment could encumber or impede our efforts to improve operating results or the value of assets

Our media and digital operations are subject to government regulation. Changing regulations, particularly FCC Regulations which affect our television stations (including changes to our shared services and similar agreements), may result in increased costs, reduced valuations for certain broadcasting properties or other impacts, all of which may adversely impact our future profitability. All of our television stations are required to hold television broadcasting licenses from the FCC; when granted, these licenses are generally granted for a period of eight years. Under certain circumstances, the FCC is not required to renew any license and could decline to renew either our current license applications that are pending or those submitted in the future.

13

Our strategic acquisitions, investments and partnerships could pose various risks, increase our leverage and may significantly impact our ability to expand our overall profitability

Acquisitions involve inherent risks, such as increasing leverage and debt service requirements and combining company cultures and facilities, which could have a material adverse effect on our results of operations or cash flow and could strain our human resources. We may be unable to successfully implement effective cost controls, achieve expected synergies or increase revenues as a result of an acquisition. Acquisitions may result in us assuming unexpected liabilities and in management diverting its attention from the operation of our business. Disclosures we make regarding past operating results of acquired entities and our pro forma results are based on financial information provided to us by acquired entities, which has not been reviewed by our auditors or subject to our internal controls. Acquisitions may result in us having greater exposure to the industry risks of the businesses underlying the acquisition. Strategic investments and partnerships with other companies expose us to the risk that we may be unable to control the operations of our investee or partnership, which could decrease the amount of benefits we realize from a particular relationship. We are exposed to the risk that our partners in strategic investments and infrastructure may encounter financial difficulties which could disrupt investee or partnership activities, or impair assets acquired, which would adversely affect future reported results of operations and shareholders’ equity. In addition, we may be unable to obtain financing necessary to complete acquisitions on attractive terms or at all. The failure to obtain regulatory approvals may prevent us from completing or realizing the anticipated benefits of acquisitions. Furthermore, acquisitions may subject us to new or different regulations which could have an adverse effect on our operations.

The value of our existing intangible assets may become impaired, depending upon future operating results

Goodwill and other intangible assets were approximately $6.98 billion at December 31, 2015, representing approximately 82% of our total assets. These assets are subject to annual impairment testing and more frequent testing upon the occurrence of certain events or significant changes in circumstance that indicate all or a portion of their carrying values may no longer be recoverable. In which case a non-cash charge to earnings may be necessary, as occurred in 2013-2015 (see Notes 3 and 11 to the consolidated financial statements). We may subsequently experience market pressures which could cause future cash flows to decline below our current expectations, or volatile equity markets could negatively impact market factors used in the impairment analysis, including earnings multiples, discount rates, and long-term growth rates. Any future evaluations requiring an asset impairment charge for goodwill or other intangible assets would adversely affect future reported results of operations and shareholders’ equity, although such charges would not affect our cash flow.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Media Segment

Our media facilities are adequately equipped with the necessary television digital broadcasting equipment. We own or lease transmitter facilities in 52 locations. All of our stations have converted to digital television operations in accordance with applicable FCC Regulations. Our broadcasting facilities are adequate for present purposes. A listing of television station locations can be found on page 10.

Digital Segment

Generally, our digital businesses lease their facilities. This includes facilities for executive offices, sales offices and data centers. Our facilities are adequate for present operations. We believe that suitable additional or alternative space, including those under lease options, will be available at commercially reasonable terms for future expansion. A listing of our significant Digital facilities can be found on pages 11.

Corporate facilities

In October 2015, we sold our corporate headquarters in McLean, VA for a purchase price of $270 million. Following the sale, we are leasing a portion of the facility back for a period of at least 18 months. Additional information regarding the corporate headquarters sale may be found in Note 12 of the Notes to Consolidated Financial Statements.

ITEM 3. LEGAL PROCEEDINGS AND ENVIRONMENTAL MATTERS

Information regarding legal proceedings may be found in Note 12 of the Notes to Consolidated Financial Statements.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

14

PART II

ITEM 5.MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our shares are traded on the New York Stock Exchange with the symbol TGNA. Information regarding outstanding shares, shareholders and dividends may be found on pages 1, 4 and 15 of this Form 10-K. Information about debt securities sold in private transactions may be found on pages 25-26 of this Form 10-K.

TEGNA Common Stock Prices

High-low range by fiscal quarters based on NYSE-composite prices. On June 29, 2015, the first day of the fiscal third quarter, we completed the separation of our publishing business through a spin-off transaction. TEGNA's common stock prices in and after the third quarter of 2015 reflect the price impact of the spin-off transaction.

