x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Delaware | 16-0442930 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

7950 Jones Branch Drive, McLean, Virginia | 22107-0910 | |

(Address of principal executive offices) | (Zip Code) | |

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $1.00 per share | The New York Stock Exchange | |

Large accelerated filer | x | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Item No. | Page | |

1 | ||

1A. | ||

1B. | ||

2 | ||

3 | ||

4 | ||

5 | ||

6 | ||

7 | ||

7A. | ||

8 | ||

9 | ||

9A. | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

15 | ||

• | Enhance local core news and marketing operations to make local franchises stronger and ties with the communities even deeper, thereby growing Publishing and higher growth, higher margin Broadcasting and Digital businesses; |

• | Leverage hometown and brand advantages to accelerate growth by entering into or expanding high potential businesses; and |

• | Optimize assets on an ongoing basis to maintain a strong financial profile to improve efficiency and effectiveness, and driving increased shareholder value. |

• | Launching “For The Win” (ftw.usatoday.com), the first mainstream sports media property focused exclusively on “social news,” and The Q (q.usatoday.com), a platform that delivers sports news to fans through curated analysis. |

• | Re-launching growth sports sites The Big Lead (www.thebiglead.com), a fast-growing and highly social media property where breaking sports news and commentary combine with pop culture, Hoopshype (www.hoopshype.com), a popular destination for NBA breaking news, and MMA Junkie (www.mmajunkie.com) a popular mixed martial arts site. |

• | USA TODAY High School Sports re-launched 39 local high school media sites across Gannett’s local properties, featuring video, text, photo, and social media capabilities. |

• | USA TODAY Sports Images became the official photo partner of Major League Soccer (MLS) and its business and marketing subsidiary, Soccer United Marketing (SUM), as part of a multi-year agreement. |

• | Expanded its Super Bowl ad-rating platform Ad Meter to The Year in Sports where fans vote in categories like Best Sports Marketing Campaign and Best Athlete Endorsement Ad. |

• | USA WEEKEND, a weekly magazine carried by more than 760 local publishers with an aggregate circulation reach of more than 22 million. |

• | Clipper Magazine, a direct mail advertising magazine that publishes hundreds of local market editions under the brands Clipper Magazine, Savvy Shopper and Mint Magazine in 29 states to more than 27 million. |

• | Gannett Government Media, a worldwide multimedia business with digital, print and broadcast media properties focused on government, military and defense technology audiences. |

• | Gannett Healthcare Group, which publishes magazines specializing in news, continuing education opportunities and employment opportunities, reaching nurses and allied health professionals nationwide. Its web sites, GannettHG.com, Nurse.com and TodayinPT.com, feature news, continuing education opportunities and information about employment opportunities for allied health professionals. Gannett Healthcare Group also operates Gannett Education, which delivers continuing education opportunities to nurses and allied health professionals and includes GannettEducation.com, ContinuingEducation.com and PearlsReview.com, an online nursing certification and continuing education web site. |

2013 | 2012 | ||||

Broadcast | 4,800 | 2,600 | |||

Publishing | 23,000 | 24,800 | |||

Digital | 3,000 | 2,500 | |||

Corporate | 800 | 800 | |||

Total company | 31,600 | 30,700 | |||

State/District of Columbia | City | Station/web site | Channel/Network | Affiliation Agreement Expires in | Weekly Audience (6) | Founded | |

Arizona | Flagstaff | KNAZ-TV: azcentral.com/12news | Ch. 2/NBC | 2017 | (7 | ) | 1970 |

Phoenix | KASW-TV(1)(2): azfamily.com | Ch. 6/CW | 2016 | 562,000 | 1995 | ||

KPNX-TV: azcentral.com/12news | Ch. 12/NBC | 2017 | 1,240,000 | 1953 | |||

KTVK-TV(1)(2): azfamily.com | Ch. 3/IND | 750,000 | 1955 | ||||

Tucson | KMSB-TV(1): tucsonnewsnow.com | Ch. 11/FOX | 2016 | 190,000 | 1967 | ||

KTTU-TV(1): tucsonnewsnow.com | Ch. 12/MNTV | 2014 | 81,000 | 1984 | |||

Arkansas | Little Rock | KTHV-TV: todaysthv.com | Ch. 11/CBS | 2015 | 421,000 | 1955 | |

California | Sacramento | KXTV-TV: news10.net | Ch. 10/ABC | 2014 | 85,300 | 1955 | |

Colorado | Denver | KTVD-TV: ktvd.com | Ch. 20/MNTV | 2014 | 536,000 | 1988 | |

KUSA-TV: 9news.com | Ch. 9/NBC | 2017 | 1,171,000 | 1952 | |||

District of Columbia | Washington | WUSA-TV: wusa9.com | Ch. 9/CBS | 2015 | 1,803,000 | 1949 | |

Florida | Jacksonville | WJXX-TV: firstcoastnews.com | Ch. 25/ABC | 2014 | 404,000 | 1989 | |

WTLV-TV: firstcoastnews.com | Ch. 12/NBC | 2017 | 501,000 | 1957 | |||

Tampa-St. Petersburg | WTSP-TV: wtsp.com | Ch. 10/CBS | 2015 | 1,262,000 | 1965 | ||

Georgia | Atlanta | WATL-TV: myatltv.com | Ch. 36/MNTV | 2016 | 793,000 | 1954 | |

WXIA-TV: 11alive.com | Ch. 11/NBC | 2017 | 1,556,000 | 1948 | |||

Macon | WMAZ-TV: 13wmaz.com | Ch. 13/CBS | 2015 | 206,000 | 1953 | ||

Idaho | Boise | KTVB-TV(5): ktvb.com | Ch. 7/NBC | 2015 | 198,000 | 1953 | |

Kentucky | Louisville | WHAS-TV(1): whas11.com | Ch. 11/ABC | 2014 | 514,000 | 1950 | |

Louisiana | New Orleans | WWL-TV: wwltv.com | Ch. 4/CBS | 2017 | 543,000 | 1957 | |

WUPL-TV(4): wupltv.com | Ch. 54/MNTV | 2014 | 169,000 | 1955 | |||

Maine | Bangor | WLBZ-TV: wlbz2.com | Ch. 2/NBC | 2017 | 107,000 | 1954 | |

Portland | WCSH-TV: wcsh6.com | Ch. 6/NBC | 2017 | 310,000 | 1953 | ||

Michigan | Grand Rapids | WZZM-TV: wzzm13.com | Ch. 13/ABC | 2014 | 394,000 | 1962 | |

Minnesota | Minneapolis-St. Paul | KARE-TV: kare11.com | Ch. 11/NBC | 2017 | 1,300,000 | 1953 | |

Missouri | St. Louis | KMOV-TV(1)(2): kmov.com | Ch. 4/CBS | 2016 | 997,000 | 1954 | |

KSDK-TV: ksdk.com | Ch. 5/NBC | 2017 | 984,000 | 1947 | |||

New York | Buffalo | WGRZ-TV: wgrz.com | Ch. 2/NBC | 2017 | 513,000 | 1954 | |

North Carolina | Charlotte | WCNC-TV: wcnc.com | Ch. 36/NBC | 2015 | 769,000 | 1967 | |

Greensboro | WFMY-TV: digtriad.com | Ch. 2/CBS | 2015 | 582,000 | 1949 | ||

Ohio | Cleveland | WKYC-TV: wkyc.com | Ch. 3/NBC | 2017 | 1,114,000 | 1948 | |

Oregon | Portland | KGW-TV(1)(3): kgw.com | Ch. 8/NBC | 2015 | 809,000 | 1956 | |

South Carolina | Columbia | WLTX-TV: wltx.com | Ch. 19/CBS | 2015 | 291,000 | 1953 | |

Tennessee | Knoxville | WBIR-TV: wbir.com | Ch. 10/NBC | 2017 | 460,000 | 1956 | |

Texas | Austin | KVUE-TV: kvue.com | Ch. 24/ABC | 2014 | 488,000 | 1971 | |

Dallas/Ft. Worth | WFAA-TV: wfaa.com | Ch. 8/ABC | 2014 | 1,694,000 | 1949 | ||

Houston | KHOU-TV: khou.com | Ch. 11/CBS | 2017 | 1,595,000 | 1953 | ||

San Antonio | KENS-TV: kens5.com | Ch. 5/CBS | 2017 | 629,000 | 1950 | ||

Virginia | Hampton/Norfolk | WVEC-TV: wvec.com | Ch. 13/ABC | 2014 | 539,000 | 1953 | |

Washington | Seattle/Tacoma | KING-TV: king5.com | Ch. 5/NBC | 2015 | 1,370,000 | 1948 | |

KONG-TV: king5.com | Ch. 16/IND | 618,000 | 1997 | ||||

Spokane | KREM-TV: krem.com | Ch. 2/CBS | 2016 | 282,000 | 1954 | ||

KSKN-TV: spokanescw22.com | Ch. 22/CW | 2016 | 95,000 | 1983 | |||

(1) | Stations serviced by Gannett under shared services and similar arrangements. |

(2) | Meredith Corporation has agreed to purchase KMOV-TV, KTVK-TV and KASW-TV. |

(3) | The company also owns KGWZ-LD, a low power television station in Portland, OR. |

(4) | The company also owns WBXN-CA, a Class A television station in New Orleans, LA. |

(5) | The company also owns KTFT-LD (NBC), a low power television station in Twin Falls, ID. |

(6) | Weekly audience is number of television households reached, according to the November 2013 Nielsen book. |

(7) | Audience numbers fall below minimum reporting standards. |

DAILY LOCAL MEDIA ORGANIZATIONS AND AFFILIATED DIGITAL PLATFORMS | ||||||||||||||

State Territory | Average 2013 Circulation - Print and Digital Replica and Non-Replica | |||||||||||||

City | Local media organization/web site | Morning | Afternoon | Sunday | Founded | |||||||||

Alabama | Montgomery | Montgomery Advertiser www.montgomeryadvertiser.com | 26,952 | 33,035 | 1829 | |||||||||

Arizona | Phoenix | The Arizona Republic www.azcentral.com | 263,348 | 509,197 | 1890 | |||||||||

Arkansas | Mountain Home | The Baxter Bulletin www.baxterbulletin.com | 8,753 | 1901 | ||||||||||

California | Palm Springs | The Desert Sun www.mydesert.com | 35,369 | 40,024 | 1927 | |||||||||

Salinas | The Salinas Californian www.thecalifornian.com | 8,059 | 1871 | |||||||||||

Visalia | Visalia Times-Delta/Tulare Advance-Register www.visaliatimesdelta.com www.tulareadvanceregister.com | 16,428 | 1859 | |||||||||||

Colorado | Fort Collins | Fort Collins Coloradoan www.coloradoan.com | 19,669 | 24,835 | 1873 | |||||||||

Delaware | Wilmington | The News Journal www.delawareonline.com | 76,945 | 107,209 | 1871 | |||||||||

Florida | Brevard County | FLORIDA TODAY www.floridatoday.com | 53,099 | 86,394 | 1966 | |||||||||

Fort Myers | The News-Press www.news-press.com | 56,787 | 76,461 | 1884 | ||||||||||

Pensacola | Pensacola News Journal www.pnj.com | 33,862 | 48,495 | 1889 | ||||||||||

Tallahassee | Tallahassee Democrat www.tallahassee.com | 30,303 | 40,933 | 1905 | ||||||||||

Guam | Hagatna | Pacific Daily News www.guampdn.com | 15,042 | 12,746 | 1944 | |||||||||

Indiana | Indianapolis | The Indianapolis Star www.indystar.com | 145,930 | 280,428 | 1903 | |||||||||

Lafayette | Journal and Courier www.jconline.com | 24,775 | 33,240 | 1829 | ||||||||||

Muncie | The Star Press www.thestarpress.com | 21,849 | 28,282 | 1899 | ||||||||||

Richmond | Palladium-Item www.pal-item.com | 10,088 | 15,097 | 1831 | ||||||||||

Iowa | Des Moines | The Des Moines Register www.desmoinesregister.com | 90,982 | 186,383 | 1849 | |||||||||

Iowa City | Iowa City Press-Citizen www.press-citizen.com | 10,359 | 1860 | |||||||||||

Kentucky | Louisville | The Courier-Journal www.courier-journal.com | 125,887 | 222,229 | 1868 | |||||||||

Louisiana | Alexandria | Alexandria Daily Town Talk www.thetowntalk.com | 16,605 | 22,242 | 1883 | |||||||||

