QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ |

||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 | |

G&K SERVICES, INC. |

||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||

Payment of Filing Fee (Check the appropriate box):

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

/ / |

Fee paid previously with preliminary materials. |

|||

/ / |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

G&K SERVICES, INC.

5995 Opus Parkway, Suite 500

Minneapolis, Minnesota 55343

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOVEMBER 8, 2001

TO THE STOCKHOLDERS OF G&K SERVICES, INC.:

Please take notice that the Annual Meeting of Stockholders of G&K Services, Inc. (the "Company") will be held, pursuant to due call by the Board of Directors of the Company, at The Hilton Minneapolis & Towers, 1001 Marquette Avenue South, Minneapolis, Minnesota, 55403, on Thursday, November 8, 2001, at 10:00 a.m. prevailing Minneapolis time, or at any adjournment or adjournments thereof, for the purpose of considering and taking appropriate action with respect to the following:

- 1.

- To

approve an amendment to the Company's Articles of Incorporation to increase the Company's authorized shares of Class A Common Stock from 50 million to

400 million shares and the authorized shares of Class B Common Stock from 10 million to 30 million, thereby increasing the total authorized shares of capital stock of the

Company from 60 million to 430 million shares;

- 2.

- To

approve amendments to the Company's Articles of Incorporation and Bylaws to classify the Board of Directors of the Company and modify the removal requirements for directors;

- 3.

- To

elect nine directors to serve for terms of one to three years;

- 4.

- To

approve an amendment to the Company's 1996 Director Stock Option Plan to increase the number of shares of Common Stock reserved for issuance thereunder from 50,000 to 100,000

shares;

- 5.

- To

ratify the appointment of Arthur Andersen LLP, Certified Public Accountants, as independent auditors of the Company for fiscal 2002; and

- 6.

- To transact any other business as may properly come before the meeting or any adjournments thereof.

Pursuant to due action of the Board of Directors, stockholders of record on September 14, 2001, will be entitled to vote at the meeting or any adjournments thereof.

A proxy for the meeting is enclosed herewith. You are requested to fill in and sign the proxy, which is solicited by the Board of Directors, and mail it promptly in the enclosed envelope.

| By Order of the Board of Directors | ||

G&K SERVICES, INC. |

||

| Jeffrey L. Wright, Secretary | ||

October 4, 2001 |

PROXY STATEMENT

OF

G&K SERVICES, INC.

5995 Opus Parkway, Suite 500

Minneapolis, Minnesota 55343

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD

NOVEMBER 8, 2001

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of G&K Services, Inc. (the "Company") to be used at the Annual Meeting of Shareholders of the Company to be held November 8, 2001 (the "Meeting"). The approximate date on which this Proxy Statement and the accompanying proxy were first sent or given to shareholders was October 4, 2001. Each shareholder who signs and returns a proxy in the form enclosed with this Proxy Statement may revoke the same at any time prior to its use by giving notice of such revocation to the Company in writing, in open meeting or by executing and delivering a new proxy to the Secretary of the Company. Unless so revoked, the shares represented by each proxy will be voted at the Meeting and at any adjournments thereof. Presence at the Meeting of a shareholder who has signed a proxy does not, alone, revoke that proxy. Only shareholders of record at the close of business on September 14, 2001 (the "Record Date") will be entitled to vote at the Meeting or any adjournments thereof. All shares which are entitled to vote and are represented at the Meeting by properly executed proxies received prior to or at the Meeting, and not revoked, will be voted at the Meeting in accordance with the instructions indicated on such proxies.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The Company has outstanding two classes of voting securities, Class A Common Stock, $0.50 par value, and Class B Common Stock, $0.50 par value, of which 19,166,412 shares of Class A Common Stock and 1,474,996 shares of Class B Common Stock were outstanding as of the close of business on the Record Date. Each share of Class A Common Stock is entitled to one vote and each share of Class B Common Stock is entitled to ten votes on all matters put to a vote of stockholders.

The following table sets forth, as of the Record Date, certain information with regard to the beneficial ownership of the Company's Class A and Class B Common Stock and the voting power resulting from the ownership of such stock by (i) all persons known by the Company to be the owner, of record or beneficially, of more than 5% of the outstanding Class A or Class B Common Stock of the Company, (ii) each of the directors and nominees for election to the Board of Directors of the Company, (iii) each executive officer named in the Summary Compensation Table, and (iv) all executive officers and directors as a group, inclusive of each Named Executive Officer and without regard to whether such persons are also reporting persons for purposes of Section 16(a) of the Securities Exchange Act of 1934, as amended (the

"Exchange Act"). Unless otherwise indicated, the address of each of the following persons is 5995 Opus Parkway, Suite 500, Minneapolis, Minnesota 55343.

| |

Class A Common Stock(2) |

Class B Common Stock |

|

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Name of Beneficial Owner(1) |

Number of Shares |

Percent of Class |

Number of Shares |

Percent of Class |

Percent of Voting Power(3) |

|||||

| Paul Baszucki(4) | 8,000(5) | * | — | — | * | |||||

| Richard Fink(4) | 175,281(6) | * | 1,315,135 | 89.2 | 39.3 | |||||

| Wayne M. Fortun(4) | 8,155(5) | * | — | — | * | |||||

| Donald W. Goldfus(4) | 11,750(5) | * | — | — | * | |||||

| William Hope(4) | 65,537(7) | * | — | — | * | |||||

| Thomas Moberly(4) | 66,198(8) | * | — | — | * | |||||

| Bernard Sweet(4) | 23,705(5) | * | — | — | * | |||||

| Robert Wood | 23,482(9) | * | — | — | * | |||||

| Jeffrey L. Wright | 20,901(10) | * | — | — | * | |||||

| D. R. Verdoorn(4) | 3,000(11) | * | — | — | * | |||||

| Michael G. Allen(12) | 1,000 | * | — | — | * | |||||

| M. Lenny Pippin(12) | — | * | — | — | * | |||||

| All executive officers and directors as a group (12 persons) | 407,009(13) | 2.1 | 1,315,135 | 89.2 | 40.0 | |||||

| Lord, Abbett & Co.(14) 90 Hudson Street Jersey City, NJ 07302 |

1,229,378 | 6.4 | — | — | 3.6 | |||||

| T. Rowe Price(14) 100 East Pratt Street Baltimore, MD 21202 |

1,188,250 | 6.2 | — | — | 3.5 | |||||

- *

- Less than 1%.

- (1)

- Unless

otherwise noted, each person or group identified possesses sole voting and investment power with respect to the shares shown opposite the name

of such person or group.

- (2)

- Does

not include shares of Class A Common Stock which may be acquired by holders of Class B Common Stock upon conversion of their

shares of Class B Common Stock, at any time, on the basis of one share of Class A Common Stock for each share of Class B Common Stock converted.

- (3)

- Holders

of Class B Common Stock are entitled to ten votes for each share on all matters submitted to a vote of stockholders. Holders of

Class A Common Stock are entitled to one vote per share on all matters submitted to a vote of stockholders.

- (4)

- Each of these persons is currently a director and nominee for election to the Board of Directors of the Company, except for Bernard Sweet who is not standing for re-election. Messrs. Fink and Moberly are also executive officers of the Company.

2

- (5)

- Includes

7,000 shares subject to options that are exercisable within the next 60 days.

- (6)

- Includes

8,016 shares subject to options that are exercisable within the next 60 days; 116,130 shares held by Richard Fink as

co-trustee for the benefit of one of his children, 6,656 shares owned by a private foundation with respect to which Mr. Fink has shared voting power and 8,700 shares held by

Mr. Fink's spouse.

- (7)

- Includes

5,860 shares subject to options that are exercisable within the next 60 days.

- (8)

- Includes

7,973 shares subject to options that are exercisable within the next 60 days, 7,400 shares held as joint tenant with his spouse, 516

shares held as guardian for his minor children and 1,000 shares held by his spouse.

- (9)

- Includes

5,577 shares subject to options that are exercisable within the next 60 days.