Dividends Paid Per Share | Common Stock Prices | ||||||

Year | Quarter | Low | High | ||||

2015 | First | $0.20 | $29.62 | $36.56 | |||

Second | $0.20 | $34.27 | $38.01 | ||||

Third | $0.20 | $22.42 | $32.97 | ||||

Fourth | $0.14 | $21.85 | $28.68 | ||||

Total 2015 | $0.74 | $21.85 | $38.01 | ||||

2014 | First | $0.20 | $25.96 | $30.43 | |||

Second | $0.20 | $25.53 | $30.98 | ||||

Third | $0.20 | $29.88 | $35.70 | ||||

Fourth | $0.20 | $25.95 | $33.70 | ||||

Total 2014 | $0.80 | $25.53 | $35.70 | ||||

Following the spin-off of our publishing businesses, on June 29, 2015, we announced that we would begin paying a regular quarterly cash dividend of $0.14 per share. We paid dividends (excluding the special spin-off distribution of our publishing businesses) totaling $167.5 million in 2015 and $181 million in 2014. On Feb. 23, 2016, the Board of Directors declared a dividend of $0.14 per share, payable on April 1, 2016, to shareholders of record as of the close of business March 4, 2016. We expect to continue paying comparable regular cash dividends in the future. The rate and frequency of future dividends will depend on future earnings, capital requirements and financial condition and other factors considered relevant by our Board of Directors.

Purchases of Equity Securities

Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Program | Approximate Dollar Value of Shares that May Yet Be Repurchased Under the Program | |||||

9/28/15 - 11/1/15 | 264,743 | $25.81 | 264,743 | $692,688,712 | |||||

11/2/15 - 11/29/15 | 939,864 | $27.26 | 939,864 | $667,066,449 | |||||

11/30/15 - 12/31/15 | 1,426,500 | $26.64 | 1,426,500 | $629,060,180 | |||||

Total 4th Quarter 2015 | 2,631,107 | $26.78 | 2,631,107 | $629,060,180 | |||||

In June 2015, our Board of Directors approved a $750 million share repurchase program to be completed over a three-year period beginning June 29, 2015. On Oct. 20, 2015, our Board of Directors approved a $75 million increase to the share repurchase program, bringing the total authorized amount to $825 million. We spent $271 million in 2015 to repurchase 9.6 million of our shares, at an average price per share of $28.16. Under the program, management has discretion to determine the dollar amount of shares to be repurchased and the timing of any repurchases in compliance with applicable law and regulation.

As of December 31, 2015, 123,000 shares were repurchased as part of the publicly announced repurchase program, but were settled after the quarter ended. The effect of those repurchases decreased the maximum dollar value available under the program to $625,874,910.