Lafayette | The Daily Advertiser www.theadvertiser.com | 24,430 | 32,653 | 1865 | ||||||||||

Monroe | The News-Star www.thenewsstar.com | 23,696 | 26,561 | 1890 | ||||||||||

Opelousas | Daily World www.dailyworld.com | 4,867 | 6,041 | 1939 | ||||||||||

Shreveport | The Times www.shreveporttimes.com | 34,946 | 51,955 | 1871 | ||||||||||

Maryland | Salisbury | The Daily Times www.delmarvanow.com | 15,447 | 20,463 | 1900 | |||||||||

DAILY LOCAL MEDIA ORGANIZATIONS AND AFFILIATED DIGITAL PLATFORMS | ||||||||||||||

State Territory | Average 2013 Circulation - Print and Digital Replica and Non-Replica | |||||||||||||

City | Local media organization/web site | Morning | Afternoon | Sunday | Founded | |||||||||

Michigan | Battle Creek | Battle Creek Enquirer www.battlecreekenquirer.com | 13,019 | 18,446 | 1900 | |||||||||

Detroit | Detroit Free Press www.freep.com | 193,420 | 784,243 | 1832 | ||||||||||

Lansing | Lansing State Journal www.lansingstatejournal.com | 38,770 | 53,244 | 1855 | ||||||||||

Livingston County | Daily Press & Argus www.livingstondaily.com | 9,913 | 14,452 | 1843 | ||||||||||

Port Huron | Times Herald www.thetimesherald.com | 16,482 | 24,894 | 1900 | ||||||||||

Minnesota | St. Cloud | St. Cloud Times www.sctimes.com | 20,925 | 27,210 | 1861 | |||||||||

Mississippi | Hattiesburg | Hattiesburg American www.hattiesburgamerican.com | 8,872 | 12,154 | 1897 | |||||||||

Jackson | The Clarion-Ledger www.clarionledger.com | 50,950 | 60,307 | 1837 | ||||||||||

Missouri | Springfield | Springfield News-Leader www.news-leader.com | 32,039 | 51,010 | 1893 | |||||||||

Montana | Great Falls | Great Falls Tribune www.greatfallstribune.com | 23,479 | 26,669 | 1885 | |||||||||

Nevada | Reno | Reno Gazette-Journal www.rgj.com | 38,046 | 60,869 | 1870 | |||||||||

New Jersey | Asbury Park | Asbury Park Press www.app.com | 90,859 | 133,276 | 1879 | |||||||||

Bridgewater | Courier News www.mycentraljersey.com | 12,082 | 15,610 | 1884 | ||||||||||

Cherry Hill | Courier-Post www.courierpostonline.com | 41,217 | 53,575 | 1875 | ||||||||||

East Brunswick | Home News Tribune www.mycentraljersey.com | 23,720 | 28,633 | 1879 | ||||||||||

Morristown | Daily Record www.dailyrecord.com | 16,152 | 19,720 | 1900 | ||||||||||

Vineland | The Daily Journal www.thedailyjournal.com | 11,700 | 1864 | |||||||||||

New York | Binghamton | Press & Sun-Bulletin www.pressconnects.com | 31,425 | 41,697 | 1904 | |||||||||

Elmira | Star-Gazette www.stargazette.com | 14,102 | 21,727 | 1828 | ||||||||||

Ithaca | The Ithaca Journal www.theithacajournal.com | 10,113 | 1815 | |||||||||||

Poughkeepsie | Poughkeepsie Journal www.poughkeepsiejournal.com | 22,756 | 30,892 | 1785 | ||||||||||

Rochester | Rochester Democrat and Chronicle www.democratandchronicle.com | 101,113 | 140,239 | 1833 | ||||||||||

Westchester County | The Journal News www.lohud.com | 64,022 | 81,896 | 1829 | ||||||||||

North Carolina | Asheville | Asheville Citizen-Times www.citizen-times.com | 29,820 | 43,845 | 1870 | |||||||||

DAILY LOCAL MEDIA ORGANIZATIONS AND AFFILIATED DIGITAL PLATFORMS | ||||||||||||||

State Territory | Average 2013 Circulation - Print and Digital Replica and Non-Replica | |||||||||||||

City | Local media organization/web site | Morning | Afternoon | Sunday | Founded | |||||||||

Ohio | Bucyrus | Telegraph-Forum www.bucyrustelegraphforum.com | 3,818 | 1923 | ||||||||||

Chillicothe | Chillicothe Gazette www.chillicothegazette.com | 8,076 | 9,895 | 1800 | ||||||||||

Cincinnati | The Cincinnati Enquirer www.cincinnati.com | 122,900 | 236,689 | 1841 | ||||||||||

Coshocton | Coshocton Tribune www.coshoctontribune.com | 3,800 | 4,748 | 1842 | ||||||||||

Fremont | The News-Messenger www.thenews-messenger.com | 5,629 | 1856 | |||||||||||

Lancaster | Lancaster Eagle-Gazette www.lancastereaglegazette.com | 8,022 | 9,865 | 1807 | ||||||||||

Mansfield | News Journal www.mansfieldnewsjournal.com | 17,572 | 25,187 | 1885 | ||||||||||

Marion | The Marion Star www.marionstar.com | 6,174 | 7,883 | 1880 | ||||||||||

Newark | The Advocate www.newarkadvocate.com | 11,821 | 14,437 | 1820 | ||||||||||

Port Clinton | News Herald www.portclintonnewsherald.com | 2,437 | 1864 | |||||||||||

Zanesville | Times Recorder www.zanesvilletimesrecorder.com | 11,314 | 13,325 | 1852 | ||||||||||

Oregon | Salem | Statesman Journal www.statesmanjournal.com | 31,894 | 38,501 | 1851 | |||||||||

South Carolina | Greenville | The Greenville News www.greenvilleonline.com | 46,957 | 92,288 | 1874 | |||||||||

South Dakota | Sioux Falls | Argus Leader www.argusleader.com | 30,295 | 55,182 | 1881 | |||||||||

Tennessee | Clarksville | The Leaf-Chronicle www.theleafchronicle.com | 12,187 | 16,785 | 1808 | |||||||||

Jackson | The Jackson Sun www.jacksonsun.com | 15,763 | 24,287 | 1848 | ||||||||||

Murfreesboro | The Daily News Journal www.dnj.com | 10,665 | 14,784 | 1848 | ||||||||||

Nashville | The Tennessean www.tennessean.com | 96,542 | 219,188 | 1812 | ||||||||||

Utah | St. George | The Spectrum www.thespectrum.com | 14,665 | 17,029 | 1963 | |||||||||

Vermont | Burlington | The Burlington Free Press www.burlingtonfreepress.com | 25,255 | 30,602 | 1827 | |||||||||

Virginia | McLean | USA TODAY* www.usatoday.com | 2,862,229 | 1982 | ||||||||||

Staunton | The Daily News Leader www.newsleader.com | 12,916 | 16,093 | 1904 | ||||||||||

Wisconsin | Appleton | The Post-Crescent www.postcrescent.com | 38,509 | 50,722 | 1853 | |||||||||

Fond du Lac | The Reporter www.fdlreporter.com | 9,911 | 13,076 | 1870 | ||||||||||

Green Bay | Green Bay Press-Gazette www.greenbaypressgazette.com | 41,542 | 61,666 | 1915 | ||||||||||

Manitowoc | Herald Times Reporter www.htrnews.com | 9,603 | 11,394 | 1898 | ||||||||||

Marshfield | Marshfield News-Herald www.marshfieldnewsherald.com | 7,608 | 1927 | |||||||||||

Oshkosh | Oshkosh Northwestern www.thenorthwestern.com | 12,712 | 17,805 | 1868 | ||||||||||

Sheboygan | The Sheboygan Press www.sheboyganpress.com | 14,054 | 17,639 | 1907 | ||||||||||

Stevens Point | Stevens Point Journal www.stevenspointjournal.com | 7,500 | 1873 | |||||||||||

Central Wisconsin Sunday | 15,880 | |||||||||||||

Wausau | Wausau Daily Herald www.wausaudailyherald.com | 14,855 | 20,029 | 1903 | ||||||||||

Wisconsin Rapids | The Daily Tribune www.wisconsinrapidstribune.com | 7,657 | 1914 | |||||||||||

* | USA TODAY morning figure is the average Print and Digital Replica and Non-Replica circulation according to the Alliance for Audited Media’s September 2013 Publisher’s Statement. |

DAILY PAID-FOR LOCAL MEDIA ORGANIZATIONS AND AFFILIATED DIGITAL PLATFORMS/NEWSQUEST PLC | ||||||

Circulation* | ||||||

City | Local media organization/web site | Monday-Saturday | Founded | |||

Basildon | Echo** www.echo-news.co.uk | 26,705 | 1969 | |||

Blackburn | Lancashire Telegraph www.lancashiretelegraph.co.uk | 18,293 | 1886 | |||

Bolton | The Bolton News www.theboltonnews.co.uk | 17,199 | 1867 | |||

Bournemouth | Daily Echo www.bournemouthecho.co.uk | 22,007 | 1900 | |||

Bradford | Telegraph & Argus www.thetelegraphandargus.co.uk | 21,641 | 1868 | |||

Brighton | The Argus www.theargus.co.uk | 16,622 | 1880 | |||

Colchester | The Gazette** www.gazette-news.co.uk | 12,889 | 1970 | |||

Darlington | The Northern Echo www.thenorthernecho.co.uk | 35,196 | 1870 | |||

Glasgow | Evening Times www.eveningtimes.co.uk | 39,234 | 1876 | |||

Glasgow | The Herald www.heraldscotland.com | 41,030 | 1783 | |||

Newport | South Wales Argus www.southwalesargus.co.uk | 19,748 | 1892 | |||

Oxford | Oxford Mail www.oxfordmail.co.uk | 16,569 | 1928 | |||

Southampton | Southern Daily Echo www.dailyecho.co.uk | 26,846 | 1888 | |||

Swindon | Swindon Advertiser www.swindonadvertiser.co.uk | 15,506 | 1854 | |||

Weymouth | Dorset Echo www.dorsetecho.co.uk | 15,195 | 1921 | |||

Worcester | Worcester News www.worcesternews.co.uk | 11,922 | 1937 | |||

York | The Press www.yorkpress.co.uk | 22,057 | 1882 | |||

* Circulation figures are according to ABC results for the period January - June 2013 ** Publishes Monday-Friday | ||||||

GANNETT DIGITAL |

CareerBuilder: www.careerbuilder.com Headquarters: Chicago, IL Sales offices: Atlanta, GA; Boston, MA; Charlotte, NC; Chicago, IL; Cincinnati, OH; Dallas, TX; Denver, CO; Detroit, MI; Edison, NJ; Los Angeles; Minneapolis, MN; Moscow, ID; Nashville, TN; New York, NY; Orlando, FL; Overland Park, KS; Philadelphia, PA; San Bruno, CA; Scottsdale, AZ; Seattle, WA; Washington, DC International offices: Brazil, Canada, China, France, Germany, Greece, India, Indonesia, Italy, Malaysia, Netherlands, Belgium, Norway, Singapore, Spain, Sweden, United Kingdom, Vietnam |

PointRoll, Inc.: www.pointroll.com Headquarters: King of Prussia, PA Sales offices: Atlanta, GA; Boston, MA; Chicago, IL; Detroit, MI; Los Angeles, CA; New York, NY; San Francisco, CA; |

Shoplocal: www.shoplocal.com Headquarters: Chicago, IL Sales office: Chicago, IL |

Mobile and Tablet: Gannett powers more than 500 local mobile and tablet products and also partners with mobile service providers to power news alerts and mobile marketing campaigns. Gannett has also developed and deployed leading applications for iPad, iPhone, Kindle, Android and Windows. | ||

USA TODAY/USATODAY.com Headquarters and editorial offices: McLean, VA Print sites: Albuquerque, NM; Atlanta, GA; Columbia, SC; Denver, CO; Des Moines, IA; Eugene, OR; Fort Lauderdale, FL; Houston, TX; Indianapolis, IN; Las Vegas, NV; Lawrence, KS; Los Angeles, CA; Louisville, KY; Milwaukee, WI; Minneapolis, MN; Mobile, AL; Nashville, TN; Newark, OH; Norwood, MA; Oklahoma City, OK; Orlando, FL; Phoenix, AZ; Plano, TX; Rochester, NY; Rockaway, NJ; St. Louis, MO; Salt Lake City, UT; San Jose, CA; Seattle, WA; Springfield, VA; Sterling Heights, MI; Tampa, FL; Warrendale, PA; Wilmington, DE; Winston-Salem, NC Advertising offices: Atlanta, GA; Chicago, IL; Dallas, TX; Detroit, MI; Los Angeles, CA; McLean, VA; New York, NY; San Francisco, CA |