- (10)

- Includes

8,333 shares subject to options that are exercisable within the next 60 days.

- (11)

- Includes

1,000 shares subject to options that are exercisable within the next 60 days.

- (12)

- Messrs. Allen

and Pippin are director nominees of the Company.

- (13)

- Includes

64,759 shares subject to options that are exercisable within the next 60 days.

- (14)

- Based solely upon the most recently filed Form 13-f.

The foregoing footnotes are provided for informational purposes only and each person disclaims beneficial ownership of shares owned by any member of his or her family or held in trust for any other person, including family members.

On June 14, 1985, Richard Fink, Chairman of the Board of the Company and certain other persons who are no longer holders of Class B Common Stock entered into a Stockholder Agreement with the Company. This Stockholder Agreement presently covers 1,315,135 shares of Class B Common Stock, representing approximately 89.2% of the outstanding shares of the Class B Common Stock. The Stockholder Agreement provides for restrictions on the transferability of the Class B Common Stock, in addition to certain restrictions contained in the Company's Restated Articles of Incorporation. The shares of Class B Common Stock were acquired pursuant to an exchange offer made by the Company in May 1985. The shares of Class B Common Stock owned by Mr. Fink represent substantial voting control of the Company.

PROPOSAL NUMBER 1:

AMENDMENT OF ARTICLES OF INCORPORATION TO INCREASE THE

NUMBER OF AUTHORIZED SHARES OF STOCK

Under the Company's current Articles of Incorporation, the Company has authority to issue Sixty Million (60,000,000) shares of capital stock, of which Fifty Million (50,000,000) shares may be classified as Class A Common Stock, par value $.50 per share and Ten Million (10,000,000) may be classified as Class B Common Stock, $.50 par value per share. As of the September 14, 2001, the Record Date for the Meeting, there were issued and outstanding 19,166,412 shares of Class A Common Stock and 1,474,996 shares of Class B Common Stock. Proposal 1 recommends to the shareholders an amendment to the Company's Articles of Incorporation that would increase the number of authorized shares of Class A Common Stock and Class B Common Stock to Four Hundred Million (400,000,000) shares and Thirty Million (30,000,000)

3

shares, respectively, thereby increasing the number of authorized shares of capital stock of the Company from Sixty Million (60,000,000) shares to Four Hundred Thirty Million (430,000,000) shares. The Board of Directors has unanimously approved the amendment contained in Proposal 1.

The additional Class A Common Stock and Class B Common Stock to be authorized upon adoption of Proposal 1 would have rights identical to the currently outstanding shares of such Classes of stock. The adoption of Proposal 1 and the issuance of Class A and Class B Common Stock authorized thereby would not affect the rights of the holders of currently outstanding Class A or Class B Common Stock of the Company, except for effects incidental to increasing the number of outstanding shares of the Company's capital stock.

The proposed increase in the authorized shares of Class A and Class B Common Stock will ensure that shares remain available to satisfy the Company's current obligations under its Shareholder Rights Plan (as discussed in greater detail under "Corporate Action Regard Takeover Attempts" on pages 10 through 12 of this Proxy Statement), both currently and in the event of any future stock split. The Shareholder Rights Plan was adopted by the Company's Board of Directors on August 30, 2001. Under the Shareholder Rights Plan, the Company distributed to its shareholders one "Right" for each share of Class A and Class B Common Stock held as of the record date for the distribution. Each Right distributed on shares of Class A Common Stock (a "Class A Right") entitles the registered holder thereof to purchase from the Company one share of the Company's Class A Common Stock at a price of $130.00 per share, and each Right distributed on shares of Class B Common Stock (a "Class B Right") entitles the registered holder thereof to purchase from the Company one share of the Company's Class B Common Stock at a price of $130.00 per share. In certain situations following a shareholder's acquisition of voting securities having 15% or more of the then voting power of the Company, each Class A Right and Class B Right (except with respect to Rights held by the acquiring shareholder) will entitle the holder thereof to receive shares of Class A Common Stock and Class B Common Stock, respectively, valued at $260 for a purchase price of $130.

The proposed increase will also ensure that a sufficient number of shares will be available, if needed, for issuance in connection with any possible future transactions approved by the Board of Directors, including, among others, stock splits, stock dividends, acquisitions, financings and other corporate purposes. Although the Company currently has no specific plans to use the additional authorized shares of Class A or Class B Common Stock for such purposes, the Board of Directors believes that the availability of the additional shares for such purposes without delay or the necessity for a special shareholders' meeting (except as may be required by applicable law or regulatory authorities or by the rules of any stock exchange on which the Company's securities may then be listed) will be beneficial to the Company by providing it with the flexibility required to consider and respond to future business opportunities and needs as they arise. The availability of additional authorized shares of Class A and Class B Common Stock will also enable the Company to act promptly when the Board of Directors determines that the issuance of additional shares of Class A or Class B Common Stock is advisable.

Upon shareholder approval of Proposal 1, the Board of Directors will have the right to authorize the issuance of additional shares of Class A and Class B Common Stock without further vote of the shareholders of the Company, except as provided under Minnesota corporate law or under the rules of any securities exchange or quotation system on which shares of Class A or Class B Common Stock of the Company are then listed. Current holders of the Company's Class A and Class B Common Stock have no preemptive or similar rights, which means that such holders do not have a prior right to purchase any new issue of common stock of the Company in order to maintain their percentage ownership of the Company.

4

The issuance of additional shares of common stock would decrease the proportionate equity interest of the Company's current shareholders and, depending upon the price paid for such additional shares, could result in dilution to the Company's current shareholders. Notwithstanding the foregoing, the Company currently intends to issue additional shares of Class B Common Stock only in conjunction with and in the same ratio as a stock dividend, split-up or division of shares of Class A Common Stock.

In addition, the authorized and unissued shares could be used, without the need for any action by the shareholders, in one or more transactions which could make more difficult, discourage or thwart attempts by third parties to gain control of the Company if the Board of Directors did not approve an attempted takeover. For example, shares of Class A or Class B Common Stock could be sold privately to purchasers who might support the Board in a control contest or to dilute the voting or other rights of a person seeking to obtain control. Such actions could not take place, however, without the Board and/or shareholders of the Company complying with the terms of the Company's Restated Articles of Incorporation which have the overall effect of discouraging unnegotiated takeover attempts. The securities laws require that proxy materials pertaining to an increase in the number of authorized shares of stock contain a brief description of provisions in the Articles of Incorporation or Bylaws that would have the effect of delaying, deferring or preventing a change in control of the Company. A description of those provisions is included under "Corporate Action Regarding Takeover Attempts" beginning on page 10 of this Proxy Statement.

RESOLUTION AND VOTE REQUIRED FOR PROPOSAL 1:

The following resolution will be submitted for approval at the Meeting:

"RESOLVED, that the Articles of Incorporation of G&K Services, Inc. be amended to increase the amount of authorized Class A Common Stock of the Company from 50,000,000 shares to 400,000,000 shares and increase the amount of authorized Class B Common Stock of the Company from 10,000,000 shares to 30,000,000 shares, thereby increasing the authorized number of shares of authorized capital stock of the Corporation from 60,000,000 shares to 430,000,000 shares."

The adoption of the amendment to the Articles of Incorporation requires the affirmative vote of the holders of a majority of the voting power of the outstanding shares of Class A and Class B Common Stock present and entitled to vote at the Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" APPROVAL AND ADOPTION OF PROPOSAL 1.