15

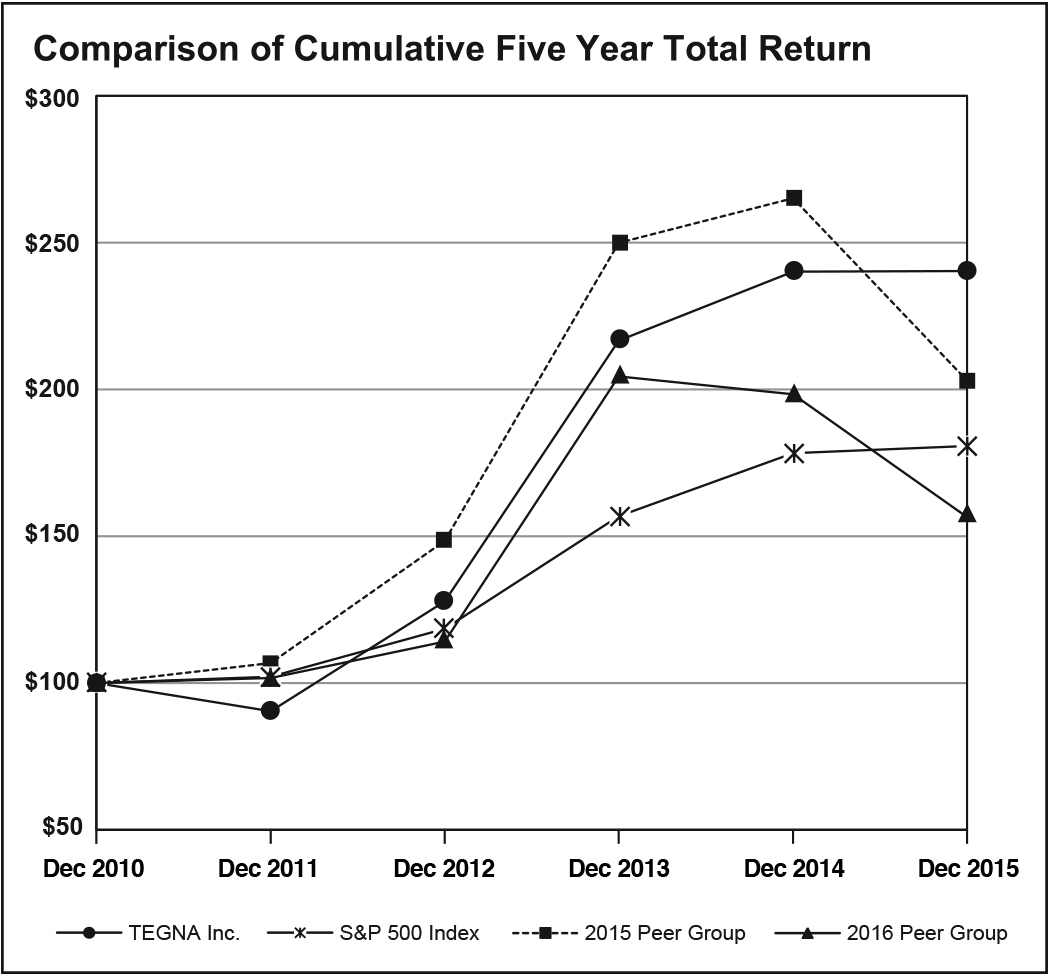

Comparison of shareholder return – 2011 to 2015

The following graph compares the performance of our common stock during the period Dec. 26, 2010, to Dec. 31, 2015, with the S&P 500 Index, and two peer group indexes we selected.

Our 2015 peer group includes A.H. Belo Corp., Discovery Communications Inc., The E.W. Scripps Company, LinkedIn Corp., The McClatchy Company, Media General, Inc. (on an adjusted basis to reflect its merger with Young Broadcasting, LLC), Meredith Corp., Monster Worldwide Inc., The New York Times Company, News Corp. (on an adjusted basis to reflect the spin-off by News Corporation), Nexstar Broadcasting Group Inc., ReachLocal Inc., Sinclair Broadcast Group Inc., and Yahoo Inc. (collectively, the “2015 Peer Group”). Many of the 2015 Peer Group companies have a strong publishing/broadcasting orientation, but the peer group also includes companies in the digital media industry.

Our 2016 peer group includes Angie's List Inc., CBS Corp., Constant Contact Inc., Discovery Communications Inc., E.W. Scripps Company, Gray Television Inc., Groupon Inc., Harte Hanks Inc., IAC/InterActiveCorp, LinkinedIn Corp., Media General, Inc., Meredith Corp., Monster Worldwide Inc., Nexstar Broadcasting Group Inc., Sinclair Broadcast Group Inc., Tribune Media Company, Yahoo Inc., and Yelp Inc. (collectively, the "2016 Peer Group"). Our 2016 Peer Group reflects our post-spin business segments and includes broadcasting and digital companies.

The S&P 500 Index includes 500 U.S. companies in the industrial, utilities and financial sectors and is weighted by market capitalization. The total returns of the Peer Groups also are weighted by market capitalization.

The graph depicts representative results of investing $100 in our common stock, the S&P 500 Index, 2015 Peer Group, and 2016 Peer Group index at closing on Dec. 26, 2010. It assumes that dividends were reinvested monthly with respect to our common stock (including, as it relates to the spin-off, the aggregate value of the former publishing businesses as distributed to our shareholders), daily with respect to the S&P 500 Index and monthly with respect to each Peer Group company.

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||

TEGNA Inc. | $ | 100 | $ | 90.37 | $ | 127.80 | $ | 216.61 | $ | 240.11 | $ | 240.31 | ||||||

S&P 500 Index | $ | 100 | $ | 102.11 | $ | 118.45 | $ | 156.82 | $ | 178.29 | $ | 180.75 | ||||||

2015 Peer Group | $ | 100 | $ | 106.82 | $ | 148.38 | $ | 249.95 | $ | 265.12 | $ | 202.97 | ||||||

2016 Peer Group | $ | 100 | $ | 101.74 | $ | 114.08 | $ | 204.45 | $ | 198.34 | $ | 156.51 | ||||||

ITEM 6. SELECTED FINANCIAL DATA

Selected financial data for the years 2011 through 2015 is contained under the heading “Selected Financial Data” on page 64 and is derived from our audited financial statements for those years.

The information contained in the “Selected Financial Data” is not necessarily indicative of the results of operations to be expected for future years, and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 and the consolidated financial statements and related notes thereto included in Item 8 of this Form 10-K.

16

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Executive Summary

Our company is comprised of a dynamic portfolio of media and digital businesses that provide content that matters and brands that deliver. Our media business includes 46 television stations operating in 38 markets, offering high-quality television programming and digital content. Our digital business primarily consists of our Cars.com and CareerBuilder business units that operate in the automotive and human capital solutions industries. The Cars.com website provides credible and easy-to-understand information from consumers and experts to provide car buyers with greater control over the car buying and servicing process. CareerBuilder helps companies target, attract and retain workforce talent through an array product offerings including talent management software and other advertising and recruitment solutions.

On the first day of our fiscal third quarter, June 29, 2015, we completed the spin-off of our publishing businesses. Our company was renamed TEGNA Inc., and our stock trades on the New York Stock Exchange under the symbol TGNA. In addition, during the fourth quarter of 2015, we sold substantially all of the businesses within our Other Segment.

We have presented the financial condition and results of operations of the former publishing businesses and Other Segment as discontinued operations in the accompanying consolidated financial statements for all periods presented. For a summary of discontinued operations, see Note 13.