USA TODAY Sports Media Group: www.bigleadsports.com; www.kffl.com; www.thehuddle.com (subscription); www.hoopsworld.com; hoopshype.com; mmajunkie.com; bnqt.com; www.baseballhq.com (subscription); www.quickish.com; www.venturethere.com; www.schedulestar.com; www.usatodayhss.com; ftw.usatoday.com; q.usatoday.com Headquarters: Los Angeles Advertising offices: Los Angeles, CA; McLean, VA; New York, NY |

USA TODAY Travel Media Group Headquarters: McLean, VA Advertising offices: McLean, VA |

USA WEEKEND: www.usaweekend.com Headquarters and editorial offices: McLean, VA Advertising offices: Chicago, IL; Los Angeles, CA; New York, NY; San Francisco, CA |

Reviewed.com: www.reviewed.com Headquarters: Cambridge, MA |

G/O Digital: BLiNQ Media: www.blinqmedia.com; Deal Chicken: www.dealchicken.com; Clipper Digital: www.clippermagazine.com; www.DoubleTakeOffers.com; G/O Digital: www.godigitalmarketing.com; Mobestream Media (Key Ring): www.keyringapp.com Headquarters: Chicago, IL Sales offices: Atlanta, GA; Chicago, IL; Dallas, TX; McLean, VA; New York, NY; Phoenix, AZ |

BLiNQ Media: www.blinqmedia.com; bam.blinqmedia.com Headquarters: New York, NY Advertising offices: Atlanta, GA; Chicago, IL; New York, NY |

Mobestream Media: www.keyringapp.com Headquarters: Dallas, TX |

Clipper Magazine: www.clippermagazine.com; DoubleTakeOffers.com Headquarters: Mountville, PA |

Gannett Healthcare Group: www.GannettHG.com; www.GannettEducation.com; www.ContinuingEducation.com; www.Nurse.com; www.TodayinPT.com; www.PearlsReview.com Headquarters: Hoffman Estates, IL Regional offices: Dallas, TX; San Jose, CA Publications: Nurse.com, Today in PT, Today in OT |

Gannett Government Media Corp. Headquarters: Springfield, VA Publications: Army Times: www.armytimes.com, Navy Times: www.navytimes.com, Marine Corps Times: www.marinecorpstimes.com, Air Force Times: www.airforcetimes.com, Federal Times: www.federaltimes.com, Defense News: www.defensenews.com, C4ISR & Networks: www.c4isrnet.com, Military Times EDGE: www.militarytimesedge.com |

Gannett Media Technologies International: www.gmti.com Headquarters: Norfolk, VA Regional offices: Cincinnati, OH; Phoenix, AZ |

Non-daily publications: Weekly, semi-weekly, monthly or bimonthly publications in Alabama, Arizona, Arkansas, California, Colorado, Delaware, Florida, Guam, Indiana, Iowa, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Jersey, New York, North Carolina, Ohio, Oregon, South Carolina, South Dakota, Tennessee, Utah, Vermont, Virginia, Wisconsin |

Gannett Publishing Services: www.gannettpublishingservices.com Headquarters: McLean, VA Sales office: Atlanta, GA |

Gannett Satellite Information Network: McLean, VA |

GANNETT ON THE NET: News and information about Gannett is available on its web site, www.gannett.com. In addition to news and other information about Gannett, the company provides access through this site to its annual report on Form 10-K, its quarterly reports on Form 10-Q, its current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after the company files or furnishes them electronically to the Securities and Exchange Commission (SEC). Certifications by Gannett’s Chief Executive Officer and Chief Financial Officer are included as exhibits to the company’s SEC reports (including to this Form 10-K). Gannett also provides access on this web site to its Principles of Corporate Governance, the charters of its Audit, Transformation, Executive Compensation and Nominating and Public Responsibility Committees and other important governance documents and policies, including its Ethics and Inside Trading Policies. Copies of all of these corporate governance documents are available to any shareholder upon written request made to the company’s Secretary at the headquarters address. In addition, the company will disclose on this web site changes to, or waivers of, its corporate Ethics Policy. | |

Year | Quarter | Low | High | Year | Quarter | Low | High | |||||||||||

2009 | First | $ | 1.95 | $ | 9.30 | 2012 | First | $ | 13.36 | $ | 15.61 | |||||||

Second | $ | 2.20 | $ | 5.48 | Second | $ | 12.33 | $ | 15.74 | |||||||||

Third | $ | 3.18 | $ | 10.14 | Third | $ | 13.20 | $ | 18.75 | |||||||||

Fourth | $ | 9.76 | $ | 15.63 | Fourth | $ | 16.63 | $ | 18.97 | |||||||||

2010 | First | $ | 13.53 | $ | 17.25 | 2013 | First | $ | 18.01 | $ | 22.07 | |||||||

Second | $ | 13.73 | $ | 18.67 | Second | $ | 19.85 | $ | 26.60 | |||||||||

Third | $ | 11.98 | $ | 15.11 | Third | $ | 24.06 | $ | 26.67 | |||||||||

Fourth | $ | 11.76 | $ | 15.78 | Fourth | $ | 24.39 | $ | 29.31 | |||||||||

2011 | First | $ | 14.49 | $ | 17.19 | 2014 | First* | $ | 26.36 | $ | 30.04 | |||||||

Second | $ | 13.30 | $ | 15.64 | * Through Feb. 18, 2014 | |||||||||||||

Third | $ | 8.55 | $ | 14.60 | ||||||||||||||

Fourth | $ | 9.16 | $ | 13.57 | ||||||||||||||

Period | (a) Total Number of Shares Purchased | (b) Average Price Paid per Share | (c) Total Number of Shares Purchased as Part of Publicly Announced Program | (d) Approximate Dollar Value of Shares that May Yet Be Repurchased Under the Program | |||||||||

9/30/13 – 11/3/13 | 398,000 | $ | 26.42 | 398,000 | $ | 252,084,536 | |||||||

11/4/13 – 12/1/13 | 945,000 | $ | 26.81 | 945,000 | $ | 226,751,369 | |||||||

12/2/13 – 12/29/13 | 75,000 | $ | 26.73 | 75,000 | $ | 224,746,379 | |||||||

Total 4th Quarter 2013 | 1,418,000 | $ | 26.69 | 1,418,000 | $ | 224,746,379 | |||||||

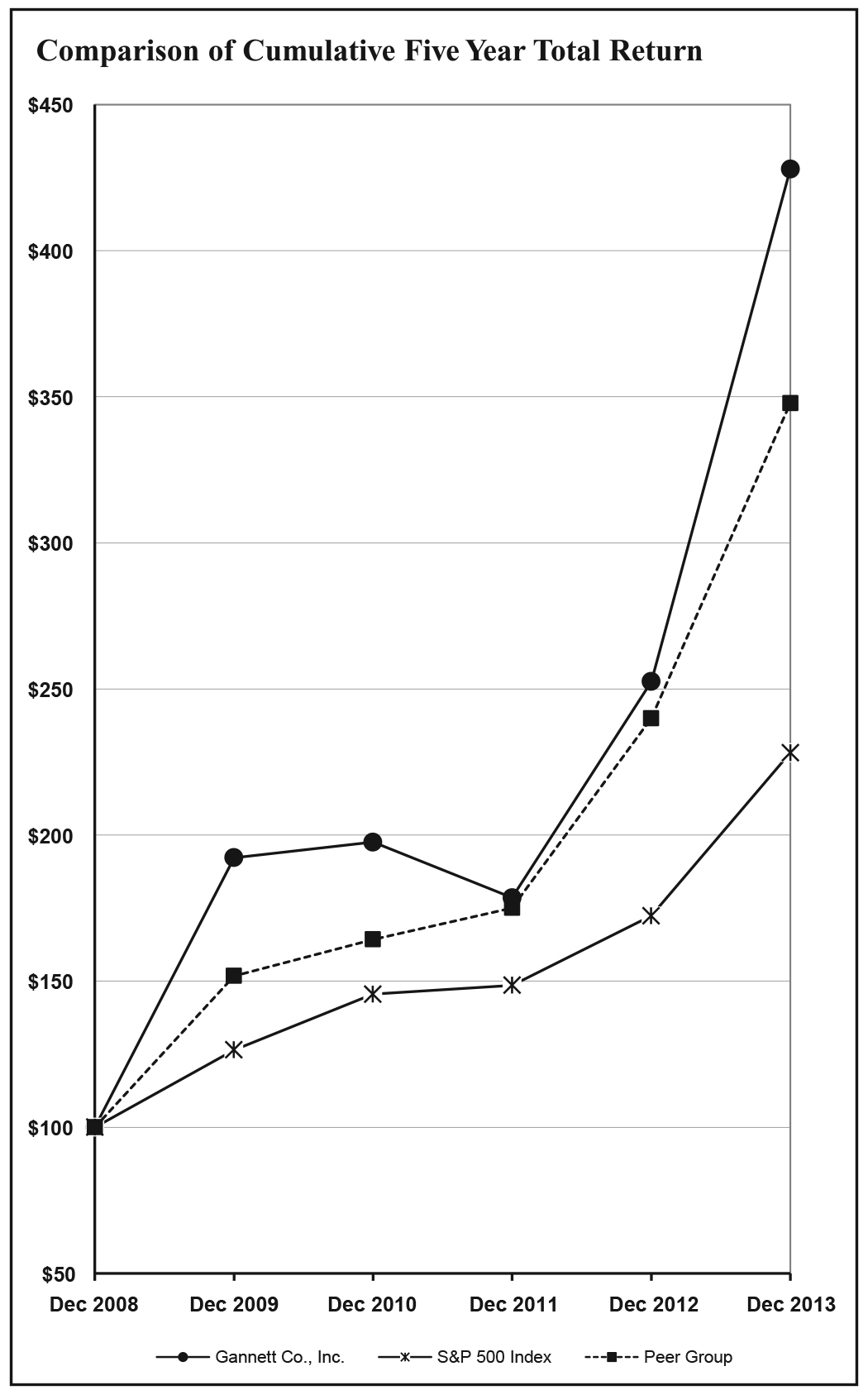

2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |||||||||||||

Gannett Co., Inc. | $ | 100 | $ | 192.25 | $ | 197.57 | $ | 178.54 | $ | 252.50 | $ | 427.96 | ||||||

S&P 500 Index | $ | 100 | $ | 126.46 | $ | 145.51 | $ | 148.59 | $ | 172.37 | $ | 228.19 | ||||||

Peer Group | $ | 100 | $ | 151.79 | $ | 164.25 | $ | 175.07 | $ | 239.98 | $ | 347.83 | ||||||