PROPOSAL NUMBER 2:

AMENDMENT AND RESTATEMENT OF THE ARTICLES OF INCORPORATION

AND BYLAWS TO CLASSIFY THE BOARD OF DIRECTORS AND

MODIFY THE REMOVAL REQUIREMENTS FOR DIRECTORS

The Company's current Articles of Incorporation do not contain provisions relating to the election, term or removal of directors. Proposal 2 recommends to the shareholders that the Company's current Articles of Incorporation and Bylaws be restated in their entireties following amendments to the Articles of Incorporation (as set forth in Appendix A) and Bylaws (as set forth in Appendix B) that would (i) increase the maximum number of directors serving on the Board of Directors from nine to twelve, (ii) authorize the Board of Directors to determine the number of directors, with a minimum of three and a maximum of twelve, to serve on the Board of Directors from time to time, (iii) divide the Board of

5

Directors into classes to allow for staggered terms of office, with one class of directors elected each year and each director so elected serving for a term of three years, (iv) require the affirmative vote of the holders of at least 80% of the voting power of the then outstanding shares of capital stock of the Company entitled to vote to (1) remove a director, with or without cause, or (2) amend, modify or repeal the provisions of the Articles of Incorporation and Bylaws fixing the number of directors or their classifications, qualifications or terms of office, or containing procedures for removing directors or filling vacancies in the Board of Directors, and (v) make non-substantive changes to the Articles of Incorporation and Bylaws to conform the number, ordering and content of the sections of the Articles of Incorporation and Bylaws to the changes described above. The Board of Directors has unanimously approved the amendments contained in Proposal 2. The summary of Proposal 2 contained in this Proxy Statement is qualified by the full text of the proposed Amended and Restated Articles of Incorporation attached as Appendix A and the proposed Amended and Restated Bylaws attached as Appendix B.

The Board of Directors believes that Proposal 2 will provide the Board of Directors a greater opportunity to protect shareholder interests and to assure continuity in the affairs and business strategies of the Company. Proposal 2 may have an impact upon the rights of shareholders and may be characterized as an anti-takeover measure which, if adopted, may tend to insulate management and make the accomplishment of certain transactions involving a potential change of control of the Company more difficult. The Board of Directors believes that Proposal 2 will supplement and strengthen the Company's existing anti-takeover measures, including the "business combination" and "control share acquisition" provisions of the Minnesota Business Corporation Act, which are described under "Corporate Action Regarding Takeover Attempts" beginning on page 10 of this Proxy Statement. The Board of Directors believes that, in certain situations, a third party could acquire a block of the Company's stock and try to gain control of the Company or attempt to realize a return on its investment without purchasing the remainder of the Company's stock through a tender offer or other means of acquisition. Such a purchaser might attempt to force the Company to accept a merger or restructuring or accept another proposal by launching a proxy contest to unseat the Company's Board of Directors. Following a substantial accumulation of stock of the Company, a hostile purchaser could seek representation on the Company's Board of Directors to increase the likelihood that its proposal would be implemented by the Company. The Board of Directors believes that the threat of removal from the Board in such a situation could curtail the Board's ability to negotiate effectively with a potential purchaser and its efforts to have the time and information necessary to evaluate the merits of such proposal and attempt to maximize the price obtained in any transaction based on such proposal. The Board of Directors believes that, if the amendments contained in Proposal 2 are adopted by the shareholders, a potential hostile purchaser will be forced to negotiate directly with the Board of Directors, and that the Board of Directors will be in a better position to negotiate effectively on behalf of all shareholders in order to realize fair and equitable shareholder value. Proposal 2, if adopted by the shareholders, will apply to every election of directors and not only an election of directors occurring after a change in control of the Company.

The amendments contained in Proposal 2 are not being recommended in response to any specific effort to which the Company is aware to accumulate the Company's stock or to obtain control of the Company or its Board of Directors by means of a solicitation in opposition to management. The Board of Directors has considered the potential adverse effects of the proposed amendments and has concluded that such adverse effects are outweighed by the benefits Proposal 2 would afford the Company and its shareholders. Nonetheless, because the amendments may significantly affect the ability of shareholders of the Company to effect rapid changes in the composition of the Board of Directors, we urge all shareholders to read carefully the following description of the amendments and their purposes and effects,

6

as well as the text of the proposed amendments to the Articles of Incorporation and Bylaws set forth in Appendix A and Appendix B, respectively.

DESCRIPTION AND INTENDED EFFECT OF PROPOSAL 2:

Classification of Board of Directors. The Minnesota Business Corporation Act provides that the Articles of Incorporation and/or Bylaws of a corporation may permit the directors to be divided into classes. Neither the Company's current Articles of Incorporation nor its current Bylaws contain any provisions relating to the classification of directors. Rather, the Company's current Articles of Incorporation provide that all directors shall continue to hold office until the next annual shareholders' meeting and until their successors are elected and qualified. The amendment contained in Proposal 2 relating to the classification of directors provides for the creation of three classes of directors with such classes to be as nearly equal in number as reasonably possible. Upon their initial election, the Class I directors will hold office for a term expiring at the 2002 Annual Meeting of shareholders, the Class II directors will hold office for a term expiring at the 2003 Annual Meeting of shareholders, and the Class III directors will hold office for term expiring at the 2004 Annual Meeting of shareholders. Commencing with the 2002 Annual Meeting of shareholders, the shareholders will elect only one class of directors each year, with each director so elected to hold office for a term expiring at the third annual meeting of shareholders following their election. The same procedure would be repeated each year, with the result that only approximately one-third of the whole Board of Directors would be elected each year.

The purpose of this amendment is to encourage potential acquirers of the Company to deal directly with the Board of Directors by making it difficult to replace the entire Board of Directors at any one annual meeting. By staggering the terms of directors, this amendment prevents any outside group or individual from gaining control of the Board of Directors at any one election of directors unless such group or individual obtains the approval of the holders of at least 80% of the voting power of the outstanding shares of capital stock entitled to vote on a change in the composition of the Board of Directors through an amendment to the Articles of Incorporation and Bylaws. If such vote is not obtained, it would take such group or individual at least two elections of directors to gain control of the Board of Directors. The effect of this two-year period is to discourage any outside group or individual from attempting to gain control of the Board of Directors and thereby undermining the ability of the Board to negotiate effectively with such a group or individual. Although the purpose of the amendment is to encourage potential acquirers of the Company to deal directly with the Board of Directors, the institution of a classified Board of Directors will also make it more difficult for shareholders to change a majority of the directors even when the only reason for the change may be the performance of the present directors.

Increase or Decrease in the Number of Directors. The MBCA provides that the number of directors of a corporation shall be fixed by or in the manner provided in the corporation's articles of incorporation or bylaws. The Company's current Articles of Incorporation provide that the number of directors of the Company shall be no less than three (3) nor greater than nine (9) persons. The Company's current Bylaws provide that the number of directors shall be determined at each annual meeting of the Company's shareholders. The Company's current Articles of Incorporation and Bylaws do not authorize the directors to increase or decrease the size of the Board of Directors.

7

Although the amendments contained in Proposal 2 do not modify the minimum number of three (3) directors, they do increase the maximum number of directors from nine (9) to twelve (12) directors and give the Board of Directors the authority to determine, from time to time, the number of directors within that range serving on the Board of Directors (no decrease in the number of directors, however, could result in the removal of a director unless the removal were authorized in the manner described below). In addition, Proposal 2 permits the shareholders to increase the number of directors only by an amendment to the Articles of Incorporation and Bylaws approved by the affirmative vote of the holders of at least 80% of the voting power of the then outstanding shares of capital stock of the Company entitled to vote. The purpose of this amendment is to provide flexibility to the directors in determining the optimal size of the Board of Directors, and to inhibit a third party from increasing the number of directors with a simple majority vote of the shares entitled to vote and filling the newly created vacancies in an attempt to gain control of the Board of Directors.