In millions of dollars | |||

Segment | Goodwill Balance | ||

Broadcasting | $ | 2,544 | |

Publishing | $ | 553 | |

Digital | $ | 576 | |

In millions of dollars, except per share amounts | |||||||||||

2013 | Change | 2012 | Change | 2011 | |||||||

Operating revenues | $ | 5,161 | (4%) | $ | 5,353 | 2% | $ | 5,240 | |||

Operating expenses | $ | 4,422 | (3%) | $ | 4,563 | 3% | $ | 4,409 | |||

Operating income | $ | 739 | (6%) | $ | 790 | (5%) | $ | 831 | |||

Non-operating expense, net | $ | 180 | 51% | $ | 119 | (33%) | $ | 178 | |||

Net income | |||||||||||

Per share – basic | $ | 1.70 | (7%) | $ | 1.83 | (5%) | $ | 1.92 | |||

Per share – diluted | $ | 1.66 | (7%) | $ | 1.79 | (5%) | $ | 1.89 | |||

In millions of dollars | |||||||||||

2013 | Change | 2012 | Change | 2011 | |||||||

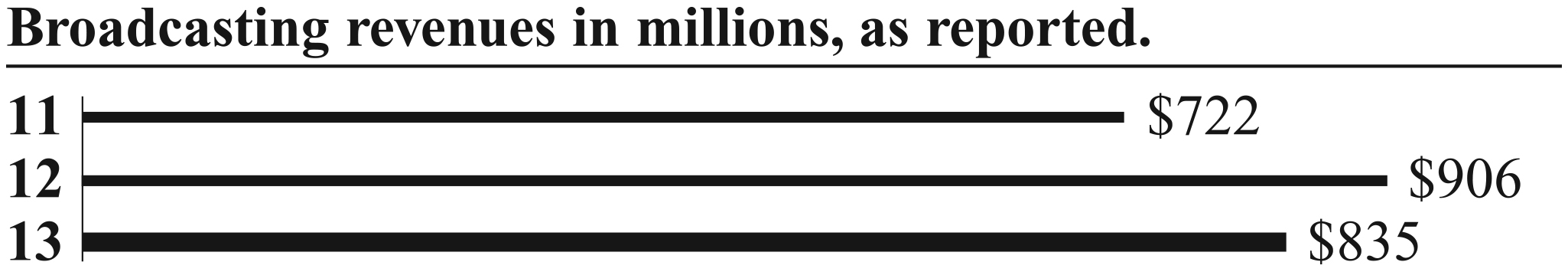

Revenues | $ | 835 | (8%) | $ | 906 | 25% | $ | 722 | |||

Expenses | 473 | 2% | 462 | 10% | 420 | ||||||

Operating income | $ | 362 | (18%) | $ | 444 | 47% | $ | 302 | |||

Publishing operating results, in millions of dollars | |||||||||||

2013 | Change | 2012(a) | Change | 2011(a) | |||||||

Revenues | $ | 3,578 | (4%) | $ | 3,728 | (3%) | $ | 3,831 | |||

Expenses | 3,264 | (3%) | 3,360 | —% | 3,354 | ||||||

Operating income | $ | 314 | (15%) | $ | 369 | (23%) | $ | 478 | |||

(a) Numbers do not sum due to rounding. | |||||||||||

Publishing operating revenues, in millions of dollars | |||||||||||

2013 | Change | 2012 | Change | 2011 | |||||||

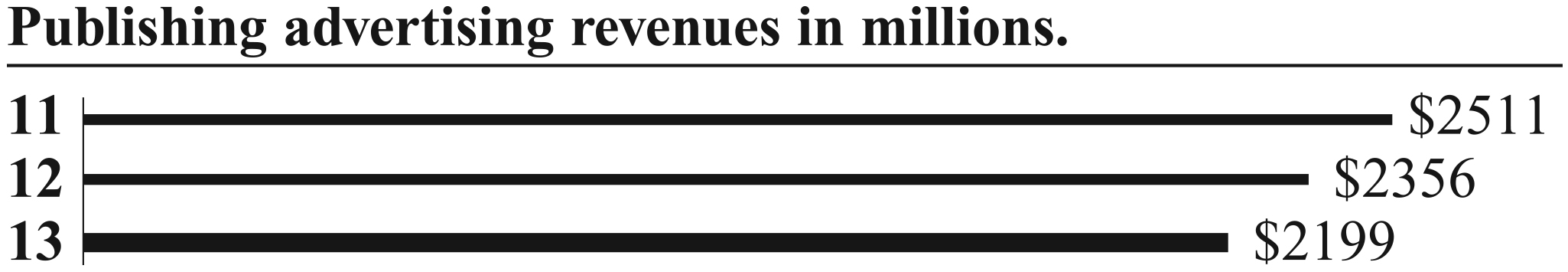

Advertising | $ | 2,199 | (7%) | $ | 2,356 | (6%) | $ | 2,511 | |||

Circulation | 1,129 | 1% | 1,117 | 5% | 1,064 | ||||||

Commercial printing and other | 250 | (2%) | 255 | —% | 256 | ||||||

Total | $ | 3,578 | (4%) | $ | 3,728 | (3%) | $ | 3,831 | |||

Advertising revenues, in millions of dollars | |||||||||||

2013 | Change | 2012 | Change | 2011 | |||||||

Retail | $ | 1,157 | (6%) | $ | 1,230 | (6%) | $ | 1,303 | |||

National | 365 | (8%) | 396 | (11%) | 446 | ||||||

Classified | 677 | (7%) | 730 | (4%) | 762 | ||||||

Total ad revenue | $ | 2,199 | (7%) | $ | 2,356 | (6%) | $ | 2,511 | |||

Advertising Revenue Comparisons by Quarter | ||||

Q1 | Q2 | Q3 | Q4 (a) | |

Retail | (3%) | (6%) | (4%) | (5%) |

National | (5%) | (1%) | (10%) | (10%) |

Classified | (6%) | (7%) | (6%) | (6%) |

Total advertising | (5%) | (5%) | (6%) | (6%) |

(a) The extra week in the fourth quarter of 2012 is excluded for comparability. | ||||

Advertising Revenue Year Over Year Comparisons | |||

U.S. Publishing | Newsquest (in pounds) | Total Publishing (constant currency) | |

Retail | (6%) | (4%) | (6%) |

National | (7%) | (16%) | (8%) |

Classified | (7%) | (8%) | (7%) |

Total | (6%) | (8%) | (7%) |

Classified Revenue Year Over Year Comparisons | |||

U.S. Publishing | Newsquest (in pounds) | Total Publishing (constant currency) | |

Automotive | (2%) | (10%) | (3%) |

Employment | (10%) | (4%) | (8%) |

Real Estate | (5%) | (9%) | (6%) |

Legal | (12%) | —% | (12%) |

Other | (8%) | (10%) | (8%) |

Total | (7%) | (8%) | (7%) |

Total average circulation volume, print and digital, replica and non-replica in thousands | ||||||||

2013 | Change | 2012 | Change | 2011 | ||||

Local Publications | ||||||||

Morning | 2,967 | (8%) | 3,240 | (8%) | 3,512 | |||

Evening | 161 | (9%) | 177 | (8%) | 193 | |||

Total daily | 3,128 | (8%) | 3,417 | (8%) | 3,705 | |||

Sunday | 4,729 | (5%) | 5,003 | (3%) | 5,150 | |||

• | Lower operating results in the U.S. and U.K. as ad revenue categories were affected by the impact of the soft economy on advertising demand, partially offset by an increase in circulation revenue at the company’s U.S. Community Publishing and U.K. operations; |

• | Strategic initiative spending in 2013 of $36 million; |

• | Special charges for facility consolidation and asset impairments as well as workforce restructuring totaled $89 million in 2013 and $74 million in 2012; |

• | Significant increase in digital revenue; |

• | Negative impact of the extra week in 2012; and |

• | A decrease in newsprint expense. |

• | Lower operating results at most U.S. and U.K. properties as ad revenue categories were affected by the impact of the soft economy on advertising demand; |

• | A decrease in newsprint expense due to a decline in usage; |

• | Higher charges in 2012 from workforce restructuring efforts and consolidations; |

• | Positive impact of a significant increase in digital revenue; and |

• | Positive impact of the extra week in 2012. |

In millions of dollars | |||||||||||

2013 | Change | 2012 | Change | 2011 | |||||||

Revenues | $ | 748 | 4% | $ | 719 | 5% | $ | 686 | |||

Expenses | 620 | (8%) | 677 | 21% | 561 | ||||||

Operating income | $ | 128 | *** | $ | 42 | (67%) | $ | 125 | |||

Consolidated operating expenses, in millions of dollars | |||||||||||

2013(a) | Change | 2012 | Change | 2011 | |||||||

Cost of sales | $ | 2,882 | (2%) | $ | 2,944 | (1%) | $ | 2,961 | |||

Selling, general and admin. expenses | 1,292 | (1%) | 1,303 | 7% | 1,223 | ||||||

Depreciation | 153 | (5%) | 161 | (3%) | 166 | ||||||

Amortization of intangible assets | 36 | 9% | 33 | 5% | 32 | ||||||

Facility consolidation and asset impairment charges | 58 | (52)% | 122 | *** | 27 | ||||||

Total | $ | 4,422 | (3%) | $ | 4,563 | 3% | $ | 4,409 | |||

(a) Numbers do not sum due to rounding. | |||||||||||

2013 | 2012 | 2011 | |

Payroll and employee benefits | 47.6% | 45.9% | 46.8% |

Newsprint and other production material | 10.1% | 11.2% | 12.1% |

In millions of dollars, except per share amounts | |||||||||||

2013 | Change | 2012 | Change | 2011 | |||||||

Net income | $ | 389 | (8%) | $ | 424 | (8%) | $ | 459 | |||

Per basic share | $ | 1.70 | (7%) | $ | 1.83 | (5%) | $ | 1.92 | |||

Per diluted share | $ | 1.66 | (7%) | $ | 1.79 | (5%) | $ | 1.89 | |||

• | Workforce restructuring charges; |

• | Transformation costs; |

• | Non-cash asset impairment charges; |

• | A non-cash charge related to a change in control and sale of interests in a business; |

• | Non-cash charges related to certain investments accounted for under the equity method; |

• | A currency-related loss recognized in other non-operating items; and |

• | Certain credits to its income tax provision. |

In millions of dollars | |||||||||||

2013 | Change | 2012(a) | Change | 2011 | |||||||

Operating expense (GAAP basis) | $ | 4,422 | (3%) | $ | 4,563 | 3% | $ | 4,409 | |||

Remove special items: | |||||||||||

Workforce restructuring | (58 | ) | 19% | (49 | ) | (34)% | (74 | ) | |||

Transformation costs | (25 | ) | (21)% | (32 | ) | 18% | (27 | ) | |||

Asset impairment charges | (33 | ) | (63)% | (90 | ) | *** | — | ||||

Former Chairman and CEO incremental retirement charges | — | *** | — | *** | (15 | ) | |||||

As adjusted (non-GAAP basis) | $ | 4,306 | (2%) | $ | 4,393 | 2% | $ | 4,293 | |||

(a) Numbers do not sum due to rounding. | |||||||||||

In millions of dollars | |||||||||||

2013 | Change | 2012(a) | Change | 2011 | |||||||

Operating income (GAAP basis) | $ | 739 | (6%) | $ | 790 | (5%) | $ | 831 | |||

Remove special items: | |||||||||||

Workforce restructuring | 58 | 19% | 49 | (34)% | 74 | ||||||

Transformation costs | 25 | (21)% | 32 | 18% | 27 | ||||||

Asset impairment charges | 33 | (63)% | 90 | *** | — | ||||||

Former Chairman and CEO incremental retirement charges | — | *** | — | *** | 15 | ||||||

As adjusted (non-GAAP basis) | $ | 855 | (11%) | $ | 960 | 1% | $ | 947 | |||

(a) Numbers do not sum due to rounding. | |||||||||||

In millions of dollars | |||||||||||

2013(a) | Change | 2012 | Change | 2011 | |||||||

Total non-operating (expense) income (GAAP basis) | $ | (180 | ) | 51% | $ | (119 | ) | (33%) | $ | (178 | ) |

Remove special items: | |||||||||||

Transformation costs | 36 | *** | — | *** | — | ||||||

Asset impairment and investment charges | 1 | (90%) | 7 | (77%) | 30 | ||||||

Other non-operating items | 19 | *** | — | *** | — | ||||||

As adjusted (non-GAAP basis) | $ | (125 | ) | 11% | $ | (112 | ) | (24%) | $ | (148 | ) |

(a) Numbers do not sum due to rounding. | |||||||||||

In millions of dollars | |||||||||

2013 | 2012 | 2011 | |||||||

Provision for income taxes as reported (GAAP basis) | $ | 113 | $ | 195 | $ | 153 | |||

Remove special items: | |||||||||

Workforce restructuring | 21 | 19 | 28 | ||||||

Transformation costs | 16 | 13 | 10 | ||||||

Asset impairment and investment charges | 14 | 6 | 12 | ||||||

Former Chairman and CEO incremental retirement charges | — | — | 6 | ||||||

Other non-operating items | 8 | — | — | ||||||

Special tax benefits | 28 | 13 | 31 | ||||||

As adjusted (non-GAAP basis) | $ | 200 | $ | 246 | $ | 240 | |||

As adjusted effective tax rate (non-GAAP basis) | 29.7 | % | 30.9 | % | 31.6 | % | |||

In millions of dollars, except per share amounts | |||||||||||

2013 | Change | 2012(a) | Change | 2011(a) | |||||||

Net income attributable to Gannett Co., Inc. (GAAP basis) | $ | 389 | (8%) | $ | 424 | (8%) | $ | 459 | |||