Removal of Directors; Filling Vacancies on the Board of Directors. The Minnesota Business Corporation Act controls the procedures for the removal of directors and the filling of vacancies on the Board of Directors caused by such removal or by any other reason, unless those procedures are modified by the corporation's articles of incorporation or bylaws. Neither the Company's current Articles of Incorporation nor the Company's current Bylaws contain provisions relating to the removal of directors. The procedures established by the Minnesota Business Corporation Act permit the shareholders to remove a director at any time, with or without cause, by the affirmative vote of the holders of a majority of shares entitled to vote at an election of directors. The MBCA also allows the Board of Directors to remove a director, with or without cause, but only if such director was appointed by the Board of Directors and the shareholders have not elected directors in the time period between the appointment and the removal. The MBCA provides that any vacancy occurring on the Board of Directors, whether as a result of death, resignation, removal or any other reason, shall be filled by the affirmative vote of a majority of directors then remaining in office, even though less than a quorum. Although the MBCA provides that a director elected to fill a vacancy shall hold office until the next annual meeting of shareholders and until his or her successor is elected and qualified, the Company's current Bylaws provide that such a director shall hold office for the remainder of the unexpired term in respect of which such vacancy occurred. Because directors elected to fill a vacancy will be identified as being of the same class as the directors they succeed, such directors will be elected to hold office for a term which shall coincide with the remaining term of that class (regardless of whether that remaining term is more than one year in duration), or until theirs successors are elected and qualified.

The amendment contained in Proposal 2 relating to the removal of directors modifies the above procedures by allowing the shareholders to remove a director at any time, with or without cause, but only if such removal is approved by the affirmative vote of the holders of at least 80% of the voting power of the then outstanding shares of capital stock of the Company entitled to vote on such removal. In addition, the amendment contained in Proposal 2 leaves intact the Board of Director's authority to fill a vacancy occurring on the Board of Directors for the remainder of the unexpired term in respect of which such vacancy occurred. The purpose of this amendment is to inhibit a third party from removing incumbent directors with a simple majority vote of the shares entitled to vote and filling the newly created vacancies in an attempt to gain control of the Board of Directors.

The provisions of the proposed amendments relating to the removal of directors are designed to protect the classified Board structure in the event a third party gains control of a majority of the voting power of the Company's outstanding capital stock. The requirement of an 80% shareholder vote to remove

8

directors, together with the provision in the Company's Articles of Amendment and Bylaws that vacancies on the Board of Directors may be filled by the directors, are intended to preclude such third party from removing incumbent directors and simultaneously gaining control of the Board of Directors by filling the vacancies created by removal. Moreover, the currently existing provision that newly created directorships are to be filled by the directors then in office, along with the proposed amendment to the Company's Articles of Incorporation requiring an 80% shareholder vote to increase the size of the Board of Directors, would prevent those seeking majority representation on the Board of Directors from obtaining such representation simply by enlarging the Board and filling the new directorships created thereby with their own nominees.

Increase in the Shareholder Vote Required for an Amendment, Modification or Repeal of Amendments Concerning the Classification, Term or Removal of Directors. The MBCA provides that a corporation's articles of incorporation may be amended, modified, or repealed by the affirmative vote of a majority of shareholders entitled to vote on such amendment, modification or repeal unless the corporation's articles of incorporation require a larger vote. The Company's current Articles of Incorporation require the affirmative vote of the holders of 80% of Company's outstanding shares to amendment, change or repeal the provisions of Article X thereof, which Article imposes a supermajority shareholder vote requirement in order to adopt a plan of dissolution or to approve certain transactions between the Company and holders of 5% or more of the outstanding shares of the Company's stock. However, the Company's current Articles of Incorporation do not otherwise contain provisions relating to the amendment, modification, or repeal of the Articles of Incorporation. The amendment contained in Proposal 2 provides that the provisions of the Articles of Incorporation or Bylaws fixing the number of directors or their classifications, qualifications or terms of office, or containing procedures for removing directors or filling vacancies in the Board of Directors classification, term or removal of directors cannot be amended, modified, or repealed without the affirmative vote of the holders of at least 80% of the voting power of the then outstanding shares of capital stock of the Company entitled to vote on such amendment, modification, or repeal. The purpose of this amendment is to inhibit a third party from eliminating the classified Board or removing incumbent directors by an amendment to the Articles of Incorporation obtained with a simple majority vote of the shares entitled to vote and filling the newly created vacancies in an attempt to gain control of the Board of Directors.

RESOLUTIONS AND VOTE REQUIRED FOR PROPOSAL 2:

The following resolutions will be submitted for approval at the meeting:

"RESOLVED, that the Articles of Incorporation of G&K Services, Inc. be amended and restated, as set forth on Appendix A attached to the Proxy Statement, to increase the maximum number of directors serving on the Board of Directors from nine to twelve, and to provide for, among other things, the classification and removal of directors.

RESOLVED, that the Bylaws of G&K Services, Inc. be amended and restated, as set forth on Appendix B attached to the Proxy Statement, to increase the maximum number of directors serving on the Board of Directors from nine to twelve and to provide for, among other things, the classification and removal of directors."

The adoption of the Amended and Restated Articles of Incorporation and Bylaws, as set forth in Proposal 2, requires the affirmative vote of the holders of a majority of the voting power of the outstanding shares of Class A and Class B Common Stock present and entitled to vote at the Meeting.

9

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" PROPOSAL 2 TO AMEND AND RESTATE THE ARTICLES OF INCORPORATION AND BYLAWS TO, AMONG OTHER THINGS, CLASSIFY THE BOARD OF DIRECTORS AND MODIFY THE REMOVAL REQUIREMENTS FOR DIRECTORS.

CORPORATE ACTION REGARDING TAKEOVER ATTEMPTS

As described above, Proposal 1, relating to an increase in the amount of the Company's authorized capital stock, and Proposal 2, pertaining to the classification and removal of directors, would, if approved by the shareholders at the Meeting, have the effect of deterring or delaying a change in control of the Company and making it more difficult for persons who have acquired a substantial stock interest in the Company to effectively exercise control.

Tender offer or other non-open market acquisitions of stock are usually made at prices above the prevailing market of a company's stock. Both the proposed increase in authorized shares and the proposed charter amendments may discourage such purchases and may thereby deprive shareholders of an opportunity to sell their stock in the Company at a temporarily higher price. In any event, the proposed amendment to increase authorized common stock is not the result of any specific effort to obtain control of the Company by a tender offer, proxy contest, business combination, or otherwise. While the Company intends to reserve a portion of the proposed increased shares of authorized Class A and Class B Common Stock for use under its Shareholder Rights Plan (which is discussed below), the Company has no other present intention to use such shares for anti-takeover purposes. In addition, the Company has no plans or proposals to enter into any other arrangements that may have material anti-takeover consequences.

The following describes the Company's Shareholder Rights Plan, adopted by the Company's Board of Directors in August 2001, and the "business combination" and "control share acquisition" provisions of the Minnesota Business Corporation Act, which also would have the effect of deterring or delaying a change in control of the Company.

Shareholder Rights Plan

The Company has a Shareholder Rights Plan intended to deter coercive or unfair takeover tactics and to prevent a potential acquirer from gaining control of the Company without offering a fair price to all of the Company's shareholders. The Shareholder Rights Plan provides a strong incentive for anyone interested in acquiring the Company to negotiate directly with the Board of Directors. Under the Rights Plan, adopted in August 2001, one right ("Right") has attached to each share of outstanding Class A and Class B Common Stock. Each Right attached to shares of Class A Common Stock (a "Class A Right") entitles the registered holder thereof to purchase from the Company one share of the Company's Class A Common Stock at a price of $130.00 per share, subject to adjustment. Similarly, each Right attached to shares of Class B Common Stock (a "Class B Right") entitles the registered holder thereof to purchase from the Company one share of the Company's Class B Common Stock at a price of $130.00 per share, subject to adjustment.

The Rights will separate from the shares of Class A and Class B Common Stock to which they are attached, and a Distribution Date (as defined below) for the Rights will occur upon the earlier of (i) the date of public announcement that a person or group of affiliated or associated persons has become an "Acquiring Person" (i.e., has become, subject to certain exceptions, the beneficial owner of voting securities having 15% or more of the then voting power of the Company without the prior approval of a

10

majority of the Board of Directors; the date of such public announcement is hereinafter referred to as the "Stock Acquisition Date") and (ii) the tenth business day following the commencement or public announcement of a tender offer or exchange offer, the consummation of which would result in a person or group of affiliated or associated persons becoming, subject to certain exceptions, an Acquiring Person (or such later date as may be determined by the Board of Directors of the Company prior to a person or group of affiliated or associated persons becoming an Acquiring Person) (the earlier of such dates being called the "Distribution Date"). Until the Distribution Date, any new certificates representing shares of the Company's Class A and Class B Common Stock issued after September 21, 2001 upon transfer or new issuance of the such common shares will contain a notation incorporating by reference the Rights Plan. The Rights are not exercisable until the Distribution Date.

In the event that any person becomes an Acquiring Person, each Class A Right (except with respect to Rights held by the acquiring shareholder) will entitle the holder thereof (subject to possible suspensions provided for in the Shareholder Rights Plan) to receive that number of shares of Class A Common Stock having a market value of two times the exercise price of the Class A Right. Likewise, each Class B Right (except with respect to Rights held by the acquiring shareholder) will entitle the holder thereof to receive that number of shares of Class B Common Stock having a market value of two times the exercise price of the Class B Right (in such event, the right to acquire such amount of Class A and Class B Common Stock is referred to as a "Flip-In Right"). A majority of the Board of Directors (as determined in its discretion by the vote of a majority of the Directors then in office) may elect to distribute cash, other securities or other property in lieu of shares of Class A and Class B Common Stock to the Right holders upon the exercise of their Rights following any such event.

In the event that, at any time following a Stock Acquisition Date, the Company is acquired in a merger or other business combination transaction where the Company is not the surviving corporation or in the event that 50% or more of its assets or earning power is sold, proper provision shall be made so that each holder of a Right will thereafter have the right (in lieu of the Flip-In Right) to receive, upon the exercise thereof at the then current purchase price of the Right, common stock of the acquiring entity which has a value equal to twice the purchase price of the Right (such right being called a "Flip-Over Right"). Upon the occurrence of any of the events giving rise to the exercisability of the Flip-In Right, any Rights that are or were at any time owned by an Acquiring Person engaging in any of such transactions or receiving the benefits thereof on or after the time the Acquiring Person became such shall become null and void.

For example, at a purchase price of $130 per Right, and assuming a current market price of $30 per share, if (i) any person becomes an Acquiring Person or (ii) the Company is the surviving corporation in a merger with an Acquiring Person in which the Class A and Class B Common Stock is not converted or exchanged, each Right other than a Right owned by the Acquiring Person would entitle its holder to purchase $260 worth of Class A Common Stock or Class B Common Stock, as applicable, for $130. If, following the Distribution Date, there occurs (i) a business combination with another entity in which the Company's Class A and Class B Common Stock is converted or exchanged, or (ii) a sale of 50% or more of the Company's assets or earning power, each Right would entitle its holder to purchase $260 worth of the acquiring entity's stock for $130.

At any time prior to the earlier to occur of (i) a person becoming an Acquiring Person, or (ii) the expiration of the Rights, the Company may redeem the Rights in whole, but not in part, at a price of $.001 per Right (the "Redemption Price"). Additionally, the Board of Directors may thereafter redeem the then outstanding Rights in whole, but not in part, at the Redemption Price provided that (a) the redemption is incidental to a merger or other business combination transaction or series of transactions involving the

11

Company but not involving an Acquiring Person, or (b) an Acquiring Person has reduced his beneficial ownership to less than 5% of the then voting power of the Company and there exists no other Acquiring Person at the time of the redemption. Upon the effective date of the redemption of the Rights, the right to exercise the Rights will terminate and the only right of the holders of Rights will be to receive the Redemption Price.

Additionally, the Board of Directors may also, at any time from and after the time that a person has become an Acquiring Person, exchange one share of Class A Common Stock or Class B Common Stock, as applicable, for each Right held by a shareholder other than the Acquiring Person during such time as the Acquiring Person holds between 15% and 50% of the voting power of the Company.

Until a Right is exercised, it will not entitle the holder to any rights as a stockholder of the Company (other than those as an existing stockholder), including, without limitation, the right to vote or to receive dividends.

The terms of the Rights may be amended by the Board of Directors of the Company in any manner prior to a person becoming an Acquiring Person, and may thereafter amend the terms of the Rights to cure any ambiguity, to correct or supplement any provision of the Shareholder Rights Plan which may be defective or inconsistent with any other provisions, or in any manner not adversely affecting the interests of the holders of the Rights.

The Rights will expire on September 16, 2011, unless extended or earlier redeemed or exchanged by the Company pursuant to the Shareholder Rights Plan.

Business Combinations and Control Share Acquisitions under the Minnesota Business Corporation Act

As a public corporation, the Company is also governed by the provisions of Sections 302A.671 and 302A.673 of the Minnesota Business Corporations Act. These anti-takeover provisions may eventually operate to deny shareholders the receipt of a premium on their Common Stock and may also have a depressive effect on the market price of the Company's Common Stock. Section 302A.671 basically provides that the shares of a corporation acquired in a "control share acquisition" have no voting rights unless voting rights are approved by the shareholders in a prescribed manner. A "control share acquisition" is generally defined as an acquisition of beneficial ownership of shares that would, when added to all other shares beneficially owned by the acquiring person, entitle the acquiring person to have voting power of 20% or more in the election of directors. Section 302A.673 prohibits a public corporation from engaging in a "business combination" with an "interested shareholder" for a period of four years after the date of the transaction in which the person became an interested shareholder, unless the business combination is approved in a prescribed manner. A "business combination" includes mergers, asset sales and other transactions. An "interested shareholder" is a person who is the beneficial owner of 10% or more of the corporation's voting stock. Reference is made to the detailed terms of Sections 302A.671 and 302A.673 of the Minnesota Business Corporation Act.

12

PROPOSAL NUMBER 3:

ELECTION OF DIRECTORS

The Board of Directors of the Company presently consists of eight persons, including Bernard Sweet, who has decided not to pursue re-election. Subject to the adoption by the shareholders of the amendments to the Company's Articles of Incorporation and Bylaws contained in Proposal 2, the Board of Directors has set the number of directors at nine and has nominated nine persons for election to the Board with three directors to be Class I directors, three directors to be Class II directors, and three directors to be Class III directors. Except for Messrs. Michael G. Allen and M. Lenny Pippin, each of the nominees is currently a director of the Company whose current term expires at the Meeting. If elected, each nominee has consented to serve as a director for the terms set forth below, and the Company knows of no reason why any of the listed nominees would be unavailable to serve.

At the Meeting and assuming the shareholders approve the amendments contained in Proposal 2, the Class I nominees will be elected to hold office until the 2002 Annual Meeting or until successors are elected and have qualified, the Class II nominees will be elected to hold office until the 2003 Annual Meeting or until successors are elected and have qualified, and the Class III nominees will be elected to hold office until the 2004 Annual Meeting or until successors are elected and have qualified. Beginning with the 2002 Annual Meeting and continuing at each annual meeting thereafter, the directors standing for election in that year shall be elected for three year terms. In the event that amendments contained in Proposal 2 are not adopted by the shareholders, all of the nominees shall be elected to hold office until the 2002 Annual Meeting or until successors are elected and qualified.

All shares represented by proxies will be voted "FOR" the election of the foregoing nominees (to the Class indicated below) unless a contrary choice is specified. If any nominee should withdraw or otherwise become unavailable for reasons not presently known, the proxies which would have otherwise been voted for such nominee will be voted for such substitute nominee as may be selected by the Board of Directors.