Remove special items (net of tax): | |||||||||||

Workforce restructuring | 37 | 26% | 29 | (35)% | 46 | ||||||

Transformation costs | 45 | *** | 20 | 12% | 18 | ||||||

Asset impairment and investment charges | 20 | (78)% | 91 | *** | 18 | ||||||

Former Chairman and CEO incremental retirement charges | — | *** | — | *** | 9 | ||||||

Other non-operating items | 10 | *** | — | *** | — | ||||||

Special tax benefits | (28 | ) | *** | (13 | ) | (57)% | (31 | ) | |||

As adjusted (non-GAAP basis) | $ | 473 | (14%) | $ | 551 | 6% | $ | 518 | |||

Diluted earnings per share (GAAP basis) | $ | 1.66 | (7%) | $ | 1.79 | (5%) | $ | 1.89 | |||

Remove special items (net of tax): | |||||||||||

Workforce restructuring | 0.16 | 33% | 0.12 | (37)% | 0.19 | ||||||

Transformation costs | 0.19 | *** | 0.08 | 14% | 0.07 | ||||||

Asset impairment and investment charges | 0.09 | (76)% | 0.38 | *** | 0.08 | ||||||

Former Chairman and CEO incremental retirement charges | — | *** | — | *** | 0.04 | ||||||

Other non-operating items | 0.04 | *** | — | *** | — | ||||||

Special tax benefits | (0.12 | ) | *** | (0.06 | ) | (54)% | (0.13 | ) | |||

As adjusted (non-GAAP basis) | $ | 2.02 | (13%) | $ | 2.33 | 9% | $ | 2.13 | |||

(a) Numbers do not sum due to rounding. | |||||||||||

In millions of dollars | |||||||||||

2013 | Change | 2012 | Change | 2011(a) | |||||||

Broadcasting Segment operating expenses (GAAP basis) | $ | 473 | 2% | $ | 462 | 10% | $ | 420 | |||

Remove special items: | |||||||||||

Workforce restructuring | (14 | ) | *** | — | *** | (1 | ) | ||||

Transformation costs | (1 | ) | *** | — | *** | — | |||||

As adjusted (non-GAAP basis) | $ | 458 | (1%) | $ | 462 | 10% | $ | 420 | |||

Broadcasting Segment operating income (GAAP basis) | $ | 362 | (18%) | $ | 444 | 47% | $ | 302 | |||

Remove special items: | |||||||||||

Workforce restructuring | 14 | *** | — | *** | 1 | ||||||

Transformation costs | 1 | — | — | *** | — | ||||||

As adjusted (non-GAAP basis) | $ | 377 | (15%) | $ | 444 | 47% | $ | 303 | |||

(a) Numbers do not sum due to rounding. | |||||||||||

In millions of dollars | |||||||||||

2013(a) | Change | 2012(a) | Change | 2011(a) | |||||||

Publishing Segment operating expenses (GAAP basis) | $ | 3,264 | (3%) | $ | 3,360 | — | $ | 3,354 | |||

Remove special items: | |||||||||||

Workforce restructuring | (43 | ) | 2% | (42 | ) | (42)% | (73 | ) | |||

Transformation costs | (24 | ) | (25%) | (32 | ) | 18% | (27 | ) | |||

Asset impairment charges | (21 | ) | *** | — | *** | — | |||||

As adjusted (non-GAAP basis) | $ | 3,175 | (3%) | $ | 3,285 | 1% | $ | 3,253 | |||

Publishing Segment operating income (GAAP basis) | $ | 314 | (15%) | $ | 369 | (23%) | $ | 478 | |||

Remove special items: | |||||||||||

Workforce restructuring | 43 | 2% | 42 | (42)% | 73 | ||||||

Transformation costs | 24 | (25%) | 32 | 18% | 27 | ||||||

Asset impairment charges | 21 | *** | — | *** | — | ||||||

As adjusted (non-GAAP basis) | $ | 402 | (9%) | $ | 443 | (23%) | $ | 578 | |||

(a) Numbers do not sum due to rounding. | |||||||||||

In millions of dollars | |||||||||||

2013(a) | Change | 2012 | Change | 2011 | |||||||

Digital Segment operating expenses (GAAP basis) | $ | 620 | (8%) | $ | 677 | 21% | $ | 561 | |||

Remove special items: | |||||||||||

Workforce restructuring | — | *** | — | *** | — | ||||||

Asset impairment charges | (12 | ) | (87%) | (90 | ) | *** | — | ||||

As adjusted (non-GAAP basis) | $ | 609 | 4% | $ | 587 | 5% | $ | 561 | |||

Digital Segment operating income (GAAP basis) | $ | 128 | *** | $ | 42 | (67%) | $ | 125 | |||

Remove special items: | |||||||||||

Workforce restructuring | — | *** | — | *** | — | ||||||

Asset impairment charges | 12 | (87%) | 90 | *** | — | ||||||

As adjusted (non-GAAP basis) | $ | 140 | 6% | $ | 132 | 5% | $ | 125 | |||

(a) Numbers do not sum due to rounding. | |||||||||||

In millions of dollars | |||||||||||

2013(a) | Change | 2012 | Change | 2011(a) | |||||||

Corporate Segment operating expenses (GAAP basis) | $ | 65 | — | $ | 64 | 13% | $ | 74 | |||

Remove special items: | |||||||||||

Workforce restructuring | — | *** | (6 | ) | *** | — | |||||

Former Chairman and CEO incremental retirement charges | — | *** | — | *** | (15 | ) | |||||

As adjusted (non-GAAP basis) | $ | 64 | 11% | $ | 58 | (2%) | $ | 60 | |||

(a) Numbers do not sum due to rounding. | |||||||||||

Working capital measurements | |||

2013 | 2012 | 2011 | |

Current ratio | 1.9-to-1 | 1.1-to-1 | 1.2-to-1 |

Accounts receivable turnover | 6.8 | 7.8 | 7.4 |

Newsprint inventory turnover | 5.5 | 6.1 | 5.7 |

In thousands of dollars | ||||||

Dec. 29, 2013 | Dec. 30, 2012 | |||||

Unsecured floating rate term loan due quarterly through August 2018 | $ | 154,800 | $ | — | ||

VIE unsecured floating rate term loans due quarterly through December 2018 | 39,270 | — | ||||

Unsecured notes bearing fixed rate interest at 8.75% due November 2014 | 250,000 | 250,000 | ||||

Unsecured notes bearing fixed rate interest at 10% due June 2015 | 66,568 | 66,568 | ||||

Unsecured notes bearing fixed rate interest at 6.375% due September 2015 | 250,000 | 250,000 | ||||

Unsecured notes bearing fixed rate interest at 10% due April 2016 | 193,429 | 193,429 | ||||

Unsecured notes bearing fixed rate interest at 9.375% due November 2017 (a) | 250,000 | 250,000 | ||||

Borrowings under revolving credit agreement expiring August 2018 | — | 205,000 | ||||

Unsecured notes bearing fixed rate interest at 7.125% due September 2018 | 250,000 | 250,000 | ||||

Unsecured notes bearing fixed rate interest at 5.125% due October 2019 | 600,000 | — | ||||

Unsecured notes bearing fixed rate interest at 5.125% due July 2020 | 600,000 | — | ||||

Unsecured notes bearing fixed rate interest at 6.375% due October 2023 | 650,000 | — | ||||

Unsecured notes bearing fixed rate interest at 7.75% due June 2027 | 200,000 | — | ||||

Unsecured notes bearing fixed rate interest at 7.25% due September 2027 | 240,000 | — | ||||

Total principal long-term debt | 3,744,067 | 1,464,997 | ||||

Other (fair market value adjustments and discounts) | (31,167 | ) | (32,897 | ) | ||

Total long-term debt | 3,712,900 | 1,432,100 | ||||

Less current portion of long-term debt maturities of VIE loans | 5,890 | — | ||||

Long-term debt, net of current portion | $ | 3,707,010 | $ | 1,432,100 | ||

(a) On Feb. 5, 2014 the company sent notice of its intent to redeem the 9.375% notes on March 14, 2014. The notes will be redeemed for 104.688% of the outstanding principal amount, pursuant to the original terms. | ||||||

In thousands of dollars | |||

2014 (1) | $ | 5,890 | |

2015 | 356,022 | ||

2016 | 232,883 | ||

2017 | 289,454 | ||

2018 | 569,818 | ||

Thereafter | 2,290,000 | ||

Total | $ | 3,744,067 | |

Contractual obligations | Payments due by period | ||||||||||||||

In millions of dollars | Total | 2014 | 2015-16 | 2017-18 | Thereafter | ||||||||||

Long-term debt (1) | $ | 5,266 | $ | 227 | $ | 989 | $ | 1,208 | $ | 2,842 | |||||

Operating leases (2) | 281 | 53 | 85 | 59 | 84 | ||||||||||

Purchase obligations (3) | 193 | 115 | 66 | 10 | 2 | ||||||||||

Programming contracts (4) | 229 | 79 | 128 | 21 | 1 | ||||||||||

Other noncurrent liabilities (5) | 399 | 135 | 64 | 61 | 139 | ||||||||||

Total | $ | 6,368 | $ | 609 | $ | 1,332 | $ | 1,359 | $ | 3,068 | |||||

(1) | See Note 7 to the Consolidated Financial Statements. The amounts included above include periodic interest payments. Interest payments are based on interest rates in effect at year-end. |

(2) | See Note 12 to the Consolidated Financial Statements. |

(3) | Includes purchase obligations related to printing contracts, capital projects, interactive marketing agreements, wire services and other legally binding commitments. Amounts which the company is liable for under purchase orders outstanding at Dec. 29, 2013, are reflected in the consolidated balance sheets as accounts payable and accrued liabilities and are excluded from the table above. |

(4) | Programming contracts include television station commitments to purchase programming to be produced in future years. In addition, this also includes amounts fixed or currently accrued under network affiliation agreements. |

(5) | Other long-term liabilities consist of both unfunded and under-funded postretirement benefit plans. Unfunded plans include the Gannett Supplemental Executive Retirement Plan and the Gannett Retiree Welfare Plan. Employer contributions, which equal the expected benefit payments, are reflected in the table above over the next ten year period. The company’s under-funded plans include the Gannett Retirement Plan, the G.B. Dealey Retirement Plan and the Newsquest Pension Scheme. Expected employer contributions for these plans are included for the following fiscal year. Contributions beyond the next fiscal year are not included due to uncertainties regarding significant assumptions involved in estimating these contributions, such as interest rate levels as well as the amount and timing of invested asset returns. |

Stock repurchases | Repurchases made in fiscal year | ||||||||

In millions | 2013 | 2012 | 2011 | ||||||

Number of shares purchased | 4.9 | 10.3 | 4.9 | ||||||

Dollar amount purchased | $ | 117 | $ | 154 | $ | 53 | |||

Cash dividends | Payment date | Per share | |||

2013 | 4th Quarter | Jan. 2, 2014 | $ | 0.20 | |

3rd Quarter | Oct. 1, 2013 | $ | 0.20 | ||

2nd Quarter | Jul. 1, 2013 | $ | 0.20 | ||

1st Quarter | Apr. 1, 2013 | $ | 0.20 | ||

2012 | 4th Quarter | Jan. 2, 2013 | $ | 0.20 | |

3rd Quarter | Oct. 1, 2012 | $ | 0.20 | ||

2nd Quarter | Jul. 2, 2012 | $ | 0.20 | ||

1st Quarter | Apr. 2, 2012 | $ | 0.20 | ||

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

Page | |

FINANCIAL STATEMENTS | |

OTHER INFORMATION | |

SUPPLEMENTARY DATA | |

FINANCIAL STATEMENT SCHEDULE | |

* | All other schedules prescribed under Regulation S-X are omitted because they are not applicable or not required. |

GANNETT CO., INC. CONSOLIDATED BALANCE SHEETS | ||||||

In thousands of dollars | ||||||

Assets | Dec. 29, 2013 | Dec. 30, 2012 | ||||

Current assets | ||||||

Cash and cash equivalents | $ | 469,203 | $ | 175,030 | ||

Trade receivables, less allowance for doubtful receivables of $15,275 and $22,006, respectively | 834,052 | 678,845 | ||||