The affirmative vote of the holders of the greater of (a) a majority of the voting power of the outstanding shares of Class A and Class B Common Stock present and entitled to vote on the election of directors or (b) a majority of the voting power of the minimum number of shares entitled to vote that would constitute a quorum for transaction of business at the Meeting, is required for election to the Board of each of the nine (9) nominees named above. A shareholder who abstains with respect to the election of directors is considered to be present and entitled to vote on the election of directors at the Meeting, and is in effect casting a negative vote, but a stockholder (including a broker) who does not give authority to a proxy to vote, or withholds authority to vote on the election of directors, shall not be considered present and entitled to vote on the election of directors.

| CLASS I DIRECTORS (One Year Initial Term) |

CLASS II DIRECTORS (Two Year Initial Term) |

CLASS III DIRECTORS (Three Year Initial Term) |

||

|---|---|---|---|---|

| Michael G. Allen Richard Fink M. Lenny Pippin |

Paul Baszucki William Hope D.R. Verdoorn |

Wayne M. Fortun Donald W. Goldfus Thomas Moberly |

13

Set forth below is information regarding the nominees, including information furnished by them as to their principal occupations for the last five years, certain other directorships held by them, and their ages as of the date hereof.

| Name and Age of Director/Nominee |

Principal Occupation, Business Experience Past Five Years and Directorships in Public Companies |

Director Since |

||

|---|---|---|---|---|

Director Nominees: |

||||

Michael G. Allen (63) |

Founder Chairman of The Michael Allen Company. Mr. Allen formerly served as Vice President of Corporate Strategy of General Electric from 1974 to 1979. |

N/A |

||

Paul Baszucki (61) |

Chairman of the Board of Directors of Norstan, Inc. since May 1997. Mr. Baszucki also served as Chief Executive Officer of that Company from 1986 until May 1997 and from December 1999 to October 2000. Mr. Baszucki is also a director and a member of the Compensation Committee of WSI Industries, Inc. |

1994 |

||

Richard Fink (71) |

Chairman of the Board of the Company. Mr. Fink was also Chief Executive Officer of the Company until January 1997. |

1968 |

||

Wayne M. Fortun (52) |

President, Chief Executive Officer, Chief Operating Officer and a director of Hutchinson Technology Inc. Mr. Fortun is also a director of C.H. Robinson Company. |

1994 |

||

Donald W. Goldfus (67) |

Retired since June 1999. Formerly the Chairman of the Board of Directors of Apogee Enterprises, Inc. Mr. Goldfus continues as a director of Apogee Enterprises, Inc. and also served as Chief Executive Officer of that company from 1986 until January 1998. |

1989 |

||

William Hope (68) |

Formerly the Chief Executive Officer of the Company from January 1997 until January 1999. From 1993 to 1997, Mr. Hope served as President and Chief Operating Officer of the Company. Mr. Hope served as a director of Minntech Corporation and the Chairman of the Board of that company from June 2000 until September 2001. Mr. Hope formerly served that company's Interim Chief Executive Officer from June 2000 to November 2000. |

1983 |

||

Thomas Moberly (53) |

Chief Executive Officer since January 1999. President since September 1997. Chief Operating Officer of the Company from September 1997 to January 1999. From February 1993 to September 1997, Mr. Moberly served as Executive Vice President of the Company. Prior thereto, Mr. Moberly was a Regional Manager of the Company. |

1998 |

||

14

M. Lenny Pippen (54) |

President and Chief Executive Officer of Schwan's Sales Enterprises, Inc. since November 1999. Mr. Pippin serves as a director of Lykes Brothers and formerly served as that company's President and Chief Executive Officer. |

N/A |

||

D. R. Verdoorn (62) |

Chief Executive Officer of C.H. Robinson Worldwide, Inc. and its predecessor since 1977, and also served as President of such corporation from 1977 until 1999. Mr. Verdoorn has served on the Board of Directors of such corporation since 1975, and has served as Chairman since 1977. Mr. Verdoorn has served on the Boards of Directors for United Fresh Fruit and Vegetable Association and the Produce Marketing Association. |

2000 |

||

Director Not Seeking Re-election: |

||||

Bernard Sweet (77) |

Retired since 1985, formerly President and Chief Executive Officer of Republic Airlines, Inc. |

1975 |

||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" ALL OF THE NOMINEES LISTED ABOVE.

DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

| Name |

Age |

Title |

Since |

|||

|---|---|---|---|---|---|---|

| Richard M. Fink | 71 | Chairman and Director | 1968 | |||

| Thomas Moberly | 53 | Chief Executive Officer, President and Director | 1993 | |||

| Robert G. Wood | 53 | Executive Vice President | 2000 | |||

| Jeffrey L. Wright | 39 | Chief Financial Officer, Treasurer and Secretary | 1999 | |||

| Paul Baszucki | 61 | Director | 1994 | |||

| Wayne M. Fortun | 52 | Director | 1994 | |||

| Donald W. Goldfus | 67 | Director | 1989 | |||

| William Hope | 68 | Director | 1983 | |||

| Bernard Sweet | 77 | Director | 1975 | |||

| D.R. Verdoorn | 62 | Director | 2000 | |||

| Michael G. Allen | 63 | Director Nominee | N/A | |||

| M. Lenny Pippin | 54 | Director Nominee | N/A |

Richard M. Fink—See "Nominees for Directors" above.

Thomas Moberly—See "Nominees for Directors" above.

Robert G. Wood has served as Executive Vice President since May 2000. He served as President of the Company's Canadian operations since 1998 and Regional Vice President since 1997. Mr. Wood joined the Company in 1995 as a General Manager. Prior to joining the Company, he was Vice President of Marketing and Director of Sales with Livingston International, Inc., where he spent 23 years in a variety of operating, sales, service and marketing positions.

15

Jeffrey L. Wright has served as the Company's Chief Financial Officer, Treasurer and Secretary since February 1999. Mr. Wright was Controller for BMC Industries, Inc. from 1996 until 1998 and served as Treasurer of that company from 1998 until the time he joined the Company. From 1993 to 1996 Mr. Wright was Treasurer for Employee Benefit Plans, Inc.

Paul Baszucki—See "Nominees for Directors" above.

Wayne M. Fortun—See "Nominees for Directors" above.

Donald W. Goldfus—See "Nominees for Directors" above.

William Hope—See "Nominees for Directors" above.

Bernard Sweet—See "Nominees for Directors" above.

D.R. Verdoorn—See "Nominees for Directors" above.

Michael G. Allen—See "Nominees for Directors" above.

M. Lenny Pippin—See "Nominees for Directors" above.

16

The following table sets forth the cash and noncash compensation for each of the last three fiscal years awarded to or earned by the Chief Executive Officer of the Company and the three other most highly compensated executive officers of the Company who have served as executive officers during the fiscal year ended June 30, 2001 (the "Named Executive Officers").

| |

|

Annual Compensation |

Long-Term Compensation—Awards |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position |

Fiscal Year |

Salary ($)(1) |

Bonus ($) |

Other Annual Compensation ($)(2) |

Restricted Stock Awards ($)(3) |

Securities Underlying Options (#) |

All Other Compensation ($)(4) |

|||||||

| Richard Fink Chairman of the Board |

2001 2000 1999 |

376,173 367,538 354,000 |

0 0 0 |

37,209 66,369 55,915 |

— — — |

6,456 16,579 3,850 |

27,858 30,101 30,615 |

|||||||

Thomas Moberly President and Chief Executive Officer |

2001 2000 1999 |

430,685 395,000 311,154 |

0 0 0 |

13,699 21,653 14,654 |

— — — |

7,242 16,891 2,880 |

22,903 23,164 18,396 |

|||||||

Jeffrey L. Wright(5) Chief Financial Officer, Treasurer & Secretary |

2001 2000 1999 |

205,788 176,539 61,539 |

0 0 25,000 |

7,530 4,898 2,227 |

221,027 79,412 68,692 |

2,639 11,540 7,500 |

10,510 5,316 46 |

|||||||

Robert Wood(6) Executive Vice President |

2001 2000 |

253,558 149,004 |

12,364 0 |

14,296 14,948 |

221,027 147,236 |

4,211 14,060 |

904 766 |

|||||||

- (1)

- Includes

cash compensation deferred at the election of the executive officer under the terms of the Company's 401(k) Savings Incentive Plan and the Executive Deferred Compensation

Plan.

- (2)

- Includes

compensation relating to reimbursement for the payment of taxes resulting from the vesting of restricted stock awards, personal use of company car and country club dues.