Other receivables | 28,592 | 20,162 | ||||

Inventories | 49,950 | 56,389 | ||||

Deferred income taxes | 21,245 | 15,840 | ||||

Assets held for sale | 395,851 | 17,508 | ||||

Prepaid expenses and other current assets | 124,592 | 108,946 | ||||

Total current assets | 1,923,485 | 1,072,720 | ||||

Property, plant and equipment | ||||||

Land | 237,554 | 148,518 | ||||

Buildings and improvements | 1,239,719 | 1,265,290 | ||||

Machinery, equipment and fixtures | 2,506,121 | 2,548,957 | ||||

Construction in progress | 24,485 | 10,184 | ||||

Total | 4,007,879 | 3,972,949 | ||||

Less accumulated depreciation | (2,338,247 | ) | (2,454,271 | ) | ||

Net property, plant and equipment | 1,669,632 | 1,518,678 | ||||

Intangible and other assets | ||||||

Goodwill | 3,790,472 | 2,846,869 | ||||

Indefinite-lived and amortizable intangible assets, less accumulated amortization of $201,178 and $221,231, respectively | 1,477,231 | 499,913 | ||||

Deferred income taxes | — | 158,275 | ||||

Investments and other assets | 379,886 | 283,431 | ||||

Total intangible and other assets | 5,647,589 | 3,788,488 | ||||

Total assets(a) | $ | 9,240,706 | $ | 6,379,886 | ||

GANNETT CO., INC. CONSOLIDATED BALANCE SHEETS | ||||||

In thousands of dollars | ||||||

Liabilities and equity | Dec. 29, 2013 | Dec. 30, 2012 | ||||

Current liabilities | ||||||

Accounts payable | ||||||

Trade | $ | 176,055 | $ | 187,705 | ||

Other | 39,245 | 24,128 | ||||

Accrued liabilities | ||||||

Compensation | 214,434 | 171,319 | ||||

Interest | 58,575 | 22,210 | ||||

Other | 226,153 | 208,811 | ||||

Dividends payable | 45,645 | 45,963 | ||||

Income taxes | 17,791 | 44,985 | ||||

Deferred income | 223,404 | 229,395 | ||||

Current portion of long-term debt | 5,890 | — | ||||

Total current liabilities | 1,007,192 | 934,516 | ||||

Income taxes | 49,748 | 83,260 | ||||

Deferred income taxes | 587,904 | — | ||||

Long-term debt | 3,707,010 | 1,432,100 | ||||

Postretirement medical and life insurance liabilities | 129,078 | 149,937 | ||||

Pension liabilities | 632,195 | 1,007,325 | ||||

Other noncurrent liabilities | 218,168 | 222,182 | ||||

Total noncurrent liabilities | 5,324,103 | 2,894,804 | ||||

Total liabilities(a) | 6,331,295 | 3,829,320 | ||||

Redeemable noncontrolling interest | 14,618 | 10,654 | ||||

Commitments and contingent liabilities (see Note 12) | ||||||

Equity | ||||||

Gannett Co., Inc. shareholders’ equity | ||||||

Preferred stock, par value $1: Authorized, 2,000,000 shares: Issued, none | — | — | ||||

Common stock, par value $1: Authorized, 800,000,000 shares: Issued, 324,418,632 shares | 324,419 | 324,419 | ||||

Additional paid-in capital | 552,368 | 567,515 | ||||

Retained earnings | 7,720,903 | 7,514,858 | ||||

Accumulated other comprehensive loss | (494,055 | ) | (701,141 | ) | ||

8,103,635 | 7,705,651 | |||||

Less Treasury stock, 96,849,744 shares and 94,376,534 shares, respectively, at cost | (5,410,537 | ) | (5,355,037 | ) | ||

Total Gannett Co., Inc. shareholders’ equity | 2,693,098 | 2,350,614 | ||||

Noncontrolling interests | 201,695 | 189,298 | ||||

Total equity | 2,894,793 | 2,539,912 | ||||

Total liabilities, redeemable noncontrolling interest and equity | $ | 9,240,706 | $ | 6,379,886 | ||

GANNETT CO., INC. CONSOLIDATED STATEMENTS OF INCOME | ||||||||||

In thousands of dollars, except per share amounts | ||||||||||

Fiscal year ended | Dec. 29, 2013 | Dec. 30, 2012 | Dec. 25, 2011 | |||||||

Net operating revenues | ||||||||||

Broadcasting | $ | 835,113 | $ | 906,104 | $ | 722,410 | ||||

Publishing advertising | 2,198,719 | 2,355,922 | 2,511,025 | |||||||

Publishing circulation | 1,129,060 | 1,117,042 | 1,063,890 | |||||||

All other Publishing | 250,025 | 255,180 | 256,193 | |||||||

Digital | 748,445 | 718,949 | 686,471 | |||||||

Total | 5,161,362 | 5,353,197 | 5,239,989 | |||||||

Operating expenses | ||||||||||

Cost of sales and operating expenses, exclusive of depreciation | 2,882,449 | 2,943,847 | 2,961,097 | |||||||

Selling, general and administrative expenses, exclusive of depreciation | 1,291,858 | 1,303,427 | 1,223,485 | |||||||

Depreciation | 153,203 | 160,746 | 165,739 | |||||||

Amortization of intangible assets | 36,369 | 33,293 | 31,634 | |||||||

Facility consolidation and asset impairment charges (see Notes 3 and 4) | 58,240 | 122,129 | 27,243 | |||||||

Total | 4,422,119 | 4,563,442 | 4,409,198 | |||||||

Operating income | 739,243 | 789,755 | 830,791 | |||||||

Non-operating (expense) income | ||||||||||

Equity income in unconsolidated investees, net (see Notes 3 and 6) | 43,824 | 22,387 | 8,197 | |||||||

Interest expense | (176,064 | ) | (150,469 | ) | (173,140 | ) | ||||

Other non-operating items | (47,890 | ) | 8,734 | (12,921 | ) | |||||

Total | (180,130 | ) | (119,348 | ) | (177,864 | ) | ||||

Income before income taxes | 559,113 | 670,407 | 652,927 | |||||||

Provision for income taxes | 113,200 | 195,400 | 152,800 | |||||||

Net income | 445,913 | 475,007 | 500,127 | |||||||

Net income attributable to noncontrolling interests | (57,233 | ) | (50,727 | ) | (41,379 | ) | ||||

Net income attributable to Gannett Co., Inc. | $ | 388,680 | $ | 424,280 | $ | 458,748 | ||||

Net income per share—basic | $ | 1.70 | $ | 1.83 | $ | 1.92 | ||||

Net income per share—diluted | $ | 1.66 | $ | 1.79 | $ | 1.89 | ||||

GANNETT CO., INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | ||||||||||

In thousands of dollars | ||||||||||

Fiscal year ended | Dec. 29, 2013 | Dec. 30, 2012 | Dec. 25, 2011 | |||||||

Net income | $ | 445,913 | $ | 475,007 | $ | 500,127 | ||||

Redeemable noncontrolling interest (income not available to shareholders) | (1,997 | ) | (254 | ) | (973 | ) | ||||

Other comprehensive income (loss), before tax: | ||||||||||

Foreign currency translation adjustments | 9,055 | 18,107 | 5,342 | |||||||

Pension and other postretirement benefit items: | ||||||||||

Actuarial gain (loss): | ||||||||||

Actuarial gain (loss) arising during the period | 286,778 | (230,799 | ) | (403,495 | ) | |||||

Amortization of actuarial loss | 64,381 | 55,372 | 43,345 | |||||||

Prior service cost: | ||||||||||

Change in prior service (costs) credit | 319 | — | (1,297 | ) | ||||||

Amortization of prior service credit | (1,599 | ) | (11,501 | ) | (11,930 | ) | ||||

Settlement charge | 3,077 | 7,946 | — | |||||||

Other | (10,158 | ) | (11,375 | ) | (295 | ) | ||||

Pension and other postretirement benefit items | 342,798 | (190,357 | ) | (373,672 | ) | |||||

Other | 2,363 | 1,791 | (5,469 | ) | ||||||

Other comprehensive income (loss) before tax | 354,216 | (170,459 | ) | (373,799 | ) | |||||

Income tax effect related to components of other comprehensive income (loss) | (145,478 | ) | 66,948 | 140,182 | ||||||

Other comprehensive income (loss), net of tax | 208,738 | (103,511 | ) | (233,617 | ) | |||||

Comprehensive income | 652,654 | 371,242 | 265,537 | |||||||

Comprehensive income attributable to noncontrolling interests, net of tax | 56,888 | 52,264 | 37,294 | |||||||

Comprehensive income attributable to Gannett Co., Inc. | $ | 595,766 | $ | 318,978 | $ | 228,243 | ||||

GANNETT CO., INC. CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||||

In thousands of dollars | ||||||||||

Fiscal year ended | Dec. 29, 2013 | Dec. 30, 2012 | Dec. 25, 2011 | |||||||

Cash flows from operating activities | ||||||||||

Net income | $ | 445,913 | $ | 475,007 | $ | 500,127 | ||||

Adjustments to reconcile net income to operating cash flows: | ||||||||||

Depreciation | 153,203 | 160,746 | 165,739 | |||||||

Amortization of intangible assets | 36,369 | 33,293 | 31,634 | |||||||

Facility consolidation and asset impairment charges (see Notes 3 and 4) | 61,014 | 122,129 | 41,772 | |||||||

Stock-based compensation — equity awards | 33,437 | 26,608 | 28,003 | |||||||

Provision for deferred income taxes | 53,900 | 122,700 | 97,500 | |||||||

Pension expense, net of pension contributions | (82,878 | ) | (95,377 | ) | (42,330 | ) | ||||

Equity income in unconsolidated investees, net (see Notes 3 and 6) | (43,824 | ) | (22,387 | ) | (8,197 | ) | ||||

Other, net, including gains on asset sales | (4,673 | ) | (36,056 | ) | (1,639 | ) | ||||

Decrease (increase) in trade receivables | (17,884 | ) | 35,799 | 33,464 | ||||||

Decrease in other receivables | 9,329 | 6,200 | 12,273 | |||||||

Decrease (increase) in inventories | 4,489 | (7,167 | ) | 22,932 | ||||||

Decrease in accounts payable | (29,310 | ) | (3,284 | ) | (12,614 | ) | ||||

Increase (decrease) in interest and taxes payable | (53,101 | ) | 853 | (57,173 | ) | |||||

Increase (decrease) in deferred income | (12,233 | ) | (5,294 | ) | 4,595 | |||||

Change in other assets and liabilities, net | (42,263 | ) | (57,030 | ) | (1,950 | ) | ||||

Net cash flow from operating activities | 511,488 | 756,740 | 814,136 | |||||||

Cash flows from investing activities | ||||||||||

Purchase of property, plant and equipment | (110,407 | ) | (91,874 | ) | (72,451 | ) | ||||

Payments for acquisitions, net of cash acquired | (1,451,006 | ) | (67,244 | ) | (23,020 | ) | ||||

Payments for investments | (3,380 | ) | (2,501 | ) | (19,406 | ) | ||||

Proceeds from investments | 63,408 | 35,629 | 52,982 | |||||||

Proceeds from sale of certain assets | 113,895 | 39,009 | 36,976 | |||||||

Net cash used for investing activities | (1,387,490 | ) | (86,981 | ) | (24,919 | ) | ||||

Cash flows from financing activities | ||||||||||

Proceeds from (payments of) borrowings under revolving credit facilities | (205,000 | ) | (30,000 | ) | 14,000 | |||||

Proceeds from issuance of long-term debt | 1,827,799 | — | — | |||||||

Proceeds from (payments of) unsecured floating rate term loans | 194,070 | — | (180,000 | ) | ||||||

Payments of unsecured fixed rate notes | (287,719 | ) | (306,571 | ) | (433,432 | ) | ||||

Payments of debt issuance and financing costs | (41,960 | ) | — | — | ||||||

Dividends paid | (183,233 | ) | (158,822 | ) | (47,946 | ) | ||||

Cost of common shares repurchased | (116,639 | ) | (153,948 | ) | (53,037 | ) | ||||

Proceeds from issuance of common stock upon exercise of stock options | 31,435 | 33,748 | 3,609 | |||||||

Repurchase of and distributions to noncontrolling membership interests | (42,608 | ) | (47,100 | ) | (108,691 | ) | ||||

Deferred payments for acquisitions | (6,132 | ) | (1,027 | ) | — | |||||

Net cash provided by (used for) financing activities | 1,170,013 | (663,720 | ) | (805,497 | ) | |||||