- (3)

- Amounts

shown in this column reflect the dollar value (net of any consideration paid by the named executive officer) of awards of restricted stock as of the date such awards were

granted, calculated by multiplying (i) the difference between (A) the closing market price of unrestricted Class A Common Stock of the registrant on the Nasdaq National Market on

the date of grant, and (B) the consideration paid by the Named Executive Officer, by (ii) the number of shares awarded. As of June 30, 2001, the Named Executive Officers held the

following as a result of grants under the 1989 Stock Option and Compensation Plan and/or the 1998 Stock Option and Compensation Plan: Mr. Fink held 15,309 restricted shares at a market value

(net of any consideration paid by Mr. Fink) of $404,158; Mr. Moberly held 16,387 restricted shares at a market value (net of any consideration

paid by Mr. Moberly) of $432,618; Mr. Wright held 11,768 restricted shares at a market value (net of any consideration paid by Mr. Wright) of $310,675; and Mr. Wood held

17,004 restricted shares at a market value (net of any consideration paid by Mr. Wood) of $448,906. Restricted stock awards vest in seven equal annual installments beginning on the first

anniversary of the date of grant. Regular dividends are paid on the restricted shares. The Company has agreed to make certain payments to the recipients of restricted stock to cover the taxes payable

by such persons upon the vesting of such shares. See footnote 2 above.

- (4)

- Represents

matching contributions by the Company under the Company's 401(k) Savings Incentive Plan and the Executive Deferred Compensation Plan and payment by the Company of term

life insurance premiums.

- (5)

- Mr. Wright

was designated an executive officer of the Company effective February 8, 1999.

- (6)

- Mr. Wood was designated an executive officer of the Company effective May 11, 2000.

17

OPTION GRANTS IN LAST FISCAL YEAR

The following table sets forth the number of individual grants of stock options made during fiscal year 2001 to the Named Executive Officers:

| |

Individual Grants |

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Percent of Total Options Granted to Employees in Fiscal Year(%) |

|

|

||||||||

| |

Number of Shares Underlying Options Granted (#) |

|

|

|||||||||

| Name |

Exercise or Base Price ($/Share)(1) |

Expiration Date |

||||||||||

| 5% ($)(3) |

10% ($)(3) |

|||||||||||

| Richard M. Fink | 6,456(2) | 2.0 | 28.50 | 09/01/10 | 115,714 | 293,242 | ||||||

| Thomas Moberly | 7,242(2) | 2.3 | 28.50 | 09/01/10 | 129,802 | 328,944 | ||||||

| Jeffrey L. Wright | 2,639(2) | 0.8 | 28.50 | 09/01/10 | 47,300 | 119,868 | ||||||

| Robert Wood | 4,211(2) | 1.3 | 28.50 | 09/01/10 | 75,476 | 191,271 | ||||||

- (1)

- Amount

represents the fair market value of the Company's Common Stock on the date of grant.

- (2)

- Options

were issued on September 1, 2000, and vest on September 1, 2003.

- (3)

- The hypothetical potential appreciation shown in these columns for the named executive is required by rules of the SEC. These amounts do not represent either the historical or anticipated future performance of the Company's common stock price appreciation.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

The following table sets forth information as to the exercise of options and number and value of unexercised options at fiscal year-end for each of the Named Executive Officers who owned options during fiscal 2001:

| Name |

Shares Acquired on Exercise(#) |

Value Realized($) |

Number of Securities Underlying Unexercised Options at 6/30/01 (#) Exercisable/Unexercisable |

Value of Unexercised in-the-Money Options at 6/30/01 ($) Exercisable/Unexercisable |

||||

|---|---|---|---|---|---|---|---|---|

| Richard M. Fink(1) | -0- | N/A | 4,167/22,898 | 7,917/15,833 | ||||

| Thomas Moberly(2) | -0- | N/A | 5,094/24,079 | 7,917/15,833 | ||||

| Jeffrey L. Wright(3) | -0- | N/A | 8,333/13,346 | 6,333/12,667 | ||||

| Robert Wood(4) | -0- | N/A | 4,167/15,514 | 7,917/15,833 |

- (1)

- Options

held as of June 30, 2001 include (i) options granted on September 1, 1998 at an exercise price of $46.00 per share; (ii) options granted on

September 1, 1999 at an exercise price of $41.56 per share; (iii) options granted on May 25, 2000 at an exercise price of $25.00 per share; and (iv) options granted on

September 1, 2000 at an exercise price of $28.50 per share. The closing sale price of the Class A Common Stock on June 29, 2001 was $26.90.

- (2)

- Options held as of June 30, 2001 include (i) options granted on January 2, 1998 at an exercise price of $41.88 per share; (ii) options granted on September 1, 1998 at an exercise price of $46.00 per share. The closing sale price of the Class A Common Stock on June 29, 2001 was $26.90; (iii) options granted on September 1, 1999 at an exercise price of $41.56 per share; (iv) options granted on September 1,

18

1999 at an exercise price of $41.56 per share; and (v) options granted on September 1, 2000 at an exercise price of $28.50 per share. The closing sale price of the Class A Common Stock on June 29, 2001 was $26.90.

- (3)

- Options

held as of June 30, 2001 include (i) options granted on February 8, 1999 at an exercise price of $53.34 per share; (ii) options granted on

September 1, 1999 at an exercise price of $41.56 per share; (iii) options granted on May 25, 2000 at an exercise price of $25.00 per share; and options granted on

September 1, 2000 at an exercise price of $28.50 per share. The closing sale price of the Class A Common Stock on June 29, 2001 was $26.90.

- (4)

- Options held as of June 30, 2001 include (i) options granted on September 1, 1998 at an exercise price of $46.00 per share; (ii) options granted on September 1, 1999 at an exercise price of $41.56 per share; (iii) options granted on May 25, 2000 at an exercise price of $25.00 per share; and (iv) options granted on September 1, 2000 at an exercise price of $28.50 per share. The closing sale price of the Class A Common Stock on June 29, 2001 was $26.90.

| |

Years of Service |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Remuneration |

15 |

20 |

25 |

30 |

35 |

|||||||||||

| $ | 125,000 | $ | 31,250 | $ | 41,667 | $ | 52,083 | $ | 62,500 | $ | 62,500 | |||||

| 150,000 | 37,500 | 50,000 | 62,500 | 75,000 | 75,000 | |||||||||||

| 175,000 | 43,750 | 58,333 | 72,917 | 87,500 | 87,500 | |||||||||||

| 200,000 | 50,000 | 66,667 | 83,333 | 100,000 | 100,000 | |||||||||||

| 225,000 | 56,250 | 75,000 | 93,750 | 112,500 | 112,500 | |||||||||||

| 250,000 | 62,500 | 83,333 | 104,167 | 125,000 | 125,000 | |||||||||||

| 300,000 | 75,000 | 100,000 | 125,000 | 150,000 | 150,000 | |||||||||||

| 350,000 | 87,500 | 116,667 | 145,833 | 175,000 | 175,000 | |||||||||||

| 400,000 | 100,000 | 133,333 | 166,667 | 200,000 | 200,000 | |||||||||||

| 450,000 | 112,500 | 150,000 | 187,500 | 225,000 | 225,000 | |||||||||||

The table above sets forth the estimated annual straight life annuity benefits payable upon an executive's retirement at age 65 under both the Company's Pension Plan and its Supplemental Executive Retirement Plan, for various compensation and years of service categories, without any reduction for Social Security benefits. These plans take into account the average annual salary and bonus shown in the Summary Compensation Table, paid during the five consecutive calendar years in which such amounts were highest (within the past 10 years). The number of years of service credited for Messrs. Fink, Moberly, Wright and Wood as of June 30, 2001 were 36 years, 27 years, 2 year and 5 years, respectively.