Effect of currency exchange rate change | 162 | 2,065 | 192 | |||||||

Increase (decrease) in cash and cash equivalents | 294,173 | 8,104 | (16,088 | ) | ||||||

Balance of cash and cash equivalents at beginning of year | 175,030 | 166,926 | 183,014 | |||||||

Balance of cash and cash equivalents at end of year | $ | 469,203 | $ | 175,030 | $ | 166,926 | ||||

GANNETT CO., INC. CONSOLIDATED STATEMENTS OF EQUITY | ||||||||||||||||||||||

In thousands of dollars | Gannett Co., Inc. Shareholders’ Equity | |||||||||||||||||||||

Fiscal years ended Dec. 25, 2011, Dec. 30, 2012, and Dec. 29, 2013 | Common stock $1 par value | Additional paid-in capital | Retained earnings | Accumulated other comprehensive income (loss) | Treasury stock | Noncontrolling Interests | Total | |||||||||||||||

Balance: Dec. 26, 2010 | $ | 324,419 | $ | 630,316 | $ | 6,874,641 | $ | (365,334 | ) | $ | (5,300,288 | ) | $ | 170,319 | $ | 2,334,073 | ||||||

Net income, 2011 | 458,748 | 41,379 | 500,127 | |||||||||||||||||||

Redeemable noncontrolling interest | (973 | ) | (973 | ) | ||||||||||||||||||

Other comprehensive loss, net of tax | (230,505 | ) | (3,112 | ) | (233,617 | ) | ||||||||||||||||

Balance: Total comprehensive income | 265,537 | |||||||||||||||||||||

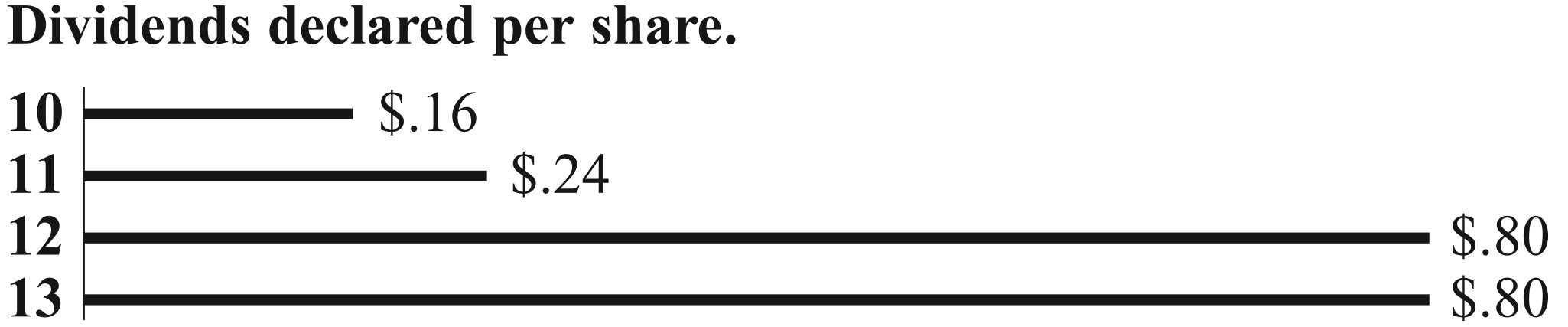

Dividends declared, 2011: $0.24 per share | (57,189 | ) | (57,189 | ) | ||||||||||||||||||

Distributions to noncontrolling membership shareholders | (23,542 | ) | (23,542 | ) | ||||||||||||||||||

Treasury stock acquired | (53,037 | ) | (53,037 | ) | ||||||||||||||||||

Stock options exercised | (7,294 | ) | 9,646 | 2,352 | ||||||||||||||||||

Stock-based compensation | 28,003 | 28,003 | ||||||||||||||||||||

401(k) match | (24,714 | ) | 41,341 | 16,627 | ||||||||||||||||||

Tax benefit derived from stock awards settled | 1,257 | 1,257 | ||||||||||||||||||||

Other activity | (9,841 | ) | 7,722 | 63 | (2,056 | ) | ||||||||||||||||

Balance: Dec. 25, 2011 | $ | 324,419 | $ | 617,727 | $ | 7,276,200 | $ | (595,839 | ) | $ | (5,294,616 | ) | $ | 184,134 | $ | 2,512,025 | ||||||

Net income, 2012 | 424,280 | 50,727 | 475,007 | |||||||||||||||||||

Redeemable noncontrolling interest | (254 | ) | (254 | ) | ||||||||||||||||||

Other comprehensive income (loss), net of tax | (105,302 | ) | 1,791 | (103,511 | ) | |||||||||||||||||

Total comprehensive income | 371,242 | |||||||||||||||||||||

Dividends declared, 2012: $0.80 per share | (185,622 | ) | (185,622 | ) | ||||||||||||||||||

Distributions to noncontrolling membership shareholders | (47,100 | ) | (47,100 | ) | ||||||||||||||||||

Treasury stock acquired | (153,948 | ) | (153,948 | ) | ||||||||||||||||||

Stock options exercised | (42,282 | ) | 66,787 | 24,505 | ||||||||||||||||||

Restricted stock awards settled | (32,860 | ) | 25,890 | (6,970 | ) | |||||||||||||||||

Stock-based compensation | 26,608 | 26,608 | ||||||||||||||||||||

Tax benefit derived from stock awards settled | 9,243 | 9,243 | ||||||||||||||||||||

Other activity | (10,921 | ) | 850 | (10,071 | ) | |||||||||||||||||

Balance: Dec. 30, 2012 | $ | 324,419 | $ | 567,515 | $ | 7,514,858 | $ | (701,141 | ) | $ | (5,355,037 | ) | $ | 189,298 | $ | 2,539,912 | ||||||

Net income, 2013 | 388,680 | 57,233 | 445,913 | |||||||||||||||||||

Redeemable noncontrolling interest | (1,997 | ) | (1,997 | ) | ||||||||||||||||||

Other comprehensive income, net of tax | 207,086 | 1,652 | 208,738 | |||||||||||||||||||

Total comprehensive income | 652,654 | |||||||||||||||||||||

Dividends declared, 2013: $0.80 per share | (182,635 | ) | (182,635 | ) | ||||||||||||||||||

Distributions to noncontrolling membership shareholders | (42,390 | ) | (42,390 | ) | ||||||||||||||||||

Treasury stock acquired | (116,639 | ) | (116,639 | ) | ||||||||||||||||||

Stock options exercised | (18,518 | ) | 40,189 | 21,671 | ||||||||||||||||||

Restricted stock awards settled | (31,707 | ) | 21,227 | (10,480 | ) | |||||||||||||||||

Stock-based compensation | 33,437 | 33,437 | ||||||||||||||||||||

Tax benefit derived from stock awards settled | 9,764 | 9,764 | ||||||||||||||||||||

Other activity | (8,123 | ) | (277 | ) | (2,101 | ) | (10,501 | ) | ||||||||||||||

Balance: Dec. 29, 2013 | $ | 324,419 | $ | 552,368 | $ | 7,720,903 | $ | (494,055 | ) | $ | (5,410,537 | ) | $ | 201,695 | $ | 2,894,793 | ||||||

In thousands of dollars | |||

Dec. 29, 2013 | |||

Current assets | $ | 4,677 | |

Plant, property and equipment, net | 8,061 | ||

Intangible and other assets | 32,008 | ||

Total assets | 44,746 | ||

Current liabilities | 7,827 | ||

Noncurrent liabilities | 34,173 | ||

Total liabilities | $ | 42,000 | |

In thousands of dollars | |||

Cash and cash equivalents | $ | 38,107 | |

Receivables and other current assets | 161,498 | ||

Assets held for sale | 429,186 | ||

Plant, property and equipment, net | 254,489 | ||

Indefinite-lived FCC licenses | 835,900 | ||

Definite-lived intangible assets: | |||

Retransmission agreements | 99,161 | ||

Network affiliation agreements | 37,030 | ||

Other | 48,782 | ||

Investments and other noncurrent assets | 53,478 | ||

Goodwill | 943,841 | ||

Total assets acquired | 2,901,472 | ||

Current liabilities | 86,128 | ||

Deferred income taxes | 525,550 | ||

Other noncurrent liabilities | 76,500 | ||

Long-term debt | 741,708 | ||

Total liabilities assumed | 1,429,886 | ||

Net assets acquired | $ | 1,471,586 | |

Unaudited | ||||||

In thousands of dollars | 2013 | 2012 | ||||

Total revenues | $ | 5,738,051 | $ | 5,948,945 | ||

Net income attributable to Gannett Co., Inc. | $ | 415,774 | $ | 427,917 | ||

In thousands, except per share amounts | |||||||||

2013 | Pre-Tax Amount (a) | After-Tax Amount(a) | Per Share Amount(a) | ||||||

Facility consolidation and asset impairment charges: | |||||||||

Goodwill: | |||||||||

Publishing | $ | 8,430 | $ | 4,930 | $ | 0.02 | |||

Digital | 11,614 | 6,914 | 0.03 | ||||||

Total goodwill | 20,044 | 11,844 | 0.05 | ||||||

Other intangible assets - Publishing | 12,952 | 7,852 | 0.03 | ||||||

Property, plant and equipment - Publishing | 14,756 | 8,856 | 0.04 | ||||||

Other: | |||||||||

Broadcasting | 1,033 | 533 | — | ||||||

Publishing | 9,454 | 5,754 | 0.02 | ||||||

Total other | 10,487 | 6,287 | 0.03 | ||||||

Total facility consolidation and asset impairment charges against operations | 58,240 | 34,840 | 0.15 | ||||||

Non-operating charges: | |||||||||

Equity method investments | 731 | 431 | — | ||||||

Other - Publishing | 2,774 | 1,774 | 0.01 | ||||||

Total charges | $ | 61,745 | $ | 37,045 | $ | 0.16 | |||

In thousands, except per share amounts | |||||||||

2012 | Pre-Tax Amount | After-Tax Amount | Per Share Amount(a) | ||||||

Facility consolidation and asset impairment charges: | |||||||||

Goodwill - Digital | $ | 90,053 | $ | 86,553 | $ | 0.37 | |||

Property, plant and equipment - Publishing | 29,520 | 17,920 | 0.08 | ||||||

Other - Publishing | 2,556 | 1,656 | 0.01 | ||||||

Total facility consolidation and asset impairment charges against operations | 122,129 | 106,129 | 0.45 | ||||||

Non-operating charges: | |||||||||

Equity method investments | 7,036 | 4,336 | 0.02 | ||||||

Total charges | $ | 129,165 | $ | 110,465 | $ | 0.47 | |||

In thousands, except per share amounts | |||||||||

2011 | Pre-Tax Amount | After-Tax Amount | Per Share Amount | ||||||

Facility consolidation and asset impairment charges: | |||||||||

Property, plant and equipment: | |||||||||

Publishing | $ | 17,085 | $ | 10,282 | $ | 0.04 | |||

Total property, plant and equipment | 17,085 | 10,282 | 0.04 | ||||||

Other: | |||||||||

Publishing | 10,158 | 7,261 | 0.03 | ||||||

Total other | 10,158 | 7,261 | 0.03 | ||||||

Total facility consolidation and asset impairment charges against operations | 27,243 | 17,543 | 0.07 | ||||||

Non-operating charges: | |||||||||

Equity method investments | 15,739 | 9,539 | 0.04 | ||||||

Other investments | 14,529 | 8,729 | 0.04 | ||||||

Total charges | $ | 57,511 | $ | 35,811 | $ | 0.15 | |||

In thousands of dollars | |||||||||

Gross | Accumulated Amortization | Net | |||||||

Dec. 29, 2013 | |||||||||

Goodwill | $ | 3,790,472 | $ | — | $ | 3,790,472 | |||

Indefinite-lived intangibles: | |||||||||

Television station FCC licenses | 1,091,204 | — | 1,091,204 | ||||||

Mastheads and trade names | 82,570 | — | 82,570 | ||||||

Amortizable intangible assets: | |||||||||

Customer relationships | 290,845 | 177,515 | 113,330 | ||||||

Other | 213,790 | 23,663 | 190,127 | ||||||

Total | $ | 5,468,881 | $ | 201,178 | $ | 5,267,703 | |||

Dec. 30, 2012 | |||||||||

Goodwill | $ | 2,846,869 | $ | — | $ | 2,846,869 | |||

Indefinite-lived intangibles: | |||||||||

Television station FCC licenses | 255,304 | — | 255,304 | ||||||

Mastheads and trade names | 95,308 | — | 95,308 | ||||||

Amortizable intangible assets: | |||||||||

Customer relationships | 313,567 | 197,300 | 116,267 | ||||||

Other | 56,965 | 23,931 | 33,034 | ||||||

Total | $ | 3,568,013 | $ | 221,231 | $ | 3,346,782 | |||

In thousands of dollars | |||

2014 | $ | 57,473 | |

2015 | $ | 48,147 | |

2016 | $ | 40,389 | |

2017 | $ | 35,546 | |

2018 | $ | 33,593 | |

In thousands of dollars | ||||||||||||

Broadcasting | Publishing | Digital | Total | |||||||||

Goodwill | ||||||||||||

Gross balance at Dec. 25, 2011 | $ | 1,618,522 | $ | 7,643,255 | $ | 680,489 | $ | 9,942,266 | ||||

Accumulated impairment losses | — | (7,050,778 | ) | (26,603 | ) | (7,077,381 | ) | |||||

Net balance at Dec. 25, 2011 | $ | 1,618,522 | $ | 592,477 | $ | 653,886 | $ | 2,864,885 | ||||

Acquisitions & adjustments | — | 22,747 | 39,241 | 61,988 | ||||||||

Impairment | — | — | (90,053 | ) | (90,053 | ) | ||||||

Foreign currency exchange rate changes | 80 | 6,918 | 3,051 | 10,049 | ||||||||

Balance at Dec. 30, 2012 | $ | 1,618,602 | $ | 622,142 | $ | 606,125 | $ | 2,846,869 | ||||

Gross balance at Dec. 30, 2012 | 1,618,602 | 7,754,959 | 722,781 | 10,096,342 | ||||||||

Accumulated impairment losses | — | (7,132,817 | ) | (116,656 | ) | (7,249,473 | ) | |||||

Net balance at Dec. 30, 2012 | $ | 1,618,602 | $ | 622,142 | $ | 606,125 | $ | 2,846,869 | ||||

Acquisitions & adjustments | 943,841 | 2,266 | 28,115 | 974,222 | ||||||||

Impairment | — | (8,430 | ) | (11,614 | ) | (20,044 | ) | |||||

Dispositions | (19,000 | ) | — | — | (19,000 | ) | ||||||

Foreign currency exchange rate changes | (110 | ) | 3,903 | 4,632 | 8,425 | |||||||

Balance at Dec. 29, 2013 | $ | 2,543,333 | $ | 619,881 | $ | 627,258 | $ | 3,790,472 | ||||

Gross balance at Dec. 29, 2013 | 2,543,333 | 7,807,416 | 755,528 | 11,106,277 | ||||||||

Accumulated impairment losses | — | (7,187,535 | ) | (128,270 | ) | (7,315,805 | ) | |||||

Net balance at Dec. 29, 2013 | $ | 2,543,333 | $ | 619,881 | $ | 627,258 | $ | 3,790,472 | ||||

In thousands of dollars | |||||||||

2013 | 2012 | 2011 | |||||||

Income taxes, net of refunds | $ | 124,378 | $ | 64,838 | $ | 128,874 | |||

Interest | $ | 126,180 | $ | 138,906 | $ | 161,960 | |||

% Owned Dec. 29, 2013 | |

Wanderful Media, LLC | 12.73% |

Ponderay Newsprint Company | 13.50% |

Captivate Holdings, LLC | 18.00% |

California Newspapers Partnership | 19.49% |

4Info | 24.53% |

Livestream | 26.03% |

Classified Ventures (1) | 26.90% |

Pearl, LLC | 32.10% |

HotelMe, LLC | 32.14% |

Homefinder.com | 33.33% |

Topix | 33.71% |

Garnet Media | 34.00% |

Texas-New Mexico Newspapers Partnership | 40.64% |

Tucson Newspaper Partnership | 50.00% |

(1) | The acquisition of Belo increased the ownership percentage in Classified Ventures from 23.6% to 26.9%. |

In thousands of dollars | ||||||

Dec. 29, 2013 | Dec. 30, 2012 | |||||

Unsecured floating rate term loan due quarterly through August 2018 | $ | 154,800 | $ | — | ||

VIE unsecured floating rate term loans due quarterly through December 2018 | 39,270 | — | ||||

Unsecured notes bearing fixed rate interest at 8.75% due November 2014 | 250,000 | 250,000 | ||||

Unsecured notes bearing fixed rate interest at 10% due June 2015 | 66,568 | 66,568 | ||||

Unsecured notes bearing fixed rate interest at 6.375% due September 2015 | 250,000 | 250,000 | ||||

Unsecured notes bearing fixed rate interest at 10% due April 2016 | 193,429 | 193,429 | ||||

Unsecured notes bearing fixed rate interest at 9.375% due November 2017 (a) | 250,000 | 250,000 | ||||

Borrowings under revolving credit agreement expiring August 2018 | — | 205,000 | ||||

Unsecured notes bearing fixed rate interest at 7.125% due September 2018 | 250,000 | 250,000 | ||||

Unsecured notes bearing fixed rate interest at 5.125% due October 2019 | 600,000 | — | ||||

Unsecured notes bearing fixed rate interest at 5.125% due July 2020 | 600,000 | — | ||||

Unsecured notes bearing fixed rate interest at 6.375% due October 2023 | 650,000 | — | ||||

Unsecured notes bearing fixed rate interest at 7.75% due June 2027 | 200,000 | — | ||||

Unsecured notes bearing fixed rate interest at 7.25% due September 2027 | 240,000 | — | ||||

Total principal long-term debt | 3,744,067 | 1,464,997 | ||||

Other (fair market value adjustments and discounts) | (31,167 | ) | (32,897 | ) | ||

Total long-term debt | 3,712,900 | 1,432,100 | ||||

Less current portion of long-term debt maturities of VIE loans | 5,890 | — | ||||

Long-term debt, net of current portion | $ | 3,707,010 | $ | 1,432,100 | ||

(a) On Feb. 5, 2014 the company sent notice of its intent to redeem the 9.375% notes on March 14, 2014. The notes will be redeemed for 104.688% of the outstanding principal amount, pursuant to the original terms. | ||||||

In thousands of dollars | |||

2014 (1) | $ | 5,890 | |

2015 | 356,022 | ||

2016 | 232,883 | ||

2017 | 289,454 | ||

2018 | 569,818 | ||

Thereafter | 2,290,000 | ||

Total | $ | 3,744,067 | |

In thousands of dollars | |||||||||

2013 | 2012 | 2011 | |||||||

Service cost—benefits earned during the period | $ | 7,538 | $ | 7,545 | $ | 7,833 | |||

Interest cost on benefit obligation | 141,030 | 155,376 | 171,339 | ||||||

Expected return on plan assets | (198,216 | ) | (189,863 | ) | (211,659 | ) | |||

Amortization of prior service costs | 7,566 | 7,689 | 7,580 | ||||||

Amortization of actuarial loss | 63,212 | 53,429 | 37,901 | ||||||

Pension expense for company-sponsored retirement plans | 21,130 | 34,176 | 12,994 | ||||||

Settlement and special termination benefit charge | 3,077 | 7,946 | 1,068 | ||||||

Total pension cost | $ | 24,207 | $ | 42,122 | $ | 14,062 | |||

In thousands of dollars | ||||||

Dec. 29, 2013 | Dec. 30, 2012 | |||||

Change in benefit obligations | ||||||

Benefit obligations at beginning of year | $ | 3,573,085 | $ | 3,351,494 | ||

Service cost | 7,538 | 7,545 | ||||

Interest cost | 141,030 | 155,376 | ||||

Plan amendments | 177 | — | ||||

Plan participants’ contributions | 4 | 7 | ||||

Actuarial (gain) loss | (104,131 | ) | 300,525 | |||

Foreign currency translation | 21,758 | 27,526 | ||||

Gross benefits paid | (230,979 | ) | (245,899 | ) | ||

Acquisitions | 274,510 | — | ||||

Settlements | (10,743 | ) | (23,489 | ) | ||

Benefit obligations at end of year | $ | 3,672,249 | $ | 3,573,085 | ||

Change in plan assets | ||||||

Fair value of plan assets at beginning of year | $ | 2,552,316 | $ | 2,408,768 | ||

Actual return on plan assets | 364,652 | 254,225 | ||||

Plan participants’ contributions | 4 | 7 | ||||

Employer contributions | 107,086 | 137,499 | ||||

Gross benefits paid | (230,979 | ) | (245,899 | ) | ||

Acquisitions | 229,774 | — | ||||

Settlements | (10,743 | ) | (23,489 | ) | ||

Foreign currency translation | 16,357 | 21,205 | ||||

Fair value of plan assets at end of year | $ | 3,028,467 | $ | 2,552,316 | ||

Funded status at end of year | $ | (643,782 | ) | $ | (1,020,769 | ) |

Amounts recognized in Consolidated Balance Sheets | ||||||

Noncurrent assets | $ | 3,684 | $ | — | ||

Accrued benefit cost—current | $ | (15,271 | ) | $ | (13,444 | ) |

Accrued benefit cost—noncurrent | $ | (632,195 | ) | $ | (1,007,325 | ) |

In thousands of dollars | |||||||||

Fair Value of Plan Assets | Benefit Obligation | Funded Status | |||||||

GRP | $ | 2,009,228 | $ | 2,194,517 | $ | (185,289 | ) | ||

SERP (a) | — | 190,791 | (190,791 | ) | |||||

Newsquest | 699,478 | 925,280 | (225,802 | ) | |||||

Belo | 229,774 | 274,510 | (44,736 | ) | |||||

All other | 89,987 | 87,151 | 2,836 | ||||||

Total | $ | 3,028,467 | $ | 3,672,249 | $ | (643,782 | ) | ||

(a) the SERP is an unfunded, unsecured liability | |||||||||

In thousands of dollars | ||||||

Dec. 29, 2013 | Dec. 30, 2012 | |||||

Accumulated benefit obligation | $ | 3,568,021 | $ | 3,546,819 | ||

Fair value of plan assets | $ | 2,938,480 | $ | 2,552,316 | ||

In thousands of dollars | ||||||

Dec. 29, 2013 | Dec. 30, 2012 | |||||

Projected benefit obligation | $ | 3,585,947 | $ | 3,573,085 | ||

Fair value of plan assets | $ | 2,938,480 | $ | 2,552,316 | ||

In thousands of dollars | ||||||

Dec. 29, 2013 | Dec. 30, 2012 | |||||

Net actuarial losses | $ | (1,390,975 | ) | $ | (1,717,674 | ) |

Prior service cost | (53,949 | ) | (61,338 | ) | ||

Amounts in accumulated other comprehensive income (loss) | $ | (1,444,924 | ) | $ | (1,779,012 | ) |

In thousands of dollars | |||

2013 | |||

Current year actuarial gain | $ | 270,568 | |

Change in prior service cost | (177 | ) | |

Amortization of actuarial loss | 63,212 | ||

Amortization of prior service costs | 7,566 | ||

Recognition of settlement | 3,077 | ||

Currency loss | (10,158 | ) | |

Total | $ | 334,088 | |

2013 | 2012 | 2011 | |

Discount rate | 4.08% | 4.83% | 5.49% |

Expected return on plan assets | 7.94% | 7.95% | 8.46% |

Rate of compensation increase | 2.97% | 2.96% | 2.95% |

Dec. 29, 2013 | Dec. 30, 2012 | |

Discount rate | 4.75% | 4.08% |

Rate of compensation increase | 2.97% | 2.97% |

Target Allocation | Allocation of Plan Assets | |||||

2014 | 2013 | 2012 | ||||

Equity securities | 65 | % | 64 | % | 51 | % |

Debt securities | 20 | 22 | 35 | |||

Other | 15 | 14 | 14 | |||

Total | 100 | % | 100 | % | 100 | % |

In thousands of dollars | |||

2014 | $ | 225,471 | |

2015 | $ | 226,259 | |

2016 | $ | 228,646 | |

2017 | $ | 234,066 | |

2018 | $ | 232,890 | |

2019-2023 | $ | 1,168,924 | |

• | The company plays no part in the management of plan investments or any other aspect of plan administration. |

• | Assets contributed to the multi-employer plan by one employer may be used to provide benefits to employees of other participating employers. |

• | If a participating employer stops contributing to the plan, the unfunded obligations of the plan may be borne by the remaining participating employers. |