Employment Agreements

Effective January 1, 2001, the Company entered into an Executive Employment Agreement for an indefinite term with each of Messrs. Fink, Moberly, Wood and Wright (each such agreement is hereinafter referred to as an "Agreement"). Each Agreement will terminate upon the death, disability or retirement of the executive who is a party to the Agreement and provides that employment may be terminated at any time by the Company or by the executive upon 30 days notice. If the Company terminates the Agreement without "Cause", and the terminated executive executes a written release form, the executive is then

19

entitled to receive the salary and benefits provided under the Agreement for a period of twelve months following his termination. Each Agreement also provides that if within one year of any "Change in Control" of the Company (as defined in the Agreements), either (1) the Company terminates the executive for any reason other than for Cause, or (2) the executive terminates his employment for "Good Reason", then the executive is then entitled to:

- (1)

- continuation

of salary and benefits for twelve months as described above; and

- (2)

- reimbursement of all reasonable outplacement expenses up to $12,000.

The Agreement defines "Cause" as, among other things: (1) the failure or refusal to perform duties, (2) indictment or conviction of a felony, (3) drunkenness or abuse of drugs, (4) material dishonesty, or (5) gross negligence. The Agreement defines "Good Reason" as, among others: (1) an adverse involuntary change in the executive's status or position, (2) a reduction, by the Company, in the executive's base salary, (3) the Company requiring the executive to be based anywhere other than where the executive's office is located as of the day before a Change in Control, or (4) any purported termination by the Company of this Agreement or the employment of the executive at any time after a Change in Control.

Messrs. Fink, Moberly, Wood and Wright each covenants and agrees that for a period of eighteen (18) months following the termination of his employment with the Company, he will not (i) compete against the Company, (ii) obtain any ownership interest in any competitor or become employed by any competitor, (iii) encourage any employees of the Company to violate the terms of their employment contracts with the Company or (iv) attempt to take away any customers of the Company. Each of Messrs. Fink, Moberly, Wood and Wright also agrees not to disclose any confidential Company information at any time before or after termination of his employment with the Company.

Change In Control Agreements

The Company has entered into change of control agreements with each of Messrs. Fink, Moberly, Wright and Wood. Each agreement provides that upon a Change in Control, as defined in 1989 Stock Option and Compensation Plan and/or the 1998 Stock Option and Compensation Plan (together the "Plans"), (i) the restrictions on all shares of restricted stock awards shall lapse immediately; (ii) all outstanding options and stock appreciation rights shall become immediately exerciseable; and (iii) all performance share objectives shall be deemed to have been met and payment thereon shall be made immediately.

Director Compensation

The Company pays each director who is not otherwise employed by the Company an annual fee of $14,000 and $2,000 for each meeting of the Board of Directors and $500 for each committee meeting of the Board of Directors attended.

In addition, directors who are not otherwise employed by the Company also participate in the 1996 Director Stock Option Plan (the "1996 Plan") which provides for an annual grant to non-employee directors of options to purchase 1,000 shares at an option exercise price equal to the average of the closing prices of the Company's Common Stock during the ten business days preceding the Company's Annual Meeting for a given year. Each such option has a ten-year term and generally becomes exercisable on the first anniversary of the grant date. In connection with the original adoption of the 1996 Plan, each of Messrs. Baszucki, Fortun, Goldfus, and Sweet received a one-time grant of options to purchase 3,000

20

shares of Common Stock. Mr. Verdoorn also received a one-time grant of options to purchase 3,000 shares of Common Stock on October 26, 2000, the date of Mr. Verdoorn's initial election to the Board of Directors. Each of the 3,000 share options has ten-year term and vests in three equal installments on each of the first, second and third anniversaries of the grant date.

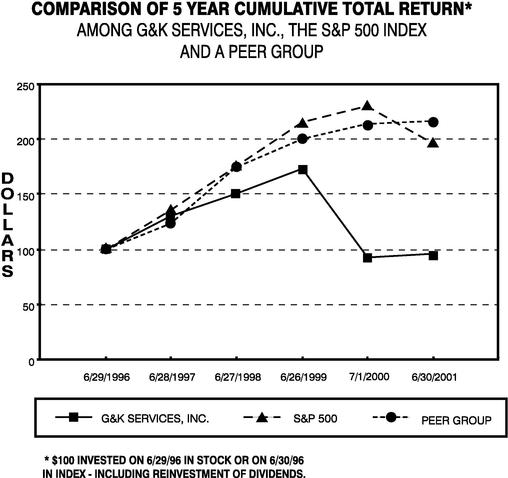

Stock Performance Graph

The following graph summarizes the cumulative five-year return on $100 invested in the Company's common stock, the Standard and Poor's ("S&P") 500 Stock Index and a nationally recognized group of companies in the uniform services industry (the "Peer Index"). The companies included in the Peer Index are Angelica Corporation, Cintas Corporation, G&K Services, Inc. and Unifirst Corporation.

The graph illustrates the cumulative values at the end of each succeeding year resulting from the change in the stock price, assuming dividend reinvestment.

21

PROPOSAL NUMBER 4:

TO INCREASE THE NUMBER OF SHARES OF COMMON STOCK RESERVED FOR ISSUANCE UNDER THE COMPANY'S 1996 DIRECTOR STOCK OPTION PLAN

On October 31, 1996, the shareholders of the Company approved the G&K Services, Inc. 1996 Director Stock Option Plan (the "1996 Plan"), covering 50,000 shares of Common Stock, as adjusted for stock splits. The Board of Directors believes that the grant of stock options is a desirable and useful means to strengthen further the non-employee directors' linkage with stockholder interests. Subject to the approval of the shareholders, on August 30, 2001, the Board of Directors further amended the Plan to increase the number of shares of Common Stock reserved for issuance thereunder from 50,000 to 100,000 shares. The brief summary of the Plan which follows is qualified in its entirety by reference to the complete text, a copy of which is attached to this Proxy Statement as Appendix C.

The 1996 Plan provides that each director who is not an employee of the Company or one or its subsidiaries (a "Non-Employee Director") shall automatically receive, as of the date of each annual meeting of shareholders, a non-qualified option to purchase 1,000 shares of the Company's Common Stock. Each such option will have a ten-year term and will generally become exercisable on the first anniversary of the grant date at an option exercise price equal to the "Average Market Value" of the Common Stock on the date the Option is granted. Average Market Value under the 1996 Plan is defined as the average of the closing prices of the Company's Common Stock during the ten business days preceding the Company's Annual Meeting for a given year, as reported on the Nasdaq National Market. In addition to an annual 1,000 stock option grant, each Non-Employee Director was granted a one-time non-qualified stock option to purchase 3,000 shares of the Company's Common Stock upon the initial adoption of the 1996 Plan or will receive a one-time non-qualified stock option to purchase 3,000 shares of the Company's Common Stock upon his or her initial election or appointment to the Board. The 3,000 share stock options have ten-year terms and are generally exercisable in three equal annual installments at an option exercise price equal to the Average Market Value. The options are not transferable except by will or the laws of descent and distribution and may be exercised during the option holder's lifetime only by him or her.

The number of shares of Common Stock which may be issued under the 1996 Plan if this amendment is approved may not exceed 100,000 shares, subject to adjustment in the event of a merger, recapitalization or other corporate restructuring. This represents approximately 0.5% of the outstanding shares of the Company's Common Stock on the Record Date. As of the Record Date, there were outstanding options for 39,000 shares under the 1996 Plan. Accordingly, as of the Record Date, the remaining number of shares which may be issued under the Plan if this amendment is approved is approximately 0.3% of the outstanding Common Stock.

The Company receives no consideration upon the grant of options under the 1996 Plan. The exercise price of an option must be paid in full upon exercise. Payment may be made in cash, check or, in whole or in part, in Common Stock of the Company already owned by the person exercising the option, valued at fair market value.

Additionally, unless otherwise determined by the Board of Directors and a majority of the Continuing Directors (as defined below), all outstanding options under the 1996 Plan will become exercisable immediately in the event: (i) any person or group of persons becomes the beneficial owner of 30% or more of any equity security of the Company entitled to vote for the election of directors; (ii) a majority of the members of the Board of Directors is replaced within a period of less than two years by directors not nominated and approved by the Board of Directors; or (iii) the stockholders of the Company approve an

22